Hitting Home: Housing Affordability Crisis in the U.S.

“`html

The issue of housing affordability is compounded by a mix of demographic shifts and regulatory hurdles. The aging population, with more seniors opting to age in place, has contributed to a supply crunch. Meanwhile, zoning laws and other regulatory restrictions limit housing density, exacerbating the shortage. These factors, coupled with the rise in mortgage rates from 3.5% to nearly 8% since early 2022, have made the path to homeownership even steeper.

The complexity of the housing affordability crisis suggests there is no quick fix. However, with concerted efforts to increase supply and reform regulatory practices, there is potential for a more balanced and accessible housing market. “`

Hitting Home: Housing Affordability in the U.S.

The American housing market is grappling with a crisis of affordability that is reshaping the landscape of homeownership and renting. A recent analysis by Econofact highlights the growing burden of housing costs on American households. With median house prices now six times the median income—up from four to five times two decades ago—the dream of homeownership is slipping away for many. Even renters, who have historically found refuge in more affordable options, are feeling the pinch as the ratio of median rents to median income has crept from 25% to 30%.

The Facts Behind the Crisis

- Worsening Affordability: The affordability crisis is not confined to coastal cities like San Francisco and New York. It is a nationwide issue, affecting both urban and rural areas.

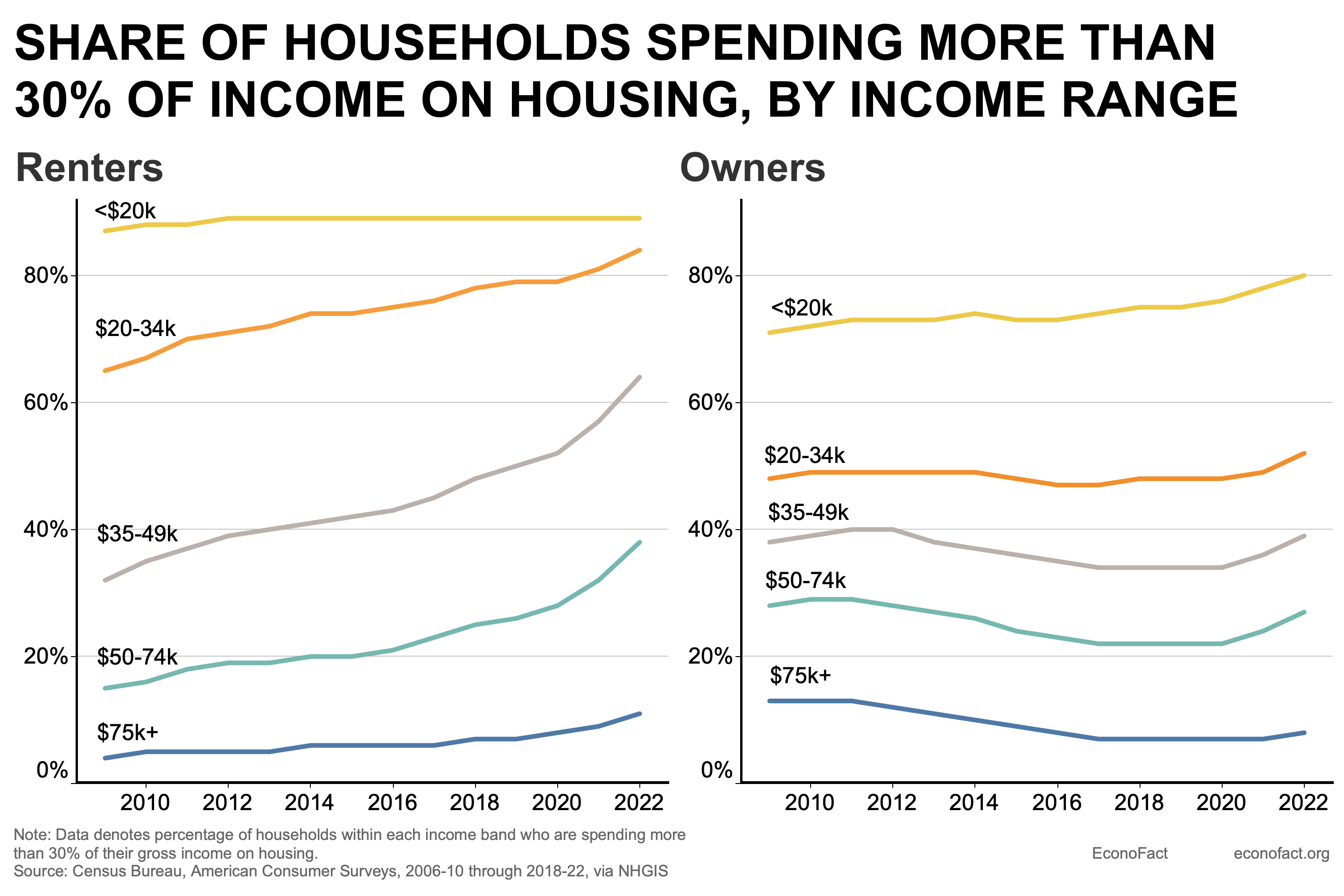

- Cost-Burdened Households: A significant increase in cost-burdened renters—those spending more than 30% of their income on housing—has been observed, particularly among those earning between $35,000 and $49,000 annually.

- Geographic Variations: Traditionally affordable regions are seeing rapid price appreciation, shrinking the affordability gap with historically expensive areas.

The issue of housing affordability is compounded by a mix of demographic shifts and regulatory hurdles. The aging population, with more seniors opting to age in place, has contributed to a supply crunch. Meanwhile, zoning laws and other regulatory restrictions limit housing density, exacerbating the shortage. These factors, coupled with the rise in mortgage rates from 3.5% to nearly 8% since early 2022, have made the path to homeownership even steeper.

Hope on the Horizon?

Despite the grim outlook, there are glimmers of hope. The anticipated reversal of the Federal Reserve’s tightening cycle could lower mortgage rates, easing the financial strain on households. Additionally, there are signs of change in urban zoning laws to allow more affordable housing construction. A surge in multifamily housing starts and a large pipeline of apartments under construction may help relieve pressure on rents.The complexity of the housing affordability crisis suggests there is no quick fix. However, with concerted efforts to increase supply and reform regulatory practices, there is potential for a more balanced and accessible housing market. “`