Michael Cameron Sidawi: A Visionary Leader in Education and Technology

More Articles

Getting licensed or staying ahead in your career can be a journey—but it doesn’t have to be overwhelming. Grab your favorite coffee or tea, take a moment to relax, and browse through our articles. Whether you’re just starting out or renewing your expertise, we’ve got tips, insights, and advice to keep you moving forward. Here’s to your success—one sip and one step at a time!

Key Property Investment Trends to Watch in 2025

Smaller Cities on the Rise

The dominance of major urban centers like New York and San Francisco is waning. According to Hajji, **smaller cities** such as Boise, Charlotte, and Tampa are experiencing rapid growth due to the shift towards **remote work**. This trend presents lucrative opportunities for investors seeking higher returns outside the traditional hotspots.Demand for Green Buildings

**Sustainability** is becoming a cornerstone of property investment. **Eco-friendly buildings**, which reduce energy consumption and environmental impact, are increasingly sought after. The Home Innovation Blog highlights the growing preference for sustainable homes, a trend echoed by government incentives for **green construction**.The Renting Revolution

With home prices continuing to rise, as noted in the Goldman Sachs Insights, **renting** is becoming more prevalent, especially among younger generations. **Build-to-rent (BTR) communities** are gaining traction, offering investors steady rental income and appealing amenities for tenants.Technological Transformations

The integration of **technology into property management** is revolutionizing the industry. **AI and automation** streamline operations, while **blockchain** enhances transaction security. Embracing these innovations can provide investors with a competitive edge.Interest Rates and Inflation

**Interest rates and inflation** remain critical factors in real estate investment. As borrowing costs rise, the market may slow, but real estate continues to be a robust hedge against inflation. Keeping a close watch on these economic indicators is crucial for making informed investment decisions.Opportunities in Affordable Housing

The demand for **affordable housing** is intensifying, with governments offering incentives for developments in this sector. **Public-private partnerships** are emerging as a solution to the housing crisis, presenting investors with a chance to achieve strong returns while contributing to social welfare.Conclusion

Navigating the property market in 2025 requires keen awareness of these evolving trends. Investors who adapt to changes in market dynamics, prioritize sustainability, and leverage technology will be well-positioned for success. As Johan Hajji emphasizes, staying ahead of the curve is essential for maximizing returns in this competitive environment.CMS Unveils Limited Digital Health Policies in Final Medicare Rule

CMS Reveals Limited Digital Health Policies in Final Medicare Rule

In a move that has drawn considerable attention just days before the 2024 presidential election, the **Centers for Medicare & Medicaid Services (CMS)** has released the final calendar year 2025 physician fee schedule (PFS) rule. This rule, which impacts **digital therapeutics**, **telehealth**, **rural health clinics**, and **opioid treatment programs**, underscores CMS’s limited authority in shaping digital health payment policies.

Digital Health Policies

CMS has finalized several digital health policies, as initially proposed in July’s draft rule. However, the offerings remain modest. New codes have been introduced for **digital therapeutics**, particularly aimed at mental healthcare. These changes mainly involve redefining existing codes to distinguish them from remote therapeutic monitoring codes. CMS’s authority in this area is limited, prompting a call for congressional action to create a new benefit category for digital therapeutics.

Telehealth Policies

With the expiration of **Medicare telehealth flexibilities** looming at the end of 2024, CMS has highlighted the necessity for Congress to extend key telehealth waivers. These waivers have significantly expanded telehealth services since 2020. Permanent coverage for audio-only visits and direct supervision via telehealth has been confirmed, yet geographical and origin site restrictions continue to pose challenges. For further details, you can refer to the original article.

Rural Health Clinics and Federally Qualified Health Centers

CMS has been striving to achieve payment parity for telehealth services compared to in-person services in **rural health clinics** and **federally qualified health centers**. While a special payment rate is applied for telehealth, CMS has opted to retain its current payment methodology for now, though reforms may be considered in the future.

Opioid Treatment Programs

The rule acknowledges the importance of telehealth in **opioid treatment programs**, especially for older Medicare beneficiaries who rely heavily on audio-only services. CMS will allow telehealth usage for periodic assessments, marking a step forward in addressing opioid use disorder through digital means.

For a comprehensive understanding of the finalized rule and its implications, visit the CMS Federal Register.

Conclusion

While CMS has made some progress, the agency emphasizes the need for congressional action to broaden and secure these developments. The future of **digital health policies** remains uncertain, with much depending on legislative support.

KBank’s Crypto Dilemma: Navigating Legislative Changes Amid IPO Plans

The financial landscape in South Korea is poised for a seismic shift as KBank, a major digital bank, grapples with a legislative curveball. The bank, which is heavily reliant on deposits from Upbit, Korea’s dominant cryptocurrency exchange, is facing a potential profit squeeze. The new Virtual Asset User Protection Act, set to take effect on July 19, 2024, mandates that banks must pay interest on crypto exchange deposits, a move that could severely impact KBank’s bottom line.

Currently, Upbit client deposits constitute a substantial 5 trillion won, approximately $3.6 billion, which is over 20% of KBank’s total client balances. While this figure reflects a decrease from previous levels, the impending requirement to pay interest could almost nullify the bank’s profits. The anticipated interest rate stands at 1%, a significant increase from the current 0.1% KBank pays. This change could necessitate an expenditure of around 50 billion won ($36 million), a figure alarmingly close to the bank’s profit margins.

The timing of this legislative change poses a particular challenge for KBank as it readies itself for an initial public offering (IPO). The potential financial strain from interest payments on crypto deposits might devalue the bank, complicating its IPO ambitions.

Bank Dependence on the Crypto Sector

KBank’s situation is reminiscent of Silvergate Bank in 2023, which faced a similar predicament due to its reliance on the crypto sector. Silvergate eventually opted for a voluntary shutdown after experiencing mass withdrawals post-crypto crash, despite having plans to repay all depositors. Similarly, Signature Bank, which had some exposure to the crypto industry, also faced collapse, although management denied that cryptocurrency was the cause.

In South Korea, no other bank shares KBank’s level of exposure to cryptocurrency exchange deposits, making its situation unique. As the banking sector braces for the implications of this new law, KBank stands at a crossroads, navigating the fine line between innovation and financial stability.

The Transformation of Healthcare: AI’s Role in Diagnostics and Personalized Medicine

From Data to Diagnosis

AI’s ability to analyze vast amounts of data is paving the way for a profound change in medical diagnostics. Khosla predicted that AI could take over up to 80% of standard medical tasks, reducing errors and biases in human diagnosis. This is particularly evident in fields like radiology and pathology, where AI’s proficiency in analyzing medical imaging allows for the early detection of diseases such as cancer, significantly improving treatment outcomes.

Moreover, AI’s integration into diagnostics is advancing global healthcare equity. By deploying AI-driven tools in under-resourced areas, high-quality diagnostics become accessible where specialized medical professionals are scarce, thus democratizing healthcare.

Personalized Medicine: Tailoring Treatment with AI

AI’s role in personalized medicine is among its most promising applications. By analyzing genetic profiles and real-time health data, AI enables treatments tailored to individual patients. This shift from a one-size-fits-all approach to personalized care reduces adverse reactions and enhances treatment effectiveness. Research in Nature Humanities and Social Sciences Communications highlights AI’s role in driving precision healthcare, where treatments are increasingly customized based on biological markers, environmental factors, and lifestyle choices.

Additionally, AI is accelerating drug development. Pharmaceutical companies are leveraging AI to analyze large datasets from clinical trials, identifying potential new drug candidates more quickly and accurately than traditional methods. This faster drug discovery process could lead to more effective treatments reaching patients sooner, potentially transforming disease management and care.

AI in Patient Care Management

AI’s potential in patient care management is substantial. By continuously monitoring patient health data, AI systems can predict potential health issues and provide timely interventions, shifting healthcare from a reactive model to a proactive one. This proactive approach not only improves patient outcomes but also reduces long-term healthcare costs. AI-driven patient care management enables continuous monitoring, allowing healthcare providers to anticipate issues before they become critical.

AI-powered predictive analytics also play a crucial role in preventive care, identifying patients at risk of developing conditions like diabetes or hypertension long before symptoms appear. This early intervention strategy can prevent the onset of these diseases, significantly reducing the burden of chronic illnesses, which are among the leading causes of death worldwide.

Ethical Considerations and Challenges

Integrating AI into healthcare is not without challenges, particularly concerning privacy, security, and ethics. AI systems require vast data to function effectively, raising concerns about data breaches and privacy. As AI systems make more autonomous decisions, ethical questions arise, such as who is responsible for incorrect diagnoses or treatment recommendations made by AI. These are complex issues that healthcare providers and regulators must address as AI becomes more prevalent in the industry (IQVIA).

The Nature article also underscores the ethical implications of AI in healthcare beyond data privacy and decision-making. AI’s use in patient care could lead to the dehumanization of healthcare, where decisions may become overly data-driven, potentially overlooking the nuances of human empathy and judgment. Balancing AI’s efficiency with the need for a human touch in patient care will be critical in the coming years.

Integrating AI

For healthcare leaders eager to embrace AI, a strategic, phased approach is recommended. Begin by identifying specific areas where AI can deliver immediate value, such as diagnostics or patient management, and launch pilot projects to test and refine these tools. It’s essential to build a multidisciplinary team that includes clinicians, data scientists, and ethicists to ensure that AI solutions are both effective and ethically sound. By focusing on small, manageable projects, AI implementation can be gradually scaled while minimizing disruption.

Equally important is addressing privacy, security, and ethical concerns upfront. Leaders should establish strong data governance frameworks to protect patient information and ensure transparency in how AI systems are used. Engaging with patients and stakeholders about the benefits and safeguards of AI is crucial for maintaining trust. Successfully integrating AI and enhancing patient care while upholding the values of compassion and ethics hinges on a culture of innovation and continuous learning.

A New Era of Healthcare

The future of healthcare lies in the seamless integration of AI technologies as partners in care, not just tools. AI is set to reshape healthcare by improving outcomes, reducing costs, and enabling personalized care. While the journey toward AI-driven healthcare is still in its early stages, the impact of these technologies is already being felt. As AI continues to advance, it will redefine the relationship between patients and healthcare providers, making care more efficient, effective, and personalized.

The Geography of Pandemic-Era Home Price Trends and Implications for Affordability

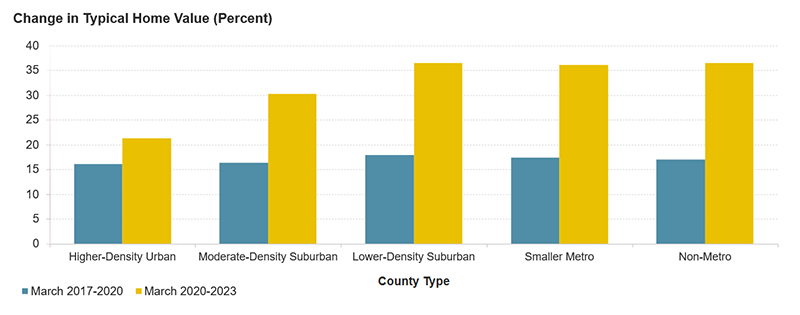

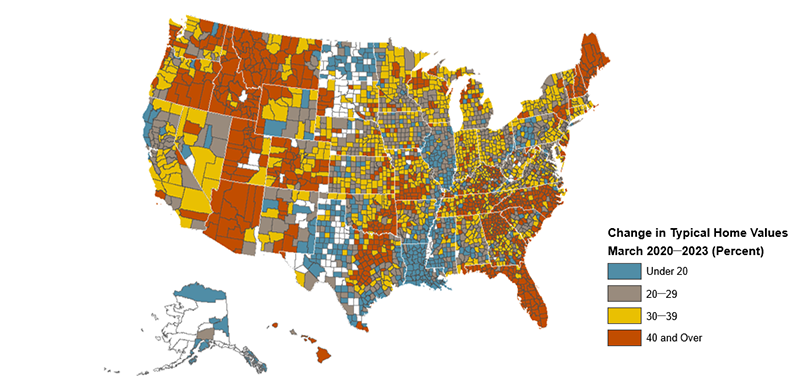

However, this growth was anything but uniform. A compelling new paper titled “The Geography of Pandemic-Era Home Price Trends and the Implications for Affordability” from the Harvard Joint Center for Housing Studies reveals that rural and low-density areas experienced the most significant price increases. The shift toward remote work allowed families to explore housing options beyond high-cost urban centers, leading to a migration trend towards more affordable, less populated regions.

In particular, low-density suburbs of large cities, smaller markets, and rural areas witnessed a notable 36 percent increase in home prices, mirroring the national trend. In contrast, urban and moderate-density suburbs within large metropolitan areas—those with populations exceeding one million—saw more modest increases of 30 percent and 21 percent, respectively. This represents a marked departure from pre-pandemic patterns when price growth was more evenly spread across different regions.

Rural Areas: A Case of Dramatic Growth

The disparity in growth is further highlighted by the fact that typical home values in 31 percent of non-metro counties surged by at least 40 percent following the pandemic. By comparison, only 18 percent of urban counties experienced growth beyond this threshold. Such disproportionate growth has intensified affordability issues, particularly in non-metro regions where the average home-value-to-income ratio has escalated from 2.5 to 3.9, approaching levels previously seen in urban counties before the pandemic.

The disparity in growth is further highlighted by the fact that typical home values in 31 percent of non-metro counties surged by at least 40 percent following the pandemic. By comparison, only 18 percent of urban counties experienced growth beyond this threshold. Such disproportionate growth has intensified affordability issues, particularly in non-metro regions where the average home-value-to-income ratio has escalated from 2.5 to 3.9, approaching levels previously seen in urban counties before the pandemic.

Affordability Challenges Intensify

The rapid increase in home prices has significantly strained affordability in areas that were once considered more cost-effective. Rising interest rates have further compounded these affordability challenges, making homeownership an increasingly elusive goal for many. Whether these trends will persist depends on several factors, including ongoing remote work dynamics, regional affordability differences, and the capacity of housing supplies to meet new demand.

The rapid increase in home prices has significantly strained affordability in areas that were once considered more cost-effective. Rising interest rates have further compounded these affordability challenges, making homeownership an increasingly elusive goal for many. Whether these trends will persist depends on several factors, including ongoing remote work dynamics, regional affordability differences, and the capacity of housing supplies to meet new demand.

The original article on this topic can be found here.

AI in Healthcare: Transforming the Industry Today and Tomorrow

AI in Healthcare: Transforming the Industry Today and Tomorrow

In a world where technology is rapidly evolving, artificial intelligence (AI) is proving to be a game-changer in the healthcare sector. Once considered experimental, AI-powered tools are now making significant strides in improving patient outcomes, enhancing operational efficiency, and reducing costs. These advancements are not just theoretical; they are reshaping the very fabric of healthcare delivery. AI Tools Delivering Value Today

The impact of AI is evident across various facets of healthcare:

AI Tools Delivering Value Today

The impact of AI is evident across various facets of healthcare:

- Diagnostics: AI algorithms are enhancing diagnostic accuracy and efficiency. For instance, Google Cloud Healthcare is improving diagnostic speed and accuracy, while the AI-powered Butterfly Network’s handheld ultrasound device offers accessible point-of-care imaging.

- Drug Discovery: AI is accelerating drug development. Companies like Insilico Medicine use AI to identify promising drug candidates much faster than traditional methods.

- Personalized Medicine: AI-driven algorithms analyze patient data to craft personalized treatment plans. Tempus Labs leverages AI to provide tailored cancer treatments by analyzing genomic data.

- Remote Patient Monitoring: AI-enabled devices enhance chronic condition management. Livongo Health uses AI to monitor glucose levels and offer personalized coaching for diabetes management.

- Predictive Analytics: Health systems like Kaiser Permanente and Mayo Clinic employ AI-powered analytics to identify high-risk patients and prevent hospital readmissions.

- Administrative Efficiency: AI streamlines administrative tasks. Platforms like Cedar automate patient billing, while AI-powered chatbots improve patient engagement and communication.

- Predictive Healthcare: Advanced AI models will enable predictive healthcare, potentially predicting events like heart attacks days before they occur.

- Natural Language Processing for Clinical Documentation: AI will automate the transcription and summarization of medical records, unlocking insights from unstructured patient data.

- AI-Driven Telehealth: Integrating AI-powered diagnostic tools will enhance telehealth platforms, allowing for remote monitoring and early interventions.

- AI-Assisted Robotic Surgery: The integration of AI in robotic surgery will provide surgeons with real-time data analysis, optimizing surgical techniques and reducing recovery times.

- Precision Medicine and Gene Editing: AI-assisted technologies like CRISPR will enable targeted treatments for genetic diseases.

- Data Privacy and Security: Balancing privacy with utility is critical as AI systems require vast amounts of sensitive health data.

- Integration with Legacy Systems: Many healthcare providers operate on outdated infrastructure, complicating AI integration.

- Regulatory Approval: Regulatory bodies are still developing frameworks for AI in healthcare, which may slow adoption.

- Ethical Considerations: The “black box” nature of AI decision-making raises ethical concerns, especially in critical patient care decisions.

- Trust and Adoption: Building trust in AI-driven decisions is essential for widespread adoption by healthcare providers and patients.

- Healthcare Organizations: Start small with high-impact areas, invest in data infrastructure, and develop an AI roadmap.

- Healthcare Professionals: Embrace continuous learning, participate in AI pilot projects, and focus on AI-human collaboration.

- Patients: Stay informed about AI tools, ask questions about AI-driven care, and responsibly share data to improve AI healthcare tools.

Revolutionizing Surgical Training with VR and AI

Revolutionizing Surgical Training with VR and AI

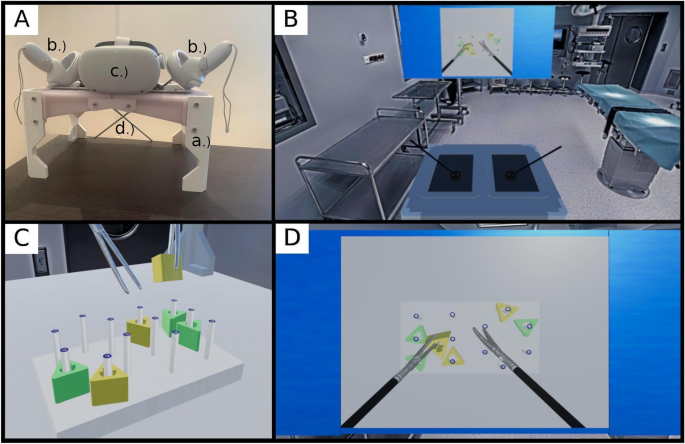

In a groundbreaking study published by Nature, researchers have unveiled a novel approach to surgical training using a low-fidelity virtual reality (VR) simulator enhanced with artificial intelligence (AI) for objective assessment. This pioneering method is poised to transform how medical students acquire laparoscopic skills, offering a cost-effective and efficient alternative to traditional training models.The Evolution of Medical Education

For decades, medical education has relied on high-fidelity simulators, which, while effective, are often expensive and inaccessible to many training centers. The study, led by experts from the University of Pécs, aims to bridge this gap by developing a VR simulator that not only mimics the physical aspects of laparoscopic training but also incorporates AI to provide an objective evaluation of surgical skills.Objective Assessment: A Game Changer

The integration of AI into the VR simulator allows for a more precise and unbiased assessment of students’ performance. By utilizing AI algorithms, the system can detect errors and evaluate the efficiency of surgical tasks, providing detailed feedback that was previously only possible through subjective human evaluation. This advancement addresses a long-standing challenge in simulation-based education, as noted in previous studies by Theodoulou et al. (2018) and Evgeniou & Loizou (2013).Validation and Results

The study involved a cohort of medical students who were randomly assigned to train using either the traditional Fundamentals of Laparoscopic Surgery (FLS) box trainer or the newly developed VR simulator. Results showed no significant difference in the improvement of surgical skills between the two groups, highlighting the VR simulator’s effectiveness. Furthermore, the AI-based assessment proved to be as reliable as human evaluators, significantly reducing the time required for evaluations.Implications for the Future

The successful validation of this VR and AI approach opens the door for wider adoption in medical schools worldwide. It offers a scalable solution that can enhance the accessibility and quality of surgical training, particularly in resource-limited settings. As the demand for distance learning and personalized education grows, this innovative tool could play a crucial role in shaping the future of medical education.

Conclusion

This study highlights the potential of combining VR and AI to revolutionize surgical training. As the medical field continues to evolve, embracing such innovative technologies will be essential in preparing the next generation of surgeons. For more detailed insights, the full study can be accessed at Nature’s website. “`AI and Machine Learning: Revolutionizing the Healthcare Industry

**AI** is already being integrated into **healthcare systems**, from developing new drugs and treatments to diagnosing complex conditions more efficiently and improving access to critical care. This is just the beginning of what **AI** can offer in a medical context.

Benefits of AI in Healthcare

**AI**, which involves using computers to perform tasks that traditionally required human intelligence, is transforming healthcare. When combined with **machine learning**, **AI** can process large datasets to learn and solve complex problems, much like a human would. This technology is being used across various medical fields, including **radiology**, **neurology**, and **emergency response services**, to enhance efficiency and effectiveness.

According to Rohit Chandra, PhD, Cleveland Clinic’s Chief Digital Officer, “AI is no longer just an interesting idea, but it’s being used in a real-life setting.” He highlights that **AI** can now read **MRIs** and **X-rays** with greater accuracy than humans in certain cases, showcasing its advanced capabilities.

AI and Diagnostics

**AI’s role in diagnostics** is particularly promising. For conditions like broken bones, breast cancer, and brain bleeds, accurate diagnosis is crucial. **AI** assists radiologists by acting as a “second pair of eyes,” helping to identify diseases earlier and more accurately. Dr. Po-Hao Chen, a diagnostic radiologist at Cleveland Clinic, explains that **AI** works alongside radiologists to enhance diagnostic performance.

In breast cancer radiology, **AI** has shown significant promise. Dr. Laura Dean, a breast cancer radiologist, notes that **AI** assists in identifying subtle changes in breast tissue patterns, which can be crucial for early detection. Programs like ProFound AI are used to compare mammography images against learned datasets, highlighting areas of concern with a confidence level.

AI in Triage and Patient Management

**AI** is also improving patient care accessibility, especially in emergency situations. For instance, **AI** is used to triage medical cases, prioritizing those most critical. In stroke cases, where every minute counts, **AI** can analyze brain scans rapidly, expediting the care process. Programs like Viz.ai streamline communication among medical professionals, ensuring timely treatment.

The Future of AI in Healthcare

The future of **AI in healthcare** is particularly bright in the realm of research. Dr. Lara Jehi, Cleveland Clinic’s Chief Resource Information Officer, emphasizes the potential of **AI** in generating new knowledge and understanding diseases better. Her work in epilepsy surgery demonstrates how **machine learning** can improve decision-making and treatment outcomes.

As we continue to explore **AI’s possibilities**, ethical and safe use remains paramount. The World Health Organization has issued guidelines to ensure **AI’s responsible integration into healthcare**.

In conclusion, **AI** is poised to transform healthcare, offering unprecedented insights and efficiencies. As **AI technology** advances, it promises to enhance patient care and drive medical research to new heights.

Telemedicine: A Revolution in Healthcare

Telemedicine: A Revolution in Healthcare

In a world where technology is rapidly reshaping every facet of our lives, the healthcare sector is no exception. The recent review published in Cureus delves into the transformative role of telemedicine and telehealth, particularly in public healthcare. This narrative review highlights the integration of telehealth and telemedicine, their historical milestones, and how the COVID-19 pandemic accelerated their adoption.

Historical Milestones and Definitions

Telemedicine, a term coined in the 1970s, literally means “distance healing.” Its roots trace back to the early 1900s with the transmission of electrocardiograms over telephone lines. Fast forward to today, and telehealth encompasses a wide array of services, from video consultations to remote monitoring, making healthcare more accessible than ever before.

Methodologies and Discussions

The review underscores the importance of telemedicine in bridging the gap between healthcare providers and patients, especially in rural areas where access to medical facilities is limited. However, it also acknowledges the challenges, such as regulatory hurdles and infrastructure issues, that must be addressed to fully realize the potential of telehealth.

Benefits and Challenges

Telemedicine offers numerous benefits, including cost-effectiveness, improved access to healthcare, and enhanced emergency preparedness. Yet, challenges remain, such as ensuring patient information security and overcoming technical obstacles in remote areas. The review provides a balanced view, highlighting both the advantages and potential drawbacks of telehealth.

The COVID-19 Pandemic’s Influence

The pandemic has been a catalyst for telemedicine, forcing healthcare systems worldwide to adopt digital solutions quickly. This shift has proven beneficial, particularly for underserved communities, by providing continuous care without the need for physical visits. The review emphasizes the need for ongoing innovation to create user-friendly platforms that cater to both providers and patients.

Recent Technological Advancements

Recent advancements in telehealth technology, such as remote patient monitoring, are paving the way for more comprehensive healthcare solutions. These innovations are crucial, especially as the global population ages, necessitating efficient and cost-effective healthcare delivery.

Conclusion

Telemedicine and telehealth are no longer futuristic concepts but vital components of modern healthcare. As the review suggests, their role in enhancing healthcare access is undeniable, yet challenges persist. Addressing these barriers will be key to unlocking the full potential of telehealth and ensuring equitable healthcare for all.

Future of Construction: Trends Shaping the Industry by 2025

Revolutionizing Construction: Key Trends

The **construction sector** is witnessing a surge in innovative methodologies. Among these, modular construction is gaining momentum for its efficiency and sustainability. By prefabricating components in a controlled environment, developers can drastically cut down on-site construction time, a boon for sectors like multi-family housing and healthcare.

Another game-changer is 3D printing, which allows for the creation of building components layer by layer. This technology is set to revolutionize affordable housing and emergency shelters, offering significant reductions in waste and labor costs.

Technological Integration

The integration of Artificial Intelligence (AI) and Machine Learning (ML) is transforming project management. These technologies enable real-time data analysis, optimizing resource allocation and enhancing safety protocols. By 2025, AI is expected to be a staple in managing construction workflows.

Moreover, advancements in Building Information Modeling (BIM) are pivotal. By linking BIM with IoT devices, stakeholders can gain enhanced control over projects, from design to demolition, fostering unprecedented collaboration.

Sustainability and Smart Technologies

**Sustainability** is no longer a mere trend but a cornerstone of modern construction. The focus is on minimizing environmental impact through eco-friendly materials and energy-efficient systems. Initiatives like zero-carbon projects and recycled materials are becoming standard practice.

Smart building technologies are also at the forefront, with IoT sensors optimizing energy usage and security. As 5G networks expand, these buildings will self-regulate, reducing operational costs.

Challenges and Opportunities

While these advancements offer numerous benefits, they also present challenges. High initial costs, a skills gap, and regulatory hurdles can hinder widespread adoption. Overcoming these barriers is essential for the industry to fully capitalize on these innovations.

Leading the Way

Key players like Skanska and Bouygues Construction are at the forefront, leveraging green building practices and advanced technologies to enhance productivity and sustainability.

As we edge closer to 2025, the **construction industry** is poised for dramatic shifts. Those who embrace these changes will lead the way in shaping a smarter, more sustainable built environment.

The Legislative Battle for Telehealth: Navigating the Future of Virtual Care

As the clock ticks toward a December 31 deadline, a major House subcommittee is considering 15 bills aimed at expanding access to telehealth services. This legislative push is crucial as pandemic-era flexibilities face expiration, potentially affecting countless patients who have come to rely on virtual care.

The American Telemedicine Association has dubbed 2024 the “Super Bowl” of telehealth regulation, advocating for the permanent establishment of Medicare flexibilities introduced during COVID-19. According to FierceHealthcare, this regulatory showdown is critical for the future of telehealth.

The Push for Permanency

Healthcare systems and providers are urging lawmakers to secure permanent Medicare coverage for telehealth services. The absence of legislative action could result in a significant loss of access, particularly for vulnerable populations. Lee Schwamm, M.D., from Yale New Haven Health System, emphasized the need for permanent solutions, stating that telehealth allows for patient-centered care, especially when in-person visits pose challenges.

Prior to the pandemic, telehealth was often a cash-only service, inaccessible to many. However, the integration of virtual and in-person care has become a new standard, as highlighted by Eve Cunningham, M.D., from Providence health system. Telehealth now represents about 20% of ambulatory care visits at Providence, and its services extend to rural and underserved urban areas.

Legislative Proposals

Two significant bills, the CONNECT for Health Act and the Telehealth Modernization Act, aim to solidify telehealth flexibilities. These proposals seek to remove geographic restrictions, expand provider eligibility, and extend audio-only telehealth coverage. The American Hospital Association supports these measures, citing telehealth’s potential to address clinician shortages and enhance patient care.

Debate Over Costs and Quality

While telehealth has shown promise in improving chronic disease management and reducing emergency visits, concerns about increased healthcare spending remain. A previous extension was estimated to raise Medicare costs by over $2 billion. However, experts like Ateev Mehrotra, M.D., argue that the value of telehealth should guide policy decisions, despite modest spending increases.

Payment parity is another contentious issue. Some advocate for lower reimbursement rates for telehealth, while others, like Schwamm, caution against significant pay cuts that could discourage virtual care. The ongoing debate highlights the need for a balanced approach to telehealth reimbursement.

Fred Riccardi from the Medicare Rights Center urged for greater oversight before expanding Medicare coverage for telehealth. The organization emphasizes policies that increase access, promote health equity, and ensure high-quality care.

Conclusion

As lawmakers deliberate these legislative moves, the future of telehealth hangs in the balance. The decisions made in the coming months will shape the landscape of healthcare delivery, determining whether telehealth remains a core function or reverts to a limited service.

Harnessing AI in Healthcare: A New Era of Precision and Efficiency

The AI Revolution in Healthcare

The Cleveland Clinic, a pioneer in medical innovation, exemplifies the profound impact of AI in healthcare. According to Rohit Chandra, PhD, the Clinic’s Chief Digital Officer, **AI’s prowess** in interpreting medical images such as MRIs and X-rays often surpasses human capabilities. This advancement is not just theoretical; it is actively enhancing patient outcomes.AI in Diagnostics

**AI’s role** in diagnostics is particularly noteworthy. In breast cancer detection, tools like iCAD’s ProFound AI assist radiologists in identifying subtle changes in breast tissue, crucial for early detection. Similarly, AI-driven systems like Viz.ai are revolutionizing stroke triage, ensuring that critical cases receive immediate attention, thereby saving precious time and lives.Transforming Research and Patient Care

Beyond diagnostics, **AI is reshaping research methodologies**. The Discovery Accelerator, a collaboration between Cleveland Clinic and IBM, exemplifies how computational power can accelerate biomedical discoveries. By consolidating vast patient data, AI aids in refining treatment decisions and predictive models, notably in fields like epilepsy surgery.The potential of **AI extends** to managing tasks and improving patient services. AI-powered chatbots streamline patient interactions, while AI systems assist healthcare providers by capturing important notes during consultations, thus enhancing the overall patient experience.

Ethical Considerations and Future Prospects

As **AI continues to permeate healthcare**, ethical considerations become paramount. The Cleveland Clinic’s involvement in the AI Alliance underscores a commitment to advancing AI’s use in medicine responsibly. This global effort aims to ensure that AI’s integration into healthcare is both safe and ethical.The journey of AI in healthcare is just beginning, with its potential to revolutionize the field growing by the day. As Dr. Lara Jehi, Cleveland Clinic’s Chief Resource Information Officer, aptly puts it, AI offers a path forward that ensures no data is left behind, opening doors to new knowledge and improved patient care.

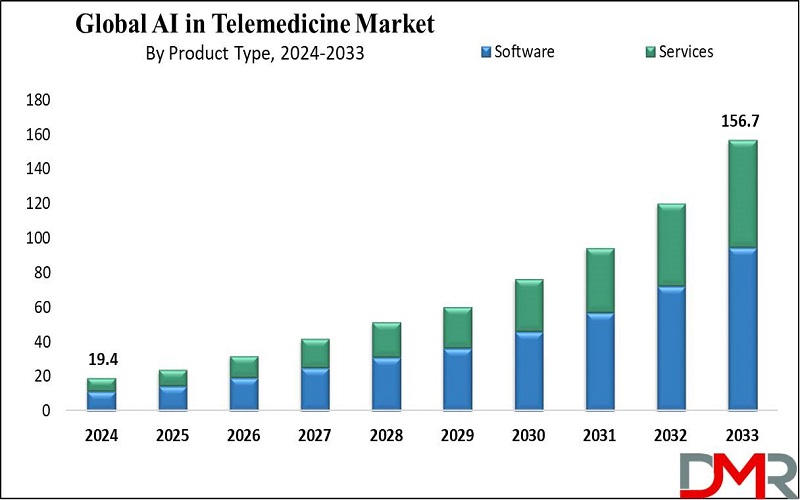

AI in Telemedicine Market on the Rise

AI in Telemedicine Market on the Rise

The AI in telemedicine market is set to experience a remarkable surge, growing from USD 19.4 billion in 2024 to an anticipated USD 156.7 billion by 2033. This represents a compound annual growth rate (CAGR) of 26.1%, driven by advancements in remote diagnostics, personalized treatments, and the integration of artificial intelligence across telemedicine platforms globally.

The Role of AI in Enhancing Telemedicine

AI technologies are revolutionizing telemedicine by enhancing remote diagnostics and personalized treatment plans. Tools such as virtual assistants and chatbots are streamlining patient interactions, reducing wait times, and improving diagnostic accuracy. These advancements are pivotal in driving the market’s growth, with teleconsultation services and IT advancements playing a significant role.Key Insights and Trends

- Market Growth: The global AI in telemedicine market is projected to expand by USD 132.7 billion between 2025 and 2033.

- Product Type: Software is expected to lead, accounting for 60.2% of revenue in 2024.

- Application Analysis: Virtual nursing assistants are anticipated to secure 26.4% of market revenue by the end of 2024.

- Regional Dominance: North America is forecasted to dominate with a 41.2% market share by 2024.

Technological advancements, including machine learning and natural language processing (NLP), are enhancing diagnostic accuracy and providing real-time data insights. The integration of cloud-based and edge AI technologies is further optimizing healthcare services.

Competitive Landscape

The market is highly competitive, with major players like Siemens Healthcare GmbH, IBM, and Cisco Systems Inc. leading the charge. These companies are driving innovation through technological advancements and addressing rising healthcare costs. Meanwhile, independent ventures are making significant strides by offering specialized services targeting specific medical conditions.Opportunities and Future Prospects

The AI in telemedicine market presents numerous opportunities, including enhanced diagnostic accuracy, streamlined efficiency, and cost reduction. These factors are expected to transform healthcare delivery, making telemedicine services more scalable and accessible.For more detailed insights, you can download the report excerpt or purchase the competition analysis dashboard.

Global Infrastructure Development: A New Frontier for Investment

Global Infrastructure Development: A New Frontier for Investment

In a world where infrastructure is the backbone of economic growth, the Global X Infrastructure Development Ex-U.S. ETF, known as IPAV, emerges as a promising investment vehicle for those looking to capitalize on the burgeoning international infrastructure sector. This ETF, listed on August 28, 2024, on the CBOE BZX, is designed to capture the growth potential of companies outside the United States that are poised to benefit from infrastructure advancements.

Driving Forces Behind the Infrastructure Boom

The revival of global infrastructure development is driven by a confluence of factors. As demographics shift and consumption increases, supportive government policies and investments become crucial. Moreover, the rise of emerging technologies such as generative AI and electric vehicles (EVs) are reshaping the landscape. These trends, while evident in the United States, are equally pronounced globally, creating a fertile ground for infrastructure investments.

- Technology and Investment: Major corporations like Alphabet, Amazon, and Microsoft are investing billions in infrastructure, focusing heavily on data centers to support AI growth.

- Geopolitical Shifts: Nations are increasingly focusing on energy security and supply chain resilience, driving infrastructure developments in domestic manufacturing.

- Urbanization and Demographics: The global population is rapidly urbanizing, necessitating new infrastructure to support social and economic mobility.

- Climate Change: The need for climate-resilient infrastructure is creating investment opportunities in sustainable projects.

Investing in the Future

The IPAV ETF targets companies involved in key sub-themes such as engineering and construction services, infrastructure transportation, raw and composite materials, construction equipment and products, and smart grid components. These sectors are vital as they provide the backbone for large-scale infrastructure projects, ranging from energy generation to telecommunications.

A Global Perspective

The international infrastructure theme is not just about traditional assets like roads and bridges. It also encompasses cutting-edge sectors like EV chargers and smart grids. As the world grapples with the challenges of climate change and aging infrastructure, the need for innovative solutions becomes more pressing. The IPAV ETF offers investors a chance to engage with these generational shifts, potentially reaping rewards from the intersection of social, demographic, technological, and energy consumption trends.

For more insights, read the full article on Global X ETFs.

Revolutionizing Medical Diagnostics with AI: A Leap Forward in Cytopathology

Revolutionizing Medical Diagnostics with AI: A Leap Forward in Cytopathology

In a groundbreaking advancement for medical diagnostics, the integration of artificial intelligence (AI) and computer vision is set to transform the analysis of cytopathological images. As reported in a recent article by Nature, this innovation is particularly crucial for developing countries where the shortage of medical professionals makes manual image analysis a daunting challenge.The Challenge of Manual Image Analysis

The interpretation of cytopathological images is a cornerstone of modern medical diagnosis. Yet, the sheer volume of image data makes it nearly impossible to manually identify and locate relevant cells. This issue is exacerbated in developing regions, where resources and trained personnel are scarce. The conventional methods of image segmentation demand extensive labeled data, which is often unavailable, leading to inefficiencies and inaccuracies.AI and Computer Vision: A Promising Solution

AI, through the lens of computer vision, offers a promising solution. By employing semi-supervised semantic segmentation, AI systems can enhance the efficiency and accuracy of image analysis. This method leverages a combination of labeled and unlabeled data, reducing the dependency on extensive human labeling. As a result, AI can significantly improve the diagnostic process, providing a more economical and effective option for cytopathology image diagnosis.Innovative Techniques and Developments

The article introduces a novel network architecture, RSAA (ResUNet-SE-ASPP-Attention), which integrates advanced modules like Squeeze and Excitation (SE), Atrous Spatial Pyramid Pooling (ASPP), and Attention mechanisms. This architecture is designed to address the challenges of segmenting cellular pathology images, particularly in the detection of osteosarcoma. The RSAA model, along with the semi-supervised learning method RU3S, demonstrates a marked improvement in segmentation accuracy, even with limited labeled data.Impact on Developing Countries

For developing countries, where medical resources are limited, these advancements are game-changers. The ability to utilize unlabeled data effectively means that AI can alleviate the pressure on healthcare systems, enabling faster and more accurate cancer diagnoses. This development not only enhances the diagnostic workflow but also opens new avenues for timely and precise cancer detection.Conclusion

As we stand on the brink of a new era in medical diagnostics, the integration of AI and computer vision in cytopathology is a testament to the potential of technology to overcome significant healthcare challenges. This innovation, as highlighted in the Nature article, underscores the importance of continued research and development in AI-assisted medical diagnostics.The Expanding Threat Landscape in Healthcare

The Expanding Threat Landscape in Healthcare

In the rapidly evolving world of healthcare technology, the rise of telemedicine and remote patient monitoring has opened new frontiers for patient care. However, these advancements also widen the footprint for potential vulnerabilities, making data protection more crucial than ever. The original article from Health Data Management underscores the urgent need for healthcare organizations to prioritize secure data exchange and implement robust cybersecurity measures.

The Consequences of Data Breaches

The consequences of poor data security can be devastating. In 2019, over 500 breaches in the healthcare sector compromised millions of electronic health records. Such breaches often lead to stolen personal information, including Social Security numbers and medical histories, which can result in identity theft and insurance fraud. Beyond financial damage, these incidents erode patient trust, making individuals hesitant to share critical health information with their providers, thus hindering effective treatment.Challenges and Solutions in Secure Data Exchange

The complexity of healthcare systems presents unique challenges for secure data exchange. With vast amounts of sensitive information circulating, the industry is vulnerable to cyber threats, human error, and technical malfunctions. Implementing strong encryption methods for data at rest and in transit is essential. Encryption ensures that even if a breach occurs, the data remains unreadable without the proper keys. Regular network monitoring can help identify potential vulnerabilities before they escalate.Employee training is another critical solution. Human error accounts for a significant portion of data breaches in healthcare. Educating staff on best practices for data security can significantly reduce risks.

Keys to Successful Data Security

Healthcare organizations can enhance their data security efforts through several practical steps:- Conduct regular risk assessments to identify and address system vulnerabilities.

- Implement access controls to limit sensitive information access based on individual roles.

- Utilize two-factor authentication for an extra layer of security.

- Create a culture of cybersecurity awareness through ongoing employee training.

Prioritizing Data Security

As healthcare technologies advance, so must strategies for securing data. The rise of telemedicine and remote patient monitoring makes secure data exchange critical for maintaining patient confidentiality. By staying abreast of evolving cybersecurity threats and implementing robust measures, healthcare organizations can protect sensitive information and maintain patient trust.The original article serves as a clarion call for improved data protection, emphasizing the importance of a proactive approach to cybersecurity in healthcare.

By fostering a culture of cybersecurity awareness and prioritizing data security, we can ensure trust in our healthcare systems while delivering quality care to patients.

Driverless Shuttles: A New Era of Mobility in Rural France

Driverless Shuttles: A New Era of Mobility in Rural France

In the picturesque yet sparsely populated region of Val de Drôme – Crest in southeastern France, a quiet revolution is underway. The deployment of self-driving shuttles is transforming the way residents navigate their rural surroundings. This initiative, launched in 2020, is part of a broader European effort to harness automated electric vehicles (EVs) as a viable public transport solution in areas where traditional services are often lacking.Yann Arnaud, director of responses to customer needs and innovation at the French insurance company MACIF, emphasized the potential of these shuttles during a conversation with Euronews. “We are trying to ensure that this is a new means of travel and mobility for people living in suburban or rural areas,” he stated, highlighting the project’s aim to reduce isolation and improve accessibility.

Technology and Safety

The shuttles operate on a predefined 5 km route, making seven stops over a 20-minute journey. A control operator oversees the operation to ensure safety. Benjamin Beaudet, general director at Beti, the operator of the automated shuttles, explained that the technology aligns with the European vision for automated vehicles. The shuttles “learn” their routes and compare real-time observations with pre-learned data to navigate safely.In contrast to American and Chinese companies like Waymo, Uber, and Tesla, which focus on self-driving taxis with flexible routes, the European approach prioritizes defined paths, enhancing safety and predictability.

Addressing Rural Needs

The introduction of these shuttles in Val de Drôme – Crest, where the population density is significantly lower than the national average, has been met with positive feedback. Residents appreciate the newfound mobility options, especially in areas where alternatives are limited. Arnaud noted, “The question of acceptability arises when you have the luxury of having other options. When you don’t have a choice, you’re very happy to have [the shuttle].”This sentiment underscores the potential of driverless vehicles to address mobility challenges in rural areas, particularly for the elderly and those without access to personal transportation.

Challenges and Future Prospects

Despite the promising start, scaling these projects to permanent services remains a challenge. High costs, logistical hurdles, and technological requirements, as outlined in an Open Research Europe article, pose significant barriers. The EU has invested €159 million in research and innovation related to automated mobility since 2021, yet achieving commercial viability continues to be elusive.The success of initiatives like AVENUE and SHOW, which have conducted pilot projects across Europe, including in Crest, offers hope. However, transitioning from pilot programs to sustainable, everyday solutions requires overcoming substantial obstacles.

As Europe continues to explore the potential of automated vehicles, the experiences in rural France provide valuable insights into the future of mobility. With continued innovation and investment, driverless shuttles could become a cornerstone of public transport in remote areas, offering a greener, more accessible alternative to traditional car use.

Digital Health Technology: A New Frontier in Medical Education

Digital Health Technology: A New Frontier in Medical Education

In a world where Digital Health Technology (DHT) is rapidly transforming the landscape of healthcare, a recent study published by BMC Medical Education has shed light on a crucial gap in medical education. As hospitals and clinics increasingly adopt digital solutions, the question arises: Are medical schools preparing future physicians to harness the full potential of these technologies?The study, titled “A landscape analysis of digital health technology in medical schools: preparing students for the future of health care,” conducted a comprehensive review of top-ranked medical schools worldwide. The findings, however, are rather surprising. Despite the growing importance of DHT, a mere handful of institutions have integrated these competencies into their curricula. The research highlights an untapped potential in medical education, urging a shift towards embracing digital innovations.

The Digital Health Revolution

The rise of wearables and telemedicine, accelerated by the COVID-19 pandemic, has placed DHT at the forefront of healthcare innovation. According to the original article, this technology encompasses a broad spectrum, from fitness trackers to advanced telemedicine platforms. Yet, the study reveals that none of the 60 analyzed medical schools explicitly mentioned DHT in their mission statements, underscoring a significant oversight.Bridging the Educational Gap

The research underscores the need for a paradigm shift in medical education. While only four universities were found to offer courses related to DHT, the study emphasizes the importance of equipping future physicians with the skills to navigate and leverage these technologies. Institutions like Stanford University have taken steps in this direction, providing courses through their innovation arms, such as the Byers Center for Biodesign.Looking Forward

As the healthcare landscape continues to evolve, the integration of DHT into medical curricula becomes imperative. The study calls for medical schools to align their educational offerings with the demands of modern healthcare, ensuring that graduates are well-prepared to enhance patient care through digital means.For more insights, visit the full article and explore the peer review reports.

AI Revolutionizes Healthcare: Present Successes and Future Prospects

Artificial Intelligence (AI) is swiftly transitioning from being a futuristic concept to a present-day reality that is reshaping the healthcare landscape. According to a recent Forbes article, AI-powered tools are no longer mere experimental prototypes but are actively driving significant improvements in patient outcomes, operational efficiency, and cost savings.

AI Tools Delivering Value Today

Across the healthcare ecosystem, AI is delivering real value. From enhancing diagnostic accuracy to streamlining administrative processes, AI is beginning to reshape how care is delivered and experienced.

- Diagnostics: AI algorithms are improving diagnostic accuracy and efficiency. Google Cloud Healthcare and Butterfly Network’s ultrasound device are notable examples.

- Drug Discovery: AI is accelerating drug development. Companies like Insilico Medicine are using AI to identify promising drug candidates in record time.

- Personalized Medicine and Genomics: AI-driven algorithms are developing personalized treatment plans. Tempus Labs is a leader in this field.

- Remote Patient Monitoring: AI-enabled devices enhance care for chronic conditions. Livongo Health uses AI to manage diabetes effectively.

- Predictive Analytics and Risk Stratification: Organizations like Kaiser Permanente and Mayo Clinic are using AI to identify high-risk patients.

- Administrative Tasks: AI streamlines tasks like claims processing and appointment scheduling. Cedar’s platform automates patient billing.

- Clinical Decision Support (CDS) Systems: Companies like Epic Systems and Cerner Corporation are integrating AI into electronic health records.

What AI Healthcare Tools Might Emerge In The Next 2-3 Years?

The potential applications of AI in healthcare are vast. In the next few years, we can expect advancements in areas such as:

- Predictive Healthcare: Advanced AI models could predict health events like heart attacks days in advance.

- Natural Language Processing (NLP) for Clinical Documentation: AI can automate medical record transcription and unlock insights from unstructured data.

- AI-Driven Telehealth and Remote Monitoring: Future platforms will integrate AI diagnostic tools for early intervention.

- AI-Assisted Robotic Surgery: Surgeons will work alongside AI systems for optimal surgical techniques.

- Precision Medicine and Gene Editing: AI-assisted technologies like CRISPR will enable targeted genetic treatments.

- AI-driven Clinical Research and Medical Devices: AI will accelerate drug development and enhance wearable health monitors.

Challenges And Barriers

Despite the potential, several hurdles remain:

- Data Privacy and Security: Balancing privacy with utility is crucial as AI systems require vast health data.

- Integration with Legacy Systems: Outdated infrastructure complicates AI integration.

- Regulatory Approval: Regulatory bodies like the FDA are developing frameworks for AI, which may slow adoption.

- Ethical Considerations: The “black box” nature of AI raises ethical concerns, especially in critical patient care decisions.

- Trust and Adoption: Building trust in AI-driven decisions is essential for widespread adoption.

Action Steps For Individuals And Organizations

To capture the benefits of AI in healthcare, consider the following steps:

For Healthcare Organizations:

- Start Small: Focus on high-impact areas like administrative tasks or image analysis.

- Invest in Data Infrastructure: Ensure robust data collection and management systems.

- Develop an AI Roadmap: Plan for AI integration, including staff training and change management.

- Partner Strategically: Collaborate with AI healthcare companies that align with your needs.

For Healthcare Professionals:

- Embrace Continuous Learning: Familiarize yourself with AI tools in your specialty.

- Participate in Pilots: Engage in AI implementation projects.

- Focus on AI-Human Collaboration: Understand how AI can augment your expertise.

For Patients:

- Stay Informed: Research AI tools used by your healthcare providers.

- Ask Questions: Inquire about AI-driven diagnoses or treatments.

- Share Data Responsibly: Participate in data-sharing initiatives to improve AI tools.

AI tools in healthcare are already delivering significant value and are poised to further transform the industry. Embracing these changes today can lead to a more effective, efficient, personalized, and accessible healthcare system in the future.

USD Receives $1.1 Million Federal Grant to Transform Telehealth Education

This transformative initiative is a collaborative effort among USD’s School of Health Sciences, Sanford School of Medicine, Department of Communication Sciences & Disorders, and Department of Psychology. Together, these departments will construct the necessary infrastructure and develop a skilled workforce to advance the telehealth project. This will enable broader service reach through spoke sites, eliminating the need for patients or providers to travel.

With the support of Senator Mike Rounds, the Telehealth Collaborative seeks to build upon USD Health Affairs’ existing investments in cutting-edge technology. “We are thankful to Senator Rounds for supporting the Telehealth Collaborative and nurturing the next generation of healthcare leaders in the state,” remarked USD President Sheila K. Gestring. “This grant not only solidifies USD’s dedication to innovative and accessible healthcare, but it also underscores our commitment to serving South Dakota communities.”

The Collaborative has outlined several pivotal goals:

- Establishing an interdisciplinary telehealth platform for training healthcare students.

- Developing a telehealth curriculum and certificate program.

- Recruiting faculty and staff with telehealth expertise.

- Fostering collaborations to support rural sites using a hub-and-spoke telehealth model, especially in underserved areas.

- Creating a regional telehealth consortium aimed at sharing resources, education, training, service, and research.

The project emphasizes integrating telehealth into educational models to ensure healthcare providers are well-trained and confident in utilizing telehealth technology. Through simulated and real patient/client interactions, the two-year project endeavors to produce a practice-ready workforce equipped with cutting-edge skills and improve access to quality care throughout South Dakota.

Senator Rounds highlighted the project’s significance, stating: “This crucial investment will construct the necessary infrastructure for telehealth education, equipping future healthcare professionals with modern tools and technology. By enhancing access to quality care, especially in rural and underserved areas, this initiative will strengthen healthcare delivery across South Dakota.”

For more information, you can read the original article from KXLG.

Telehealth: Bridging the Gap in Healthcare Access

Telehealth: Bridging the Gap in Healthcare Access

Ensuring Equitable Access

Ensuring Equitable AccessHealthcare providers are grappling with significant challenges in delivering services to disadvantaged communities. Telehealth has emerged as a vital tool in this endeavor, playing a crucial role in providing equitable healthcare access by increasing the availability of specialists and reducing transportation barriers. This is particularly important for rural communities and the LGBTQ+ population.

Despite the medical community’s commitment to health equity, demographic factors continue to hinder many individuals from accessing necessary care. Disparities in healthcare access and outcomes are especially pronounced among different racial and ethnic groups. For instance, Black women have a 40% higher death rate from breast cancer compared to white women.

For rural communities, telehealth reduces the need for travel and supports primary care providers. Among LGBTQ+ populations, telehealth facilitates access to sensitive and knowledgeable care, ensuring privacy and confidentiality.

The Role of Telehealth

Telehealth not only offers a pathway to more equitable healthcare access but also ensures culturally competent care. It allows for flexible scheduling and provides cost-effective solutions. However, to maximize the benefits of telehealth for minority, rural, and LGBTQ+ communities, it’s crucial to address ongoing challenges such as digital literacy and access, ensuring provider training on unique health needs, and maintaining the privacy and security of digital health platforms.

Telehealth has not only been a lifeline during the COVID-19 pandemic but has also become a new standard in providing inclusive care, underscoring the need for ongoing efforts to ensure it serves all communities effectively.

Revolutionizing Liver Cancer Diagnosis: An Emerging Market Potential

Revolutionizing Liver Cancer Diagnosis: An Emerging Market Potential

Liver cancer continues to be a significant health challenge globally, ranking as one of the leading causes of cancer-related deaths. Over the past few decades, there has been a notable increase in the demand for both diagnosis and treatment of liver cancer. With remarkable progress in diagnostic technologies, including imaging, blood tests, and molecular diagnostics, the liver cancer diagnostic market is expected to expand considerably.Market Overview and Growth Projections

As of 2023, the global liver cancer diagnostic market is valued at USD 8.2 billion. Projections indicate a growth at a compound annual rate (CAGR) of 7.6% from 2024, anticipated to reach USD 15.7 billion by 2032. This expansion is driven by the rising incidence of liver cancer, innovations in diagnostic technologies, and heightened investments in the healthcare sector.Driving Factors in Market Growth

The increasing prevalence of liver cancer, especially in regions facing high hepatitis B and C rates, significantly elevates the need for effective diagnostics. Furthermore, technological advancements, such as liquid biopsy providing non-invasive options, propel market growth. Additionally, governmental and non-governmental screening initiatives promote early detection and improved survival outcomes. For further insights, the report is accessible for download at Acumen Research.Challenges and Opportunities in the Market

Despite promising advancements, certain challenges persist, such as the high costs of advanced diagnostics and limited accessibility in regions with underdeveloped healthcare infrastructure. Nevertheless, the market holds substantial opportunities, particularly with the rise of personalized medicine and the development of non-invasive diagnostic methods that reduce patient discomfort while maintaining accuracy.Segmentation and Regional Growth

The liver cancer diagnostic market can be segmented by test type, end-user, and geography. Test types include laboratory, blood, imaging tests, and more. End-users encompass hospitals, diagnostic labs, academic research institutes, and pharmaceutical entities.Regionally, North America leads the market, fueled by advanced healthcare systems and significant expenditure. In the Asia-Pacific, rapid growth is expected due to increasing cancer rates and improved healthcare infrastructures in countries like China and India. Europe, led by the UK and Germany, also shows promising expansion with investments in cancer research. Meanwhile, Latin America and the Middle East & Africa are witnessing gradual growth due to better awareness and healthcare access.

Emerging Trends in Diagnostic Strategies

One of the foremost trends is the adoption of liquid biopsy for non-invasive diagnosis. The increasing integration of artificial intelligence in diagnostics enhances accuracy by analyzing substantial medical data to detect early-stage liver cancer. Moreover, advances in molecular and genetic testing offer more precise diagnostics, enabling targeted therapies. Telemedicine and remote diagnostic services are revolutionizing access in regions with limited healthcare facilities.Competitive Landscape and Market Players

The market features intense competition with leading companies like Abbott Laboratories, F. Hoffmann-La Roche Ltd., and Siemens Healthineers innovating to maintain their positions. These players focus on expanding their product lines through partnerships, acquisitions, and robust investment in research and development.In Conclusion

The liver cancer diagnostic market is headed for significant growth, driven by the increasing prevalence of the disease and advancements in diagnostic technology. Despite certain limitations, the market presents vital opportunities in the field of non-invasive diagnostics and personalized medicine. As innovations continue, these advancements promise to enhance patient outcomes significantly.For further details, the original source can be viewed at Acumen Research.

World Cities Day 2024: A Global Movement Towards Sustainable Urban Futures

World Cities Day 2024: A Global Movement Towards Sustainable Urban Futures

In the spirit of World Cities Day, celebrated on October 31st, cities worldwide are embracing the theme “Youth Leading Climate and Local Action for Cities.” This theme underscores the pivotal role of young leaders in driving sustainable urban solutions, a movement gaining momentum through community-led initiatives and progressive policies. As cities grapple with the challenges posed by the climate crisis and the need for cultural heritage conservation, innovative urban planning emerges as a beacon of hope.

Preservation and Innovation: A Balancing Act

Highlighting this global trend, Barcelona’s La Rambla has completed the first phase of its extensive multi-year renovation. This project exemplifies the commitment to preserving urban heritage while embracing modernity. Similarly, Chicago’s historic skyscrapers have been saved from demolition, showcasing efforts to maintain the architectural legacy amid urban evolution.Addressing Urban Challenges

Cities like Venice and Los Angeles are tackling pressing issues such as overtourism and housing shortages. Venice has implemented entrance tickets to manage tourist influx during peak weekends, while Los Angeles is pioneering a radical approach to affordable housing. These initiatives strive to balance livability with growth, ensuring sustainable urban environments.Reimagining Urban Spaces

Ambitious master plans are reshaping urban landscapes. Projects like the revitalization of industrial sites in Tallinn and Connecticut are transforming old infrastructures into vibrant public spaces, reflecting how cities are reimagining their urban fabric.Resilience and Renewal

Post-disaster rebuilding efforts in Kharkiv and Türkiye underscore the urgency of resilience-driven design. These projects ensure cities can withstand and adapt to future challenges, fostering cultural renewal and community resilience. As reported by ArchDaily, these transformative updates offer a glimpse into the global forces reshaping urban landscapes, driven by preservation, innovation, and resilience.The Road Ahead: Self-Driving Cars Reshape the Automotive Industry

Self-Driving Cars: A Glimpse into the Future

The road to a future dominated by autonomous vehicles (AVs) is being paved with a blend of optimism and skepticism. According to a recent Goldman Sachs report, partially autonomous cars are projected to make up 10% of new vehicle sales by 2030. This development hints at a revolution in the automotive industry, driven by advancements in artificial intelligence and decreasing hardware costs.

The Role of AI in Accelerating AV Adoption

AI’s role in boosting the self-driving car industry cannot be overstated. While some AVs are currently operational in cities like San Francisco and Beijing, the technology is not yet widespread. Presently, only about 60% of vehicles have some level of driver assistance, with a mere 1-2% of global vehicle sales in 2026 expected to feature Level 3 automation.

However, there is hope on the horizon. AI advances, including enhanced computational power and larger datasets, are poised to improve model performance, potentially accelerating the adoption of more autonomous vehicles.

Cost-Effective Solutions and Market Implications

One of the key factors likely to spur AV adoption is the reduction in hardware costs. Modern autonomous vehicles rely on a multitude of cameras, sensors, and lidar devices. As these components become more affordable, AVs will not only be cheaper but also more efficient. This shift could benefit a range of sectors, from chipmakers to rideshare companies and automakers.

Looking further ahead, Goldman Sachs envisions a scenario where AV sales, particularly those with Level 3 automation or higher, could account for 60% of all light vehicle sales by 2040. Even in a less optimistic scenario, AVs are expected to comprise nearly 40% of new sales.

Geographic Variations in AV Adoption

The adoption rates of AVs are expected to vary significantly across regions. China leads the charge, with Level 3 or higher AV sales potentially making up 90% of all sales by 2040. Europe and the United States are also anticipated to see substantial growth, with advanced AVs comprising about 80% and 65% of all car sales, respectively, by the same year.

As the industry stands at the cusp of this technological revolution, the mixed sentiments regarding autonomous vehicle adoption continue to spark debate. Whether these expectations materialize remains to be seen, but the journey towards a more autonomous future is undeniably underway.

Semaglutide: A Promising Ally Against Alzheimer’s?

Semaglutide: A Promising Ally Against Alzheimer’s?

In a groundbreaking study, researchers at Case Western Reserve School of Medicine have identified a potential new benefit of semaglutide, a widely used diabetes and weight-loss drug. According to their findings, semaglutide may significantly reduce the risk of Alzheimer’s disease in individuals with type 2 diabetes (T2D), outperforming seven other anti-diabetic medications.

Alzheimer’s disease, a devastating brain disorder that erodes memory and cognitive abilities, affects nearly 7 million Americans aged 65 and older, as reported by the Alzheimer’s Association. Alarmingly, it claims more lives annually than breast and prostate cancer combined.

Published in Alzheimer’s & Dementia: The Journal of the Alzheimer’s Association, the study suggests that T2D patients taking semaglutide had a markedly lower risk of developing Alzheimer’s disease. This trend was consistent across various subgroups, regardless of obesity status, gender, or age.

Semaglutide, a glucagon-like peptide receptor (GLP-1R) agonist, is the active ingredient in popular medications like Wegovy and Ozempic. It works by reducing hunger and regulating blood sugar levels in T2D patients.

Under the leadership of Rong Xu, a professor of biomedical informatics, the research team analyzed three years of electronic health records from nearly one million U.S. patients with T2D. Their statistical approach, which mimicked a randomized clinical trial, revealed that patients prescribed semaglutide had a significantly lower risk of Alzheimer’s compared to those on other anti-diabetic medications.

According to the CDC, Alzheimer’s disease results in approximately 120,000 deaths annually, ranking as the seventh-leading cause of death in the United States.

“This new study provides real-world evidence for semaglutide’s potential impact on Alzheimer’s disease,” Xu stated. “While preclinical research has hinted at its protective effects against neurodegeneration and neuroinflammation, our findings suggest the need for further exploration through randomized clinical trials.”

Despite these promising results, the study’s limitations prevent researchers from drawing definitive causal conclusions. Xu emphasized the importance of continued research into semaglutide’s potential as a treatment for this debilitating condition, encouraging further investigation into alternative drugs.

For more information, please contact Patty Zamora at patty.zamora@case.edu.