Cost-Cutting Strategy at PNC Bank Leads to Staff Layoffs

Cost-Cutting Strategy at PNC Bank Leads to Staff Layoffs

Shift in Focus to Expense Management and Strategic Priorities

PNC Bank, in a recent move, has implemented a cost-cutting strategy aimed at managing expenses and aligning its workforce with strategic priorities. This decision has led to the layoff of an undisclosed number of employees.

The bank’s initiative to streamline operations and enhance efficiency has resulted in a reduction in staffing levels in certain areas. Initially, PNC Bank set a target to cut $400 million in expenses by 2023, which was later increased to $450 million.

This article delves into PNC Bank’s cost-cutting strategy, its impact on various business areas, and the reallocation of resources to support long-term goals and growth.

Business Areas Affected

The layoffs at PNC Bank are expected to significantly impact various business areas, including residential mortgage, corporate and institutional banking, and asset management. As the bank shifts its focus away from work that does not align with its strategic priorities, it is reallocating resources to areas that are more in line with its long-term goals and growth strategy. This strategic reallocation aims to optimize the bank’s operations and enhance its ability to deliver value to its customers and shareholders.

Efficiency Improvement and Operational Streamlining

PNC Bank’s cost-cutting strategy involves streamlining its operations and improving efficiency. By eliminating work that does not align with its strategic priorities, the bank aims to optimize its resources and enhance its overall performance. This strategy includes a reduction in staffing levels, which has led to the recent layoffs. PNC Bank acknowledges the impact of these layoffs on the affected employees and is committed to providing support and assistance during the transition period.

The bank’s focus on improving efficiency and reallocating resources is part of its broader strategy to adapt to changing market conditions and position itself for long-term success. By aligning its workforce with its strategic priorities, PNC Bank aims to deliver value to its customers and shareholders while maintaining a competitive edge in the retail banking industry.

Support for Employees Affected

PNC Bank recognizes the impact of the layoffs on the affected employees and is committed to providing support and assistance during the transition period. The bank understands the importance of helping these employees navigate through this challenging time and is dedicated to offering resources and guidance to facilitate their career transition. By prioritizing the well-being of its employees, PNC Bank demonstrates its commitment to maintaining a positive and supportive work environment.

Strategic Cost-Cutting Measures at PNC Bank

In conclusion, PNC Bank’s implementation of a cost-cutting strategy and staff layoffs are part of its broader efforts to manage expenses and align its workforce with strategic priorities. By streamlining operations, improving efficiency, and reallocating resources, the bank aims to optimize its performance and deliver value to its customers and shareholders. PNC Bank remains committed to supporting the affected employees during the transition period and maintaining a positive work environment. Through these strategic measures, the bank positions itself for long-term success in the retail banking industry.

To learn more about PNC Bank’s cost-cutting strategy and its impact on the industry, visit Cameron Academy, a nationally recognized career education school. Led by CEO Michael Cameron, with 20 years of industry experience, Cameron Academy offers online courses that provide a competitive advantage in chosen career paths. With a commitment to delivering high-quality education tailored to individual needs and goals, Cameron Academy’s team of professionals is dedicated to positively impacting students’ lives. Get started today and unlock your potential with Cameron Academy!

Online Career Education at Cameron Academy

Experience the Innovation and Convenience of Online Learning

At Cameron Academy, we understand the importance of continuous learning and professional growth. Our online career education courses offer a flexible schedule, dedicated support, and real-world skills that give you a competitive edge in today’s dynamic job market. Whether you’re seeking professional license renewal, pre-license education, or state-specific real estate education, we have the courses you need to thrive in your chosen field. Join thousands of satisfied students who have embarked on a digital career pathway with Cameron Academy.

Begin Your Journey Today

Visit Cameron Academy’s website to explore our wide range of online courses and take the next step towards achieving your career goals. With our interactive quiz layout, convenient access to course materials, and engaging learning experience, you’ll be on your way to success in no time.

Start Learning NowDiscover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

More Articles

Getting licensed or staying ahead in your career can be a journey—but it doesn’t have to be overwhelming. Grab your favorite coffee or tea, take a moment to relax, and browse through our articles. Whether you’re just starting out or renewing your expertise, we’ve got tips, insights, and advice to keep you moving forward. Here’s to your success—one sip and one step at a time!

The Deep-Learning Triple Threat Transforming Medical Imaging

The Deep-Learning Triple Threat Transforming Medical Imaging

In a world where technology is reshaping industries at an unprecedented pace, the field of radiology stands on the cusp of a revolution, thanks to advancements in artificial intelligence (AI). The integration of AI into medical imaging systems has introduced a new era of speed, detail, and precision, promising to redefine the landscape of healthcare diagnostics. AI: A Triple Threat in Radiology AI is being hailed as a “triple threat” in radiology, impacting planning, scanning, and diagnosis. As detailed in a recent column by Kelly Londy of GE HealthCare, these intelligent imaging systems are ushering in seismic changes reminiscent of the transformative impact of computer-assisted tomography in the late 20th century. You can read the full article on AuntMinnie. Unleashing the Power of Deep Learning A subset of AI, deep learning, is at the heart of these advancements. By employing artificial neural networks, deep learning mimics the human brain’s ability to learn, enabling computers to process complex data with remarkable efficiency. This capability allows for the creation of detailed, comprehensive imaging data, even in challenging conditions such as patient movement during scans. Enhancing Patient Care and Workflow

The benefits of AI in radiology extend beyond image quality and scan speed. By automating routine tasks like image segmentation and measurement, AI serves as an “intelligent assistant” to radiologists, potentially reducing burnout and enhancing job satisfaction. This, in turn, allows healthcare professionals to dedicate more time to patient interactions and personal care.

Sustainability and Access

AI’s impact is not limited to clinical outcomes. As Londy notes, AI technologies are driving sustainability in healthcare by reducing energy consumption and CO2 emissions, thereby alleviating cost pressures and improving access to essential imaging services.

Looking Ahead

The future of medical imaging is bright, with AI poised to play an even more significant role. As deep learning continues to evolve, its applications will extend into planning and diagnosis, revolutionizing the patient experience and unlocking new possibilities in personalized medicine.

In the realm of neuroscience, AI-powered MRI is already making strides, offering insights into brain structures and functionalities previously unexplored. These innovations promise to enhance the diagnosis and treatment of complex neurological disorders, paving the way for breakthroughs in medical science.

As we stand on the brink of this technological transformation, the potential for AI to empower clinicians and improve patient care is immense. The integration of AI into clinical practice is set to revolutionize radiology, making diagnostics faster, more accurate, and more accessible than ever before.

Kelly Londy is president and CEO of GE HealthCare’s MR business. The views expressed in this article are her own and do not necessarily reflect those of AuntMinnie.com.

“`

Enhancing Patient Care and Workflow

The benefits of AI in radiology extend beyond image quality and scan speed. By automating routine tasks like image segmentation and measurement, AI serves as an “intelligent assistant” to radiologists, potentially reducing burnout and enhancing job satisfaction. This, in turn, allows healthcare professionals to dedicate more time to patient interactions and personal care.

Sustainability and Access

AI’s impact is not limited to clinical outcomes. As Londy notes, AI technologies are driving sustainability in healthcare by reducing energy consumption and CO2 emissions, thereby alleviating cost pressures and improving access to essential imaging services.

Looking Ahead

The future of medical imaging is bright, with AI poised to play an even more significant role. As deep learning continues to evolve, its applications will extend into planning and diagnosis, revolutionizing the patient experience and unlocking new possibilities in personalized medicine.

In the realm of neuroscience, AI-powered MRI is already making strides, offering insights into brain structures and functionalities previously unexplored. These innovations promise to enhance the diagnosis and treatment of complex neurological disorders, paving the way for breakthroughs in medical science.

As we stand on the brink of this technological transformation, the potential for AI to empower clinicians and improve patient care is immense. The integration of AI into clinical practice is set to revolutionize radiology, making diagnostics faster, more accurate, and more accessible than ever before.

Kelly Londy is president and CEO of GE HealthCare’s MR business. The views expressed in this article are her own and do not necessarily reflect those of AuntMinnie.com.

“`Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

Federal Reserve’s Interest Rate Cut: Implications for the Housing Market

Mortgage Rate Dynamics

Despite the Federal Reserve’s interest rate cut, mortgage rates might not see a dramatic drop. Currently, the average rate for a 30-year fixed mortgage stands at 6.2%, according to Freddie Mac. While this is a decrease from previous highs, it remains significantly above the sub-3% rates seen during the pandemic.Charlie Dougherty, a senior economist at Wells Fargo, anticipates only a marginal decline in rates, projecting them to settle around 5.5% by the end of 2025. This suggests that while the Fed’s decision may offer some relief, it won’t be a panacea for the housing market’s challenges.

Impact on Housing Prices

Interestingly, lower mortgage rates could paradoxically lead to higher housing prices. As rates decrease, more buyers are likely to re-enter the market, intensifying competition for a limited housing supply. This scenario is particularly concerning for first-time buyers, who have already been grappling with affordability issues.Kim Kronenberger, a real estate agent from Denver, highlights the struggles faced by these buyers, many of whom regret not purchasing homes when prices were lower. The increased demand could further escalate prices, making it even harder for new entrants to secure their first homes.

Potential for Increased Housing Supply

The rate cut could, however, spur an increase in housing supply. The U.S. is currently facing a shortfall of millions of housing units, as noted in a JCHS Blog. Lower interest rates may enable builders, especially smaller developers, to commence new projects, potentially alleviating some supply-side pressures.As builders respond to the anticipated rise in demand, more homes could enter the market, gradually easing the upward pressure on prices. However, the construction and completion of these new homes will take time.

Affordability Challenges Persist

Despite the potential benefits of lower rates, affordability remains a significant hurdle. Home prices have surged by about 50% since early 2020, outpacing income growth and making housing increasingly inaccessible for many. Furthermore, a substantial number of homeowners are locked into low-rate mortgages from the pandemic era, reducing the incentive to sell and further constricting inventory.Greg McBride from Bankrate.com underscores that the housing market has yet to see a substantial boost from recent rate reductions. With home prices at record highs and inventory levels below pre-pandemic norms, the Fed’s rate cut alone is unlikely to resolve these deep-seated issues.

In conclusion, while the Federal Reserve’s rate cut introduces several dynamics that could reshape the housing market, it is clear that a multifaceted approach will be necessary to address the complex challenges of affordability and supply.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

Public Perceptions of AI in Healthcare: A Balancing Act Between Innovation and Ethics

Public Perceptions of AI in Healthcare: A Balancing Act Between Innovation and Ethics

In the rapidly evolving landscape of healthcare, the integration of artificial intelligence (AI) stands as a beacon of both promise and concern. A recent study published in BMC Medical Ethics on June 22, 2024, delves into the public perceptions surrounding AI’s role in patient-centered care. The study, which can be accessed here, highlights both the potential benefits and ethical dilemmas posed by AI in the medical field.The research underscores a significant tension: while AI has the capability to enhance healthcare delivery, there is palpable unease about its impact on the traditional physician-patient relationship. As AI technologies become more prevalent, concerns about the erosion of personal interactions in healthcare settings have come to the forefront.

Ethical Concerns and Public Perception

The study reveals that a substantial portion of the public remains wary of AI’s involvement in personal healthcare decisions. This apprehension stems from fears of losing the “human touch” that is integral to patient-centered care. The findings align with previous research, such as that by Epstein and Street, which emphasizes the value of empathy and understanding in healthcare interactions.Moreover, the study calls attention to the lack of oversight and guidance in integrating AI with patient-centered care. This gap in regulation raises ethical questions about transparency, accountability, and patient consent. The need for robust guidelines is echoed in the fundamentals of open access and open research, which advocate for ethical practices in scientific advancements.

Opportunities for AI in Healthcare

Despite these concerns, the potential for AI to support patient care cannot be overlooked. The study highlights how AI can assist in administrative tasks, freeing up healthcare professionals to focus more on patient interactions. This dual role of AI as both a tool and a potential disruptor is a recurring theme in the discourse on AI in healthcare.To address these challenges, the study suggests a cautious approach to AI integration, emphasizing the importance of maintaining the core principles of patient-centered care. The findings suggest that with proper regulation and ethical considerations, AI can be a valuable ally in the healthcare sector.

Conclusion

As the medical community continues to explore the integration of AI, the balance between innovation and ethics remains crucial. This study serves as a reminder that while technology can drive progress, the human element in healthcare must not be compromised. For a more detailed exploration of these findings, the full article is available here.Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

The Ethical Dilemmas of AI: A Modern Conundrum

The Ethical Dilemmas of AI: A Modern Conundrum

As artificial intelligence (AI) technology advances, it presents a myriad of ethical dilemmas and challenges that demand urgent attention. The USC Annenberg School for Communication and Journalism recently explored these pressing issues, highlighting the complexities involved in AI’s deployment.

As artificial intelligence (AI) technology advances, it presents a myriad of ethical dilemmas and challenges that demand urgent attention. The USC Annenberg School for Communication and Journalism recently explored these pressing issues, highlighting the complexities involved in AI’s deployment.Bias and Fairness: One of the primary concerns is the potential for AI systems to inherit and amplify biases present in their training data. This can result in unfair or discriminatory outcomes, particularly in critical sectors like law enforcement and hiring. Ensuring fairness in AI algorithms is a critical ethical concern.

Privacy: AI systems often require access to large datasets, raising concerns about privacy violations. The ethical challenge lies in collecting, using, and protecting this data responsibly.

Transparency and Accountability: Many AI algorithms operate as “black boxes,” making them difficult to understand or interpret. Ensuring transparency and accountability in AI decision-making is crucial for building user trust and maintaining ethical standards.

Autonomy and Control: As AI systems become more autonomous, the potential loss of human control becomes a significant concern, especially in applications like autonomous vehicles and military drones.

Job Displacement: AI-driven automation can lead to job displacement and economic inequality. Addressing the societal impact of automation and ensuring a just transition for workers is an ethical imperative.

Security and Misuse: The potential for AI to be used for malicious purposes, such as in cyberattacks or surveillance, poses a significant security challenge.

Environmental Impact: The computational resources required for AI can have a substantial environmental impact. Ethical considerations include minimizing AI’s carbon footprint and promoting sustainable development.

AI in Education and Healthcare: The integration of AI in education and healthcare raises concerns about data privacy, the quality of education, and the preservation of human expertise.

Addressing these ethical issues requires a multidisciplinary approach involving technologists, ethicists, policymakers, and society at large. Developing ethical guidelines, regulations, and best practices is essential to ensure AI technologies benefit humanity while minimizing harm.

In a surprising twist, the article itself, co-authored by ChatGPT, raises further ethical questions about the use of AI-generated content. As Kirk Stewart, CEO of KTStewart and adjunct faculty member at USC Annenberg, emphasizes, it is vital to establish regulatory frameworks that safeguard civic life while embracing technological advancements.

CSS for Styling

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

Revolutionizing Radiology: AI’s Impact on Diagnostics

Qure.ai, alongside other innovators such as Arterys, DeepMind (acquired by Google), and Cleerly, is pioneering the use of AI in radiology to address diagnostic challenges. Their technologies process vast numbers of X-rays, CT scans, and MRIs, diagnosing conditions like tuberculosis, lung cancer, and stroke with remarkable speed and precision.

In resource-constrained environments, AI technology is crucial. For instance, Qure.ai’s systems deployed on mobile units in the Philippines have reduced the TB diagnosis process from weeks to seconds. This technology is now operational in over 3,000 global sites, demonstrating its scalability and impact.

Advancing Diagnostic Accuracy

AI’s role extends beyond speed; it enhances diagnostic consistency. As Prashant Warier, CEO of Qure.ai, explained, AI offers consistent results where human radiologists may often disagree. This reliability is vital for diseases requiring timely intervention, such as lung cancer, where early detection is crucial.

Qure.ai’s AI tools, in partnership with AstraZeneca, assist in triaging lung cancer risks through routine X-rays, ensuring high-risk patients receive prompt medical attention. Their reach spans over 90 countries, processing more than 10 million scans annually, reinforcing their significance in modern medicine.

Global Reach and Future Prospects

The recent Series D funding round, raising $65 million, highlights Qure.ai’s growth trajectory. This funding will enable them to scale AI capabilities further and expand into new markets, like the United States.

Qure.ai’s success reflects a broader trend towards AI-enhanced healthcare that extends into treatment strategies and patient management. Future developments involve integrating AI with genomics and electronic health records, providing a holistic view of patient health. As Warier suggests, the fusion of multiple health data points will facilitate more informed, comprehensive medical decisions.

This development marks a new era where AI not only supports but transforms healthcare delivery globally, promising more advanced, equitable solutions for everyone.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

Exploring the Shifting Landscape of Real Estate in 2024

Exploring the Shifting Landscape of Real Estate in 2024

The real estate market is undergoing significant transformations as we step into 2024, with several trends reshaping the industry. This analysis, based on insights from the original article on Exploding Topics, delves into the top nine trends that are expected to impact the real estate sector this year.1. Home Prices on the Rise The demand for single-family homes continues to outpace supply, resulting in a substantial increase in home prices. Over the past four years, prices have surged by 43%, as detailed in a recent report. While this trend benefits existing homeowners through increased equity, first-time buyers face significant barriers to entry.

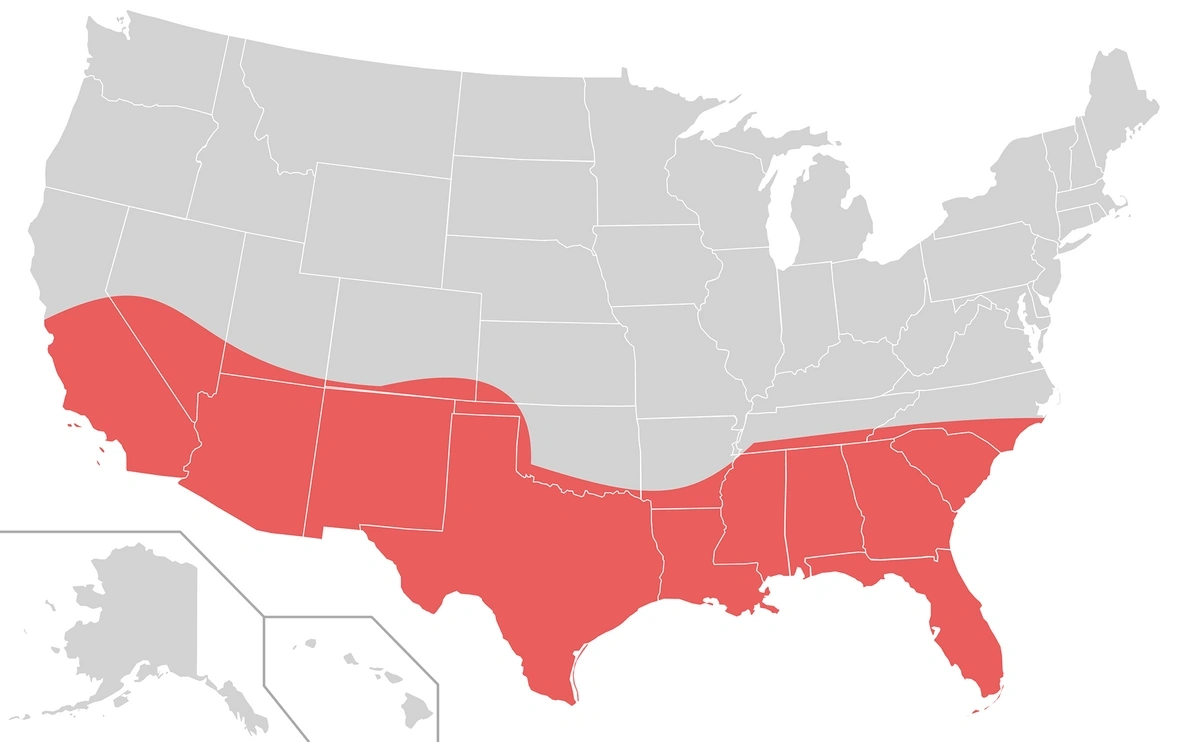

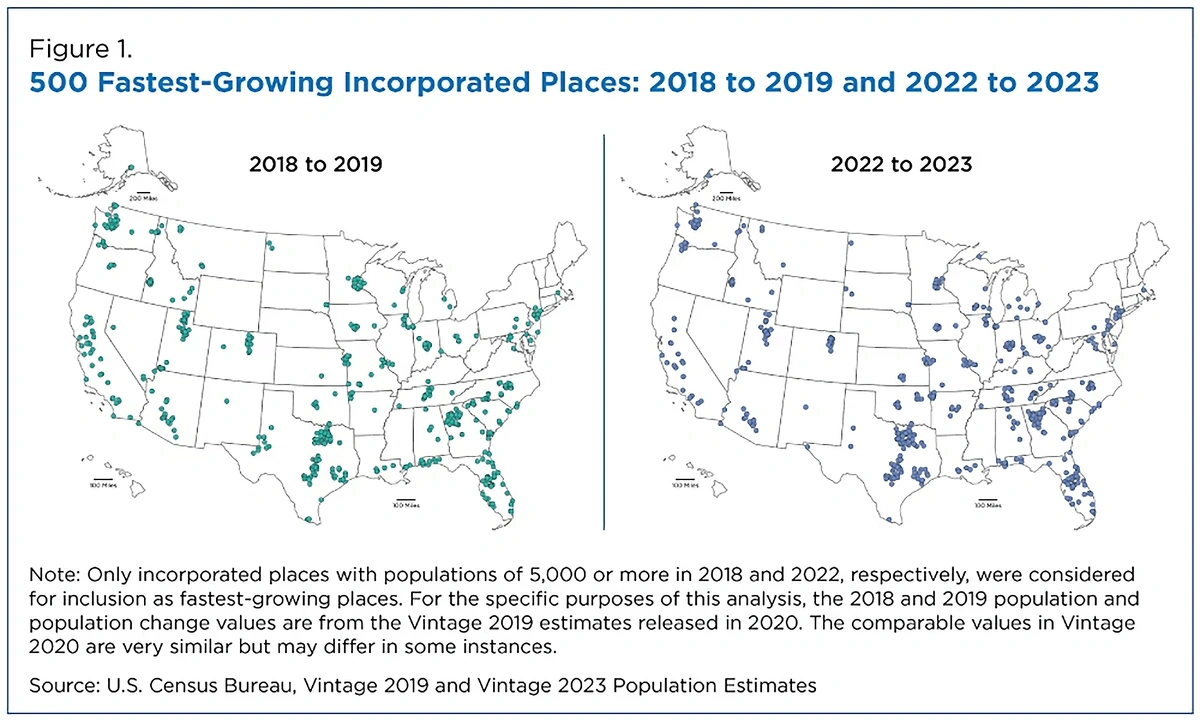

2. The Sun Belt’s Growing Appeal The Sun Belt, a region stretching from California to North Carolina, is witnessing a remarkable population influx. This trend is driven by factors such as lower taxes and affordable housing. As a result, cities like Dallas and Tampa are emerging as top destinations for real estate investment, according to recent rankings.

3. Digital Transformation in House Hunting The real estate sector is embracing digital innovations, with technologies like 3D tours, drone videos, and virtual staging becoming integral to the home-buying process. The National Association of Realtors highlights that online tools are now the starting point for over 40% of property buyers.

4. Suburban Migration Continues The shift from urban centers to suburbs persists, driven by the affordability and lifestyle choices offered by smaller cities. The US Census Bureau reports a continued migration trend, with suburbs offering a balance of urban amenities and suburban tranquility.

5. Single-Family Housing Shortages The demand for single-family homes is outstripping supply, creating a significant gap in the market. Since 2012, there has been a shortfall of over 7 million homes, as noted in a recent analysis. This shortage is exacerbated by institutional investors acquiring a substantial portion of available properties.

6. Rise of Multi-Generational Living Economic pressures and cultural shifts are leading to an increase in multi-generational households. This trend is particularly prominent among immigrant communities and is driven by both necessity and choice.

7. Mortgage Rates Remain High In response to inflation, mortgage rates have seen a steady increase. Although predictions suggest a slight decrease in the coming years, rates are expected to remain relatively high, impacting home affordability.

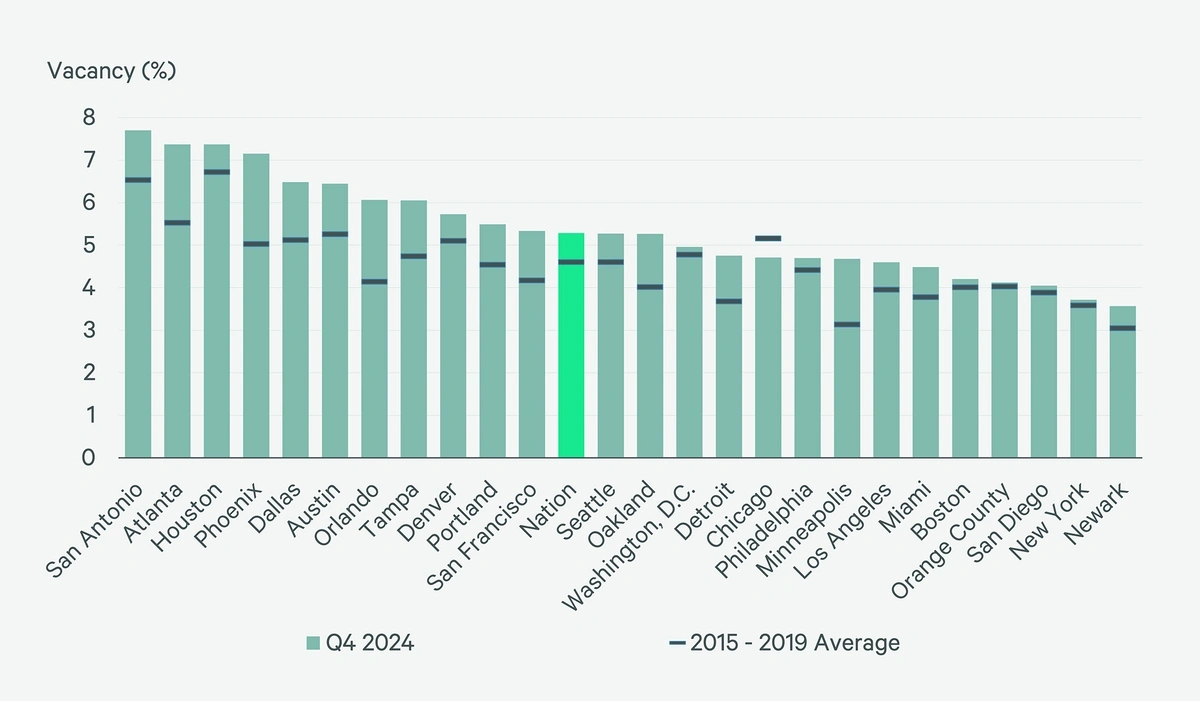

8. Decline in Urban Rental Markets The rental market in major cities is experiencing a decline as more individuals opt for homeownership or alternative living arrangements. However, smaller cities are witnessing a surge in rental demand due to limited housing supply.

9. Evolving Commercial Real Estate The commercial real estate landscape is in flux, with office vacancies reaching record highs. However, opportunities are emerging in retail and multi-family properties, driven by changing consumer preferences and work patterns.

Conclusion The real estate industry in 2024 is marked by a dynamic interplay of trends, including rising home prices, suburban migration, and technological advancements. As these trends unfold, they present both challenges and opportunities for investors, homeowners, and prospective buyers alike.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

AI Revolutionizing Clinical and Molecular Diagnostics

AI Revolutionizing Clinical and Molecular Diagnostics

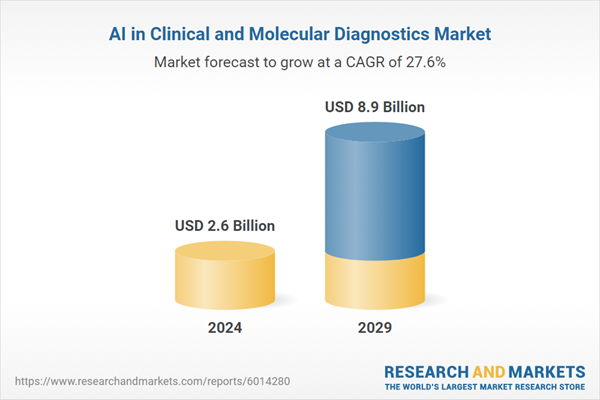

In a groundbreaking development, the market for AI in clinical and molecular diagnostics is set to experience a phenomenal growth trajectory. According to the recent report by ResearchAndMarkets.com, the market, valued at USD 2.6 billion in 2024, is projected to skyrocket to USD 8.9 billion by 2029. This represents a robust compound annual growth rate (CAGR) of 27.6%.Driving Forces Behind Market Growth

The surge in demand for accurate and efficient diagnostic solutions is a key driver of this growth. Advances in AI technologies, notably machine learning and deep learning, are enhancing traditional diagnostic methods in imaging, genomics, and laboratory testing. This technological evolution is paving the way for more precise and personalized medicine.

Moreover, the integration of AI into healthcare systems is becoming increasingly critical. As noted in the full report, major regions such as North America, Europe, and Asia-Pacific are at the forefront of this digital health revolution, investing heavily in innovative diagnostic solutions.

Strategic Initiatives and Challenges

The report highlights the strategic initiatives of leading companies like Siemens Healthineers AG, F. Hoffmann-La Roche Ltd., and Koninklijke Philips N.V. These firms are expanding their R&D efforts, forming strategic partnerships, and diversifying their product portfolios to capitalize on emerging opportunities.

However, the path to widespread AI adoption is not without hurdles. Regulatory challenges and data security concerns pose significant obstacles. Yet, the report identifies untapped opportunities in developing markets and across various AI technologies, presenting a promising outlook for stakeholders.

Implications for Healthcare

In an era of rapid technological advancements, the integration of AI in clinical and molecular diagnostics promises to revolutionize healthcare. It is expected to significantly improve patient outcomes and healthcare efficiency. Stakeholders, including healthcare providers, technology developers, and policymakers, are encouraged to leverage these insights for strategic planning and innovation.

For a comprehensive analysis and detailed insights, refer to the full report on ResearchAndMarkets.com.

“`

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

2025 Banking and Capital Markets Outlook: Navigating Low-Growth Challenges

The pressing need to control soaring expenses due to heightened compensation and technological investments underscores the vital focus on expense management, targeting a 60% efficiency ratio by 2025. Credit conditions are returning to normalcy with expectations of a modest increase in delinquencies and net charge-offs from 2024 levels. However, large diversified banks find themselves in a favorable position thanks to their broad revenue streams and financial resilience, vis-a-vis regional banks that face tighter credit standards.

Strategic Adaptation and Technological Modernization

The overarching goal for banks will be to adapt adeptly to macroeconomic shifts and regulatory implementations such as the Basel III Endgame re-proposal, which calls for strategic recalibration to ensure compliance without sacrificing growth. The detailed 2025 Banking Outlook emphasizes the strategic necessity for technological modernization, particularly leveraging AI to streamline operations, manage cost efficiencies, and propel banking institutions into future-ready entities.

By addressing both immediate financial metrics and underlying technological frameworks, banks are poised for a transformative journey amidst an unprecedented future. This transformation will require a delicate balance between maintaining robust financial health and pioneering innovation in banking services.

Harnessing Insights for Competitive Advantage

Considering these dynamics, banking leaders must strategize effectively to harness these insights. Weighty decisions involving technology investments, compliance expenditures, and workforce management will undeniably shape the banks’ ability to maintain competitiveness and secure growth in a rapidly shifting sectoral ecosystem.The insights from Deloitte’s report serve as a crucial guide for banks aiming to navigate the complexities of 2025 and beyond, ensuring they remain resilient and adaptable in an ever-evolving financial world.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

CRISPR Technology Market Poised for Remarkable Growth to USD 12,461 Million by 2031

CRISPR Technology Market Expected to Surge Beyond USD 12,461 Million by 2031

The global CRISPR technology market is poised for remarkable growth, as reported by Coherent Market Insights. Valued at USD 3,642.1 million in 2024, it is anticipated to soar to USD 12,461 million by 2031, marking a robust CAGR of 19.2%.

Market Dynamics

CRISPR technology, renowned for its precision in gene editing, is revolutionizing gene therapy and research. It has become an essential tool for advancing treatments for various genetic disorders. The surge in demand for genomics research and personalized medicine is fueling this market’s growth.

The technology’s application extends beyond healthcare, finding use in genetically modified crops and innovative research in biological development and disease. Companies like Beam Therapeutics and CRISPR Therapeutics are at the forefront, developing groundbreaking treatments for genetic disorders such as sickle cell disease.

Market Trends

The biotechnology sector is playing a crucial role in supporting the CRISPR technology market. Companies are leveraging CRISPR and other genome-editing tools to develop new therapeutic options. Recent advancements include the development of a CRISPR/Cas9-based therapy for Sickle Cell Disease by CRISPR Therapeutics and Vertex Pharmaceuticals, highlighting the technology’s potential in clinical applications.

Regional Insights

North America is expected to maintain a dominant position in the CRISPR technology market, driven by intensive research and development activities and the presence of key players like Merck KGaA and Thermo Fisher Scientific. The region’s growth is further supported by increased funding from public and private entities.

Challenges and Opportunities

While the CRISPR technology market shows immense promise, it faces challenges such as high costs and ethical considerations. Addressing these challenges is crucial for stakeholders to ensure sustainable growth.

Conclusion

The CRISPR technology market is on a promising trajectory, with significant growth anticipated in the coming years. The advancements in genetic editing, coupled with broader applications in agriculture, healthcare, and industrial sectors, underscore the transformative potential of CRISPR. As the market continues to evolve, it will be imperative for stakeholders to navigate the associated challenges thoughtfully.

Read the original article for more insights.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

Mortgage Rates Rise: A Window for Buyers Amid a Cloudy Future

Mortgage Rates Rise: A Window for Buyers Amid a Cloudy Future

Mortgage rates are climbing, with the 30-year fixed mortgage rate now at 6.64% and the 15-year fixed rate at 5.98%. This increase, reported by Yahoo Finance, suggests a challenging landscape for potential refinancing, but a possible opportunity for homebuyers as competition wanes during the holiday season.

The Current Rate Landscape

According to the latest Zillow data, here are the prevailing national averages:

- 30-year fixed: 6.64%

- 20-year fixed: 6.54%

- 15-year fixed: 5.98%

- 5/1 ARM: 7.27%

- 7/1 ARM: 7.21%

- 30-year VA: 5.99%

- 15-year VA: 5.49%

- 5/1 VA: 6.25%

- 30-year FHA: 5.70%

- 15-year FHA: 5.69%

- 5/1 FHA: 4.88%

Future Predictions and Market Implications

Experts indicate that a significant decline in rates is unlikely before the end of 2024, with 2025’s outlook remaining uncertain. This forecast suggests that those waiting for a drop in rates might be disappointed, making now a strategic time to purchase a home.

For those considering refinancing, the current climate might not be favorable. With refinance rates slightly higher than purchase rates, holding off might be prudent unless necessary for other reasons.

Understanding Mortgage Types

Choosing between mortgage types, such as a 15-year and 30-year mortgage, involves weighing long-term savings against higher monthly payments. Meanwhile, adjustable-rate mortgages (ARMs) could initially offer lower rates but carry the risk of future increases.

Strategies for Lower Rates

To secure a better deal, consider improving your credit score and saving for a larger down payment. Exploring options like discount points or a temporary interest rate buydown might also be beneficial, depending on your long-term plans.

For more insights, visit the original Yahoo Finance article.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

Gene Editing: A Promising Frontier in Biotechnology

Gene Editing: A Promising Frontier in Biotechnology

Gene editing technology is swiftly emerging as a transformative force in both healthcare and agriculture. This innovation, particularly through tools like CRISPR-Cas9, is reshaping the landscape of biotechnology by providing precise methods to modify genes. Such advancements promise to revolutionize the treatment of genetic disorders, cancer, and infectious diseases.Healthcare Innovation and Investment

In healthcare, gene editing is not only enhancing the understanding of disease causes but also paving the way for personalized medicine. The initial high costs and time-consuming processes associated with gene editing have significantly decreased, making production now a matter of days. This reduction has spurred strategic investments in research and development, crucial for advancing new treatments. Venture capital firms and public funding sources have shown keen interest in early-stage biotech companies focused on gene editing. These investments are vital for supporting research, development, and clinical trials, ultimately leading to groundbreaking treatments. Collaborations between biotech startups, pharmaceutical companies, and academic institutions further bolster this progress by sharing costs and accelerating the development of new therapies.Revolutionizing Agriculture

In agriculture, gene editing holds the potential to create stronger, more sustainable, and nutritious crops. By enabling precise modifications to plant genes, scientists can develop crops that resist pests, diseases, and harsh environmental conditions. This technology also offers the possibility of reducing pesticide use, thereby lowering greenhouse gas emissions and promoting biodiversity.Ethical Considerations and Regulatory Frameworks

While the potential of gene editing is immense, it is accompanied by ethical concerns. Debates persist over its use in enhancing human abilities or creating designer children, as well as its potential to exacerbate social inequalities. It is crucial that regulatory frameworks evolve alongside technological advancements to ensure ethical and safe applications of gene editing. Agencies like the FDA play a pivotal role in regulating the approval and sale of gene-edited products.Economic Prospects with Ethical Guardrails

The economic potential of gene editing is substantial, with experts predicting significant market growth driven by research, partnerships, and new therapies. However, ethical considerations must guide investments to ensure responsible and fair use of this technology. As highlighted in the original article from Forbes, an “ethics first, investment second” approach is essential for navigating the complex landscape of gene editing.Conclusion Gene editing technology offers remarkable opportunities for advancing healthcare and agriculture while posing significant ethical challenges. As investments continue to flow into this promising field, it is imperative to balance scientific progress with ethical responsibility to ensure a future where gene editing benefits humanity as a whole.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

Empowering the Gig Economy: AXA’s Tailored Protection

Empowering the Gig Economy: AXA’s Tailored Protection

The gig economy, a burgeoning landscape of non-standard employment forms like gig work, flexi-work, and freelance work, is reshaping the labor market, particularly for Gen-Z. This generation, driven by a thirst for flexibility and autonomy, is at the forefront of this transformation. However, as the South China Morning Post highlights, this shift is not without its challenges.

In Hong Kong, a notable segment of the workforce identifies as self-employed, yet they often find themselves outside the protective embrace of traditional social safety nets. Government data reveals that out of a working population of 3.69 million, 0.29 million are self-employed, a figure that excludes unpaid family workers. This gap leaves many vulnerable to financial risks associated with illness, accidents, and retirement insecurity.

Angela Wong, Chief Marketing and Customer Officer at AXA Hong Kong & Macau, underscores the critical need for comprehensive insurance solutions for gig workers. “Being self-employed shouldn’t be a risk,” she asserts. The lack of health and accident insurance can lead to substantial medical bills, jeopardizing financial stability and forcing gig workers to continue working despite health challenges.

According to a World Bank report, individuals in non-standard employment often remain outside the scope of social insurance schemes. This underscores the importance of formulating policies that extend coverage to these vulnerable segments of the workforce.

AXA is stepping up to fill this gap by offering tailored insurance solutions. By doing so, they aim to provide gig workers with the financial security and peace of mind they need to thrive in this new economy, ensuring that freedom of work comes with a safety net.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

Ethical Deployment of AI in Healthcare: AMA’s Guiding Strategies

The Ethical Landscape of AI in Healthcare

The potential of AI in healthcare is vast and varied, encompassing everything from informing clinical management to autonomously diagnosing diseases. A recent AMA survey revealed that nearly two-thirds of physicians recognize AI’s potential benefits. However, with great potential comes significant risk. The AMA highlights that AI’s integration must be guided by the fundamental principles of medical ethics: patient autonomy, beneficence, nonmaleficence, and justice. The risk of bias at any stage of AI development underscores the need for physician involvement to safeguard these principles.

Physicians’ Role in AI Implementation

Physicians are urged to engage actively with professional organizations to assess AI algorithms specific to their practice, ensuring that these tools align with clinical needs. Engaging in these assessments not only aids in the reliable adoption of AI but also aligns with the standard of care for medical interventions.

Continuous Learning and Vigilance

The AMA’s Ed Hub™ CME series serves as a resource for healthcare professionals to build knowledge and skills necessary for evaluating AI algorithms. Understanding when and how to apply AI, alongside evaluating its performance, is crucial for enhancing patient care.

Legal and Ethical Awareness

As the legal landscape surrounding AI evolves, it is imperative for healthcare professionals to stay informed about changes in laws and regulations. The AMA provides a detailed overview of current governance and regulation, emphasizing the importance of aligning practices with the most current requirements.

Conclusion

The AMA’s efforts to make technology work for physicians reflect a dedication to ensuring that AI serves as an asset rather than a burden. By advocating for ethical and safe AI usage, the AMA paves the way for a future where technology and healthcare coexist harmoniously, benefitting both practitioners and patients.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

AI’s Role in Revolutionizing Medical Education

AI’s Role in Revolutionizing Medical Education

As artificial intelligence (AI) continues to evolve, its integration into medical education is becoming increasingly imperative. AI, which simulates human intelligence, is reshaping various sectors, particularly healthcare. The ability to perform complex tasks, such as diagnostics and personalized healthcare, is no longer confined to human capabilities alone. This shift is prompting educational institutions to rethink their curricula to prepare future healthcare professionals for an AI-driven world.AI’s Transformative Impact on Learning

The recent surge in AI technologies, notably ChatGPT, has revolutionized digital education. These tools promote personalized learning experiences, acting as tutors, writing coaches, and question generators. The integration of AI in medical education offers unique opportunities to enhance learning, close knowledge gaps, and improve patient care.Ethical Considerations in AI Usage

Despite the promising potential of AI, ethical concerns remain prevalent. Issues such as accountability in clinical settings, where AI might err, highlight the need for clear guidelines and roles. It is essential for educational systems to instill ethical AI usage and uphold scholarly integrity among students. The original article from Frontiers emphasizes the importance of addressing these ethical responsibilities.Integrating AI into Curricula

To keep pace with technological advancements, medical schools are encouraged to incorporate AI-based tools into their curricula. This integration can enhance and personalize learning experiences, using AI for clinical communication practice and adaptive e-learning systems. The article suggests that AI literacy programs for both faculty and students are crucial for informed curriculum integration.Institutional Adaptation and Future Prospects

Educational institutions must adapt to the technological landscape by incorporating AI into their systems. This adaptation ensures they remain relevant and do not fall behind. The responsible adoption of AI could transform healthcare services, offering novel methods for training medical professionals. As we embrace AI in education, maintaining vigilance on ethical boundaries is paramount.

Conclusion

AI has emerged as a powerful tool in medical education, offering opportunities to advance healthcare and empower the next generation of professionals. By leveraging AI’s capabilities, medical education can become more personalized and efficient. However, careful attention to ethical considerations, technical infrastructure, and faculty training is essential for the responsible integration of AI into medical education.Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

AI Chatbots in Chronic Disease Diagnosis

Revolutionizing Healthcare: AI Chatbots in Chronic Disease Diagnosis

In a groundbreaking development, artificial intelligence has once again demonstrated its transformative potential, this time within the realm of healthcare. A recent study published in Nature on July 25, 2024, unveils a cutting-edge chatbot named Chat Ella, designed to assist in the diagnosis of chronic diseases. This innovation leverages the power of large language models, specifically the GPT-2, to enhance patient care and streamline diagnostic processes.The Rise of AI in Healthcare

With telemedicine and AI technologies gaining global traction, the healthcare sector is witnessing a paradigm shift. Chronic diseases, which account for a significant portion of healthcare burdens, are now being addressed through innovative solutions like Chat Ella. This chatbot employs advanced AI to interpret patient symptom descriptions, offering preliminary diagnostic insights that can be crucial, particularly in regions with limited medical resources.Chat Ella: A Technological Marvel

Chat Ella is not just another chatbot; it’s a sophisticated system integrated with a comprehensive medical database. By utilizing the GPT-2 model, it provides a conversational interface that engages with patients, delving into symptom details and offering diagnostic recommendations. This development is a testament to the potential of AI in revolutionizing healthcare services by making them more accessible, efficient, and cost-effective.Study Insights and Methodology

The study, conducted by researchers Sainan Zhang and Jisung Song, highlights the integration of large-trained language models in healthcare applications. By employing a rigorous methodology, the team has demonstrated how AI can significantly enhance the diagnostic process. The study’s findings suggest that AI-driven tools like Chat Ella could alleviate the unequal distribution of healthcare resources and reduce the burden on medical professionals.Future Prospects and Enhancements

While Chat Ella represents a significant leap forward, the study acknowledges certain limitations, such as the need for a more extensive dataset and support for multiple languages. The authors propose future updates to include voice input and image recognition features, further broadening the system’s capabilities and usability.Conclusion

As AI continues to evolve, its integration into clinical workflows becomes increasingly vital. Chat Ella exemplifies how AI can complement human decision-making in healthcare, improving patient experiences and reducing economic costs. This technology offers a promising avenue for patients seeking efficient and convenient diagnostic services, particularly those unable to access face-to-face consultations.For more detailed insights, the original article can be accessed on Nature’s website.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

Revolutionizing Genetic Research with CRISPR-Cas Technology

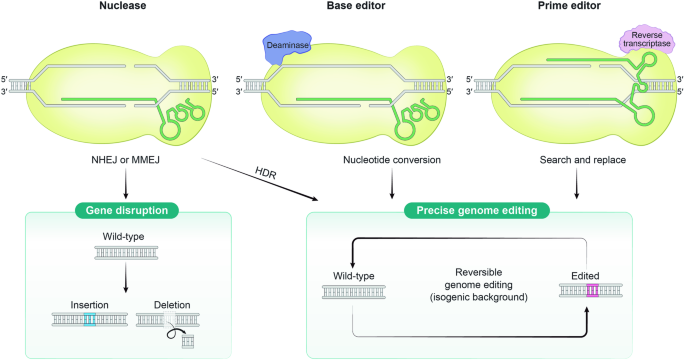

Unlocking the Secrets of Genetic Variants

For years, scientists have grappled with the challenge of deciphering the role of genetic mutations, particularly those classified as variants of unknown significance (VUSs). These mutations, often linked to human diseases, have remained elusive due to limited knowledge about their impact on cellular phenotypes. However, the advent of CRISPR-Cas technology is changing the game.CRISPR-Cas, a precise genome editing tool, allows researchers to manipulate specific DNA sequences with unprecedented accuracy. As noted by Wang and Doudna, this technology is not just a tool but a gateway to understanding the genetic influences on diseases. By facilitating the study of both protein-coding and noncoding regions of the genome, CRISPR-Cas offers a comprehensive approach to unraveling the genetic underpinnings of various conditions.

The Power of High-Throughput Sequencing

The marriage of CRISPR technology with high-throughput sequencing has opened new avenues for functional genomics research. Techniques like Illumina and Oxford Nanopore Technology (ONT) are enabling the detailed analysis of genetic mutations on a massive scale. This integration allows scientists to conduct high-throughput screens, analyzing the functions of numerous genetic mutations simultaneously.Moreover, advancements in single-cell sequencing are enhancing the granularity of genetic studies. By examining individual cells, researchers can gain deeper insights into the specific effects of genetic knockouts and the global changes in gene expression they induce.

CRISPR’s Role in Precision Medicine

The implications of these advancements are profound, particularly in the realm of precision medicine. By providing a detailed understanding of genetic variants, CRISPR-Cas technology holds the potential to transform diagnostic and therapeutic approaches. Researchers are now able to create isogenic disease models, facilitating the accurate analysis of phenotypic changes resulting from specific genetic mutations.Furthermore, the ability to study noncoding regions and regulatory elements expands the scope of genetic research, offering new possibilities for therapeutic interventions targeting genetic disorders at their root.

Challenges and Future Directions

Despite its promise, CRISPR technology is not without challenges. The efficiency of gene editing varies, and the risk of unintended genomic alterations remains a concern. However, ongoing research and technological advancements continue to address these limitations, paving the way for broader applications in various fields.As the scientific community delves deeper into the world of CRISPR-based functional genomics, the potential for groundbreaking discoveries is immense. With each new development, we move closer to a future where precision medicine is not just a possibility but a reality.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

The Impact of Remote Work on Real Estate Investment in India

The Rise of Remote Working

Remote work has shifted traditional office-based environments as more companies adopt flexible work policies. This shift affects the demand for different types of properties, with a notable decrease in the need for commercial spaces and an increase in the appeal of residential setups.Impact on Real Estate Investment

Investors are now prioritizing residential properties, particularly those in suburban and rural areas, which provide spacious environments conducive to home offices. This shift has reinvigorated interest in locations offering enhanced quality of life, breathing space, and amenities that urban centers often lack.The demand for such properties has led to fluctuating real estate prices across different areas. While urban centers witness steady or reducing prices due to lessening demand for commercial offices, suburban and rural regions are experiencing a rise due to increased desirability and potential for appreciation.

Important Considerations for Investors

- Connectivity & Infrastructure: High-speed internet and comprehensive infrastructure are key for appealing property investments.

- Quality of Life: Desirable properties are in areas with high living standards, safety, and community amenities.

- Property Features: Homes with office spaces, natural light, and sufficient outdoor areas are in high demand.

- Market Trends: Keeping up with real estate dynamics is essential for strategic investment.

- Legal & Regulatory Factors: Understanding property laws and zoning regulations is critical to compliance.

- Future Prospects: Long-term area potential hinges on factors like infrastructure projects and economic policies.

- Community Engagement: Areas with active social communities and cultural amenities are attractive to remote workers.

For investors navigating this changing landscape, several critical factors must be considered. Connectivity, particularly high-speed internet, becomes a decisive factor, as does infrastructure support in these regions. Moreover, remote workers value quality-of-life aspects like air quality, safety, and community, pushing investors to lean towards investing in areas rich with these attributes.

Furthermore, staying abreast with market trends is vital. Investors should closely monitor current demand-supply dynamics and future development plans to make informed decisions. A thorough understanding of legal and regulatory demands ensures compliance, while insights into future prospects based on economic growth potential help in identifying high-return opportunities.

In summary, remote work is dramatically reshaping real estate trends in India. By understanding and adapting to these shifts, investors can make savvy decisions, aligning their strategies with this evolving landscape and capitalizing on the burgeoning opportunities that remote working presents.

For more personalized advice, it may be beneficial to explore Buddhist solutions like Feng Shui for your remote workspace, which can enhance productivity and tranquility in home offices.

Have questions or insights on this topic? Feel free to reach out to Jhumur Ghosh, Editor-in-Chief, at jhumur.ghosh1@housing.com.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

Wearable Tech: A New Frontier in Heart Failure Management

Wearable Tech: A New Frontier in Heart Failure Management

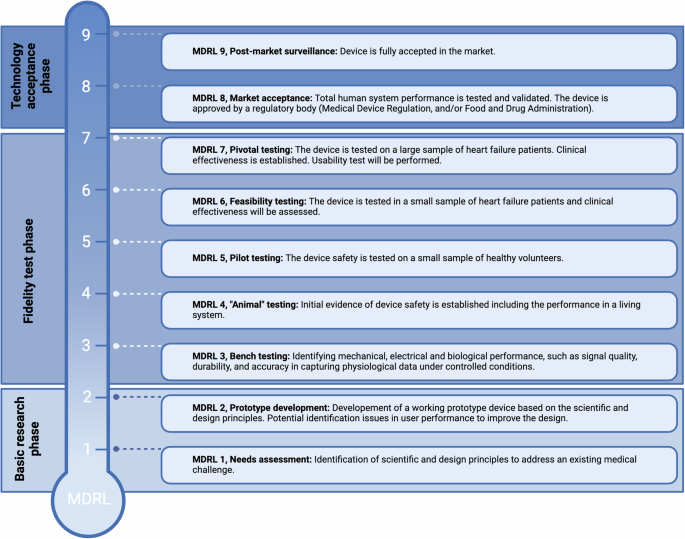

In the bustling corridors of healthcare innovation, a quiet revolution is underway. Wearable technologies are emerging as a beacon of hope for heart failure (HF) management, promising a future where patient care is not just reactive but proactive. As reported in a recent Nature article, these devices are poised to transform how we monitor and manage HF patients.

Potential and Promise

Wearable devices, ranging from accelerometers to ECG and bio-impedance sensors, provide a continuous stream of real-time data. This data is crucial for tracking heart rhythm, rate, and even pulmonary congestion, offering insights that can inform clinical decisions and potentially reduce hospitalizations. The integration of such technology could alleviate the burden on healthcare systems, allowing for more efficient patient care.Current Challenges

Despite their potential, most wearables are still in the feasibility phase, lacking the robust evidence needed to demonstrate substantial clinical benefits. The review highlights the necessity for large-scale randomized controlled trials (RCTs) to validate these technologies. Without such evidence, the adoption of wearables in clinical practice remains limited.Future Directions

The path forward is clear: comprehensive studies across diverse populations are essential. Ensuring that these technologies provide equitable benefits will be key to their success. As researchers like Niels T. B. Scholte and his team at Erasmus Medical Center continue to push the boundaries, the hope is that wearables will soon transition from promising prototypes to integral components of HF management.Conclusion

The journey of wearable technology in heart failure management is just beginning. As the field evolves, the focus must remain on rigorous validation and equitable access. Only then can we unlock the full potential of these innovations, transforming patient care and health outcomes.References

- Disease, G. B. D., Injury, I., & Prevalence, C. Global burden of disease study (2017). Lancet, 392, 1789–1858.

- Savarese, G. et al. Global burden of heart failure. Cardiovasc. Res., 118, 3272–3287 (2023).

- Scholte, N. T. B. et al. Telemonitoring for heart failure. Eur. Heart J., 44, 2911–2926 (2023).

- Seva, R. R. et al. Medical device readiness level. Theor. Issues Erg. Sci., 24, 189–205 (2023).

Contact

For more information, reach out to Niels T. B. Scholte at n.scholte@erasmusmc.nl.Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

Transformative Potential of EV Infrastructure: A Collaborative Approach

Collaborative Efforts for Workforce Development

The collaborative aims to develop a skilled workforce to support the burgeoning EV infrastructure, fostering career pathways in marginalized areas. This initiative is a joint effort among government entities, industry experts, and educational leaders. Key figures, including Justine Johnson, Chief Mobility Officer for Michigan, and Stephanie Piko, Mayor of Centennial, Colorado, co-chaired the taskforce. Federal representatives, such as Gabe Klein from the U.S. Department of Energy and Transportation, also participated, highlighting the importance of leveraging NEVI funding for workforce development.

Key Discussions and Strategies

Over the course of two days, the event featured in-depth discussions on building a talent pipeline and creating inclusive workforce strategies. Abigail Campbell Singer from Siemens USA shared insights from the EVeryone Charging Forward initiative, emphasizing the need for inclusive EV workforce development. Other discussions highlighted the role of educational institutions and industry leaders in supporting a diverse EV workforce through technical certificate programs and pre-apprenticeship courses.

Moving Forward: Innovation and Collaboration

The meeting concluded with a call for continued innovation and collaboration. Policymakers, educators, and industry leaders were urged to work together to ensure equitable opportunities arising from EV advancements. Plans to develop resources and working groups were initiated to address data and action gaps identified during the event.

By fostering these discussions, the EV Workforce Collaborative is committed to ensuring that America’s shift to electric vehicles is paralleled by the creation of skilled, equitable employment opportunities, supporting a sustainable and inclusive economic transition for all communities.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

Parametric Insurance: A New Frontier in Climate Risk Management

Parametric Insurance: A New Frontier in Climate Risk Management

In the face of escalating climate challenges, risk managers are increasingly turning to parametric insurance as a vital tool to supplement traditional property programs. This innovative approach, grounded in an “if-then” model, offers a strategic advantage by aligning capital more effectively with the unpredictable nature of natural disasters.

Climate Change and Insurance Challenges

The impact of climate change is undeniable, with a marked increase in both the frequency and severity of natural catastrophes. According to Aon’s insights, the traditional insurance market is struggling to keep pace, leaving significant economic exposures unaddressed. This is where parametric insurance steps in, offering a tailored solution that extends beyond mere physical damage to cover broader economic impacts.The Mechanics of Parametric Insurance

Parametric insurance operates on three core principles:- The “if”: Coverage is triggered by specific, independent events, as verified by neutral third-party data, which streamlines the underwriting process.

- The “then”: Once triggered, pre-agreed payouts are swiftly executed, often within ten days, providing critical liquidity during crises.

- Closing the Protection Gap: This model makes previously uninsurable risks insurable, bridging the gap with contingent capital.

Expanding Applications

Parametric solutions are particularly effective for “grey swan” events—unpredictable but impactful occurrences like hurricanes, earthquakes, and severe weather. As these events become more common, businesses are integrating parametric insurance into their risk management portfolios, freeing up capital and enhancing resilience.Moreover, the flexibility of parametric insurance allows it to address other exogenous risks, such as pandemics and cloud service outages, by leveraging independent data to define clear triggers.

Conclusion

As the climate continues to present complex challenges, parametric insurance emerges as a transformative force in risk management. By offering rapid, reliable financial responses to disasters, it provides a crucial buffer for businesses navigating an increasingly volatile world.Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

National Association of REALTORS® 2024 Survey Highlights Green Revolution in Real Estate

Green Data Fields: Illuminating Sustainable Features

The inclusion of green data fields signifies a transformative change in how residential properties are presented. These fields serve as guiding lights for buyers interested in earth-friendly homes, ensuring that sustainable features are highlighted and easily accessible.Education Empowers: Embracing Sustainable Practices

Education plays a crucial role in this green transition. The survey reveals that 25% of residents in homes with sustainable features have received training related to these aspects. This growing understanding of energy-efficient appliances, renewable energy systems, and environmentally-friendly building materials empowers real estate agents to champion green living and cater to eco-conscious clients.

Energy Efficiency: A Valuable Asset

The emphasis on energy efficiency is evident, with over half of the respondents acknowledging its importance in property listings. This focus is crucial for attracting buyers and enhancing the marketability of homes, as demand for sustainable living solutions continues to rise.Client Interest: A Shift Towards Sustainability

Nearly half of the respondents noted a growing interest in sustainability from their clients, indicating a broader societal movement towards eco-conscious living. By aligning with these evolving priorities, REALTORS® are not only facilitating transactions but also advancing environmental sustainability.Green Certifications: Dispelling Myths

The survey dispels common myths that green certifications hinder marketability. Over 40% of green-certified homes did not experience prolonged time on the market, showcasing the acceptance of eco-friendly certifications among buyers.Client Priorities: Comfort Meets Consciousness

Clients are increasingly prioritizing features like windows, doors, and living spaces alongside sustainability in homes. This dual focus underscores the need for holistic design approaches that balance environmental responsibility with quality of life.High-Performance Homes: Investing in the Future

The survey reveals that 13% of high-performance homes command a 1% to 5% premium over their non-high-performance counterparts. This financial incentive highlights the value of investing in homes that prioritize comfort, health, and operational efficiency.Direct Involvement: Driving Change

A significant majority of respondents have been directly involved with properties featuring green elements in the past year, reflecting the proactive steps the real estate industry is taking to integrate sustainability into residential transactions.Conclusion: A Green Horizon Beckons

The NAR 2024 Sustainability Report outlines a promising landscape for sustainable real estate. With the integration of green data fields and increasing client interest in eco-friendly homes, the sector is poised to lead the transition towards a greener future. By emphasizing education, advocating energy efficiency, and engaging with green properties, real estate professionals are setting the foundation for a more sustainable market.Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

AI’s Transformative Role in Healthcare: A New Era

AI’s Transformative Role in Healthcare: A New Era

In the ever-evolving landscape of healthcare, Artificial Intelligence (AI) is emerging as more than just a tool—it’s a transformative force reshaping the industry. Visionaries like Vinod Khosla have long predicted AI’s potential to revolutionize healthcare, and that potential is now being realized. The shift from human-centered care to AI-driven systems is becoming a reality, as AI technologies begin to outperform traditional methods, particularly in areas requiring precision and data processing.As Kris Pahuja, co-founder of the Y-Combinator backed startup Piramidal, observes, AI is making significant strides in healthcare. From X-Ray to MRI imaging, AI “co-pilots” are becoming standard in assisting physicians with decision-making. This evolution is evident in complex environments like the ICU, where AI’s integration is proving invaluable.

From Data to Diagnosis: AI’s Precision

AI’s unmatched ability to analyze vast amounts of data is more than just automation; it represents a profound change in medical diagnostics. As noted in a Fortune article, AI could potentially take over up to 80% of standard medical tasks, reducing errors and biases that can occur in human diagnosis. This leads to better patient outcomes, particularly in fields like radiology and pathology, where AI aids in the early detection of diseases such as cancer.Moreover, AI’s integration into diagnostics is advancing global healthcare equity. AI-driven tools can be deployed in under-resourced areas, providing high-quality diagnostics where specialized medical professionals are scarce. This democratization of healthcare could be key in reducing global health disparities.

Personalized Medicine: Tailoring Treatment with AI

AI’s role in personalized medicine is among its most promising applications. By analyzing genetic profiles and real-time health data, AI enables treatments tailored to individual patients. This shift from a one-size-fits-all approach reduces adverse reactions and enhances treatment effectiveness. Research published in Nature Humanities and Social Sciences Communications highlights AI’s role in driving precision healthcare, where treatments are increasingly customized based on biological markers, environmental factors, and lifestyle choices.Additionally, AI is accelerating drug development. Pharmaceutical companies are leveraging AI to analyze large datasets from clinical trials, identifying potential new drug candidates more quickly and accurately than traditional methods. This faster drug discovery process could lead to more effective treatments reaching patients sooner.

AI in Patient Care Management

AI’s potential in patient care management is substantial. By continuously monitoring patient health data, AI systems can predict potential health issues and provide timely interventions, shifting healthcare from a reactive model to a proactive one. This proactive approach not only improves patient outcomes but also reduces long-term healthcare costs.AI-powered predictive analytics also play a crucial role in preventive care, identifying patients at risk of developing conditions like diabetes or hypertension long before symptoms appear. This early intervention strategy can prevent the onset of these diseases, significantly reducing the burden of chronic illnesses.

Ethical Considerations and Challenges

Integrating AI into healthcare is not without challenges, particularly concerning privacy, security, and ethics. AI systems require vast data to function effectively, raising concerns about data breaches and privacy. Additionally, as AI systems make more autonomous decisions, ethical questions arise, such as who is responsible for incorrect diagnoses or treatment recommendations made by AI. These are complex issues that healthcare providers and regulators must address as AI becomes more prevalent in the industry.The IQVIA blog also underscores the ethical implications of AI in healthcare beyond data privacy and decision-making. AI’s use in patient care could lead to the dehumanization of healthcare, where decisions may become overly data-driven, potentially overlooking the nuances of human empathy and judgment.

Integrating AI: A Strategic Approach

For healthcare leaders eager to embrace AI, a strategic, phased approach is recommended. Begin by identifying specific areas where AI can deliver immediate value and launch pilot projects to test and refine these tools. It’s essential to build a multidisciplinary team that includes clinicians, data scientists, and ethicists to ensure that AI solutions are both effective and ethically sound.Equally important is addressing privacy, security, and ethical concerns upfront. Leaders should establish strong data governance frameworks to protect patient information and ensure transparency in how AI systems are used. Engaging with patients and stakeholders about the benefits and safeguards of AI is crucial for maintaining trust.

A New Era of Healthcare

The future of healthcare lies in the seamless integration of AI technologies as partners in care, not just tools. AI is set to reshape healthcare by improving outcomes, reducing costs, and enabling personalized care. As AI continues to advance, it will redefine the relationship between patients and healthcare providers, making care more efficient, effective, and personalized.Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

AI Pioneers a New Era in Drug Development and Diagnostic Accuracy

AI Medical Tools Revolutionize Healthcare Landscape

In a groundbreaking development, scientists at Wayne State University are pioneering artificial intelligence models to significantly reduce costs in complex drug design. This initiative focuses on creating new medications, particularly those involving complex drug types traditionally challenging to simulate.Alice Walker, an assistant professor of chemistry at Wayne State, emphasized the potential of these AI models in a recent news release. “Most drug design is done with small organic molecules,” she explained, highlighting the difficulties with unusual drug scaffolds like sugars and fluorescent molecules. Her team aims to develop new computational techniques to address these challenges, potentially leading to breakthrough treatments with fewer side effects.

AI Outperforms Human Doctors in Diagnostics

A Stanford University study has revealed a remarkable achievement by ChatGPT-4, which scored a 92% accuracy rate in medical diagnostics, outperforming traditional physicians who scored 74%. This significant finding, published in JAMA Network Open, underscores the transformative potential of AI in healthcare.Despite these advancements, the study noted that doctors with access to ChatGPT did not show substantial improvement in diagnostic reasoning, although they completed assessments more swiftly. Co-lead author Ethan Goh, a postdoctoral scholar at Stanford, remarked in a blog post that while AI won’t replace doctors, it could greatly enhance their capabilities.

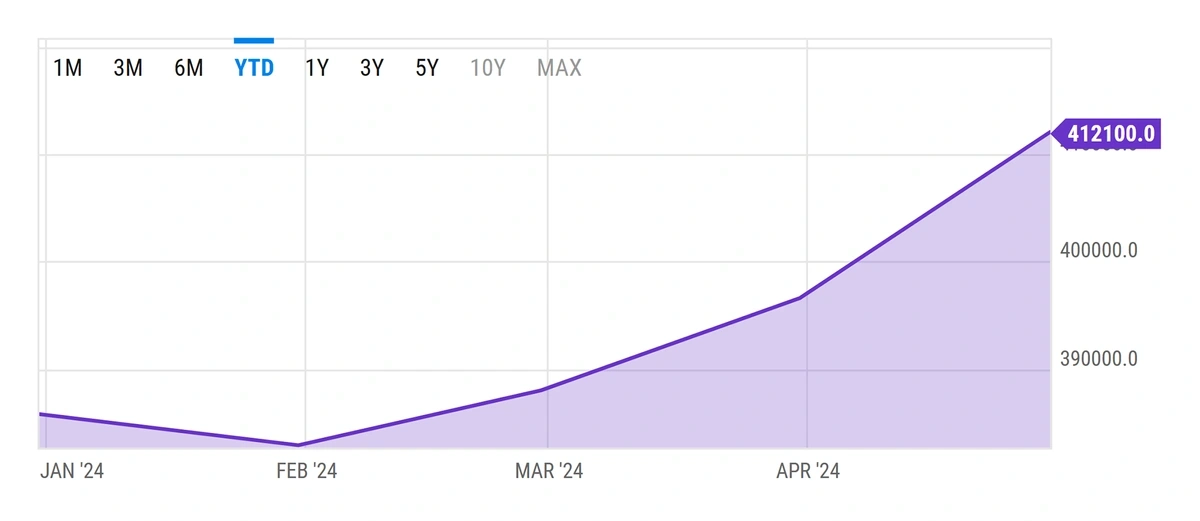

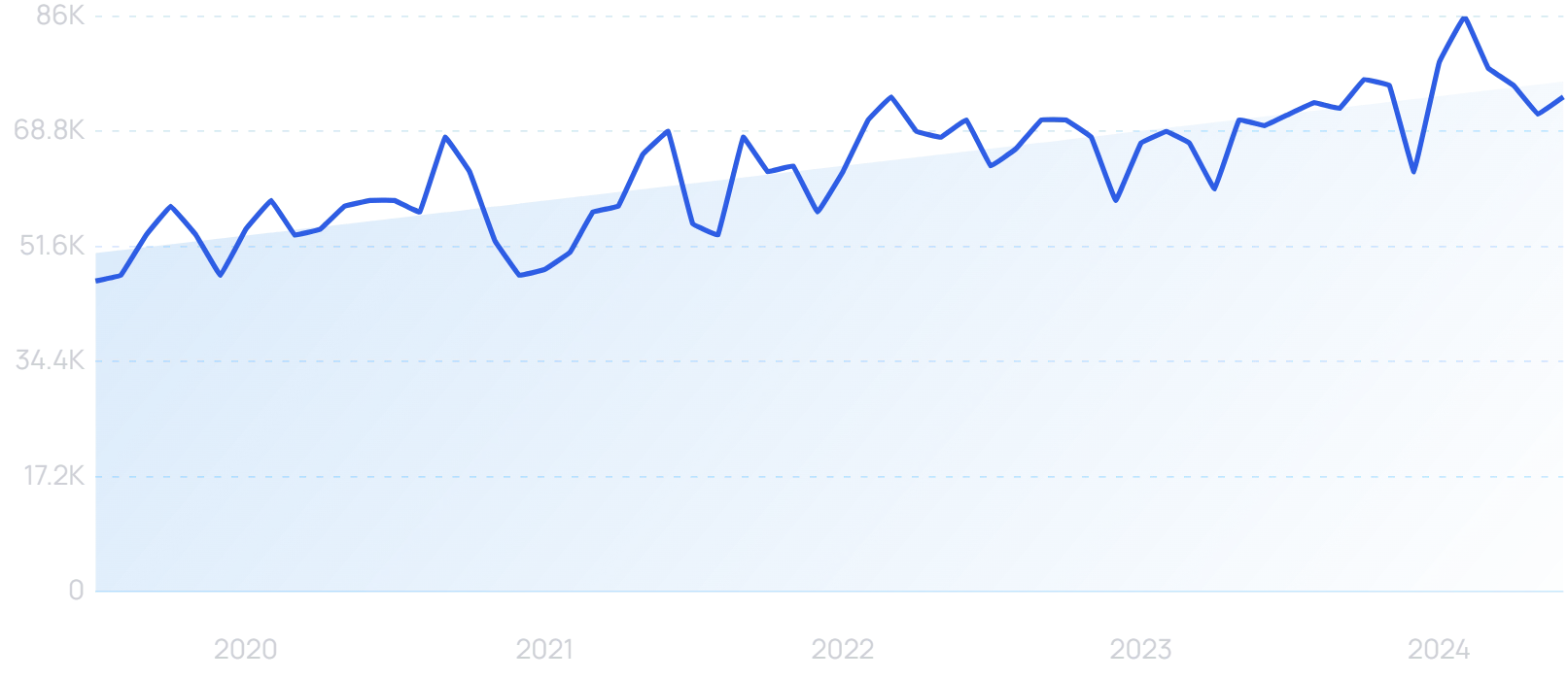

Health Tech Sector Experiences Robust Growth

The health tech sector has witnessed a 12% rise in stocks in 2024, buoyed by substantial investments in AI, according to Bessemer Venture Partners’ annual report. The report highlights that AI-focused companies now attract 38% of venture capital in healthcare, with valuations soaring up to five times higher than their non-AI counterparts.Despite this growth, early-stage funding challenges persist, with Series A companies taking 50% longer to secure capital compared to previous years. Bessemer partners Sofia Guerra and Steve Kraus noted the sector’s “remarkable adaptability and strength in the face of ongoing market challenges.”

For more insights on AI advancements, subscribe to the PYMNTS AI Newsletter.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

AI Revolutionizes the Real Estate Industry

AI Revolutionizes the Real Estate Industry

In a world where technology is reshaping industries at an unprecedented pace, the real estate sector is not left behind. Artificial Intelligence (AI) is proving to be a game-changer, optimizing and automating processes that enhance customer satisfaction and decision-making. The integration of AI is facilitating a paradigm shift in property management, investment strategies, and customer interactions.AI’s capabilities extend to automating administrative tasks and enhancing property valuation, heralding a new era of growth and efficiency for the real estate industry. As highlighted in a recent Appinventiv article, AI applications and tools, such as virtual tours and property management software, underscore its influence and potential in reshaping industry norms.

Transformative AI Applications in Real Estate

The article explores numerous AI applications, including virtual property tours, lead generation, and property valuation automation. AI acts as a catalyst for market change, offering personalized experiences to buyers and sellers, automating repetitive tasks, and optimizing operations for enhanced efficiency.Companies like Zillow and Trulia are at the forefront of this revolution, leveraging AI to offer property value estimates and personalized recommendations, respectively. Zillow’s use of neural networks to analyze digital photos and generate property estimates exemplifies AI’s transformative power. Meanwhile, Trulia’s AI-powered platform enhances user experience by analyzing behavior and preferences to provide tailored property suggestions.

The Future of AI in Real Estate

The future of real estate is inextricably linked with AI and machine learning. As the industry continues to evolve, stakeholders must remain informed about technological advancements to maintain a competitive edge. The synergy between AI and real estate will streamline operations, improve decision-making processes, and boost overall efficiency.AI’s capacity to swiftly analyze extensive datasets empowers real estate professionals in making informed decisions, effectively managing risks, and seizing competitive opportunities. This integration is set to undergo further transformative evolution, intersecting with emerging technologies such as blockchain, robotics, and cloud computing. Together, these technologies promise to revolutionize property transactions, enhance security, automate processes, and create immersive virtual experiences.

Conclusion

As AI continues to revolutionize the real estate industry, its integration into workflows not only redefines standards but also drives innovation and sustainable growth. For companies aiming to redefine property management and leverage digital advancements, AI is a pivotal technology.For more insights into how AI is transforming the real estate industry, visit the original article on Appinventiv.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

The Power of Real Estate Designations and Certifications

The Power of Real Estate Designations and Certifications

The National Association of REALTORS® (NAR) offers a suite of designations and certifications that elevate the professional standards of REALTORS® across the globe. These specialized credentials are designed to enhance the skills, proficiency, and knowledge of real estate professionals, distinguishing them as experts in their respective fields.Understanding Designations and Certifications

Designations and certifications serve as vital tools for REALTORS® aiming to advance their careers. While both require NAR membership, there are distinct differences. Designations entail annual dues and a commitment to ongoing education, offering extensive benefits that are regularly updated. Certifications, on the other hand, require only an application fee and do not demand annual dues.Highlighted Designations and Certifications

- Accredited Buyer’s Representative (ABR®): This designation, presented by the Real Estate Buyer’s Agent Council, equips REALTORS® with the skills to represent homebuyers effectively. More details can be found here.

- Certified Commercial Investment Member (CCIM): Recognized as the global standard for commercial real estate achievement, the CCIM designation involves a rigorous curriculum and a network of 13,000 professionals worldwide. Learn more here.

- Seller Representative Specialist (SRS): This designation is the premier credential for seller representation, enhancing REALTORS®’ ability to advocate for sellers. More information is available here.

- At Home With Diversity® (AHWD): This certification teaches REALTORS® how to work effectively in today’s diverse real estate market. Details can be found here.

The Importance of Professional Development

The NAR’s commitment to professional development is evident through its extensive range of programs and services. These initiatives are designed to ensure REALTORS® are equipped with the latest skills and knowledge, enabling them to provide exemplary service to their clients. By investing in these credentials, real estate professionals not only enhance their expertise but also gain a competitive edge in the marketplace.Conclusion

In an ever-evolving real estate landscape, the importance of continuous learning and professional development cannot be overstated. The NAR’s designations and certifications offer REALTORS® the opportunity to stay ahead, ensuring they remain trusted advisors in their respective markets.Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.