Exploring the Intersection of AI and Patient-Centered Care

Exploring the Intersection of AI and Patient-Centered Care

In a groundbreaking study published in BMC Medical Ethics, researchers have delved into the public’s perception of artificial intelligence (AI) in healthcare, spotlighting both ethical concerns and potential opportunities for enhancing patient-centered care. As AI continues to permeate various facets of medical practice, understanding its impact on patient trust and decision-making has become increasingly critical.AI in Healthcare: A Double-Edged Sword

The study, conducted by researchers from Florida Atlantic University and the University of South Florida, surveyed 600 adults in Florida to gauge their comfort levels with AI in healthcare tasks. The findings reveal a complex relationship between AI integration and patient trust. While AI is seen as a tool that could potentially improve efficiency and support medical professionals, there is a palpable concern about losing the “human touch” in patient care.Interestingly, the study found that while 84.2% of respondents felt comfortable with AI handling administrative tasks, such as scheduling appointments, only 33.7% were comfortable with AI administering medications. This dichotomy underscores the need for careful integration of AI into healthcare settings, ensuring it complements rather than replaces human interaction.

Trust and Autonomy: Key Concerns

One of the study’s critical insights is the public’s apprehension about AI’s role in clinical decision-making. Many participants expressed discomfort with AI making autonomous medical decisions, highlighting a broader concern about maintaining patient autonomy and consent. As AI technologies advance, the study suggests that incorporating informed consent procedures and clearly communicating the benefits and risks of AI to patients could enhance trust and acceptance.Regulation and Ethical Guidelines: A Call to Action

Despite AI’s potential to revolutionize healthcare, the study emphasizes the urgent need for regulation and ethical guidelines. Without clear oversight, the integration of AI could inadvertently undermine patient-centered care principles. The researchers advocate for a framework that includes transparency, accountability, and patient choice, ensuring AI’s role in healthcare aligns with ethical standards.Opportunities for Equitable Care

Beyond the challenges, the study also highlights opportunities for AI to contribute to more equitable healthcare. By eliminating biases and supporting data-driven decisions, AI has the potential to enhance patient outcomes and reduce disparities. However, this potential can only be realized if AI systems are designed with patient values and preferences in mind.For those interested in exploring the full findings and methodology of this study, the original article is accessible on BMC Medical Ethics. The data, publicly released on September 6, 2023, is available on the University of South Florida’s webpage.

Conclusion

As AI continues to shape the future of healthcare, this study serves as a crucial reminder of the importance of balancing technological advancements with ethical considerations. By prioritizing patient-centered care and addressing public concerns, the medical community can harness AI’s potential to improve healthcare delivery while preserving the essential human elements of care.More Articles

Getting licensed or staying ahead in your career can be a journey—but it doesn’t have to be overwhelming. Grab your favorite coffee or tea, take a moment to relax, and browse through our articles. Whether you’re just starting out or renewing your expertise, we’ve got tips, insights, and advice to keep you moving forward. Here’s to your success—one sip and one step at a time!

The Transformation of Real Estate in India Due to Remote Work

The Transformation of Real Estate in India Due to Remote Work

The real estate sector in India is experiencing a profound transformation, driven by the rise of remote working. As professionals embrace flexibility, their preferences for living spaces have evolved, impacting both residential and commercial real estate dynamics.

Introduction to Remote Working Trends

Remote working, once a necessity during the pandemic, has become a permanent fixture in India. According to a 2022 survey by TeamLease, 58% of Indian employees prefer hybrid working models. This shift is altering how individuals select their living spaces, significantly impacting real estate investment.

Residential Property Trends

Homebuyers now seek larger living spaces that can comfortably accommodate home offices. A report by Knight Frank highlights that over 70% of buyers consider a home office essential. Additionally, access to high-speed internet and green spaces has become critical.

Suburban and Rural Migration

Remote working has encouraged a move away from urban centers in favor of suburban and rural areas, driven by affordability and quality of life. For instance, housing prices in Pune have surged by 12% year-on-year as remote workers seek spacious homes.

Commercial Real Estate Shifts

Companies are re-evaluating their office space needs, leading to increased demand for co-working spaces and flexible offices. JLL predicts a 30% annual growth in such spaces, reflecting the new workplace landscape.

Technological Integration

Digital advancements are streamlining real estate operations, offering online platforms for transactions and virtual property tours. Investors are increasingly leveraging data analytics to identify market opportunities.

Investment in Home Offices

With the necessity for home office design, investment opportunities have arisen in ergonomic furniture and workspace solutions, spurred by potential company cost-savings.

Impact on Urban Development

Long-term effects of remote work include a shift towards mixed-use developments and the decentralization of urban areas, promoting sustainable growth and improved quality of life.

Conclusion

As remote working continues to reshape real estate investment in India, stakeholders must stay informed of evolving market dynamics. Flexible and comfortable living options will drive future property values and investment yields. Understanding these trends is crucial for capitalizing on the new real estate opportunities in India.

For more insights, refer to the original article on Times Property.

The Shifting Landscape of Commercial Real Estate in 2025

The Shifting Landscape of Commercial Real Estate in 2025

The commercial real estate sector is bracing for a tumultuous year ahead, as it navigates the unpredictable waters of economic uncertainty and fluctuating interest rates. Recent insights from Deloitte shed light on the challenges and opportunities facing the industry in 2025.As noted in the Deloitte article, the sector is grappling with high interest rates, a situation compounded by recent decisions from major financial institutions. The European Central Bank’s rate cut, as reported by Daniel Cunningham, was met with cautious optimism, signaling potential relief for investors. Similarly, the Bank of England’s first rate cut since 2020, covered by Eshe Nelson, marks a pivotal shift in monetary policy.

Global Economic Forecasts and Their Implications

The global economic outlook remains a critical focus, with reports like those from Ira Kalish providing a comprehensive view of potential market trajectories. In the United States, the Federal Reserve’s stance, as detailed by Jeanna Smialek in The New York Times, suggests a possible rate cut in September if inflation trends remain favorable.Regional Outlooks: Europe and Asia-Pacific

In Europe, the real estate sector faces unique challenges, particularly with the looming maturity wall. As highlighted by Matthew Toma, the European real estate maturity wall poses a significant hurdle, though strategies involving legal finance offer potential solutions.Meanwhile, the Asia-Pacific region contends with a debt funding gap, as noted by CBRE. This gap underscores the need for innovative financing solutions to sustain growth in the region’s real estate markets.

Looking Ahead

The commercial real estate industry must remain agile, adapting to the evolving economic landscape and leveraging opportunities presented by shifts in monetary policy. As the sector braces for what lies ahead, insights from industry leaders and economic forecasts will be instrumental in guiding strategic decisions.Real Estate Investment Insights for International Buyers in the U.S.

Real Estate Investment Insights for International Buyers in the U.S.

The allure of U.S. real estate as a lucrative investment draws interest from international buyers. However, non-resident individuals must navigate complex U.S. tax laws and carefully choose suitable holding structures to maximize their investment and minimize risk.

Understanding U.S. Taxes:

Estate Tax Considerations: Foreign investors should be aware that owning U.S.-based property could subject them to the estate tax. Non-resident aliens (NRAs) are taxed progressively up to 40%, with an exemption only on the first $60,000 of property value. Example: Roberto, an Argentinian citizen, owns a property in Miami worth $8 million. Upon his death, his estate could face taxes of approximately $3 million unless the property is held through a foreign corporation. Capital Gains Tax: When selling U.S. real estate, NRAs face capital gains taxes, influenced by factors like ownership duration and structure. A direct owner benefits from a 20% tax rate on gains held over a year, whereas a foreign corporation incurs a 21% rate, which offers added estate tax protection. Example: If Roberto sells his property, he could encounter around $600,000 in taxes on a $3 million gain, realizing slight savings if structured under a corporate entity. Income Tax on Rentals: Rental income attracts U.S. taxation, typically at a 30% withholding rate on gross income for NRAs and foreign corporations. Opting for it as business income allows using common deductions, applying ordinary rates to net income.Strategic Considerations:

Liability Protection: It’s advisable to use a Limited Liability Company (LLC) or similar entity to shield personal assets from property-related liabilities. While an LLC provides asset protection, it requires additional planning to avoid estate taxes. Succession Planning: Efficient property transference after an owner’s death avoids extensive probate processes. Using foreign corporations or trusts can facilitate smoother successions without departing from local inheritance norms.Assistance from Professionals:

Engaging with wealth advisors, like those at J.P. Morgan, and legal experts is crucial to effectively address the unique complexities international investors face with U.S. real estate acquisitions. For further reading, check the original publication here.A New Era in Real Estate: The Ultimate CRM Tools for 2024

A New Era in Real Estate: The Ultimate CRM Tools for 2024

In the dynamic world of real estate, where relationships are the cornerstone of success, the right Customer Relationship Management (CRM) software can be a game-changer. According to a recent TechRadar article, the best CRM solutions for 2024 are tailored to meet the unique demands of real estate professionals, enhancing customer experiences, reducing operational costs, and boosting sales.

1. Freshsales

Freshsales stands out with its intuitive and customizable interface, making it a favorite among real estate agents. Its advanced AI forecasting and automation features streamline operations, although it offers fewer third-party integrations compared to competitors like Salesforce.

2. HubSpot CRM

Known for its user-friendly interface and competitive free plan, HubSpot CRM integrates with over 300 third-party applications. While premium plans might be pricey, the free version offers substantial functionality, making it an attractive option for budget-conscious agencies.

3. Zoho CRM

For those already using Zoho’s suite of products, Zoho CRM offers seamless integration and robust lead generation tools. Despite a tiered pricing structure, its ease of use and integration capabilities make it a strong contender.

4. Insightly

With integrated project management tools and extensive automation, Insightly provides a versatile platform for real estate businesses. While it lacks live support options, its customizable features are ideal for managing complex workflows.5. BoomTown

BoomTown is specifically designed for realtors, offering real-time property updates and listings. Though it has limited customizations and integrations, its lead generation and automation features, such as predictive insights, are invaluable for real estate professionals.6. Monday.com

Monday.com offers a visually appealing project management system with flexible workflows. While some advanced features require higher subscriptions, its attractive interface and integration support make it a popular choice.Each of these CRM platforms brings unique strengths to the table, catering to various needs within the real estate sector. As the industry continues to evolve, choosing the right CRM can significantly impact a business’s ability to manage relationships and streamline operations.

“`

Florida’s Real-Estate Market Faces Turmoil Amid Back-to-Back Hurricanes

Florida’s Real-Estate Market Faces Turmoil Amid Back-to-Back Hurricanes

As Florida braces for the impact of Hurricane Milton, the state’s real-estate market finds itself in a precarious position. This powerful Category 4 storm, following closely after Hurricane Helene, threatens to exacerbate an already volatile situation. With peak winds reaching 160 mph, Milton is expected to make landfall near Tampa Bay, bringing heavy rain and significant flood risks.Governor Ron DeSantis has declared a state of emergency across 51 counties, prompting mandatory evacuations. Tampa Mayor Jane Castor issued a stark warning, emphasizing that remaining in the city could be fatal as the storm approaches. The aftermath of Hurricane Helene, which resulted in over 220 deaths and $34 billion in damage, has left the state reeling. The combination of natural disasters has residents reconsidering their future in a state prone to such climate threats.

The financial burden on Florida homeowners is mounting. High insurance premiums are a significant concern, with one homeowner paying $7,000 annually for flood and hazard insurance. Despite these challenges, the allure of Florida’s extensive coastline continues to attract interest. However, insurers are increasingly withdrawing from the market, with potential rate hikes of over 300% on the horizon.

The situation is reflective of broader challenges in the real-estate market. Once a sought-after location, Florida’s appeal has waned due to the fallout from COVID-19 and changing climate conditions. This shift is evident as hurricane-damaged properties see price cuts, sparking investor interest. Yet, the desire to leave Florida is counterbalanced by the ongoing attraction of its coastline.

Meanwhile, states like Texas are facing similar real-estate issues, highlighting a broader trend across the nation. The Sunshine State, with its blend of beauty and adversity, remains a focal point in the evolving landscape of American real estate.

For more insights, read the original article on Business Insider.

Jersey City Tops 2024 Apartment Investment List Amid New York Metro Challenges

In a surprising turn of events, Jersey City, New Jersey, has emerged as the top prospect for apartment investment in 2024, according to real estate professionals surveyed for the Urban Land Institute’s “Emerging Trends” report. This finding comes amid a backdrop of population decline in the New York metro area, yet the region’s apartment market remains robust.

Despite losing approximately 400,000 residents between 2020 and 2022, the New York City metro area, which includes Jersey City, continues to thrive in the real estate market. The New York City vacancy rate stands at a mere 2.5%, a figure that underscores the ongoing demand driven by household growth rather than sheer population numbers.

According to Cushman & Wakefield data, the New York City metro area is currently constructing over 61,000 apartment units, the highest in the country. However, this construction boom is proportionally smaller compared to the existing number of units, unlike in Miami where vacancy rates have surpassed 7%.

The ULI’s report indicates a shift in investor interest towards the Northeast and Midwest regions, which are now leading the country in rent growth. This trend is partly due to muted buy recommendations for 2024, influenced by high interest rates that have dampened apartment investment sales.

Interestingly, Jersey City secured a 61% buy recommendation for 2024, surpassing Brooklyn’s 53%, which had held the top spot previously. This marks a significant change in investor sentiment, with Sunbelt metros losing favor, as evidenced by the drop of cities like Jacksonville, Tampa, and Miami from the top 20 list.

As investors navigate these shifts, the report highlights the importance of strategic decisions in a landscape marked by economic uncertainties. The focus on regions with steady rent growth and manageable construction pipelines offers a glimpse into the evolving dynamics of the apartment investment market.

CSS Styling

The Best CRM for Real Estate of 2024: A Comprehensive Guide

The Best CRM for Real Estate of 2024: A Comprehensive Guide

In the ever-evolving world of real estate, maintaining strong relationships is the cornerstone of success. Realtors are increasingly turning to Customer Relationship Management (CRM) software to streamline their operations and enhance client interactions. According to TechRadar, the best CRM solutions for real estate in 2024 offer a blend of intuitive interfaces, powerful automation, and robust lead generation tools.

Why CRM Matters

CRM software is more than just a digital address book. It is a vital tool that can transform how real estate professionals manage their client relationships. By leveraging CRM, agencies can improve customer experiences, reduce operational costs, and ultimately boost sales. The best CRM software offers customizable features that cater specifically to the needs of real estate businesses, from managing property listings to tracking client interactions.

Top CRM Solutions for Real Estate

- Freshsales: Known for its intuitive and customizable interface, Freshsales is a popular choice among realtors. It offers advanced AI forecasting and a mobile app with voice note features. However, lead generation tools are only available with the Enterprise plan.

- HubSpot: With a competitive free plan and over 300 third-party app integrations, HubSpot is ideal for those on a budget. Its modular approach allows agencies to expand their CRM capabilities as they grow.

- Zoho CRM: Perfect for those already using the Zoho suite, this CRM offers seamless integration with other Zoho apps. It features social media scraping tools for lead generation and a user-friendly interface.

- Insightly: This CRM excels in project management and offers extensive customization options. Its integrated project management tools and user-friendly interface make it a strong contender for larger brokerages.

- BoomTown: Built specifically for realtors, BoomTown offers real-time property updates and a website builder with built-in insights. Its “Success Assurance” program helps convert cold leads into transaction-ready customers.

Choosing the Right CRM

When selecting a CRM, real estate professionals should consider factors such as lead generation capabilities, customizability, and automation features. For instance, Freshsales and Zoho offer powerful automations that allow realtors to focus more on client interactions and less on administrative tasks.

For those seeking a budget-friendly option with extensive free functionality, HubSpot provides a solid foundation that can be expanded as needed. Meanwhile, Insightly and BoomTown cater to larger teams and real estate-focused needs, respectively.

Conclusion

The right CRM can be a game-changer for real estate professionals, offering tools to enhance client relationships and streamline operations. As the industry continues to evolve, staying ahead with the best CRM solutions will be crucial for success.

Federal Reserve Rate Cut: Impact on Housing Market

Mortgage Rates: A Mixed Bag

Mortgage rates, which soared to nearly 8% last year, have already begun to decline, even before the Fed’s official announcement. Currently, long-term fixed-rate mortgages are hovering around 6.2%, the lowest since February 2023. However, experts like Charlie Dougherty from Wells Fargo suggest that while rates might dip slightly, significant reductions are unlikely in the immediate future.Impact on Home Prices

While lower mortgage rates might seem like a boon for homebuyers, they could paradoxically drive up housing prices. As rates drop, more buyers may re-enter the market, intensifying competition for a limited supply of homes. This scenario is particularly daunting for first-time buyers, who have already faced challenges from bidding wars and high prices.The Supply Dilemma

The U.S. housing market is grappling with a significant supply shortage, estimated to be millions of units short. High interest rates have previously hampered smaller developers from initiating new projects. The recent rate cut could ease this burden, encouraging more construction and potentially alleviating some of the supply constraints.

Affordability Challenges Persist

Despite the potential for lower monthly payments due to reduced mortgage rates, the overarching issue of affordability remains. Home prices have surged by approximately 50% since early 2020, outpacing average household income growth, according to Dougherty. This disparity continues to place homeownership out of reach for many.As the market adjusts to these changes, it is clear that the Federal Reserve’s rate cut is just one piece of a complex puzzle. For more insights, visit the original article on NPR.

Binance Integrates USDT on TON: A New Era for Stablecoin Transactions

Binance Integrates USDT on TON: A New Era for Stablecoin Transactions

In a groundbreaking move, Binance has announced the integration of Tether’s USDT token on The Open Network (TON), a development that promises to enhance liquidity and reduce transaction fees for its users. As of June 21, Binance users can now deposit and withdraw USDT on TON, marking a significant step in the evolution of stablecoin transactions.Enhanced Liquidity and Cost-Effective Transactions

The integration allows for greater flexibility in moving stablecoin liquidity onto the TON blockchain. This move is expected to improve transaction speeds and offer a more cost-effective method for handling USDT transactions. Binance’s official announcement encourages users to check their assigned token deposit addresses and the smart contract address on TON, ensuring seamless and compliant transactions.

Regulatory Landscape: Preparing for MiCA

This integration comes at a crucial time, with anticipated regulatory changes under the Markets in Crypto-Assets Regulation (MiCA) in the European Economic Area (EEA). These changes could impose restrictions on unauthorized stablecoins like USDT. Binance has proactively advised its users to stay informed about these developments to ensure compliance and avoid potential disruptions to their crypto activities.

In a related development, the cryptocurrency exchange Uphold has announced plans to delist USDT and five other stablecoins due to the upcoming MiCA regulations. This highlights the importance of staying updated with regulatory shifts that could impact the stablecoin market.

Telegram’s Vision for the TON Blockchain

Adding to the momentum around the TON blockchain, Telegram founder Pavel Durov recently announced plans to tokenize stickers and emojis on the platform using TON. Speaking at Token2049 in Dubai, Durov emphasized the importance of privacy and freedom, aligning with the core principles of blockchain technology. His vision includes building Telegram functionalities on The Open Network, further integrating USDT and exploring ad revenue-sharing options.

This strategic integration by Binance, coupled with Telegram’s commitment to TON, underscores a broader trend in blockchain utilization, paving the way for innovative applications and improved user experiences.

“`

Finding the Ideal CRM for Real Estate

The Quest for the Perfect CRM in Real Estate

In the bustling world of real estate, where client management and property listings are the lifeline of business, a reliable CRM (Customer Relationship Management) system becomes an indispensable tool. As competition intensifies, with agents vying to outshine each other, choosing the right CRM can be the key to staying ahead.The article from Zapier offers a comprehensive analysis of the best CRM software available in 2024, tailored specifically for real estate professionals. It meticulously evaluates various CRM platforms, ensuring agents can streamline operations and enhance their competitive edge.

The Top Contenders

The article highlights eight standout CRM systems, each with unique features catering to different needs within the real estate sector:- Follow Up Boss: Ideal for brokerages, this CRM excels in integration, connecting seamlessly with over 250 apps.

- Sierra Interactive: An all-in-one solution known for its powerful lead management and nurturing tools.

- LionDesk: Focused on client communication, it offers AI-powered lead follow-up.

- IXACT Contact: Perfect for new agents, with a six-month free trial to help rookies get started.

- CINC: Known for buying leads, it features excellent lead organization and team management capabilities.

- Lofty: Specializes in automation with robust team management features.

- Top Producer: Focused on lead nurturing, offering direct MLS integration.

- Real Geeks: Best suited for small teams, with easy-to-build, SEO-optimized websites.

Key Features to Consider

When selecting a CRM, the article emphasizes several crucial features that can make or break the decision:- Lead Generation: Effective tools for capturing and tracking leads are essential.

- Workflow Management: A streamlined workflow is crucial in managing tasks and deadlines.

- Integration and Automation: Seamless integration with existing tools and automation of routine tasks can save valuable time.

- Mobility and Accessibility: A mobile-friendly, cloud-based CRM ensures productivity on the go.

- Ease of Use: User-friendly interfaces are key to quick adoption and efficient use.

- Industry Focus: Real estate-specific features, such as property tracking and commission calculations, are vital.

Conclusion

The right CRM can transform a real estate business, making it more organized, efficient, and ultimately more successful. As agents weigh their options, considering personal and business needs against the features offered by each CRM is critical. The original Zapier article serves as an invaluable resource, guiding real estate professionals through the labyrinth of CRM choices.The Real Estate Landscape Shifts: Navigating the NAR Settlement

The Real Estate Landscape Shifts: Navigating the NAR Settlement

In the ever-evolving world of real estate, the recent NAR multimillion dollar settlement has sent ripples through the industry, leaving brokers and agents scrambling to adapt. As the dust settles, questions loom over how these changes will impact both homebuyers and sellers.

Understanding the NAR Settlement

The settlement, coming on the heels of a sexual harassment scandal, is a pivotal moment for the National Association of Realtors (NAR). At the heart of the matter is the restructuring of buyer broker compensation, which can no longer be included in the Multiple Listing Service (MLS). Instead, buyers must now sign a Buyer Representation Agreement.Implications for Buyers and Sellers

While this shift aims to create transparency, it also raises concerns about the future of real estate transactions. Emily Ross, a seasoned Realtor from Austin, Texas, shares her insights on the potential challenges. She notes that the traditional 5-6% sales commission may become a relic of the past, with sellers possibly adopting alternative methods like buyer credits to navigate the new landscape.The Role of Real Estate Agents

Despite the upheaval, Ross emphasizes the enduring value of real estate agents. In a world where buyers might have to shoulder more responsibilities, agents continue to play multifaceted roles—from negotiators to therapists. The question remains: how will these professionals be compensated fairly for their expertise?Looking Ahead

As the industry grapples with these changes, Ross advises potential buyers to act swiftly, suggesting that those looking to purchase should aim to close deals by July 1 to avoid uncertainty. Meanwhile, the real estate community must decide how to adapt without compromising the integrity of their work. In the words of Emily Ross, the real estate journey is akin to a reality TV show, full of unexpected twists and turns. As the industry moves forward, both buyers and sellers must prepare for a new era in real estate transactions, where adaptability and resilience will be key.Revolutionizing Real Estate with ChatGPT

Revolutionizing Real Estate with ChatGPT

The real estate industry is on the brink of a technological revolution, thanks to the versatile capabilities of ChatGPT, a chatbot developed by OpenAI. Since its online debut on November 30, 2022, ChatGPT has been transforming how real estate agents and brokers conduct business, offering innovative solutions to streamline tasks and boost productivity.OpenAI, in partnership with Microsoft, ensures that ChatGPT remains a staple in the tech world, continually evolving with enhancements to its user interface. While free versions are available, the premium Plus and Enterprise users can leverage real-time data access, making it a powerful tool for industry professionals.

12 Game-Changing Applications for Real Estate Professionals

Real estate agents, often overwhelmed with writing tasks and market data analysis, can now turn to ChatGPT for support. Here are 12 ways this AI tool can revolutionize your business:- Email Campaigns: Create personalized emails that reflect your brand, moving away from generic CRM templates.

- Property Descriptions: Generate standout property listings that capture attention and drive engagement.

- Social Media Content: Enhance your online presence with engaging posts tailored for platforms like Facebook, Instagram, and LinkedIn.

- Content Marketing: Produce blog posts and articles that showcase your expertise and attract organic web traffic.

- Neighborhood Information: Offer detailed guides on local amenities, schools, and hotspots.

- FAQ Responses: Use ChatGPT to provide instant answers to common client questions, enhancing customer service.

- Automated Email Responses: Save time by automating responses to frequent inquiries.

- Market Reports: Demonstrate your market knowledge with comprehensive reports generated by ChatGPT.

- Language Translation: Break language barriers and cater to a diverse client base with multilingual support.

- Buyer and Seller Guides: Create detailed guides to assist clients through the buying or selling process.

- Video Scripts: Craft scripts for video content to engage your audience on platforms like YouTube and Instagram.

- Market Insights: Stay informed with real-time data and trends to provide clients with the latest market insights.

Mastering ChatGPT Prompts

To maximize ChatGPT’s potential, it’s crucial to craft effective prompts. Here are some best practices:- Be Clear and Specific: Clearly state your requirements, such as asking for recent sales data for a specific ZIP code.

- Use Open-Ended Questions: Encourage detailed responses by framing questions in an open-ended manner.

- Break Down Complex Questions: Simplify multi-part inquiries for more accurate results.

- Include Context: Provide background information to help ChatGPT understand the question’s context.

- Specify Data and Sources: Direct ChatGPT to use specific data sources when necessary.

For more insights, see the full article on HousingWire.

Conclusion: Embrace the Future

The integration of ChatGPT into real estate practices is not just a trend but a necessity for staying competitive. By utilizing this AI tool, agents can work smarter, not harder, and focus on what truly matters—building relationships and closing deals.My ChatGPT Cheat Sheet

Not sure where to start? Here are 20 prompts to kickstart your journey with ChatGPT in real estate:- “Can you provide a brief overview of the factors that affect property valuations?”

- “What are some effective home staging tips to make properties more appealing to potential buyers?”

- “Give me insights into the current real estate market trends in [Your City].”

- “What should I consider when advising a client on purchasing an investment property?”

- “Can you create a guide for first-time homebuyers on the steps to purchasing a home?”

These prompts are just a starting point. Feel free to explore and experiment with ChatGPT, as you can’t break anything, and the AI won’t get mad at you.

CSS for Styling

“`Exploring the Best CRM Solutions for Real Estate in 2024

Exploring the Best CRM Solutions for Real Estate in 2024

In the dynamic world of real estate, managing relationships is paramount. The TechRadar article delves into the best CRM software solutions for 2024, highlighting their potential to transform how realtors engage with clients. By optimizing customer interactions, these tools can significantly reduce operational costs and boost sales.The Role of CRM in Real Estate

For real estate professionals, CRM systems are not just about storing contacts; they are about building lasting relationships. The article emphasizes that successful agencies leverage top CRM software to enhance customer experiences and streamline communications, both in the office and on-site.Top CRM Providers for Real Estate

- Freshsales: Known for its intuitive interface and advanced AI features, Freshsales offers a customizable experience, making it a top choice for realtors. However, its lead generation tools are limited to enterprise plans. Read the full Freshsales review.

- HubSpot: With a modular approach, HubSpot allows users to start with a free plan and scale up as needed. Its extensive third-party integrations make it a versatile choice. Discover more in the HubSpot CRM review.

- Zoho CRM: Ideal for those already using Zoho’s suite, this CRM offers seamless integration and powerful lead generation tools. Read the Zoho CRM review for more details.

- Insightly: Known for its project management capabilities, Insightly is perfect for larger brokerages. It offers a customizable dashboard and robust automation features. Check out the Insightly review.

- BoomTown: Specifically designed for real estate, BoomTown offers realtor-focused features and extensive lead-generation capabilities. Its integrations are limited, but it excels in real estate-specific functionalities.

- Monday.com: A flexible project management tool that supports integrations with other platforms, Monday.com is praised for its user-friendly interface and transparency-promoting features. Learn more in the Monday.com review.

Choosing the Right CRM

Selecting the appropriate CRM requires understanding your unique business needs. Whether it’s lead generation, customization, or automation, each CRM offers distinct advantages. The article suggests considering factors like existing workflows, budget constraints, and required integrations when making a decision.Conclusion

The TechRadar article provides a comprehensive guide to the best CRM solutions for real estate in 2024. By leveraging these tools, real estate professionals can enhance client relationships, optimize operations, and ultimately drive sales growth.7 Benefits of Hiring an Experienced Real Estate Agent in Jamaica

1. Regional Knowledge

Jamaica’s diverse neighborhoods and landscapes each offer unique charms and subtleties. An expert real estate agent possesses in-depth knowledge of the **local market**, including the best neighborhoods, average property prices, and current trends. This expertise is invaluable in helping clients find a neighborhood that aligns with their preferences and lifestyle.2. Access to Exclusive Listings

**Experienced agents** often have access to private listings not readily available to the public. For those seeking unique and desirable properties, these off-market opportunities can be a treasure trove, enabling clients to discover hidden gems they might otherwise miss.3. Negotiation Skills

Negotiating prices is a crucial aspect of **real estate transactions**. Skilled Jamaican agents bring honed negotiation skills to the table, assisting clients in securing the best deals, whether buying or selling a property.4. Legal Expertise

Real estate transactions involve complex legalities. Jamaican agents are well-versed in the relevant laws and regulations, ensuring a smooth process and helping clients avoid costly mistakes by managing all necessary documentation accurately.5. Efficient Marketing

Effective marketing is essential to attract potential buyers when selling a property. Seasoned agents leverage a network of professionals and resources to market properties efficiently, offering services such as virtual tours and professional photography to ensure maximum exposure.6. Time and Stress Savings

The real estate process can be time-consuming and stressful. Hiring an **experienced agent** alleviates this burden, as they manage all the details and coordinate with stakeholders, allowing clients to focus on other aspects of their lives.7. Valuable Connections

Experienced agents in Jamaica often have established relationships with appraisers, contractors, lenders, and inspectors. These connections are crucial in expediting the buying or selling process, providing clients with access to reliable professionals when needed.Conclusion

Engaging a knowledgeable **real estate agent in Jamaica** can lead to a successful and stress-free transaction. Their local expertise, negotiation skills, and access to exclusive listings position clients to make informed decisions and achieve their real estate goals. Whether buying or selling, the guidance of an experienced agent is invaluable in navigating Jamaica’s vibrant real estate market.For those seeking professional assistance, Century 21 Jamaica offers a team of registered, reliable agents with extensive listings. Clients can also list their properties for sale or rent to attract genuine buyers.

New Real Estate Tax Amendments: Implications for the Energy Sector

The proposed legislative changes, set to take effect on January 1, 2025, aim to refine the definition of taxable ‘structures.’ The new definition explicitly includes only the building parts of **photovoltaic (PV) farms**, **energy storage facilities**, and standalone industrial facilities as liable for the 2% RET. This adjustment is expected to reduce tax burdens on elements previously deemed non-essential to construction under a broader interpretation.

In a departure from earlier drafts, the ambiguous concept of “technical-functional entirety” has been removed. Furthermore, “free-standing technical facilities permanently attached to the ground” have been exempted from RET responsibilities, signaling a commitment to fiscal continuity that primarily benefits **renewable energy sectors**.

The draft law also seeks to clarify the inclusion of “building facilities” under the RET scope, recognizing their role in ensuring the functional use of a building or structure. However, the broad definition might still lead to ambiguities in tax application, prompting businesses to seek further clarity.

To accommodate these changes, the deadline for filing RET returns for 2025 has been extended to March 31, 2025. This extension is designed to give taxpayers sufficient time to adapt to the new regulations and assess their impact on business operations.

The **Ministry of Finance’s** approach reflects a willingness to engage with stakeholders, incorporating demands from various industries. However, the broad definitions of ‘structure’ and ‘permanent attachment to the ground’ continue to present interpretational challenges, necessitating advisory consultations.

As the legislative process progresses, a resolution by the end of October is crucial to ensure industry compliance and the seamless integration of the updated RET framework into business strategies. The brief consultation period, concluding on September 9, 2024, is a pivotal phase for crystallizing stakeholder interests before government approval and parliamentary discussion.

Businesses are advised to proactively evaluate the implications of these legal reforms on their RET obligations and adjust their fiscal strategies accordingly. For further guidance, the Dentons Tax Team is available to provide comprehensive support and assistance.

This article highlights the dynamic interplay between legislative amendments and industrial adaptation, showcasing an evolving real estate tax landscape. For more details, you can read the original article on Dentons.

CoStar Group’s Acquisition of Matterport: A $1.6 Billion Expansion

CoStar Group Expands with Major Acquisition

In a monumental move within the real estate technology sector, CoStar Group has announced its acquisition of Matterport, a leader in photorealistic 3D virtual property tours. This $1.6 billion transaction is set to be split evenly between cash and stock, marking a significant expansion for CoStar, which operates renowned online property marketplaces such as Apartments.com and Homes.com.

According to the official announcement, Matterport shareholders will receive $2.75 in cash and an additional $2.75 in CoStar stock for each share they hold. This strategic acquisition underscores CoStar’s commitment to enhancing its digital offerings and solidifying its position as a leader in the property technology space.

Matterport’s Impressive Reach

Matterport has built a formidable reputation with its cutting-edge 3D virtual tours, known as digital twins, which provide immersive property experiences. Utilizing a global network of photographers and capture service technicians, the company produces thousands of these tours monthly. Matterport’s expansive spatial property data library now boasts 12 million spaces, covering an estimated 38 billion square feet across 177 countries.

This acquisition aligns with CoStar’s vision to integrate advanced technology into its platforms, offering users a comprehensive and interactive property search experience. By incorporating Matterport’s digital twin technology, CoStar aims to enhance the way properties are showcased online, providing a more detailed and engaging perspective for potential buyers and renters.

Industry Implications

The acquisition of Matterport by CoStar is poised to have significant implications for the real estate industry, particularly in how properties are marketed and viewed online. As virtual tours become increasingly popular, the integration of Matterport’s technology is expected to set new standards for property listings, offering unparalleled detail and realism.

For more information on this acquisition, you can read the original article on Globest.

Florida’s Real Estate Market: A Glimpse into 2024

Florida’s Real Estate Market: A Glimpse into 2024

If you’re in the market for a new home, you might be eagerly watching mortgage rates. According to NBC 6 South Florida, there’s potential good news on the horizon. Redfin’s 2024 housing predictions suggest that mortgage rates may steadily decline, possibly dipping into the 6% range. This could be a welcome relief for potential homebuyers who have been waiting for more favorable conditions.

Real Estate Broker Elisha Lopez notes, “With rates already dropping, interest rates and that little bug, that perception for buyers, especially first-time homebuyers that have been sitting on the sideline for over a year now waiting for rates to come down, it’s already triggering, I guess you could say, the hype that it’s time to buy.”

What to Expect in 2024

As we look towards 2024, Redfin anticipates an increase in new listings and home sales. However, Lopez warns that an influx of buyers could drive prices up due to heightened demand. “There’s more inventory now, but if you flood the market again with buyers that are going to start looking out anyway and then all those buyers that have been waiting, the natural thing that’s going to happen is that prices are going to go up because there’s so much demand again,” she explains.

Interestingly, while some areas in coastal Florida, like Cape Coral, may see a significant drop in prices due to the rising cost of home insurance linked to natural disaster risks, Miami’s housing market is expected to remain fiercely competitive. Lopez attributes this to Miami’s unique position as a melting pot that attracts international attention and interest.

Advice for Homebuyers

For those considering purchasing a home next year, especially first-time buyers, Lopez suggests connecting with a real estate agent to navigate the process. She emphasizes the importance of exploring financing options and notes that some sellers might be willing to cover closing costs, particularly if a listing has been on the market for some time.

Her final piece of advice? Negotiate. Even in a competitive market like South Florida, there’s always room to secure a better deal.

“`

“`“Real Estate Opportunities in Florida: Top Cities for Investment”

While not all urban areas in Florida are experiencing economic growth, certain cities have emerged as prime locations for investment. According to insights from GOBankingRates, four cities are particularly noteworthy for their potential.

Boca Raton

Boca Raton is experiencing a surge in demand, driven by a migration from the Northeast post-COVID-19. The opening of new restaurants and increased walkability have contributed to this trend. Victor Ballestas of Integra Investments notes the shift from older properties to newer developments, highlighting the city’s appeal as a safe investment due to its established coastal community status and ongoing growth.North Miami

North Miami’s appeal has been bolstered by the SoLe Mia Project, a transformative development that includes residential units, office space, retail venues, and more. Edgardo Defortuna, CEO of Fortune International Group, emphasizes the area’s potential for value increase, attracting young professionals and investors alike.Bonita Springs

Nestled on Florida’s southwest coast, Bonita Springs offers a serene environment with access to nature and abundant golfing. Mark Wilson of London Bay Development Group highlights the city’s low taxes and crime rates, coupled with its burgeoning population, as key factors driving market value and investment potential.Orlando

Beyond its famed theme parks, Orlando presents a wealth of investment opportunities. Robert Thorne of Urban Network Capital Group describes the city as an underrated gem, with a thriving tourism industry and job market fueling a real estate boom. Compared to other areas in Florida, Orlando offers more attainable prices with promising home value projections.

The original article from Yahoo Finance underscores the importance of careful research and market insight for successful real estate investment in Florida. As these cities continue to grow and evolve, they offer exciting prospects for those looking to capitalize on the state’s dynamic real estate market.

The Federal Reserve’s Interest Rate Cut: A Potential Game-Changer for Homebuyers

The Federal Reserve’s recent decision to cut its benchmark interest rate by half a percentage point has sent ripples through the housing market, offering a glimmer of hope for homebuyers. This unexpected move, described by Bill Banfield, chief business officer at Rocket Companies, as giving “a little extra,” comes at a time when mortgage rates have already seen a significant decline over the past year.

According to Bankrate’s national survey of large lenders, mortgage rates have fallen from 8.01 percent in October 2023 to 6.20 percent as of September 18. This shift by the Federal Reserve could potentially invigorate the housing market, encouraging both buyers and sellers to engage more actively.

Lisa Sturtevant, chief economist at Bright MLS, notes that declining interest rates are particularly beneficial for homebuyers facing affordability challenges. She anticipates that this reduction in borrowing costs will not only fuel demand but also increase the supply of homes available for sale, thereby stabilizing home prices in various local markets.

The Federal Reserve and the Housing Market

The Federal Reserve’s earlier rate hikes had a cooling effect on the housing market, leading to a sharp drop in home sales while pushing home prices to record highs. Now, with inflation on the decline, the Fed’s policy shift represents a pivotal moment in monetary policy.

Mike Fratantoni, chief economist at the Mortgage Bankers Association, suggests that if mortgage rates remain near current levels, the housing market could experience a stronger-than-usual fall season, with a potential rebound in activity next spring.

How the Fed Affects Mortgage Rates

Although the Federal Reserve does not directly set mortgage rates, its policies significantly influence them. Mortgage rates typically move in tandem with 10-year Treasury yields. The Fed’s actions set the overall tone, impacting how much consumers pay for home loans.

Historically, low mortgage rates have fueled housing booms, as seen in 2020 and 2021. However, when rates surged to levels unseen in two decades, the market slowed dramatically. Despite this, home prices reached unprecedented levels, with the nationwide median existing-home price hitting $422,600 in July, close to the all-time high of $426,900 in June.

Fratantoni points out that elevated mortgage rates and steep home-price growth have significantly reduced affordability. Yet, as rates decline, affordability could improve, potentially drawing more buyers into the market.

Next Steps for Borrowers

- Shop around for a mortgage: Conducting an online search can help find lenders offering lower rates and competitive fees. Savvy shopping can save thousands of dollars.

- Be cautious about ARMs: Adjustable-rate mortgages might seem tempting, but they come with the risk of higher future rates. Borrowers should avoid using ARMs as a crutch for affordability.

- Consider a home equity loan or HELOC: Homeowners can tap into their home equity with a HELOC, which might be more cost-effective than refinancing at higher rates.

Colliers’ Insights on APAC Cap Rates: Q1 2024 Report

Colliers’ Latest Insights on APAC Cap Rates

Colliers has unveiled its Q1 2024 APAC Cap Rates Report, shedding light on the performance across office, retail, and industrial sectors in 19 markets. This comprehensive analysis reveals that 11 of these markets have witnessed movements in cap rates.

“The Asian market remains stable, without any significant factors driving movements in cap rates,” states Dorothy Chow, Head of Valuation & Advisory Services at Colliers Hong Kong. However, Australia and New Zealand have experienced shifts in cap rates, particularly in the office and industrial sectors. The retail sector, meanwhile, has seen stability over the past quarter, with exceptions in Brisbane, Melbourne, and Sydney.

Dorothy Chow highlights that the stability in Asian markets is mainly due to oversupply and pressure on rents, leading to increased cap rates. The oversupply situation in some Asian markets will require time to absorb, with recovery hinging on overall business activities and economic conditions, placing additional pressure on rental growth.

Key Findings:

- Office Sector:

- Beijing is grappling with declining demand, resulting in high vacancy rates. Investors are wary of oversupply and falling rents.

- Bangkok has seen a slight uptick in cap rates due to changes in rental rates, though sales transactions remain limited.

- Shanghai faces challenges in attracting leasing demand, causing downward pressure on rents.

- Jakarta is experiencing an influx of new office supply, with businesses optimizing existing spaces instead of expanding.

- In Sydney and Auckland, significant asset sales are anticipated, which may provide clearer pricing benchmarks.

- Retail Sector:

- Beijing and Shanghai enjoyed robust retail performance during the Chinese New Year.

- Investors in Hong Kong remain cautious due to vacancy rates.

- Jakarta has seen increased visitor numbers and new brand entries, yet the competitive landscape with new malls keeps investors cautious.

- Industrial Sector:

- Hong Kong’s industrial sector remains stable, buoyed by positive import and export figures.

- Bangkok has witnessed increased sales transactions, while rental rates have remained flat.

- Beijing is dealing with declining rental rates and increased occupancy in neighboring cities, impacting the industrial market.

- Shanghai is experiencing cautious investment sentiment, leading to high cap rate expectations from investors.

For further insights, contact Dorothy Chow, Head of Valuation & Advisory Services at Colliers Hong Kong. You can access the full report here.

Exploring the Florida Real Estate Market: A Haven for Homebuyers

Exploring the Florida Real Estate Market: A Haven for Homebuyers

Florida has long been a beacon for those seeking a unique and diverse lifestyle, offering a vibrant real estate market that caters to a wide array of preferences and budgets. From luxurious oceanfront mansions and elegant condos to charming cottages, the state provides ample opportunities for both buyers and sellers. According to a recent article by Little Big Homes, the Florida housing market is poised for growth and transformation in 2024.Why Florida Remains a Hotspot for Homebuyers

Florida’s allure is multifaceted, drawing home seekers with its breathtaking scenery, vibrant communities, and year-round warm weather. The state’s landscape is adorned with pristine beaches, turquoise waters, and picturesque streets lined with towering palm trees. Its bustling city centers and quaint neighborhoods offer a rich tapestry of cultural attractions, fine dining, shopping, and entertainment.Moreover, Florida’s moderate cost of living, coupled with the absence of a state income tax, makes it an attractive destination for many. The state’s strong economy, bolstered by sectors such as tourism, aerospace, and manufacturing, further enhances its appeal.

Current Market Dynamics and Trends

The Florida real estate market is currently influenced by several factors, including the aftermath of the COVID-19 pandemic and rising inflation. The pandemic initially disrupted the market but later spurred growth due to record-low interest rates and the rise of remote work. This shift increased demand for properties in rural and suburban areas.Rising inflation has also impacted the market, with urban areas experiencing higher housing prices and living costs. As a result, there is a growing demand for residential properties outside major cities.

Market Conditions and Future Outlook

According to Redfin, the median home price in Florida is $401,100, reflecting a 1.5% increase from the previous year. Despite this rise, Florida homes remain relatively affordable compared to other booming markets, such as California. Inventory levels indicate a seller’s market, with a limited supply of homes leading to increased buyer competition and potentially higher prices.Sales activity has slowed, with a decrease in the number of homes sold year over year. However, the strong demand and limited inventory suggest this may be a temporary slowdown rather than a long-term trend.

Trends Shaping the Market

Several trends are shaping Florida’s real estate market, including net population migration, rising mortgage rates, and a booming vacation home market. The state has experienced significant population growth, contributing to increased demand for real estate. Meanwhile, rising mortgage rates have made it more challenging for buyers to secure financing, impacting sales volume.The vacation rental market is thriving, with areas like Indialantic achieving high occupancy rates. Additionally, property technology advancements, such as virtual tours and 3D mapping, are revolutionizing the buying process.

Guidance for Buyers and Sellers

For buyers, understanding market trends and fluctuations is crucial. Working with a qualified real estate agent can provide valuable insights and assistance throughout the buying process. Timing is also essential, with off-peak seasons potentially offering better deals.Sellers should focus on enhancing their property’s curb appeal, setting competitive prices, and marketing effectively to attract high offers. Consulting with a real estate agent can help navigate the complexities of the market and achieve favorable outcomes.

Conclusion

The Florida real estate market presents a dynamic landscape full of opportunities for both buyers and sellers. With its economic strength and high quality of life, the state is expected to continue attracting prospective homeowners. As the market evolves, staying informed and enlisting professional guidance will be key to success.Understanding the Shifting Sands of Consumer Behavior in 2024

Understanding the Shifting Sands of Consumer Behavior in 2024

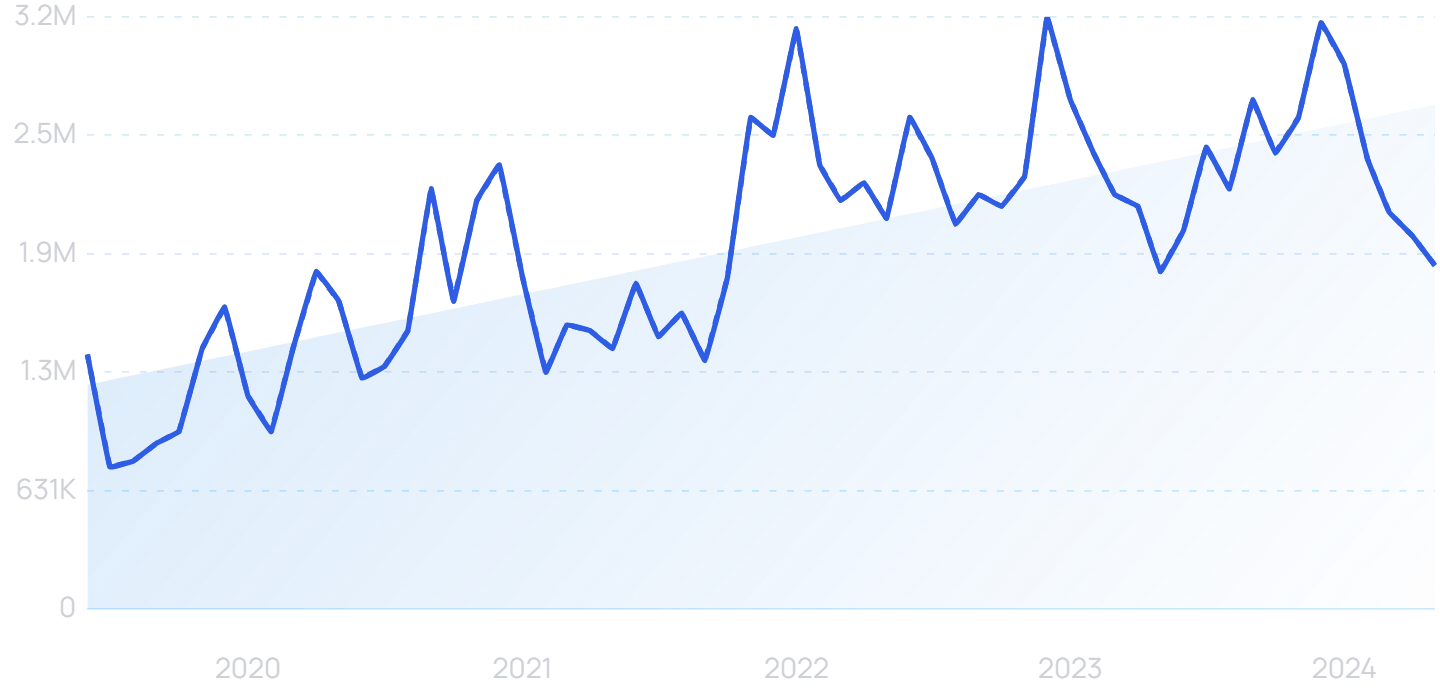

In a world where consumer preferences are evolving at an unprecedented pace, businesses must stay ahead of the curve to remain competitive. According to a recent report by Exploding Topics, nine key trends in consumer behavior are set to shape the market landscape in 2024 and beyond.1. Diverse Payment Options: The New Norm

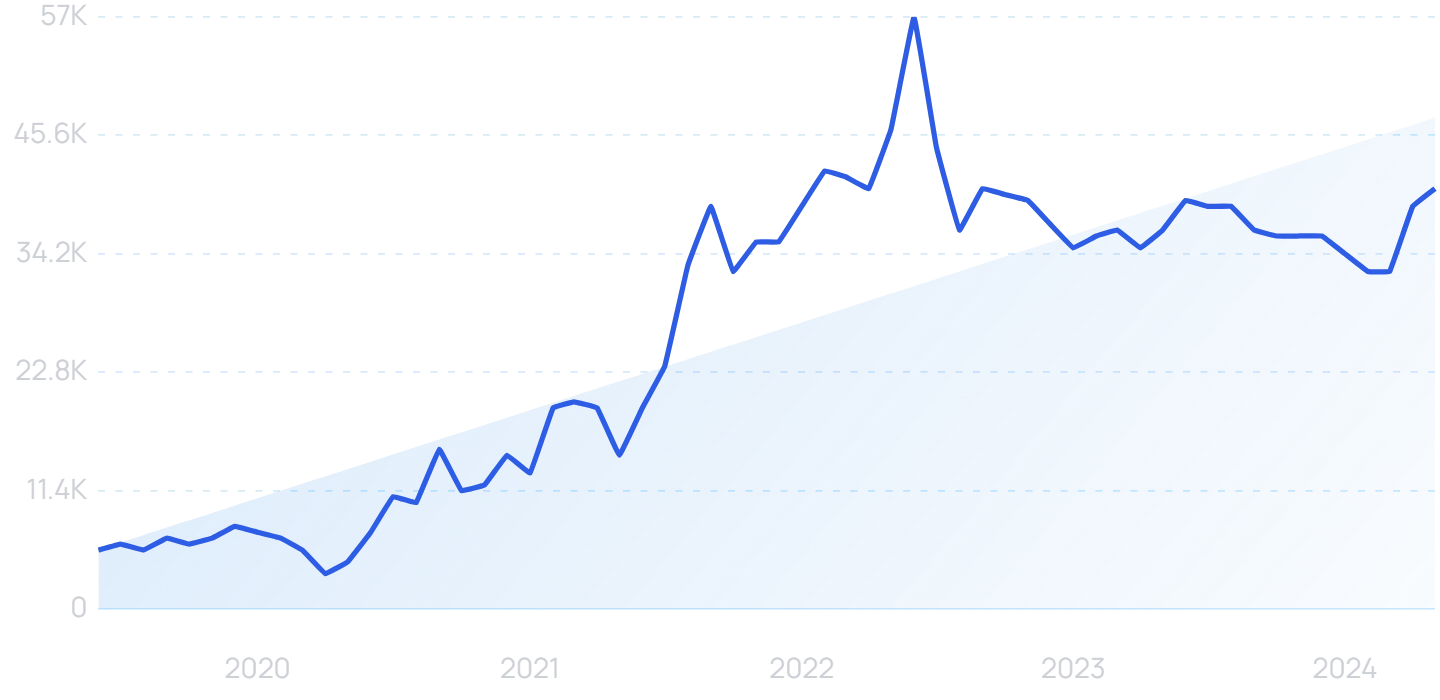

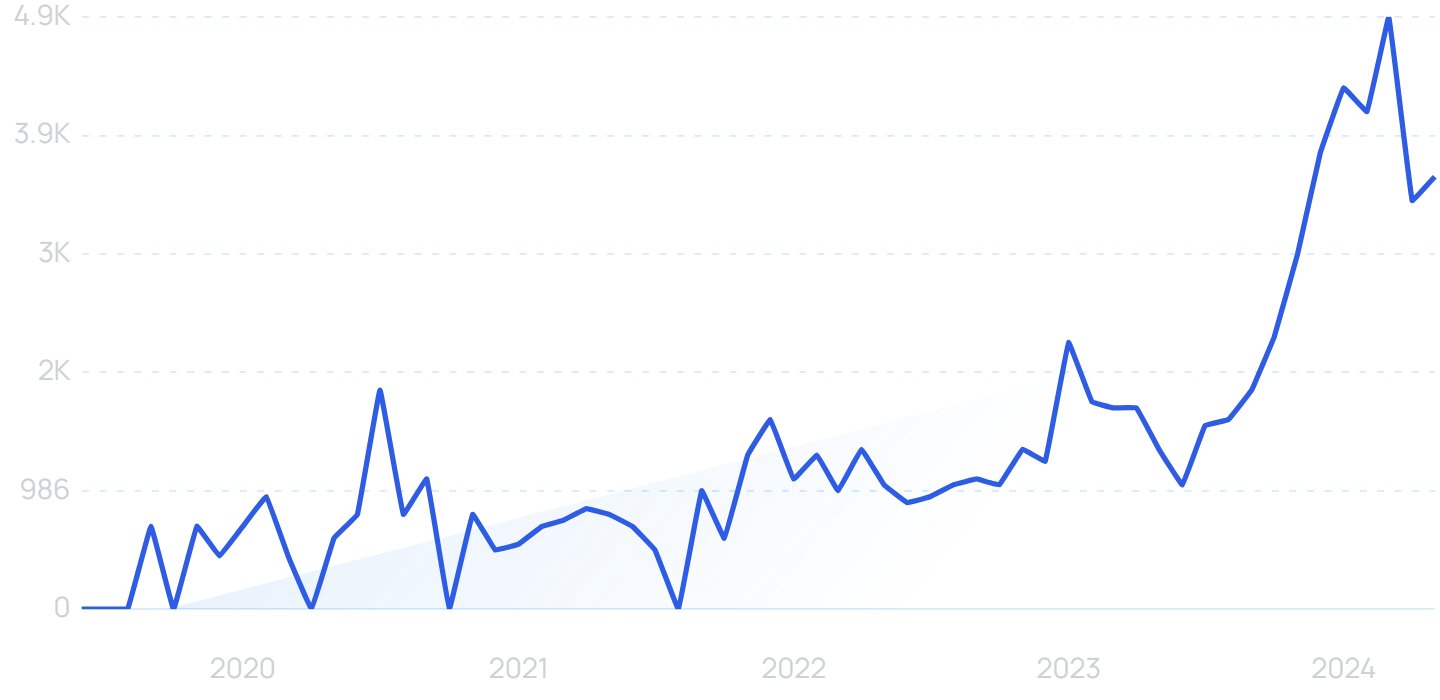

As eCommerce continues to flourish, consumers now expect a variety of payment methods at checkout. The “Buy Now, Pay Later” (BNPL) trend is particularly noteworthy, with searches for “BNPL” growing sixfold over the past five years. Companies like Afterpay and Sezzle are leading this charge, catering to the increasing demand for flexible payment solutions.

2. Expectation for Home Delivery

Consumers now anticipate that virtually everything, from eyeglasses to groceries, will be delivered to their doorstep. This shift has propelled the growth of direct-to-consumer brands, such as Warby Parker and Instacart, as they meet the demand for convenience.

3. The Rise of Ethical and Sustainable Products

Sustainability and ethical practices are more than just buzzwords; they are key drivers of consumer decisions. A study by IBM indicates that 77% of consumers value these attributes in brands. This trend is evident in the increasing popularity of products like bamboo clothing, which offer a smaller environmental footprint.

4. Health and Wellness at Home

The home has become a sanctuary for health and wellness, with consumers embracing at-home treatments like red light therapy. This trend underscores a shift towards personal health management within the comfort of one’s home.

5. Micro-Influencers: The New Power Players

The influence of social media personalities on consumer choices has not waned. However, the focus is shifting towards micro-influencers, who boast higher engagement rates. Their authentic and niche content resonates more effectively with targeted audiences.

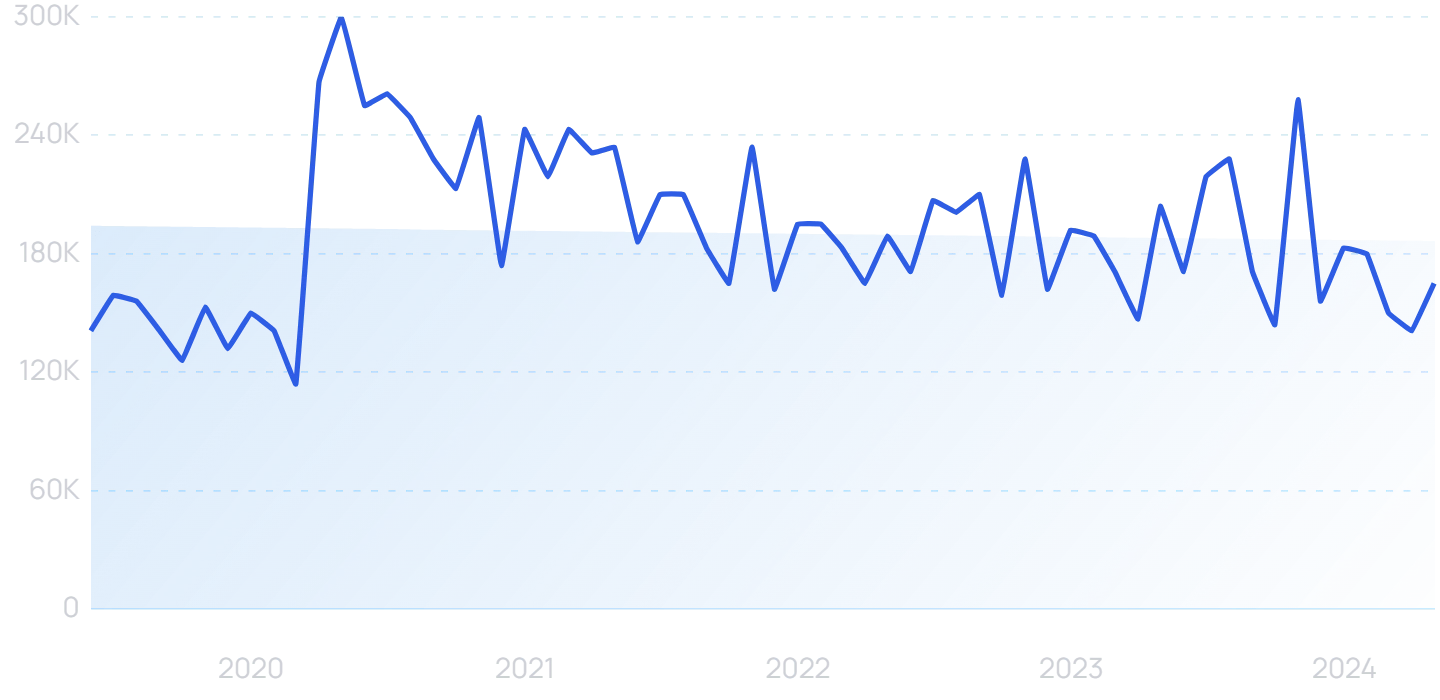

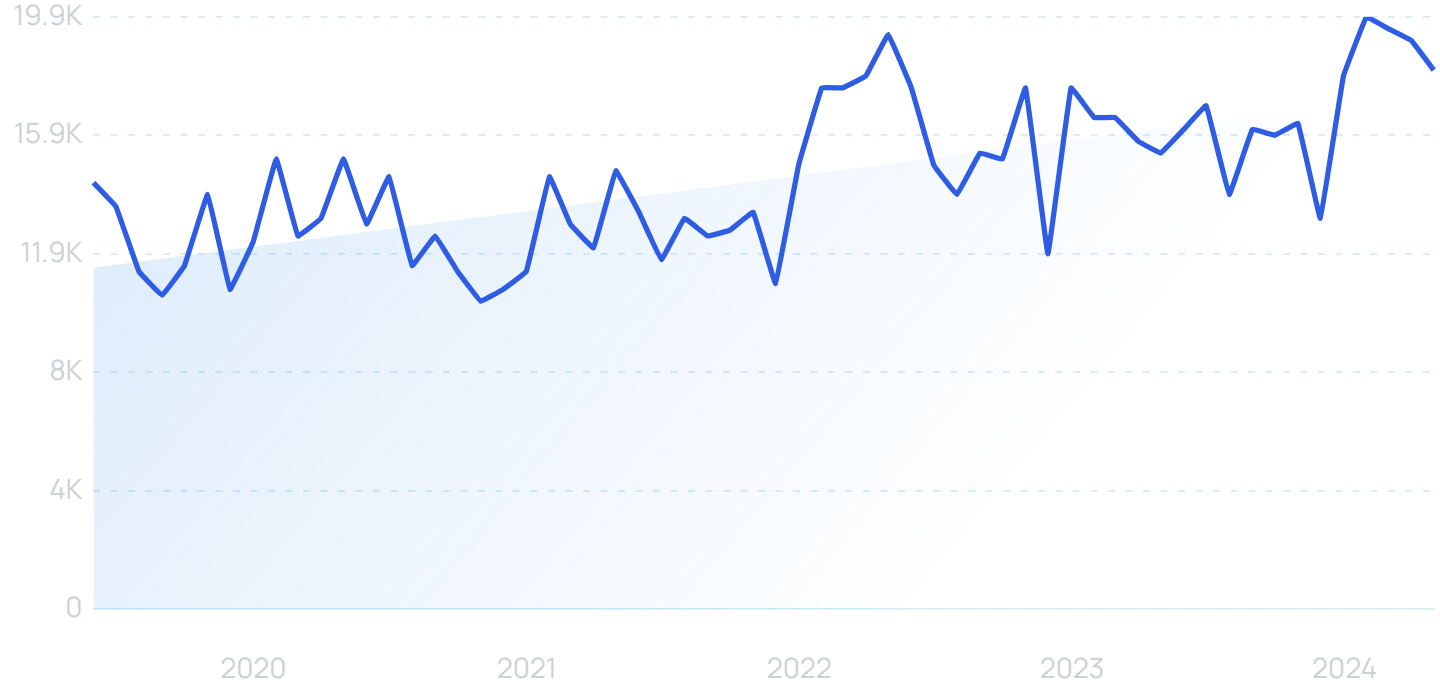

6. Subscription Services: A Growing Market

The subscription model is thriving, with a 90% year-over-year increase in subscribers. From gaming to streaming services, consumers are drawn to the convenience and variety these subscriptions offer.

7. Elevated Spending on Pets

Pet owners are increasingly investing in luxury products for their furry companions. The pet industry is witnessing a surge in demand for items like CBD for dogs and high-end pet furniture.

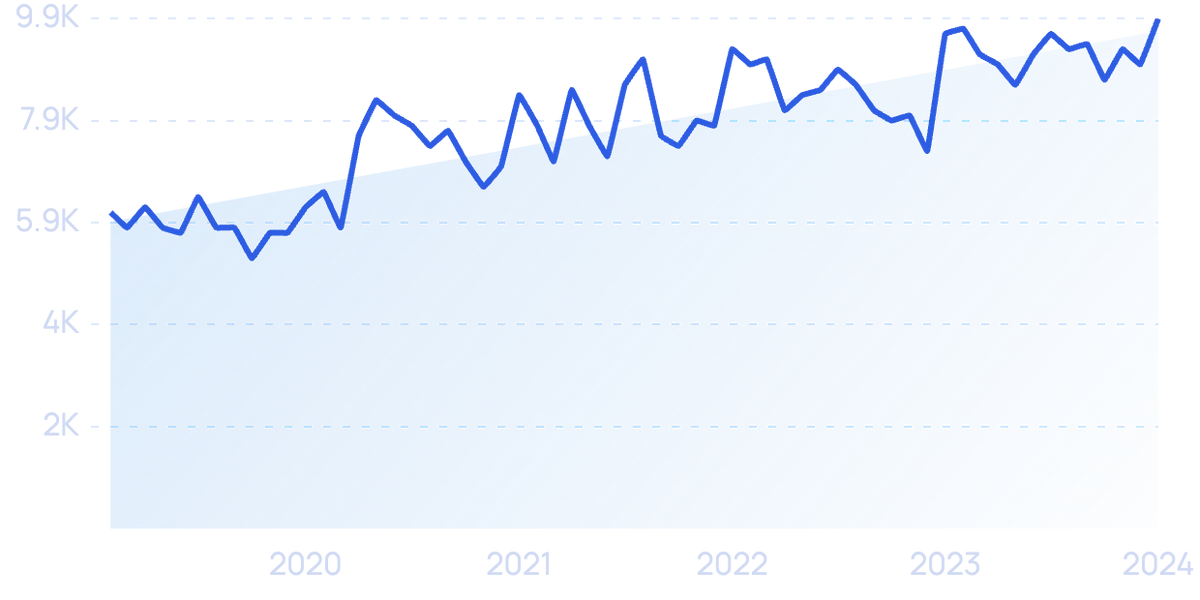

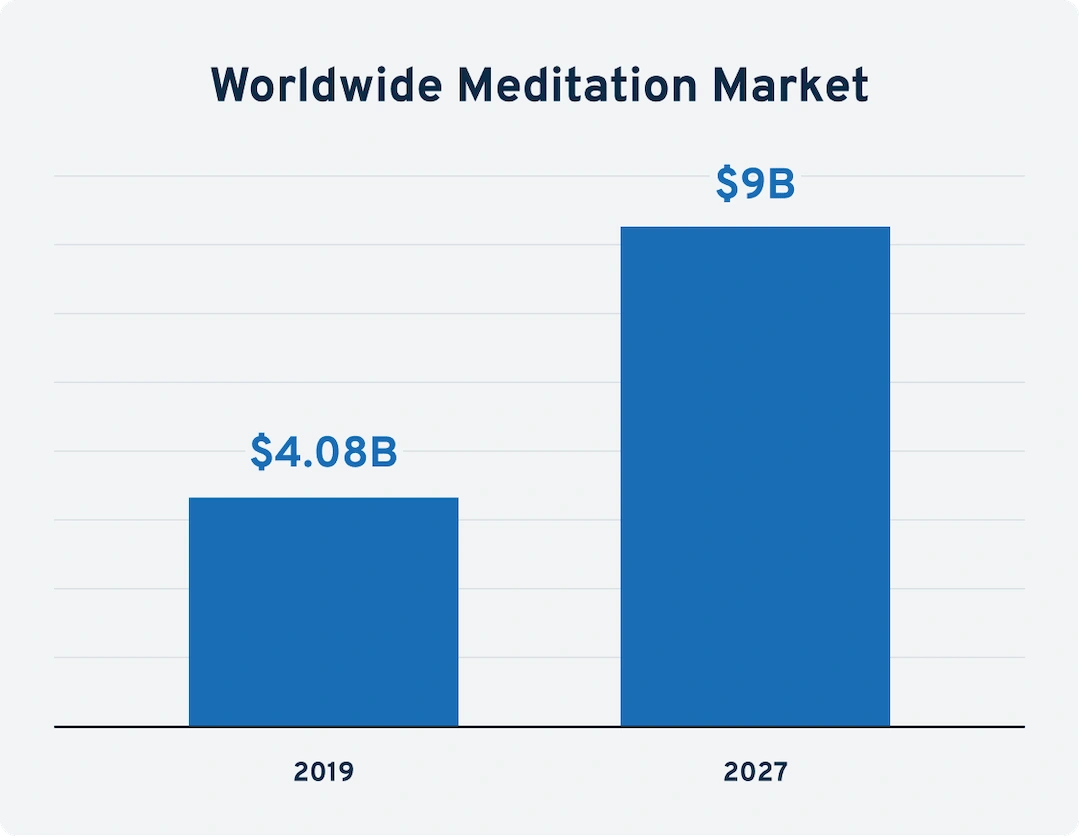

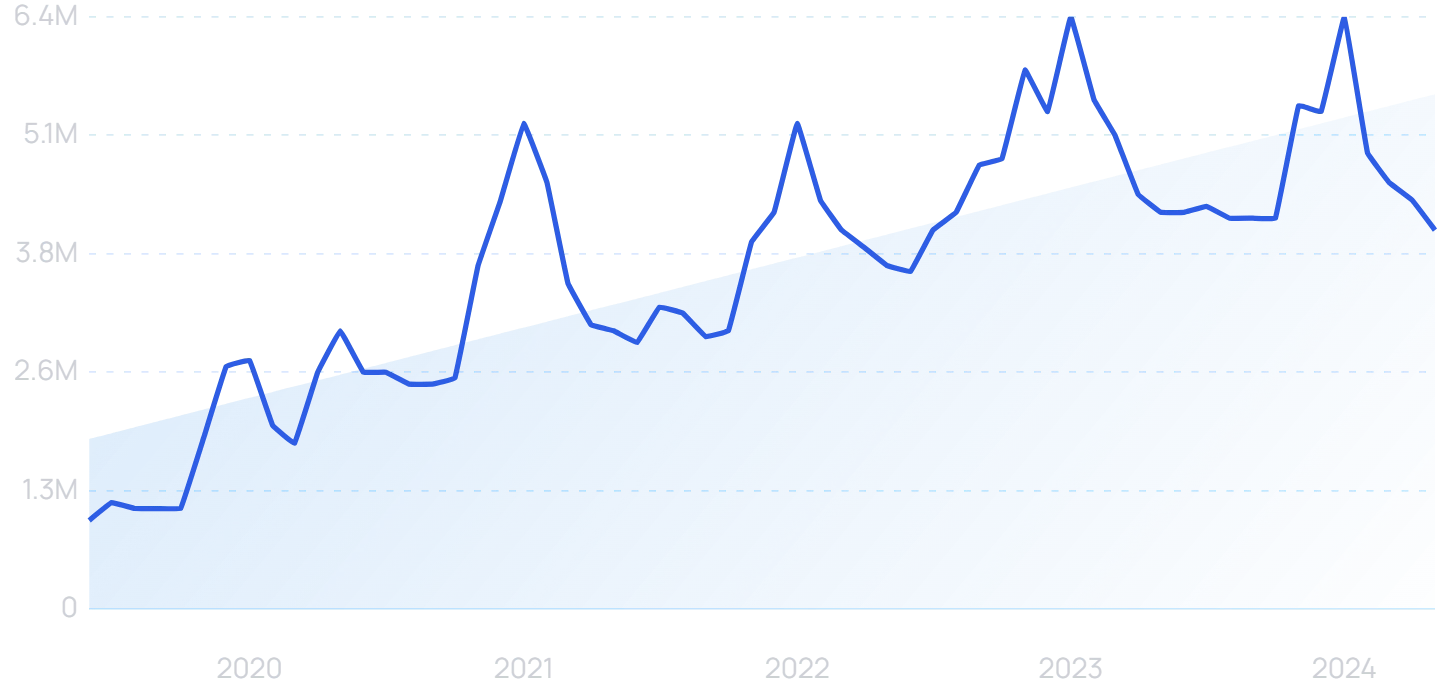

8. The Expanding Mindfulness Market

With the global meditation market projected to reach $9 billion by 2027, mindfulness practices are becoming mainstream. Apps like Calm and Headspace are leading the charge in providing accessible mental wellness solutions.

9. The Home as the Central Hub

With more people working remotely, the home has evolved into a multifaceted hub for work, leisure, and security. This has spurred interest in products like smart doorbells and air fryers, enhancing both convenience and functionality at home.

Conclusion

These trends highlight a consumer landscape increasingly focused on convenience, sustainability, and enhanced home environments. As brands navigate this evolving terrain, understanding these shifts will be crucial in meeting consumer expectations and driving future growth. “`

Top CRM Solutions for Real Estate in 2024

Top CRM Solutions for Real Estate

Leading the pack is Freshsales, celebrated for its intuitive interface and advanced AI forecasting. With a starting price of $15 per user per month, it offers a customizable experience that caters specifically to the needs of real estate professionals. Freshsales stands out with its mobile app features and automation capabilities, although some lead generation tools are reserved for enterprise plans. For more insights, you can read the full Freshsales review.

Another notable mention is HubSpot CRM, which provides a competitive free plan. Its modular approach allows real estate agencies to start with zero costs, adding features as needed. HubSpot’s integration with over 300 third-party applications makes it a flexible choice for various workflows. Explore the HubSpot CRM review for more details.

Zoho CRM is an excellent option for those already utilizing Zoho’s suite of products. With prices starting at $14 per user per month, it offers seamless integration with other Zoho apps. Zoho CRM is particularly lauded for its social media scraping tool, which aids in lead generation. Delve deeper into Zoho’s offerings through the Zoho CRM review.

Specialized and Budget-Friendly Options

For project management enthusiasts, Insightly provides a robust platform with integrated tools and over 250 app integrations. Although its interface may seem overwhelming initially, the potential for workflow automation is significant. Insightly is detailed further in the Insightly review.

BoomTown, designed specifically for realtors, offers real-time property updates and extensive lead-generation features. Although it lacks some integrations, its realtor-focused tools make it a valuable asset for those in the industry.

Choosing the Right CRM

When selecting a CRM, consider factors such as lead generation capabilities, customizability, and automation features. Whether you’re a small agency or a large brokerage, there is a CRM solution tailored to your needs. For a comprehensive comparison, visit the best CRM software guide.

Conclusion

The best CRM solutions for real estate in 2024 are not just about managing contacts but transforming how agencies interact with clients. By leveraging these tools, real estate professionals can enhance client satisfaction, reduce operational costs, and ultimately drive sales growth.

Understanding the Current Landscape of Investment Property Interest Rates

Understanding the Current Landscape of Investment Property Interest Rates

In today’s real estate market, understanding the nuances of investment property loans is crucial for both seasoned investors and newcomers alike. The average cost of a house in the U.S. stands at $420,800, making loans an essential tool for many aspiring property owners. These loans not only enable investors to leverage their investments but also offer potential tax benefits.However, not all loans are created equal. The type of investment property loan you choose can significantly impact the interest rates you pay. For example, house hacking allows investors to take advantage of owner-occupied mortgage rates, which are generally lower than those for traditional investment properties.

Current Interest Rates at a Glance

According to a recent analysis from SparkRental, interest rates for investment properties are notably higher than those for homeowner mortgages. For instance, conventional 15-year fixed-rate loans range from 5.87% to 6.95%, while 30-year fixed-rate loans vary between 5.8% and 8.27%. These rates are influenced by numerous factors, including credit scores and loan-to-value ratios.Creative Financing Options

For those looking to explore beyond conventional loans, various creative financing strategies are available. Owner financing offers a unique opportunity to negotiate directly with sellers, potentially securing more favorable terms. Similarly, the BRRRR strategy allows investors to refinance short-term hard money loans into long-term portfolio loans.Another innovative approach is fractional real estate ownership, which provides an alternative for those seeking passive investment opportunities without the hassle of traditional financing.

The Role of Credit Scores

Your credit score plays a pivotal role in determining the interest rates you receive on investment property loans. A higher score not only opens doors to more favorable rates but also expands your financing options. Therefore, improving your credit score should be a top priority for anyone serious about real estate investing.Final Thoughts

Navigating the world of investment property loans can be daunting, but understanding the landscape can empower you to make informed decisions. Whether you opt for conventional loans or explore creative financing methods, the key is to align your strategy with your investment goals. As the market continues to evolve, staying informed about the latest trends and rates will be crucial for maximizing your returns.For more insights on investment property interest rates, visit SparkRental.

SEO for Real Estate Agents: Unlocking Local Leads and Traffic

SEO for Real Estate Agents: Unlocking Local Leads and Traffic

In the ever-evolving digital landscape, real estate agents are increasingly turning to local SEO to enhance their online presence and attract clients within their specific geographic areas. As highlighted in a recent article by 23 Window Media, optimizing websites for location-based keywords such as “real estate agent in [your city]” or “[your neighborhood] homes for sale” is crucial for success.

Creating Neighborhood-Specific Landing Pages

One key strategy explored involves developing dedicated landing pages for each neighborhood or community served. These pages not only showcase an agent’s expertise but also highlight local market data, featured listings, and insider knowledge about the community. By offering valuable, hyper-local content, agents can attract more targeted traffic and establish themselves as the go-to experts in their respective neighborhoods.

Leveraging Local Partnerships

The article also emphasizes the importance of forming strategic partnerships with local businesses and organizations. Collaborations such as sponsoring community events, hosting neighborhood open houses, or working with local home staging companies can significantly boost an agent’s visibility. These partnerships not only enhance online presence but also reinforce an agent’s reputation as a community expert.

Trends and Insights

The trend towards hyper-local content and community engagement is becoming increasingly vital for real estate agents aiming to become the preferred choice in their targeted communities. By focusing on these strategies, agents can enhance their online visibility and drive more leads and traffic to their realtor websites.