The Evolving Role of Virtual Tours in Real Estate: A Study of 75,000 Home Sales

In an era where technology continues to reshape the landscape of real estate, the role of virtual tours remains a topic of debate. According to a recent study published by HBS Working Knowledge, virtual tours, which surged in popularity during the COVID-19 pandemic, might not significantly enhance home sale prices or reduce the time properties spend on the market.

The comprehensive research, conducted by Isamar Troncoso of Harvard Business School and Mengxia Zhang of Western University, analyzed over 75,000 home sales in the greater Los Angeles area. Their findings suggest that while virtual tours offer certain advantages, their impact on sales outcomes is less pronounced than previously thought.

Troncoso’s study, accessible here, reveals that the quality of photos and listing descriptions often overshadow the benefits of virtual tours. “Maybe it doesn’t help you to get a 5 percent sales price rise by using visual tools—but it might help sellers in many other ways,” Troncoso notes. In the post-pandemic world, the initial boost virtual tours provided seems to have waned, with traditional factors like location and presentation regaining their prominence.

The study utilized cutting-edge machine learning techniques to sift through data from the real estate platform Redfin, examining various aspects such as sale prices, market duration, and initial pricing strategies. Interestingly, only about 22 percent of the listings included virtual tours, and these often came with higher-quality photos and longer descriptions.

One intriguing insight from the research is the nuanced role of virtual tours in different neighborhoods. In areas served by smaller real estate firms or those less sought after, virtual tours might still offer a marginal benefit. Troncoso explains, “These are areas in which these technologies penetrated less. So that’s why you see a little bit more of a marginal effect when those sellers have virtual tours.”

For buyers, virtual tours can streamline the house-hunting process by helping them eliminate properties that don’t meet their criteria, making their search more efficient. “Maybe it doesn’t really get you to say, ‘Oh, now I really like that house,’ but it’s going to help you to be like, ‘Oh, I don’t like this one, so I won’t bother to go and see it,’” Troncoso adds.

As virtual tour technologies continue to evolve and become more affordable, their application might expand beyond home sales to areas like long- and short-term rentals. However, for now, the key takeaway for sellers is to prioritize high-quality photos and descriptions unless specific conditions suggest otherwise.

In conclusion, the study underscores the importance of context in leveraging virtual tours effectively in real estate. For further insights and related topics, readers can explore articles such as When Glasses Land the Gig: Employers Still Choose Workers Who ‘Look the Part’ and Shrinking the Racial Wealth Gap, One Mortgage at a Time.

For more information and to view the original research, visit the HBS Working Knowledge website.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

More Articles

Getting licensed or staying ahead in your career can be a journey—but it doesn’t have to be overwhelming. Grab your favorite coffee or tea, take a moment to relax, and browse through our articles. Whether you’re just starting out or renewing your expertise, we’ve got tips, insights, and advice to keep you moving forward. Here’s to your success—one sip and one step at a time!

Q3 2024 Down Payments Decline Slightly, Still Near Historic Highs

Down Payments Ease but Remain High

The average down payment fell to 14.5% in Q3 2024 from the historical peak of 14.9% in Q2. This represents a modest decrease but still ranks as the third-highest percentage in recent history. The median down payment amount also dropped slightly to $30,300 from $32,700, reflecting the easing competition in the housing market.

Regional Disparities in Down Payment Trends

Regional differences are evident, with the Northeast states experiencing the most significant increases in down payments, while Southern states are witnessing declines. High-priced metros continue to demand larger down payments, but more affordable regions are seeing the most growth. This disparity highlights the ongoing impact of economic dynamics and buyer behavior across the nation.

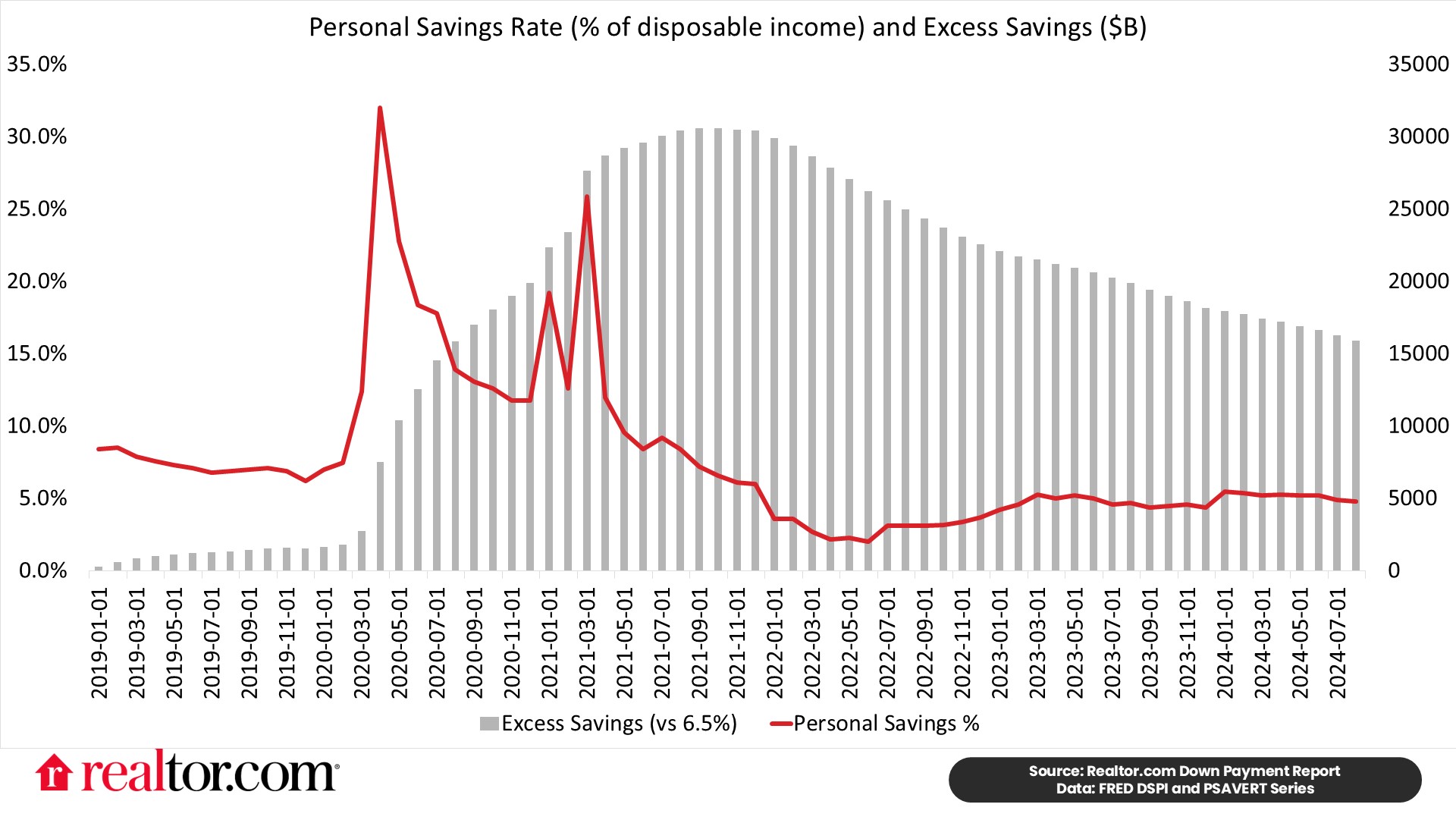

The Role of Pandemic-Era Savings

The influence of pandemic-era savings is still felt in the market. During the pandemic, personal savings rates surged, allowing many buyers to afford larger down payments. Although savings rates have since fallen, the accumulated savings continue to support consumer spending and home buying.

Impact of Falling Mortgage Rates

The recent drop in mortgage rates, which began in May and stayed below 7% from June, is expected to further impact down payment trends. As rates continue to fall, potential buyers might hold off in anticipation of even lower rates, or conversely, increased buyer competition could drive down payments upward again.

Primary Residences vs. Investment Properties

Primary residences typically see lower down payments compared to second homes and investment properties, which have down payments nearly double the typical share of primary residences. In dollar terms, down payments for investment and second homes were significantly larger than those for primary residences in Q3 2024.

Future Outlook

As we look ahead, the question remains whether this easing trend will continue or if down payments will climb again due to market conditions. The interplay of mortgage rates, personal savings, and housing market dynamics will continue to shape these trends.

For further insights, explore the Home Purchase Sentiment Index and the Employment Report for October 2024.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

Transforming U.S. Cities: Opportunities for Real Estate Through Federal Infrastructure Funds

Unlocking Opportunities

With a staggering $394 billion earmarked over the next decade for decarbonization and clean energy conversion through the IRA, and at least $550 billion allocated for U.S. transportation networks via the BIL, the scale of potential impact is immense. As Urban Land Institute resources suggest, these funds could trigger urban resilience and sustainable outcomes.

Developers as Key Players

Real estate developers stand at the forefront of this movement, leveraging government funds to drive sustainability. The IRA’s tax incentives create a predictable environment for investments in green technologies, offering financial returns through reduced operating costs and increased property values. By strategically blending state, local, and federal funds, developers can achieve profitable outcomes while contributing to a healthier planet.

Public-Private Synergies

The synergy between public investments and private real estate initiatives can manifest significant community benefits. For instance, public investments in highway conversions that enhance walkability and access to green spaces may unlock opportunities for adjacent real estate development. Such collaborations promise cleaner air, more opportunities for community engagement with nature, and overall resilience.

Case Studies in Action

Examples like the Washington, DC region’s National Landing and Tallahassee’s Southside Transit Center illustrate the transformative potential of these synergistic infrastructure projects. In Tallahassee, a $15 million RAISE grant is already spurring adjacent infrastructure improvements and affordable housing developments, showcasing the power of strategic federal investments.

Navigating Federal Funding

To access these opportunities, developers must navigate a complex landscape of federal grants and tax incentives. Resources like Grants.gov provide searchable lists of funding opportunities, while professional guidance on tax implications can help maximize benefits.

Conclusion

As Urban Land Magazine emphasizes, the strategic utilization of federal funding enables developers to mold resilient communities. With comprehensive insights into available programs and benefits, developers are encouraged to proactively participate in federal opportunities for sustainable development outcomes. Stay informed with Urban Land Magazine for future articles elaborating on specific funding ventures.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

California Rent Control Back on the Ballot, Twice

California Rent Control Back on the Ballot, Twice

In a state where the cost of living continues to skyrocket, Californians are once again faced with crucial decisions on housing policies. This November, voters will find two propositions on the ballot that address rent control, each with its own distinct approach and implications.

In a state where the cost of living continues to skyrocket, Californians are once again faced with crucial decisions on housing policies. This November, voters will find two propositions on the ballot that address rent control, each with its own distinct approach and implications. Proposition 33 seeks to empower local governments with greater authority over rent caps. Currently, restrictions prevent cities from limiting rents on single-family homes, apartments built post-1995, and for new tenants. By eliminating these constraints, Prop. 33 aims to stabilize housing markets and reduce homelessness. Supporters argue that this measure is essential for keeping more people housed, while opponents, notably landlord groups, caution that it could decrease profitability and worsen the existing housing crunch.

This isn’t the first time Californians have faced such a choice. Similar measures were struck down in both 2018 and 2020. The ongoing debate highlights the tension between tenant advocates and property owners, each vying for a solution that addresses their concerns.

Meanwhile, Proposition 34 introduces a different kind of reform, targeting fiscal responsibility within the healthcare sector. This measure would compel California healthcare providers to allocate at least 98% of revenue from a specific prescription drug discount program towards direct patient care. The AIDS Healthcare Foundation, which has historically funded rent control initiatives, is at the center of this proposition. Landlord groups, aiming to curtail the foundation’s influence, support Prop. 34 as a means of enforcing accountability.

For voters seeking to delve deeper into these propositions, Marisa Kendall of CalMatters provides a detailed analysis, while Erica Yee offers an interactive quiz to help voters assess their stance. Additionally, a video explainer offers a quick overview of Prop. 33’s potential impact.

As the November election approaches, Californians are encouraged to stay informed and engaged. The decisions made at the ballot box will undoubtedly shape the future of housing and healthcare policies in the state.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

FTC’s Non-Compete Ban Blocked: Implications for U.S. Physicians and Workers

Non-compete agreements have traditionally restricted physicians, with 37% to 45% bound by such terms, according to the American Medical Association. These agreements were intended to safeguard confidential information for employers but have long been criticized for limiting professional mobility. The FTC’s efforts to ban non-competes aimed to liberate physicians and bolster career opportunities, much to the delight of the medical community.

However, Judge Brown’s ruling cited the FTC’s overreach, labeling the rule as “arbitrary and capricious” and expressing concerns about irreparable harm. The FTC is considering appealing the decision, arguing that the ruling doesn’t prevent them from targeting non-competes through individual actions. Meanwhile, professionals in the field warn colleagues against hasty moves, as legal battles are far from over.

For many physicians, including those in Dr. Nisha Mehta’s Physician Side Gigs community, which boasts 190,000 members, non-competes remain a significant hurdle in career negotiations. The momentum against these clauses is building slowly but steadily, offering a glimmer of hope for future changes in employment contracts.

The recent Supreme Court decision in Loper Bright Enterprises v. Raimondo has only intensified the scrutiny of agency power, potentially complicating the FTC’s path. Before this decision, courts typically deferred to agency interpretation of ambiguous laws, but now they possess greater autonomy to evaluate such authority, paving the way for more intense legal challenges surrounding non-competes.

On a broader scale, should the FTC’s ban on non-competes succeed in the future, the implications could reach millions of American workers. Non-competes would be invalidated, except for senior executives earning above a certain threshold. Yet, questions linger about the inclusion of medical personnel and employees of nonprofit hospitals, many of which argue for their exemption based on their operational models.

The ongoing debate sees opinions split; while many advocate for the barrier-free mobility of healthcare professionals, others claim these agreements are critical for retaining talent within hospitals. Public sentiment, however, largely favors dismantling non-competes, with a vast majority of feedback to the FTC supporting the ban.

Despite the latest legal setbacks, the dialogue surrounding non-competes is poised for evolution. Experts like Dr. Robert Pearl, a former CEO and current educator, remain optimistic, highlighting positive outcomes in jurisdictions like California where non-competes are already outlawed. The aspiration is for fairer, more flexible employment practices to emerge, fostering environments where physicians and patients alike can thrive.

As the tide slowly turns against non-competes, the healthcare sector watches with anticipation, prepared for gradual yet impactful shifts in their professional landscapes.

Read the full article here.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

Florida Housing Market: A Resilient Outlook Amidst Economic Fluctuations

Florida Housing Market: A Resilient Outlook Amidst Economic Fluctuations

In the ever-evolving landscape of real estate, the Florida housing market remains a beacon of interest for buyers, sellers, and investors. With its alluring sunny beaches and vibrant cities, Florida has long been a hotspot for real estate activity. However, the question of sustainability looms large as the market continues its upward trajectory.

Market Stability and Growth Projections

Experts are optimistic, dismissing fears of an imminent crash in the next two years. While the pace of growth may decelerate due to rising interest rates, Florida’s demographics and economic resilience paint a picture of stability. The state’s population growth, fueled by migration and lifestyle appeal, continues to support housing demand, counterbalancing economic pressures.

As we look ahead to 2025-2026, the Florida housing market is expected to maintain its positive trend, albeit at a slower pace. Home values have surged approximately 80% over the past five years, and this upward momentum is forecasted to persist, albeit with more moderate appreciation rates.

Current Trends and Influences

- Price Adjustments: Following a period of rapid price increases, analysts anticipate stabilization. Some markets may experience temporary declines, but a rebound is expected by 2024, leading to sustainable appreciation rates of 3% to 5% annually.

- Inventory Levels: A 27.8% year-over-year rise in housing inventory is likely to continue, offering more options for buyers and moderating price growth.

- Mortgage Rates: Elevated mortgage rates, hovering around 6% to 7%, are expected to gradually decline as inflation pressures ease, potentially making home buying more accessible by late 2024 into 2025.

- Demographic Support: Ongoing population growth driven by migration and lifestyle appeal continues to fuel housing demand, supporting the market despite economic headwinds.

The Road Ahead

By 2026, the market is expected to see a return to normalized appreciation rates, with home values likely increasing by 3% to 5% annually. This growth will be underpinned by strong demographic trends and economic fundamentals. The housing market may begin to thaw, with increased sales activity as mortgage rates decline and inventory levels stabilize.

However, challenges remain. Elevated mortgage rates and potential economic fluctuations could impact buyer sentiment and market dynamics, leading to localized downturns in areas with significant price increases.

In conclusion, while the Florida housing market may experience fluctuations and stabilization in growth rates, a crash seems unlikely. The combination of economic fundamentals, population growth, and the state’s inherent appeal suggests a market that will continue to attract interest and investment. For those considering entering the Florida real estate market, staying informed and vigilant about market trends is crucial for making sound decisions.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

Strategic Foresight in Commercial Real Estate: Embracing Change by 2025

Macroeconomic Influence

The global economic outlook plays a crucial role in shaping the commercial real estate sector. As noted in the United States Economic Forecast: Q2 2024, the U.S. economy is poised for changes that will inevitably impact real estate dynamics. Similarly, the Eurozone economic outlook and India’s economic forecast highlight regional variations that could influence investment strategies.

Interest Rate Adjustments

Monetary policy changes by leading global banks are reshaping lending practices. The Bank of England’s recent interest rate cut and the Federal Reserve’s openness to a possible rate cut, as reported by The New York Times, signal a shift that could ease borrowing costs and stimulate investment in real estate.

Technological Advancements and Sustainability

The demand for sustainable and green real estate solutions is on the rise. Organizations are increasingly focusing on eco-friendly practices and technologies to meet the expectations of environmentally conscious consumers and investors. This trend is not only beneficial for the planet but also serves as a competitive advantage in the marketplace.

Strategic Positioning for Future Growth

As the Deloitte Commercial Real Estate Outlook suggests, this is a golden opportunity for organizations to strategically position themselves. By leveraging the insights from the economic forecasts and adapting to the changing market dynamics, companies can secure a robust footing in the future landscape.

In conclusion, the 2025 commercial real estate outlook underscores the importance of strategic foresight and adaptability. As the sector stands at a crossroads, organizations that embrace these changes and invest in sustainable, technologically advanced solutions are likely to thrive in the coming years.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

The Future of the Housing Market: A Decade of Change

The Future of the Housing Market: A Decade of Change

The housing market has been on a rollercoaster ride in recent years, with prices skyrocketing due to a combination of pandemic-induced shifts and historically low interest rates. As we look forward to the next decade, prospective homebuyers are left pondering: Will prices continue their upward trajectory? How will affordability be affected?According to a recent article from Norada Real Estate Investments, the real estate market is poised for significant transformation over the next ten years. This transformation will be driven by several dynamic trends.

Key Trends Shaping the Market

- Changing Demographics: As Millennials and Gen Z enter the housing market, their preferences and buying power will significantly influence demand.

- Interest Rate Fluctuations: The cost of borrowing will continue to play a crucial role in shaping affordability and buyer behavior.

- Technological Advancements: From virtual tours to AI-driven insights, technology is set to redefine the industry, making processes more efficient and personalized.

Moreover, environmental considerations are taking center stage, with sustainable building practices and resilient home designs becoming more prevalent. Government policies, innovative housing models, and a shift towards inclusive real estate practices aim to address the ongoing affordability challenge.

Predictions for 2030

By 2030, home values in certain cities are expected to see significant increases. For instance, the average price of homes in San Francisco and San Jose could surpass $2 million, driven by continued growth patterns. A study by RenoFi predicts that the average price of a single-family home in the U.S. could reach $382,000, although this varies significantly by location.

For those looking to navigate this complex future, early savings and strategic investment are key. Prospective homeowners are encouraged to invest in options like index funds and robo-advisors to counter inflation. Keeping a close eye on mortgage rate trends will also be essential as they prepare for potential opportunities to lock in favorable rates.

Conclusion

While the path to homeownership may seem daunting, strategic financial planning and early preparation can help individuals realize their dream of owning a home amidst evolving market conditions.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

Commercial Real Estate Faces Uncertain Terrain

Commercial Real Estate Faces Uncertain Terrain

As the commercial real estate industry peers into the future, a landscape fraught with challenges and opportunities comes into focus. The complexities of economic shifts, policy changes, and emerging trends have created a dynamic environment for stakeholders. This outlook, as detailed in Deloitte’s 2025 Commercial Real Estate Outlook, highlights the pivotal changes shaping the industry.Economic Shifts and Policy Changes

The United States Economic Forecast: Q2 2024 by Robyn Gibbard underscores the economic fluctuations impacting real estate markets. Similarly, the Eurozone’s economic outlook, analyzed by Dr. Alexander Boersch and Dr. Pauliina Sandqvist, reveals how policy adjustments, like the ECB’s rate cuts, are being received by the industry.In India, Dr. Rumki Majumdar’s insights provide a regional perspective, while Ira Kalish’s global economic outlook offers a broader view of the challenges and opportunities on the horizon. These reports, collectively, suggest that the commercial real estate sector must adapt to a rapidly changing economic landscape.

Interest Rates and Market Dynamics

Interest rate adjustments are a significant factor influencing the real estate market. The Bank of England’s decision to cut rates for the first time since 2020, as reported by Eshe Nelson, reflects a strategic move to stimulate economic growth. Similarly, the Federal Reserve’s openness to a potential rate cut, as mentioned by Jeanna Smialek, indicates a cautious approach to managing inflation.These monetary policy shifts are crucial for real estate investors, as they directly affect borrowing costs and investment returns. Stakeholders must stay informed and agile to navigate these changes effectively.

Emerging Trends and Opportunities

The commercial real estate industry is also witnessing the emergence of new trends that present both challenges and opportunities. The rise of remote work, the increasing importance of sustainable building practices, and the integration of technology are reshaping the sector. Adapting to these trends will be essential for long-term success.As the industry moves towards 2025, the ability to innovate and embrace change will be key. Stakeholders must be proactive in identifying opportunities amidst uncertainties. The insights provided by Deloitte’s comprehensive outlook serve as a valuable guide for navigating this evolving landscape.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

Los Angeles Revolutionizes Affordable Housing Policy

In a city where the notion of a “100% affordable project” without public funding once seemed a contradiction, Los Angeles is witnessing an unprecedented transformation. Thanks to an executive order signed by Mayor Karen Bass, the city is now approving these projects by the hundreds, reshaping the landscape of affordable housing.

The executive order, enacted in December 2022, has led to plans for more than 13,770 affordable units, a figure nearly matching the combined total of the previous three years. This policy has not only accelerated the approval process but has also opened the doors for private developers, traditionally focused on luxury housing, to venture into affordable housing.

Developers like Andrew Slocum and Terry Harris are now spearheading projects like the proposed seven-story building on West Court Street. These projects, once deemed financially unfeasible without subsidies, are now viable due to the streamlined processes and incentives provided by the executive order.

However, this rapid development has sparked political debates and legal challenges. Two lawsuits and ongoing discussions in the city council highlight the contentious nature of transforming a mayoral decree into a permanent policy. The executive order, while expediting affordable housing, has also raised questions about its long-term sustainability and impact on existing neighborhoods.

A Shift in Housing Policy

The shift in policy has allowed developers to bypass traditional hurdles such as environmental impact studies and city council hearings. This expedited process, coupled with the absence of prevailing wage requirements, has made affordable housing projects financially attractive to profit-driven developers.

Yet, the affordability of these projects remains a topic of debate. While they cater to individuals earning under $100,000, the rent for a studio can still reach $1,800, a far cry from the lower rates offered by subsidized housing projects.

The Road Ahead

As Los Angeles navigates this new terrain, the city council is considering a permanent ordinance to solidify the executive order’s provisions. The outcome of this legislative process will determine the future of affordable housing in Los Angeles and whether the city can maintain this momentum without sacrificing community integrity.

For more insights on this evolving story, refer to the original article from CalMatters.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

Philadelphia’s Center City Office Market: A Summer of Transformation

Philadelphia’s Center City Office Market: A Summer of Transformation

This summer marked a significant shift in Philadelphia’s Center City office market, as the long-standing effects of the COVID-19 pandemic and the rise of remote work began to thaw. Between June and August, five major office buildings changed hands, albeit for prices significantly lower than their previous valuations. This shift reflects the broader challenges facing commercial real estate in the era of hybrid work.

Among the notable transactions, two buildings, 399 and 1760 Market Street, will remain as office spaces but with drastically reduced rents. Meanwhile, 400 Market Street is set for conversion into apartments, and Three Parkway will be transformed into a mixed-use building, half residential and half office. Additionally, the iconic Bourse building on Independence Mall will see parts of it converted into hotel space.

The Wanamaker building, one of the white elephants of Center City real estate, saw its loan sold at a $45 million loss to New York City’s TF Cornerstone Inc., which already owns the Macy’s space on the lower floors. This sale is a precursor to potential full ownership and a reimagining of the building’s future.

A Complex Picture

The recent flurry of activity is not without its downsides. Building owners and investors, including public pension funds, have incurred substantial losses. The Pennsylvania school (PSERS), Pennsylvania state workers (SERS), and New Jersey state pension funds reported a combined loss of $1.3 billion from real estate investments, even as they paid over $180 million in fees to Wall Street real estate firms. For these funds, real estate has been their worst-performing asset class.

Commercial real estate owners are challenging property tax assessments, arguing that their buildings are worth less than before, which poses a threat to municipal finances. Office vacancy rates in the second quarter of this year stood at over 19%, according to Jones Lang LaSalle (JLL). The year 2025 is expected to see a peak in lease expirations, with 1.4 million square feet of space up for renewal. The Center City District reports that retail occupancy remains below 2019 levels.

Despite these challenges, there is a sense of cautious optimism. An anticipated interest rate cut could ease pressure on new projects and building owners with floating rate loans. “I don’t know if cautious optimism is the right word, but there is a feeling that there is a way to work our way through this,” said Tom Weitzel, JLL’s managing director in Philadelphia. “This is not good, this is not easy, but there’s a light at the end of the tunnel.”

Office-to-Residential Conversions

While the initial enthusiasm for converting vacant office spaces into housing waned as the complexities became apparent, this summer saw two additional conversions. Lubert-Adler Real Estate Funds and Keystone Real Estate Group purchased the Bourse building and 400 Market Street. The Bourse will be partly converted into hotel and event space, while 400 Market Street will become 176 apartment units.

These transactions represent a growing trend of office-to-residential conversions in Center City, with seven such projects announced, totaling 1.5 million square feet of space and adding over 1,350 apartment units to the area. “It’s way more [conversions] than we predicted,” said Clint Randall, vice president of economic development with Center City District. “It’s not a silver bullet, but thanks to conversions, we help the supply side of the equation moderate.”

Cheaper Office Sales, Cheaper Rents

Residential conversion isn’t the only outcome for post-COVID office building sales. The east and west sides of Market Street saw sales of midsize buildings that will preserve office uses while reducing rents to attract startups, nonprofits, and small businesses. At 399 Market Street, residential developer Ori Feibush purchased the old Colonial Penn Life Insurance Co. building for $14 million, a markdown of one-third from its previous valuation.

Feibush has been successful in cutting office suites into smaller chunks and reducing rents to $23-$25 a square foot, below the regional average of $29.95. A similar strategy is underway at 1760 Market Street, which changed hands for two-thirds less than its previous sale price in 2018. “Leasing activity is robust,” said James L. Paterno, founder of Stockton Real Estate Advisors, which manages 1760 Market Street.

Looking Ahead

While the uptick in transactions may not necessarily indicate a healthier market, it does show a willingness among building owners and investors to accept substantial losses to move forward. “The uptick in transaction volume doesn’t speak to a healthier market necessarily, so much as it does just more desire to unload properties or to shift burdens elsewhere,” said Ashley DeLuca, co-leader of the distressed property team at Ballard Spahr.

As the market continues to evolve, these transactions could pave the way for a new chapter in Center City’s office landscape. “This happens every 20 years or so,” said Glenn Blumenfeld, principal with Tactix Real Estate Advisors. “This is when people get rich in real estate. It’s easier when you have big distressed situations.”

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

The Best Investor Opportunities? Look South

The Best Investor Opportunities? Look South

In the ever-evolving landscape of real estate investment, the southern United States has emerged as a beacon of opportunity. A recent report from RealEstateNews.com highlights Florida, North Carolina, and Texas as the leading markets for investors seeking growth and stability. Key Findings from the Report- Florida remains a top market due to its annual price growth, personal income increases, and population expansion.

- North Carolina and Texas also present ripe opportunities for investors, with major cities showing promising metrics.

- Despite high potential, some markets like Texas and Arizona have experienced significant declines in home prices.

Challenges on the Horizon

While the southern markets boast enticing metrics, they are not without risks. Notably, Austin and Dallas have witnessed steep drops in home prices since their peak. Additionally, inventory continues to pile up in Phoenix, and Florida is shifting towards a buyer’s market. Investors must also navigate increasing property taxes and rising home and flood insurance costs, especially in Florida, where extreme weather events are becoming more frequent. According to the National Association of Realtors, existing home sales fell by 2.5% between July and August, with the South experiencing a more pronounced downturn of 6% year-over-year. In conclusion, while the South offers abundant opportunities for real estate investors, careful consideration and strategic planning are essential to navigate the complexities of these dynamic markets.Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

Innovative Solutions to Tackle California’s Housing Crisis

1. Industrialized Construction Methods

Rising construction costs, as noted in the California Construction Cost Index, have surged by 36.5% from January 2021 to January 2024. To combat this, industrialized methods such as modular construction, panelized construction, and 3D printing offer promising alternatives. These methods promise reduced costs, faster build times, and environmental benefits, which could be pivotal in making projects financially viable.2. Alternative Homeownership Models

Traditional homeownership has not served everyone equally, with significant disparities in ownership rates among different racial groups. Community land trusts, housing cooperatives, and Tenancy in Commons provide alternative pathways to ownership, fostering shared wealth and stewardship. These models challenge conventional norms, offering more inclusive and affordable options for communities historically excluded from homeownership.3. Cross-Sector Housing Solutions

Addressing the housing crisis requires collaboration across sectors. The Partnership for the Bay’s Future is a prime example, leveraging diverse perspectives to increase housing affordability and build vibrant communities. By combining innovative financing and cross-sector collaboration, this initiative has protected over 73,000 tenants and financed homes for 11,000 people.4. Learning from COVID-19 Housing Solutions

The COVID-19 pandemic prompted unprecedented government action, including eviction moratoriums and rental relief programs. These measures, such as California’s $5.2 billion rental relief program, prevented evictions and supported over 370,000 households. Local efforts, like those in Santa Clara County, further demonstrated the effectiveness of cash aid programs in preventing homelessness.5. Transforming Surplus Lands

Converting surplus and underutilized lands into affordable housing is a strategic solution to the housing shortage. Recent legislation in California prioritizes building on government-owned land and streamlines development processes for religious organizations and nonprofit colleges. This approach unlocks thousands of acres, offering potential for millions of new homes.6. Infill Housing and Densification

Infill housing, including accessory dwelling units (ADUs) and lot splitting, maximizes urban spaces. California’s strong ADU laws and legislation like Senate Bill 35 facilitate expedited housing approvals, making infill housing a viable and eco-friendly solution.7. Preserving Existing Lower-Cost Housing

Preserving naturally occurring affordable housing is crucial to maintaining affordable options. Initiatives like the Los Angeles Local Rental Owners Collaborative support local landlords and prevent displacement, ensuring these homes remain accessible to low-income households.As California navigates its housing challenges, these solutions offer a roadmap for progress. By embracing innovative and inclusive strategies, the state can move towards a future where everyone has a safe, stable, and affordable place to call home.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

Housing Markets in Key U.S. Regions Face Elevated Risk

Housing Markets in Key U.S. Regions Face Elevated Risk

In a recent analysis by ATTOM, the housing markets of California, New Jersey, and Illinois have been spotlighted for their susceptibility to downturns. Despite a generally robust national market, these states exhibit significant vulnerabilities, particularly in the metropolitan areas of New York City and Chicago.The Q2 2024 Special Housing Risk Report by ATTOM highlights the intricate landscape of the U.S. housing market, focusing on home affordability, underwater mortgages, foreclosures, and unemployment. This analysis reveals that nearly half of the most at-risk counties are concentrated in the aforementioned states.

Regional Disparities in Housing Market Risks

While the housing market continues to expand, certain regions are showing signs of potential instability. Rob Barber, CEO of ATTOM, notes, “These observations point to uneven levels of risk without signifying imminent red flags or downturns.”The study evaluated 589 counties, uncovering that almost 50% of the markets most susceptible to decline are in California, New Jersey, and Illinois. These areas have been identified as having significant clusters of risk, particularly in New York City, Chicago, and inland California. Conversely, regions such as Virginia, Wisconsin, and Tennessee are considered less vulnerable.

Key Indicators and Findings

- Foreclosure risks are significant, with one in every 1,000 properties facing foreclosure in 39 of the most vulnerable counties.

- High unemployment rates are notably prevalent in central California.

- Counties like Tangipahoa Parish, LA, and Peoria County, IL, have some of the highest rates of underwater mortgages.

- Charlotte County, FL, leads in foreclosure actions.

In contrast, many parts of the South and Midwest demonstrate resilience, with lower housing expenses relative to wages and significantly reduced foreclosure and unemployment rates.

For more detailed insights, visit ATTOM’s Data Solutions.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

The Metaverse: A New Frontier in Real Estate

The Metaverse: A New Frontier in Real Estate

As the virtual world continues to expand, the metaverse has emerged as a transformative force in the real estate industry. This immersive 3D iteration of the internet offers shared virtual environments where avatars can engage in a myriad of activities, including socializing, gaming, and shopping. Now, the metaverse is carving out a niche in real estate, raising the question: are there buyers for these virtual properties?

According to an analysis by ExpertMarketResearch.com, the metaverse real estate market was valued at $1.69 billion in 2023. With a projected compound annual growth rate of 48.6%, it is expected to reach a staggering $59.38 billion by 2032. This growth has been fueled by shifts in cryptocurrency interests, which have significantly impacted virtual land prices.

Despite the allure of the metaverse, it’s not without its challenges. The market is subject to the cyclical nature of cryptocurrencies, with prices fluctuating wildly. For instance, Snoop Dogg’s virtual estate saw a dramatic depreciation, losing 94% of its value by mid-2023. The average cost of a parcel of virtual land plummeted from about $18,000 in January 2022 to less than $2,000 by mid-2023.

However, the foundation of many blockchain-based metaverse worlds on Ethereum provides some stability, as the value of ether is relatively stable compared to other cryptocurrencies. This stability is crucial as the metaverse has the potential to reshape the real estate industry by introducing blockchain technologies. These technologies can streamline processes like asset verification and transaction settlements, offering a more transparent and secure system.

Bridging the Virtual and Real Worlds

The metaverse’s impact isn’t confined to the digital realm. It is beginning to overlap with the real world, as demonstrated by initiatives like ONE Sotheby’s International Realty’s MetaReal properties. This approach links physical estates to their virtual counterparts, offering buyers a unique blend of real and virtual real estate.

The emergence of virtual real estate brokerage further underscores the metaverse’s potential. While the space remains largely unregulated compared to traditional real estate, brokers can help buyers and sellers navigate these virtual worlds, negotiate favorable prices, and provide valuable advice on asset utilization.

The future of metaverse real estate hinges on technological advancements and societal adaptation to virtual living. As noted in the original article from Chicago Agent Magazine, early adopters may find immense value in this innovative domain, or they may face significant risks. Nevertheless, exploring metaverse real estate could offer a unique opportunity to diversify investments and acquire new skills.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

Remote Work Reshapes California’s Living Landscape

Remote Work Reshapes California’s Living Landscape

The COVID-19 pandemic has ignited a seismic shift in the work habits of Californians, with remote work becoming a staple across various industries. This transformation is particularly pronounced among better-educated and higher-income employees, whose roles often allow the flexibility of working from home. This shift has not only altered how Californians perform their duties but also impacted where they choose to reside, with the San Francisco Bay Area experiencing significant consequences.

Migration trends within California reveal a marked exodus from the Bay Area and Los Angeles, with many opting for more affordable locales such as Sacramento, the Northern San Joaquin Valley, and the Central Coast. Meanwhile, the Inland Empire has emerged as a preferred destination for those leaving Los Angeles. These patterns were already in motion before the pandemic, but recent Census data from 2021 and 2022 indicate an acceleration.

Remote work has played a pivotal role in this migration surge, particularly among high-income earners. The Bay Area’s remote work rate of 28% in 2021 and 2022, had it been a state, would have topped the nation, surpassing California’s overall rate of 19% and the rest of the US at 16%. This has allowed many workers to relocate to areas with more affordable housing without changing jobs, effectively reducing daily commutes and fueling the exodus from job-rich but housing-constrained regions.

The Bay Area, a hub of high-paying jobs yet plagued by housing shortages, has seen its net outmigration more than double since 2018–2019. This trend is exacerbated by the rise in remote work and a notable outflow of high-income earners. Conversely, while remote work has influenced migration from Los Angeles, the city has experienced a slight reduction in net loss since the pandemic.

This migration shift presents a double-edged sword. While regions gaining new residents benefit from an expanded tax base, they also face increased housing demand, driving up costs and straining existing renters. These dynamics underscore the stark mismatch between California’s employment and housing markets, particularly in the Bay Area.

The state has responded with a flurry of legislation aimed at easing construction constraints, particularly in dense urban areas. Although there has been an uptick in new housing in high-demand areas, it has yet to stem the overall population decline. As these legislative measures take effect, the Public Policy Institute of California will continue to monitor these developments.

Conclusion

Remote work has undeniably reshaped California’s labor and housing landscape. While it offers new living possibilities for some, it remains a temporary solution to the state’s housing crisis, leaving deeper issues unaddressed. The future will reveal whether legislative efforts can bridge the gap between employment opportunities and housing availability.Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

Housing Costs Surge: Navigating the 2024 Construction Material Price Hike

Understanding the Impact of Rising Building Material Costs

The escalating costs of essential materials such as softwood lumber, steel, and aluminum are contributing to a housing affordability crisis. These materials, often imported, are subject to price volatility that only exacerbates the situation. Builders now face the dual challenge of completing homes on time and ensuring they appraise correctly to reflect these rising costs.Factors Contributing to the Rise in Material Costs

The classic economic principle of supply and demand is at play, as the demand for building materials spikes during peak construction seasons while supply remains constrained. Inflationary pressures, global trade disruptions, and a push towards sustainable building practices further heighten the cost challenges.

Impact on the Construction Industry

The ramifications for the construction sector are profound. Rising project costs and shrinking profit margins are direct outcomes, as builders pass increased expenses onto home buyers. This not only diminishes housing affordability but also complicates the appraisal process, making it difficult to accurately reflect home values.Potential Solutions to Mitigate the Effects of High Material Costs

Industry experts suggest several strategies to combat these challenges. These include negotiating a new softwood lumber agreement with Canada, adopting efficient material use practices, and securing long-term contracts to stabilize costs. Exploring alternative materials and enhancing supplier collaborations are also crucial steps. Moreover, the construction industry must tackle a significant labor shortage, with job openings on the rise. Investing in workforce development and embracing automation could help mitigate these labor challenges.Adapting to the Changing Material Cost Landscape

As the industry navigates this turbulent landscape, builders are urged to adopt innovative practices and technologies. This could involve rethinking project designs, forming strategic partnerships, and embracing more affordable housing solutions.By staying proactive and adaptable, the home building industry can not only survive but thrive amidst these challenges, positioning itself for success in a rapidly evolving market.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

Texas High-Tech Sector Rebounds Post-Pandemic, Set for New Growth Trajectory

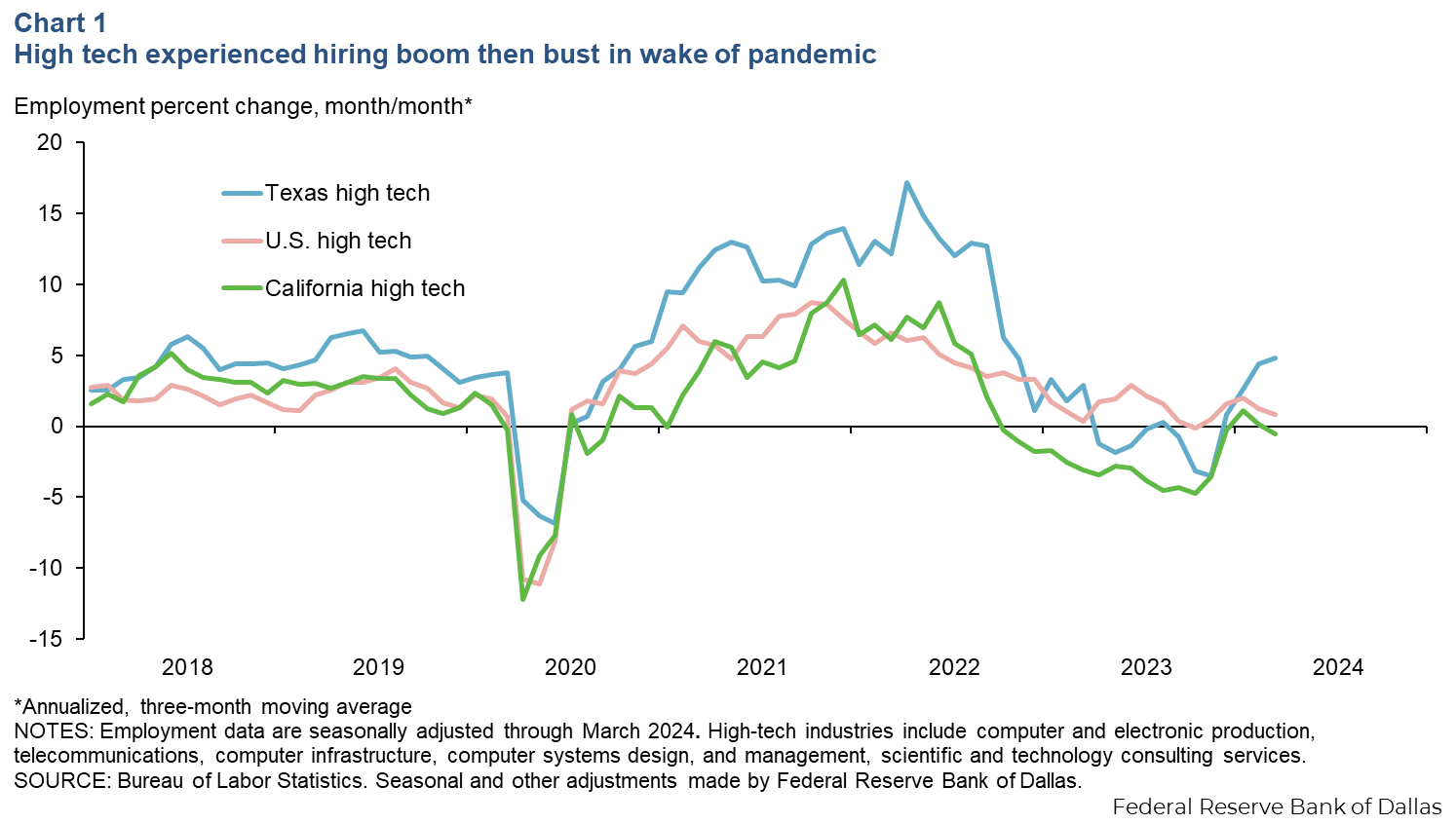

As the dust settles from the pandemic, Texas’ high-tech sector is shaking off its post-pandemic slump and gearing up for a new growth trajectory. The state, already a significant player in the U.S. economy, is poised for further expansion as it attracts business relocations from other tech hubs like Silicon Valley and rides the wave of increased demand for emerging AI technologies.

High tech contributes nearly 5% to Texas’ GDP and over 9% to employment, making it an essential driver of innovation and technological development. This sector, characterized by rapid growth and high wages, is crucial for productivity and is positioned to benefit from ongoing business relocations and new investments in high-tech manufacturing capacity. For more insights into the sector’s impact, visit the Federal Reserve Bank of Dallas.

High-Tech Hiring Dynamics

The high-tech industry experienced a hiring boom post-pandemic, driven by the surge in demand for technology products and services. However, this rapid expansion led to overhiring, and companies soon faced cost pressures, resulting in layoffs. Despite these challenges, Texas managed to avoid the severe job losses seen in California, thanks in part to the reallocation of tech activity to other parts of the country.

Layoff announcements in Texas spiked during early 2023 but have since moderated, suggesting stabilization in the local tech labor market. The state’s resilience is attributed to gains in computer manufacturing and tech consulting services, which offset losses in other tech industries.

Legislative Support and Future Outlook

The federal CHIPS and Science Act, along with the Texas CHIPS Act, provides significant support to the high-tech sector. These initiatives encourage semiconductor manufacturing, helping stabilize supply chains and aiming for technological self-sufficiency. Investments include Texas Instruments’ $30 billion semiconductor manufacturing plant and Samsung’s $44 billion investment in semiconductor facilities.

Corporate relocations and population migrations have also fueled high-tech growth in Texas. Major companies like Hewlett Packard and Apple have moved to Texas, bringing along a highly skilled workforce from states like California and New York. This influx of talent has bolstered the state’s high-tech sector, making it a pillar of Austin’s economy. For more on corporate relocations, see the Dallas Fed’s report.

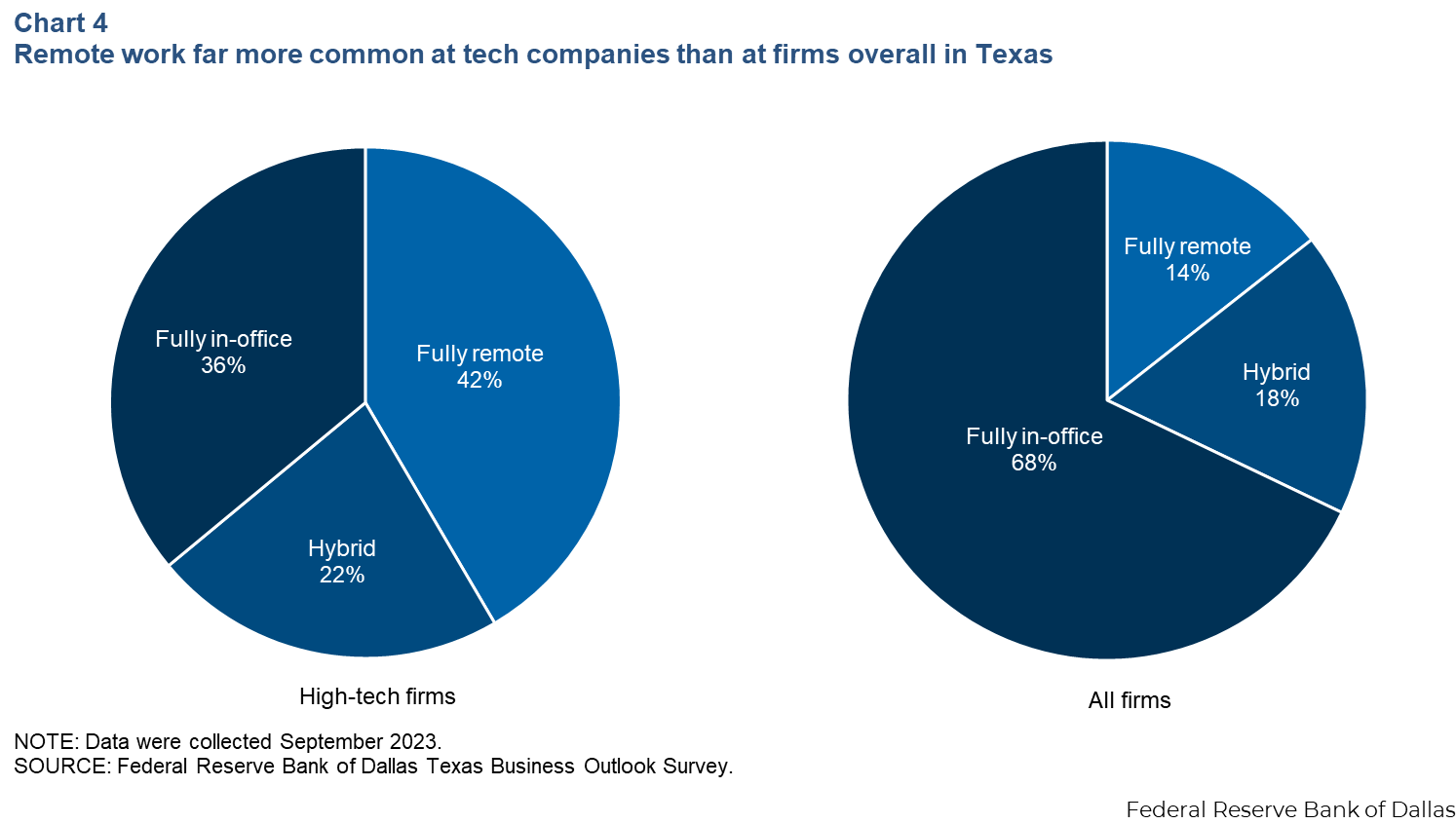

Skilled Labor and Remote Work

High-tech wages in Texas are significantly higher than the state average, with 2022 hourly wages averaging $43.51 compared to $29.26 for workers overall. The sector employs a larger share of highly skilled workers, supporting elevated pay. The prevalence of remote work in high tech is notable, with 36% of employees working fully remote, compared to 14% in other sectors. For trends in remote work, refer to the Harvard Business Review.

Looking ahead, high-tech firms in Texas are optimistic about future growth, buoyed by continued investments and policy support for emerging technologies like AI and semiconductor production. This optimism could be a precursor to further expansion in the sector.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

Struggling Landlords Seek Relief Amid Rising Insurance Costs

Struggling Landlords Seek Relief Amid Rising Insurance Costs

In the ever-evolving landscape of commercial real estate, a new challenge has emerged, straining the resilience of landlords and developers alike. As reported in The New York Times, the soaring costs of insurance, exacerbated by climate-induced natural disasters, are creating a formidable obstacle for property owners.

The Growing Burden

Post-pandemic vacancies and mounting debt payments have plagued the commercial real estate sector for over two years. Yet, even as these challenges begin to subside, landlords face a persistent threat: escalating insurance costs. This issue is not unfamiliar to homeowners across the nation. With the rise in climate-related disasters, insurance companies are either hiking rates or withdrawing from vulnerable markets altogether.

Particularly affected are coastal cities and towns, where the risk of storms and floods is high. However, insurers and banks are increasingly recognizing that no region is immune to extreme weather events.

Insurance Woes and Financial Strain

Recent hurricanes, such as Hurricane Helene and Hurricane Milton, have left insurers potentially liable for as much as $75 billion in damages. The repercussions are felt acutely by building owners, who find themselves caught between insurers and lenders. Lenders, wary of catastrophic losses, are reluctant to permit any adjustments to insurance policies, leaving struggling borrowers with little room to maneuver.

The situation is dire enough that some industry insiders report deals collapsing due to insurance costs. Mario Kilifarski, head of asset management at Fundamental Advisors, highlighted the pressure on developers and investors in an environment of rising interest rates and material costs. Insurance expenses, he noted, can tip the scales.

Insurance Premiums on the Rise

According to Marsh McLennan, an insurance brokerage, commercial property premiums increased by an average of 11 percent nationwide last year. In storm-prone areas like the Gulf Coast and California, premiums surged by as much as 50 percent. This year, some locations have seen premiums double.

For apartment buildings, insurance now constitutes 8 percent of operating expenses, double the figure from five years ago. Paul Fiorilla, director of research at Yardi Matrix, emphasized that while insurance remains a smaller expense relative to taxes and maintenance, it adds to the strain of stagnating rents and higher borrowing costs.

The Call for Flexibility

Kevin Kaseff, co-founder and managing partner of Titan Real Estate Investment Group, expressed frustration over the lack of support from lenders. Despite lenders’ keen interest in his insurance strategies, they show no willingness to offer assistance.

Seeking Solutions

Commercial property owners, like homeowners, must carry insurance if they have a mortgage. However, the requirements are often more stringent. Modifications to insurance coverage require lender approval, which can be nearly impossible if the loan is securitized and sold to Wall Street investors.

Danielle Lombardo from Willis Towers Watson noted that insurance pricing has halted deals and forced some into foreclosure. She pointed out that costs can escalate between the time financing is arranged and the deal’s closure.

Kaseff suggests that banks should allow owners to purchase insurance with higher deductibles or policies covering only the loan value, not the replacement cost of the building. However, banks remain cautious, fearing that inadequate coverage could destabilize the real estate market in the event of a disaster.

Looking Ahead

While the insurance dilemma is more of a headache than a catastrophe, data on loan delinquencies shows stress but not alarm. By exercising caution and shedding older loans, banks may have averted a crisis. Delinquencies have risen to 1.5 percent of all outstanding loans, far below the 10 percent during the 2008 financial crisis.

The commercial real estate slump has hit larger banks harder, particularly those with urban properties affected by pandemic-driven occupancy changes. However, a recent Federal Reserve interest rate cut offers a glimmer of hope for property owners.

The challenges of navigating insurance coverage have elevated its significance within the industry. Once a task for middle managers, it now commands the attention of senior executives. As the real estate sector grapples with these complexities, one thing is clear: the road ahead requires careful analysis and strategic planning.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

Navigating the Bay Area Housing Market in 2024

Current Market Dynamics

The California Association of Realtors has released its September 2024 data, painting a picture of mixed signals within the region. While mortgage rates have seen a decline, the expected surge in buying activity hasn’t materialized. Instead, the market is characterized by a cautious approach from both buyers and sellers, leading to fluctuating prices and a slowdown in sales.

Key Trends

- Mixed Price Changes: The Bay Area displays a patchwork of price variations. Some counties, like Marin and San Mateo, have witnessed significant annual price increases, while others, such as Alameda and Contra Costa, show year-over-year declines.

- Decreased Sales Volume: A reduction in home sales across most counties highlights the prevailing buyer hesitancy, further contributing to the market’s sluggish pace.

- Mortgage Rate Influence: Despite falling rates, economic uncertainties and affordability concerns continue to weigh heavily on potential buyers, preventing a full-fledged market recovery.

County Insights

The data reveals a nuanced county-by-county breakdown:

- Alameda: With a median sold price of $1,267,500, the county experienced a year-over-year price decrease.

- Contra Costa: Notable for a 2.6% month-over-month price increase, yet showing a decline from the previous year.

- Marin and San Mateo: These counties continue to attract interest with significant price hikes, underscoring their enduring desirability.

- Santa Clara: Although prices have seen modest gains, the sales volume has notably dipped.

Forecast and Predictions

Looking ahead, the Bay Area housing market is expected to undergo modest corrections while maintaining strong long-term prospects. The predictions for 2024 range from slight price declines to stagnant growth and even continued, albeit slower, price increases.

Conclusion

In conclusion, the Bay Area housing market remains a resilient and attractive option for investors and homebuyers alike. Despite the current fluctuations, the region’s robust economy and perennial appeal suggest that the market will retain its vigor. For those navigating this landscape, monitoring key indicators such as inventory levels, days on market, and price-to-rent ratios will be essential in making informed decisions.

CSS Styling for Enhanced Presentation: “`css div { color: #b40101; line-height: 1.6; margin-bottom: 20px; } a { color: #b40101; text-decoration: none; } a:hover { text-decoration: underline; } h3, h4 { margin-top: 30px; margin-bottom: 10px; color: #b40101; } ul { margin-left: 20px; } li { margin-bottom: 10px; } “` This CSS styling ensures that the story is visually appealing and easy to read, enhancing the overall user experience while maintaining a focus on the vital information about the Bay Area housing market.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

CDK Global’s Cyberattack Disrupts U.S. Car Dealerships

CDK Global’s Cyberattack Disrupts U.S. Car Dealerships

In a significant cyberattack that has disrupted operations across the United States, CDK Global, a leading provider of cloud-based software to automotive dealerships, was forced to shut down most of its systems. This precautionary measure, described as taken “out of an abundance of caution” by spokesperson Lisa Finney, left dealerships resorting to manual, handwritten forms to continue operations.

CDK Global, which supports over 15,000 retail locations in North America, began a system restoration process that is expected to take several days. The company had initially restored some systems, but a subsequent cyberattack forced them offline again. This incident has highlighted the vulnerabilities and rising trend of cyberattacks targeting the auto industry.

Ransom Demands and Cybersecurity Challenges

According to a report by Bloomberg News, an insider revealed that a group believed to be based in Eastern Europe is demanding tens of millions of dollars in ransom. There are rumors that CDK might comply with the demands, though this remains unconfirmed.

The incident underscores the urgent need for fortified cybersecurity measures within the auto industry. Despite CDK Global’s emphasis on a robust cybersecurity strategy, the attack has exposed significant challenges in mitigating such threats. This situation is not isolated, as a recent attack on Findlay Automotive Group further illustrates the growing threat to dealerships.

Dealerships Adapting to Challenges

Dealerships like Northtown Automotive Companies in Buffalo, New York, have implemented contingency plans that allowed them to continue operations using manual methods. Craig Schreiber, one of the company’s owners, noted that their preparedness enabled them to go “old school” with handwritten forms, though he acknowledged the inevitable backlog once systems are restored.

Eric Watson, vice president of sales operations for Kia America, acknowledged the disruption to “many Kia Dealers” using CDK’s platform and advised them to rely on manual tools in the interim. This advice reflects a broader need for dealerships to enhance their preparedness against cyber threats.

Why Are Dealerships Targeted?

Car dealerships have become attractive targets for cybercriminals due to the vast amounts of sensitive customer data they hold, including credit applications and financial information. A 2023 report from CDK highlighted that 17% of surveyed dealers experienced a cyberattack in the past year, with 46% reporting negative financial or operational impacts.

The interconnected nature of dealership systems with external interfaces and often outdated software further exacerbates their vulnerability, as noted in a 2023 article from Zurich North America.

“`Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

Commercial Real Estate: A Sector Under Siege

Commercial Real Estate: A Sector Under Siege

In a recent statement, Jerome Powell, Chair of the Federal Reserve, highlighted the enduring stress within the commercial real estate sector. Speaking before the Senate Banking Committee, Powell emphasized that this risk is not fleeting but rather a persistent challenge that banks must confront with honest assessments of their exposure.The commercial real estate landscape has experienced seismic shifts, particularly with properties purchased prior to the Covid-19 pandemic. Many of these assets now hold diminished value compared to the loans used to acquire them. This has led to a surge in distressed property sales, creating a new wave of investment opportunities for savvy real estate investors.

The Continental Center: A Case Study

A prime example of this phenomenon is the 41-story Continental Center located at 180 Maiden Lane in Manhattan’s Financial District. Recently sold to 99c, a real estate firm owned by Canadian biotech investor Carlo Bellini, the skyscraper fetched a price of just $297 million. This is a stark contrast to its 2015 purchase price of $470 million.The building’s previous owners, Clarion Partners and MHP, had invested heavily in renovations, pushing their total investment north of $645 million. The rapid sale was reportedly an effort to stave off foreclosure, illustrating the precarious nature of current market conditions.

Manhattan’s Office Meltdown

As noted by Triple Net Investor on X, the situation in Manhattan’s office market is dire, with vacancy rates soaring. The Continental Center’s occupancy has dropped to 68%, nearly triple the average vacancy rate for commercial real estate in New York City, which stood at 12.8% in March.The pandemic-induced shift towards remote work has significantly reduced demand for office spaces, effectively doubling vacancy rates. New York’s commercial real estate vacancy rate was a modest 6.4% in early 2020, but the landscape has since transformed dramatically.

National Trends and Emerging Opportunities

This trend is not isolated to New York. Earlier this year, the U.S. commercial real estate vacancy rate reached its highest level since 1979, hovering around 20%. By May, it had slightly improved to 17.8%, as reported by CommercialEdge.Despite these challenges, there is a glimmer of hope. A recent report by real estate firm Colliers noted a 70% increase in leasing activity in New York City compared to the previous year. While this uptick offers optimism, the persistence of remote and hybrid work trends suggests that vacancy rates may remain stable across the country.

Investment Landscape

ETFs tracking the real estate sector have struggled to perform. The Vanguard Real Estate Index Fund ETF and the Schwab US REIT ETF have both shown modest gains but remain down over the past six months. Meanwhile, residential real estate continues to grapple with high interest rates, pushing home affordability to its lowest level in 17 years.For further insights, explore the original article on Benzinga.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

Discovering Prime Real Estate Investment Opportunities for 2024

Discovering Prime Real Estate Investment Opportunities for 2024

The landscape of real estate investment is ever-evolving, and as we look towards 2024, certain cities in the United States are emerging as prime locations for savvy investors. Despite recent fluctuations in the housing market, real estate remains a compelling asset class, offering potential for recurrent income and long-term appreciation. According to a recent article by Norada Real Estate Investments, the US housing market continues to present opportunities, even as it transitions into a moderate seller’s market with slowing price growth and rising inventory.

Key Insights into the 2024 Real Estate Market

The article highlights that despite high-interest rates, investing in real estate can still yield significant returns. This is particularly true for single-family rentals (SFR), which have shown resilience amidst economic uncertainties. The Arbor’s March 2024 Report underscores the robustness of the SFR sector, noting its ability to maintain value and low delinquency rates.Top Cities for Real Estate Investment

For those considering real estate investment in 2024, the article identifies several cities with promising prospects:- Boise, Idaho: Known for its strong job market and affordable housing, Boise offers a stable real estate market with potential for appreciation.

- Houston, Texas: With its diverse economy and affordable housing, Houston remains a top choice for investors.

- Dallas, Texas: Dallas boasts a growing population and a diverse real estate market, making it an attractive option for investment.

- Las Vegas, Nevada: Despite its past real estate bust, Las Vegas is experiencing a resurgence, driven by a strong job market and high rental demand.

- Atlanta, Georgia: Atlanta’s booming economy and diverse culture make it a hotspot for real estate investment.

Considerations for Investors

Investors are advised to conduct thorough research and choose locations with high rental occupancy, favorable mortgage-to-rent ratios, and low tenant default rates. Understanding local market dynamics is crucial for making informed investment decisions.The article also emphasizes the importance of timing and market conditions, suggesting that potential investors consult with an investment counselor for guidance on the best real estate markets in the United States.

Foreign Investment in US Real Estate

Foreign investment continues to play a significant role in the US real estate market. The National Association of Realtors® (NAR) report indicates that foreign buyers remain active, with significant purchases from countries like Canada, Mexico, and China.Conclusion

As we navigate the complexities of the real estate market in 2024, opportunities abound for those who are well-prepared and informed. By focusing on the right locations and leveraging expert insights, investors can find lucrative opportunities in the ever-changing real estate landscape.Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

Ivory Innovations Announces 2024 Housing Affordability Prize Finalists

Ivory Innovations Unveils Top 25 Finalists for 2024 Housing Affordability Prize

In a significant stride towards addressing the housing affordability crisis, Ivory Innovations, in collaboration with the University of Utah’s Ivory Boyer Real Estate Center, has announced the Top 25 Finalists for the 2024 Ivory Prize for Housing Affordability. These finalists represent a diverse array of innovative approaches poised to tackle the critical challenges of housing in the United States.

Abby Ivory, President of Ivory Innovations, emphasized the record participation in this year’s competition, noting the growing number of innovators dedicated to increasing housing affordability. “We are passionate about increasing the impact and scale of new ideas with the potential to improve the housing ecosystem,” she stated. The finalists, now part of Ivory Innovations’ network of innovators, gain access to valuable resources, including student internships and pro bono consulting services.

Innovative Approaches Across Sectors

The finalists’ projects span three key categories: Construction & Design, Finance, and Policy & Regulatory Reform.

- Construction & Design: Companies like Apis Cor, known for mobile 3D printing solutions, and Villa, focusing on prefab homes, are at the forefront of revolutionizing housing design and construction technology.

- Finance: Organizations such as Foyer provide financial pathways for first-time homebuyers, while Home Lending Pal utilizes AI to streamline mortgage assistance program eligibility.

- Policy & Regulatory Reform: Pioneering projects from municipal and community organizations, such as the City of Detroit’s Land Value Tax Plan, bring innovative changes to policy landscapes to enhance housing access and affordability.

The Ivory Prize, operational since 2018, is renowned for spotlighting transformative and sustainable solutions aimed at reshaping the landscape of housing affordability. This year’s finalists join a comprehensive overview of more than 500 promising housing organizations across the country, as documented in the Ivory Innovations Housing Innovation Database.

Looking Forward

The announcement of the 2024 Top 10 Ivory Prize Finalists is slated for April, with the final winners to be revealed on May 16. For more information on these innovative solutions and to follow the upcoming announcements, visit Ivory Innovations.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

Turbulence in the Commercial Real Estate Sector: Charlie Munger’s Cautionary Tale

In a landscape once considered a bastion of stability, the commercial real estate sector is now navigating turbulent waters. Legendary investor Charlie Munger sounded the alarm in April 2023, warning of a seismic shift in the industry. Speaking to the Financial Times, Munger remarked, “A lot of real estate isn’t so good any more,” highlighting troubled office buildings and shopping centers as areas of concern.

Statistics paint a stark picture. The total dollar volume of commercial real estate transactions plummeted to $647 billion in 2023, a sharp decline from $1.14 trillion in 2022. Analysts attribute this downturn to high interest rates and declining office values, with the latter suffering a 14% drop in value over the past year.

Key Sector Trends

Investment trends reveal significant shifts in the commercial real estate landscape. Multifamily and industrial properties have overtaken office spaces, reflecting the enduring impact of remote work and supply chain challenges. Multifamily properties, in particular, have seen a surge in investment, as detailed in an analysis by the National Association of Realtors.

Meanwhile, the office sector grapples with record-high vacancy rates, with San Francisco leading the charge at a staggering 22.65%. This trend is echoed across tech hubs, where the shift to remote work has left a significant footprint.

Sector-Specific Challenges

- Office: With vacancy rates soaring, office spaces are struggling to maintain value and attract investment.

- Hotel: Although showing signs of recovery, the hotel sector’s occupancy rates remain below pre-pandemic levels.

- Industrial: Despite a slowdown, industrial real estate continues to benefit from logistics demand.

- Retail: Retail properties boast the lowest vacancy rates, driven by neighborhood centers and general retail stores.

Investors seeking to diversify their portfolios may consider options such as Real Estate Investment Trusts (REITs) or real estate funds. These vehicles offer exposure to different sectors and geographic markets, providing opportunities to capitalize on emerging trends.

As the industry navigates these challenges, the original article from The Motley Fool provides a comprehensive overview of the current state of commercial real estate, offering insights into the factors shaping its future.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

Exploring the Best Cities for Real Estate Investment in 2024

Exploring the Best Cities for Real Estate Investment in 2024

In the dynamic landscape of 2024, the U.S. housing market continues to present promising opportunities for real estate investors. Despite the challenges posed by rising interest rates, the sector remains resilient, particularly in the realm of single-family rentals (SFR). This year, the market has embraced a moderate seller’s dynamic, characterized by a slowdown in price growth and a rise in inventory levels. Yet, the allure of real estate endures, driven by a steady increase in rental demands and the potential for long-term appreciation.A key highlight in this evolving market is the robustness of the SFR sector, which maintains strong home values and low delinquency rates amid economic uncertainties. The surge in build-to-rent (BTR) projects is noteworthy, as declining homeownership affordability spurs unprecedented growth in SFR construction starts.

Top Cities for Real Estate Investment

A selection of cities across the U.S. has emerged as prime destinations for real estate investment in 2024. These cities have been chosen for their strong economic foundations, population growth, favorable housing trends, and high rental demands:- Boise, Idaho: Known for its robust job market and affordable housing.

- Houston, Texas: Offers a strong economy and tax benefits for investors.

- Dallas, Texas: Features a diverse real estate market and a pro-business environment.

- Las Vegas, Nevada: High rental demand driven by a strong job market and thriving tourist industry.

- Atlanta, Georgia: An economic hub with a robust real estate market.

- Orlando, Florida: Known for its strong tourism industry and affordable cost of living.

- Tampa, Florida: A growing population and access to beaches drive real estate demand.

- Spokane, Washington: Offers affordable housing with strong economic growth.

- Chicago, Illinois: Large rental market with revitalizing neighborhoods.

- Austin, Texas: Tech hub with booming economy and strong demand for rentals.

- Columbus, Ohio: Fast-growing city with strong job market and affordable housing.

- Lakeland, Florida: Known for affordable housing and a strong tourism sector.

- Ocala, Florida: Presents low property prices and a solid rental market.

- Birmingham, Alabama: Offers affordable real estate with economic diversity.

- Durham, North Carolina: Strong economy and growing job market.

- Charlotte, North Carolina: Diverse economy and rapid population growth.

- Colorado Springs, Colorado: Attractive due to its strong job market and outdoor recreational opportunities.

- Denver, Colorado: Consistent growth with booming real estate market.

- Raleigh, North Carolina: Offers a thriving tech industry and strong economy.

- Phoenix, Arizona: Beneficial economic conditions and affordable housing attract investors.

- Seattle, Washington: Top real estate market due to strong economic prospects.

Moreover, the global aspect of the real estate market is crucial, with foreign investments playing a pivotal role in the U.S. economy. The trend underscores the U.S. as a preferred destination due to its economic stability and potential for sustainable growth.

For more insights and detailed analysis, visit Norada Real Estate Investments.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.