Exploring Innovative Strategies for Managing Student Loan Payments

Exploring Innovative Strategies for Managing Student Loan Payments

In a landscape where student loan debt is a growing concern, borrowers are exploring creative methods to manage their financial obligations. According to EducationData.org’s 2023 report, the average federal student loan borrower owes $37,574, while private borrowers face an even steeper average of $54,921. With these daunting figures, many are considering unconventional methods to ease their financial burden.

- Contact Your Lender

For those with private loans, reaching out to your lender can reveal whether credit card payments are an option. While not all lenders offer this flexibility, some do, providing a possible avenue for managing payments more conveniently. - Utilize Third-Party Payment Platforms

Federal student loan borrowers might consider third-party platforms like PaySimply and Plastiq. These services enable payments via credit card by converting them into wire transfers or cash equivalents, although fees ranging from 2.5% to 3% can offset any potential rewards benefits. - Consider a Balance Transfer

For those nearing the end of their loan term, transferring the balance to a 0% APR balance transfer credit card could be a viable option. This method can provide an interest-free period of up to 21 months, though it comes with a transfer fee of 2% to 3%. - Creative Budgeting

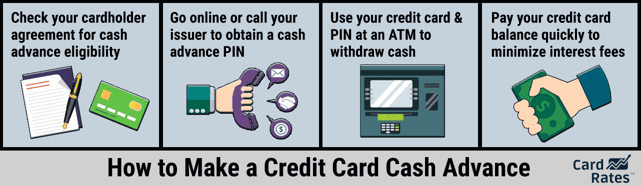

A strategic approach involves reallocating expenses. For example, paying for groceries with a credit card can free up cash for student loan payments, achieving the same financial effect without direct loan charges. - Cash Advances

While not ideal due to high APR rates and immediate interest accrual, cash advances can be a last-resort option. Borrowers should weigh the costs carefully before proceeding. - Explore Deferment and Forbearance

Federal loan holders should explore deferment and forbearance options, which offer payment relief without credit damage. Private lenders may also provide hardship plans, though these vary by institution.

While these strategies can provide temporary relief, borrowers must remain vigilant about the potential pitfalls, such as high interest rates and the risk of accumulating more debt. The original article by Erica Sandberg on CardRates.com emphasizes the importance of informed financial decisions and responsible credit management.

CSS for Styling

“`css h3 { color: #b40101; margin-bottom: 20px; } h4 { color: #b40101; margin-top: 30px; margin-bottom: 10px; } p { margin-bottom: 15px; } b { color: #b40101; } a { color: #b40101; text-decoration: none; } a:hover { text-decoration: underline; } img { margin: 20px 0; max-width: 100%; height: auto; } “`

This approach ensures that borrowers are equipped with the knowledge to navigate their financial landscape effectively, prioritizing both short-term relief and long-term financial health.

More Articles

Getting licensed or staying ahead in your career can be a journey—but it doesn’t have to be overwhelming. Grab your favorite coffee or tea, take a moment to relax, and browse through our articles. Whether you’re just starting out or renewing your expertise, we’ve got tips, insights, and advice to keep you moving forward. Here’s to your success—one sip and one step at a time!

The Crypto Revolution: Bridging Traditional Finance and DeFi

The Crypto Revolution: Bridging Traditional Finance and DeFi

The financial world is on the brink of a revolution. With the rise of Bitcoin and decentralized finance (DeFi), traditional finance is experiencing a seismic shift. This transformation is not just a passing trend but a fundamental change in how financial systems operate, offering a fascinating juxtaposition of innovation and regulation.

Traditional Finance Meets Blockchain

Long considered the pillars of stability, traditional banks are now embracing blockchain technology. Major investment banks are exploring this technology to streamline operations and reduce costs. Some have even launched their own crypto trading platforms to stay competitive in this rapidly evolving market.

It’s not just about keeping pace; these institutions recognize the potential of DeFi to revolutionize everything from lending and borrowing to asset management. By adopting blockchain, they are unlocking new avenues for growth and efficiency.

The Rise of DeFi: A Game-Changer for Investors

DeFi is more than just a buzzword; it represents a new way of thinking about financial services. DeFi platforms are challenging traditional banking models with innovative products like yield farming and flash loans. For retail investors, this means access to a wider range of financial instruments and potentially higher returns. However, it also comes with increased risks and volatility.

Understanding these new opportunities is crucial for anyone looking to diversify their portfolio in the digital age.

Navigating the Regulatory Landscape

As cryptocurrencies and DeFi gain mainstream attention, regulators are taking notice. The challenge lies in balancing innovation with consumer protection. This regulatory uncertainty creates both risks and opportunities for investors and businesses alike.

Staying informed about regulatory developments is essential for anyone involved in the crypto space. It’s a rapidly evolving landscape, and what’s permissible today might be restricted tomorrow.

The Future of Finance: Hybrid Models and Innovation

Looking ahead, we are likely to see a hybrid model emerge, combining the best of traditional finance and DeFi. This could lead to more efficient markets, increased liquidity, and greater financial inclusion.

For traders and investors, this means staying adaptable and open to new ideas. The financial world is changing fast, and those who can navigate both traditional and decentralized systems will be best positioned to capitalize on emerging opportunities.

For a deeper dive into how these changes are reshaping the financial landscape, you can read the original article on Disruption Banking.

AI and Machine Learning: Transforming Healthcare Today

AI’s Role in Modern Healthcare

Already, AI is being harnessed to develop new drugs, enhance diagnostic accuracy, and improve patient access to critical care. The projected growth of AI in healthcare into a $188 billion industry by 2030 underscores its transformative potential. But what does this mean for patients and healthcare providers?

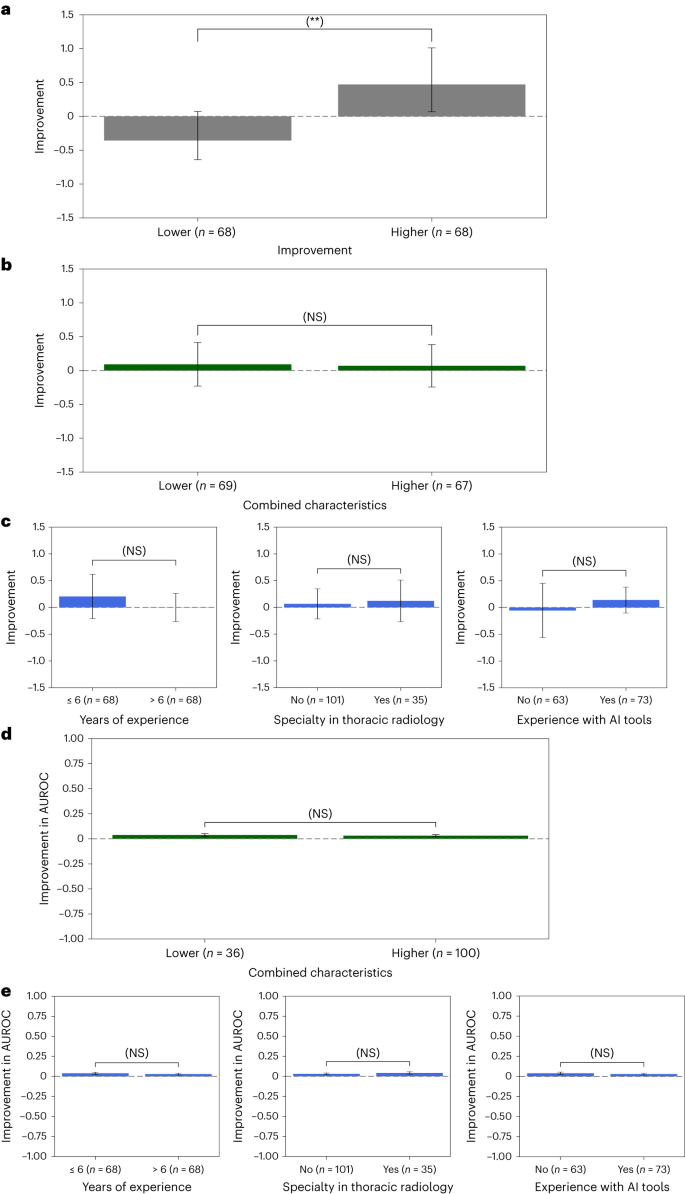

AI’s capabilities extend across various medical fields. From radiology to neurology, AI is enhancing the precision and speed of diagnostics. For instance, in radiology, AI acts as a “second pair of eyes,” assisting radiologists in identifying complex conditions like bone fractures and breast cancer. As Dr. Laura Dean explains, AI programs such as iCAD’s ProFound AI can highlight potential malignancies, functioning as a critical tool in early cancer detection.

The Cleveland Clinic’s Commitment to AI

The Cleveland Clinic is at the forefront of AI integration, having joined a global AI Alliance to promote safe and responsible AI use. This collaboration, initiated by IBM and Meta, includes over 90 leading organizations in AI technology and research.

In addition, the Discovery Accelerator, a partnership between the Cleveland Clinic and IBM, aims to accelerate biomedical discoveries using AI. As Dr. Lara Jehi notes, the shift from traditional lab experiments to computational tools is reshaping biomedical research, allowing for more detailed genetic analyses and improved treatment outcomes.

AI in Diagnostics and Triage

AI’s impact on diagnostics is profound. In stroke cases, for example, AI tools like Viz.ai expedite diagnosis and treatment by quickly analyzing brain scans and coordinating care. This rapid response is crucial in emergencies, where every minute counts.

In the realm of triage, AI helps prioritize cases based on urgency, ensuring patients receive timely care. This technology is particularly beneficial in managing complex conditions, where early intervention can significantly improve outcomes.

Future Prospects and Ethical Considerations

The future of AI in healthcare is bright, with ongoing research focused on enhancing predictive models and understanding genetic factors in diseases like epilepsy. As Dr. Jehi emphasizes, AI offers unprecedented insights, transforming how we conduct research and develop new treatments.

However, as AI continues to evolve, ethical considerations remain paramount. The World Health Organization has issued guidelines to ensure AI is used safely and ethically in healthcare settings.

As we navigate this AI-driven era, the potential for improved patient care and medical advancements is limitless, provided we maintain a focus on ethics and safety.

Revamping New York City: A New Era of Commercial Zoning

In a significant stride towards modernizing New York City’s landscape, the City Council has approved a landmark initiative aimed at revitalizing commercial zoning regulations. This initiative, known as the Zoning for Economic Opportunity, represents the second phase of Mayor Eric Adams’ ambitious City of Yes campaign, which seeks to transform the city’s economic and environmental framework.

The newly approved zoning changes, which were officially sanctioned on June 6, 2024, are set to overhaul decades-old restrictions, thereby expanding the potential for commercial and manufacturing growth across the city. This update marks the first major revision to commercial zoning laws since 1961, underscoring a pivotal shift towards fostering economic recovery and sustainable job creation.

Key Highlights of the Initiative

- Expansion of business locations to include more areas citywide.

- Doubling of available space for small-scale clean manufacturing.

- Facilitation of adaptive reuse projects for existing buildings.

- Elimination of zoning impediments that hinder business expansion.

Mayor Adams, in a statement, emphasized the importance of this initiative, stating, “We have taken another historic step to bring our city’s zoning code into the 21st century.” The changes are designed to support local businesses, fill vacant storefronts, and promote vibrant commercial corridors throughout the city.

Driving Economic Recovery

This zoning update is part of a broader strategy to drive New York City’s economic recovery through commonsense policy changes. These changes aim to help businesses find space, support entrepreneurs, and enable more vibrant streetscapes. The initiative also places a strong emphasis on expanding manufacturing, allowing small enterprises like microbreweries and apparel makers to thrive in commercial corridors across all five boroughs.

The initiative follows the City of Yes for Carbon Neutrality initiative approved in December, which aimed to remove barriers to renewable energy installations and promote cleaner air and lower energy costs.

In addition to supporting local businesses, the zoning changes aim to enhance pedestrian experiences and ensure that commercial uses contribute positively to their surroundings. The city council is expected to vote on the third and final phase of the City of Yes initiative, City of Yes for Housing Opportunity, by the end of the year. This phase will focus on adaptive reuse as part of a plan to build 500,000 new homes in New York City by 2032.

Personalized Cardiac Care: Pioneering Atrial Fibrillation Treatment at University of Miami

In a groundbreaking effort to revolutionize the treatment of heart rhythm disorders, the University of Miami Miller School of Medicine is leading the charge in personalizing patient care. The cardiac electrophysiology group at the institution is pioneering innovative research and treatment strategies for patients with abnormal heart rhythms, particularly atrial fibrillation.

Under the leadership of Dr. Jeffrey Goldberger, the team is making significant strides in understanding atrial fibrillation through advanced methods like catheter ablation. Despite the procedure’s stagnant success rate of 60%, Dr. Goldberger advocates for a more personalized approach to treatment, tailoring strategies based on genetics, age, body composition, and other factors.

Innovative Research and Personalized Care

Dr. Goldberger’s research emphasizes the importance of moving beyond a one-size-fits-all approach. His team utilizes cutting-edge technologies, including artificial intelligence and genetic testing, alongside lifestyle interventions. This holistic approach aims to enhance patient outcomes and pave the way for future breakthroughs in cardiac care.

Dr. Raul Mitrani, a key collaborator, highlights the team’s dedication to personalizing medicine for a broad range of patients. The group operates one of Florida’s only comprehensive risk factor management centers for atrial fibrillation. They offer customized treatment plans, addressing factors such as weight, blood pressure, and sleep apnea, in conjunction with medical interventions.

Research Beyond Borders

The group’s commitment to advancing cardiac care is evident in its participation in several federally funded research projects. Among these is the Liraglutide Effect on Atrial Fibrillation (LEAF) study, which explores the impact of weight-loss drugs on treatment outcomes. The findings suggest a potential doubling of success rates for catheter ablation when combined with adjunctive strategies.

Other notable projects include the OMICS study, which investigates the role of epicardial adipose tissue in atrial fibrillation risk, and the development of 4D Flow MRI technology to better assess stroke risk.

Future Directions

Dr. Goldberger acknowledges the progress made but emphasizes the need for continued innovation. “There have been many real improvements in our approach to atrial fibrillation, but we still have a long, long way to go to get to optimal treatment,” he stated in the original article. The team’s focus remains on identifying gaps and areas for impactful advancements in cardiac care.

Laughing Your Way Through the Real Estate Exam Journey

Ever Wonder Why Your Brain Feels Like a “Real Estate Exam”? Here’s a Reaction That Might Help You Laugh Through the Pain!

Let’s be real for a second: who hasn’t frantically crammed for an exam, only to feel like your brain is a soggy sponge afterward? If you haven’t experienced the joys of a real estate exam yet, buckle up. Judging by this transcript, you’re in for a ride full of mortgages, licenses, encroachments, and possibly regretting life decisions. But don’t panic—I’m here to break it down with you, one confusing real estate term at a time.

You’ve Got Questions. This Video Has… Even More.

So, imagine this: you’re sitting there with your coffee (probably your third cup by now), trying to remind yourself why you signed up to be a real estate agent in the first place. Then, BAM! You open this video. **“We’re diving into the top 25 real estate exam practice questions,”** the host announces, as if you weren’t already stressed enough from trying to remember terms like “encroachment” and “littoral rights.” I know, super thrilling.

Apparently, the point of these questions is to sharpen your knowledge and “boost your confidence for the big day.” Boost my confidence? More like boost my blood pressure! I’m over here reading questions about subordination clauses and deed restrictions and wondering, “Wait, am I even qualified to be an adult, let alone a real estate agent?”

Main Reaction: My Brain Hurts (But Like in a Good Way)

Okay. Let’s talk about the questions. The very first one hits you with this doozy:

“Which type of mortgage typically includes a partial release clause?”

Choices: Construction Mortgage, Blanket Mortgage, Wraparound Mortgage, or Package Mortgage.

Ah, yes. Because we all know what a blanket mortgage is, right? Oh wait—THANKFULLY, the host fills us in. Apparently, a blanket mortgage is a loan covering multiple properties AND comes with a partial release clause. So, next time you accidentally buy several houses, you’ll know what kind of financing to ask for. (Honestly, I’m still trying to finance a reliable used car, so this question feels a little ambitious for me.)

Question after question introduced more terms than I’d ever remember without notes, Post-its, or a “Phone a Friend” option. I learned about granting clauses, easements, and why bidding on foreclosed properties isn’t like shopping on eBay, although I kind of wish it was.

Which of the following groups of people is NOT protected under Fair Housing Laws?

(Spoiler, it’s college students!—sorry, broke kids) I felt like I’d been through an emotional rollercoaster of real estate jargon.

Sometimes It Actually Gets Fun (Kinda)

Now, I know real estate law doesn’t sound fun… unless you’re, like, a lawyer or a very committed Monopoly player. But this transcript had moments of pure entertainment. For instance, when we hit stuff like:

“You have received verbal consent to park in a friend’s driveway while attending a football game. What’s that permission classified as?”

Apparently, that’s called a license—like, cool, now I feel licensed in football-related real estate activities. In another bizarre turn, there’s a question about whether a drunken man’s contract is void or voidable. Spoiler alert: it’s voidable. Because, let’s face it, Uncle Jim’s decision to auction his house after one too many tequilas should NOT be set in stone.

Ever wonder what happens if your broker dies while you’re trying to sell a property? Yeah, they went there too.

Analysis: Why Is Real Estate So Extra Compared to Other Professions?

Here’s the thing: I’ve prepared for a lot of exams in my life (well, like, four). But the real estate exam seems particularly over-the-top! The sheer number of terms—granting clauses, blanket mortgages, encroachments, and littoral rights? (what is it with fancy words for things we’ll never remember?)—makes me feel like real estate agents must secretly moonlight as attorneys. Why can’t it be simple, like handing someone a box of cookies and calling it a day?

But in reality, there’s a reason for all the complexity. Buying property is probably the single most expensive thing most of us will ever do, and crossing your T’s is essential. So, I guess I get it. People want to trust their real estate agents, not hand their life savings over to someone who thinks a “wraparound mortgage” is a sushi order.

Community Vibes: How Did YOU Survive the Real Estate Exam?

I must admit, after reading through this transcript, I’m honestly impressed by anyone who has passed this exam and lived to tell the tale. So, if you’re a real estate pro, my question to you is:

How did you power through? Did you consume a week’s worth of coffee, tears, and flashcards? Or did you just wing it (and, if so, teach us your ways).

Even if you’re just now contemplating whether or not you can pull this off, hang in there. It seems like overwhelming now, but so did figuring out what the heck “FHA loans” were, and look how far you’ve come! You’re literally reading an article about reaction content to real estate exam prep—so clearly, you’re committed.

Plus, think of all the fun conversations you’ll have at parties, dropping terms like “mechanic’s lien” and “earnest money” into casual conversation. You’ll be the life of the party… or maybe the person everyone avoids because you can’t stop talking about zoning restrictions. Either way, victory!

You Tell Me: Which Real Estate Term Broke You First?

So, friends—are we all on the same page here? Which real estate term made you want to throw your textbook into a lake? Is it “littoral rights” (pun intended)? Let me know in the comments below. And if you made it through the exam without losing your sanity, hats off to you. Seriously.

Until next time, happy studying. And may your mortgage clauses always be crystal clear! – Over and out.

Why Kris Krohn’s ‘Real Estate for Dummies’ is the Video You Didn’t Know You Needed

Why Kris Krohn’s ‘Real Estate for Dummies’ is the Video You Didn’t Know You Needed

Ever wondered why reaction videos are dominating your feed? It’s because there’s something oddly satisfying about watching someone break down concepts we’re too shy to admit we don’t fully understand. Like, who hasn’t zoned out as friends throw around terms like “equity” and “mortgage” while we nod and smile, low-key Googling under the table? 🙋 Well, welcome to 2023—where Kris Krohn comes to the rescue with a Real Estate for Dummies guide. And let me tell you, whether you’ve got 10 properties under your belt or still wondering if Monopoly money counts—this video just gets you.

Context: So, What’s This All About?

Kris Krohn’s latest video isn’t your typical jargon-laden, snooze-worthy real estate bro talk. Instead, it’s more like that friend who sits you down with a whiteboard (yes, he has a literal whiteboard) and says, “Okay, here’s the tea on real estate—without making you feel, well… dumb.”

In his attempt to simplify the basics of real estate, Krohn goes over seven main buzzwords: real estate, equity, mortgage, down payment, landlord, tenant, flipping, and rentals. If you’ve ever been foggy on what separates these concepts or how they actually apply to you—ding ding ding—you’re who this video was made for.

Main Reaction: It’s Like a Netflix ‘Real Estate 101’ Binge

Listen, I’m far from a real estate mogul. Honestly, the most “equity” I’ve got is a couple of IKEA shelves I managed to put together without extra screws leftover. So, when Krohn started throwing around words like “equity,” bracing myself for a mental shutdown seemed inevitable. Spoiler alert: it wasn’t. 😳

He kicks off asking, “Ever heard words like equity and cash flow and been like, what do these words mean?” Uh, YES! It’s as if he read my brain and knew that despite repeated Google searches, my understanding of “equity” was still at “something to do with money?”

He demystifies it by walking through a hypothetical case of buying a $200,000 property for $160,000 and explains how equity—the difference between what it’s worth and what you owe—works its monetary magic over time.

What’s better? He’s not condescending about this at all. Not once did I feel like I was being talked down to. He speaks with the earnestness of an older sibling trying to teach you to ride a bike. If you fall off (read: get confused), they’ll pick you back up with a smile and hold those handlebars steady.

Analysis & Comparison: Home Buying Meets Real Life

Here’s the thing—Kris’s approach is refreshing because it excludes none of us. Whether you’ve been contemplating buying real estate or you’ve just gotten sucked into Zillow listings “for fun,” Kris runs you through it all in a way that’s—for lack of a better word—realistic.

If you’ve ever watched those corporate real estate “explainers,” you know the ones that make buying a house sound as breezy as picking up groceries—this ain’t that. Kris offers relatable analogies and acknowledges that, yeah, the real world is a *bit* more complicated.

And I love that he broke down risks too, implying that real estate isn’t all sunshine. You won’t buy a house today and sell it for a million bucks tomorrow simply because Kris said so, but with knowledge, practice, and the right mindset… you might just build your way there.

Doing the Numbers + Relating to Real Life

Hate math? No problem, because Kris breaks down the numbers you need to know in an *almost* fun way. Imagine buying a house for $160,000 that’s really worth $200,000—strategically gaining equity by choosing the right properties, and then renting it out with enough cash flow to pay your mortgage *and* make a profit?

When put so clearly, it gave me a slight itch to check the real estate listings in my town. (I quickly closed that tab before making any life-altering decisions, FYI).

The way he talked about flipping homes, too—buy low, sell high—sounded, dare I say, realistic (read: easier to understand than on TV).

Closing Thoughts + Encouragement to Engage 💬

Kris closes the video inviting viewers to comment, reminding us that no question is too dumb. I’m honestly tempted to throw a question or two in the comments myself because he makes the engagement feel accessible. Like, imagine a universe where a guru with a multi-million-dollar empire still wants to answer your question, “So, where do I even *start*?”

And that’s the beauty of the whole video. It’s not just educational content—it’s an invitation to get involved with a community of learners. So, if you’re even a fraction as interested in real estate as I suddenly found myself after watching this, why not chime in the comments yourself?

Bottom Line: It’s Educational, But It’s Also Just Fun

Here’s the truth: This might’ve just been a basic vocabulary lesson on real estate, but Krohn managed to make it not only digestible but actually fun (yeah, I said it). I’d honestly recommend giving the video a shot whether or not you’re into real estate because it’s an opportunity to dive into a jargon-filled world that might not be as intimidating as we once thought.

So, what do *you* think? Still unsure about jumping into the real estate game? Have a funny story about learning real estate the hard way? Let’s chat in the comments—I’d love to hear your take. 🌟

Real Estate vs. Stocks: Breaking Down the Buzz

Ever Wondered Why Everyone’s Buzzing About Real Estate vs. Stocks? Let’s Break It Down!

Alright, let’s talk about something you’ve probably seen pop up countless times on your feed, especially if you’ve ever Googled “how to invest” on a random Tuesday afternoon. Stocks vs. Real Estate – which one’s the better way to build wealth? And once you dive into it, it’s easy to see why reaction videos and discussions about this topic are all over the internet.

So, imagine you’re sitting there with your coffee (or wine, no judgment), browsing through YouTube, and up pops this video by Shelby Church titled “5 Years in Stocks vs. Real Estate: Which Made Me More Money?” Sounds like a solid question, right? We’ve all had that gnawing question about where to put our money. Plus, who doesn’t dream of escaping the 9-5 grind with dividends and rent checks?

The Big Question: Real Estate or Stocks?

Let’s be honest, who hasn’t fantasized about being the next property mogul like they’re walking the set of Selling Sunset? Or maybe you’re more comfortable picturing yourself sipping cocktails while your index fund quietly does its thing in the background.

Our host, Stefan, jumps into Shelby’s comparison and adds his two cents. Right off the bat, he makes one thing clear: Real estate? Not passive. No sir. It’s like that one group project where you do 90% of the work while Greg never shows up. Sure, real estate can make you loads of money, but it’s going to involve a lot more elbow grease than, say, parking your cash in an index fund and binging Netflix for the next few years (or decades).

Stocks – The Quiet Performer

Shelby’s video lays out a pretty shocking stat: If you had invested $300,000 in the stock market in 1988, you’d be looking at a cool $14 million now. Say what?! That’s an almost 4,000% return. Mind blown.

Now before you start imagining Scrooge McDuck swimming in coins, Stefan breaks it down further: stocks, especially if you’re playing it smart with dividends and tax-advantaged accounts, offer those sweet returns and the simplicity many of us crave as we get older. Can we talk about “stress-free” for a second here?

Stocks are like setting up an easygoing autopilot – you invest what you can, and over time, that cash starts multiplying. Of course, nothing’s ever totally risk-free, but stocks offer that peace of mind.

The Glamorous (but High-Maintenance) Life of Real Estate

Not to be outdone, real estate certainly has its positive moments. The allure of being able to leverage your investments is intriguing. Stefan throws out an example: if you put $100,000 down on a $400,000 property, you get to control the whole thing and any appreciation can skyrocket your return.

But, reality kicks in when you crunch numbers: property taxes, insurance, maintenance, commissions, and hello… tenants who may (or may not) be ideal. Real estate’s a commitment, like a long-term relationship. Except instead of remembering anniversaries, you’re fixing water heaters and repainting old railings.

Real Talk: What’s More Painless?

This video was packed with golden nuggets that made me reconsider getting too fancy with real estate. Stefan, about halfway through the video, drops one of those hard-to-hear truths:

“The older I get… I value peace of mind.”

I feel that. Who wouldn’t trade a little bit of additional return for less stress? These days, more than ever, it seems like we’re all craving simplicity.

Stocks and Real Estate – A Balancing Act?

Now, Stefan doesn’t just bash real estate. Heck, he’s been in the game since 2008. He’s seen some major wins from it. But with high mortgage rates and low inventory, real estate is starting to look like more of a headache than a gold mine.

So… What’s the Verdict?

If there’s one thing this video drives home, it’s that there’s no one-size-fits-all answer. For me? As much as I love diving into Zillow, I’m leaning more towards stocks. They hit that sweet spot between returns and “no headaches after 10PM.”

But what about you? Let’s chat in the comments – I’d love to hear your thoughts!

Ever Wondered What a Second Donald Trump Presidency Could Mean for the Housing Market?

Ever Wondered What a Second Donald Trump Presidency Could Mean for the Housing Market? Strap In.

We’ve all been there, scrolling through your feed at 2 AM, being bombarded with reaction videos. But have you ever wondered what we’d get if you created a reaction to, well, the future? Buckle up because today, we’re diving deep into the possible fallout of a Trump presidency on the U.S. housing market by 2025. Yes, we know, predicting the future can feel a bit like reading tea leaves, but if there’s one thing more unpredictable than the weather, it’s political economic policy. Still here? Good. Let’s dive into this rollercoaster of speculation.

The Context: Trump, Interest Rates, and a Housing Market that Never Sleeps

Now, before you snooze off (please don’t), here’s a quick refresher on why this is relevant. We’ve all been watching in fascination (and a wee bit of panic) as housing prices have shot through the roof—pun intended. Throw a Trump presidency into the mix, and we’re on a whole new wild ride. According to the transcript I’m reacting to, mortgage rates, which are already dancing around 7%, are expected to soar even higher.

Wait, what? Didn’t Trump campaign on lowering interest rates?

Yep! So, why the sudden spike? Something called the “Trump Trade.” Picture this: As Trump’s chances of winning the election rise, so do long-term interest rates. And as much as Trump, the businessman, is all about cutting rates, his fiscal policies and that infamous tariff-loving streak might do the exact opposite. It’s kind of like saying you’re on a diet, but then eating a pizza. The paradox is real, folks.

My Take: “Pro-Business” Magic? Or a Bigger Bubble?

Part of me kinda likes the idea of optimism encouraging more home-buying. After all, who doesn’t want more people experiencing that sweet joy of home ownership (and the not-so-sweet mortgage payments that come with it)? And, yeah, Trump did inspire some confidence in the housing market years ago. Back when he took office in 2016, mortgage applications spiked like crazy—like everyone suddenly had FOMO and decided that immediately after the election was the golden moment to buy a house.

But—and it’s a big ol’ BUT—circumstances now are a bit like comparing apples to, well, exploding apples. Affordability? She doesn’t live here anymore. In 2016, the monthly cost to own a home was a breezy $1,200. Fast forward to our current nightmare, and it’s skyrocketed to $2,800. Considering most people now have to chuck away 40% of their income just to make mortgage payments? Yeah. Just casually marrying yourself to a mortgage sounds a bit like economic masochism right now.

Analysis: Déjà Vu or New Housing Bubble?

This transcript really got me thinking, though—especially about past housing market trends. Remember 2008? You know, the year that brought us the housing crash that soon led you to memorize budgets like your life depended on it. Well, we might be edging towards a repeat—at least according to the icy (pun intended) foreclosure data mentioned in the transcript. Apparently, early-stage delinquencies on mortgages are reaching levels we haven’t seen since that frosty collapse of ‘08.

Want to hear something even more terrifying? There’s this HUGE backlog of foreclosures that’s just waiting for its moment, like the villain creeping around in the third act of a horror movie.

Unlike the pandemic-induced moratorium (which plastered over the cracks), these foreclosed properties aren’t going to wait forever. And Trump, being significantly less hands-on when it comes to economic interventions, might lift the lid on that foreclosure jar. Imagine that—your neighbor defaults and suddenly there’s a “For Sale” sign on every block.

A more laissez-faire approach from a Trump presidency might result in all those distressed homes hitting the market, accelerating price drops. But here’s the thing: housing markets thrive on more buying, not just selling, unless it’s your goal to create the biggest game of Monopoly ever.

What About the FED: The Trump-Powell Smackdown (Sequel)

Now, let’s pivot to the ultimate showdown: Trump vs. Jerome Powell (again). If you didn’t catch the live-action drama during Trump’s first presidency, let me remind you that Trump was not Powell’s biggest fan. He basically blasted the guy on Twitter like Powell was some contestant on The Celebrity Apprentice who messed up the boardroom task.

Trump already pressured Powell back in 2018 and 2019 to cut rates. Will history repeat itself if the same two characters enter the ring in 2025?

I can already picture Trump tweeting at the FED from the Oval Office about “disastrous rate policies.” But will Powell cave again? Seeing as higher interest rates could continue squeezing not just buyers but investors as well, this tug-of-war could be a major game-changer. The longer interest rates stay up, the more painful it gets for anyone using debt as a crutch—more so considering we’re already feeling like the band-aid is getting ripped off too slowly.

So, Is it Time to Panic?

Ah, panic. That comforting blanket you throw on when the economy takes wild swings. But fret not! As the transcript emphasizes, the macro news—interest rates, the FED, Trump’s policies—certainly matters, but don’t overlook what’s happening locally. It’s often the neighborhood-level fundamentals that will make or break the decision to buy or invest in the real estate market. Maybe it’s time you start paying attention to “cap rates” and other key indicators that can guide your real estate Game of Thrones strategy.

What Do You Think? The Future, Politics, and Your Pocket

So, after this rollercoaster journey through what a Trump presidency could spell for home buyers, sellers, and renters alike, what do you think? Would you hold off on buying that dream house and risk waiting to see a burst bubble in 2025—or do you think Trump could rally some much-needed optimism that might stabilize prices even with the foreclosures coming?

I’m curious—where are YOU at in your housing journey? Drop your thoughts below! Let’s build this little community of fellow housing-market watchers and maybe, just maybe, we’ll get through 2025 together with a bit fewer gray hairs.

Oh, and before I forget—if you’re a real estate nerd (like me, c’mon, it’s cool), go check out ReVenture’s app. It’s like Zillow on steroids, giving you juicy details on everything from cap rates to market trends, and might just help you dodge some of those lurking 2025 pitfalls. 🌪️🏠

Unveiling Success Through Ryan Serhant’s Lens: Winning in Real Estate and Life

Ever Wondered Why Some People Just Keep Winning? Let’s Dive Into the Mind of Real Estate Guru Ryan Serhant

Alright, let me start with this: ever caught yourself wondering why some people just won’t stop winning? I know, it’s like ugh, can’t relate. But here’s something wild – I just stumbled upon a transcript of Ryan Serhant chatting on The School of Greatness podcast, and let me tell you, this guy didn’t just drop real estate gems, he unloaded freakin’ life hacks! For those of you who may not know, Ryan Serhant is that tall, smiley dude from Million Dollar Listing who somehow makes selling million-dollar penthouses in Manhattan look as easy as deciding what to order for lunch (though, let’s face it, even choosing between a sandwich and a salad can feel herculean sometimes). And while he’s been on TV, written books, and launched his own real estate empire, his journey proves that not everything has been rainbows and commissions. The guy has put in WORK.Wake Up Call: It’s Not About Being Important – It’s About Being Happy

So let’s kick off with this bombshell Ryan dropped during the podcast – he said there was this moment where he realized he’d spent the last 20 years trying to feel important, but what he really wanted was to feel happy. I mean, relatable, right? We’ve ALL been there, grinding away at that 9-to-5, posting on social media, thirsting for validation with every like and emoji reaction. Yet, at the end of it all, sometimes we’re left asking ourselves, “But wait… am I happy?” And Ryan, at the top of his game, had that exact lightbulb moment at 40. You can’t be important to everyone and still feel empty when it comes to yourself. I’m not saying quit your job and go “Eat, Pray, Love” on us, but sometimes, we all need that reminder to check in with ourselves. What’s the point of doing all this work – collecting accolades and paycheck after paycheck – if we aren’t enjoying the ride?The Fear of Being Embarrassed > The Fear of Failing

One of the hardest-hitting truths Ryan shared in the transcript was this: “People aren’t afraid of being failures, they’re afraid of being embarrassed.” Let that sink in for a second. Embarrassment – that stomach-dropping, face-flushing moment when something doesn’t go as planned and you KNOW people are watching. Yikes. It’s like, who doesn’t have that voice in the back of their mind saying, “But what if I look dumb?” Ryan went on to say how important it is to make mistakes. He spent a year and hundreds of thousands of dollars creating apps and virtual platforms that NO ONE used. Like, crickets. And though those projects flopped, they weren’t just mistakes; they were stepping stones. He learned, adapted, and ended up launching something that actually worked – his software, Simple, which streamlines tedious tasks for real estate agents. Heck, he’s now got a 97% usage rate. Try topping that. So next time you’re holding back because you’re worried what your colleague Karen or your judgmental cousin might think if you fail, just remember this: even Ryan Serhant spent boatloads of time and cash on ideas people ignored. If he can bounce back, so can you.100x Your Mindset – Like a Billionaire Does!

Okay, let’s be real for a sec. Anyone else here just hoping for 2x results on anything in their life? Lose weight twice as fast? Double my annual salary? Have two good hair days in a row? Meanwhile, Ryan’s hanging out with billionaires who’ve completely flipped the script. These movers and shakers aren’t thinking in small, gradual growth. These folks are striving for 100x, baby. Why take small swings when you can knock it out the park? Ryan is surrounded by people who are asking themselves big questions like, “How can I take this idea and scale it to 100x?” and “How do I turn every person I meet into a future collaborator?” I mean, I don’t know about you, but my brain Googles “how to scale anything to 100x” and starts buffering right away. But think about it – it’s powerful. Millionaires think about money, billionaires think about time. They streamline, they delegate, they make decisions fast. Ryan even pointed out how these people barely glance at menus in restaurants – they just tell the server, “Surprise me,” so they can focus on way more important matters. And honestly, that sounds like a life hack in itself – less time spent agonizing over choices, more time living life.What We Can Learn from Ryan: Embrace the Hustle—but with Purpose

Ryan has this undefinable, burning passion for sales – a profession that unlocked his potential. But when talking about success, he’s quick to elaborate that you have to figure out what YOU’RE actually passionate about. Is it the work or the results? He used to think he loved the grind of closing deals, but realized he was more about the satisfaction and freedom those results provided. Someone once said that the best opportunities will knock on both sides of the door (or maybe I just made that up?), and Ryan is the epitome of this. Through trials, flops, and massive wins, his journey screams: don’t be afraid to screw up. In fact, welcome it. Heck, invite failure over for coffee. Just learn from it. He’s built his empire not by playing it safe, but by consistently trying and retrying until something worked. He even says, “You work so hard you make luck easy to find.” Which is probably one of the greatest pieces of advice anyone hustling out there could hear. Make it so success doesn’t have a choice but to knock at your door… persistently.Closing Thoughts: What Can We Take Away?

If there’s anything you take away from Ryan Serhant’s entrepreneurial journey, it’s this: risk it. Show up. Keep showing up. You don’t have to know the whole roadmap. Hell, you don’t even need GPS. Just keep driving toward something that excites you. And hey, maybe all those serial reaction videos lighting up your feed right now have something in common with Ryan’s take on vital life lessons: experiment, create, fail fast, and always aim for a bigger horizon. And who knows? Maybe Netflix will come knocking at your door too.So What Do You Think? What’s YOUR Key Takeaway?

Have you had an “aha” moment like Ryan’s—where you realized it’s time to chase happiness over importance? Or maybe you’ve made some epic mistakes that led to something better? Hit that comment section below and let’s talk!Is Florida’s Booming Real Estate Market Becoming Unaffordable?

Ever Wondered if Florida is Becoming Unaffordable? Let’s Dive Into the Real Estate Crisis that’s Shaking Up the Sunshine State

Alright, here’s the thing—Florida, home to sun, sand, and a ridiculous amount of gators, is also becoming infamous for something else: a massive real estate crisis. If you were dreaming of your feet in the sand and maybe considering moving (or continuing to live) in the Sunshine State, well, buckle up because the stakes just got real. Like, rollercoaster after three cups of coffee real.

But hey, before you dash off to Zillow scrolling through homes in Alaska, let’s break down what’s happening in Florida’s housing market and why it’s becoming a significant turning point—possibly the largest in recent decades.

The Perfect Storm of Havoc – What’s Going On?

So, imagine you’re a homeowner in Florida (or want to be one)—cool breeze, coastal views, the works. Then you wake up one day to find out that your property insurance has ballooned up by 300%. Yep, you read that correctly. If this isn’t bad enough, FEMA comes along with what’s now known as the “50% Rule.” Essentially, if your home is damaged and repair costs exceed half of your home’s value, you’re stuck upgrading it to meet current flood codes or you’re booted out. Oh, and by the way, those upgrades (like elevating your house 9 feet) could easily cost between $150,000 to $400,000. Gulp.

It’s like buying a beach house only to have someone hand you a bill for rebuilding the world’s most expensive treehouse. Spoiler alert: the insurance company isn’t picking up the tab for elevation; they’re just covering the damage. So now, are you starting to see why coastal Floridians are giving their homes serious side-eye?

Here’s the kicker. If you’re in one of those “flood-prone” mobile home communities and your trailer survives a minor flood but your entire park is condemned, guess what? You’re out. Goodbye home, hello doom scroll for new housing. It’s happening across cities like Bradenton Beach, Fort Myers, and all along the Panhandle. Not exactly the vacation vibe you were hoping for, right?

The Insurance Meltdown: Where Everyone Loses?

Here’s the part where I get to say, “You thought it couldn’t get worse, but wait…” Grab some popcorn, because Florida’s home insurance numbers are about to blow your mind. Home insurance premiums in Florida have soared up to $4,231 a year—almost three times the national average. And those sweet, sweet coastal views? Wind insurance has leaped 150% since 2021. (Yeah, a small fortune just to keep the breeze from your front yard from blowing your roof away.)

Flood insurance premiums have also gone off the rails thanks to FEMA’s new Risk Rating 2.0 program, which has driven up rates by 500% for high-risk areas. Translation: If you own a $300,000 home, your combined annual insurance in coastal areas could hit over $112,000 by 2025. I’m not making this up—someone actually ran those numbers, and they’re terrifying. To put this in perspective, that’s 20% of the average homeowner’s mortgage. So, not like a latte at Starbucks—more like buying the entire Starbucks franchise, annually.

Hedge Funds Swooping In: A Sneaky Land Grab?

Oh, but it doesn’t stop there. You’ve heard of hedge funds, right? They’re not just sticking to stocks anymore—they’re buying up beachfront properties in Florida like it’s a clearance sale. After every hurricane, these corporations swoop in, grab distressed properties at rock-bottom prices, and then build luxury condos that your average Floridian can’t even dream of affording.

In places like Fort Myers Beach, investment firms have snagged over 200 properties since Hurricane Ian. Two hundred! In Pensacola alone, one hedge fund now owns 12% of all beachfront properties. It’s like real-life Monopoly, but instead of you collecting $200 when you pass “Go,” they’re collecting properties left and right, turning entire neighborhoods into high-end resorts. So, yeah, even the Monopoly guy would raise an eyebrow at this.

So, Is Moving to Florida a Nightmare? (Maybe, Depends on How Much You Love Sand)

Okay, let’s be fair—Florida’s a mixed bag. Sure, the dreamy lifestyle of beach days and sunshine is as appealing as ever, but the financials? Yikes. I won’t say Florida’s completely “unlivable,” but it’s becoming suspiciously hard to afford unless you’re rolling in stacks of cash higher than a Category 5 hurricane wind gust. For middle-class homeowners, the crunch of rising insurance premiums, strict regulations, and developers outbidding everyone is making life down South real tricky.

So, what’s the play? Are you doomed if you’re considering Florida? Not necessarily—but you’ll need to be ridiculously well-informed and prepared for what’s coming. Here are some things you should think about before you hit “submit” on that Zillow offer:

- Location Matters—Like Really, REALLY Matters: Look for properties that are high enough in elevation to minimize risk. You don’t want to be the guy left holding a flooding property while all your tall land neighbors are sipping cocktails in peace.

- Insurance and Repairs Will Be Your New Hobby: Get ready to shop for—and pay—a lot for insurance. Multiple vendors, detailed policies, the works. Also, ensure your home is fortified to withstand the inevitable Cat 5 hurricanes. You know, your everyday stuff.

- Regulation Whiplash: FEMA’s rules and local building codes can change frequently, often NOT in favor of the homeowner. Keep an eye on them because you’ll need to be as agile as an ice skater in a snowstorm.

What Does This Mean for You?

It’s a wild ride, this Florida real estate game. Some homeowners are prospering by adapting, while others are losing properties or walking away entirely. Florida is set to change more dramatically in the next five years than it has in recent decades, and whether you want to simply live under its sunshine or invest in its growing complexity, knowing the rules of the new game is critical.

So, what do you think? Are you ready to put up with hurricanes, hedge funds, and insurance chaos for some sandy toes? Or are you spooked by the risks?

Let me know in the comments below! Your thoughts, stories, or dreams of beachfront property are always welcomed, whether you’re for the Gulf Coast life or retreating fast to higher, less windy grounds.

—

Hey, just before you go, think you’re ready for more crazy info like this? Hit that subscribe button and follow along for all things chaotic, real estate, and everything in between.

Revolutionizing Cancer Therapy: The Promise of Patient-Derived Organoids

Revolutionizing Cancer Therapy: The Promise of Patient-Derived Organoids

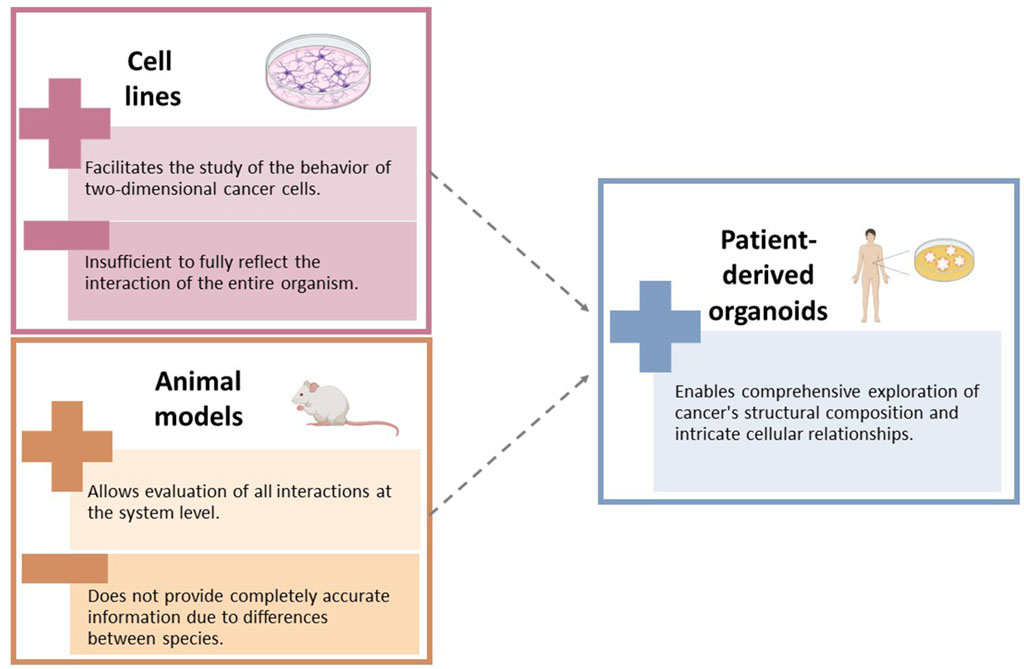

In a groundbreaking exploration published by Frontiers in Cell and Developmental Biology, the future of cancer therapy is being reshaped by patient-derived organoids (PDOs). These three-dimensional cell cultures, directly harvested from a patient’s tumor, are poised to transform drug development and personalized medicine.PDOs offer an unprecedented opportunity to replicate the complex structure and genetic makeup of cancers, providing a more accurate model for clinical drug screening and pharmacognostic assessment. Their ability to mimic the patient’s tumor environment allows researchers to predict treatment responses and facilitate novel drug discoveries, marking a significant advancement in oncology.

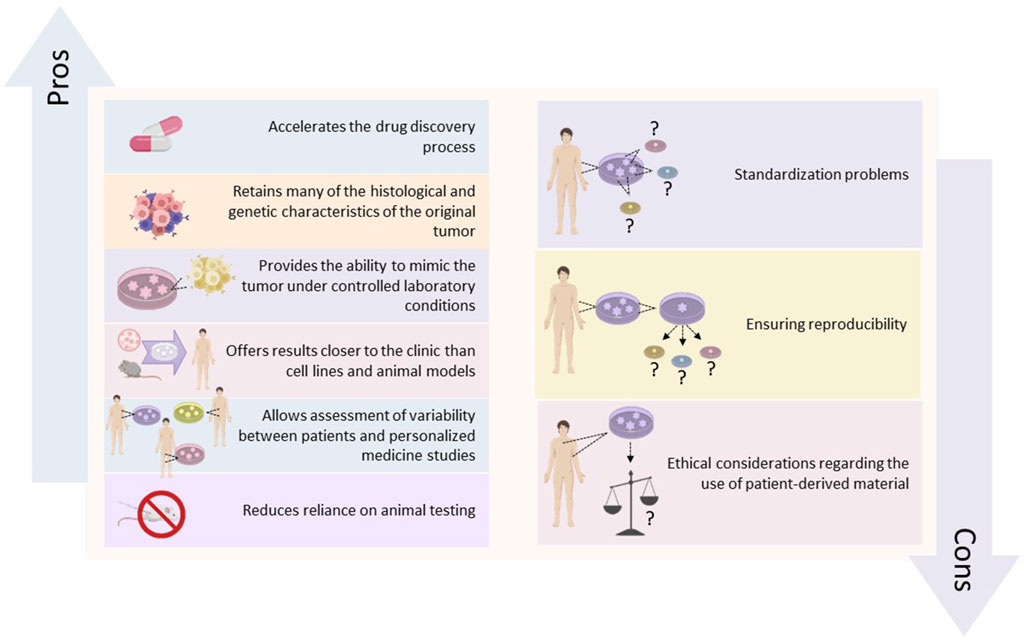

The Rise of Personalized Medicine

The integration of PDOs into personalized medicine is not just a trend but a necessity. By tailoring treatments to the individual genetic profiles of patients, these organoids are revolutionizing how clinicians approach cancer therapy. This shift towards a more personalized strategy is anticipated to enhance treatment efficacy while reducing side effects.However, the application of PDOs is not without challenges. Scaling up organoid cultures, ensuring consistent results, and addressing ethical concerns related to the use of patient-derived materials are significant hurdles that researchers must overcome. These challenges underscore the importance of a multidisciplinary approach, involving collaboration across fields such as oncology, biology, pharmacology, and ethics.

Technological Advancements

Recent biotechnological advancements have propelled the field of PDOs forward. Innovations in organoid culturing, such as the use of synthetic hydrogels and microfluidic systems, are enhancing the reproducibility and scalability of these models. Moreover, the integration of 3D bioprinting technology allows for the creation of complex structures that more accurately reflect the tumor microenvironment, including vascular networks crucial for studying anticancer drug effects.Despite these technological strides, the full potential of PDOs in cancer research is yet to be realized. The scientific community continues to address challenges related to cost, accessibility, and standardization to ensure broader adoption in research and clinical settings.

Future Perspectives

As the oncology landscape evolves, PDOs are set to play a pivotal role in the future of cancer treatment. They hold the promise of bridging the gap between preclinical studies and clinical outcomes, ultimately enhancing patient care worldwide. The continued investment in research and the development of robust regulatory frameworks will be crucial in overcoming current obstacles and unlocking the transformative potential of PDOs.For more insights into the potential of patient-derived organoids in drug development, visit the original article.

The AI Revolution in Dermatology: A Systematic Review

The AI Revolution in Dermatology: A Systematic Review

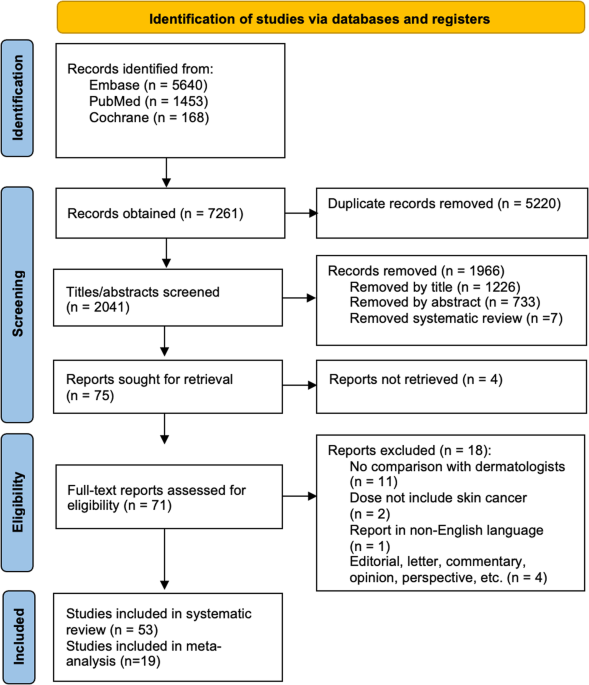

In a groundbreaking study published in Nature, researchers have delved into the burgeoning field of artificial intelligence (AI) in dermatology, specifically examining its role in diagnosing skin cancer. The study, titled “A Systematic Review and Meta-Analysis of Artificial Intelligence Versus Clinicians for Skin Cancer Diagnosis,” offers a comprehensive look at how AI stacks up against human clinicians in this critical area of healthcare.The research highlights a significant trend: AI is rapidly becoming a valuable tool in dermatology, offering diagnostic capabilities that rival those of experienced dermatologists. The study’s findings are based on a meticulous systematic review and meta-analysis of numerous studies that compare AI algorithms with clinicians in diagnosing skin cancer.

AI’s Diagnostic Performance

The study reveals that AI algorithms demonstrate comparable sensitivity and specificity to dermatologists. This finding is particularly noteworthy as it suggests that AI can serve as an effective diagnostic aid, especially for non-expert clinician groups. In fact, when AI-assisted tools were employed, there were significant improvements in diagnostic accuracy for these groups.This comprehensive analysis underscores the potential of AI to enhance diagnostic precision, a crucial factor in early skin cancer detection. The implications are profound, suggesting that AI could play a pivotal role in improving healthcare outcomes for patients worldwide.

Implications for Clinical Practice

While the study affirms AI’s effectiveness in clinical settings, it also emphasizes the need for further prospective, real-world evaluations. These evaluations are essential to substantiate AI’s practical application in dermatological diagnostics. The integration of AI into clinical practice could aid less experienced practitioners, providing them with the tools to make more accurate diagnoses and ultimately improve patient care.For more detailed insights, the full study is accessible here.

Future Prospects

As AI continues to evolve, its role in dermatology is expected to expand. The study’s findings pave the way for further research and development in AI-assisted diagnostic tools, which could revolutionize the field of dermatology. The potential for AI to assist in early detection and treatment of skin cancer is immense, promising a future where technology and healthcare work hand in hand to save lives.

Conclusion

This study marks a significant milestone in the integration of AI into dermatological practice. By demonstrating AI’s potential to match, and in some cases, enhance the diagnostic skills of human clinicians, it sets the stage for a future where AI is an indispensable part of medical diagnostics.For further reading, explore the references cited in the study: Reference 1, Reference 2, Reference 3, and Reference 4.

“`

The Fast Lane to Fully Autonomous Vehicles: Industry Innovations and Future Prospects

Industry Insights: What’s New in Autonomous Driving?

The automotive world is abuzz with announcements from major players like Tesla, Rimac, Renault, and Nissan, each unveiling plans to introduce autonomous vehicles in the near future. Tesla’s much-anticipated “CyberCab” is set for an October 2024 debut, while Rimac and Renault are gearing up for releases in 2026. Nissan’s ambitious rollout of autonomous-drive mobility services by 2027 aims to serve both urban and rural areas in Japan.Understanding the Levels of Automation

The journey towards fully autonomous vehicles is marked by progressive levels of automation, each reducing the need for human intervention. Here’s a brief overview:- Level 1 to Level 2: Systems assist with steering and acceleration/braking, but drivers must remain vigilant.

- Level 2 to Level 3: Vehicles can handle all driving tasks under specific conditions, with drivers ready to take over if needed.

- Level 3 to Level 4: Cars manage all functions independently within defined areas, though manual control is still possible.

- Level 5: Full automation is achieved, eliminating the need for human intervention entirely.

Key Players and Technological Advancements

In 2024, a significant majority of vehicles in Europe and America will feature Level 1 autonomous driving capabilities. Car manufacturers are focusing on developing Level 2 and Level 3 vehicles, with companies like BMW, Hyundai-Kia, and Stellantis leading the charge. Meanwhile, tech giants such as Google and Amazon are also making strides in the autonomous vehicle market, often through strategic partnerships and joint ventures.Transforming Vehicle Interiors

As autonomous technology advances, the interior of vehicles is undergoing a remarkable transformation. FORVIA, a leader in automotive technology, is pioneering innovations to enhance safety, comfort, and personalization in autonomous vehicles. From smart surfaces and innovative interfaces to full cabin infotainment systems, the focus is on creating an experience akin to a mobile living room.Global Collaborations and Regulatory Progress

The development of autonomous vehicles is a global effort, with manufacturers forming alliances to share technology and mitigate costs. Regions like Asia are heavily investing in infrastructure to support autonomous vehicles, while states such as California and Arizona in the U.S. provide flexible regulatory environments for testing.Regulatory frameworks are crucial for the safe deployment of these technologies. Countries like Germany and states in the U.S. are paving the way with laws that permit real-world testing and operation of Level 4 autonomous vehicles, setting the stage for broader adoption.

Futureproofing for Insurers: The Role of AI and Hyper-Personalization

Futureproofing for Insurers: The Role of AI

In a rapidly evolving industry, insurance companies are turning to artificial intelligence (AI) and hyper-personalization to stay ahead of the curve. As noted in a recent article from PropertyCasualty360, these technological advancements are reshaping how insurers engage with customers, assess risks, and enhance operational efficiency.AI and Customer Engagement

By leveraging AI-driven insights, insurers can now customize policies to align with the unique needs of their clients. This shift towards hyper-personalization not only fosters stronger customer loyalty but also enhances satisfaction through personalized coverage options and real-time adjustments.

The Importance of Decision Platforms

While the potential of AI is vast, experts emphasize the need to operationalize these technologies effectively through decision-making platforms. This approach ensures that AI delivers tangible benefits rather than being overshadowed by trendy terms like generative AI.

Modernization and Hyper-Personalization

The trend of modernization within the insurance sector is being driven by AI, with a notable shift towards hyper-personalization. This approach allows insurers to better meet customer expectations, ultimately improving satisfaction and loyalty.

As the industry continues to evolve, the integration of AI and personalization strategies will be crucial for insurers aiming to futureproof their operations and maintain a competitive edge.

Revolutionizing Healthcare: The Power and Potential of AI

AI’s Role in Healthcare

AI technology offers a multitude of benefits, from enhancing patient outcomes to reducing healthcare costs and improving population health. Its application ranges from preventive screenings to complex diagnostic procedures, marking a new era in medical care.Preventive Care and Diagnosis

In the realm of preventive care, AI is making significant strides. For instance, cancer screenings utilizing radiology, such as mammograms, can leverage AI to deliver faster and more accurate results. The Mayo Clinic has demonstrated AI’s prowess in automating labor-intensive tasks, like analyzing kidney images for polycystic kidney disease, reducing the time from 45 minutes to mere seconds.Risk Assessment and Chronic Disease Management

AI’s capabilities extend to risk assessment, particularly in cardiology. A study by Mayo Clinic revealed AI’s success in identifying individuals at risk of left ventricular dysfunction, a condition often without symptoms. This highlights AI’s potential in predicting diseases and guiding early interventions.AI’s Impact on Efficiency and Accuracy

AI is not only about speed but also accuracy. In some cases, AI has outperformed traditional methods in predicting outcomes, such as survival rates in malignant mesothelioma cases. It also plays a crucial role in identifying colon polyps, enhancing the accuracy of colonoscopies.Supporting Healthcare Professionals

While AI offers remarkable efficiency, it complements rather than replaces healthcare professionals. The American Medical Association emphasizes “augmented intelligence,” where AI assists in routine tasks, allowing practitioners to focus on more critical aspects of patient care.Challenges and Future Directions

Despite its promising potential, AI in healthcare is not without challenges. Issues like bias and misinformation necessitate effective regulation. The Health AI Partnership aims to address these concerns, ensuring AI’s equitable and safe integration into healthcare.Looking ahead, AI could transform medical practices by selecting patients for clinical trials, developing remote health-monitoring devices, and predicting disease risks years in advance. As Mayo Clinic continues to explore AI’s capabilities, the future of healthcare looks promisingly intelligent.

Exploring the Top Real Estate Trends of 2024

Exploring the Top Real Estate Trends of 2024

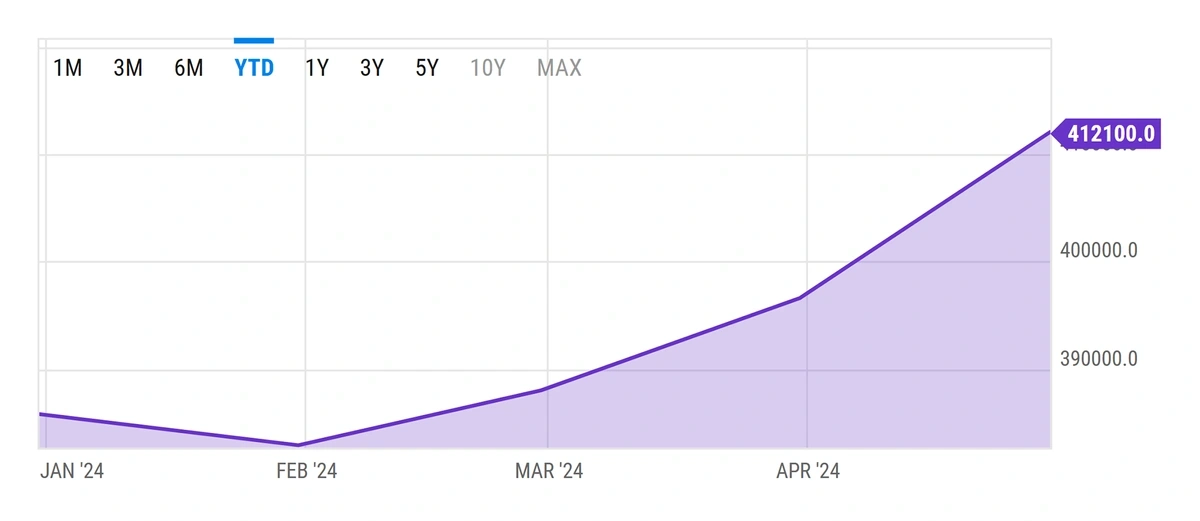

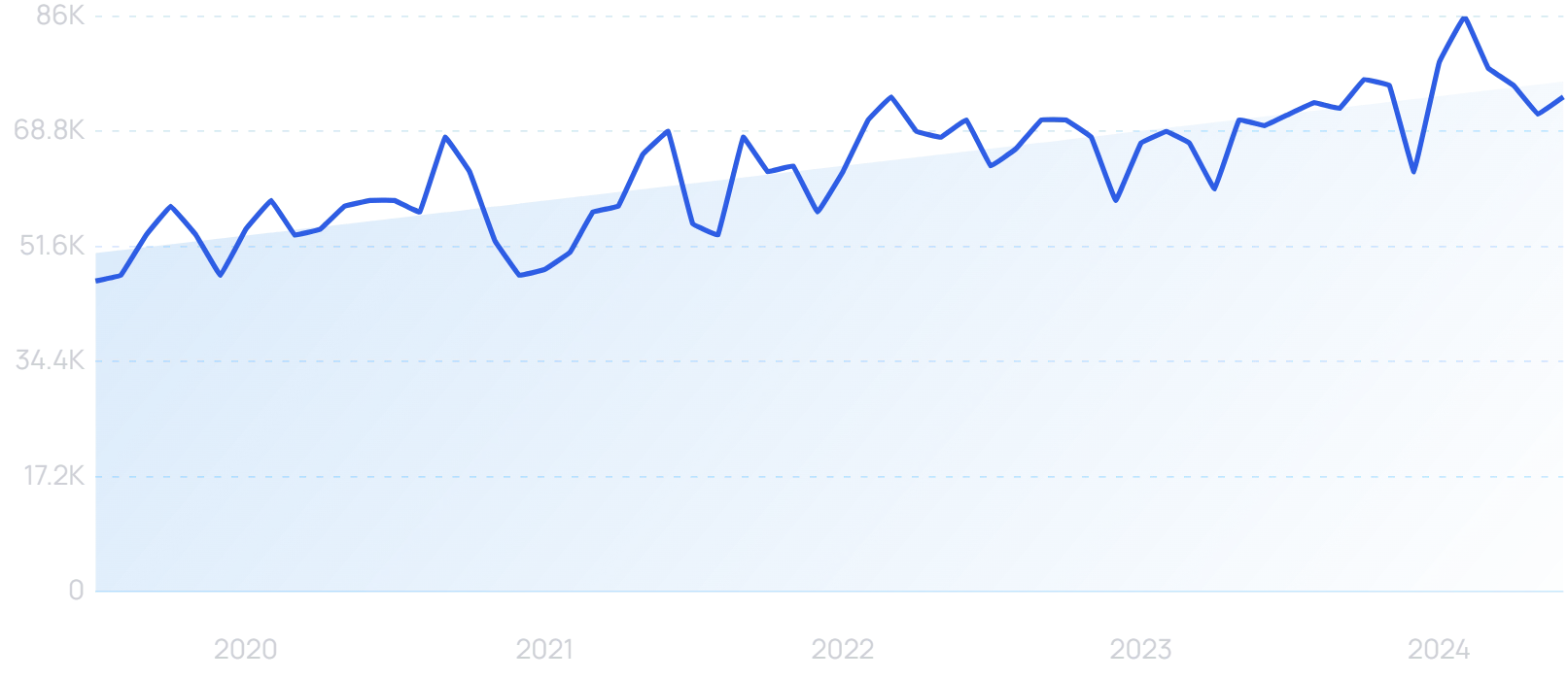

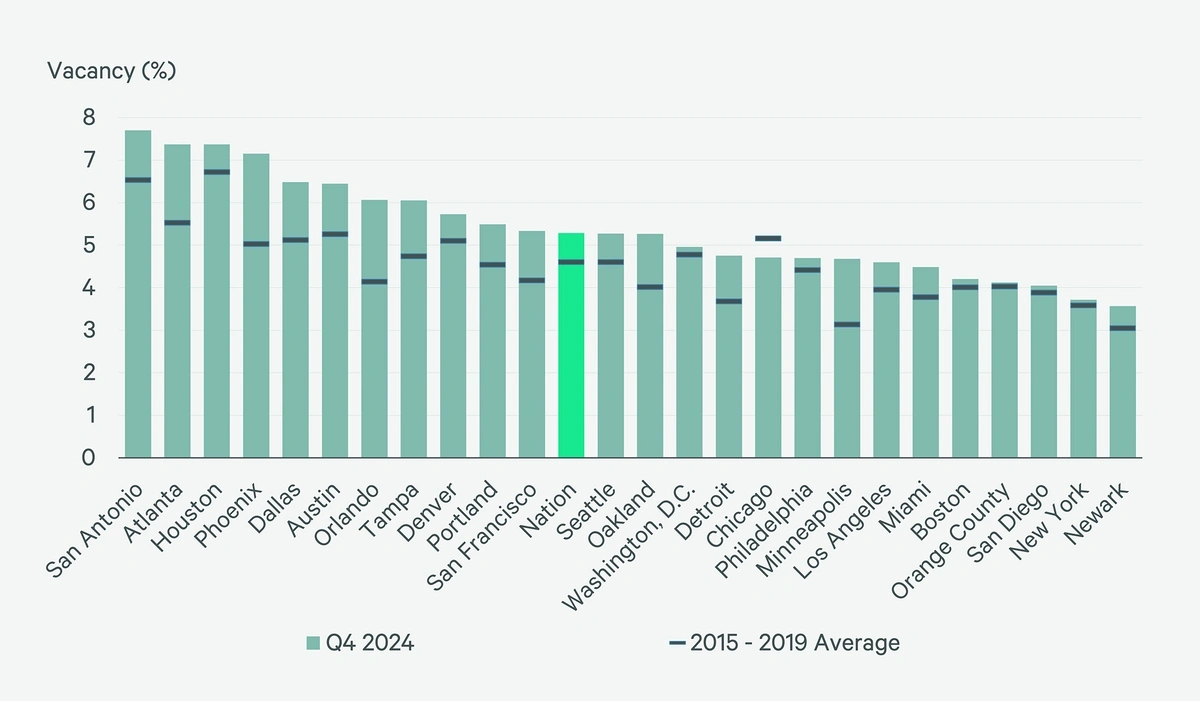

As we navigate the ever-evolving landscape of real estate, 2024 presents a fascinating array of trends that are reshaping the industry. According to a comprehensive report by Exploding Topics, nine pivotal trends are poised to redefine the market over the next 18-24 months.1. Home Prices Continue to Climb

The quest for single-family homes is driving prices skyward, with a staggering 43% increase over the past four years. This surge, while beneficial for existing homeowners, poses significant challenges for first-time buyers. The average US homeowner saw a 9.6% equity increase last year, adding $1.5 trillion collectively. However, a cooling trend is emerging, as median prices declined in early 2024.

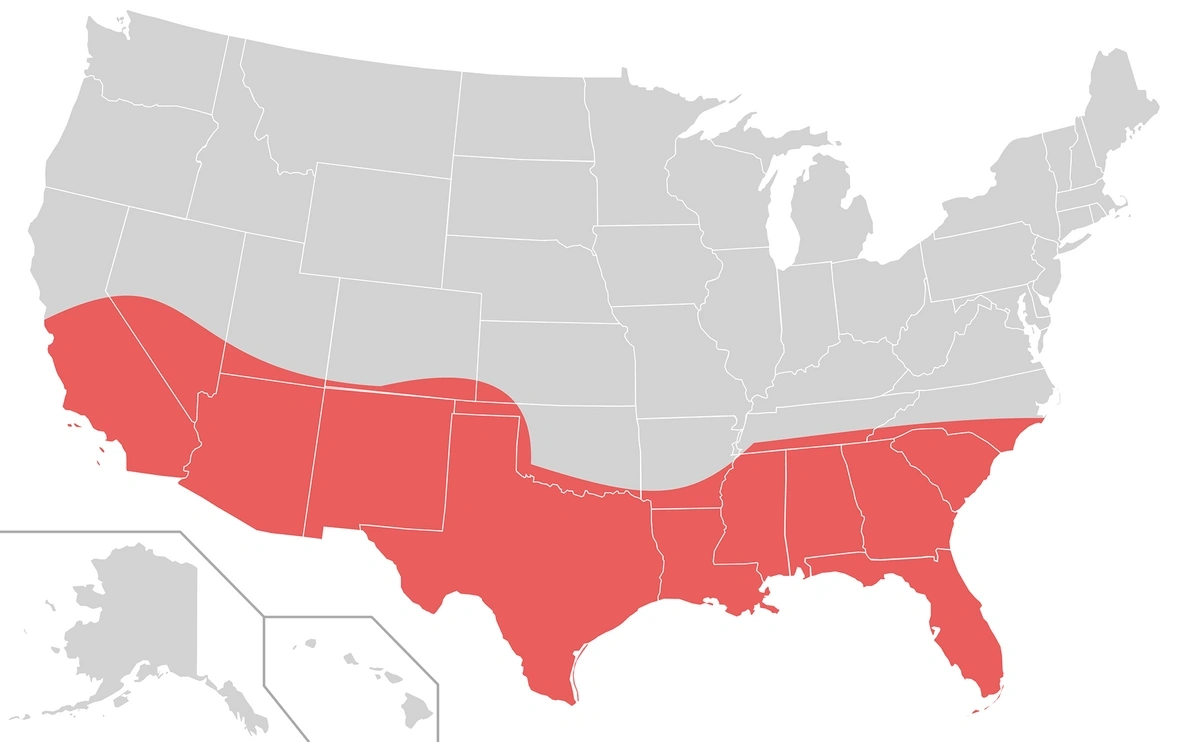

2. The Sun Belt’s Rising Popularity

The Sun Belt, stretching from California to North Carolina, is experiencing a population boom. With 80% of the nation’s growth concentrated here, the region’s appeal is undeniable. Lower taxes and affordable housing are drawing both retirees and young professionals. Cities like Dallas and Tampa are now among the top ten US cities for real estate potential.

3. Digital-First House Hunting

The digital transformation of real estate is in full swing. Virtual tours, drone videos, and online staging are revolutionizing how buyers interact with properties. The National Association of Realtors highlights that the internet is the starting point for 41% of buyers, underscoring the shift to digital-first strategies.

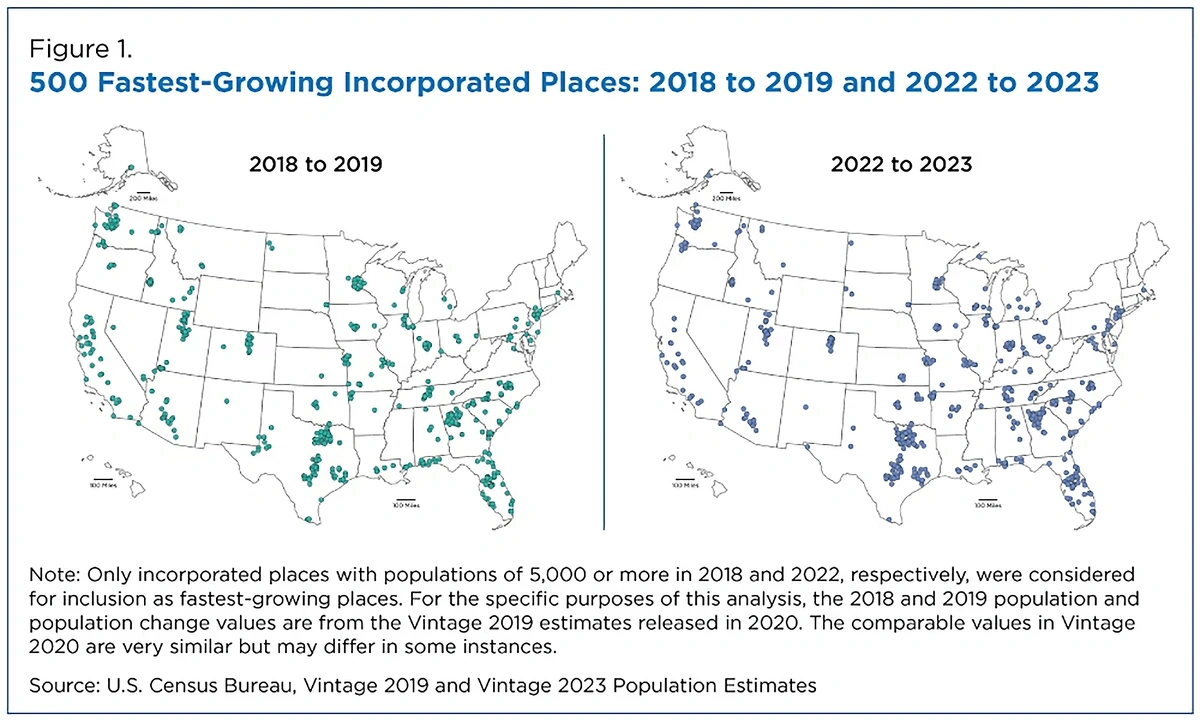

4. Movement from Cities to Suburbs

The suburban migration continues, driven by affordability and remote work flexibility. The US Census Bureau reports a significant shift towards smaller cities and suburbs, with “middle neighborhoods” offering a blend of suburban and urban amenities.

5. Single-Family Housing Demand Creates Shortages

The demand for single-family homes is outpacing supply, with a gap of over 7 million homes since 2012. This shortage is exacerbated by millennials entering the housing market and institutional investors purchasing a significant share of available homes.

6. Multi-Generational Living on the Rise

Economic pressures and cultural shifts are driving an increase in multi-generational households. This trend is particularly notable among immigrant communities and is reshaping the housing landscape.7. Mortgage Rates Remain High

Mortgage rates, which once hit record lows, have climbed to around 7% in 2024. This rise is making home buying more expensive and impacting monthly payments for variable-rate mortgages. Fannie Mae forecasts a slight decrease in rates over the coming years.8. Decline in the Rental Property Market

The rental market in major cities is experiencing a downturn as more people seek homeownership or alternative living arrangements. However, mid-size and smaller cities are witnessing rising rental demand as housing supply struggles to keep up.9. Commercial Real Estate in Flux

Changing work patterns continue to impact commercial real estate. While office vacancies are high, opportunities are emerging in retail and multi-family properties. Moody’s Analytics notes a positive trend in neighborhood shopping centers.

Conclusion As these trends unfold, they present both challenges and opportunities within the real estate market. While high prices and mortgage rates may deter some buyers, the shifts to digital platforms and suburban living offer new avenues for growth and investment. For more insights, explore the full report on Exploding Topics.

The Rapid Evolution of Telehealth Under Medicare

The Rapid Evolution of Telehealth Under Medicare

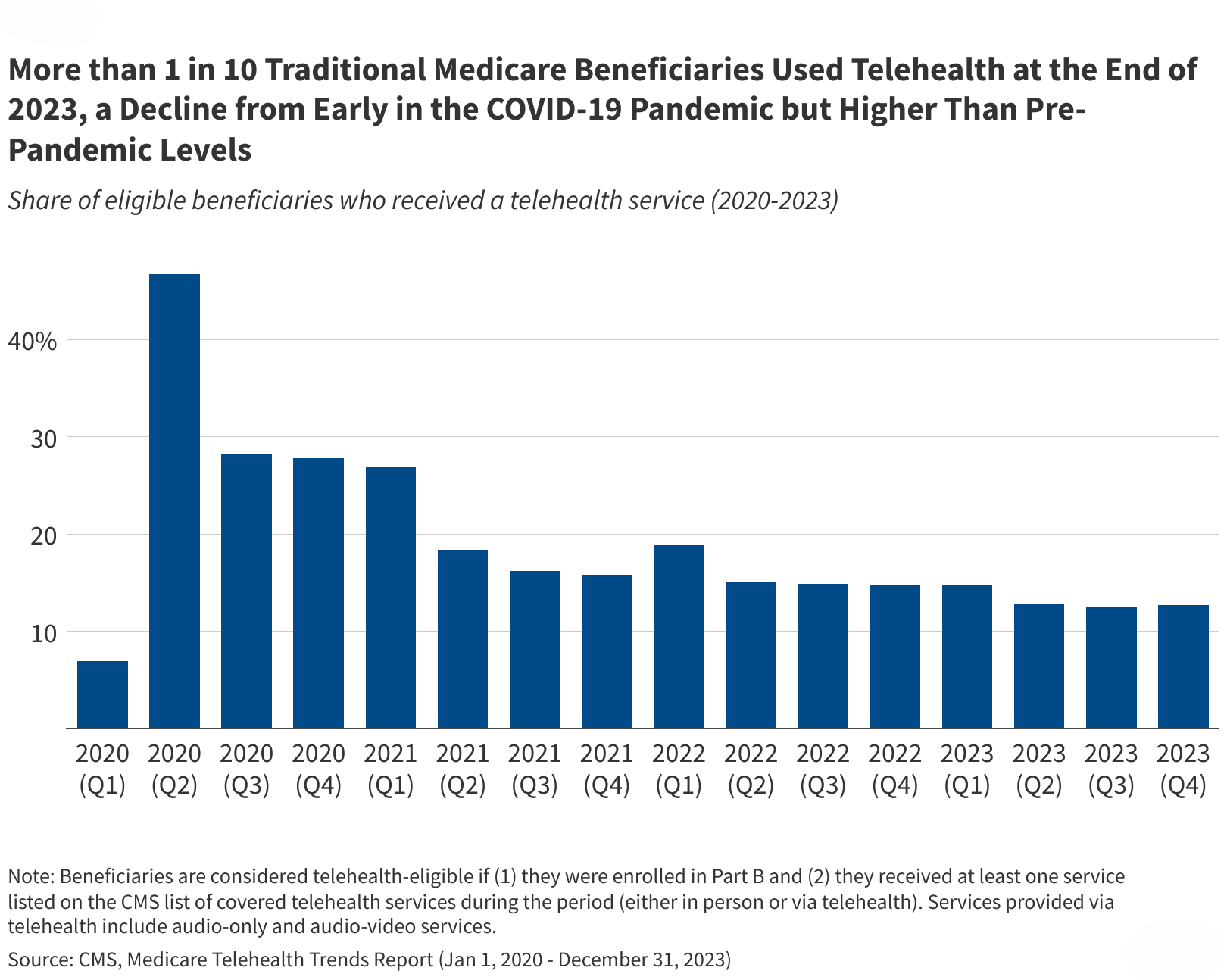

The landscape of healthcare has dramatically shifted in recent years, with telehealth emerging as a key player in the delivery of medical services. This transformation has been particularly evident in the realm of Medicare, where telehealth has seen a significant uptick in utilization. The Kaiser Family Foundation recently highlighted this trend, noting the legislative changes and policy shifts that have facilitated the growth of telehealth services for Medicare beneficiaries.

The landscape of healthcare has dramatically shifted in recent years, with telehealth emerging as a key player in the delivery of medical services. This transformation has been particularly evident in the realm of Medicare, where telehealth has seen a significant uptick in utilization. The Kaiser Family Foundation recently highlighted this trend, noting the legislative changes and policy shifts that have facilitated the growth of telehealth services for Medicare beneficiaries.

The Pandemic’s Role in Telehealth Expansion

Prior to the onset of the COVID-19 pandemic, telehealth was a relatively niche service within Medicare, primarily available to those in rural settings. However, the public health emergency necessitated rapid adaptation, leading to a dramatic increase in telehealth utilization. Temporary measures were introduced, allowing for broader access and coverage, as detailed in the Medicare Telehealth Report. These changes not only increased access but also highlighted the potential of telehealth to address healthcare disparities.Legislative Measures and Future Prospects

With the official end of the COVID-19 public health emergency on May 11, 2023, Congress faces the challenge of deciding the future of these telehealth flexibilities. There is bipartisan support for extending these measures, as seen in proposed legislation like the Preserving Telehealth, Hospital, and Ambulances Act. However, the majority of these flexibilities are set to expire by December 2024, prompting ongoing discussions about the potential for permanent expansion.Demographic Disparities in Telehealth Usage

The adoption of telehealth services varies significantly across different demographics. Urban areas have seen higher rates of telehealth use compared to rural regions, likely due to disparities in broadband access and communication technologies, as noted in a Brookings article. Additionally, usage is higher among Asian, Pacific Islander, and Hispanic beneficiaries, suggesting that telehealth may play a role in improving access to care for certain groups.The Financial Implications

Medicare’s payment structure for telehealth services has also evolved, with current rates matching those of in-person visits. This parity is crucial for encouraging providers to invest in telehealth infrastructure. However, questions remain about the long-term financial impact on the Medicare program. The Congressional Budget Office has estimated the cost of extending telehealth flexibilities, and ongoing research is needed to assess the balance between increased spending and potential savings from reduced emergency department visits and improved medication adherence.Ensuring Program Integrity

As telehealth becomes more entrenched in the Medicare landscape, concerns about program integrity and potential fraud have arisen. Despite some high-profile cases, investigations have shown minimal evidence of widespread misuse. Recommendations from the MedPAC include increased scrutiny of outlier billing patterns and in-person visit requirements for high-cost services.In conclusion, while telehealth has proven to be a valuable tool for expanding access to healthcare, its future within Medicare remains uncertain. The ongoing legislative discussions will determine whether the current flexibilities will become a permanent fixture, shaping the healthcare landscape for years to come.

The Rise of Central Bank Digital Currencies: Reshaping Global Finance

Understanding the Emergence of Central Bank Digital Currencies

Central bank digital currencies (CBDCs) are reshaping the financial landscape, emerging as a pivotal innovation in the digital age. Unlike decentralized cryptocurrencies, CBDCs are digital forms of a nation’s fiat currency, issued and regulated by central banks. This distinction ensures stability and trust, akin to traditional money.Exploration and Implementation

Around the globe, countries are actively exploring the integration of CBDCs into their financial systems. This forward-thinking move aims to enhance financial inclusion, streamline cross-border transactions, and provide a stable alternative to the volatile cryptocurrency market. Nations such as Jamaica, Nigeria, and The Bahamas have already implemented CBDCs, signaling a new era in digital finance. These currencies maintain the core attributes of fiat money while leveraging the efficiencies of distributed ledger technologies.:max_bytes(150000):strip_icc()/terms_c_central-bank-digital-currency-cbdc_FINAL-671aefb2905b407583007d63fa46e49d.jpg)

Key Advantages of CBDCs

CBDCs offer a myriad of benefits. For consumers, they promise enhanced convenience and security in financial transactions, reducing dependence on physical cash. Central banks, meanwhile, gain a powerful tool to implement monetary policies, manage inflation, and establish direct connections with the public. Additionally, CBDCs can bolster the global standing of a nation’s currency, exemplified by the enduring influence of the U.S. dollar.Challenges and Considerations

The path to widespread CBDC adoption is not without its challenges. Concerns about privacy, cybersecurity, and the impact on existing financial systems are paramount. These issues must be addressed to prevent potential destabilization of current monetary frameworks. As highlighted in the original article, the balance between innovation and stability is crucial.The Way Forward

Despite these hurdles, the move towards digital currencies marks a transformative phase for global economies. As more countries embark on pilot programs and develop the necessary technological infrastructure, the financial landscape continues to evolve. This evolution promises a more inclusive and efficient future for transactions and economic operations worldwide.For a deeper dive into the intricacies of CBDCs and their global impact, visit the comprehensive exploration available at Investopedia. “`

Navigating Real Estate Tactics: Protecting Your Interests

Tricks Real Estate Agents Play

Real estate transactions often involve significant sums of money, making them prime targets for unscrupulous tactics. Here are some of the most common strategies that both buyers and sellers should watch out for:1. Convincing Homeowners to Sell Off Market

Some agents may persuade homeowners to sell their property off market. This tactic is often aimed at properties that need updates or renovations. By convincing the seller to avoid listing the property, the agent can facilitate a private sale to an investor, often at a price substantially lower than market value—sometimes 20% to 40% less. This allows the investor to reap the profits that rightfully belong to the seller.2. Overpromising on the Listing Price

Agents may exaggerate the potential selling price of a property to secure a listing. This can lead to homes languishing on the market, eventually selling for less than their true value. Sellers should be cautious and seek multiple opinions on their property’s worth.3. Underquoting

Conversely, underquoting involves listing a property at a price much lower than its expected selling price to attract more buyers. This can create a competitive bidding environment, driving up the final sale price. Buyers should be aware that initial quotes might be 10% to 25% below the actual selling price.4. Vague Pricing

Some agents use vague pricing to gauge buyer interest and encourage competitive bidding. This tactic can mislead buyers, who should insist on clear and transparent pricing information.5. Tactical Fear of Loss

Creating a sense of urgency is another common strategy. Agents may suggest that other buyers are interested in the property, triggering a Fear of Missing Out (FOMO) response. Buyers should remain calm and evaluate their options carefully to avoid making hasty decisions.6. Inflated Rental Estimates

Agents might provide overly optimistic rental income projections to make a property appear more attractive to investors. Buyers should conduct their own research to verify these estimates and avoid relying solely on the agent’s figures.7. Pre-Auction Offers

Encouraging pre-auction offers can be a tactic to gauge a buyer’s willingness to pay. Buyers should be cautious about revealing their maximum price too early and understand the vendor’s motivations.8. Rental Guarantees

Offering a rental guarantee can be a red flag, indicating potential issues with the property or its market demand. Buyers should question the necessity of such guarantees and investigate further.9. Emotional Appeal

Agents may use emotional tactics to connect with buyers, making them more likely to overlook practical considerations. It’s important for buyers to focus on the property’s value and suitability rather than getting swayed by emotional pitches.The Importance of Choosing the Right Agent

Selecting a trustworthy real estate agent is crucial to avoid falling victim to these tactics. Look for agents with the right qualifications, recent experience, outstanding reviews, and a lower-than-average number of dual agency transactions. Ensure there is an easy way to cancel the agent agreement if needed.Advice for Buyers and Sellers

- Do Your Research: Whether buying or selling, conduct thorough research on property values, market trends, and agent reputations.

- Seek Multiple Opinions: Don’t rely on a single agent’s assessment. Get multiple evaluations to ensure a fair understanding of the property’s worth.

- Stay Informed: Educate yourself about common real estate practices and tactics to make informed decisions.

- Engage Professionals: Consider hiring a buyer’s agent or valuer to provide additional protection and ensure a fair deal.

Additional Insights from Resources

- Triple Commission Proposal: Be wary of agents who might be influenced by investors offering higher commissions to secure off-market deals.

- Hidden Offers: Some agents may hide competing offers to favor buyers they have personal connections with.

- Manipulating Offer Timelines: Delayed responses to offers can be a tactic to create pressure or manipulate negotiations.

- Bait Pricing: Listing properties at low prices to generate interest, only to drive the sale price much higher.

- Phantom Offers: Fabricating non-existent offers to pressure buyers into higher bids or quicker decisions.

- Pressure Tactics: High-pressure sales tactics may create a false sense of urgency, pushing buyers into hasty decisions.

- Omitting Crucial Information: Withholding important property details can leave buyers unaware of potential problems.

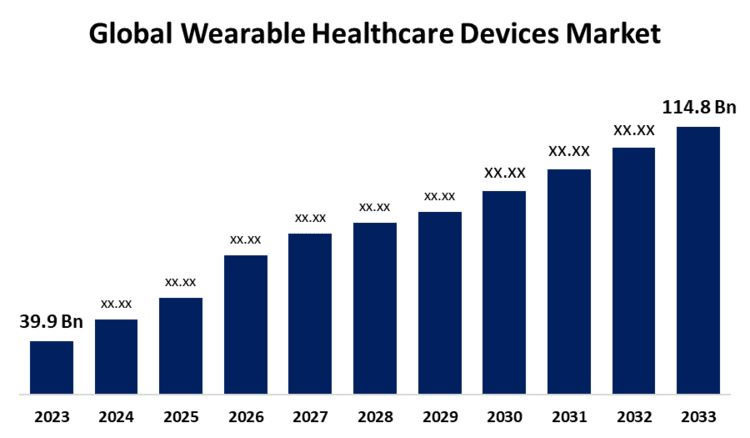

Global Surge in Wearable Healthcare Devices Market

Global Surge in Wearable Healthcare Devices Market

The global wearable healthcare devices market is on a remarkable growth trajectory, projected to escalate from USD 39.9 billion in 2023 to an impressive USD 114.8 billion by 2033. This surge, at a compound annual growth rate (CAGR) of 11.15%, underscores the increasing demand for proactive health management and advancements in sensor technology.Wearable healthcare devices, including smartwatches and trackers, have become essential tools for individuals eager to monitor and manage their health proactively. These devices are more than just fitness trackers; they offer a multitude of functions such as heart rate monitoring, smartphone notifications, and integration with third-party applications. However, the continuous health monitoring they provide raises significant concerns about the security and privacy of sensitive health data.

Market Segmentation and Trends

The market is categorized by product types, applications, and distribution channels. Smartwatches are anticipated to lead the product segment, while the general health and fitness application segment is expected to dominate due to the growing focus on real-time health monitoring. E-commerce emerges as the leading distribution channel, facilitating the availability of these devices through digital platforms.Geographical Insights

North America holds the largest market share, driven by favorable reimbursement laws, high per capita spending on advanced technologies, and significant investments by market players. Meanwhile, the Asia-Pacific region is expected to experience the fastest growth, propelled by initiatives to reduce patient hospital stays in countries like China, Japan, and India.Competitive Landscape