Colliers’ Insights on APAC Cap Rates: Q1 2024 Report

Colliers’ Latest Insights on APAC Cap Rates

Colliers has unveiled its Q1 2024 APAC Cap Rates Report, shedding light on the performance across office, retail, and industrial sectors in 19 markets. This comprehensive analysis reveals that 11 of these markets have witnessed movements in cap rates.

“The Asian market remains stable, without any significant factors driving movements in cap rates,” states Dorothy Chow, Head of Valuation & Advisory Services at Colliers Hong Kong. However, Australia and New Zealand have experienced shifts in cap rates, particularly in the office and industrial sectors. The retail sector, meanwhile, has seen stability over the past quarter, with exceptions in Brisbane, Melbourne, and Sydney.

Dorothy Chow highlights that the stability in Asian markets is mainly due to oversupply and pressure on rents, leading to increased cap rates. The oversupply situation in some Asian markets will require time to absorb, with recovery hinging on overall business activities and economic conditions, placing additional pressure on rental growth.

Key Findings:

- Office Sector:

- Beijing is grappling with declining demand, resulting in high vacancy rates. Investors are wary of oversupply and falling rents.

- Bangkok has seen a slight uptick in cap rates due to changes in rental rates, though sales transactions remain limited.

- Shanghai faces challenges in attracting leasing demand, causing downward pressure on rents.

- Jakarta is experiencing an influx of new office supply, with businesses optimizing existing spaces instead of expanding.

- In Sydney and Auckland, significant asset sales are anticipated, which may provide clearer pricing benchmarks.

- Retail Sector:

- Beijing and Shanghai enjoyed robust retail performance during the Chinese New Year.

- Investors in Hong Kong remain cautious due to vacancy rates.

- Jakarta has seen increased visitor numbers and new brand entries, yet the competitive landscape with new malls keeps investors cautious.

- Industrial Sector:

- Hong Kong’s industrial sector remains stable, buoyed by positive import and export figures.

- Bangkok has witnessed increased sales transactions, while rental rates have remained flat.

- Beijing is dealing with declining rental rates and increased occupancy in neighboring cities, impacting the industrial market.

- Shanghai is experiencing cautious investment sentiment, leading to high cap rate expectations from investors.

For further insights, contact Dorothy Chow, Head of Valuation & Advisory Services at Colliers Hong Kong. You can access the full report here.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

More Articles

Getting licensed or staying ahead in your career can be a journey—but it doesn’t have to be overwhelming. Grab your favorite coffee or tea, take a moment to relax, and browse through our articles. Whether you’re just starting out or renewing your expertise, we’ve got tips, insights, and advice to keep you moving forward. Here’s to your success—one sip and one step at a time!

Unlocking the Future of Real Estate: USC’s Dollinger Master of Real Estate Development Program

Explore one of the premier programs for aspiring leaders in the real estate industry through the Dollinger Master of Real Estate Development (MRED) at the USC Price School. As one of the most respected programs of its kind since 1986, the USC MRED program is designed to prepare students to excel in all facets of the real estate industry.

A testament to its enduring excellence, the MRED program at USC equips students with a comprehensive understanding of real estate finance, governance, and development. This graduate program offers an innovative curriculum that bridges academic theory with practical experience, ensuring that graduates are well-versed in essential real estate fundamentals. By combining lectures, case studies, and real-world projects led by industry professionals and full-time faculty, students gain insights into market analysis, site planning, and project management.

Moreover, the program’s connection with the USC’s Lusk Center for Real Estate provides unparalleled industry linkages, facilitating professional development and industry engagement. Students are also encouraged to engage in global learning through international study trips, elevating their perspectives on diverse real estate markets.

For students passionate about making a community impact, USC Price offers Community Impact Scholarships for incoming master’s students in various programs, including MRED. In addition, financial aid opportunities are widely available to support students in their educational journey.

Completing the MRED program significantly enhances the career prospects of graduates, with recorded earnings of $123,932 one year after graduation and $250,439 after ten years, and an impressive return on investment of $4,214,687, as highlighted in data from FREEOPP.

By choosing the USC Price Dollinger MRED program, students set the stage to become visionary leaders in shaping the future of real estate, meeting the challenges of today while anticipating the opportunities of tomorrow. Discover more at the USC Price School website and take the first step towards a transformative career in real estate development.

Russ Sommer

Program Manager,

Real Estate Development

[email protected]

Ashley Flinn

Program Administrator,

Real Estate Development

[email protected]

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

Breaking Free from Square Footage: A New Era in Commercial Real Estate

The historical emphasis on square footage as a standard unit of measurement in real estate has deep roots, tracing back to the Middle Ages. However, this focus often oversimplifies the complex nature of property value, overlooking critical factors like location, amenities, and overall quality.

As coworking demand continues to rise, with a 240% increase in inquiries on the Yardi Listing Network, the industry is exploring new strategies to achieve profitability. Successful coworking spaces are shifting their focus towards community building and hospitality, as noted by coworking management software leader [OfficeRnD](http://officernd.com/). They cater to specialized niches and expand into suburban markets, offering remote employees flexible workspace options.

The article suggests that coworking operators and landlords collaborate to redefine the boundaries of office space real estate. By embracing hospitality, community building, virtual offices, and event memberships as revenue drivers, the industry can unlock new growth opportunities and move towards a more sustainable future.

As the commercial real estate landscape evolves, it’s time for more coworking operators to free themselves from the constraints of square footage and embrace a holistic approach that aligns with the changing dynamics of the modern workforce.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

How PropTech is Revolutionizing the Real Estate Industry

Key Areas of PropTech

PropTech encompasses various areas such as online marketplaces, smart home technology, property management tools, and construction technologies. These innovations connect buyers, sellers, and renters online, enhance home automation and security, ease landlord-tenant relationships, and promote sustainable building practices.

Core Technologies Driving PropTech

In 2024, core technologies like AI, VR, blockchain, and big data are leading the PropTech revolution. AI analyzes extensive datasets to offer personalized property recommendations, automate tasks, and predict market trends. Platforms like Jome.com exemplify AI’s impact, providing insights on pricing trends and neighborhood amenities.

VR and AR technologies are transforming how potential buyers experience properties through immersive virtual tours. Blockchain secures real estate transactions with tamper-proof records and smart contracts, while big data analytics provide insights into neighborhood trends and consumer behaviors.

Benefits of PropTech

PropTech offers numerous benefits, including faster transactions, improved transparency, enhanced customer experiences, and cost savings. Notably, Jome.com leverages AI and big data to streamline the home-buying process, offering data aggregation, AI-powered features, and a user-friendly platform.

The Future of PropTech

Looking ahead, PropTech is poised to introduce groundbreaking innovations such as sustainable real estate practices, predictive analytics for market forecasting, decentralized marketplaces, and enhanced personalization. As technology evolves, PropTech will continue to redefine the real estate landscape, making it more accessible and efficient for all stakeholders involved.

For more insights, the original article published by BNO News delves deeper into how PropTech is transforming the real estate industry in 2024 and beyond.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

Unlocking Real Estate Wealth in 2025: Strategies for Success

Unlocking Real Estate Wealth in 2025: Strategies for Success

Step into 2025, where the real estate market emerges as a resilient beacon amidst economic unpredictability. Investors are increasingly drawn to secondary cities like Austin and Manchester, attracted by their growth potential, affordability, and enhanced quality of life. These markets promise higher returns, though they come with challenges such as slower sales and liquidity issues.Sustainability has become the new benchmark in real estate. Eco-friendly properties not only cater to environmentally conscious consumers but also command premium prices. This trend aligns with a broader consumer shift towards green living, emphasizing the importance of energy-efficient buildings.

However, the landscape is not without its hurdles. High interest rates and evolving regulations on short-term rentals in major cities pose significant challenges. Investors must adopt strategic approaches, utilizing innovative financing options and staying informed about local laws to navigate these complexities.

Technology, particularly AI, plays a crucial role in democratizing access to real estate insights. While digital tools enrich market analysis, the nuanced understanding provided by local expertise remains invaluable. No algorithm can fully capture the essence of promising neighborhoods or emerging markets.

For those prepared to decode the complex threads of this year’s market, 2025 offers a rich tapestry of real estate opportunities. By embracing sustainability, leveraging technology, and maintaining an adaptable strategy, investors can harness the wealth potential of this transformative landscape.

For further insights, visit credible real estate websites like the National Association of Realtors or consult a professional financial advisor specializing in real estate.

Additional Resources

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

AI and Urbanization Drive Home Services Market Growth

AI and Urbanization Drive Home Services Market Growth

The global home services market is poised for significant growth, with projections indicating an increase of USD 1.03 trillion from 2025 to 2029. This forecasted expansion is attributed to increasing urbanization and the transformative impact of AI on market trends, according to a recent report by Technavio.

As urban areas continue to expand, the demand for home services is expected to rise, driving the market at a compound annual growth rate (CAGR) of 10.5%. The integration of AI is reshaping the landscape, offering innovative solutions and streamlining services for consumers and businesses alike.

Key Market Drivers and Challenges

The rise of digitalization and e-commerce platforms is a major driver of growth in the home services sector. Companies such as Ginger and One Medical are pioneering in the healthcare segment, while Zimmber and Timesaverz lead in home cleaning and maintenance services.

However, the market faces challenges including regulatory issues, labor shortages, and technological disruptions. Environmental considerations and price wars add further complexity to the evolving market dynamics.

Regional Insights and Market Players

North America is expected to contribute significantly to the market’s growth, accounting for 46% of the overall expansion. Key players in the market include Amazon.com Inc., American Home Shield Corp., Angi Inc., and Home Depot Inc., among others.

The market structure remains fragmented, with opportunities for companies to capitalize on the growing demand for services such as plumbing, HVAC maintenance, and home improvement.

Future Prospects

As the home services market continues to evolve, companies are focusing on enhancing safety, comfort, and aesthetic appeal for consumers. The integration of AI and digital platforms is expected to play a pivotal role in shaping the future of the industry.

For more detailed insights, you can explore the Technavio Analysis and view the Free Sample PDF.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

Decoding the U.S. Housing Crisis: A Study of Historic Policy Missteps and Demographic Shift

In a revealing study by USC, the roots of the current housing crisis in the United States are traced back to policy missteps and demographic changes that have been unfolding since the early 2000s. The study highlights how these factors have left millennials and people of color disproportionately affected. The housing shortage, now at a deficit of over 4.5 million homes, has been exacerbated by natural disasters such as the recent wildfires in Los Angeles.

Dowell Myers, a professor at the USC Price School of Public Policy, underscores the impact of a tightly constrained housing supply on resilience against disasters. “A lack of flexibility in housing stock could rapidly intensify gentrification,” Myers warns, as relocations from disaster-stricken areas strain the existing housing market. For more insights from Myers, visit his profile.

The study, published in the Russell Sage Foundation Journal of the Social Sciences, critiques the policy decisions post-2008 recession that inadvertently tightened mortgage lending standards and limited new construction. These measures, intended to prevent another housing bubble, occurred just as millennials entered the housing market, leading to a historic low in construction.

A Crisis Decades in the Making

The research identifies several key factors contributing to the crisis:

- Severe underestimations of millennial demand: Policymakers misjudged the housing needs of millennials, which only became evident after a surge in demand post-2016.

- Overlooked “age waves”: The impact of demographic shifts, particularly millennials reaching home-buying age, was not adequately considered.

- Forgotten lagging effects: The long-term effects of past policy decisions were ignored, leading to current mismatches in housing supply and demand.

- Flawed demand measurements: Current methods fail to account for potential households unable to form due to housing shortages.

- Misunderstood homeownership trends: The decline in homeownership post-recession was misinterpreted as a permanent shift in preferences.

Racial Disparities in Homeownership Recovery

The USC study also highlights racial disparities in homeownership recovery. While white homeownership rates showed some improvement by 2021, Black Americans faced a much larger gap, with homeownership still significantly lower than expected. Hispanics, however, saw a substantial recovery, even exceeding expected levels by the end of the study period.

Myers emphasizes the need for targeted interventions to address systemic barriers and ensure equitable access to housing. “Without proactive policy, we risk not only falling short of meeting demand but also being unprepared for climate-driven disasters,” he states.

For further details, the full report is available here. The study is a stark reminder of the consequences of overlooking demographic trends and the necessity for foresight in housing policy.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

Best Real Estate Crowdfunding Platforms for February 2025: Investopedia’s Top Picks

In the ever-evolving world of real estate investment, Investopedia has shed light on the top real estate crowdfunding platforms for February 2025. In a comprehensive analysis, the financial education giant has named Fundrise as the best overall platform for both accredited and non-accredited investors. This accolade is attributed to Fundrise’s transparency, low entry barriers, and a user-friendly interface.

Fundrise stands out for offering investors a chance to diversify their portfolios with real estate exposure through proprietary funds. With a minimum investment as low as $10, it opens doors to beginners and seasoned investors alike. The platform’s fees are competitive, with a 0.15% advisory fee and additional management fees depending on the fund type.

Other Notable Platforms

While Fundrise takes the top spot, the report also highlights other platforms that cater to specific investor needs:

- EquityMultiple: Best for accredited investors and transparency. It offers a range of short- and long-term real estate opportunities. Learn more.

- Yieldstreet: Recognized for alternative investment selection, offering unique opportunities beyond real estate, such as art and crypto. Discover Yieldstreet.

- Crowdstreet: Ideal for expert real estate investors, despite recent challenges involving missing funds in deals with Nightingale Properties. Explore Crowdstreet.

- RealtyMogul: Best for commercial real estate, offering diverse projects from healthcare facilities to industrial sites. Visit RealtyMogul.

- Arrived: The go-to for rental properties, with a low minimum investment of $100. Check out Arrived.

- DLP Capital: Offers comprehensive real estate investment selection, but only for accredited investors with a minimum investment of $200,000. Learn about DLP Capital.

Understanding Real Estate Crowdfunding

Real estate crowdfunding allows investors to pool their money to purchase properties, offering a chance to own a piece of real estate without the need for large upfront capital or active management. This method opens up alternative investment opportunities traditionally reserved for institutional investors.

While the potential returns can be high, these investments come with risks, such as limited liquidity and high minimum investments. Platforms like Fundrise offer quarterly liquidity events but emphasize that liquidity is not guaranteed.

Conclusion

Investopedia’s review provides a valuable resource for investors looking to navigate the real estate crowdfunding landscape. With platforms catering to a wide range of investment needs, from beginner-friendly options to sophisticated offerings for accredited investors, there’s something for everyone.

For a deeper dive into these platforms and to explore the full review, visit the original article.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

Top Real Estate Investment Apps of 2025: A Guide for First-Time and Experienced Investors

One of the standout platforms, according to Business Insider’s editors, is RealtyMogul, recognized as the best overall real estate investing app. It simplifies investments in public, non-traded REITs and ensures access to commercial real estate investments for all investors, including those who are non-accredited. Despite requiring a minimum investment of $5,000 for REITs, RealtyMogul stands out for its approachability and thoughtful investment options. Detailed insights can be found in their RealtyMogul review.

Fundrise is noted as the best platform for non-accredited investors, offering an entry with a low minimum investment requirement of $10. It’s ideal for those looking for a hands-off approach to investing, with features like dividend reinvesting and auto-investing. An in-depth look at the platform can be accessed through their Fundrise review. However, potential investors should be aware of the five-year minimum investment horizon that is typically associated with Fundrise portfolios.

For those interested in alternative assets, Yieldstreet provides opportunities that extend beyond real estate into art, litigation, and marine finance. Although primarily available to accredited investors, non-accredited individuals can still engage in the Prism Fund. Full details are available in the Yieldstreet review.

When considering short-term real estate investments, Groundfloor offers promising options with investment terms ranging from 30 days to 36 months. The platform caters to both accredited and non-accredited investors, notable for not imposing management fees. Take a deeper dive into their offerings in the Groundfloor review.

EquityMultiple is tailored for accredited investors with a wider net worth and capital available to invest. They allow investments in commercial real estate, with a minimum of $5,000. Despite its high threshold and specific clientele, its absence of publicly traded REITs may be a deterrent for some. Explore their offerings further in the EquityMultiple review.

Finally, Arrived stands out for offering quarterly liquidity, unique among platforms focused on real estate investment. It’s particularly appealing to those who want to diversify their retirement portfolios through real estate shares. While their fees are relatively high, Arrived is praised for its retirement-focused features. Further information is available in the Arrived review.

Overall, the choice of the best real estate investing app largely hinges on individual investment goals, risk tolerance, and preferences regarding liquidity and investment horizons. Whether you are a seasoned accredited investor or someone just starting to explore property shares, the variety of platforms available offers many opportunities to grow your wealth through strategic investments in real estate.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

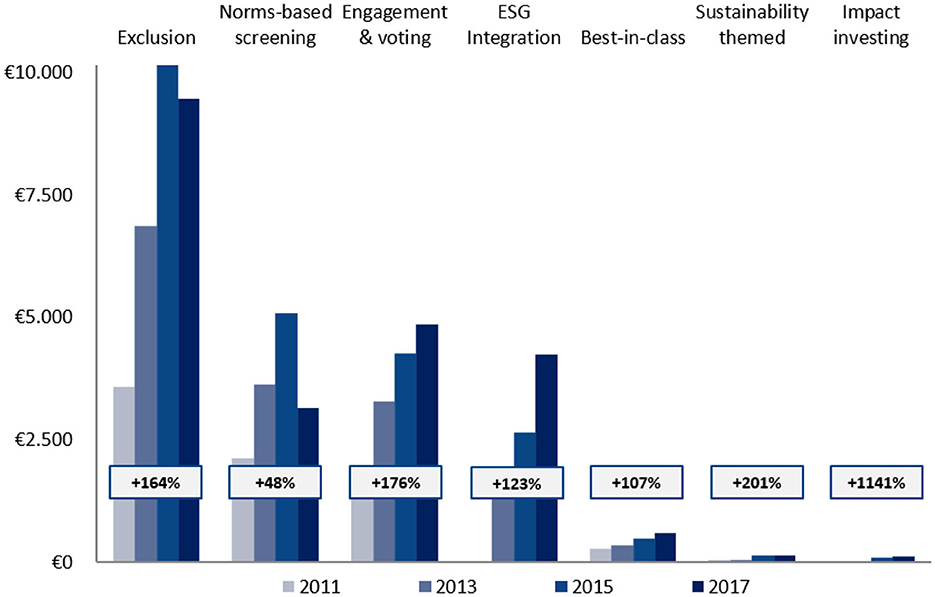

The Financial Impact of ESG Tools on Investment Portfolios: An In-depth Review

In a world where investment strategies are constantly evolving, the recent publication from Frontiers has shed light on the intersection of responsible investing and financial performance. This comprehensive review explores how Environmental, Social, and Governance (ESG) tools impact the return/risk profile of investment portfolios.

The paper, titled “Environmental, social, and governance tools and investment fund portfolio characteristics: a practical-question-oriented review,” delves into the practical implications of ESG factors on investment returns. It highlights the increasing use of ESG tools such as exclusion, best-in-class practices, and engagement, examining their effects across different asset classes and regions.

Notably, the review concludes that ESG factors generally contribute positively or neutrally to financial returns, suggesting that socially responsible investing is viable without compromising profitability. This finding is particularly relevant in the context of global initiatives like the Paris Climate Agreement, which has spurred a shift in investor preferences towards sustainability.

Key Insights from the Review

The review identifies several key trends and developments in ESG investment. There is a growing emphasis on sustainability legislation, with regions like Europe leading the way in developing laws and regulations surrounding ESG investing. This is reflected in the proportion of sustainable investments relative to total assets under management, which has increased globally, except in Europe.

Another notable trend is the exclusion of fossil fuels from investment portfolios, a strategy that aims to reduce CO2 footprints. The review cites research indicating that excluding fossil energy does not adversely affect portfolio performance, challenging conventional wisdom.

Impact of ESG Tools

The review examines three primary ESG tools: exclusion, best-in-class, and engagement. Exclusion, the most popular tool, can have mixed financial outcomes. Systematically excluding entire sectors may decrease portfolio returns, while excluding specific companies often has no negative impact and may even enhance returns.

The best-in-class approach, which selects companies leading in ESG within their sectors, generally has a positive or neutral effect on risk-adjusted returns. Meanwhile, successful engagement activities positively impact both intangible and financial returns, with the success of engagement largely dependent on the materiality of the engagement topic.

Looking Ahead

As the ESG landscape continues to evolve, the review calls for further research on the financial effects of responsible investment, particularly in the areas of bonds and real estate. It also highlights the importance of understanding investor preferences and the role of ESG in mitigating risks and enhancing long-term returns.

For more detailed insights, you can read the full article on Frontiers.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

Top Real Estate Investment Apps for 2025

In the ever-evolving world of real estate investment, the digital age has ushered in a new era of convenience and accessibility. According to a recent Business Insider article, the best apps for real estate investors in February 2025 offer a range of features designed to cater to both accredited and non-accredited investors. These apps are not just about low fees and dividend payouts; they also provide access to pre-vetted properties and property managers.

Among the top contenders is RealtyMogul, hailed as the best overall real estate investing app. This platform offers a seamless experience for investors by providing pre-vetted public, non-traded REITs, making it accessible to all investors regardless of their accreditation status. For a more detailed review, you can visit the RealtyMogul review.

For those who are new to the investment scene or do not meet the criteria for accreditation, Fundrise emerges as a top choice. With a low entry point of just $10, Fundrise offers a variety of investment options, including electronic real estate funds and IPOs. More insights can be found in the Fundrise review.

Investors looking to diversify into alternative asset classes might find Yieldstreet appealing. This platform provides access to unique investments such as legal finance and art, alongside traditional real estate options. However, it is primarily geared towards accredited investors. To learn more, check out the Yieldstreet review.

For short-term real estate investments, Groundfloor offers a compelling proposition. This platform is suitable for both accredited and non-accredited investors, with investment terms ranging from 30 days to 36 months. The platform boasts a history of a 10% annual return. For further reading, visit the Groundfloor review.

Finally, for those who meet the accreditation requirements and are willing to invest at least $5,000, EquityMultiple offers a wide array of investment options in commercial real estate. This platform is ideal for investors looking to explore various property types. More details can be found in the EquityMultiple review.

In summary, the landscape of real estate investing has been significantly transformed by these innovative apps. Whether you’re a seasoned investor or just starting, these platforms offer a variety of options to suit different investment goals and risk appetites. For more comprehensive insights, you can explore the original Business Insider article.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

Revolutionizing Real Estate: Top 6 PropTech Trends Shaping 2025 to 2028

First up, eSigning is becoming the norm. The pandemic accelerated the adoption of digital signatures, and the global market is projected to grow at an impressive 41.2% annually from 2024 through 2033. Companies like HelloSign, acquired by Dropbox, and DocuSign, which entered the digital notary space by acquiring LiveOak Technologies, are leading the charge. This shift not only offers flexibility and security but also paves the way for smart contracts on the blockchain, which Deloitte calls “the next big thing in commercial real estate.”

Next, the real estate industry is tapping into proprietary advertising solutions. Platforms like Audience Town and Nextdoor are providing custom solutions to enhance real estate advertising. Audience Town recently secured $2.1 million to expand its platform, while Nextdoor’s hyper-localized campaigns continue to grow, with an IPO on the horizon.

Rental property management and automation are also taking off. Companies like Knock CRM and ManageCasa are automating property management tasks, increasing efficiency for property owners. Knock CRM raised $20 million to expand its SaaS platform, while ManageCasa partnered with Stripe to automate rent payments and property expenses.

Interest in fractional real estate investments is rising, fueled by the success of retail investing platforms. Proptech companies like Republic, Fundrise, and Groundfloor offer low barriers to entry, making real estate investment more accessible to the masses. The global crowdfunding real estate market is expected to skyrocket from $13 billion in 2018 to nearly $870 billion by 2027.

Smart homes are becoming the norm, especially among Gen-Z renters who prioritize smart-home tech over traditional amenities. Companies like Ecobee and SmartRent are leading the charge, with SmartRent raising $60 million to expand its offerings. The household penetration of smart home devices is expected to grow from 52.4% to 75.1% by 2028.

Finally, the rise of iBuyers is reshaping the real estate landscape. Companies like Opendoor, which recently went public via a SPAC IPO, offer quick sales and convenience, appealing to a growing number of sellers. While iBuying currently holds about 1% of the total residential real estate market, it is poised for significant growth in the coming years.

As we look to the future, these proptech trends promise to disrupt the real estate industry, driven by the rapid adoption of digital and automated solutions. For more insights, check out the full article on Exploding Topics.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

Diverse Business Opportunities Await Entrepreneurs in 2025

Exploring Lucrative Business Ideas for 2025

In a world where entrepreneurship is continually evolving, the quest for the next big business idea is an ongoing journey. A recent article from Business News Daily sheds light on 26 promising business ideas to ignite the entrepreneurial spirit in 2025. Let’s delve into some of these innovative concepts that cater to diverse skills and interests, offering avenues to turn passions into profitable ventures.Embrace the Outdoors with a Lawn Care Service

If the outdoors is your sanctuary, a lawn care service might be your calling. With minimal equipment and a love for landscaping, this venture can transform tedious tasks into a rewarding experience. As the article notes, this business can evolve into a full-fledged landscaping company by offering premium services and building a reputable brand.

Drive into the Future with Rideshare Driving

For those hesitant to dive headfirst into entrepreneurship, rideshare driving offers a flexible entry point. Leveraging platforms like Uber and Lyft, aspiring business owners can enjoy the independence of a small business without the logistical burdens. This idea is perfect for individuals seeking a side hustle with minimal commitment.

Pet Sitting: A Pawsitively Rewarding Opportunity

With approximately 70% of U.S. families owning pets, a pet-sitting business presents a lucrative opportunity. This venture allows you to provide peace of mind to pet owners while enjoying the company of furry friends. As highlighted in the article, pet sitting can be seamlessly integrated with other online income streams, making it an ideal choice for multitaskers.

Unleash Creativity with T-shirt Printing

For those with a flair for fashion or humor, launching a T-shirt printing business can be a creative outlet. With the right setup, entrepreneurs can print custom designs or licensed artwork on T-shirts, catering to a global audience through e-commerce platforms.

Clean Up with a Cleaning Service

A cleaning service offers a straightforward path to entrepreneurship with relatively low overhead. By providing additional services like floor waxing or power-washing, new businesses can stand out in a competitive market. The article emphasizes the importance of planning, dedication, and marketing to attract a loyal customer base.

Online Reselling: A Thrifty Business Model

For those with an eye for fashion and sales, online reselling offers a chance to turn thrift finds into profit. Platforms like Poshmark and Mercari provide a starting point for this venture, allowing entrepreneurs to expand into their own resale websites over time.

Teaching from Home: The Rise of Online Education

The demand for online education continues to grow, providing opportunities for entrepreneurs to teach subjects they are passionate about. Whether it’s academic subjects or teaching English as a foreign language, this business model offers flexibility and a global reach.

Conclusion

The article from Business News Daily highlights the diverse range of small business ideas available for aspiring entrepreneurs in 2025. Whether you’re drawn to the digital realm or prefer hands-on ventures, there’s a path to success for everyone. As the business landscape continues to evolve, these ideas present exciting opportunities to turn passions into profitable enterprises.Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

Navigating the Future: Challenges and Opportunities for the Commercial Real Estate Sector

In a rapidly evolving landscape, the commercial real estate sector is poised at a crossroads, presenting both challenges and opportunities for stakeholders. As highlighted in the 2025 Commercial Real Estate Outlook by Deloitte, organizations are urged to strategically navigate the shifting tides to secure a robust position for the future.

Global Economic Forecasts

The economic forecasts for 2024 paint a varied picture across different regions. In the United States, the economic outlook is cautiously optimistic, with potential growth tempered by inflationary pressures. Meanwhile, the Eurozone and Asia-Pacific regions are navigating their own unique challenges and opportunities, as detailed in reports from Deloitte Insights.

Interest Rate Policies

Interest rate policies by major banks such as the Bank of England and the Federal Reserve are pivotal in shaping the economic landscape. These policies have far-reaching implications for the real estate sector, affecting everything from loan maturities to investment strategies.

Technological Advancements and Climate Policies

The rise of artificial intelligence and technological demand is driving unprecedented growth in global data centers. This technological boom is coupled with a growing emphasis on decarbonization efforts, which are reshaping the real estate landscape. The sector is increasingly being influenced by climate change and regulatory adaptations, as noted in the TIME article on climate change’s impact on real estate.

Generational Workforce Shifts

The real estate industry is also experiencing a generational shift in workforce dynamics. As detailed by Deloitte, a new generation of workers is stepping up, bringing fresh perspectives and challenges to the fore. This shift is critical for the industry’s evolution and adaptation to modern demands.

In conclusion, the 2025 Commercial Real Estate Outlook underscores the importance of strategic positioning in the face of evolving global trends. By embracing innovation and sustainability, real estate organizations can not only overcome current challenges but also thrive in the future.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

DeepSeek Overtakes ChatGPT as Top AI Contender

In a remarkable turn of events, the artificial intelligence (AI) landscape has been shaken by the unexpected rise of Chinese startup DeepSeek. Launched in January, DeepSeek’s free AI assistant has quickly climbed the ranks, overtaking OpenAI’s ChatGPT as the top app on Apple’s App Store. This swift ascent has sparked concerns about OpenAI’s dominance in the AI sector.

The timing of DeepSeek’s rise coincides with a major announcement from former President Trump, who revealed a joint venture worth $500 billion involving OpenAI, SoftBank, Oracle, and MGX. This initiative aims to bolster U.S. AI infrastructure and maintain American leadership in the sector. As 2025 unfolds, the AI race is set to become even more competitive.

Best-Value AI Stocks

Value investing focuses on identifying stocks trading below their intrinsic worth. Investors often use the price-to-earnings (P/E) ratio to find undervalued stocks. However, it is crucial to consider the reasons behind a stock’s discounted price and whether the gap with peers is likely to close.

- Yiren Digital Ltd.: A fintech company from China, Yiren Digital connects investors with borrowers and offers various financial services. The company is enhancing its AI capabilities and recently joined the China Artificial Intelligence Industry Alliance.

- i3 Verticals, Inc.: Specializing in software solutions for public sectors and healthcare, i3 Verticals leverages AI to boost customer engagement.

- Perion Network Ltd.: Based in Israel, Perion is a global digital advertising company using AI to optimize ad campaigns through its proprietary solutions, SORT and WAVE.

Fastest-Growing AI Stocks

Growth investors seek companies with increasing revenue and earnings per share (EPS), signaling strong business fundamentals. However, relying solely on these metrics can be misleading, so a balanced assessment is necessary.

- Sportradar Group AG: A global sports technology company providing data analytics and AI-driven solutions for sports organizations and media outlets.

- Duolingo, Inc.: The leading mobile learning platform, Duolingo is integrating AI-powered innovations to enhance language learning experiences.

- ODDITY Tech Ltd: A consumer tech company leveraging AI and data science to create digital-first beauty and wellness brands.

AI Stocks With the Most Momentum

Momentum investing involves capitalizing on existing market trends by investing in stocks that have recently outperformed. While AI momentum stocks offer high returns, investors must consider the company’s financials to ensure growth prospects are sustainable.

- Quantum Computing, Inc.: Focused on developing affordable quantum computing solutions, the company has secured partnerships with NASA.

- SoundHound AI, Inc.: Known for its voice recognition technology, SoundHound recently partnered with Rekor Systems to enhance police and emergency vehicles with voice-controlled AI.

- Palantir Technologies, Inc.: Providing data integration and analytics platforms, Palantir recently extended its partnership with the U.S. Army to enhance AI-driven data solutions.

Advantages and Disadvantages of AI Stocks

Advantages

- Mass Disruption: AI’s rapid evolution and widespread applications across industries provide significant growth opportunities.

- Innovation: AI-driven automation enhances efficiency and reduces costs, securing long-term competitive advantages for leading companies.

- Investor Enthusiasm: AI stocks often experience rapid price appreciation due to strong investor sentiment.

Disadvantages

- High Valuations and Market Speculation: Many AI stocks trade at high valuations, posing risks of price corrections.

- Regulatory Risks: Increasing scrutiny from governments may lead to stricter regulations impacting growth prospects.

- Stiff Competition: The AI industry is highly competitive, with major players and emerging startups constantly advancing their technologies.

In conclusion, while AI stocks offer substantial growth potential, investors must carefully navigate high valuations, regulatory uncertainties, and intense competition. Thorough scrutiny of a company’s financials and risk management is essential to avoid speculative bubbles and hype. For more insights, refer to the original article on Investopedia.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

California’s Commercial Leasing Landscape Set for Transformation

California’s Commercial Leasing Landscape Set for a Transformation

In a significant legislative shift, California is poised to introduce new protections for commercial tenants starting January 1, 2025. The Commercial Tenant Protection Act, enacted as SB 1103, extends a suite of protections to “Qualified Commercial Tenants” (QCTs) that were traditionally reserved for residential tenants.

Under this new law, QCTs are defined as small enterprises including sole proprietorships, partnerships, limited liability companies, or corporations with five or fewer employees, as well as restaurants with fewer than 10 employees and nonprofits with fewer than 20 employees. These entities often struggle with access to capital, making the protections especially critical.

The legislation mandates several key changes:

- Notice for Rent Increases: Property owners must provide QCTs with at least 30 days’ notice for rent hikes up to 10% over the past year, and a 90-day notice for increases exceeding 10%.

- Automatic Renewal of Tenancies: Month-to-month tenancies will automatically renew unless a termination notice is given 60 days in advance for tenancies longer than a year, or 30 days for shorter durations.

- Language Translation: Lease agreements negotiated in languages such as Spanish, Chinese, Tagalog, Vietnamese, or Korean must be translated and provided to the tenant.

- Building Operating Costs: These must be proportionately allocated among tenants, with detailed documentation provided. Violations may allow tenants to claim damages.

This move, as reported by Holland & Knight, signals a broader trend towards legislative efforts to protect small business operators in commercial settings. For those interested in the full details of how these changes will impact commercial property management, consulting with legal experts from Holland & Knight’s West Coast Real Estate Practice Group is advised.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

Flexible Office Sector Booms Amid Hybrid Work Evolution

The flexible office sector is on an upward trajectory, continuing to expand as hybrid work models evolve. According to a recent report from CoworkingCafe, the coworking inventory grew by an impressive 13% in square footage year-over-year as of the third quarter of 2024. This surge is further underscored by a 22% increase in the total number of coworking spaces during the same period.

Suburban and tertiary markets are particularly experiencing significant growth in coworking spaces. Hybrid employees, seeking to avoid lengthy commutes, are increasingly opting to work closer to home. Notably, New Jersey, one of New York’s major suburban markets, saw its coworking space inventory swell by 36% year-over-year, reflecting the robust demand in these regions.

This trend is highlighted in the original article published by Globest, which outlines the continued expansion of flexible office spaces. The article emphasizes how changing work preferences and technological advancements are driving this growth, with expectations for the trend to persist through 2025.

Key Trends and Observations

- The flexible office sector is expanding due to evolving work dynamics.

- Suburban markets are witnessing a rise in coworking spaces as employees seek proximity to home.

- Technological advancements are playing a crucial role in supporting this growth.

As we move forward, the flexible office sector is poised for continued growth, adapting to the needs of a changing workforce. For more detailed insights, visit the full article on Globest.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

Navigating North Jersey’s 2025 Real Estate Market: A Forecast for Steady Growth

In the ever-evolving landscape of North Jersey’s real estate market, 2025 promises to be a year of continued growth, albeit at a more measured pace. According to insights from a recent Bergen Record article, home values in New Jersey have been on a consistent upward trajectory. However, the rate of increase is expected to slow, with projections indicating a rise of just 2% to 4% in 2025.

Interest rates are another crucial factor influencing the market. The Federal Reserve’s decision to implement two interest rate cuts in 2024 has brought mortgage rates down from their peak of 8% to a more manageable range of 6% to 7%. This shift is likely to benefit both current homeowners looking to relocate and first-time buyers.

Despite these positive trends, homeowners should brace for a potential rise in home insurance premiums. Factors such as increased property values, inflation, and the growing frequency of national disasters are expected to drive premiums up. A survey by Fitch Ratings reveals that 56% of experts anticipate insurance price hikes in 2025.

The demographic profile of homebuyers is also shifting. The median age for first-time homebuyers reached a record high of 38 years in 2024, according to the National Association of Realtors. This trend is expected to persist as buyers take longer to save for their purchases amid rising home values.

Meanwhile, the rental market in the greater New York metropolitan area is poised for modest rent increases in 2025. Although there has been a nationwide decline in rent prices, the demand for rentals in this region continues to outstrip supply, particularly as more people move from cities to suburban areas seeking more space.

For those interested in further details, the original article from the Bergen Record provides a comprehensive overview of these trends and more. As the North Jersey real estate market continues to evolve, staying informed will be key for both buyers and sellers navigating this dynamic environment.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

How Hybrid Work Models Shape the Future of Commercial Real Estate

The Remote Work Revolution

As the pandemic unfolded, office occupancy in major US markets plummeted by a staggering 90% from late February to March 2020. Although there was a partial recovery by the end of 2023, occupancy rates remain at approximately half of their pre-pandemic levels. The ongoing uncertainty surrounding remote work continues to dampen office occupancy, lease revenue, and renewal rates in the commercial real estate sector.

Hybrid Work: A Glimmer of Hope

Despite these challenges, the hybrid work model offers a glimmer of hope. The researchers found that companies expecting employees in the office only one day per week saw a 41% drop in office space demand from 2019 to 2023. In contrast, demand fell by just 9% for those with staff onsite two to three days per week and even grew by 1% for companies with a four to five-day office presence.

Economic Implications

The economic ramifications of declining office values are significant. New York, for instance, experienced the largest dollar decline in office space value, with a $90 billion drop from December 2019 to December 2023. Looking ahead, projections suggest that New York’s office values could remain 47% to 67% below 2019 levels, depending on future workplace norms.

Adapting to Change

The research underscores the importance of adaptation. A “flight to quality” has seen newer office buildings with more amenities fare better, as companies strive to enhance office quality to entice workers back. Moreover, the conversion of vacant office spaces into multifamily residential units is proposed as a viable solution to address vacancies. Programs like New York’s Office Conversion Accelerator are already working toward this goal.

Fiscal Challenges for Urban Areas

The decline in office values has far-reaching implications for urban areas, where taxes from commercial real estate contribute about 10% of overall tax revenue. As tax revenue declines, cities may face tough choices: raising other tax rates or cutting government spending on services, potentially making them less attractive places to live.

This insightful analysis from the University of Chicago Booth School of Business serves as a clarion call for stakeholders in the commercial real estate sector to navigate these changes strategically and creatively.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

MetaWealth: Transforming Real Estate Investment with Blockchain

In the fast-paced world of tech funding, where attention often shifts from one buzzword to another, blockchain technology continues to quietly revolutionize industries, despite the current spotlight on AI. A prime example of this evolution is MetaWealth, a startup that is transforming real estate investment through blockchain technology.

In a recent episode of “TechTalk with TFN,” Jack Land, Head of Marketing and UK Growth for MetaWealth, shared insights on how the company is democratizing real estate investment. With their platform, individuals can invest in real estate with as little as $100, utilizing blockchain to tokenize these investments. This not only simplifies the investment process but also makes it accessible to a broader audience.

Revolutionizing Real Estate Investment

“Real estate is a cornerstone of a well-rounded portfolio,” Land explained. “But accessing worthwhile deals is incredibly difficult.” MetaWealth aims to change this by allowing investments to be completed in less than ten minutes, regardless of the investor’s location. This approach is about accessibility and inclusivity, ensuring that property investment is no longer exclusive to high-net-worth individuals.

Founded by Amr Adawi, Darren Carvalho, and Michael Topolinski, MetaWealth is experiencing rapid growth. The company is currently raising funds to further expand its platform, which already serves investors from approximately 25 different countries. Land emphasized their commitment to tackling wealth disparity and promoting diversity by offering educational resources to help investors understand their investments.

Blockchain’s Emerging Role

Despite the challenges facing the Web3 sector, blockchain’s adoption by major companies like Visa and PayPal signals a growing confidence in its potential. MetaWealth is at the forefront of making blockchain technology accessible, aiming to reshape the fintech industry. Based in London, MetaWealth is strategically positioned at the heart of Europe’s tech scene, ready to lead the next wave of fintech innovation.

The future of real estate investment is intertwined with Web3, and MetaWealth is poised to be a key player in this transformation. As blockchain technology matures, MetaWealth’s model demonstrates the potential for technological advancements to create a more inclusive financial landscape.

For more detailed insights, you can read the original article on Tech Funding News.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

AI Revolutionizes Facility Management Amidst Labor and Efficiency Challenges

Cupertino, CA — Facility management is at a crossroads, facing unprecedented challenges that threaten its very foundation. Overwhelmed by labor shortages and operational inefficiencies, facility managers are turning to artificial intelligence (AI) as a lifeline. According to a recent survey by QByte AI, AI-powered tools are rapidly reshaping the landscape of facility management in 2025.

The survey highlights that a staggering 80% of managers spend excessive hours hunting for information, while 60% are burdened by unsustainable workloads. This has led to a troubling trend, with 40% contemplating leaving their roles. These statistics underscore a crisis in the industry, demanding immediate attention.

AI is emerging as a beacon of hope. By providing instant access to maintenance data through simple prompts, enabling proactive monitoring, and improving real-time collaboration, AI is poised to alleviate the pressures faced by maintenance teams. As noted by industry expert Sam Manjunath, cofounder of QByte AI, “With facility teams stretched thin, the industry is rapidly embracing AI to remove manual workload burdens.”

The integration of AI-driven Computerized Maintenance Management Systems (CMMS) is transforming how facility managers operate. Companies are investing in AI to streamline operations, reduce unplanned downtime, and enhance overall efficiency. The adoption of AI technologies, such as those developed by QByte AI, is not just a trend but a necessary evolution.

Kim Anderson, a seasoned facility manager, experienced firsthand the transformative power of AI during a critical HVAC system failure. With maintenance records scattered across multiple systems, AI-enabled tools provided the timely insights needed to address the crisis efficiently. “Having AI-powered tools right at my fingertips felt like a breath of fresh air—suddenly, I could focus on what truly mattered instead of drowning in endless details,” Anderson remarked.

This shift towards AI is not only a response to labor shortages but also a strategic move to enhance operational efficiency. As companies navigate the complexities of modern facility management, AI offers a sustainable solution to the challenges of today and tomorrow.

For further insights into how AI is reshaping facility management, the original article can be accessed here.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

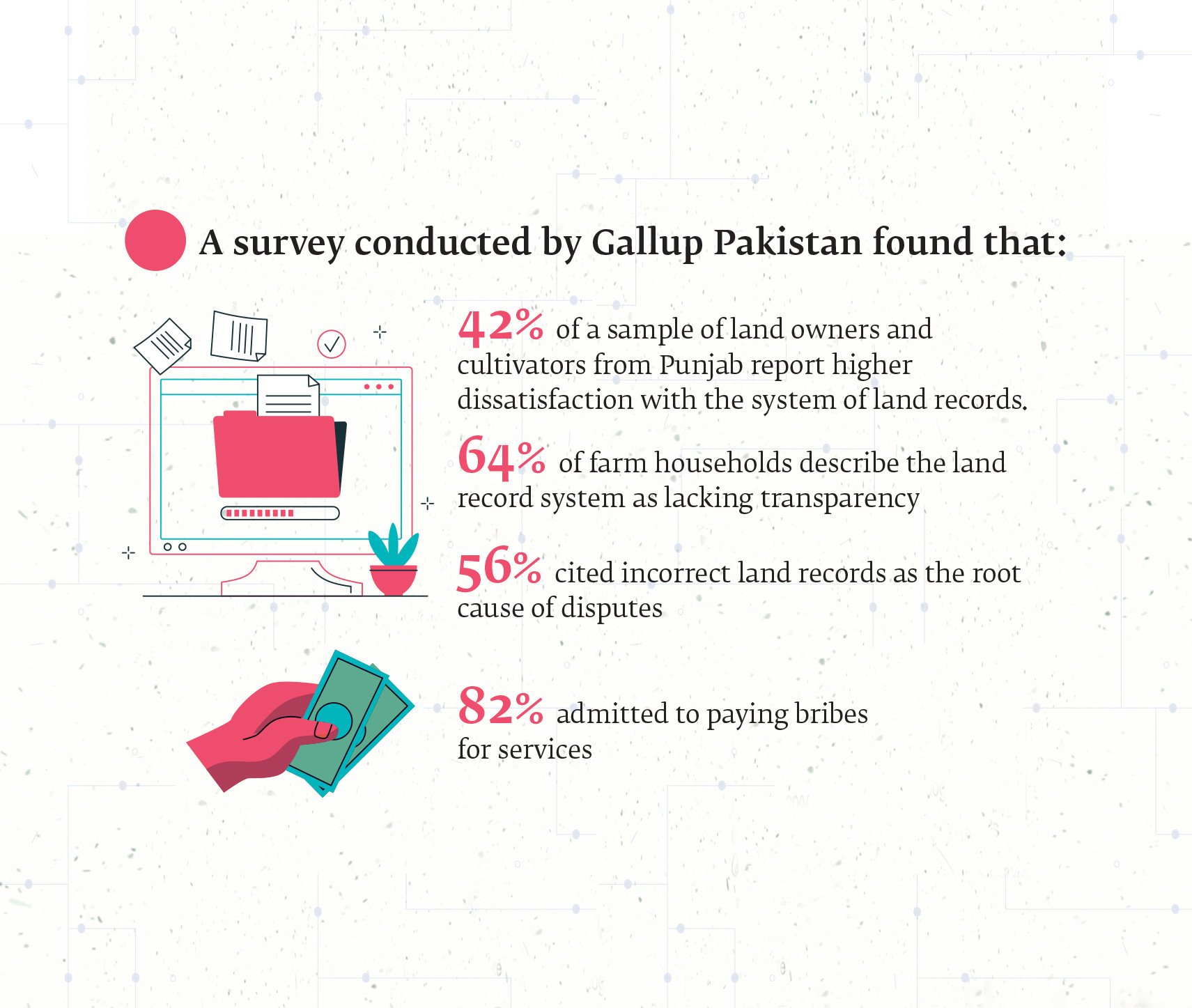

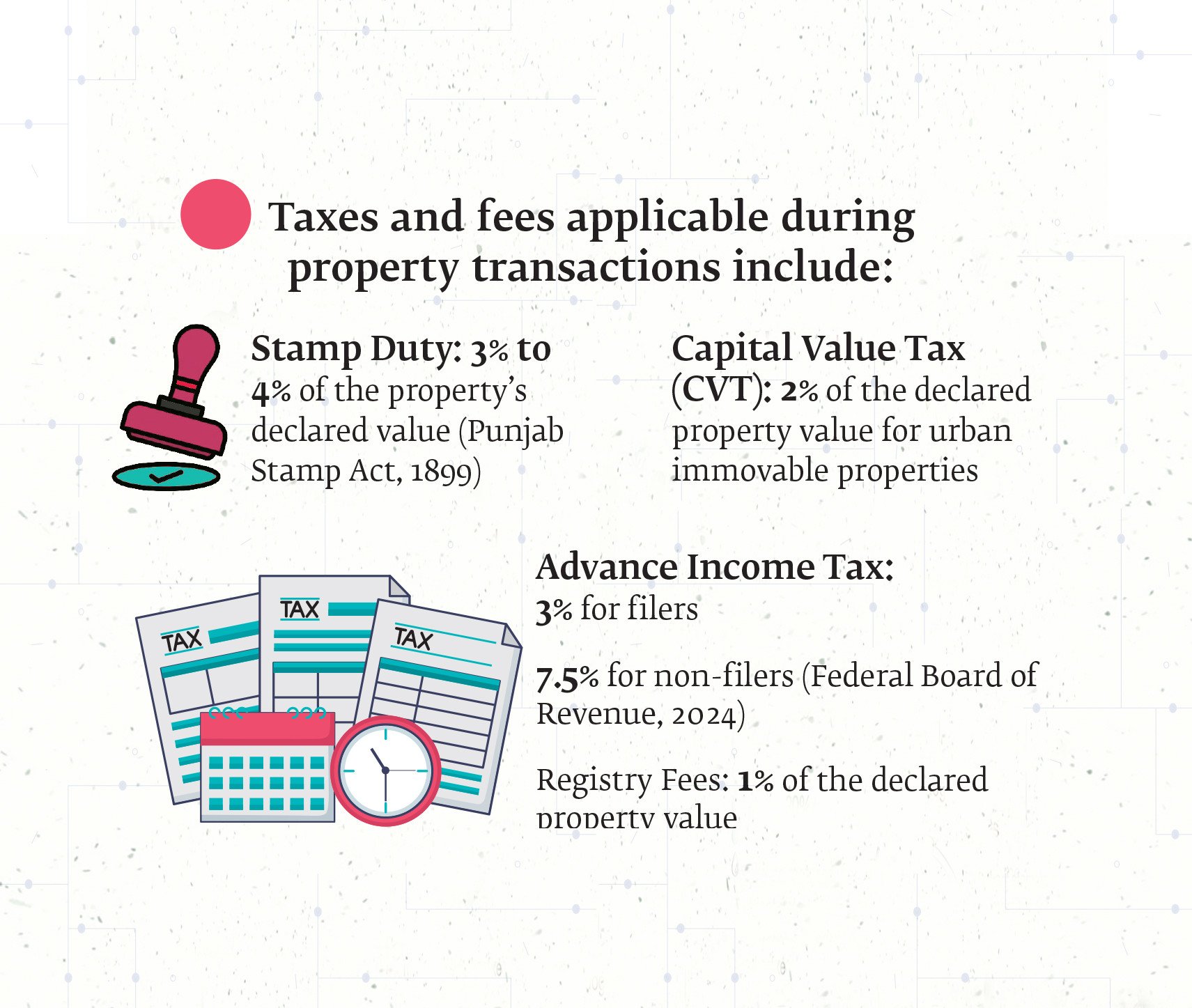

Blockchain to Revolutionize Pakistan’s Land Management

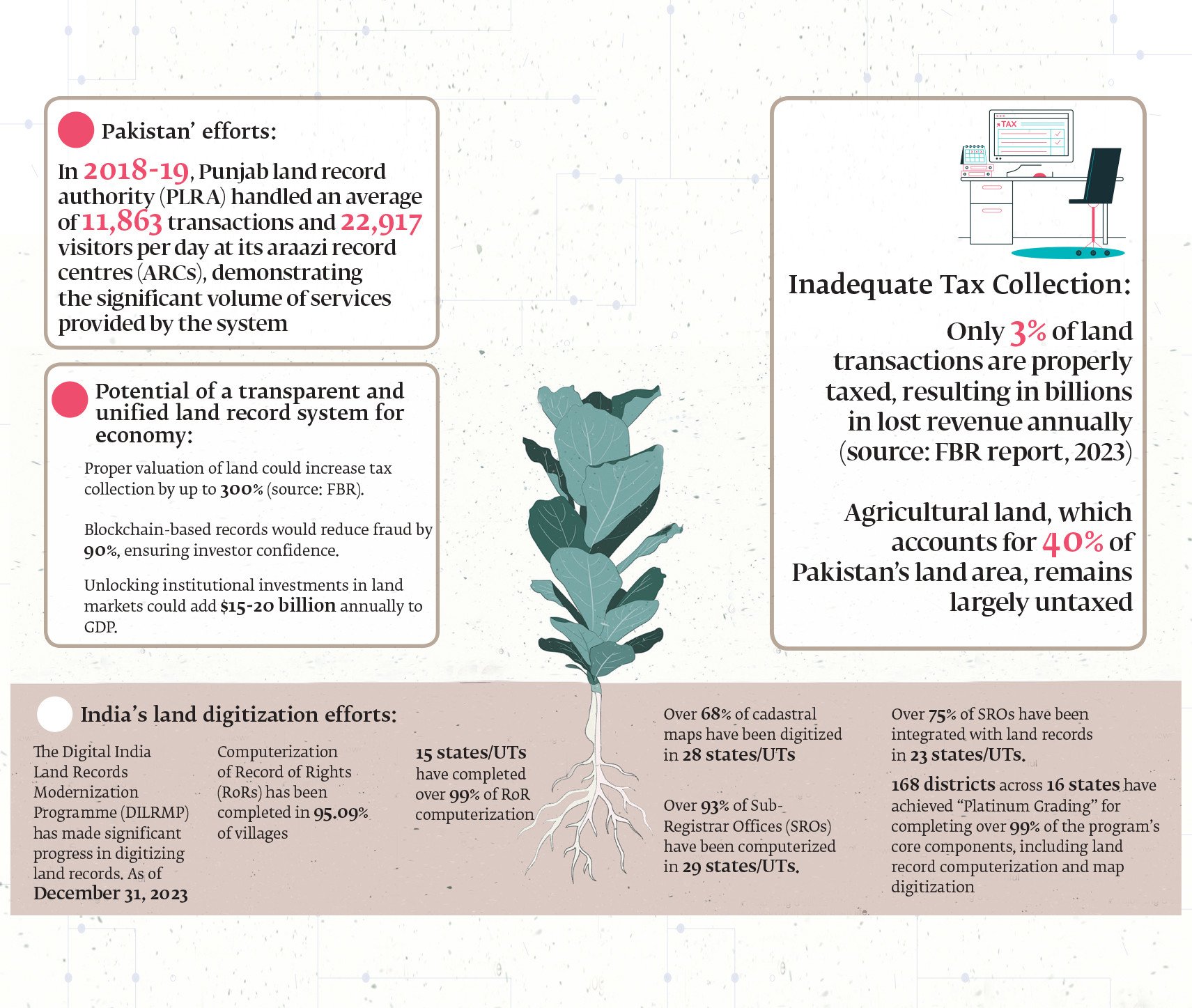

In the heart of Pakistan’s bustling cities and sprawling rural landscapes lies a persistent challenge that has long stifled economic growth and social stability: land management. For decades, the system has been mired in inefficiencies, corruption, and outdated colonial-era practices, leaving millions frustrated and the nation’s economic potential untapped.

Efforts to modernize this convoluted system have been made, notably through initiatives like Punjab’s Land Record Management Information System (LRMIS). However, these efforts remain fragmented and limited in scope. The slow pace of digitization and the continued reliance on manual records mean that the full benefits of these initiatives are yet to be realized. According to a recent article in The Express Tribune, the ongoing challenges in land ownership and management are a significant hurdle to Pakistan’s progress.

Blockchain: A Beacon of Hope

Amidst these challenges, blockchain technology emerges as a promising solution. Known for its secure and transparent nature, blockchain could revolutionize land management in Pakistan by ensuring clear and immutable land titles. This technology has the potential to reduce corruption and fraudulent transactions, offering a path towards a more efficient and equitable system.

International examples provide a blueprint for success. Georgia’s blockchain land registry, for instance, has been hailed as a triumph in transparency and fraud prevention. By storing land records on an immutable digital ledger, Georgia has effectively eliminated disputes arising from document manipulation. This model offers valuable lessons for Pakistan, highlighting the transformative potential of blockchain in governance.

Challenges and the Road Ahead

Despite its promise, implementing blockchain in Pakistan is not without challenges. Political resistance, bureaucratic inertia, and a lack of technical expertise pose significant hurdles. Moreover, vested interests benefiting from the current system’s opacity are likely to oppose such reforms. Overcoming these obstacles will require strong political will and collaboration across federal and provincial levels.

To pave the way for blockchain adoption, Pakistan must first consolidate existing digitization efforts, integrating provincial databases into a unified national platform. Legislation should standardize land valuation methods, eliminating disparities and closing loopholes that allow tax evasion. Public awareness campaigns will also be crucial in ensuring widespread adoption and trust in the new system.

Conclusion: A Call for Urgent Reform

The inefficiencies in Pakistan’s land management system have persisted for too long, hindering economic growth and legal transparency. However, with the right reforms and the adoption of cutting-edge technology, Pakistan has the potential to revolutionize its land administration. By learning from global examples and embracing blockchain’s capabilities, the country can unlock billions in economic value, boost investor confidence, and strengthen tax revenues.

The need for reform is urgent — Pakistan cannot afford to let its land management crisis continue unchecked. As highlighted in The Express Tribune, the time for action is now.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

Ocean City Council Enacts New Short-Term Rental Restrictions

Ocean City, Md. – In a decisive move, the Ocean City Council has approved new restrictions on short-term rentals, despite opposition from over 200 residents. The council’s decision came after a comprehensive review of community concerns and potential impacts on local neighborhoods.

Occupancy Limits Enforced

The newly approved occupancy proposal limits the number of guests in rental units to two people per bedroom, plus an additional two occupants. Significantly, children under 10 years old are not counted in this total. The ordinance also prohibits the conversion of attics, garages, and other non-bedroom spaces into bedrooms unless they comply with town permitting requirements. This measure aims to maintain the integrity of residential areas and align with the town’s noise ordinance, adjusting the overnight accommodation period to midnight through 7 a.m.

Minimum Stay Requirement

A second proposal, which establishes a five-night minimum stay for rentals in R-1 and MH zoning districts, passed its first reading with a 5-2 vote. This proposal is set for a second reading for final approval. Realtor Terry Miller, who spearheaded opposition with approximately 200 signatures, argued that this policy could drastically reduce rental income during the summer months, as the national average stay is just 3.41 days. However, Mayor Rick Meehan defended the measure, emphasizing the need to preserve the character and tranquility of residential neighborhoods.

Moratorium on New Licenses

Adding to the regulatory changes, the council has enacted an 11-month moratorium on new short-term rental licenses in the R-1 and MH districts. This moratorium is effective immediately but does not affect applications submitted before January 28, 2025. Property owners with existing rental licenses can apply for renewal and supplementary short-term rental licenses for the 2025 license year.

The original article detailing these developments can be accessed here. This decision by the Ocean City Council marks a significant shift in local policy, aimed at balancing rental activity with community interests. The minimum stay proposal awaits further deliberation in the upcoming council meeting.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

Redefining D.C.: A City of Dual Perceptions and Meaningful Work

Washington, D.C., a city often labeled as a “swamp,” is simultaneously a beacon for those driven by a sense of mission and purpose. While the term “swamp” has been used pejoratively to describe the political landscape of the capital, many who reside and work there see it as a place where significant contributions to society are made. This dual perception is explored in an insightful NPR article by Brian Naylor.

From the early days of its establishment, Washington has been criticized. Timothy Noah, a writer and journalist, notes that even before the city was built, it was described as a “political hive” by Thomas Treadwell, an Anti-Federalist senator. Yet, this view overlooks the “other” Washington, where residents and workers strive to make a positive impact.

In this “other” Washington, the National Institutes of Health in Bethesda, Maryland, played a crucial role in developing the blueprint for the COVID-19 vaccine. According to Noah, this breakthrough was not the result of private companies but rather the work of dedicated government researchers.

Federal agencies are involved in a wide array of functions, from managing the National Parks to processing tax returns and launching telescopes into deep space. Eric Choy, a leader in Customs and Border Protection, is committed to stopping the import of goods produced by forced labor, driven by a sense of duty to uphold national values.

Choy, who was honored with the Service to America Medal, emphasizes the importance of service to something greater than oneself. His perspective is shared by others like Christy Delafield of FHI 360, who moved to D.C. to contribute to global health and humanitarian aid systems.

Ryan O’Toole, a congressional staffer, reflects on his experiences in Washington, including being in the House chamber during the January 6th Capitol riot. He witnessed Senate staffers safeguarding the electoral college votes, actions he describes as heroic.

Despite its reputation, Washington is a vibrant and diverse community. While some may come seeking fame or fortune, many more are motivated by the desire to do good, as highlighted in Naylor’s article. This narrative challenges the notion of D.C. as merely a swamp, portraying it instead as a place where meaningful work is pursued.

For more insights on the history and dynamics of Washington, D.C., explore this National Mall history.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

Addressing America’s Housing Crisis: Efforts and Challenges under the Biden Administration

The American housing crisis is not merely a statistic; it is a pressing reality affecting millions of families nationwide. Under the Biden administration, rent prices have soared to unprecedented levels, and homeownership has become an elusive dream for many. Over the past four years, the administration has taken several steps to address this entrenched issue. Let us delve into these measures and assess their effectiveness while casting light on the current state of housing in the United States.

Federal Investment and Housing Initiatives

The Biden administration has made significant federal investments in affordable housing. Billions have been allocated in grants and funding to enhance the availability of affordable housing, with a goal to build 2 million new homes, reduce rental costs, and offer tax credits for homebuyers.

Moreover, the administration expanded the Low-Income Housing Tax Credit (LIHTC) and proposed a Neighborhood Homes Tax Credit. Despite these efforts, the U.S. still faces a 4.5 million home shortage, underscoring the critical nature of the crisis.

Homelessness and Federal Response

While funding for homelessness prevention increased, the nation witnessed an 18% rise in homelessness in 2024. The lack of affordable units has significantly contributed to this surge. The National Alliance to End Homelessness reports that approximately 700,000 individuals are experiencing homelessness in the U.S.

Challenges in Addressing Housing Issues

Efforts to tackle the housing crisis have encountered substantial obstacles. Bipartisan cooperation is essential for sustainable solutions, yet political division remains a significant barrier. Additionally, high mortgage rates and supply shortages continue to impede progress.

Protecting Renters and Curbing Corporate Practices

The administration has taken measures to protect renters from unfair practices. It cracked down on corporate landlords exploiting algorithms to inflate rents and proposed capping rent increases at 5% for properties built with federal tax credits. The introduction of a Renters Bill of Rights further outlines principles for fair rental markets and prohibits hidden fees in rental agreements.

Looking Ahead

Although the Biden administration has laid the groundwork for addressing the housing crisis, much work remains. Future policies must focus on increasing supply, reducing costs, and protecting vulnerable populations. Only then can we hope to see real progress in making housing affordable for all.

The original article from Norada Real Estate Investments provides an in-depth analysis of these initiatives and the ongoing challenges in the housing sector.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

The Future of Real Estate: Technology’s Transformative Impact by 2025

In a rapidly evolving world, technology is set to redefine the real estate landscape by 2025. As reported by AZ Big Media, several cutting-edge technologies are poised to revolutionize how properties are bought, sold, rented, and managed. From artificial intelligence (AI) and blockchain to virtual reality (VR) and data analytics, these innovations are reshaping the expectations of consumers and intensifying competition among real estate businesses.

AI-Driven Property Recommendations

AI is set to become the cornerstone of property searches, offering personalized recommendations based on user preferences such as budget, location, and lifestyle. John Beebe, CEO and Founder of Classic Car Deals, highlights that AI algorithms will employ predictive analytics to identify valuable assets and forecast market conditions, streamlining the property search process for buyers and renters.

Blockchain for Transparent Transactions

The integration of blockchain technology promises enhanced security and transparency in real estate transactions. Dr. Nick Oberheiden, Founder of Oberheiden P.C., notes that smart contracts will automate agreements, eliminating intermediaries and reducing transaction costs. Blockchain will also facilitate fractional ownership, opening new investment opportunities.

Virtual Reality for Property Tours

Virtual reality is transforming property marketing by allowing potential buyers to tour homes remotely. Gerrid Smith, Founder & CEO of Fortress Growth, emphasizes that VR technology will offer hyper-realistic experiences, enabling international shoppers to explore properties without traveling.

Big Data for Market Insights

Big data platforms will provide valuable market insights, helping stakeholders make informed decisions. Sam Hodgson of ISA.co.uk explains that predictive analytics will highlight market trends and property appreciation rates, benefiting buyers and sellers alike.

IoT-Enabled Smart Homes

The Internet of Things (IoT) will integrate advanced solutions into homes, from energy-efficient systems to community-level innovations. Alex L. of StudyX anticipates that these developments will appeal to environmentally conscious consumers seeking sustainable living options.

Digital Twins for Property Development

Digital twins, or virtual replicas of physical structures, will become mainstream by 2025. Ivy Berezo of LUCAS PRODUCTS & SERVICES highlights that this technology will enhance accuracy and efficiency in property development, allowing real-time collaboration across geographical boundaries.

Enhanced Marketing with AR and AI

Augmented reality (AR) and AI will revolutionize property marketing by offering interactive experiences. Leonidas Sfyris of Need a Fixer notes that AR apps will allow buyers to visualize renovations, while AI chatbots will provide instant answers to inquiries.

Sustainable Real Estate Practices

Technology will drive sustainability in real estate, with AI and IoT enabling energy-efficient designs. Deborah Kelly of Brickhunter explains that integrated systems will optimize resource consumption, appealing to eco-conscious buyers.

Remote Work Influencing Location Choices

The rise of remote work will shift property preferences, with demand for homes offering dedicated workspaces and internet capabilities. Gemma Hughes of iGrafx suggests that developers should cater to these trends by incorporating flexible workspaces into residential complexes.

Frictionless Transactions Through Digital Platforms

Digital platforms will streamline real estate transactions, from virtual tours to e-signing documents. Dean Lee of Sealions predicts that blockchain and AI will enhance transaction efficiency, setting a new standard for smart real estate practices.

As we look to the future, these technological advancements will drive significant changes in the real estate market by 2025. Industry stakeholders must adapt to these innovations to remain competitive and meet the evolving demands of consumers.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.