The Call for Climate Change in Medical Curricula

The Call for Climate Change in Medical Curricula

As the world grapples with the multifaceted impacts of climate change, a new urgency is emerging within the medical community. Experts argue that medical curricula must evolve to include comprehensive climate change education, a topic that was recently at the forefront of discussions at the Asia-Pacific forum of the World Health Summit in Melbourne. This forum highlighted the critical need for future health professionals to understand and mitigate the health impacts of global warming, which are becoming increasingly evident across all fields of human health.Escalating Health Crisis Jonathan Patz, a visiting professor at Monash University and a lead author for the United Nations Intergovernmental Panel on Climate Change, emphasized the severity of the situation. “Climate crisis is a human health emergency,” he stated, underscoring that climate change exacerbates nearly every type of illness. From waterborne diseases caused by extremes in the water cycle to respiratory issues linked to wildfire smoke, the pathways through which climate change impacts health are numerous and complex.

Education as a Tool for Change Despite the increasing recognition of these issues, a 2020 survey revealed that only 15 percent of medical schools had incorporated the health impacts of climate change into their curricula. This gap in education has prompted calls from experts like Professor Patz and others to expand medical training to prepare future health professionals for the realities of climate-related health challenges. An open letter from 2022 urged educators to ensure graduates can identify, prevent, and respond to these impacts.

Global Health and Policy Implications The forum also highlighted the broader implications of climate change on global health policies. Renzo Guinto of Duke-NUS Medical School in Singapore pointed out the mental health challenges associated with climate anxiety, particularly among young people in countries like the Philippines. He advocated for embedding climate health content into health curricula to address these emerging issues and ensure a steady supply of informed health workers.

Opportunities and Challenges While the challenges are significant, there are also opportunities for health benefits as the world tackles the climate crisis. Professor Patz noted that addressing air pollution from fossil fuels, which accounts for over 5 million premature deaths annually according to a BMJ report, could lead to substantial health improvements.

Conclusion

As the forum concluded, the message was clear: integrating climate change education into medical curricula is not just an option but a necessity. This integration will equip future health professionals with the knowledge and skills needed to face one of the most pressing global health emergencies of our time. For more insights from the original article, visit Times Higher Education.More Articles

Getting licensed or staying ahead in your career can be a journey—but it doesn’t have to be overwhelming. Grab your favorite coffee or tea, take a moment to relax, and browse through our articles. Whether you’re just starting out or renewing your expertise, we’ve got tips, insights, and advice to keep you moving forward. Here’s to your success—one sip and one step at a time!

AI Transforming Healthcare: A Leap Forward in Diagnostic Accuracy and Efficiency

AI Transforming Healthcare: A Leap Forward in Diagnostic Accuracy and Efficiency

The healthcare industry is undergoing a seismic shift, driven by the rapid advancement of artificial intelligence (AI). According to a recent TechTarget article, AI’s profound impact on healthcare is revolutionizing diagnostic accuracy, surgical precision, and operational efficiency.

A comprehensive study from Tata Consultancy Services reveals that nearly 94% of healthcare executives have already integrated AI or have plans to do so. This widespread adoption underscores AI’s transformative potential in the medical field.

Enhancing Diagnostic Accuracy

AI’s ability to analyze medical images with a precision that often surpasses human capabilities is one of its most promising applications. This technology is pivotal in early disease detection, such as identifying cancerous cells in mammograms, thereby improving patient outcomes through timely interventions.

Revolutionizing Surgical Procedures

AI is also making waves in surgical procedures. Robotics-assisted surgeries, like endovascular neurosurgery, are becoming more common, offering enhanced precision and reducing complication risks. These systems empower surgeons to perform complex operations with greater accuracy, leading to improved patient outcomes and shorter recovery times.

Boosting Productivity

According to the TCS study, AI is a significant driver of productivity in healthcare. Approximately 40% of executives anticipate incremental productivity gains, while 26% expect AI to double their productivity. AI achieves this by automating routine tasks, streamlining operations, and providing decision support to healthcare professionals.

Challenges and Ethical Considerations

Despite AI’s immense potential, the study highlights several challenges in its implementation, such as the lack of cohesive AI strategies and metrics to measure success. Additionally, nearly 75% of companies are revamping their strategies to leverage AI fully. This includes changes to business models and ensuring staff are adequately trained to use AI tools effectively.

The rapid advancement of AI in healthcare raises important regulatory and ethical considerations. The study notes that 81% of leaders have called for a global set of regulations and standards on AI to ensure responsible use and protect patient privacy and data security.

As AI continues to evolve, it is poised to revolutionize the healthcare industry by enhancing diagnostic accuracy, improving surgical precision, and boosting productivity. However, to fully realize these benefits, healthcare providers must develop cohesive AI strategies, establish clear KPIs, and navigate the regulatory landscape carefully.

AI in Healthcare: Revolutionizing the Medical Field

AI in Healthcare: Revolutionizing the Medical Field

In the rapidly evolving landscape of healthcare, artificial intelligence (AI) is making waves, transforming how medical professionals diagnose, treat, and care for patients. With the AI healthcare market projected to skyrocket from $20.9 billion in 2024 to an astounding $148.4 billion within five years, the future of AI in healthcare promises unprecedented advancements.

AI: Beyond Virtual Assistance

The integration of AI in healthcare extends far beyond being a mere virtual assistant. From patient assistance to surgical precision and pharmaceutical development, AI is enhancing every facet of the medical field. As automation and AI continue to evolve, they are streamlining administrative workflows, thus allowing healthcare professionals to focus more on patient care.Fraud Prevention and Administrative Efficiency

AI plays a pivotal role in combating healthcare fraud, which is estimated to account for 3% to 10% of total US healthcare spending. By identifying suspicious patterns in insurance claims, AI helps prevent fraudulent activities, safeguarding valuable resources. Moreover, AI-powered tools are enhancing administrative efficiency, enabling clinicians to maintain accurate medical records through content summarization and note-taking.Advancements in Surgery and Patient Care

AI-assisted robotic surgeries are reducing risks associated with infection, post-surgery pain, and blood loss. These advancements lead to improved recovery times and better patient outcomes. Additionally, AI-powered chatbots are aiding patients in medication management, ensuring accuracy in self-administered treatments.Improving Diagnostics and Patient Experiences

AI’s impact on diagnostics is profound, offering enhanced accuracy and efficiency. By leveraging big data, AI can rapidly identify genetic biomarkers, improving diagnostic processes and reducing costs. Moreover, AI is revolutionizing patient experiences by facilitating clearer communication between clinicians and patients, as highlighted in a post-pandemic study.Challenges and Governance

Despite its potential, AI in healthcare faces challenges such as regulatory hurdles and ethical concerns. The World Health Organization’s Ethics & Governance of Artificial Intelligence for Health report emphasizes the importance of transparency, equity, and accountability in AI applications. Addressing these challenges is crucial for AI to meet the high standards of the healthcare industry.The Future of AI in Healthcare

As AI continues to evolve, its role in healthcare will expand, offering more precise diagnostics, improved patient monitoring, and enhanced drug safety. Despite the challenges, the promising future of AI in healthcare is undeniable. For those looking to navigate the complexities of AI integration, partnering with specialized AI companies can be invaluable.The Fintech Boom: Redefining Banking Services In The Digital Age

The Fintech Boom: Redefining Banking Services In The Digital Age

The financial services industry is undergoing a seismic shift, driven by the rise of new fintech technologies. These innovations are revolutionizing how people invest, lend, and save money, responding to the modern demand for efficiency and convenience. Fintech provides transformative solutions that deviate from traditional banking practices, addressing long-standing challenges in the financial sector. Companies like DeepInspire are at the forefront, using innovative technologies to change the delivery of financial services.

Personalized Banking Experiences

One of the most significant advancements in fintech is the ability to offer personalized banking experiences through digital platforms, such as multifunctional mobile apps. Advanced data analytics enable a deep understanding of customer behavior, allowing businesses to tailor financial solutions to individual preferences. Budgeting apps provide insights into spending habits, suggest savings strategies, and warn against potential overspending. In contrast, traditional banks, burdened by outdated systems, struggle to match the level of personalization offered by fintech, risking market share loss to more agile competitors.User-Centric Design

Modern fintech solutions are characterized by their user-centric design, featuring intuitive and accessible mobile applications. These apps facilitate easy navigation of various banking functions and incorporate biometric security measures, such as fingerprint and facial recognition, to enhance security while simplifying login processes. Unlike the cumbersome interfaces of traditional banks, fintech solutions remove barriers to financial access, allowing clients to manage transactions, loans, and accounts seamlessly from anywhere at any time.Relentless Innovation

The innovation cycle in fintech is relentless, consistently presenting comprehensive financial solutions that elevate client interactions with banks. Fintech facilitates real-time transactions, prompt loan approvals, and immediate fund transfers. Platforms offering streamlined lending cut through the red tape of traditional banks’ approvals, setting industry benchmarks that compel banks to recalibrate operations and expand service offerings.Cost-Effectiveness

Fintech’s cost-effectiveness is another notable contribution, achieved by automating processes and eliminating the need for physical branches. This leads to reduced service costs and competitive pricing. The overheads experienced by traditional banks often translate to less favorable pricing for customers, while fintech leverages innovation to enhance service accessibility and affordability.Operational Efficiency

The adoption of technology in banking breathes new life into operational efficiencies, significantly reducing errors through tools like robotic process automation. Mundane tasks are expedited, freeing human resources for critical customer engagement activities. Moreover, tools for AI-driven financial analysis advance the accuracy of data interpretation, fostering informed decision-making.Emergence of New Business Models

New business models birthed by fintech include open banking, which champions third-party apps interfacing with financial institutions, fostering cooperation in service innovation. Neo-banks, operating without physical branches, deliver a streamlined, cost-efficient banking experience favorable to niche markets such as freelancers and younger clientele who prioritize transparency and convenience. Furthermore, peer-to-peer lending platforms revolutionize loan access by directly connecting borrowers with investors, enhancing competitive access to credit.Conclusion

The rapid evolution of the fintech sector is profoundly reshaping banking services through enhanced personalization, seamless user experience, optimized operations, and novel business models. The symbiotic relationship between fintech and traditional banking will be pivotal in defining the financial landscape of the future, as highlighted in the original article on ABCmoney.co.uk.Zoning Reforms to Mitigate America’s Affordable Housing Crisis

Zoning Reforms to Mitigate America’s Affordable Housing Crisis

The affordable housing crisis in the United States has reached a critical point, prompting cities to consider zoning reforms as a potential solution. As outlined in a recent article from Urban Land Magazine, outdated zoning laws have significantly contributed to housing shortages by favoring low-density, single-family homes. Reforming these laws could act as a catalyst for increasing housing supply.

According to M. Nolan Gray, a Los Angeles-based city planner and author of Arbitrary Lines: How Zoning Broke the American City and How to Fix It, the severity of the crisis has made it a top priority for politicians. Gray notes that numerous cities have already scrapped exclusionary single-family home zoning and parking requirements, a move that was previously unimaginable.

David Garcia, policy director for the Terner Center for Housing Innovation at the University of California, Berkeley, emphasizes that many jurisdictions are hesitant to embrace zoning reform due to potential backlash. However, the concept of allowing multiple units on single-family parcels is gaining traction.

While many cities have recently initiated zoning changes, their impacts are just beginning to materialize. Toccarra Nicole Thomas, director of land use and development at Smart Growth America, argues that zoning reform must be comprehensive to effectively address the affordable housing shortage. Piecemeal reforms, such as allowing accessory dwelling units (ADUs) or “missing middle” housing, may be easier to achieve but are unlikely to be as effective.

Challenges and Options

Zoning reform is not without its challenges. Political hurdles, including NIMBYism and bureaucratic barriers, are significant obstacles. Reform options include allowing ‘by right’ buildings to streamline permitting, focusing on revitalizing commercial corridors, and reducing parking minimums.

For instance, Oakland, California, revitalized its Auto Row, a languishing neighborhood, by adding about 1,000 housing units through comprehensive planning. This success story illustrates the potential of zoning reform to increase housing supply.

- Rezone to encourage missing middle housing: This approach allows for greater density without altering a community’s character.

- Repurpose underused land: Former industrial areas, like D.C.’s Navy Yard, have been successfully rezoned for mixed uses, including residential.

- Reduce parking minimums: Reducing these requirements can lower developer costs and increase density.

- Streamline the permitting process: Making the process more predictable and financially feasible can significantly impact affordable housing projects.

Gray warns that poorly executed zoning reform could erode public trust. A balanced approach, involving both zoning reform and subsidies, is essential to address the crisis effectively.

Developers play a crucial role in this process. Engaging with community and city leaders early on can build trust and streamline reform efforts. As Garcia suggests, developers should present data demonstrating how new housing can enhance existing property values.

To explore zoning reform further, you can access the report Reshaping the City: Zoning for a More Equitable, Resilient, and Sustainable Future and listen to the webinar discussion featuring insights from Nolan Gray and Toccarra Nicole Thomas.

Navigating Foreign Investments in U.S. Real Estate: Balancing Economic Benefits and National Security

Navigating the Complex Terrain of Foreign Investments in U.S. Real Estate

In recent years, the landscape of foreign investment in the United States’ real estate sector has become increasingly complex and contentious. Scholars and policymakers are actively debating the regulatory measures needed to mitigate potential threats posed by such investments. The original article from The Regulatory Review highlights the multifaceted issues surrounding this topic, drawing attention to national security concerns, economic implications, and housing affordability challenges.

Foreign Investments: A Double-Edged Sword

Over the last 15 years, foreign investment in U.S. real estate has surpassed $1.2 trillion. This influx of capital has led to significant changes in the real estate market, with foreign ownership of agricultural land increasing by 50% since 2017. While this investment can bolster the economy, it also raises national security concerns, especially when properties are located near sensitive military installations.

Regulatory Oversight and Challenges

The Committee on Foreign Investments in the United States (CFIUS) plays a pivotal role in reviewing foreign investments for potential security threats. However, the complexity of these transactions often leaves gaps in oversight. For instance, a controversial purchase of 370 acres near an Air Force base by a Chinese company in 2022 highlighted the limitations of CFIUS’s jurisdiction.

Economic Impacts and Housing Affordability

The economic implications of foreign investments extend beyond national security. As housing affordability has declined dramatically over the past two decades, foreign investments have been blamed for exacerbating this issue. In cities where housing prices have soared, foreign buyers are often seen as contributing to the demand shock that drives up prices.

Legislative Responses

In response to these challenges, both federal and state legislatures have begun to restrict foreign investment in specific real estate categories. States like Louisiana and Oklahoma have enacted laws limiting property ownership by foreign nationals from adversary states, aiming to protect national interests.

Recommendations and Future Directions

To enhance transparency and mitigate risks, experts recommend several measures. The GAO suggests improving data accessibility related to foreign investments, while scholars advocate for the use of the Corporate Transparency Act to identify real estate owners. Additionally, a working paper by Andolfatto and Rekkas highlights the potential of foreign buyers’ taxes to stabilize housing markets.

The intricate balance between welcoming foreign investment and safeguarding national interests continues to be a subject of rigorous debate. As the United States navigates this complex terrain, the insights from scholars and regulatory experts will be crucial in shaping effective policies.

Navigating the Shifting Housing Market: Opportunities Amid Falling Mortgage Rates

Current Market Dynamics

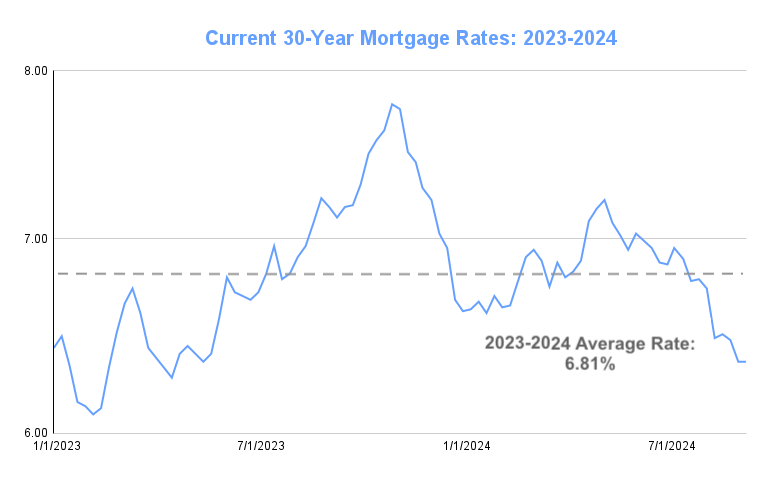

The recent article from Forbes highlights that mortgage rates have fallen below 6.5%, providing relief for buyers compared to previous peaks. This change is partly influenced by the Federal Reserve’s interest rate policies, which could further impact rates in the coming months.Meanwhile, experts like Lisa Sturtevant from Bright MLS suggest that declining mortgage rates, combined with increasing inventory, might stabilize home prices. However, the market still faces challenges with fewer homes being sold, maintaining pressure on affordability.

Supply Challenges

Despite more inventory entering the market, the demand continues to outpace supply. Existing homeowners locked into low rates contribute to this imbalance, indicating a prolonged demand-supply mismatch. This persistent deficit suggests that the housing market will need more time to achieve equilibrium.Regulatory Changes Impacting Buyers and Sellers

The National Association of Realtors (NAR) has implemented new regulations following legal settlements. These changes alter commission structures and require buyers to enter agreements with brokers, potentially shifting financial responsibilities in real estate transactions. The impact of these changes on market activity remains to be seen.Expert Insights on Market Conditions

Economists like Ralph McLaughlin of Realtor.com predict periods of slowed home price growth, followed by rebounds as buyer purchasing power improves. Anticipated rate cuts by the Federal Reserve and the gradual easing of home prices might provide relief, with expectations for a more balanced market by 2025.Looking Forward: Opportunities and Risks

While affordability remains a concern, the combination of declining rates and increased home inventory presents a more promising outlook for buyers. However, the risk of a potential demand surge could reignite price growth, posing challenges for affordability.Conclusion: A Time of Cautious Optimism

Despite ongoing challenges, lower mortgage rates and increased purchasing options offer buyers more leverage in negotiations. Experts advise against waiting for perfect market conditions, encouraging potential homeowners to explore opportunities as they arise.For a deeper understanding of market predictions and evolving dynamics in the real estate sector, refer to the original article.

Foreign Investments in U.S. Real Estate: A Double-Edged Sword

Foreign Investments in U.S. Real Estate: A Double-Edged Sword

In recent years, foreign investment in U.S. real estate has surged to unprecedented levels, surpassing 1.2 trillion dollars over the past 15 years. This influx has sparked a robust debate among scholars and policymakers about the potential threats and benefits posed by such investments.The increase in foreign-owned agricultural land has raised national security concerns, particularly when these investments occur near sensitive military locations. For instance, a Chinese company’s purchase of 370 acres near an Air Force base in North Dakota led to significant criticism and highlighted the potential risks involved.

Regulatory Measures and Challenges The regulation of foreign investments traditionally falls under the purview of the Committee on Foreign Investments in the United States (CFIUS). However, scholars argue that existing frameworks may prioritize financial gains over national security. The Government Accountability Office (GAO) has recommended improving data accessibility to enhance oversight and mitigate risks.

On the economic front, foreign investments have been linked to rising housing prices, exacerbating affordability issues in cities across the nation. The effects of foreign capital influx are particularly pronounced in places like California, where home prices have surged by 30%, as noted in a study published in the Review of Financial Studies.

State-Level Responses and Policy Innovations

In response to these challenges, some states have enacted laws to curb foreign ownership. For example, Oklahoma has implemented measures preventing noncitizens from acquiring land, while Louisiana has restricted purchases by entities from countries deemed adversarial.Meanwhile, scholars from the Brookings Institution suggest leveraging the Corporate Transparency Act to increase transparency in real estate ownership through shell companies. This approach mirrors successful initiatives in the UK that have curbed offshore investments.

Balancing Act As the debate continues, the U.S. faces a complex balancing act between attracting foreign capital and safeguarding national interests. The insights from the original article emphasize the need for nuanced regulatory strategies that address both economic and security concerns.

Aflac’s Strategic Engagement with Gen Z: A Digital Evolution

Aflac’s Strategic Engagement with Gen Z: A Digital Evolution

In a world where purchasing behaviors are rapidly evolving, brands like Aflac are adapting to meet the demands of a new generation. With the rise of digital interactions, Aflac is tailoring its strategies to engage Gen Z and other demographics, focusing on seamless digital experiences and omnichannel engagement.Adapting to Mobile-First Consumers

The shift towards mobile-first interactions is undeniable. According to a survey by ecommerce software company StoreConnect, 62% of consumers trust mobile devices over personal computers for significant purchases. This trend is even more pronounced among Millennials, with 64.2% expressing confidence in mobile channels for booking flights and vacation rentals. Aflac recognizes this shift and is keen to meet consumers where they are most comfortable.

Engagement Strategies for Gen Z

Keith Farley, SVP of individual voluntary benefits at Aflac, emphasizes the importance of digital engagement for Gen Z, a demographic that grew up in the era of the iconic Aflac Duck commercials. While Gen Z values digital interactions, they also appreciate the human touch during critical moments, such as receiving a health diagnosis. Aflac’s strategy involves maintaining a balance between digital convenience and human support, ensuring a comprehensive customer journey.

Omnichannel Approach and Privacy

Aflac’s omnichannel approach is designed to cater to diverse consumer preferences. Customers can purchase insurance and file claims entirely through digital channels, offering flexibility and convenience. However, when privacy is paramount, as in health-related matters, Aflac ensures secure communications through email, chat, and phone.

Promoting Wellness and Brand Loyalty

To foster ongoing engagement, Aflac offers an annual wellness benefit, encouraging customers to maintain their health. This initiative not only promotes good health but also strengthens customer relationships. According to Farley, 80% of wellness claims are processed through Aflac’s mobile app, underscoring the efficiency of their digital platforms.

By promoting seamless claim processes and wellness benefits, Aflac aims to “close the loop on the promise the company made,” ensuring that customers experience the full value of their insurance policies. This approach is highlighted in the original article on MarTech, which delves into Aflac’s strategies for engaging modern consumers.

Conclusion

Aflac’s commitment to adapting its engagement strategies reflects a broader trend in consumer-brand interactions. By embracing digital platforms and maintaining a human touch, Aflac is well-positioned to meet the evolving expectations of Gen Z and beyond. For a deeper understanding of Aflac’s approach, explore the full article on MarTech. “`US Housing Market Faces Setback Amid Rising Mortgage Rates

US Housing Market Faces Setback Amid Rising Mortgage Rates

In a recent report from Reuters, the U.S. single-family homebuilding sector has hit an eight-month low in June, largely due to escalating mortgage rates. This downturn suggests a potential drag on the nation’s economic growth during the second quarter.

Single-family housing starts saw a decline of 2.2%, while building permits for future construction decreased by 2.3%, reaching a one-year low. This trend indicates that any anticipated recovery in the housing market, even with expected interest rate cuts by the Federal Reserve later this year, might be subdued.

Despite these challenges, the housing market continues to grapple with a shortage of previously owned homes, which keeps prices elevated. The higher mortgage rates, which had peaked above 7% earlier this year, have dampened the construction momentum seen in previous months.

Manufacturing Sector Shows Promise

Contrasting with the housing market’s struggles, the manufacturing sector has shown signs of recovery. Manufacturing production increased by 0.4% in June, signaling emerging positive trends within this interest-rate-sensitive sector.

According to a separate report from the Federal Reserve, motor vehicle production surged to a nine-year high, contributing to the overall increase in factory output.

Economic Outlook and Implications

Economists forecast a mixed impact on the residential construction sector from upcoming interest rate adjustments. While the Atlanta Fed projects a 2.7% annualized GDP growth rate for the second quarter, there are concerns that rising unemployment could curb the flow of new buyers, even if mortgage rates decrease.

The multifamily housing market continues to benefit from a shift towards renting, with permits for multi-unit projects seeing a significant increase. This trend further highlights the complexities and challenges within the current housing market landscape.

For more insights into the day ahead in U.S. and global markets, consider subscribing to the Morning Bid U.S. newsletter.

U.S. Economy Shows Resilience Amidst Cooling Labor Market

U.S. Economy Shows Resilience Amidst Cooling Labor Market

The U.S. economy continues to demonstrate its robustness, as evidenced by a notable GDP growth of 2.8% in the second quarter of 2024. This growth, as reported by Freddie Mac, is primarily driven by consumption spending and non-residential investment. However, the labor market is showing signs of softening, with a rise in the unemployment rate and a slight decline in job openings.Housing Market Struggles Despite Lower Mortgage Rates

In the housing sector, demand remains weak despite a reduction in mortgage rates. June marked a significant low in home sales, a level not seen since 2011. High borrowing costs and affordability issues continue to deter potential homebuyers. The report highlights that refinance volumes have plummeted to levels reminiscent of the mid-1990s, attributed to elevated interest rates.Anticipated Decline in Mortgage Rates

Freddie Mac forecasts a gradual decline in mortgage rates, which could potentially revive homebuyer interest, particularly among first-time buyers. Homeowner equity remains high, leading to opportunities for cash-out refinances. However, substantial activity in this segment is expected only if further rate cuts occur, responding to favorable inflation data.Optimistic Economic Outlook

The overall outlook remains optimistic, with expectations of moderate economic growth and no imminent recession fears. This is supported by stable inflation projections and anticipated adjustments in Federal Reserve policies.For more detailed insights, visit the full report at Freddie Mac Research.

Rising Tide of Risk: The Insurance Industry’s Climate Challenge

In the ever-intensifying dance between nature and human resilience, insurance companies find themselves at a critical juncture. As hurricanes grow in frequency and ferocity, the property and casualty (P&C) insurance industry is grappling with a new era of risk, driven largely by climate change. This shift is forcing insurers to reconsider long-standing practices, with traditional risk models faltering under the weight of mounting insured losses.

The Evolving Nature of Hurricane Risk

Today’s hurricanes are no longer the predictable forces they once were. Rapidly intensifying storms, like this year’s devastating Hurricane Helene, have become the norm, particularly in the United States where seven of the ten most expensive insured loss events occurred. This unsettling trend, highlighted by Gallagher Re, underscores the urgent need for the insurance industry to adapt.

Rising Premiums and Narrowing Coverage Options

For residents in high-risk coastal areas such as Florida and Louisiana, the consequences of these shifting patterns are stark. Insurance premiums are on the rise, and coverage options are dwindling. Some insurers, faced with the escalating costs of claims, have opted to exit these volatile markets entirely. Major players like Allstate and Berkshire Hathaway have already begun to limit their exposure, citing climate change as a key factor in their strategic recalibrations.

Last Resort Insurance Pools

In response to the diminishing availability of private insurance, coastal states have established last-resort insurance pools. These pools serve as a crucial safety net for property owners who find themselves unable to secure affordable coverage. However, as the costs associated with these pools rise, they too are becoming financially strained, leading to higher premiums or reliance on state tax revenues, further complicating affordability for residents.

The Long-Term Outlook

Looking ahead, the prospect of insurance becoming unaffordable or unattainable looms large. The Future of Financial Services report by GlobalData suggests that regulatory measures to address climate risks may exacerbate these challenges, potentially leading to increased costs and fewer options for policyholders. As insurance becomes more complex and potentially uninsurable, property values in hurricane-prone regions could plummet, deterring investment and destabilizing local economies.

As we navigate this rising tide of risk, the insurance industry must innovate and adapt to ensure that protection remains viable for those who need it most. The stakes have never been higher, and the time for action is now.

Analyzing Mortgage Rate Trends in 2024: A Historical Perspective

Analyzing Mortgage Rate Trends in 2024: A Historical Perspective

The past few years have presented a challenging landscape for homebuyers, with both mortgage rates and home prices rising sharply. However, recent trends suggest a potential easing of this financial squeeze. As reported by The Mortgage Reports, mortgage rates have been on a gradual decline, raising the question of whether this trend will continue or reverse.

Current Landscape and Historical Context

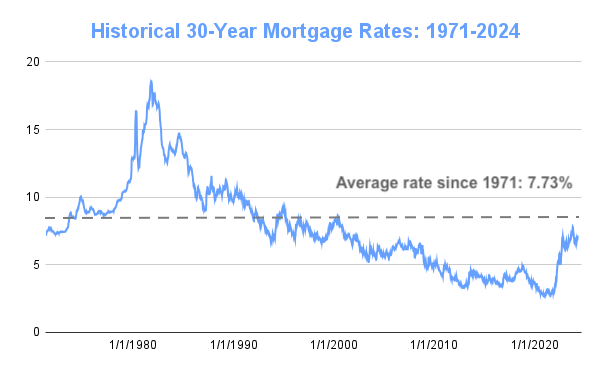

With rates now in the low 6% range, a recent 50-basis-point rate cut by the Federal Reserve has sparked optimism among prospective buyers. Historically, mortgage rates have fluctuated significantly, with Freddie Mac data showing a long-term average of 7.73% for 30-year fixed-rate mortgages since 1971.

Notable Historical Events

- 1981: The all-time high for mortgage rates, with averages peaking at 16.63%.

- 2008: The mortgage slump, with rates at 6.03% amidst the financial crisis.

- 2021: Record-low rates, reaching 2.65% due to pandemic-induced Federal Reserve policies.

The Road Ahead

The Federal Reserve’s recent actions and anticipated future cuts could further influence mortgage rates. Experts predict that rates might fall to between 5.5% and 6.0% by the end of next year, providing potential relief for homebuyers. However, with economic conditions remaining unpredictable, borrowers are advised to focus on their financial readiness rather than attempting to time the market.

For those exploring their mortgage options, understanding the factors affecting rates—such as credit score, down payment, and loan type—is crucial. Personalized rates often diverge from the average, offering opportunities for savvy borrowers to secure favorable terms.

Conclusion

As the housing market navigates these evolving conditions, staying informed about mortgage rate trends and historical context is essential. For more detailed insights, refer to the original article on The Mortgage Reports.

2025 Commercial Real Estate Outlook: Navigating a Shifting Landscape

2025 Commercial Real Estate Outlook: Navigating a Shifting Landscape

As we delve into the 2025 commercial real estate outlook, a comprehensive analysis by Deloitte offers valuable insights to help industry leaders navigate recent challenges and seize upcoming opportunities. This report, published approximately a month ago, draws on a myriad of economic forecasts and trends shaping the sector globally.Economic Forecasts and Regional Insights

The report provides a detailed examination of economic conditions across various regions, including the United States, Eurozone, and India. These analyses are crucial for understanding the complex interplay of factors influencing real estate markets. The global economic outlook, further elaborated in the Global Economic Outlook 2024, provides context for the anticipated shifts in commercial real estate dynamics.Monetary Policies and Their Impacts

Interest rate changes from major financial institutions such as the Bank of England and the Federal Reserve are pivotal in shaping the commercial real estate landscape. The ECB’s recent rate cut has been met with a mixed response, highlighting the nuanced impacts of monetary policy on the sector.Emerging Trends and Challenges

The report identifies several key trends influencing real estate investment. These include the challenges posed by climate change, the increasing importance of nearshoring, and the burgeoning demand for data centers. As businesses adapt to these trends, they must also contend with the potential for increased regulatory scrutiny and the need for sustainable practices.Positioning for Opportunities

For commercial real estate leaders, the insights from Deloitte’s report are invaluable for strategic planning. By understanding the economic conditions and emerging trends, organizations can better position themselves to capitalize on opportunities and mitigate risks in this evolving landscape.Conclusion

In conclusion, the 2025 commercial real estate outlook offers a roadmap for navigating the complexities of today’s market. By leveraging insights from economic forecasts and understanding the implications of policy changes, industry leaders can make informed decisions that drive success in the coming years.The Aerospace and Defense Industry: A Technological Transformation in 2025

The Aerospace and Defense Industry: A Technological Transformation in 2025

In a year marked by significant geopolitical tensions and a post-pandemic recovery, the aerospace and defense industry is gearing up for a transformative 2025. According to Deloitte’s 2025 Aerospace and Defense Industry Outlook, the sector is set to operationalize a range of advanced technologies, with artificial intelligence (AI) at the forefront.The commercial air travel sector has bounced back impressively from the COVID-19 downturn, with global air passenger traffic expected to grow by 11.6% in 2024, as per the International Air Transport Association. This recovery is not just a return to form but a springboard for further advancements. The demand for air travel has spurred aerospace companies to integrate AI and digital technologies to enhance aftermarket services and optimize supply chains, addressing persistent challenges such as supply chain disruptions and workforce shortages.

On the defense front, geopolitical tensions have driven countries to increase their defense spending, with expenditures surpassing $2.4 trillion in 2023, according to the Stockholm International Peace Research Institute. This trend is expected to continue, with strategic investments focusing on advanced air mobility (AAM) and unmanned systems. The Biden administration’s request for a $849.8 billion budget for the Department of Defense in fiscal 2025 underscores the priority given to technological innovations in the sector.

AI and Digital Technologies: Revolutionizing Operations

AI is set to revolutionize the industry by enhancing operational efficiency and customer experience. Companies are increasingly comfortable with AI, utilizing it for predictive maintenance, inventory optimization, and resource allocation. The integration of AI into maintenance, repair, and overhaul (MRO) services is expected to extend the operational lifespan of aircraft, ensuring their availability and reliability.Strategic Spending and Technological Innovations

The industry’s strategic spending is heavily influenced by defense priorities. The space economy, fueled by commercial sector growth, is projected to expand significantly, with positioning, navigating, and timing technologies playing a crucial role. Investments in solid rocket motors and unmanned aerial systems are also on the rise, driven by both military and commercial demands.Workforce Challenges and Digital Solutions

The aerospace and defense industry faces ongoing challenges in attracting and retaining talent. With an aging workforce and high turnover rates, companies are leveraging digital technologies to enhance traditional talent strategies. Apprenticeship programs and extended reality technologies are being utilized to build a robust talent pipeline and ensure knowledge transfer.Supply Chain Resilience and Visibility

The complexity of the aerospace and defense supply chain necessitates a focus on resilience and visibility. Companies are working to balance efficiency with the need to secure critical materials and ensure timely delivery of parts and components. The formation of the Aviation Supply Chain Integrity Coalition highlights the industry’s commitment to maintaining the integrity of its supply chain.As 2025 approaches, the aerospace and defense industry is poised for a year of differentiation through operations. By embracing technological advancements and strategic investments, companies can navigate the challenges of supply chain disruptions and workforce shortages, driving growth and innovation.

Biden-Harris Administration Unveils Ambitious Student Debt Relief Plans

Following the Supreme Court’s June 2023 decision to overturn the initial student debt cancellation plan, President Joe Biden swiftly introduced a comprehensive “plan B.” This new approach seeks to establish clear guidelines on eligibility and debt cancellation limits, potentially impacting around 27.6 million borrowers. To date, the administration has delivered $168 billion in relief, with the new measures projected to cost an additional $147 billion over the next decade.

A central focus of the plan is to address inequitable interest accumulation. Proposed policies aim to benefit an estimated 23 million borrowers by capping interest growth. Furthermore, specific borrowers, particularly those who have been repaying loans for over two decades, may see their debts fully forgiven.

The relief will be automatic for eligible individuals, effectively bypassing the bureaucratic hurdles that previously impeded access. Importantly, these policies target those most burdened by student debts, including low-income groups, borrowers of color, and individuals who attended institutions now held accountable for failing to meet federal standards. The proposed regulations ensure that the benefits extend to these more vulnerable demographics, countering criticisms that the relief favors the affluent.

Moreover, the new initiatives aim to address systemic racial disparities in educational debt. Black borrowers, who typically incur higher debt levels and face longer repayment challenges than their white counterparts, stand to gain significantly from these proposals. Provisions such as the interest waiver are set to benefit a substantial portion of Black and Latino borrowers, with the intent to mitigate the racial wealth gap exacerbated by student loans.

These actions are part of the administration’s broader focus on accountability, underscoring the need for rigorous institutional oversight. The proposed regulations also include waivers for borrowers from unscrupulous or failed educational programs, aiming to protect future students from similar predicaments.

As deliberations continue, the Department of Education is fine-tuning these policies to ensure they align with broader financial equity objectives. While the current administration’s tenure may influence the timeline for enactment, future administrations have the potential to advance these reforms, fostering a more equitable and supportive educational financing system across the nation.

Q3 2024 Down Payments Decline Slightly, Still Near Historic Highs

Down Payments Ease but Remain High

The average **down payment** fell to 14.5% in Q3 2024 from the historical peak of 14.9% in Q2. This represents a modest decrease but still ranks as the third-highest percentage in recent history. The median **down payment amount** also dropped slightly to $30,300 from $32,700, reflecting the easing competition in the **housing market**.

Regional Disparities in Down Payment Trends

Regional differences are evident, with the **Northeast states** experiencing the most significant increases in **down payments**, while **Southern states** are witnessing declines. High-priced metros continue to demand larger **down payments**, but more affordable regions are seeing the most growth. This disparity highlights the ongoing impact of economic dynamics and **buyer behavior** across the nation.

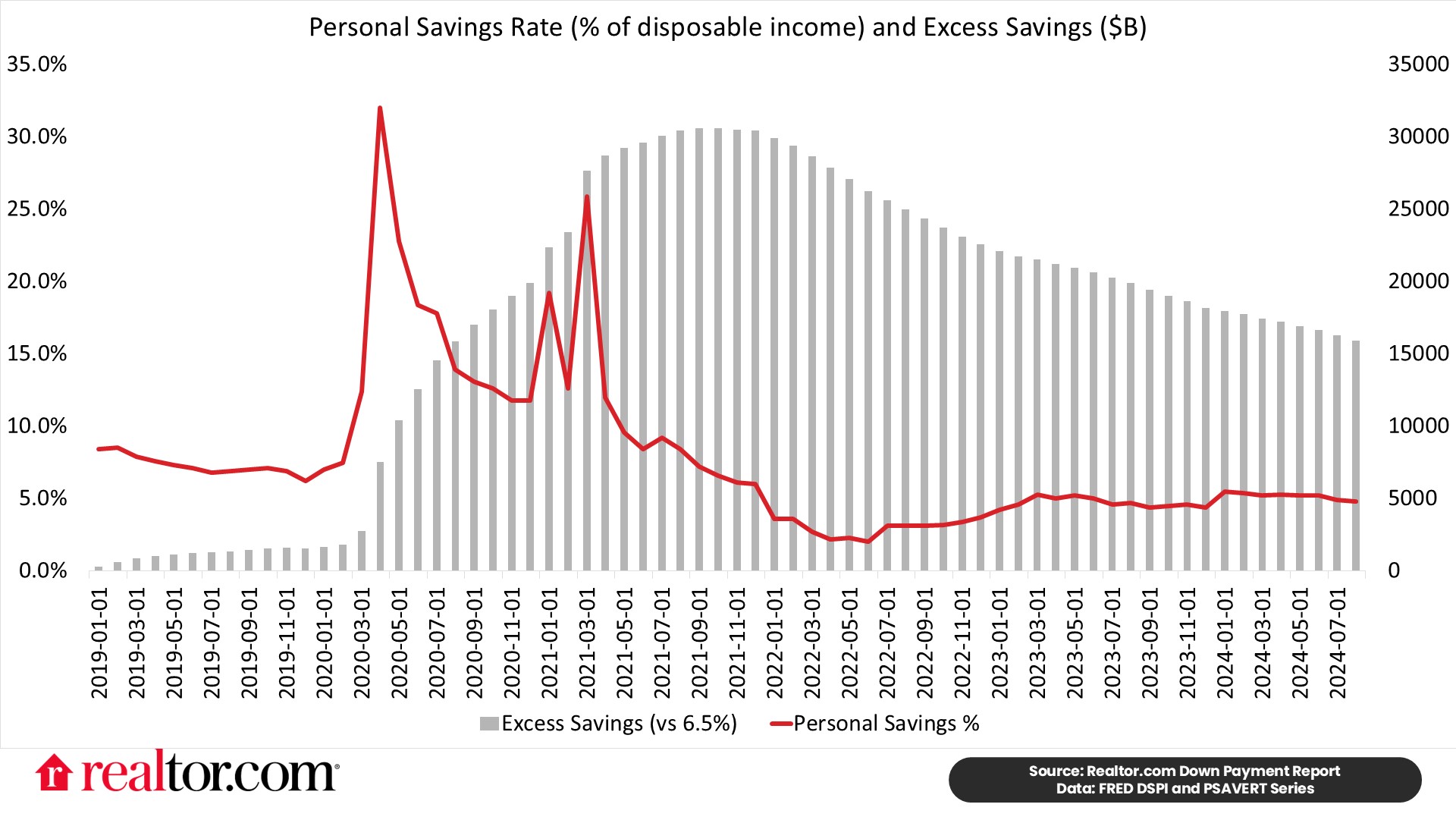

The Role of Pandemic-Era Savings

The influence of **pandemic-era savings** is still felt in the market. During the pandemic, personal savings rates surged, allowing many buyers to afford larger **down payments**. Although savings rates have since fallen, the accumulated savings continue to support consumer spending and **home buying**.

Impact of Falling Mortgage Rates

The recent drop in **mortgage rates**, which began in May and stayed below 7% from June, is expected to further impact **down payment trends**. As rates continue to fall, potential buyers might hold off in anticipation of even lower rates, or conversely, increased **buyer competition** could drive **down payments** upward again.

Primary Residences vs. Investment Properties

**Primary residences** typically see lower **down payments** compared to second homes and **investment properties**, which have **down payments** nearly double the typical share of primary residences. In dollar terms, **down payments** for **investment and second homes** were significantly larger than those for **primary residences** in Q3 2024.

Future Outlook

As we look ahead, the question remains whether this easing trend will continue or if **down payments** will climb again due to **market conditions**. The interplay of **mortgage rates**, personal savings, and **housing market dynamics** will continue to shape these trends.

For further insights, explore the Home Purchase Sentiment Index and the Employment Report for October 2024.

Transforming U.S. Cities: Opportunities for Real Estate Through Federal Infrastructure Funds

Unlocking Opportunities

With a staggering $394 billion earmarked over the next decade for **decarbonization** and **clean energy conversion** through the IRA, and at least $550 billion allocated for **U.S. transportation networks** via the BIL, the scale of potential impact is immense. As Urban Land Institute resources suggest, these funds could trigger urban resilience and sustainable outcomes.

Developers as Key Players

**Real estate developers** stand at the forefront of this movement, leveraging government funds to drive sustainability. The IRA’s tax incentives create a predictable environment for investments in **green technologies**, offering financial returns through reduced operating costs and increased property values. By strategically blending state, local, and federal funds, developers can achieve profitable outcomes while contributing to a healthier planet.

Public-Private Synergies

The synergy between public investments and private real estate initiatives can manifest significant community benefits. For instance, public investments in **highway conversions** that enhance walkability and access to green spaces may unlock opportunities for adjacent **real estate development**. Such collaborations promise cleaner air, more opportunities for community engagement with nature, and overall resilience.

Case Studies in Action

Examples like the Washington, DC region’s **National Landing** and Tallahassee’s **Southside Transit Center** illustrate the transformative potential of these synergistic infrastructure projects. In Tallahassee, a $15 million RAISE grant is already spurring adjacent infrastructure improvements and affordable housing developments, showcasing the power of strategic federal investments.

Navigating Federal Funding

To access these opportunities, developers must navigate a complex landscape of federal grants and tax incentives. Resources like Grants.gov provide searchable lists of funding opportunities, while professional guidance on tax implications can help maximize benefits.

Conclusion

As Urban Land Magazine emphasizes, the strategic utilization of federal funding enables developers to mold resilient communities. With comprehensive insights into available programs and benefits, developers are encouraged to proactively participate in federal opportunities for sustainable development outcomes. Stay informed with Urban Land Magazine for future articles elaborating on specific funding ventures.

California Rent Control Back on the Ballot, Twice

California Rent Control Back on the Ballot, Twice

In a state where the cost of living continues to skyrocket, Californians are once again faced with crucial decisions on housing policies. This November, voters will find two propositions on the ballot that address rent control, each with its own distinct approach and implications.

In a state where the cost of living continues to skyrocket, Californians are once again faced with crucial decisions on housing policies. This November, voters will find two propositions on the ballot that address rent control, each with its own distinct approach and implications. Proposition 33 seeks to empower local governments with greater authority over rent caps. Currently, restrictions prevent cities from limiting rents on single-family homes, apartments built post-1995, and for new tenants. By eliminating these constraints, Prop. 33 aims to stabilize housing markets and reduce homelessness. Supporters argue that this measure is essential for keeping more people housed, while opponents, notably landlord groups, caution that it could decrease profitability and worsen the existing housing crunch.

This isn’t the first time Californians have faced such a choice. Similar measures were struck down in both 2018 and 2020. The ongoing debate highlights the tension between tenant advocates and property owners, each vying for a solution that addresses their concerns.

Meanwhile, Proposition 34 introduces a different kind of reform, targeting fiscal responsibility within the healthcare sector. This measure would compel California healthcare providers to allocate at least 98% of revenue from a specific prescription drug discount program towards direct patient care. The AIDS Healthcare Foundation, which has historically funded rent control initiatives, is at the center of this proposition. Landlord groups, aiming to curtail the foundation’s influence, support Prop. 34 as a means of enforcing accountability.

For voters seeking to delve deeper into these propositions, Marisa Kendall of CalMatters provides a detailed analysis, while Erica Yee offers an interactive quiz to help voters assess their stance. Additionally, a video explainer offers a quick overview of Prop. 33’s potential impact.

As the November election approaches, Californians are encouraged to stay informed and engaged. The decisions made at the ballot box will undoubtedly shape the future of housing and healthcare policies in the state.

FTC’s Non-Compete Ban Blocked: Implications for U.S. Physicians and Workers

Non-compete agreements have traditionally restricted physicians, with 37% to 45% bound by such terms, according to the American Medical Association. These agreements were intended to safeguard confidential information for employers but have long been criticized for limiting professional mobility. The FTC’s efforts to ban non-competes aimed to liberate physicians and bolster career opportunities, much to the delight of the medical community.

However, Judge Brown’s ruling cited the FTC’s overreach, labeling the rule as “arbitrary and capricious” and expressing concerns about irreparable harm. The FTC is considering appealing the decision, arguing that the ruling doesn’t prevent them from targeting non-competes through individual actions. Meanwhile, professionals in the field warn colleagues against hasty moves, as legal battles are far from over.

For many physicians, including those in Dr. Nisha Mehta’s Physician Side Gigs community, which boasts 190,000 members, non-competes remain a significant hurdle in career negotiations. The momentum against these clauses is building slowly but steadily, offering a glimmer of hope for future changes in employment contracts.

The recent Supreme Court decision in Loper Bright Enterprises v. Raimondo has only intensified the scrutiny of agency power, potentially complicating the FTC’s path. Before this decision, courts typically deferred to agency interpretation of ambiguous laws, but now they possess greater autonomy to evaluate such authority, paving the way for more intense legal challenges surrounding non-competes.

On a broader scale, should the FTC’s ban on non-competes succeed in the future, the implications could reach millions of American workers. Non-competes would be invalidated, except for senior executives earning above a certain threshold. Yet, questions linger about the inclusion of medical personnel and employees of nonprofit hospitals, many of which argue for their exemption based on their operational models.

The ongoing debate sees opinions split; while many advocate for the barrier-free mobility of healthcare professionals, others claim these agreements are critical for retaining talent within hospitals. Public sentiment, however, largely favors dismantling non-competes, with a vast majority of feedback to the FTC supporting the ban.

Despite the latest legal setbacks, the dialogue surrounding non-competes is poised for evolution. Experts like Dr. Robert Pearl, a former CEO and current educator, remain optimistic, highlighting positive outcomes in jurisdictions like California where non-competes are already outlawed. The aspiration is for fairer, more flexible employment practices to emerge, fostering environments where physicians and patients alike can thrive.

As the tide slowly turns against non-competes, the healthcare sector watches with anticipation, prepared for gradual yet impactful shifts in their professional landscapes.

Read the full article here.

Florida Housing Market: A Resilient Outlook Amidst Economic Fluctuations

Florida Housing Market: A Resilient Outlook Amidst Economic Fluctuations

In the ever-evolving landscape of real estate, the Florida housing market remains a beacon of interest for buyers, sellers, and investors. With its alluring sunny beaches and vibrant cities, Florida has long been a hotspot for real estate activity. However, the question of sustainability looms large as the market continues its upward trajectory.

Market Stability and Growth Projections

Experts are optimistic, dismissing fears of an imminent crash in the next two years. While the pace of growth may decelerate due to rising interest rates, Florida’s demographics and economic resilience paint a picture of stability. The state’s population growth, fueled by migration and lifestyle appeal, continues to support housing demand, counterbalancing economic pressures.

As we look ahead to 2025-2026, the Florida housing market is expected to maintain its positive trend, albeit at a slower pace. Home values have surged approximately 80% over the past five years, and this upward momentum is forecasted to persist, albeit with more moderate appreciation rates.

Current Trends and Influences

- Price Adjustments: Following a period of rapid price increases, analysts anticipate stabilization. Some markets may experience temporary declines, but a rebound is expected by 2024, leading to sustainable appreciation rates of 3% to 5% annually.

- Inventory Levels: A 27.8% year-over-year rise in housing inventory is likely to continue, offering more options for buyers and moderating price growth.

- Mortgage Rates: Elevated mortgage rates, hovering around 6% to 7%, are expected to gradually decline as inflation pressures ease, potentially making home buying more accessible by late 2024 into 2025.

- Demographic Support: Ongoing population growth driven by migration and lifestyle appeal continues to fuel housing demand, supporting the market despite economic headwinds.

The Road Ahead

By 2026, the market is expected to see a return to normalized appreciation rates, with home values likely increasing by 3% to 5% annually. This growth will be underpinned by strong demographic trends and economic fundamentals. The housing market may begin to thaw, with increased sales activity as mortgage rates decline and inventory levels stabilize.

However, challenges remain. Elevated mortgage rates and potential economic fluctuations could impact buyer sentiment and market dynamics, leading to localized downturns in areas with significant price increases.

In conclusion, while the Florida housing market may experience fluctuations and stabilization in growth rates, a crash seems unlikely. The combination of economic fundamentals, population growth, and the state’s inherent appeal suggests a market that will continue to attract interest and investment. For those considering entering the Florida real estate market, staying informed and vigilant about market trends is crucial for making sound decisions.

Strategic Foresight in Commercial Real Estate: Embracing Change by 2025

Macroeconomic Influence

The global economic outlook plays a crucial role in shaping the **commercial real estate sector**. As noted in the United States Economic Forecast: Q2 2024, the U.S. economy is poised for changes that will inevitably impact real estate dynamics. Similarly, the Eurozone economic outlook and India’s economic forecast highlight regional variations that could influence investment strategies.

Interest Rate Adjustments

Monetary policy changes by leading global banks are reshaping lending practices. The Bank of England’s recent interest rate cut and the Federal Reserve’s openness to a possible rate cut, as reported by The New York Times, signal a shift that could ease borrowing costs and stimulate investment in real estate.

Technological Advancements and Sustainability

The demand for sustainable and green real estate solutions is on the rise. Organizations are increasingly focusing on eco-friendly practices and technologies to meet the expectations of environmentally conscious consumers and investors. This trend is not only beneficial for the planet but also serves as a competitive advantage in the marketplace.

Strategic Positioning for Future Growth

As the Deloitte Commercial Real Estate Outlook suggests, this is a golden opportunity for organizations to strategically position themselves. By leveraging the insights from the economic forecasts and adapting to the changing market dynamics, companies can secure a robust footing in the future landscape.

In conclusion, the 2025 **commercial real estate outlook** underscores the importance of strategic foresight and adaptability. As the sector stands at a crossroads, organizations that embrace these changes and invest in sustainable, technologically advanced solutions are likely to thrive in the coming years.

The Future of the Housing Market: A Decade of Change

The Future of the Housing Market: A Decade of Change

The housing market has been on a rollercoaster ride in recent years, with prices skyrocketing due to a combination of pandemic-induced shifts and historically low interest rates. As we look forward to the next decade, prospective homebuyers are left pondering: Will prices continue their upward trajectory? How will affordability be affected?According to a recent article from Norada Real Estate Investments, the real estate market is poised for significant transformation over the next ten years. This transformation will be driven by several dynamic trends.

Key Trends Shaping the Market

- Changing Demographics: As Millennials and Gen Z enter the housing market, their preferences and buying power will significantly influence demand.

- Interest Rate Fluctuations: The cost of borrowing will continue to play a crucial role in shaping affordability and buyer behavior.

- Technological Advancements: From virtual tours to AI-driven insights, technology is set to redefine the industry, making processes more efficient and personalized.

Moreover, environmental considerations are taking center stage, with sustainable building practices and resilient home designs becoming more prevalent. Government policies, innovative housing models, and a shift towards inclusive real estate practices aim to address the ongoing affordability challenge.

Predictions for 2030

By 2030, home values in certain cities are expected to see significant increases. For instance, the average price of homes in San Francisco and San Jose could surpass $2 million, driven by continued growth patterns. A study by RenoFi predicts that the average price of a single-family home in the U.S. could reach $382,000, although this varies significantly by location.

For those looking to navigate this complex future, early savings and strategic investment are key. Prospective homeowners are encouraged to invest in options like index funds and robo-advisors to counter inflation. Keeping a close eye on mortgage rate trends will also be essential as they prepare for potential opportunities to lock in favorable rates.

Conclusion

While the path to homeownership may seem daunting, strategic financial planning and early preparation can help individuals realize their dream of owning a home amidst evolving market conditions.

Commercial Real Estate Faces Uncertain Terrain

Commercial Real Estate Faces Uncertain Terrain

As the commercial real estate industry peers into the future, a landscape fraught with challenges and opportunities comes into focus. The complexities of economic shifts, policy changes, and emerging trends have created a dynamic environment for stakeholders. This outlook, as detailed in Deloitte’s 2025 Commercial Real Estate Outlook, highlights the pivotal changes shaping the industry.Economic Shifts and Policy Changes

The United States Economic Forecast: Q2 2024 by Robyn Gibbard underscores the economic fluctuations impacting real estate markets. Similarly, the Eurozone’s economic outlook, analyzed by Dr. Alexander Boersch and Dr. Pauliina Sandqvist, reveals how policy adjustments, like the ECB’s rate cuts, are being received by the industry.In India, Dr. Rumki Majumdar’s insights provide a regional perspective, while Ira Kalish’s global economic outlook offers a broader view of the challenges and opportunities on the horizon. These reports, collectively, suggest that the commercial real estate sector must adapt to a rapidly changing economic landscape.

Interest Rates and Market Dynamics

Interest rate adjustments are a significant factor influencing the real estate market. The Bank of England’s decision to cut rates for the first time since 2020, as reported by Eshe Nelson, reflects a strategic move to stimulate economic growth. Similarly, the Federal Reserve’s openness to a potential rate cut, as mentioned by Jeanna Smialek, indicates a cautious approach to managing inflation.These monetary policy shifts are crucial for real estate investors, as they directly affect borrowing costs and investment returns. Stakeholders must stay informed and agile to navigate these changes effectively.

Emerging Trends and Opportunities

The commercial real estate industry is also witnessing the emergence of new trends that present both challenges and opportunities. The rise of remote work, the increasing importance of sustainable building practices, and the integration of technology are reshaping the sector. Adapting to these trends will be essential for long-term success.As the industry moves towards 2025, the ability to innovate and embrace change will be key. Stakeholders must be proactive in identifying opportunities amidst uncertainties. The insights provided by Deloitte’s comprehensive outlook serve as a valuable guide for navigating this evolving landscape.

Los Angeles Revolutionizes Affordable Housing Policy

In a city where the notion of a “100% affordable project” without public funding once seemed a contradiction, Los Angeles is witnessing an unprecedented transformation. Thanks to an executive order signed by Mayor Karen Bass, the city is now approving these projects by the hundreds, reshaping the landscape of affordable housing.

The executive order, enacted in December 2022, has led to plans for more than 13,770 affordable units, a figure nearly matching the combined total of the previous three years. This policy has not only accelerated the approval process but has also opened the doors for private developers, traditionally focused on luxury housing, to venture into affordable housing.

Developers like Andrew Slocum and Terry Harris are now spearheading projects like the proposed seven-story building on West Court Street. These projects, once deemed financially unfeasible without subsidies, are now viable due to the streamlined processes and incentives provided by the executive order.

However, this rapid development has sparked political debates and legal challenges. Two lawsuits and ongoing discussions in the city council highlight the contentious nature of transforming a mayoral decree into a permanent policy. The executive order, while expediting affordable housing, has also raised questions about its long-term sustainability and impact on existing neighborhoods.

A Shift in Housing Policy

The shift in policy has allowed developers to bypass traditional hurdles such as environmental impact studies and city council hearings. This expedited process, coupled with the absence of prevailing wage requirements, has made affordable housing projects financially attractive to profit-driven developers.

Yet, the affordability of these projects remains a topic of debate. While they cater to individuals earning under $100,000, the rent for a studio can still reach $1,800, a far cry from the lower rates offered by subsidized housing projects.

The Road Ahead

As Los Angeles navigates this new terrain, the city council is considering a permanent ordinance to solidify the executive order’s provisions. The outcome of this legislative process will determine the future of affordable housing in Los Angeles and whether the city can maintain this momentum without sacrificing community integrity.

For more insights on this evolving story, refer to the original article from CalMatters.

Philadelphia’s Center City Office Market: A Summer of Transformation

Philadelphia’s Center City Office Market: A Summer of Transformation

This summer marked a significant shift in Philadelphia’s Center City office market, as the long-standing effects of the COVID-19 pandemic and the rise of remote work began to thaw. Between June and August, five major office buildings changed hands, albeit for prices significantly lower than their previous valuations. This shift reflects the broader challenges facing commercial real estate in the era of hybrid work.

Among the notable transactions, two buildings, 399 and 1760 Market Street, will remain as office spaces but with drastically reduced rents. Meanwhile, 400 Market Street is set for conversion into apartments, and Three Parkway will be transformed into a mixed-use building, half residential and half office. Additionally, the iconic Bourse building on Independence Mall will see parts of it converted into hotel space.

The Wanamaker building, one of the white elephants of Center City real estate, saw its loan sold at a $45 million loss to New York City’s TF Cornerstone Inc., which already owns the Macy’s space on the lower floors. This sale is a precursor to potential full ownership and a reimagining of the building’s future.

A Complex Picture

The recent flurry of activity is not without its downsides. Building owners and investors, including public pension funds, have incurred substantial losses. The Pennsylvania school (PSERS), Pennsylvania state workers (SERS), and New Jersey state pension funds reported a combined loss of $1.3 billion from real estate investments, even as they paid over $180 million in fees to Wall Street real estate firms. For these funds, real estate has been their worst-performing asset class.

Commercial real estate owners are challenging property tax assessments, arguing that their buildings are worth less than before, which poses a threat to municipal finances. Office vacancy rates in the second quarter of this year stood at over 19%, according to Jones Lang LaSalle (JLL). The year 2025 is expected to see a peak in lease expirations, with 1.4 million square feet of space up for renewal. The Center City District reports that retail occupancy remains below 2019 levels.

Despite these challenges, there is a sense of cautious optimism. An anticipated interest rate cut could ease pressure on new projects and building owners with floating rate loans. “I don’t know if cautious optimism is the right word, but there is a feeling that there is a way to work our way through this,” said Tom Weitzel, JLL’s managing director in Philadelphia. “This is not good, this is not easy, but there’s a light at the end of the tunnel.”

Office-to-Residential Conversions

While the initial enthusiasm for converting vacant office spaces into housing waned as the complexities became apparent, this summer saw two additional conversions. Lubert-Adler Real Estate Funds and Keystone Real Estate Group purchased the Bourse building and 400 Market Street. The Bourse will be partly converted into hotel and event space, while 400 Market Street will become 176 apartment units.

These transactions represent a growing trend of office-to-residential conversions in Center City, with seven such projects announced, totaling 1.5 million square feet of space and adding over 1,350 apartment units to the area. “It’s way more [conversions] than we predicted,” said Clint Randall, vice president of economic development with Center City District. “It’s not a silver bullet, but thanks to conversions, we help the supply side of the equation moderate.”

Cheaper Office Sales, Cheaper Rents

Residential conversion isn’t the only outcome for post-COVID office building sales. The east and west sides of Market Street saw sales of midsize buildings that will preserve office uses while reducing rents to attract startups, nonprofits, and small businesses. At 399 Market Street, residential developer Ori Feibush purchased the old Colonial Penn Life Insurance Co. building for $14 million, a markdown of one-third from its previous valuation.

Feibush has been successful in cutting office suites into smaller chunks and reducing rents to $23-$25 a square foot, below the regional average of $29.95. A similar strategy is underway at 1760 Market Street, which changed hands for two-thirds less than its previous sale price in 2018. “Leasing activity is robust,” said James L. Paterno, founder of Stockton Real Estate Advisors, which manages 1760 Market Street.

Looking Ahead

While the uptick in transactions may not necessarily indicate a healthier market, it does show a willingness among building owners and investors to accept substantial losses to move forward. “The uptick in transaction volume doesn’t speak to a healthier market necessarily, so much as it does just more desire to unload properties or to shift burdens elsewhere,” said Ashley DeLuca, co-leader of the distressed property team at Ballard Spahr.

As the market continues to evolve, these transactions could pave the way for a new chapter in Center City’s office landscape. “This happens every 20 years or so,” said Glenn Blumenfeld, principal with Tactix Real Estate Advisors. “This is when people get rich in real estate. It’s easier when you have big distressed situations.”