Biden-Harris Administration Unveils Ambitious Student Debt Relief Plans

Following the Supreme Court’s June 2023 decision to overturn the initial student debt cancellation plan, President Joe Biden swiftly introduced a comprehensive “plan B.” This new approach seeks to establish clear guidelines on eligibility and debt cancellation limits, potentially impacting around 27.6 million borrowers. To date, the administration has delivered $168 billion in relief, with the new measures projected to cost an additional $147 billion over the next decade.

A central focus of the plan is to address inequitable interest accumulation. Proposed policies aim to benefit an estimated 23 million borrowers by capping interest growth. Furthermore, specific borrowers, particularly those who have been repaying loans for over two decades, may see their debts fully forgiven.

The relief will be automatic for eligible individuals, effectively bypassing the bureaucratic hurdles that previously impeded access. Importantly, these policies target those most burdened by student debts, including low-income groups, borrowers of color, and individuals who attended institutions now held accountable for failing to meet federal standards. The proposed regulations ensure that the benefits extend to these more vulnerable demographics, countering criticisms that the relief favors the affluent.

Moreover, the new initiatives aim to address systemic racial disparities in educational debt. Black borrowers, who typically incur higher debt levels and face longer repayment challenges than their white counterparts, stand to gain significantly from these proposals. Provisions such as the interest waiver are set to benefit a substantial portion of Black and Latino borrowers, with the intent to mitigate the racial wealth gap exacerbated by student loans.

These actions are part of the administration’s broader focus on accountability, underscoring the need for rigorous institutional oversight. The proposed regulations also include waivers for borrowers from unscrupulous or failed educational programs, aiming to protect future students from similar predicaments.

As deliberations continue, the Department of Education is fine-tuning these policies to ensure they align with broader financial equity objectives. While the current administration’s tenure may influence the timeline for enactment, future administrations have the potential to advance these reforms, fostering a more equitable and supportive educational financing system across the nation.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

More Articles

Getting licensed or staying ahead in your career can be a journey—but it doesn’t have to be overwhelming. Grab your favorite coffee or tea, take a moment to relax, and browse through our articles. Whether you’re just starting out or renewing your expertise, we’ve got tips, insights, and advice to keep you moving forward. Here’s to your success—one sip and one step at a time!

Top 10 Industries Attracting the Most Startup Funding in 2024

Artificial Intelligence: Leading the Charge

Artificial Intelligence (AI) is at the forefront, amassing an astounding $24 billion in startup funding. This surge is fueled by breakthroughs in generative AI, natural language processing, and machine learning. These technologies are reshaping industries such as healthcare, finance, and education by optimizing workflows and offering innovative solutions.Healthcare Tech: A New Era of Health Solutions

Healthcare technology continues to capture investor interest, securing over $11 billion. The focus has shifted towards long-term innovations in digital health and telemedicine, with startups leveraging AI to personalize healthcare experiences and enhance remote diagnostics.Fintech: Revolutionizing Financial Services

Fintech startups are transforming the financial landscape with approximately $15 billion in funding. Innovations in digital banking and decentralized finance (DeFi) are expanding financial inclusion and offering users greater control over their assets, particularly in North and Latin America.Cybersecurity: Safeguarding the Digital World

As cyber threats become more sophisticated, cybersecurity startups have garnered $2.7 billion to develop robust solutions like zero-trust architectures and AI-driven threat intelligence. These innovations are crucial for protecting digital assets and ensuring secure remote work environments.Clean Tech: Pioneering Sustainability

With $5 billion in funding, clean tech is a beacon of hope for addressing climate concerns. Startups are innovating in renewable energy, electric vehicles, and carbon capture technologies, essential for meeting global sustainability goals.E-commerce and Retail Tech: Enhancing the Shopping Experience

Retail tech startups have attracted over $4 billion, focusing on personalization, logistics, and omnichannel experiences. These innovations are key to providing seamless shopping journeys and optimizing supply chains.AgriTech: Feeding the Future

AgriTech startups, with $3 billion in funding, are addressing food production challenges through precision agriculture and AI-based soil health monitoring, promoting sustainability and efficiency in farming.Robotics and Automation: Redefining Efficiency

The robotics sector, securing $2 billion, is transforming industries like manufacturing and logistics with autonomous vehicles and robotic arms, enhancing operational efficiency and reducing human error.EdTech: Revolutionizing Learning

Education technology, with $2.5 billion in funding, is adapting to the growing demand for flexible learning models. Startups are developing AI-powered tools and digital platforms to make education more inclusive and customizable.PropTech: Innovating Real Estate Management

PropTech startups have attracted $1.8 billion, pioneering innovations in property management and smart buildings. These technologies are essential for optimizing urban spaces and addressing sustainability challenges.Embracing 2024’s Funding Landscape

The article underscores the importance of partnerships in these burgeoning sectors as a strategic approach to harness technological advancements and drive sustainable growth. By aligning with high-growth startups, businesses can unlock transformative tools and pave the way for success.For further insights into the transformative role of technology, explore related articles like NASA’s Parker Solar Probe’s Historic Venus Flyby and The Transformative Role of Technology in Public Services.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

Commercial Real Estate: Signs of Recovery Amid Economic Challenges

Commercial Real Estate: Signs of Recovery Amid Economic Challenges

In a world where commercial real estate has been grappling with unprecedented challenges, including high interest rates, rising inflation, and the transformative impact of remote work, there are now glimmers of hope on the horizon. According to a recent roundtable discussion with leading economists featured in Nareit, the sector is beginning to show signs of recovery.

The experts, including Mariya Letdin from Florida State University, Abby Rosenbaum from Oxford Economics, Eva Steiner from The Penn State Smeal College of Business, and Susan Wachter from The Wharton School, shared their insights into the evolving landscape of commercial real estate. They anticipate that declining interest rates and easing inflationary pressures will play a pivotal role in stabilizing asset values and renewing investor confidence.

Interest Rates and Inflation: A Turning Point?

One of the most significant factors influencing the commercial real estate market is the anticipated decline in interest rates and inflation. As Letdin points out, “It’s easier to make deals work with lower interest rates,” a sentiment echoed by Rosenbaum, who sees potential tailwinds for sectors like retail and industrial as borrowing becomes more accessible.

Sector-Specific Trends: A Mixed Bag

While retail emerges as a “star” and both industrial and multifamily sectors remain stable, the office sector continues to be the “problem child,” according to Letdin. The experts agree that the office market’s recovery will be slow, with older buildings facing increasing vacancies as leases expire.

Financing Conditions: Improving Yet Cautious

Financing conditions are showing signs of improvement, with interest rate caps designed to stimulate borrowing and investment. Steiner notes optimism among U.S. bank CEOs regarding increased borrowing demand, indicating a potential uptick in lending activity. However, the office sector remains a nonstarter for many lenders, with conservative loan-to-value ratios reflecting current economic realities.

Monitoring Economic Indicators: The Key to Future Trends

Economists are closely monitoring key indicators such as the 10-year bond yield and job market trends. Wachter emphasizes the importance of interest rates, while Letdin underscores the significance of employment, stating, “Jobs just drive so much of everything else.”

Supply and Demand Dynamics: Navigating Imbalances

The commercial real estate sector is grappling with supply and demand imbalances, particularly in the multifamily and industrial sectors. As Wachter highlights, while there is oversupply, both sectors are expected to see absorption and declines in vacancy rates. Meanwhile, the demand for well-located office spaces with attractive amenities remains strong.

In conclusion, the commercial real estate market is poised for a potential recovery, driven by favorable economic indicators and strategic sectoral shifts. The insights from industry experts provide a roadmap for navigating the challenges and opportunities that lie ahead in 2025 and beyond.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

2025 Commercial Real Estate Outlook: Navigating Transformative Opportunities

2025 Commercial Real Estate Outlook: Navigating Transformative Opportunities

As the global economic landscape continues to evolve, the commercial real estate sector is poised at the brink of transformative opportunities. The 2025 Commercial Real Estate Outlook from Deloitte Insights, published on September 23, 2024, delves into the strategic advancements real estate organizations must consider.Nearshoring Impacts and Workforce Dynamics

With nearshoring becoming a pivotal trend, particularly in North America, the commercial real estate market is witnessing significant shifts. This strategy, highlighted in Forbes, is reshaping industrial real estate, especially in regions like Mexico, as companies adjust their supply chains. Additionally, generational shifts in workforce dynamics are creating new challenges and opportunities for industry leaders, as discussed in Bisnow Media.

Technology and AI Integration

The integration of technology and artificial intelligence is another cornerstone of the real estate transformation. As noted in Propmodo, companies are leveraging AI to enhance efficiency and close competitive gaps. However, the sector must address challenges such as the ‘bad data’ problem, as highlighted by Urban Land Magazine.

Global Economic and Regulatory Trends

The global economic outlook remains a crucial factor influencing real estate investments. The United States Economic Forecast by Deloitte Insights emphasizes the impact of economic policies and interest rate adjustments on the sector. Additionally, the Eurozone’s economic trajectory, as detailed by Deloitte Insights, provides vital context for investors navigating regulatory changes.

As these elements converge, the commercial real estate sector faces both challenges and opportunities. The insights from the 2025 Commercial Real Estate Outlook offer a comprehensive roadmap for industry stakeholders to strategically position themselves for future growth.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

Commercial Real Estate Faces a Transformative Era

Commercial Real Estate Faces a Transformative Era

As we step into 2025, the commercial real estate sector stands at a pivotal juncture. According to a recent Deloitte Insights report, the industry is poised to embrace a future defined by digital transformation, sustainability initiatives, and demographic shifts. This comprehensive outlook, published on September 23, 2024, provides a roadmap for real estate organizations aiming to navigate these changes effectively.Embracing Innovation and Sustainability

The 2025 commercial real estate outlook highlights a generational opportunity for organizations to strategically reposition themselves. Moving beyond traditional operational methods, the industry is increasingly adopting innovative strategies and technologies. This shift is crucial to addressing the challenges posed by an evolving marketplace. Deloitte’s analysis underscores the importance of sustainability, a theme echoed in the recent interest rate cuts by the Bank of England. These measures, aimed at fostering economic stability, align with the growing emphasis on sustainable practices within the real estate sector.Global Economic Influences

The global economic landscape plays a significant role in shaping the commercial real estate industry. Reports such as the United States Economic Forecast and the Eurozone Economic Outlook provide insights into regional economic conditions. These analyses are crucial for real estate organizations to understand the broader economic factors influencing their strategies.Demographic Shifts and Technological Advancements

Demographic shifts are another key trend reshaping the industry. As the workforce evolves, real estate organizations must adapt to meet the needs of a diverse and dynamic population. This includes leveraging technological advancements to create more efficient and responsive environments. The integration of technology is not just a trend but a necessity. As noted in the Deloitte report, digital transformation is critical for staying competitive in the modern marketplace.Positioning for the Future

The 2025 outlook emphasizes the need for real estate organizations to adopt a forward-thinking approach. By embracing innovation, sustainability, and adaptability, the industry can position itself for success in a rapidly changing world. As we look to the future, the insights from Deloitte and other economic forecasts provide valuable guidance for navigating the complexities of the commercial real estate landscape.Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

The YIMBY Push for Multifamily Housing Faces Stiff Resistance

The YIMBY Push for Multifamily Housing Faces Stiff Resistance

In recent years, cities like Minneapolis and states such as Oregon have embarked on ambitious zoning reforms aimed at dismantling the long-standing exclusivity of single-family-home zoning. These efforts, heralded by proponents as a gateway to more inclusive and affordable housing, have been met with significant opposition, stalling the anticipated “yes-in-my-backyard” (YIMBY) revolution.

Despite the initial optimism, the movement has encountered formidable roadblocks. Homeowners across the nation have voiced concerns about potential spikes in traffic, strains on infrastructure, and changes to neighborhood character. In response, multifamily zoning advocates argue that these changes are necessary for broader societal benefits, including addressing the growing crisis of housing affordability and homelessness.

Legal Challenges and Public Sentiment

Legal battles have become a common theme in this zoning reform saga. In a recent decision, the Montana Supreme Court ruled in favor of state laws that encourage multifamily housing, despite objections from homeowners. This ruling highlights the tension between state-level reforms and local homeowner interests, exemplified by the case in Montana where a group named Montanans Against Irresponsible Densification (MAID) challenged the laws as unconstitutional.

Glenn Monahan, a Bozeman resident and managing partner of MAID, expressed his concerns about the impact of increased density on property values and neighborhood aesthetics. “I dread the possibility of waking up one morning and finding that one of my neighbors has sold her property to a developer,” Monahan stated in an affidavit.

Historical Context and Current Trends

The roots of single-family zoning in the United States are intertwined with racial segregation, as evidenced by the establishment of exclusive residential zones in places like Berkeley, California, back in 1916. Today, approximately 75% of residential land in the U.S. is zoned exclusively for single-family homes, often in wealthier and whiter neighborhoods. This historical context has fueled ongoing debates about the role of zoning in perpetuating inequality.

Minneapolis was the first major U.S. city to abolish single-family-only zoning citywide in 2019, allowing up to three dwelling units on any residential lot. Similarly, Oregon passed legislation permitting duplexes and other multifamily structures in certain areas. However, the implementation of these reforms is a slow process, with experts like Stephen Menendian from UC Berkeley noting that it can take up to a decade to see tangible effects.

Community Conversations and Future Prospects

Diana Drogaris, outreach coordinator for the National Zoning Atlas, emphasizes the importance of clear communication between city leaders and residents. She believes that while zoning changes will impact communities, leaders are improving their engagement strategies to address public concerns.

As cities like Austin, Alexandria, and Berkeley continue to explore upzoning proposals, legal challenges remain a significant hurdle. In Berkeley, the city council’s efforts to end exclusionary zoning are part of a broader initiative to address the city’s racist legacy. However, as former councilmember Lori Droste notes, zoning reform is a long-term endeavor that requires patience and persistence.

“Zoning reform is going to take time. It’s probably going to take 20 years before anyone notices real changes,” Droste remarked, underscoring the need for continued efforts to address the housing crisis.

“`Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

Navigating the Future: AI and the Transformation of Investment Management in 2025

AI: A Disruptive Force

The integration of AI technologies into the investment management sector has surpassed expectations set in previous years. As noted in Deloitte’s 2025 investment management outlook, AI is not only enhancing operational efficiency but also potentially driving significant alpha generation. Firms that quickly adapt to these technologies are likely to see stark contrasts in results compared to those that lag behind.The Shift to Low-Expense Products

A notable trend is the ongoing shift towards low-expense ratio products, such as exchange-traded funds (ETFs). With increasing investor appetite for cost-effective investment options, traditional mutual funds are experiencing net outflows, while ETFs continue to gain momentum. This trend is forcing investment managers to reconsider their product strategies and explore innovative solutions to remain competitive.Alternative Investments and M&A Activity

The landscape of alternative investments is also evolving. While private capital performance was mediocre in 2023, hedge funds exceeded expectations. However, geopolitical uncertainties and a preference for more liquid investment vehicles have led to continued net outflows from hedge funds. Despite these challenges, strategic alliances and mergers and acquisitions (M&A) are reshaping the industry. Firms are leveraging these partnerships to expand their reach into private credit and other alternative asset classes.Managing Risks in a Digital Age

As investment management firms embrace digital transformation, they face mounting risks in cybersecurity and technological advancements. AI innovations, while bolstering security measures, also present new threats. Firms are responding by updating security policies and training staff to recognize AI-enabled cyber frauds. Moreover, the emergence of direct indexing and mutual fund-to-ETF conversions introduces additional strategic and operational risks that firms must navigate.The Road Ahead

The investment management industry is poised for rapid change in 2025. As firms strive to balance growth, efficiency, and risk management, those that effectively integrate AI and adapt to market shifts will likely emerge as leaders. The year ahead presents a once-in-a-generation opportunity for firms to differentiate themselves and set new standards in the industry.For a deeper dive into the evolving landscape of investment management, explore the original Deloitte article and other related insights.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

The New Real Estate Frontier: Enhancing CX with Tech and Loyalty

The New Real Estate Frontier: Enhancing CX with Tech and Loyalty

In the ever-evolving landscape of real estate, a paradigm shift is underway, positioning customer experience (CX) and brand loyalty at the forefront of innovation. Traditionally reserved for the hospitality sector, the emphasis on creating memorable tenant experiences is now permeating the residential real estate market. This transformation is driven by the potential to blend superior CX with cost-effective operations, a concept explored in a recent McKinsey & Company article.The integration of technology is reshaping how real estate operators engage with tenants, offering personalized experiences that resonate with their lifestyle aspirations. By leveraging tools like generative AI and digital marketing platforms, operators can create touchpoints that not only enhance tenant satisfaction but also foster brand loyalty. This approach can lead to a significant premium in market performance, as highlighted by McKinsey’s research.

Key Trends and Innovations

- Segment-Specific Communities: Real estate brands are shifting from commodity offerings to building communities that cater to specific market segments. This involves creating shared spaces and experiences that align with tenants’ values and interests.

- Personalized Experiences: Tenants are increasingly seeking individualized interactions. Whether it’s a birthday reminder or a maintenance update, personalized communication can significantly enhance tenant loyalty.

- AI-Enabled Operations: The use of AI in property management is streamlining operations, reducing wait times, and meeting the on-demand expectations of modern consumers.

Strategies for Success

To thrive in this new landscape, real estate companies must embrace an eight-step framework that includes identifying target segments, understanding community values, and leveraging technology to deliver exceptional CX. This involves a commitment to bold experimentation, supported by data-driven insights to continuously refine and enhance tenant experiences.

The future of brand strategy in real estate is about creating an agile, engaging brand that evolves with consumer expectations. By focusing on moments that matter, companies can not only increase net operating income but also build lasting tenant relationships.

As the article suggests, the real estate industry is poised for a transformation, driven by the demand for polished self-service and sophisticated loyalty programs. It is now up to real estate owners and operators to heed this call for change and deliver branded moments that truly matter.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

The Outlook for Housing Starts: A Future Defined by Demographics and Demand

The Outlook for Housing Starts: A Future Defined by Demographics and Demand

The Congressional Budget Office (CBO) has released a comprehensive report on the outlook for housing starts over the next 30 years, highlighting the critical role of population growth and demographic shifts in shaping the future of housing construction in the United States. This analysis, available in full at CBO’s official website, underscores the complex interplay between economic factors and housing demand.Strong Beginnings and Future Declines

According to the CBO’s projections, housing starts will remain robust through the end of the current decade, driven by the pent-up demand for more living space post-pandemic and the sustained household formation by new immigrants. The report anticipates an average of 1.6 million housing starts per year over the next decade. However, as the 2030s and 2040s approach, a notable decline is expected, with housing starts averaging 1.1 million per year from 2034 to 2043 and 0.8 million per year from 2044 to 2053. This decline is attributed to a slowdown in population growth, an aging demographic, and a return of immigration levels to historical norms.Key Factors Influencing Housing Starts

The report identifies several factors that could lead to variations in housing starts compared to the projections. Changes in net immigration, for instance, could significantly alter outcomes over the 30-year period. Additionally, financial conditions such as mortgage rates and lending standards play a crucial role in determining the number of housing starts in any given year.The Demographic Shift

The CBO’s analysis emphasizes the significance of demographic changes in shaping the housing market. As the population ages, the number of deaths rises, slowing the growth of the adult population. By the 2040s, net immigration is projected to contribute almost as much to the demand for new housing as domestic population growth, marking a significant shift from past trends.Economic Implications

Housing construction is a vital component of the U.S. economy, accounting for over 2% of the gross domestic product (GDP). The CBO projects that the contribution of housing starts to GDP will decline as housing starts decrease in the coming decades. This decline may be partially offset by increased residential improvements, as households choose to upgrade existing homes rather than purchase new ones.

Uncertainty and Future Projections

Despite the detailed projections, the CBO acknowledges significant uncertainty in the forecast of housing starts. Financial and cyclical conditions, demographic factors, and changes in headship rates contribute to this uncertainty. The report also explores alternative scenarios, such as differing rates of net immigration and life expectancy, to illustrate the potential variability in housing starts.

For a deeper dive into the methods used for these projections and the potential implications for the economy, readers can access the full report at CBO’s official website. The analysis provides valuable insights for policymakers, economists, and stakeholders in the housing industry as they navigate the evolving landscape of U.S. housing starts.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

2025: A Transformative Year for the AEC/O Industry

2025: A Transformative Year for the AEC/O Industry

The AEC/O industry is on the cusp of a seismic transformation, driven by the integration of advanced technologies and innovative practices. As outlined in a recent article by Nemetschek, 2025 is set to be a landmark year, with significant shifts in workflows, sustainability priorities, and collaboration methods.

1. Interoperability as a Catalyst for Collaboration

Interoperability, particularly through open standards like OPEN BIM, is poised to play an even greater role in fostering seamless collaboration among architects, engineers, and construction professionals. This approach allows for unrestricted data exchange, enabling creative and high-quality project delivery.2. User Experience Amidst Technical Complexity

Despite the growing complexity of technology, the emphasis remains on simplicity. By prioritizing intuitive design, the industry aims to empower users to leverage powerful solutions without the burden of navigating intricate interfaces.3. Digital Twins Unlocking New Potentials

The focus on Digital Twins is set to simplify building digitization, unlocking insights that enhance predictive analytics, sustainability, and efficiency. This technology connects information across the building lifecycle, offering data-driven recommendations.4. Open-Minded Innovation

Industry consolidation is anticipated as companies strive for greater efficiencies. Embracing innovation with an open mind is crucial for addressing complex challenges and driving technological advancements.5. AI’s Prominent Role

Artificial Intelligence is expected to be prominently integrated into AEC/O solutions, enhancing efficiency and attracting tech-savvy talent, which is essential for alleviating the industry’s skills shortage.6. Sustainability Integration

Sustainability will be seamlessly incorporated across all phases of AEC/O projects, supported by technologies like BIM, AI, and Digital Twins, to meet stricter environmental standards.A Year to Remember

In 2025, the AEC/O industry is encouraged to embrace change by engaging with technologies like AI, Digital Twins, and BIM. By doing so, the sector can enhance efficiency, collaboration, and innovation, setting a new standard for others to follow.Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

Commercial Real Estate Trends: A 2025 Transformation

Office Market Stabilization

The office sector, which has faced persistent challenges, is expected to find stability. According to CBRE, a construction slowdown coupled with a shift in occupier sentiment towards expansion is anticipated to result in a 5% increase in office leasing volume by 2025. Prime office spaces are predicted to become scarcer, with vacancy rates returning to pre-Covid levels by 2027.

Technological and Industrial Growth

The rise of AI is not only driving investment in data centers but also sparking interest in cold storage facilities, EV battery plants, and quantum computing campuses. These developments are likely to capture the attention of investors, despite the inherent challenges.Enhancing Workplace Experience

As more employers mandate a return to the office, the focus is shifting towards creating more appealing work environments. Ariel Lumry of Perkins&Will suggests that custom spaces that enhance emotional and psychological connections can foster collaboration, offering benefits that virtual environments cannot replicate.Retail Sector Dynamics

With a lack of new retail construction over recent years, retail rents are expected to rise as the national availability rate drops below 5%. Retailers are likely to seek long-term leases on prime locations to secure favorable terms.Life Sciences Evolution

The rapid advances in AI and heightened attention to health issues such as obesity and Type 1 diabetes are prompting life science companies to reassess their strategies. This includes re-evaluating lab requirements and site preferences, potentially leading to more flexible and technologically advanced facilities.Geographic Shifts and Industrial Demand

Changes in trade policy are expected to drive demand for industrial properties near the U.S.-Mexico border. CBRE predicts increased interest in distribution facilities along corridors like I-29 and I-35, affecting markets such as San Antonio and Dallas-Fort Worth.Acoustic Management in Offices

With the return to office environments, managing noise has become crucial. Doug West from TPG Architecture highlights the importance of sophisticated sound management, including sound-proofing finishes and strategic office design to accommodate both employee interactions and video conferencing needs.Collaborative Office Spaces

The shift towards “we” spaces in office environments is anticipated to continue. This includes the creation of common work hubs and strategically placed conversation areas to encourage team collaboration and spontaneous meetings.These trends underscore a dynamic period ahead for commercial real estate, with a blend of technological innovation, strategic location choices, and evolving workplace designs leading the charge.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

Housing Market Predictions for 2025: What You Need to Know

Housing Market Predictions for 2025: What You Need to Know

As we look towards 2025, the housing market continues to be a topic of great interest and speculation. According to Ramsey Solutions, the coming year holds several key developments that could impact both buyers and sellers. While predicting the housing market can be as unpredictable as forecasting the weather, there are some trends and expert insights worth considering.

Interest Rates on the Decline

One of the most significant predictions is the expected decrease in interest rates. The Federal Reserve has already taken steps to lower the federal funds rate, which could lead to further reductions in mortgage rates. As noted by Freddie Mac, the typical rate for a 30-year fixed-rate mortgage has dropped from 7.79% in October 2023 to 6.12% in October 2024. This trend is likely to continue, making it potentially more affordable for buyers to secure financing.

Housing Inventory and Demand

While the housing inventory has shown signs of growth, it remains below pre-COVID levels. Realtor.com reports a 29.2% increase in available homes from the previous year. However, demand remains steady, with 28.6% of homes selling above their listing prices as of September 2024, according to Redfin. This dynamic suggests that while there may be more options for buyers, competition is still present.

Market Stability and Foreclosures

Concerns about a potential market crash appear to be unfounded, with Freddie Mac indicating that home prices are expected to grow in 2025. Additionally, foreclosure rates have decreased, with a 13% year-over-year decline reported by ATTOM Data. This stability is reassuring for both current homeowners and potential buyers.

Advice for Buyers and Sellers

For those considering buying a home, financial readiness should be the primary factor in decision-making. Ramsey Solutions advises that buyers should be debt-free, have an emergency fund, and ensure their mortgage payments do not exceed 25% of their monthly take-home pay. Sellers, on the other hand, can expect favorable conditions, with homes likely to sell quickly and close to asking prices.

In conclusion, while the housing market in 2025 presents challenges, it also offers opportunities. Whether you’re buying or selling, staying informed and financially prepared is key. For more expert advice, explore the resources available through the Ramsey Solutions Real Estate Home Base.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

Predictive Analytics: Transforming Commercial Real Estate

Predictive Analytics: Transforming Commercial Real Estate

The commercial real estate industry is on the brink of a technological revolution, driven by the rapid rise of artificial intelligence (AI) and data science. According to a recent JLL report, AI and generative AI are among the top three technologies anticipated to significantly impact the sector. In 2023 alone, an impressive $630 million was invested in AI-powered proptech, underscoring the growing reliance on technology.As the industry navigates economic headwinds, AI-powered solutions are becoming indispensable for property owners and landlords. These technologies enable them to better understand the market, adopt proactive leasing strategies, and engage tenants more effectively while operating cost-efficiently.

Understanding Predictive Analytics

Predictive analytics has emerged as a critical tool, revolutionizing how commercial real estate owners and operators leverage technology to stay ahead of the market. By pulling insights from millions of data points, predictive analytics offers a holistic view of market activity and real estate portfolios. This capability allows landlords to anticipate tenant demand and make informed decisions—something previously unattainable due to the slower pace of technological advancement in real estate.Predictive Analytics And Real-Time Data In Action

Landlords can leverage predictive analytics in various ways to enhance decision-making and operational efficiency. A notable application is forecasting market activity, which helps landlords anticipate and prepare for market fluctuations. For example, as highlighted by VTS‘s Leasing Prediction Outlook, cities like New York City and San Francisco are experiencing positive growth signals year-over-year.Real-time data aggregation is crucial for generating predictive insights, emphasizing the importance of data-oriented solutions in daily operations. Landlords must evaluate their current data collection processes and systems to ensure they provide the real-time data necessary for informed decision-making.

Challenges And Considerations

Implementing predictive analytics involves aggregating real-time data to create predictive insights. Landlords should assess their data sources to determine the solutions needed for accurate portfolio and market activity insights. Investing in predictive analytics tools and platforms can generate real-time data sets, offering unparalleled insight for commercial real estate owners and operators.However, AI-powered solutions are relatively new to the real estate industry and often met with skepticism. Providing space for exploration and training with this technology will benefit teams, building confidence and understanding of how to apply these tools effectively.

As proptech continues to evolve, predictive analytics exemplifies the maturation of technology in the real estate sector. With economic challenges like hybrid working models and high-interest rates, tools offering a comprehensive market view are more critical than ever. Landlords now have a powerful tool to build and execute forward-looking strategies for long-term success.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

2025 Commercial Real Estate Outlook: Navigating New Horizons

2025 Commercial Real Estate Outlook: Navigating New Horizons

The commercial real estate sector is poised for a transformative year in 2025 as it navigates a landscape shaped by economic shifts, generational changes, and evolving industry trends. According to Deloitte’s 2025 Commercial Real Estate Outlook, the industry must strategically adapt to these dynamics to capitalize on emerging opportunities.Economic Conditions and Interest Rate Adjustments

The economic outlook for the United States, as detailed in the United States Economic Forecast: Q2 2024 by Robyn Gibbard, suggests a cautious optimism. As the Federal Reserve contemplates a potential rate cut in September if inflation remains manageable, commercial real estate players must stay vigilant to these monetary policy shifts. Similarly, the Bank of England’s recent interest rate cut and the European Central Bank’s measured approach signal a global trend of easing monetary policies aimed at stimulating growth.Generational Shifts and Strategic Positioning

As the workforce undergoes significant generational changes, the real estate sector faces a retirement cliff, with seasoned professionals exiting the industry. This shift necessitates a focus on nurturing new talent and embracing innovative strategies, as highlighted in Deloitte’s insights. The seismic generational shift in New York’s real estate giants underscores the urgency of this transition.Emerging Trends and Opportunities

The industry’s evolution is also driven by technological advancements and a growing emphasis on sustainability. The revival of the US semiconductor industry provides a boost to commercial properties, while the increasing demand for data centers due to AI growth presents new opportunities. Moreover, the focus on decarbonization and sustainability is reshaping investment strategies, with impact investing gaining momentum.Conclusion

As the commercial real estate sector prepares for 2025, it must navigate a complex interplay of economic policies, workforce dynamics, and technological innovations. By strategically positioning themselves to adapt to these changes, industry players can seize the opportunities that lie ahead.Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

Empowering Veterans Through the #MissionZero Campaign

The findings suggest that many Veterans might miss out on achieving homeownership—a vital component of the American Dream—simply due to a lack of awareness. Real estate professionals are stepping in to rectify this, emphasizing that no barriers, including financial ones, should impede Veterans from securing a home.

Empowering Veterans: The Role of Real Estate Agents

To address this, the #MissionZero initiative seeks support from real estate agents, encouraging them to disseminate this information broadly, ensuring every Veteran is informed about what they’ve earned. Additional resources are readily available at Realtor.com’s dedicated section on #MissionZero and the Veteran Home Loan Center.

The narrative further unveils that Veterans could substantially influence home-buying demand in the upcoming years. According to a 2024 survey by Veterans United Home Loans, 74% of surveyed Veterans expressed readiness to buy a home within the next year—a figure surpassing that of civilian counterparts.

Building Trust and Expertise

Real estate agents are urged to become allies for Veterans by building trust through expertise, offering relevant resources, and understanding VA loan processes. They can bolster their credentials by obtaining certifications like the Military Relocation Professional (MRP) from the National Association of REALTORS®, enhancing their capacity to serve this unique clientele effectively.

In closing, the article calls real estate professionals to action, emphasizing the shared mission of making a meaningful difference in the lives of Veterans by maximizing their awareness of available home-buying benefits. Each agent’s contribution to raising this awareness plays a critical role in ensuring that more Veterans can realize their homeownership aspirations.

Join the #MissionZero Movement

Encourage joining the #MissionZero movement by spreading valuable information to both Veterans and civilians alike, fostering an environment where Veterans are fully supported in their home-buying journeys. For comprehensive guides and tools, agents and Veterans alike can explore Realtor.com’s #MissionZero page — a robust platform dedicated to bringing Veteran home-buyers’ dreams into reality.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

Exploring New Horizons: The Dynamic Shift in the Net Lease Market for 2025

Exploring New Horizons: The Dynamic Shift in the Net Lease Market for 2025

As the backdrop for real estate investment evolves, the net lease market is poised for a significant transformation in 2025. Investors are keenly observing trends in geographic expansion and property types, while adapting to economic shifts. Although the United States continues to be a core market, there is an increasing focus on global prospects, particularly in Mexico. As highlighted by Tyler Swann, Managing Director of Investments at W. P. Carey, international growth opportunities are becoming more compelling.“Mexico is a market we’ll be watching closely next year,” states Swann. The country presents lucrative sale-leaseback and build-to-suit possibilities due to the influx of American and international manufacturers establishing operations there.

In addition to these international prospects, investors like W. P. Carey are broadening their search to include new property types, such as data centers. There is a burgeoning need for considerable capital to support the creation of these infrastructure-heavy facilities. Also drawing interest are healthcare properties, particularly those situated in prime locations. Such investments focus on proximity to populous regions with beneficial demographic patterns, aligning with long-term lease agreements to ensure significant returns.

Continued Interest Rate Volatility and Market Adaptation

Swann emphasizes that ongoing interest rate volatility remains a critical concern as 2025 approaches. This volatility, alongside fluctuating long-term Treasury rates, influences asset pricing and broader investment strategies. Nevertheless, W. P. Carey is less susceptible to rate changes, potentially benefiting in volatile environments and securing deals under changing economic conditions.For further insights from the W. P. Carey thought leadership series, explore here.

This article revels in the ongoing evolution of the net lease market, underscoring the importance of flexibility and proactivity in recognizing emerging opportunities across geographic and property spectrums. Investors are urged to remain vigilant of broader economic trends to adeptly navigate these shifts in a dynamic market landscape.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

California’s Real Estate: A Market on the Cusp of Transformation

California’s Real Estate: A Market on the Cusp of Transformation

The real estate landscape in California is bracing for a seismic shift over the next five years. With population growth, evolving economic conditions, and housing supply challenges at the forefront, the market is on the brink of significant transformation. As detailed in a recent report by Norada Real Estate Investments, these factors are set to shape the Golden State’s housing market from 2024 to 2029.

The Inventory Impasse

California’s chronic housing shortage remains a pressing issue. The limited availability of land, coupled with stringent regulations and lengthy permitting processes, has stifled new construction. This scarcity, particularly in affordable housing, is expected to persist, posing a challenge to the market’s growth.

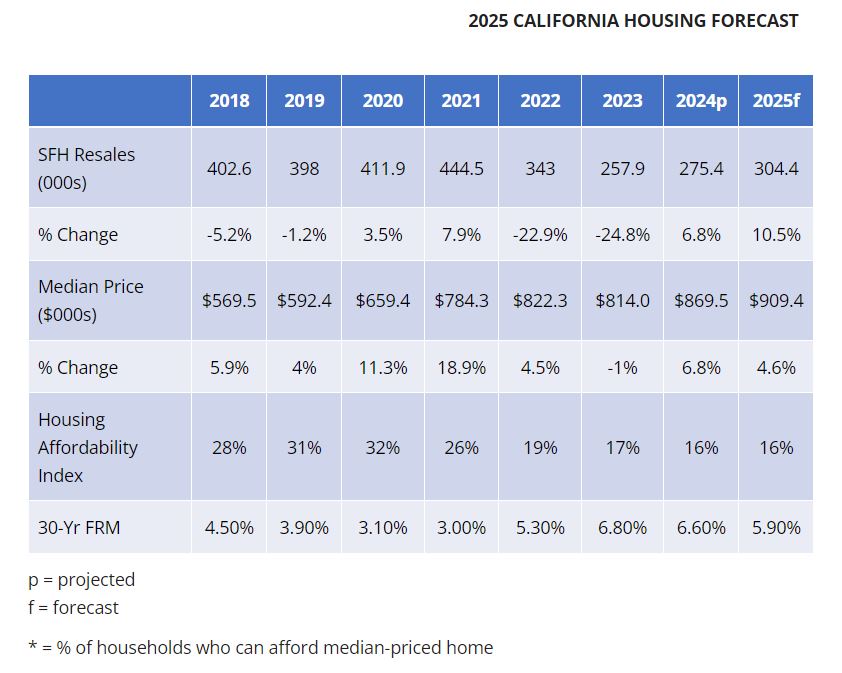

Price Predictions and Interest Rates

Forecasting home prices is akin to peering into a murky crystal ball. The California Association of Realtors (C.A.R.) projects a modest 6.2% increase in the median home price for 2024, reaching $860,300. Over the next five years, experts anticipate a price appreciation of 15% to 25%, though regional variations are expected. Areas with robust job markets and limited housing stock may see price hikes outpacing the national average.

Interest rates, a critical factor in affordability, are predicted to decline from 6.7% in 2023 to 6.0% in 2024, potentially sparking renewed buyer interest. The Federal Reserve’s monetary policy, however, remains a significant wildcard in this equation.

Emerging Trends and Regulatory Changes

The California housing market is more than just numbers. Emerging trends such as the rise of iBuyers, shifting demographics, and technological innovations are reshaping the landscape. Millennials and Gen Z are influencing development patterns with their preference for walkable neighborhoods and proximity to amenities.

Policy changes also loom large. Rent control debates continue, with potential implications for both affordability and investment in new rental properties. Regulations on short-term rentals like Airbnb could tighten, impacting both the rental inventory and the tourism industry.

The Road Ahead

As we look to the future, the California housing market presents a cautious yet optimistic outlook. While challenges around affordability persist, the anticipated decrease in interest rates and a slight boost in housing inventory offer a glimmer of hope. For prospective buyers and sellers, staying informed and adaptable will be key to navigating this ever-evolving landscape.

For further insights, explore California Housing Market Predictions 2025 and Will Housing Prices Drop in 2025 in California?.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

Donald Trump Wins Presidency Again: Economic and Policy Implications

Economic Expectations and Fiscal Concerns

Trump’s supporters are eagerly anticipating immediate economic changes, such as lower taxes and deregulation. Yet, his 20-point platform raises fiscal concerns. Analysts, including those from the Committee for Responsible Federal Budget, warn that his proposals could significantly increase the national deficit, potentially fueling inflation and impacting real estate investments.

Real Estate Implications

The real estate sector faces uncertainty under Trump’s fiscal plan. The potential rise in deficit borrowing could lead to higher inflation, making it unlikely for the Federal Reserve to lower interest rates as much as investors hope. This scenario could stymie investment in housing, as high debt costs remain a barrier.

Trade and Immigration Policies

Trump’s stance on immigration and trade could further impact the economy. Plans to restrict legal immigration and impose tariffs on major trade partners like Mexico, Canada, and China could lead to higher consumer prices and wage stagnation. The last trade war with China had already shifted agricultural trade dynamics, affecting U.S. farmers.

Potential Benefits of Tax Cuts

Despite these challenges, Trump’s proposed tax cuts could offer some relief. By lowering corporate taxes and extending individual tax cuts, consumers might experience increased after-tax incomes, potentially easing housing affordability issues. However, whether this will offset the broader economic pressures remains to be seen.

Looking Ahead

Economists like Kevin Thorp from Cushman & Wakefield advise patience, noting that the new administration’s economic policies will take time to manifest. While the current GDP growth is strong, the real estate market must navigate uncertainties in interest rates and fiscal policies.

For more insights on Trump’s economic impact, visit the original article on Hospitality Investor.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

Unveiling the Future of Investment: AI-Driven Tools for Smarter Decisions

Unveiling the Future of Investment: AI-Driven Tools for Smarter Decisions

In a world where data reigns supreme, the power of informed decision-making has never been more critical—especially in the high-stakes arena of investing. Welcome to the era of AI-driven insights, where advanced algorithms sift through mountains of information and reveal patterns that would take human analysts ages to uncover. If you’re looking to elevate your investment strategies and outsmart market volatility, you’ve come to the right place! The original article explores some cutting-edge research tools that harness artificial intelligence to enhance financial analysis.Revolutionizing Investment Research with AI

In today’s fast-paced financial landscape, making sound investment decisions is more crucial than ever. The sheer volume of data available can be overwhelming, but the right tools can transform this complexity into clarity. Enter investment research tools powered by artificial intelligence (AI) and data analytics—game-changers in how investors analyze markets and manage portfolios.These advanced technologies offer a new lens through which we can view potential investments, helping to identify trends and insights that were once buried beneath layers of information. Whether you’re a seasoned investor or just starting out, harnessing the power of AI can elevate your decision-making process. Let’s explore how these innovative tools are reshaping the way we approach investing and unlock opportunities for growth like never before.

AI: The Brainpower Behind Investment Research

Artificial Intelligence, commonly known as AI, refers to the simulation of human intelligence in machines. These systems are designed to think and learn like humans but can process vast amounts of data at lightning speed.In investment research, AI algorithms analyze market trends and patterns that would be impossible for humans to detect alone. They sift through financial reports, news articles, and social media sentiment to provide insights that drive better decision-making.

Machine learning models help predict future stock performance by evaluating historical data. Natural language processing tools assess qualitative factors such as earnings calls or analyst predictions.

This technology not only enhances accuracy but also saves time—allowing investors to focus on strategy rather than drowning in data. As a result, incorporating AI into investment research transforms how analysts approach their work and influences outcomes significantly.

Harnessing the Power of Data Analytics

Data analytics revolutionizes investment research by transforming vast amounts of information into actionable insights. It allows investors to identify trends and patterns that may not be immediately obvious through traditional analysis.Investors can make more informed decisions with predictive modeling, which anticipates future market movements based on historical data. This foresight minimizes risks and maximizes potential returns.

Additionally, data analytics enhances portfolio optimization. By analyzing performance metrics, investors can adjust their strategies to align better with their goals and risk tolerance.

Real-time data access is another significant advantage. Investors receive timely updates that enable them to react promptly to market fluctuations or emerging opportunities.

Lastly, automation reduces human error. Algorithms handle repetitive tasks efficiently, allowing analysts to focus on strategic thinking rather than mundane calculations.

Top Investment Research Tools

- Market Analysis Software: These tools leverage AI to sift through vast amounts of market data, offering insights that would take human analysts much longer to uncover.

- Portfolio Management Software: By leveraging AI, these tools provide real-time insights into portfolio performance, helping users make informed decisions.

- Robo-advisors: Automated platforms that use algorithms to create and manage a diversified portfolio tailored to an investor’s risk tolerance and financial goals.

- News Aggregators: They consolidate critical information from numerous sources, allowing investors to stay ahead of market trends.

Real-World Success Stories

One standout example comes from a hedge fund that integrated market analysis software into its strategy. By leveraging AI, the firm predicted shifts in market trends with remarkable accuracy, ultimately leading to a 30% increase in returns over two years.Another case involved an individual investor using robo-advisors for portfolio management. These tools analyzed personal financial goals and risk tolerance, providing tailored investment strategies. As a result, this investor achieved consistent growth while minimizing losses during volatile markets.

Challenges and Considerations

While AI offers remarkable advantages in investment research, it’s not without its limitations. One significant challenge is the quality of data. If the input data is flawed or biased, the analysis can lead to poor decision-making.Moreover, algorithms may struggle with unpredictable market conditions. Events like political upheaval or sudden economic shifts can confound even advanced models that rely on historical trends.

There’s also a reliance on technology that could be problematic. An over-dependence might dull human intuition and experience—factors essential for sound investing.

The Road Ahead

The future of AI in investment research is set to revolutionize the industry. As algorithms become more sophisticated, they will analyze vast datasets with unprecedented speed and accuracy.Predictive analytics will evolve, allowing investors to foresee market trends before they emerge. This proactive approach could reshape portfolio strategies significantly.

Furthermore, machine learning models will adapt over time, continuously improving their recommendations based on real-time data and historical performance. The potential for personalized investing experiences is immense.

Conclusion

In today’s fast-paced investment landscape, utilizing AI and data-driven tools can give investors a crucial edge in making the most informed decisions. From predictive analytics to market sentiment analysis, these top investment research tools are revolutionizing the way we analyze and interpret data. As technology continues to advance, it is essential for investors to stay ahead of the curve and incorporate these powerful tools into their strategies. With the help of AI, we can elevate our investment analysis and confidently make evidence-based decisions for maximum returns.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

Real Estate Agents Predict Housing Market Challenges in 2025

Real Estate Agents Predict Housing Market Challenges in 2025

The housing market in 2025 is expected to be a mixed bag, influenced by reduced interest rates, shifting demand, and various economic and societal changes. According to a recent report by Clever, while there may be some improvements for buyers and sellers, challenges are anticipated.Economic Uncertainty

A significant 56% of real estate agents surveyed predict that economic uncertainty will pose challenges for the housing market in 2025. As Nick Pisano, a data writer for Clever Real Estate, explains, “Economic uncertainty is a significant factor for the housing market in 2025, since so much of the strength of the past few years has been powered by strong buyer demand.” Rising rates and home prices have strained this demand, and a potential economic downturn could further impact it.If unemployment rises, fewer potential homeowners may be financially able to buy, leading to a cautious market. This uncertainty could cause a slowdown as both buyers and sellers adopt a wait-and-see approach. However, nervous sellers might drop prices, offering prepared buyers potential bargains.

Declining Home Affordability

The affordability crisis is expected to worsen, with 54% of real estate agents predicting a decline in home affordability by 2025. Even if the Federal Reserve cuts interest rates, increased demand from new buyers could drive prices higher. Pisano highlights that not only home prices but also insurance and property taxes might become less affordable.Despite these challenges, prospective buyers shouldn’t give up. Pisano advises buyers to remain flexible and distinguish between wants and must-haves to expand their options. Additionally, those with home improvement and DIY skills might consider fixer-uppers to save money.

Low Housing Inventory

Approximately 51% of agents foresee low housing inventory as a challenge for 2025. A decrease in new housing starts and limited sales from aging boomers could lead to heightened competition for available homes, driving prices up.Preparing for Market Challenges

To navigate these challenges, Pisano emphasizes preparation. Buyers should know their budget, define must-haves, and act quickly when finding suitable properties. An experienced real estate agent can help negotiate the best deals and avoid pitfalls. Financial readiness, including a sizable down payment and a healthy credit score, is crucial.For further insights, visit the original article on GOBankingRates. “`

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

Fort Collins Housing Market: A Balancing Act in 2025

Fort Collins Housing Market: A Balancing Act in 2025

The Fort Collins housing market is currently experiencing a fascinating transition, marked by a slight cooling trend. While this might sound ominous, it’s far from a freefall. According to a recent report from Norada Real Estate Investments, the market remains vibrant, with increased inventory and a mixed bag of price changes across different property types.

In December 2024, Fort Collins saw a remarkable 46.4% increase in single-family home sales compared to the previous year. This surge suggests a robust demand even during the typically slower winter months. Meanwhile, sales of townhouses and condos also rose, albeit at a more modest rate.

Price Trends: A Tale of Two Markets

The market is showing diverging price trends. The median sales price for single-family homes increased by 1.7%, whereas townhouses and condos experienced a 4.4% decrease. Despite a decline in average prices for both property types in December, single-family homes recorded a year-to-date price increase. This indicates a preference for more spacious, detached homes among buyers.

Inventory and Market Balance

The housing supply paints a picture of contrasting trends. There was a 5.4% decrease in single-family home listings, while townhouses and condos saw a 7.3% increase in listings. This shift might introduce more balance into the market, although both categories still reflect a seller’s market due to lower-than-average inventory levels.

Market Dynamics and Buyer Power

Market dynamics such as extended days on market and sellers receiving 98-99% of list prices suggest that buyers have gained slightly more negotiating power. The affordability index indicates a decline in affordability for single-family homes but a slight increase for townhouses and condos.

Looking Ahead: Steady Growth Predicted

Expert forecasts anticipate a 1% rise in Fort Collins home values by the end of 2025, reflecting a stable growth trajectory. This aligns with moderate predictions for other Colorado cities, as detailed in the Colorado Housing Market Predictions 2025. Despite fears of a market crash, Fort Collins remains stable, with gradual price increases expected.

With its strong rental market and favorable regulatory environment, Fort Collins continues to be a compelling choice for real estate investors. For those considering an investment, the city’s robust market fundamentals, diverse housing options, and proximity to Denver make it an attractive prospect.

Conclusion

While the Fort Collins housing market is no longer the frenetic seller’s paradise it once was, it remains a dynamic and promising environment for both buyers and investors. As the market continues to evolve, keeping a close eye on these trends will be crucial for making informed real estate decisions.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

Hard Money Lenders Arizona Expands Real Estate Investment Programs

Hard Money Lenders Arizona Expands Real Estate Investment Programs

In a significant move to bolster Arizona’s thriving real estate market, Hard Money Lenders Arizona has announced an expansion of its loan programs, offering enhanced support to local investors. The private loan provider, under the leadership of CEO and founder Michael Iuculano, is introducing new Development and Acquisition financing solutions tailored to meet the evolving needs of developers and real estate investors in the region.Arizona’s real estate market has seen a surge in demand for accessible and flexible financing solutions, enabling investors to capitalize on the growing opportunities. Recognizing this trend, Hard Money Lenders Arizona has crafted innovative financing options that streamline the investment process, allowing investors to secure funding swiftly and efficiently.

Michael Iuculano commented on the expansion, stating, “We understand the challenges that real estate investors face when it comes to securing funding for their ventures, especially in a competitive market.” He further added, “With our expanded loan programs, we’re in a great position to provide quick and reliable financing solutions that enable investors to seize opportunities and develop successful projects.”

The expanded loan programs offer several key benefits for investors:

- Flexible Loan Terms: Each loan is designed to meet the specific needs of unique projects, providing more flexibility than traditional financing options.

- Fast Approval Process: Lending decisions are typically made within 24 to 48 hours, streamlining the application timeframe.

- Competitive Rates: Loans are offered at competitive rates, with fewer paperwork requirements, expediting the approval process.

Hard Money Lenders Arizona has established a reputation for high-quality financial services, supporting both seasoned investors and newcomers. The company’s commitment to local investors is evident in its efforts to bolster the region’s economy by facilitating market entry and funding for both commercial and residential property development.

For more information, visit the original article on GlobeNewswire.

About Hard Money Lenders Arizona

Hard Money Lenders Arizona is a leading provider of hard money loans based in Arizona. The company focuses on speed, simplicity, and expertise, offering fast and flexible financing solutions for real estate investors, fix-and-flip investors, and other borrowers requiring quick capital access.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

10 Mindset Shifts for Thriving in Real Estate

The real estate industry is akin to a thrilling rollercoaster ride, where agents find themselves soaring with successful deals one moment, only to confront unforeseen challenges the next. In such a dynamic field, cultivating a resilient mindset is not just beneficial—it’s essential. As we step into a new year, embracing strategies that foster growth and adaptability can be the key to thriving in this unpredictable landscape.

1. Embrace a Growth Mindset

Believing in the potential for growth through learning and experience is the cornerstone of a growth mindset. This attitude encourages resilience and openness to feedback, turning setbacks into stepping stones. When a deal doesn’t pan out as expected, reflect and learn from it. This approach not only strengthens your career foundation but also opens doors to new opportunities.

2. Set Clear Goals

Setting clear and achievable goals can transform overwhelming targets into manageable tasks. Break down your annual objectives into quarterly, monthly, or even weekly milestones. This method not only keeps you motivated but also allows for strategic adjustments along the way. For more guidance, explore An Agent’s Guide to Goal-Setting.

3. Visualize Your Success

Incorporating visualization into your morning routine can set a positive tone for the day. Spend a few moments picturing a successful day, from smooth client meetings to closing deals. This practice can boost your confidence and focus.

4. Learn from Failures

Failures are inevitable but serve as powerful teachers. Instead of moving on quickly, analyze what went wrong and how you can improve. Each setback provides valuable lessons, enhancing your strategic and resilient capabilities.

5. Turn Challenges into Opportunities

Adopt an abundance mindset by viewing challenges as opportunities. A tough market might push you to explore new strategies or niches. This perspective shift can inspire creative solutions and uncover hidden opportunities.

6. Step Outside Your Comfort Zone

Growth happens outside the comfort zone. Experiment with new marketing tactics or attend unfamiliar networking events. Embrace the excitement of the unknown to unlock potential and expand your professional network.

7. Seek Mentorship

A mentor can provide invaluable guidance and insights. Learning from someone with experience can accelerate your growth and help you avoid common pitfalls. Consider finding a mentor through the NAR Spire Program.

8. Celebrate Success and Practice Gratitude

Recognize and celebrate your achievements, no matter how small. This practice boosts motivation and fosters a positive work environment. Additionally, expressing gratitude towards clients and colleagues can strengthen relationships.

9. Commit to Continuous Learning

The real estate industry is ever-evolving, and staying ahead requires a commitment to continuous learning. Attend workshops, listen to industry podcasts, or enroll in online courses to enhance your knowledge and skills.

10. Build Strong Relationships

Success in real estate is built on strong relationships. Use a CRM tool to keep track of important dates and maintain regular contact with clients. Consistently adding value to your network will ensure long-term support and success.

Long-Term Achievements through Positive Mindset Shifts

Adopting these mindset strategies can lead to significant, long-term achievements in your real estate career. Commit to these practices and witness how they transform your business in the coming year. For more insights, visit the agent resource center.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

Oyssey: A New Dimension in Real Estate

Oyssey: A New Dimension in Real Estate

A groundbreaking real estate platform is redefining how homebuyers explore potential neighborhoods. Oyssey, a tech startup now available in South Florida and New York City, provides unprecedented insights into neighborhood dynamics, including political affiliations, based on election results and campaign contributions.

Beyond the Basics: Socially Informed Decisions

The platform is tailored for today’s discerning buyers, who are increasingly interested in the values of their potential neighbors, as much as they are in property features. As Huw Nierenberg, CEO of Oyssey, explains, “It’s about getting buyers homes that they love.” The platform’s functionality extends beyond mere property listings, offering a comprehensive view of neighborhood demographics and housing trends.Oyssey operates as a one-stop shop for homebuyers, streamlining the process from browsing listings to signing contracts and communicating with agents, all while integrating block-by-block political and consumer data. This innovation is particularly timely, given the recent shakeup in the real estate industry, where buyers must now sign contracts with agents and negotiate commission fees upfront.

The Social Impact: A Double-Edged Sword

While Oyssey aims to empower buyers with data-driven insights, it also raises concerns about further deepening societal divides. One industry insider warns, “We are already becoming increasingly polarized as a nation; I fear this could further deepen it.”The platform’s launch is a strategic move to capitalize on evolving buyer priorities and industry changes. By offering political transparency, Oyssey provides a competitive edge for agents and a sense of belonging for buyers seeking like-minded communities.

The Future of Real Estate

As Oyssey continues to expand, its impact on the real estate landscape will be closely watched. The platform’s innovative approach to integrating political and consumer data with real estate tools is set to redefine how buyers and agents navigate the home-buying process.CSS Styling: “`css h3 { color: #b40101; font-weight: bold; } h4 { color: #b40101; font-weight: bold; } p { margin-bottom: 15px; } img { margin: 15px 0; display: block; max-width: 100%; height: auto; } “`

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

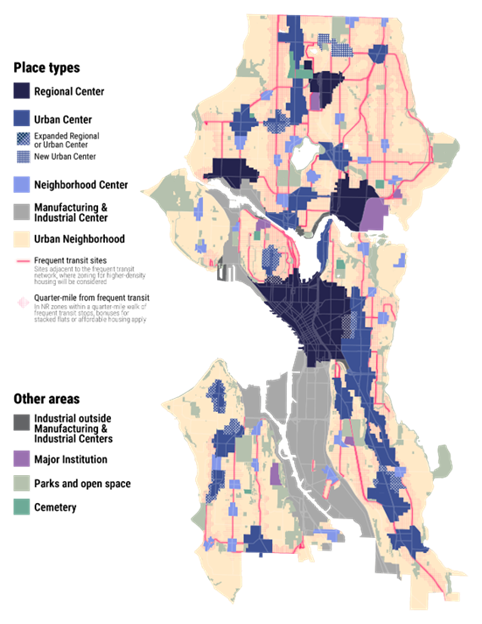

Seattle’s Bold Plan to Revolutionize Housing

The plan, a visionary initiative to dramatically expand housing opportunities, is designed to address the pressing issues of affordability and availability in urban areas. With a target to increase Seattle’s housing capacity to over 330,000 units, the proposal is a response to current cost pressures and anticipated population growth. Mayor Harrell emphasized the importance of this once-in-a-decade opportunity to update Seattle’s Comprehensive Plan, allowing the city to meet its dynamic housing needs while centering core values of inclusivity and economic sustainability.

Key Components of the Update

- Diverse Housing Types: The integration of diverse housing types such as duplexes, triplexes, and quadplexes citywide aligns with recent legislative changes under HB 1110. This aims to diversify housing options in all neighborhoods, bringing much-needed family-sized and community-friendly housing closer to amenities and transit routes.

- Innovative Strategies: The plan introduces innovative strategies such as an Affordable Housing Bonus and expansion of the Mandatory Housing Affordability program, providing incentives for affordable housing development near frequent transit routes.

- Urban Centers and Neighborhood Centers: The introduction of new Urban Centers and the designation of 30 Neighborhood Centers aim to boost housing availability near transit hubs, making Seattle’s neighborhoods more accessible and vibrant.

Commitment to Community Protection

The plan underscores the city’s commitment to protecting existing communities through robust anti-displacement measures, ensuring that vulnerable and historically marginalized communities can remain in their neighborhoods. Strategic investments in community-driven projects and new legislation to prevent predatory home buying are pivotal elements to mitigate displacement.

Through these proposed changes, Mayor Harrell seeks to position Seattle as a leader in addressing urban housing challenges, creating a more equitable and accessible city environment for all residents. The City of Seattle has invited public feedback on the draft zoning maps, with in-person and online sessions scheduled until December 20, 2024.

The comprehensive update is supported by local officials, housing advocates, and community leaders who express optimism about the plan’s potential to transform Seattle into a more inclusive, affordable, and sustainable city.

Statements from Stakeholders

Representative Nicole Macri:

“I’m grateful for this plan which clearly addresses the escalating demand for increased and diverse housing across Seattle. It acknowledges the necessity to combat displacement risks for low-income and BIPOC communities, with a vision of affordable and accessible housing.”

Patience Malaba, Executive Director, Housing Development Consortium:

“The increase in zoning capacity is a critical step towards alleviating the housing shortage by providing a wider variety of homes in every neighborhood. This plan actively promotes equitable, livable communities, aligning with our shared vision of a welcoming and sustainable city.”

Mayor Harrell’s release of the Comprehensive Plan Update is a strategic step towards a more inclusive future, ensuring Seattle grows responsibly to meet the housing needs of its diverse residents.

Read the original article for more information.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

Commercial Real Estate: Navigating the Next Five Years

Commercial Real Estate: Navigating the Next Five Years

As the commercial real estate landscape continues to evolve, stakeholders are gearing up for a transformative journey over the next five years. The industry is poised at a critical juncture, influenced by economic shifts, technological innovations, and changing consumer preferences. Understanding these dynamics is essential for making informed strategic decisions.

Key Market Dynamics

- Remote Work and Office Spaces: The traditional office space is undergoing a significant transformation. With an increasing number of companies adopting flexible work arrangements, the demand for office spaces is projected to decline. According to the JPMorgan Chase report, offices in prime locations may outperform, but overall demand remains tepid.

- Retail Real Estate Adaptations: Retail spaces are reinventing themselves to keep up with the e-commerce boom. There’s a shift towards creating immersive experiences and integrating omnichannel strategies that blend online and offline shopping.

- Industrial Real Estate Boom: The rise of e-commerce is driving demand for warehouses and distribution centers. Companies are investing in expanding logistics hubs to meet delivery expectations, as highlighted by Statista’s market outlook.

- Sustainability Trends: Sustainability is no longer optional; it’s a necessity. Investors are gravitating towards properties that meet environmental standards. Green building certifications and energy-efficient systems are becoming essential.

- Economic and Technological Factors: The influence of interest rates, inflation, and economic growth cannot be overlooked. Technological innovations such as PropTech and smart buildings are reshaping the industry, as noted by Deloitte’s insights.

Market Outlook and Challenges

While opportunities abound in the commercial real estate sector, challenges such as market volatility, regulatory changes, and evolving workforce dynamics pose significant hurdles. Investors must remain agile, ready to pivot their strategies in response to these evolving conditions. The future promises a transformative phase, demanding strategic foresight and adaptability. Staying informed and responsive to changing work patterns, consumer behavior, and societal expectations will be crucial for thriving in this new commercial real estate paradigm.Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.