Forecasting the Future: Housing Market Insights for 2025 to 2028

Forecasting the Future: Housing Market Insights for 2025 to 2028

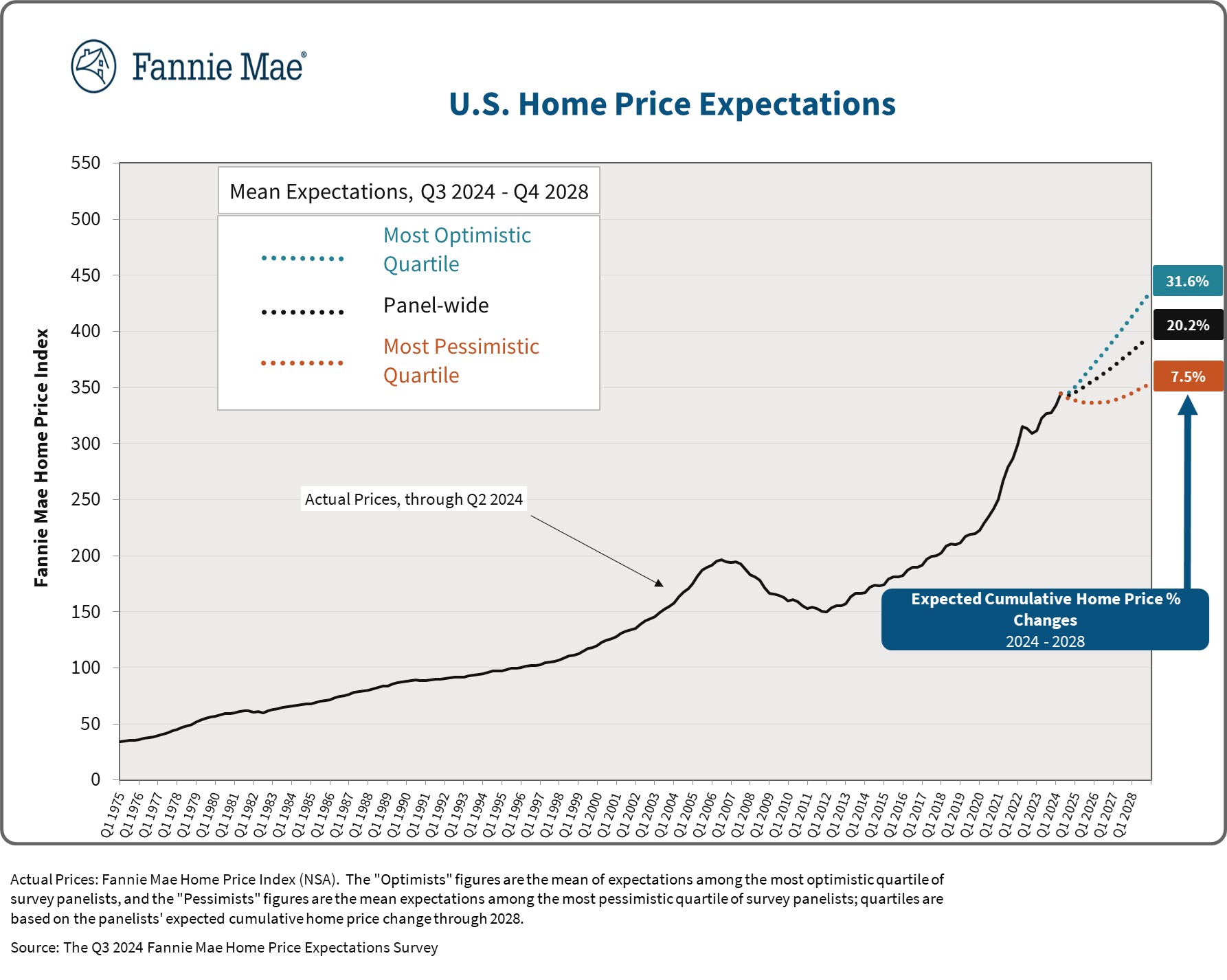

As we look to the horizon of the U.S. housing market, Fannie Mae’s Home Price Expectations Survey offers a crucial glimpse into the coming years. Compiled from the insights of over 100 housing experts, this survey predicts notable changes in home prices from 2025 to 2028. The analysis, originally detailed by Norada Real Estate Investments, suggests a shift in market dynamics that could impact homeowners and investors alike.

Slowing Growth in Home Prices

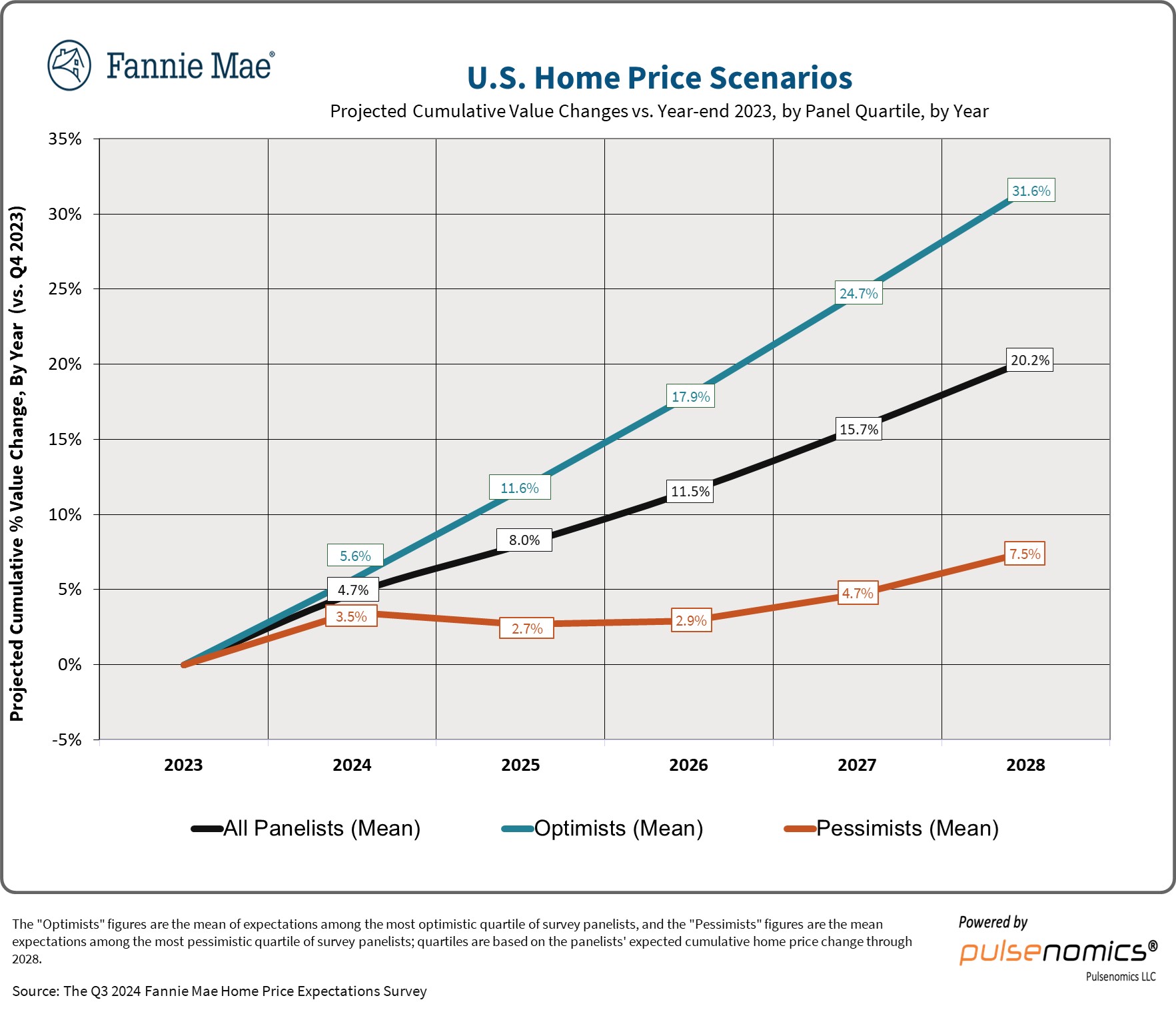

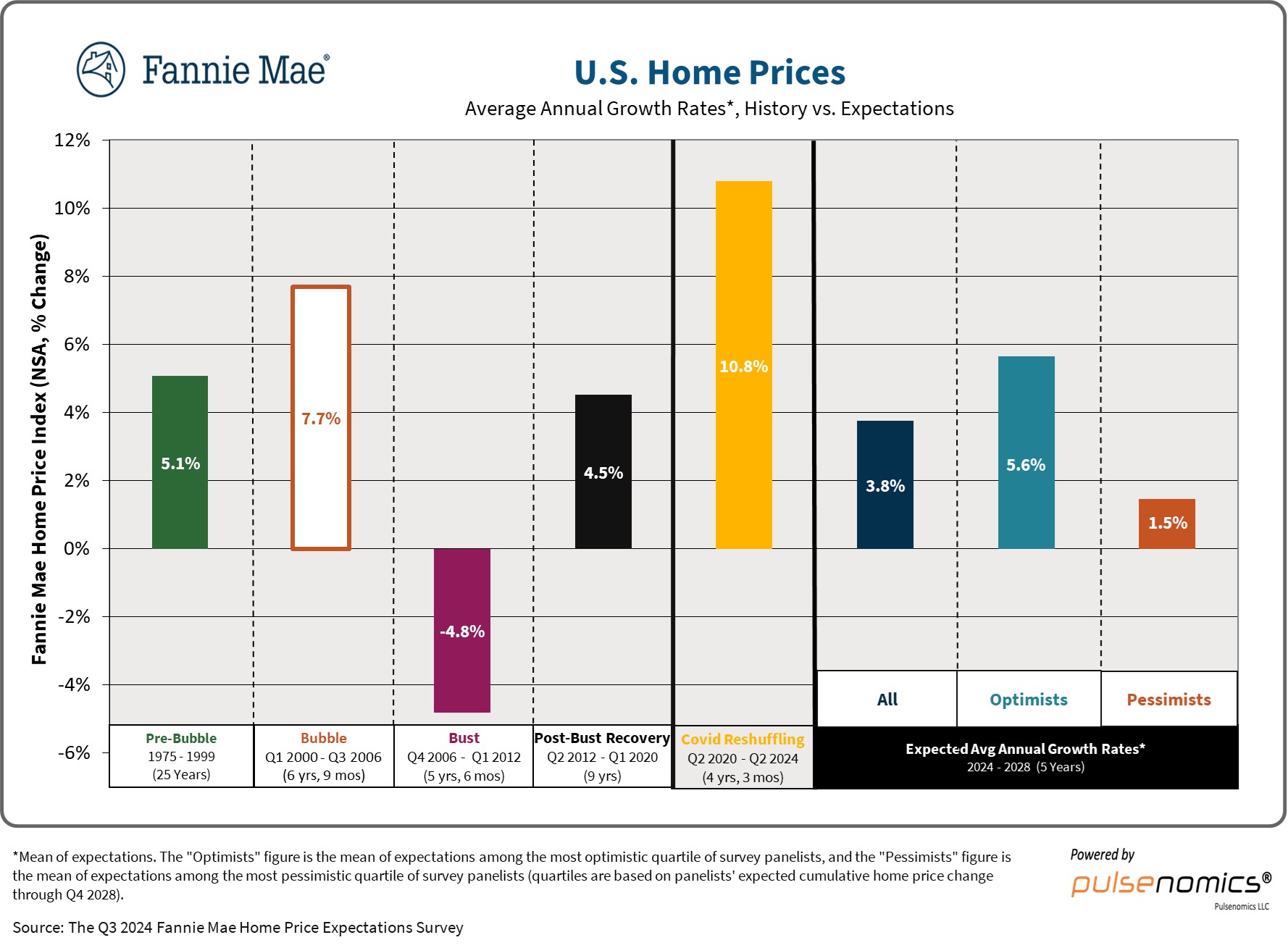

The survey anticipates a slower pace of home price growth in the coming years compared to the robust 6% increase seen in 2023. For 2024, experts forecast a 4.7% growth, with a further decline to 3.1% in 2025. This trend reflects a potential cooling of the market, influenced by policy changes and ongoing supply constraints.

Diverging Predictions and Market Uncertainty

The panel’s projections reveal a wide range of outcomes, from optimistic to pessimistic scenarios. By the end of 2028, the most optimistic forecasts suggest a 31.6% cumulative gain in home prices, while the most pessimistic predict only a 7.5% increase. This divergence highlights the uncertainty and complexity of the market’s future.

Historical Context and Future Implications

Examining historical data from key periods such as the “Pre-Bubble”, “Bubble”, “Bust”, and “Covid Reshuffling” phases, the survey provides a comprehensive view of market fluctuations. These insights are invaluable for buyers, sellers, and investors, each facing unique challenges and opportunities in light of the projected trends.

- For Buyers: Expect a more moderate pace of price appreciation and continued affordability challenges due to the housing shortage.

- For Sellers: Anticipate slower home price appreciation and a potentially more balanced market.

- For Investors: Returns might moderate, but rental demand is likely to remain strong.

The Role of Policy and Supply Constraints

The persistent shortage of housing remains a major issue, with an estimated deficit of approximately 2.8 million homes. Potential policy reforms, such as zoning and permitting changes, could positively impact housing supply, but there is skepticism about their widespread adoption and effectiveness.

The Path Ahead

While home prices are expected to continue their upward trend, albeit at a reduced pace, the future of the housing market remains intricately linked to external factors such as policy reform and economic conditions. For a deeper understanding, readers are encouraged to explore the original article and related reports provided by Norada Real Estate Investments.

More Articles

Getting licensed or staying ahead in your career can be a journey—but it doesn’t have to be overwhelming. Grab your favorite coffee or tea, take a moment to relax, and browse through our articles. Whether you’re just starting out or renewing your expertise, we’ve got tips, insights, and advice to keep you moving forward. Here’s to your success—one sip and one step at a time!

2407, 2023

Montana

Forgive the Cyber Dust

We will return shortly after upgrades are complete

2407, 2023

Missouri

Forgive the Cyber Dust

We will return shortly after upgrades are complete

2407, 2023

Mississippi

Forgive the Cyber Dust

We will return shortly after upgrades are complete

2407, 2023

Minnesota

Forgive the Cyber Dust

We will return shortly after upgrades are complete

2407, 2023

Michigan

Forgive the Cyber Dust

We will return shortly after upgrades are complete

2407, 2023

Massachusetts

Forgive the Cyber Dust

We will return shortly after upgrades are complete

2407, 2023

Maryland

Forgive the Cyber Dust

We will return shortly after upgrades are complete

2407, 2023

Maine

Forgive the Cyber Dust

We will return shortly after upgrades are complete

2407, 2023

Louisiana

Forgive the Cyber Dust

We will return shortly after upgrades are complete

2407, 2023

Kentucky

Forgive the Cyber Dust

We will return shortly after upgrades are complete

2407, 2023

Kansas

Forgive the Cyber Dust

We will return shortly after upgrades are complete

2407, 2023

Iowa

Forgive the Cyber Dust

We will return shortly after upgrades are complete

2407, 2023

Indiana

Forgive the Cyber Dust

We will return shortly after upgrades are complete

2407, 2023

Illinois

Forgive the Cyber Dust

We will return shortly after upgrades are complete

2407, 2023

Idaho

Forgive the Cyber Dust

We will return shortly after upgrades are complete

2407, 2023

Hawaii

Forgive the Cyber Dust

We will return shortly after upgrades are complete

2407, 2023

Georgia

Forgive the Cyber Dust

We will return shortly after upgrades are complete

2407, 2023

Florida

Forgive the Cyber Dust

We will return shortly after upgrades are complete

2407, 2023

Delaware

Forgive the Cyber Dust

We will return shortly after upgrades are complete

2407, 2023

Connecticut

Forgive the Cyber Dust

We will return shortly after upgrades are complete

2407, 2023

Colorado

Forgive the Cyber Dust

We will return shortly after upgrades are complete

2407, 2023

California

Forgive the Cyber Dust

We will return shortly after upgrades are complete

2407, 2023

Arkansas

Forgive the Cyber Dust

We will return shortly after upgrades are complete

2407, 2023

Arizona

Forgive the Cyber Dust

We will return shortly after upgrades are complete

2407, 2023