Texas High-Tech Sector Rebounds Post-Pandemic, Set for New Growth Trajectory

As the dust settles from the pandemic, Texas’ high-tech sector is shaking off its post-pandemic slump and gearing up for a new growth trajectory. The state, already a significant player in the U.S. economy, is poised for further expansion as it attracts business relocations from other tech hubs like Silicon Valley and rides the wave of increased demand for emerging AI technologies.

High tech contributes nearly 5% to Texas’ GDP and over 9% to employment, making it an essential driver of innovation and technological development. This sector, characterized by rapid growth and high wages, is crucial for productivity and is positioned to benefit from ongoing business relocations and new investments in high-tech manufacturing capacity. For more insights into the sector’s impact, visit the Federal Reserve Bank of Dallas.

High-Tech Hiring Dynamics

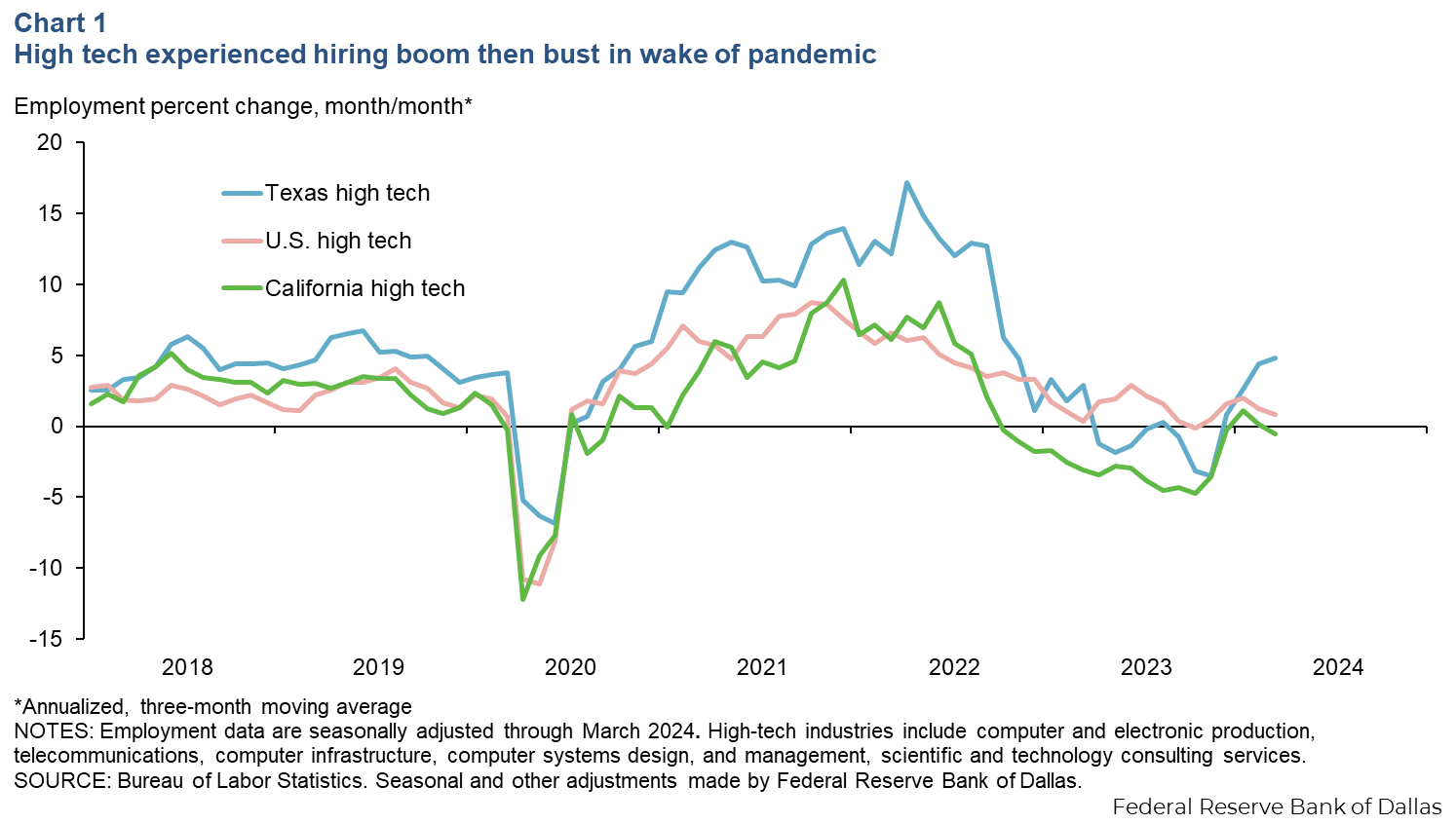

The high-tech industry experienced a hiring boom post-pandemic, driven by the surge in demand for technology products and services. However, this rapid expansion led to overhiring, and companies soon faced cost pressures, resulting in layoffs. Despite these challenges, Texas managed to avoid the severe job losses seen in California, thanks in part to the reallocation of tech activity to other parts of the country.

Layoff announcements in Texas spiked during early 2023 but have since moderated, suggesting stabilization in the local tech labor market. The state’s resilience is attributed to gains in computer manufacturing and tech consulting services, which offset losses in other tech industries.

Legislative Support and Future Outlook

The federal CHIPS and Science Act, along with the Texas CHIPS Act, provides significant support to the high-tech sector. These initiatives encourage semiconductor manufacturing, helping stabilize supply chains and aiming for technological self-sufficiency. Investments include Texas Instruments’ $30 billion semiconductor manufacturing plant and Samsung’s $44 billion investment in semiconductor facilities.

Corporate relocations and population migrations have also fueled high-tech growth in Texas. Major companies like Hewlett Packard and Apple have moved to Texas, bringing along a highly skilled workforce from states like California and New York. This influx of talent has bolstered the state’s high-tech sector, making it a pillar of Austin’s economy. For more on corporate relocations, see the Dallas Fed’s report.

Skilled Labor and Remote Work

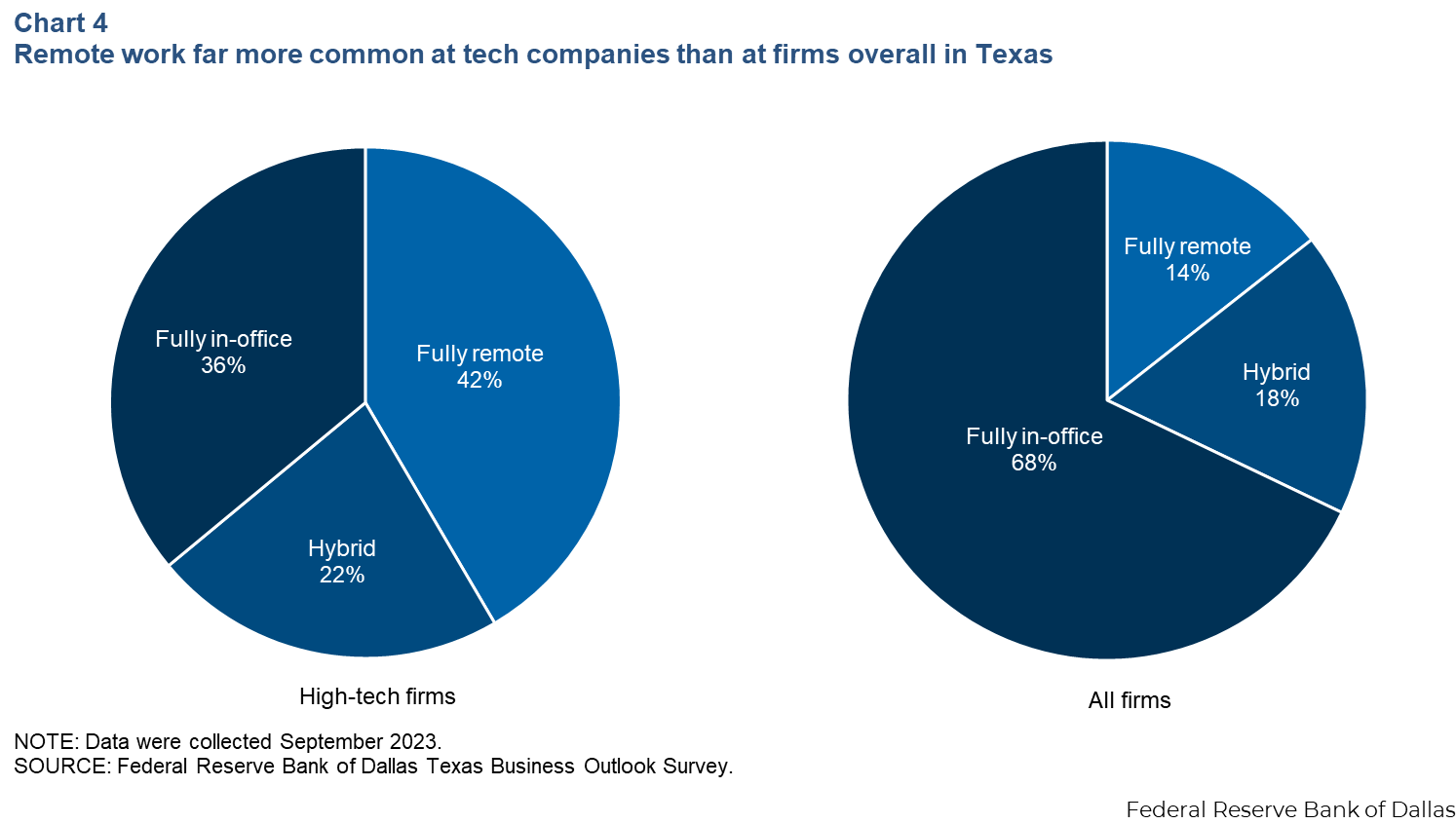

High-tech wages in Texas are significantly higher than the state average, with 2022 hourly wages averaging $43.51 compared to $29.26 for workers overall. The sector employs a larger share of highly skilled workers, supporting elevated pay. The prevalence of remote work in high tech is notable, with 36% of employees working fully remote, compared to 14% in other sectors. For trends in remote work, refer to the Harvard Business Review.

Looking ahead, high-tech firms in Texas are optimistic about future growth, buoyed by continued investments and policy support for emerging technologies like AI and semiconductor production. This optimism could be a precursor to further expansion in the sector.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

More Articles

Getting licensed or staying ahead in your career can be a journey—but it doesn’t have to be overwhelming. Grab your favorite coffee or tea, take a moment to relax, and browse through our articles. Whether you’re just starting out or renewing your expertise, we’ve got tips, insights, and advice to keep you moving forward. Here’s to your success—one sip and one step at a time!

Suburban Living: The New Frontier in Home Buying Trends

1. More Space at an Affordable Price

The steep property prices in metropolitan areas present a challenge to many prospective homeowners. On the contrary, suburban areas offer more spacious homes, often featuring gardens, balconies, and dedicated workspaces, at a comparatively lower cost. The post-pandemic era has heightened the need for comfortable living environments, rendering suburban homes particularly appealing to families and working professionals.2. The Remote Work Revolution

As hybrid and remote work models become the norm, the need to live close to the office diminishes. Professionals now prefer residences in quieter, greener environments that support a balanced lifestyle. This preference has led to increased demand for suburban properties as individuals realise they no longer have to compromise on space to enjoy the convenience of city living.3. Enhanced Quality of Life

Suburban areas generally offer a more relaxed and family-friendly atmosphere, with lower pollution levels, less traffic congestion, and ample green space. Quality schools, parks, and recreational facilities further enhance their appeal, making suburbs a desirable choice for families who value well-being and work-life balance.4. Improved Infrastructure and Connectivity

Recent advancements in transportation infrastructure, such as metro extensions, expressways, and upgraded road networks, have effectively bridged the gap between urban hubs and suburban neighborhoods. Additionally, the availability of top-tier hospitals, shopping malls, and entertainment centers means suburban residents can access essential services without traveling far.5. The Rise of Gated Communities and Smart Townships

Modern suburban developments go beyond spacious homes to offer world-class amenities. Gated communities now include security measures, clubhouses, pools, fitness centers, and vibrant social spaces, providing a comprehensive lifestyle solution within a well-planned ecosystem.6. Lower Cost of Living

Besides real estate affordability, the overall cost of living in suburban regions is markedly lower compared to urban cores. Everyday expenses like groceries, dining, childcare, and entertainment are more budget-friendly, making suburban living an economically wise choice for many households.7. Strong Investment Potential

As suburban regions continue to develop, the value of real estate in these areas rises. Investors recognise these regions as emerging hotspots, with property appreciation driven by infrastructure expansion and growing demand. For homebuyers, this signifies not just improved living conditions but also a smart financial investment.Conclusion

The growing preference for suburban homes stems from evolving lifestyle needs, infrastructural developments, and economic considerations. As these areas continue to offer modern amenities with seamless urban connectivity, this trend is expected to accelerate. For today’s homebuyers, relocating to the suburbs is not solely about affordability; it’s about embracing a lifestyle prioritising space, comfort, and overall well-being.Note: The author, Aksha Kamboj, is an executive chairperson of a conglomerate. The views expressed in this article are personal and do not constitute professional advice from Times Property.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

Smart Money Podcast: A Guide to the 2025 Housing Market

Smart Money Podcast: A Guide to the 2025 Housing Market

As the housing market gears up for another challenging year, buyers and sellers face the daunting task of navigating high interest rates and tight inventory. In a recent episode of NerdWallet’s Smart Money podcast, hosts Sean Pyles and Sara Rathner, along with mortgage reporter Holden Lewis, delve into strategies for thriving in the 2025 real estate landscape.Challenges and Strategies for Buyers

For potential homebuyers, the question looms: how to secure a property amid high rates? Lewis emphasizes the importance of getting pre-approved for a mortgage and budgeting for rising homeowners insurance premiums. He warns against attempting to time the market, as mortgage rates remain unpredictable. Instead, buyers should focus on finding a suitable home within their means.Preparing Homes for Sale

On the flip side, sellers are advised to enhance their home’s curb appeal and document recent repairs to attract potential buyers. Professional staging and photography can make a significant difference in standing out in a crowded market. Lewis also highlights the importance of realistic pricing and understanding the recent changes to real estate agent commission rules.Broader Housing Trends

The podcast also sheds light on broader housing trends that could impact the market. The phenomenon of “rate lock-in,” where homeowners are hesitant to sell due to low existing mortgage rates, continues to affect inventory levels. Additionally, the connection between Federal Reserve policies and mortgage rates plays a crucial role in shaping the housing market dynamics.Looking Ahead

As we move through 2025, both buyers and sellers need to stay informed and adaptable. The podcast serves as a valuable resource for anyone looking to make informed decisions in the current market climate. For more insights, check out the full episode on your favorite podcast platform or visit the original article on NerdWallet.Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

Global Cryptocurrency Regulation: Navigating the Complex Landscape

In the ever-evolving landscape of cryptocurrency, regulation remains a pivotal issue both in the United States and globally. As governments strive to balance innovation with investor protection, the rules governing digital currencies like Bitcoin and Ethereum are becoming increasingly complex and varied across different nations.

In the United States, cryptocurrencies are primarily treated as property for tax purposes, akin to assets such as stocks or real estate. This classification subjects crypto transactions to capital gains tax, with the IRS requiring meticulous record-keeping and reporting. From January 1, 2025, cryptocurrency brokers in the U.S. will be mandated to report users’ digital asset sales to the IRS using Form 1099-DA.

Globally, the regulatory landscape is as diverse as the nations themselves. In Australia, for instance, anyone operating a digital currency exchange must register with AUSTRAC under the Anti-Money Laundering and Counter-Terrorism Financing Act 2006. Meanwhile, Brazil has introduced the Virtual Assets Act to ensure crypto service providers comply with financial regulations.

In Canada, crypto exchanges are required to register with FINTRAC, adhering to anti-money laundering laws, while in China, the government has imposed stringent restrictions, branding crypto mining as an “undesirable industry” due to energy consumption concerns.

The European Union has established the Markets in Crypto-Assets Regulation (MiCA), aiming to safeguard consumer protection, financial stability, and market integrity. This regulation requires Crypto-Asset Service Providers (CASPs) to obtain authorization, ensuring they meet specific standards to protect users.

India, on the other hand, imposes a flat 30% tax on income from the transfer of Virtual Digital Assets (VDAs), with additional provisions for Tax Deducted at Source (TDS) on payments exceeding certain thresholds. Japan categorizes crypto profits as “miscellaneous income”, subjecting them to progressive tax rates.

Singapore’s approach under the Payment Services Act 2019 (PSA) exempts digital payment tokens from GST, while South Korea will implement a 20% tax on cryptocurrency gains exceeding 50 million Korean won in 2025.

In the UK, cryptocurrency activities are overseen by the Financial Conduct Authority (FCA) under the Money Laundering Regulations (MLRs). Crypto is taxed under Capital Gains Tax (CGT) and Income Tax, depending on its use.

As noted in the original article from NFT Evening, the challenge for governments worldwide is to find the right balance between regulation and innovation. While rules are essential to prevent scams and protect investors, overly stringent regulations could stifle technological advancement.

As the global digital currency market continues to evolve, staying informed about the regulatory environment is crucial for investors and businesses alike. The next few years will be pivotal in determining how cryptocurrencies integrate into the global financial system.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

Why Sustainability is the Key to Profitable Real Estate Investments

In the evolving landscape of real estate, sustainability is no longer just a trend—it’s becoming a necessity. A recent analysis by Cushman & Wakefield, referenced in the National Association of REALTORS® article, highlights how green practices can enhance returns on investment.

Jacob Albers, co-author of the report and head of alternatives insights at Cushman & Wakefield, notes that LEED-certified buildings have consistently outperformed their non-certified counterparts. Despite facing slightly lower occupancy rates, these buildings command higher rents and generate greater cash flows. Albers emphasizes, “Sustainability commitments are not a nice-to-have, but a need-to-have for trophy assets.”

Sam Tenenbaum, head of multifamily insights at Cushman & Wakefield, discusses the slower adoption of sustainability in multifamily housing. Financial incentives from entities like Freddie Mac and Fannie Mae are encouraging developers to embrace green upgrades. Tenenbaum points out that the rent premium for green-certified multifamily units is modest, around 3%, but the financial incentives are significant.

Creating Value Through Retrofits

The article also highlights the potential for existing buildings to enhance their market value through retrofits and certifications like Energy Star. Nicholas Stolatis, a veteran in property management, underscores the importance of energy efficiency, stating that even low-cost operational improvements can significantly boost profitability.

Stolatis shares an example from his work with TIAA, where replacing incandescent bulbs with compact fluorescents led to substantial savings. He argues that sustainability is crucial for long-term competitiveness in real estate, as it aligns with both financial returns and reputation management.

As the real estate market continues to evolve, the integration of sustainable practices is proving to be a strategic advantage. With new regulations and tax incentives, the shift towards green real estate is not just beneficial but essential for staying competitive.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

Eric Elfman’s Vision for Disrupting Real Estate Tech with AI

Eric Elfman, the newly appointed CEO of MoxiWorks, is charting a bold course for disruption in the real estate technology sector. With his appointment in June, Elfman aims to challenge industry complacency by harnessing the power of artificial intelligence and reinforcing a customer-centric approach.

Elfman, speaking to Real Estate News, criticized many vendors for resting on their laurels in the “old world” of real estate tech. He believes the industry, including MoxiWorks, is “ripe for disruption.”

With a background in fast-paced tech startups, Elfman sees untapped opportunities in leveraging AI to process the industry’s vast data reserves. “We are hiring data scientists to begin crawling through our data to figure out where the best, highest value, earliest use of AI will be for us,” he stated.

Revamping the MoxiWorks Platform

Under Elfman’s leadership, MoxiWorks is revamping its platform to adapt to the “new reality for agents.” This involves rethinking the economics for brokerages and agents, especially in light of the NAR’s $418 million settlement. The new platform is expected to launch at the end of the year, with full availability by next summer.

Startup Perspective in Proptech

Elfman brings an entrepreneurial drive to MoxiWorks, a trait honed over 25 years of leading companies he founded. He aims to inject this dynamism into an industry he claims is “totally disruptable.” He argues that as B2B companies mature, they often prioritize profitability over innovation, a trend he intends to reverse.

AI: The Key to Untapped Data

Elfman sees real estate as lagging behind other content-rich markets in utilizing AI. “What you won’t see from MoxiWorks is marketing-speak about AI with no teeth. We will announce our strategy when we have something meaningful for the market,” he assured.

Competing in a Changing Market

Elfman’s vision for MoxiWorks is to focus on helping agents secure listings. “If MoxiWorks were a factory, the single widget that we produce is a listing for an agent,” he explained. This strategy involves taking on competitors to expand market share and offering advanced capabilities against both established and emerging players.

For more insights into Elfman’s plans and the future of MoxiWorks, read the full article on Real Estate News.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

Exploring the Future of Luxury Real Estate in 2025

Exploring the Future of Luxury Real Estate in 2025

In a world where luxury real estate is constantly evolving, the Christie’s International Real Estate 2025 Global Luxury Forecast unveils key trends that are set to shape the landscape this year. According to the report, which draws insights from over 100 independent brokerage firms worldwide, we can expect a shift towards heritage architectural styles, an increased focus on security and privacy, and a spotlight on emerging markets such as Madrid and the Balkans.

A Focus on Security and Heritage

Security is becoming a priority for luxury homeowners. From intelligent camera systems to ballistic entry doors, the market is seeing a rise in both high-tech and analog security amenities. This trend reflects a growing desire for privacy and safety among high-net-worth individuals.

Meanwhile, there is a renewed interest in heritage architecture. Buyers are increasingly drawn to styles that reflect the history and natural qualities of their surroundings. Rustic homes in the U.S. mountains and Victorian designs in the U.K. are examples of this trend, which contrasts with the modern forms that have dominated recent decades.

Climate Impact and Emerging Markets

The report highlights the impact of climate change on luxury real estate. With events like the Los Angeles wildfires, climate-related issues are influencing purchasing decisions. In response, governments and builders are planning for a sustainable future, as noted by brokerage affiliates in San Francisco, Dubai, Naples, and Geneva.

As for emerging luxury markets, areas such as Madrid, Perth, and the Balkan nations of Albania and Bulgaria are gaining attention. These regions offer enticing incentives, relative value, and strong potential for appreciation, making them attractive to luxury home buyers and investors.

Trends and Notable Sales

Among the hottest trends in 2025 are infrared saunas, car showrooms, and toy barns, which are becoming must-have amenities. Additionally, biophilic design is on the rise as buyers emphasize environmental impact and healthy living.

The report also sheds light on significant home sales from 2024, including a record-breaking $152 million private island in Palm Beach and a $90 million Los Angeles mansion purchased with Bitcoin. These sales underscore the dynamic nature of the luxury market.

Thad Wong, co-CEO of Christie’s International Real Estate, emphasizes the thriving and ever-evolving nature of global luxury real estate. He hopes these insights will empower buyers and sellers to make informed decisions in today’s market and beyond.

For more information, visit Christie’s International Real Estate and Compass.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

Adapting to Change: Navigating the Commercial Real Estate Landscape in 2025

The commercial real estate sector in 2025 presents a landscape of both challenges and opportunities, driven by the ongoing shifts in the economic climate, financial concerns, and regulatory changes. As the industry navigates these turbulent waters, stakeholders are urged to adapt their strategies and embrace innovative solutions to remain competitive.

According to a recent article by Scotsman Guide, the commercial real estate market is experiencing a mixed bag of challenges and opportunities. The instability in the economic climate has been a significant factor, but the stabilization of interest rates offers a glimmer of hope for borrowers and investors alike. With the Federal Reserve adopting a cautious approach, the cost of acquisition and refinancing is expected to settle, providing much-needed clarity to the market.

Transforming Office Spaces

One of the most significant trends this year is the transformation of office spaces. While some companies, like Amazon, have required employees to return to the office full-time, the hybrid work model persists. This shift is leading to a decline in demand for traditional office spaces, particularly in secondary markets. Businesses are now seeking properties that offer flexibility, or they are converting office buildings into mixed-use projects to meet the demands for residential or retail spaces.

Industrial and Multifamily Sectors on the Rise

The industrial property market is expected to remain robust, fueled by the growth of e-commerce and the demand for last-mile logistics centers. Additionally, the rise in online grocery sales is driving the need for cold storage facilities, further boosting industrial property prospects.

Multifamily properties are also poised for growth, with national rent increases projected at around 1.5%. The demand for rentals is rising as potential homebuyers face high interest rates and housing costs. This trend is particularly evident in the Sun Belt region, where the rental market is thriving due to favorable climates and job opportunities.

Challenges in Office and Retail Financing

Despite some stabilization in the office sector, financing office and retail projects remains challenging. Non-core markets, in particular, continue to struggle due to lower demand and fewer corporate tenants. Innovative financing solutions may be required, such as repositioning or redeveloping older office buildings into mixed-use or residential properties.

Retail properties are at a crossroads, with neighborhood centers anchored by essential services thriving, while large shopping malls continue to struggle. Investors are advised to approach large retail projects with caution, as consumer habits and foot traffic evolve.

Future Strategies for Success

To thrive in this evolving landscape, stakeholders must focus on high-demand sectors like industrial and multifamily. Niche areas such as cold storage and build-to-rent communities are expected to be particularly strong. Offering flexible lease terms for office and retail properties can attract tenants in uncertain markets.

Adaptive reuse of underutilized office and retail properties into mixed-use or residential spaces presents a promising opportunity. Staying updated on regulatory, environmental, social, and governance trends will be crucial for understanding property values and financing.

As the commercial real estate market undergoes transformation, those who can navigate the complexities of this transitioning market and provide specialized financing solutions will be well-positioned for success.

Ben Reinberg, CEO of the Alliance Consolidated Group of Companies, emphasizes the importance of adapting to these market dynamics. His company, with a portfolio valued at over $500 million, is at the forefront of commercial real estate investments in major U.S. markets. For more insights, you can view his author profile.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

2025 Commercial Real Estate Outlook: Navigating the Future

2025 Commercial Real Estate Outlook: Navigating the Future

The commercial real estate landscape is undergoing transformative changes as we approach 2025. The Deloitte 2025 Commercial Real Estate Outlook offers a comprehensive guide for industry leaders to overcome recent challenges and strategically position their organizations for future success.Economic Forecasts and Interest Rate Impacts The report draws from various economic forecasts, including the United States Economic Forecast: Q2 2024 by Robyn Gibbard and the Eurozone Economic Outlook by Dr. Alexander Boersch and Dr. Pauliina Sandqvist. These insights provide a backdrop of the economic conditions affecting the real estate market.

Globally, central banks are adjusting interest rates to balance inflationary pressures. Notably, the Bank of England’s rate cut marks a significant shift since 2020, as reported by Eshe Nelson in The New York Times. Similarly, Jeanna Smialek highlights the Federal Reserve’s openness to a September rate cut if inflation remains cool.

Debt Challenges in Asia-Pacific A key focus of the outlook is addressing debt challenges, particularly in the Asia-Pacific region. The CBRE report on the debt funding gap underscores the financial hurdles faced by real estate investors in this area.

Strategies for Future Positioning The report emphasizes strategies to navigate the current economic landscape. Leaders are encouraged to leverage these insights to enhance their decision-making processes and ensure resilience in their operations.

In conclusion, the 2025 Commercial Real Estate Outlook by Deloitte serves as a crucial resource for industry stakeholders. By understanding economic forecasts, interest rate impacts, and regional challenges, leaders can better prepare for the evolving market dynamics.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

California’s New Commercial Leasing Law: A Game Changer for Small Tenants

California’s New Commercial Leasing Law: A Game Changer for Small Tenants

In a significant legislative shift, California is set to extend a protective arm to its small business community with the introduction of the Commercial Tenant Protection Act, SB 1103. Effective January 1, 2025, this law will offer a lifeline to “Qualified Commercial Tenants (QCTs)“—a move that resonates with the residential tenant protections already in place.

These new safeguards, as detailed in a Holland & Knight article, are poised to impact microenterprises, small restaurants, and nonprofits across California. This legislation is a clear indication of the state’s commitment to bolster small businesses, offering them a shield against the unpredictable dynamics of commercial leasing.

Key Provisions of SB 1103

The Act stipulates several critical changes:

- Rent Increase Notifications: For month-to-month tenancies or short-term leases, landlords must provide a 30-day notice for rent hikes of up to 10%, and a 90-day notice for increases exceeding 10%.

- Automatic Lease Renewals: Month-to-month tenancies will renew automatically unless terminated with a 60-day notice for tenancies over a year, or a 30-day notice for shorter tenancies.

- Language Translation: Lease agreements negotiated in Spanish, Chinese, Tagalog, Vietnamese, or Korean must be translated into the relevant language.

- Billing for Operating Costs: These costs must be proportionately allocated and supported with detailed documentation. Tenants can use non-compliance as a defense in disputes.

The introduction of SB 1103 marks a pivotal moment, reflecting a broader trend towards leveling the playing field for small business tenants. As we look to the future, this legislation could pave the way for further protective measures, aligning commercial tenant rights more closely with those in the residential sector.

For those navigating the complexities of commercial property ownership and management in California, the full implications of this law are worth exploring further. More insights can be found in the original Holland & Knight publication.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

Navigating 2025’s High-Dividend ETFs: A Guide to Smart Passive Income Investments

In the ever-evolving landscape of investment, dividend stocks remain a cornerstone for those seeking passive income. The allure of regular dividend payments continues to draw investors, and in 2025, exchange-traded funds (ETFs) focusing on high dividends have taken center stage. These ETFs offer a diversified and cost-effective way to invest in dividend stocks, as highlighted in a recent Morningstar article.

Morningstar’s analysis underscores the importance of understanding the diverse strategies that these ETFs employ. With many earning Morningstar Medalist Ratings of Gold or Silver, they are poised to outperform over full market cycles. Yet, each ETF’s unique strategy means that investors must do their homework to select the one that aligns with their financial goals.

Understanding High-Dividend ETFs

High-dividend ETFs provide investors with a simple one-stop solution for income generation. They maintain a portfolio of dividend stocks, offering instant diversification and generally low costs. Furthermore, these ETFs are easily accessible, managed by popular asset managers with brokerage platforms.

For investors considering high-dividend ETFs, the choice is vast. The funds are categorized based on factors such as active vs. passive management, domestic vs. international focus, and dividend frequency. This diversity allows investors to tailor their portfolios according to their income needs and risk appetite.

Key ETFs to Watch

- Capital Group Dividend Value ETF (CGDV): Actively managed with a focus on US investment-grade companies, offering a 1.53% yield.

- Fidelity High Dividend ETF (FDVV): A passive approach balancing high yield with quality, yielding 2.91%.

- FlexShares Quality Dividend ETF (QDF): Offers exposure to technology stocks with a 1.89% yield.

- Franklin US Low Volatility High Dividend ETF (LVHD): Focuses on stability with a high yield of 4.17%.

- Schwab International Dividend Equity ETF (SCHY): Targets international stocks, providing a 4.46% yield.

These ETFs, among others, showcase the variety of strategies available to investors. Whether focusing on large-cap US companies or international stocks, high-dividend ETFs cater to a wide range of preferences.

Choosing the Right ETF

Investors must consider several factors when selecting a high-dividend ETF. Do they prefer a focus on large US companies, or are they interested in international dividend-payers? Is a passive approach more appealing, or does an actively managed fund suit their strategy better?

Moreover, the frequency of dividend payments—monthly or quarterly—can influence the decision. Finally, investors should weigh the benefits of a high dividend yield against the potential for dividend growth over time.

For those seeking additional resources, Morningstar offers tools such as the Screener tool and a comprehensive list of The Best Dividend Funds.

As the market continues to evolve, high-dividend ETFs remain a reliable option for generating passive income. By understanding the nuances of each fund, investors can make informed decisions that align with their financial objectives.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

California Housing Market 2025: Opportunities Amidst Challenges

The California housing market is currently a landscape of contrasts, showing both vigor and challenges as it moves into 2025. While affordability remains a significant hurdle, the market has seen a notable increase in both home sales and median prices. According to the latest data from the California Association of Realtors (C.A.R.), December 2024 experienced a 19.8% rise in sales compared to the previous year, with a total annual sales increase of 4.3%.

Home prices have also surged, with the median statewide price reaching $861,020, marking a 5.0% increase from December 2023. This trend of rising prices underscores a persistent demand, despite economic uncertainties and high mortgage rates.

Current Market Conditions

The market is more active than it was a year ago, pointing to a potential upswing as we approach the spring buying season. However, the tight inventory remains a critical issue. The Unsold Inventory Index (UII) indicates a limited supply of homes relative to demand, which continues to drive prices upward.

Regional Market Trends

California’s diverse regions show varying trends in sales and price growth. The Central Coast and Southern California lead in sales increases, while higher-end market segments outperform lower-priced homes. This highlights the disparities within the state, where the luxury market remains robust.

Looking Ahead to 2025

Forecasts for 2025 suggest a continued rise in home sales and prices, with median prices potentially reaching $909,400. Interest rates and improved inventory levels are expected to play pivotal roles in shaping the market dynamics. However, affordability challenges will likely persist, influencing buyer behavior.

Economic Influences

The broader economic landscape will impact the housing market, with expectations of a modest slowdown in economic growth. Nonetheless, the job market is projected to remain stable, and interest rates may provide some relief to potential buyers.

For a comprehensive analysis of the California housing market and its future trends, the original article by Norada Real Estate Investments offers valuable insights. You can explore more about the market’s dynamics and predictions by visiting the California Housing Market Predictions 2025.

In conclusion, while the California housing market faces ongoing challenges, it also presents opportunities for those navigating its complexities. Staying informed and consulting with real estate professionals will be crucial for making well-informed decisions in this dynamic environment.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

The $5,000 Doge Dividend: Brilliant Idea or Inflation Nightmare?

Check Out Your Savings Today

Imagine waking up one morning to find an extra $5,000 in your bank account. No, you didn’t win the lottery, and no, your long-lost millionaire uncle didn’t suddenly remember you exist. Instead, it’s a special refund, courtesy of Elon Musk and a newly proposed initiative called the Doge Dividend. Sounds wild, right? Well, let’s dive in and see if this is actually happening or just another Twitter fever dream that caught fire.

What’s the Deal with the Doge Dividend?

First off, no—this has nothing to do with Dogecoin. I know, I know, the name is misleading, but bear with me. The "Doge Dividend" is actually linked to something called the Department of Government Efficiency (DOGE). The basic idea? Cut government waste, save billions of dollars, and then send out $5,000 refund checks to every American taxpayer.

The whole thing went viral after a post on X (formerly Twitter) suggested that Donald Trump and Elon Musk team up to announce a tax refund check funded entirely by government efficiency savings. And just like that, crypto blogs, finance YouTubers, and even news outlets like Fox News started buzzing. Could this actually happen?

Will You Really Get $5,000?

Short answer: probably not anytime soon. Long answer: it’s complicated.

First off, this proposal isn’t law, nor is it officially endorsed by the government—at least, not yet. While Elon Musk is an adviser, he doesn’t have the power to unilaterally approve tax refunds. That would require approval from both the President and Congress. And last I checked, getting those two to agree on anything is about as easy as convincing my dog that going to the vet is, in fact, a fun adventure.

But let’s say this does get traction. The proposal suggests taking 20% of the total savings from cutting wasteful government spending and redistributing it to taxpayers as a one-time check. The remaining 80%? That would go toward paying down America’s ever-growing national debt (which is currently about as terrifying as a horror movie plot).

The Math Behind the Madness

- DOGE has reportedly already saved around $50–55 billion in just a month or so.

- The long-term goal? Cut up to $2 trillion in wasteful spending.

- If 20% of those savings were distributed, it would amount to $400 billion—enough to give roughly $5,000 per household in the U.S.

But hold up—there’s a catch. The viral proposal initially suggested that every individual (not just households) would receive $5,000. Given that the U.S. has around 341 million citizens, that would cost a cool $1.7 trillion—almost the entire amount DOGE is hoping to save over four years.

More realistically, if the checks were only given to those who pay taxes (around 155 million people), the total cost would be about $775 billion, which is still... a lot.

But, Wouldn’t This Just Bring Back Inflation?

Ah yes, the not-so-small issue of inflation, aka the reason your grocery bill now makes you rethink every financial decision you've ever made.

We’ve seen this movie before. After the 2020 and 2021 stimulus checks, inflation skyrocketed to the highest levels in 40 years. One study from MIT estimated that about 42% of the early 2022 inflation spike was due to massive federal spending.

So naturally, people are asking: Would this Doge Dividend cause inflation all over again? Probably—unless the money was strictly coming from savings without new government spending.

If Washington started handing out these checks before the savings were fully realized, they’d have to reshuffle budgets, pull funds from elsewhere, or, worse yet, issue new government debt. And when the government injects massive amounts of money into the economy, prices tend to rise.

(Translation: Don’t get too excited about those refund checks just yet.)Is This Actually a Smart Idea?

On paper, the logic makes sense—cut wasteful spending and return some of that money to taxpayers. And let’s be real, the government has wasted money on some truly bizarre things (I’m looking at you, $10 million for voluntary medical male circumcision programs in Mozambique). So if DOGE really can save hundreds of billions, why not give some of it back?

But the big challenges remain: How much can actually be saved? How long will it take? And will politicians agree on where the money goes? The U.S. government isn't exactly known for its speed or efficiency, so this could take years, if it even happens at all.

Final Thoughts

As of right now, the chances of this happening are pretty slim, but not impossible. If DOGE does continue its aggressive cost-cutting and actually hits its ambitious savings goals, we might see some sort of taxpayer refund—just probably not a no-strings-attached $5,000 check anytime soon.

What do you think? Would you support something like this, or are you worried about inflation coming roaring back? Drop your thoughts (and even your best conspiracy theories) in the comments!

TL;DR:

- The Doge Dividend is a viral proposal suggesting each taxpayer gets a $5,000 refund from government savings.

- Elon Musk and Donald Trump are linked to the idea, but nothing is official yet.

- It could technically be funded without inflation issues, but only if enough money is saved first.

- Realistically, this idea would take years to materialize (if it ever does).

- Inflation is the elephant in the room if this isn’t handled properly.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

DOGE Dividend: How Much Will We Get? A Promise of Relief or a Path to Inflation?

Check Out Your Savings Today

In recent months, a proposal for issuing "DOGE Dividend" checks to American citizens has sparked considerable debate. This initiative, championed by President Donald Trump and inspired by Elon Musk's Department of Government Efficiency (DOGE), aims to distribute a portion of the savings identified by DOGE directly to taxpayers. While the concept promises immediate financial relief, it raises significant concerns about its potential to exacerbate inflation, an issue already troubling the U.S. economy.

The Proposal: A Closer Look

The idea of DOGE Dividend checks originated from a suggestion on Musk's social media platform, X. The proposal outlines that 20% of DOGE savings would be allocated to taxpayer households, with another 20% directed toward reducing the national debt, which was estimated at $36.2 trillion as of 2025. However, the remaining 60% of the savings remains unspecified, raising questions about the full scope and intent of the initiative.

James Fishback, CEO of the investment firm Azoria, formally proposed the idea, suggesting a "tax refund check" to American households. Fishback's estimates suggest a $5,000 check per household, derived from a $2 trillion savings target by DOGE. However, this target is ambitious, with current savings reported at significantly lower figures.

Economic Implications: Inflation Concerns

Economists have expressed concerns that issuing such checks could worsen inflation, which stood at 3% in January 2025, exceeding the Federal Reserve's target of 2%. The principle of supply and demand suggests that injecting billions into the economy without a corresponding increase in supply could lead to higher prices.

Historical precedents, such as the COVID-19 stimulus checks, highlight the inflationary risks of direct government payments. The Federal Reserve Bank of St. Louis noted that government spending contributed significantly to the 7.9% inflation rate in February 2022. As the U.S. continues to navigate post-pandemic economic challenges, the introduction of DOGE Dividend checks could complicate efforts to stabilize prices.

For more insights, you can read the Forbes article discussing the potential introduction of DOGE dividend checks and its impact on the financial landscape.

Balancing the Budget: A Fiscal Priority

While the DOGE Dividend checks aim to provide immediate relief, they also underscore the importance of fiscal responsibility. Musk himself acknowledged the need to balance the budget, emphasizing that DOGE savings should not become a new source of government spending. The federal government recorded a $1.8 trillion deficit in the previous fiscal year, highlighting the urgency of addressing fiscal imbalances before considering taxpayer payouts.

Furthermore, the proposal's reliance on savings rather than deficit spending is a critical point. Fishback argues that targeting net income tax-paying households could mitigate inflationary effects, as higher-earning individuals are more likely to save rather than spend additional income.

To understand the broader economic implications, you may refer to the Forbes article on how DOGE dividend checks could contribute to inflation.

Conclusion: Navigating Economic Uncertainty

The prospect of DOGE Dividend checks presents both opportunities and challenges for the U.S. economy. While the proposal offers a potential financial boost to households, it also poses risks of increasing inflationary pressures. As policymakers weigh the benefits and drawbacks, the need for a balanced approach to fiscal policy remains paramount.

For citizens and policymakers alike, understanding the nuances of such proposals is essential. As the debate continues, staying informed and considering the broader economic context will be crucial in determining the best path forward.

For a broader perspective on the economic implications, consider reading the CNN article covering the plan for DOGE dividend checks and its potential impact on inflation.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

Top Investing Books of 2025 Recommended by Business Insider

In the ever-evolving world of finance, investing remains a cornerstone for building wealth. Yet, for many, the journey into investing can be daunting, with a myriad of options and strategies to consider. Thankfully, Business Insider has curated a list of the best investing books of 2025 to guide both novices and seasoned investors alike.

For those just beginning their investment journey, “Broke Millennial Takes on Investing” by Erin Lowry offers a comprehensive introduction. Lowry debunks myths, such as the need to be debt-free before investing, and provides practical advice on choosing investment platforms and aligning investments with personal values.

Meanwhile, “Cashing Out: Win the Wealth Game by Walking Away” by Julien and Kiersten Saunders stands out as the best overall pick. This book not only inspires those aiming for early retirement but also addresses the unique challenges faced by BIPOC investors. The Saunders, known for their blog rich & REGULAR and YouTube channel, share their personal journey of overcoming debt and embracing the F.I.R.E. movement.

For intermediate investors, “How I Invest My Money” by Joshua Brown and Brian Portnoy provides insights from 25 financial experts, showcasing diverse strategies and personal investment philosophies.

Understanding the stock market’s cycles is crucial, and Howard Marks’ “Mastering the Market Cycle” equips readers with the knowledge to navigate market fluctuations effectively.

Real estate enthusiasts will find Brandon Turner’s “The Book on Rental Property Investing” invaluable, offering guidance on property types, location selection, and financing options.

Day trading, though risky, is an area explored by Andrew Aziz in “How to Day Trade for a Living”, providing a roadmap for those intrigued by this high-stakes investment strategy.

These books, highlighted by Business Insider, cater to a diverse audience, ensuring that whether you’re interested in stocks, real estate, or ethical investing, there’s something for everyone. The original article can be found here, offering a deeper dive into each recommendation.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

Global Commercial Real Estate Market: A $427.3 Billion Expansion by 2029

In a remarkable development, the global commercial real estate market is projected to expand by USD 427.3 billion between 2025 and 2029. This significant growth is primarily driven by the flourishing global commercial sector, as outlined in a detailed report by Technavio.

According to the report, the market is expected to rise at a CAGR of 4.6% during the forecast period. Notably, the influence of artificial intelligence is a significant feature in this transformation, as AI continues to drive innovation and reshape the industry landscape.

The report highlights the adaptive changes shaping the market, such as the increasing popularity of co-working spaces, driven by technological advancements like virtual reality and AI. Furthermore, challenges such as the rise of remote work and changes in consumer behavior are poised to impact traditional office space demands.

Developers are responding by integrating flexibility and technology, underscoring the importance of data analytics in decision-making processes. The market’s evolution presents both opportunities and obstacles, with advances in AI and technology continuing to drive market transformation.

Key market players mentioned in the article include Atlas Technical Consultants, Boston Commercial Properties Inc., Brookfield Business Partners LP, CBRE Group Inc., among others. These companies, along with emerging trends, contribute significantly to the market dynamics during the forecast period.

For more detailed insights, you can explore the full report or view a free sample report PDF.

Market Trends and Challenges

The report underscores the thriving retail and hospitality industries, buoyed by a stable economic environment. The Smart Cities Mission is driving demand for commercial spaces, particularly in IT and engineering sectors. Additionally, the growth of e-commerce is fueling demand for warehouses, while the vaccine campaign boosts confidence in hospitality and office spaces.

However, the market faces challenges from the rise of remote work and online shopping, which are reshaping traditional office space demands. Businesses are adapting by offering flexible workspaces and integrating advanced technology like virtual reality.

Conclusion

In summary, the commercial real estate market is experiencing a dynamic shift with the convergence of various trends. The future of commercial real estate is technology-driven, sustainable, and adaptive to changing business needs, presenting a vibrant landscape for investors and businesses alike.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

The Impact of Geopolitics on Real Estate – Insights from José Manuel Durȃo Barroso

As the Urban Land Institute’s European conference commenced in Milan, Italy, on June 12, former Portuguese Prime Minister José Manuel Durȃo Barroso took center stage. In a compelling address, he underscored the pervasive influence of geopolitics on the contemporary real estate landscape. His insights, reported by Urban Land Magazine, highlighted the increasing relevance of global tensions in shaping strategic decisions within the industry.

Durȃo Barroso articulated a stark view of the current geopolitical climate, describing it as “polarized, fragmented, very volatile… unpredictable and dangerous.” He emphasized that these dynamics are not mere background noise but critical factors that must be integrated into the decision-making processes of businesses and economies alike.

The former European Commission president’s remarks resonated with many real estate leaders, as the industry grapples with the implications of political instability. The Global Outlook Emerging Trends in Real Estate 2024 report released in March highlighted similar concerns, with political instability, including the upcoming U.S. presidential election, flagged as a pivotal consideration.

Geopolitical Tensions and Economic Impact

Barroso noted that the industry has weathered numerous challenges since the 2007-2008 Global Financial Crisis. However, he pointed out that the world has irrevocably changed following Russia’s invasion of Ukraine in February 2022. This conflict has not only reshaped geopolitical alliances but has also had profound economic repercussions, notably in terms of inflation and energy prices.

“Many found we were so dependent on Russian supplies of gas,” Barroso remarked, “and Europe has adapted remarkably in a very short period, but with some costs.” He highlighted a shift towards protectionist policies and a renewed focus on national resilience, challenging Europe’s traditionally open trade stance.

The Role of Technology

Beyond geopolitical tensions, Barroso urged European leaders to capitalize on the burgeoning opportunities presented by technological advancements, especially in artificial intelligence. He warned that Europe is “lagging behind” the U.S. and China in AI investments and competitiveness. “AI is able to solve problems that we could not solve as humans, and it’s going to change everything,” he asserted, emphasizing the need for Europe to bolster its competitive edge.

As the conference unfolded, the insights shared by Durȃo Barroso and others painted a complex picture of the challenges and opportunities facing the real estate sector. The interplay of geopolitical instability, economic pressures, and technological innovation will undoubtedly shape the industry’s trajectory in the years to come.

For a deeper dive into these discussions, readers can explore the full article on Urban Land Magazine.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

The Future of the US Housing Market: A Look Ahead to 2034

As we stand on the brink of a new decade, the housing market in 10 years promises to be a landscape shaped by technological innovation, demographic shifts, and evolving economic factors. By 2034, the real estate sector will likely have undergone significant transformations, presenting both challenges and opportunities for homeowners, investors, and industry professionals alike.

This in-depth exploration will delve into the potential future of the US housing market, examining key trends, predictions, and factors that may influence its trajectory over the next decade.

1. Demographic Shifts and Their Impact on Housing Demand

The composition of the US population is expected to undergo substantial changes by 2034, which will inevitably affect housing demand and preferences. According to the US Census Bureau’s 2017 National Population Projections, by 2030, all baby boomers will be older than 65, comprising 21% of the population. This aging demographic will have significant implications for the housing market:

a) Increased demand for age-friendly housing

As the population ages, there will likely be a growing need for homes that cater to older adults, featuring single-story layouts, wider doorways, and other accessibility features.

b) Downsizing trends

Many retirees may opt to downsize, potentially increasing the supply of larger family homes in suburban areas while boosting demand for smaller, more manageable properties.

c) Multi-generational living

The rise of multi-generational households could lead to increased demand for homes that can accommodate extended families, with features like in-law suites or separate living spaces.

Simultaneously, millennials and Gen Z will continue to shape the housing market as they enter their prime homebuying years. Their preferences for urban living, sustainability, and technology-integrated homes may drive development in city centers and influence home design trends.

2. Technological Advancements in Real Estate

The rapid pace of technological innovation is set to revolutionize various aspects of the housing market by 2034:

a) Virtual and augmented reality

House hunting may become predominantly virtual, with immersive 3D tours allowing potential buyers to explore properties from anywhere in the world.

b) Artificial intelligence and machine learning

AI-powered algorithms could revolutionize property valuation, mortgage approval processes, and predictive maintenance for homes.

c) Smart home technology

The integration of Internet of Things (IoT) devices and artificial intelligence in homes is likely to become standard, offering enhanced energy efficiency, security, and convenience.

d) 3D printing and modular construction

These technologies may significantly reduce construction times and costs, potentially addressing housing shortages in high-demand areas.

3. Climate Change and Sustainable Housing

As climate change concerns intensify, the housing market in 2034 is likely to place a greater emphasis on sustainability and resilience:

a) Energy-efficient homes

Expect a surge in demand for properties with high energy efficiency ratings, incorporating features like solar panels, advanced insulation, and smart energy management systems.

b) Resilient construction

In areas prone to natural disasters, there may be increased focus on building homes that can withstand extreme weather events.

c) Urban planning

Cities may prioritize mixed-use developments and transit-oriented communities to reduce carbon footprints and improve livability.

d) Green building materials

The use of sustainable, eco-friendly materials in construction is likely to become more prevalent, driven by both consumer demand and potential regulatory requirements.

4. Evolving Work Patterns and Their Impact on Housing

The COVID-19 pandemic accelerated the trend towards remote work, and this shift is likely to have lasting effects on the housing market by 2034:

a) Home office spaces

Dedicated work areas within homes may become a standard feature, influencing home design and buyer preferences.

b) Suburban and rural revival

With less need to commute daily, some workers may opt for larger homes in suburban or rural areas, potentially reversing the trend of urbanization.

c) Flexible living spaces

Homes that can easily adapt to changing needs (e.g., convertible spaces that can serve as offices, gyms, or guest rooms) may become increasingly popular.

5. Economic Factors and Housing Affordability

The affordability of housing remains a critical issue, and several economic factors could shape the market by 2034:

a) Interest rates

The trajectory of interest rates over the next decade will significantly impact housing affordability and mortgage markets.

b) Income inequality

If current trends continue, income inequality could further exacerbate housing affordability issues in desirable areas.

c) Government policies

Future housing policies, including zoning laws, tax incentives, and affordable housing initiatives, will play a crucial role in shaping the market.

d) Alternative financing models

New approaches to homeownership, such as rent-to-own schemes or shared equity models, may gain traction to address affordability concerns.

6. The Rise of Build-to-Rent and Institutional Investors

The rental market is likely to evolve significantly by 2034, with potential implications for both renters and homeowners:

a) Build-to-rent communities

Purpose-built rental communities, offering amenities and professional management, may become more prevalent, particularly in suburban areas.

b) Institutional investors

Large-scale investors may continue to play a significant role in the single-family rental market, potentially influencing housing supply and rental rates.

c) Short-term rentals

The future of platforms like Airbnb and their impact on local housing markets remains to be seen, with the potential for increased regulation or integration into the broader housing ecosystem.

7. Urban Development and Redevelopment

Cities are likely to undergo significant changes by 2034, driven by population growth, changing preferences, and sustainability concerns:

a) Densification

Many cities may focus on increasing density through infill development and the redevelopment of underutilized urban areas.

b) Adaptive reuse

The conversion of commercial and industrial buildings into residential spaces may accelerate, particularly if remote work trends lead to reduced demand for office space.

c) 15-minute cities

Urban planning concepts that prioritize walkability and access to essential services within a 15-minute radius may gain traction, influencing development patterns.

8. Regional Shifts and Migration Patterns

Changing climate conditions, economic opportunities, and lifestyle preferences may lead to significant regional shifts in housing demand by 2034:

a) Climate migration

Areas facing increased risks from climate change (e.g., coastal regions vulnerable to sea-level rise) may see population declines, while more resilient regions could experience growth.

b) Economic hubs

The emergence of new economic centers, particularly in technology and innovation sectors, could drive housing demand in unexpected areas.

c) Quality of life factors

Regions offering a high quality of life, including access to nature, cultural amenities, and good healthcare, may see increased housing demand.

9. The Evolution of Real Estate Services

The real estate industry itself is likely to undergo significant changes by 2034, potentially altering how properties are bought, sold, and managed:

a) AI-powered agents

Artificial intelligence may take on a larger role in the home buying and selling process, potentially reducing the need for human intermediaries in some transactions.

b) Blockchain and property transactions

The use of blockchain technology could streamline property transactions, making them faster, more transparent, and potentially reducing fraud.

c) Data-driven decision making

Advanced analytics and big data will likely play an increasingly important role in investment decisions, property management, and urban planning.

10. Challenges and Opportunities in the 2034 Housing Market

As we look ahead to the US housing market in 2034, several key challenges and opportunities emerge:

Challenges:

- Addressing housing affordability and supply shortages in high-demand areas

- Balancing the need for density with desires for space and privacy

- Adapting existing housing stock to meet changing demographic needs and sustainability requirements

- Navigating potential disruptions from climate change and technological advancements

Opportunities:

- Leveraging technology to create more efficient, sustainable, and user-friendly housing solutions

- Developing innovative financing and ownership models to increase access to homeownership

- Reimagining urban spaces to create more livable, sustainable communities

- Harnessing data and AI to optimize real estate investment and management strategies

The US housing market in 10 years is poised for significant transformation, driven by a complex interplay of demographic, technological, economic, and environmental factors. By 2034, we may see a housing landscape that is more diverse, technologically advanced, and responsive to the needs of an evolving population. From smart homes that anticipate our needs to communities designed for sustainability and resilience, the future of housing holds both exciting possibilities and formidable challenges.

As circumstances shift, adaptability and forward-thinking will be key. Homeowners, investors, policymakers, and industry professionals must remain attuned to emerging trends and be prepared to innovate in response to new realities. While the exact contours of the 2034 housing market remain to be seen, one thing is certain: the coming decade promises to be a period of significant change and opportunity in American real estate.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

Unlocking the Power of Green Finance: A Path to Decarbonizing Real Estate

Unlocking the Power of Green Finance: A Path to Decarbonizing Real Estate

In the quest to decarbonize the built environment, green finance emerges as a pivotal tool. However, its potential remains largely untapped. Despite the issuance of an impressive US$7.1 trillion in sustainable debt over the past five years, a mere 7% has been channeled into real estate, with only 12% of green bonds dedicated to decarbonizing buildings.

The crux of the problem lies in the misalignment among stakeholders on pricing and strategy. Current green finance offerings fail to captivate investors on their own merits. The market is plagued by a pricing mismatch, where lenders lack the data to offer attractive rates for green projects, and the existing rates do not sufficiently incentivize participation.

The Challenge of Sustainability-Linked Loans

Sustainability-linked loans, which offer discounts for achieving sustainable KPIs, illustrate the challenge. Borrowers must establish a baseline and report progress, but historically, the discounts have not been enticing enough to justify the additional loan terms.

Consider a case study from Singapore. A sponsor upgrading an HVAC system for basic green certification was questioned by banks about not pursuing higher classifications. The sponsor revealed that the financial gains from higher classifications were insufficient to justify the costs.

Strategic Alignment and Practical Solutions

The lack of strategic guidance on measurable KPIs is a significant hurdle. Many borrowers are unclear on how to set these KPIs, while most lenders rely on self-reporting or third-party validations. Partnerships between banks, borrowers, and real estate advisors could shape loan terms to incentivize adoption, with advisors ensuring asset-specific KPIs demonstrate direct benefits.

In Australia, the Commonwealth Bank’s Green Buildings Tool offers a promising solution. This tool recommends actions and provides estimated capex to improve energy efficiency, decarbonization, and onsite renewables, thus eliminating initial consultancy costs. The Bank’s Business Green Loan supports businesses in financing property upgrades identified through the tool.

Creating Alignment for Sustainable Success

Achieving alignment on sustainability is crucial for effectively leveraging green finance. JLL Risk Advisory’s collaboration with international banks demonstrates how strategic ESG assessments can provide clarity on asset vulnerability and potential for green premiums, enhancing decision-making for portfolio management.

In a case study involving an international bank, JLL Risk Advisory conducted an ESG impact assessment to identify assets most exposed to brown discounts and those offering green premiums. This enabled the bank to prioritize the top 10% of assets to avoid discounts or achieve premiums, gaining greater clarity on future value linked to ESG.

Ultimately, the article from us.jll.com calls for a fundamental transformation in deploying climate finance to encourage substantial investment in building decarbonization, yielding economic and environmental benefits.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

Uplist’s RECAPTURE™ Wins Prestigious Awards for Mortgage Innovation

Uplist’s flagship product, RECAPTURE™, has garnered significant attention in the mortgage industry by receiving two prestigious accolades: the 2025 Tech100 Mortgage Award from HousingWire and the Innovations Award from Progress in Lending. This marks the second consecutive year that Uplist has been honored by Progress in Lending, underscoring the company’s ongoing commitment to innovation.

RECAPTURE™ is a comprehensive tool that revolutionizes the mortgage refinancing process by automating refinance analysis for loan officers. It allows professionals to swiftly identify optimal refinancing opportunities and present personalized options to clients, enhancing efficiency and customer satisfaction.

Key Features of RECAPTURE™:

- Automated Refinance Analysis: Continuously monitors key metrics and provides alerts for favorable refinancing opportunities.

- Efficiency at Scale: Automates tasks such as property ownership checks and financial benefit calculations, saving loan officers time.

- Scenario Planning: Models potential savings for homeowners, enabling tailored refinancing solutions.

- Customer Outreach Automation: Builds borrower presentations and custom emails for personalized client engagement.

- Integrated with Leading PPEs: Seamlessly connects with pricing engines for accurate analysis and alerts.

Jeff Bell, President of Uplist, expressed gratitude for the recognition, stating, “Winning the Innovations Award for the second consecutive year reinforces our mission to push the boundaries of mortgage technology and provide solutions that truly make a difference.”

The original article from FOX40 News highlights how these awards emphasize Uplist’s transformative impact on the mortgage industry. By automating critical tasks, RECAPTURE™ not only benefits loan officers but also enhances the refinancing experience for homeowners.

For more details about RECAPTURE™, visit the official Uplist page.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

Unlocking the Future of Real Estate: USC’s Dollinger Master of Real Estate Development Program

Explore one of the premier programs for aspiring leaders in the real estate industry through the Dollinger Master of Real Estate Development (MRED) at the USC Price School. As one of the most respected programs of its kind since 1986, the USC MRED program is designed to prepare students to excel in all facets of the real estate industry.

A testament to its enduring excellence, the MRED program at USC equips students with a comprehensive understanding of real estate finance, governance, and development. This graduate program offers an innovative curriculum that bridges academic theory with practical experience, ensuring that graduates are well-versed in essential real estate fundamentals. By combining lectures, case studies, and real-world projects led by industry professionals and full-time faculty, students gain insights into market analysis, site planning, and project management.

Moreover, the program’s connection with the USC’s Lusk Center for Real Estate provides unparalleled industry linkages, facilitating professional development and industry engagement. Students are also encouraged to engage in global learning through international study trips, elevating their perspectives on diverse real estate markets.

For students passionate about making a community impact, USC Price offers Community Impact Scholarships for incoming master’s students in various programs, including MRED. In addition, financial aid opportunities are widely available to support students in their educational journey.

Completing the MRED program significantly enhances the career prospects of graduates, with recorded earnings of $123,932 one year after graduation and $250,439 after ten years, and an impressive return on investment of $4,214,687, as highlighted in data from FREEOPP.

By choosing the USC Price Dollinger MRED program, students set the stage to become visionary leaders in shaping the future of real estate, meeting the challenges of today while anticipating the opportunities of tomorrow. Discover more at the USC Price School website and take the first step towards a transformative career in real estate development.

Russ Sommer

Program Manager,

Real Estate Development

[email protected]

Ashley Flinn

Program Administrator,

Real Estate Development

[email protected]

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

Breaking Free from Square Footage: A New Era in Commercial Real Estate

The historical emphasis on square footage as a standard unit of measurement in real estate has deep roots, tracing back to the Middle Ages. However, this focus often oversimplifies the complex nature of property value, overlooking critical factors like location, amenities, and overall quality.

As coworking demand continues to rise, with a 240% increase in inquiries on the Yardi Listing Network, the industry is exploring new strategies to achieve profitability. Successful coworking spaces are shifting their focus towards community building and hospitality, as noted by coworking management software leader [OfficeRnD](http://officernd.com/). They cater to specialized niches and expand into suburban markets, offering remote employees flexible workspace options.

The article suggests that coworking operators and landlords collaborate to redefine the boundaries of office space real estate. By embracing hospitality, community building, virtual offices, and event memberships as revenue drivers, the industry can unlock new growth opportunities and move towards a more sustainable future.

As the commercial real estate landscape evolves, it’s time for more coworking operators to free themselves from the constraints of square footage and embrace a holistic approach that aligns with the changing dynamics of the modern workforce.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

How PropTech is Revolutionizing the Real Estate Industry

Key Areas of PropTech

PropTech encompasses various areas such as online marketplaces, smart home technology, property management tools, and construction technologies. These innovations connect buyers, sellers, and renters online, enhance home automation and security, ease landlord-tenant relationships, and promote sustainable building practices.

Core Technologies Driving PropTech

In 2024, core technologies like AI, VR, blockchain, and big data are leading the PropTech revolution. AI analyzes extensive datasets to offer personalized property recommendations, automate tasks, and predict market trends. Platforms like Jome.com exemplify AI’s impact, providing insights on pricing trends and neighborhood amenities.

VR and AR technologies are transforming how potential buyers experience properties through immersive virtual tours. Blockchain secures real estate transactions with tamper-proof records and smart contracts, while big data analytics provide insights into neighborhood trends and consumer behaviors.

Benefits of PropTech

PropTech offers numerous benefits, including faster transactions, improved transparency, enhanced customer experiences, and cost savings. Notably, Jome.com leverages AI and big data to streamline the home-buying process, offering data aggregation, AI-powered features, and a user-friendly platform.

The Future of PropTech

Looking ahead, PropTech is poised to introduce groundbreaking innovations such as sustainable real estate practices, predictive analytics for market forecasting, decentralized marketplaces, and enhanced personalization. As technology evolves, PropTech will continue to redefine the real estate landscape, making it more accessible and efficient for all stakeholders involved.

For more insights, the original article published by BNO News delves deeper into how PropTech is transforming the real estate industry in 2024 and beyond.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

Unlocking Real Estate Wealth in 2025: Strategies for Success

Unlocking Real Estate Wealth in 2025: Strategies for Success

Step into 2025, where the real estate market emerges as a resilient beacon amidst economic unpredictability. Investors are increasingly drawn to secondary cities like Austin and Manchester, attracted by their growth potential, affordability, and enhanced quality of life. These markets promise higher returns, though they come with challenges such as slower sales and liquidity issues.Sustainability has become the new benchmark in real estate. Eco-friendly properties not only cater to environmentally conscious consumers but also command premium prices. This trend aligns with a broader consumer shift towards green living, emphasizing the importance of energy-efficient buildings.

However, the landscape is not without its hurdles. High interest rates and evolving regulations on short-term rentals in major cities pose significant challenges. Investors must adopt strategic approaches, utilizing innovative financing options and staying informed about local laws to navigate these complexities.

Technology, particularly AI, plays a crucial role in democratizing access to real estate insights. While digital tools enrich market analysis, the nuanced understanding provided by local expertise remains invaluable. No algorithm can fully capture the essence of promising neighborhoods or emerging markets.

For those prepared to decode the complex threads of this year’s market, 2025 offers a rich tapestry of real estate opportunities. By embracing sustainability, leveraging technology, and maintaining an adaptable strategy, investors can harness the wealth potential of this transformative landscape.

For further insights, visit credible real estate websites like the National Association of Realtors or consult a professional financial advisor specializing in real estate.

Additional Resources

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

AI and Urbanization Drive Home Services Market Growth

AI and Urbanization Drive Home Services Market Growth

The global home services market is poised for significant growth, with projections indicating an increase of USD 1.03 trillion from 2025 to 2029. This forecasted expansion is attributed to increasing urbanization and the transformative impact of AI on market trends, according to a recent report by Technavio.

As urban areas continue to expand, the demand for home services is expected to rise, driving the market at a compound annual growth rate (CAGR) of 10.5%. The integration of AI is reshaping the landscape, offering innovative solutions and streamlining services for consumers and businesses alike.

Key Market Drivers and Challenges

The rise of digitalization and e-commerce platforms is a major driver of growth in the home services sector. Companies such as Ginger and One Medical are pioneering in the healthcare segment, while Zimmber and Timesaverz lead in home cleaning and maintenance services.

However, the market faces challenges including regulatory issues, labor shortages, and technological disruptions. Environmental considerations and price wars add further complexity to the evolving market dynamics.

Regional Insights and Market Players

North America is expected to contribute significantly to the market’s growth, accounting for 46% of the overall expansion. Key players in the market include Amazon.com Inc., American Home Shield Corp., Angi Inc., and Home Depot Inc., among others.

The market structure remains fragmented, with opportunities for companies to capitalize on the growing demand for services such as plumbing, HVAC maintenance, and home improvement.

Future Prospects

As the home services market continues to evolve, companies are focusing on enhancing safety, comfort, and aesthetic appeal for consumers. The integration of AI and digital platforms is expected to play a pivotal role in shaping the future of the industry.

For more detailed insights, you can explore the Technavio Analysis and view the Free Sample PDF.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

Decoding the U.S. Housing Crisis: A Study of Historic Policy Missteps and Demographic Shift