How Hybrid Work Models Shape the Future of Commercial Real Estate

The Remote Work Revolution

As the pandemic unfolded, office occupancy in major US markets plummeted by a staggering 90% from late February to March 2020. Although there was a partial recovery by the end of 2023, occupancy rates remain at approximately half of their pre-pandemic levels. The ongoing uncertainty surrounding remote work continues to dampen office occupancy, lease revenue, and renewal rates in the commercial real estate sector.

Hybrid Work: A Glimmer of Hope

Despite these challenges, the hybrid work model offers a glimmer of hope. The researchers found that companies expecting employees in the office only one day per week saw a 41% drop in office space demand from 2019 to 2023. In contrast, demand fell by just 9% for those with staff onsite two to three days per week and even grew by 1% for companies with a four to five-day office presence.

Economic Implications

The economic ramifications of declining office values are significant. New York, for instance, experienced the largest dollar decline in office space value, with a $90 billion drop from December 2019 to December 2023. Looking ahead, projections suggest that New York’s office values could remain 47% to 67% below 2019 levels, depending on future workplace norms.

Adapting to Change

The research underscores the importance of adaptation. A “flight to quality” has seen newer office buildings with more amenities fare better, as companies strive to enhance office quality to entice workers back. Moreover, the conversion of vacant office spaces into multifamily residential units is proposed as a viable solution to address vacancies. Programs like New York’s Office Conversion Accelerator are already working toward this goal.

Fiscal Challenges for Urban Areas

The decline in office values has far-reaching implications for urban areas, where taxes from commercial real estate contribute about 10% of overall tax revenue. As tax revenue declines, cities may face tough choices: raising other tax rates or cutting government spending on services, potentially making them less attractive places to live.

This insightful analysis from the University of Chicago Booth School of Business serves as a clarion call for stakeholders in the commercial real estate sector to navigate these changes strategically and creatively.

More Articles

Getting licensed or staying ahead in your career can be a journey—but it doesn’t have to be overwhelming. Grab your favorite coffee or tea, take a moment to relax, and browse through our articles. Whether you’re just starting out or renewing your expertise, we’ve got tips, insights, and advice to keep you moving forward. Here’s to your success—one sip and one step at a time!

Flexible Office Sector Booms Amid Hybrid Work Evolution

The flexible office sector is on an upward trajectory, continuing to expand as hybrid work models evolve. According to a recent report from CoworkingCafe, the coworking inventory grew by an impressive 13% in square footage year-over-year as of the third quarter of 2024. This surge is further underscored by a 22% increase in the total number of coworking spaces during the same period.

Suburban and tertiary markets are particularly experiencing significant growth in coworking spaces. Hybrid employees, seeking to avoid lengthy commutes, are increasingly opting to work closer to home. Notably, New Jersey, one of New York’s major suburban markets, saw its coworking space inventory swell by 36% year-over-year, reflecting the robust demand in these regions.

This trend is highlighted in the original article published by Globest, which outlines the continued expansion of flexible office spaces. The article emphasizes how changing work preferences and technological advancements are driving this growth, with expectations for the trend to persist through 2025.

Key Trends and Observations

- The flexible office sector is expanding due to evolving work dynamics.

- Suburban markets are witnessing a rise in coworking spaces as employees seek proximity to home.

- Technological advancements are playing a crucial role in supporting this growth.

As we move forward, the flexible office sector is poised for continued growth, adapting to the needs of a changing workforce. For more detailed insights, visit the full article on Globest.

Navigating North Jersey’s 2025 Real Estate Market: A Forecast for Steady Growth

In the ever-evolving landscape of North Jersey’s real estate market, 2025 promises to be a year of continued growth, albeit at a more measured pace. According to insights from a recent Bergen Record article, home values in New Jersey have been on a consistent upward trajectory. However, the rate of increase is expected to slow, with projections indicating a rise of just 2% to 4% in 2025.

Interest rates are another crucial factor influencing the market. The Federal Reserve’s decision to implement two interest rate cuts in 2024 has brought mortgage rates down from their peak of 8% to a more manageable range of 6% to 7%. This shift is likely to benefit both current homeowners looking to relocate and first-time buyers.

Despite these positive trends, homeowners should brace for a potential rise in home insurance premiums. Factors such as increased property values, inflation, and the growing frequency of national disasters are expected to drive premiums up. A survey by Fitch Ratings reveals that 56% of experts anticipate insurance price hikes in 2025.

The demographic profile of homebuyers is also shifting. The median age for first-time homebuyers reached a record high of 38 years in 2024, according to the National Association of Realtors. This trend is expected to persist as buyers take longer to save for their purchases amid rising home values.

Meanwhile, the rental market in the greater New York metropolitan area is poised for modest rent increases in 2025. Although there has been a nationwide decline in rent prices, the demand for rentals in this region continues to outstrip supply, particularly as more people move from cities to suburban areas seeking more space.

For those interested in further details, the original article from the Bergen Record provides a comprehensive overview of these trends and more. As the North Jersey real estate market continues to evolve, staying informed will be key for both buyers and sellers navigating this dynamic environment.

How Hybrid Work Models Shape the Future of Commercial Real Estate

The Remote Work Revolution

As the pandemic unfolded, office occupancy in major US markets plummeted by a staggering 90% from late February to March 2020. Although there was a partial recovery by the end of 2023, occupancy rates remain at approximately half of their pre-pandemic levels. The ongoing uncertainty surrounding remote work continues to dampen office occupancy, lease revenue, and renewal rates in the commercial real estate sector.

Hybrid Work: A Glimmer of Hope

Despite these challenges, the hybrid work model offers a glimmer of hope. The researchers found that companies expecting employees in the office only one day per week saw a 41% drop in office space demand from 2019 to 2023. In contrast, demand fell by just 9% for those with staff onsite two to three days per week and even grew by 1% for companies with a four to five-day office presence.

Economic Implications

The economic ramifications of declining office values are significant. New York, for instance, experienced the largest dollar decline in office space value, with a $90 billion drop from December 2019 to December 2023. Looking ahead, projections suggest that New York’s office values could remain 47% to 67% below 2019 levels, depending on future workplace norms.

Adapting to Change

The research underscores the importance of adaptation. A “flight to quality” has seen newer office buildings with more amenities fare better, as companies strive to enhance office quality to entice workers back. Moreover, the conversion of vacant office spaces into multifamily residential units is proposed as a viable solution to address vacancies. Programs like New York’s Office Conversion Accelerator are already working toward this goal.

Fiscal Challenges for Urban Areas

The decline in office values has far-reaching implications for urban areas, where taxes from commercial real estate contribute about 10% of overall tax revenue. As tax revenue declines, cities may face tough choices: raising other tax rates or cutting government spending on services, potentially making them less attractive places to live.

This insightful analysis from the University of Chicago Booth School of Business serves as a clarion call for stakeholders in the commercial real estate sector to navigate these changes strategically and creatively.

MetaWealth: Transforming Real Estate Investment with Blockchain

In the fast-paced world of tech funding, where attention often shifts from one buzzword to another, blockchain technology continues to quietly revolutionize industries, despite the current spotlight on AI. A prime example of this evolution is MetaWealth, a startup that is transforming real estate investment through blockchain technology.

In a recent episode of “TechTalk with TFN,” Jack Land, Head of Marketing and UK Growth for MetaWealth, shared insights on how the company is democratizing real estate investment. With their platform, individuals can invest in real estate with as little as $100, utilizing blockchain to tokenize these investments. This not only simplifies the investment process but also makes it accessible to a broader audience.

Revolutionizing Real Estate Investment

“Real estate is a cornerstone of a well-rounded portfolio,” Land explained. “But accessing worthwhile deals is incredibly difficult.” MetaWealth aims to change this by allowing investments to be completed in less than ten minutes, regardless of the investor’s location. This approach is about accessibility and inclusivity, ensuring that property investment is no longer exclusive to high-net-worth individuals.

Founded by Amr Adawi, Darren Carvalho, and Michael Topolinski, MetaWealth is experiencing rapid growth. The company is currently raising funds to further expand its platform, which already serves investors from approximately 25 different countries. Land emphasized their commitment to tackling wealth disparity and promoting diversity by offering educational resources to help investors understand their investments.

Blockchain’s Emerging Role

Despite the challenges facing the Web3 sector, blockchain’s adoption by major companies like Visa and PayPal signals a growing confidence in its potential. MetaWealth is at the forefront of making blockchain technology accessible, aiming to reshape the fintech industry. Based in London, MetaWealth is strategically positioned at the heart of Europe’s tech scene, ready to lead the next wave of fintech innovation.

The future of real estate investment is intertwined with Web3, and MetaWealth is poised to be a key player in this transformation. As blockchain technology matures, MetaWealth’s model demonstrates the potential for technological advancements to create a more inclusive financial landscape.

For more detailed insights, you can read the original article on Tech Funding News.

AI Revolutionizes Facility Management Amidst Labor and Efficiency Challenges

Cupertino, CA — Facility management is at a crossroads, facing unprecedented challenges that threaten its very foundation. Overwhelmed by labor shortages and operational inefficiencies, facility managers are turning to artificial intelligence (AI) as a lifeline. According to a recent survey by QByte AI, AI-powered tools are rapidly reshaping the landscape of facility management in 2025.

The survey highlights that a staggering 80% of managers spend excessive hours hunting for information, while 60% are burdened by unsustainable workloads. This has led to a troubling trend, with 40% contemplating leaving their roles. These statistics underscore a crisis in the industry, demanding immediate attention.

AI is emerging as a beacon of hope. By providing instant access to maintenance data through simple prompts, enabling proactive monitoring, and improving real-time collaboration, AI is poised to alleviate the pressures faced by maintenance teams. As noted by industry expert Sam Manjunath, cofounder of QByte AI, “With facility teams stretched thin, the industry is rapidly embracing AI to remove manual workload burdens.”

The integration of AI-driven Computerized Maintenance Management Systems (CMMS) is transforming how facility managers operate. Companies are investing in AI to streamline operations, reduce unplanned downtime, and enhance overall efficiency. The adoption of AI technologies, such as those developed by QByte AI, is not just a trend but a necessary evolution.

Kim Anderson, a seasoned facility manager, experienced firsthand the transformative power of AI during a critical HVAC system failure. With maintenance records scattered across multiple systems, AI-enabled tools provided the timely insights needed to address the crisis efficiently. “Having AI-powered tools right at my fingertips felt like a breath of fresh air—suddenly, I could focus on what truly mattered instead of drowning in endless details,” Anderson remarked.

This shift towards AI is not only a response to labor shortages but also a strategic move to enhance operational efficiency. As companies navigate the complexities of modern facility management, AI offers a sustainable solution to the challenges of today and tomorrow.

For further insights into how AI is reshaping facility management, the original article can be accessed here.

Blockchain to Revolutionize Pakistan’s Land Management

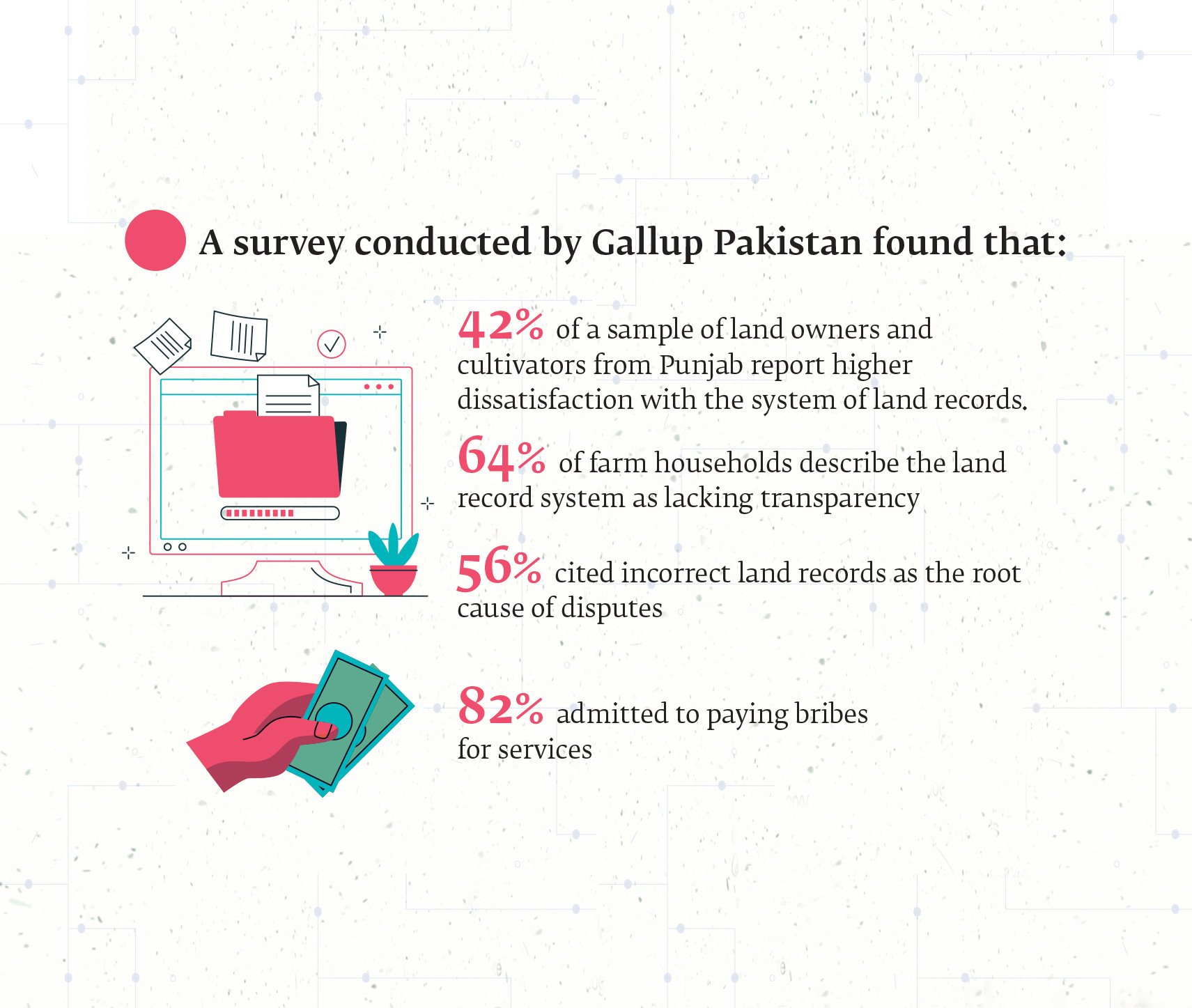

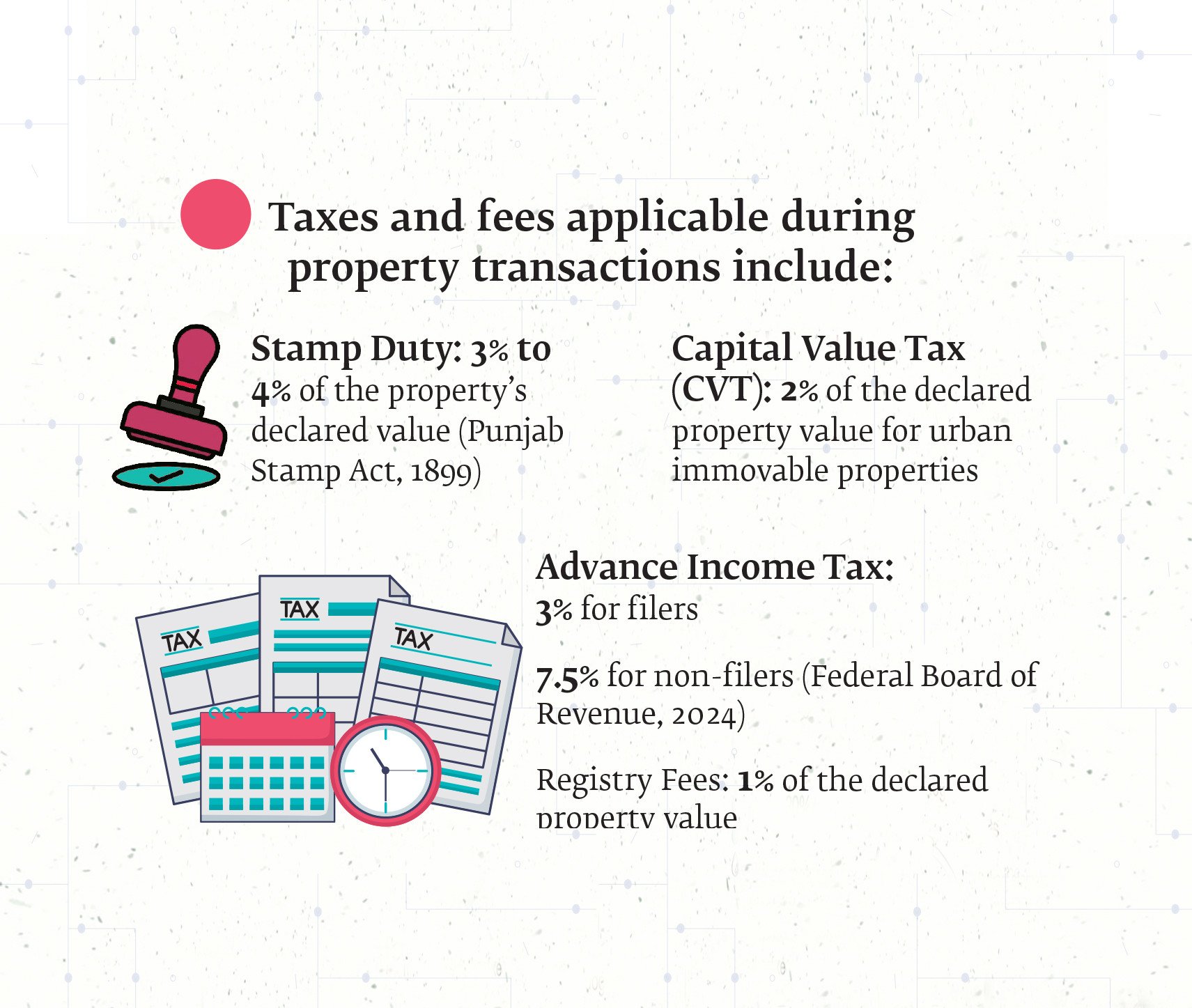

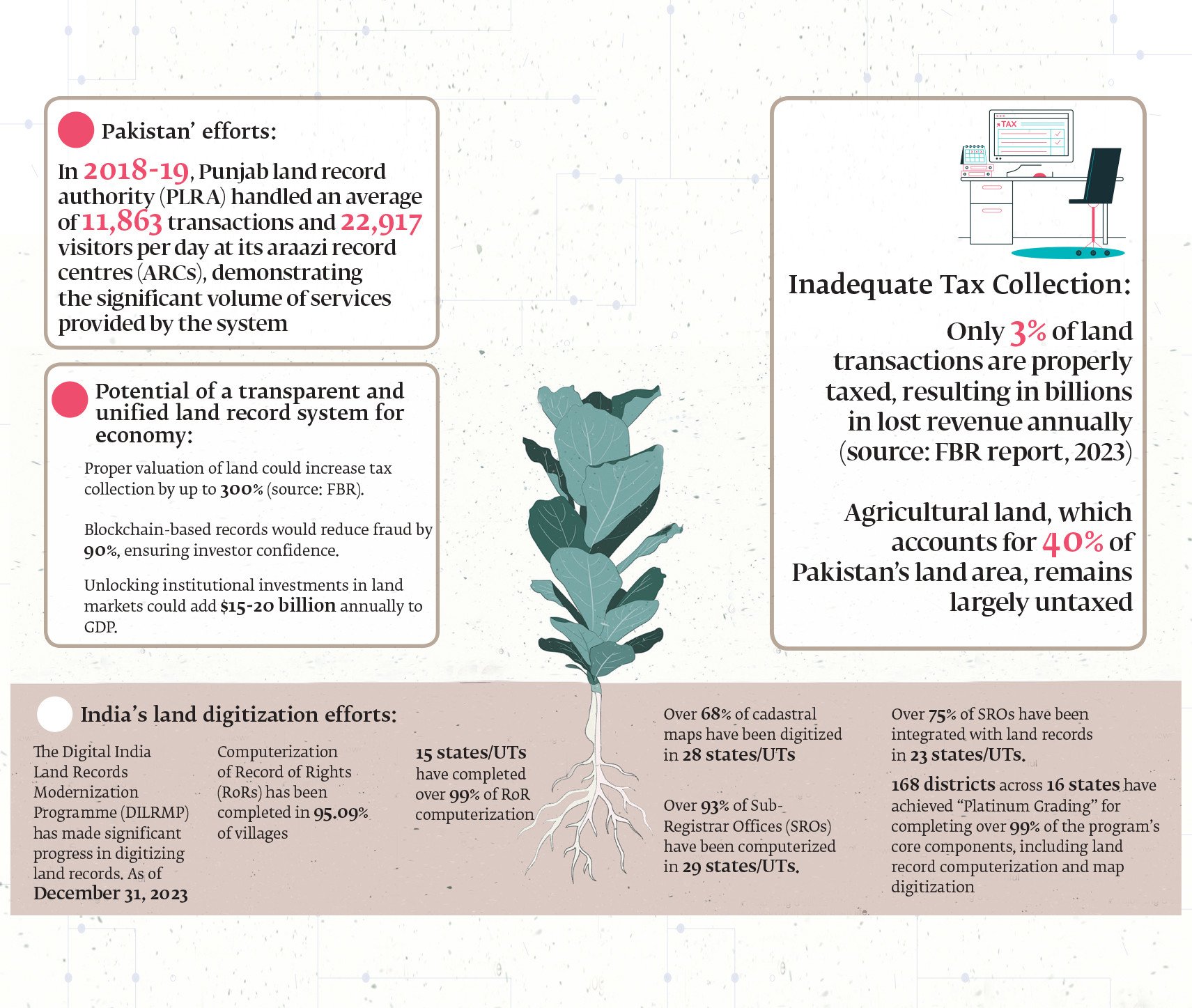

In the heart of Pakistan’s bustling cities and sprawling rural landscapes lies a persistent challenge that has long stifled economic growth and social stability: land management. For decades, the system has been mired in inefficiencies, corruption, and outdated colonial-era practices, leaving millions frustrated and the nation’s economic potential untapped.

Efforts to modernize this convoluted system have been made, notably through initiatives like Punjab’s Land Record Management Information System (LRMIS). However, these efforts remain fragmented and limited in scope. The slow pace of digitization and the continued reliance on manual records mean that the full benefits of these initiatives are yet to be realized. According to a recent article in The Express Tribune, the ongoing challenges in land ownership and management are a significant hurdle to Pakistan’s progress.

Blockchain: A Beacon of Hope

Amidst these challenges, blockchain technology emerges as a promising solution. Known for its secure and transparent nature, blockchain could revolutionize land management in Pakistan by ensuring clear and immutable land titles. This technology has the potential to reduce corruption and fraudulent transactions, offering a path towards a more efficient and equitable system.

International examples provide a blueprint for success. Georgia’s blockchain land registry, for instance, has been hailed as a triumph in transparency and fraud prevention. By storing land records on an immutable digital ledger, Georgia has effectively eliminated disputes arising from document manipulation. This model offers valuable lessons for Pakistan, highlighting the transformative potential of blockchain in governance.

Challenges and the Road Ahead

Despite its promise, implementing blockchain in Pakistan is not without challenges. Political resistance, bureaucratic inertia, and a lack of technical expertise pose significant hurdles. Moreover, vested interests benefiting from the current system’s opacity are likely to oppose such reforms. Overcoming these obstacles will require strong political will and collaboration across federal and provincial levels.

To pave the way for blockchain adoption, Pakistan must first consolidate existing digitization efforts, integrating provincial databases into a unified national platform. Legislation should standardize land valuation methods, eliminating disparities and closing loopholes that allow tax evasion. Public awareness campaigns will also be crucial in ensuring widespread adoption and trust in the new system.

Conclusion: A Call for Urgent Reform

The inefficiencies in Pakistan’s land management system have persisted for too long, hindering economic growth and legal transparency. However, with the right reforms and the adoption of cutting-edge technology, Pakistan has the potential to revolutionize its land administration. By learning from global examples and embracing blockchain’s capabilities, the country can unlock billions in economic value, boost investor confidence, and strengthen tax revenues.

The need for reform is urgent — Pakistan cannot afford to let its land management crisis continue unchecked. As highlighted in The Express Tribune, the time for action is now.

Ocean City Council Enacts New Short-Term Rental Restrictions

Ocean City, Md. – In a decisive move, the Ocean City Council has approved new restrictions on short-term rentals, despite opposition from over 200 residents. The council’s decision came after a comprehensive review of community concerns and potential impacts on local neighborhoods.

Occupancy Limits Enforced

The newly approved occupancy proposal limits the number of guests in rental units to two people per bedroom, plus an additional two occupants. Significantly, children under 10 years old are not counted in this total. The ordinance also prohibits the conversion of attics, garages, and other non-bedroom spaces into bedrooms unless they comply with town permitting requirements. This measure aims to maintain the integrity of residential areas and align with the town’s noise ordinance, adjusting the overnight accommodation period to midnight through 7 a.m.

Minimum Stay Requirement

A second proposal, which establishes a five-night minimum stay for rentals in R-1 and MH zoning districts, passed its first reading with a 5-2 vote. This proposal is set for a second reading for final approval. Realtor Terry Miller, who spearheaded opposition with approximately 200 signatures, argued that this policy could drastically reduce rental income during the summer months, as the national average stay is just 3.41 days. However, Mayor Rick Meehan defended the measure, emphasizing the need to preserve the character and tranquility of residential neighborhoods.

Moratorium on New Licenses

Adding to the regulatory changes, the council has enacted an 11-month moratorium on new short-term rental licenses in the R-1 and MH districts. This moratorium is effective immediately but does not affect applications submitted before January 28, 2025. Property owners with existing rental licenses can apply for renewal and supplementary short-term rental licenses for the 2025 license year.

The original article detailing these developments can be accessed here. This decision by the Ocean City Council marks a significant shift in local policy, aimed at balancing rental activity with community interests. The minimum stay proposal awaits further deliberation in the upcoming council meeting.

Redefining D.C.: A City of Dual Perceptions and Meaningful Work

Washington, D.C., a city often labeled as a “swamp,” is simultaneously a beacon for those driven by a sense of mission and purpose. While the term “swamp” has been used pejoratively to describe the political landscape of the capital, many who reside and work there see it as a place where significant contributions to society are made. This dual perception is explored in an insightful NPR article by Brian Naylor.

From the early days of its establishment, Washington has been criticized. Timothy Noah, a writer and journalist, notes that even before the city was built, it was described as a “political hive” by Thomas Treadwell, an Anti-Federalist senator. Yet, this view overlooks the “other” Washington, where residents and workers strive to make a positive impact.

In this “other” Washington, the National Institutes of Health in Bethesda, Maryland, played a crucial role in developing the blueprint for the COVID-19 vaccine. According to Noah, this breakthrough was not the result of private companies but rather the work of dedicated government researchers.

Federal agencies are involved in a wide array of functions, from managing the National Parks to processing tax returns and launching telescopes into deep space. Eric Choy, a leader in Customs and Border Protection, is committed to stopping the import of goods produced by forced labor, driven by a sense of duty to uphold national values.

Choy, who was honored with the Service to America Medal, emphasizes the importance of service to something greater than oneself. His perspective is shared by others like Christy Delafield of FHI 360, who moved to D.C. to contribute to global health and humanitarian aid systems.

Ryan O’Toole, a congressional staffer, reflects on his experiences in Washington, including being in the House chamber during the January 6th Capitol riot. He witnessed Senate staffers safeguarding the electoral college votes, actions he describes as heroic.

Despite its reputation, Washington is a vibrant and diverse community. While some may come seeking fame or fortune, many more are motivated by the desire to do good, as highlighted in Naylor’s article. This narrative challenges the notion of D.C. as merely a swamp, portraying it instead as a place where meaningful work is pursued.

For more insights on the history and dynamics of Washington, D.C., explore this National Mall history.

Addressing America’s Housing Crisis: Efforts and Challenges under the Biden Administration

The American housing crisis is not merely a statistic; it is a pressing reality affecting millions of families nationwide. Under the Biden administration, rent prices have soared to unprecedented levels, and homeownership has become an elusive dream for many. Over the past four years, the administration has taken several steps to address this entrenched issue. Let us delve into these measures and assess their effectiveness while casting light on the current state of housing in the United States.

Federal Investment and Housing Initiatives

The Biden administration has made significant federal investments in affordable housing. Billions have been allocated in grants and funding to enhance the availability of affordable housing, with a goal to build 2 million new homes, reduce rental costs, and offer tax credits for homebuyers.

Moreover, the administration expanded the Low-Income Housing Tax Credit (LIHTC) and proposed a Neighborhood Homes Tax Credit. Despite these efforts, the U.S. still faces a 4.5 million home shortage, underscoring the critical nature of the crisis.

Homelessness and Federal Response

While funding for homelessness prevention increased, the nation witnessed an 18% rise in homelessness in 2024. The lack of affordable units has significantly contributed to this surge. The National Alliance to End Homelessness reports that approximately 700,000 individuals are experiencing homelessness in the U.S.

Challenges in Addressing Housing Issues

Efforts to tackle the housing crisis have encountered substantial obstacles. Bipartisan cooperation is essential for sustainable solutions, yet political division remains a significant barrier. Additionally, high mortgage rates and supply shortages continue to impede progress.

Protecting Renters and Curbing Corporate Practices

The administration has taken measures to protect renters from unfair practices. It cracked down on corporate landlords exploiting algorithms to inflate rents and proposed capping rent increases at 5% for properties built with federal tax credits. The introduction of a Renters Bill of Rights further outlines principles for fair rental markets and prohibits hidden fees in rental agreements.

Looking Ahead

Although the Biden administration has laid the groundwork for addressing the housing crisis, much work remains. Future policies must focus on increasing supply, reducing costs, and protecting vulnerable populations. Only then can we hope to see real progress in making housing affordable for all.

The original article from Norada Real Estate Investments provides an in-depth analysis of these initiatives and the ongoing challenges in the housing sector.

The Future of Real Estate: Technology’s Transformative Impact by 2025

In a rapidly evolving world, technology is set to redefine the real estate landscape by 2025. As reported by AZ Big Media, several cutting-edge technologies are poised to revolutionize how properties are bought, sold, rented, and managed. From artificial intelligence (AI) and blockchain to virtual reality (VR) and data analytics, these innovations are reshaping the expectations of consumers and intensifying competition among real estate businesses.

AI-Driven Property Recommendations

AI is set to become the cornerstone of property searches, offering personalized recommendations based on user preferences such as budget, location, and lifestyle. John Beebe, CEO and Founder of Classic Car Deals, highlights that AI algorithms will employ predictive analytics to identify valuable assets and forecast market conditions, streamlining the property search process for buyers and renters.

Blockchain for Transparent Transactions

The integration of blockchain technology promises enhanced security and transparency in real estate transactions. Dr. Nick Oberheiden, Founder of Oberheiden P.C., notes that smart contracts will automate agreements, eliminating intermediaries and reducing transaction costs. Blockchain will also facilitate fractional ownership, opening new investment opportunities.

Virtual Reality for Property Tours

Virtual reality is transforming property marketing by allowing potential buyers to tour homes remotely. Gerrid Smith, Founder & CEO of Fortress Growth, emphasizes that VR technology will offer hyper-realistic experiences, enabling international shoppers to explore properties without traveling.

Big Data for Market Insights

Big data platforms will provide valuable market insights, helping stakeholders make informed decisions. Sam Hodgson of ISA.co.uk explains that predictive analytics will highlight market trends and property appreciation rates, benefiting buyers and sellers alike.

IoT-Enabled Smart Homes

The Internet of Things (IoT) will integrate advanced solutions into homes, from energy-efficient systems to community-level innovations. Alex L. of StudyX anticipates that these developments will appeal to environmentally conscious consumers seeking sustainable living options.

Digital Twins for Property Development

Digital twins, or virtual replicas of physical structures, will become mainstream by 2025. Ivy Berezo of LUCAS PRODUCTS & SERVICES highlights that this technology will enhance accuracy and efficiency in property development, allowing real-time collaboration across geographical boundaries.

Enhanced Marketing with AR and AI

Augmented reality (AR) and AI will revolutionize property marketing by offering interactive experiences. Leonidas Sfyris of Need a Fixer notes that AR apps will allow buyers to visualize renovations, while AI chatbots will provide instant answers to inquiries.

Sustainable Real Estate Practices

Technology will drive sustainability in real estate, with AI and IoT enabling energy-efficient designs. Deborah Kelly of Brickhunter explains that integrated systems will optimize resource consumption, appealing to eco-conscious buyers.

Remote Work Influencing Location Choices

The rise of remote work will shift property preferences, with demand for homes offering dedicated workspaces and internet capabilities. Gemma Hughes of iGrafx suggests that developers should cater to these trends by incorporating flexible workspaces into residential complexes.

Frictionless Transactions Through Digital Platforms

Digital platforms will streamline real estate transactions, from virtual tours to e-signing documents. Dean Lee of Sealions predicts that blockchain and AI will enhance transaction efficiency, setting a new standard for smart real estate practices.

As we look to the future, these technological advancements will drive significant changes in the real estate market by 2025. Industry stakeholders must adapt to these innovations to remain competitive and meet the evolving demands of consumers.

India’s Real Estate Revolution: Growth, Opportunities, and Technological Transformations

India, poised to emerge as a global power, now sees its real estate industry as a crucial indicator of economic health, playing a vital role in the nation’s development pathway. The motto “Roti, Kapda, Makaan” emphasizes the essential Indian dream, wherein a ‘Makaan’ or home symbolizes security and prosperity. This dream is propelling the real estate market to unprecedented levels.

Chintan Vasani, a Founder Partner at Wisebiz Developers, underscores the importance of acquiring essential skills for success in this burgeoning sector.

Impact of COVID-19 on Housing Preferences

The COVID-19 pandemic has drastically shifted perspectives, motivating people to re-evaluate their housing needs. With homes evolving into workspaces, learning centers, and sanctuaries, the preference for renting diminished. This pivot, accentuated by historically low interest rates, has significantly boosted homeownership, a trend anticipated to endure.Recognizing the sector’s potential, the Indian government has initiated policies to support and expand it. The Real Estate (Regulation and Development) Act (RERA) has introduced critical transparency and accountability, empowering buyers and instilling market confidence. Moreover, government focus on affordable housing and infrastructure development is opening fresh avenues for real estate stakeholders.

Technological Progressions

The advent of technology is also reshaping the real estate landscape. The incorporation of Proptech—blending property and technology—is revolutionizing industry interactions. Tools like virtual tours, online listings, and digital payments are now commonplace.Despite challenges, India’s real estate future looks promising. A growing middle class, rapid urbanization, and increasing disposable incomes are key growth drivers. Pursuing a career in this sector provides diverse opportunities and can be highly rewarding, ranging from property brokerage and sales to project management and real estate law.

With the industry’s expansion, skilled professionals are in high demand. Those possessing a nuanced understanding of market dynamics alongside strong interpersonal skills are likely to excel.

In summary, the real estate sector is pivotal to India’s development. Its ongoing growth aligns with the aspirations of millions of Indians. As the industry persists in evolving—buoyed by technological advances and government initiatives—it offers a compelling career proposition. Individuals equipped with passion, expertise, and strategic insight can achieve significant success in this dynamic field.

For more insights, you may refer to the original article on India Today.

Top Real Estate Investment Trends for 2025: Expert Insights

As the real estate landscape evolves, strategic investments can make all the difference for stakeholders aiming to maximize returns. Johan Hajji, Cofounder at UpperKey, shares his insights into pivotal trends expected to shape property investment in 2025. Passionate about property management, real estate investments, proptech, and business growth, Johan outlines the key areas that investors should focus on to stay ahead.

Property investors face a rapidly changing market environment, influenced by rising costs, technological advancements, and altered housing preferences. As we approach 2025, it’s crucial to track trends that are likely to impact the property sector significantly.

1. Booming Interest in Smaller Cities

Emerging as new investment hotspots, cities like Boise, Charlotte, and Tampa are experiencing rapid growth due to the increasing popularity of remote work. This trend allows more people to relocate from traditionally expensive cities like New York and San Francisco to places offering a lower cost of living. Investors might discover greater potential in these smaller markets, where property prices are competitive and growth prospects abound. For further insights, explore the discussion on city affordability.

2. Rising Demand for Green Buildings

Sustainability is at the forefront for real estate investments. Eco-friendly buildings that minimize energy use are gaining traction not only for their environmental benefits but also for their appeal to cost-conscious tenants. Governments are also incentivizing sustainable construction through tax breaks, heralding a promising avenue for investors. Learn more about sustainable housing preferences here.

3. A Surge in Renting Patterns

With ongoing increases in home prices, renting has become a preferable option for many. This has catalyzed the rise of build-to-rent (BTR) communities, which provide long-term rental solutions for those not inclined to purchase property. These developments commonly feature shared amenities and appeal to renters seeking elevated living standards. The growth of BTR properties is examined here.

4. Transformation Through Property Technology

The integration of technology in property transactions and management is revolutionizing the sector. Tools like AI optimize tenant management and maintenance scheduling, while blockchain enhances transaction speed and security. For comprehensive insights, consider how technology impacts property markets.

5. Navigating Interest Rates and Inflation

Interest rate fluctuations and inflation remain critical influencers of real estate valuations. While high rates can dampen market activity by making borrowing costly, real estate is a strong hedge against inflation due to concurrent rental price increases. For a deeper understanding, review how interest rates affect economic conditions.

6. The Growing Appeal for Affordable Housing

The demand for affordable housing is surging, prompting public-private partnerships to fulfill this critical need. This sector offers substantial returns alongside social benefits, complemented by attractive tax incentives for investors participating in affordable housing projects. Learn more about affordable housing initiatives.

As outlined by Johan, staying informed of these real estate trends and adapting strategies accordingly will be fundamental for investors aiming for success and maximizing returns in the competitive landscape of 2025. The full potential of these evolving trends promises not only personal gains but also broad societal benefits.

For additional opportunities and insights, visit the Forbes Business Council.

The Role of Zoning Regulations in the Housing Affordability Crisis

As the nation confronts the ongoing housing affordability crisis, a key focus has emerged on the role of zoning regulations in either hindering or promoting the construction of affordable housing. These regulations, which dictate land use and building specifics, have come under scrutiny for their potential to either restrict or facilitate housing production.

Zoning laws, historically rooted in early 20th-century urbanization efforts, have evolved significantly since New York City’s pioneering ordinance in 1916. This landmark regulation sought to manage urban density and building heights, setting a precedent for what would become known as Euclidean Zoning. This form of zoning, legitimized by the U.S. Supreme Court in the 1926 case Village of Euclid v. Ambler Realty Co., remains the most prevalent type in the United States.

However, the intricacies of zoning laws often create barriers to housing development. Common obstacles such as minimum lot sizes, height restrictions, and parking requirements can limit the supply of affordable units. Conversely, incentives like density bonuses and streamlined approval processes can encourage developers to build more accessible housing.

Inclusionary Zoning: A Double-Edged Sword

One strategy, Inclusionary Zoning (IZ), mandates that a portion of new developments include affordable units. However, this approach can inadvertently increase costs for market-rate units and reduce overall housing production. A study on Los Angeles’s Transit-Orientated Communities program revealed that a 20% IZ requirement could slash new housing production by nearly half.

Similarly, a 2019 report from the Mercatus Center highlighted that IZ often fails to significantly boost real housing supply, with minimal impact on multifamily starts and a decrease in single-family starts.

Innovative Approaches to Overcome Zoning Barriers

Cities like Salt Lake City and Minneapolis are pioneering efforts to overcome zoning barriers. Salt Lake City, for instance, allows missing middle housing types in areas traditionally zoned for single-family homes, exempting them from certain lot requirements. Minneapolis has seen a 45% increase in permits for 2-4 unit buildings due to reduced parking mandates.

On a broader scale, states like California and New York are implementing policies to pre-empt local zoning laws that restrict housing supply. California’s SB 9 and SB 10 enable duplexes and small multifamily developments in single-family zones, while New York’s initiatives aim to increase density near transit hubs.

Looking Ahead

As policymakers strive to create a more equitable housing landscape, the challenge lies in crafting zoning laws that balance density with livability. Thoughtful zoning reforms, coupled with incentives for developers, can significantly enhance affordable housing efforts. By embracing innovative approaches and fostering public-private partnerships, we can work towards a future where housing is accessible for all.

For further insights, explore the original article from the National Association of Home Builders, which delves deeper into the complexities of zoning and housing affordability.

Real Estate Investment Outlook for 2024: Key Cities and Market Insights

Market Trends

The U.S. housing market remains robust, driven by strong buyer demand despite rising interest rates. A notable trend is the resilience of single-family rentals, particularly with the shift towards build-to-rent projects that address affordability constraints in homeownership.Key Cities for Investment

- Boise, Idaho: Praised for its strong job market and affordable housing, Boise is a top contender for real estate investors.

- Houston, Texas: Known for its robust real estate market, driven by a thriving job sector.

- Dallas, Texas: Offers diverse real estate opportunities with a rapidly growing population and economy.

- Las Vegas, Nevada: Recognized for its high rental demand paired with affordable housing.

- Atlanta, Georgia: Noted for its low cost of living and strong real estate market fundamentals.

Emerging Markets and Strategies

Investors are advised to consider factors such as rental occupancy rates, local economic conditions, and real estate appreciation potential when choosing locations.Conclusion and Advice

As the article from Norada Real Estate Investments emphasizes, due diligence and understanding local market dynamics are crucial for profitable real estate investments in 2024.Foreign Investment Insights

Foreign buyers continue to play a significant role in the U.S. real estate market. The latest data from the National Association of Realtors highlights ongoing international investment trends, underscoring the global appeal of U.S. real estate.For those considering real estate investments in 2024, this comprehensive guide serves as a critical resource in identifying potential lucrative markets across the United States. To explore more about these prime locations, visit the Norada Real Estate Blog.

Key Themes in Commercial Real Estate for 2025: A Tentative Revival

As we step into 2025, the commercial real estate (CRE) sector is poised for a tentative revival, following a year of transition in 2024. According to a recent report by Oxford Economics, five key themes are expected to shape the industry’s outlook, offering both opportunities and challenges for investors and market participants.

Global Economic and Interest Rate Dynamics

The global economy is projected to experience moderate growth, coupled with a continuation of interest rate cuts. However, geopolitical uncertainties may add complexities to this landscape. The shift towards a more protectionist global economy is likely to redefine trade, price stability, and investment strategies, influencing the CRE sector’s trajectory.

Capital Value Growth Prospects

Despite ongoing policy rate cuts, long-term bond yields are expected to remain below pre-pandemic levels, limiting the potential for real estate yield compression. As such, capital value growth may be tempered, requiring investors to adopt a cautious yet strategic approach to maximize returns.

Regional and Sector-Specific Investment Opportunities

Oxford Economics highlights that the next 12 to 18 months present a favorable window for direct real estate investments in specific regions and sectors. This period is anticipated to offer the most advantageous entry point in the current cycle, encouraging investors to explore diverse opportunities across the global market.

Rebound in CRE Transaction Volumes

Global CRE transaction volumes have reached near-decade lows, but emerging trends suggest a potential resurgence. As trust in the market begins to rebuild, a convergence of powerful trends is expected to ignite a strong rebound in transaction volumes, providing a renewed sense of optimism for the industry.

Interest in Alternative and Niche Sectors

Alternative and niche sectors such as student housing, seniors housing, healthcare, and data centers continue to attract global investor interest. While these sectors offer promising opportunities, balancing strategies against inherent risks and countervailing structural forces will be critical for optimizing returns in 2025 and beyond.

For more detailed insights and forecasts, download the full report from Oxford Economics or register for the upcoming webinar to gain a deeper understanding of the factors driving this tentative rebound in CRE values.

Stay informed and prepared as the CRE sector navigates this pivotal year, leveraging the insights and analyses provided by industry experts to make informed investment decisions.

Real Estate Crowdfunding: A New Frontier for Investors

Real Estate Crowdfunding: A New Frontier for Investors

The landscape of real estate investing is undergoing a remarkable transformation, thanks to the rise of real estate crowdfunding platforms. As highlighted in a recent NerdWallet article, these platforms are democratizing access to real estate investments, once the exclusive domain of affluent investors.Lower Barriers, Higher Potential Returns

One of the most compelling aspects of these platforms is their ability to lower the barriers to entry. With low account minimums and reasonable fee structures, they provide an opportunity for average investors to diversify their portfolios with real estate. Unlike traditional REITs, which are accessible through brokerages, real estate crowdfunding allows participation in private REITs and individual property investments. This could potentially offer higher returns, albeit with increased risk.Diverse Investment Opportunities

These platforms don’t just stop at real estate. As the article notes, some also offer investments in venture capital, private equity, and even collectables like art. This diversification is appealing to investors looking to broaden their investment horizons.The Best Platforms of February 2025

NerdWallet’s article provides a detailed evaluation of the top real estate crowdfunding platforms available in February 2025. The criteria for selection include account minimums, customer support, redemption options, and fees. This comprehensive analysis helps investors make informed decisions about where to allocate their funds.For those interested in exploring the full range of options, the original article offers an in-depth look at this growing trend. Real estate crowdfunding is poised to become a popular investment vehicle, offering a new way for everyday investors to engage with the real estate market.

A 22-Year-Old’s Journey to $103K in Real Estate

Okay, let’s be real—who wouldn’t want to make six figures in their first year on the job? That’s the kind of success story that makes you sit up and go, Wait, what? How?!

So, meet Anna, a now 26-year-old real estate agent and mortgage loan originator, who’s sharing the ups, downs, and bank account-changing experiences of her first year in the real estate world. And let me tell you, it’s not as simple as just slapping a For Sale sign on a mansion and collecting a bag of cash.

The Journey from College Student to Six-Figure Realtor

Anna got her real estate license at the end of 2017 and officially entered the big leagues in 2018. But instead of starting from scratch, she smartly positioned herself with a top-producing luxury real estate team in Orange County. That move alone gave her early exposure, experience, and—most importantly—leads.

Like many fresh-faced agents, she transitioned off a paid internship into a commission-based role, where her first major sale—an $800,000 condo—landed her a check for $10,120. Not bad for a first deal, right? But before you start writing your resignation letter to become a real estate mogul overnight, let’s break down where the rest of that commission went.

See, in real estate, it’s not just you cashing in that big payday. Brokers, teams, and splits take their cuts, meaning Anna was only pocketing half of what the total commission for that deal actually was. And that’s just a small taste of Reality Check #1 in this profession: You don’t keep everything you earn.

The Harsh Lessons of Being a Real Estate Newbie

After the high of that first deal, Anna hit a dry spell—a struggle that many first-year agents face. Finding clients was rough, and she even had a $1.9 million sale completely vanish when the buyer went behind her back and worked directly with the listing agent. Talk about betrayal! Lesson learned: If you don’t lock in a client agreement, you’re leaving a lot up to chance.

At this point, her one big check from earlier wasn’t going to pay the bills indefinitely (even though, props to her, she stretched that $10K like a budgeting queen). That’s when she decided to pivot.

Switching Gears: Salary + Commission = Stability

Realizing that feast-or-famine income wasn’t for her, Anna discovered a real estate startup that offered a $5,000 monthly salary—yes, steady money—plus commissions on any closings she landed. This gave her the best of both worlds: guaranteed money hitting the bank account each month while still racking up real estate deals.

By structuring her income this way, Anna was closing four to five homes a month for the remainder of 2018. While her commissions weren’t as high as traditional real estate gigs, her new model brought consistent income without the stress of dealing-to-dealing survival. By the end of the year, she had pulled in a grand total of $103,000.

Not bad for year one!

What We Can Learn from Anna’s Real Estate Grind

Anna’s story is not just about making a lot of money—it’s about how she made it. And more importantly, what lessons aspiring realtors (or anyone, really) can take from her journey:

- Don’t rely on just one client. That $1.9M sale that went poof taught Anna a valuable lesson: Diversify your leads and always have multiple deals in motion.

- Look for alternative ways to earn money in real estate. It’s not just about million-dollar home sales—rental deals, team splits, and different payment models like salary-based real estate roles can all stack up to a serious paycheck.

- Your first paycheck might be big, but it won’t last forever. Anna stretched her first $10K commission like a pro, but she quickly realized that consistent income beats sporadic windfall commissions.

- Getting burned is part of the industry. Losing deals, backstabbing clients, and navigating brokerage splits are all part of the game—what matters is how you adapt.

Is Real Estate Worth It?

Honestly, Anna’s first-year earnings are way above the norm for new real estate agents. Most struggle to hit just half of what she made. A ton of realtors don’t even close a deal in their first year. But Anna put herself in the right position—starting under an experienced team, finding alternate income sources, and recognizing when a steady paycheck was the smarter move.

So, is jumping into real estate a guaranteed golden ticket? Nope. But with the right strategy and relentless drive (seriously, this girl hustled), you can make it work.

What do you think—would you take the risk to chase commissions, or do you prefer the stability of a monthly paycheck? Let’s talk about it. Drop your thoughts in the comments! 🚀

The Ultimate Real Estate Exam Cheat Sheet: My Reaction to Maggie’s Top 20 Terms

Alright, future real estate moguls, you’re in for a ride because I just watched Maggie break down the top 20 must-know terms for the real estate exam, and let me tell you—it was like getting hit with a knowledge bomb (in the best way possible). Let’s dive in!

First Impression: So Many Terms, So Little Brain Space

So, Maggie jumps right in, no fluff, no small talk—just straight-up essential real estate knowledge. If you’re about to take your real estate exam and you don’t know about “deed restrictions” or the “Maria Test,” well, buckle up, because this video is basically your survival guide.

I’ve always thought of real estate as glamorous—you know, selling million-dollar homes, negotiating like a shark, closing deals over coffee. But turns out, there are a ton of rules, legalities, and downright scary terms that you have to understand before you even get close to your first transaction.

Let’s Talk About A Few Terms That Blew My Mind

1. Deed Restrictions – So You Can’t Just Go Wild with a House?!

So, apparently, if you buy a home with deed restrictions, you can’t just do whatever you want with it. Want to paint it bright neon green? Nope. Thinking of building a pirate ship in your front yard? Again, no. These restrictions are put in place by developers or homeowners associations (HOAs) to keep the neighborhood looking a certain way. Honestly, I could see myself forgetting about this and buying a home, only to find out I can’t add a massive slide from the roof to the backyard. Tragic.

2. The Maria Test – Not a Person, But Definitely Important

No, “Maria” isn’t Maggie’s bestie giving us exam tips—it’s actually an acronym (Method, Adaptability, Relationship, Intention, Agreement) to determine if something in a house is a fixture or personal property. Basically, if it’s bolted, screwed in, or clearly meant to stay, it’s part of the sale. If not, it’s up in the air. Imagine buying a house thinking you’re getting a fancy chandelier, only for the sellers to take it when they leave. The Maria Test will save you from heartbreak!

3. Non-Conforming Use – AKA, the Rebellious Buildings

If a small grocery store exists in a residential neighborhood just chillin’ between houses, that’s thanks to non-conforming use—basically, it’s “grandfathered in” because it was built before zoning laws changed. But once it shuts down, it has to conform to the new rules. It’s like your friend who was the only one allowed to wear sneakers in gym class because they had a doctor’s note.

4. Antitrust Regulations – No Price-Fixing Allowed, Folks!

Did you know it’s illegal for real estate brokers to agree on commission rates together? Yeah, it’s called price-fixing, and apparently, that’s a huge no-no (thanks, Sherman Act!). I love that Maggie emphasized this because, let’s be real, a lot of people probably assume all agents secretly agree to charge the same rates. Not today, capitalism says no.

Bigger Takeaways – This Stuff Really Matters

What this video made super clear is that real estate isn’t just about selling houses—it’s about laws, ethics, and avoiding lawsuits. Every term Maggie covered plays a huge role in how agents conduct business, protect homebuyers, and—most importantly—stay out of trouble.

For example, lead-based paint disclosure? That’s not just a nice suggestion; it’s a federal requirement. If you don’t tell a buyer that a 1970s house might contain lead paint, you could be facing some serious legal drama. The same with blockbusting and steering—practices that have a dark history in real estate and are now illegal due to the Fair Housing Act. It’s wild to think that unethical real estate tactics once shaped entire neighborhoods!

How This Relates to the Bigger Picture

Maggie’s breakdown reminded me of how understanding laws in any industry is critical, whether it’s real estate, finance, or even tech. This actually made me think of how big companies get fined millions of dollars for violating regulations they should’ve understood (looking at you, giant corporations). It’s the same for new real estate agents—know the rules, or you could lose your license before you even get started.

And let’s not forget the economic and functional obsolescence part—this section personally hurt my soul. Turns out, sometimes your home’s value drops for reasons completely out of your control, like a noisy freeway getting built next door (economic obsolescence), or because your house is stuck in the past, like having only one bathroom when modern homes have three (functional obsolescence). It’s like investing in Myspace stock—bad call.

Final Thoughts – This is the Cheat Code for Passing Your Exam

So if you’re preparing for your real estate exam, watch this video ASAP. Maggie somehow manages to make a firehose of information feel digestible, and you can tell she really knows her stuff. Plus, her breakdowns make it easier to remember these terms when crunch time hits and you’re staring at a multiple-choice question, sweating bullets.

And by the way, if you’re anything like me and need an extra push to absorb all of this, Maggie’s ebook “The Educated Agent” sounds like a solid investment. (Because let’s be real—we’ve all spent money on things way less useful, like that gym membership we swore we’d use.)

What do you think—are you feeling prepared for your real estate exam? Or did one of these terms totally throw you off? Let’s chat in the comments! 🚀

Gulf of America: Politics in Geography

Gulf of America? Google Maps Just Got Political, and We’re Still Processing

You ever wake up, check the news, and immediately question if you’re still dreaming? That was me this morning when I saw this headline: The Gulf of Mexico has been renamed the Gulf of America. Excuse me? Come again?

Wait, What Just Happened?

So, here’s the deal. President Trump, on his first day back in office, signed an executive order renaming the Gulf of Mexico to the Gulf of America. (Because apparently, top priority.) Google Maps, not one to shy away from a government-approved change, hopped right on board and updated the name on their platform. They even posted on X (formerly Twitter) that they have a “longstanding practice” of adjusting names according to official sources.

Translation: “Hey, don’t blame us. We’re just following the paperwork.”

Oh, and here’s the kicker—if you’re in Mexico, it’s still the Gulf of Mexico. So, depending on where you’re standing, that body of water has two different names. International waters just got a whole lot pettier.

My Immediate Reaction?

I have so many questions—mostly why? Who woke up and thought: You know what needs fixing? Not the economy, not infrastructure, but the name of that big ol’ body of water.

Also, imagine being a geography teacher right now. Yesterday, they were explaining the Gulf of Mexico. Today, they’re rewriting all their lesson plans.

And let’s not even start on travelers planning spring break trips. Google Maps is out here casually rewriting borders without warning. Imagine trying to meet your friends on the beach and texting, “Just follow the Gulf of Mexico signs—wait, sorry, I mean America. I mean… I don’t even know anymore.”

Is This a Trend Now?

Honestly, this feels like a sequel to that time when Google Maps had Crimea switching names depending on who was looking at the map. One glance from Russia? Crimea. A peek from Ukraine? Nope, different name.

Naming disputes aren’t new. Countries have been playing tug-of-war with names for centuries—Sea of Japan vs. East Sea, anyone? But THIS? This is like renaming Lasagna to ‘Freedom Pasta’ and expecting everyone to just roll with it.

What’s Next?

- Are we renaming the Atlantic Ocean to the Freedom Pond?

- Will the Grand Canyon become the Patriot’s Trench?

- How far does this go?

Honestly, I need to hear from you—because I can’t be the only one feeling like we’ve entered some alternate reality. Do you think this change actually matters? Are you calling it the Gulf of America now? Or will you be forever loyal to “Mexico” like an old-school map purist?

Drop your thoughts (or complaints) in the non-renamed comment section—because at this rate, even that might not be safe.

Commercial Real Estate Market: A $384.46 Billion Opportunity

Commercial Real Estate Market: A $384.46 Billion Opportunity

The global commercial real estate market is on the brink of a substantial transformation, projected to grow by USD 384.46 billion from 2024 to 2028. According to a recent report by Technavio, this growth is driven by the expanding commercial sector worldwide, with a compound annual growth rate (CAGR) of 4.36%. However, the shift towards remote work and the rise of e-commerce present significant challenges.

Key Market Players

The market landscape is fragmented with key players such as Atlas Technical Consultants LLC, Boston Commercial Properties Inc., and CBRE Group Inc. These companies are leveraging integrated marketing communication strategies, utilizing channels like newspapers, magazines, and social media to enhance customer engagement and drive sales.Emerging Trends

Significant trends are reshaping the market. The demand for larger distribution centers is fueled by e-commerce, while reshoring in manufacturing is increasing the need for industrial spaces. The office sector is evolving with flexible work arrangements and a focus on health and safety. Additionally, the logistics sector is experiencing a surge in demand due to the rise in e-commerce sales.Challenges Ahead

The commercial real estate market faces hurdles, particularly from the shift towards online shopping and remote work. Traditional retail spaces and office buildings are seeing decreased demand. Businesses are adapting by incorporating co-working spaces and flexible workspaces, challenging conventional real estate models.Technological Impact

Technology plays a pivotal role in this transformation. The adoption of smart buildings, coworking spaces, and energy-efficient solutions is becoming increasingly important. The use of AI and IT solutions, such as virtual property tours and online leasing platforms, is revolutionizing how properties are marketed and managed.For more detailed insights, you can view the full report or explore a free sample PDF.

Conclusion

The commercial real estate market is dynamic and complex, requiring businesses to adapt swiftly to align with evolving trends and technological advancements. As noted in the original article, the integration of AI and technology is crucial in navigating these changes and capitalizing on new opportunities.Harnessing the Power of Marketing Certifications in 2025

In the ever-evolving landscape of 2025, marketing professionals are increasingly turning to certifications as a means to stay ahead of the curve and gain a competitive edge. With rapid advancements in technology and shifts in consumer behavior, these certifications have become a vital tool for marketers seeking to validate and expand their skill sets.

According to a recent article from TechTarget, certifications in areas such as AI, data analytics, and digital innovation are proving invaluable. These credentials not only differentiate professionals but also equip them with the tools needed to bring substantial value to both their teams and customers.

Why Marketing Certifications Matter

Marketing certifications serve as a testament to a professional’s expertise in specific areas such as social media marketing, SEO, and digital analytics. They provide a competitive edge in job applications and foster career growth by opening doors to new opportunities.

In 2025, the commitment to continuous education through certifications is crucial. It signals a willingness to invest time in professional development, staying abreast of industry trends and best practices, which is a blueprint for success.

Free vs. Paid Marketing Certifications

When choosing between free and paid marketing certifications, professionals must consider their personal goals, time, and budget. Paid certifications generally offer more comprehensive education with structured learning materials and professional feedback. They often come from recognized institutions and may require tests or projects to demonstrate proficiency.

Conversely, free certifications, while lacking the depth of paid options, are more accessible. They provide a flexible, self-paced learning experience through online tutorials and resources. Both paths offer valuable opportunities to enhance marketing knowledge and career potential.

Top Certifications and Courses for 2025

- AI in Marketing:

- AI for Business and Marketing – Offered by the Digital Marketing Institute, this course provides a comprehensive introduction to AI tools and strategies. Price: $535

- AI for Marketing – A free course by HubSpot Academy, covering AI integration in marketing efforts.

- Advanced SEO Courses:

- Google SEO Fundamentals – Available via Coursera, this self-paced program covers essential SEO topics. Price: Requires Coursera subscription

- Semrush Academy – Free SEO courses focusing on keyword research and digital advertising, offered by Semrush Academy.

- Digital Marketing Innovations:

- Meta Certifications – Validate expertise in platforms like Facebook and Instagram. Price: $99-$150 per exam. More info at Meta Blueprint.

- Google Ads Search Certification – Free course on Skillshop, focusing on search ad campaigns.

As we delve deeper into 2025, the importance of marketing certifications continues to grow. They not only enhance individual skill sets but also provide a strategic advantage in a competitive industry landscape. For more insights, visit the original article on TechTarget.

Seismic Shifts in Global Economy Amidst US Tariff Threats

The global economic landscape is undergoing a seismic shift as countries brace for potential US tariffs. Since the dawn of the Trump Administration in 2017, the US share of global trade has been on the decline, even as its GDP share has risen. This paradox is driven by robust US economic growth and soaring equity valuations, reflecting investor confidence in American innovation.

However, the world is not standing still. Non-US trade is flourishing, with countries actively signing new trade agreements to reduce reliance on the US. The European Union, for instance, has recently finalized deals with South American nations and is in talks with Australia and Indonesia, as reported by FT. Meanwhile, China is pivoting towards Asia-Pacific partnerships and engaging with Latin American countries.

The US Economy Remains Strong

Despite these global shifts, the US economy continues to show resilience. According to recent data from the Bureau of Economic Analysis, the US GDP grew by 2.8% in 2024, driven by a surge in consumer spending, particularly on durable goods.

Yet, there are signs of caution. Business investment fell, and trade made a negative contribution to GDP growth in the fourth quarter. The looming threat of tariffs could further complicate matters, potentially leading to higher consumer prices and impacting export growth.

US Federal Reserve Keeps Policy Unchanged

The Federal Reserve, as expected, has kept interest rates steady. In a recent press conference, Fed Chair Powell highlighted that while the labor market has cooled, inflation remains “elevated.” This cautious stance led to a drop in equity prices and a rise in bond yields, reflecting investor sentiment.

Eurozone Economy Stagnates While ECB Cuts Rates

Across the Atlantic, the Eurozone economy is facing stagnation. Recent reports from Eurostat show no growth in the fourth quarter of 2024. The European Central Bank (ECB) responded by cutting interest rates, aiming to boost activity amid ongoing economic headwinds.

ECB President Lagarde noted that while manufacturing is weak, services remain strong. However, potential US tariffs pose a risk, potentially impacting the Eurozone’s growth trajectory.

As the global economic narrative unfolds, the world watches closely, anticipating the US’s next move on tariffs and its ripple effects on global trade and economic stability.

Urban Resurgence: The Return of Homebuyers to the City

Urban Resurgence: The Return of Homebuyers to the City

In a striking reversal of pandemic-era trends, homebuyers are once again flocking back to urban centers after a brief suburban exodus. This shift is detailed in a recent report by the National Association of Realtors (NAR), which highlights emerging patterns in the housing market.

During the height of the COVID-19 pandemic, wealthy urbanites from cities like New York City and San Francisco sought refuge in rural areas and small towns, leading many to speculate the demise of urban living. However, data from NAR reveals a different narrative.

Between 2017 and 2021, the share of home purchases in rural areas and small towns remained consistent. Yet, 2022 saw a notable increase, with rural areas capturing 19% and small towns 29% of the market. This surge came at the expense of suburban areas, which saw their share drop from a steady 50% to 39%.

Fast forward to 2024, and the tide has turned once more. Suburban home purchases have rebounded to 45%, while urban centers have surged to 16%, surpassing pre-pandemic levels. Meanwhile, rural and small-town purchases have returned to their typical shares of 14% and 23%, respectively.

“When bad things happen in New York, pundits often say it’s the end of the city,” notes the article from HousingWire. Yet, many New Yorkers simply relocated within the city, moving from Manhattan to Brooklyn, rather than leaving entirely.

San Francisco, with its tech-heavy population, has been slower to recover due to the prevalence of remote work. However, as major tech firms call employees back to the office, the urban housing market shows signs of revival.

Additional insights from the NAR report indicate a return to shorter migration distances, with the median dropping from 50 miles in 2022 back to 20 miles. The age of homes being purchased has also stabilized, with the typical home now being built in 1994, aligning with pre-pandemic trends.

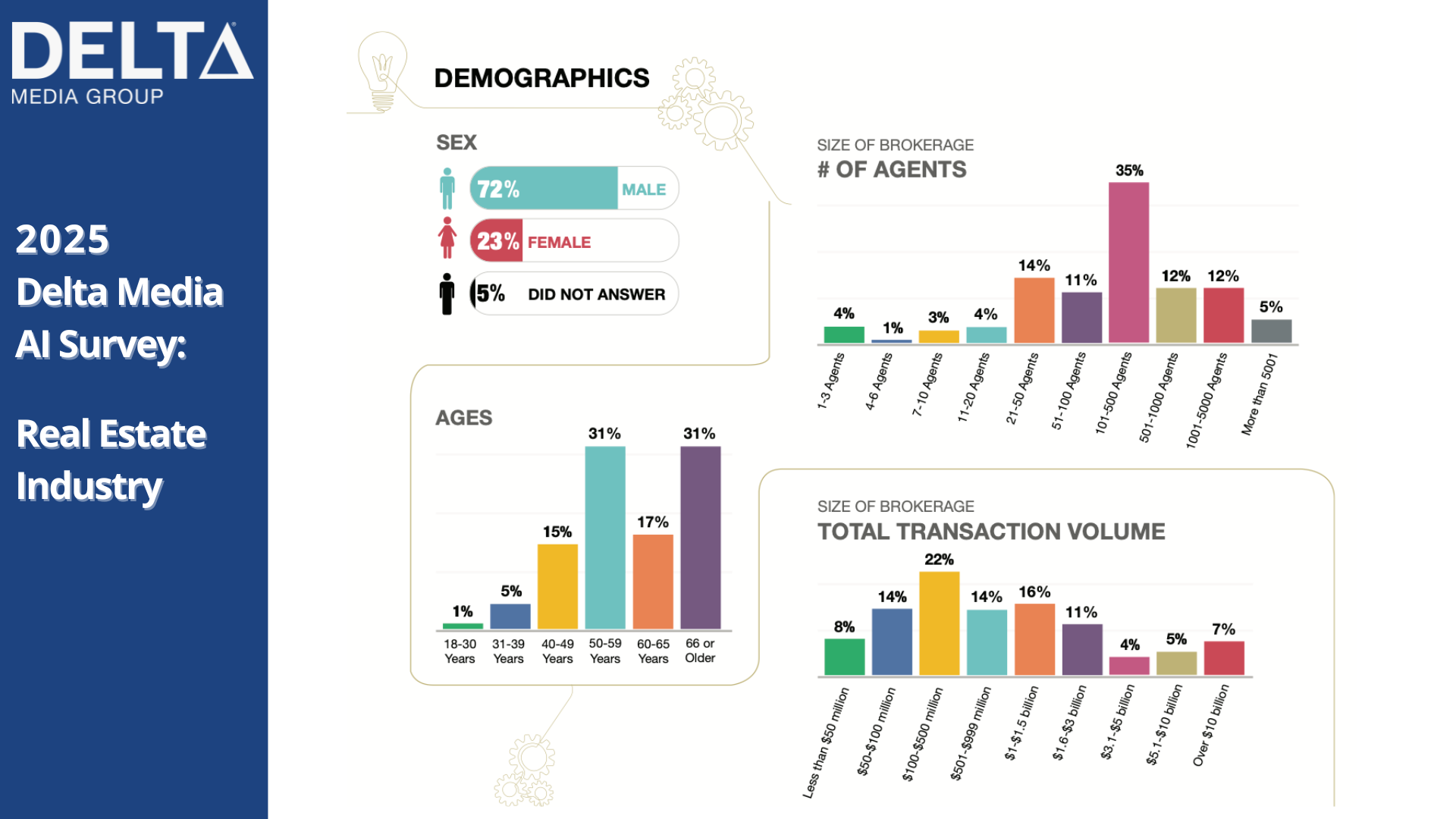

AI’s Pervasive Influence in Real Estate: A Transformative Shift

AI’s Pervasive Influence in Real Estate: A Transformative Shift

In a revealing report by RISMedia, the 2025 Real Estate Leadership AI Survey conducted by Delta Media Group highlights the sweeping integration of artificial intelligence within the real estate sector. The survey indicates that nearly 90% of brokerage leaders now report their agents’ active use of AI tools, illustrating a 7% increase from the previous year.

Michael Minard, CEO and owner of Delta Media Group, underscores the transformative nature of AI, stating, “AI is no longer a new shiny object; it’s fast become an irreplaceable tool for brokerages and agents alike.” This shift is evident as AI’s role expands beyond marketing and content creation to encompass customer support and administrative automation.

The survey, which gathered insights from over 100 residential brokerage leaders responsible for more than half of all US real estate transactions, reveals a remarkable change in AI adoption and perception. Leaders rated AI’s current significance at 5.9 out of 10, up from 5.0 in 2024, with future importance anticipated to rise to 7.2—a 22% increase.

Key Findings

- Broader Demographic Adoption: Age-based disparities in AI usage have vanished, and gender gaps have narrowed, with both male and female leaders reporting high AI engagement.

- Top AI Use Cases: While creating property descriptions remains the primary application, AI is increasingly used for digital marketing, client communications, data analysis, and administrative task automation.

- Easing Risk Concerns: The percentage of leaders highly concerned about AI risks fell from 50.4% in 2024 to 42.2% in 2025.

- Operational Shift: Brokerages are moving from marketing-focused AI applications to broader operational uses, reflecting a strategic shift toward holistic technology integration.

Medium to large brokerages, with their scale and resources, are leading AI adoption, while smaller brokerages face challenges that limit widespread implementation. As we look to the future, Delta anticipates 2025 as a pivotal year for AI in real estate, with expanded usage in automation and customer service poised to redefine operational efficiency.

For a comprehensive understanding, access the full report here.

The 20 Fastest Growing Cities in the US: A Closer Look

The 20 Fastest Growing Cities in the US: A Closer Look

In a rapidly evolving landscape, the United States is witnessing unprecedented growth in certain metropolitan areas. The latest report from Exploding Topics delves into the top 20 fastest-growing cities and metros across the nation, revealing intriguing trends and factors driving this expansion.

Austin, Texas: The Lone Star Leader

Austin, Texas, has emerged as the fastest-growing metro area in the United States. With a current metro population of 2,473,275 and a growth rate of 25.84%, Austin is becoming a hub of diversity and innovation. The city’s thriving tech scene, bolstered by major players like Apple and Tesla, has attracted a wave of new residents. The University of Texas at Austin also plays a pivotal role in fostering a vibrant, youthful community.

Raleigh, North Carolina: Tech and Talent

Raleigh’s growth is driven by its strong educational institutions and burgeoning tech industry. The Research Triangle is home to prominent universities and tech companies, drawing talent from across the globe. With a metro growth rate of 19.84%, Raleigh is a city on the rise, offering a blend of cultural and professional opportunities.

Orlando, Florida: Beyond the Theme Parks

While Orlando is famous for its theme parks, its growth story extends beyond tourism. The metro area has seen a 19.69% increase in population, driven by a robust healthcare sector and a thriving retirement industry. According to a recent study, Florida’s appeal to retirees continues to fuel its expansion.

Charleston, South Carolina: A Historic Gem

Charleston blends history with modern growth, experiencing an 18.5% increase in its metro population. Known for its charm and coastal beauty, the city attracts both tourists and new residents. Charleston’s economy is diverse, with a mix of tourism, manufacturing, and technology sectors contributing to its growth.

Houston, Texas: A Giant on the Move

As one of the largest cities in the US, Houston’s metro area has grown by 17.36%. The city’s diverse economy, including a strong energy sector, continues to draw people from across the country. Despite challenges like hurricanes and heat, Houston remains an attractive destination for families and professionals alike.

Sarasota-Bradenton, Florida: Coastal Growth

The Sarasota-Bradenton area has seen a 16.81% increase in its metro population. Known for its beautiful beaches and cultural amenities, this area is a magnet for retirees and tourists. The local economy is bolstered by a strong tourism industry and a growing healthcare sector.

San Antonio, Texas: Military and More

San Antonio’s growth is anchored by its military presence and a diverse economy. With a 16.59% increase in its metro population, the city offers affordable living and a rich cultural heritage. Tourism, healthcare, and manufacturing are key sectors driving San Antonio’s expansion.

Dallas-Fort Worth, Texas: The Metroplex

The Dallas-Fort Worth Metroplex continues to thrive, with a 16.58% growth rate. This sprawling area is a hub for business, culture, and education. Major corporations and a vibrant arts scene make DFW an attractive destination for newcomers.

Phoenix, Arizona: The Valley of the Sun

Phoenix’s warm climate and growing economy have contributed to a 15.61% increase in its metro population. The city is a magnet for retirees and young professionals alike, offering a range of opportunities in healthcare, finance, and technology.

Nashville, Tennessee: Music City

Nashville’s reputation as a music and cultural hub is complemented by its economic growth. With a 15.35% increase in its metro population, the city attracts talent from various industries, including healthcare, education, and entertainment.

These cities represent a dynamic shift in the US urban landscape, driven by factors such as climate, economic opportunities, and cultural attractions. As the nation continues to evolve, these metros stand out as beacons of growth and innovation.