Housing Industry Innovation: 5 Ways AI Can Help Boost Supply and Affordability

In an era where artificial intelligence (AI) is becoming increasingly pervasive, the housing industry stands on the cusp of a transformative phase. As reported by the Bipartisan Policy Center, AI is reshaping five critical areas in housing: predevelopment, construction, credit assessments, home appraisals, and property tax assessments. These advancements promise to enhance accessibility, reduce costs, and accelerate housing production.

AI and Predevelopment

Generative AI, a subset of machine-learning technology, is revolutionizing the predevelopment phase of housing projects. By automating various tasks, AI tools can significantly cut down on time and expenses. These tools generate multiple design options, emphasizing sustainable designs by considering local climate, energy usage, and available building materials. Developers can also leverage AI to ensure compliance with zoning and land-use regulations, thus avoiding costly delays. For more insights on generative AI in real estate, visit the Generative AI Applied to Real Estate article.

AI and Construction

The United States has grappled with a housing shortage, having “underbuilt” by millions of homes over the past two decades. AI is poised to bridge this gap by streamlining construction processes. AI-driven technologies, such as drones and mobile robots, monitor construction site progress and enhance safety by flagging potential hazards. This integration not only improves efficiency but also attracts new talent by creating job opportunities in emerging fields.

AI and Creditworthiness

The mortgage lending process is evolving with AI’s ability to incorporate alternative data, such as on-time utility or rent payments, to assess creditworthiness more accurately. This innovation broadens access to credit, particularly for those without traditional credit histories. However, the use of AI in credit scoring raises privacy and discrimination concerns, necessitating transparency and regulatory oversight. The Consumer Finance Blog provides further details on alternative data usage.

AI and Home Appraisals

Home appraisals, crucial for determining property value, are increasingly relying on automated valuation models (AVMs) powered by AI. These models offer more accurate valuations compared to traditional methods, although they require comprehensive and unbiased data to avoid perpetuating existing biases. The Urban Institute’s report explores the potential of AI in appraisals.

AI and Property Tax Assessments

Property tax assessments, essential for calculating taxes owed, benefit from AI’s ability to conduct frequent and accurate evaluations. By leveraging AI, jurisdictions can reduce workloads and improve assessment precision, thereby addressing disparities such as the over-assessment of Black-owned homes.

Looking ahead, the Biden administration’s executive order on AI aims to establish safety standards and encourage innovation across federal agencies, including the Department of Housing and Urban Development. Meanwhile, Congress evaluates AI’s impact through hearings and task forces, shaping the legislative landscape for AI’s role in housing.

AI presents a wealth of opportunities for the housing industry, from reducing project timelines to enhancing credit access. However, careful consideration of ethical and regulatory frameworks is essential to ensure these technologies benefit all Americans.

More Articles

Getting licensed or staying ahead in your career can be a journey—but it doesn’t have to be overwhelming. Grab your favorite coffee or tea, take a moment to relax, and browse through our articles. Whether you’re just starting out or renewing your expertise, we’ve got tips, insights, and advice to keep you moving forward. Here’s to your success—one sip and one step at a time!

The AI Revolution in Real Estate: A New Era of Market and Property Insights

The AI Revolution in Real Estate: A New Era of Market and Property Insights

The real estate industry, long perceived as conservative and slow to adapt, is now on the cusp of a technological revolution. At the forefront of this transformation is the integration of artificial intelligence (AI), particularly in the realms of market prediction and property valuation.

In a recent Forbes article, Andrei Kasyanau, co-founder and CEO of Glorium Technologies, discusses the burgeoning role of AI in real estate. While generative AI has already made significant inroads in real estate marketing, enhancing customer journeys and content creation, it is predictive AI that is poised to reshape the industry. This technology leverages historical data and complex algorithms to anticipate market trends and accurately forecast property values.

How Predictive AI Works

Predictive analytics in real estate is built on a foundation of vast data sets and sophisticated algorithms. By analyzing historical sales data, demographic information, and economic indicators, AI systems can identify patterns and make forecasts. Companies like Compass and Zillow are already harnessing these tools to gain a competitive edge. For instance, Compass has developed a machine learning-driven recommendation system, “Likely to Sell,” which aids agents in identifying potential sellers before their homes are listed.

During the Compass Q2 2024 earnings conference call, CEO Robert Reffkin highlighted the company’s AI model, which currently describes 7% of the market, as a tool for market forecasting and further extrapolation.

Predicting Market Trends

AI’s ability to predict market trends with remarkable accuracy is one of its most powerful applications. A striking example is how AI models predicted the post-pandemic suburban boom. Zillow, utilizing data from the U.S. Census Bureau, anticipated that remote work would drive urban renters to purchase homes in suburban areas. This prediction proved prescient, as evidenced by a surge in suburban home purchases following the pandemic.

Beyond large-scale shifts, AI can forecast price fluctuations and market cycles, analyzing factors such as interest rates and employment data. This level of insight is invaluable for investors, developers, and homebuyers.

Enhancing Property Valuation Accuracy

AI also plays a crucial role in property valuation. By combining human insights with data analysis and predictive modeling, AI-driven valuation models estimate property values with unprecedented accuracy. These models analyze comparable sales, property characteristics, and market trends, uncovering data patterns beyond human perception.

A recent project led by Glorium Technologies exemplifies the power of AI in property valuation. They developed a deep learning model capable of predicting property prices using real-time market data, allowing a real estate organization to identify undervalued properties and make informed decisions.

Challenges and Limitations

Despite its benefits, implementing AI in real estate is not without challenges. Data quality and availability can hinder progress, as AI models are only as effective as the data they are trained on. Moreover, there is often a lack of AI expertise within real estate organizations, underscoring the need for dedicated AI specialists.

As AI technology continues to evolve, its impact on real estate will only grow. The industry must embrace these changes to harness the full potential of AI-powered predictive analytics. Those who succeed will be well-positioned to thrive in the rapidly evolving real estate landscape.

Remote Working’s Transformative Impact on India’s Real Estate

Changing Residential Preferences

Remote work has redefined what homebuyers seek in a property. The demand for larger living spaces has surged as individuals prioritize homes that can accommodate both living and working activities. A Knight Frank report highlights that over 70% of homebuyers now consider a dedicated home office crucial. This trend is further supported by the necessity for high-speed internet connectivity, which has become indispensable in this digital age. Moreover, access to green spaces is increasingly important. The pandemic has heightened awareness of the benefits of nature, driving a desire for homes near parks and serene environments.Suburban and Rural Appeal

The allure of suburban and rural areas is growing, primarily due to affordability and space. Cities like Pune, Nashik, and Coimbatore are becoming popular choices as they offer a balance of cost-effective housing and connectivity to urban amenities. The National Housing Bank reports a 12% rise in Pune’s housing prices, driven by remote workers seeking larger homes at lower costs.Commercial Real Estate Evolution

The commercial sector is not immune to these shifts. The rise of co-working spaces and flexible office environments reflects the adoption of hybrid work models. As the JLL report suggests, co-working spaces in India are projected to grow by 30% annually. This trend offers scalability and reduced overheads, appealing especially to startups and small businesses. Rental yields in traditional office spaces have seen a decline, as evidenced by an 8% drop in Gurugram. This shift underscores the growing preference for flexible workspace solutions.Technological Integration

Technology is at the forefront of this transformation. Digital platforms, virtual tours, and data analytics are revolutionizing property transactions and management. These advancements are not only streamlining operations but also enhancing the customer experience.Future Prospects and Government Support

The future of real estate in India is intertwined with government initiatives like the Digital India Initiative, enhancing internet connectivity, especially in rural areas. Such policies are essential in supporting the remote work revolution. As urban development evolves, mixed-use developments and sustainable growth models are expected to dominate. These changes promise to create vibrant, decentralized communities that offer a high quality of life. In conclusion, the rise of remote working is not just a trend but a catalyst for reshaping the real estate investment landscape in India. As preferences continue to evolve, staying informed about these dynamics will be crucial for investors and developers aiming for long-term success.Navigating the Commercial Real Estate Terrain in 2025: Challenges and Renewed Opportunities

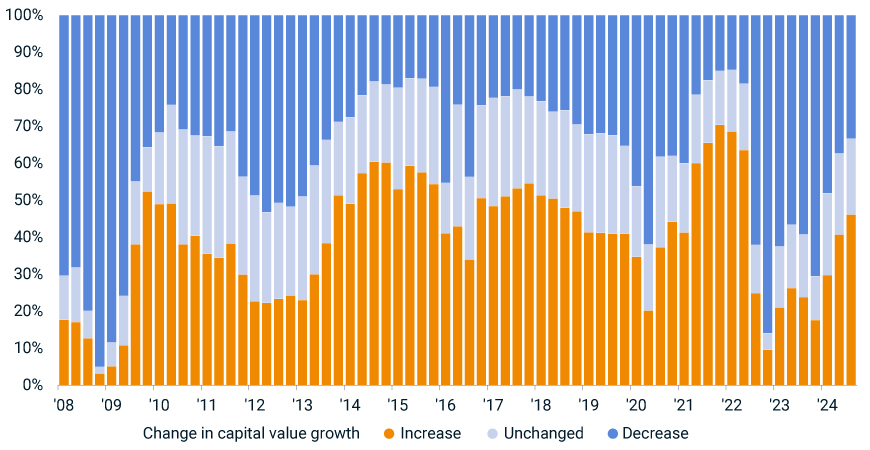

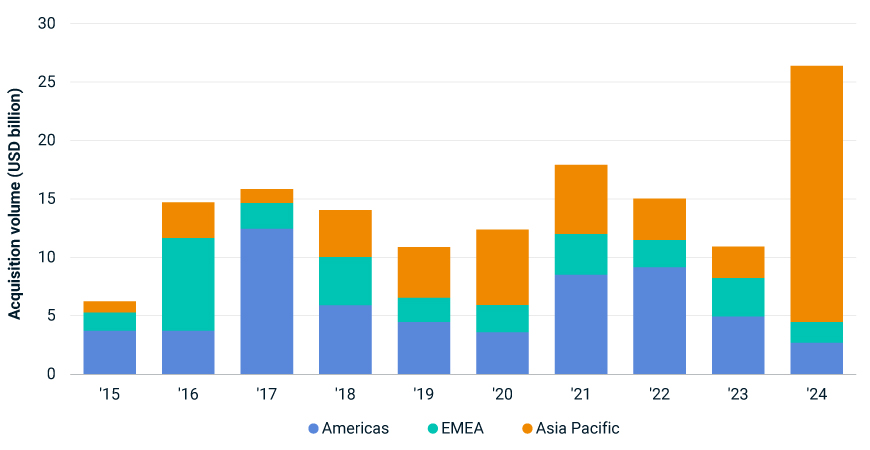

In 2024, interest rates began to decline, leading to a stabilization in transactional activity and the reemergence of asset-value growth in certain segments. However, the recovery is uneven, with different areas of the market moving at varied paces. This presents both opportunities and risks for investors, who must navigate a landscape marked by both cyclical and structural changes.

Recovery – Not Everywhere All at Once

The recovery phase, which began in 2024, is still in its infancy. Lower interest rates are expected to help buyers and sellers align more closely on pricing, improving liquidity. Yet, investor preferences are shifting, with a focus on living sectors, industrial assets, and properties aligned with broader socioeconomic and technological trends. A notable transaction in 2024 was Blackstone Inc.’s $16 billion acquisition of data-center operator AirTrunk, underscoring the growing demand for assets that straddle the line between traditional property and infrastructure.

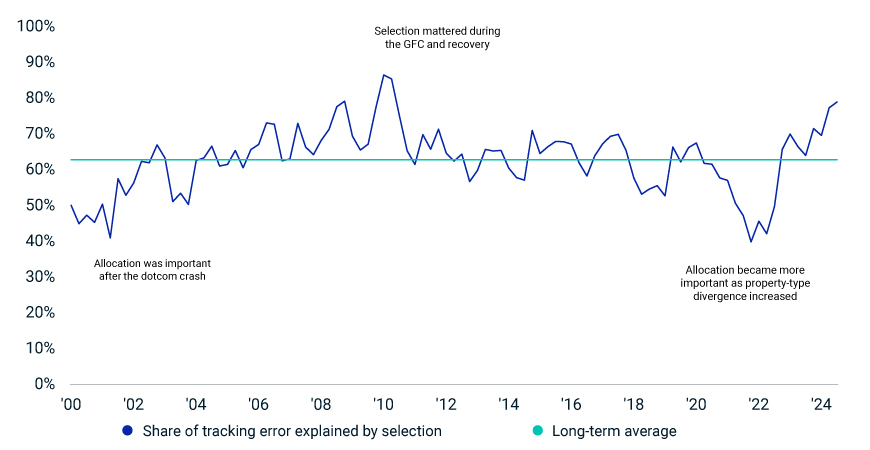

Investment Pendulum Swings Back to Asset Selection

The real estate market is entering a new investment cycle where active asset selection and management are crucial. With market conditions evolving, the traditional playbook for delivering returns is changing. Investors must balance top-down allocation strategies with granular, bottom-up asset-selection decisions. The interplay between these approaches has become more complex, demanding a keen understanding of the drivers of performance.

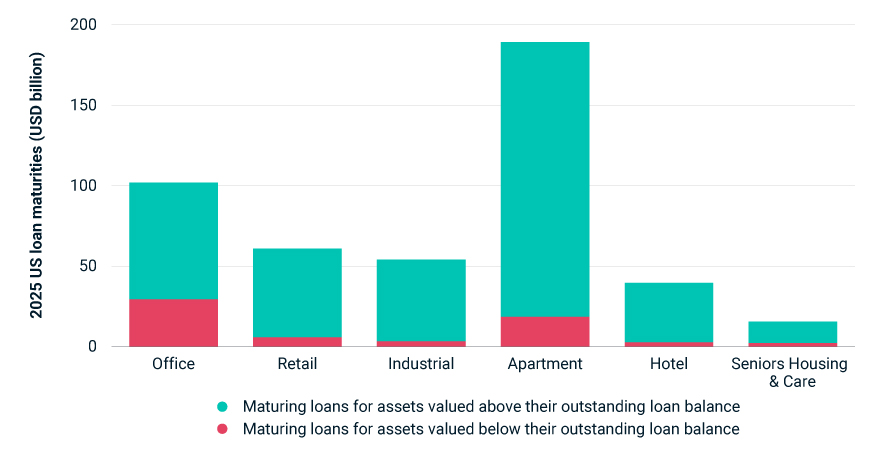

Underwater Assets Come to Light

Higher interest rates and ongoing price declines have put pressure on borrowers’ ability to refinance commercial-property loans. In the U.S., nearly $500 billion of loans are set to mature in 2025, with about 14% potentially underwater. U.S. offices face particularly bleak refinancing prospects, with nearly 30% of maturing office loans tied to properties worth less than the debt secured against them.

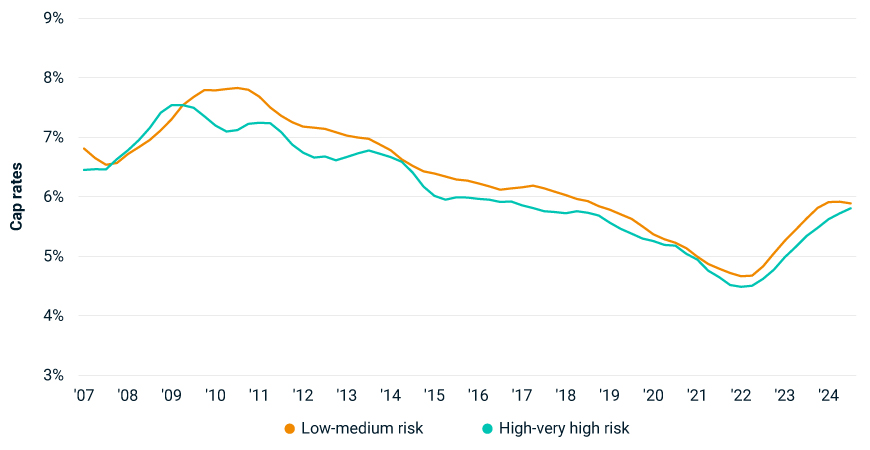

Investors Get to Grips with Physical Climate Risk

Extreme weather events are expected to become more common, affecting real-estate asset values through higher insurance premiums and disruption costs. Despite this, the risk is not yet adequately priced into transaction yields. As climate risks intensify, pricing should adjust to reflect the increased risk to property values.

Property Investors Seek a Ride on the AI Train

The rapid development of AI is driving demand for data centers, transforming the investment landscape. Significant capital is being committed to developing new data centers, with notable deals like Blackstone’s acquisition of AirTrunk. This surge in interest is reshaping market dynamics, with traditional property investors now competing in a space once dominated by infrastructure investors.

As we move further into 2025, the commercial real estate market remains a complex and evolving landscape. Investors must remain vigilant and adaptable, leveraging insights and strategies to navigate the challenges and opportunities that lie ahead.

Generative AI: A New Era for Commercial Real Estate

Generative AI: A New Era for Commercial Real Estate

In the rapidly evolving landscape of commercial real estate, Generative AI (GenAI) is emerging as a transformative force. As companies seek to leverage this cutting-edge technology, they must carefully balance the potential risks and rewards to reshape their organizational strategies.

Revolutionizing Real Estate Operations

GenAI is poised to revolutionize the real estate sector by automating and optimizing a myriad of functions. From property operations and acquisition strategies to investor relations and asset management, the potential applications are vast. This technology allows for lightning-speed data analysis, offering unprecedented insights and efficiency gains.

The original article from EY highlights how GenAI is being compared to the digital transformation wave of the early 2000s, which similarly disrupted industries across the board.

Strategic Vision and Ethical Use

Developing a long-term strategic vision for GenAI is crucial. Companies must ensure they use AI in a safe, responsible, and ethical manner. This involves addressing challenges such as workforce impact, cybersecurity, intellectual property, and potential biases in AI systems.

As noted by Umar Riaz, Managing Director of Real Estate, Hospitality, and Construction Consulting at EY, the key to success lies in creating a robust AI adoption approach. This involves selecting use cases, transforming processes, and building a scalable AI governance framework.

Transformative Applications

The article outlines several transformative applications of GenAI in real estate:

- Acquisitions: Automating due diligence and enhancing portfolio planning.

- Investor Relations: Streamlining communications and targeting potential investors.

- Business Support: Revolutionizing HR, IT, and legal functions.

- Asset Management: Improving data analysis for budgeting and forecasting.

- Finance and Accounting: Enhancing financial reporting and fraud detection.

- Property Operations: Optimizing energy management and tenant services.

Implementing GenAI

Real estate companies are encouraged to develop a comprehensive GenAI approach that includes:

- Use case selection and process transformation.

- Technology roadmap and selection.

- Responsible and ethical AI practices.

- Organizational transformation roadmap.

- Talent transformation and upskilling.

The implementation of GenAI requires a strategic alignment of technology and business goals. Companies must consider foundational models, data storage, and hosting options to effectively deploy AI solutions.

Conclusion

As GenAI continues to transform the real estate industry, companies must navigate the complexities of AI adoption. By balancing risks and rewards, businesses can harness the power of GenAI to drive innovation and efficiency.

For more insights, explore EY’s resources on Real Estate, Hospitality & Construction and Transformation Realized.

Almal Real Estate Expands into Commercial and Global Markets

Almal Real Estate, known for its innovative approaches in the real estate sector, is now setting its sights on international markets, including the UAE, Bali, and Thailand. This expansion is part of a broader strategy to diversify its portfolio and tap into the lucrative commercial real estate sector.

The company’s decision to venture into new verticals and international markets is driven by the growing demand for commercial spaces and the increasing globalization of business operations. By expanding its footprint, Almal Real Estate aims to leverage its expertise in residential development to cater to the commercial sector’s evolving needs.

This move is not just about geographical expansion; it represents a strategic pivot towards a more diversified business model. The company is looking to capitalize on the robust growth prospects in the commercial real estate market, which has been buoyed by increasing urbanization and the rise of new business hubs.

For more details on this development, you can read the original article here.

Strategic Growth Initiatives

The expansion is part of Almal Real Estate’s broader strategic growth initiatives, which include enhancing its operational capabilities and strengthening its market presence. By entering new markets, the company aims to establish itself as a key player in the global real estate landscape.

Impact on the Real Estate Sector

Almal Real Estate’s expansion into commercial and international markets is expected to have a ripple effect across the real estate sector. As the company adapts to the demands of these new markets, it is likely to set new benchmarks in terms of quality and innovation.

This strategic move not only underscores Almal Real Estate’s commitment to growth but also reflects its adaptability in a rapidly changing market environment. As the company embarks on this new journey, it is poised to redefine its role in the global real estate industry.

Transformative Trends in Commercial Real Estate for 2025

Transformative Trends in Commercial Real Estate for 2025

The commercial real estate sector is poised for significant transformation as we move into 2025. This evolution is driven by a confluence of economic shifts, demographic changes, and technological advancements, creating both challenges and opportunities for stakeholders in the industry.

With recent interest rate adjustments by major financial institutions such as the European Central Bank (ECB) and the Bank of England, market dynamics are rapidly evolving. The ECB’s recent rate cuts, as reported by Daniel Cunningham, and the Federal Reserve’s stance on potential rate adjustments, highlighted by Jeanna Smialek from The New York Times, are particularly influencing investment strategies and market confidence.

In this context, the intersection of technology and sustainability is becoming crucial. The growth of artificial intelligence and a focus on decarbonization are driving significant demand for data centers, as emphasized by Kimberley Steele from JLL. Environmental considerations are not only shaping infrastructure developments but also influencing the regulatory landscape, with energy performance standards and retrofitting policies gaining prominence.

The strategic importance of nearshoring is underscored by investments in regions such as Mexico, bolstered by shifts in global supply chains. These actions highlight the broader trend towards enhancing operational efficiencies and sustainability practices across real estate portfolios.

References in the original article underline these points, including insights from Robyn Gibbard on economic forecasts. As the industry navigates through the complex landscape of 2025, the opportunity to redefine strategic priorities is paramount—establishing a pathway not just for resilience but for growth and leadership in the new era of commercial real estate.

Additional Insights

Real Estate Sector Gains Momentum with Budget 2025

Real Estate Sector Gains Momentum with Budget 2025

In a strategic move poised to reshape the landscape of India’s commercial real estate, the introduction of a national guidance framework for Global Capability Centres (GCCs) is set to bolster the sector significantly. This development, highlighted in the Real-Estate Sector Budget 2025, is expected to stimulate growth, particularly in tier-II and tier-III cities.

Sanjeev Dasgupta, Chief Executive Officer of CapitaLand Investment (India), emphasized the framework’s alignment with India’s ambition to become a hub for high-value global operations. By enhancing infrastructure and talent pipelines, this initiative aims to strengthen the country’s ability to host GCCs effectively.

Real estate experts predict substantial opportunities for commercial real estate as a result of this framework. The overarching theme of urban development, prevalent in this year’s budget, underscores a commitment to infrastructure enhancement through increased public-private partnerships (PPP) and comprehensive fiscal reforms.

The budget also introduces tax reforms designed to increase disposable income for the middle class, thereby encouraging investment and consumption. Urban infrastructure initiatives, coupled with support for MSMEs, reflect a broad economic strategy aimed at sustainable urban growth and improved quality of life.

The guidance framework for GCCs, with its focus on boosting commercial real estate, plays a crucial role in the broader efforts to transform India’s economic landscape. This move benefits both investors and the local economy, reinforcing India’s position as a prime destination for global operations.

Key Takeaways

- The national guidance framework targets growth in tier-II and tier-III cities.

- Focus on enhancing infrastructure and talent development in states.

- Budget highlights include increased PPP and infrastructure initiatives.

- Tax reforms aim to bolster disposable income and investment.

Budget 2025: A New Dawn for Middle-Class Homebuyers

Budget 2025: A New Dawn for Middle-Class Homebuyers

The recent announcements in the Budget 2025 have brought a wave of optimism for middle-class homebuyers. In a bid to enhance disposable income and affordability, the Finance Minister has raised the income tax exemption limit to ₹12 lakh, which further increases to ₹12.75 lakh when standard deductions are considered. This strategic move is set to boost household spending power, subsequently driving housing demand and invigorating investments in the real estate sector.Real estate experts suggest that these measures will have a positive impact on both primary and secondary housing markets. As highlighted in Hindustan Times, the government’s streamlined approach to taxation is expected to fortify household purchasing power.

SWAMIH Fund 2: A Lifeline for Stalled Projects

A cornerstone of this budget is the SWAMIH Fund 2, with an allocation of ₹15,000 crore aimed at completing an additional 1 lakh housing units. This initiative is a lifeline for thousands of homebuyers affected by stalled projects. The fund builds on the success of the existing SWAMIH scheme, which has seen 50,000 units completed, showcasing the government’s commitment to resolving the housing crisis. More details can be found in the SWAMIH-2 Investment Fund article.Tax Reforms: A Boon for Landlords and Investors

The Budget also proposes raising the threshold for TDS on rent from ₹2.40 lakh to ₹6 lakh annually. This change is expected to ease compliance burdens on small landlords and taxpayers, as discussed in the TDS limit on rent analysis.In a significant policy shift, investors can now claim a Nil valuation for two self-occupied properties instead of just one. This reform is likely to encourage property ownership and investment, making real estate an attractive option for investors.

Urban Development: Transforming Cities into Growth Hubs

The establishment of a ₹1 lakh crore Urban Challenge Fund is another highlight of the budget. This fund aims to enhance urban infrastructure, unlocking real estate potential and transforming cities into major growth hubs. The urban development fund initiative is expected to significantly impact city planning and governance.Challenges in Affordable Housing

Despite these promising initiatives, the budget has been critiqued for not addressing affordable housing adequately. Rising home loan interest rates and outdated definitions of affordable housing continue to pose challenges for potential homeowners. Experts emphasize the need for a national policy towards rental housing to boost the housing program.Conclusion: A Progressive Shift in Real Estate

The Budget 2025‘s focus on investor-friendly policies and creating a conducive environment for real estate growth is evident. By removing tax on deemed rent for self-occupied properties, the government is aligning with the evolving housing needs of Indian families. This progressive shift not only encourages homeownership but also sets the stage for a revitalized real estate sector.Predictive Analytics: The New Frontier in Commercial Real Estate

Predictive Analytics: The New Frontier in Commercial Real Estate

As the commercial real estate sector navigates a landscape marked by economic uncertainties and technological advancements, a new player has emerged to revolutionize the game—predictive analytics. According to a recent report by JLL, AI and generative AI are among the top technologies reshaping the industry. In 2023 alone, a staggering $630 million was funneled into AI-driven proptech, underscoring its growing importance.Understanding Predictive Analytics Predictive analytics in commercial real estate involves extracting insights from vast data sets, offering a holistic view of market trends and tenant behavior. This technology enables landlords to anticipate market movements and tenant demand, a capability previously out of reach due to the sector’s slower technological adoption.

Real-Time Data in Action The application of predictive analytics is multifaceted, allowing landlords to forecast market activity and prepare for fluctuations. For instance, data from the Leasing Prediction Outlook indicates positive growth signals in New York City and San Francisco. Real-time data aggregation is crucial, as it forms the backbone of predictive insights, helping landlords identify opportunities, manage risks, and maintain a competitive edge.

Challenges and Considerations

While predictive analytics offers significant advantages, it also requires a robust data infrastructure. Landlords must evaluate their current data sources and systems to ensure they support real-time data collection and analysis. Investing in the right tools and working with data analysts can help integrate these insights effectively, despite the initial learning curve.AI-powered solutions, though still nascent in real estate, are essential for developing forward-looking strategies. As the industry continues to evolve, these tools will be vital for navigating the challenges posed by hybrid work models and high interest rates.

For further insights, the original article can be explored on Forbes.

Decoding India’s Housing Future: Trends Driving Residential Real Estate in 2025

Decoding India’s Housing Future: Trends Driving Residential Real Estate in 2025

In a rapidly evolving landscape, India’s residential real estate market stands on the cusp of a major transformation. With a bold ambition to achieve a $40 trillion GDP by 2047, the sector is being positioned as a vital engine of economic growth. As the nation gears up to construct 100 million homes by the end of this decade, 2025 is set to be a pivotal year for housing development.

According to The Tribune, several key trends are expected to dominate the sector, including the adoption of technology, customized housing demand, and sustainability. These trends are driven by a combination of government policies, rising incomes, regional diversification, and technological advancements.

Government Policies Driving Housing Development

India’s aspiration to achieve a $40 trillion GDP by 2047 puts the housing sector at the forefront of national economic growth. Initiatives such as the Pradhan Mantri Awas Yojana (PMAY), aimed at providing affordable housing for all, play a crucial role in promoting homeownership. Moreover, tax benefits and infrastructure development projects, like smart cities, create favorable conditions for buyers and developers alike.

The Rise of Customized Housing

One of the defining trends for 2025 is the increasing demand for customized housing solutions. Moving away from standardized apartments, these homes offer flexibility in design, privacy, and alignment with homeowners’ unique needs. This shift is particularly driven by affluent buyers and multi-generational families seeking personalized spaces.

Advancements in modular construction, digital design platforms, and virtual reality tools empower homeowners to actively participate in the design process. Reports indicate a growing preference for bespoke living spaces, with many homebuyers prioritizing individuality, functionality, and premium finishes.

Sustainability Takes Centre Stage

Sustainability has emerged as a key driver in the residential real estate sector. Growing environmental awareness has led both developers and homeowners to prioritize green construction practices. This includes the use of renewable materials, energy-efficient technologies, and homes designed with lower carbon footprints.

Government initiatives like the Energy Conservation Building Code (ECBC) and incentives for renewable energy adoption are making sustainable housing more accessible. By prioritizing eco-friendly practices, stakeholders are contributing to reduced carbon footprints while reaping long-term economic and environmental benefits.

Technology Enabling Organization of a Fragmented Sector

The need for 100 million homes within the decade highlights the necessity for more organized and accountable practices in the construction industry. Traditionally fragmented, the sector is now undergoing a shift toward structured operations, largely driven by technology adoption.

AI-driven project management tools, real-time progress tracking systems, and automated workflows are streamlining processes, enhancing transparency, and ensuring adherence to timelines and budgets. This technological shift is crucial as demand for housing surges and urban areas struggle to keep pace with infrastructure and service requirements.

Affordability and Regional Shifts

Rising incomes, coupled with government incentives, are improving housing affordability and accessibility. While affordable housing continues to dominate urban markets, Tier-2 and Tier-3 cities are emerging as attractive alternatives for homebuyers. Improved infrastructure, lower living costs, and the availability of larger plots make these regions ideal for families seeking more spacious and customized living options.

According to a report by Knight Frank, Tier-2 and Tier-3 cities accounted for nearly 40% of residential real estate sales in 2023, driven by factors such as better connectivity through smart city initiatives and the expansion of transport corridors like Bharatmala and Sagarmala projects.

The Future of Housing: 2025 is the Pivotal Year

2025 is poised to redefine residential real estate in India. Custom-built homes are leading the way, offering homeowners the ability to create spaces that reflect their individuality while meeting the demands of modern living. As the industry becomes more organized and technology-driven, the dream of owning a sustainable, personalized home is more accessible than ever.

By addressing the challenges of affordability, sustainability, and scalability, the construction sector is laying the foundation for a housing ecosystem that aligns with the aspirations of New India.

How AI is Transforming the Real Estate Sector

How AI is Transforming the Real Estate Landscape

In a world where technology is rapidly reshaping industries, the real estate sector is no exception. Netguru has delved into how artificial intelligence (AI) is revolutionizing property acquisition, sales, and management. This transformation is marked by the integration of predictive analytics, virtual property tours, and enhanced decision-making processes.

AI in Property Valuation and Management

A significant finding from Deloitte’s research reveals that 52% of corporate real estate developers believe AI ensures precise property valuation. This highlights AI’s pivotal role in accurate property assessment and pricing. Moreover, Buildium reports that 48% of property managers plan to boost revenue through tech-driven efficiency.

Proptech Market Growth

AI solutions are central to the rapidly expanding proptech sector. According to a global market report, the proptech market is projected to reach $94.2 billion by 2030, with a compound annual growth rate of 15.8% from 2022 to 2030. In 2021, global investments in proptech companies reached a remarkable $24.3 billion, showcasing a consistent upward trend since 2012.

AI’s Impact on Market Analysis and Sustainability

AI-driven data-powered market analysis is a game-changer for the real estate industry. It empowers rapid evaluation of projects and enhances investment strategies by streamlining approaches and reducing risks. Lennar’s collaboration with Climate Alpha exemplifies this, using AI analytics to identify climate-resilient residential areas in the US.

Moreover, AI technology is pivotal in promoting environmental sustainability. The real estate sector, responsible for 40% of global CO2 emissions, can leverage AI for smart decarbonization strategies and green building technologies. Insights from McKinsey suggest that approximately $7.5 trillion in property value is at risk due to climate-related challenges, underlining the urgency for AI-driven solutions.

Enhanced Property Search and Recommendations

AI-powered platforms are transforming traditional property searches into personalized experiences. These platforms utilize advanced algorithms to learn from user feedback, enhancing suggestions based on past behavior. This results in a more efficient property search process, displaying relevant listings that align with user preferences.

Real estate companies benefit significantly from these technologies. For instance, Realtor.com employs AI algorithms to provide personalized insights and recommendations, ensuring users receive a tailored experience.

Virtual and Augmented Reality in Property Showcasing

Virtual and augmented reality (AR) technologies offer a more convenient approach to property showcasing, saving time for both tenants and managers. Companies like ReimagineHome harness AI, virtual reality, and smart home devices to enhance the homebuying and renting experience, creating a seamless and immersive environment for users.

AI Chatbots and Assistants

AI chatbots and assistants have revolutionized customer service in real estate. These tools provide round-the-clock support, assisting with tasks from answering inquiries to scheduling viewings. Keller Williams introduced Kelle, an AI-powered personal assistant app, to enhance agent experiences and drive sales growth.

Conclusion

The proptech industry continues to advance, promising to transform the real estate landscape by improving accessibility, convenience, and the overall experience for all participants. As AI continues to integrate more deeply into the sector, the potential for innovation and growth is limitless.

Commercial Real Estate’s Transformative Five-Year Journey

Commercial Real Estate’s Transformative Five-Year Journey

As we delve into the commercial real estate forecast for the next five years, it becomes clear that the industry is on the brink of significant transformation. This shift is driven by a confluence of factors, including technological innovations, evolving consumer preferences, and economic dynamics.Remote Work and Office Spaces

The traditional office space landscape is undergoing a seismic shift. As remote work and hybrid models become entrenched, many companies are reducing their office footprints. According to the JPMorgan Chase report, office properties in prime locations may outperform, but overall demand is expected to remain subdued. This trend is further emphasized by the Deloitte’s outlook, highlighting the non-uniform recovery across property types.

- Reduction in Footprint: Companies are embracing flexible work arrangements, impacting long-term leases and new office construction.

- Repurposing Spaces: Excess office spaces are being transformed into residential units or mixed-use developments.

Retail spaces are reinventing themselves to keep pace with e-commerce growth. The focus is shifting towards creating immersive experiences to attract customers, integrating entertainment and dining options, and adopting omnichannel strategies.

- Experience Over Transactions: Retail is pivoting to offer immersive experiences over mere transactions.

- Omnichannel Strategies: Retailers blend online and offline experiences to cater to consumer preferences.

The demand for industrial real estate, particularly warehouses and distribution centers, is soaring as e-commerce continues its upward trajectory. Companies are expanding logistics hubs to meet same-day delivery expectations, investing in automation and advanced warehousing technologies.

- Expanding Logistics Hubs: The rise of e-commerce drives the need for well-located industrial properties.

- Investment in Automation: Automation investments streamline operations and enhance efficiency.

US Market Insights

The United States is set to remain a global leader in commercial real estate, with the market projected to be valued at approximately $25.28 trillion by 2024, according to Statista. The anticipated compound annual growth rate (CAGR) through 2029 is 2.18%.Sustainability and PropTech

Sustainability is no longer a trend—it’s an expectation. Investors are gravitating towards properties that meet environmental standards, with a surge in green building certifications. The integration of PropTech solutions is streamlining operations, enhancing energy efficiency, and promoting smart building initiatives.

- Green Building Certifications: Certifications like LEED and BREEAM are becoming standard for new developments.

- Energy Efficiency: Implementing energy-efficient systems and sustainable materials appeals to environmentally conscious tenants.

Conclusion

The next five years in commercial real estate are poised for considerable change, influenced by dynamic economic, technological, and social factors. Stakeholders need agility and forward-thinking strategies to harness opportunities and navigate challenges in this ever-evolving landscape. By aligning with sustainability, leveraging technology, and adapting to market conditions, investors and businesses can thrive in the upcoming period.The Rise of Small-Cap Stocks Amid Australia’s Mixed Market

The Australian Market’s Mixed Performance and the Rise of Small-Cap Stocks

The Australian market has recently been a mixed bag, with the ASX200 index closing slightly down. While sectors such as Real Estate and Utilities have faced significant downturns, Discretionary and Telecommunications have shown resilience. Amidst these fluctuations, small-cap stocks are increasingly drawing attention for their potential to excel in specific niches, particularly as investors align their portfolios with emerging trends like ethical investing.

Spotlight on Australian Ethical Investment Ltd

Among the intriguing small-cap options, Australian Ethical Investment Ltd stands out. With a market cap of A$572.77 million, this company has demonstrated robust growth metrics despite challenges from non-recurring expenses. It has shown an impressive earnings growth of 75% over the past year, outpacing the Capital Markets industry’s average. The company’s debt-free status for five years and positive free cash flow reflect strong financial health, suggesting potential for continued growth. For a deeper dive into its financial health, you can explore their comprehensive health report.

Other Notable Small-Cap Performers

In addition to Australian Ethical Investment, other small caps such as Fiducian Group and Schaffer Corporation are making waves. Fiducian Group showcases strong revenue growth, while Schaffer Corporation, despite a slight decline in earnings, maintains a healthy debt-to-equity ratio. The potential of these companies is underscored by their ability to navigate the current economic conditions and sector dynamics.

Exploring Further Opportunities

For those interested in the broader landscape of small-cap stocks with strong fundamentals, a full list of 49 stocks from the ASX Undiscovered Gems With Strong Fundamentals screener is available. This list includes diverse opportunities for investors focused on long-term potential.

GR Engineering Services: A Promising Prospect

GR Engineering Services, another promising small-cap, offers engineering, procurement, and construction services to the mining and mineral processing sectors globally. With a market capitalization of A$461.44 million, it represents a solid investment opportunity for those interested in the engineering prowess within the mining sector.

Conclusion

The Australian market’s recent mixed performance highlights the significance of small-cap stocks in providing unique investment opportunities. As ethical investing continues to gain traction, companies like Australian Ethical Investment and GR Engineering Services are well-positioned to thrive, offering promising prospects for investors seeking to align with current trends.

US Tech Stocks Take a Hit Amid China’s AI Surge

US Tech Stocks Take a Hit Amid China’s AI Surge

In a dramatic turn of events, US tech stocks have suffered a staggering $1 trillion loss following China’s groundbreaking AI launch. The market trembled as DeepSeek, a Chinese AI model, made its debut, sending ripples through the tech industry. Notably, Nvidia’s shares plummeted by 17%, triggering a widespread sell-off in AI stocks. Despite this turbulence, experts suggest this may be an overreaction, urging investors to remain calm and view this dip as a potential opportunity. The long-term growth prospects for the AI sector remain robust, with analysts advising diversification and strategic investments. For further insights, read more on this development here.Revolutionizing Real Estate Financing

Technological advancements are reshaping the landscape of real estate financing, particularly for mid-sized developers. These developers have traditionally struggled with securing affordable financing, often paying higher interest rates than their larger counterparts. However, innovations such as smart project monitoring solutions, predictive analytics, and AI-driven forecasts are leveling the playing field. By enhancing transparency and efficiency, these technologies are helping developers lower costs and build investor trust. This shift is paving the way for a more diverse and competitive real estate market. Discover more about these tech solutions here.Exciting Job Opportunities at Lenovo

Lenovo is on the hunt for a Technical Support Manager to join their Bangalore team. This role involves managing technical service planning and ensuring service delivery excellence. The ideal candidate will have 10-15 years of experience in IT/hardware services, with a strong background in technical support management. Key responsibilities include analyzing failure rates, developing training programs, and collaborating with cross-functional teams to meet performance metrics. If you have a passion for problem-solving and customer satisfaction, explore this opportunity here.Bitcoin’s Surge and the Federal Reserve’s Stance

Bitcoin is nearing its all-time high, driven by a surge following the Federal Reserve’s decision to pause rate hikes. This move provided relief to markets, coinciding with pro-crypto remarks from Fed Chairman Jerome Powell. Powell’s statements mark a shift from the previous administration’s stance, suggesting banks can serve crypto customers if risks are managed. The U.S. Senate Banking Committee is set to investigate debanking practices against crypto firms, amidst allegations against major banks like Bank of America and JPMorgan. Stay updated on this unfolding story here.AI’s Role in Predicting Market Crashes

The potential of AI to predict market crashes has been a hot topic in financial circles. While AI has made strides in processing vast amounts of data and identifying patterns, its accuracy in predicting market downturns remains under scrutiny. Ongoing research continues to explore the capabilities and limitations of AI in financial forecasting. For a deeper dive into this subject, read more here.Revolutionizing Real Estate: Blockchain’s Impact

In 2020, the global market for blockchain in the real estate sector was valued at a staggering $328.3 million. By 2028, this figure is projected to soar to $3.8 billion, underscoring the technology’s transformative potential. A testament to its promise, a significant 86% of industry decision-makers believe blockchain could fundamentally change the game.

Applications of Blockchain in Real Estate

Due Diligence

The arduous process of due diligence is streamlined through blockchain, which allows for secure digital documentation. This minimizes the risk of data tampering and automates tasks, enhancing speed and accuracy.Property Search

Traditional property listings often involve prohibitive fees and inaccuracies. Blockchain disrupts this by enabling decentralized data sharing, fostering peer-to-peer efficiency and real-time data accuracy for brokers and clients.Property Management

By integrating blockchain, property management processes are simplified. Smart contracts automate transactions, such as lease payments, ensuring a secure and seamless experience for both landlords and tenants.File and Payments Handling

Blockchain reduces the complexities of file management and transactions by introducing digital identities and cryptocurrencies, streamlining processes and cutting associated costs.Real Estate Investing

Tokenization through blockchain allows for fractional ownership, promoting transparency and reducing fraud, thereby enhancing investment security.

Challenges in Adopting Blockchain

While the benefits are compelling, the adoption of blockchain in real estate is not without its challenges. The costs associated with development and integration are significant, and the scarcity of skilled professionals with the necessary expertise can be a barrier. Furthermore, despite blockchain’s inherent security advantages, vulnerabilities such as insider threats and smart contract bugs necessitate robust security measures. The evolving regulatory landscape also poses a challenge, as countries worldwide have varying laws regarding technology and real estate.Conclusion

Despite these hurdles, the potential of blockchain to revolutionize the real estate sector is undeniable. As highlighted in the original article from Impakter, keeping a keen eye on blockchain’s evolution will be crucial in understanding its full impact on the real estate landscape.Thailand: The New Epicenter for Foreign Property Investment

Thailand: The New Epicenter for Foreign Property Investment

Thailand has emerged as Asia’s leading destination for foreign property buyers, surpassing its regional counterparts. This trend is explored in depth in the article “Investing in Thailand Property: The Ultimate Guide” by InvestAsian. The piece provides a comprehensive analysis of why Thailand’s real estate market is flourishing, offering crucial insights for global investors.

Thailand has emerged as Asia’s leading destination for foreign property buyers, surpassing its regional counterparts. This trend is explored in depth in the article “Investing in Thailand Property: The Ultimate Guide” by InvestAsian. The piece provides a comprehensive analysis of why Thailand’s real estate market is flourishing, offering crucial insights for global investors.

Thailand’s central location in Southeast Asia has long established it as a crucial business hub, a legacy that continues to this day. With borders shared with four countries and its proximity to emerging frontier markets like Vietnam and Cambodia, Thailand offers a strategic advantage, providing access to cost-effective labor and a vast consumer base.

The capital city, Bangkok, is a testament to Thailand’s vibrant nature. As a top global tourist destination, Bangkok exemplifies Thailand’s minimal bureaucracy and business-friendly environment. The nation ranks 21st in the global Ease of Doing Business ratings, showcasing its competitiveness against regional peers like Singapore and Malaysia.

Despite political challenges, including a military coup nearly a decade ago, Thailand remains a beacon for foreign investors. The country presents fewer bureaucratic obstacles compared to other developing Asian regions, and the overall business climate is welcoming, with swift bank account setups available even for tourists.

Economically, Thailand maintains its status as a leading exporter of electronics and vehicles, supporting a robust middle class and escalating property values. The market’s growth since the 1980s is evident in cities such as Bangkok, Pattaya, and Hua Hin, where new residential developments continue to rise.

In the face of obstacles like political instability and an underperforming education system, Thailand’s economy remains resilient. The notion of “Teflon Thailand” encapsulates its history of enduring coups and recessions while consistently outperforming neighboring countries.

For those considering investing in Thailand’s property market, the potential rewards are intertwined with the economic promise of “Teflon Thailand,” making it an attractive option for real estate ventures seeking to leverage the nation’s enduring stability and strategic benefits.

Social Skills: Navigating the Social Media Landscape in Real Estate

Social Skills: Navigating the Social Media Landscape in Real Estate

In an era where social media trends evolve more rapidly than real estate listings, staying ahead of the curve is not just advantageous—it’s essential. According to a recent feature in RISMedia’s Daily News, mastering the digital landscape can significantly enhance a real estate agent’s business.

Researching Social Media Trends

To stay relevant, agents should follow top real estate influencers on platforms like LinkedIn, Twitter, and Instagram. Engaging with their content and noting high-engagement topics is crucial. Setting up alerts for real estate-related keywords and participating in professional groups on LinkedIn and Facebook can offer insights into emerging trends. Attending webinars and discussions, such as those on buyer agency discussions and commissions lawsuits, is also recommended.

Staying Relevant

Agents are encouraged to subscribe to real estate newsletters, read industry blogs, and engage with real estate webinars and podcasts. Active engagement with audiences through comments and reviews builds relationships and keeps agents in tune with their audience’s interests.

Understanding Each Social Media Platform

Each platform offers unique opportunities. LinkedIn is ideal for networking and thought leadership, while Facebook is great for community building. Twitter (referred to as “X” in the article) is best for real-time updates, and Instagram excels in visual storytelling. YouTube allows for in-depth content, and TikTok is perfect for creative, short-form videos.

Platform-Specific Strategies

- LinkedIn: Share market reports and participate in discussions.

- Facebook: Use Facebook Live for virtual tours and engage with polls.

- Twitter: Post quick updates and use trending hashtags.

- Instagram: Utilize Stories and Reels for engagement.

- YouTube: Invest in quality video production for detailed content.

- TikTok: Engage with trending hashtags and participate in popular trends.

Staying updated with social media trends is vital for real estate agents aiming to remain relevant and effectively engage with their audience. By leveraging each platform’s strengths, agents can create compelling content that resonates and drives business success.

For those looking to boost their online presence, ACESocial offers simple content marketing solutions to highlight expertise, increase engagement, and generate leads.

India’s Green Building Revolution: A Vision for 2025

India’s Green Building Revolution: A Vision for 2025

As the world confronts the challenges of climate change, India has positioned itself as a pivotal force in the global movement to reduce carbon emissions and foster sustainable development. The green building sector, in particular, offers a promising avenue to address the environmental impact of rapid urbanization, blending ecological responsibility with economic potential. By 2025, the acceleration of green building technologies in India is expected to gain momentum, fueled by policy support, technological innovations, and heightened stakeholder awareness.In 2024, India achieved remarkable progress in lowering carbon emissions, fulfilling two out of three Nationally Determined Contributions (NDCs) as per the Paris Agreement ahead of schedule. Despite a projected 4.6% rise in fossil fuel emissions, India’s investment in renewable energy and robust regulatory frameworks underscores its commitment to net-zero targets. This dedication is mirrored in the swift adoption of green building practices, bolstered by initiatives like the annual Green Building Congress and measures in the Union Budget emphasizing net-zero construction and resource-efficient design.

Looking forward, the green building market is anticipated to grow at a compound annual growth rate (CAGR) exceeding 5% through 2028, reflecting the increasing demand for environmentally conscious construction solutions. This aligns with global sustainability goals and positions the construction industry as a central player in discussions around net-zero and decarbonization.

Trends and Technologies Shaping the Future

As 2024 draws to a close, it’s crucial to examine the key trends and technologies poised to shape the green building sector in the coming year. Innovations in AI, IoT, and other advanced technologies will enhance building management systems, making them more agile and efficient. The integration of renewable energy sources, particularly solar power, will be increasingly incorporated at the building design stage. Building-integrated photovoltaics (BIPV) and advanced solar panel technologies will empower structures to generate their own clean energy, reducing reliance on fossil fuels.The residential buildings sector is expected to see significant growth, driven by consumers’ increasing preference for sustainable real estate investments. The proliferation of ‘micro units’ for independent homes and residential complexes will play a pivotal role in this expansion.

A Collaborative Approach to Decarbonization

The path to decarbonizing buildings in India necessitates a multifaceted approach, integrating technology, policy, and community efforts. From renewable energy integration and smart building technologies to waste and water management strategies, solutions must be tailored to India’s diverse climate conditions and construction needs. A consultative approach, rather than a one-size-fits-all strategy, is essential for addressing the unique requirements of India’s building stock.India stands on the cusp of a green revolution in its construction sector, with tailored solutions crucial for driving progress toward a resilient, low-carbon future.

Author: Arun Awasthy, President & Managing Director, Johnson Controls India

Note: The opinions expressed in this article are those of the author and do not necessarily reflect the views of The Week.

The Role of AVMs in Commercial Real Estate Valuations

The Intricate Dance of AVMs and Commercial Real Estate

In the world of real estate, Automated Valuation Models (AVMs) have long been a staple in residential property assessments, ever since Zillow’s audacious debut of the “Zestimate” in 2006. This tool, initially intended to provoke curiosity and drive web traffic, revolutionized how homeowners viewed property valuations. However, the transition of AVMs into the realm of commercial real estate has been anything but straightforward.Commercial real estate valuation is a complex tapestry woven from numerous threads: rent rolls, lease agreements, and building expenses, to name a few. Unlike residential data, these elements are not readily accessible, creating a challenge for AVMs in this sector. Yet, companies like JLL Risk Advisory are pioneering the use of AVMs to provide rapid assessments and identify properties that may be undervalued or overvalued. As Charles Fisher, Director of Value and Risk Analytics at JLL, notes, these models serve as an essential component of a broader valuation strategy.

- AVMs offer speed and efficiency, evaluating numerous properties in record time.

- They act as a preliminary tool rather than a comprehensive solution.

- Human oversight remains crucial to account for valuation nuances.

As AVMs evolve, they are anticipated to more closely replicate human appraisals. Technologies like computer vision could enable AVMs to better assess property conditions, but challenges remain. Encoding nuanced building characteristics into machine-readable data is a significant hurdle. Currently, AVMs still require human verification to address potential blind spots in their analyses.

In conclusion, while AVMs are not poised to replace human appraisers, they are carving out a significant role in the commercial real estate industry. As computational models advance, they promise to expedite decision-making, offering investors a competitive edge while underscoring the indispensable role of human expertise in the valuation process. For more insights, you can read the original article on Propmodo.

Ohio Governor DeWine Unveils $18.2 Million Infrastructure Grant Package

Ohio Governor Mike DeWine, flanked by Lt. Governor Jon Husted and Ohio Department of Development Director Lydia Mihalik, has announced a significant financial boost for the state’s infrastructure. On September 19, 2024, the trio unveiled a sweeping $18.2 million grant package aimed at revitalizing neighborhoods and enhancing critical infrastructure across 34 communities in Ohio. This monumental investment is poised to transform the landscape of these regions, focusing on upgrading water and sewer systems, repairing roads, and bolstering public safety measures.

Infrastructure and Neighborhood Revitalization

The announcement underscores a commitment to not only improve the quality of life for Ohioans but also to lay the groundwork for robust economic development. As Governor DeWine eloquently stated, “With this funding, we are addressing vital needs in communities across the state.” This initiative is a testament to the collaborative efforts between the government and local communities, aiming to make Ohio’s neighborhoods safer and more vibrant for future generations.

Economic Development and Quality of Life Improvement

Lt. Governor Husted emphasized the economic implications of the investment, noting that “Strong infrastructure is the foundation of a thriving economy.” The grants will enable communities to develop resources crucial for job creation and an enhanced quality of life, ensuring that Ohio remains competitive and attractive for businesses and residents alike.

Critical Infrastructure and Neighborhood Revitalization Grants

The funding is divided into two main categories:

- Neighborhood Revitalization grants: Ten communities will share $7.5 million, focusing on public facility improvements, fire protection facilities, and community centers in low- and moderate-income areas.

- Critical Infrastructure grants: 24 communities will receive a total of $10.7 million, targeting high-priority improvements such as flood and drainage facilities, water and sanitary sewer facilities, and street reconstruction.

For more detailed information about the projects and specific community allocations, the full original article provides an in-depth look at how these funds will be utilized.

Government and Community Collaboration

Director Lydia Mihalik highlighted the often unseen but crucial impact of infrastructure projects, stating, “This type of infrastructure may not always be visible, but its impact is felt every day.” The projects funded through this initiative will not only strengthen the physical foundation of Ohio’s communities but also prepare them to be the next great economic success story.

Commitment to Enhancing Safety and Services

The grant awards, funded through the federal Community Development Block Grant program, reflect a broader trend of investing in public infrastructure to enhance safety and services in local communities. This strategic allocation of resources is expected to yield long-term benefits, reinforcing Ohio’s position as a leader in community development and infrastructure innovation.

Generative AI: Shaping the Future of Commercial Real Estate

Generative AI: Shaping the Future of Commercial Real Estate

In the rapidly evolving landscape of commercial real estate, leaders are increasingly turning to generative AI (GenAI) to enhance efficiency and reduce costs. As highlighted in a recent EY article, this technology is not just a tool but a transformative force reshaping property operations, acquisition strategies, and portfolio planning.

Unlocking New Potential

Commercial real estate companies are leveraging technology to drive innovation. GenAI is at the forefront, offering solutions that could redefine how businesses operate. The potential of GenAI spans various functional areas, including sales, marketing, finance, HR, and IT. This technological shift is akin to the digital transformation wave of the early 2000s, which sparked widespread innovation and disruption across industries. The World Economic Forum anticipates a net increase of 58 million jobs due to automation. GenAI is poised to replace repetitive tasks with more engaging roles, fostering better customer interactions and enhancing product quality.Navigating Challenges and Opportunities

With the promise of GenAI comes a set of challenges. Companies must address workforce impacts, ethical AI use, cybersecurity, and intellectual property concerns. The real estate sector, in particular, faces hurdles in talent retention, investor demands, and technology adoption. GenAI offers a pathway to overcome these obstacles, paving the way for new business models and enhanced operational efficiency.Strategic Vision and Ethical AI

A long-term strategic vision is crucial for integrating GenAI into real estate. Companies must prioritize safe, responsible, and ethical AI use. This involves developing a comprehensive GenAI approach, selecting use cases, transforming processes, and building a robust technology roadmap. The EY article emphasizes the importance of aligning people strategy with business strategy to drive enterprise transformation. Companies should focus on talent transformation, ensuring that employees are equipped to harness the potential of GenAI.Implementation and Impact

Real estate companies should consider a structured approach to GenAI implementation. This includes selecting use cases, transforming processes, and establishing a technology roadmap. Responsible AI practices must be embedded into organizational culture, with a focus on transparency and ethical use. As companies embark on this journey, they can draw insights from EY’s article on winning with GenAI in wealth and asset management. This resource offers valuable guidance on leveraging technology for strategic advantage. ConclusionThe transformative power of GenAI is undeniable. As commercial real estate companies navigate this new frontier, they must balance risks and rewards, experimenting with technology to craft a long-term strategy. By embracing GenAI, the industry can unlock new efficiencies, drive innovation, and shape a future where technology and human ingenuity go hand in hand.

Commercial Real Estate Market Set for Significant Growth

Commercial Real Estate Market Set for Significant Growth

In a recent report from PR Newswire, the global commercial real estate market is projected to expand by a staggering USD 427.3 billion between 2025 and 2029. This remarkable growth is largely driven by the robust expansion of the global commercial sector and the transformative power of technological innovations, particularly those harnessed by artificial intelligence (AI).

Technological Innovations and Market Dynamics

The market is expected to grow at a compound annual growth rate (CAGR) of 4.6% over the forecast period. While the rise of remote work and e-commerce presents challenges, these shifts are simultaneously reshaping traditional office and retail spaces. Major players such as CBRE Group Inc. and WeWork Inc. are at the forefront of navigating these changes. The report highlights the increasing trend towards smart city infrastructure, which is boosting demand for commercial spaces, particularly in the IT and engineering sectors. Moreover, co-working and flexible office spaces are gaining traction as businesses adapt to new work patterns.AI and Virtual Reality: Transforming the Landscape

Technological advancements, including AI and virtual reality, are revolutionizing the commercial real estate sector. These innovations are enhancing property management through data analytics and providing virtual property tours, thereby offering a more immersive experience for potential tenants and buyers. The Technavio report further underscores the role of AI in driving market trends and competitive dynamics, offering businesses the tools to stay ahead in an evolving landscape.Opportunities and Challenges

While the commercial real estate market is poised for growth, it must navigate several challenges. The shift towards online shopping has reduced demand for traditional retail spaces, impacting foot traffic in physical stores. Similarly, the trend towards remote work is affecting the need for conventional office spaces. To address these challenges, businesses are focusing on flexible office layouts and integrating advanced technologies like virtual reality. These strategies are crucial for adapting to the changing consumer behaviors and technological advancements that are reshaping the commercial real estate market.Conclusion

The commercial real estate market is on the cusp of a significant transformation, driven by global commercial sector growth and AI-powered innovations. As businesses adapt to new realities, the market offers exciting opportunities for innovation and growth, with key players leveraging technology to redefine the future of commercial spaces. Discover more about the evolving commercial real estate market and the role of AI by accessing the full report from Technavio.Are Sydney and Melbourne the Next Silicon Valley for AI?

Are Sydney and Melbourne the Next Silicon Valley for AI?

The allure of San Francisco and Silicon Valley’s tech evolution has long captivated the global imagination. Now, it appears that Sydney and Melbourne are on the cusp of a similar transformation, emerging as pivotal tech hubs for AI companies. According to insights from JLL, these cities are well-positioned to capture a significant share of Australia’s knowledge workers and population, making them prime candidates for AI clustering.

With 76% of AI companies already established in Sydney and Melbourne, the momentum is undeniable. Bhimjiani highlights the tendency of AI firms to cluster, facilitating knowledge sharing and competitiveness. However, this burgeoning growth is contingent on addressing key infrastructure challenges, such as enhancing data center capacity, improving network infrastructure, and resolving latency issues.

The Role of Landlords in the AI Revolution

Bianca Docker, head of growth, office leasing at JLL, underscores the strategic advantage for landlords who embrace the AI revolution. By positioning assets strategically, landlords can attract a new wave of tenants, capitalizing on AI clustering by building offices near crucial infrastructure like data centers and tech hubs. This forward-thinking approach could provide a significant edge in a rapidly evolving market.

Office Space Demand on the Rise

The demand for office space is set to surge, as evidenced by the nearly 100,000 sqm of leasing activity in San Francisco in 2024, driven by AI. This reflects a remarkable 23.7% year-on-year growth. The penetration of AI companies in San Francisco’s Bay Area office market has grown from a mere 0.2% in 2014 to an impressive 5.0% in 2023.

In contrast, Australia’s current AI penetration rate stands at 0.7%, with a projected office demand of 483,000 sqm by 2030, reflecting a penetration rate of 2.5%. Early AI adopters in Sydney and Melbourne, such as Salesforce, SAP, Google, and Infomedia, have already made a significant impact on net office space uptake, offsetting the declining demand from the financial services sector.

As Sydney and Melbourne gear up to become the next key players in the AI landscape, the lessons from San Francisco’s tech journey serve as a guiding beacon. The potential is immense, but the path to success is paved with the need for robust infrastructure and strategic foresight.

Strategic Positioning in Commercial Real Estate Amid Economic Shifts

Strategic Positioning in Commercial Real Estate Amid Economic Shifts

The commercial real estate sector is at a pivotal crossroads, as organizations find themselves with a generational opportunity to strategically position for future developments. This comes as they navigate the aftermath of recent economic fluctuations and interest rate changes by major central banks.

The 2025 Commercial Real Estate Outlook from Deloitte presents a comprehensive analysis of these dynamics. As the report suggests, real estate organizations must adapt to the evolving landscape shaped by global economic forecasts and monetary policies.

Global Economic Forecasts and Their Impact

The economic outlooks for the United States, Eurozone, and India, as detailed in reports from Deloitte Insights, indicate varied trajectories for these regions. The United States is projected to experience moderate growth in Q2 2024, while the Eurozone and India are expected to navigate their unique economic challenges. These forecasts play a critical role in shaping strategies for real estate investments and developments.

Central Bank Policies: A Game Changer

Recent decisions by central banks, including the European Central Bank’s rate cut and the Bank of England’s first rate cut since 2020, have been met with a measured response from the industry. Similarly, the Federal Reserve’s openness to a potential rate cut in September, contingent on inflation trends, underscores the fluidity of the current economic environment.

Strategic Adjustments for Real Estate

In light of these economic signals, real estate organizations are urged to reassess their strategic positions. The ability to leverage these economic insights and adjust investment strategies will be crucial for success in the coming years. As highlighted in the Deloitte report, the sector must embrace innovation and adaptability to thrive amidst these changes.

Conclusion

The commercial real estate sector stands at a significant juncture. With careful strategic positioning and responsiveness to global economic and monetary developments, organizations can navigate the challenges and seize the opportunities that lie ahead.

U.S. Housing Market Outlook 2025: Navigating Challenges and Opportunities

Market Dynamics and Mortgage Rates

Would-be homebuyers continue to face challenges due to elevated mortgage rates and ever-rising home prices. As of early January 2025, the average 30-year mortgage rate has climbed to 7.08 percent, despite multiple rate cuts by the Federal Reserve. This trend suggests that affordability will remain a pressing issue. Greg McBride, CFA, chief financial analyst for Bankrate, highlights that “continued economic growth and worries about inflation and government debt will keep mortgage rates elevated.” For more insights, you can explore Bankrate’s 2025 mortgage rates forecast.Inventory and Housing Affordability

While housing inventory has seen some improvement, it remains below the levels needed for a balanced market. The National Association of Realtors (NAR) reports a 3.8-month supply at the end of November 2024, marking a 17.7 percent improvement from the previous year. However, the market still leans towards a seller’s advantage, with limited inventory keeping prices high.Political Implications

The inauguration of a new presidential administration adds another layer of uncertainty. According to Redfin economists, potential policy changes, such as tax cuts and tariffs proposed by Donald Trump, could influence the housing market dynamics, keeping mortgage rates elevated.Home Sales and Price Trends

Despite the challenges, there is a glimmer of hope as existing-home sales saw a 4.8 percent increase in November 2024, the first rise since 2021. Lawrence Yun, NAR’s chief economist, notes that “home sales momentum is building” as more buyers adjust to the new normal of mortgage rates between 6 and 7 percent. However, Selma Hepp from CoreLogic warns that “the prospect of elevated mortgage rates throughout 2025 suggests that housing market activity will continue to be challenged.”Looking Ahead

As we move into 2025, the housing market is expected to remain a seller’s market in most areas, although regions with increased inventory may offer more opportunities for buyers. For those considering entering the market, it’s advisable to consult with an experienced local real estate agent to navigate these complex conditions.For a comprehensive understanding of the housing market predictions for 2025, you can visit the original article on Bankrate.