Understanding the 2008 Housing Market Crash: A Retrospective

Understanding the 2008 Housing Market Crash: A Retrospective

In the annals of economic history, the housing market crash of 2008 stands as a monumental event, reshaping the landscape of the global economy. The crash, as detailed in a recent article by Norada Real Estate Investments, was primarily triggered by a confluence of factors including subprime mortgages, predatory lending practices, and a stark lack of regulation in the financial sector.The Subprime Mortgage Crisis

The subprime mortgage crisis played a pivotal role in the collapse. Financial institutions, in a bid to maximize profits, extended loans to individuals with questionable creditworthiness. These loans were then packaged into mortgage-backed securities and sold to investors. As defaults surged, the value of these securities plummeted, leading to catastrophic losses for investors and financial institutions alike.

Adjustable-Rate Mortgages and Rising Defaults

Another compounding factor was the prevalence of adjustable-rate mortgages (ARMs). Initially attractive due to their low introductory rates, these mortgages became untenable for many homeowners as interest rates adjusted upwards. This led to widespread defaults and foreclosures, exacerbating the financial turmoil.

Lack of Financial Regulation

The deregulation of the financial sector, notably the repeal of the Glass-Steagall Act in 1999, allowed for risky investments without adequate oversight. This lack of regulation was a significant contributor to the reckless behavior that precipitated the crash.

The Economic Fallout

The repercussions of the 2008 housing market crash were severe and far-reaching. Millions of Americans lost their homes and jobs, triggering a global economic recession. The interconnectedness of the global financial system meant that the crisis in the United States had a ripple effect worldwide, with countries like Iceland, Ireland, and Spain suffering particularly acute economic consequences.Governments across the globe scrambled to stabilize their economies. In the United States, the Troubled Asset Relief Program (TARP) was introduced to provide financial assistance to struggling banks. The Federal Reserve also took unprecedented steps to inject liquidity into the financial system by slashing interest rates and implementing quantitative easing programs.

Lessons Learned and Current Market Dynamics

The 2008 crash underscored the need for stringent financial regulation. In response, the Dodd-Frank Wall Street Reform and Consumer Protection Act was enacted in 2010 to enhance transparency and accountability in the financial sector.Today, the housing market operates under a different paradigm. Stricter lending standards and a more diverse housing market have contributed to its stability. Unlike the oversupply of homes that characterized the pre-crash era, the current market is marked by a shortage of housing, driving up prices.

The Federal Reserve remains vigilant, adjusting interest rates to maintain market stability. While interest rates are on the rise in 2023, there is a greater emphasis on responsible borrowing and lending practices, reducing the likelihood of a repeat of the 2008 crisis.

Conclusion

The housing market crash of 2008 serves as a cautionary tale, reminding us of the perils of unchecked financial practices. While the market has since rebounded, the lessons learned continue to shape the policies that govern it today. Ensuring a stable housing market is crucial not only for the American dream of homeownership but also for the overall health of the economy.As we look to the future, it is imperative to remain vigilant, ensuring that the safeguards put in place remain robust and effective. By doing so, we can hope to prevent a recurrence of such a devastating economic event.

More Articles

Getting licensed or staying ahead in your career can be a journey—but it doesn’t have to be overwhelming. Grab your favorite coffee or tea, take a moment to relax, and browse through our articles. Whether you’re just starting out or renewing your expertise, we’ve got tips, insights, and advice to keep you moving forward. Here’s to your success—one sip and one step at a time!

Cryptocurrencies: A New Era in Finance

Cryptocurrencies: A New Era in Finance

In a little over a decade, **cryptocurrencies** have evolved from digital curiosities to trillion-dollar technologies with the potential to transform the global financial landscape. These digital assets, like Bitcoin and Ethereum, are not just reshaping how we perceive money but are also challenging traditional financial institutions.Proponents argue that **cryptocurrencies** democratize finance by decentralizing money creation and control, taking power away from central banks and Wall Street. Yet, critics warn that these digital currencies can empower criminal organizations and rogue states, exacerbate inequality, and consume vast amounts of electricity. The debate is intense, with 130 countries, including the United States, considering their own central bank digital currencies (CBDCs) to counter the cryptocurrency boom.

Understanding Cryptocurrencies

**Cryptocurrencies** are digital or virtual currencies that use cryptography for security. They operate on decentralized networks based on blockchain technology—a distributed ledger enforced by a network of computers. **Bitcoin**, launched in 2009 by the enigmatic Satoshi Nakamoto, is the most well-known, with a market capitalization once exceeding $1 trillion.Transactions are recorded on a blockchain, providing transparency and security. This system eliminates the need for intermediaries like banks, offering a degree of anonymity. However, if a wallet owner’s identity is revealed, their transactions can be traced.

The Popularity Surge

Once a niche interest, **cryptocurrencies** have captured mainstream attention. Their appeal lies in their decentralized nature, allowing for quick and anonymous transfers without bank fees. In countries with unstable currencies, like El Salvador, **Bitcoin** has even become legal tender.Despite their potential, **cryptocurrencies** are volatile. Their value can fluctuate wildly, limiting their use as a stable means of transaction. **Stablecoins**, pegged to traditional currencies, offer more stability but have faced their own challenges.

Challenges and Controversies

**Cryptocurrencies** pose significant challenges, including concerns about illicit activities, environmental impact, and regulatory uncertainties. Cybercriminals often demand ransom payments in cryptocurrency, and the energy-intensive process of **Bitcoin mining** raises environmental concerns.Regulatory responses vary globally. While some countries embrace digital currencies, others, like China, have imposed bans. The U.S. is cautiously crafting rules, with the SEC likening the sector to a “Wild West” and calling for stronger regulations.

The Future with CBDCs

In response to the rise of **cryptocurrencies**, many central banks are exploring **CBDCs**. These digital currencies promise the benefits of cryptocurrencies without the associated risks. However, their implementation could centralize power and data, raising privacy and cybersecurity concerns.As the world navigates this financial evolution, the balance between innovation and regulation will be crucial. The journey of **cryptocurrencies** and digital currencies continues to unfold, reshaping the future of money.

Artificial Intelligence: Transforming the Landscape of Modern Medicine

Artificial Intelligence: Transforming the Landscape of Modern Medicine

In the bustling corridors of healthcare, a silent revolution is underway. Artificial Intelligence (AI), with its machine learning prowess, is redefining how medical data is processed, offering invaluable insights that enhance health outcomes and patient experiences. This transformation, as detailed in a recent IBM article, is not just a technological marvel but a beacon of hope in modern medicine.AI’s Role in Clinical Decision Support and Imaging Analysis

AI is swiftly becoming an indispensable ally in clinical settings. From clinical decision support to imaging analysis, AI tools are empowering healthcare professionals with quick access to relevant research and data. This aids in making informed decisions about treatments and medications, particularly in detecting subtle findings in CT scans, x-rays, and MRIs that might elude the human eye.Accelerated Adoption During the COVID-19 Pandemic

The COVID-19 pandemic, while a global challenge, served as a catalyst for AI adoption in healthcare. Many organizations began field-testing AI-supported technologies, such as patient monitoring algorithms and COVID-19 screening tools. The ongoing research from these tests underscores AI’s growing role and the evolving standards in the medical field.AI Applications: From Disease Detection to Drug Development

- Disease Detection and Diagnosis: AI models, untiring and vigilant, monitor vital signs and alert clinicians to potential risks. For instance, an AI model developed for premature babies has shown 75% accuracy in detecting severe sepsis.

- Personalized Treatment: With AI, precision medicine becomes more accessible, offering real-time, customized recommendations based on a patient’s history and preferences.

- Medical Imaging: AI’s proficiency in analyzing medical images is comparable to that of human radiologists, assisting in early disease detection and managing the deluge of patient images.

- Clinical Trial Efficiency: AI enhances the speed and accuracy of medical code assignments, significantly reducing the time spent on this task.

- Drug Development: AI accelerates drug discovery by optimizing drug design and identifying promising new combinations, addressing big data challenges in life sciences.

Benefits of AI in Medicine

AI’s integration into healthcare is not just about efficiency; it holds the promise of informed patient care, error reduction, and cost savings. By providing contextual relevance and enhancing doctor-patient engagement, AI ensures that patients receive timely support and that their medical information is managed with precision. A systematic review of peer-reviewed studies highlights AI’s potential in improving patient safety through decision support tools that enhance error detection and drug management.The Future of AI in Medicine

As we stand on the cusp of a new era in digital health systems, AI is poised to become a core component of modern medicine. Its ability to streamline processes, reduce errors, and personalize care heralds a future where healthcare is not only more efficient but also more compassionate.Transforming Healthcare Delivery: Johnson & Johnson’s AI Revolution

In the ever-evolving landscape of healthcare, the role of artificial intelligence (AI) is becoming increasingly pivotal. At the forefront of this technological revolution is Johnson & Johnson, leveraging AI to enhance the delivery of healthcare services and ensure that crucial therapies reach patients efficiently.

From predicting supply and demand fluctuations to managing disruptions in the supply chain, AI is reshaping how healthcare products are distributed. As reported by Johnson & Johnson, the implementation of AI solutions helps prioritize areas most affected by potential risks, ensuring that patients receive the treatments they rely on.

Building a Resilient Supply Chain

Vishal Varma, Director of Supply Chain Digital & Data Science and Operations Research at Johnson & Johnson, emphasizes the importance of AI in creating a stable supply chain. “AI is helping us build a stable, efficient, and resilient supply chain so we can deliver on that obligation,” he notes. This stability is crucial in a world where economic disruptions and severe weather events can threaten supply lines.

Enhancing Patient Care with Engagement.ai

AI’s role extends beyond logistics into the realm of patient care. The company’s global capability, Engagement.ai, is designed to optimize interactions with healthcare professionals. As Jeff Headd, Vice President and Head of Technology, explains, “These insights from Engagement.ai allow us to prioritize when, where, and how we connect with healthcare providers to ensure they have relevant and appropriate information when making treatment decisions.”

This strategic use of AI not only supports providers but also enhances the understanding of disease progression, ensuring that patients receive timely interventions.

Commitment to Patient-First Initiatives

At the core of Johnson & Johnson’s AI strategy is a commitment to patient-first initiatives, as outlined in their Credo. Jim Swanson, Executive Vice President and Chief Information Officer, underscores this ethos, stating, “When we use AI, it’s always with a purpose. Our Credo states that our patients and customers come first, and that will continue as we move forward with this technology.”

As AI continues to advance, Johnson & Johnson remains dedicated to harnessing its power to improve healthcare outcomes and ensure that patients have reliable access to life-saving treatments.

Material Costs Surging: Implications for Housing Affordability and Construction

Material Costs Surging: Implications for Housing Affordability and Construction

The housing and construction sectors are grappling with unprecedented challenges as the prices of building materials soar in 2024. This surge marks the highest year-over-year growth since early 2023, raising significant concerns about housing affordability. A multitude of factors, including supply chain disruptions, inflationary pressures, and global geopolitical issues, are exacerbating the situation. Builders are striving to mitigate the impact on consumers while safeguarding their profit margins.

The ripple effect of these price hikes is extensive. Builders are employing innovative strategies to control expenditures in response to high costs. These strategies include negotiating long-term contracts to stabilize prices, optimizing material usage, and exploring alternative sustainable building practices. Although potentially more expensive, these practices support eco-friendly construction.

Moreover, builders face additional pressure from labor shortages, affecting productivity in construction-related industries. Solutions such as advanced workforce development and enhanced compensation packages are essential to attract skilled labor. Meanwhile, the industry is adapting by prioritizing more affordable housing solutions and embracing partnerships to share costs and potential risks.

Factors Contributing to Rising Costs

- Supply and Demand: The classic economic principle of supply and demand plays a crucial role as the demand for building materials increases while supply remains limited due to global shortages and disruptions.

- Inflation: Inflationary pressures are contributing to higher material costs, impacting the price of construction materials.

- Global Factors: Geopolitical tensions and trade disputes, particularly in commodities like softwood lumber, steel, and aluminum, disrupt supply chains and lead to price increases.

- Sustainability Initiatives: The demand for eco-friendly, sustainable building materials is rising, increasing costs as these specialty materials often come with a higher price tag.

As builders adapt to these challenging economic conditions, they remain cautious of the long-term implications for homebuyer affordability and the industry’s financial health. By focusing on innovative technologies and strategic collaborations, the construction industry aims to sustain progress amid these material cost fluctuations, benefiting both consumers and businesses.

“`California’s Bold Move: Speed Assistance Technology Now Mandated in Vehicles

California’s Bold Move: Speed Assistance Technology

In an unprecedented legislative action, California is poised to become the first state in the United States to mandate speed assistance technology in vehicles. This initiative, spearheaded by state senator Scott Wiener, aims to warn drivers when they exceed the speed limit by more than 10 miles per hour. The proposed legislation has stirred a mix of support and opposition, highlighting the complexities of implementing new technology in the automotive industry.

The Legislative Journey

The bill, introduced by Wiener earlier this year, initially proposed an active speed assistance model that would physically prevent vehicles from surpassing speed limits. However, following significant pushback, the bill was revised to incorporate a passive system that merely alerts drivers of their speeding. This change was made to accommodate concerns while still prioritizing safety.The National Transportation Safety Board (NTSB) has lauded the bill, stating that the widespread use of speed assistance could reduce the frequency of speeding-related accidents, potentially saving lives. Despite the NTSB’s support, it lacks the authority to enforce such measures, leaving the decision in the hands of state and federal lawmakers.

Voices of Opposition

Critics of the bill, including the National Motorists Association and the automotive industry, argue that the technology is not yet ready for widespread deployment. Jay Beeber of the National Motorists Association expressed concerns over the potential for “false positives” and the risk of distracting drivers. The Specialty Equipment Market Association also voiced opposition, emphasizing California’s overreach and the need for federal oversight.A significant challenge noted by opponents is the lack of consistent speed limit signage across the U.S., which is essential for the effective operation of speed assistance systems. This contrasts with Europe, where such infrastructure is more developed, allowing for reliable use of the technology.

Looking Ahead

California’s decision to push forward with this legislation, despite federal inertia, mirrors historical precedents in auto safety innovation, such as the early adoption of seat belts. The bill has passed the California legislature and now awaits Governor Gavin Newsom’s approval, a decision that could set a new standard in vehicular safety and influence national policy.For more details on this evolving story, visit the original NPR article.

AI in Medical Diagnosis: Revolutionizing Healthcare Standards

AI in Medical Diagnosis: Revolutionizing Healthcare Standards

The integration of artificial intelligence in the medical domain is rapidly transforming healthcare, particularly in the realms of disease diagnostics and therapeutic management. This technological advancement is not just a fleeting trend but a significant shift in how healthcare services are provided, aiming to alleviate the pressures on medical services through more accurate diagnostics.In the United States, around 5% of outpatients are misdiagnosed, with errors especially prevalent in serious medical conditions. AI and machine learning are emerging as powerful technologies to address this issue, improving the accuracy of medical diagnosis and revolutionizing healthcare with their myriad applications. AI facilitates medical management, automates administrative tasks, and optimizes workflows in medical diagnostics, as highlighted in a Statista Survey.

Unlike traditional methods that rely solely on correlations between symptoms and potential causes, modern AI approaches employ causal reasoning in machine learning. This advancement provides reliable and accurate diagnoses even in regions with limited access to healthcare providers.

Key Applications of AI in Medical Diagnosis

AI assists healthcare practitioners across various departments by analyzing symptoms, detecting lethal ailments at an early stage, suggesting targeted therapies, and predicting potential risks. Whether in surgery, pathology, infertility, pandemic management, or patient care, AI is becoming an integral tool in medical diagnostics. Beyond diagnosis, AI enhances various aspects of healthcare, including drug discovery and telehealth.Symptom Analysis & Personalized Treatment Recommendations

Many healthcare practitioners are already using intelligent symptom checkers. These systems ask patients questions about their symptoms and recommend appropriate actions for therapy. AI medical diagnosis technology advances precision medicine by synthesizing data and forming conclusions, allowing for better-educated and personalized therapy.Risk Prediction and Clinical Trials

AI can create algorithms that forecast individual and community health risks, improving patient experiences. For instance, doctors at the University of Pennsylvania developed a machine learning algorithm to predict sepsis 12 hours before symptoms appear. In clinical trials, AI enhances diagnostic accuracy and reduces errors, ensuring more reliable and precise diagnoses.Oncology and Virtual Biopsies

AI significantly enhances oncology by aiding in the early detection and precise diagnosis of cancers, such as lung and breast cancer. It supports personalized treatment plans, optimizing therapy, and improving patient outcomes. For example, AI systems can monitor breast cancer with 95% accuracy, matching the performance of an average breast radiologist. Additionally, AI is transforming diagnostics with virtual biopsies, allowing clinicians to detect tumor characteristics without invasive procedures.Challenges and Solutions

Despite AI’s potential, the technology poses challenges such as data privacy, data quality, and interoperability issues. To address these, robust data encryption protocols, high-quality data collection, and open standards for seamless integration are essential.Future of AI in Healthcare

The Global AI and medical diagnosis market is expected to grow significantly, driven by the need for time-saving diagnosis methods and government investments in advanced medical treatments. The future of healthcare is on the verge of a major transformation, with AI poised to reshape the current system from reactive, medicine-based care to a proactive, preventative approach focused on overall well-being.For those seeking to leverage AI in medical diagnosis, Appinventiv offers cutting-edge custom AI development services in the medical sector, paving the way for more accurate and efficient patient care.

AI in Breast Imaging Market Set for Explosive Growth

AI in Breast Imaging Market Set for Explosive Growth

The global AI in breast imaging market is on a remarkable growth trajectory, projected to swell from USD 451.6 million in 2023 to an impressive USD 5944.3 million by 2033. This represents a compound annual growth rate (CAGR) of 29.4%, primarily driven by cutting-edge advancements in AI technologies that significantly enhance diagnostic accuracy, facilitate early detection, and boost healthcare efficiency.Despite this optimistic outlook, the market is not without its challenges. Regulatory hurdles in deploying AI technologies, the prohibitive costs of cancer treatment, and stringent compliance requirements for patient privacy and data use present significant obstacles. Moreover, the financial burden associated with breast cancer treatment could limit patient access to advanced diagnostic technologies.

Currently, North America leads the market with a revenue of USD 205.4 million, thanks to its high breast cancer incidence and sophisticated healthcare infrastructure. However, the Asia-Pacific region is expected to experience the fastest growth, driven by rising breast cancer prevalence, increased healthcare investments, and technological advancements in imaging. These regional dynamics underscore the market’s evolving nature and its transformative impact on global healthcare.

Recent industry developments have highlighted a focus on collaborations and innovations to refine breast imaging technologies. Strategic alliances, such as those between Google Health and iCAD, emphasize AI’s potential to enhance the accuracy of breast cancer screenings and risk assessments. These partnerships merge medical expertise with cutting-edge technology, paving the way for accelerated market expansion.

In conclusion, while the AI in breast imaging market is poised for significant growth, overcoming current challenges is crucial. Strategic innovations and collaborations, as evidenced by products like the Genius AI Detection 2.0 by Hologic and GE Healthcare’s MyBreastAI Suite, will further propel the market, enhancing breast cancer detection and patient care. As AI systems continue to integrate into clinical workflows, they hold the promise of redefining breast cancer diagnosis and treatment, offering promising solutions to enhance patient outcomes and healthcare efficiency.

For more in-depth insights, refer to the original article.

Virtual Real Estate: Navigating Investments in Metaverse Platforms

Exploring the Metaverse Investment Potential

Among the various platforms available, **Decentraland**, **The Sandbox**, and **Holiverse** are leading the charge. Each offers unique opportunities for investors to diversify their **virtual portfolios**. **Decentraland** stands out for its vibrant community and impressive growth, while **The Sandbox** has attracted attention with high-profile collaborations, including a landmark sale next to **Snoop Dogg’s virtual mansion**.

**Holiverse**, however, is making waves with its innovative approach to digital interaction. The platform has notably partnered with Dr. Dmitry Chebanov to integrate DNA avatar technology, allowing users to create digital prototypes based on genetic codes. This collaboration opens new doors in personalized medicine, offering potential for safer and more effective therapeutic practices.

The Influence of Celebrities and Corporations

The allure of **virtual real estate** is further amplified by the involvement of celebrities and major brands. **Snoop Dogg’s** creation of the “Snoop Verse” in **The Sandbox** and **Ariana Grande’s concert** in **Fortnite** highlight the entertainment potential of these digital spaces. Meanwhile, corporations like **JP Morgan** and **Warner Music Group** are establishing a presence in metaverses, signaling a growing acceptance and recognition of **virtual real estate’s value**.Market Growth and Challenges

The **virtual real estate market** is on an upward trajectory, with projections indicating an increase from $1.14 billion in 2022 to $15.7 billion by 2030. **North America** currently leads this market, but the **Asia Pacific region** is expected to experience the fastest growth, driven by advancements in **VR and AR technologies**.However, challenges persist. **Cybersecurity** remains a major concern as the value of virtual assets rises, and regulatory frameworks are still in development, posing potential risks for investors. Despite these hurdles, the future of **virtual real estate** looks promising, with continuous innovations in **metaverse technologies** paving the way for new investment opportunities.

For more insights, you can refer to the original article at e-architect.

The Transformative Power of AI in In-Vitro Diagnostics

The Transformative Power of AI in In-Vitro Diagnostics

In the ever-evolving landscape of healthcare, artificial intelligence (AI) and machine learning are at the forefront of revolutionizing in-vitro diagnostic (IVD) tools. As highlighted in a recent article from BW Healthcare, these cutting-edge technologies are redefining diagnostics and enhancing healthcare outcomes on multiple fronts.Enhanced Diagnostic Accuracy

AI’s ability to process vast datasets with remarkable speed and precision is unparalleled. By detecting patterns and anomalies often missed by human observation, AI-driven IVD platforms are paving the way for more accurate diagnostics. This advancement is particularly crucial in the early detection of diseases like cancer and genetic disorders.

Personalised Medicine

The era of one-size-fits-all treatment is fading into history. Machine learning enables the personalization of diagnostic results, tailoring treatments based on an individual’s genetic makeup and medical history. This approach not only improves patient outcomes but also guides personalized treatment plans for conditions such as diabetes and cardiovascular diseases.

Automation and Workflow Efficiency

In high-throughput environments like clinical laboratories, AI-powered IVD tools automate repetitive tasks, enhancing workflow efficiency and reducing human error. Automated systems can interpret complex data sets in real-time, thereby accelerating diagnosis and alleviating the workload on lab technicians.

Predictive Analytics

AI’s predictive capabilities are a game-changer in disease management. By analyzing historical and real-time data, AI algorithms can forecast disease outbreaks and progression, empowering healthcare systems to prepare for potential challenges proactively.

Integration with IoT and Wearables

The integration of AI-driven IVD tools with wearables and IoT devices is enabling continuous health monitoring. This seamless connectivity allows for real-time diagnostic data collection, facilitating proactive disease management and early interventions.

Cost Reduction

AI’s role in reducing healthcare costs cannot be overstated. By minimizing diagnostic errors and streamlining procedures, AI-driven IVD tools significantly lower the financial burden on healthcare systems.

Early Disease Prediction

AI’s prowess in processing large datasets is instrumental in the early prediction of diseases, even before symptoms manifest. This capability is invaluable in preventive healthcare, allowing for timely interventions and lifestyle modifications.

Standardisation and Reduction of Human Error

Ensuring consistency and standardization in diagnostic procedures, AI minimizes human error and variability, leading to more reliable and uniform results across different laboratories.

Self-Learning Diagnostic Tools

AI-powered IVD systems are continuously learning and adapting. As they process more diagnostic data, they improve their accuracy, making them invaluable assets in the healthcare sector.

%20(1).jpg) The author of the article is Chandra Ganjoo, Group CEO of Trivitron Healthcare, who eloquently outlines the transformative impact of AI and machine learning on in-vitro diagnostics.

The author of the article is Chandra Ganjoo, Group CEO of Trivitron Healthcare, who eloquently outlines the transformative impact of AI and machine learning on in-vitro diagnostics.

The Future of Life Sciences: A Vision for 2030

The Future of Life Sciences: A Vision for 2030

As we edge closer to 2030, the life sciences industry stands on the threshold of transformative changes. With a global valuation exceeding $2 trillion, the sector is poised for significant growth, driven by technological advancements and an aging population. The resilience demonstrated during the COVID-19 pandemic has set the stage for ongoing evolution in healthcare development.Current Innovations and Trends

The rapid acceleration of digital technology, particularly artificial intelligence (AI), machine learning, and genomics, has revolutionized drug discovery and personalized medicine. Technologies such as wearables and telemedicine are reshaping healthcare delivery, marking the dawn of a digital health revolution.- AI and Machine Learning: These technologies are at the forefront of the industry’s progress, enhancing medical devices, discovering data patterns, and boosting productivity. However, legal challenges regarding intellectual property and data privacy remain.

- Precision Medicine: Leveraging genomics and AI, precision medicine offers tailored treatments to individual health profiles, significantly improving the management of chronic diseases like cancer and diabetes.

- Digital Health Technologies: The pandemic accelerated the adoption of cloud computing and AI, leading to scientific breakthroughs and improved manufacturing efficiency. Wearables and healthcare apps are crucial in early health issue detection and patient care enhancement.

- Patient-Centric Care: Smart technologies enable personalized healthcare through remote monitoring and tailored treatments, shifting the focus to a more patient-centric approach.

- Biotechnology Innovations: Companies are using biological processes to address global challenges, resulting in more effective medicines and sustainable farming solutions.

Challenges and Opportunities

The Inflation Reduction Act in the U.S. presents challenges for drug pricing and company revenue, prompting a reevaluation of investment strategies. Increasing diversity in clinical trials is essential for equitable treatment development. Legal and ethical concerns around gene editing and data privacy necessitate robust guidelines.Opportunities for Growth

Developing AI solutions that support healthcare workers’ daily decisions could revolutionize healthcare delivery, making it more personal and effective. Embracing advanced analytics enables healthcare organizations to make data-driven decisions, enhancing patient care and operational efficiency. Additionally, utilizing AI for drug repurposing could lead to innovative treatments for challenging conditions.As we look towards 2030, the life sciences industry is on the cusp of groundbreaking innovations that promise enhanced, personalized healthcare for all. The key challenge remains ensuring these advancements are accessible and beneficial to everyone, emphasizing the need for collaboration between governments, healthcare providers, and biotechnology companies.

Telehealth: A Boon for Patients, A Challenge for Rural Hospitals

Telehealth: A Boon for Patients, A Challenge for Rural Hospitals

The advent of telehealth has revolutionized the way patients, particularly those in rural areas, access health care. By offering remote consultations and follow-up care, telehealth provides a convenient alternative to traveling long distances to urban hospitals. However, this technological advancement brings with it a set of challenges that could reshape the rural health care landscape.

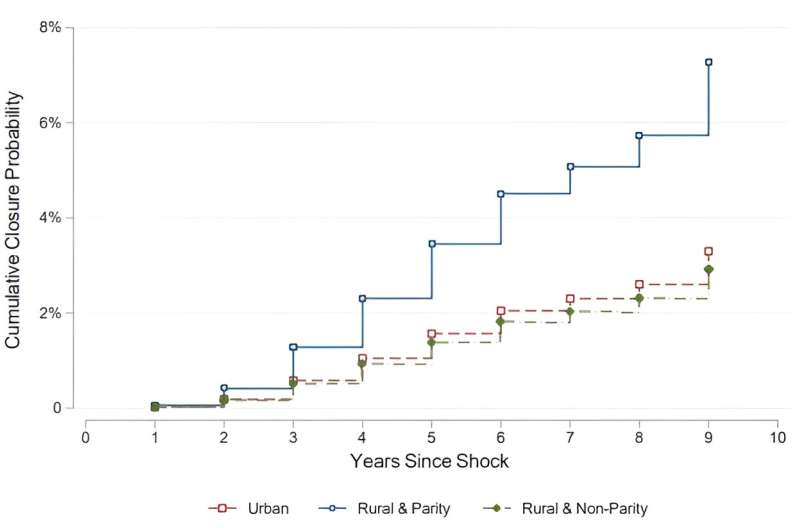

The advent of telehealth has revolutionized the way patients, particularly those in rural areas, access health care. By offering remote consultations and follow-up care, telehealth provides a convenient alternative to traveling long distances to urban hospitals. However, this technological advancement brings with it a set of challenges that could reshape the rural health care landscape.A recent study by Zihan Ye from the University of Tennessee, alongside Kimberly Cornaggia from Penn State University and Xuelin Li from Columbia Business School, sheds light on the financial impacts of telehealth on rural hospitals. Their research, soon to be published in the Review of Financial Studies, reveals that while telehealth services enhance patient access to urban hospitals, they simultaneously drain resources from rural health care providers. This shift can lead to financial instability, increased leverage, and even bankruptcy for rural hospitals.

The study highlights a competitive imbalance, with urban hospitals benefiting from a larger patient base and the ability to charge higher fees. Conversely, rural hospitals, often unable to offer telehealth services, face dwindling patient numbers and diminished financial viability. The situation is exacerbated by disparities in insurance reimbursements, particularly from Medicare and Medicaid, which often fall short compared to private insurers.

Ye and her colleagues urge policymakers to consider the long-term effects of telehealth expansion, advocating for collaborative programs that allow rural hospitals to partake in the telehealth market’s benefits. Such measures could alleviate financial pressures and ensure continued access to health care for rural communities.

As communication technology continues to evolve, understanding its broader impacts remains crucial for a balanced and equitable health care system. For more insights, visit the original article on Medical Xpress.

References:

The Genetic Revolution: CRISPR and Public Opinion

The Genetic Revolution: CRISPR and Public Opinion

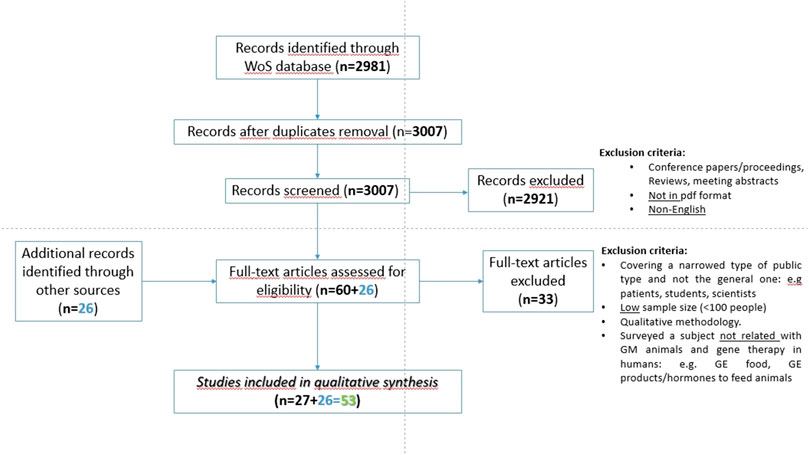

It was a monumental shift in the world of genetics when CRISPR-Cas9 burst onto the scene in 2012, democratizing the ability to edit genomes with unprecedented precision and ease. This revolutionary technology, as detailed in a systematic review published by Frontiers, has not only transformed scientific research but has also sparked a profound societal and ethical debate.

The CRISPR Effect

CRISPR’s impact is far-reaching, influencing fields from biomedical research and clinical practice to food production. The ability to edit genes with such precision has opened doors to potential cures for genetic diseases, enhancements in agricultural yields, and even the controversial editing of human embryos.

However, this power comes with significant ethical concerns. As the review notes, the application of CRISPR to human embryos has reignited debates over genetic manipulation, reminiscent of past controversies surrounding genetic engineering.

Public Sentiment: A Mixed Bag

Over the past 35 years, surveys have painted a complex picture of public attitudes towards genetic modification. Generally, there is strong support for therapeutic gene editing in humans, particularly when it comes to treating or preventing diseases. Yet, opinions diverge sharply when it comes to germline modifications and genetic enhancements, often viewed with skepticism or outright opposition.

The review highlights that while many embrace the potential health benefits, the notion of “designer babies” raises red flags for both ethical and safety reasons. This echoes the sentiments expressed by scholars like Camporesi and Cavaliere, who have explored the ethical dimensions of CRISPR in their work (Camporesi and Cavaliere, 2016).

Responsible Innovation

The key takeaway from the review is the critical need for responsible research and innovation (RRI). Aligning technological advancements with societal values is paramount. As CRISPR technology continues to evolve, ensuring that it is used ethically and responsibly will require ongoing dialogue between scientists, policymakers, and the public.

Looking Ahead

The path forward for CRISPR and genetic engineering is one of both promise and caution. As noted by Nordberg et al., the regulatory landscape will need to adapt to keep pace with these rapid advancements (Nordberg et al., 2018).

In conclusion, while CRISPR offers a glimpse into a future where genetic diseases could be eradicated, it also challenges us to consider the ethical implications of such power. The conversation is far from over, and as society grapples with these issues, the voices of both advocates and critics will be crucial in shaping the future of genetic engineering.

Revolutionizing Healthcare: The AI Transformation

Revolutionizing Healthcare: The AI Transformation

Artificial Intelligence (AI) is no longer a futuristic concept in healthcare; it is a reality reshaping the industry today. Visionaries like Vinod Khosla have long predicted AI’s potential, foreseeing its ability to replace up to 80% of standard medical tasks. This transformation is now evident as AI technologies begin to outperform traditional methods, particularly in areas requiring precision and data processing.

From Data to Diagnosis

AI is increasingly being integrated into healthcare systems, shifting from human-centered care to AI-driven solutions. As Kris Pahuja, co-founder of the Y Combinator-backed startup Piramidal, observes, AI “co-pilots” are becoming standard in medical decision-making, especially in complex environments like the ICU. This integration is not just about automation; it represents a profound change in medical diagnostics, reducing errors and biases in human diagnosis and leading to better patient outcomes.AI’s proficiency in analyzing medical imaging, particularly in fields like radiology and pathology, allows for the early detection of diseases such as cancer. This capability significantly improves treatment outcomes by enabling more accurate and timely diagnoses.

Personalized Medicine: Tailoring Treatment with AI

One of the most promising applications of AI in healthcare is its role in personalized medicine. By analyzing genetic profiles and real-time health data, AI enables treatments tailored to individual patients, moving away from the traditional one-size-fits-all approach. This personalization reduces adverse reactions and enhances treatment effectiveness. A study published in Nature Humanities and Social Sciences Communications highlights AI’s role in driving precision healthcare.Accelerating Drug Development

AI is also accelerating drug development by allowing pharmaceutical companies to analyze large datasets from clinical trials. This capability identifies potential new drug candidates more quickly and accurately than traditional methods, potentially transforming disease management and care.AI in Patient Care Management

AI’s potential in patient care management is substantial. By continuously monitoring patient health data, AI systems can predict potential health issues and provide timely interventions, shifting healthcare from a reactive model to a proactive one. This proactive approach not only improves patient outcomes but also reduces long-term healthcare costs.AI-powered predictive analytics also play a crucial role in preventive care, identifying patients at risk of developing conditions like diabetes or hypertension long before symptoms appear. This early intervention strategy can prevent the onset of these diseases, significantly reducing the burden of chronic illnesses.

Ethical Considerations and Challenges

Integrating AI into healthcare is not without challenges, particularly concerning privacy, security, and ethics. AI systems require vast amounts of data to function effectively, raising concerns about data breaches and privacy. As AI systems make more autonomous decisions, ethical questions arise, such as who is responsible for incorrect diagnoses or treatment recommendations made by AI. These are complex issues that healthcare providers and regulators must address as AI becomes more prevalent in the industry.The Nature article also underscores the ethical implications of AI in healthcare beyond data privacy and decision-making. AI’s use in patient care could lead to the dehumanization of healthcare, where decisions may become overly data-driven, potentially overlooking the nuances of human empathy and judgment.

Integrating AI

For healthcare leaders eager to embrace AI, a strategic, phased approach is recommended. Begin by identifying specific areas where AI can deliver immediate value, such as diagnostics or patient management, and launch pilot projects to test and refine these tools. Building a multidisciplinary team that includes clinicians, data scientists, and ethicists is essential to ensure that AI solutions are both effective and ethically sound.A New Era of Healthcare

The future of healthcare lies in the seamless integration of AI technologies as partners in care, not just tools. AI is set to reshape healthcare by improving outcomes, reducing costs, and enabling personalized care. While the journey toward AI-driven healthcare is still in its early stages, the impact of these technologies is already being felt. As AI continues to advance, it will redefine the relationship between patients and healthcare providers, making care more efficient, effective, and personalized.Original Article

Exploring the Intersection of AI and Patient-Centered Care

Exploring the Intersection of AI and Patient-Centered Care

In a groundbreaking study published in BMC Medical Ethics, researchers have delved into the public’s perception of artificial intelligence (AI) in healthcare, spotlighting both ethical concerns and potential opportunities for enhancing patient-centered care. As AI continues to permeate various facets of medical practice, understanding its impact on patient trust and decision-making has become increasingly critical.AI in Healthcare: A Double-Edged Sword

The study, conducted by researchers from Florida Atlantic University and the University of South Florida, surveyed 600 adults in Florida to gauge their comfort levels with AI in healthcare tasks. The findings reveal a complex relationship between AI integration and patient trust. While AI is seen as a tool that could potentially improve efficiency and support medical professionals, there is a palpable concern about losing the “human touch” in patient care.Interestingly, the study found that while 84.2% of respondents felt comfortable with AI handling administrative tasks, such as scheduling appointments, only 33.7% were comfortable with AI administering medications. This dichotomy underscores the need for careful integration of AI into healthcare settings, ensuring it complements rather than replaces human interaction.

Trust and Autonomy: Key Concerns

One of the study’s critical insights is the public’s apprehension about AI’s role in clinical decision-making. Many participants expressed discomfort with AI making autonomous medical decisions, highlighting a broader concern about maintaining patient autonomy and consent. As AI technologies advance, the study suggests that incorporating informed consent procedures and clearly communicating the benefits and risks of AI to patients could enhance trust and acceptance.Regulation and Ethical Guidelines: A Call to Action

Despite AI’s potential to revolutionize healthcare, the study emphasizes the urgent need for regulation and ethical guidelines. Without clear oversight, the integration of AI could inadvertently undermine patient-centered care principles. The researchers advocate for a framework that includes transparency, accountability, and patient choice, ensuring AI’s role in healthcare aligns with ethical standards.Opportunities for Equitable Care

Beyond the challenges, the study also highlights opportunities for AI to contribute to more equitable healthcare. By eliminating biases and supporting data-driven decisions, AI has the potential to enhance patient outcomes and reduce disparities. However, this potential can only be realized if AI systems are designed with patient values and preferences in mind.For those interested in exploring the full findings and methodology of this study, the original article is accessible on BMC Medical Ethics. The data, publicly released on September 6, 2023, is available on the University of South Florida’s webpage.

Conclusion

As AI continues to shape the future of healthcare, this study serves as a crucial reminder of the importance of balancing technological advancements with ethical considerations. By prioritizing patient-centered care and addressing public concerns, the medical community can harness AI’s potential to improve healthcare delivery while preserving the essential human elements of care.The AI Revolution in Real Estate

The AI Revolution in Real Estate

The real estate industry is experiencing a seismic shift, thanks to the integration of artificial intelligence (AI). This cutting-edge technology is fundamentally transforming property acquisition, sales, and management processes. AI’s influence extends to predictive analytics, which are reshaping investment decisions, and virtual property tours, which are revolutionizing how we navigate the real estate landscape.According to Deloitte’s research, 52% of corporate real estate developers believe AI can ensure precise property valuation, highlighting its pivotal role in property assessment and pricing accuracy. Additionally, 48% of property managers plan to enhance their revenue through tech-driven efficiency, as noted by Buildium.

Proptech: The Future of Real Estate

AI solutions are central to the rapidly expanding proptech sector. The global proptech market is projected to reach $94.2 billion by 2030, with a compound annual growth rate (CAGR) of 15.8% from 2022 to 2030.In 2021, global investments in proptech companies reached a remarkable total of $24.3 billion. This figure has shown a consistent upward trend since 2012, with the exception of 2020 when new proptech company establishment decreased. The United States recorded 154 proptech funding rounds in 2021, and 2022 secured the second-highest spot on the record charts, with an impressive count of 109 deals.

AI and ML: Streamlining Real Estate Processes

AI and machine learning (ML) technologies are revolutionizing the real estate sector, particularly by streamlining manual processes that have traditionally been paperwork-intensive. Entrepreneur reports that incorrect data in real estate can result in substantial revenue losses, including missed opportunities, lost sales, operational inefficiencies, legal complications, and poor decision-making.The global property management software market is anticipated to grow significantly, with its value projected to increase from $22.05 billion in 2023 to approximately $42.89 billion by 2030.

Data-Driven Market Analysis

Data-powered market analysis is a game-changer for the real estate industry, driven by AI platforms that empower rapid evaluation of real estate projects. These analyses, fueled by data from diverse sources, provide a solid foundation for informed decision-making. Additionally, AI-driven predictive analytics enhance investment strategies by streamlining approaches, reducing risks, and seizing market opportunities.For instance, Lennar collaborated with Climate Alpha, an AI analytics platform, to identify climate-resilient residential areas in the US for future investments.

Image source: REimagineHome

Image source: REimagineHome

Sustainability and Energy Efficiency

The real estate sector carries a substantial environmental burden, responsible for a staggering 40% of annual global CO2 emissions. McKinsey’s research suggests that approximately $7.5 trillion in property value is at risk due to climate-related challenges or the inability to decarbonize existing structures.Proptech presents a significant opportunity for the real estate industry by potentially reducing maintenance costs for green buildings by an average of 20%. To expedite the adoption of sustainable real estate practices, proptech introduces smart decarbonization strategies and green building technologies.

Conclusion

As the proptech industry continues to advance and introduce innovations, it holds the potential to transform the real estate landscape, improving accessibility, convenience, and the overall experience for all participants in the industry. This includes property managers, real estate agents, buyers, renters, and investors alike.Virtual Care in 2024: Challenges and Opportunities for Telehealth

Virtual Care in 2024: Challenges and Opportunities for Telehealth

The telehealth market is experiencing a remarkable surge, driven by the increasing adoption of digital health solutions and remote care services. As reported by PharmiWeb.com, the market was valued at USD 91.4 billion in 2023 and is projected to soar to USD 789.7 billion by 2032, with a compound annual growth rate (CAGR) of 27.4%. This growth highlights telehealth’s transformative role in enhancing healthcare delivery, promising improved accessibility, efficiency, and cost-effectiveness.Several key drivers are propelling this expansion. Advancements in digital health platforms, such as mobile health applications and live video consultations, are breaking down geographical barriers, providing unprecedented access to quality healthcare. The increasing demand for remote patient monitoring (RPM) technologies allows for real-time patient data tracking, ensuring proactive healthcare management. Additionally, the rising prevalence of chronic diseases like diabetes and hypertension accentuates the necessity for telehealth solutions. Government initiatives promoting digital healthcare adoption, particularly during the COVID-19 pandemic, have further strengthened the industry.

Moreover, telehealth’s cost-effective nature significantly reduces healthcare expenses for both providers and patients by minimizing the need for in-person visits and optimizing resource allocation.

Telehealth Market Segmentation

The telehealth market is segmented by component (software, services, hardware), mode of delivery (web-based, cloud-based, on-premises), and end-users (healthcare providers, patients, payers). Regionally, North America leads in telehealth adoption due to advanced technology, high healthcare spending, and favorable regulations. However, the Asia-Pacific region is expected to witness rapid growth, driven by increasing smartphone penetration and supportive governmental policies.Challenges and Innovations

Despite the positive outlook, the industry faces challenges, notably data privacy and security concerns, infrastructure limitations in developing regions, and regulatory hurdles for cross-border healthcare services. Innovations driving market growth include AI and machine learning for enhanced diagnostics, integration of wearable devices for continuous monitoring, blockchain for secure data management, and AR/VR technologies for immersive healthcare experiences.The COVID-19 pandemic dramatically accelerated telehealth adoption, acting as a catalyst for virtual healthcare solution uptake—a trend expected to continue post-pandemic as telehealth becomes integral to healthcare systems.

Prominent players in the telehealth market, such as Teladoc Health, American Well, and MDLIVE, are heavily investing in research and development to innovate and bolster their market standing, paving the way for a promising future in telehealth.

For more detailed insights, access the sample report or purchase the full report from Ameco Research.

NAR 2024 Sustainability Report: A Greener Future for Real Estate

Green Data Fields: A Step Towards Transparency

A notable shift is the integration of green data fields into the Multiple Listing Service (MLS). This innovation is transforming how properties are presented, emphasizing sustainable features to guide buyers towards eco-friendly homes. Such transparency not only promotes healthier living environments but also prepares the housing market for a sustainable future.Empowering Through Education

Education plays a crucial role in this transformation. The survey reveals that a quarter of individuals living in homes with sustainable features have received some form of training. This growing awareness among real estate professionals encompasses energy-efficient appliances, renewable energy systems, and eco-friendly building materials. Armed with this knowledge, agents are better equipped to advocate for green living, meeting the evolving demands of environmentally conscious clients.Energy Efficiency: A Key Market Driver

Energy efficiency is becoming a valuable asset in property descriptions, with more than half of the respondents recognizing its importance. As the demand for sustainable living grows, agents who champion energy-efficient properties are positioned as key change agents, enhancing the marketability of these buildings.Client Interest: Aligning with Eco-Conscious Preferences

The survey highlights a growing client interest in sustainability, with nearly half of respondents noting this trend. This shift underscores the necessity for REALTORS® to align with client preferences, fostering not just transactions but also positive environmental change.

Green Certifications: Dispelling Myths

Contrary to common misconceptions, over 40% of homes with green certifications experienced no difference in market time. This dispels the myth that eco-friendly certifications hinder marketability, highlighting the growing acceptance of green-certified homes.High-Performance Homes: A Worthwhile Investment

Interestingly, homes with high-performance features command a premium of 1% to 5% in dollar value compared to similar homes. This underscores the financial incentives associated with investing in homes that prioritize comfort, health, and operational efficiency.

Conclusion: A Green Horizon Beckons

The NAR 2024 Sustainability Report paints a landscape ready for transformation. It emphasizes the potential for the residential real estate sector to lead a more sustainable, resilient future by integrating green data fields and accepting eco-friendly certifications.As interest in sustainable living grows, real estate professionals are essential advocates for eco-friendly homes and practices. By furthering education, championing energy efficiency, and engaging with green properties, the real estate industry is paving the way for a greener future. For more details, explore the NAR 2024 Sustainability Report.

2025 Commercial Real Estate Outlook: Navigating a New Era

2025 Commercial Real Estate Outlook: Navigating a New Era

The commercial real estate landscape is on the brink of transformation as leaders seek to navigate the challenges of recent years and position their organizations for future opportunities. As we look into 2025, the insights from Deloitte’s Commercial Real Estate Outlook provide a comprehensive guide to understanding the shifting dynamics in this sector.Economic Insights: A Global Perspective

The economic forecasts from various regions offer a critical backdrop for understanding the commercial real estate market. In the United States, the economic outlook for Q2 2024 highlights a period of cautious optimism. Meanwhile, the Eurozone is navigating its economic challenges with a focus on stability, as detailed in the April 2024 report. In India, the April 2024 outlook emphasizes growth opportunities amidst global uncertainties. These regional insights, coupled with the global economic outlook from January 2024, underscore the interconnected nature of the commercial real estate market.Strategic Responses to Economic Fluctuations

In response to these economic conditions, businesses are reshaping their strategies to better align with the evolving market landscape. This includes adapting to post-pandemic realities and leveraging new opportunities. The integration of new technologies and innovative strategies is paramount in this transition, as organizations strive to maintain a competitive edge.Leveraging New Opportunities

The outlook for 2025 encourages leaders to harness emerging opportunities in commercial real estate. This involves not only adapting to current challenges but also anticipating future trends. By focusing on strategic innovation and resilience, businesses can position themselves to thrive in a rapidly changing environment.Conclusion The 2025 Commercial Real Estate Outlook serves as a pivotal resource for leaders seeking to navigate the complexities of the current market. By understanding regional economic insights and adopting strategic responses, organizations can effectively position themselves for success in the coming years.

The Emerging Mental Health Crisis Among Healthcare Workers During the COVID-19 Pandemic

The Emerging Mental Health Crisis

The pandemic has ushered in a wave of mental health challenges that affect healthcare workers profoundly. From the onset of COVID-19, these professionals have been at the forefront, facing immense pressure, long hours, and the constant fear of exposure. This has led to heightened levels of stress, burnout, and even post-traumatic stress disorder (PTSD) among many, as highlighted in a recent article from Frontiers.Stress and Burnout: The Silent Epidemic

Healthcare workers are no strangers to stress, but the pandemic has exacerbated this issue to unprecedented levels. The World Health Organization estimates a significant shortfall in healthcare workers by 2030, which further compounds the stress and burnout experienced by those currently in the field. The emotional toll of making life-and-death decisions, often with limited resources, adds to the moral injury many healthcare workers endure.Self-Care and Systemic Support

While individual self-care practices are crucial, they are not enough. The article emphasizes the need for systemic changes to provide robust support structures for healthcare workers. Implementing evidence-based interventions and policies that prioritize mental health can create a more sustainable and supportive work environment.Strategies for Promoting Mental Health

Several strategies can be employed to support healthcare workers’ mental health. These include providing psychological first aid, resilience training, and access to mental health resources. The use of telemedicine and digital platforms can also alleviate some of the pressures by offering remote consultations and support, as demonstrated during the COVID-19 outbreak in China.Moving Towards Systemic Change

The pandemic has underscored the need for a systemic shift in how we approach healthcare workers’ mental health. This involves not only addressing the immediate mental health needs but also implementing long-term strategies that foster resilience and well-being. As the article suggests, engaging healthcare workers in policy-making processes and promoting a culture of empathy and support are vital steps towards achieving this goal.

Conclusion

In conclusion, the mental health of healthcare workers is a critical public health priority that cannot be overlooked. By implementing systemic changes and providing comprehensive support, we can ensure that these essential workers are equipped to handle current and future health crises. As we move forward, let us remember the invaluable contributions of healthcare workers and strive to create a more supportive and resilient healthcare system.)

Ethical Concerns of Large Language Models in Healthcare

Since the release of ChatGPT by OpenAI in 2022, LLMs have rapidly expanded into healthcare, promising advancements in clinical decision-making, diagnosis, and patient communication. However, the review underscores persistent ethical challenges, including issues of fairness, bias, transparency, and privacy. These concerns underscore the pressing need for well-defined ethical guidelines and human oversight in medical applications.

Exploring Ethical Implications

The study identifies several core themes in the ethical use of LLMs. In clinical settings, LLMs hold potential for assisting in initial patient diagnosis and triage. Yet, there is apprehension about biases that may lead to incorrect diagnoses or treatment recommendations, highlighting the necessity for careful oversight by healthcare professionals.

Patient support applications of LLMs aim to improve health literacy and facilitate communication across language barriers. However, concerns about data privacy and the reliability of medical advice generated by these models remain significant.

Public Health Perspectives

From a broader public health perspective, the study warns of potential risks, such as the dissemination of misinformation and the concentration of AI capabilities in the hands of a few corporations. This could exacerbate existing health disparities and undermine public health efforts.

Ultimately, while LLMs present promising advancements in medical fields, ensuring their ethical deployment requires careful consideration. Addressing biases, enhancing transparency, and maintaining human oversight are crucial to mitigating potential harms and promoting equitable patient care.

For further insights, you can read the original article on News-Medical. Additionally, the full study is available on npj Digital Medicine.

The Role of Wearable Devices in Chronic Disease Monitoring and Patient Care: A Comprehensive Review

The Role of Wearable Devices in Chronic Disease Monitoring and Patient Care: A Comprehensive Review

In the ever-evolving landscape of healthcare, **wearable health devices** have emerged as pivotal tools in the management of chronic diseases. These devices, ranging from sophisticated smartwatches to implanted sensors, offer real-time monitoring and personalized care, thus transforming patient outcomes and healthcare delivery.Revolutionizing Chronic Disease Management Wearable devices have become integral in managing chronic conditions such as diabetes, cardiovascular diseases, and respiratory disorders. By providing continuous health data, these devices empower patients and healthcare professionals with insights that were previously unattainable. For instance, continuous glucose monitors (CGMs) have revolutionized diabetes management, offering real-time glucose readings that lead to precise insulin dosing and improved glycemic control.

Moreover, **wearable technologies** play a crucial role in cardiology by monitoring heart rate and blood pressure, aiding in the detection of arrhythmias, and supporting cardiac rehabilitation. In respiratory health, these devices continuously track vital indicators like respiratory rate and oxygen saturation, facilitating early diagnosis and treatment of conditions such as asthma and COPD.

Challenges and Opportunities Despite their potential, wearable health devices face several challenges. Data accuracy and reliability remain significant concerns, especially under varying physical conditions. Integrating wearable data with existing health records poses operational challenges, necessitating standardized protocols and robust data structures.

Data privacy and security are also critical issues. The continuous collection and transmission of sensitive health information expose users to potential data breaches. Ensuring confidentiality and compliance with regulatory standards like HIPAA and GDPR is essential to build trust among users and healthcare providers.

Cost is another barrier to widespread adoption, particularly in resource-constrained settings. While prices have declined, the initial investment in hardware, software, and training can be prohibitive for some patients and healthcare professionals.

Expanding the Horizon The potential of wearable devices extends beyond individual health management to broader public health interventions. Aggregate data from these devices can provide valuable insights into public health issues, disease outbreaks, and the effectiveness of interventions. This capability positions wearable devices as powerful tools for conducting extensive epidemiological studies and shaping public health policies.

Conclusion As wearable health devices continue to evolve, their integration into healthcare systems signifies a step toward improved patient care and resource utilization. To fully harness their benefits, continuous innovations and collaborations among healthcare professionals, researchers, and technology developers are essential. Addressing challenges related to data accuracy, privacy, and cost will be crucial in realizing the full potential of wearable devices in chronic disease management.

For more insights, refer to the original article on Cureus.

AI Training Mandates: Navigating Legal Waters in Dentistry

AI Training Mandates: Navigating Legal Waters in Dentistry

The integration of artificial intelligence (AI) into dental practices is more than a technological trend; it represents a seismic shift in the industry. This transformation is reshaping skill sets and prompting a thorough examination of legal and ethical implications. As AI systems increasingly perform tasks traditionally handled by human intelligence, the dental sector is grappling with new challenges and opportunities.Since its inception in the 1950s, AI has advanced rapidly, leading to its widespread adoption in healthcare and dentistry. This evolution has been driven by significant strides in computing power and data accessibility, ushering in an era where AI technologies are deeply embedded in dental practice management, patient care optimization, and administrative efficiency.

Legal Frameworks Across the Globe

In Canada, the dual framework of federal and provincial legislation governs employment law. While dental practices primarily fall under provincial jurisdiction, existing laws like the Personal Information Protection and Electronic Documents Act (PIPEDA) are crucial. As AI systems process sensitive patient data, the proposed Artificial Intelligence and Data Act (AIDA) signifies a forthcoming regulatory framework to oversee high-impact AI technologies.In the United States, the employment law landscape is shaped by federal statutes and state-specific regulations. The Equal Employment Opportunity Commission (EEOC) has proactively scrutinized AI’s role in hiring, ensuring applications align with federal civil rights laws, thus mitigating risks of discriminatory practices.

Meanwhile, the European Union has pioneered AI regulation within employment law, focusing on data protection and ethical AI deployment. The General Data Protection Regulation (GDPR) and the proposed AI Act impose stringent rules on AI systems, safeguarding privacy and ensuring fairness in employment contexts.

Employment Implications and Legal Challenges

Implementing AI training mandates in dental offices introduces several implications. Skill gaps among staff necessitate tailored training approaches, potentially impacting daily operations. Traditional roles may evolve to include AI-related responsibilities, altering job descriptions and expectations. Moreover, privacy concerns arise as AI systems handle sensitive patient data.Mandating AI training could also lead to constructive dismissal claims if it significantly alters employment terms. Legal precedents in Canada, such as Farber v. Royal Trust Co., highlight the potential for claims arising from substantial changes in job duties or skill requirements.

Discrimination concerns, particularly age-related disparities, are also significant. Mandatory AI training may disproportionately affect older employees, potentially leading to age discrimination claims. Dental offices must align AI training initiatives with human rights legislation, ensuring accommodations for employees with disabilities.

Strategies for Mitigation and Best Practices

To mitigate legal risks, transparent communication regarding AI training requirements is essential. Dental offices should clearly articulate the reasons for AI integration and document employee consent to participate in training programs. Consulting with legal experts and conducting audits of AI training programs can further ensure compliance with evolving legal frameworks.Offering voluntary AI training programs with incentives and implementing phased introductions to AI technologies can enhance employee motivation and engagement. By customizing training programs to individual needs, dental offices can foster a supportive learning environment.

As AI continues to transform the dental industry, navigating these advancements demands careful attention to legal and ethical principles. By embracing a thoughtful and inclusive approach to AI integration, dental offices can harness AI’s transformative potential while mitigating legal risks and cultivating a positive work environment.

For more insights, refer to the original article on the Oral Health Group.

Smart Home Energy Management Devices: A Market Poised for Growth

Smart Home Energy Management Devices: A Market Poised for Growth

The Global Smart Home Energy Management Device Market is on the brink of a significant transformation, driven by escalating demands for energy-efficient solutions and the increasing adoption of smart home technologies. As consumers become more conscious of the importance of energy conservation, fueled by environmental concerns and rising energy costs, the market is set for a promising trajectory.Government initiatives play a crucial role in promoting sustainable practices and integrating renewable energy sources, further accelerating the market’s expansion. Technological advancements, particularly in artificial intelligence and IoT connectivity, have enhanced these devices’ capabilities, making them more intuitive and user-friendly.

North America: Leading the Charge

North America has emerged as the dominant region in the Global Smart Home Energy Management Device Market, a position it is expected to maintain. This strong market presence is attributed to high consumer awareness about energy conservation, widespread adoption of smart home technologies, and supportive government initiatives. The region’s well-established IoT infrastructure and prevalent home automation systems have significantly contributed to the widespread adoption of these devices.Despite the promising growth, challenges such as integration complexities, data security concerns, and high initial costs persist. However, the future looks bright as innovations continue to shape the industry. According to a report, the market value is expected to rise from $3.7 billion in 2023 to $8.91 billion by 2029, marking a compound annual growth rate of 15.6%.

Key Market Drivers and Challenges

- Drivers: Increasing consumer awareness, advancements in IoT technology, government initiatives, and the integration of renewable energy sources.

- Challenges: Interoperability and integration complexity, data security and privacy concerns, limited consumer awareness, and high initial costs.

Looking Ahead

As the market continues to evolve with innovative product offerings and increasing consumer demand, North America is expected to maintain its leadership position. This growth will drive the Global Smart Home Energy Management Device Market in the coming years, contributing significantly to the global shift towards sustainable living.For more information, visit the original report.

Telehealth and Technology: Revolutionizing Behavioral Health Care

Telehealth: Expanding Access and Enhancing Care

**Telehealth** has emerged as a cornerstone of healthcare delivery, particularly in the realm of **behavioral health**. The COVID-19 pandemic accelerated its adoption, turning it from a supplementary service into a primary mode of care. **Telehealth** effectively bridges the gap for rural and underserved populations, offering treatment options right at patients’ doorsteps. As **telemedicine platforms** become more sophisticated and integrate seamlessly with **electronic health records (EHRs)**, they promise to provide personalized care and ensure continuity for a broader patient base.The Role of Technology in Behavioral Health

**AI** and **machine learning** are at the forefront of revolutionizing **behavioral health**. By developing predictive models, these technologies can identify individuals at risk of **mental health issues** before they become severe. **Wearable technology**, which monitors real-time physiological data, and **digital therapeutics**, which deliver evidence-based interventions through software programs, offer valuable insights into patients’ mental and physical health. These tools are proving to be cost-effective solutions for managing therapy and treatment.The Future Outlook

As **telehealth** and technology blend into every aspect of care, the healthcare industry is moving towards continuous, personalized, and preventive healthcare models. Advances in **genomics** and **precision medicine** will further aid healthcare providers in diagnosing and treating diseases tailored to individuals’ genetic makeups, enhancing both surgical outcomes and patient satisfaction.However, as these advancements unfold, the industry faces challenges in safeguarding **patient data** and ensuring that **AI tools** are responsibly utilized. Balancing technological progression with ethical practices is crucial. For healthcare to successfully integrate these innovations, it must focus on enhancing the human element in medical care, while leveraging technology’s vast potential to improve **patient outcomes**.

Revolutionizing Healthcare: AI and Precision Medicine for Chronic Diseases

Revolutionizing Healthcare: AI and Precision Medicine for Chronic Diseases

In a groundbreaking effort to redefine healthcare, the National Institute of Diabetes and Digestive and Kidney Diseases (NIDDK) is spearheading a workshop focused on the integration of Artificial Intelligence (AI) and Machine Learning (ML) in precision medicine, specifically targeting diabetes and other chronic diseases. This initiative aims to leverage recent advancements in AI, including generative AI and Large Language Models (LLMs), to innovate biomarker development, drug discovery, and diagnostics.

The workshop, detailed in the original article from the National Institutes of Health (NIH), promises to be a landmark event. It aims to bring together biomedical researchers and AI/ML experts to discuss the critical challenges, crosscutting gaps, and opportunities for actionable items in leveraging AI/ML in precision medicine.

Workshop Objectives and Agenda

The primary goal of the workshop is to heighten understanding of the unique opportunities AI provides in personalizing healthcare. Participants will delve into:

- The transformative power of AI in personalizing healthcare.

- Current approaches to precision medicine for chronic conditions.

- Addressing community needs and identifying gaps in current methodologies.

The event includes pre-workshop webinars designed to set the stage for discussions. Notable sessions include Part I: The Bio-Behavioral Dimensions of Diabetes Heterogeneity on October 17, featuring Dr. Yao Qin and Dr. Ashu Sabharwal, and Part II: Advances in AI and Applications in Biomedicine on October 24, featuring Dr. James Zou and Dr. Eran Halperin.

Key Organizers and Participants

The workshop will feature esteemed personnel, including external co-chairs Marcela Brissova from Vanderbilt University, Jeffrey Grethe from the University of California, San Diego, and Wei Wang from the University of California, Los Angeles. Participating NIH/NIDDK experts include Eric Brunskill, Debbie Gipson, Daniel Gossett, Carol Haft, Jia Nie, Xujing Wang, and Ashley Xia.

Event Details and Registration

The workshop was held at the Neuroscience Center Building in Rockville, MD, with virtual participation options available. Although registration has concluded, the event’s impact is expected to resonate throughout the scientific community.

For further information, interested parties could have contacted Xujing Wang, Ph.D., or Jia Nie, Ph.D., at the NIH, or Mark Dennis from The Scientific Consulting Group for logistical concerns.

Conclusion