Futureproofing for Insurers: The Role of AI and Hyper-Personalization

Futureproofing for Insurers: The Role of AI

In a rapidly evolving industry, insurance companies are turning to artificial intelligence (AI) and hyper-personalization to stay ahead of the curve. As noted in a recent article from PropertyCasualty360, these technological advancements are reshaping how insurers engage with customers, assess risks, and enhance operational efficiency.AI and Customer Engagement

By leveraging AI-driven insights, insurers can now customize policies to align with the unique needs of their clients. This shift towards hyper-personalization not only fosters stronger customer loyalty but also enhances satisfaction through personalized coverage options and real-time adjustments.

The Importance of Decision Platforms

While the potential of AI is vast, experts emphasize the need to operationalize these technologies effectively through decision-making platforms. This approach ensures that AI delivers tangible benefits rather than being overshadowed by trendy terms like generative AI.

Modernization and Hyper-Personalization

The trend of modernization within the insurance sector is being driven by AI, with a notable shift towards hyper-personalization. This approach allows insurers to better meet customer expectations, ultimately improving satisfaction and loyalty.

As the industry continues to evolve, the integration of AI and personalization strategies will be crucial for insurers aiming to futureproof their operations and maintain a competitive edge.

More Articles

Getting licensed or staying ahead in your career can be a journey—but it doesn’t have to be overwhelming. Grab your favorite coffee or tea, take a moment to relax, and browse through our articles. Whether you’re just starting out or renewing your expertise, we’ve got tips, insights, and advice to keep you moving forward. Here’s to your success—one sip and one step at a time!

Mortgage Rates Rise: A Window for Buyers Amid a Cloudy Future

Mortgage Rates Rise: A Window for Buyers Amid a Cloudy Future

Mortgage rates are climbing, with the 30-year fixed mortgage rate now at 6.64% and the 15-year fixed rate at 5.98%. This increase, reported by Yahoo Finance, suggests a challenging landscape for potential refinancing, but a possible opportunity for homebuyers as competition wanes during the holiday season.

The Current Rate Landscape

According to the latest Zillow data, here are the prevailing national averages:

- 30-year fixed: 6.64%

- 20-year fixed: 6.54%

- 15-year fixed: 5.98%

- 5/1 ARM: 7.27%

- 7/1 ARM: 7.21%

- 30-year VA: 5.99%

- 15-year VA: 5.49%

- 5/1 VA: 6.25%

- 30-year FHA: 5.70%

- 15-year FHA: 5.69%

- 5/1 FHA: 4.88%

Future Predictions and Market Implications

Experts indicate that a significant decline in rates is unlikely before the end of 2024, with 2025’s outlook remaining uncertain. This forecast suggests that those waiting for a drop in rates might be disappointed, making now a strategic time to purchase a home.

For those considering refinancing, the current climate might not be favorable. With refinance rates slightly higher than purchase rates, holding off might be prudent unless necessary for other reasons.

Understanding Mortgage Types

Choosing between mortgage types, such as a 15-year and 30-year mortgage, involves weighing long-term savings against higher monthly payments. Meanwhile, adjustable-rate mortgages (ARMs) could initially offer lower rates but carry the risk of future increases.

Strategies for Lower Rates

To secure a better deal, consider improving your credit score and saving for a larger down payment. Exploring options like discount points or a temporary interest rate buydown might also be beneficial, depending on your long-term plans.

For more insights, visit the original Yahoo Finance article.

Gene Editing: A Promising Frontier in Biotechnology

Gene Editing: A Promising Frontier in Biotechnology

Gene editing technology is swiftly emerging as a transformative force in both healthcare and agriculture. This innovation, particularly through tools like CRISPR-Cas9, is reshaping the landscape of biotechnology by providing precise methods to modify genes. Such advancements promise to revolutionize the treatment of genetic disorders, cancer, and infectious diseases.Healthcare Innovation and Investment

In healthcare, gene editing is not only enhancing the understanding of disease causes but also paving the way for personalized medicine. The initial high costs and time-consuming processes associated with gene editing have significantly decreased, making production now a matter of days. This reduction has spurred strategic investments in research and development, crucial for advancing new treatments. Venture capital firms and public funding sources have shown keen interest in early-stage biotech companies focused on gene editing. These investments are vital for supporting research, development, and clinical trials, ultimately leading to groundbreaking treatments. Collaborations between biotech startups, pharmaceutical companies, and academic institutions further bolster this progress by sharing costs and accelerating the development of new therapies.Revolutionizing Agriculture

In agriculture, gene editing holds the potential to create stronger, more sustainable, and nutritious crops. By enabling precise modifications to plant genes, scientists can develop crops that resist pests, diseases, and harsh environmental conditions. This technology also offers the possibility of reducing pesticide use, thereby lowering greenhouse gas emissions and promoting biodiversity.Ethical Considerations and Regulatory Frameworks

While the potential of gene editing is immense, it is accompanied by ethical concerns. Debates persist over its use in enhancing human abilities or creating designer children, as well as its potential to exacerbate social inequalities. It is crucial that regulatory frameworks evolve alongside technological advancements to ensure ethical and safe applications of gene editing. Agencies like the FDA play a pivotal role in regulating the approval and sale of gene-edited products.Economic Prospects with Ethical Guardrails

The economic potential of gene editing is substantial, with experts predicting significant market growth driven by research, partnerships, and new therapies. However, ethical considerations must guide investments to ensure responsible and fair use of this technology. As highlighted in the original article from Forbes, an “ethics first, investment second” approach is essential for navigating the complex landscape of gene editing.Conclusion Gene editing technology offers remarkable opportunities for advancing healthcare and agriculture while posing significant ethical challenges. As investments continue to flow into this promising field, it is imperative to balance scientific progress with ethical responsibility to ensure a future where gene editing benefits humanity as a whole.

Empowering the Gig Economy: AXA’s Tailored Protection

Empowering the Gig Economy: AXA’s Tailored Protection

The gig economy, a burgeoning landscape of non-standard employment forms like gig work, flexi-work, and freelance work, is reshaping the labor market, particularly for Gen-Z. This generation, driven by a thirst for flexibility and autonomy, is at the forefront of this transformation. However, as the South China Morning Post highlights, this shift is not without its challenges.

In Hong Kong, a notable segment of the workforce identifies as self-employed, yet they often find themselves outside the protective embrace of traditional social safety nets. Government data reveals that out of a working population of 3.69 million, 0.29 million are self-employed, a figure that excludes unpaid family workers. This gap leaves many vulnerable to financial risks associated with illness, accidents, and retirement insecurity.

Angela Wong, Chief Marketing and Customer Officer at AXA Hong Kong & Macau, underscores the critical need for comprehensive insurance solutions for gig workers. “Being self-employed shouldn’t be a risk,” she asserts. The lack of health and accident insurance can lead to substantial medical bills, jeopardizing financial stability and forcing gig workers to continue working despite health challenges.

According to a World Bank report, individuals in non-standard employment often remain outside the scope of social insurance schemes. This underscores the importance of formulating policies that extend coverage to these vulnerable segments of the workforce.

AXA is stepping up to fill this gap by offering tailored insurance solutions. By doing so, they aim to provide gig workers with the financial security and peace of mind they need to thrive in this new economy, ensuring that freedom of work comes with a safety net.

Ethical Deployment of AI in Healthcare: AMA’s Guiding Strategies

The Ethical Landscape of AI in Healthcare

The potential of AI in healthcare is vast and varied, encompassing everything from informing clinical management to autonomously diagnosing diseases. A recent AMA survey revealed that nearly two-thirds of physicians recognize AI’s potential benefits. However, with great potential comes significant risk. The AMA highlights that AI’s integration must be guided by the fundamental principles of medical ethics: patient autonomy, beneficence, nonmaleficence, and justice. The risk of bias at any stage of AI development underscores the need for physician involvement to safeguard these principles.

Physicians’ Role in AI Implementation

Physicians are urged to engage actively with professional organizations to assess AI algorithms specific to their practice, ensuring that these tools align with clinical needs. Engaging in these assessments not only aids in the reliable adoption of AI but also aligns with the standard of care for medical interventions.

Continuous Learning and Vigilance

The AMA’s Ed Hub™ CME series serves as a resource for healthcare professionals to build knowledge and skills necessary for evaluating AI algorithms. Understanding when and how to apply AI, alongside evaluating its performance, is crucial for enhancing patient care.

Legal and Ethical Awareness

As the legal landscape surrounding AI evolves, it is imperative for healthcare professionals to stay informed about changes in laws and regulations. The AMA provides a detailed overview of current governance and regulation, emphasizing the importance of aligning practices with the most current requirements.

Conclusion

The AMA’s efforts to make technology work for physicians reflect a dedication to ensuring that AI serves as an asset rather than a burden. By advocating for ethical and safe AI usage, the AMA paves the way for a future where technology and healthcare coexist harmoniously, benefitting both practitioners and patients.

AI’s Role in Revolutionizing Medical Education

AI’s Role in Revolutionizing Medical Education

As artificial intelligence (AI) continues to evolve, its integration into medical education is becoming increasingly imperative. AI, which simulates human intelligence, is reshaping various sectors, particularly healthcare. The ability to perform complex tasks, such as diagnostics and personalized healthcare, is no longer confined to human capabilities alone. This shift is prompting educational institutions to rethink their curricula to prepare future healthcare professionals for an AI-driven world.AI’s Transformative Impact on Learning

The recent surge in AI technologies, notably ChatGPT, has revolutionized digital education. These tools promote personalized learning experiences, acting as tutors, writing coaches, and question generators. The integration of AI in medical education offers unique opportunities to enhance learning, close knowledge gaps, and improve patient care.Ethical Considerations in AI Usage

Despite the promising potential of AI, ethical concerns remain prevalent. Issues such as accountability in clinical settings, where AI might err, highlight the need for clear guidelines and roles. It is essential for educational systems to instill ethical AI usage and uphold scholarly integrity among students. The original article from Frontiers emphasizes the importance of addressing these ethical responsibilities.Integrating AI into Curricula

To keep pace with technological advancements, medical schools are encouraged to incorporate AI-based tools into their curricula. This integration can enhance and personalize learning experiences, using AI for clinical communication practice and adaptive e-learning systems. The article suggests that AI literacy programs for both faculty and students are crucial for informed curriculum integration.Institutional Adaptation and Future Prospects

Educational institutions must adapt to the technological landscape by incorporating AI into their systems. This adaptation ensures they remain relevant and do not fall behind. The responsible adoption of AI could transform healthcare services, offering novel methods for training medical professionals. As we embrace AI in education, maintaining vigilance on ethical boundaries is paramount.

Conclusion

AI has emerged as a powerful tool in medical education, offering opportunities to advance healthcare and empower the next generation of professionals. By leveraging AI’s capabilities, medical education can become more personalized and efficient. However, careful attention to ethical considerations, technical infrastructure, and faculty training is essential for the responsible integration of AI into medical education.AI Chatbots in Chronic Disease Diagnosis

Revolutionizing Healthcare: AI Chatbots in Chronic Disease Diagnosis

In a groundbreaking development, artificial intelligence has once again demonstrated its transformative potential, this time within the realm of healthcare. A recent study published in Nature on July 25, 2024, unveils a cutting-edge chatbot named Chat Ella, designed to assist in the diagnosis of chronic diseases. This innovation leverages the power of large language models, specifically the GPT-2, to enhance patient care and streamline diagnostic processes.The Rise of AI in Healthcare

With telemedicine and AI technologies gaining global traction, the healthcare sector is witnessing a paradigm shift. Chronic diseases, which account for a significant portion of healthcare burdens, are now being addressed through innovative solutions like Chat Ella. This chatbot employs advanced AI to interpret patient symptom descriptions, offering preliminary diagnostic insights that can be crucial, particularly in regions with limited medical resources.Chat Ella: A Technological Marvel

Chat Ella is not just another chatbot; it’s a sophisticated system integrated with a comprehensive medical database. By utilizing the GPT-2 model, it provides a conversational interface that engages with patients, delving into symptom details and offering diagnostic recommendations. This development is a testament to the potential of AI in revolutionizing healthcare services by making them more accessible, efficient, and cost-effective.Study Insights and Methodology

The study, conducted by researchers Sainan Zhang and Jisung Song, highlights the integration of large-trained language models in healthcare applications. By employing a rigorous methodology, the team has demonstrated how AI can significantly enhance the diagnostic process. The study’s findings suggest that AI-driven tools like Chat Ella could alleviate the unequal distribution of healthcare resources and reduce the burden on medical professionals.Future Prospects and Enhancements

While Chat Ella represents a significant leap forward, the study acknowledges certain limitations, such as the need for a more extensive dataset and support for multiple languages. The authors propose future updates to include voice input and image recognition features, further broadening the system’s capabilities and usability.Conclusion

As AI continues to evolve, its integration into clinical workflows becomes increasingly vital. Chat Ella exemplifies how AI can complement human decision-making in healthcare, improving patient experiences and reducing economic costs. This technology offers a promising avenue for patients seeking efficient and convenient diagnostic services, particularly those unable to access face-to-face consultations.For more detailed insights, the original article can be accessed on Nature’s website.

Revolutionizing Genetic Research with CRISPR-Cas Technology

Unlocking the Secrets of Genetic Variants

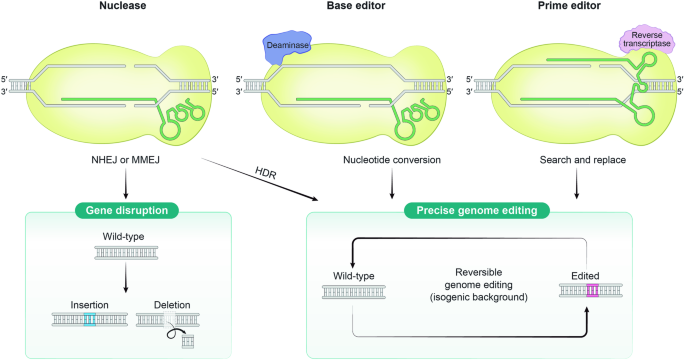

For years, scientists have grappled with the challenge of deciphering the role of genetic mutations, particularly those classified as variants of unknown significance (VUSs). These mutations, often linked to human diseases, have remained elusive due to limited knowledge about their impact on cellular phenotypes. However, the advent of CRISPR-Cas technology is changing the game.CRISPR-Cas, a precise genome editing tool, allows researchers to manipulate specific DNA sequences with unprecedented accuracy. As noted by Wang and Doudna, this technology is not just a tool but a gateway to understanding the genetic influences on diseases. By facilitating the study of both protein-coding and noncoding regions of the genome, CRISPR-Cas offers a comprehensive approach to unraveling the genetic underpinnings of various conditions.

The Power of High-Throughput Sequencing

The marriage of CRISPR technology with high-throughput sequencing has opened new avenues for functional genomics research. Techniques like Illumina and Oxford Nanopore Technology (ONT) are enabling the detailed analysis of genetic mutations on a massive scale. This integration allows scientists to conduct high-throughput screens, analyzing the functions of numerous genetic mutations simultaneously.Moreover, advancements in single-cell sequencing are enhancing the granularity of genetic studies. By examining individual cells, researchers can gain deeper insights into the specific effects of genetic knockouts and the global changes in gene expression they induce.

CRISPR’s Role in Precision Medicine

The implications of these advancements are profound, particularly in the realm of precision medicine. By providing a detailed understanding of genetic variants, CRISPR-Cas technology holds the potential to transform diagnostic and therapeutic approaches. Researchers are now able to create isogenic disease models, facilitating the accurate analysis of phenotypic changes resulting from specific genetic mutations.Furthermore, the ability to study noncoding regions and regulatory elements expands the scope of genetic research, offering new possibilities for therapeutic interventions targeting genetic disorders at their root.

Challenges and Future Directions

Despite its promise, CRISPR technology is not without challenges. The efficiency of gene editing varies, and the risk of unintended genomic alterations remains a concern. However, ongoing research and technological advancements continue to address these limitations, paving the way for broader applications in various fields.As the scientific community delves deeper into the world of CRISPR-based functional genomics, the potential for groundbreaking discoveries is immense. With each new development, we move closer to a future where precision medicine is not just a possibility but a reality.

The Impact of Remote Work on Real Estate Investment in India

The Rise of Remote Working

Remote work has shifted traditional office-based environments as more companies adopt flexible work policies. This shift affects the demand for different types of properties, with a notable decrease in the need for commercial spaces and an increase in the appeal of residential setups.Impact on Real Estate Investment

Investors are now prioritizing residential properties, particularly those in suburban and rural areas, which provide spacious environments conducive to home offices. This shift has reinvigorated interest in locations offering enhanced quality of life, breathing space, and amenities that urban centers often lack.The demand for such properties has led to fluctuating real estate prices across different areas. While urban centers witness steady or reducing prices due to lessening demand for commercial offices, suburban and rural regions are experiencing a rise due to increased desirability and potential for appreciation.

Important Considerations for Investors

- Connectivity & Infrastructure: High-speed internet and comprehensive infrastructure are key for appealing property investments.

- Quality of Life: Desirable properties are in areas with high living standards, safety, and community amenities.

- Property Features: Homes with office spaces, natural light, and sufficient outdoor areas are in high demand.

- Market Trends: Keeping up with real estate dynamics is essential for strategic investment.

- Legal & Regulatory Factors: Understanding property laws and zoning regulations is critical to compliance.

- Future Prospects: Long-term area potential hinges on factors like infrastructure projects and economic policies.

- Community Engagement: Areas with active social communities and cultural amenities are attractive to remote workers.

For investors navigating this changing landscape, several critical factors must be considered. Connectivity, particularly high-speed internet, becomes a decisive factor, as does infrastructure support in these regions. Moreover, remote workers value quality-of-life aspects like air quality, safety, and community, pushing investors to lean towards investing in areas rich with these attributes.

Furthermore, staying abreast with market trends is vital. Investors should closely monitor current demand-supply dynamics and future development plans to make informed decisions. A thorough understanding of legal and regulatory demands ensures compliance, while insights into future prospects based on economic growth potential help in identifying high-return opportunities.

In summary, remote work is dramatically reshaping real estate trends in India. By understanding and adapting to these shifts, investors can make savvy decisions, aligning their strategies with this evolving landscape and capitalizing on the burgeoning opportunities that remote working presents.

For more personalized advice, it may be beneficial to explore Buddhist solutions like Feng Shui for your remote workspace, which can enhance productivity and tranquility in home offices.

Have questions or insights on this topic? Feel free to reach out to Jhumur Ghosh, Editor-in-Chief, at jhumur.ghosh1@housing.com.

Wearable Tech: A New Frontier in Heart Failure Management

Wearable Tech: A New Frontier in Heart Failure Management

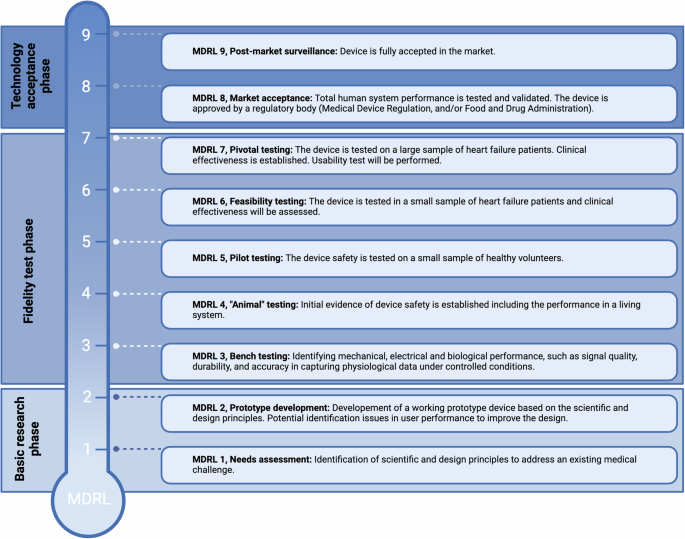

In the bustling corridors of healthcare innovation, a quiet revolution is underway. Wearable technologies are emerging as a beacon of hope for heart failure (HF) management, promising a future where patient care is not just reactive but proactive. As reported in a recent Nature article, these devices are poised to transform how we monitor and manage HF patients.

Potential and Promise

Wearable devices, ranging from accelerometers to ECG and bio-impedance sensors, provide a continuous stream of real-time data. This data is crucial for tracking heart rhythm, rate, and even pulmonary congestion, offering insights that can inform clinical decisions and potentially reduce hospitalizations. The integration of such technology could alleviate the burden on healthcare systems, allowing for more efficient patient care.Current Challenges

Despite their potential, most wearables are still in the feasibility phase, lacking the robust evidence needed to demonstrate substantial clinical benefits. The review highlights the necessity for large-scale randomized controlled trials (RCTs) to validate these technologies. Without such evidence, the adoption of wearables in clinical practice remains limited.Future Directions

The path forward is clear: comprehensive studies across diverse populations are essential. Ensuring that these technologies provide equitable benefits will be key to their success. As researchers like Niels T. B. Scholte and his team at Erasmus Medical Center continue to push the boundaries, the hope is that wearables will soon transition from promising prototypes to integral components of HF management.Conclusion

The journey of wearable technology in heart failure management is just beginning. As the field evolves, the focus must remain on rigorous validation and equitable access. Only then can we unlock the full potential of these innovations, transforming patient care and health outcomes.References

- Disease, G. B. D., Injury, I., & Prevalence, C. Global burden of disease study (2017). Lancet, 392, 1789–1858.

- Savarese, G. et al. Global burden of heart failure. Cardiovasc. Res., 118, 3272–3287 (2023).

- Scholte, N. T. B. et al. Telemonitoring for heart failure. Eur. Heart J., 44, 2911–2926 (2023).

- Seva, R. R. et al. Medical device readiness level. Theor. Issues Erg. Sci., 24, 189–205 (2023).

Contact

For more information, reach out to Niels T. B. Scholte at n.scholte@erasmusmc.nl.Transformative Potential of EV Infrastructure: A Collaborative Approach

Collaborative Efforts for Workforce Development

The collaborative aims to develop a skilled workforce to support the burgeoning EV infrastructure, fostering career pathways in marginalized areas. This initiative is a joint effort among government entities, industry experts, and educational leaders. Key figures, including Justine Johnson, Chief Mobility Officer for Michigan, and Stephanie Piko, Mayor of Centennial, Colorado, co-chaired the taskforce. Federal representatives, such as Gabe Klein from the U.S. Department of Energy and Transportation, also participated, highlighting the importance of leveraging NEVI funding for workforce development.

Key Discussions and Strategies

Over the course of two days, the event featured in-depth discussions on building a talent pipeline and creating inclusive workforce strategies. Abigail Campbell Singer from Siemens USA shared insights from the EVeryone Charging Forward initiative, emphasizing the need for inclusive EV workforce development. Other discussions highlighted the role of educational institutions and industry leaders in supporting a diverse EV workforce through technical certificate programs and pre-apprenticeship courses.

Moving Forward: Innovation and Collaboration

The meeting concluded with a call for continued innovation and collaboration. Policymakers, educators, and industry leaders were urged to work together to ensure equitable opportunities arising from EV advancements. Plans to develop resources and working groups were initiated to address data and action gaps identified during the event.

By fostering these discussions, the EV Workforce Collaborative is committed to ensuring that America’s shift to electric vehicles is paralleled by the creation of skilled, equitable employment opportunities, supporting a sustainable and inclusive economic transition for all communities.

Parametric Insurance: A New Frontier in Climate Risk Management

Parametric Insurance: A New Frontier in Climate Risk Management

In the face of escalating climate challenges, risk managers are increasingly turning to parametric insurance as a vital tool to supplement traditional property programs. This innovative approach, grounded in an “if-then” model, offers a strategic advantage by aligning capital more effectively with the unpredictable nature of natural disasters.

Climate Change and Insurance Challenges

The impact of climate change is undeniable, with a marked increase in both the frequency and severity of natural catastrophes. According to Aon’s insights, the traditional insurance market is struggling to keep pace, leaving significant economic exposures unaddressed. This is where parametric insurance steps in, offering a tailored solution that extends beyond mere physical damage to cover broader economic impacts.The Mechanics of Parametric Insurance

Parametric insurance operates on three core principles:- The “if”: Coverage is triggered by specific, independent events, as verified by neutral third-party data, which streamlines the underwriting process.

- The “then”: Once triggered, pre-agreed payouts are swiftly executed, often within ten days, providing critical liquidity during crises.

- Closing the Protection Gap: This model makes previously uninsurable risks insurable, bridging the gap with contingent capital.

Expanding Applications

Parametric solutions are particularly effective for “grey swan” events—unpredictable but impactful occurrences like hurricanes, earthquakes, and severe weather. As these events become more common, businesses are integrating parametric insurance into their risk management portfolios, freeing up capital and enhancing resilience.Moreover, the flexibility of parametric insurance allows it to address other exogenous risks, such as pandemics and cloud service outages, by leveraging independent data to define clear triggers.

Conclusion

As the climate continues to present complex challenges, parametric insurance emerges as a transformative force in risk management. By offering rapid, reliable financial responses to disasters, it provides a crucial buffer for businesses navigating an increasingly volatile world.National Association of REALTORS® 2024 Survey Highlights Green Revolution in Real Estate

Green Data Fields: Illuminating Sustainable Features

The inclusion of green data fields signifies a transformative change in how residential properties are presented. These fields serve as guiding lights for buyers interested in earth-friendly homes, ensuring that sustainable features are highlighted and easily accessible.Education Empowers: Embracing Sustainable Practices

Education plays a crucial role in this green transition. The survey reveals that 25% of residents in homes with sustainable features have received training related to these aspects. This growing understanding of energy-efficient appliances, renewable energy systems, and environmentally-friendly building materials empowers real estate agents to champion green living and cater to eco-conscious clients.

Energy Efficiency: A Valuable Asset

The emphasis on energy efficiency is evident, with over half of the respondents acknowledging its importance in property listings. This focus is crucial for attracting buyers and enhancing the marketability of homes, as demand for sustainable living solutions continues to rise.Client Interest: A Shift Towards Sustainability

Nearly half of the respondents noted a growing interest in sustainability from their clients, indicating a broader societal movement towards eco-conscious living. By aligning with these evolving priorities, REALTORS® are not only facilitating transactions but also advancing environmental sustainability.Green Certifications: Dispelling Myths

The survey dispels common myths that green certifications hinder marketability. Over 40% of green-certified homes did not experience prolonged time on the market, showcasing the acceptance of eco-friendly certifications among buyers.Client Priorities: Comfort Meets Consciousness

Clients are increasingly prioritizing features like windows, doors, and living spaces alongside sustainability in homes. This dual focus underscores the need for holistic design approaches that balance environmental responsibility with quality of life.High-Performance Homes: Investing in the Future

The survey reveals that 13% of high-performance homes command a 1% to 5% premium over their non-high-performance counterparts. This financial incentive highlights the value of investing in homes that prioritize comfort, health, and operational efficiency.Direct Involvement: Driving Change

A significant majority of respondents have been directly involved with properties featuring green elements in the past year, reflecting the proactive steps the real estate industry is taking to integrate sustainability into residential transactions.Conclusion: A Green Horizon Beckons

The NAR 2024 Sustainability Report outlines a promising landscape for sustainable real estate. With the integration of green data fields and increasing client interest in eco-friendly homes, the sector is poised to lead the transition towards a greener future. By emphasizing education, advocating energy efficiency, and engaging with green properties, real estate professionals are setting the foundation for a more sustainable market.AI’s Transformative Role in Healthcare: A New Era

AI’s Transformative Role in Healthcare: A New Era

In the ever-evolving landscape of healthcare, Artificial Intelligence (AI) is emerging as more than just a tool—it’s a transformative force reshaping the industry. Visionaries like Vinod Khosla have long predicted AI’s potential to revolutionize healthcare, and that potential is now being realized. The shift from human-centered care to AI-driven systems is becoming a reality, as AI technologies begin to outperform traditional methods, particularly in areas requiring precision and data processing.As Kris Pahuja, co-founder of the Y-Combinator backed startup Piramidal, observes, AI is making significant strides in healthcare. From X-Ray to MRI imaging, AI “co-pilots” are becoming standard in assisting physicians with decision-making. This evolution is evident in complex environments like the ICU, where AI’s integration is proving invaluable.

From Data to Diagnosis: AI’s Precision

AI’s unmatched ability to analyze vast amounts of data is more than just automation; it represents a profound change in medical diagnostics. As noted in a Fortune article, AI could potentially take over up to 80% of standard medical tasks, reducing errors and biases that can occur in human diagnosis. This leads to better patient outcomes, particularly in fields like radiology and pathology, where AI aids in the early detection of diseases such as cancer.Moreover, AI’s integration into diagnostics is advancing global healthcare equity. AI-driven tools can be deployed in under-resourced areas, providing high-quality diagnostics where specialized medical professionals are scarce. This democratization of healthcare could be key in reducing global health disparities.

Personalized Medicine: Tailoring Treatment with AI

AI’s role in personalized medicine is among its most promising applications. By analyzing genetic profiles and real-time health data, AI enables treatments tailored to individual patients. This shift from a one-size-fits-all approach reduces adverse reactions and enhances treatment effectiveness. Research published in Nature Humanities and Social Sciences Communications highlights AI’s role in driving precision healthcare, where treatments are increasingly customized based on biological markers, environmental factors, and lifestyle choices.Additionally, AI is accelerating drug development. Pharmaceutical companies are leveraging AI to analyze large datasets from clinical trials, identifying potential new drug candidates more quickly and accurately than traditional methods. This faster drug discovery process could lead to more effective treatments reaching patients sooner.

AI in Patient Care Management

AI’s potential in patient care management is substantial. By continuously monitoring patient health data, AI systems can predict potential health issues and provide timely interventions, shifting healthcare from a reactive model to a proactive one. This proactive approach not only improves patient outcomes but also reduces long-term healthcare costs.AI-powered predictive analytics also play a crucial role in preventive care, identifying patients at risk of developing conditions like diabetes or hypertension long before symptoms appear. This early intervention strategy can prevent the onset of these diseases, significantly reducing the burden of chronic illnesses.

Ethical Considerations and Challenges

Integrating AI into healthcare is not without challenges, particularly concerning privacy, security, and ethics. AI systems require vast data to function effectively, raising concerns about data breaches and privacy. Additionally, as AI systems make more autonomous decisions, ethical questions arise, such as who is responsible for incorrect diagnoses or treatment recommendations made by AI. These are complex issues that healthcare providers and regulators must address as AI becomes more prevalent in the industry.The IQVIA blog also underscores the ethical implications of AI in healthcare beyond data privacy and decision-making. AI’s use in patient care could lead to the dehumanization of healthcare, where decisions may become overly data-driven, potentially overlooking the nuances of human empathy and judgment.

Integrating AI: A Strategic Approach

For healthcare leaders eager to embrace AI, a strategic, phased approach is recommended. Begin by identifying specific areas where AI can deliver immediate value and launch pilot projects to test and refine these tools. It’s essential to build a multidisciplinary team that includes clinicians, data scientists, and ethicists to ensure that AI solutions are both effective and ethically sound.Equally important is addressing privacy, security, and ethical concerns upfront. Leaders should establish strong data governance frameworks to protect patient information and ensure transparency in how AI systems are used. Engaging with patients and stakeholders about the benefits and safeguards of AI is crucial for maintaining trust.

A New Era of Healthcare

The future of healthcare lies in the seamless integration of AI technologies as partners in care, not just tools. AI is set to reshape healthcare by improving outcomes, reducing costs, and enabling personalized care. As AI continues to advance, it will redefine the relationship between patients and healthcare providers, making care more efficient, effective, and personalized.AI Pioneers a New Era in Drug Development and Diagnostic Accuracy

AI Medical Tools Revolutionize Healthcare Landscape

In a groundbreaking development, scientists at Wayne State University are pioneering artificial intelligence models to significantly reduce costs in complex drug design. This initiative focuses on creating new medications, particularly those involving complex drug types traditionally challenging to simulate.Alice Walker, an assistant professor of chemistry at Wayne State, emphasized the potential of these AI models in a recent news release. “Most drug design is done with small organic molecules,” she explained, highlighting the difficulties with unusual drug scaffolds like sugars and fluorescent molecules. Her team aims to develop new computational techniques to address these challenges, potentially leading to breakthrough treatments with fewer side effects.

AI Outperforms Human Doctors in Diagnostics

A Stanford University study has revealed a remarkable achievement by ChatGPT-4, which scored a 92% accuracy rate in medical diagnostics, outperforming traditional physicians who scored 74%. This significant finding, published in JAMA Network Open, underscores the transformative potential of AI in healthcare.Despite these advancements, the study noted that doctors with access to ChatGPT did not show substantial improvement in diagnostic reasoning, although they completed assessments more swiftly. Co-lead author Ethan Goh, a postdoctoral scholar at Stanford, remarked in a blog post that while AI won’t replace doctors, it could greatly enhance their capabilities.

Health Tech Sector Experiences Robust Growth

The health tech sector has witnessed a 12% rise in stocks in 2024, buoyed by substantial investments in AI, according to Bessemer Venture Partners’ annual report. The report highlights that AI-focused companies now attract 38% of venture capital in healthcare, with valuations soaring up to five times higher than their non-AI counterparts.Despite this growth, early-stage funding challenges persist, with Series A companies taking 50% longer to secure capital compared to previous years. Bessemer partners Sofia Guerra and Steve Kraus noted the sector’s “remarkable adaptability and strength in the face of ongoing market challenges.”

For more insights on AI advancements, subscribe to the PYMNTS AI Newsletter.

AI Revolutionizes the Real Estate Industry

AI Revolutionizes the Real Estate Industry

In a world where technology is reshaping industries at an unprecedented pace, the real estate sector is not left behind. Artificial Intelligence (AI) is proving to be a game-changer, optimizing and automating processes that enhance customer satisfaction and decision-making. The integration of AI is facilitating a paradigm shift in property management, investment strategies, and customer interactions.AI’s capabilities extend to automating administrative tasks and enhancing property valuation, heralding a new era of growth and efficiency for the real estate industry. As highlighted in a recent Appinventiv article, AI applications and tools, such as virtual tours and property management software, underscore its influence and potential in reshaping industry norms.

Transformative AI Applications in Real Estate

The article explores numerous AI applications, including virtual property tours, lead generation, and property valuation automation. AI acts as a catalyst for market change, offering personalized experiences to buyers and sellers, automating repetitive tasks, and optimizing operations for enhanced efficiency.Companies like Zillow and Trulia are at the forefront of this revolution, leveraging AI to offer property value estimates and personalized recommendations, respectively. Zillow’s use of neural networks to analyze digital photos and generate property estimates exemplifies AI’s transformative power. Meanwhile, Trulia’s AI-powered platform enhances user experience by analyzing behavior and preferences to provide tailored property suggestions.

The Future of AI in Real Estate

The future of real estate is inextricably linked with AI and machine learning. As the industry continues to evolve, stakeholders must remain informed about technological advancements to maintain a competitive edge. The synergy between AI and real estate will streamline operations, improve decision-making processes, and boost overall efficiency.AI’s capacity to swiftly analyze extensive datasets empowers real estate professionals in making informed decisions, effectively managing risks, and seizing competitive opportunities. This integration is set to undergo further transformative evolution, intersecting with emerging technologies such as blockchain, robotics, and cloud computing. Together, these technologies promise to revolutionize property transactions, enhance security, automate processes, and create immersive virtual experiences.

Conclusion

As AI continues to revolutionize the real estate industry, its integration into workflows not only redefines standards but also drives innovation and sustainable growth. For companies aiming to redefine property management and leverage digital advancements, AI is a pivotal technology.For more insights into how AI is transforming the real estate industry, visit the original article on Appinventiv.

The Power of Real Estate Designations and Certifications

The Power of Real Estate Designations and Certifications

The National Association of REALTORS® (NAR) offers a suite of designations and certifications that elevate the professional standards of REALTORS® across the globe. These specialized credentials are designed to enhance the skills, proficiency, and knowledge of real estate professionals, distinguishing them as experts in their respective fields.Understanding Designations and Certifications

Designations and certifications serve as vital tools for REALTORS® aiming to advance their careers. While both require NAR membership, there are distinct differences. Designations entail annual dues and a commitment to ongoing education, offering extensive benefits that are regularly updated. Certifications, on the other hand, require only an application fee and do not demand annual dues.Highlighted Designations and Certifications

- Accredited Buyer’s Representative (ABR®): This designation, presented by the Real Estate Buyer’s Agent Council, equips REALTORS® with the skills to represent homebuyers effectively. More details can be found here.

- Certified Commercial Investment Member (CCIM): Recognized as the global standard for commercial real estate achievement, the CCIM designation involves a rigorous curriculum and a network of 13,000 professionals worldwide. Learn more here.

- Seller Representative Specialist (SRS): This designation is the premier credential for seller representation, enhancing REALTORS®’ ability to advocate for sellers. More information is available here.

- At Home With Diversity® (AHWD): This certification teaches REALTORS® how to work effectively in today’s diverse real estate market. Details can be found here.

The Importance of Professional Development

The NAR’s commitment to professional development is evident through its extensive range of programs and services. These initiatives are designed to ensure REALTORS® are equipped with the latest skills and knowledge, enabling them to provide exemplary service to their clients. By investing in these credentials, real estate professionals not only enhance their expertise but also gain a competitive edge in the marketplace.Conclusion

In an ever-evolving real estate landscape, the importance of continuous learning and professional development cannot be overstated. The NAR’s designations and certifications offer REALTORS® the opportunity to stay ahead, ensuring they remain trusted advisors in their respective markets.Navigating Telemedicine: Challenges Amid DEA’s Regulatory Delays

In the evolving landscape of telemedicine, the U.S. Drug Enforcement Agency’s (DEA) potential crackdown on telemedicine prescribing has stirred concerns among healthcare professionals. Nathaniel Lacktman, a partner at Foley & Lardner LLP and a board member of the American Telemedicine Association, shared insights into these challenges in an article published by Endpoints News, a Financial Times publication.

Lacktman highlighted the ramifications of the DEA’s repeated delays in enacting telemedicine prescribing regulations, which have placed doctors and patients in a precarious position. The dilemma revolves around the conflict between federal prescribing laws and state laws on continuity of care. Should the DEA allow current waivers to expire without a viable alternative, patients may find themselves without necessary in-person medical support. This could expose doctors to claims of patient abandonment. “It’s putting doctors in a really difficult situation to determine if and when do I tell my patients that I can’t care for them?” Lacktman remarked.

Foley & Lardner LLP’s Telemedicine and Digital Health Industry Team is at the forefront of addressing these emerging issues. Recognized nationally by Chambers USA, the team supports organizations and entrepreneurs in navigating the complexities of virtual care, helping them provide innovative solutions for patients both locally and globally. Clients have praised Foley as “the premier firm for telehealth counsel,” “a market leader in telemedicine issues,” and “the Dream Team.”

The ongoing regulatory delays by the DEA underscore the challenges posed by a mixed federal-state legal landscape affecting telemedicine. As the telemedicine industry continues to grow, the need for clear and consistent regulations becomes increasingly critical to ensure that both doctors and patients can navigate this new frontier safely and effectively.

Bitcoin: A New Era or Just a Passing Phase?

Bitcoin: A New Era or Just a Passing Phase?

:max_bytes(150000):strip_icc()/business_building_153697270-5bfc2b9846e0fb0083c07d69.jpg) In the ever-evolving landscape of financial technology, Bitcoin stands as a revolutionary force, challenging the traditional stronghold of central banks. As a decentralized peer-to-peer digital currency, Bitcoin operates independently of government oversight, sparking debates about its potential to replace fiat currencies.

In the ever-evolving landscape of financial technology, Bitcoin stands as a revolutionary force, challenging the traditional stronghold of central banks. As a decentralized peer-to-peer digital currency, Bitcoin operates independently of government oversight, sparking debates about its potential to replace fiat currencies.

The Role of Central Banks

Central banks, such as the Federal Reserve in the United States and the Bank of England, are pivotal in managing national economies. They control inflation, regulate money supply, and set interest rates. These institutions have been instrumental in stabilizing economies, but they have also been criticized for their role in economic crises, such as the Great Depression and the Great Recession.Bitcoin’s Decentralized Promise

Bitcoin’s decentralized nature offers an alternative to the centralized control of traditional financial systems. Proponents argue that it could democratize access to financial services and reduce the risk of economic mismanagement by central authorities. However, the challenges of widespread adoption and security vulnerabilities cannot be ignored.Challenges and Limitations

Despite its potential, Bitcoin faces significant hurdles. The complexity of its initial interface and the risk of software vulnerabilities present barriers to its widespread use. Furthermore, its value is inherently tied to fiat currencies, which are subject to inflationary pressures. The limited supply of Bitcoin also raises concerns about its ability to function as a stable medium of exchange.Central Banks and Digital Currencies

In response to the rise of Bitcoin, central banks are exploring the development of central bank digital currencies (CBDCs). These digital currencies aim to combine the benefits of digital transactions with the stability of government backing. While still in the exploratory phase, CBDCs could offer a competitive alternative to Bitcoin.The Future of Financial Systems

While Bitcoin has captured the imagination of speculators and tech enthusiasts, its role in the future of financial systems remains uncertain. As central banks continue to adapt and innovate, the interplay between traditional financial institutions and decentralized technologies will shape the future of global economies.“`

Cryptocurrency: A New Financial Frontier

Cryptocurrency: A New Financial Frontier

Cryptocurrencies have emerged as a groundbreaking innovation in the financial landscape, offering a decentralized alternative to traditional currencies. These digital or virtual currencies are secured by cryptography, which makes them resistant to fraud and double-spending. They operate on decentralized networks using blockchain technology, a distributed ledger enforced by a network of computers. This system provides both advantages and challenges, as detailed in a recent Investopedia article.

Understanding the Basics

At the core of cryptocurrencies is the concept of decentralization. Unlike traditional currencies, they are not issued by any central authority, making them theoretically immune to government interference. This decentralized structure allows for faster and cheaper transactions, as it eliminates the need for third-party intermediaries like banks.

Blockchain technology is central to the functionality of cryptocurrencies. It consists of a series of connected blocks of information, each containing a set of transactions that are independently verified by a network of validators. This makes it nearly impossible to forge transaction histories, as the contents must be agreed upon by a network of computers.

Types of Cryptocurrency

There are various types of cryptocurrencies, each serving different purposes. For example, Ethereum’s ether is used for validating transactions on its blockchain. Other types include transactional tokens like Bitcoin, governance tokens like Uniswap, and security tokens representing ownership of assets.

Investing in Cryptocurrency

Investing in cryptocurrencies requires careful consideration due to their inherent risks. While they offer potential for high returns, they are also known for their volatility and regulatory ambiguity. Investors can purchase cryptocurrencies through exchanges or invest in crypto ETFs, which provide exposure to the asset class without the need for a digital wallet.

The legal status of cryptocurrencies varies worldwide. In the United States, they are considered securities when purchased by institutional buyers but not by retail investors. In Asia, countries like Japan recognize Bitcoin as legal property, while China has banned cryptocurrency exchanges and transactions.

Advantages and Disadvantages

Cryptocurrencies offer several advantages, including the removal of single points of failure, easier fund transfers, and the elimination of third-party intermediaries. However, they also pose challenges such as pseudonymous transactions, which can be used for criminal activities, and high energy consumption for mining.

Despite these challenges, cryptocurrencies continue to gain popularity, with a total market capitalization reaching trillions of dollars. As digital assets, they appeal to those interested in speculative investments, but they require a cautious approach due to the risks involved.

:max_bytes(150000):strip_icc()/TermDefinitions_crypto_final-940e93a6cb5341999a5d735fbf04fbfe.png)

The Bottom Line

Cryptocurrencies represent a new financial paradigm, offering both opportunities and challenges. While they have the potential to disrupt various industries, they also require investors to understand the risks involved. As highlighted in the original article, it is crucial for investors to approach this innovative technology with caution and awareness of its potential and limitations.

AI Transforming Health Care: Bridging Academic and Clinical Practices

In the ever-evolving landscape of health care, artificial intelligence (AI) is emerging as a transformative force, bridging the gap between academic institutions and clinical practice. As reported by Oncology Nurse Advisor, AI is revolutionizing diagnostics, treatment, and patient care, with significant advancements particularly noted in fields like radiology and oncology.

AI’s potential to enhance diagnostic accuracy has been a focal point, as its integration with physician diagnoses is believed to improve confidence and system performance. The original article highlights how AI is being utilized to develop automated cancer detection software, which is crucial for early diagnosis and personalized treatment regimens.

AI in Academic vs Clinical Settings

While academic institutions are at the forefront of AI research, focusing on developing and validating digital therapeutic tools, clinical practices are leveraging AI primarily to improve workflow efficiency. Dr. Ravi B Parikh from the University of Pennsylvania emphasizes that AI tools approved by the FDA are often more accessible to larger academic health systems, leaving smaller clinics at a disadvantage due to cost and data limitations.

Despite these challenges, the potential for AI to reduce the administrative burden in clinical settings is promising. AI can streamline tasks such as billing and claims processing, which could significantly enhance patient satisfaction and management.

Remote Monitoring and Telemedicine

The COVID-19 pandemic has accelerated investment in remote monitoring technologies, with AI-powered wearables and virtual nursing assistants emerging as key tools for patient care. These innovations are particularly beneficial for underserved areas, where AI-driven diagnostic tools can aid health care professionals in making accurate diagnoses based on patient-reported symptoms.

However, device literacy remains a barrier, as noted by Dr. Parikh, who calls for solutions that enhance the ability to process patient visits and improve documentation without necessarily requiring FDA approval.

The Future of AI in Health Care

AI and machine learning hold the promise of more precise immune therapies, improved clinical decision-making, and ultimately, better patient outcomes. Dr. Parikh predicts that within the next 5 to 10 years, AI will become as integrated into health care as electronic health records once were.

As AI continues to evolve, the focus must remain on making these technologies accessible to all health care providers, ensuring that the benefits of AI are felt across both large academic systems and community-based health facilities.

AI Revolutionizes Cancer Diagnostics

The AI Advantage in Oncology

AI’s integration into healthcare, particularly in oncology, marks a significant shift towards precision medicine. By analyzing vast datasets, AI can detect cancerous cells with greater accuracy, aiding doctors in diagnosing potential cancers, predicting developments, and planning personalized treatments. This technological advancement is not only enhancing imaging processes but also helping reduce unnecessary biopsies and false positives.

A Patient’s Journey

Consider the case of a woman who discovered a worrying lump in her thyroid. Initially, her doctor ordered an ultrasound and subsequent biopsy due to concerning results. However, seeking a second opinion from a radiologist utilizing AI-driven ultrasound exams revealed that the tissue was benign. This revelation, supported by her biopsy results, highlights AI’s potential to prevent invasive procedures and alleviate patient anxiety.

FDA-Approved AI Tools

The FDA has approved AI-assisted tools for detecting various cancer types, including brain, breast, lung, prostate, skin, and thyroid cancers. These tools are trained on enormous amounts of data, providing a deeper analysis of images such as mammograms, sonograms, x-rays, and MRIs. AI’s ability to highlight lesions with precision and differentiate levels of abnormalities is akin to consulting a brilliant colleague, as described by experts in the field.

Benefits and Challenges

- AI-assisted imaging offers several benefits, such as accelerating diagnosis and treatment, reducing false positives, and enabling earlier intervention.

- However, challenges remain, including the potential for false readings and inherent biases within AI algorithms.

In conclusion, as AI continues to evolve, it promises to transform cancer diagnostics, offering hope for better health outcomes and a more proactive approach to patient care.

AI in Precision Medicine: Navigating Challenges and Embracing Opportunities

AI in Precision Medicine: Navigating Challenges and Embracing Opportunities

In the rapidly evolving landscape of healthcare, Artificial Intelligence (AI) is emerging as a pivotal force in precision medicine, promising to enhance diagnostic accuracy and treatment outcomes. However, as highlighted in a recent review article published in the Journal of Translational Medicine on April 30, 2024, the journey toward fully integrating AI into healthcare systems is fraught with challenges.

The Promise of AI in Healthcare

AI’s potential to revolutionize healthcare lies in its ability to process vast amounts of data, uncover hidden patterns, and support clinical decision-making. It is particularly promising in the realms of drug development and clinical practice, where it can streamline processes, reduce costs, and improve patient experiences. The article underscores AI’s role in making healthcare more sustainable by enhancing efficiency and reducing diagnostic errors.

Challenges and Limitations

Despite its promise, the application of AI in precision medicine is not without hurdles. Key concerns include data quality, biases in AI algorithms, and issues related to data privacy and security. The article emphasizes the need for high-quality, well-annotated datasets and robust privacy safeguards to ensure the ethical and effective deployment of AI technologies.

Unlocking AI’s Full Potential

To truly harness AI’s capabilities, the healthcare industry must address these challenges head-on. This involves implementing strategies to mitigate biases, ensuring data integrity, and fostering interdisciplinary collaborations. The authors, Claudio Carini and Attila A. Seyhan, affiliated with institutions like King’s College London and Brown University, advocate for a concerted effort to integrate AI into healthcare systems while maintaining a focus on equity and ethics.

Looking Ahead

As AI continues to advance, its integration into precision medicine offers the potential to transform healthcare delivery. By addressing existing challenges and leveraging AI’s strengths, the industry can move closer to realizing a future where healthcare is more personalized, efficient, and accessible.

For more insights into the fundamentals of open access and open research, visit Springer Nature. Metrics and additional details about the article can be found on the journal’s website.

Author Information

Claudio Carini is affiliated with the School of Cancer and Pharmaceutical Sciences at King’s College London and the Biomarkers Consortium at the Foundation of the National Institute of Health. Attila A. Seyhan is based at Brown University, involved with various departments including the Laboratory of Translational Oncology and Experimental Cancer Therapeutics.

Contact

For correspondence, reach out to Claudio Carini at claudio.carini@kcl.ac.uk or Attila A. Seyhan at attila_seyhan@brown.edu.

The Expanding Role of Telehealth in Nursing

The Expanding Role of Telehealth in Nursing

Nurses, the unsung heroes on the front lines of patient care, are increasingly embracing telehealth technology as a core component of their roles. As reported by Southern New Hampshire University, telehealth offers a transformative opportunity to enhance patient outcomes and broaden access to healthcare. This shift is particularly pertinent in the face of an aging population and ongoing nursing shortages. “Across the entire patient experience, and wherever there is someone in need of care, nurses work tirelessly to identify and protect the needs of the individual,” said Dr. Lisa Bechok, a clinical faculty member for SNHU nursing programs. Her insights underscore the indispensable role of nurses in safeguarding public health, as they navigate the complexities of diagnosis, treatment, and public education.

“Across the entire patient experience, and wherever there is someone in need of care, nurses work tirelessly to identify and protect the needs of the individual,” said Dr. Lisa Bechok, a clinical faculty member for SNHU nursing programs. Her insights underscore the indispensable role of nurses in safeguarding public health, as they navigate the complexities of diagnosis, treatment, and public education.

Telehealth: A New Era in Patient Care

Telehealth is defined by the National Institute of Biomedical Imaging and Bioengineering as the use of communication technology to provide medical care at a distance. This innovation allows patients to remain at home while receiving care, thereby reducing healthcare costs and improving outcomes. The U.S. Department of Health and Human Services notes that telehealth usage surged during the COVID-19 pandemic, highlighting its growing importance in healthcare delivery.Benefits and Challenges of Telehealth

The benefits of telehealth are manifold. It supports in-patient care, enables remote monitoring of vital signs, and facilitates real-time data sharing with doctors and specialists worldwide. Moreover, telehealth can significantly reduce healthcare costs. The National Cancer Institute reports that telehealth services can save patients an average of $147 to $186 per visit.However, challenges remain. Limited access to broadband internet in rural areas, regulatory hurdles in medical licensure, and patient privacy concerns are barriers to widespread telehealth adoption. Despite these challenges, the pandemic has accelerated the integration of telehealth, offering new tools and technologies for nurses.

The Future of Telehealth in Nursing

As telehealth continues to evolve, it is clear that its role in nursing will only expand. While the technology offers flexibility and efficiency, it is crucial for both providers and patients to embrace its potential. Dr. Bechok emphasizes, “The role of the nurse in telehealth is no different than face-to-face nursing, it is just done in a different way using technology.”In conclusion, telehealth represents a significant shift in healthcare delivery, offering a promising path forward for nursing. As we navigate this new era, the dedication and adaptability of nurses will remain the cornerstone of patient care.

Consolidation in FinTech: The New Era of Bank-Partnerships

In the ever-evolving world of finance, the FinTech sector has been a beacon of innovation and disruption over the past decade. Recently, however, a noticeable shift towards consolidation has emerged, reshaping the landscape of bank-FinTech partnerships.

Speaking to PYMNTS, Priority Chief Strategy Officer Sean Kiewiet explained how a few key events have catalyzed a consolidation cycle within the industry. “Back in the heyday, it was expanding,” Kiewiet remarked, highlighting the era of rapid growth and frequent new partnerships. Now, however, the focus has shifted to a more selective collaboration between banks and FinTechs, emphasizing proven technology and value propositions.

The Best of Both Worlds

At the heart of successful bank-FinTech partnerships lies the promise of blending the best of both worlds. Banks bring stability and trust, while FinTechs offer speed and innovation. “It’s the promise of the best of both worlds,” Kiewiet noted, underscoring the potential of these collaborations to enhance financial services without compromising core stability.

However, this synergy is not without its challenges. Banks, often slow to change, must navigate the rapid iteration and innovation that FinTechs champion. The cultural and operational differences between these entities can create friction, yet when aligned properly, they can drive significant advancements in the industry.

Targeting Synergies for Maximum Impact

The consolidation trend has brought to light the importance of targeting specific synergies for maximum impact. While some partnerships thrive on vertical integration, offering specialized services like loan processing, others face challenges when attempting to merge batch-based systems with real-time operations.

“Banks operate with a very specific set of requirements,” Kiewiet explained, pointing to the regulatory capital and risk structures that banks must adhere to. Conversely, FinTechs often adopt a more flexible approach, which can lead to operational discrepancies if not carefully managed.

Ultimately, the most successful partnerships are those that understand and leverage each party’s strengths and limitations. By focusing on well-defined use cases and aligning operational models, banks and FinTechs can continue to innovate while maintaining the stability that customers rely on.

AI Revolutionizing Healthcare: From Diagnostics to Pandemics

Dr. Thomas M. Maddox, a leading expert in digital products and innovation at BJC HealthCare, predicts that **AI** will soon be embedded in almost every aspect of healthcare. This year, tech budgets for **AI in healthcare companies** are expected to grow significantly, reflecting its increasing importance.

**AI’s impact** on clinical diagnostics is profound. It enhances the ability to interpret medical images such as X-rays and MRIs, often surpassing human accuracy. By identifying patterns that even seasoned professionals might miss, **AI** complements human expertise, improving diagnostic precision.

Moreover, **AI** is driving breakthroughs in research. Dr. Lee Schwamm from Yale School of Medicine highlights how **AI** has enabled the visualization of proteins within DNA, paving the way for targeted treatments that were once beyond reach.

Beyond diagnostics, **AI’s potential** extends to predicting future pandemics. According to a Medical Science Monitor editorial, **AI systems** had already flagged unusual pneumonia cases before the COVID-19 outbreak, demonstrating its capacity to detect early signs of infectious diseases.

However, the proliferation of **AI in healthcare** raises ethical concerns. Ensuring that **AI systems** are free from biases and privacy risks is crucial. Regulatory bodies like the FDA, alongside the American Medical Association, are working to establish ethical guidelines for **AI use in healthcare**.

Despite these challenges, **AI** promises to enhance healthcare efficiency and patient experience. By automating documentation, physicians can focus more on patient interaction. **AI-powered scheduling systems** can also adapt to various factors, potentially reducing waiting times.

As **AI** continues to integrate into healthcare, it will undoubtedly transform the landscape. While **AI-equipped physicians** may outperform those without such tools, the technology is seen as an augmentation of the human touch, not a replacement.