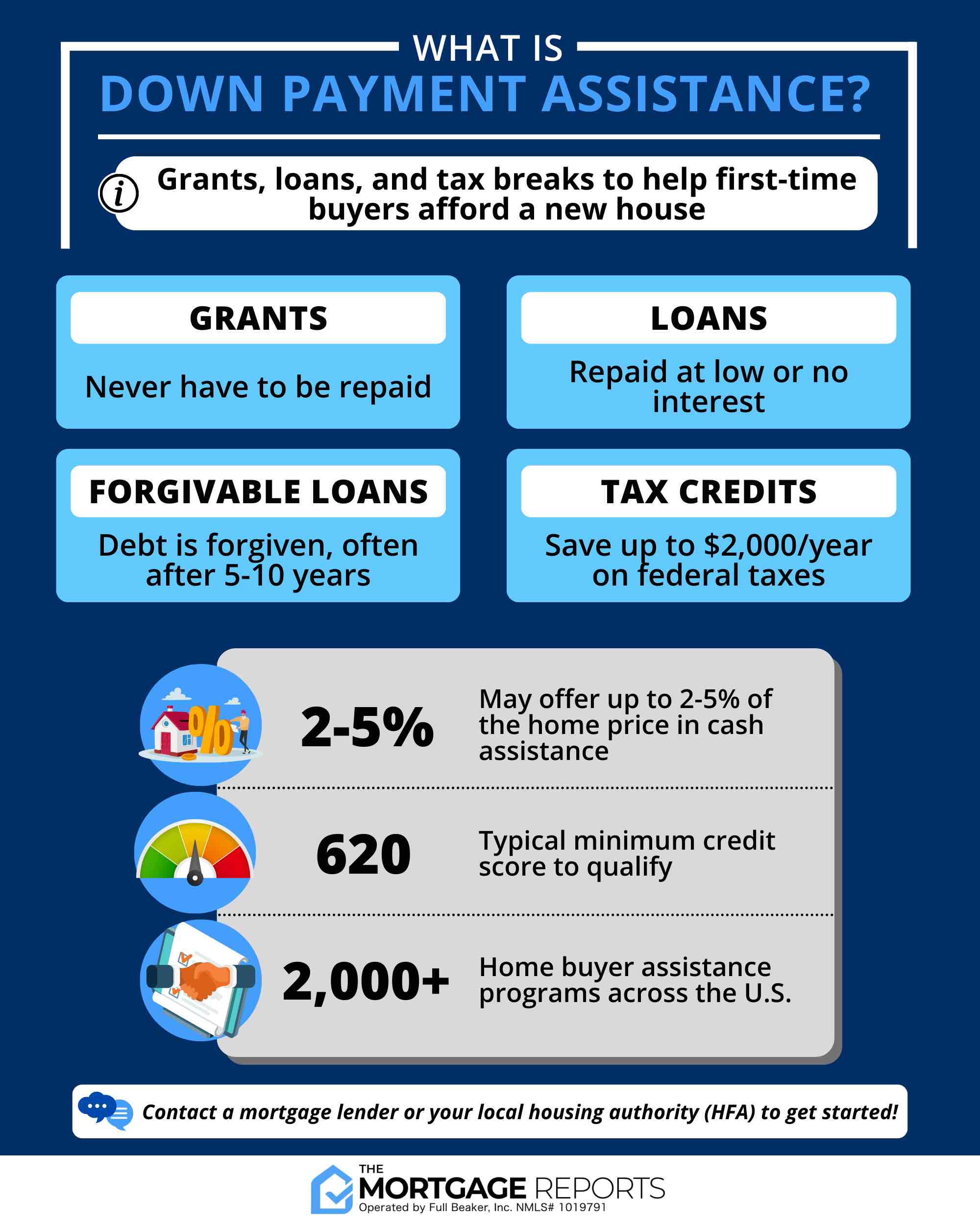

In a world where the dream of owning a home often feels out of reach, **down payment assistance (DPA) programs** have emerged as a beacon of hope for aspiring homeowners. With over 2,000 programs available nationwide, these initiatives are designed to make **homeownership** more accessible by alleviating the financial burden of upfront costs. State, county, and city governments across the United States are spearheading these efforts, offering a variety of loans and grants that can cover part or all of a home buyer’s down payment and closing costs.

Understanding Down Payment Assistance

**Down payment assistance** is available in multiple forms, including grants and loans, some of which may be interest-free or forgivable over time. These programs are particularly beneficial for **first-time homebuyers** or those who haven’t owned a home in the past three years. To qualify, individuals typically need to meet certain income requirements and, in some cases, purchase properties in designated areas.

Eligibility and Application

Eligibility criteria for **DPA programs** often include being a first-time homebuyer and meeting income qualifications. Programs may also require purchasing within specific price limits or using approved mortgage programs. The original article from

The Mortgage Reports provides a comprehensive guide to these programs, emphasizing the importance of consulting with local loan officers or brokers who can offer insights into regional grants and loans.

Exploring Resources

For those eager to explore their options, the article encourages potential homebuyers to leverage resources like the

U.S. Department of Housing and Urban Development (HUD), which lists various statewide and local assistance programs. Additionally, aspiring homeowners can benefit from understanding the intricacies of securing **down payment assistance**, as outlined in the article, to confidently navigate their path to homeownership.

Conclusion

In essence, **down payment assistance programs** serve as a crucial tool for those looking to overcome the financial barriers to homeownership. By providing financial support and reducing upfront costs, these initiatives are paving the way for more individuals to achieve their dream of owning a home. For further details, readers are encouraged to visit the original article and explore additional resources such as the

guide on buying a house with $0 down and the

guide to mortgage closing costs.