Real Estate’s Resilience Amidst Economic Turbulence

Real Estate’s Resilience Amidst Economic Turbulence

In a riveting discussion at the Fortune Future of Finance conference, real estate experts Sean Dobson and Julie Ingersoll explored the perplexing durability of the housing market. Despite numerous economic pressures, home prices remain steadfast, a phenomenon senior editor-at-large Shawn Tully likened to “defying gravity.”Commercial Real Estate in Crisis The conversation shifted between the residential and commercial sectors, with Julie Ingersoll, from CBRE Investment Management, highlighting the vulnerabilities faced by commercial real estate. The sector grapples with higher interest rates and dwindling demand, particularly in office spaces. Ingersoll noted the alarming office vacancy rate, which has soared to 18% and may soon reach 20%.

The NIMBY Challenge The dialogue also addressed the historic inventory crisis exacerbated by NIMBYism—”not in my backyard” attitudes that hinder housing development. Ingersoll pointed to California’s struggles, where policy failures and community resistance continue to stifle housing supply despite recent legislative efforts to ease building constraints.

The Remote Work Revolution Remote work‘s enduring impact on real estate was another focal point. Sean Dobson, of Amherst Group, discussed how remote work has reshaped the sector, contributing to the pandemic housing boom and altering office dynamics. He predicted that hybrid work models are here to stay, challenging traditional commuting cultures.

Converting Commercial to Residential Ingersoll proposed converting underutilized commercial properties into residential spaces as a potential solution to the housing shortage. However, she acknowledged the financial and logistical hurdles involved in such transformations.

Unique American Factors The dialogue underscored uniquely American elements affecting the market, such as the 30-year mortgage and the decentralized nature of housing governance. These factors contribute to the complex landscape of real estate in the United States.

Conclusion As the real estate sector navigates these challenges, the insights shared by Dobson and Ingersoll offer a nuanced understanding of the forces at play. Their discussion at the conference, as reported in the original article, underscores the intricate interplay between economic pressures and market resilience.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

More Articles

Getting licensed or staying ahead in your career can be a journey—but it doesn’t have to be overwhelming. Grab your favorite coffee or tea, take a moment to relax, and browse through our articles. Whether you’re just starting out or renewing your expertise, we’ve got tips, insights, and advice to keep you moving forward. Here’s to your success—one sip and one step at a time!

The AI Revolution in Healthcare: Erez Meltzer’s Vision for the Future

Erez Meltzer, CEO of Nanox, is at the forefront of a groundbreaking transformation in healthcare. With over 35 years of leadership experience, Meltzer is steering the industry into an era where artificial intelligence (AI) is reshaping patient care. This evolution goes beyond mere enhancements; it promises truly individualized healthcare on a grand scale.

The concept of personalized medicine is not new, yet its effective implementation has been hampered by the complexities of human biology and the vast data involved. Enter AI, with its unparalleled computing power and analytic capabilities, capable of processing this complexity to offer meaningful insights. As AI continues to learn from healthcare data, its accuracy and predictive power grow, further enhancing its ability to tailor patient care.

Enhancing Diagnostics and Early Detection

In diagnostics, AI is making remarkable strides. Deep learning models analyze medical imaging data with impressive speed and precision. These AI systems are not replacing radiologists but augmenting their capabilities, leading to more precise diagnoses and the quick identification of incidental findings.

AI’s real strength lies in personalizing the diagnostic process. By considering individual risk factors, AI can tailor screening schedules, ensuring high-risk patients receive more frequent screenings while minimizing unnecessary procedures for low-risk individuals. This approach not only improves patient outcomes but also optimizes healthcare resources.

Predictive Analytics: A New Frontier in Preventive Care

AI’s potential in predictive analytics is vast. By integrating data from diverse sources, such as electronic health records and genetic information, AI models can predict individual patient risks with unprecedented accuracy. For instance, researchers at the University of Virginia have developed an AI model for predicting outcomes in heart failure patients, offering personalized risk assessments that enable tailored interventions.

Similarly, a pancreatic cancer risk model developed at MIT can potentially expand the group of patients who benefit from early screening. Such predictive capabilities pave the way for proactive care strategies, reducing chronic disease burdens and improving overall health outcomes.

Personalizing Treatment Plans

AI’s impact extends into treatment planning. A team at Northwestern University’s McGaw Medical Center is working on a model to predict long-term outcomes for breast cancer patients. This model aims to help pathologists recategorize patients, allowing for shorter, less intense treatment plans with fewer side effects, marking a significant advancement in personalized cancer treatment.

Addressing Challenges and Ethical Considerations

Despite AI’s promise in healthcare, challenges remain. Institutional complexity and potential biases in AI models are significant hurdles. Ensuring AI-driven healthcare is fair and equitable requires ongoing attention to diverse data sets and the adaptability of AI algorithms. As AI becomes more integral to healthcare decisions, addressing these challenges is paramount to maintaining patient trust and improving outcomes.

The Path Forward

Looking ahead, AI holds the promise of revolutionizing healthcare by enabling personalization across the patient journey. From early detection to treatment planning, AI can help create a more effective, efficient, and patient-centered healthcare system. However, it’s crucial to remember that AI is a tool to support healthcare professionals, not replace them.

As we continue to develop AI technologies, we must do so responsibly, focusing on improving patient outcomes and maintaining trust. The future of healthcare is personalized, predictive, and proactive, and by embracing these technologies thoughtfully, we can work toward a system that truly centers on the individual patient.

The AI revolution in healthcare is well underway. As industry leaders, it’s our responsibility to guide this transformation, ensuring that we harness the power of AI to create a healthcare system that serves all patients better. The potential benefits—lives improved and saved—are too significant to ignore.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

Predictive Analytics Tools in 2025: Revolutionizing Business Intelligence

Revolutionizing Business Intelligence

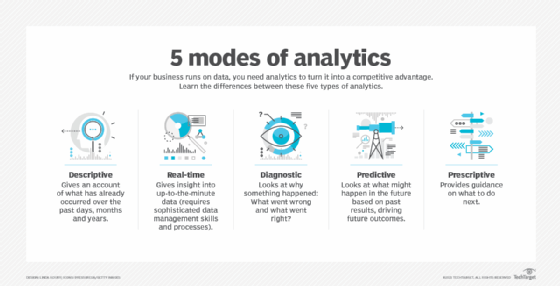

Predictive analytics has undergone a significant transformation. Once the domain of specialized data scientists, advancements in AI have democratized these tools, making them user-friendly even for those without technical expertise. As TechTarget reports, this shift is driven by a need to simplify complex analytics processes and integrate machine learning models into business workflows.

Top Tools for 2025

In its recent feature, TechTarget profiles eight leading predictive analytics tools that are setting the stage for 2025:- Altair AI Studio: Known for its data mining capabilities, it simplifies data extraction and modeling workflows.

- Alteryx AI Platform: Offers automated data preparation and integration with other ML platforms.

- Dataiku: Provides a platform for both technical and non-technical users to generate insights.

- H2O Driverless AI: Focuses on automation in AI development, making it accessible to all.

- IBM Watson Studio: Integrates predictive analytics with a broad range of functions, enhancing collaboration.

- Microsoft Azure Machine Learning: Complements its core tools with lifecycle management for predictive analytics.

- SAP Analytics Cloud: Combines BI, planning, and predictive analytics into a unified suite.

- SAS: Continues its legacy with modernized data science and machine learning workflows.

The Democratization of Analytics

Carlie Idoine of Gartner highlights the growing accessibility of these tools, noting that automation has reduced the need for deep technical expertise. This democratization is further evidenced by platforms like Tableau’s integration with Einstein Discovery, which empowers business users with AI-driven insights.Looking Ahead

As businesses prepare for the future, the integration of predictive analytics tools into everyday operations is crucial. The insights from TechTarget underscore the importance of selecting the right tools to meet diverse business needs, from lead scoring to fraud reduction.In conclusion, the landscape of predictive analytics is poised for continued growth and innovation. By leveraging these tools, businesses can not only gain a competitive edge but also drive informed decision-making processes across all levels.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

Navigating TikTok: A Realtor’s Guide to Success

So, You’re a Realtor and Want to Crush It on TikTok? Here’s What You Need to Know

Ever wondered how TikTok became the playground for realtors? I mean, who would’ve thought that a platform famous for dance challenges and lip-syncing could double as a powerhouse lead-generation tool? If you’re not on TikTok yet as a real estate agent, what are you even doing? Seriously, the market is there, it’s free, and it’s begging for you to shine. But don’t panic if you’re starting from scratch—today, we’re diving into Karis’s masterclass on the TikTok basics for realtors. Spoiler: It’s the step-by-step guide you didn’t know you needed.

Setting the Stage—Why TikTok?

Let’s address the elephant in the room—TikTok, for realtors? Yes, absolutely! Karis kicks off the conversation by acknowledging a common struggle: so many agents know they should be on TikTok but have zero clue where to begin. And hey, no shame—jumping into a new app can feel like showing up to an open house in your pajamas.

TikTok isn’t just for teens or viral dances anymore. It’s proven itself as a legit tool for branding and lead generation for realtors. Karis herself says that TikTok is the top source for her business, and she’s not gatekeeping her playbook.

A Realtor’s TikTok Starter Pack

Okay, so imagine you’re downloading TikTok for the very first time—no filters, no followers, just you and the untapped power of your potential. Here’s the breakdown straight from Karis:

- Claim Your Identity (Name + Username): Your username is searchable—huge win! Stick with your full name or add “Realtor” if you’re building a personal brand. If you rep a team, branding cohesion is key.

- Keep It Cohesive (Profile Picture): This isn’t a selfie free-for-all. Karis recommends using the same profile picture across all platforms (Instagram, LinkedIn, Google My Business). Why? Because consistency builds trust, and people recognize your face.

- Craft a Killer Bio: Two MUST-haves in there:

- Mention you’re a realtor or real estate agent.

- Include your location (state, city, or region).

- Don’t skimp on adding a website! Karis suggests using a tool like Linktree for bonus efficiency. Why list one link when you can subtly flex all your platforms in one neat package? Genius.

TikTok Navigation—Master the Playground

Navigating TikTok as a newbie can feel like wandering into IKEA—it’s overwhelming, and everything looks fun. Karis demystifies it step by step:

- Your Home Page has two sections: the Following tab (for accounts you follow) and the For You page (where the algorithm gets witchy and shows you curated content). Initialize your feed by following other top creators in your niche—hello, instant inspo!

- The Discover Page is where trends, sounds, and hashtags live. Use it to spy on what’s hot in your area and niche. Think of it like networking at a conference—but you’re in your pajamas.

- Drafts are Your Best Friend: Batch content creation, people! Spend an hour pumping out content, save it to drafts, and drip-feed it later. This is TikTok 101 for busy professionals.

A Crash Course in Video Creation

Now for the crux of it all: making your first TikTok. Karis turns this potentially terrifying feat into something as straightforward as assembling a pre-cut charcuterie board.

- Set your video timer to 60 seconds. Not only does this keep things concise, but it also makes your video repurposable for Instagram Reels and YouTube Shorts. Multitasking for the win!

- Use tripods and timers to shoot hands-free (and avoid the dreaded shaky camera look).

- Add captions and hashtags: Create context for your audience by detailing what your video is about and using a sprinkle of niche-specific hashtags (3–5 is perfect).

- Pin your BEST videos: Highlight your top three performing TikToks on your profile to make your page binge-worthy for new visitors.

But Why Does the TikTok Algorithm Feel Like a Magic Eight Ball?

TikTok isn’t pulling content out of a hat; it’s running on a laser-focused algorithm that learns your preferences as you engage. Karis explains it brilliantly: your early posts will feel like dropping a pebble into a massive pond, but as the algorithm analyzes user behavior (views, likes, shares), it’ll start showing your content to more people who might care.

Want to find top-performing realtors or trends in your area? Search for them. Want TikTok to know you’re into real estate content? Binge-watch a few related videos. The app learns what you like—and what your future followers will like, too.

TikTok Is More Than Fun—it’s a Legit Business Tool

Now, here’s where Karis really drives it home: TikTok is free. If you’re not leveraging a platform that can send you high-quality leads while making entertaining content, are you even hustling? (Harsh, but true.) Not to mention, TikTok gives you that sweet opportunity to connect with people not just as a salesperson but as, you know, you.

Karis suggests involving TikTok in your overall real estate strategy and seeing where it takes you. Why wouldn’t you want to do something that’s equal parts fun and lucrative?

Final Thoughts: The TikTok Realtor Revival is Here

Karis delivers a goldmine of tips for TikTok noobs, but honestly, her advice transcends the real estate niche. Whether you’re a realtor, a small business owner, or just somebody trying to get your face on the digital map, there’s something valuable here for everyone.

So, let’s pass the mic to you: Have you started creating TikTok content yet? Did you try any of Karis’s tips already? Let’s talk in the comments because, let’s face it, we’re all just here trying to figure out this wacky little app together.

Your move, realtors! Hit me up with your stories or even drop your TikTok handle below—I could always use some niche-specific inspo myself. Who needs another scrolling binge when we could be scrolling you?

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

Why Toronto’s Real Estate Market Is a Rollercoaster Using Would You Rather Decisions

Why Toronto’s Real Estate Market Is Basically Playing ‘Would You Rather?’

Ever find yourself scrolling through charts and stats about real estate prices and think, “This looks like my retirement plan—confusing and kind of worrisome?” Well, buckle up, because Toronto’s real estate market has been on a rollercoaster ride that makes Canada’s Wonderland look like a kids’ playground. And honestly, it’s giving me some serious “Do I laugh or cry?” vibes.

The Great Toronto Housing Drama You Missed

Let’s get everyone up to speed with some context, shall we? Picture this: in 2020, the average home price in the Greater Toronto Area (GTA) sat at a (still crazy) $930,000. Then came the pandemic—a time when sourdough bread rose, TikTok dances went viral, and apparently, home prices decided to hit turbo mode. By 2022, the average cost had skyrocketed to $1.19 million. That’s, like, a 28% increase in just three years!

But as with all wild parties, there was an inevitable hangover. Cue the economic chaos, spiking interest rates, and “what-is-happening-right-now” vibes in the market. By the end of 2024, everything sort of… plateaued? The average price dipped just slightly to $1.126 million, which, let’s be honest, is still an astronomical price tag. Compared to the peak, that’s only a 5.3% drop. Let’s pause for a moment of silence for my very not-millionaire-level bank account.

The Big Question: Up or Down in 2025?

Okay, so here’s where things get spicy. Are we gearing up for another housing boom, or should we brace for more tears (and maybe some very serious calls to our landlords)? That depends on who you ask.

- On the bullish side: Big banks like TD are forecasting a 6.4% increase in prices by 2025. Now, I’m no economist, but I do know a suspiciously optimistic prediction when I see one.

- On the bearish side: Remember when Toronto’s housing market imploded in the late ’80s? Prices didn’t just drop—they spent seven years in the real estate penalty box before beginning a snail-paced recovery.

Mark Twain’s famous words, “History doesn’t repeat, but it often rhymes,” never felt more relevant.

My Personal Take: This Is Like Predicting the Oscars

You know that moment when you’re watching the Oscars, and you’re absolutely sure your favorite movie will win Best Picture? And then they call something completely unexpected, and you’re left shaking your popcorn bag in disbelief? Yeah, that’s how it feels trying to guess Toronto’s housing market right now.

- Freehold Properties: These are the prom king and queen of the housing world. Everyone loves them, they’re in demand, and they perform better (looking at you, townhomes and semi-detached).

- Condos: Sorry, condos, but you’re kind of like the reliable but boring friend in the GTA real estate market. You’re staying flat while everyone else is out here stealing the show.

If I had to throw my hat in the ring, I’d go with a more modest prediction. Maybe we’re looking at a small increase (2.5% max if rates drop—big if there) or relative stability. A major boom? Hard to imagine unless the Bank of Canada busts a move with those interest rates. At the same time, I don’t see prices absolutely tanking either.

Analysis: Is Real Estate Still the Move?

Here’s the truth, friends: deciding if you should keep chasing property ownership in Toronto is like trying to figure out if you should bet on Teslas because Elon Musk tweets funny memes. The transcript draws a great parallel here: just like you can’t judge Tesla stock by looking at its did-you-just-skyrocket chart, you can’t judge Toronto’s housing market just by glancing at price tags.

Context matters. Nuances matter. And, let’s be real, timing really, really matters.

Let’s Chat! What’s Your Move?

So, what do YOU think? Are we in for a 1980s-style market meltdown or another era of climbing prices and sad PayPal balances? Would you buy now or hold out for a theoretical crash? And seriously, if someone actually predicts 2025 prices correctly, can we name them the real estate Oracle of Toronto?

Drop your thoughts in the comments (or, you know, just yell them into the void—you do you). In the meantime, I’ll be over here plotting my next move… or at least trying to figure out if I should switch to buying plants instead of real estate. Less commitment, more green vibes.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

TikTok’s Ban: US Social Media Frenzy

TikTok’s Ban Has Everyone Spiraling—Here’s What You Need to Know (and Why It’s Hilarious)

Ever wondered what happens when you try to take away the internet’s favorite toy? Spoiler alert: chaos. Absolute chaos.What Just Happened?

Okay, quick context for those out of the loop: TikTok, beloved by 200 million U.S. users, has officially been yeeted off the app store because, long story short, its Chinese parent company, ByteDance, wouldn’t stop sharing user data with Beijing. And when I say they wouldn’t stop, I mean this was like your mom saying, “I better not catch you sneaking cookies again,” and then finding you elbow-deep in the cookie jar 15 minutes later. The U.S. government had repeatedly warned them, and finally said, “Alright, we’re done. Say goodbye to your favorite distraction.” Now, let’s get this straight—this isn’t necessarily a “free speech” issue, even though some folks on the conservative side are spinning it that way. The government isn’t trying to shut people up; they just wish ByteDance would stop handing over our memes, dance tutorials, and search histories to another country.But do I think banning TikTok outright is the best move? Not really. I get the whole “data security” thing is serious, but let’s be honest: Facebook and Instagram are ALSO snooping through your life like the nosiest neighbor on the block.

The Reactions: Armageddon or Comedy Gold?

Oh man, the drama. Between influencers crying about losing their “safe space” and others live blogging the “death of culture,” I am living for the TikTok ban’s content (ironically). One guy tearfully posted, comparing the ban to parents yanking him out of school mid-year and saying goodbye to all his friends. Bro, it’s an app, not a childhood dog.- Some people are comparing it to losing a job.

- Others are dismissing it as just “content creators whining.”

- Meanwhile, meme-makers are thriving over the chaos.

Is This Just Another Trend?

Now, let’s zoom out for a second—is the TikTok ban a one-time, big-time event, or is this another sign of the shift in how we think about data privacy? Remember when Donald Trump also flirted with banning TikTok, before doing a total 180 by proposing a fun little idea of the U.S. owning 50% of the app? Well, it seems like we’ve hit the sequel, but without the promise of dramatic Trumpian executive orders to#SaveTikTok.

And let’s not forget this might be the start of a multi-platform domino effect. If TikTok is toast, Instagram Reels, YouTube Shorts, or bizarre TikTok lookalikes (looking at you, Lemon8) are poised to swoop in and capitalize.

What’s Next for Us, the TikTok-Orphans?

If you’re in the “I need my short-form hit of dopamine” camp, don’t panic just yet. TikTok isn’t down-for-the-count forever—or at least, that seems unlikely. Let’s give it a week, and I wouldn’t be shocked if it strikes some great big deal to “fix its issues” (translation: sell part of the company). In the meantime, creators are urging folks to follow them on other platforms. Everyone’s practically screaming, “Follow me on Instagram Reels! It’s basically the same thing, only clunkier!”Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

Sutter Health’s Innovative Approach to Sepsis Management

Sutter Health’s Innovative Approach to Sepsis Management

Sutter Health is pioneering a transformative approach in critical care by introducing the FloPatch, a novel wearable device aimed at enhancing clinical decision-making. This initiative focuses on improving sepsis management within intensive care units (ICUs), leveraging real-time data to support critical treatment decisions. Sepsis, a severe condition marked by an extreme response to infection, affects approximately 1.7 million American adults each year, often resulting in significant mortality. Sutter Health’s deployment of the FloPatch device aims to refine fluid management protocols, which are crucial for precise sepsis treatment.

Sepsis, a severe condition marked by an extreme response to infection, affects approximately 1.7 million American adults each year, often resulting in significant mortality. Sutter Health’s deployment of the FloPatch device aims to refine fluid management protocols, which are crucial for precise sepsis treatment.

The Role of Advanced Technology in Sepsis Management

The potential of advanced technologies in reducing sepsis risks is well-documented. For instance, a study revealed that implementing AI models in emergency departments significantly reduced sepsis mortality rates. Sutter Health anticipates similar improvements with the FloPatch, scheduled to go live on September 9, 2024, in selected medical centers. The FloPatch focuses on left-sided heart functions by assessing carotid artery blood flow, providing clinicians with critical data to evaluate stroke volume and fluid responsiveness. By replacing indirect surrogate methods, the device aims to minimize the risks associated with fluid overload or inadequate resuscitation.Expert Insights and Expectations

Dr. Kristina Kury, medical director of critical care at Sutter’s Eden Medical Center, underscores the device’s potential to revolutionize sepsis management. She emphasizes the importance of accurate blood circulation assessment in preventing tissue damage and cell death. The device’s deployment extends beyond ICUs to emergency and trauma units, where rapid fluid resuscitation decisions are vital. Despite the initial resistance that often accompanies new healthcare technologies, the response from frontline clinicians has been overwhelmingly positive. Sutter Health’s proactive approach included engaging bedside nurses through a feedback-driven process to ensure buy-in and address usability concerns effectively.Monitoring and Future Prospects

As the launch approaches, Sutter Health will monitor various metrics to evaluate the FloPatch’s efficacy in reducing sepsis-related complications. A successful outcome could decrease sepsis mortality and reduce the need for interventions like intubation or dialysis, ultimately shortening hospital stays and improving patients’ quality of life post-recovery. In summary, Sutter Health’s integration of the FloPatch device represents a critical leap forward in sepsis management, blending cutting-edge wearable technology with traditional healthcare expertise to ensure better, data-driven patient outcomes.Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

TikTok Ban in the U.S.: A Landmark Moment in National Security

In a significant development that has sent shockwaves across the digital landscape, TikTok, the immensely popular social media app, is now banned in the United States. This decision follows a Supreme Court ruling that upheld a law mandating TikTok to sever its ties with its China-based parent company, ByteDance, or face a ban. The ruling has led to the app being inaccessible to its 170 million American users, marking a pivotal moment in the ongoing debate over national security and data privacy.

Background and Legal Proceedings

On January 19, 2025, TikTok voluntarily shut down its services in the U.S., anticipating the enforcement of a law passed by a bipartisan majority in Congress. This law requires ByteDance to divest its ownership of TikTok or be barred from operating in the U.S. market. The Supreme Court’s decision came after TikTok’s legal challenge failed, with the court ruling that the law does not violate the First Amendment. The Biden administration has left the enforcement of this law to the incoming Trump administration, which has expressed a willingness to explore solutions to reinstate TikTok.

Read more about TikTok’s voluntary shutdown in the U.S. on CBS News.National Security Concerns

U.S. officials have long expressed concerns over TikTok’s potential threat to national security. The crux of the issue lies in the app’s ties to China and the possibility of the Chinese government using it to collect data on American users or influence public opinion. Chinese national security laws require organizations to cooperate with intelligence activities, which has heightened fears about data privacy and security.

FBI Director Christopher Wray and other lawmakers have warned that TikTok could be used to track users’ locations, read messages, and access phone records. This has been likened to a “spy balloon” in Americans’ phones, with the potential to compromise personal and national security.

Project Texas: A Safeguard Initiative

In response to these concerns, TikTok launched “Project Texas,” an initiative aimed at safeguarding American users’ data by storing it on servers in the U.S. However, the Justice Department deemed this plan insufficient, citing the continued risk of data flowing to China. Despite these efforts, the divest-or-ban law gained bipartisan support, with some lawmakers arguing that it infringes on free speech rights.

The Supreme Court’s Decision

The Supreme Court’s ruling focused on the national security justification of countering China’s data collection from TikTok’s U.S. users. The justices unanimously agreed that Congress had a valid reason to single out TikTok for special treatment, given the potential threat posed by the app’s data practices. While the court did not support the government’s claim of covert content manipulation by China, it emphasized the importance of addressing data privacy concerns.

Learn more about the Supreme Court’s decision on NPR.The Future of TikTok in the U.S.

With TikTok’s future in the U.S. hanging in the balance, President-elect Donald Trump has indicated a desire to save the app. He has proposed a 90-day extension to delay the ban, allowing TikTok time to dissociate from ByteDance. This potential extension, however, would require legal and congressional action, as experts argue that Trump lacks the authority to unilaterally postpone the ban.

As the situation unfolds, TikTok’s fate will depend on negotiations and potential national security agreements, such as the previously proposed Project Texas. The app’s shutdown has left content creators and users in a state of uncertainty, as they await a resolution that balances national security concerns with the app’s widespread popularity.

Conclusion

The TikTok ban in the U.S. underscores the complex intersection of technology, national security, and international relations. As the debate continues, it is crucial for stakeholders to navigate these challenges with a focus on transparency, data privacy, and user protection. The outcome of this situation will likely set a precedent for how digital platforms are regulated and governed in the future.

For users and content creators affected by the ban, exploring alternative platforms and diversifying their online presence may provide a temporary solution. Additionally, staying informed about legal developments and potential policy changes will be essential in adapting to the evolving digital landscape.

Explore the reasons behind the TikTok ban on CBS News.Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

AI and Robotics Revolutionizing Indian Healthcare

In a rapidly evolving landscape, the integration of Artificial Intelligence (AI) and robotics is reshaping the Indian healthcare sector, offering unprecedented precision, efficiency, and accessibility. As the nation stands at the cusp of a technological revolution, these advancements promise to redefine the quality of life and healthcare services for millions.

AI is poised to revolutionize the diagnostic process, enabling more accurate and faster diagnoses than ever before. Traditional methods, which rely heavily on manual interpretations of medical images, often suffer from delays and errors. In contrast, AI-driven diagnostic tools can swiftly analyze vast amounts of medical data, including X-rays, MRIs, and CT scans, with remarkable precision. This technology is already being leveraged for the early detection of diseases such as cancer and diabetic retinopathy, making diagnostics more efficient and accessible than ever.

Robotic-Assisted Surgery: A New Frontier

Robotic-assisted surgery is another area where technology is making significant strides in India. These robotic systems allow surgeons to perform intricate procedures with robotic arms that mimic human hand movements, enhancing dexterity and precision. This innovation is particularly impactful in minimally invasive surgeries, such as laparoscopic and cardiac procedures, offering benefits like smaller incisions, reduced blood loss, and faster recovery times for patients.

Adoption and Accessibility

Indian hospitals are increasingly adopting robotic surgery techniques for a wide range of procedures, from organ transplants to orthopedic surgeries. As the cost of these robotic systems gradually decreases, this high-tech medical facility becomes accessible to a broader population. The integration of AI-powered telemedicine platforms also holds promise for bridging the healthcare gap between urban and rural areas, offering remote consultations and digital diagnostics.

The government’s initiatives, such as the National Digital Health Mission, further highlight the importance of technology in healthcare. These efforts are crucial in fostering a more democratized and effective healthcare system across India.

A Vision for the Future

Equipping healthcare professionals with the skills to work alongside these technologies is essential for their successful integration into the medical ecosystem. AI and robotics are not just transforming Indian healthcare but are setting new standards for global innovation. From improving diagnostic accuracy to enabling precision surgeries and bridging rural-urban healthcare gaps, these technologies are redefining what is possible in medicine.

For more insights, visit the original article here.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

Embracing Smart Renovations: Europe’s Path to Sustainable Building

In a pivotal move towards a greener Europe, the European Environment Agency (EEA) has spotlighted the transformative potential of smart renovations and sustainable building practices. As outlined in their latest report, the construction, usage, and demolition of buildings are substantial contributors to environmental degradation and climate change.

Currently, buildings account for over 30% of the EU’s environmental footprint, a staggering figure that underscores the urgency of reform. The EEA report, Addressing the environmental and climate footprint of buildings, reveals that this sector is responsible for a significant chunk of material consumption, energy use, and greenhouse gas emissions.

Renovations using sustainable materials, coupled with designs that incorporate green solutions like vegetation, are emphasized as critical strategies. Such measures not only reduce energy consumption but also enhance climate resilience and promote biodiversity.

Policy Support and Initiatives

The report highlights the role of EU policies in facilitating this transition. Notably, the New European Bauhaus initiative launched in 2021 aims to foster sustainable transformations in the built environment. Furthermore, the European Commission is poised to intensify its focus on affordable and sustainable housing through upcoming strategies.

Future Directions

As Europe looks to the future, a multi-faceted approach that marries renovation with robust policy support is essential. This strategy not only promises to enhance environmental performance but also aims to build a more resilient and inclusive housing system, paving the way for a sustainable future.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

UK Government Charts Course for Crypto Regulation

UK Government Charts Course for Crypto Regulation

In a significant move post the July 2024 UK general election, Economic Secretary to the UK Treasury, Tulip Siddiq MP, delivered a pivotal speech at the Tokenisation Summit on November 21, 2024. This address marked the unveiling of the UK government’s strategic approach towards digital asset regulation, underscoring a commitment to innovation within the financial services sector.Cryptoassets Regulation

The UK government is reaffirming its stance on previously proposed regulations, including the creation of new regulated activities for cryptoassets. This encompasses the operation of cryptoasset trading platforms and an extension of market abuse rules. The Financial Conduct Authority’s “Crypto Roadmap” suggests these measures will be implemented by 2026, following consultations slated for 2025.

Stablecoins Regulation

In tandem with cryptoassets, the government plans to introduce regulated activities for stablecoins, addressing specific risks associated with their backing assets. However, stablecoins will not be integrated into UK payments regulation to avoid disproportionate regulatory burdens.

Clarifying Cryptoasset Staking Services

Addressing the ambiguity surrounding cryptoasset staking services, Secretary Siddiq announced that the upcoming regulatory regime would explicitly permit these services. This clarification ensures they are not categorized as Collective Investment Schemes, thus paving the way for clearer operational guidelines.

FCA’s ‘Crypto Roadmap’ and Consumer Insights

Shortly after Siddiq’s speech, the FCA released its fifth piece of research on consumer attitudes towards cryptoassets. The findings reveal a 93% awareness rate and a 12% ownership rate among UK citizens, highlighting the pressing need for comprehensive regulations.

Looking Ahead

Crypto firms are expected to welcome these regulatory clarifications, particularly regarding staking services. As the UK gears up for a potentially regulated environment by 2026, firms will need to engage with the FCA’s proposals and prepare for the forthcoming changes.

This report draws from insights provided by Skadden, Arps, Slate, Meagher & Flom LLP, serving educational and informational purposes.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

Revolutionizing Rare Disease Diagnosis: How AI and Large Language Models are Changing the Game

Earlier, Accurate Diagnosis

In the evolving landscape of healthcare, genetic disorders have always presented significant diagnostic challenges. The complexity of their genetic and phenotypic characteristics often leaves clinicians grappling for answers. Enter the CLinAI Initiative, a groundbreaking project spearheaded by Dr. Hamid Alinejad Rokny from UNSW. This initiative is changing the game by leveraging advanced AI and Large Language Models (LLMs) to process and analyze vast amounts of genetic, clinical, and phenotypic data. The result? A more precise identification of genetic markers linked to diseases, allowing doctors to intervene earlier and tailor treatments for those who need them most.“We’re not just diagnosing conditions faster; we’re diagnosing them better,” says Dr. Rokny. The power of AI and LLMs lies in their ability to uncover patterns in data that were previously invisible, offering a revolutionary approach to tackling rare and complex heart diseases.

Individual Treatments, Global Impact

Cardiovascular diseases, known for their unpredictability, underscore the critical need for early and accurate diagnosis. The AI-driven platform developed by the CLinAI team promises to cut diagnostic times by a staggering 80% and reduce healthcare costs by 70%. This means quicker treatments, fewer hospital visits, and improved outcomes for patients and their families.“I can’t imagine the relief this will bring to so many people,” remarks Prof. Nigel Lovell, Head of UNSW Biomedical Engineering School. “The earlier we catch these conditions, the more we can do to prevent severe complications down the line.”

What sets this initiative apart is the global collaboration propelling it forward. UNSW is working closely with partners like NSW Health (Professor Tony Roscioli), the Chinese Academy of Sciences, and the Thailand Genomics Service to push the boundaries of AI and LLMs in healthcare. This collaborative effort ensures that the innovations are not just theoretical but are making a tangible difference in the real world.

“By working together, we’re making sure that these innovations aren’t just theoretical—they’re making a real-world difference,” Dr. Rokny explains.

For more details, visit the original article.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

Navigating AI in Healthcare: Empowering Clinicians for a Technological Revolution

Introduction & Background

The exploration of artificial intelligence (AI) in healthcare has seen transformative growth, heralding an era of dynamic innovation. Clinicians now find themselves at the forefront of a technological revolution that promises to tackle complex healthcare challenges. Key to this evolution is the adoption of generative AI models and multimodal approaches that open new possibilities for solving entrenched healthcare problems.However, successful AI integration in healthcare demands clinician involvement throughout the research, development, and implementation phases. In a systematic review, inconsistent collaboration between developers and clinicians was noted during AI tool creation, often occurring at later stages. Achieving trust in AI systems, addressing burnout, and ensuring liability are vital concerns that signify the need for a multidisciplinary approach in AI development.

The Road to Becoming an AI-Literate Clinician

Understanding AI: Clinicians should establish concrete learning goals as the first step on their AI journey. Familiarity with AI terminology and competencies is critical. This understanding forms the basis for evaluating AI tools, enhancing patient care, and promoting operational efficacy without relying solely on technical teams.Formal Education & Practical Exposure: Incorporating AI education into medical curricula can accelerate adoption among clinicians. Training in programming languages such as Python complements hands-on experimentation, essential for grasping the nuances of AI applications. Online and in-person courses each offer unique benefits – clinicians should choose based on flexibility, cost, and networking opportunities.

Healthcare AI Resource Toolkit

A plethora of resources is available for clinicians to kickstart their AI journey. These include specialized online courses, academic journals, textbooks, and vibrant community networks, all of which serve as valuable knowledge reservoirs. Engaging in datathons and collaborative projects can foster a deep understanding and practical application of AI.- American Board of AI in Medicine (ABAIM)

- AI in Healthcare Specialization (Coursera, Stanford Online)

- AI for Medicine Specialization (deeplearning.ai)

- AI for Healthcare

Measuring Success

Clinicians can set milestones to gauge progress, from pilot projects to course completion. Recognizing process and outcome measures is critical, allowing practitioners to refine strategies and incorporate feedback for continuous learning and adaptation.

Conclusion

AI in healthcare unveils exciting avenues for learning and innovation. Equipped with structured approaches and resources, clinicians can actively contribute to AI development, ensuring that solutions are both patient-centered and impactful. Through proactive engagement with AI, healthcare professionals can drive forward a new era of patient care enhancement and operational excellence.Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

Telemedicine: A Beacon of Hope for Healthcare Accessibility

Telemedicine: A Beacon of Hope for Healthcare Accessibility

Telemedicine, a transformative force in healthcare, is reshaping how we access medical services, especially in underserved and remote regions. In a recent review article published by Cureus, the profound impact of telemedicine on healthcare accessibility is explored in depth. The article highlights how telemedicine addresses various barriers—geographical, temporal, financial, sociocultural, and infrastructural—thereby enhancing healthcare access for communities that need it the most.Breaking Geographical Barriers

Telemedicine has emerged as a crucial tool in bridging geographical divides. By leveraging technological advancements such as video conferencing and wearable sensors, healthcare professionals can now reach patients in otherwise isolated regions. This not only facilitates round-the-clock consultations but also reduces unnecessary patient travel, offering a cost-effective solution to healthcare delivery.Addressing Financial Hurdles

One of the significant advantages of telemedicine is its ability to cut travel expenses for patients, particularly in rural settings. However, the article points out that the initial costs of implementing telemedicine and the complexities of reimbursement frameworks pose challenges that require systematic policy support for sustainable growth.Overcoming Sociocultural Challenges

The review sheds light on the cultural and language barriers that can impede telemedicine‘s effectiveness. It advocates for inclusive services tailored to diverse demographics, emphasizing the necessity of language interpretation services and culturally competent care to ensure equitable healthcare access.The Road Ahead

Looking to the future, the article calls for enhanced integration of telemedicine across healthcare systems. This includes robust policy frameworks that support equitable access and quality service delivery while ensuring patient safety and data privacy. By addressing these challenges, stakeholders can harness telemedicine‘s full potential, ultimately advancing global healthcare accessibility.Through collaborative efforts from policymakers, healthcare providers, and technology innovators, telemedicine‘s transformative potential can be accelerated. This will improve health equity and outcomes globally, ensuring that all individuals, regardless of their location or socioeconomic status, have access to the healthcare they need.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

Transforming Finance: The Rise of Decentralized Finance with Kavita Gupta & Robert Mitchnick

Kavita Gupta, the Founder and Managing Partner of Delta Blockchain Fund, stands at the forefront of investment in blockchain technology. Her emphasis on innovative financial solutions that empower users and streamline transactions positions her as a key influencer in the investment realm. Gupta’s extensive experience and visionary approach continue to drive advancements in the blockchain sector.

Joining her in this transformative journey is Robert Mitchnick, who leads BlackRock’s Digital Assets division. Mitchnick provides critical insights into how traditional finance is increasingly integrating with digital asset strategies. His expertise is essential for understanding the balance between traditional investments and emerging technologies, illustrating a significant shift in investor focus towards blockchain-backed opportunities.

The conversation is facilitated by Anna Irrera from Bloomberg News, whose journalistic acumen brings clarity to the dialogue. With a keen eye on market dynamics, Irrera ensures that the critical elements are articulated, guiding the audience through the complexities of the crypto landscape.

Together, these leaders represent a pivotal shift in how we perceive finance, leveraging blockchain to enhance transparency and accessibility. As the digital asset market grows, their contributions promise to redefine the boundaries of financial innovation. For more insights, visit Bloomberg.

Revolutionizing Finance: The Decentralized Future

In the contemporary landscape of finance, the rise of decentralized finance (DeFi) is not only transforming how we conduct transactions but is also having profound implications for the environment, humanity, and the global economy. Pioneers like Kavita Gupta, Robert Mitchnick, and journalists like Anna Irrera are at the helm of this revolution, championing the infusion of blockchain technology into the investment sphere.

The growing adoption of decentralized finance holds promise for a multitude of positive environmental impacts. Traditional financial systems often rely on centralized institutions that consume vast amounts of energy. In contrast, blockchain technology operates on decentralized networks that can significantly reduce energy consumption. By employing consensus mechanisms such as proof of stake, blockchain can minimize its carbon footprint—a critical consideration in the fight against climate change.

Moreover, the shift towards decentralized finance has the potential to enhance financial inclusion, radically affecting humanity as a whole. Many underserved populations globally lack access to basic banking services. DeFi platforms enable individuals to engage with financial markets without needing traditional banking infrastructure, thus empowering people in developing regions. By bridging this financial gap, we create a more equitable society where everyone has a chance to participate in economic activities, ultimately contributing to a more stable world.

Economically, the integration of blockchain technology into traditional financial systems, as discussed by Robert Mitchnick, highlights a significant transition in investor sentiment. The traditional investment landscape is evolving, with increasing interest in crypto assets and blockchain investments. This evolution represents not just a diversification of portfolios but also a shift in how value is perceived and transferred. As these digital assets gain traction, they herald a potential shift towards more resilient economic models that prioritize transparency and reduce systemic risk—a lesson learned from past financial crises.

Looking toward the future, the collaborative efforts of industry leaders signify a broader transformation within global finance. They are not merely adapting to technological advancements; they are actively shaping them. The increased focus on digital assets can foster innovation, creating new opportunities for economic growth and job creation. However, it also necessitates a new framework of regulations and standards to ensure security and compliance in this burgeoning landscape.

In conclusion, as decentralized finance continues to gather momentum, it brings with it significant implications for the environment, humanity, and the global economy. By harnessing blockchain technology, we have the opportunity to create a more sustainable, inclusive, and resilient financial system. The way forward is not just in embracing these changes, but in ensuring they are equitable, transparent, and beneficial for all, setting the foundation for the future of humanity in a rapidly evolving financial world.

Unlocking the Future of Decentralized Finance: Insights from Industry Leaders

In the fast-paced world of decentralized finance (DeFi), influential figures are shaping the evolution of digital assets. This article delves into the insights and contributions of key players in the blockchain sphere, focusing on their impact on the financial landscape.

Key Players in Decentralized Finance

Kavita Gupta: Pioneering Blockchain Investments

Kavita Gupta, the Founder and Managing Partner of Delta Blockchain Fund, is a central figure in the push for innovative financial solutions. Under her leadership, the fund focuses on investment opportunities that not only drive technological advancement but also empower users through increased accessibility. Gupta has built a reputation for fostering environments where emerging blockchain solutions can thrive, thus spearheading the conversation around investment in digital technologies.

Robert Mitchnick: Bridging Traditional and Digital Finance

At the helm of BlackRock’s Digital Assets division is Robert Mitchnick. His work illustrates the growing convergence between traditional financial systems and blockchain technology. Mitchnick’s insights reveal a paradigm shift as investors increasingly seek opportunities in digital assets. His analysis of the market dynamics showcases the challenges and rewards of integrating blockchain-driven strategies within established financial models.

The Role of Journalistic Insight

Facilitating this essential dialogue is Anna Irrera from Bloomberg News, whose expertise in financial reporting ensures that complex topics are communicated clearly. Irrera’s investigative approach has illuminated the nuances of the cryptocurrency landscape, making her an invaluable asset in discussions surrounding DeFi.

Features and Innovations in DeFi

- Transparent Transactions: Blockchain technology inherently increases transparency, facilitating trust between users and service providers.

- Accessibility: By reducing barriers to entry, decentralized finance allows a broader base of users to participate in financial systems.

- Smart Contracts: These self-executing contracts with the terms of the agreement directly written into code automate processes and reduce the need for intermediaries.

Use Cases and Market Transformations

Decentralized finance is not just a trend; it’s transforming how we think about finance. Use cases range from peer-to-peer lending platforms to decentralized exchanges, offering innovative ways to manage assets. As these platforms gain traction, more traditional financial institutions are exploring how to incorporate similar technologies.

Pros and Cons of DeFi

Pros:

- Greater Financial Inclusion: DeFi can serve underserved populations.

- Lower Costs: Reduces overhead by eliminating intermediaries.

- Enhanced Security: Blockchain technology provides secure transaction methods.

Cons:

- Regulatory Uncertainty: The lack of regulation can lead to risks for investors.

- Volatility: Cryptocurrency values can fluctuate dramatically.

- Scalability Issues: As more users join networks, performance can degrade.

Predicted Trends in Decentralized Finance

As DeFi evolves, we can expect several trends to emerge:

- Integration of Artificial Intelligence (AI) to analyze market trends.

- Increased regulatory frameworks to provide a safer investment environment.

- Mergers between traditional and digital financial institutions, blending established practices with innovative technologies.

Conclusion

Kavita Gupta and Robert Mitchnick, alongside Anna Irrera, represent a transformative force in decentralized finance. Their contributions and insights not only enhance our understanding of the digital asset landscape but also pave the way for future innovations that will redefine finance as we know it. As we progress, staying informed about these changes will be vital for navigating the evolving financial terrain.

For more information on the evolving world of decentralized finance, visit Bitperfect.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

Unveiling the Dual Nature of AI in Oncology

Unveiling the Dual Nature of AI in Oncology

Patrick I. Borgen, MD, chair of the Department of Surgery at Maimonides Medical Center and head of the Maimonides Breast Center, recently shared insights into the evolving role of artificial intelligence (AI) in oncology. In a report by OncLive, Dr. Borgen discusses the groundbreaking potential and inherent challenges of AI in cancer treatment.At the 41st Annual Miami Breast Cancer Conference, Anant Madabhushi, PhD, from the Winship Cancer Institute of Emory University, highlighted significant advancements in AI for cancer image analysis. The research presented suggests that AI could rival or even outperform traditional genomic profiling in predicting critical cancer characteristics. This positions AI as a potential disruptor in the tumor analysis industry, which heavily relies on genomic, proteomic, and expression assays. AI’s capacity to analyze microscopic images at unprecedented speeds and reduced costs could revolutionize oncology practices.

Balancing Promise with Caution

Despite these promising developments, Dr. Borgen emphasizes the importance of recognizing AI’s current limitations. At the upcoming 42nd Annual Miami Breast Cancer Conference, Joshua Feinberg, MD, from Maimonides Medical Center, will present findings on the performance of AI platforms such as ChatGPT and Google Gemini in breast cancer board examinations. These platforms achieved around 70% accuracy, raising concerns about their reliability in clinical decision-making. A 30% error rate underscores the risks of depending on AI-driven tools for medical guidance, particularly in tasks like interpreting X-rays and pathology slides.The Path Forward

While AI holds immense potential for enhancing cancer diagnostics and treatment planning, understanding its strengths and weaknesses remains crucial. As the medical community continues to integrate AI into oncology, these insights stress the need for a balanced approach, ensuring technological advancements align with clinical efficacy.Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

Exploring the Benefits and Risks of AI in Oncology

Exploring the Benefits and Risks of AI in Oncology

In the rapidly evolving landscape of healthcare, the integration of artificial intelligence (AI) into oncology is a topic of significant interest and debate. Recently, Ted A. James, MD, MHCM, FACS, a prominent figure in the field, shared his insights on this subject. As the Chief of Breast Surgical Oncology at Beth Israel Deaconess Medical Center and an Associate Professor at Harvard Medical School, Dr. James is at the forefront of exploring how AI can revolutionize oncology care.The Promise of AI in Healthcare

The potential of AI to transform medical services is immense. From enhancing diagnostic precision to personalizing treatment options, AI is poised to play a pivotal role in the future of healthcare. In oncology, AI’s ability to analyze vast datasets can lead to more accurate prognostic indicators and improve patient outcomes. Dr. James emphasizes the importance of utilizing AI for precision medicine, particularly by integrating tumor characteristics with genetic profiles.

Challenges and Concerns

However, the journey towards widespread AI adoption in healthcare is fraught with challenges. One of the primary concerns is the risk of AI-induced biases, which can arise from the data used to train these systems. Additionally, data privacy and security are critical issues that must be addressed to ensure patient safety. Dr. James highlights the need for regulatory oversight and ethical guidelines to navigate these complexities.

Current Applications and Future Prospects

AI is already being utilized in various healthcare applications, from diagnostic assistance to operational efficiencies. For instance, AI systems can monitor patients post-discharge to detect early signs of complications. In oncology, AI shows promise in risk assessment and predictive analytics, enabling proactive patient care.

Dr. James advocates for oncologists to explore AI tools in their practice, particularly in personalized treatment and administrative processes. By identifying high-risk patients and tailoring care plans, AI can enhance patient care and streamline workflows.

Building Trust in AI

For clinicians to embrace AI, trust in its accuracy and reliability is paramount. Dr. James stresses the importance of transparency and validation studies to build confidence in AI-powered tools. Explainable AI, which clarifies how conclusions are drawn, is crucial in fostering trust among healthcare professionals.

Ethical Considerations and Accountability

The ethical implications of AI in healthcare cannot be overlooked. Cybersecurity breaches, the potential for AI to generate false information, and the risk of dehumanizing patient care are pressing concerns. Dr. James underscores the importance of shared accountability among technology developers, healthcare organizations, and physicians to mitigate these risks.

Conclusion

As AI continues to evolve, its integration into healthcare holds the promise of transformative change. Dr. James envisions a future where AI enables precision medicine and empowers patients to take an active role in their healthcare. However, careful implementation and collaboration among stakeholders are essential to harness AI’s full potential while safeguarding against its pitfalls.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

The Future of Oncology: How TechBio is Revolutionizing Cancer Treatment and Beyond

Latest Technologies Transforming Cancer Diagnosis and Therapy

The domain of oncology is witnessing unprecedented dynamism, propelled by innovations in artificial intelligence (AI), machine learning (ML), genomics, and personalized medicine. These technological marvels are radically altering the methods of cancer detection, understanding, and treatment.- AI-Powered Diagnostics: Cutting-edge AI systems are integral in diagnosing cancer with greater speed and accuracy. By analyzing imaging scans, pathology slides, and biomarkers, AI can identify cancerous changes at the earliest, most treatable stages. For instance, Google’s DeepMind and similar systems have proven their proficiency, even surpassing human radiologists in detecting breast cancer and other malignancies earlier.

- Genomics and Precision Medicine: Breakthroughs in genomic sequencing have unveiled the potential to pinpoint genetic mutations that drive individual cancers. This paves the way for targeted therapies, designed to block specific mutations fueling tumor growth. Therapies like trastuzumab for HER2-positive breast cancer and osimertinib for EGFR-mutant lung cancer illustrate the transformative power of precision medicine.

- Immunotherapy: The oncology sector is abuzz with the promise of immunotherapies, such as immune checkpoint inhibitors and CAR-T cell therapy. These treatments leverage the patient’s immune system to target and destroy cancer cells. Although presently expensive and logistically demanding, scalable technologies are expected to democratize their use.

- AI-Driven Drug Discovery: AI and machine learning are revolutionizing the drug discovery process, with platforms like BenevolentAI and Recursion Pharmaceuticals scrutinizing vast datasets to swiftly pinpoint new cancer drug candidates. This innovation could significantly abbreviate the timeline from discovery to clinical trials, ushering life-saving treatments to patients more swiftly.

Are We Close to a Breakthrough?

While completely defeating cancer remains an ambition, there is a growing belief in managing it as a chronic condition. The focus shifts not to a singular “cure,” but to controlling cancer effectively—a feasible future scenario. Early-stage cancers detected through liquid biopsies, using non-invasive blood tests, have shown potential in significantly improving survival rates.Emerging technologies such as CRISPR-based gene editing offer hope to rectify cancer-causing mutations. Concurrently, digital twin simulations—virtual models of a patient’s body—are employed to predict treatment outcomes and refine therapies in real-time, inching us closer to a future where cancer diagnoses come with an assurance of effective, personalized care.

Democratizing Cancer Care: Accessibility and Affordability

Despite these scientific strides, a critical concern remains: ensuring that breakthroughs are not limited to affluent regions. Technology can dismantle traditional barriers of cost, geography, and expertise, playing a pivotal role in democratizing cancer care.- Telemedicine and Remote Monitoring: These can enhance access to treatments while lowering costs. AI-equipped telehealth platforms offer patients in remote or underserved areas access to oncology specialists without the need for travel.

- Cloud-Based Data Sharing: The secure global sharing of clinical data can democratize research and improve patient outcomes worldwide. Open-source AI models trained on diverse datasets will help craft treatment strategies effective across varying populations.

- Automation: With appropriate use, automation can diminish human error and slash costs and waiting times. From automated drug manufacturing to AI-driven clinical trial optimization, digital health solutions promise to lower development and delivery costs, ensuring even low-resource settings benefit from cutting-edge technologies.

A New Approach to Healthcare

The innovations in oncology transcend cancer itself, foreshadowing a revolution in healthcare diagnostics and treatments at large. Technologies that emerged in the fight against cancer—from AI-driven drug discovery to personalized medicine—are redefining treatments for diseases ranging from rare genetic disorders to common chronic conditions like diabetes. By building a robust infrastructure linking biotechnology and technology, a healthcare system prioritizing accessibility, precision, and sustainability is within reach.Challenges, including data standardization and regulatory and ethical concerns, persist. However, the path forward is visible. With a commitment to TechBio innovations, the oncology community can deliver transformative care globally. By embracing collaboration, investing wisely, and enacting supportive policy frameworks, we can soon witness a world where life-saving treatments are not exclusive privileges but universal rights.

The future of oncology is about more than conquering cancer; it’s an opportunity to redefine healthcare access and equity worldwide, ensuring hope and healing for all.

Read the full article for more insights.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

Telehealth: A New Frontier in Equitable Healthcare Access

Telehealth: A New Frontier in Equitable Healthcare Access

In the evolving landscape of healthcare, telehealth is emerging as a pivotal solution for expanding access to medical services, particularly for underserved communities. As healthcare providers strive to reach disadvantaged groups, telehealth offers a viable strategy to achieve health equity across diverse populations.

Disparities in healthcare access and outcomes remain a formidable challenge. For example, Black women face a 40% higher mortality rate from breast cancer compared to their white counterparts. Similarly, minority ethnic groups experience diabetes rates 1.5 times higher than those observed in the white population.

Challenges in Rural Communities

Geographic isolation in rural areas further compounds these challenges, leading to elevated mortality rates linked to chronic conditions such as cancer and cardiovascular diseases. Limited access to healthcare resources, economic barriers, scarcity of health insurance, lack of specialized care, and critical workforce shortages exacerbate these issues. For more insights, see the GAO’s report on healthcare access in rural America.

LGBTQ+ Health Disparities

The LGBTQ+ community also faces significant health disparities, despite ongoing efforts to combat discrimination. Higher rates of chronic conditions, obesity, and mental health issues are prevalent, often linked to systemic discrimination and stigma. Research by the CDC highlights these disparities in chronic conditions.

The Promise of Telehealth

Fortunately, telehealth offers a promising avenue to bridge these gaps. By facilitating the provision of specialists, reducing travel needs, and ensuring culturally sensitive care, telehealth promotes health inclusivity. It empowers rural communities by supporting primary care providers and offers LGBTQ+ individuals confidential access to necessary healthcare services.

The expanded use of telehealth during the COVID-19 pandemic has showcased its potential as a new benchmark in inclusive healthcare. However, to fully optimize its benefits, ongoing challenges such as digital literacy, provider training, and privacy must be diligently addressed.

Telehealth’s role as a lifeline during these times underscores the need for deliberate efforts to ensure it serves all communities effectively.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

Heart Attack Diagnostics Market Surges with Technological Innovations

Heart Attack Diagnostics Market Surges with Technological Innovations

The heart attack diagnostics market is poised for remarkable growth, driven by groundbreaking advancements in artificial intelligence, biomarkers, and cutting-edge imaging technologies. According to a recent report, this burgeoning sector is projected to expand from USD 11.68 billion in 2024 to USD 27.95 billion by 2035, reflecting a compound annual growth rate (CAGR) of 8.26% during the forecast period.The surge in the market is attributed to several factors, including rising rates of cardiovascular diseases (CVDs), increased healthcare awareness, and substantial government funding and initiatives. Moreover, the proliferation of diagnostic centers and laboratories further fuels this growth.

Innovations in diagnostic technologies are at the forefront of this expansion. The introduction of high-sensitivity troponin tests has notably enhanced early detection capabilities. An exemplary advancement is GE Healthcare’s Caption AI, integrated into the Vscan Air SL, which was launched in April 2024. This technology broadens access to cardiac care by enabling a wider range of clinicians to capture diagnostic-quality cardiac images.

Market Segmentation

- By Type: Non-invasive tests dominated the market in 2024 due to their safety, accessibility, and patient-friendly nature. Technologies like CT and MRI scans continue to advance, offering safer diagnostic options.

- By Test: The ECG segment led the market, benefiting from its cost-effectiveness and reliability in diagnosing acute myocardial infarction.

- By End-User: Hospitals and clinics accounted for the highest revenue, thanks to their advanced diagnostic infrastructure and skilled healthcare professionals.

Regionally, North America is expected to maintain the highest revenue share, driven by advanced healthcare infrastructure and significant healthcare expenditure. Meanwhile, the Asia Pacific region is predicted to grow at the fastest CAGR due to improving healthcare infrastructure and increasing awareness of heart health.

For more details on the market dynamics, visit the full report.

“`Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

ClearValue Consulting Teams Up with Restb.ai to Revolutionize Real Estate Appraisals

In a bold move to transform the real estate appraisal landscape, ClearValue Consulting has announced a strategic partnership with Restb.ai. This collaboration is set to integrate cutting-edge computer vision technology into ClearValue’s renowned valuation review platform, Certainty, bringing about a new era of efficiency and precision in appraisal processes.

“Our goal has always been to provide clients with the most advanced, efficient, and reliable tools available,” remarked ClearValue CEO Don Juhl. His words reflect the company’s unwavering commitment to leveraging state-of-the-art technology to modernize appraisals, reduce operational costs, and enhance accuracy in reviews. The synergy between ClearValue and Restb.ai is poised to deliver substantial improvements in resource management and operational efficiency.

Revolutionizing Appraisal Reviews

The Certainty platform is a trusted tool among mortgage lenders and valuation providers. The integration of an AI-powered system allows for automated analysis of property photos, facilitating both identification and verification processes. Restb.ai’s innovative technology ensures compatibility across various evaluation formats, including broker price opinions, appraisals, inspections, and forms.

“By leveraging our advanced market-proven computer vision technology, ClearValue provides clients with a powerful tool that reduces the time and resources spent on reviews, allowing professionals to focus on higher-risk valuations,” stated Tony Pistilli, Restb.ai’s general manager of valuations.

Expanding Technological Footprint

This partnership is a part of Restb.ai’s broader strategy to expand its technological influence within the real estate sector. Earlier this month, Restb.ai confirmed a partnership with Lundy, aimed at introducing voice-driven property searches to assist visually impaired users navigating multiple listing services. In August 2023, the company launched a collaboration with Bradford Technologies, further solidifying its presence in the appraisal domain.

As the real estate sector continues to seek solutions for cost reduction and minimizing revisions without compromising quality, Certainty’s enhanced platform promises an unmatched comprehensive review experience. As highlighted by Juhl, the integration of AI technology positions Certainty as a critical tool for addressing the challenges of modern appraisal processes head-on.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

Artificial Intelligence: The New Frontier in Combating Infectious Diseases

Artificial Intelligence: The New Frontier in Combating Infectious Diseases

In a world increasingly challenged by infectious diseases, the advent of artificial intelligence (AI) is proving to be a game-changer. According to a recent article published in Nature on January 7, 2025, AI is transforming how we diagnose and treat infectious diseases, particularly in the realm of antibiotic resistance.

The Role of AI in Antibiotic Discovery

Traditional methods of discovering new antibiotics are notoriously slow, often taking years to yield results. However, AI is accelerating this process dramatically. As highlighted by researchers such as Wong et al. in their work on leveraging AI in infectious disease control, computers can now identify potential new antibiotics in a matter of hours. This rapid discovery process is crucial in the fight against antibiotic-resistant bacteria, which pose a significant threat to global health.

Machine Learning in Diagnostics

AI’s impact is not limited to drug discovery. Machine learning, a subset of AI, is enhancing diagnostic capabilities, allowing for quicker and more accurate identification of infectious diseases. As the Nature article notes, deep learning models are being used to analyze complex datasets, improving the precision of disease diagnosis and treatment planning. This technological advancement is vital in critical care settings, where timely and accurate diagnostics can save lives.

Ethical Considerations

Despite its promise, the integration of AI into healthcare is not without challenges. Ethical considerations, such as data privacy and algorithmic bias, are significant concerns. The article emphasizes the importance of developing AI models using diverse, representative datasets to ensure fairness and accuracy for all patient groups. Addressing these ethical issues is crucial for the responsible deployment of AI in healthcare.

Looking Ahead

As AI technology continues to evolve, its potential to revolutionize the field of infectious diseases is immense. The Nature article suggests that AI will play an indispensable role in refining infection treatment regimens and enhancing antibiotic stewardship. However, for AI to reach its full potential, ongoing collaboration among healthcare professionals, developers, and regulatory bodies is essential to ensure safe and ethical deployment.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

The AI Boom in Cancer: Game-Changer or Just Hype?

The AI Boom in Cancer: Game-Changer or Just Hype?

The promise of artificial intelligence (AI) in the field of oncology is nothing short of revolutionary. As the world grapples with the complexities of cancer, AI is emerging as a potential game-changer in diagnostics, treatment personalization, and drug discovery. However, this technological marvel also raises the question: is AI in oncology truly transformative, or is it just another bubble waiting to burst?According to Labiotech.eu, the integration of AI into oncology is reshaping our understanding of cancer care. This transformation is evident in the strides made in cancer diagnostics, particularly in radiology, where AI’s advanced image analytics are enhancing early detection capabilities. Ryan Schoenfeld, CEO of the Mark Foundation for Cancer Research, emphasizes AI’s ability to analyze scans with unprecedented speed and accuracy.

Yet, not everyone is convinced of AI’s superiority. Philip Lieberman of Analog Informatics points out that while AI may not surpass human technicians in accuracy, its consistency and ability to identify subtle artifacts make it a valuable adjunct technology, especially in underserved regions.

AI’s Role in Drug Discovery