The DeFi Revolution: Reshaping Finance

The DeFi Revolution: Reshaping Finance

The rise of blockchain technology is fundamentally transforming the financial landscape, ushering in a new era of Decentralized Finance (DeFi). This is not just a passing trend but a significant leap in how financial services will be delivered and accessed in the future. DeFi enables peer-to-peer financial interactions without intermediaries, challenging the very foundations of traditional banking systems.From Bitcoin to Ethereum: A New Financial Frontier

Since the introduction of Bitcoin in 2008, blockchain technology has evolved significantly. The launch of Ethereum in 2015, with its smart contract capabilities, opened up new possibilities in finance. This paved the way for platforms like Aave, MakerDAO, Compound, and Uniswap to disrupt traditional financial systems, offering decentralized alternatives for lending, borrowing, and trading.As of 2024, the Total Value Locked (TVL) in DeFi protocols is approximately $54 billion, indicating a growing trend where conventional financial institutions must engage with this disruptive technology.

Convergence of Traditional and Decentralized Finance

Initially, financial institutions approached blockchain with caution, maintaining a clear separation from the crypto space. However, consumer demand has led to a hybrid integration, blending digital and traditional financial services. DeFi’s systemic capabilities, such as enhanced accessibility, transparency, and efficiency, are becoming increasingly appealing.Unlike traditional banking systems that often exclude individuals due to insufficient credit history or geographical barriers, DeFi provides open access to anyone with internet connectivity. Moreover, DeFi’s transparent operations stand in stark contrast to the opaque practices of traditional banks.

Impact on Lending and Payments Markets

In the lending market, DeFi’s rapid growth is evident. Although it constitutes less than 1% of global household debt, DeFi’s impact is profound, prompting traditional institutions to reassess their risk assessment and underwriting models. DeFi offers unique lending models outside conventional broker channels, providing higher yields and improved accessibility.The payments sector is also undergoing transformation. Traditional cross-border settlements often involve lengthy procedural bottlenecks, especially during weekends and holidays. Cryptocurrencies facilitate quicker transactions, and global payment networks like Visa and Mastercard are exploring stablecoin settlements, hinting at a reshaped payments landscape.

New Investment Instruments and Strategies

The rise of cryptocurrency exchange-traded products (ETPs) and ETFs introduces new investment opportunities. With around 900 products listed globally, amounting to nearly $10 billion, these instruments make digital assets more accessible to traditional investors. Institutional involvement in crypto investments substantiates the mainstream status cryptocurrencies are acquiring.Tokenization of assets represents another trend, enabling digital ownership of physical assets such as gold and real estate, facilitating fractional ownership and enhanced liquidity. This nascent development is drawing interest from individual and corporate investors alike.

The Future of Finance

Looking forward, DeFi has the potential to dramatically change the way financial services are delivered. While it might not entirely replace traditional banking, DeFi could help enhance transparency, efficiency, and inclusiveness within the industry. The article suggests a potential convergence between decentralized and mainstream financial models, offering a cooperative future in finance.The original article was authored by Svyatoslav Garal, Global Head of Payments at Wirex, a fintech leader with extensive experience in banking, payments, and crypto industries. “`

More Articles

Getting licensed or staying ahead in your career can be a journey—but it doesn’t have to be overwhelming. Grab your favorite coffee or tea, take a moment to relax, and browse through our articles. Whether you’re just starting out or renewing your expertise, we’ve got tips, insights, and advice to keep you moving forward. Here’s to your success—one sip and one step at a time!

Revolutionizing Real Estate with ChatGPT

Revolutionizing Real Estate with ChatGPT

The real estate industry is on the brink of a technological revolution, thanks to the versatile capabilities of ChatGPT, a chatbot developed by OpenAI. Since its online debut on November 30, 2022, ChatGPT has been transforming how real estate agents and brokers conduct business, offering innovative solutions to streamline tasks and boost productivity.OpenAI, in partnership with Microsoft, ensures that ChatGPT remains a staple in the tech world, continually evolving with enhancements to its user interface. While free versions are available, the premium Plus and Enterprise users can leverage real-time data access, making it a powerful tool for industry professionals.

12 Game-Changing Applications for Real Estate Professionals

Real estate agents, often overwhelmed with writing tasks and market data analysis, can now turn to ChatGPT for support. Here are 12 ways this AI tool can revolutionize your business:- Email Campaigns: Create personalized emails that reflect your brand, moving away from generic CRM templates.

- Property Descriptions: Generate standout property listings that capture attention and drive engagement.

- Social Media Content: Enhance your online presence with engaging posts tailored for platforms like Facebook, Instagram, and LinkedIn.

- Content Marketing: Produce blog posts and articles that showcase your expertise and attract organic web traffic.

- Neighborhood Information: Offer detailed guides on local amenities, schools, and hotspots.

- FAQ Responses: Use ChatGPT to provide instant answers to common client questions, enhancing customer service.

- Automated Email Responses: Save time by automating responses to frequent inquiries.

- Market Reports: Demonstrate your market knowledge with comprehensive reports generated by ChatGPT.

- Language Translation: Break language barriers and cater to a diverse client base with multilingual support.

- Buyer and Seller Guides: Create detailed guides to assist clients through the buying or selling process.

- Video Scripts: Craft scripts for video content to engage your audience on platforms like YouTube and Instagram.

- Market Insights: Stay informed with real-time data and trends to provide clients with the latest market insights.

Mastering ChatGPT Prompts

To maximize ChatGPT’s potential, it’s crucial to craft effective prompts. Here are some best practices:- Be Clear and Specific: Clearly state your requirements, such as asking for recent sales data for a specific ZIP code.

- Use Open-Ended Questions: Encourage detailed responses by framing questions in an open-ended manner.

- Break Down Complex Questions: Simplify multi-part inquiries for more accurate results.

- Include Context: Provide background information to help ChatGPT understand the question’s context.

- Specify Data and Sources: Direct ChatGPT to use specific data sources when necessary.

For more insights, see the full article on HousingWire.

Conclusion: Embrace the Future

The integration of ChatGPT into real estate practices is not just a trend but a necessity for staying competitive. By utilizing this AI tool, agents can work smarter, not harder, and focus on what truly matters—building relationships and closing deals.My ChatGPT Cheat Sheet

Not sure where to start? Here are 20 prompts to kickstart your journey with ChatGPT in real estate:- “Can you provide a brief overview of the factors that affect property valuations?”

- “What are some effective home staging tips to make properties more appealing to potential buyers?”

- “Give me insights into the current real estate market trends in [Your City].”

- “What should I consider when advising a client on purchasing an investment property?”

- “Can you create a guide for first-time homebuyers on the steps to purchasing a home?”

These prompts are just a starting point. Feel free to explore and experiment with ChatGPT, as you can’t break anything, and the AI won’t get mad at you.

CSS for Styling

“`Exploring the Best CRM Solutions for Real Estate in 2024

Exploring the Best CRM Solutions for Real Estate in 2024

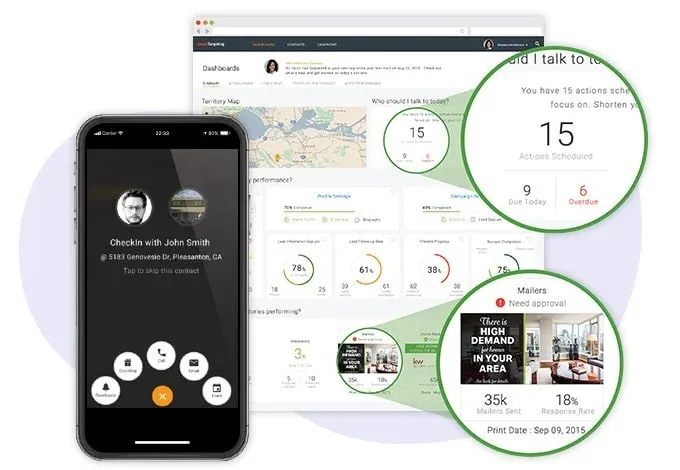

In the dynamic world of real estate, managing relationships is paramount. The TechRadar article delves into the best CRM software solutions for 2024, highlighting their potential to transform how realtors engage with clients. By optimizing customer interactions, these tools can significantly reduce operational costs and boost sales.The Role of CRM in Real Estate

For real estate professionals, CRM systems are not just about storing contacts; they are about building lasting relationships. The article emphasizes that successful agencies leverage top CRM software to enhance customer experiences and streamline communications, both in the office and on-site.Top CRM Providers for Real Estate

- Freshsales: Known for its intuitive interface and advanced AI features, Freshsales offers a customizable experience, making it a top choice for realtors. However, its lead generation tools are limited to enterprise plans. Read the full Freshsales review.

- HubSpot: With a modular approach, HubSpot allows users to start with a free plan and scale up as needed. Its extensive third-party integrations make it a versatile choice. Discover more in the HubSpot CRM review.

- Zoho CRM: Ideal for those already using Zoho’s suite, this CRM offers seamless integration and powerful lead generation tools. Read the Zoho CRM review for more details.

- Insightly: Known for its project management capabilities, Insightly is perfect for larger brokerages. It offers a customizable dashboard and robust automation features. Check out the Insightly review.

- BoomTown: Specifically designed for real estate, BoomTown offers realtor-focused features and extensive lead-generation capabilities. Its integrations are limited, but it excels in real estate-specific functionalities.

- Monday.com: A flexible project management tool that supports integrations with other platforms, Monday.com is praised for its user-friendly interface and transparency-promoting features. Learn more in the Monday.com review.

Choosing the Right CRM

Selecting the appropriate CRM requires understanding your unique business needs. Whether it’s lead generation, customization, or automation, each CRM offers distinct advantages. The article suggests considering factors like existing workflows, budget constraints, and required integrations when making a decision.Conclusion

The TechRadar article provides a comprehensive guide to the best CRM solutions for real estate in 2024. By leveraging these tools, real estate professionals can enhance client relationships, optimize operations, and ultimately drive sales growth.7 Benefits of Hiring an Experienced Real Estate Agent in Jamaica

1. Regional Knowledge

Jamaica’s diverse neighborhoods and landscapes each offer unique charms and subtleties. An expert real estate agent possesses in-depth knowledge of the local market, including the best neighborhoods, average property prices, and current trends. This expertise is invaluable in helping clients find a neighborhood that aligns with their preferences and lifestyle.2. Access to Exclusive Listings

Experienced agents often have access to private listings not readily available to the public. For those seeking unique and desirable properties, these off-market opportunities can be a treasure trove, enabling clients to discover hidden gems they might otherwise miss.3. Negotiation Skills

Negotiating prices is a crucial aspect of real estate transactions. Skilled Jamaican agents bring honed negotiation skills to the table, assisting clients in securing the best deals, whether buying or selling a property.4. Legal Expertise

Real estate transactions involve complex legalities. Jamaican agents are well-versed in the relevant laws and regulations, ensuring a smooth process and helping clients avoid costly mistakes by managing all necessary documentation accurately.5. Efficient Marketing

Effective marketing is essential to attract potential buyers when selling a property. Seasoned agents leverage a network of professionals and resources to market properties efficiently, offering services such as virtual tours and professional photography to ensure maximum exposure.6. Time and Stress Savings

The real estate process can be time-consuming and stressful. Hiring an experienced agent alleviates this burden, as they manage all the details and coordinate with stakeholders, allowing clients to focus on other aspects of their lives.7. Valuable Connections

Experienced agents in Jamaica often have established relationships with appraisers, contractors, lenders, and inspectors. These connections are crucial in expediting the buying or selling process, providing clients with access to reliable professionals when needed.Conclusion

Engaging a knowledgeable real estate agent in Jamaica can lead to a successful and stress-free transaction. Their local expertise, negotiation skills, and access to exclusive listings position clients to make informed decisions and achieve their real estate goals. Whether buying or selling, the guidance of an experienced agent is invaluable in navigating Jamaica’s vibrant real estate market.For those seeking professional assistance, Century 21 Jamaica offers a team of registered, reliable agents with extensive listings. Clients can also list their properties for sale or rent to attract genuine buyers.

New Real Estate Tax Amendments: Implications for the Energy Sector

The proposed legislative changes, set to take effect on January 1, 2025, aim to refine the definition of taxable ‘structures.’ The new definition explicitly includes only the building parts of photovoltaic (PV) farms, energy storage facilities, and standalone industrial facilities as liable for the 2% RET. This adjustment is expected to reduce tax burdens on elements previously deemed non-essential to construction under a broader interpretation.

In a departure from earlier drafts, the ambiguous concept of “technical-functional entirety” has been removed. Furthermore, “free-standing technical facilities permanently attached to the ground” have been exempted from RET responsibilities, signaling a commitment to fiscal continuity that primarily benefits renewable energy sectors.

The draft law also seeks to clarify the inclusion of “building facilities” under the RET scope, recognizing their role in ensuring the functional use of a building or structure. However, the broad definition might still lead to ambiguities in tax application, prompting businesses to seek further clarity.

To accommodate these changes, the deadline for filing RET returns for 2025 has been extended to March 31, 2025. This extension is designed to give taxpayers sufficient time to adapt to the new regulations and assess their impact on business operations.

The Ministry of Finance’s approach reflects a willingness to engage with stakeholders, incorporating demands from various industries. However, the broad definitions of ‘structure’ and ‘permanent attachment to the ground’ continue to present interpretational challenges, necessitating advisory consultations.

As the legislative process progresses, a resolution by the end of October is crucial to ensure industry compliance and the seamless integration of the updated RET framework into business strategies. The brief consultation period, concluding on September 9, 2024, is a pivotal phase for crystallizing stakeholder interests before government approval and parliamentary discussion.

Businesses are advised to proactively evaluate the implications of these legal reforms on their RET obligations and adjust their fiscal strategies accordingly. For further guidance, the Dentons Tax Team is available to provide comprehensive support and assistance.

This article highlights the dynamic interplay between legislative amendments and industrial adaptation, showcasing an evolving real estate tax landscape. For more details, you can read the original article on Dentons.

CoStar Group’s Acquisition of Matterport: A $1.6 Billion Expansion

CoStar Group Expands with Major Acquisition

In a monumental move within the real estate technology sector, CoStar Group has announced its acquisition of Matterport, a leader in photorealistic 3D virtual property tours. This $1.6 billion transaction is set to be split evenly between cash and stock, marking a significant expansion for CoStar, which operates renowned online property marketplaces such as Apartments.com and Homes.com.

According to the official announcement, Matterport shareholders will receive $2.75 in cash and an additional $2.75 in CoStar stock for each share they hold. This strategic acquisition underscores CoStar’s commitment to enhancing its digital offerings and solidifying its position as a leader in the property technology space.

Matterport’s Impressive Reach

Matterport has built a formidable reputation with its cutting-edge 3D virtual tours, known as digital twins, which provide immersive property experiences. Utilizing a global network of photographers and capture service technicians, the company produces thousands of these tours monthly. Matterport’s expansive spatial property data library now boasts 12 million spaces, covering an estimated 38 billion square feet across 177 countries.

This acquisition aligns with CoStar’s vision to integrate advanced technology into its platforms, offering users a comprehensive and interactive property search experience. By incorporating Matterport’s digital twin technology, CoStar aims to enhance the way properties are showcased online, providing a more detailed and engaging perspective for potential buyers and renters.

Industry Implications

The acquisition of Matterport by CoStar is poised to have significant implications for the real estate industry, particularly in how properties are marketed and viewed online. As virtual tours become increasingly popular, the integration of Matterport’s technology is expected to set new standards for property listings, offering unparalleled detail and realism.

For more information on this acquisition, you can read the original article on Globest.

Florida’s Real Estate Market: A Glimpse into 2024

Florida’s Real Estate Market: A Glimpse into 2024

If you’re in the market for a new home, you might be eagerly watching mortgage rates. According to NBC 6 South Florida, there’s potential good news on the horizon. Redfin’s 2024 housing predictions suggest that mortgage rates may steadily decline, possibly dipping into the 6% range. This could be a welcome relief for potential homebuyers who have been waiting for more favorable conditions.

Real Estate Broker Elisha Lopez notes, “With rates already dropping, interest rates and that little bug, that perception for buyers, especially first-time homebuyers that have been sitting on the sideline for over a year now waiting for rates to come down, it’s already triggering, I guess you could say, the hype that it’s time to buy.”

What to Expect in 2024

As we look towards 2024, Redfin anticipates an increase in new listings and home sales. However, Lopez warns that an influx of buyers could drive prices up due to heightened demand. “There’s more inventory now, but if you flood the market again with buyers that are going to start looking out anyway and then all those buyers that have been waiting, the natural thing that’s going to happen is that prices are going to go up because there’s so much demand again,” she explains.

Interestingly, while some areas in coastal Florida, like Cape Coral, may see a significant drop in prices due to the rising cost of home insurance linked to natural disaster risks, Miami’s housing market is expected to remain fiercely competitive. Lopez attributes this to Miami’s unique position as a melting pot that attracts international attention and interest.

Advice for Homebuyers

For those considering purchasing a home next year, especially first-time buyers, Lopez suggests connecting with a real estate agent to navigate the process. She emphasizes the importance of exploring financing options and notes that some sellers might be willing to cover closing costs, particularly if a listing has been on the market for some time.

Her final piece of advice? Negotiate. Even in a competitive market like South Florida, there’s always room to secure a better deal.

“`

“`“Real Estate Opportunities in Florida: Top Cities for Investment”

While not all urban areas in Florida are experiencing economic growth, certain cities have emerged as prime locations for investment. According to insights from GOBankingRates, four cities are particularly noteworthy for their potential.

Boca Raton

Boca Raton is experiencing a surge in demand, driven by a migration from the Northeast post-COVID-19. The opening of new restaurants and increased walkability have contributed to this trend. Victor Ballestas of Integra Investments notes the shift from older properties to newer developments, highlighting the city’s appeal as a safe investment due to its established coastal community status and ongoing growth.North Miami

North Miami’s appeal has been bolstered by the SoLe Mia Project, a transformative development that includes residential units, office space, retail venues, and more. Edgardo Defortuna, CEO of Fortune International Group, emphasizes the area’s potential for value increase, attracting young professionals and investors alike.Bonita Springs

Nestled on Florida’s southwest coast, Bonita Springs offers a serene environment with access to nature and abundant golfing. Mark Wilson of London Bay Development Group highlights the city’s low taxes and crime rates, coupled with its burgeoning population, as key factors driving market value and investment potential.Orlando

Beyond its famed theme parks, Orlando presents a wealth of investment opportunities. Robert Thorne of Urban Network Capital Group describes the city as an underrated gem, with a thriving tourism industry and job market fueling a real estate boom. Compared to other areas in Florida, Orlando offers more attainable prices with promising home value projections.

The original article from Yahoo Finance underscores the importance of careful research and market insight for successful real estate investment in Florida. As these cities continue to grow and evolve, they offer exciting prospects for those looking to capitalize on the state’s dynamic real estate market.

The Federal Reserve’s Interest Rate Cut: A Potential Game-Changer for Homebuyers

The Federal Reserve’s recent decision to cut its benchmark interest rate by half a percentage point has sent ripples through the housing market, offering a glimmer of hope for homebuyers. This unexpected move, described by Bill Banfield, chief business officer at Rocket Companies, as giving “a little extra,” comes at a time when mortgage rates have already seen a significant decline over the past year.

According to Bankrate’s national survey of large lenders, mortgage rates have fallen from 8.01 percent in October 2023 to 6.20 percent as of September 18. This shift by the Federal Reserve could potentially invigorate the housing market, encouraging both buyers and sellers to engage more actively.

Lisa Sturtevant, chief economist at Bright MLS, notes that declining interest rates are particularly beneficial for homebuyers facing affordability challenges. She anticipates that this reduction in borrowing costs will not only fuel demand but also increase the supply of homes available for sale, thereby stabilizing home prices in various local markets.

The Federal Reserve and the Housing Market

The Federal Reserve’s earlier rate hikes had a cooling effect on the housing market, leading to a sharp drop in home sales while pushing home prices to record highs. Now, with inflation on the decline, the Fed’s policy shift represents a pivotal moment in monetary policy.

Mike Fratantoni, chief economist at the Mortgage Bankers Association, suggests that if mortgage rates remain near current levels, the housing market could experience a stronger-than-usual fall season, with a potential rebound in activity next spring.

How the Fed Affects Mortgage Rates

Although the Federal Reserve does not directly set mortgage rates, its policies significantly influence them. Mortgage rates typically move in tandem with 10-year Treasury yields. The Fed’s actions set the overall tone, impacting how much consumers pay for home loans.

Historically, low mortgage rates have fueled housing booms, as seen in 2020 and 2021. However, when rates surged to levels unseen in two decades, the market slowed dramatically. Despite this, home prices reached unprecedented levels, with the nationwide median existing-home price hitting $422,600 in July, close to the all-time high of $426,900 in June.

Fratantoni points out that elevated mortgage rates and steep home-price growth have significantly reduced affordability. Yet, as rates decline, affordability could improve, potentially drawing more buyers into the market.

Next Steps for Borrowers

- Shop around for a mortgage: Conducting an online search can help find lenders offering lower rates and competitive fees. Savvy shopping can save thousands of dollars.

- Be cautious about ARMs: Adjustable-rate mortgages might seem tempting, but they come with the risk of higher future rates. Borrowers should avoid using ARMs as a crutch for affordability.

- Consider a home equity loan or HELOC: Homeowners can tap into their home equity with a HELOC, which might be more cost-effective than refinancing at higher rates.

Colliers’ Insights on APAC Cap Rates: Q1 2024 Report

Colliers’ Latest Insights on APAC Cap Rates

Colliers has unveiled its Q1 2024 APAC Cap Rates Report, shedding light on the performance across office, retail, and industrial sectors in 19 markets. This comprehensive analysis reveals that 11 of these markets have witnessed movements in cap rates.

“The Asian market remains stable, without any significant factors driving movements in cap rates,” states Dorothy Chow, Head of Valuation & Advisory Services at Colliers Hong Kong. However, Australia and New Zealand have experienced shifts in cap rates, particularly in the office and industrial sectors. The retail sector, meanwhile, has seen stability over the past quarter, with exceptions in Brisbane, Melbourne, and Sydney.

Dorothy Chow highlights that the stability in Asian markets is mainly due to oversupply and pressure on rents, leading to increased cap rates. The oversupply situation in some Asian markets will require time to absorb, with recovery hinging on overall business activities and economic conditions, placing additional pressure on rental growth.

Key Findings:

- Office Sector:

- Beijing is grappling with declining demand, resulting in high vacancy rates. Investors are wary of oversupply and falling rents.

- Bangkok has seen a slight uptick in cap rates due to changes in rental rates, though sales transactions remain limited.

- Shanghai faces challenges in attracting leasing demand, causing downward pressure on rents.

- Jakarta is experiencing an influx of new office supply, with businesses optimizing existing spaces instead of expanding.

- In Sydney and Auckland, significant asset sales are anticipated, which may provide clearer pricing benchmarks.

- Retail Sector:

- Beijing and Shanghai enjoyed robust retail performance during the Chinese New Year.

- Investors in Hong Kong remain cautious due to vacancy rates.

- Jakarta has seen increased visitor numbers and new brand entries, yet the competitive landscape with new malls keeps investors cautious.

- Industrial Sector:

- Hong Kong’s industrial sector remains stable, buoyed by positive import and export figures.

- Bangkok has witnessed increased sales transactions, while rental rates have remained flat.

- Beijing is dealing with declining rental rates and increased occupancy in neighboring cities, impacting the industrial market.

- Shanghai is experiencing cautious investment sentiment, leading to high cap rate expectations from investors.

For further insights, contact Dorothy Chow, Head of Valuation & Advisory Services at Colliers Hong Kong. You can access the full report here.

Exploring the Florida Real Estate Market: A Haven for Homebuyers

Exploring the Florida Real Estate Market: A Haven for Homebuyers

Florida has long been a beacon for those seeking a unique and diverse lifestyle, offering a vibrant real estate market that caters to a wide array of preferences and budgets. From luxurious oceanfront mansions and elegant condos to charming cottages, the state provides ample opportunities for both buyers and sellers. According to a recent article by Little Big Homes, the Florida housing market is poised for growth and transformation in 2024.Why Florida Remains a Hotspot for Homebuyers

Florida’s allure is multifaceted, drawing home seekers with its breathtaking scenery, vibrant communities, and year-round warm weather. The state’s landscape is adorned with pristine beaches, turquoise waters, and picturesque streets lined with towering palm trees. Its bustling city centers and quaint neighborhoods offer a rich tapestry of cultural attractions, fine dining, shopping, and entertainment.Moreover, Florida’s moderate cost of living, coupled with the absence of a state income tax, makes it an attractive destination for many. The state’s strong economy, bolstered by sectors such as tourism, aerospace, and manufacturing, further enhances its appeal.

Current Market Dynamics and Trends

The Florida real estate market is currently influenced by several factors, including the aftermath of the COVID-19 pandemic and rising inflation. The pandemic initially disrupted the market but later spurred growth due to record-low interest rates and the rise of remote work. This shift increased demand for properties in rural and suburban areas.Rising inflation has also impacted the market, with urban areas experiencing higher housing prices and living costs. As a result, there is a growing demand for residential properties outside major cities.

Market Conditions and Future Outlook

According to Redfin, the median home price in Florida is $401,100, reflecting a 1.5% increase from the previous year. Despite this rise, Florida homes remain relatively affordable compared to other booming markets, such as California. Inventory levels indicate a seller’s market, with a limited supply of homes leading to increased buyer competition and potentially higher prices.Sales activity has slowed, with a decrease in the number of homes sold year over year. However, the strong demand and limited inventory suggest this may be a temporary slowdown rather than a long-term trend.

Trends Shaping the Market

Several trends are shaping Florida’s real estate market, including net population migration, rising mortgage rates, and a booming vacation home market. The state has experienced significant population growth, contributing to increased demand for real estate. Meanwhile, rising mortgage rates have made it more challenging for buyers to secure financing, impacting sales volume.The vacation rental market is thriving, with areas like Indialantic achieving high occupancy rates. Additionally, property technology advancements, such as virtual tours and 3D mapping, are revolutionizing the buying process.

Guidance for Buyers and Sellers

For buyers, understanding market trends and fluctuations is crucial. Working with a qualified real estate agent can provide valuable insights and assistance throughout the buying process. Timing is also essential, with off-peak seasons potentially offering better deals.Sellers should focus on enhancing their property’s curb appeal, setting competitive prices, and marketing effectively to attract high offers. Consulting with a real estate agent can help navigate the complexities of the market and achieve favorable outcomes.

Conclusion

The Florida real estate market presents a dynamic landscape full of opportunities for both buyers and sellers. With its economic strength and high quality of life, the state is expected to continue attracting prospective homeowners. As the market evolves, staying informed and enlisting professional guidance will be key to success.Understanding the Shifting Sands of Consumer Behavior in 2024

Understanding the Shifting Sands of Consumer Behavior in 2024

In a world where consumer preferences are evolving at an unprecedented pace, businesses must stay ahead of the curve to remain competitive. According to a recent report by Exploding Topics, nine key trends in consumer behavior are set to shape the market landscape in 2024 and beyond.1. Diverse Payment Options: The New Norm

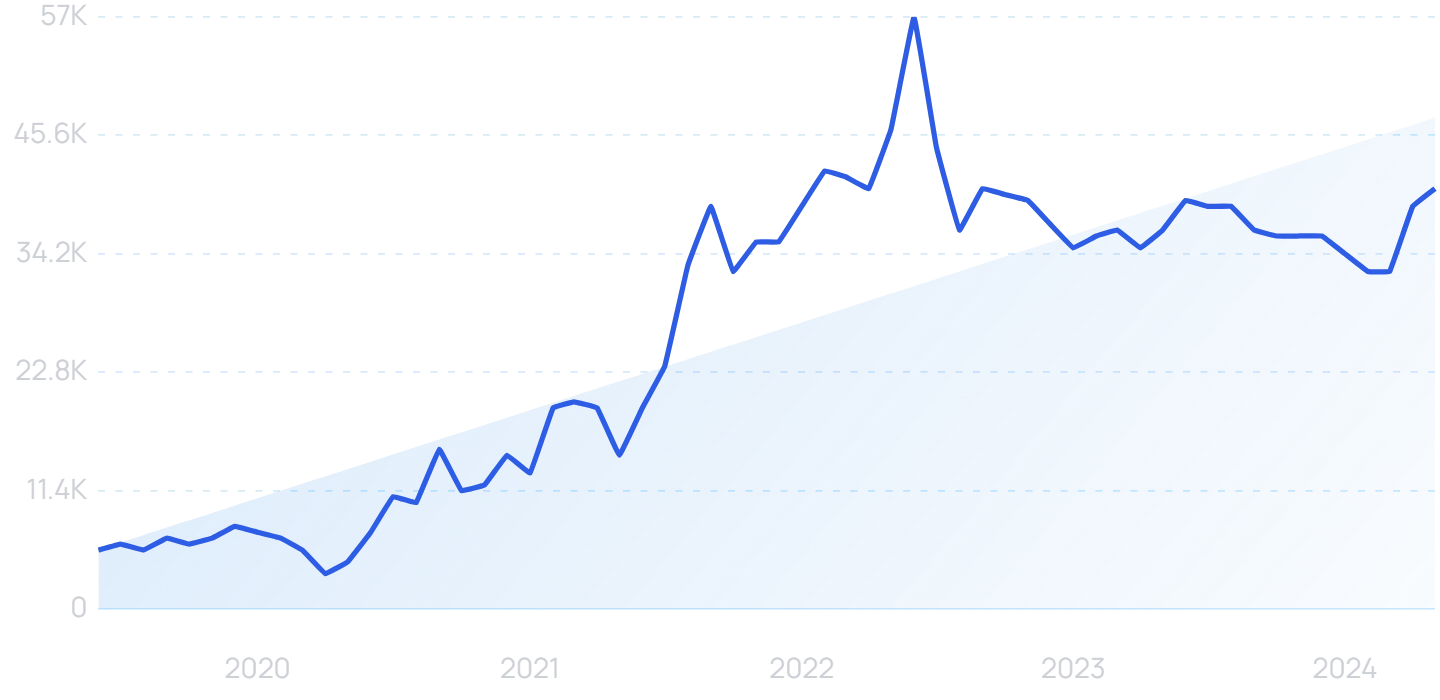

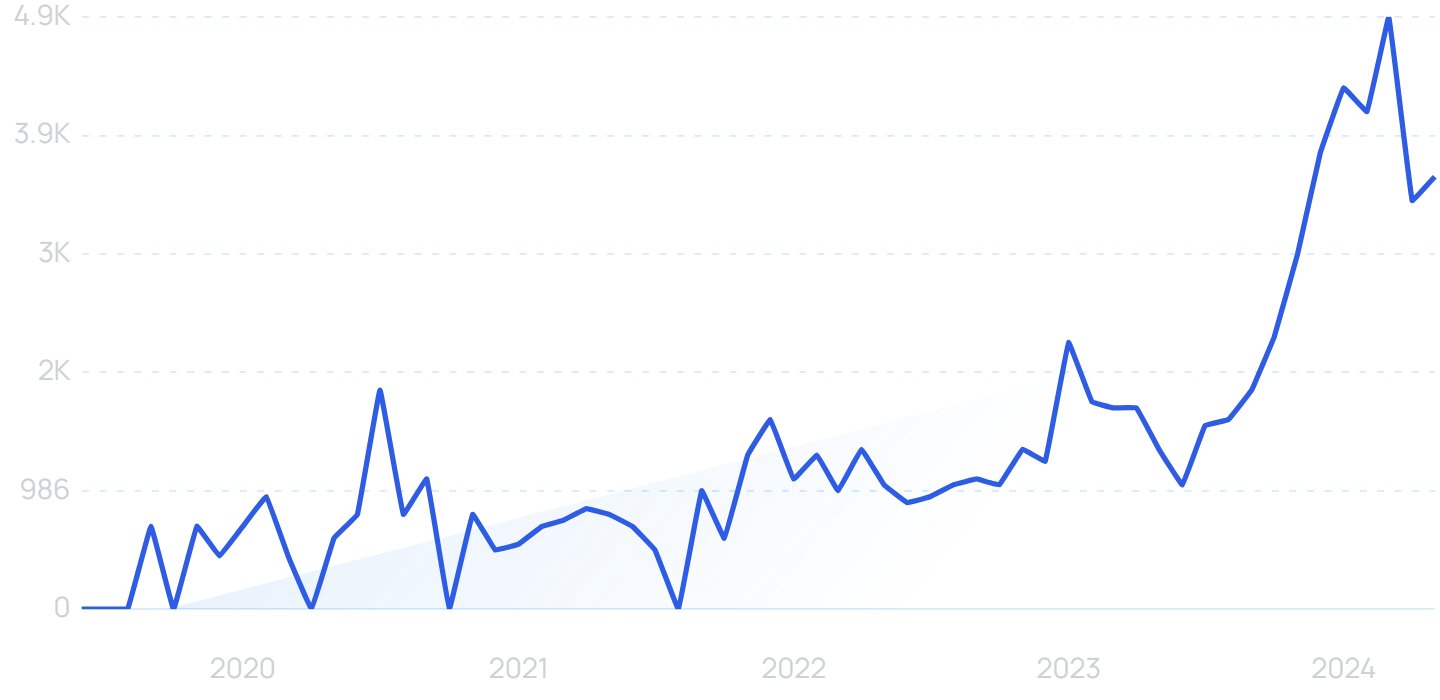

As eCommerce continues to flourish, consumers now expect a variety of payment methods at checkout. The “Buy Now, Pay Later” (BNPL) trend is particularly noteworthy, with searches for “BNPL” growing sixfold over the past five years. Companies like Afterpay and Sezzle are leading this charge, catering to the increasing demand for flexible payment solutions.

2. Expectation for Home Delivery

Consumers now anticipate that virtually everything, from eyeglasses to groceries, will be delivered to their doorstep. This shift has propelled the growth of direct-to-consumer brands, such as Warby Parker and Instacart, as they meet the demand for convenience.

3. The Rise of Ethical and Sustainable Products

Sustainability and ethical practices are more than just buzzwords; they are key drivers of consumer decisions. A study by IBM indicates that 77% of consumers value these attributes in brands. This trend is evident in the increasing popularity of products like bamboo clothing, which offer a smaller environmental footprint.

4. Health and Wellness at Home

The home has become a sanctuary for health and wellness, with consumers embracing at-home treatments like red light therapy. This trend underscores a shift towards personal health management within the comfort of one’s home.

5. Micro-Influencers: The New Power Players

The influence of social media personalities on consumer choices has not waned. However, the focus is shifting towards micro-influencers, who boast higher engagement rates. Their authentic and niche content resonates more effectively with targeted audiences.

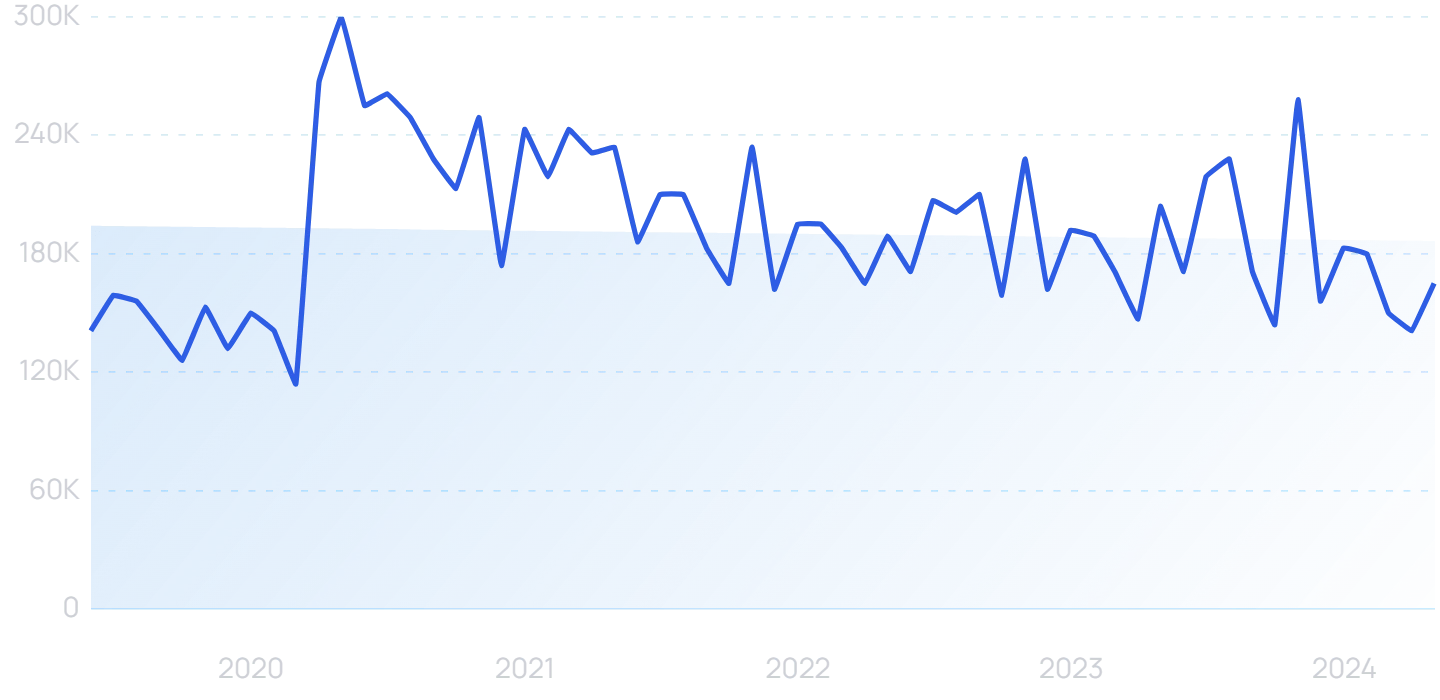

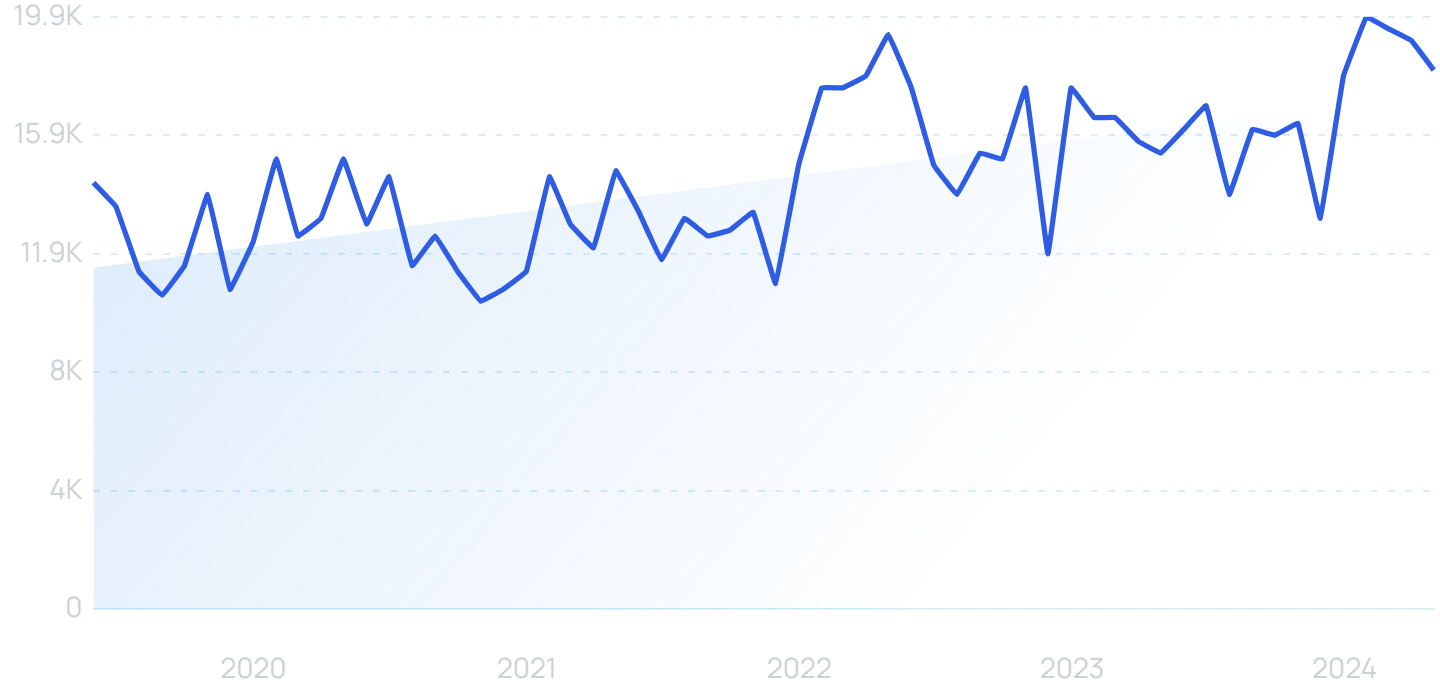

6. Subscription Services: A Growing Market

The subscription model is thriving, with a 90% year-over-year increase in subscribers. From gaming to streaming services, consumers are drawn to the convenience and variety these subscriptions offer.

7. Elevated Spending on Pets

Pet owners are increasingly investing in luxury products for their furry companions. The pet industry is witnessing a surge in demand for items like CBD for dogs and high-end pet furniture.

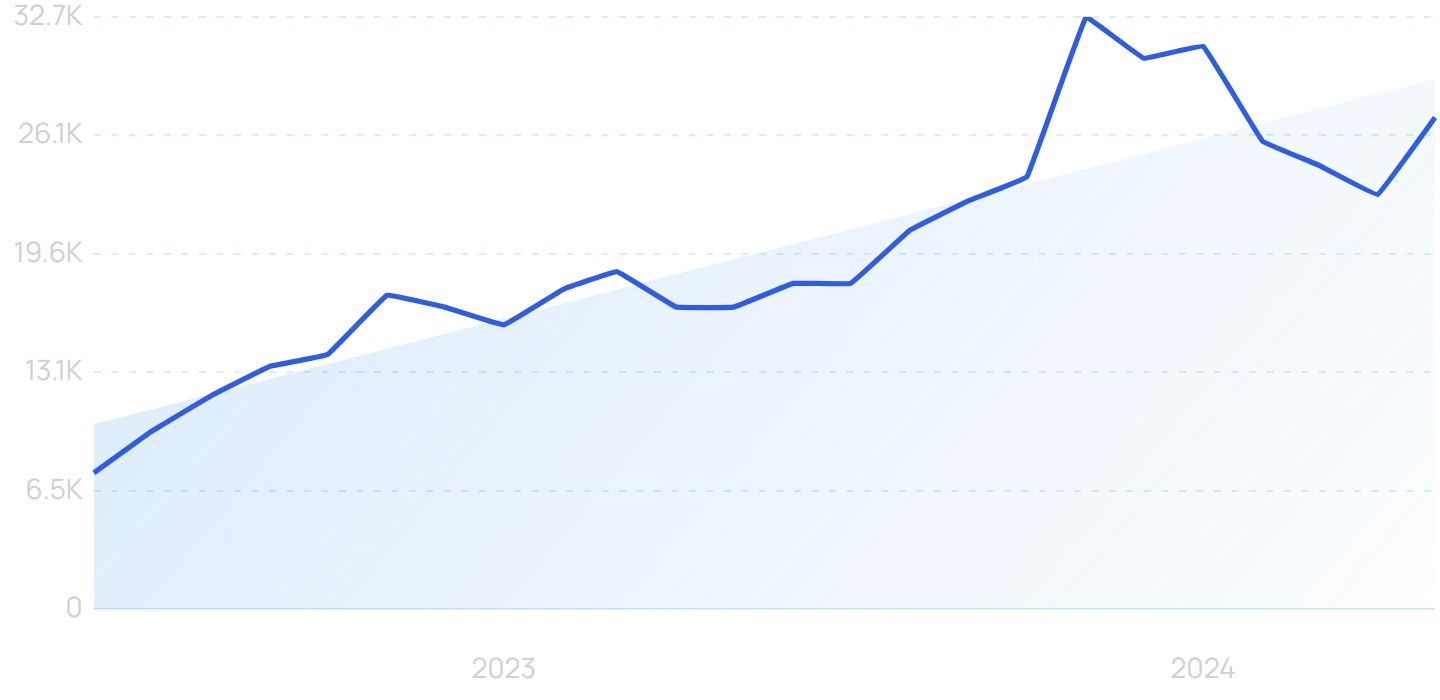

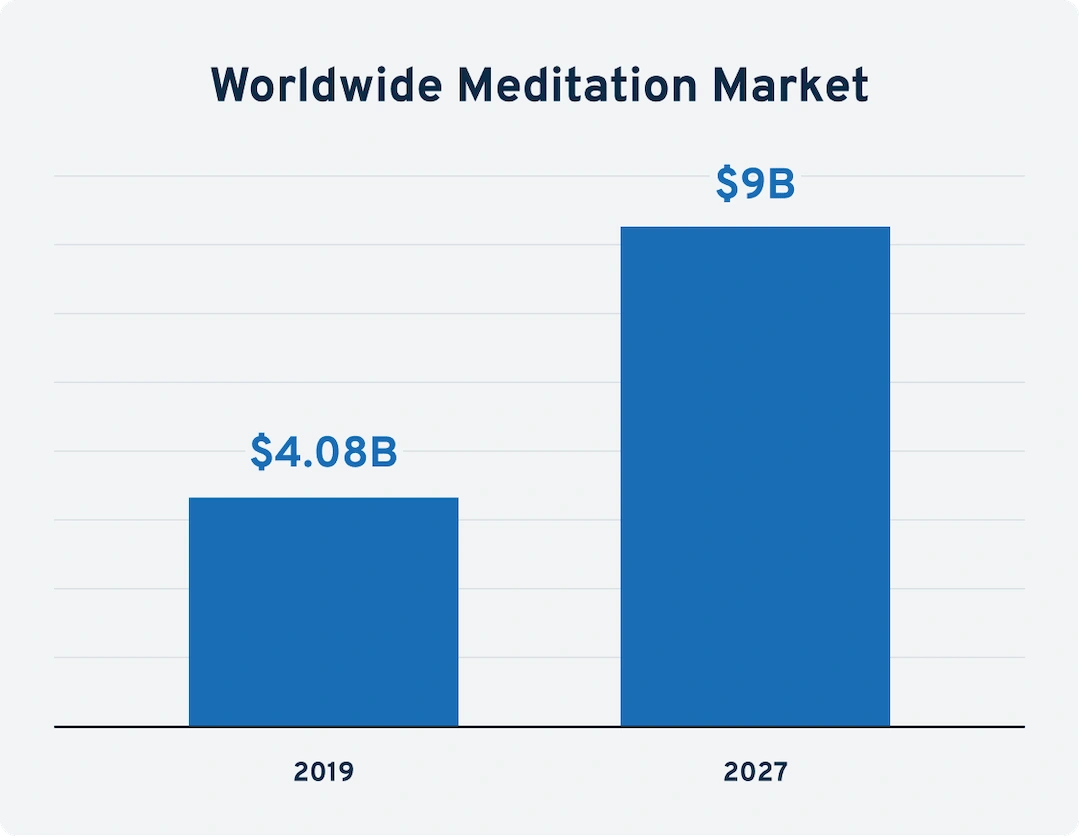

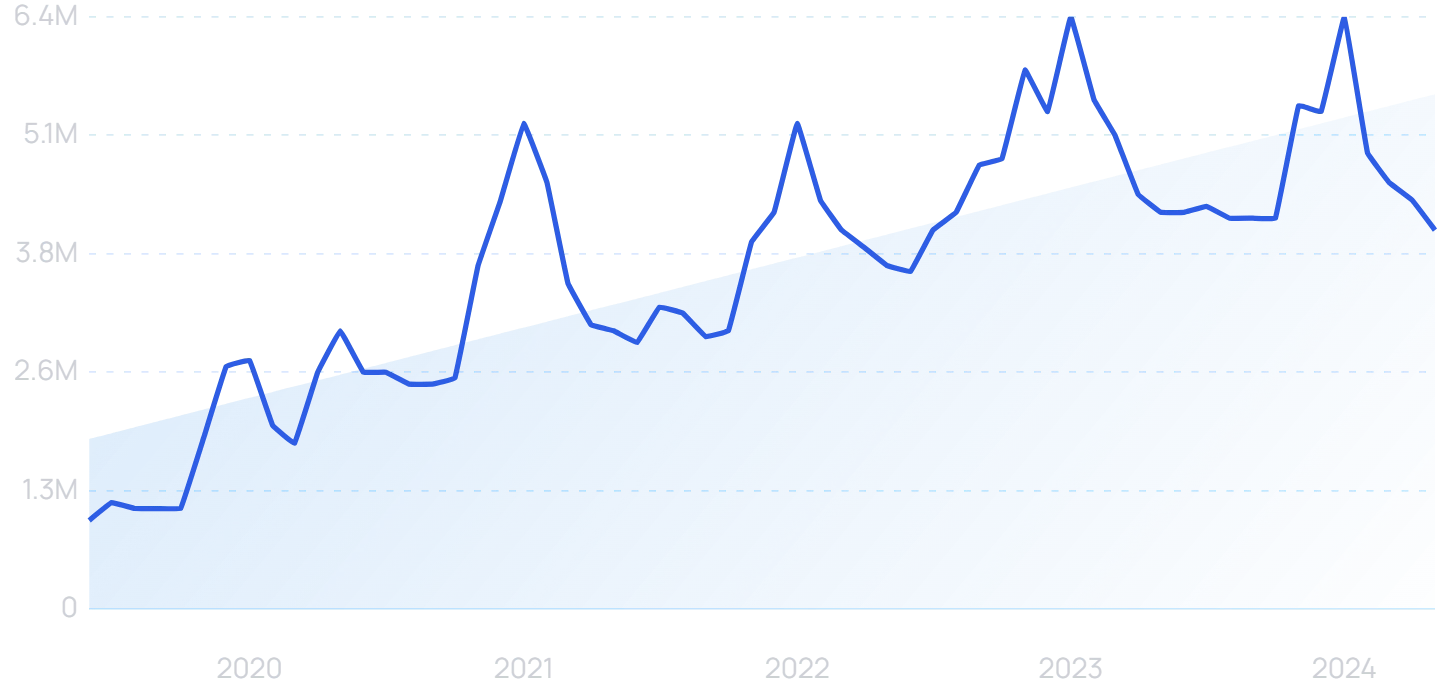

8. The Expanding Mindfulness Market

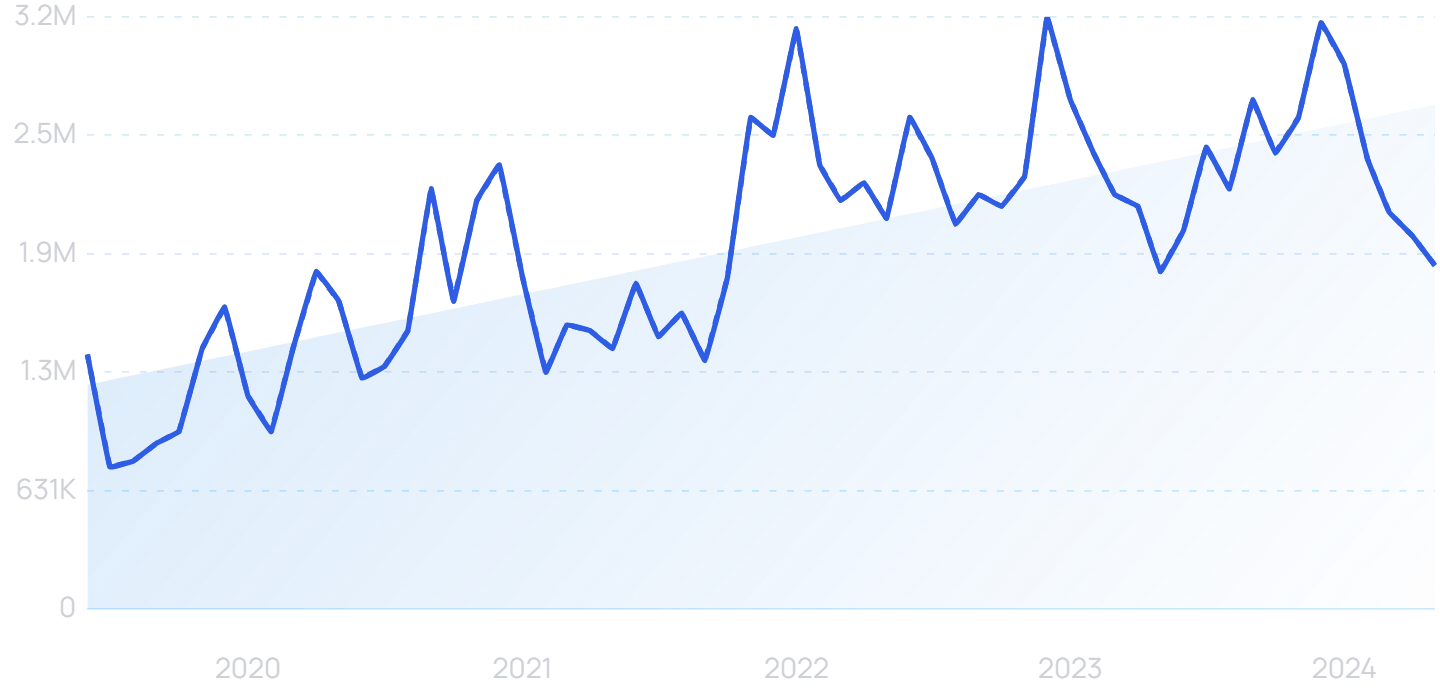

With the global meditation market projected to reach $9 billion by 2027, mindfulness practices are becoming mainstream. Apps like Calm and Headspace are leading the charge in providing accessible mental wellness solutions.

9. The Home as the Central Hub

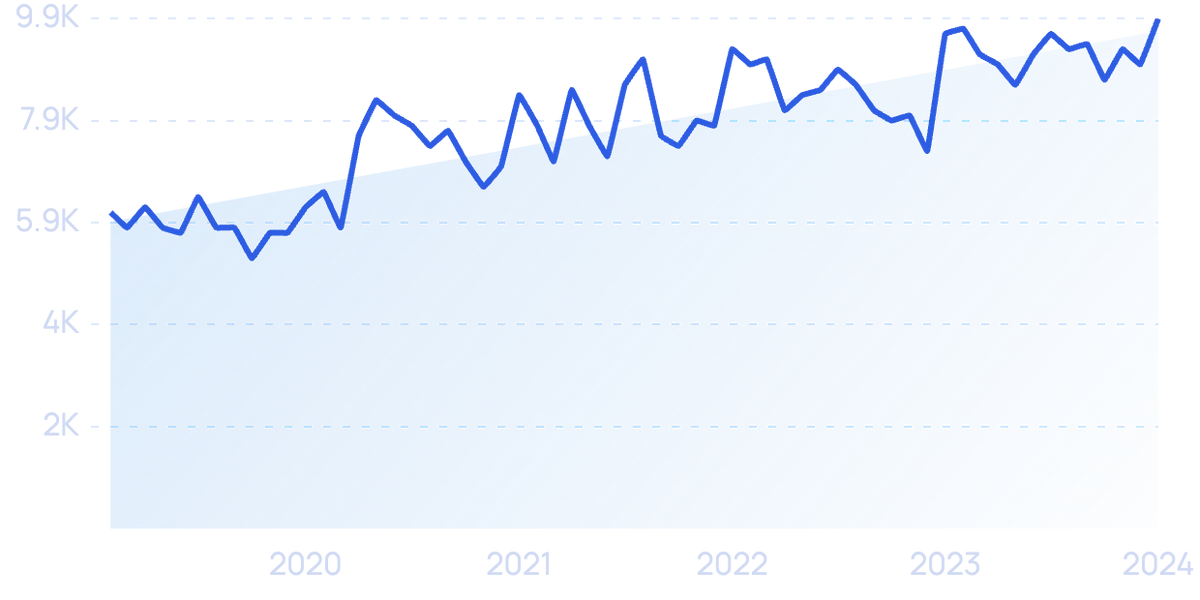

With more people working remotely, the home has evolved into a multifaceted hub for work, leisure, and security. This has spurred interest in products like smart doorbells and air fryers, enhancing both convenience and functionality at home.

Conclusion

These trends highlight a consumer landscape increasingly focused on convenience, sustainability, and enhanced home environments. As brands navigate this evolving terrain, understanding these shifts will be crucial in meeting consumer expectations and driving future growth. “`

Top CRM Solutions for Real Estate in 2024

Top CRM Solutions for Real Estate

Leading the pack is Freshsales, celebrated for its intuitive interface and advanced AI forecasting. With a starting price of $15 per user per month, it offers a customizable experience that caters specifically to the needs of real estate professionals. Freshsales stands out with its mobile app features and automation capabilities, although some lead generation tools are reserved for enterprise plans. For more insights, you can read the full Freshsales review.

Another notable mention is HubSpot CRM, which provides a competitive free plan. Its modular approach allows real estate agencies to start with zero costs, adding features as needed. HubSpot’s integration with over 300 third-party applications makes it a flexible choice for various workflows. Explore the HubSpot CRM review for more details.

Zoho CRM is an excellent option for those already utilizing Zoho’s suite of products. With prices starting at $14 per user per month, it offers seamless integration with other Zoho apps. Zoho CRM is particularly lauded for its social media scraping tool, which aids in lead generation. Delve deeper into Zoho’s offerings through the Zoho CRM review.

Specialized and Budget-Friendly Options

For project management enthusiasts, Insightly provides a robust platform with integrated tools and over 250 app integrations. Although its interface may seem overwhelming initially, the potential for workflow automation is significant. Insightly is detailed further in the Insightly review.

BoomTown, designed specifically for realtors, offers real-time property updates and extensive lead-generation features. Although it lacks some integrations, its realtor-focused tools make it a valuable asset for those in the industry.

Choosing the Right CRM

When selecting a CRM, consider factors such as lead generation capabilities, customizability, and automation features. Whether you’re a small agency or a large brokerage, there is a CRM solution tailored to your needs. For a comprehensive comparison, visit the best CRM software guide.

Conclusion

The best CRM solutions for real estate in 2024 are not just about managing contacts but transforming how agencies interact with clients. By leveraging these tools, real estate professionals can enhance client satisfaction, reduce operational costs, and ultimately drive sales growth.

Understanding the Current Landscape of Investment Property Interest Rates

Understanding the Current Landscape of Investment Property Interest Rates

In today’s real estate market, understanding the nuances of investment property loans is crucial for both seasoned investors and newcomers alike. The average cost of a house in the U.S. stands at $420,800, making loans an essential tool for many aspiring property owners. These loans not only enable investors to leverage their investments but also offer potential tax benefits.However, not all loans are created equal. The type of investment property loan you choose can significantly impact the interest rates you pay. For example, house hacking allows investors to take advantage of owner-occupied mortgage rates, which are generally lower than those for traditional investment properties.

Current Interest Rates at a Glance

According to a recent analysis from SparkRental, interest rates for investment properties are notably higher than those for homeowner mortgages. For instance, conventional 15-year fixed-rate loans range from 5.87% to 6.95%, while 30-year fixed-rate loans vary between 5.8% and 8.27%. These rates are influenced by numerous factors, including credit scores and loan-to-value ratios.Creative Financing Options

For those looking to explore beyond conventional loans, various creative financing strategies are available. Owner financing offers a unique opportunity to negotiate directly with sellers, potentially securing more favorable terms. Similarly, the BRRRR strategy allows investors to refinance short-term hard money loans into long-term portfolio loans.Another innovative approach is fractional real estate ownership, which provides an alternative for those seeking passive investment opportunities without the hassle of traditional financing.

The Role of Credit Scores

Your credit score plays a pivotal role in determining the interest rates you receive on investment property loans. A higher score not only opens doors to more favorable rates but also expands your financing options. Therefore, improving your credit score should be a top priority for anyone serious about real estate investing.Final Thoughts

Navigating the world of investment property loans can be daunting, but understanding the landscape can empower you to make informed decisions. Whether you opt for conventional loans or explore creative financing methods, the key is to align your strategy with your investment goals. As the market continues to evolve, staying informed about the latest trends and rates will be crucial for maximizing your returns.For more insights on investment property interest rates, visit SparkRental.

SEO for Real Estate Agents: Unlocking Local Leads and Traffic

SEO for Real Estate Agents: Unlocking Local Leads and Traffic

In the ever-evolving digital landscape, real estate agents are increasingly turning to local SEO to enhance their online presence and attract clients within their specific geographic areas. As highlighted in a recent article by 23 Window Media, optimizing websites for location-based keywords such as “real estate agent in [your city]” or “[your neighborhood] homes for sale” is crucial for success.

Creating Neighborhood-Specific Landing Pages

One key strategy explored involves developing dedicated landing pages for each neighborhood or community served. These pages not only showcase an agent’s expertise but also highlight local market data, featured listings, and insider knowledge about the community. By offering valuable, hyper-local content, agents can attract more targeted traffic and establish themselves as the go-to experts in their respective neighborhoods.

Leveraging Local Partnerships

The article also emphasizes the importance of forming strategic partnerships with local businesses and organizations. Collaborations such as sponsoring community events, hosting neighborhood open houses, or working with local home staging companies can significantly boost an agent’s visibility. These partnerships not only enhance online presence but also reinforce an agent’s reputation as a community expert.

Trends and Insights

The trend towards hyper-local content and community engagement is becoming increasingly vital for real estate agents aiming to become the preferred choice in their targeted communities. By focusing on these strategies, agents can enhance their online visibility and drive more leads and traffic to their realtor websites.

Revolutionizing Real Estate: The AI Tools Transforming the Industry

Revolutionizing Real Estate: The AI Tools Transforming the Industry

In an era where technology is reshaping industries, the real estate sector is no exception. A recent article from HousingWire highlights how Artificial Intelligence (AI) tools are becoming indispensable for real estate agents, equipping them with capabilities that were once unimaginable.

AI’s Role in Real Estate

AI tools, such as ChatGPT, have already made their mark by providing real estate professionals with a means to streamline operations. However, the true game changers are the predictive analytics and data-driven marketing tools that are transforming the way agents generate leads and manage their resources.

Noteworthy AI Tools

- Top Producer’s Smart Targeting: This AI tool uses predictive analytics to identify potential sellers, integrating seamlessly with a CRM that agents are familiar with.

- Offrs + RAIA AI: Offers a blend of predictive analytics and a patented AI chat tool, providing an edge in lead nurturing and conversion.

- Virtual Staging AI: Known for its realistic virtual staging capabilities, allowing agents to select furniture styles and revise until satisfied.

- Reimaginehome: Provides virtual staging and customization options, free for up to 30 images monthly.

- Canva: A versatile graphic design platform with AI features to enhance marketing material creation.

- Lofty’s AI Assistant: Facilitates lead conversion and nurturing through AI-driven campaigns.

- Real Geeks’ Geek AI & SEO Fast Track: Enhances search engine rankings with AI chatbots and SEO tools.

Enhancing Customer Interaction

AI is not just about efficiency; it’s about enhancing customer service. By automating routine tasks, agents can focus on building meaningful relationships with clients. Tools like Roof AI and Structurely are leading the charge in AI-powered client engagement, ensuring that potential leads are nurtured from the moment they express interest.

The Future of Real Estate

As AI continues to evolve, its integration into the real estate sector promises not only to boost operational productivity but also to refine client interactions. By freeing agents from mundane tasks, AI tools allow them to focus on what truly matters—providing exceptional service and fostering client relationships.

For more insights into how AI is revolutionizing real estate, visit the original article on HousingWire.

Jersey City Emerges as Top Pick for 2024 Apartment Investments

Jersey City Emerges as Top Pick for 2024 Apartment Investments

In an unexpected turn of events, Jersey City, New Jersey, has claimed the spotlight as the premier destination for apartment investments in 2024, according to the Urban Land Institute’s (ULI) annual “Emerging Trends” report. This finding defies the narrative of population decline in the broader New York City area, highlighting the resilience and appeal of the apartment market.

Jersey City’s ascent to the top of the investment charts reflects a broader shift in investor sentiment that began in 2022. As rent growth slows in Sunbelt markets, where apartment construction has surged, attention has turned to the Northeast and Midwest, where rent growth remains strong. This shift is underscored by the fact that New York City, despite losing approximately 468,000 residents between 2020 and 2022, maintains a low vacancy rate of about 2.5%, as reported by Cushman & Wakefield.

Sam Tenenbaum, a multifamily economist at Cushman & Wakefield, explains, “New York City is the tightest market in the country from a vacancy standpoint, so renters are being pushed out to New Jersey, which has some of the strongest rent growth in the country at the moment.”

The Big Apple’s Population Puzzle

While New York City has seen a significant population decline, the demand for apartments remains robust. The city’s population, now at 8.33 million, is down from 8.8 million in mid-2020, yet the metro area, including Jersey City, still boasts 19.6 million residents. Tenenbaum attributes this paradox to household growth driving apartment demand, coupled with limited new construction and nominal job growth.

Interestingly, the ULI report indicates a muted enthusiasm for apartment investments in 2024 compared to 2023, largely due to higher interest rates. However, the Northeast and Midwest are leading the nation in rent growth, making them attractive targets for investors.

Investment Trends and Recommendations

In ULI’s survey, 61% of respondents recommended buying in Jersey City for 2024. Brooklyn, which topped the list last year, received a 53% buy recommendation for the coming year. Other notable mentions include Madison, Wisconsin, and Columbus, Ohio, which are also gaining investor interest.

Conversely, many Sunbelt metro areas have fallen out of favor. Cities like Jacksonville, Tampa, and Miami did not make the ULI’s top 20 list, leaving West Palm Beach as the sole representative from Florida. This shift highlights a changing landscape in real estate investment, where performance is now being measured against national standards.

For a deeper dive into these trends, you can read the full Forbes article by Richard Lawson.

Corruption and Money Laundering in the U.S. Real Estate Market

The real estate market has increasingly become a focal point for discussions on corruption and money laundering. This sector, particularly in the United States, offers a unique combination of stability and opacity, making it an attractive avenue for illicit activities. Major cities such as Miami, New York, and San Diego have emerged as hotspots for these activities, where corrupt actors can easily launder illicitly obtained funds through property purchases.

The U.S. Real Estate Market: A Haven for Corruption

As Treasury Secretary Janet Yellen highlighted in 2021, the United States provides an appealing environment for hiding and laundering ill-gotten gains. This is largely due to the lack of stringent regulations on cash transactions and beneficial ownership declarations. The U.S. Treasury Department’s Financial Crimes Enforcement Network (FinCEN) has identified the commercial real estate market as particularly vulnerable to money laundering, especially by sanctioned individuals such as Russian oligarchs.

The complexity and opacity of ownership structures in these transactions pose significant challenges for financial institutions tasked with detecting illicit activities. The anonymity provided in these transactions further facilitates the concealment of illicit wealth, allowing corrupt individuals to invest in high-value properties without the risk of their illegal activities being uncovered and punished.

Proposed Regulatory Changes

In response to these challenges, the Biden administration’s 2021 Strategy on Countering Corruption aims to close these loopholes. A proposed rule, anticipated to take effect in early 2024, will mandate real estate professionals to report the identities of beneficial owners in non-financed residential property purchases. This rule seeks to make permanent the temporary geographic targeting orders (GTOs) that currently require title insurance companies to disclose the natural persons behind shell companies in high-value cash transactions in select metropolitan areas.

These proposed changes are expected to enhance transparency, deter money laundering, and address sanctions evasion. As the U.S. and its allies continue to impose sanctions against Russian aggression, strengthening anti-money laundering measures in the real estate sector is crucial to combating illicit finance and safeguarding national security.

The Role of Real Estate Data

Real estate data can be instrumental in detecting potential money laundering and other criminal activities. Access to comprehensive property-related data—including legal and beneficial ownership, historical ownership information, and transaction details—can help authorities, journalists, and activists identify red flags indicative of corruption.

In 2017, Transparency International conducted an analysis focusing on anti-money laundering and corruption prevention mechanisms within the real estate sector across four key markets: Australia, Canada, the United Kingdom, and the United States. The report, titled “Doors Wide Open,” identified ten significant issues that allow corrupt individuals to anonymously purchase luxury properties and launder stolen money.

Despite these findings, the availability of critical real estate and beneficial ownership data remains limited. This lack of transparency means that much is still unknown about property ownership and whether these assets were acquired using illicit funds. The situation persists in the aforementioned markets, highlighting the ongoing challenge of combating corruption in the real estate sector.

Conclusion: Enhancing Transparency and Accountability

To effectively address corruption in the real estate market, it is crucial to enhance the availability and accessibility of real estate data. Strengthening anti-money laundering laws and ensuring transparency in property transactions can help expose and deter corrupt practices, ultimately fostering a more accountable and fair real estate market globally.

Advice and Suggestions

- For Real Estate Professionals: Stay informed about regulatory changes and ensure compliance with new rules regarding beneficial ownership reporting.

- For Policymakers: Consider implementing stricter regulations and enhancing data transparency to deter illicit activities in the real estate sector.

- For Investors: Conduct thorough due diligence and seek properties with clear ownership histories to avoid potential legal complications.

References

- Real Estate in 2024 – Anticipating a Crackdown on Corruption & Fraud – Institute for Financial Integrity

- Transparency International’s 2021 assessment of the US real estate sector

- Time to Clean House: Unpacking the Harms of Massive Money Laundering in the Real Estate Sector

- Global Financial Integrity Report

- Transparency International U.S. Report

- Real estate data: Shining a light on the corrupt – Transparency.org

- Doors wide open: Corruption and real estate in four key markets

Navigating the Threats: How to Identify and Avoid Real Estate Scams

Real estate transactions are often complex and fraught with potential pitfalls, making them a prime target for scammers. Whether you’re buying, selling, or refinancing, it’s crucial to be aware of the various scams that could impact your financial well-being. This guide provides an in-depth look at some of the most common real estate scams and offers tips on how to protect yourself.

Understanding Common Real Estate Scams

1. Wire Fraud Scam

Wire fraud is a significant threat in the real estate sector. Scammers often pose as real estate agents or other trusted parties to trick buyers into wiring funds to fraudulent accounts. These scams can be particularly challenging to detect as scammers use sophisticated software to mimic legitimate email addresses and phone numbers.

Protection Tips: To safeguard yourself, always verify wiring instructions through a trusted phone number and stay on the call during the transaction. Never rely solely on email communications for such sensitive transactions.

2. Foreclosure Relief Scam

Homeowners facing foreclosure are often targets of scammers who promise to stop the process or modify loans for an upfront fee. Unfortunately, victims not only lose money but also remain at risk of losing their homes.

Protection Tips: Avoid paying upfront for services that have not been completed. Verify the legitimacy of individuals or companies offering help by checking attorney credentials through state bar websites.

3. Loan-Flipping Scam

This scam involves convincing homeowners to refinance their mortgages repeatedly, incurring high fees and reducing home equity. Seniors, who often have significant equity, are particularly vulnerable.

Protection Tips: Work only with trusted lenders and consult with family or friends before making financial decisions. Always read the fine print and understand all terms before agreeing to refinance.

4. Messages From Fake Buyers

Scammers may send unsolicited messages to homeowners, pretending to be interested buyers to extract personal information. This can lead to identity theft or other forms of fraud.

Protection Tips: Protect yourself by working with a trusted real estate agent who can vet potential buyers. If you are selling on your own, be prepared to do thorough background checks on interested parties.

General Tips to Avoid Real Estate Scams

Awareness and diligence are key to avoiding these scams. Always verify the identity of individuals and companies you are dealing with, and consult trusted professionals when in doubt. Here are some additional tips:

- Use trusted real estate professionals and check their credentials.

- Be wary of deals that seem too good to be true.

- Keep your personal information secure and be cautious about sharing it.

- Stay informed about the latest scams and tactics used by fraudsters.

By staying informed and vigilant, you can protect yourself from becoming a victim of real estate scams. Always take the time to verify information and consult with trusted professionals before making any significant financial decisions.

For more detailed information on real estate scams, consider visiting the following resources:

- Rocket Mortgage – Avoid These 7 Dangerous Real Estate Scams: Offers a comprehensive overview of prevalent scams and practical advice on protection.

- Bankrate – 5 Common Real Estate Scams: Highlights warning signs and provides actionable steps for safeguarding against scams.

- National Cybersecurity Alliance – 5 Common Real Estate Scams You Need to Know About: Focuses on cybersecurity aspects and suggests methods to enhance security.

South Florida Housing Market: A Resilient Ecosystem

South Florida Housing Market: A Resilient Ecosystem

The South Florida housing market continues to defy expectations, thriving amidst challenges that could have hindered its progress in 2024. Known for its allure to retirees and snowbirds, the region has now emerged as a global investment hub and cultural epicenter.Economic Indicators and Projections

Economic forecasts for South Florida suggest a potential decline in mortgage rates to 6.6% by the end of 2024. This reflects anticipated Federal Reserve actions aimed at easing inflation. Further projections indicate a drop to 5.7% by 2025, potentially invigorating interest from buyers in the lower- and mid-priced segments.Single-Family Homes vs. Condos

Sales trends highlight robust activity in the single-family home sector, with an expected 7.8% increase in sales volume. However, the condo market may face stagnation, attributed to potential maintenance fee hikes and regulatory impacts from the Florida Building Safety Act.Price and Market Dynamics

The median single-family home price is predicted to rise by 6.9% in 2024. Luxury properties above $1 million maintain a stronghold in the market, with areas like Miami-Dade, Broward, and Palm Beach seeing a surge in high-value property transactions.Migration and Employment Impact

Southeast Florida continues to attract new residents due to its absence of state income tax and vibrant lifestyle offerings. This influx sustains demand across various housing sectors, ensuring a lively market supported by strong business and employment growth. With a projected 2.4% job increase in 2025 and tax incentives through the Florida Business Rent Tax, South Florida positions itself as a favorable destination for both domestic and international investors.Conclusions: A Market Poised for Growth

Despite potential obstacles, the South Florida housing market is poised for continued expansion through 2025. Lower mortgage rates and sustained economic conditions are expected to support a recovery in home sales, with luxury markets leading the charge.For further insight and detailed analyses, readers are encouraged to explore the original article, which provides in-depth knowledge of the current and future states of the South Florida housing market. Additional perspectives can be found in the Miami Association of REALTORS® Report and Finance Yahoo.

Top Places in Florida for Real Estate Investment: Insights and Opportunities

Florida’s real estate market is a dynamic landscape, offering a plethora of investment opportunities. Known for its sunny weather, vibrant cities, and diverse economic growth, Florida continues to attract real estate investors from across the globe. In this article, we delve into the top places in Florida for real estate investment, providing insights into their unique characteristics and potential returns.

Jacksonville: An Underrated Gem

Jacksonville stands out as a prime location for real estate investment due to its affordability, urban and coastal lifestyle, and diverse employment prospects. As the largest city by land area in the United States, Jacksonville is experiencing significant growth and development, especially in downtown and oceanfront suburbs. With a median property price of $321,000 and a median rental income of $1,350 monthly, it offers affordable suburban living with access to city amenities and strong rental demand. Learn more about the potential of Jacksonville from Jacksonville Real Estate Investment.

Orlando: The Theme Park Capital of the World

Orlando is a key player in the real estate market, driven by its thriving tourism industry and diverse property options. Known as the “Theme Park Capital of the World,” Orlando boasts significant population growth and job creation. With a median property price of $395,000 and a median rental income of $2,101 monthly, the city’s strong rental market is bolstered by millions of annual visitors, making it a lucrative investment opportunity. Discover more about Orlando’s real estate potential from Orlando Real Estate Investment. Watch a video about Orlando here.

Tampa: A Thriving Economic Hub

Tampa offers a robust environment for real estate investors, particularly those interested in long-term rentals. Renowned for its beaches and low cost of living, Tampa has a median property price of $430,000 and a median rental income of $2,300 monthly. With a high renter fraction and a growing population, Tampa is an attractive city for real estate investment. Explore more about Tampa’s real estate market from Best Places to Invest in Real Estate in Florida 2025 | Mashvisor. Watch a video about Tampa here.

St. Augustine: Historical Charm Meets Modern Living

St. Augustine, known as the nation’s oldest city, offers a unique blend of historical charm and modern economic stability. The city attracts tourists and students year-round, providing a steady rental market. Its diverse industries, including tourism and healthcare, ensure a strong real estate market, making it an appealing destination for investors.

Miami: A Coastal Metropolis

Miami is a major coastal metropolis that attracts people seeking favorable tax rates and warm weather. With a median property price of $589,000 and a median rental income of $3,700 monthly, Miami has seen significant real estate appreciation. The city’s vibrant lifestyle and high percentage of properties occupied by renters make it a promising location for investment.

Additional Noteworthy Locations

- West Palm Beach: With a median property price of $947,714 and a monthly long-term rental income of $3,386, West Palm Beach offers a strong rental market with a favorable cash on cash return of 3.66%. Learn more from Best Places to Invest in Real Estate in Florida 2025 | Mashvisor.

- Fort Lauderdale: Known for its vibrant city center and job market, Fort Lauderdale has a median property price of $625,000 and a median rental income of $3,334 monthly, making it a promising location for investment.

- St. Petersburg: With cultural attractions and waterfront views, St. Petersburg has a median property price of $770,176 and a monthly long-term rental income of $2,756.

- Winter Park: Offering a charming atmosphere and proximity to Orlando’s attractions, Winter Park has a median property price of $936,768 and a monthly long-term rental income of $3,191.

- Nokomis: Known for its serene environment, Nokomis has a median property price of $847,526 and a monthly long-term rental income of $3,095.

Investing in Florida real estate offers the potential for passive income and long-term financial growth. Whether you’re a seasoned investor or new to the market, Florida’s diverse real estate landscape provides opportunities for everyone. By understanding the unique characteristics of each location, investors can make informed decisions to capitalize on the state’s thriving real estate market.

Michael Cameron Sidawi: A Visionary Leader in Education and Technology

Cameron Academy: Leading Choice in Florida Real Estate Education

In the competitive landscape of Florida real estate education, Cameron Academy of Real Estate has emerged as a premier institution, offering unique advantages over other providers such as Gold Coast Schools. With a focus on delivering exceptional value to aspiring real estate professionals, Cameron Academy stands out by providing a comprehensive and tailored educational experience.

Comprehensive and Tailored Curriculum

Cameron Academy offers a curriculum that is meticulously designed to meet the specific needs of aspiring real estate professionals. Unlike many other providers, the academy ensures that its courses are not only state-approved but also tailored to address the nuances of the Florida real estate market. This approach ensures that students receive an education that is both relevant and practical.

Experienced Instructors

The academy boasts a team of seasoned instructors who bring real-world experience into the classroom. This practical insight is invaluable for students, providing them with a deeper understanding of real estate concepts and practices that go beyond textbook knowledge. Experienced instructors play a critical role in bridging the gap between theory and practice.

“The personalized instruction and experienced faculty at Cameron Academy have been highlighted by users on Yelp as key strengths, distinguishing it from more standardized programs offered by competitors like Gold Coast.”

Flexible Learning Options

Recognizing the diverse needs of students, Cameron Academy offers both in-person and online learning options. This flexibility allows students to choose a learning format that best suits their lifestyle and commitments, ensuring that education is accessible to all. Whether you’re a working professional or a full-time student, Cameron Academy has a solution that fits.

Enhanced Student Support

Cameron Academy places a strong emphasis on student support, offering personalized assistance to help students navigate their educational journey. This includes access to instructors for queries and additional resources to aid learning, ensuring that students are well-prepared for their exams. The focus on enhanced student support sets Cameron Academy apart from its competitors.

“Students have praised the academy’s strong post-graduation support and flexible scheduling options, which are often highlighted in reviews on Yelp for real estate schools in Osceola County.”

Focus on Exam Success

The academy’s courses are strategically designed to maximize students’ chances of passing the Florida real estate exam on their first attempt. With comprehensive study materials, practice exams, and targeted exam preparation sessions, Cameron Academy equips students with the tools they need to succeed. The academy’s commitment to exam success is evident in its structured approach to learning.

“Cameron Academy’s tailored exam preparation strategies and higher pass rates have been recognized in evaluations of Florida real estate exam prep courses, setting it apart from competitors like Gold Coast.”

Innovative Teaching Methods

By incorporating modern teaching techniques and technology, Cameron Academy ensures that its students receive a cutting-edge education. Interactive lessons and up-to-date content keep students engaged and informed about the latest industry trends and regulations. The use of innovative teaching methods enhances the learning experience and prepares students for real-world challenges.

Community and Networking Opportunities

Cameron Academy fosters a community environment where students can connect with peers and industry professionals. Networking opportunities and events are integral to the academy’s offerings, providing students with valuable connections that can enhance their career prospects. Building a strong professional network is essential in the real estate industry, and Cameron Academy facilitates this through various initiatives.

In summary, Cameron Academy of Real Estate stands out in the realm of real estate education by offering a comprehensive, flexible, and supportive learning experience. Its commitment to student success and innovative approach to education make it a superior choice for those seeking to excel in the Florida real estate industry.

Earnings and Benefits of a Real Estate Career in Florida

In Florida, the earnings of a real estate agent can vary significantly based on numerous factors including experience, location, and the current state of the housing market. The potential earnings are quite broad, with average salaries ranging from $40,000 to $90,000 per year. However, top-performing agents in high-demand areas can earn well above this range, sometimes exceeding $100,000 annually. According to the U.S. Bureau of Labor Statistics in 2023, the income for Florida real estate agents can span from $24,856 to $162,283, with very top producers making over a million dollars annually.

According to Indeed, the average salary for a real estate agent in Florida can vary based on experience, location, and other factors. As of the latest data, real estate agents in Florida earn an average salary that ranges significantly, with top earners making considerably more than the average.

Commission Structure and Expenses

The income of a real estate agent is largely commission-based, meaning agents earn a percentage of the sales price of the properties they sell. Typically, this commission is around 5% to 6% of the property’s sale price, which is then split between the buyer’s agent and the seller’s agent, and further divided with their respective brokerages. This commission structure means that an agent’s earnings can vary significantly from sale to sale.

Additionally, real estate agents face various expenses such as marketing costs, licensing fees, and association dues, which can impact their net income. Successful agents often have a strong network, excellent negotiation skills, and a deep understanding of the local market, which can contribute to higher earnings.

Factors Influencing Earnings

Experience

The first year in real estate is often the most challenging. However, agents who persist can reap the rewards of their efforts within a few years. A supportive broker and a growing network are crucial as you establish your business. All real estate candidates in Florida must first complete 63 hours of approved pre-licensing education to obtain their license.

Location

Real estate agents’ earnings can vary significantly depending on their metropolitan area. For instance, agents in Tampa earn an average of $83,418 annually, whereas in Tallahassee, the average salary is $75,926. Miami Beach agents see average earnings of $85,985, while those in Port St. Lucie average $84,417 a year. The Fort Lauderdale area boasts an average agent income of $81,620 per year.

Hours Worked

The number of hours worked also plays a crucial role in determining income. Full-time agents have an average gross income of $72,247, compared to $24,298 for part-time agents. While real estate offers the opportunity for a flexible schedule, those who dedicate more hours can achieve their full earning potential.

Specialties

Agents who focus on specific niches often earn more than those who do not. The most profitable specializations include luxury real estate, foreign investments, short sales and foreclosures, and green or eco-friendly properties.

Benefits of a Real Estate Career in Florida

In addition to potentially high earnings, a career in real estate offers several other benefits. As a real estate agent, you are self-employed, which means you have the freedom to work from home or any location of your choice. This flexibility allows you to set your schedule and work at times that suit you best.

The real estate field is rich with professional development opportunities. Whether through courses, seminars, business experience, coaching, mentoring, or public speaking, agents can continuously expand their knowledge and skills. The industry also provides a wide community of like-minded individuals to connect with, from investors and brokers to building contractors.

Being self-employed also means that business-related expenses are tax-deductible. This includes travel for sales calls, business equipment, and professional development costs. However, it’s important to note that self-employment taxes will apply.

Overall, starting a career as a real estate agent in Florida can be an excellent opportunity for those who desire a flexible schedule, are disciplined enough to put in the necessary hours, and enjoy engaging with the community.

For a more detailed breakdown of real estate agent salaries across Florida, ZipRecruiter offers insights indicating that the salary range can be quite broad. The data provided includes estimates of the highest and lowest earners, giving a clear picture of potential earnings.

What to Know Before Screening a Section 8 Tenant

Understanding Section 8 and Fair Housing Laws

The Section 8 Housing Choice Voucher Program is a federal initiative that assists low-income families, the elderly, and the disabled in affording housing. Tenants pay a portion of their income towards rent, while the government subsidizes the remainder. This program allows tenants the flexibility to choose where they live, provided the property meets HUD’s housing quality standards and the rent is within the program’s limits. Landlords must comply with the Fair Housing Act (FHA), which prohibits discrimination based on race, color, national origin, religion, sex, familial status, or disability. Additionally, Florida law prohibits discrimination based on age and marital status. While the FHA does not specifically address discrimination based on Section 8 vouchers, several counties in Florida, such as Broward, Miami-Dade, and Hillsborough, have enacted laws prohibiting discrimination based on the source of income. It is essential to check local ordinances to ensure compliance.Best Practices for Screening Section 8 Tenants

- Internal Policies: Develop a written policy for all employees and agents involved in advertising and screening applicants. Consistency in responses regarding Section 8 acceptance is crucial to avoid discrimination claims.

- Training: Engage in training opportunities through local realtor associations or professional groups to stay informed about housing discrimination laws and best practices.

- Neutral Screening Criteria: Apply the same neutral and non-discriminatory criteria to all applicants, including those with Section 8 vouchers. This includes consistent credit checks, rental history, and background checks.

- Inspection Requirements: Properties rented to Section 8 tenants must pass a Housing Quality Standards (HQS) inspection. Be prepared for periodic inspections and ensure your property meets the required standards.

Lease Agreements and Rent Determination

When renting to Section 8 tenants, use a standard lease agreement and be prepared to include the HUD Tenancy Addendum, which outlines the rights and responsibilities of both landlord and tenant under the Section 8 program. Additionally, you will need to sign a Housing Assistance Payments (HAP) contract with the local Public Housing Agency (PHA). The rent charged must be reasonable compared to similar unassisted units in the area. The PHA will assess rent reasonableness as part of the approval process, ensuring it aligns with the tenant’s income and the area’s Fair Market Rent (FMR).Payment Process and Communication with PHA

Once the lease and HAP contract are in place, you will receive rental payments directly from the PHA, while the tenant pays their portion directly to you. It is essential to have a reliable system for tracking payments and handling any discrepancies. Maintain open communication with the local PHA, as they are a valuable resource for understanding program requirements and resolving any issues that may arise.Legal and Insurance Considerations

Consider obtaining property manager errors and omissions insurance or real estate errors and omissions insurance with a property management endorsement to protect your business from potential legal claims. Additionally, be aware that “Testers” might pose as renters to gather evidence of unlawful practices. Consistent and lawful responses are essential to avoid liability. By following these guidelines, landlords and property managers can effectively screen Section 8 tenants while remaining compliant with applicable laws, thus reducing the risk of legal issues and fostering an inclusive housing environment.Cape Coral Grapples with Rising Housing Costs Post-Hurricane Ian

Cape Coral Faces Spike in Housing Costs Two Years After Hurricane Ian

CAPE CORAL, Fla. — As the Atlantic Hurricane Season looms, forecasts indicate increased activity, casting a shadow over Florida’s southwest coast where Cape Coral is still dealing with the aftermath of Hurricane Ian. The storm, which struck over a year and a half ago, left a trail of destruction valued at more than $117 billion, impacting housing and insurance costs significantly. Many homeowners, facing unsustainable financial burdens, have put their properties on the market.

Cape Coral, with its intricate network of 400 miles of canals providing boat access to the Gulf of Mexico, attracted residents like Jerry Smith from New Jersey. He moved there during the COVID pandemic, drawn by visions of a serene Florida lifestyle. Although Smith’s home suffered only minor damage, insurance premiums have increased dramatically, posing financial challenges for locals.

In the late 1950s, developers transformed Cape Coral into what they marketed as a “waterfront wonderland,” but today, such a venture might never materialize due to environmental considerations. Realtor Sam Yaffe notes that, while Cape Coral once offered a cost advantage, recent months have seen a slowdown in sales, attributed primarily to soaring mortgage rates and rising insurance costs.