Navigating the Commercial Real Estate Terrain in 2025: Challenges and Renewed Opportunities

As the global property market cautiously steps into 2025, the commercial real estate sector is beginning to show signs of recovery. This follows a significant downturn that began in 2022, primarily driven by rising interest rates. The original article from MSCI highlights several key trends and challenges that investors should keep an eye on as the market evolves.

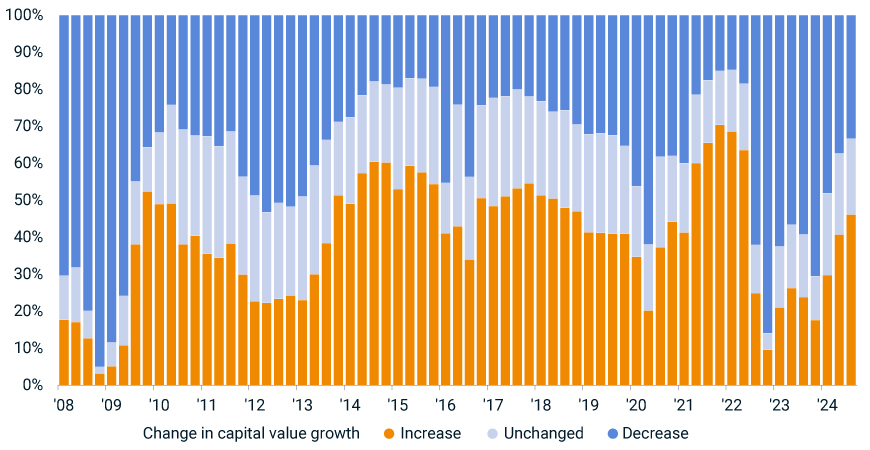

In 2024, interest rates began to decline, leading to a stabilization in transactional activity and the reemergence of asset-value growth in certain segments. However, the recovery is uneven, with different areas of the market moving at varied paces. This presents both opportunities and risks for investors, who must navigate a landscape marked by both cyclical and structural changes.

As we move further into 2025, the commercial real estate market remains a complex and evolving landscape. Investors must remain vigilant and adaptable, leveraging insights and strategies to navigate the challenges and opportunities that lie ahead.

In 2024, interest rates began to decline, leading to a stabilization in transactional activity and the reemergence of asset-value growth in certain segments. However, the recovery is uneven, with different areas of the market moving at varied paces. This presents both opportunities and risks for investors, who must navigate a landscape marked by both cyclical and structural changes.

Recovery – Not Everywhere All at Once

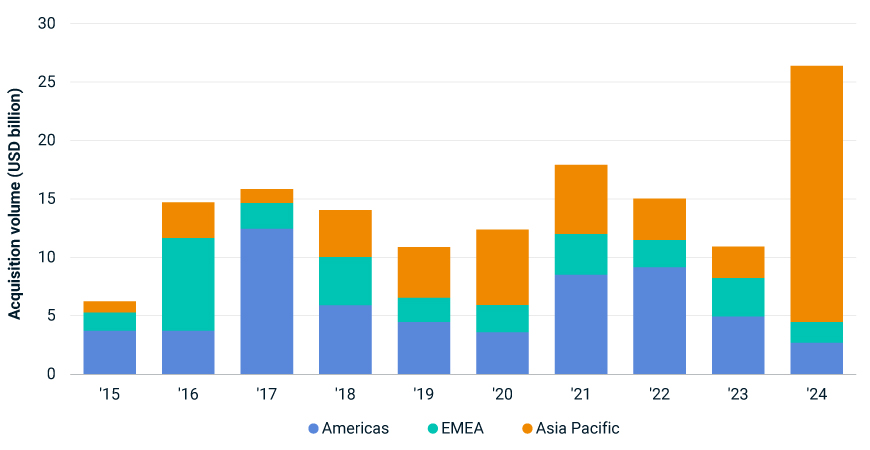

The recovery phase, which began in 2024, is still in its infancy. Lower interest rates are expected to help buyers and sellers align more closely on pricing, improving liquidity. Yet, investor preferences are shifting, with a focus on living sectors, industrial assets, and properties aligned with broader socioeconomic and technological trends. A notable transaction in 2024 was Blackstone Inc.’s $16 billion acquisition of data-center operator AirTrunk, underscoring the growing demand for assets that straddle the line between traditional property and infrastructure.

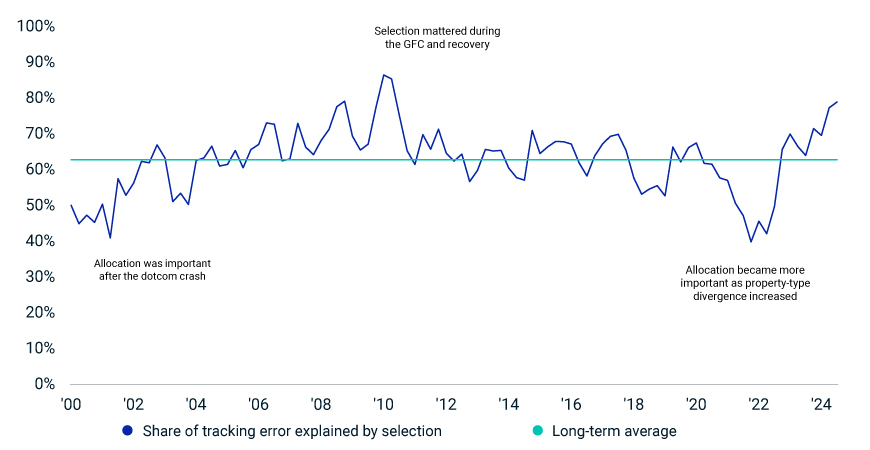

Investment Pendulum Swings Back to Asset Selection

The real estate market is entering a new investment cycle where active asset selection and management are crucial. With market conditions evolving, the traditional playbook for delivering returns is changing. Investors must balance top-down allocation strategies with granular, bottom-up asset-selection decisions. The interplay between these approaches has become more complex, demanding a keen understanding of the drivers of performance.

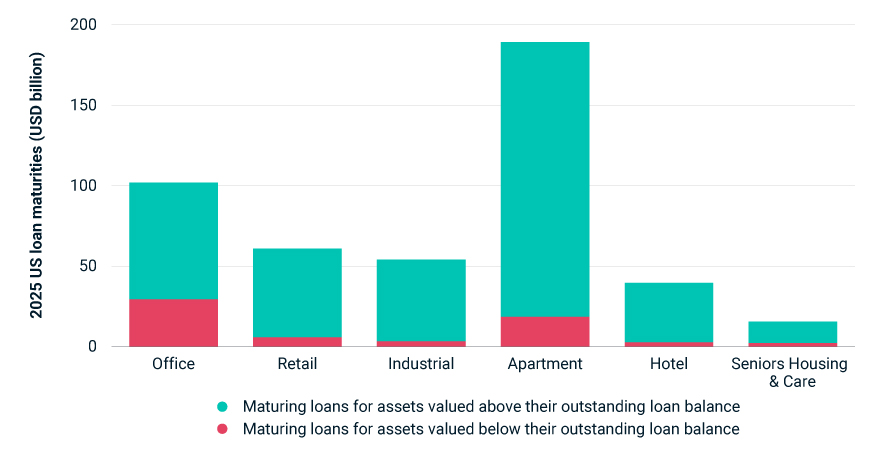

Underwater Assets Come to Light

Higher interest rates and ongoing price declines have put pressure on borrowers’ ability to refinance commercial-property loans. In the U.S., nearly $500 billion of loans are set to mature in 2025, with about 14% potentially underwater. U.S. offices face particularly bleak refinancing prospects, with nearly 30% of maturing office loans tied to properties worth less than the debt secured against them.

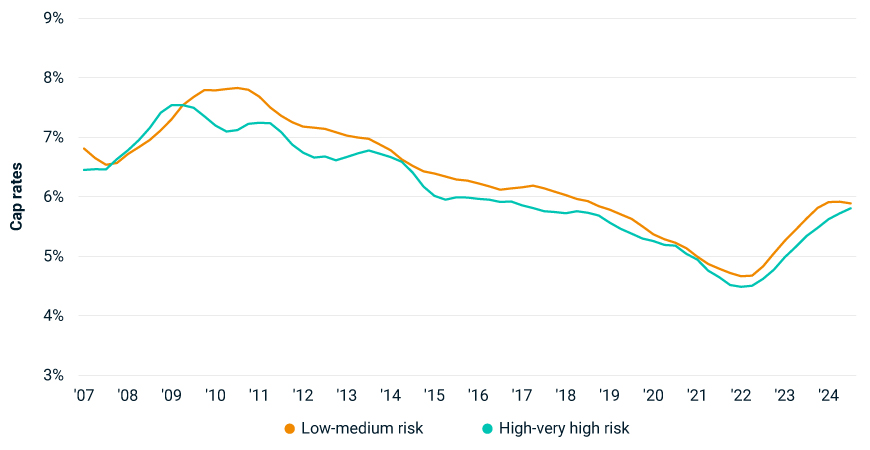

Investors Get to Grips with Physical Climate Risk

Extreme weather events are expected to become more common, affecting real-estate asset values through higher insurance premiums and disruption costs. Despite this, the risk is not yet adequately priced into transaction yields. As climate risks intensify, pricing should adjust to reflect the increased risk to property values.

Property Investors Seek a Ride on the AI Train

The rapid development of AI is driving demand for data centers, transforming the investment landscape. Significant capital is being committed to developing new data centers, with notable deals like Blackstone’s acquisition of AirTrunk. This surge in interest is reshaping market dynamics, with traditional property investors now competing in a space once dominated by infrastructure investors.

As we move further into 2025, the commercial real estate market remains a complex and evolving landscape. Investors must remain vigilant and adaptable, leveraging insights and strategies to navigate the challenges and opportunities that lie ahead.

More Articles

Getting licensed or staying ahead in your career can be a journey—but it doesn’t have to be overwhelming. Grab your favorite coffee or tea, take a moment to relax, and browse through our articles. Whether you’re just starting out or renewing your expertise, we’ve got tips, insights, and advice to keep you moving forward. Here’s to your success—one sip and one step at a time!

908, 2023

House Hunting? Overcoming Obstacles to Find Your Dream Home

Introduction

The real estate market has witnessed a sluggish period recently, as various factors have hindered its growth and stability. Affordability concerns, limited inventory, credit tightening, rising interest rates, and a rebound in home prices following a brief correction last fall have all contributed to the challenges faced by both buyers and sellers. In this article, we will explore these intricacies of the current housing market and provide valuable insights to help you navigate this dynamic landscape.

1. Affordability Challenges

The dream of homeownership has become increasingly difficult to achieve for many individuals and families. Over the past few years, housing prices have outpaced wage growth, making homes less affordable. This affordability gap has been exacerbated by the limited supply of affordable homes, particularly in highly sought-after areas. As a result, potential buyers find themselves struggling to find suitable options that align with their budget and lifestyle preferences.

2. Limited Inventory

Another key issue plaguing the housing market is the shortage of available properties for sale. The demand for homes continues to outstrip the supply, leading to increased competition among buyers. This scarcity not only drives up prices but also limits the range of choices available to prospective homeowners. Consequently, buyers often find themselves compromising on their preferences or delaying their homeownership plans until more inventory becomes available.

3. Credit Tightening

Access to credit plays a vital role in the real estate market. However, recent credit tightening measures have made it more challenging for some buyers to secure financing. Lenders have become more cautious, implementing stricter requirements that may exclude potential homeowners who previously would have qualified for a mortgage. While these measures aim to reduce the risk of another housing crisis, they can add an additional layer of complexity for those seeking to secure a home loan.

4. Rising Interest Rates

Interest rates are another factor contributing to the current slowdown in the housing market. After a prolonged period of historically low rates, the Federal Reserve has gradually raised rates in response to a strengthening economy. Higher interest rates translate into increased mortgage costs, which can deter some potential buyers. Moreover, rising rates also impact affordability, as higher monthly mortgage payments decrease the purchasing power of borrowers. Consequently, this can further intensify the challenges faced by buyers in an already competitive market.

5. Home Prices Firming Up

In recent years, the housing market experienced a correction period, characterized by a temporary decline in home prices. However, this correction has largely subsided, and home prices are once again on the rise. While homeowners may welcome this trend, buyers are confronted with the reality of higher purchase prices. This situation pushes affordability barriers even further, hampering the ability of many potential buyers to enter the market.

Tips for Prospective Buyers and Sellers

Despite the complexities of the current housing market, there are strategies that can help buyers and sellers navigate these challenges successfully. Consider the following tips:

1. Conduct Thorough Research: As a prospective buyer or seller, it is crucial to stay informed about market trends, interest rates, and local inventory levels. This knowledge will empower you to make informed decisions and capitalize on favorable conditions.

2. Partner with a Knowledgeable Real Estate Agent: Enlisting the help of a reputable and experienced real estate agent can prove invaluable. Agents possess in-depth knowledge of the local market and can guide you through the buying or selling process, providing insights and strategies specific to your situation.

3. Plan for Your Budget and Mortgage: Buyers should thoroughly evaluate their financial situation and establish a realistic budget before beginning their search. Becoming pre-approved for a mortgage can streamline the purchasing process and increase the chances of securing a desirable property. Additionally, sellers should work with an agent to set an appropriate listing price to maximize their chances of a successful transaction.

4. Seek Out Alternative Financing Options: If traditional lending options prove challenging, consider exploring alternative financing routes, such as government-backed loan programs or down payment assistance programs. These options may offer more flexibility and accessibility in achieving homeownership goals.

5. Patience and Flexibility: In a competitive market, patience and flexibility are essential. Buyers may need to compromise on certain preferences or expand their search radius to find suitable options. Similarly, sellers should be open to negotiation and market feedback to ensure a successful sale.

Conclusion

The current state of the housing market presents challenges that require careful consideration and strategic planning for both buyers and sellers. Affordability concerns, limited inventory, credit tightening, rising interest rates, and firming home prices all contribute to the complexity of this dynamic landscape. However, armed with knowledge, realistic expectations, and the right support system, individuals can overcome these challenges and achieve their real estate goals. Remember to stay up to date with market conditions, seek professional guidance, and remain patient and flexible throughout the process. With perseverance, informed decision-making, and adaptability, the path to successful real estate transactions can be navigated in any market environment.

2407, 2023

Wyoming

Forgive the Cyber Dust

We will return shortly after upgrades are complete

2407, 2023

Wisconsin

Forgive the Cyber Dust

We will return shortly after upgrades are complete

2407, 2023

West Virginia

Forgive the Cyber Dust

We will return shortly after upgrades are complete

2407, 2023

Washington

Forgive the Cyber Dust

We will return shortly after upgrades are complete

2407, 2023

Virginia

Forgive the Cyber Dust

We will return shortly after upgrades are complete

2407, 2023

Vermont

Forgive the Cyber Dust

We will return shortly after upgrades are complete

2407, 2023

Utah

Forgive the Cyber Dust

We will return shortly after upgrades are complete

2407, 2023

Texas

Forgive the Cyber Dust

We will return shortly after upgrades are complete

2407, 2023

Tennessee

Forgive the Cyber Dust

We will return shortly after upgrades are complete

2407, 2023

South Dakota

Forgive the Cyber Dust

We will return shortly after upgrades are complete

2407, 2023

South Carolina

Forgive the Cyber Dust

We will return shortly after upgrades are complete

2407, 2023

Rhode Island

Forgive the Cyber Dust

We will return shortly after upgrades are complete

2407, 2023

Pennsylvania

Forgive the Cyber Dust

We will return shortly after upgrades are complete

2407, 2023

Oregon

Forgive the Cyber Dust

We will return shortly after upgrades are complete

2407, 2023

Oklahoma

Forgive the Cyber Dust

We will return shortly after upgrades are complete

2407, 2023

Ohio

Forgive the Cyber Dust

We will return shortly after upgrades are complete

2407, 2023

North Dakota

Forgive the Cyber Dust

We will return shortly after upgrades are complete

2407, 2023

North Carolina

Forgive the Cyber Dust

We will return shortly after upgrades are complete

2407, 2023

New York

Forgive the Cyber Dust

We will return shortly after upgrades are complete

2407, 2023

New Mexico

Forgive the Cyber Dust

We will return shortly after upgrades are complete

2407, 2023

New Jersey

Forgive the Cyber Dust

We will return shortly after upgrades are complete

2407, 2023

New Hampshire

Forgive the Cyber Dust

We will return shortly after upgrades are complete

2407, 2023

Nevada

Forgive the Cyber Dust

We will return shortly after upgrades are complete

2407, 2023