Housing Market Outlook for 2024: Will Affordability Return?

In a climate of fluctuating mortgage rates and shifting economic tides, the housing market remains a focal point of interest for prospective buyers and industry experts alike. As reported by Forbes, the landscape of homeownership is evolving, with mortgage rates finally dipping into a range that offers a glimmer of hope for many eager buyers.

While home prices continue to reach unprecedented heights, the pace of growth is starting to slow, thanks to an increase in inventory and a decrease in demand. This shift is providing buyers with more bargaining power as they engage with sellers. Yet, as the Federal Reserve recently enacted significant interest rate cuts, many potential buyers are choosing to wait on the sidelines, anticipating further reductions that could make homeownership even more attainable.

The S&P CoreLogic Case-Shiller Home Price Index indicates a 5% annual gain, reflecting a deceleration from previous months. However, the index still registers record highs, suggesting that affordability remains a challenge for many. Lisa Sturtevant, chief economist at Bright MLS, posits that the decline in mortgage rates could lead to slower home price growth as inventory rises, although this may only be a temporary respite.

Looking ahead to 2024 and 2025, experts like Ralph McLaughlin from Realtor.com predict a potential rebound in home price growth, fueled by falling mortgage rates and increased buyer purchasing power. The consensus is clear: waiting for further rate drops might leave many would-be homeowners scrambling in a competitive market.

For a sustainable recovery in the housing market, Keith Gumbinger of HSH.com emphasizes the need for a significant increase in home listings to alleviate price pressures. While recent mortgage rate declines have begun to ease inventory constraints, the journey to a balanced market is far from over.

Amidst these dynamics, the National Association of Realtors (NAR) has implemented practice changes following antitrust settlements, aiming to enhance transparency in real estate transactions. These reforms could influence affordability, as buyers may now bear more responsibility for broker commissions.

The question on everyone’s mind is whether the housing market will crash by 2025. Experts like Tom Hutchens of Angel Oak Mortgage Solutions suggest that low housing supply acts as a buffer against a potential downturn. Moreover, homeowners today are in a stronger financial position than during the 2008 crisis, with substantial equity and many owning their homes outright.

As we navigate through the latter part of 2024, the prospect of a foreclosure surge seems unlikely, with foreclosure activities remaining below pre-pandemic levels. The key takeaway for prospective buyers is that the housing market—like any other market—is challenging to time. Orphe Divounguy of Zillow Home Loans advises that the best time to buy is when a home meets one’s needs and budget.

In conclusion, as we move closer to 2025, the housing market presents a complex yet cautiously optimistic outlook. While affordability challenges persist, strategic planning and informed decision-making can pave the way for successful homeownership. For more insights, read the full article on Forbes.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

More Articles

Getting licensed or staying ahead in your career can be a journey—but it doesn’t have to be overwhelming. Grab your favorite coffee or tea, take a moment to relax, and browse through our articles. Whether you’re just starting out or renewing your expertise, we’ve got tips, insights, and advice to keep you moving forward. Here’s to your success—one sip and one step at a time!

AI’s Role in Shaping Our Work Lives

Exploring the Future: AI’s Role in Shaping Our Work Lives

As artificial intelligence (AI) continues to evolve at an astonishing pace, its impact on the job market is becoming a focal point of discussion. A recent article from Futurist Speaker presents a compelling set of 25 questions designed to help individuals navigate the potential influence of AI on their careers and industries.Automation and Job Security

One of the key areas explored is the possibility of automation and its implications for job security. While AI could relieve workers from repetitive tasks, there’s a looming concern about roles becoming redundant. This duality underscores the need for a proactive approach in adapting to AI’s capabilities.

Human Skills vs. AI Replication

The article delves into the unique human skills that AI might struggle to replicate, such as emotional intelligence and creativity. However, as AI technology advances, even these skills may face challenges, prompting individuals to continuously enhance their skillsets.

Emerging Roles and Ethical Considerations

AI’s integration into the workplace is likely to give rise to new roles, such as AI trainers and ethics officers. These roles not only offer fresh career paths but also highlight the importance of addressing ethical considerations in AI deployment. For more on this, visit The Coming AI Job Explosion.

AI’s Impact on Income and Collaboration

The potential for AI to affect wage structures and income inequality is another critical discussion point. While AI could enhance productivity, it might also concentrate benefits among a select group. Furthermore, the article envisions new forms of human-AI collaboration, which could redefine workplace dynamics.

Adapting to an AI-Driven Future

To thrive in an AI-influenced job market, the article emphasizes maintaining a growth mindset and embracing lifelong learning. As AI reshapes industries, staying informed about developments and being adaptable will be crucial for success. Further insights can be found in The Great AI Disruption: Six Startling Predictions That Will Shape Our Lives and Test Our Limits.

Final Thoughts

The future impact of AI on the job market is not predetermined. By engaging in self-reflection and critical thinking, individuals can better prepare for the changes ahead. The article from Futurist Speaker encourages readers to focus on developing uniquely human skills while embracing AI technologies, ultimately fostering a future where humans and AI collaborate to create greater value.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

Tokenization: Reshaping Financial Landscapes

Tokenization: Reshaping Financial Landscapes

The advent of blockchain technology and decentralized finance (DeFi) is revolutionizing how we perceive and interact with financial markets. Central to this transformation is the concept of tokenization, a process that converts assets into digital tokens on a blockchain, enhancing security, accessibility, and liquidity.Tokenization is breaking down traditional barriers by fractionalizing assets, allowing investors with modest incomes to access markets like real estate and art. This democratization is particularly transformative for sectors historically dominated by high entry requirements. By 2030, real estate is expected to become the largest type of tokenized asset, signaling a significant shift in investment landscapes.

Understanding Tokenization

Tokenization involves transforming ownership of tangible and intangible assets into digital tokens, each representing a stake in the asset’s value or returns. These tokens are stored on a blockchain, ensuring data integrity and security through its decentralized nature. This technological foundation prevents unauthorized alterations and fraud, providing a robust system for verifying and tracking ownership.

The real advantage lies in fractionalizing assets, opening investment opportunities to a broader audience. This approach democratizes investment, particularly in markets like real estate and fine art, traditionally dominated by high entry barriers.

Impact on Real Estate and Art

Real estate, characterized by high capital requirements and transactional complexity, is undergoing a transformation through tokenization. It utilizes DeFi to make property investment more accessible and liquid. Investors can now invest in real estate with considerably lower initial capital through fractional shares, broadening the pool of potential investors and enhancing market liquidity.

Similarly, the art market is experiencing a revolution. Investors can purchase fractional shares in art, a market historically requiring significant upfront capital and insider knowledge. Tokenization lowers financial barriers, increasing liquidity and dynamism.

This type of asset is more liquid because it can be bought and sold on digital platforms without physical paperwork or face-to-face meetings. This liquidity allows investors to convert their investments into cash much faster than traditional real estate or art sales.

Addressing Challenges

While the potential is revolutionary, tokenization faces hurdles, including regulatory uncertainties, technological integration difficulties, investor skepticism, and scalability issues. The industry should explore regulatory technology (RegTech) to enhance compliance and adapt to changing legal frameworks efficiently.

Advancements in blockchain infrastructure, such as Layer-2 solutions, are crucial for scaling tokenization to meet enterprise demands. Educating potential investors and building robust business cases are also pivotal in overcoming skepticism and demonstrating the tangible benefits and security measures associated with tokenized assets.

The Future of Financial Ecosystems

The integration of DeFi frameworks and tokenization is reshaping financial markets, creating a more inclusive environment. As these technologies mature, they promise to redefine economic interactions and enhance the efficacy of financial systems, marking a shift towards a more equitable financial future.

Disclaimer: The views expressed in this article are those of the author and do not necessarily reflect the opinions of CCN, its management, or its employees. This content is intended for informational purposes and should not be construed as professional advice.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

Revolutionizing Real Estate: The AI and Blockchain Advantage

Revolutionizing Real Estate: The AI and Blockchain Advantage

In an era where technology is reshaping industries at an unprecedented pace, the real estate sector is no exception. As reported by Inman, the integration of AI and blockchain technology is set to transform how real estate professionals conduct business, offering a competitive edge in a rapidly evolving market.Streamlining Transactions and Security

The marriage of AI and blockchain promises to streamline transaction processing, significantly reducing paperwork and processing time. This newfound efficiency allows agents to handle more deals at their own pace, enhancing productivity and client satisfaction. Furthermore, the use of smart contracts ensures automated and transparent contract execution, minimizing disputes and expediting deal closures.

Blockchain technology also enhances security and transparency in property records, reducing the risk of fraud. This assurance of secure, transparent transactions fosters trust among clients, a vital component in attracting more business.

Global Market Outreach and Automation

With platforms like Propy, agents can expand their reach to a global marketplace, facilitating seamless cross-border transactions. This global outreach increases the likelihood of connecting with suitable buyers and sellers, ultimately leading to more deals.

Moreover, the adoption of AI and blockchain in real estate listings and buyer presentations significantly boosts the chances of being hired. The tech-savvy new generation demands tech-smart agents, while the older generation recognizes the opportunities that new technology brings to buying and selling homes.

Automation is another game-changer, potentially driving US transactions to 20 million homes sold annually, compared to the current 4-5 million. This surge in transactions will enable professional agents to close more deals faster each year.

Embracing the Digital Shift

The digital shift in finance and investment is led by giants like BlackRock, which has launched a Bitcoin ETF and aims to tokenize $10 trillion in assets. This reflects the rise of Real World Assets (RWA) tokenization, promising enhanced liquidity, ownership evidence, and transparency. BlackRock’s $39 billion real estate tokenization initiative aims to revolutionize property ownership, boosting market liquidity and transaction speed while ensuring integrity and reducing fraud risk.

In a real-world scenario, a Miami agent utilized Propy to streamline identity verification, analyze agreements, and send deposit links, impressing clients with efficiency. Platforms like Propy Title and Escrow further enhance transaction security with blockchain and smart contracts, providing a seamless experience for all parties involved.

Conclusion

The integration of AI and blockchain technology is poised to reshape the real estate industry significantly. Agents and brokers who embrace and adapt to these advancements will be well-positioned to capitalize on new opportunities, enhance their services, and drive success in the future.

Image:

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

New York City’s Commercial Real Estate on the Brink: A ‘Doom Loop’ Warning

Office Vacancies and Economic Impact

Office Vacancies and Economic ImpactThe rise of remote work, accelerated by the COVID-19 pandemic, has left a significant mark on urban office spaces. In New York City, office vacancies have soared to unprecedented levels, with nearly 20% of spaces sitting empty. This vacancy rate not only hemorrhages potential revenue but also shrinks the city’s tax base, a concern echoed in Colliers’ report.

Van Nieuwerburgh warns that the repercussions of these vacancies could extend far beyond real estate. The anticipated decline in tax revenue may force the government to cut spending on essential services such as transportation, education, and sanitation, making urban living less attractive and potentially driving residents to relocate to states with more favorable tax environments.

Changing Office Space Preferences

As companies adapt to new work paradigms, the demand for office spaces has shifted. Businesses are now seeking smaller, modern offices equipped with amenities to entice employees back to in-person work. This trend, as noted by Fred Cordova, CEO of real estate consultancy Corion Enterprises, is putting pressure on traditional office buildings, many of which face refinancing challenges due to expiring loans from the post-financial crisis era.

Banking Sector Vulnerabilities

The banking sector, particularly smaller regional banks, is heavily exposed to the commercial real estate market. According to Van Nieuwerburgh, these banks hold a significant portion of the $6 trillion in commercial real estate debt in the United States. With the potential for rising vacancies and declining property values, these financial institutions could face severe instability unless market conditions improve.

Potential Solutions and the Path Forward

To avoid the grim scenario outlined by Van Nieuwerburgh, substantial policy interventions are necessary. These could include strategic investments in public infrastructure and incentives to attract businesses back to urban centers. Without decisive action, the city risks entering a cycle of economic decline, echoing the fiscal challenges of the 1970s.

As New York City stands at this critical juncture, the insights from Fortune’s detailed analysis serve as a clarion call for city leaders and stakeholders to address these pressing challenges head-on.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

The Migration Shift: Affordable Housing’s Role in Changing US Migration Trends

A recent analysis by Zillow, leveraging data from United Van Lines, reveals a significant shift in interstate migration patterns. Last year, individuals often moved to regions where housing markets were less competitive, and new home construction was keeping pace with demand. On average, homes in these new metros were approximately $7,500 cheaper than those in the areas people left behind.

Migration Trends Driven by Affordability

Orphe Divounguy, a senior economist at Zillow, emphasizes the pivotal role of affordability in shaping these migration patterns. “Housing affordability has always mattered…and you’re seeing it across the country,” he notes, highlighting how this factor is influencing where people choose to live.

Jessica Lautz, deputy chief economist at the National Association of Realtors, points to a strong migration flow into states like Florida, North Carolina, South Carolina, Tennessee, and Texas. These regions are increasingly popular due to their combination of affordable housing options and robust job markets.

- Charlotte, North Carolina

- Providence, Rhode Island

- Indianapolis, Indiana

- Orlando, Florida

- Raleigh, North Carolina

These cities, among others, have become magnets for movers seeking not only affordable living but also substantial employment opportunities. For instance, Charlotte and Raleigh have emerged as tech and financial hubs, attracting workers from more expensive metro areas like New York City.

Economic and Job Factors

The appeal of these Southern and Midwestern cities lies not only in their affordability but also in their dynamic job markets. As Divounguy notes, these areas are “markets where jobs are being created rapidly,” providing a dual incentive for relocation—affordable housing and employment prospects.

As the real estate market continues to face a low supply of active listings, builders are stepping in to fill the gap, but only in areas where it is financially viable for both buyers and builders. This has led to a rise in the popularity of these relatively more affordable markets.

Conclusion

As the landscape of American housing continues to evolve, the influence of affordability on migration trends becomes increasingly evident. With states like Florida and the Carolinas leading the charge, the search for affordable housing coupled with promising job markets is set to redefine where and how Americans choose to live.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

Washington State Department of Commerce Awards $220,000 in Growth Management Grants

In a bold move to address the pressing housing needs of Washington’s most vulnerable residents, the Washington State Department of Commerce has awarded $220,000 in growth management grants to seven community partnerships. This initiative is part of a larger effort to meet the projected demand for over 1.1 million new housing units over the next 20 years, half of which are earmarked for residents earning less than half of their area median income.

Commerce Director Mike Fong emphasized the importance of housing security, stating, “Housing security, especially for our most vulnerable residents, is top of mind for many communities across the state.” With this in mind, the Department of Commerce is equipping local communities with the tools and resources necessary to tackle housing challenges head-on, laying the groundwork for a more equitable future.

Innovative Planning Tools

The department has introduced a first-of-its-kind toolkit designed to guide local governments in meeting the housing needs of their lowest-income residents. Developed in collaboration with Abt Associates and the Corporation for Supportive Housing (CSH), these tools include:

- STEP Model Ordinance, User Guide, and Best Practice Report to assist local jurisdictions in developing their own ordinances.

- STEP State of the Practice Report summarizing best practices for the development of emergency and supportive housing.

- Four STEP Case Studies showcasing successful implementations in King County, Spokane, Vancouver, and Wenatchee.

- STEP Communications Toolkit to aid jurisdictions in communicating the benefits and challenges of STEP.

Grant Awards and Collaborative Efforts

In addition to the planning tools, the department has distributed an additional $220,000 through Coordinated Low-Income Housing Planning (CLIHP) grants to support the coordination of land use and homeless services planning. To date, $460,000 has been awarded across 13 counties.

Kimberly Hendrickson, Housing, Health, and Human Services Director for the City of Poulsbo, highlighted the impact of these grants, noting that they provide opportunities for collaboration with neighboring areas like Bainbridge Island to explore STEP options and establish shared goals. The latest list of grant awards further outlines these collaborative efforts.

With the grant application period remaining open until funds are exhausted, eligible applicants can receive up to $25,000 to support their planning efforts. For more details, see the CLIHP grant instructions.

Conclusion

By providing both financial resources and insightful tools, the Washington State Department of Commerce is setting a proactive example of sustainable and inclusive community planning. This comprehensive effort signifies a concerted push towards meeting housing demands and ensuring that vulnerable populations find opportunities for stable habitats.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

The Role of Blockchain in Real Estate: A New Era of Transparency and Efficiency

The Role of Blockchain in Real Estate: A New Era of Transparency and Efficiency

The transformative power of blockchain technology is reshaping the real estate industry, traditionally known for its complexity and inefficiencies. As noted in a recent article by Appinventiv, blockchain is not merely a novelty but a practical solution addressing the sector’s prevailing challenges.

Real estate has long been plagued by lack of transparency, tedious paperwork, higher risk of fraud, expensive investments, and poor transaction speed. Blockchain technology offers a decentralized record-keeping system, which not only enhances transparency but also reduces the need for intermediaries. This shift is paving the way for a more secure and efficient market landscape.

Enhanced Security and Transparency

Blockchain’s immutable ledger of property records significantly lowers the possibility of fraud and disputes by offering transparent transaction histories. This increased level of security boosts confidence among buyers, sellers, and investors, creating a more reliable ecosystem. For further details, refer to the Appinventiv article on how blockchain resolves data privacy and security issues for businesses.

Increased Efficiency and Streamlined Processes

By automating processes and eliminating intermediaries, blockchain reduces administrative costs and speeds up transactions. Smart contracts, a key feature of blockchain, automate property transfers and lease agreements, enhancing reliability and precision. This automation is further explained in the Smart Contract Guide by Appinventiv.

Fractional Ownership and Asset Tokenization

Blockchain facilitates fractional ownership, allowing investors to purchase and sell fractional shares of properties. This democratizes real estate investment, making it more accessible to a broader audience. Additionally, asset tokenization turns tangible properties into digital tokens, enhancing market liquidity. Learn more about this innovative approach in the Tokenization in Real Estate article.

Global Accessibility

The decentralized nature of blockchain supports cross-border transactions, enabling foreign buyers and sellers to conduct business without intermediaries. This aspect is crucial for global real estate markets, as highlighted in the cross-border transactions discussion.

Real-World Applications and Challenges

Major players like CBRE Group and Brookfield Asset Management are leveraging blockchain to streamline operations and offer innovative investment opportunities. However, the adoption of blockchain in real estate is not without challenges. Issues such as inadequate knowledge, scaling, and chain interoperability need addressing to fully harness blockchain’s potential. For a deeper dive into these challenges, visit the Enterprise Compliance with Blockchain article.

Conclusion

As blockchain technology continues to permeate the real estate sector, the industry is poised for a revolution. Enhanced security, transparency, and efficiency are just the beginning. The future of real estate lies in embracing these technological advancements to create a more inclusive and dynamic market.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

Current Mortgage Rates: A Closer Look at the Week of October 7 to October 11, 2024

Current Mortgage Rates: A Closer Look at the Week of October 7 to October 11, 2024

In a week marked by significant fluctuations, current mortgage rates have captured the attention of borrowers and industry experts alike. According to the latest data from Money’s daily rate survey, borrowers seeking a 30-year fixed-rate purchase loan found rates averaging 6.711%. Meanwhile, the 30-year refinance rate is averaging slightly higher at 6.814%.

Freddie Mac reported a notable rise in the average rate for a 30-year fixed-rate mortgage, which jumped to 6.32%, marking an increase of 0.20 percentage points from the previous week. Similarly, the 15-year fixed-rate mortgage saw an uptick, averaging 5.41%, with a 0.16 percentage point increase.

Despite these increases, mortgage rates remain nearly a full percentage point lower than the year’s high of 7.22%. This trend reflects the largest week-over-week increase since last April. In a press release, Sam Khater, Freddie Mac’s chief economist, emphasized that while higher rates present challenges for prospective buyers, the underlying strength of the U.S. economy “should continue to support the recovery of the housing market.”

For those navigating the current mortgage landscape, it’s crucial to shop around and compare offers from multiple lenders. Money’s list of the Best Mortgage Lenders and the Best Mortgage Refinance Companies can provide a starting point for finding competitive rates. Additionally, utilizing Money’s mortgage calculator can help borrowers estimate their monthly payments under different rate scenarios.

Understanding Mortgage Rate Trends

The recent rise in mortgage rates is partly attributed to last week’s better-than-expected jobs report, which sent yields on 10-year Treasury bonds higher, subsequently pulling mortgage rates up as well. As more economic data emerges, prospective buyers should brace for continued volatility in the near term.

When considering mortgage options, it’s essential to understand the differences between fixed-rate and adjustable-rate mortgages. Fixed-rate loans offer stability with a consistent interest rate throughout the loan’s duration, while adjustable-rate mortgages (ARMs) begin with a fixed rate that later adjusts at regular intervals.

Factors Influencing Mortgage Rates

- Loan Term: Longer loans typically have smaller payments but may cost more overall.

- Loan Type: Fixed-rate loans offer steady payments, while ARMs adjust periodically.

- Economic Factors: Rates are influenced by the federal funds rate, Treasury yields, and borrower qualifications.

For those contemplating refinancing, it’s crucial to weigh the pros and cons, as refinance rates tend to be higher. Resources like the Is Now a Good Time to Refinance guide can help homeowners make informed decisions.

Securing the Best Mortgage Rate

To secure the best mortgage rate, shopping around is key. Freddie Mac suggests that obtaining rate quotes from multiple lenders can lead to significant savings over the life of the loan. Additionally, buying discount points can lower the interest rate, offering further savings. More details on this can be found in the Discount Points guide.

For those with higher-than-average rates, improving credit scores and exploring multiple lender options can help lower offers. Guidance on enhancing credit can be found in the 7 Ways to Improve Credit Score article.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

A Glimpse into the U.S. Housing Market: 2025-2029 Forecast

2025 Forecast

The housing market in 2025 is expected to see a slight rise in home prices, projected to be between 1% and 2% above current inflation rates. This growth is anticipated due to increased real incomes and lower mortgage rates, which will enhance affordability. As millennials reach their prime home-buying age, demand is expected to rise, with new constructions attempting to mitigate the ongoing inventory shortage. Despite improvements, underbuilding will continue to affect market dynamics.2026 Outlook

In 2026, more buyers are likely to collaborate with family and friends to manage high housing costs. Emerging technologies are set to revolutionize home construction, making it faster and more cost-efficient. Builders will be urged to consider the rising costs associated with climate change, focusing on sustainability and resilience in new developments.2027 Expectations

Looking towards 2027, demographic trends such as urbanization and shifts in worker preferences due to remote work will influence market demand. Interest rates are expected to stabilize, potentially settling between 5.5% and 7%, impacting mortgage affordability. An increase in housing demand in suburban and rural areas is anticipated as people seek more space and community amenities.2028 Projections

By 2028, the rise in housing inventory may return the market to a more balanced state, with supply meeting demand. This balance could ease competition in local markets, particularly in fast-growing Southern cities. However, housing affordability will continue to pose challenges, especially in densely populated urban centers.2029 Vision

Approaching 2029, gradual changes in economic conditions, technological advances, and demographic shifts are expected to shape the housing landscape. As Millennials and Gen Z dominate the buying market, preferences will shift towards environmentally friendly, affordable housing solutions. Innovations like virtual tours and data analytics will streamline the home buying process and provide greater market transparency.Despite the uncertainties posed by external factors and economic shifts, the housing market is expected to provide opportunities for both buyers and sellers. Monitoring these developments closely will be crucial for making informed investment and purchasing decisions.

For more in-depth analysis, refer to the original article from Norada Real Estate Investments.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

Florida’s New Real Estate Laws Aim to Enhance Housing Affordability and Protection

Today marks a significant shift for homeowners in Florida as a suite of new laws takes effect, driven by the legislative efforts of Florida Realtors. These laws, approved by Governor Ron DeSantis, are designed to enhance affordability and protection for residents, touching on various aspects of the real estate industry.

Boosting Housing Programs

At the forefront is the Hometown Heroes Housing Program (SB 328), which sees an additional $100 million allocated to aid first-time homebuyers, particularly those in essential service roles such as teachers and healthcare workers. This initiative aligns with previous efforts to stimulate private investment in affordable housing, providing necessary guidance on local zoning and density regulations. Realtors are encouraged to direct clients to the Hometown Heroes Program.

In a similar vein, the My Safe Florida Home Program (SB 7028) receives a $200 million boost, aimed at empowering homeowners to fortify their homes against severe weather, thereby reducing insurance costs. The program now includes free inspections and grants up to $10,000 for low-income homeowners without the need for matching funds. More details can be found here.

Expanding Protection to Condos

The My Safe Florida Condominium Pilot Program (HB 1029) extends these protective measures to coastal condominiums, with $30 million dedicated to strengthening roofs and openings against storms. Information for interested parties is available here.

Additionally, the Protecting Private Property Rights (HB 62) law addresses the issue of illegal squatting, allowing property owners to swiftly evict unauthorized occupants, further details of which can be accessed here.

Financial and Environmental Initiatives

Lawmakers have earmarked $408 million for state and local affordable housing programs, alongside a mandate for a 1.75% deduction in property insurance premiums under Property Insurance Cost Reductions (HB 7073). These measures aim to alleviate financial pressures on homeowners.

Environmental efforts are bolstered with over $1.2 billion allocated for water quality initiatives, including Everglades restoration and mitigation of harmful algal blooms.

Looking Ahead

Future legislation includes increased transparency in condominium and homeowners’ association documents, with requirements for digital accessibility. Upcoming laws will also mandate seller flood disclosures and digital record-keeping for homeowner associations, with phased implementation over the next few years.

These legislative changes, as highlighted in the original article, reflect a proactive approach by Florida’s legislative assembly and Florida Realtors to address critical housing and environmental issues, promising widespread benefits for Floridians.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

Opportunities Emerge as Mortgage Rates Decline Amid Record-High Home Prices

After weeks of steady declines, mortgage rates have finally reached a range that brings the dream of homeownership closer for many hopeful buyers. This shift suggests potential relief in the inflated housing market, offering buyers increased purchasing power despite ongoing high home prices. Experts indicate that the current conditions could favor those looking to enter the housing market before potential demand surges occur once again.

Although home prices continue to break records, price growth is slowing due to loosening inventory and sluggish demand. Buyers are gaining leverage when negotiating with sellers, creating a window of opportunity for those ready to make a move.

Despite the positive trend in mortgage rates, many potential buyers remain cautious, waiting for further Federal Reserve rate cuts that could lead to even lower mortgage rates. However, experts warn that waiting too long could result in missing out on favorable market conditions. Lisa Sturtevant, chief economist at Bright MLS, suggests that lower rates this fall could coincide with slower home price growth as more sellers enter the market and inventory rises.

Housing Market Forecast for 2024 and 2025

The U.S. housing market continues to be a hot topic, with home prices posting a 5% annual gain according to the latest S&P CoreLogic Case-Shiller Home Price Index. While this is a slowdown from June’s 5.5% gain, home prices remain at record highs, making affordability a challenge for many.

Ralph McLaughlin, senior economist at Realtor.com, echoes the sentiment that home price growth will slow before rebounding. He notes that with mortgage rates falling to 24-month lows and a high probability of further rate reductions, home price growth could bottom out before reaccelerating as buyer purchasing power improves.

Can We Expect a Housing Market Recovery in 2025?

For a housing recovery to take place, several conditions need to unfold. Keith Gumbinger, vice president at HSH.com, suggests that inventories of homes for sale must increase significantly to ease upward pressure on prices. The recent decline in mortgage rates is beginning to help loosen inventory, albeit gradually.

After peaking at 7.79% in October 2023, the average 30-year fixed mortgage rate has been below 6.5% since mid-August, landing at 6.12% the week ending October 3. This trend, coupled with the Federal Reserve’s recent rate cut, offers a glimmer of hope for potential buyers.

NAR Practice Changes: What Buyers and Sellers Need To Know

In a landmark settlement, the National Association of Realtors (NAR) agreed to pay $418 million to settle antitrust lawsuits, leading to new rules that promote a more transparent home-buying process. These changes, effective since August 17, aim to benefit both consumers and agents by clarifying the financial aspects of real estate transactions.

For decades, it was standard practice for home sellers to cover the buyer’s broker commission, but now buyers must enter into written agreements with agents before touring homes. Buyers can negotiate commission payments, adding a new layer of complexity to the transaction process.

How Will the New Rules Impact Affordability?

With buyers more likely to be responsible for paying broker commissions, affordability concerns arise. Matt Side from Realty ONE Group Eclipse notes that buyers with fewer resources could be particularly affected. However, he advises that sellers will continue to offer compensation to buyer representatives to increase demand for their homes.

Housing Inventory Forecast: When Will There Be Sufficient Supply To Reduce Prices?

Despite more resale and new homes entering the market, inventory remains well below pre-Covid averages. Many homeowners are “locked in” at ultra-low mortgage rates, unwilling to exchange for higher rates in a high-priced market, leading to demand outpacing supply.

Rick Sharga, founder and CEO of CJ Patrick Company, suggests that a meaningful increase in supply won’t occur until mortgage rates return to the low 5% range, likely not in 2024. However, declining rates could loosen the lock-in effect, providing some much-needed housing supply.

Will the Housing Market Crash in 2025?

Concerns about a housing market crash akin to 2008 are prevalent, but experts like Tom Hutchens from Angel Oak Mortgage Solutions believe the record-low supply of houses protects against such a scenario. Today’s homeowners are on more secure footing, with many having substantial home equity.

Jess Schulman from Bluebird Lending agrees, noting that further Fed rate cuts could lead to more transactions and potential home price increases due to pent-up demand.

Will 2024 or 2025 Be Better to Buy a Home?

Buying a house is a highly personal decision, and while predicting future market conditions is challenging, experts advise against waiting for the perfect moment. Orphe Divounguy from Zillow Home Loans suggests that the best time to buy is when you find a home that meets your needs and budget.

Keith Gumbinger concurs, warning that waiting for better conditions may not be the best strategy, as home prices generally keep rising, moving the goalposts for amassing a down payment.

In conclusion, while the housing market presents challenges, there are opportunities for those ready to navigate the complexities. As mortgage rates decline and home prices stabilize, potential buyers and sellers must stay informed and prepared to make the most of the evolving landscape.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

The $47.5 Trillion Housing Market Boom Driven by Remote Work

Remote Work and Secondary Cities

A key driver of this surge is the allure of remote work, which has reshaped the demand for housing in specific metropolitan areas. More affordable cities, often referred to as “secondary cities,” have emerged as significant beneficiaries. For instance, Newark, New Jersey, and New Haven, Connecticut, experienced notable increases in home values, with Newark’s housing market skyrocketing by 12.8% over the last year. This trend is largely due to their proximity to larger urban centers and their appeal to those priced out of expensive metros like New York.

The Subcity Phenomenon

The concept of a “subcity,” as described in a colloquial definition, plays a crucial role in this dynamic. These are cities that function as secondary hubs to larger metropolitan areas. With the remote work trend solidifying into a hybrid model, these subcities have become attractive alternatives, offering affordability and accessibility.

Winners and Losers in the Housing Market

While secondary cities flourish, traditional boomtowns and high-cost areas have faced stagnation or decline. Cities like Boise, Idaho, and New York City saw declines in home values, attributed to their already high prices or pandemic-fueled influxes that have since waned. Meanwhile, suburban and rural areas have also seen growth, with suburban home values rising by 5.6% to about $29 trillion.

Challenges for Prospective Buyers

Despite the overall market growth, prospective buyers face significant challenges. Elevated mortgage rates, limited inventory, and high home prices have made homeownership increasingly unaffordable. As reported by Fortune, the housing market experienced a freeze, with existing home sales plummeting to their lowest point in nearly three decades.

However, there is a silver lining. Experts anticipate that mortgage rates may start to decline before the end of 2024, potentially easing affordability concerns. Until then, homeowners continue to hold substantial housing wealth, benefiting from the supply shortage that maintains elevated home values.

Conclusion

As the housing market continues to evolve, the interplay between remote work, secondary cities, and economic factors will remain pivotal. For a deeper dive into these trends, you can explore the original article on Fortune’s website.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

U.S. Housing Market: A Glimpse into the Future

U.S. Housing Market: A Glimpse into the Future

The U.S. housing market is poised for significant changes over the next five years, according to a recent analysis by Norada Real Estate Investments. With a complex interplay of factors, including rising interest rates and increased housing supply, the market is expected to experience a slowdown, with home prices either remaining flat or seeing a modest decline.- Rising Interest Rates: The Federal Reserve’s measures to combat inflation have led to higher borrowing costs, impacting home affordability.

- Increased Supply of Homes: More homes are expected to enter the market, providing relief from the current supply shortage.

- Affordability Challenges: Despite a potential easing in prices, affordability remains a concern for many prospective buyers.

Stabilizing Mortgage Rates

Recent data suggests that mortgage rates are expected to stabilize in the coming months, offering some respite to buyers. If the trend of declining high inflation continues, it could align with the Federal Reserve’s targets, leading to reduced volatility in mortgage rates. This environment may prove more favorable for buyers grappling with affordability concerns.Technological Advancements and Demographic Shifts

The housing market is also expected to be influenced by technological advancements and changes in buyer demographics. Emerging technologies, such as virtual tours and data analytics, are reshaping how homes are bought and sold. Additionally, changing demographics, including the rise of remote work, are driving demand for housing in suburban and rural areas.Looking Ahead: 2025 and Beyond

As we move towards 2025, the market is anticipated to witness moderate growth, with home prices rising by approximately 1% to 2% above the current inflation rate. This increase will be driven by factors such as the rise in real incomes, lower mortgage rates, and increased affordability. However, it may take time to reach the home value heights of mid-2022.The trend of buyers pooling resources with friends and family to purchase homes is expected to continue, as the rising cost of housing drives people to seek more space and privacy. This shift is likely to result in more multi-generational households and co-living arrangements.

The 2028 Housing Market: A Buyer’s or Seller’s Paradise?

Looking further ahead to 2028, the market is expected to experience gradual price increases, with an annual appreciation of 1-2%. Improved affordability, rising inventory, and regional variations are anticipated to shape the market dynamics. However, affordability concerns might be more pronounced in some areas compared to others.For a more detailed analysis, visit the Latest U.S. Housing Market Trends and Zillow’s Housing Predictions.

Conclusion

The next few years are likely to bring significant changes to the U.S. housing market. While the market is expected to remain strong, stakeholders must stay informed about the latest trends and developments to make informed decisions.For more insights and updates, visit the original article by Norada Real Estate Investments.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

AI: The New Architect of Real Estate Transformation

AI: The New Architect of Real Estate Transformation

The real estate industry, traditionally steeped in manual processes and human intuition, is undergoing a seismic shift, thanks to artificial intelligence (AI). As the article from Appinventiv highlights, AI is not just a tool but a transformative force reshaping how we buy, sell, and manage properties.Revolutionizing Real Estate Practices

AI is streamlining transactions, enhancing customer experiences, and boosting productivity. By automating routine tasks, such as property valuations and customer interactions, AI allows real estate professionals to focus on strategic decision-making. The integration of AI in real estate is set to redefine property management, customer service, and investment strategies, with a projected market growth driven by advancements in AI technology.

Applications and Innovations

The article delves into various applications of AI, from virtual tours and automated property valuations to predictive analytics and tenant behavior analysis. Companies like Zillow and Trulia are leveraging AI to provide property valuations and personalized user experiences, respectively. The use of ChatGPT for automated listing descriptions and metaverse technologies for virtual property tours exemplifies AI’s pervasive influence.

Statistical Insights and Future Prospects

According to Precedence Research, the real estate market is expected to grow by $1,047 million by 2032, with AI as a key driver. This growth is fueled by the demand for automated solutions and AI’s ability to offer personalized customer experiences. The article also references a study by JLL Research, which places AI among the top technologies impacting real estate.

Challenges and Opportunities

While the integration of AI in real estate presents opportunities for innovation and competitive advantage, it also poses challenges. Data accessibility, regulatory concerns, and integration complexities are hurdles that need addressing. However, with strategic implementation and ongoing optimization, AI’s role in real estate will continue to expand.

Conclusion

AI is not merely a trend but a catalyst for a new era in real estate. As it integrates with emerging technologies like blockchain and cloud computing, AI promises to revolutionize property transactions, enhance security, and create immersive experiences. The future of real estate is being built on AI’s foundation, offering a blueprint for innovation and growth.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

Understanding the Future of the U.S. Housing Market

Understanding the Future of the U.S. Housing Market

The U.S. housing market is poised for a significant transformation over the next five years, according to a recent article from Norada Real Estate Investments. As we navigate through 2025 to 2029, several key trends and predictions will shape the market landscape.Price Trends and Market Stability

In the coming years, the housing market is expected to experience a slowdown, with home prices remaining flat or experiencing a modest decline. This trend reflects a shift towards a more stable market, where the rapid price increases of recent years will ease. According to Zillow’s latest forecast, home values are projected to rise by a modest 1.8% nationally in 2024, suggesting a trend of stability.Mortgage Rates and Affordability

Mortgage rates, a critical factor in the housing market, are anticipated to remain stable in the near future. The Federal Reserve’s efforts to combat inflation have led to higher interest rates, but a gradual decline is expected, potentially spurring renewed demand in the housing market. This decrease in rates, coupled with income growth, is likely to improve affordability for prospective buyers.Supply and Demand Dynamics

The housing market is also expected to see an increase in the supply of homes. The previous shortage of available homes, which drove prices up, is anticipated to ease as more homes are built and listed for sale. This increase in supply could help alleviate market competition and stabilize prices.Looking Ahead: 2025 and Beyond

By 2025, the market is expected to pick up again, with home prices rising modestly by 1% to 2% above the current inflation rate. This growth will be driven by factors such as real income increases and lower mortgage rates. Additionally, technological advancements in construction, such as 3D printing, are likely to improve building quality and speed up timelines.Long-term Predictions: 2026 to 2029

In the latter part of the decade, the housing market is projected to continue its upward trend, with a gradual increase in home prices. The demand for housing is expected to shift towards suburban and rural areas, driven by changing demographics and a desire for more space. Technological innovations will continue to reshape the buying process, offering greater transparency and efficiency.Conclusion

The U.S. housing market is set to undergo significant changes over the next five years, influenced by a combination of economic factors, technological advancements, and evolving consumer preferences. As we move forward, stakeholders must stay informed about these trends to make strategic decisions.

References:

- Latest U.S. Housing Market Trends

- 2008 Housing Market Crash

- Why today’s housing market in 2024 is different from 2008

- Is it a good time to buy a house?

- Buyer’s Market

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

Exploring Innovative Strategies for Managing Student Loan Payments

Exploring Innovative Strategies for Managing Student Loan Payments

In a landscape where student loan debt is a growing concern, borrowers are exploring creative methods to manage their financial obligations. According to EducationData.org’s 2023 report, the average federal student loan borrower owes $37,574, while private borrowers face an even steeper average of $54,921. With these daunting figures, many are considering unconventional methods to ease their financial burden.

- Contact Your Lender

For those with private loans, reaching out to your lender can reveal whether credit card payments are an option. While not all lenders offer this flexibility, some do, providing a possible avenue for managing payments more conveniently. - Utilize Third-Party Payment Platforms

Federal student loan borrowers might consider third-party platforms like PaySimply and Plastiq. These services enable payments via credit card by converting them into wire transfers or cash equivalents, although fees ranging from 2.5% to 3% can offset any potential rewards benefits. - Consider a Balance Transfer

For those nearing the end of their loan term, transferring the balance to a 0% APR balance transfer credit card could be a viable option. This method can provide an interest-free period of up to 21 months, though it comes with a transfer fee of 2% to 3%. - Creative Budgeting

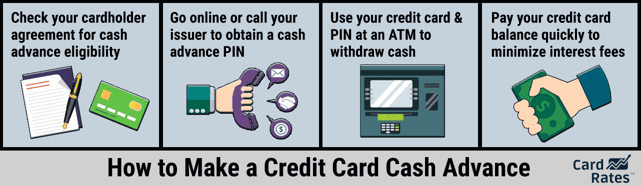

A strategic approach involves reallocating expenses. For example, paying for groceries with a credit card can free up cash for student loan payments, achieving the same financial effect without direct loan charges. - Cash Advances

While not ideal due to high APR rates and immediate interest accrual, cash advances can be a last-resort option. Borrowers should weigh the costs carefully before proceeding. - Explore Deferment and Forbearance

Federal loan holders should explore deferment and forbearance options, which offer payment relief without credit damage. Private lenders may also provide hardship plans, though these vary by institution.

While these strategies can provide temporary relief, borrowers must remain vigilant about the potential pitfalls, such as high interest rates and the risk of accumulating more debt. The original article by Erica Sandberg on CardRates.com emphasizes the importance of informed financial decisions and responsible credit management.

CSS for Styling

“`css h3 { color: #b40101; margin-bottom: 20px; } h4 { color: #b40101; margin-top: 30px; margin-bottom: 10px; } p { margin-bottom: 15px; } b { color: #b40101; } a { color: #b40101; text-decoration: none; } a:hover { text-decoration: underline; } img { margin: 20px 0; max-width: 100%; height: auto; } “`

This approach ensures that borrowers are equipped with the knowledge to navigate their financial landscape effectively, prioritizing both short-term relief and long-term financial health.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

Rising Material Costs Challenge Home Builders Amid Inflation Slowdown

Rising Material Costs Challenge Home Builders Amid Inflation Slowdown

As inflation trends downward, the construction industry faces a paradox: the relentless rise in residential construction material costs since early 2024. This surge, marking its peak in June 2024, presents a formidable challenge for home builders already navigating inflated expenses.

The escalating cost of building materials, including softwood lumber, steel, and aluminum, is eroding housing affordability. These volatile prices, compounded by uncertainties in production timelines, leave builders grappling with cost management, often resulting in appraisals that fail to reflect true costs accurately.

Factors Driving Material Cost Increases

- Supply and Demand: Peak construction seasons intensify demand, while global shortages and disruptions constrain supply, driving up prices.

- Inflation: Economy-wide inflationary pressures inevitably impact construction material costs.

- Global Influences: Geopolitical tensions and trade disputes further exacerbate price hikes.

- Sustainability Initiatives: The shift towards sustainable building practices often involves costlier materials.

The construction industry feels the strain as these factors inflate project costs, squeeze profit margins, and exacerbate housing affordability issues. Developers face delayed production cycles and heightened financial risks, while appraisals struggle to keep pace with cost fluctuations.

Strategies to Mitigate Material Cost Challenges

Builders are employing a range of strategies to manage these rising costs:

- Long-term Contracts: Securing consistent pricing through long-term agreements with suppliers.

- Efficient Material Use: Minimizing waste and optimizing material usage.

- Negotiation: Engaging suppliers directly to negotiate better prices.

- Exploring Alternatives: Considering cost-effective materials that deliver similar performance.

Efforts to resolve trade disputes and centralize negotiations are underway, aiming to stabilize global material supplies. Automation and advanced technologies are also being explored to address labor shortages and supply chain disruptions. Investing in workforce development is critical for attracting new talent, ensuring resilience within the industry.

Adapting to a New Reality

As builders navigate these challenges, the industry is undergoing a transformation. Traditional project models are being rethought, and innovative approaches embraced to thrive amidst current uncertainties. Through adaptive measures and collaborative efforts, home builders are poised to future-proof their operations against ongoing fluctuations in material costs and availability.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

The Impact of FinTech on Sub-Saharan Africa’s Financial Landscape

The Impact of FinTech on Sub-Saharan Africa’s Financial Landscape

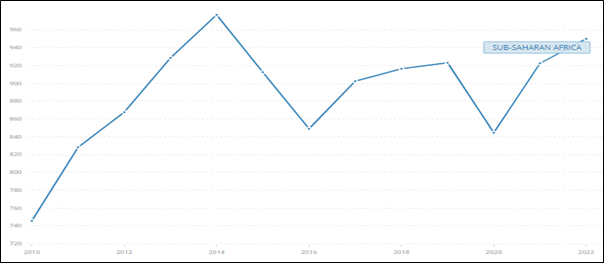

The financial sector worldwide has been revolutionized by the advent of Financial Technology (FinTech), marking a new phase in the evolution of financial services. According to a detailed analysis by TRENDS Research & Advisory, FinTech’s integration of technological innovations with financial services has brought about a transformative impact, offering novel, flexible, and cost-effective financial products.Sub-Saharan Africa: A Fertile Ground for FinTech

Sub-Saharan Africa, with its youthful demographic—approximately 40% of its population is under 15—presents a ripe opportunity for FinTech adoption. This region’s large underbanked population, estimated at 42% of adults, underscores the potential for FinTech to drive financial inclusion. The widespread use of mobile technology, with around 650 million mobile users, further enhances this potential. The GSMA Mobile Economy Report highlights that Sub-Saharan Africa leads globally in mobile money transactions, totaling $490 billion in 2020.

Challenges and Opportunities

Despite the promising landscape, FinTech adoption in Sub-Saharan Africa faces several challenges. Regulatory hurdles, infrastructure limitations, and cybersecurity threats are significant barriers. However, these challenges also present opportunities for growth. Policy reforms, investment in infrastructure, and public-private partnerships are vital to overcoming these obstacles and seizing the opportunities FinTech offers.Success Stories and Future Prospects

Countries like Zambia and Nigeria illustrate the transformative power of FinTech. Zambia has seen a dramatic rise in digital financial inclusion, with active digital financial accounts increasing from 2% to 44% of the adult population between 2014 and 2019. Meanwhile, Nigeria’s FinTech sector is thriving, driven by a tech-savvy population and government support for digital financial solutions.Looking ahead, the future of FinTech in Sub-Saharan Africa is promising. Emerging technologies such as AI-driven solutions and blockchain applications hold significant potential for enhancing financial services accessibility and efficiency. With continued investment and innovation, FinTech is poised to play a pivotal role in transforming the financial landscape of the region and improving the lives of millions.

Conclusion

The impact of FinTech on Sub-Saharan Africa’s financial services sector is profound, fostering financial inclusion and reshaping traditional banking paradigms. As the region continues to embrace innovative solutions, collaboration among policymakers, regulators, and stakeholders is crucial to harnessing the full potential of FinTech for sustainable growth.Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

Top Cities for Affordable Homes in 2024

Exploring the Top Cities for Affordable Homes in 2024

In a comprehensive analysis by Forbes Advisor, the spotlight is on the best U.S. cities for buying an affordable home in 2024. The study, published four weeks ago, delves into key metrics such as median income, average home prices, and real estate affordability, providing homebuyers with a roadmap to the most budget-friendly urban landscapes.

Pittsburgh, Pennsylvania, emerges as the front-runner, showcasing a harmonious blend of low median home prices and affordable homeowner costs. With a median home price of $236,067, Pittsburgh homeowners spend just 14.8% of their median household income on housing costs, making it an attractive destination for budget-conscious buyers. The city’s ample housing inventory and quality public schools further enhance its appeal.

Following Pittsburgh, Fort Wayne, Indiana, boasts a robust job market with major employers like Google and Amazon, while Buffalo, New York, offers one of the lowest home prices among the cities analyzed. Huntsville, Alabama, impresses with its low crime rate and access to outdoor amenities, and Oklahoma City, Oklahoma, balances affordability with a vibrant arts and culture scene.

The top ten list also includes Indianapolis, El Paso, Lexington, Louisville, and Omaha, each offering a unique mix of affordability and lifestyle benefits. These cities provide potential homeowners with various advantages, from solid educational systems to lively community vibes.

Key Takeaways

- Pittsburgh leads with a median home price of $236,067 and low homeowner costs.

- Fort Wayne is notable for its job opportunities with major tech companies.

- Buffalo presents one of the most affordable home prices in the analysis.

- Huntsville offers a safe environment with access to nature and outdoor activities.

- Oklahoma City combines affordability with cultural and recreational offerings.

Forbes Advisor also provides valuable home-buying advice, discussing various mortgage options and strategies for saving up for a home. Tips include setting aside funds for a down payment and cutting unnecessary expenses, ensuring potential buyers are well-prepared for their homeownership journey.

For a more detailed exploration of these findings and to access the full article, visit the original Forbes article.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

Eco-Friendly Construction: Innovations and Trends

Adopting Green Construction Tech

Emerging trends in green construction innovations are making headway, utilizing both passive and active technologies to foster sustainability. Examples of passive technological advances include smart glass, which adapts to light conditions to reduce reliance on mechanical heating and cooling, and cool roofs that reflect more sunlight, thereby cutting down on air conditioning energy use. Meanwhile, active technologies such as AI-driven quantity surveying software reduce material waste by accurately predicting project needs. IoT devices also contribute by optimizing electricity consumption and enhancing tool automation efficiency.By comprehensively integrating these tools, construction projects can achieve a holistic green footprint. Continuing research and adoption of these technologies empowers developers to make environmentally sound decisions.

Using Alternative Materials

The availability of sustainable building materials marks a significant technological advancement in eco-friendly construction. New materials such as bio-based insulation, derived from mycelium, offer robust, biodegradable options beyond traditional synthetic substances. Recycled materials, including repurposed wood and plastics, and resources like bamboo provide strong, flexible building alternatives with reduced environmental impact. Such materials lessen the strain on natural ecosystems and mitigate harmful emissions traditionally associated with material production and transport.Embracing Energy Advancements

Energy efficiency is a growing priority in sustainable construction, particularly as climate conditions exert pressure on power grids. Projects can enhance resilience to anticipated outages through smart energy practices. Installing solar power systems is one effective strategy; contractors can take advantage of educational courses and tax incentives while optimizing solar array placement from project inception. During the construction phase, energy consumption can be minimized by utilizing solar-generated power, maximizing daylight hours, and favoring electric vehicles and tools over diesel.Prioritizing Environmental Stewardship

Commitment to environmental stewardship is invaluable in project management and organization. Green certifications, such as those offered by the U.S. Green Buildings Council’s LEED program, encourage developers to strive for sustainability without compromising on quality or safety. Additionally, building information modeling (BIM) software assists in accurate material needs assessment, helping to reduce excess and waste.A Sustainable Future

Continued exploration and integration of innovative green technologies are crucial for driving sustainable construction. By using new materials and relying on renewable energy sources, the industry can progress towards more sustainable practices. As the sector evolves, construction professionals need to remain adaptive, incorporating advancements that benefit businesses, homeowners, and the planet.Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

Exploring the Sacramento Housing Market: A Wise Investment?

Exploring the Sacramento Housing Market: A Wise Investment?

Are you contemplating where to invest your hard-earned money? With a plethora of options available, you might be considering whether the Sacramento housing market is a viable choice. Let’s delve into the key aspects you need to know before making that crucial decision.

Understanding the Sacramento Housing Market

Sacramento, the capital of California, has seen notable shifts in its real estate market over the years. The city’s significant population growth has led to increased housing demand. As job opportunities expand, particularly in the tech and healthcare sectors, the potential for property value appreciation becomes enticing for investors.Current Trends in Sacramento

This year, Sacramento’s real estate market has demonstrated resilience amidst economic changes. Here are some trends that may influence your investment decision:- Population Growth: Sacramento’s population has steadily increased, partly due to its affordable living costs compared to nearby cities like San Francisco and Los Angeles.

- Job Market: The job landscape is evolving, with a surge in tech and healthcare industries, bringing stability to the housing market.

- Rental Demand: A growing population has led to increased demand for rental properties, potentially generating passive income for investors.

Price Growth and Market Speed

- Median home price reached $520,000 in June 2024, marking an 11.2% increase year-over-year, according to Redfin.

- Homes are selling quickly, averaging 12 days on the market, compared to 9 days last year.

- Despite faster sales, the number of homes sold has dipped slightly, indicating a decrease in available inventory.

Competition and Buyer Migration

The market is highly competitive, with homes receiving an average of four offers. “Hot homes” can sell for over the list price and go pending within six days. The average sale price is around 1% above the list price.- While 68% of Sacramento residents are looking to move within the area, 32% are considering locations outside the metro area.

- San Francisco, Los Angeles, and Fresno are top sources of incoming homebuyers to Sacramento, while Boise, Nashville, and Portland are popular destinations for those leaving.

Why Consider Investing?

Investing in real estate in Sacramento offers several potential benefits:Potential for Appreciation

- Historical Increases: Past housing prices have shown a consistent upward trend, especially following economic recoveries.

- Future Projections: Experts project continued growth due to infrastructure improvements and demographic trends.

Cash Flow Opportunities

If you’re considering rental properties, cash flow is crucial. Sacramento’s rental market is buoyed by:- Strong Rental Market: Increasing demand for rentals allows for competitive yet profitable rates.

- Diverse Tenant Pool: The city’s diverse community ensures a range of potential tenants, stabilizing your income stream.

Risks to Consider

While there are many potential benefits, there are also risks involved:Economic Fluctuations

- Dependence on Key Industries: Relying heavily on a few industries can be risky if those sectors experience downturns.

- Job Loss Impact: High unemployment rates can lead to increased vacancies and decreased rental income.

Market Competition

- Buyer Competition: Be prepared for bidding wars, especially in desirable neighborhoods.

- Rental Market Saturation: As more investors enter the market, current rental rates may stabilize or decline, affecting cash flow.

Neighborhood Breakdown

Where you invest in Sacramento can make all the difference. Each neighborhood has its unique character and investment potential:- Midtown Sacramento: High demand for rental units and proximity to entertainment, but higher property prices could impact cash flow.

- East Sacramento: Strong community appeal, but entry prices can be high.

- North Sacramento: Affordable properties with potential for substantial appreciation, though crime rates may be a concern.

- Land Park: Desirable schools and stable property values, but competition among buyers can drive up prices.

Financing Your Investment

Understanding how to finance your investment is crucial:- Conventional Loans: Offer lower interest rates but require good credit and a larger down payment.

- FHA Loans: Suitable for first-time investors with lower down payment requirements.

- Hard Money Loans: Quick access to cash but come with high interest rates and short repayment terms.

Evaluating Return on Investment (ROI)

Calculating your potential ROI is essential:Cash Flow Analysis

For rental properties, analyze:- Income: Monthly rental income.

- Expenses: Mortgage, taxes, insurance, maintenance, and management fees.

Appreciation

Consider property appreciation over time:- Historical Data: Examine historical rates of appreciation.

- Market Trends: Monitor local development projects affecting property values.

Legal Considerations

Investing in real estate comes with legal responsibilities:- Landlord-Tenant Laws: Understand regulations on security deposits and eviction procedures.

- Property Management Regulations: Comply with local property management laws and fair housing advertising rules.

Final Thoughts

Investing in the Sacramento housing market presents both opportunities and challenges. By considering your investment goals, evaluating potential risks, and researching neighborhoods, you can position yourself for success. Remember, real estate is a long-term investment that often rewards those who persevere through market fluctuations. For more insights, refer to the original article on Norada Real Estate Investments.Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

Proptech Trends 2024: How Technology is Transforming Real Estate

Technology: A Beacon of Hope in Real Estate

Mark Fleming, Chief Economist at First American Financial Corporation, aptly described the current housing market as a Goldilocks scenario: “If the 2020-2021 housing market was too hot, then the 2023 market was probably too cold, but 2024 won’t yet be just right.” Despite the challenges, the industry is ripe for a digital transformation, with technologies like artificial intelligence (AI), augmented reality (AR), and predictive analytics leading the charge.

Key Drivers of Digital Acceleration

- Artificial Intelligence: AI is revolutionizing market understanding, enabling accurate property value predictions and enhancing customer service through chatbots.

- Augmented and Virtual Reality: These technologies allow potential buyers to tour properties virtually, breaking geographical barriers.

- Predictive Analytics: By forecasting market trends and buyer behavior, predictive analytics empower agents to strategize effectively.

- Personalization: Hyper-personalized property recommendations are transforming the search experience for buyers and renters.

The Democratization of Real Estate Investing

The advent of AI assistants like Alma by DealMachine is making real estate investing more accessible. These tools provide insights into potential rental income and repair costs, streamlining the investment process.Next-Gen Experience and Tech-Enabled Brokerages

As Baby Boomers retire, a new generation of tech-savvy professionals is embracing proptech, driving a surge in digital innovation. Brokerages like Redfin and Compass are leading this transformation, enhancing client experiences and boosting productivity.Embracing Sustainability and Efficiency

With a focus on sustainability, AI-powered tools are reducing building emissions and optimizing energy use, aligning with global net-zero targets. Meanwhile, AI is streamlining property management, automating tasks like rent collection and maintenance.The Future is Now

In 2024, technologies like 3D home touring and AI-powered underwriting are set to redefine real estate transactions, making them more efficient and customer-friendly. As the industry continues to evolve, early adopters of these innovations will gain a competitive edge, as highlighted in the PwC Emerging Trends in Real Estate 2024 report.This digital acceleration is not just a trend but a transformative force, promising to make the real estate market more accessible, sustainable, and personalized than ever before.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

Exploring the Cheapest Places to Buy a House in America in 2024

Exploring the Cheapest Places to Buy a House in America in 2024

As the cost of living continues to rise, finding an affordable place to call home has become a priority for many Americans. A recent analysis by Norada Real Estate Investments highlights the top 10 cheapest housing markets in the United States for 2024, providing potential homebuyers with economically viable options.

According to the Zillow Home Value Index as of April 2024, several states stand out for their affordability. These states not only offer budget-friendly housing but also boast unique characteristics and attractions that make them desirable places to live.

Top 10 Cheapest States to Buy a House

- West Virginia: Leading the list with a Zillow Home Value Index of $163,443, West Virginia offers affordable housing amidst breathtaking natural beauty and outdoor recreational opportunities.

- Mississippi: With a Zillow Home Value Index of $179,749, Mississippi combines affordability with rich cultural heritage and diverse landscapes.

- Louisiana: Known for its vibrant cultural experiences, Louisiana offers a Zillow Home Value Index of $202,392, making it an attractive option for homebuyers.

- Arkansas: At a Zillow Home Value Index of $206,394, Arkansas presents an affordable market with stunning natural beauty, including the Ozark Mountains.

- Oklahoma: With a Zillow Home Value Index of $206,689, Oklahoma provides a diverse range of living options, from urban to rural settings.

- Kentucky: Known for its bluegrass music and equestrian heritage, Kentucky offers a Zillow Home Value Index of $207,548.

- Iowa: Positioned with a Zillow Home Value Index of $217,641, Iowa offers friendly communities and a strong educational system.

- Kansas: With a Zillow Home Value Index of $226,870, Kansas offers diverse landscapes and Midwestern charm.

- Ohio: Offering a Zillow Home Value Index of $227,542, Ohio provides affordable living in diverse cities like Columbus, Cleveland, and Cincinnati.

- Alabama: Rounding out the top 10 with a Zillow Home Value Index of $228,241, Alabama combines warm Southern hospitality with affordable housing options.

These states showcase the diversity of affordable living opportunities available across the country, with each offering its own set of attractions and amenities.

Cheapest Counties Offering Affordable Homeownership

The analysis also delves into the cheapest counties in the US, where homebuyers can find budget-friendly options. Leading the pack is McDowell County, West Virginia, with a Zillow Home Value Index of just $33,391. Other notable mentions include Phillips County, Arkansas, and Alexander County, Illinois, offering affordable living with unique cultural and natural attractions.

Most Affordable Cities in the US

Complementing this analysis, a report by Forbes identifies the most affordable cities for homebuyers. Detroit, Michigan, ranks first, followed by Cleveland and Toledo in Ohio. These cities offer low housing costs and vibrant communities, making them attractive options for budget-conscious buyers.

In conclusion, despite the rising cost of living in certain areas, there are still numerous affordable housing markets across the United States. Whether you’re drawn to the scenic landscapes of West Virginia or the cultural richness of Louisiana, these locations offer a range of options for prospective homeowners looking to invest wisely in the real estate market.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

Elon Musk’s Revolutionary $10,000 Homes: A New Era in Affordable Housing