Sioux Falls Multifamily Projects Transform Housing Landscape

Two pioneering multifamily projects in the eastern part of Sioux Falls are gaining ground, backed by compelling interest and investment from local stakeholders. Spearheaded by the Sioux Falls-based Ernst Capital Group, the city sees a significant influx of new housing options tailored to meet diverse rental needs.

“We’re seeing an exceptional performance in our portfolio, especially highlighting some of the best winter leasing activities on record,” said Chris Daugaard, a partner in Ernst Capital Group. “This enthusiasm encourages us as we progress with these new projects.”

Willowbrook Village

The first project, Willowbrook Village, has already welcomed its initial residents. Situated northeast of Veterans and Arrowhead parkways, this build-to-rent community introduces 57 single-family homes managed by Lloyd Companies. Each residence boasts two- or three-bedroom configurations complete with attached garages. Residents have noted the quality finishes, comparing them to freshly constructed homes intended for sale rather than rentals.

This innovative approach to multifamily living focuses on striking a balance between affordability and quality, making it an appealing option without the overhead of luxury amenities. This move aligns well with the broadly thriving residential market within the area, further fortified by the strategic location chosen for development.

Split Rock Village

Simultaneously, Split Rock Village, another development under Signature Fund VI, is progressing at 26th Street and Six Mile Road. It targets a mix of dwellings with upcoming leases for 100 units across studio, one-, two-, and three-bedroom apartments. The inclusive amenity package planned features a clubhouse, pool, and additional recreational facilities, aligning with the growing expectations of the modern tenant.

Ernst Capital’s ventures reflect years of strategic investment and partnership, marking its 38th collaboration since 2007, with 16 specifically focused on projects like those seen with Signature Companies. Chris Daugaard notes the long-term potential of these locations, tying their development closely to the ever-increasing population and demand.

These developments signify more than just urban expansion; they offer local investors a chance to engage deeply with Sioux Falls’ growth story, emphasizing quality and evolving residential preferences. As Ernst Capital opens doors to new investment opportunities, there’s little doubt these projects will carve out a new definition for Sioux Falls’ multifamily housing landscape.

For further information or to get involved with Ernst Capital Group, visit their official website here.

For the full story, refer to the original article on SiouxFalls.Business.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

More Articles

Getting licensed or staying ahead in your career can be a journey—but it doesn’t have to be overwhelming. Grab your favorite coffee or tea, take a moment to relax, and browse through our articles. Whether you’re just starting out or renewing your expertise, we’ve got tips, insights, and advice to keep you moving forward. Here’s to your success—one sip and one step at a time!

Sioux Falls Multifamily Projects Transform Housing Landscape

Two pioneering multifamily projects in the eastern part of Sioux Falls are gaining ground, backed by compelling interest and investment from local stakeholders. Spearheaded by the Sioux Falls-based Ernst Capital Group, the city sees a significant influx of new housing options tailored to meet diverse rental needs.

“We’re seeing an exceptional performance in our portfolio, especially highlighting some of the best winter leasing activities on record,” said Chris Daugaard, a partner in Ernst Capital Group. “This enthusiasm encourages us as we progress with these new projects.”

Willowbrook Village

The first project, Willowbrook Village, has already welcomed its initial residents. Situated northeast of Veterans and Arrowhead parkways, this build-to-rent community introduces 57 single-family homes managed by Lloyd Companies. Each residence boasts two- or three-bedroom configurations complete with attached garages. Residents have noted the quality finishes, comparing them to freshly constructed homes intended for sale rather than rentals.

This innovative approach to multifamily living focuses on striking a balance between affordability and quality, making it an appealing option without the overhead of luxury amenities. This move aligns well with the broadly thriving residential market within the area, further fortified by the strategic location chosen for development.

Split Rock Village

Simultaneously, Split Rock Village, another development under Signature Fund VI, is progressing at 26th Street and Six Mile Road. It targets a mix of dwellings with upcoming leases for 100 units across studio, one-, two-, and three-bedroom apartments. The inclusive amenity package planned features a clubhouse, pool, and additional recreational facilities, aligning with the growing expectations of the modern tenant.

Ernst Capital’s ventures reflect years of strategic investment and partnership, marking its 38th collaboration since 2007, with 16 specifically focused on projects like those seen with Signature Companies. Chris Daugaard notes the long-term potential of these locations, tying their development closely to the ever-increasing population and demand.

These developments signify more than just urban expansion; they offer local investors a chance to engage deeply with Sioux Falls’ growth story, emphasizing quality and evolving residential preferences. As Ernst Capital opens doors to new investment opportunities, there’s little doubt these projects will carve out a new definition for Sioux Falls’ multifamily housing landscape.

For further information or to get involved with Ernst Capital Group, visit their official website here.

For the full story, refer to the original article on SiouxFalls.Business.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

The Liberation of Angels

Elimination of Rights for Disabled Students

Project 2025 proposes structural changes that would severely impact disabled students. By moving the Office of Special Education and Rehabilitative Services to the Department of Health and Human Services, coordination of resources and knowledge would become challenging, undermining the promise of an equitable education for disabled students.Major Cuts to Health Coverage

The project threatens to convert Medicaid funding into block grants, limiting states’ ability to provide essential home- and community-based services. Moreover, repealing Medicare’s ability to negotiate drug prices could lead to increased costs for millions of Americans.Barriers to Employment

By eliminating key data collection and constraining the Equal Employment Opportunity Commission’s enforcement capabilities, Project 2025 could strip away critical protections for disabled workers. The plan also aims to eliminate the Office of Federal Contract Compliance Programs, further reducing oversight.Restriction of Social Benefits

The automation of the U.S. Department of Veterans Affairs claims process and increased work requirements for SNAP could make it more difficult for disabled individuals to access needed benefits. This could result in significant hardship for those relying on these essential services.Reduced Enforcement of the ADA

Project 2025’s proposal to discontinue disparate impact regulations would weaken the federal government’s ability to enforce civil rights protections under the ADA, potentially perpetuating discrimination in various sectors.

Conclusion

The Center for American Progress warns that Project 2025 could severely hinder disabled individuals’ ability to live independently and participate in their communities. The report underscores the necessity of maintaining and strengthening protections and services for this vulnerable population.For more details on the implications of Project 2025, visit the original article.

Image credit: Getty/Sandy Huffaker

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

Navigating the Transformative Waves: The 2025 Housing Landscape of New Hampshire’s Lakes Region

The Lakes Region of New Hampshire is undergoing a significant metamorphosis in its housing market as the year 2025 unfolds, offering a landscape marked by both opportunity and scarcity. Buyers face a complex environment reminiscent of the serene yet intricate waters of Lake Winnipesaukee.

Reflecting back on 2024, a paradox of growth emerged. Single-family home sales and condo transactions fell by nearly 5%, yet median prices surged, underscoring a strong demand confronting limited supply. Specifically, single-family median home prices jumped by 10.39%, with condos not far behind with a 6.8% increase.

In 2025, this narrative begins to shift. The market experienced an increase in single-family home transactions and a notable rise in median sales prices, signaling sustained demand. However, the average time homes spend on the market has expanded, shining a light on cautious, discerning buyers. Nonetheless, the Lakes Region remains a desirable destination due to its natural beauty and a thriving short-term rental sector.

Amidst this bustling activity, a pressing concern surfaces: skyrocketing affordability challenges. Monthly payments have increased by 164% since 2019, pricing many locals out of the market as median incomes lag behind housing costs.

Navigating this evolving housing theatre will require both buyers and sellers in New Hampshire to embrace patience and strategy. The vigor of the market reflects an evolving domain demanding attentive observation and judicious decision-making, especially as New Hampshire eyes the need for 60,000 additional housing units by 2030.

Unlocking the Secrets of New Hampshire’s Lakes Region Housing Market

How-To Steps & Life Hacks for Buyers and Sellers:

- Stay Informed: Monitor market trends through local real estate reports and news.

- Leverage Local Expertise: Engage real estate agents with in-depth knowledge of the Lakes Region market.

- Consider Timing: Explore listings during fall and winter to face less competition.

- Explore Financing Options: Look into state programs aiding first-time buyers.

- Negotiate Smartly: Understand factors beyond price that strengthen your offer in a seller’s market.

Real-World Use Cases:

- Investment Opportunity: Tap into the profitable short-term rental market by investing in rental properties given the area’s tourist appeal.

- Retirement Destination: Ideal for retirees longing for tranquility and natural beauty, along with convenient amenities.

Experts suggest that the desirability of the Lakes Region will ensure steady demand despite rising median prices. According to Zillow, there may be a slight plateau in pricing, given the constraints in inventory.

Market Forecasts & Industry Trends:

The Lakes Region housing market attracts higher prices compared to the wider New Hampshire area due to its unique geographic appeal and tourism draw.

Controversies & Limitations:

- Affordability Crisis: Rising costs challenge local residents as prices surpass median income levels.

- Infrastructure Strains: Growing demand poses challenges such as traffic congestion and overcrowded schools.

Future Insights and Predictions:

The natural allure and seasonal population influxes imply continuous interest and investment. However, balancing development with the need for affordability and infrastructure improvements remains a priority.

For more insights and housing opportunities, visit the New Hampshire Association of Realtors for the latest listings and market information.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

Smart Home Evolution 2024: Innovations Transforming Modern Living

In the rapidly evolving world of smart home technology, the promise of a home where you can control any appliance with an app is now fully realized. As of 2024, the global smart home market, valued at an astounding $80.21 billion in 2022, is projected to catapult to $338.28 billion by 2030.

As of 2023, there are 63.43 million households in the US equipped with smart home devices, marking a 10.2% increase from the previous year. Globally, it’s estimated that 785 million users will be taking advantage of smart home features by 2028.

Samsung SmartThings

Samsung’s Smart Home, known as SmartThings, is a platform enabling users to control and monitor their compatible devices through a single app. Launched in 2013 and acquired by Samsung in 2014, SmartThings is an open system that integrates hundreds of devices. It uses Matter, a connectivity standard supported by more than 280 companies, allowing users to choose which devices to bring home. The SmartThings Hub connects wirelessly with a wide range of smart devices, making them work together seamlessly.

Tado

Tado, a German company, specializes in smart heating and energy management products. As of January 2023, they had over 3 million devices in European homes. Their products, including Smart Radiator Thermostats and Smart AC Controls, can save up to 31% on heating bills. Tado’s products are compatible with most smart home platforms, including Alexa, Google Assistant, and Apple HomeKit. According to Christian Deilmann, Co-Founder and Chief Product Officer, “Tado is scaling a unique energy management offering to reduce heating costs and CO2 emissions.”

LG ThinQ

LG ThinQ is a smart home solution allowing users to control and monitor LG smart appliances from their phone. Available on most LG devices, it integrates with Google Assistant and Amazon Alexa for voice control. In August 2023, ThinQ UP 2.0 was unveiled, offering personalized appliance features. Lyu Jae-cheol, president of LG Electronics Home Appliance & Air Solution Company, emphasized the shift towards a service-based business model with this launch.

Eufy

Eufy offers user-friendly smart home devices, including security cameras and robotic vacuums. Their products are used in over 5 million residences worldwide. Eufy’s latest feature uses AI to track movement across devices, as noted by Frank Zhu, Eufy Security’s General Manager: “Our dual-camera lineup signifies a major advancement in home security.”

Govee

Govee provides smart home solutions that blend functionality with aesthetic enhancement. Their LED strip lights respond to music or voice commands, and their products are highly rated for quality and user-friendliness. In April 2023, Govee won the Red Dot Design Award and the iF Design Award. CEO Eric Wu remarked, “These awards reflect our dedication to user-centric designs.”

Arenti

Arenti specializes in smart cameras for home security, offering quality products at affordable prices. Their cloud storage solutions, hosted on Amazon’s AWS, ensure data security. The Arenti app allows real-time interaction with your home, providing a comprehensive security solution.

SwitchBot

SwitchBot offers intelligent products to upgrade existing home features, like smart locks and automated curtains. Their Hub Mini and Hub 2 provide robust smart home integration, supporting Alexa, Google Assistant, and Siri. SwitchBot emphasizes user-friendly and affordable solutions for a seamless transition to smart home automation.

Vivint

Vivint, a leader in the U.S. smart home market, offers innovative products focused on security and convenience. Their charitable wing, Vivint Gives Back, supports children with intellectual disabilities. Vivint’s products, including the Smart Hub, integrate with popular platforms like Amazon Echo and Google Home for enhanced functionality.

Rachio

Rachio offers smart yard solutions, like the Smart Sprinkler Controller, which optimizes water use based on weather data. The Rachio 3 provides uninterrupted service by switching between weather stations. CEO Kim Sentovich stated, “Rachio is a software company enabled through hardware products, offering an unparalleled in-app experience.”

For those interested in developing smart home products, Netguru can help design and build beautiful digital experiences.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

Embracing the AI Frontier: USPTO’s Strategic Vision

Embracing the AI Frontier: USPTO’s Strategic Vision

The realm of Artificial Intelligence (AI) within intellectual property is undergoing a transformative phase. On January 14, 2025, the U.S. Patent and Trademark Office (USPTO) unveiled its comprehensive AI Strategy, an initiative designed to navigate the intricate landscape of AI’s integration into intellectual property (IP) policy, agency operations, and the broader innovation ecosystem.This strategic document, as reported by Mintz, arrives amidst significant shifts in U.S. administration policies. Initially crafted in alignment with President Biden’s 2023 Executive Order on AI, the strategy faced a pivotal change when President Trump revoked this order on January 20, 2025. Trump’s administration subsequently issued a new directive titled “Removing Barriers to American Leadership in Artificial Intelligence”, emphasizing the enhancement of American global AI dominance.

Key Focus Areas of the USPTO’s AI Strategy

The USPTO’s AI Strategy delineates five critical focus areas:- Advancing IP Policies: The strategy underscores the need for inclusive AI innovation, addressing emerging AI-related IP policy issues, and fostering involvement with educational institutions.

- Building AI Capabilities: By investing in computational infrastructure and data resources, the USPTO aims to enhance its operational efficiencies and extend AI tools into trademark and design patent examination processes.

- Promoting Responsible AI Use: Guided by principles of safety, fairness, and transparency, the USPTO seeks to uphold public trust in AI systems and ensure ethical data use.

- Developing AI Expertise: The strategy includes expanded training for USPTO Examiners and aims to attract talent with AI-related expertise.

- Collaborating on AI Initiatives: The USPTO emphasizes a collaborative approach with other U.S. agencies, international partners, and the public on AI matters impacting the global IP system.

Anticipating the Future

As the USPTO navigates these strategic pathways, it anticipates a significant uptick in AI-related patent filings, a trend already evident with a 33% increase since 2018. This surge underscores the agency’s commitment to nurturing innovation and competitiveness within the U.S. and globally.In the words of Mintz, the USPTO’s AI Strategy is a bold vision to “unleash American potential” through AI adoption, driving U.S. innovation, inclusive capitalism, and global competitiveness. As we witness the unfolding of this strategic initiative, the interplay between evolving presidential directives and the USPTO’s mission will undoubtedly shape the future of AI in intellectual property.

For more insights and updates, consider subscribing to Mintz Viewpoints.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

Strategic Positioning in the 2025 Commercial Real Estate Landscape

Strategic Positioning in the 2025 Commercial Real Estate Landscape

As we delve into the 2025 commercial real estate outlook, it is evident that the landscape is evolving rapidly, presenting a generational opportunity for real estate organizations to strategically position themselves for future developments. The comprehensive analysis presented by Deloitte in their 2025 Commercial Real Estate Outlook sheds light on the multifaceted challenges and opportunities that lie ahead.Interest Rate Dynamics and Economic Indicators

The global economic environment is undergoing significant shifts, with major central banks adjusting interest rates in response to changing economic conditions. For instance, the Bank of England’s recent rate cut marks a pivotal moment, being the first since 2020. Similarly, the Federal Reserve has signaled potential rate adjustments, contingent on inflation trends, as reported by The New York Times. These monetary policies are crucial for the real estate sector, influencing borrowing costs and investment strategies.Challenges in Global Real Estate Markets

The real estate sector across various regions is grappling with unique challenges. In the Eurozone, the ECB’s rate cut has been met with cautious optimism, while in the Asia-Pacific, there’s a notable debt funding gap impacting real estate investments. These regional insights are crucial for stakeholders aiming to navigate the intricate global real estate market.Technological Advancements and Sustainability

The rise of artificial intelligence and data centers is reshaping the real estate landscape, with an unprecedented demand for infrastructure to support these technologies. However, this growth also presents sustainability challenges, as highlighted by concerns over the environmental impact of data centers. The industry is at a crossroads, balancing technological advancement with sustainable practices.Investment Opportunities and Strategic Moves

Despite the challenges, there are promising investment opportunities on the horizon. The trend of reshoring in North America is driving a boom in industrial real estate, particularly in regions like Mexico, as companies shift supply chains. Additionally, the push for impact investing is gaining momentum, encouraging sustainable and socially responsible investments.In conclusion, the 2025 commercial real estate outlook, as detailed by Deloitte, emphasizes the need for strategic foresight and adaptability. As organizations navigate this complex landscape, they must be prepared to leverage opportunities while addressing the inherent challenges. For a deeper understanding of these dynamics, the full report is available on Deloitte’s website.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

California Housing Market: 2025 Insights and Predictions

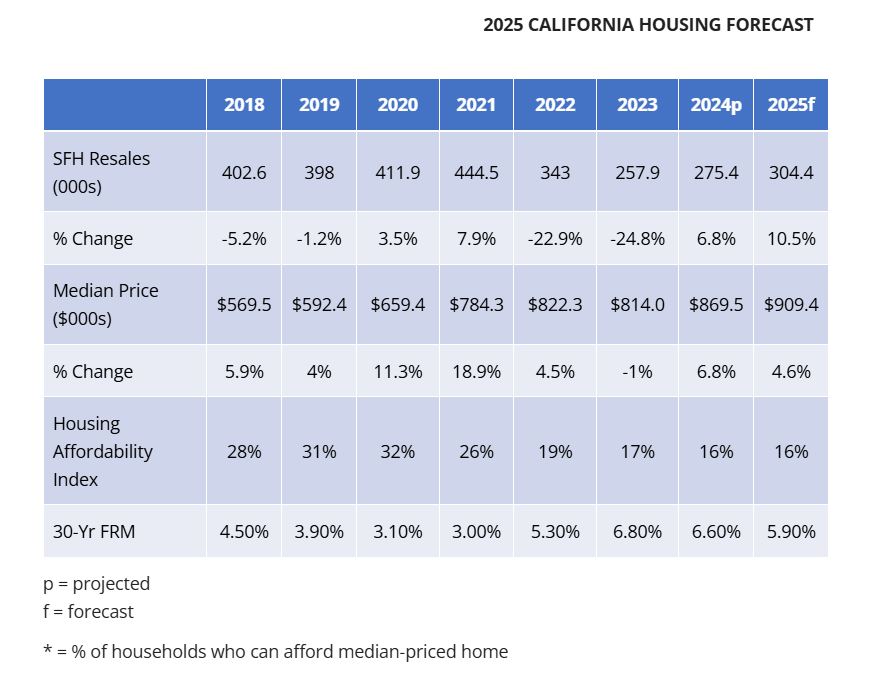

The California housing market continues to be a subject of intense scrutiny and interest, as it remains one of the most dynamic and challenging real estate landscapes in the United States. With a mix of rising prices, regional disparities, and economic influences, understanding the current state and future outlook is crucial for both buyers and sellers.

A Closer Look: January 2025 Market Overview

In January 2025, the California Association of Realtors® (C.A.R.) reported a complex picture of the state’s housing market. Home sales dropped by 10% from December, with a seasonally adjusted annualized rate of 254,110 homes sold, marking a 1.9% decrease from January 2024. Meanwhile, the median home price rose to $838,850, a 6.3% increase year-over-year but a 2.6% decline from the previous month. Elevated mortgage rates and the impact of wildfires have significantly influenced these trends.

Mortgage Rates and Their Market Impact

The average 30-year fixed mortgage rate stood at 6.96% in January 2025, up from 6.64% a year earlier. This increase in borrowing costs has led to reduced buyer demand and longer decision-making times. Potential buyers are closely monitoring interest rate trends, hoping for a decline that could make home purchases more affordable.

Regional Differences: A Diverse Market

California’s housing market is characterized by significant regional diversity. For example, the Central Coast experienced both sales and price increases, while the Far North saw a decline in sales. These variations are driven by factors such as local economies, population growth, and housing supply.

Inventory and Home Buying Challenges

January 2025 saw the Unsold Inventory Index at 4.1 months, indicating more options for buyers compared to December 2024. Homes took an average of 35 days to sell, suggesting a slightly cooling market, though it remains competitive.

Looking Forward: What Lies Ahead?

As we move further into 2025, there is cautious optimism. The spring buying season typically brings increased activity, which could lead to more competition and higher prices. The anticipated decline in mortgage rates from 6.6% in 2024 to 5.9% in 2025 may encourage hesitant buyers to enter the market. The C.A.R. forecast expects a 10.5% increase in single-family home sales, highlighting potential growth.

Final Thoughts

While challenges such as affordability and natural disaster impacts persist, California’s housing market remains significant due to its economic influence and diverse opportunities. Staying informed and working with local real estate professionals can help buyers and sellers make strategic decisions in this ever-evolving market.

For more detailed analysis and information, individuals are encouraged to explore resources like those provided by Norada Real Estate Investments.

For further insights, readers are also invited to check related articles on broader market predictions and historical trends, accessible through the original source.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

Remote Work is Transforming the Restaurant Industry

In the evolving landscape of the restaurant industry, remote work is redefining the way businesses operate. As more employees embrace hybrid and remote work environments, a shift in dining habits is emerging, prompting fast-casual chains to adapt their strategies. According to the U.S. Chamber of Commerce, chains like DIG, CAVA, and Sweetgreen are experiencing success in suburban markets as they cater to the changing needs of their customers.

Suburban Expansion: A Strategic Move

With over half of U.S. employees now working in hybrid or remote settings, restaurant chains are finding suburban locations more lucrative. A Gallup poll indicates that 52% of workers are in hybrid environments, compared to just 32% in 2019. This shift has led to a decline in urban store visits, prompting chains to focus on suburban development.

For instance, DIG, a New York-based chain, has strategically opened locations in suburban areas like Stamford, Connecticut, and Bethesda, Maryland. Tracy Kim, CEO of DIG, noted, “COVID changed consumer behavior— I think forever, frankly.” The company is now focusing on residential areas to capture the all-day dining market, a departure from its previous lunch-heavy urban operations.

Operational Adjustments for New Markets

Adapting to suburban markets requires operational changes. DIG, for example, has observed a shift toward more all-day dining in these areas, necessitating a consistent level of service throughout the day. “The business is much more spread out throughout the day,” Kim said, likening the change to “the difference between a sprint and a marathon.”

Additionally, suburban locations demand more on-site dining capacity and parking space, as customers prefer to dine in with family, including small children. Kim emphasized the importance of creating a welcoming dining room atmosphere, a consideration less critical in urban settings.

Challenges and Opportunities

Despite the opportunities, suburban expansion is not without challenges. The availability of prime real estate is limited, with suburban areas experiencing increased competition for retail spaces. Daniel Diebel, an economist at CBRE Econometric Advisors, highlighted the competition for these spaces, noting that urban real estate availability has now exceeded suburban availability for the first time.

However, the migration to the suburbs presents a long-term opportunity for restaurants. As Diebel remarked, “We think this more hybrid working environment is going to persist. Once consumers find something they like, they continue to do it.”

Success in Smaller Markets

Chains like CAVA and Sweetgreen are also capitalizing on the trend. CAVA, which had already been exploring suburban development before the pandemic, has found success in both urban and suburban markets. The company is now expanding by converting Zoe’s Kitchen locations into higher-volume CAVA-branded sites, as noted in their 2018 acquisition strategy.

Similarly, Sweetgreen has seen strong performance in suburban areas, with new locations performing on par with top urban sites. The company is even testing its latest automation innovations in suburban units before rolling them out to urban locations.

As remote work continues to shape consumer behavior, the restaurant industry is adapting to meet the demands of a new dining landscape. With strategic suburban expansions and operational adjustments, fast-casual chains are poised to thrive in this evolving market.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

Proptech Revolution: Shaping the Future of Real Estate in 2024

Proptech encompasses a wide array of tech tools used in the real estate sector to research, market, buy, sell, and manage properties. This technological revolution aims to optimize real estate transactions, enhance operational efficiency, and elevate the overall experience for buyers, sellers, renters, agents, and property managers. Industry giants like Zillow and Airbnb are just the tip of the iceberg, as proptech extends to advanced technologies like AI, blockchain, and IoT, promising more efficient property management and transactions.

The proptech market is on a significant growth trajectory, expected to soar from $19.6 billion in 2023 to $47.8 billion by 2033, reflecting a compound annual growth rate (CAGR) of 9.3%. This surge is fueled by innovations in Virtual Reality (VR), Artificial Intelligence (AI), blockchain, and GreenTech, which are reshaping the real estate landscape.

Top Proptech Trends for 2024

1. AI-powered Property Listing Descriptions

AI is revolutionizing property listings by converting images into text, generating descriptions based on photos. This not only saves agents’ time but also enhances the sales process by optimizing images and boosting conversion rates.

2. Data-powered Market Analysis

AI-driven platforms enable faster analysis of real estate projects, transforming data from multiple sources into complex market analysis. This data-driven approach removes bias, reduces costs, and facilitates efficient decision-making.

3. AI-chatbots & Assistants

With 78% of leads staying with the realtor who responds first, AI-chatbots are becoming indispensable. They offer agents instant access to crucial data and automate investment strategies, making real estate more accessible to lower-capital consumers.

4. AI-driven Marketing

AI enhances real estate marketing by automating efforts, increasing efficiency, and simplifying the search for quality tenants. From auto-generating ads to AI-backed CRMs analyzing lead conversion, AI is reshaping the marketing landscape.

5. Energy Optimization

With real estate responsible for 40% of global CO2 emissions, proptech is critical for decarbonization and energy optimization. Companies like Cushman & Wakefield are building software to assess and reduce carbon emissions, offering an environmentally responsible way to manage properties.

6. AR/VR-driven Touring and Staging

AR/VR technologies offer immersive virtual tours and 3D renderings, providing potential buyers a comprehensive understanding of properties from the comfort of their homes. This trend is set to increase in 2024, enhancing the buyer experience and sales potential.

7. Blockchain

Blockchain simplifies real estate transactions by creating digital agreements and storing transaction details securely. This technology eliminates third-party intermediaries and physical paper trails, enhancing transparency and security.

The proptech landscape is dynamic, with companies like Airbnb, EquipmentShare, View, Opendoor, Compass, Pacaso, and Hippo leading the charge in the U.S. These companies are leveraging significant funding to innovate and disrupt traditional real estate practices.

For those interested in diving deeper into the world of proptech, the original article on Netguru provides a comprehensive overview of how these technologies are driving change in the real estate sector. As the industry continues to evolve, staying ahead of these trends will be crucial for anyone involved in real estate.

The future of real estate is being shaped by the dynamic evolution of proptech. After years of tech-hibernation, the real estate industry has finally woken up and is hungry for change. Proptech companies understand that the key to efficient innovation is accelerated speed-to-value, best achieved through minimum viable products that allow for swift validation of new concepts.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

Fed Rate Cuts and the Future of Northwest Arkansas Real Estate

The Federal Reserve’s recent decision to lower the federal funds rate by a total of 0.75 percentage points over its last two meetings has sparked discussions on its impact on the commercial real estate market in Northwest Arkansas. A potential additional cut of 0.25 percentage points by the end of the year has been signaled, promising further implications for the region’s economic landscape.

Paul Esterer, a seasoned expert in commercial real estate and managing director of Moses Tucker Partners, offers a nuanced perspective on these developments. According to Esterer, the drop in short-term rates does not correlate with the 10-year Treasury yield, which is a critical indicator for commercial rates used by banks and investors nationwide. While short-term rates have decreased, long-term rates have risen, presenting both opportunities and risks in repricing assets tied to short-term construction and variable rates.

The inversion of the yield curve, where the two-year Treasury yield hovers close to the 10-year yield, is typically seen as a harbinger of economic slowdown. As of mid-November, the 10-year Treasury note was at 4.28%, while the two-year note was at 4.26%, a situation that has real estate investors concerned about the potential for a shift in the yield curve.

Bank Liquidity and Investor Capital

Esterer remains optimistic about Northwest Arkansas’s future, citing the strong liquidity position of community banks. The lower interest rates have facilitated short-term lending, benefiting smaller projects, refinancing efforts, consumer loans, and small business activities. “Banks are lending again, repricing necessary assets, which is a positive sign,” Esterer noted.

Northwest Arkansas stands out among U.S. metro areas due to its rapid population growth, driving the need for extensive residential and commercial construction, as well as infrastructure projects like sewer, water, and energy improvements. Esterer highlighted the region’s attractiveness to a broad base of investors and developers, viewing it as a primary growth market in the U.S.

Skyline Report Insights

The Arvest Bank Skyline Report, now in its 20th year, underscores the health of the real estate market in Northwest Arkansas. The report noted an 8.5% increase in home sales in the first half of 2024 compared to the same period last year, with 1,896 new constructions among the 4,799 homes sold. Multifamily vacancy rates rose slightly but remained healthy, while commercial vacancy rates stayed flat, reflecting a robust market.

Despite national trends, the office market vacancy rate in Northwest Arkansas dropped from 8.8% to 7.4% in the first half of 2024, with strong leasing activity in the class A submarket. Retail vacancy rates also declined, driven by vibrant leasing in the class B retail submarket. However, the warehouse submarket saw a rise in vacancy rates due to new space entering the market and existing spaces becoming available, although demand for additional warehouse space remains strong.

Potential Warning Signs

Esterer cautioned that policy changes under the Trump administration could lead to significant economic shifts. Developers are in a holding pattern, assessing the potential impacts of tariffs, labor force changes, and shifts in stimulus funding for infrastructure projects.

Mortgage rates are slower to decline, a crucial factor for a region grappling with housing affordability for its growing labor force. Esterer emphasized the importance of infrastructure investment and affordable construction to sustain growth, noting, “The biggest challenge for commercial real estate is ensuring the capital needed for infrastructure, such as water, sewer, and electricity, is available to support growth.”

Mervin Jebaraj from the University of Arkansas highlighted the mixed impact of interest rate cuts, noting that while they haven’t significantly affected new projects due to persistent lot and construction costs, the region’s growth necessitates continued infrastructure development and affordability measures.

For a detailed look at these developments, visit the original article on Talk Business & Politics.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

Free Money in 2026? The Truth About the DOGE Dividend Stimulus Check

Check Out Your Savings Today

The DOGE Dividend: What You Need to Know About the Proposed 2026 Stimulus Check

Hey there! If you’ve been wondering about the so-called DOGE Dividend stimulus check coming in 2026, you’re definitely not alone. I’ve been hearing a ton of questions about when (or if) these checks are going to roll out. So, let’s get straight to it—what this is all about, where things currently stand, and what it might mean for you.

What’s the Deal with the DOGE Dividend?

The DOGE Dividend is a proposed one-time payout to taxpayers, all thanks to the Department of Government Efficiency (DOGE). This initiative was launched in 2025 by President Trump and is being led by none other than Elon Musk. The basic idea? Cut government waste, save a ton of money, and hand 20% of those savings right back to taxpayers. Sounds great, right? Well, let’s take a closer look.

How Much Money Are We Talking About?

The original goal was to rack up $2 trillion in savings by July 4, 2026. If that happens, every taxpaying household could get around $5,000. Some people are even speculating that savings could hit $4 trillion, which would mean even bigger checks.

Can DOGE Really Eliminate Inflation?

Now, here’s where things get interesting. Musk has been saying that one of DOGE’s biggest goals is to reduce or even eliminate inflation by slashing unnecessary government spending. The idea is that if the government spends less, inflation goes down, and your money holds its value better.

But here’s the problem—so far, DOGE has only managed to find $55 billion in savings. That’s a tiny fraction of the $2 trillion target. Plus, a lot of experts are skeptical that cutting waste alone is enough to fix inflation, especially when so much federal spending is locked into Social Security, Medicare, and defense. And then there’s another issue: some economists warn that handing out giant checks to taxpayers could actually make inflation worse instead of better. It’s a tricky balancing act.

So… Will You Actually Get a Check?

Here’s the honest truth—this isn’t a done deal yet. While the idea is out there, Congress still has to approve it before anyone gets a dime. Right now, there’s no official law backing these checks, so we’ll have to wait and see what happens.

What Needs to Happen Next?

- DOGE needs to find way more savings—billions (or even trillions) more.

- Congress has to sign off on the plan.

- The whole thing has to be tested against inflation concerns to make sure it actually helps, rather than hurts, the economy.

Try Our DOGE Dividend Calculator!

Curious about what your potential check could be? We’ve got a free web app that lets you play around with different savings numbers and see what kind of payout you could be looking at. It’s fun, easy, and totally free—so why not give it a shot?

Final Thoughts

Look, the DOGE Dividend is definitely an exciting idea, but let’s keep it real—it’s not a sure thing yet. Right now, it’s more of a political proposal than a guarantee. That said, we’ll keep tracking the latest updates and let you know if anything changes.

In the meantime, check out the calculator, stay informed, and keep the conversation going!

What do you think about the DOGE Dividend? Do you think it’s actually going to happen? Drop your thoughts in the comments!

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

Navigating Seller’s Market: Twin Cities Housing Trends and Predictions for 2024

Home Prices and Sales

The median home price in the Twin Cities metro saw a 3.3% rise, reaching $380,000, which remains below the national median. Notably, luxury homes priced over $1 million have surged by 12.3%, reflecting a robust demand in this segment. The preference for single-family homes and larger properties continues to dominate, with cash transactions becoming increasingly prevalent.

Inventory and Market Dynamics

By the end of 2024, the housing supply had dwindled by 3.4%, perpetuating a seller’s market environment. Despite the scarcity, the market is showing signs of gradual balance. The high mortgage rates, currently hovering around 7%, are adding layers of complexity, influencing both affordability and buyer behavior.

Forecast and Future Outlook

Experts anticipate a subtle decline in home values over the next year, projecting a 1.0% decrease by early 2026. In the short term, however, modest increases are expected. This forecast aligns with the insights from the 2024 Annual Twin Cities Housing Market Report, which also highlights the slowing rate of price increases.

Conclusion

As Minneapolis continues to navigate these mixed signals, potential buyers and sellers are advised to remain informed and strategic. The market’s trajectory will largely depend on shifts in mortgage rates, inventory levels, and broader economic conditions. For those considering investments, Minneapolis’s diverse economy and strong rental market present compelling opportunities.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

Future Homes: Sustainability and Smart Technology Shaping Real Estate

In the ever-evolving landscape of real estate, two groundbreaking trends are shaping the homes of tomorrow: sustainability and smart home technology. As consumers become increasingly aware of their environmental impact and as technology continues to advance at lightning speed, these trends are significantly influencing buying decisions in the residential real estate market. This is particularly true for the LGBTQ community, where understanding these trends is crucial for those looking to buy or sell a home.

According to a recent article from the Washington Blade, sustainability is no longer just a buzzword. It has become a pivotal factor in the decision-making process for many homebuyers. Modern consumers are seeking homes that are not only energy-efficient but also align with their environmental values. These sustainable homes, often equipped with solar panels and energy-efficient windows, offer not only reduced utility bills but also long-term cost savings. Governments often support sustainable living with tax incentives, making green technologies financially attractive.

Simultaneously, smart home technology has transitioned from luxury to expectation in modern homes. These homes are equipped with devices that can be controlled remotely via smartphones or voice-activated assistants, enhancing convenience and security. Smart technologies can also optimize energy usage, learning homeowner habits to adjust settings for maximum efficiency.

The real innovation lies at the intersection of sustainability and smart technology. Forward-thinking homes are integrating these elements to offer reduced environmental impact and enhanced living experiences. Imagine homes where solar panels are connected to a smart grid optimizing energy use based on real-time data, or rainwater collection systems that work in tandem with smart irrigation systems. These innovations are already being implemented, adding significant value to properties.

As these trends become more prevalent, their impact on property values is increasingly evident. Homes equipped with these features are often valued higher, as buyers are willing to pay premiums for energy efficiency and modern conveniences. For the LGBTQ community, particularly those who value innovation and environmental responsibility, these trends represent exciting opportunities.

At GayRealEstate.com, we are committed to guiding our clients through these emerging trends. Our network of knowledgeable and LGBTQ-friendly real estate professionals is here to support buyers and sellers every step of the way. Together, we can make sustainable, smart living a reality for everyone.

Jeff Hammerberg, the founding CEO of Hammerberg & Associates, Inc., can be reached at 303-378-5526 or via email.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

Harvard Study Projects Dramatic Slowdown in U.S. Household Growth

Harvard Study Projects Dramatic Slowdown in U.S. Household Growth

In a comprehensive analysis by Harvard’s Joint Center for Housing Studies, there is a projected increase of 8.6 million households in the United States from 2025 to 2035. This equates to approximately 860,000 new households per year, marking a significant deceleration compared to the post-Great Recession era, which saw a sluggish yet larger gain of 10.1 million households.Future Growth Rates: A Historical Low

The study anticipates an even more pronounced slowdown between 2035 and 2045, with an expected addition of only 5.1 million households. This would represent the lowest growth rate in any decade over the past century.

Demographic Shifts

A notable finding is the predicted surge in households led by individuals aged 80 and older, which is expected to rise by nearly 60%, translating to approximately 6 million households. This shift underscores the growing need for housing that accommodates senior citizens.

Immigration’s Role

The projections assume stable immigration levels at 870,000 per year from 2025 to 2035. However, a scenario with reduced immigration could see household growth dip to 6.9 million in the same period. This highlights the critical impact of immigration policies on future housing dynamics.

Construction Demand and Housing Shortage

The report emphasizes that household growth is the principal driver of new housing demand. New housing construction is projected to decline from the current 1.4 million units annually to 1.1 million from 2025 to 2035, and further down to 800,000 units from 2035 to 2045. These figures fall short of the historical average of 1.6 to 2.1 million units per year observed from the 1970s to the 2000s.

The existing housing shortfall, estimated between 1.5 million to 5.5 million units, poses a significant challenge. Future construction may need to exceed projected demand to address this deficit effectively.

Policy Implications

These projections underscore the need for adaptive policies to manage housing needs amid shifting demographic landscapes. As household growth slows, strategies must be developed to accommodate the aging population and potential changes in immigration trends.

For further insights, the full analysis is available through Window + Door magazine, which provides a detailed overview of these critical findings.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

AI Revolutionizing Real Estate: Predicting Trends and Values

The real estate industry, often seen as conservative, is gradually embracing technological advancements with AI leading the charge. Generative AI is already revolutionizing real estate marketing by enhancing customer experiences and optimizing content creation. However, a more transformative technology is predictive AI, which leverages historical data and algorithms to forecast market trends and predict property values accurately.

Despite being early in its adoption phase, the potential improvements AI can bring to market prediction accuracy and personalized property recommendations make it a compelling investment. Companies like Compass and Zillow are at the forefront, utilizing AI to identify market trends and shifts, such as the post-pandemic move towards suburban living.

AI’s capabilities aren’t confined to market predictions alone; it also improves property valuation accuracy by using machine learning to analyze data patterns invisible to humans. This innovation helps organizations make informed decisions and identify lucrative investment opportunities.

However, the adoption of AI in real estate is not without challenges. Data quality issues and a lack of expertise in AI underscore the need for dedicated roles, such as a chief AI officer, to bridge the gap between technology and business application.

As AI technology continues to evolve, its impact on real estate will grow. Successfully integrating AI demands not just the acquisition of tools, but also the expertise to harness its full potential. Those able to navigate these waters will secure a significant edge in the dynamic real estate market.

For more insights on how AI is transforming the real estate landscape, refer to the original article on Forbes.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

In-Person Work Policies: A Beacon of Hope for Commercial Real Estate

In a world still grappling with the aftermath of the pandemic, in-person work policies are emerging as a beacon of hope for the commercial real estate sector. A recent study by a team of researchers, including New York University’s Arpit Gupta, University of North Carolina’s Vrinda Mittal, and Columbia University’s Stijin Van Nieuwerburgh, highlights the intricate dance between office policies and real estate demand.

The study underscores that work from home has significantly disrupted the value of commercial office real estate in the short and medium term. With office occupancy plummeting by 90% from February to March 2020, the impact of remote work was palpable. However, the researchers found that hybrid mandates and adding more in-office days could mitigate some of these challenges.

Data spanning from December 2019 to December 2023 reveals a fascinating correlation: companies with a one-day-a-week policy experienced a staggering 41% drop in office demand, whereas a two- or three-day-a-week policy saw only a 9% drop. Remarkably, those enforcing a four- or five-day in-office policy witnessed a 1% increase in demand for office space.

The report further notes that each additional day in the office translates into a 7% reduction in declining office values. This insight comes at a time when over 80% of CEOs are eager to bring employees back to the office full-time within the next three years, according to a KPMG survey.

Despite this push, companies are also rightsizing their leases in response to the evolving landscape of hybrid work. Last year’s leasing activity was 10% below prepandemic levels, with new leases plummeting from 414M SF in the second half of 2019 to 150M SF in the same period in 2023.

Interestingly, the study points out a trend towards luxe, Class-A office spaces, which are rich with amenities. These high-quality spaces have seen less decline in rent compared to their lower-quality counterparts, and in some cases, rents have even increased.

This comprehensive analysis, as detailed in the newly updated academic report, offers a nuanced perspective on how hybrid work is reshaping the office market’s recovery. For more details, you can read the original article on Bisnow.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

The Impact of AI and IoT on Real Estate and Smart Living

The convergence of Artificial Intelligence (AI) and the Internet of Things (IoT) is driving a digital transformation within the real estate market, redefining traditional practices and client interactions. As technological advancements continue, they are revolutionizing how properties are bought, sold, and managed, fostering increased efficiency and improved living standards. The synergy between AI and IoT offers enhanced convenience and creates more sustainable and personalized living environments.

Critical Concepts of AI and IoT in Real Estate

At its essence, AI equips machines with the ability to simulate human intelligence, enabling adaptability and decision-making based on experiential learning and new data inputs. Conversely, IoT connects physical devices and sensors to the internet, promoting data exchange and communication. These technological innovations arm homeowners, developers, agents, and property managers with the capability to make informed decisions driven by real-time data analytics.

Picture a property capable of foreseeing maintenance needs before they manifest, optimizing energy consumption, or facilitating seamless communication between residents and management—this is the vision behind AI and IoT in real estate. These interconnected technologies are reshaping homeownership and property management for the 21st century.

The Role of Smart Homes

Smart homes represent the pinnacle of technological advancement in real estate, manifesting the integration of AI and IoT to create environments catering to inhabitants’ needs. These homes utilize a suite of connected devices and systems that communicate with each other, empowering residents to monitor and control various aspects of their living spaces globally.

AI-driven Home Assistants

Devices like Amazon’s Alexa or Google Home serve as personal companions, managing household tasks through voice commands. These systems control integrated smart home setups, handle schedules, and dispense reminders, all while progressively taking on more complex tasks by learning user preferences.

Integrated IoT Devices

These devices form the backbone of smart homes, seamlessly linking lighting, security systems, and more. Such integration means homeowners can personalize their living experience through a unified platform, bypassing the need for multiple controls.

Internet of Things (IoT) in Smart Living

The IoT has emerged as a groundbreaking force in business, healthcare, and now smart living, integrating tech into daily activities. IoT allows homeowners to manage environments in real-time via interconnected devices and systems, enhancing convenience, comfort, energy efficiency, and security.

Smart Home Devices and Automation

IoT dramatically alters our interaction with living spaces. Smart devices—connected HVAC, lighting, surveillance systems—enable environment control from any location and learn user behaviors over time for automation that boosts comfort and efficiency.

Energy Management and Sustainability

IoT is fundamental in managing home and building energy. Smart meters and connected devices provide real-time energy use data, helping identify consumption patterns and encourage renewable energy integration, aligning usage with household needs.

Smart Locks and Surveillance Systems

IoT smart locks and surveillance systems enhance home security and convenience. Homeowners can remotely manage property access, while connected video surveillance systems provide real-time home updates accessible from smartphones.

Applications of IoT and AI in Real Estate

AI significantly redefines the real estate landscape. By utilizing big data, predictive analytics, and machine learning, AI streamlines processes, uncovers new insights, and improves decision-making, enhancing efficiency, accuracy, and outcomes for buyers and sellers alike.

Financing the Future

IoT is revolutionizing real estate finance by enhancing data collection and analysis. IoT devices in properties generate real-time operational data, enabling more informed property valuations, risk assessments, and investment strategies.

Virtual Tours and 3D Modeling

AI applications in virtual tours and 3D modeling add new dimensions to property display. Prospective buyers can explore properties via immersive virtual reality from home, improving engagement and accelerating sales.

Simplifying Taxes

AI tax chatbots simplify the complex real estate taxation process, leveraging algorithms and analytics to assess property values, identify tax breaks, and ensure compliance, minimizing human error and streamlining tax preparations.

The merger of AI and IoT is undoubtedly transforming real estate and smart living. As technology evolves, the real estate sector must adopt these tools to optimize property management, streamline transactions, and enhance residents’ quality of life. The future of real estate is promising, with smarter homes and communities leading the way to more sustainable, secure, and engaged living environments.

For more insights, visit the original article here.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

2025 Housing Market Outlook: Navigating Change and Uncertainty

As the United States stands on the cusp of 2025, the housing market is poised for significant transformation. The past year has been a whirlwind of elections, natural disasters, and policy shifts, setting the stage for a year of change and adaptation. As Fast Company reports, these factors are converging to redefine the landscape of housing in the coming year.

Government Policy and Housing

Federal policies will play a pivotal role in shaping the housing market. With land development on federal land and potential new tariffs, the cost and availability of housing are under scrutiny. However, regulatory changes following recent natural disasters could temporarily lower costs and accelerate rebuilding efforts, offering a glimmer of hope for affordable housing.

Demographic Shifts and Labor Market Dynamics

The housing market will also be influenced by demographic shifts and changes in the labor market. Slower immigration and workforce reductions could impact housing demand and the construction labor supply. Deportation policies might further strain the workforce, pushing the industry towards technological solutions to bridge the gap.

Addressing the Homelessness Crisis

California is taking bold steps to tackle its homelessness crisis, accounting for a significant portion of the nation’s homeless population. Recent legislation, including the Interim Housing Act and Proposition A, aims to increase the supply of interim housing. If successful, these initiatives could serve as a model for other states.

The Rise of Accessory Dwelling Units (ADUs)

Accessory dwelling units, or ADUs, are gaining popularity as a solution to increase housing density and affordability. Legislative changes, particularly in California, have made it easier to build ADUs, potentially leading to a significant boost in housing supply.

Technological Innovations in Housing Construction

Advancements in technology, such as 3D printing and automation, are set to revolutionize housing construction. These innovations promise to reduce costs, shorten construction timelines, and improve the overall quality and sustainability of housing.

Artificial Intelligence in Real Estate

Artificial intelligence is poised to transform the real estate industry. AI-powered tools will enhance data analysis, trend prediction, and property management, streamlining operations and improving tenant satisfaction. Virtual and augmented reality tools will further enrich the home-buying experience.

Climate Change and Sustainable Housing

With climate change reaching crisis proportions, the housing industry is focusing on sustainability. Energy-efficient designs, renewable energy integration, and water conservation are becoming standard practices. The use of sustainable materials and green certifications is gaining traction, as seen with companies like Azure Printed Homes.

Interest Rates and Economic Volatility

Interest rate fluctuations will heavily impact housing affordability. As the Federal Reserve adjusts rates in response to economic conditions, mortgage rates will influence housing demand and the ability of homeowners to sell. The incoming presidential team has prioritized lowering inflation and interest rates, a move that could stimulate new housing starts.

Final Thoughts

As we navigate the complexities of the 2025 housing market, staying informed about policy changes, economic conditions, and demographic trends is crucial. The combination of legislative initiatives, technological advancements, and innovative housing solutions offers hope for addressing the housing crisis and creating a more equitable future.

For more insights, subscribe to the Compass newsletter, delivering Fast Company’s trending stories daily.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

Will Home Prices Drop? Expert Predictions for the 2025 Housing Market

Will Home Prices Drop? Expert Predictions for the 2025 Housing Market

As we look ahead to 2025, the housing market presents a mixed bag for potential homebuyers. While the original article from Business Insider provides a comprehensive outlook, there are several key takeaways worth noting.

Current Market Conditions: The past year witnessed subdued housing activity due to high mortgage rates and limited inventory. With the average 30-year mortgage rate at 6.71% in January, as per Zillow data, home values have seen a year-over-year increase of 2.7%, reaching an average of $355,328.

Future Predictions: Expert forecasts indicate that home prices are expected to rise modestly between 1.3% and 3.5% in 2025. While this suggests a continued upward trend, the pace of growth may slow, providing some relief to potential buyers.

Economic Influences

The housing market remains heavily influenced by economic factors such as inflation and Federal Reserve policies. The Federal Reserve’s recent actions to control inflation have kept mortgage rates elevated, impacting affordability.Supply and Demand Dynamics

A chronic low supply of housing, particularly in entry-level homes, continues to drive prices upward. According to a Freddie Mac report, the U.S. remains 3.8 million units short of a healthy housing supply.Regional Variations: While overall prices are projected to rise, local markets may experience different trends. For instance, Austin has seen a 4% decline in home prices year-over-year, as reported by Zillow. Potential buyers are encouraged to consult local real estate agents to understand specific market conditions.

Conclusion

The 2025 housing market offers both challenges and opportunities. While prices are unlikely to drop significantly, easing mortgage rates could improve affordability. As always, the best time to buy is when it fits your budget and personal circumstances. For more insights, visit the Business Insider article.Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

Suburban Living: The New Frontier in Home Buying Trends

1. More Space at an Affordable Price

The steep property prices in metropolitan areas present a challenge to many prospective homeowners. On the contrary, suburban areas offer more spacious homes, often featuring gardens, balconies, and dedicated workspaces, at a comparatively lower cost. The post-pandemic era has heightened the need for comfortable living environments, rendering suburban homes particularly appealing to families and working professionals.2. The Remote Work Revolution

As hybrid and remote work models become the norm, the need to live close to the office diminishes. Professionals now prefer residences in quieter, greener environments that support a balanced lifestyle. This preference has led to increased demand for suburban properties as individuals realise they no longer have to compromise on space to enjoy the convenience of city living.3. Enhanced Quality of Life

Suburban areas generally offer a more relaxed and family-friendly atmosphere, with lower pollution levels, less traffic congestion, and ample green space. Quality schools, parks, and recreational facilities further enhance their appeal, making suburbs a desirable choice for families who value well-being and work-life balance.4. Improved Infrastructure and Connectivity

Recent advancements in transportation infrastructure, such as metro extensions, expressways, and upgraded road networks, have effectively bridged the gap between urban hubs and suburban neighborhoods. Additionally, the availability of top-tier hospitals, shopping malls, and entertainment centers means suburban residents can access essential services without traveling far.5. The Rise of Gated Communities and Smart Townships

Modern suburban developments go beyond spacious homes to offer world-class amenities. Gated communities now include security measures, clubhouses, pools, fitness centers, and vibrant social spaces, providing a comprehensive lifestyle solution within a well-planned ecosystem.6. Lower Cost of Living

Besides real estate affordability, the overall cost of living in suburban regions is markedly lower compared to urban cores. Everyday expenses like groceries, dining, childcare, and entertainment are more budget-friendly, making suburban living an economically wise choice for many households.7. Strong Investment Potential

As suburban regions continue to develop, the value of real estate in these areas rises. Investors recognise these regions as emerging hotspots, with property appreciation driven by infrastructure expansion and growing demand. For homebuyers, this signifies not just improved living conditions but also a smart financial investment.Conclusion

The growing preference for suburban homes stems from evolving lifestyle needs, infrastructural developments, and economic considerations. As these areas continue to offer modern amenities with seamless urban connectivity, this trend is expected to accelerate. For today’s homebuyers, relocating to the suburbs is not solely about affordability; it’s about embracing a lifestyle prioritising space, comfort, and overall well-being.Note: The author, Aksha Kamboj, is an executive chairperson of a conglomerate. The views expressed in this article are personal and do not constitute professional advice from Times Property.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

Smart Money Podcast: A Guide to the 2025 Housing Market

Smart Money Podcast: A Guide to the 2025 Housing Market

As the housing market gears up for another challenging year, buyers and sellers face the daunting task of navigating high interest rates and tight inventory. In a recent episode of NerdWallet’s Smart Money podcast, hosts Sean Pyles and Sara Rathner, along with mortgage reporter Holden Lewis, delve into strategies for thriving in the 2025 real estate landscape.Challenges and Strategies for Buyers

For potential homebuyers, the question looms: how to secure a property amid high rates? Lewis emphasizes the importance of getting pre-approved for a mortgage and budgeting for rising homeowners insurance premiums. He warns against attempting to time the market, as mortgage rates remain unpredictable. Instead, buyers should focus on finding a suitable home within their means.Preparing Homes for Sale

On the flip side, sellers are advised to enhance their home’s curb appeal and document recent repairs to attract potential buyers. Professional staging and photography can make a significant difference in standing out in a crowded market. Lewis also highlights the importance of realistic pricing and understanding the recent changes to real estate agent commission rules.Broader Housing Trends

The podcast also sheds light on broader housing trends that could impact the market. The phenomenon of “rate lock-in,” where homeowners are hesitant to sell due to low existing mortgage rates, continues to affect inventory levels. Additionally, the connection between Federal Reserve policies and mortgage rates plays a crucial role in shaping the housing market dynamics.Looking Ahead

As we move through 2025, both buyers and sellers need to stay informed and adaptable. The podcast serves as a valuable resource for anyone looking to make informed decisions in the current market climate. For more insights, check out the full episode on your favorite podcast platform or visit the original article on NerdWallet.Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

Global Cryptocurrency Regulation: Navigating the Complex Landscape

In the ever-evolving landscape of cryptocurrency, regulation remains a pivotal issue both in the United States and globally. As governments strive to balance innovation with investor protection, the rules governing digital currencies like Bitcoin and Ethereum are becoming increasingly complex and varied across different nations.

In the United States, cryptocurrencies are primarily treated as property for tax purposes, akin to assets such as stocks or real estate. This classification subjects crypto transactions to capital gains tax, with the IRS requiring meticulous record-keeping and reporting. From January 1, 2025, cryptocurrency brokers in the U.S. will be mandated to report users’ digital asset sales to the IRS using Form 1099-DA.

Globally, the regulatory landscape is as diverse as the nations themselves. In Australia, for instance, anyone operating a digital currency exchange must register with AUSTRAC under the Anti-Money Laundering and Counter-Terrorism Financing Act 2006. Meanwhile, Brazil has introduced the Virtual Assets Act to ensure crypto service providers comply with financial regulations.

In Canada, crypto exchanges are required to register with FINTRAC, adhering to anti-money laundering laws, while in China, the government has imposed stringent restrictions, branding crypto mining as an “undesirable industry” due to energy consumption concerns.

The European Union has established the Markets in Crypto-Assets Regulation (MiCA), aiming to safeguard consumer protection, financial stability, and market integrity. This regulation requires Crypto-Asset Service Providers (CASPs) to obtain authorization, ensuring they meet specific standards to protect users.

India, on the other hand, imposes a flat 30% tax on income from the transfer of Virtual Digital Assets (VDAs), with additional provisions for Tax Deducted at Source (TDS) on payments exceeding certain thresholds. Japan categorizes crypto profits as “miscellaneous income”, subjecting them to progressive tax rates.

Singapore’s approach under the Payment Services Act 2019 (PSA) exempts digital payment tokens from GST, while South Korea will implement a 20% tax on cryptocurrency gains exceeding 50 million Korean won in 2025.

In the UK, cryptocurrency activities are overseen by the Financial Conduct Authority (FCA) under the Money Laundering Regulations (MLRs). Crypto is taxed under Capital Gains Tax (CGT) and Income Tax, depending on its use.

As noted in the original article from NFT Evening, the challenge for governments worldwide is to find the right balance between regulation and innovation. While rules are essential to prevent scams and protect investors, overly stringent regulations could stifle technological advancement.

As the global digital currency market continues to evolve, staying informed about the regulatory environment is crucial for investors and businesses alike. The next few years will be pivotal in determining how cryptocurrencies integrate into the global financial system.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

Why Sustainability is the Key to Profitable Real Estate Investments

In the evolving landscape of real estate, sustainability is no longer just a trend—it’s becoming a necessity. A recent analysis by Cushman & Wakefield, referenced in the National Association of REALTORS® article, highlights how green practices can enhance returns on investment.

Jacob Albers, co-author of the report and head of alternatives insights at Cushman & Wakefield, notes that LEED-certified buildings have consistently outperformed their non-certified counterparts. Despite facing slightly lower occupancy rates, these buildings command higher rents and generate greater cash flows. Albers emphasizes, “Sustainability commitments are not a nice-to-have, but a need-to-have for trophy assets.”

Sam Tenenbaum, head of multifamily insights at Cushman & Wakefield, discusses the slower adoption of sustainability in multifamily housing. Financial incentives from entities like Freddie Mac and Fannie Mae are encouraging developers to embrace green upgrades. Tenenbaum points out that the rent premium for green-certified multifamily units is modest, around 3%, but the financial incentives are significant.

Creating Value Through Retrofits

The article also highlights the potential for existing buildings to enhance their market value through retrofits and certifications like Energy Star. Nicholas Stolatis, a veteran in property management, underscores the importance of energy efficiency, stating that even low-cost operational improvements can significantly boost profitability.

Stolatis shares an example from his work with TIAA, where replacing incandescent bulbs with compact fluorescents led to substantial savings. He argues that sustainability is crucial for long-term competitiveness in real estate, as it aligns with both financial returns and reputation management.

As the real estate market continues to evolve, the integration of sustainable practices is proving to be a strategic advantage. With new regulations and tax incentives, the shift towards green real estate is not just beneficial but essential for staying competitive.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

Eric Elfman’s Vision for Disrupting Real Estate Tech with AI

Eric Elfman, the newly appointed CEO of MoxiWorks, is charting a bold course for disruption in the real estate technology sector. With his appointment in June, Elfman aims to challenge industry complacency by harnessing the power of artificial intelligence and reinforcing a customer-centric approach.

Elfman, speaking to Real Estate News, criticized many vendors for resting on their laurels in the “old world” of real estate tech. He believes the industry, including MoxiWorks, is “ripe for disruption.”

With a background in fast-paced tech startups, Elfman sees untapped opportunities in leveraging AI to process the industry’s vast data reserves. “We are hiring data scientists to begin crawling through our data to figure out where the best, highest value, earliest use of AI will be for us,” he stated.

Revamping the MoxiWorks Platform

Under Elfman’s leadership, MoxiWorks is revamping its platform to adapt to the “new reality for agents.” This involves rethinking the economics for brokerages and agents, especially in light of the NAR’s $418 million settlement. The new platform is expected to launch at the end of the year, with full availability by next summer.

Startup Perspective in Proptech

Elfman brings an entrepreneurial drive to MoxiWorks, a trait honed over 25 years of leading companies he founded. He aims to inject this dynamism into an industry he claims is “totally disruptable.” He argues that as B2B companies mature, they often prioritize profitability over innovation, a trend he intends to reverse.

AI: The Key to Untapped Data

Elfman sees real estate as lagging behind other content-rich markets in utilizing AI. “What you won’t see from MoxiWorks is marketing-speak about AI with no teeth. We will announce our strategy when we have something meaningful for the market,” he assured.

Competing in a Changing Market

Elfman’s vision for MoxiWorks is to focus on helping agents secure listings. “If MoxiWorks were a factory, the single widget that we produce is a listing for an agent,” he explained. This strategy involves taking on competitors to expand market share and offering advanced capabilities against both established and emerging players.

For more insights into Elfman’s plans and the future of MoxiWorks, read the full article on Real Estate News.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

Exploring the Future of Luxury Real Estate in 2025

Exploring the Future of Luxury Real Estate in 2025

In a world where luxury real estate is constantly evolving, the Christie’s International Real Estate 2025 Global Luxury Forecast unveils key trends that are set to shape the landscape this year. According to the report, which draws insights from over 100 independent brokerage firms worldwide, we can expect a shift towards heritage architectural styles, an increased focus on security and privacy, and a spotlight on emerging markets such as Madrid and the Balkans.

A Focus on Security and Heritage

Security is becoming a priority for luxury homeowners. From intelligent camera systems to ballistic entry doors, the market is seeing a rise in both high-tech and analog security amenities. This trend reflects a growing desire for privacy and safety among high-net-worth individuals.

Meanwhile, there is a renewed interest in heritage architecture. Buyers are increasingly drawn to styles that reflect the history and natural qualities of their surroundings. Rustic homes in the U.S. mountains and Victorian designs in the U.K. are examples of this trend, which contrasts with the modern forms that have dominated recent decades.