Real Estate vs. Stocks: Breaking Down the Buzz

Ever Wondered Why Everyone’s Buzzing About Real Estate vs. Stocks? Let’s Break It Down!

Alright, let’s talk about something you’ve probably seen pop up countless times on your feed, especially if you’ve ever Googled “how to invest” on a random Tuesday afternoon. Stocks vs. Real Estate – which one’s the better way to build wealth? And once you dive into it, it’s easy to see why reaction videos and discussions about this topic are all over the internet.

So, imagine you’re sitting there with your coffee (or wine, no judgment), browsing through YouTube, and up pops this video by Shelby Church titled “5 Years in Stocks vs. Real Estate: Which Made Me More Money?” Sounds like a solid question, right? We’ve all had that gnawing question about where to put our money. Plus, who doesn’t dream of escaping the 9-5 grind with dividends and rent checks?

The Big Question: Real Estate or Stocks?

Let’s be honest, who hasn’t fantasized about being the next property mogul like they’re walking the set of Selling Sunset? Or maybe you’re more comfortable picturing yourself sipping cocktails while your index fund quietly does its thing in the background.

Our host, Stefan, jumps into Shelby’s comparison and adds his two cents. Right off the bat, he makes one thing clear: Real estate? Not passive. No sir. It’s like that one group project where you do 90% of the work while Greg never shows up. Sure, real estate can make you loads of money, but it’s going to involve a lot more elbow grease than, say, parking your cash in an index fund and binging Netflix for the next few years (or decades).

Stocks – The Quiet Performer

Shelby’s video lays out a pretty shocking stat: If you had invested $300,000 in the stock market in 1988, you’d be looking at a cool $14 million now. Say what?! That’s an almost 4,000% return. Mind blown.

Now before you start imagining Scrooge McDuck swimming in coins, Stefan breaks it down further: stocks, especially if you’re playing it smart with dividends and tax-advantaged accounts, offer those sweet returns and the simplicity many of us crave as we get older. Can we talk about “stress-free” for a second here?

Stocks are like setting up an easygoing autopilot – you invest what you can, and over time, that cash starts multiplying. Of course, nothing’s ever totally risk-free, but stocks offer that peace of mind.

The Glamorous (but High-Maintenance) Life of Real Estate

Not to be outdone, real estate certainly has its positive moments. The allure of being able to leverage your investments is intriguing. Stefan throws out an example: if you put $100,000 down on a $400,000 property, you get to control the whole thing and any appreciation can skyrocket your return.

But, reality kicks in when you crunch numbers: property taxes, insurance, maintenance, commissions, and hello… tenants who may (or may not) be ideal. Real estate’s a commitment, like a long-term relationship. Except instead of remembering anniversaries, you’re fixing water heaters and repainting old railings.

Real Talk: What’s More Painless?

This video was packed with golden nuggets that made me reconsider getting too fancy with real estate. Stefan, about halfway through the video, drops one of those hard-to-hear truths:

“The older I get… I value peace of mind.”

I feel that. Who wouldn’t trade a little bit of additional return for less stress? These days, more than ever, it seems like we’re all craving simplicity.

Stocks and Real Estate – A Balancing Act?

Now, Stefan doesn’t just bash real estate. Heck, he’s been in the game since 2008. He’s seen some major wins from it. But with high mortgage rates and low inventory, real estate is starting to look like more of a headache than a gold mine.

So… What’s the Verdict?

If there’s one thing this video drives home, it’s that there’s no one-size-fits-all answer. For me? As much as I love diving into Zillow, I’m leaning more towards stocks. They hit that sweet spot between returns and “no headaches after 10PM.”

But what about you? Let’s chat in the comments – I’d love to hear your thoughts!

More Articles

Getting licensed or staying ahead in your career can be a journey—but it doesn’t have to be overwhelming. Grab your favorite coffee or tea, take a moment to relax, and browse through our articles. Whether you’re just starting out or renewing your expertise, we’ve got tips, insights, and advice to keep you moving forward. Here’s to your success—one sip and one step at a time!

Exploring the Top Real Estate Trends of 2024

Exploring the Top Real Estate Trends of 2024

As we navigate the ever-evolving landscape of real estate, 2024 presents a fascinating array of trends that are reshaping the industry. According to a comprehensive report by Exploding Topics, nine pivotal trends are poised to redefine the market over the next 18-24 months.1. Home Prices Continue to Climb

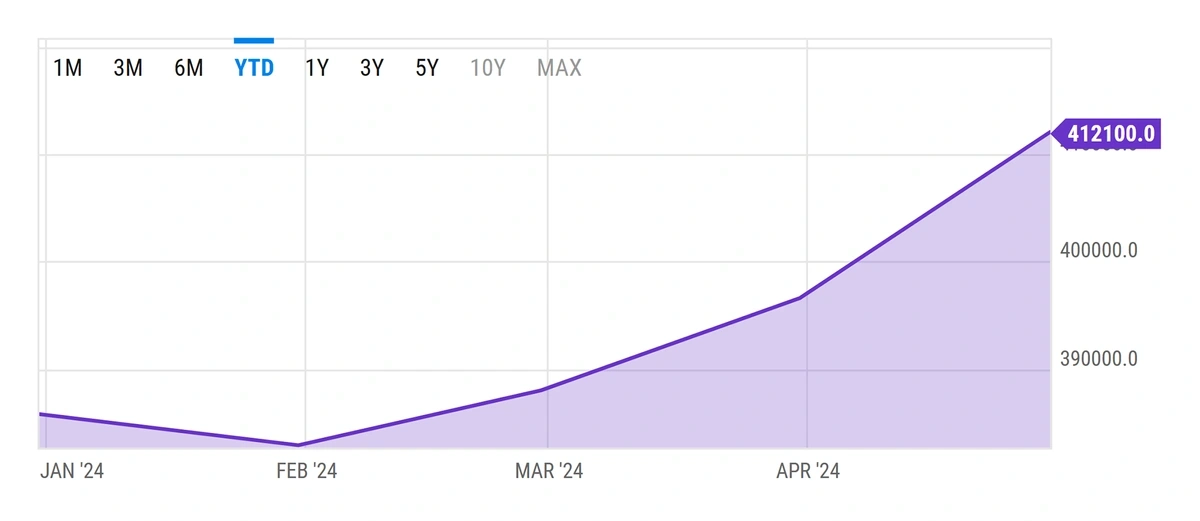

The quest for single-family homes is driving prices skyward, with a staggering 43% increase over the past four years. This surge, while beneficial for existing homeowners, poses significant challenges for first-time buyers. The average US homeowner saw a 9.6% equity increase last year, adding $1.5 trillion collectively. However, a cooling trend is emerging, as median prices declined in early 2024.

2. The Sun Belt’s Rising Popularity

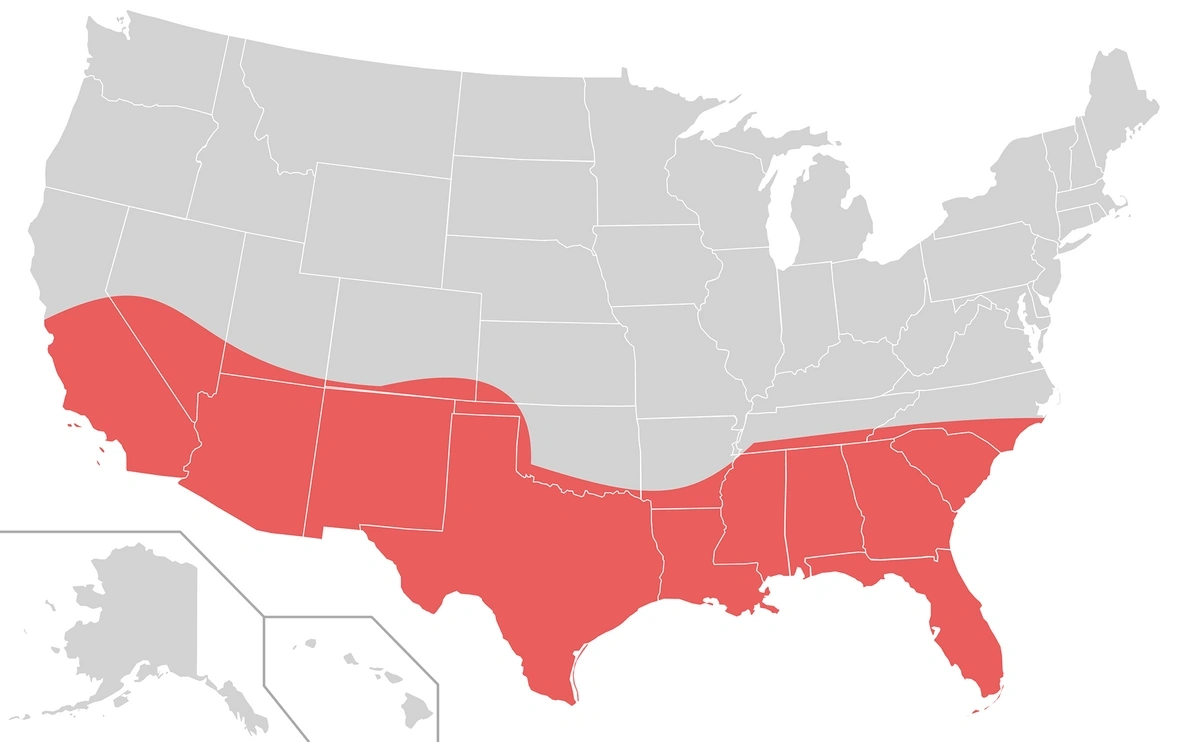

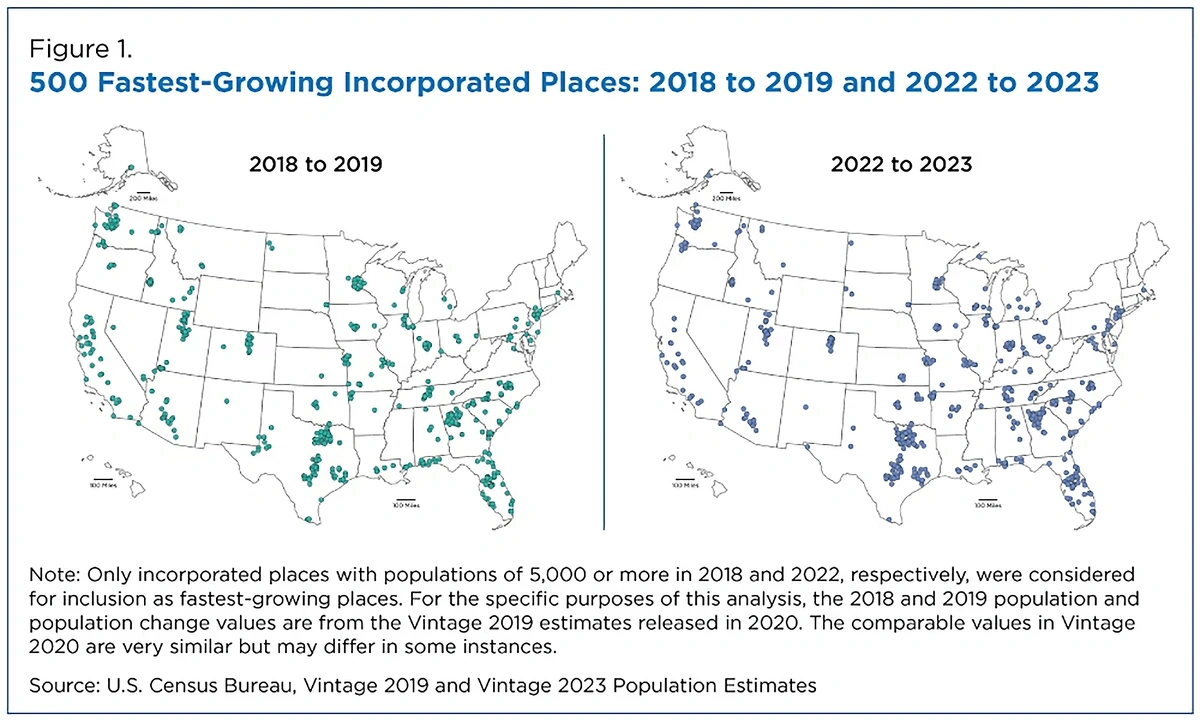

The Sun Belt, stretching from California to North Carolina, is experiencing a population boom. With 80% of the nation’s growth concentrated here, the region’s appeal is undeniable. Lower taxes and affordable housing are drawing both retirees and young professionals. Cities like Dallas and Tampa are now among the top ten US cities for real estate potential.

3. Digital-First House Hunting

The digital transformation of real estate is in full swing. Virtual tours, drone videos, and online staging are revolutionizing how buyers interact with properties. The National Association of Realtors highlights that the internet is the starting point for 41% of buyers, underscoring the shift to digital-first strategies.

4. Movement from Cities to Suburbs

The suburban migration continues, driven by affordability and remote work flexibility. The US Census Bureau reports a significant shift towards smaller cities and suburbs, with “middle neighborhoods” offering a blend of suburban and urban amenities.

5. Single-Family Housing Demand Creates Shortages

The demand for single-family homes is outpacing supply, with a gap of over 7 million homes since 2012. This shortage is exacerbated by millennials entering the housing market and institutional investors purchasing a significant share of available homes.

6. Multi-Generational Living on the Rise

Economic pressures and cultural shifts are driving an increase in multi-generational households. This trend is particularly notable among immigrant communities and is reshaping the housing landscape.7. Mortgage Rates Remain High

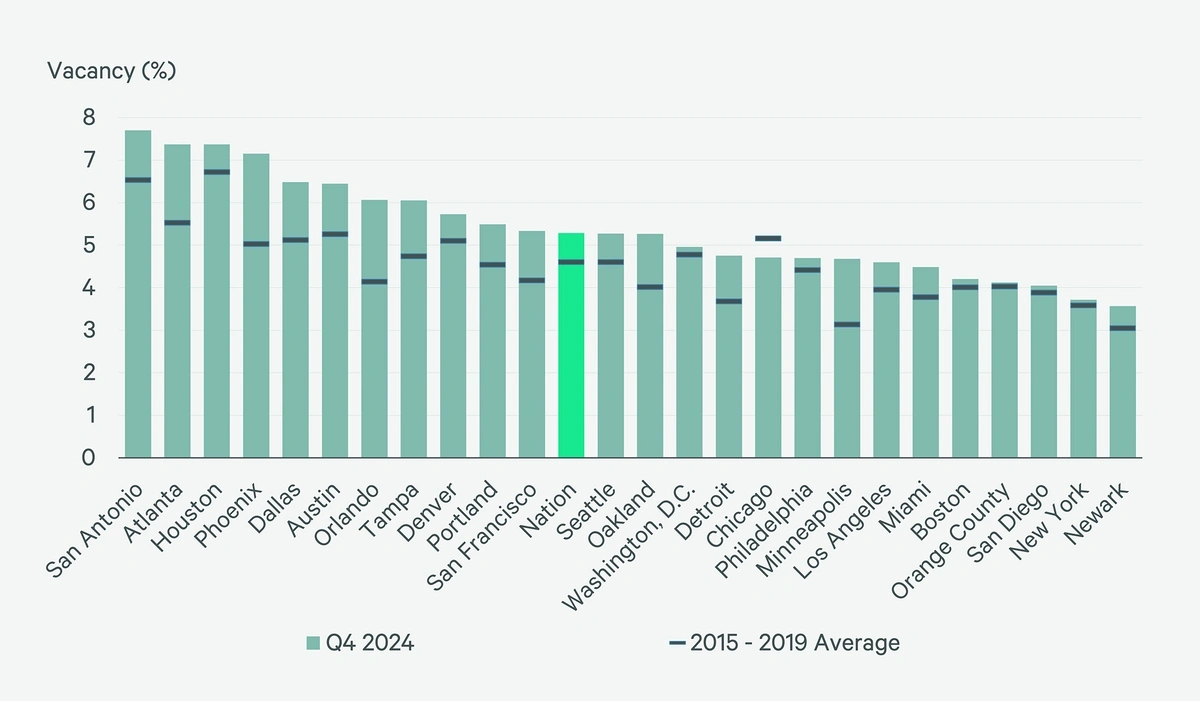

Mortgage rates, which once hit record lows, have climbed to around 7% in 2024. This rise is making home buying more expensive and impacting monthly payments for variable-rate mortgages. Fannie Mae forecasts a slight decrease in rates over the coming years.8. Decline in the Rental Property Market

The rental market in major cities is experiencing a downturn as more people seek homeownership or alternative living arrangements. However, mid-size and smaller cities are witnessing rising rental demand as housing supply struggles to keep up.9. Commercial Real Estate in Flux

Changing work patterns continue to impact commercial real estate. While office vacancies are high, opportunities are emerging in retail and multi-family properties. Moody’s Analytics notes a positive trend in neighborhood shopping centers.

Conclusion As these trends unfold, they present both challenges and opportunities within the real estate market. While high prices and mortgage rates may deter some buyers, the shifts to digital platforms and suburban living offer new avenues for growth and investment. For more insights, explore the full report on Exploding Topics.

The Rapid Evolution of Telehealth Under Medicare

The Rapid Evolution of Telehealth Under Medicare

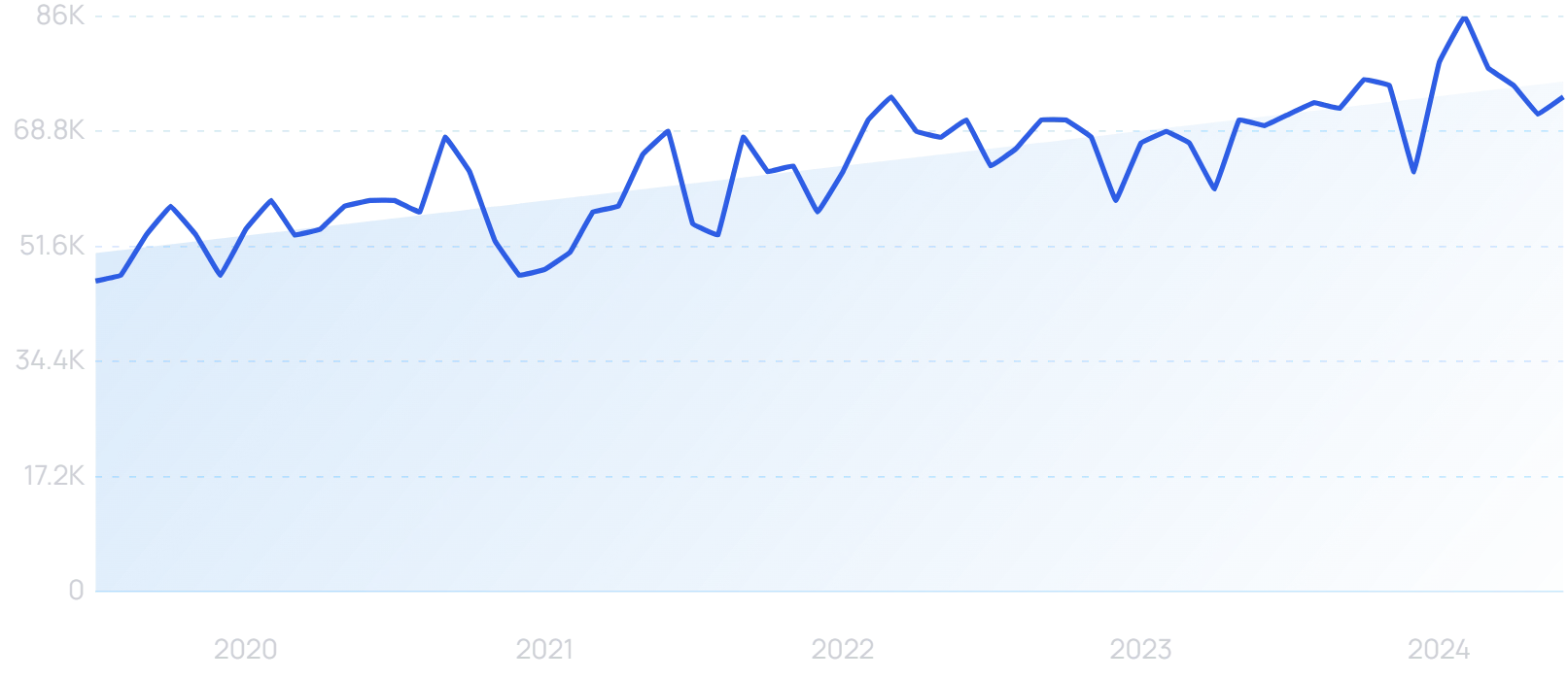

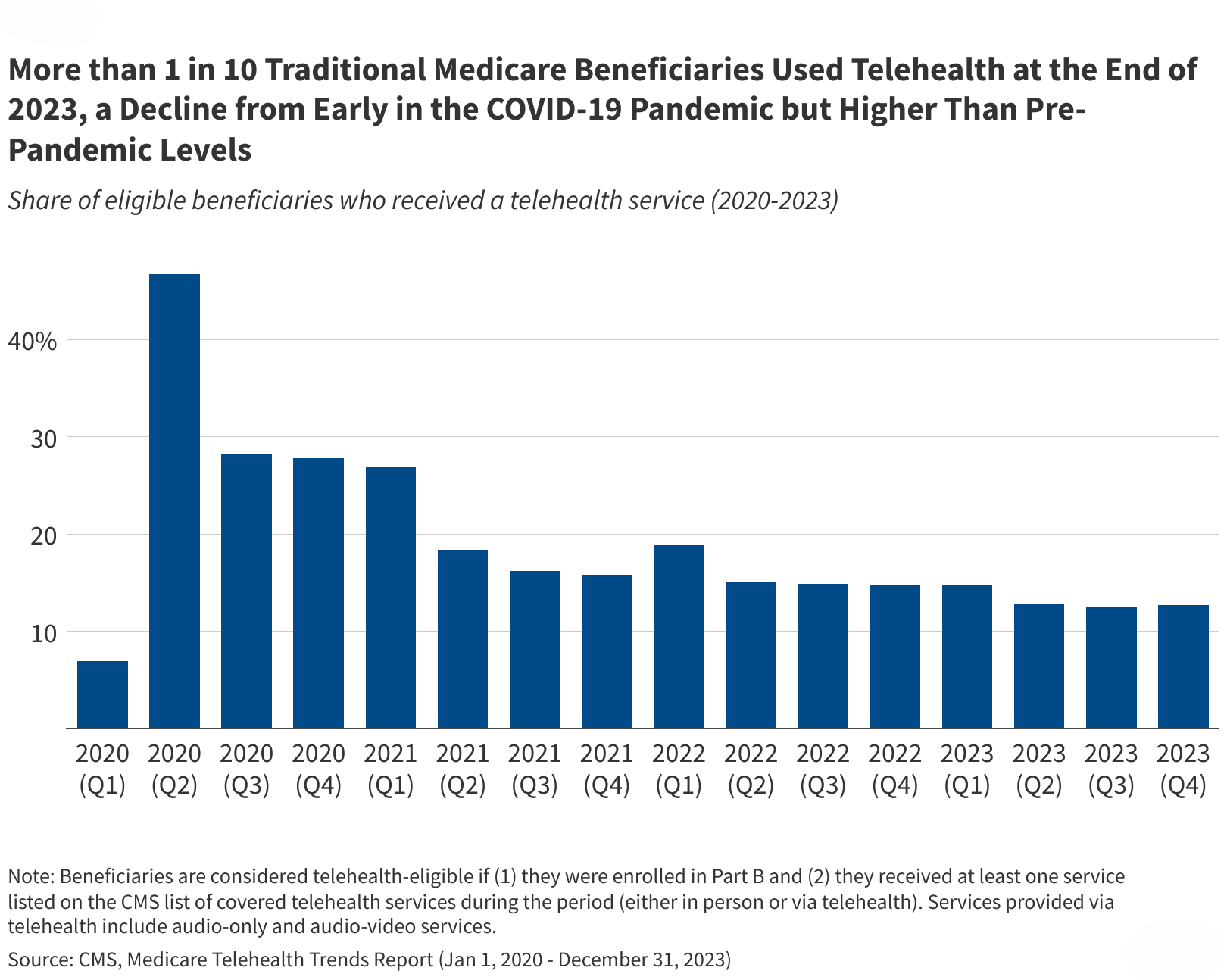

The landscape of healthcare has dramatically shifted in recent years, with telehealth emerging as a key player in the delivery of medical services. This transformation has been particularly evident in the realm of Medicare, where telehealth has seen a significant uptick in utilization. The Kaiser Family Foundation recently highlighted this trend, noting the legislative changes and policy shifts that have facilitated the growth of telehealth services for Medicare beneficiaries.

The landscape of healthcare has dramatically shifted in recent years, with telehealth emerging as a key player in the delivery of medical services. This transformation has been particularly evident in the realm of Medicare, where telehealth has seen a significant uptick in utilization. The Kaiser Family Foundation recently highlighted this trend, noting the legislative changes and policy shifts that have facilitated the growth of telehealth services for Medicare beneficiaries.

The Pandemic’s Role in Telehealth Expansion

Prior to the onset of the COVID-19 pandemic, telehealth was a relatively niche service within Medicare, primarily available to those in rural settings. However, the public health emergency necessitated rapid adaptation, leading to a dramatic increase in telehealth utilization. Temporary measures were introduced, allowing for broader access and coverage, as detailed in the Medicare Telehealth Report. These changes not only increased access but also highlighted the potential of telehealth to address healthcare disparities.Legislative Measures and Future Prospects

With the official end of the COVID-19 public health emergency on May 11, 2023, Congress faces the challenge of deciding the future of these telehealth flexibilities. There is bipartisan support for extending these measures, as seen in proposed legislation like the Preserving Telehealth, Hospital, and Ambulances Act. However, the majority of these flexibilities are set to expire by December 2024, prompting ongoing discussions about the potential for permanent expansion.Demographic Disparities in Telehealth Usage

The adoption of telehealth services varies significantly across different demographics. Urban areas have seen higher rates of telehealth use compared to rural regions, likely due to disparities in broadband access and communication technologies, as noted in a Brookings article. Additionally, usage is higher among Asian, Pacific Islander, and Hispanic beneficiaries, suggesting that telehealth may play a role in improving access to care for certain groups.The Financial Implications

Medicare’s payment structure for telehealth services has also evolved, with current rates matching those of in-person visits. This parity is crucial for encouraging providers to invest in telehealth infrastructure. However, questions remain about the long-term financial impact on the Medicare program. The Congressional Budget Office has estimated the cost of extending telehealth flexibilities, and ongoing research is needed to assess the balance between increased spending and potential savings from reduced emergency department visits and improved medication adherence.Ensuring Program Integrity

As telehealth becomes more entrenched in the Medicare landscape, concerns about program integrity and potential fraud have arisen. Despite some high-profile cases, investigations have shown minimal evidence of widespread misuse. Recommendations from the MedPAC include increased scrutiny of outlier billing patterns and in-person visit requirements for high-cost services.In conclusion, while telehealth has proven to be a valuable tool for expanding access to healthcare, its future within Medicare remains uncertain. The ongoing legislative discussions will determine whether the current flexibilities will become a permanent fixture, shaping the healthcare landscape for years to come.

The Rise of Central Bank Digital Currencies: Reshaping Global Finance

Understanding the Emergence of Central Bank Digital Currencies

Central bank digital currencies (CBDCs) are reshaping the financial landscape, emerging as a pivotal innovation in the digital age. Unlike decentralized cryptocurrencies, CBDCs are digital forms of a nation’s fiat currency, issued and regulated by central banks. This distinction ensures stability and trust, akin to traditional money.Exploration and Implementation

Around the globe, countries are actively exploring the integration of CBDCs into their financial systems. This forward-thinking move aims to enhance financial inclusion, streamline cross-border transactions, and provide a stable alternative to the volatile cryptocurrency market. Nations such as Jamaica, Nigeria, and The Bahamas have already implemented CBDCs, signaling a new era in digital finance. These currencies maintain the core attributes of fiat money while leveraging the efficiencies of distributed ledger technologies.:max_bytes(150000):strip_icc()/terms_c_central-bank-digital-currency-cbdc_FINAL-671aefb2905b407583007d63fa46e49d.jpg)

Key Advantages of CBDCs

CBDCs offer a myriad of benefits. For consumers, they promise enhanced convenience and security in financial transactions, reducing dependence on physical cash. Central banks, meanwhile, gain a powerful tool to implement monetary policies, manage inflation, and establish direct connections with the public. Additionally, CBDCs can bolster the global standing of a nation’s currency, exemplified by the enduring influence of the U.S. dollar.Challenges and Considerations

The path to widespread CBDC adoption is not without its challenges. Concerns about privacy, cybersecurity, and the impact on existing financial systems are paramount. These issues must be addressed to prevent potential destabilization of current monetary frameworks. As highlighted in the original article, the balance between innovation and stability is crucial.The Way Forward

Despite these hurdles, the move towards digital currencies marks a transformative phase for global economies. As more countries embark on pilot programs and develop the necessary technological infrastructure, the financial landscape continues to evolve. This evolution promises a more inclusive and efficient future for transactions and economic operations worldwide.For a deeper dive into the intricacies of CBDCs and their global impact, visit the comprehensive exploration available at Investopedia. “`

Navigating Real Estate Tactics: Protecting Your Interests

Tricks Real Estate Agents Play

Real estate transactions often involve significant sums of money, making them prime targets for unscrupulous tactics. Here are some of the most common strategies that both buyers and sellers should watch out for:1. Convincing Homeowners to Sell Off Market

Some agents may persuade homeowners to sell their property off market. This tactic is often aimed at properties that need updates or renovations. By convincing the seller to avoid listing the property, the agent can facilitate a private sale to an investor, often at a price substantially lower than market value—sometimes 20% to 40% less. This allows the investor to reap the profits that rightfully belong to the seller.2. Overpromising on the Listing Price

Agents may exaggerate the potential selling price of a property to secure a listing. This can lead to homes languishing on the market, eventually selling for less than their true value. Sellers should be cautious and seek multiple opinions on their property’s worth.3. Underquoting

Conversely, underquoting involves listing a property at a price much lower than its expected selling price to attract more buyers. This can create a competitive bidding environment, driving up the final sale price. Buyers should be aware that initial quotes might be 10% to 25% below the actual selling price.4. Vague Pricing

Some agents use vague pricing to gauge buyer interest and encourage competitive bidding. This tactic can mislead buyers, who should insist on clear and transparent pricing information.5. Tactical Fear of Loss

Creating a sense of urgency is another common strategy. Agents may suggest that other buyers are interested in the property, triggering a Fear of Missing Out (FOMO) response. Buyers should remain calm and evaluate their options carefully to avoid making hasty decisions.6. Inflated Rental Estimates

Agents might provide overly optimistic rental income projections to make a property appear more attractive to investors. Buyers should conduct their own research to verify these estimates and avoid relying solely on the agent’s figures.7. Pre-Auction Offers

Encouraging pre-auction offers can be a tactic to gauge a buyer’s willingness to pay. Buyers should be cautious about revealing their maximum price too early and understand the vendor’s motivations.8. Rental Guarantees

Offering a rental guarantee can be a red flag, indicating potential issues with the property or its market demand. Buyers should question the necessity of such guarantees and investigate further.9. Emotional Appeal

Agents may use emotional tactics to connect with buyers, making them more likely to overlook practical considerations. It’s important for buyers to focus on the property’s value and suitability rather than getting swayed by emotional pitches.The Importance of Choosing the Right Agent

Selecting a trustworthy real estate agent is crucial to avoid falling victim to these tactics. Look for agents with the right qualifications, recent experience, outstanding reviews, and a lower-than-average number of dual agency transactions. Ensure there is an easy way to cancel the agent agreement if needed.Advice for Buyers and Sellers

- Do Your Research: Whether buying or selling, conduct thorough research on property values, market trends, and agent reputations.

- Seek Multiple Opinions: Don’t rely on a single agent’s assessment. Get multiple evaluations to ensure a fair understanding of the property’s worth.

- Stay Informed: Educate yourself about common real estate practices and tactics to make informed decisions.

- Engage Professionals: Consider hiring a buyer’s agent or valuer to provide additional protection and ensure a fair deal.

Additional Insights from Resources

- Triple Commission Proposal: Be wary of agents who might be influenced by investors offering higher commissions to secure off-market deals.

- Hidden Offers: Some agents may hide competing offers to favor buyers they have personal connections with.

- Manipulating Offer Timelines: Delayed responses to offers can be a tactic to create pressure or manipulate negotiations.

- Bait Pricing: Listing properties at low prices to generate interest, only to drive the sale price much higher.

- Phantom Offers: Fabricating non-existent offers to pressure buyers into higher bids or quicker decisions.

- Pressure Tactics: High-pressure sales tactics may create a false sense of urgency, pushing buyers into hasty decisions.

- Omitting Crucial Information: Withholding important property details can leave buyers unaware of potential problems.

Global Surge in Wearable Healthcare Devices Market

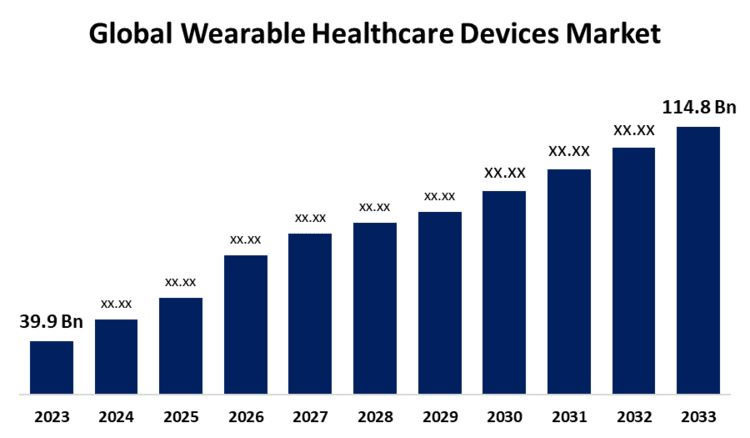

Global Surge in Wearable Healthcare Devices Market

The global wearable healthcare devices market is on a remarkable growth trajectory, projected to escalate from USD 39.9 billion in 2023 to an impressive USD 114.8 billion by 2033. This surge, at a compound annual growth rate (CAGR) of 11.15%, underscores the increasing demand for proactive health management and advancements in sensor technology.Wearable healthcare devices, including smartwatches and trackers, have become essential tools for individuals eager to monitor and manage their health proactively. These devices are more than just fitness trackers; they offer a multitude of functions such as heart rate monitoring, smartphone notifications, and integration with third-party applications. However, the continuous health monitoring they provide raises significant concerns about the security and privacy of sensitive health data.

Market Segmentation and Trends

The market is categorized by product types, applications, and distribution channels. Smartwatches are anticipated to lead the product segment, while the general health and fitness application segment is expected to dominate due to the growing focus on real-time health monitoring. E-commerce emerges as the leading distribution channel, facilitating the availability of these devices through digital platforms.Geographical Insights

North America holds the largest market share, driven by favorable reimbursement laws, high per capita spending on advanced technologies, and significant investments by market players. Meanwhile, the Asia-Pacific region is expected to experience the fastest growth, propelled by initiatives to reduce patient hospital stays in countries like China, Japan, and India.Competitive Landscape

The competitive landscape features major vendors such as Dr. Reddy’s Laboratories Ltd, Samsung Electronics, Huawei Technologies, Fitbit, and Apple. These companies continue to innovate and collaborate, fueling the market’s expansion. A notable development is the introduction of Nerivio, a non-invasive wearable for managing migraines, by Dr. Reddy’s Laboratories in Germany, marking its expansion in the European digital therapy market.For those interested in delving deeper, the complete report and related documents are accessible through the following link. This information is crucial for stakeholders aiming to strategize and capitalize on burgeoning opportunities within the wearable healthcare devices marketplace.

Generative AI: Transforming the Real Estate Landscape

In the ever-evolving world of real estate, the advent of Generative AI is set to redefine the roles of industry professionals. As reported by Forbes, this transformative technology is not just a futuristic concept but a present-day reality poised to automate routine tasks and enhance property analysis.

The Impact on Real Estate Professionals

Generative AI is revolutionizing the way real estate agents, appraisers, and brokers operate. By automating tasks such as creating property descriptions and analyzing market trends, AI tools are freeing up professionals to focus on strategic, high-value responsibilities. This shift is expected to generate up to $180 billion in value for the industry, according to a McKinsey report.

Automation and Efficiency

Real estate agents can now leverage AI to quickly generate personalized property listings using computer vision to analyze photographs and floor plans. In addition, chatbots are handling customer service inquiries, scheduling tours, and even assisting with mortgage applications. This level of automation not only enhances efficiency but also allows professionals to dedicate more time to building client relationships.

Ethical Considerations

While AI brings numerous advantages, it also introduces ethical challenges. Professionals must ensure that AI usage complies with local laws and regulations, particularly when it comes to marketing and data protection. Transparency is key, especially when AI-generated visuals are used in marketing properties. Real estate agents must clearly communicate to clients when they are viewing AI-generated content.

The Future of Real Estate in an AI-Driven World

As AI continues to handle routine tasks, the demand for professionals with strong communication and problem-solving skills is set to rise. Those who can effectively integrate AI tools into their workflows will likely emerge as industry leaders. While some entry-level roles may be at risk, new opportunities such as prompt engineering and technology integration are expected to arise.

The real estate industry, driven by competition, will see AI become an indispensable part of the professional toolkit. Those who adapt and leverage these technologies are likely to find themselves at the forefront of the industry.

AI Assistance in Radiology: A Nuanced Tool for Diagnostic Precision

AI Assistance in Radiology: A Nuanced Tool for Diagnostic Precision

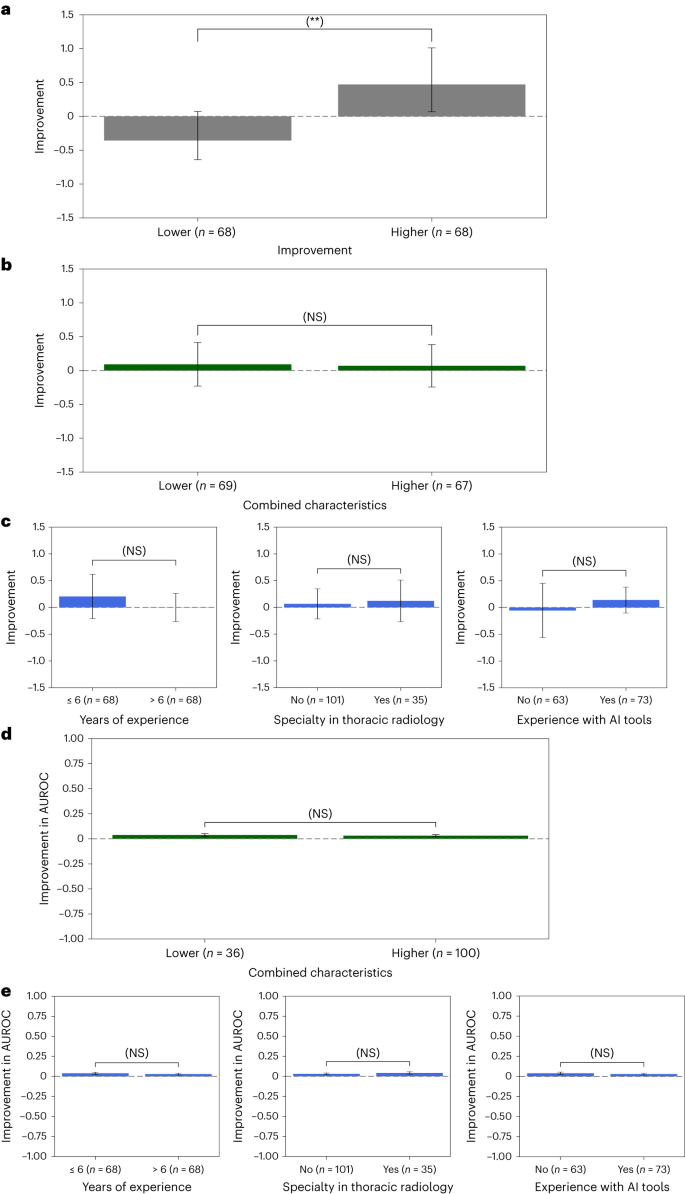

In a groundbreaking study published by Nature on March 19, 2024, researchers have unveiled the complex dynamics of artificial intelligence (AI) assistance in radiology, emphasizing the need for personalized strategies to harness its full potential. The study, titled “Heterogeneity and Predictors of the Effects of AI Assistance on Radiologists,” delves into how AI impacts diagnostic accuracy across a diverse group of clinicians.The research, conducted on 140 radiologists performing 15 diagnostic tasks, highlights significant variability in AI’s effectiveness. This variation underscores the necessity for tailored approaches in clinical settings to optimize AI’s benefits. The study’s findings are pivotal, as they suggest that a one-size-fits-all approach to AI assistance in healthcare may not be effective.

One of the critical insights from the study is the heterogeneous nature of AI’s impact, which varies significantly based on individual clinician characteristics and the quality of AI predictions. This variability suggests that while some radiologists may experience enhanced diagnostic accuracy with AI assistance, others might not benefit as much, or could even be hindered by it.

The study is part of a growing body of research exploring AI’s role in healthcare. For instance, earlier works like CheXNet and Deep Learning for Chest Radiograph Diagnosis have paved the way for understanding AI’s capabilities in medical imaging. This latest research builds on these foundations, offering a more nuanced view of AI’s role in clinical practice.

Key Takeaways:

- AI assistance in radiology shows significant variability in effectiveness across different radiologists.

- Individualized strategies are crucial for optimizing AI’s benefits in clinical settings.

- Quality of AI predictions plays a significant role in determining its impact on diagnostic accuracy.

The study’s findings are a call to action for healthcare providers and AI developers to collaborate closely. By understanding the factors that influence AI’s effectiveness, they can develop more refined tools that cater to the unique needs of each clinician. This approach not only enhances diagnostic precision but also fosters greater trust and acceptance of AI in healthcare.

For more detailed insights, you can access the full study on Nature’s website.

Enroll in Cameron Academy’s 63-Hour Pre-License Real Estate Course Starting December 2024

If you are seeking to embark on a career in the real estate industry, the Cameron Academy offers a comprehensive in-person Florida Real Estate Sales Associate 63-Hour Pre-License Course starting on December 2, 2024. This course is meticulously designed to equip aspiring real estate professionals with the skills and knowledge necessary to thrive in Florida’s dynamic real estate market.

Course Schedule & Location

- Dates: December 2nd to December 13th, 2024

- Times: 5 PM to 10 PM EST

- Days: Monday to Friday

- Location: 7009 Dr. Phillips Blvd #110, Orlando, Florida 32819

The course will be held at Cameron Academy’s main campus, offering a prime location for learners to immerse themselves in the educational experience.

Course Features

This in-person class provides a comprehensive curriculum covering essential real estate topics. Participants will benefit from:

- Expert instructors with extensive industry experience

- Interactive study materials that enhance learning

- Classroom textbook available in both physical and digital formats

- An online final exam requiring a 70% passing grade

These features are designed to ensure participants gain a robust understanding of real estate fundamentals, preparing them for successful careers.

Enrollment Benefits

Enrolling in Cameron Academy’s pre-license course comes with numerous advantages:

- Receive an instant certificate upon course completion

- Access to a wealth of study materials and resources

- Optional background check and fingerprinting services available at an additional cost

These benefits are aimed at smoothing the transition from education to professional practice, offering support at every step.

Eligibility Requirements

Prospective students must meet the following criteria:

- Be at least 18 years old

- Possess a high school diploma or equivalent

- Have a valid Social Security number

- Exhibit good character and a reputation for fair dealing

Ensuring these requirements are met is crucial for a successful enrollment process.

Why Choose Cameron Academy?

Cameron Academy stands out as Florida’s top-rated real estate school, boasting over 3,000 5-star reviews. The academy is renowned for its flexible delivery methods and outstanding customer service, making it the ideal choice for aspiring real estate professionals.

For those interested in joining this esteemed institution, enrollment is now open. Secure your spot early, as spaces are limited. Visit our event page for more information and to register.

For further inquiries, contact Cameron Academy at 220-CAMERON (226-3766) from Monday to Friday, 9 AM to 5 PM.

Additional Resources and Support

For more details on course offerings, FAQs, and additional support, explore our website or reach out directly through our contact page. Our dedicated support team is ready to assist you in taking the first step towards mastering real estate with confidence and expertise.

Visit the Cameron Academy’s Website for a broader overview of all real estate courses offered, including the December 2nd class.

Advice for Aspiring Real Estate Professionals

Entering the real estate industry can be a rewarding venture. Here are some tips to help you succeed:

- Network: Building connections within the industry is vital. Attend events and engage with peers and mentors.

- Stay Informed: Keep up with market trends and changes in real estate laws and regulations.

- Continuous Learning: Consider further certifications and courses to expand your knowledge and skills.

By following these suggestions, you can enhance your career prospects and establish yourself as a competent and successful real estate professional.

Exploring the Future: AI Projects for All Levels

Exploring the Future: AI Projects for All Levels

In a world where technology is rapidly evolving, Artificial Intelligence (AI) is at the forefront, reshaping industries and altering our everyday lives. Recently, Simplilearn published an insightful article detailing the top 30 AI project ideas for 2025, offering a comprehensive guide for enthusiasts from beginners to advanced practitioners.Impact of AI Across Industries

AI’s transformative power is evident across multiple sectors. In healthcare, AI-driven diagnostics and personalized medicine are revolutionizing patient care. The financial industry benefits from enhanced fraud detection and risk assessment capabilities. Manufacturing sees improvements through predictive maintenance and optimized production processes, while transportation is becoming safer with autonomous vehicles and intelligent traffic systems. Education is also being personalized, making learning more accessible.

However, AI’s influence extends beyond industry-specific applications. It is reshaping the job market, demanding new skills and creating innovative opportunities. This technological shift brings with it ethical and social concerns, such as privacy and job displacement, necessitating careful management and regulation.

Beginner to Advanced AI Projects

For those eager to dive into AI, the article outlines a series of projects that cater to different skill levels. Beginners can start with projects like a Spam Email Detector or Sentiment Analysis of Product Reviews. These projects introduce fundamental AI concepts using machine learning algorithms like Naive Bayes.

Intermediate projects such as a Chatbot for Customer Service or an Image Classification System allow developers to delve deeper into natural language processing and computer vision. Meanwhile, advanced projects like an Autonomous Driving System or AI-Based Medical Diagnosis System require a sophisticated understanding of AI and machine learning algorithms.

Building a Career in AI

Embarking on a career in AI involves a blend of education, practical experience, and continuous learning. The article suggests starting with a strong foundation in mathematics and computer science, followed by engaging in practical projects and participating in competitions on platforms like GitHub. Specializing in areas like robotics or natural language processing can further enhance one’s career prospects.

For those looking to formalize their education, Simplilearn offers a Professional Certificate Program in AI and ML in collaboration with Purdue University, designed to equip learners with the necessary skills to thrive in this dynamic field.

Conclusion

Delving into AI projects is a thrilling journey of creativity and development. For those seeking to deepen their understanding and mastery of AI, Simplilearn’s Post Graduate Program in AI and Machine Learning offers a comprehensive curriculum, real-world projects, and practical learning experiences.

FAQs: Navigating the AI Landscape

What is the difference between machine learning and deep learning?

Machine learning, a subset of AI, enables computers to learn from data. Deep learning, a further specialization, uses multi-layered neural networks for more complex pattern recognition.Can AI replace human jobs, or will it create new opportunities?

While AI can automate tasks, potentially displacing jobs, it also creates roles in development, maintenance, and oversight, emphasizing the need for skills adaptation.How to learn AI for free?

Simplilearn’s SkillUp resources offer free learning opportunities for those seeking to enhance their AI knowledge.AI’s Transformative Role in Healthcare: The 2023 Shift in Patient Diagnostics

The Dawn of AI-Driven Diagnostics

AI has not only automated certain diagnostic tasks but, more importantly, augmented the abilities of medical professionals in making informed decisions. By swiftly analyzing vast amounts of data, AI assists in identifying diseases in their early stages, allowing for prompt and accurate interventions that greatly affect patient outcomes.Case Studies and Real-World Applications

In 2024, AI diagnostic tools, especially in the realm of medical imaging, have become remarkably precise. Such tools, leveraging advanced machine learning algorithms, have been recognized with numerous FDA approvals, particularly in radiology. The capability of AI to handle both structured and unstructured data has revolutionized healthcare, making AI indispensable in this field.Impact on Healthcare Delivery

The implications of AI integration in healthcare extend beyond mere diagnostics, redefining the essence of patient care itself. AI enables more personalized and effective treatment regimens, greatly enhancing patient experiences. By analyzing comprehensive patient data, AI facilitates personalized care, transcending the traditional one-size-fits-all approach and ensuring that treatments are tailored to individual needs.Personalization at the Forefront

One remarkable aspect of AI’s application in healthcare is its ability to enhance the accuracy of treatment plans. Through pattern recognition and data correlation, AI predicts the most effective treatments, minimizing trial and error. This significant improvement saves both time and resources in healthcare delivery.Real-world examples in 2024 illustrate the success of AI-driven treatment plans, particularly in oncology, where AI models integrate diverse types of clinical data. These models precisely predict treatment outcomes and personalize cancer care, advancing precision medicine.

Navigating Ethical Complexities

However, with these advancements come challenges, notably ethical and privacy concerns. As AI technology continues to evolve, issues surrounding data privacy, algorithmic bias, and the moral implications of AI decisions need addressing. Fairness, transparency, and respect for patient data confidentiality are crucial.Data Privacy and Security

With AI systems processing vast amounts of personal health data, safeguarding this information is critical. The industry faces the challenge of protecting patient data while harnessing AI’s potential for improving healthcare outcomes.Algorithmic Bias and Fairness

There’s an ongoing concern about biases in AI algorithms, which can stem from skewed data sets or flawed programming. Ensuring these algorithms are as objective and unbiased as possible is crucial for equitable healthcare delivery.Balancing AI and Human Judgment

Balancing AI with human judgment remains vital, ensuring that AI acts as a valuable tool to support, rather than replace, the expert decisions of medical professionals. As the future of AI in healthcare looks promising, ongoing efforts are essential to address ethical challenges, ensuring AI remains advantageous for all stakeholders in healthcare.Looking Ahead

The future of AI in healthcare is bright, but it necessitates a collaborative effort to address these ethical considerations. As AI continues to evolve, so too must approaches to managing these challenges, ensuring AI remains a beneficial tool for all in healthcare.About the Author: Dr. Liz Kwo, the chief commercial officer of Everly Health, is a recognized entrepreneur in healthcare, a practicing physician, and a faculty lecturer at Harvard Medical School. Her academic credentials include an MD from Harvard Medical School, an MBA from Harvard Business School, and an MPH from the Harvard T.H. Chan School of Public Health.

Unveiling the Future: Technology Trends to Watch in 2025

Unveiling the Future: Technology Trends to Watch in 2025

In an ever-evolving digital landscape, staying ahead of the curve is not just an option but a necessity. As we edge closer to 2025, the technological horizon is brimming with innovations poised to redefine industries and reshape our daily lives. According to a recent article on Simplilearn.com, 25 emerging technology trends are set to dominate the future, urging IT professionals to adopt a mindset of continuous learning and adaptation.Generative AI leads the pack as a transformative force, promising to revolutionize content creation across various sectors. With advancements in models like GPTs, the potential applications are vast, from design automation to interactive experiences. For those keen on diving deeper, Simplilearn offers an Applied Generative AI Specialization.

Quantum Computing is another game-changer, leveraging quantum mechanics to solve complex problems beyond the reach of classical computers. Its implications in cryptography and drug discovery are just the tip of the iceberg. Learn more about this groundbreaking technology in the Quantum Computing Tutorial.

The 5G Expansion continues to gain momentum, enabling transformative technologies like IoT and augmented reality by providing faster data speeds and more stable connections. This expansion is crucial for real-time communications, paving the way for innovations such as autonomous vehicles.

Virtual Reality (VR) 2.0 and Augmented Reality (AR) are set to offer even more immersive experiences, with applications ranging from gaming to education. As hardware evolves, these technologies are expected to become more integrated into our daily lives, enhancing how we interact with the digital world.

The Internet of Things (IoT) plays a pivotal role in smart cities, optimizing everything from traffic management to energy use. IoT technology is essential for managing urban complexities and improving residents’ quality of life.

In agriculture, Biotechnology is making strides with techniques like CRISPR, creating crops that are more resilient to environmental stresses. This is crucial for adapting to climate change and ensuring food security.

The journey doesn’t end here. The article delves into other significant trends, including Autonomous Vehicles, Blockchain Beyond Crypto, Edge Computing, and Personalized Medicine. Each of these technologies holds the promise of reshaping industries and creating new opportunities.

Preparing for Tomorrow’s Job Market

With these technological advancements come new career opportunities. By 2025, roles such as AI Specialist, Quantum Computing Engineer, and 5G Network Engineer will be in high demand. The evolving landscape highlights the importance of acquiring relevant skills to thrive in the future job market.Conclusion

As we navigate through these technological shifts, it becomes clear that the future is not just about adopting new tools but embracing a mindset of constant evolution. By staying informed and adaptable, professionals can position themselves at the forefront of innovation, ready to tackle the challenges and opportunities that lie ahead.Understanding the Legal and Ethical Challenges AI Poses in Oncology

Understanding the Legal and Ethical Challenges AI Poses in Oncology

The field of oncology is undergoing a transformation, driven by the rapid integration of artificial intelligence (AI) technology. These advancements promise unprecedented improvements in cancer detection, personalized treatment strategies, and patient support. However, as the integration of AI into oncology progresses, a myriad of legal and ethical challenges emerges.AI in Diagnosis and Treatment AI tools have been instrumental in enhancing the analysis of medical imaging data, such as MRI scans, CT scans, and mammograms. These algorithms are adept at identifying subtle patterns that might elude human observation, potentially leading to faster and more accurate cancer detection. AI also plays a crucial role in treatment delivery and decision-making, particularly in radiation therapy and immunotherapy regimen design.

Yet, the use of AI in diagnosis raises significant legal questions. Traditionally, human physicians are not held strictly liable for incorrect diagnoses or treatments if their conduct meets the standard of care. However, defining a legal standard for AI-related errors remains uncertain. Some propose a strict liability standard, holding manufacturers accountable for defects without needing to prove fault, while others suggest alternative product liability standards.

Legal Standards and Liability

The complexity of applying legal standards to AI tools is compounded by their evolving nature. AI algorithms often change as they process more data, challenging traditional product liability frameworks. Different jurisdictions are adopting varied approaches to liability, with the European Commission discussing a proposed AI Liability Directive for high-risk AI systems.

Legal Standards and Liability

The complexity of applying legal standards to AI tools is compounded by their evolving nature. AI algorithms often change as they process more data, challenging traditional product liability frameworks. Different jurisdictions are adopting varied approaches to liability, with the European Commission discussing a proposed AI Liability Directive for high-risk AI systems.

Patient Counseling and Ethical Considerations Beyond diagnostics, AI is also being explored for patient counseling. Studies have evaluated the use of AI chatbots for cancer-related inquiries, with mixed results. While these chatbots can provide helpful information, they are not yet fully ready for patient-facing roles. A recent study found that AI chatbots were as effective as human counselors in educating breast cancer patients about genetic dimensions, suggesting potential in freeing up human resources for more intensive counseling.

However, using AI in patient counseling introduces critical ethical issues, particularly regarding data security and informed consent. Patients must be aware they are receiving advice from an AI system, and there must be safeguards against harmful advice.

Future Directions and Challenges The integration of AI into oncology presents long-term challenges, including ensuring that AI enhances rather than diminishes professional skills. Oncology professionals must be trained to effectively use AI tools, much like adapting to electronic medical records in previous eras.

In conclusion, while AI offers promising advancements in oncology, its legal and ethical implications are evolving and uncertain. Understanding these complexities is crucial to ensuring that AI serves as a tool to augment human expertise and improve patient outcomes. For more details, refer to the original article on The ASCO Post.

Transforming Healthcare: AI Innovations in Diagnosis, Treatment, and Hospital Management

In healthcare, AI tools excel at analyzing extensive patient data, from health history to lifestyle choices. By leveraging this information, healthcare practitioners can create highly customized treatment plans tailored to individual needs, resulting in improved healthcare outcomes.

AI in Aesthetic Medicine

AI’s potential is particularly pronounced in aesthetic medicine. The introduction of AI-powered image analysis tools has enabled dermatologists and clinicians to diagnose and treat skin conditions with remarkable precision. These tools can accurately identify facial features and skin conditions, facilitating more effective clinical decisions. A notable tool is Crisalix’s 3D imaging system, which allows cosmetic surgeons to simulate surgery outcomes for refined planning and decision-making. Continuous monitoring of skin health through AI offers enhanced patient care by providing data-driven insights. For more on this, explore How AI Is Revolutionizing Aesthetics.AI Algorithms for Skin Disease Diagnosis

Researchers at the Technical University of Munich have developed an AI algorithm, FusionM4Net, to improve the diagnosis of skin diseases and cancer. This algorithm combines visual data and meta-data, offering heightened accuracy in classifying skin lesions, thus assisting less experienced physicians in reducing human error. Discover more about this innovation at A New AI Algorithm to Help Doctors Spot Skin Diseases.AI in Immunotherapy Discovery

AI is also making waves in immunotherapy discovery through platforms like Evaxion Biotech’s AI-Immunology™. This platform synthesizes predictive models for next-generation therapies by simulating the human immune system. Its integrated AI models, such as PIONEER™, EDEN™, RAVEN™, and ObsERV™, are pivotal in crafting novel personalized cancer vaccines and addressing infectious diseases. For a deeper dive, refer to Evaxion’s AI-Immunology™: Transforming Vaccine and Immunotherapy Discovery.AI and Hospital Waste Management

Furthermore, AI’s role extends to optimizing hospital operations, as seen in waste management innovations where AI-powered solutions automate and enhance waste segregation practices, ensuring compliance with rigorous regulatory standards. For more insights, visit How Can AI Help With Hospital Waste Management?.These AI-driven breakthroughs herald an exciting era in healthcare, promising a future where patient care is increasingly precise, personalized, and efficient. For a more comprehensive exploration of these pioneering advancements, refer to the full articles linked above.

2024 Election: Potential Shifts in Banking Regulation

Regulatory Changes and Legal Challenges

The **financial sector** is bracing for a wave of legal challenges, as evidenced by **JPMorgan Chase’s threat of litigation** against the **Consumer Financial Protection Bureau (CFPB)**. Similarly, the **Financial Technology Association’s lawsuit** against the **CFPB’s interpretive rule** on **buy-now-pay-later services** highlights growing tensions.Impact of the Elections on the Banking Sector

The **economic philosophy** of the incoming administration could profoundly influence regulation. A **Republican majority** in the Senate might accelerate regulatory nominations, impacting the pace and nature of **financial oversight**. However, if Congress remains closely divided, significant legislative changes appear unlikely.

Supreme Court Rulings and Their Implications

Recent **Supreme Court decisions** have reshaped the regulatory landscape. These rulings, such as **Loper Bright v. Raimondo**, which ended deference to federal agency expertise, could embolden banks to challenge regulators more frequently.The Role of CFPB and Potential Changes

The **CFPB**, under Director **Rohit Chopra**, remains a focal point of regulatory activism. Should former President **Trump** return to office, Chopra’s tenure could end, leading to potential reversals of current policies. Conversely, a **Harris administration** could maintain the status quo, albeit with possible shifts in leadership.

Banking Industry’s Response

Amid these uncertainties, **industry leaders** are advised to stay agile and engaged with **trade associations**. Whether under a **Harris or Trump administration**, the industry must navigate a complex regulatory environment influenced by evolving political dynamics.How AI Is Revolutionizing Patient Care in Hospitals

How AI Is Revolutionizing Patient Care in Hospitals

In a world where technology is reshaping every facet of our lives, healthcare is no exception. The integration of artificial intelligence (AI) into hospital systems is not just a futuristic concept but a present-day reality. According to a recent article by Netguru, AI is transforming patient care, making it more accessible, efficient, and personalized.AI’s influence in healthcare is vast and varied, spanning from diagnostics to personalized treatment plans and even hospital administration. Imagine a world where hospitals operate at peak efficiency, patient care is tailored to individual needs, and healthcare providers collaborate seamlessly. This is the world AI is creating.

Enhancing Patient Experience with AI

AI is revolutionizing the way patients experience healthcare by introducing innovations like AI-assisted scheduling, virtual health assistants, and remote monitoring. These advancements reduce wait times and improve overall patient satisfaction. As highlighted in the Netguru article, AI-assisted patient scheduling uses algorithms to analyze patient data and optimize appointment times, enhancing patient flow in hospitals.AI-Powered Medical Diagnostics

The power of AI extends to medical diagnostics, significantly improving the accuracy and speed of identifying medical conditions. AI-driven image analysis and radiology, for instance, employ advanced machine learning techniques to interpret medical images with higher precision. This transformation is particularly beneficial in detecting early signs of diseases, allowing for faster intervention and treatment.AI-Driven Personalized Treatment Plans

AI is pivotal in developing personalized treatment plans. By leveraging precision medicine, drug dosing and monitoring, and predictive analytics, AI creates tailored treatment plans based on individual patient data. This approach not only improves patient outcomes but also reduces healthcare costs by eliminating unnecessary treatments and tests.AI Applications in Hospital Administration

Beyond patient care, AI is streamlining hospital administration processes. From revenue cycle management to clinical documentation improvement and supply chain optimization, AI is enhancing operational efficiency. For instance, AI-driven revenue cycle management automates billing processes, reducing financial waste and ensuring that hospitals can focus on delivering high-quality patient care.Overcoming Challenges in Implementing AI

While AI holds immense potential, its implementation in patient care comes with challenges such as ethical considerations, workforce adaptation, and regulatory compliance. Addressing these issues is crucial for successful integration and maintaining patient trust.As AI continues to evolve, the future of healthcare looks promising. By embracing the potential of AI, the healthcare industry can look forward to a future where patient care is more personalized, efficient, and effective than ever before.

“`

“`The Age of AI in Healthcare: Revolutionizing Patient Care and Operational Efficiency

Revolution in Diagnosis and Treatment Planning

**AI’s capacity for enhancing diagnostics** is creating new paradigms, where diseases are detected with unprecedented speed and accuracy. Notably, **AI algorithms** can analyze medical images for patterns that evade traditional methods, such as in the case of breast cancer where detection rates have reached an impressive 94.5% accuracy, significantly outpacing traditional approaches. Beyond diagnosis, **AI supports** the formulation of individualized treatment plans by evaluating a patient’s medical history, lifestyle, and genetic profile.Enhanced Patient Satisfaction and Engagement

**AI-driven tools**, including virtual health assistants and chatbots, have become integral in empowering patients to manage their healthcare effectively. Offering 24/7 access to healthcare information, these tools provide answers to queries, appointment reminders, and scheduling services, thereby promoting higher levels of **patient engagement** and satisfaction. Furthermore, **AI chatbots** manage over 70% of medication inquiries, freeing up healthcare professionals to focus on more complex patient needs.Streamlining Administrative Processes

In the realm of healthcare administration, **AI serves as a catalyst for productivity**, simplifying tasks such as scheduling, billing, and data entry. This results in fewer errors and reduced operational costs. Studies have shown that the introduction of **AI into administrative tasks** can lead to a 30% increase in productivity, allowing healthcare providers to dedicate more resources to patient care.Harnessing Predictive Insights for Better Outcomes

The ability of **AI to analyze large datasets** from clinical trials and medical records enables the detection of trends and the anticipation of disease outbreaks. This predictive analytic capability not only aids in early disease detection but also informs responsive public health strategies, thereby enhancing health outcomes and resource allocation.Support for Health Professionals

Importantly, **AI is designed to assist** rather than replace healthcare professionals. While **AI can provide valuable insights** and pattern recognition, the intuition and expertise of physicians remain paramount. **AI complements the decision-making process**, allowing healthcare providers to make more informed decisions.In conclusion, **AI stands as a transformative force** in the healthcare industry, facilitating diagnostic precision, patient-centered care, and efficient data management. The future promises a continued evolution in healthcare delivery, driven by **AI’s capacity to offer personalized, efficient, and responsive services** across the board.

The Rise of DeFi: Opportunities and Challenges in the Financial Landscape

In recent years, the rise of Decentralised Finance (DeFi) has signaled a seismic shift in the financial landscape, leveraging blockchain technology to disrupt traditional financial systems. This innovative approach offers financial services without intermediaries, bringing unprecedented levels of transparency, accessibility, and efficiency to the sector.

Opportunities Unlocked by DeFi

DeFi is poised to revolutionize financial inclusion by extending services to those previously excluded from traditional banking systems. By eliminating identification and geographical barriers, DeFi empowers individuals in underserved regions to engage in saving, borrowing, and investing.

Moreover, DeFi’s peer-to-peer model removes the need for centralized intermediaries, significantly reducing fees and enhancing efficiency. The transparency inherent in blockchain technology allows for open auditing of all transactions, reducing opportunities for fraud and corruption.

DeFi also introduces programmability and automation through smart contracts, paving the way for innovative financial instruments such as Automated Market Makers (AMMs), yield farming, and decentralized insurance.

Challenges on the Horizon

Despite its potential, DeFi faces substantial challenges, primarily in the areas of regulation, security, and scalability. The decentralized and borderless nature of DeFi complicates regulatory oversight, necessitating a delicate balance to protect consumers while fostering innovation.

Security remains a critical concern, as the open and complex nature of smart contracts makes the ecosystem vulnerable to hacks. Additionally, as DeFi adoption grows, there is an urgent need for more advanced infrastructure to support increased transaction volumes.

The user experience also presents a hurdle, with current platforms being anything but user-friendly for the average individual. Enhancements in user interface and experience are crucial for broader DeFi adoption.

DeFi’s Disruptive Promise

DeFi platforms are already challenging traditional banking models by enabling direct lending and borrowing without intermediaries. This shift is particularly impactful in developing markets, where traditional institutions may be less prevalent.

Furthermore, stablecoins are transforming payments and remittances, offering faster and more cost-effective cross-border transactions compared to conventional banking systems. DeFi also introduces decentralized insurance platforms, providing new methods for risk management without reliance on traditional insurers.

As highlighted in a recent FinTech Futures article, the rise of DeFi marks the beginning of a fundamental shift in our interaction with financial systems. While the challenges are formidable, the opportunities for financial inclusion, efficiency, and innovation are immense.

About the Author

Hesham Zreik, a renowned investor and entrepreneur, was recognized by Forbes in 2018 as one of the top 50 investors. With investments in over 100 startups and co-founding more than 40, Zreik is the founder and CEO of FasterCapital, an online incubator that supports startups in raising capital.

Medical Schools Lag in Digital Health Training

Medical Schools Falling Behind in Digital Health Training

As the world of medicine continues to embrace the digital revolution, a recent study published in BMC Medical Education highlights a pressing issue: top-ranked medical schools are not adequately preparing future physicians to harness the power of Digital Health Technology (DHT). Despite the increasing prominence of technologies such as wearable devices and virtual reality in healthcare, medical curricula seem to be lagging, leaving a significant gap in the education of upcoming doctors.

Lagging Behind the Digital Curve

The study, conducted through a descriptive landscape analysis of 60 top-ranked medical schools worldwide, reveals a stark reality. Out of the 57 universities analyzed, none explicitly mentioned DHT in their mission statements, and only nine made vague references to innovation. This lack of emphasis on digital health in foundational educational documents underscores the need for a major curricular overhaul.

In the study’s second phase, researchers delved into the actual curricular offerings regarding DHT. The findings were concerning: only four universities had integrated some form of digital health education into their programs. Notable examples include Stanford University and Johns Hopkins University, which have incorporated DHT through elective courses and innovation programs emphasizing problem-based learning and multidisciplinary collaboration.

Implications for Future Physicians

This gap in digital health education poses significant implications for the future of healthcare. As technologies like wearable tech and virtual reality continue to evolve, the ability to effectively utilize these tools will be crucial for enhancing patient care. However, without structured training, future physicians may find themselves ill-equipped to leverage these advancements.

The study’s authors call for urgent curricular adjustments to bridge this educational gap. They emphasize the importance of integrating digital health and innovation into medical education to ensure that future doctors are well-prepared to meet the demands of modern healthcare.

Moving Forward

The findings of this study serve as a wake-up call for medical schools worldwide. As the healthcare landscape continues to evolve, educational institutions must adapt their curricula to keep pace with technological advancements. By doing so, they can equip future physicians with the competencies necessary to improve the quality of care and meet the needs of an increasingly digital world.

For more insights into the study, visit the original article on BMC Medical Education.

Bridging the Mental Health Care Gap in Rural America with Telehealth

Bridging the Mental Health Care Gap in Rural America

Across the vast landscapes of rural America, a silent crisis brews—one that affects the mental well-being of millions. The shortage of mental health care providers, coupled with geographic isolation, has created a significant gap in mental health services. However, a glimmer of hope emerges through telehealth technology, promising to bridge this divide.

What is Telehealth?

Telehealth is the delivery of health care services via digital communication technologies, such as video calls, phone calls, and online messaging. This innovative approach allows patients to connect with healthcare providers remotely, facilitating consultations, diagnoses, and follow-up care without the need for in-person visits. By leveraging internet-based tools, telehealth aims to improve healthcare accessibility, especially for individuals in remote or underserved areas.

Challenges in Rural Mental Health Care

Rural areas face unique challenges in accessing mental health care:

- Shortage of Providers: A significant shortage of mental health professionals exists in rural regions, leading to long wait times and limited access to care.

- Geographic Isolation: The vast distances to mental health facilities pose substantial barriers for patients, often requiring extensive travel.

- Stigma: In tight-knit communities, mental health stigma can deter individuals from seeking help due to fear of judgment.

- Limited Resources: Inadequate funding and resources hinder the availability of necessary mental health services.

- Economic Barriers: Lower income levels and limited insurance coverage exacerbate access issues.

- Technology Access: Reliable internet access and technological literacy are essential for effective telehealth implementation.

Despite these challenges, telehealth emerges as a transformative tool, offering increased accessibility and continuity of care. It allows individuals to receive treatment from the privacy of their homes, reducing stigma and providing cost-effective solutions.

Overcoming Access Challenges

While telehealth offers significant benefits, several issues need addressing:

- Technology Access: Expanding broadband connectivity is crucial to ensure telehealth services reach all who need them.

- Training and Support: Both healthcare providers and patients require training to use telehealth technology effectively.

- Privacy and Security: Ensuring patient information remains private and secure is vital.

- Insurance Reimbursement: Consistent and equitable coverage for telehealth services is necessary for widespread adoption.

Integrating telehealth into rural mental health care represents a significant step forward in addressing long-standing disparities. As technology advances, telehealth holds the potential to become an indispensable tool in bridging the mental health care gap.

Read the original article on Psychology Today for more insights into this evolving landscape.Revolutionizing Healthcare: The Role of AI at Dartmouth’s CPHAI

Hassanpour emphasizes that AI’s ability to analyze large datasets of biomedical information is crucial to this transformation. AI techniques can recognize patterns that humans might overlook, leading to earlier disease detection and improved outcomes. This proficiency in pattern recognition not only aids early diagnosis but also highlights risk factors, allowing for preventive interventions that contribute to overall population health.

The mission of the CPHAI is to facilitate advancements through novel and interdisciplinary research, while ensuring ethical AI usage. As Hassanpour highlights, Dartmouth aims to lead globally in demonstrating the seamless integration of AI in healthcare, setting a model for other institutions.

Established on the Dartmouth Hitchcock Medical Center campus in June 2023, the CPHAI has received initial funding of $2 million from Dartmouth’s Geisel School of Medicine and the Dartmouth Cancer Center. Dartmouth Health will also partner with the Center in ongoing collaborative research, clinical trials, and the incorporation of AI solutions in clinical settings.

The diverse team at CPHAI includes clinical associate directors from various departments, supported by a broad advisory board of leaders and stakeholders from Dartmouth Health. This collaboration is essential in developing clinically relevant AI solutions that can be swiftly translated into patient care, providing significant benefits to both local and global communities.

The Center also focuses on equity and ethics, ensuring the technologies developed are devoid of biases. Protecting patient privacy and data security remains a priority, aligned with promoting equitable access to AI advancements. With AI in healthcare projected to burgeon from under $5 billion in 2020 to over $45 billion by 2026, CPHAI is paving the way by cultivating a local workforce skilled in AI. This initiative, including a Dartmouth graduate program with machine learning courses, will enhance the pool of skilled individuals to drive innovation in the healthcare domain.

Hassanpour anticipates a future where AI dramatically transforms healthcare, improving every aspect from diagnosis to treatment and prevention, ultimately leading to superior patient outcomes for all.

Real Estate Market: A Decade of Transformation Awaits

Real Estate Market: A Decade of Transformation Awaits

The housing market has been a rollercoaster of skyrocketing prices in recent years, leaving many potential homebuyers feeling overwhelmed. This surge in prices stems from the pandemic-driven migration to suburban areas and historically low interest rates. But what lies ahead for the real estate market over the next decade? Will prices continue to climb, or will they stabilize? As we peer into the crystal ball of real estate, we can expect a dynamic market shaped by evolving demographics, interest rate fluctuations, and technological advancements.Evolving Demographics: Millennials and Gen Z are stepping onto the property ladder, significantly influencing housing demands. Their preferences will drive changes in the market landscape.

Interest Rate Fluctuations: The cost of borrowing will continue to impact affordability and buyer behavior, making interest rates a crucial factor in the real estate equation.

Technological Advancements: From virtual tours to AI-powered property management, technology is reshaping the industry, offering new opportunities and challenges.

The Rise of the Hybrid Homes

The concept of a “hybrid home” is gaining traction, going beyond the traditional home office. These homes feature flexible spaces that can be transformed for work, play, or relaxation. The emphasis on well-being is also increasing, with designs that incorporate natural light, indoor-outdoor flow, and dedicated spaces for fitness and recreation. Smart home features like automation for lighting, temperature control, and security are becoming essential for enhancing comfort and efficiency.Tech-Powered Real Estate

The real estate industry is embracing technology like never before. Virtual Reality and Augmented Reality are evolving into immersive experiences, allowing potential buyers to explore properties remotely and personalize their vision. AI-driven insights provide personalized recommendations and market insights, empowering buyers and sellers. Furthermore, Blockchain Technology could revolutionize real estate transactions by streamlining processes and ensuring secure data storage.The Evolving Urban Landscape

Urban areas are witnessing a shift towards mixed-use developments that combine residential, commercial, and recreational spaces, fostering vibrant, walkable communities. The “15-minute city” concept is gaining momentum, aiming to offer essential services within a 15-minute radius, promoting sustainability and community engagement.Climate Considerations Take Center Stage

Sustainability is becoming a cornerstone of the real estate industry. Sustainable construction practices, including the use of eco-friendly materials and renewable energy sources, are becoming standard. Water conservation methods, such as rainwater harvesting systems, are crucial for managing resources. Homes are being designed to withstand extreme weather events, ensuring long-term livability.The Affordability Challenge

Addressing the affordability crisis is paramount. Government intervention through policies like zoning reforms and tax incentives will play a crucial role. Innovative housing models, such as co-living and modular housing, could offer more accessible options for first-time buyers. A shift in mindset towards building more starter homes is essential for creating a more inclusive real estate market.In a recent article by Norada Real Estate Investments, the forecast for 2030 suggests that the average price of a single-family home in the United States could reach $382,000. However, this varies significantly by location, with cities like San Francisco and San Jose potentially seeing average home prices exceeding $2 million.

Aspiring homeowners are encouraged to start saving early and consider investing their savings to combat inflation. Strategic financial planning can help individuals navigate the evolving housing market and realize their dream of owning a home.

Predicting 2030 Home Prices and Mortgage Rates

While predicting home prices in 2030 is challenging, experts anticipate growth aligning more closely with historical norms. Mortgage rates remain uncertain, but some experts believe they will become more favorable in the coming years.For more insights, explore Housing Market Predictions for the Next 4 Years and other related articles.

AI in Healthcare: Revolutionizing Patient Care and Hospital Efficiency

Imagine a healthcare system where hospitals operate with peak efficiency, patient care is meticulously tailored to individual needs, and healthcare providers collaborate seamlessly. This vision is becoming a reality, thanks to AI’s integration into patient care. As highlighted in a recent article by Netguru, AI is not just a futuristic concept but a present-day revolution in healthcare.

Enhancing Patient Experience with AI

AI is reshaping the patient experience by making healthcare more accessible, efficient, and personalized. Through AI-assisted scheduling, virtual health assistants, and remote monitoring, patients receive care that is tailored to their specific needs, significantly reducing wait times and enhancing overall satisfaction.

AI-Assisted Patient Scheduling

Long wait times have long been a bane for both patients and healthcare providers. AI-assisted scheduling utilizes algorithms to analyze patient data and determine optimal appointment times, thereby improving patient flow and hospital resource utilization.

Virtual Health Assistants

Navigating the complexities of the healthcare system can be daunting for patients. Virtual health assistants provide personalized support and real-time assistance, empowering patients to take control of their health journey.

AI-Powered Medical Diagnostics

The role of AI extends beyond patient experience into the realm of medical diagnostics. AI-driven tools, such as image analysis in radiology and pathology, enhance the accuracy and speed of medical condition identification, leading to better patient outcomes.

Image Analysis and Radiology

AI-driven image analysis is revolutionizing radiology by employing advanced machine learning techniques to improve diagnostic accuracy, particularly in early disease detection.

Pathology and Lab Tests

AI applications in pathology streamline processes, increasing efficiency and accuracy in diagnosing diseases, as evidenced by companies like PathAI.

AI-Driven Personalized Treatment Plans

AI is also transforming how healthcare providers approach treatment plans. By leveraging precision medicine, drug dosing, and predictive analytics, AI creates tailored treatment plans, improving patient outcomes and reducing healthcare costs.

Precision Medicine

AI plays a pivotal role in precision medicine by analyzing vast amounts of patient data to identify the most effective treatments, reducing side effects and enhancing patient satisfaction.

AI Applications in Hospital Administration

Beyond patient care, AI is streamlining hospital administration processes, including revenue cycle management, clinical documentation improvement, and supply chain optimization.

Revenue Cycle Management

AI-driven revenue cycle management automates billing processes, reducing financial waste and enhancing hospital operations.

Overcoming Challenges in Implementing AI

While AI holds immense potential, its implementation faces challenges such as ethical considerations, workforce adaptation, and regulatory compliance. Addressing these challenges is crucial to unlocking AI’s full potential in healthcare.

As AI continues to evolve, the future of patient care in hospitals looks promising, with improved outcomes, streamlined operations, and reduced costs. By embracing the potential of AI, the healthcare industry can look forward to a future where patient care is more personalized, efficient, and effective than ever before.

Healthcare AI: The Dawn of a New Era

Healthcare AI: The Dawn of a New Era

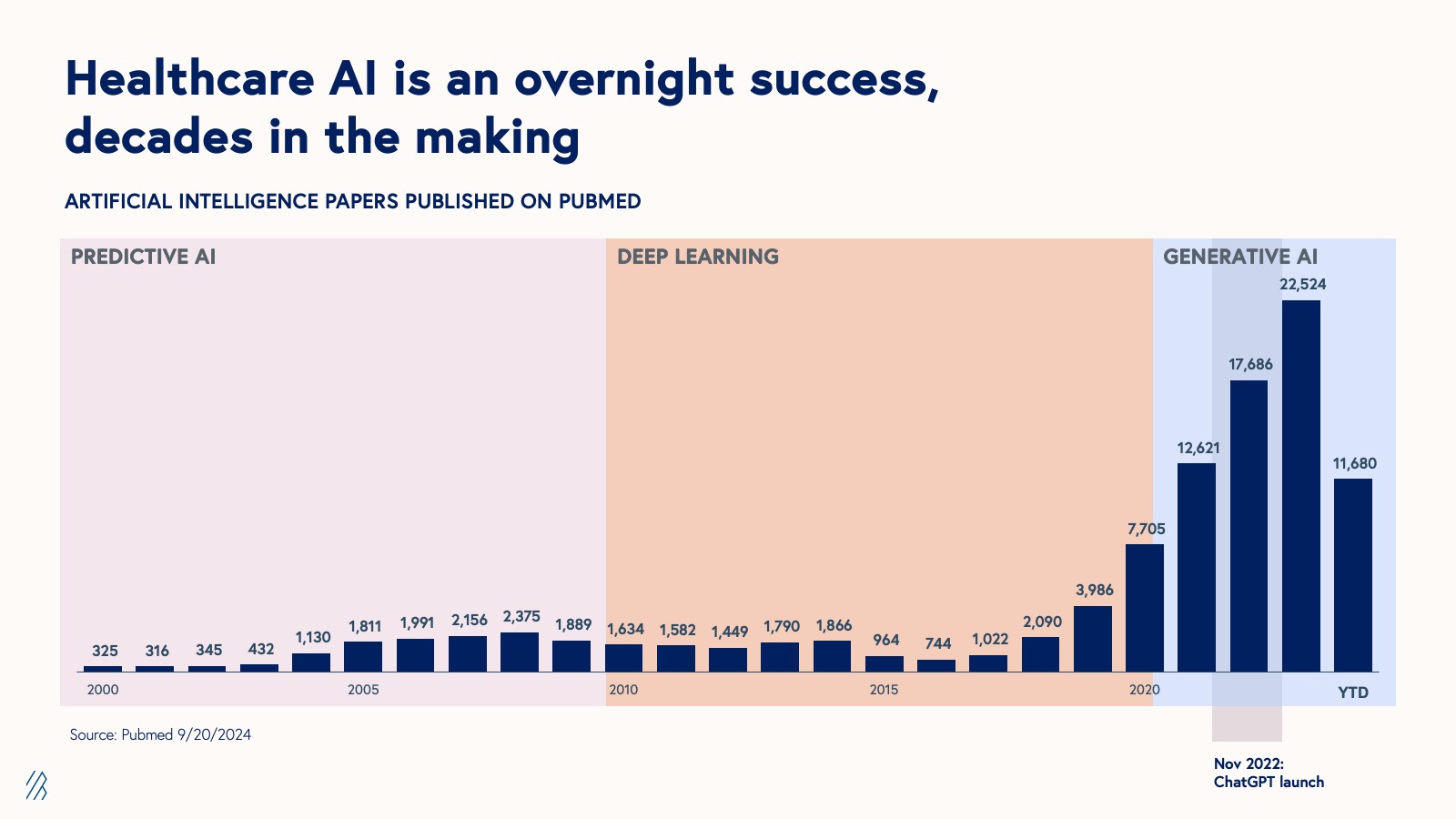

The healthcare industry stands on the precipice of a transformative era, driven by the integration of artificial intelligence (AI) into its core operations. This evolution is not a sudden phenomenon but the culmination of over eighty years of technological advancements and strategic innovations.A recent article from Bessemer Venture Partners delves into this pivotal moment, highlighting how AI is reshaping markets and modern medicine. The demand for healthcare AI solutions is unprecedented, with a significant surge in interest from startups and established tech giants alike. This is not just hype; it’s a reflection of the tangible benefits AI brings to the table.

In a survey, 70% of healthcare providers and payers reported implementing generative AI, with expectations for continued investment growth. This trend underscores the sector’s readiness to embrace AI-driven efficiencies.

The groundwork for this AI revolution was laid through decades of investment in electronic health records (EHRs), which have digitized vast amounts of clinical and administrative data. This digital foundation is now fertile ground for AI applications, with nearly 40% of healthcare startups in 2024 focusing on AI technologies.

Healthcare AI’s potential extends from the micro-level, such as protein functions, to macro-level population health dynamics. As new data types emerge and AI research accelerates, the sector is poised for rapid evolution, aiming to solve real-world healthcare challenges.

However, this promising landscape is not without its challenges. Navigating complex regulations and market dynamics requires innovative solutions and strategic partnerships. Understanding these factors is crucial for startups aiming to thrive in this competitive environment.

The insights from the Bain Research and other sources suggest that both startups and incumbents stand to gain significantly as the market matures. This evolution promises not only economic growth but also enhanced patient care and systemic improvements in healthcare delivery.

Challenges and Opportunities

Despite the promising developments, AI startups in healthcare face numerous obstacles. The US healthcare system, bound by intricate regulations and misaligned incentives, presents a challenging landscape. Founders must be prepared for resistance to change, as innovation and pushback evolve in tandem.Regulation, while a barrier to entry, also serves as an enduring moat for incumbents. The dense regulatory landscape creates obstacles for newcomers, but it also protects established players. Engaging in advocacy and lobbying work can help startups navigate this environment.

Moreover, the healthcare market is fragmented, with numerous smaller markets rather than a monolithic industry. Identifying and targeting the right sub-verticals is crucial for unlocking sufficient total addressable market (TAM).

The ongoing digital transformation and the advent of multimodal AI offer significant opportunities for healthcare. These technologies can diagnose diseases earlier, identify barriers to patient recovery, and enhance healthcare system efficiency.

Investment and Future Prospects

Bessemer Venture Partners has dedicated $1 billion to investments in AI companies, actively seeking promising new partners in this rapidly evolving field. The potential for AI to redefine healthcare is immense, with opportunities for startups to make a real difference for patients and healthcare professionals.As the concept of a “learning healthcare system” becomes a reality, driven by AI, the industry is poised for a new era of continuous improvement and innovation. The journey from digital transformation to AI-driven healthcare is just beginning, and the best is yet to come.

Visual Technologies: Revolutionizing Healthcare

Visual Technologies: Revolutionizing Healthcare