The Genetic Revolution: CRISPR and Public Opinion

The Genetic Revolution: CRISPR and Public Opinion

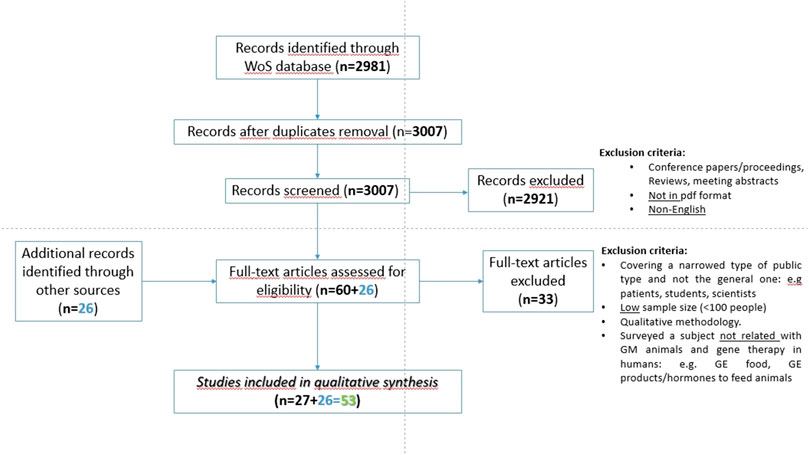

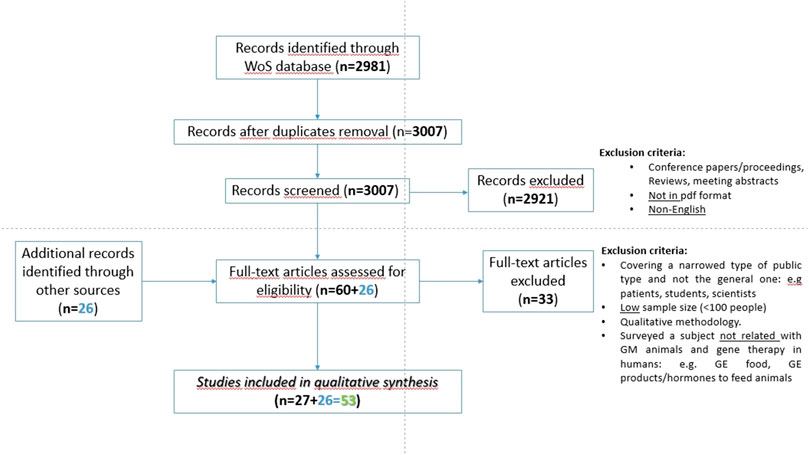

It was a monumental shift in the world of genetics when CRISPR-Cas9 burst onto the scene in 2012, democratizing the ability to edit genomes with unprecedented precision and ease. This revolutionary technology, as detailed in a systematic review published by Frontiers, has not only transformed scientific research but has also sparked a profound societal and ethical debate.

The CRISPR Effect

CRISPR’s impact is far-reaching, influencing fields from biomedical research and clinical practice to food production. The ability to edit genes with such precision has opened doors to potential cures for genetic diseases, enhancements in agricultural yields, and even the controversial editing of human embryos.

However, this power comes with significant ethical concerns. As the review notes, the application of CRISPR to human embryos has reignited debates over genetic manipulation, reminiscent of past controversies surrounding genetic engineering.

Public Sentiment: A Mixed Bag

Over the past 35 years, surveys have painted a complex picture of public attitudes towards genetic modification. Generally, there is strong support for therapeutic gene editing in humans, particularly when it comes to treating or preventing diseases. Yet, opinions diverge sharply when it comes to germline modifications and genetic enhancements, often viewed with skepticism or outright opposition.

The review highlights that while many embrace the potential health benefits, the notion of “designer babies” raises red flags for both ethical and safety reasons. This echoes the sentiments expressed by scholars like Camporesi and Cavaliere, who have explored the ethical dimensions of CRISPR in their work (Camporesi and Cavaliere, 2016).

Responsible Innovation

The key takeaway from the review is the critical need for responsible research and innovation (RRI). Aligning technological advancements with societal values is paramount. As CRISPR technology continues to evolve, ensuring that it is used ethically and responsibly will require ongoing dialogue between scientists, policymakers, and the public.

Looking Ahead

The path forward for CRISPR and genetic engineering is one of both promise and caution. As noted by Nordberg et al., the regulatory landscape will need to adapt to keep pace with these rapid advancements (Nordberg et al., 2018).

In conclusion, while CRISPR offers a glimpse into a future where genetic diseases could be eradicated, it also challenges us to consider the ethical implications of such power. The conversation is far from over, and as society grapples with these issues, the voices of both advocates and critics will be crucial in shaping the future of genetic engineering.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

More Articles

Getting licensed or staying ahead in your career can be a journey—but it doesn’t have to be overwhelming. Grab your favorite coffee or tea, take a moment to relax, and browse through our articles. Whether you’re just starting out or renewing your expertise, we’ve got tips, insights, and advice to keep you moving forward. Here’s to your success—one sip and one step at a time!

World Cities Day 2024: A Global Movement Towards Sustainable Urban Futures

World Cities Day 2024: A Global Movement Towards Sustainable Urban Futures

In the spirit of World Cities Day, celebrated on October 31st, cities worldwide are embracing the theme “Youth Leading Climate and Local Action for Cities.” This theme underscores the pivotal role of young leaders in driving sustainable urban solutions, a movement gaining momentum through community-led initiatives and progressive policies. As cities grapple with the challenges posed by the climate crisis and the need for cultural heritage conservation, innovative urban planning emerges as a beacon of hope.

Preservation and Innovation: A Balancing Act

Highlighting this global trend, Barcelona’s La Rambla has completed the first phase of its extensive multi-year renovation. This project exemplifies the commitment to preserving urban heritage while embracing modernity. Similarly, Chicago’s historic skyscrapers have been saved from demolition, showcasing efforts to maintain the architectural legacy amid urban evolution.Addressing Urban Challenges

Cities like Venice and Los Angeles are tackling pressing issues such as overtourism and housing shortages. Venice has implemented entrance tickets to manage tourist influx during peak weekends, while Los Angeles is pioneering a radical approach to affordable housing. These initiatives strive to balance livability with growth, ensuring sustainable urban environments.Reimagining Urban Spaces

Ambitious master plans are reshaping urban landscapes. Projects like the revitalization of industrial sites in Tallinn and Connecticut are transforming old infrastructures into vibrant public spaces, reflecting how cities are reimagining their urban fabric.Resilience and Renewal

Post-disaster rebuilding efforts in Kharkiv and Türkiye underscore the urgency of resilience-driven design. These projects ensure cities can withstand and adapt to future challenges, fostering cultural renewal and community resilience. As reported by ArchDaily, these transformative updates offer a glimpse into the global forces reshaping urban landscapes, driven by preservation, innovation, and resilience.Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

The Road Ahead: Self-Driving Cars Reshape the Automotive Industry

Self-Driving Cars: A Glimpse into the Future

The road to a future dominated by autonomous vehicles (AVs) is being paved with a blend of optimism and skepticism. According to a recent Goldman Sachs report, partially autonomous cars are projected to make up 10% of new vehicle sales by 2030. This development hints at a revolution in the automotive industry, driven by advancements in artificial intelligence and decreasing hardware costs.

The Role of AI in Accelerating AV Adoption

AI’s role in boosting the self-driving car industry cannot be overstated. While some AVs are currently operational in cities like San Francisco and Beijing, the technology is not yet widespread. Presently, only about 60% of vehicles have some level of driver assistance, with a mere 1-2% of global vehicle sales in 2026 expected to feature Level 3 automation.

However, there is hope on the horizon. AI advances, including enhanced computational power and larger datasets, are poised to improve model performance, potentially accelerating the adoption of more autonomous vehicles.

Cost-Effective Solutions and Market Implications

One of the key factors likely to spur AV adoption is the reduction in hardware costs. Modern autonomous vehicles rely on a multitude of cameras, sensors, and lidar devices. As these components become more affordable, AVs will not only be cheaper but also more efficient. This shift could benefit a range of sectors, from chipmakers to rideshare companies and automakers.

Looking further ahead, Goldman Sachs envisions a scenario where AV sales, particularly those with Level 3 automation or higher, could account for 60% of all light vehicle sales by 2040. Even in a less optimistic scenario, AVs are expected to comprise nearly 40% of new sales.

Geographic Variations in AV Adoption

The adoption rates of AVs are expected to vary significantly across regions. China leads the charge, with Level 3 or higher AV sales potentially making up 90% of all sales by 2040. Europe and the United States are also anticipated to see substantial growth, with advanced AVs comprising about 80% and 65% of all car sales, respectively, by the same year.

As the industry stands at the cusp of this technological revolution, the mixed sentiments regarding autonomous vehicle adoption continue to spark debate. Whether these expectations materialize remains to be seen, but the journey towards a more autonomous future is undeniably underway.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

Semaglutide: A Promising Ally Against Alzheimer’s?

Semaglutide: A Promising Ally Against Alzheimer’s?

In a groundbreaking study, researchers at Case Western Reserve School of Medicine have identified a potential new benefit of semaglutide, a widely used diabetes and weight-loss drug. According to their findings, semaglutide may significantly reduce the risk of Alzheimer’s disease in individuals with type 2 diabetes (T2D), outperforming seven other anti-diabetic medications.

Alzheimer’s disease, a devastating brain disorder that erodes memory and cognitive abilities, affects nearly 7 million Americans aged 65 and older, as reported by the Alzheimer’s Association. Alarmingly, it claims more lives annually than breast and prostate cancer combined.

Published in Alzheimer’s & Dementia: The Journal of the Alzheimer’s Association, the study suggests that T2D patients taking semaglutide had a markedly lower risk of developing Alzheimer’s disease. This trend was consistent across various subgroups, regardless of obesity status, gender, or age.

Semaglutide, a glucagon-like peptide receptor (GLP-1R) agonist, is the active ingredient in popular medications like Wegovy and Ozempic. It works by reducing hunger and regulating blood sugar levels in T2D patients.

Under the leadership of Rong Xu, a professor of biomedical informatics, the research team analyzed three years of electronic health records from nearly one million U.S. patients with T2D. Their statistical approach, which mimicked a randomized clinical trial, revealed that patients prescribed semaglutide had a significantly lower risk of Alzheimer’s compared to those on other anti-diabetic medications.

According to the CDC, Alzheimer’s disease results in approximately 120,000 deaths annually, ranking as the seventh-leading cause of death in the United States.

“This new study provides real-world evidence for semaglutide’s potential impact on Alzheimer’s disease,” Xu stated. “While preclinical research has hinted at its protective effects against neurodegeneration and neuroinflammation, our findings suggest the need for further exploration through randomized clinical trials.”

Despite these promising results, the study’s limitations prevent researchers from drawing definitive causal conclusions. Xu emphasized the importance of continued research into semaglutide’s potential as a treatment for this debilitating condition, encouraging further investigation into alternative drugs.

For more information, please contact Patty Zamora at patty.zamora@case.edu.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

Revolutionizing Healthcare: The AI Transformation in Louisiana

Revolutionizing Healthcare: The AI Transformation in Louisiana

In the heart of Louisiana, a digital revolution is underway, reshaping the landscape of healthcare diagnostics with the power of artificial intelligence (AI). As reported by Big Easy Magazine, AI is not just a tool but a transformative force, enhancing diagnostic accuracy, improving patient outcomes, and reducing costs.

The Role of AI in Modern Healthcare

Why is AI becoming indispensable in healthcare diagnostics? The answer lies in its unparalleled ability to process vast datasets with remarkable precision and speed. AI systems, by identifying patterns and anomalies often missed by the human eye, are revolutionizing diagnostic accuracy and treatment planning. Healthcare providers, such as Northshore Orthodontics, are leveraging these advanced technologies to deliver more personalized care, ensuring better health outcomes and increased efficiency.

Moreover, AI is streamlining administrative tasks, freeing healthcare professionals to focus more on patient care. By automating routine processes such as appointment scheduling and billing, AI minimizes human errors and reduces administrative burdens. Predictive analytics powered by AI also help optimize resource allocation and forecast patient admission rates, leading to better preparedness and cost savings.

Enhancing Diagnostic Accuracy

AI’s impact on diagnostic accuracy cannot be overstated. Diagnostic errors, which can lead to incorrect treatments or delayed interventions, are being minimized through AI integration. These systems, trained on extensive datasets, predict disease progression and recommend appropriate interventions, significantly enhancing the accuracy of medical diagnostics.

Early detection is another area where AI shines, identifying diseases at stages when they are more treatable, thereby improving patient outcomes.

Improving Patient Care

Beyond accuracy, AI enriches the overall patient experience. AI-driven chatbots and virtual assistants provide timely information and support, enhancing patient engagement and satisfaction. Predictive analytics tailor treatments to individual needs, ensuring optimal care. These tools make healthcare more accessible and empower patients by involving them actively in their care decisions.

The Future of AI in Healthcare

Looking to the future, AI’s role in healthcare is set to expand. With ongoing improvements in machine learning and data processing, AI’s potential applications in diagnostics are boundless. From enhancing early detection rates to supporting clinical decision-making, AI’s contributions are invaluable. As technology progresses, the integration of AI into healthcare systems will likely become more seamless and widespread, ushering in a new era of medical innovation and excellence.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

Fed Rate Cut: Understanding Its Impact on Stocks

Understanding the Fed’s Recent Rate Cut and Its Impact on Stocks

The Federal Open Market Committee’s (FOMC) recent decision to lower its benchmark interest rate by 0.25% to a range of 4.25% to 4.50% is a strategic move aimed at stabilizing inflation around 2%. This adjustment follows previous cuts, indicating a cautious approach by the Federal Reserve amidst fluctuating inflation rates that recently rose to 2.7% in November.

Investors are closely monitoring these developments, given the complex relationship between interest rate changes and stock market performance. Historically, falling rates have tended to boost stock prices, as they often signal higher future earnings and encourage business expansion through cheaper borrowing.

However, the context of these rate cuts is crucial. If reductions occur in response to slowing inflation, the outcome is typically favorable for growth. Conversely, if they are prompted by economic uncertainty, reactions can be mixed, with cautious investment strategies potentially prevailing.

Key Sectors Poised for Growth

Certain sectors are expected to benefit significantly from the rate cuts. Automotive, apparel, and retail industries are among those likely to see gains. Additionally, real estate investment trusts (REITs), particularly mortgage REITs, could thrive as rates continue to fall into 2024, offering attractive investment opportunities.

As investors navigate these changes, maintaining a long-term focus is advisable. Rather than making reactive shifts, a diversified portfolio with periodic reviews may offer the best strategy, ensuring minimal disruptions and maximizing growth potential in a fluctuating rate environment.

For more insights, visit the original article on Yahoo Finance.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

Cryptocurrencies: A New Era in Finance

Cryptocurrencies: A New Era in Finance

In a little over a decade, cryptocurrencies have evolved from digital curiosities to trillion-dollar technologies with the potential to transform the global financial landscape. These digital assets, like Bitcoin and Ethereum, are not just reshaping how we perceive money but are also challenging traditional financial institutions.Proponents argue that cryptocurrencies democratize finance by decentralizing money creation and control, taking power away from central banks and Wall Street. Yet, critics warn that these digital currencies can empower criminal organizations and rogue states, exacerbate inequality, and consume vast amounts of electricity. The debate is intense, with 130 countries, including the United States, considering their own central bank digital currencies (CBDCs) to counter the cryptocurrency boom.

Understanding Cryptocurrencies

Cryptocurrencies are digital or virtual currencies that use cryptography for security. They operate on decentralized networks based on blockchain technology—a distributed ledger enforced by a network of computers. Bitcoin, launched in 2009 by the enigmatic Satoshi Nakamoto, is the most well-known, with a market capitalization once exceeding $1 trillion.Transactions are recorded on a blockchain, providing transparency and security. This system eliminates the need for intermediaries like banks, offering a degree of anonymity. However, if a wallet owner’s identity is revealed, their transactions can be traced.

The Popularity Surge

Once a niche interest, cryptocurrencies have captured mainstream attention. Their appeal lies in their decentralized nature, allowing for quick and anonymous transfers without bank fees. In countries with unstable currencies, like El Salvador, Bitcoin has even become legal tender.Despite their potential, cryptocurrencies are volatile. Their value can fluctuate wildly, limiting their use as a stable means of transaction. Stablecoins, pegged to traditional currencies, offer more stability but have faced their own challenges.

Challenges and Controversies

Cryptocurrencies pose significant challenges, including concerns about illicit activities, environmental impact, and regulatory uncertainties. Cybercriminals often demand ransom payments in cryptocurrency, and the energy-intensive process of Bitcoin mining raises environmental concerns.Regulatory responses vary globally. While some countries embrace digital currencies, others, like China, have imposed bans. The U.S. is cautiously crafting rules, with the SEC likening the sector to a “Wild West” and calling for stronger regulations.

The Future with CBDCs

In response to the rise of cryptocurrencies, many central banks are exploring CBDCs. These digital currencies promise the benefits of cryptocurrencies without the associated risks. However, their implementation could centralize power and data, raising privacy and cybersecurity concerns.As the world navigates this financial evolution, the balance between innovation and regulation will be crucial. The journey of cryptocurrencies and digital currencies continues to unfold, reshaping the future of money.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

Artificial Intelligence: Transforming the Landscape of Modern Medicine

Artificial Intelligence: Transforming the Landscape of Modern Medicine

In the bustling corridors of healthcare, a silent revolution is underway. Artificial Intelligence (AI), with its machine learning prowess, is redefining how medical data is processed, offering invaluable insights that enhance health outcomes and patient experiences. This transformation, as detailed in a recent IBM article, is not just a technological marvel but a beacon of hope in modern medicine.AI’s Role in Clinical Decision Support and Imaging Analysis

AI is swiftly becoming an indispensable ally in clinical settings. From clinical decision support to imaging analysis, AI tools are empowering healthcare professionals with quick access to relevant research and data. This aids in making informed decisions about treatments and medications, particularly in detecting subtle findings in CT scans, x-rays, and MRIs that might elude the human eye.Accelerated Adoption During the COVID-19 Pandemic

The COVID-19 pandemic, while a global challenge, served as a catalyst for AI adoption in healthcare. Many organizations began field-testing AI-supported technologies, such as patient monitoring algorithms and COVID-19 screening tools. The ongoing research from these tests underscores AI’s growing role and the evolving standards in the medical field.AI Applications: From Disease Detection to Drug Development

- Disease Detection and Diagnosis: AI models, untiring and vigilant, monitor vital signs and alert clinicians to potential risks. For instance, an AI model developed for premature babies has shown 75% accuracy in detecting severe sepsis.

- Personalized Treatment: With AI, precision medicine becomes more accessible, offering real-time, customized recommendations based on a patient’s history and preferences.

- Medical Imaging: AI’s proficiency in analyzing medical images is comparable to that of human radiologists, assisting in early disease detection and managing the deluge of patient images.

- Clinical Trial Efficiency: AI enhances the speed and accuracy of medical code assignments, significantly reducing the time spent on this task.

- Drug Development: AI accelerates drug discovery by optimizing drug design and identifying promising new combinations, addressing big data challenges in life sciences.

Benefits of AI in Medicine

AI’s integration into healthcare is not just about efficiency; it holds the promise of informed patient care, error reduction, and cost savings. By providing contextual relevance and enhancing doctor-patient engagement, AI ensures that patients receive timely support and that their medical information is managed with precision. A systematic review of peer-reviewed studies highlights AI’s potential in improving patient safety through decision support tools that enhance error detection and drug management.The Future of AI in Medicine

As we stand on the cusp of a new era in digital health systems, AI is poised to become a core component of modern medicine. Its ability to streamline processes, reduce errors, and personalize care heralds a future where healthcare is not only more efficient but also more compassionate.Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

Transforming Healthcare Delivery: Johnson & Johnson’s AI Revolution

In the ever-evolving landscape of healthcare, the role of artificial intelligence (AI) is becoming increasingly pivotal. At the forefront of this technological revolution is Johnson & Johnson, leveraging AI to enhance the delivery of healthcare services and ensure that crucial therapies reach patients efficiently.

From predicting supply and demand fluctuations to managing disruptions in the supply chain, AI is reshaping how healthcare products are distributed. As reported by Johnson & Johnson, the implementation of AI solutions helps prioritize areas most affected by potential risks, ensuring that patients receive the treatments they rely on.

Building a Resilient Supply Chain

Vishal Varma, Director of Supply Chain Digital & Data Science and Operations Research at Johnson & Johnson, emphasizes the importance of AI in creating a stable supply chain. “AI is helping us build a stable, efficient, and resilient supply chain so we can deliver on that obligation,” he notes. This stability is crucial in a world where economic disruptions and severe weather events can threaten supply lines.

Enhancing Patient Care with Engagement.ai

AI’s role extends beyond logistics into the realm of patient care. The company’s global capability, Engagement.ai, is designed to optimize interactions with healthcare professionals. As Jeff Headd, Vice President and Head of Technology, explains, “These insights from Engagement.ai allow us to prioritize when, where, and how we connect with healthcare providers to ensure they have relevant and appropriate information when making treatment decisions.”

This strategic use of AI not only supports providers but also enhances the understanding of disease progression, ensuring that patients receive timely interventions.

Commitment to Patient-First Initiatives

At the core of Johnson & Johnson’s AI strategy is a commitment to patient-first initiatives, as outlined in their Credo. Jim Swanson, Executive Vice President and Chief Information Officer, underscores this ethos, stating, “When we use AI, it’s always with a purpose. Our Credo states that our patients and customers come first, and that will continue as we move forward with this technology.”

As AI continues to advance, Johnson & Johnson remains dedicated to harnessing its power to improve healthcare outcomes and ensure that patients have reliable access to life-saving treatments.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

Material Costs Surging: Implications for Housing Affordability and Construction

Material Costs Surging: Implications for Housing Affordability and Construction

The housing and construction sectors are grappling with unprecedented challenges as the prices of building materials soar in 2024. This surge marks the highest year-over-year growth since early 2023, raising significant concerns about housing affordability. A multitude of factors, including supply chain disruptions, inflationary pressures, and global geopolitical issues, are exacerbating the situation. Builders are striving to mitigate the impact on consumers while safeguarding their profit margins.

The ripple effect of these price hikes is extensive. Builders are employing innovative strategies to control expenditures in response to high costs. These strategies include negotiating long-term contracts to stabilize prices, optimizing material usage, and exploring alternative sustainable building practices. Although potentially more expensive, these practices support eco-friendly construction.

Moreover, builders face additional pressure from labor shortages, affecting productivity in construction-related industries. Solutions such as advanced workforce development and enhanced compensation packages are essential to attract skilled labor. Meanwhile, the industry is adapting by prioritizing more affordable housing solutions and embracing partnerships to share costs and potential risks.

Factors Contributing to Rising Costs

- Supply and Demand: The classic economic principle of supply and demand plays a crucial role as the demand for building materials increases while supply remains limited due to global shortages and disruptions.

- Inflation: Inflationary pressures are contributing to higher material costs, impacting the price of construction materials.

- Global Factors: Geopolitical tensions and trade disputes, particularly in commodities like softwood lumber, steel, and aluminum, disrupt supply chains and lead to price increases.

- Sustainability Initiatives: The demand for eco-friendly, sustainable building materials is rising, increasing costs as these specialty materials often come with a higher price tag.

As builders adapt to these challenging economic conditions, they remain cautious of the long-term implications for homebuyer affordability and the industry’s financial health. By focusing on innovative technologies and strategic collaborations, the construction industry aims to sustain progress amid these material cost fluctuations, benefiting both consumers and businesses.

“`Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

California’s Bold Move: Speed Assistance Technology Now Mandated in Vehicles

California’s Bold Move: Speed Assistance Technology

In an unprecedented legislative action, California is poised to become the first state in the United States to mandate speed assistance technology in vehicles. This initiative, spearheaded by state senator Scott Wiener, aims to warn drivers when they exceed the speed limit by more than 10 miles per hour. The proposed legislation has stirred a mix of support and opposition, highlighting the complexities of implementing new technology in the automotive industry.

The Legislative Journey

The bill, introduced by Wiener earlier this year, initially proposed an active speed assistance model that would physically prevent vehicles from surpassing speed limits. However, following significant pushback, the bill was revised to incorporate a passive system that merely alerts drivers of their speeding. This change was made to accommodate concerns while still prioritizing safety.The National Transportation Safety Board (NTSB) has lauded the bill, stating that the widespread use of speed assistance could reduce the frequency of speeding-related accidents, potentially saving lives. Despite the NTSB’s support, it lacks the authority to enforce such measures, leaving the decision in the hands of state and federal lawmakers.

Voices of Opposition

Critics of the bill, including the National Motorists Association and the automotive industry, argue that the technology is not yet ready for widespread deployment. Jay Beeber of the National Motorists Association expressed concerns over the potential for “false positives” and the risk of distracting drivers. The Specialty Equipment Market Association also voiced opposition, emphasizing California’s overreach and the need for federal oversight.A significant challenge noted by opponents is the lack of consistent speed limit signage across the U.S., which is essential for the effective operation of speed assistance systems. This contrasts with Europe, where such infrastructure is more developed, allowing for reliable use of the technology.

Looking Ahead

California’s decision to push forward with this legislation, despite federal inertia, mirrors historical precedents in auto safety innovation, such as the early adoption of seat belts. The bill has passed the California legislature and now awaits Governor Gavin Newsom’s approval, a decision that could set a new standard in vehicular safety and influence national policy.For more details on this evolving story, visit the original NPR article.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

AI in Medical Diagnosis: Revolutionizing Healthcare Standards

AI in Medical Diagnosis: Revolutionizing Healthcare Standards

The integration of artificial intelligence in the medical domain is rapidly transforming healthcare, particularly in the realms of disease diagnostics and therapeutic management. This technological advancement is not just a fleeting trend but a significant shift in how healthcare services are provided, aiming to alleviate the pressures on medical services through more accurate diagnostics.In the United States, around 5% of outpatients are misdiagnosed, with errors especially prevalent in serious medical conditions. AI and machine learning are emerging as powerful technologies to address this issue, improving the accuracy of medical diagnosis and revolutionizing healthcare with their myriad applications. AI facilitates medical management, automates administrative tasks, and optimizes workflows in medical diagnostics, as highlighted in a Statista Survey.

Unlike traditional methods that rely solely on correlations between symptoms and potential causes, modern AI approaches employ causal reasoning in machine learning. This advancement provides reliable and accurate diagnoses even in regions with limited access to healthcare providers.

Key Applications of AI in Medical Diagnosis

AI assists healthcare practitioners across various departments by analyzing symptoms, detecting lethal ailments at an early stage, suggesting targeted therapies, and predicting potential risks. Whether in surgery, pathology, infertility, pandemic management, or patient care, AI is becoming an integral tool in medical diagnostics. Beyond diagnosis, AI enhances various aspects of healthcare, including drug discovery and telehealth.Symptom Analysis & Personalized Treatment Recommendations

Many healthcare practitioners are already using intelligent symptom checkers. These systems ask patients questions about their symptoms and recommend appropriate actions for therapy. AI medical diagnosis technology advances precision medicine by synthesizing data and forming conclusions, allowing for better-educated and personalized therapy.Risk Prediction and Clinical Trials

AI can create algorithms that forecast individual and community health risks, improving patient experiences. For instance, doctors at the University of Pennsylvania developed a machine learning algorithm to predict sepsis 12 hours before symptoms appear. In clinical trials, AI enhances diagnostic accuracy and reduces errors, ensuring more reliable and precise diagnoses.Oncology and Virtual Biopsies

AI significantly enhances oncology by aiding in the early detection and precise diagnosis of cancers, such as lung and breast cancer. It supports personalized treatment plans, optimizing therapy, and improving patient outcomes. For example, AI systems can monitor breast cancer with 95% accuracy, matching the performance of an average breast radiologist. Additionally, AI is transforming diagnostics with virtual biopsies, allowing clinicians to detect tumor characteristics without invasive procedures.Challenges and Solutions

Despite AI’s potential, the technology poses challenges such as data privacy, data quality, and interoperability issues. To address these, robust data encryption protocols, high-quality data collection, and open standards for seamless integration are essential.Future of AI in Healthcare

The Global AI and medical diagnosis market is expected to grow significantly, driven by the need for time-saving diagnosis methods and government investments in advanced medical treatments. The future of healthcare is on the verge of a major transformation, with AI poised to reshape the current system from reactive, medicine-based care to a proactive, preventative approach focused on overall well-being.For those seeking to leverage AI in medical diagnosis, Appinventiv offers cutting-edge custom AI development services in the medical sector, paving the way for more accurate and efficient patient care.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

AI in Breast Imaging Market Set for Explosive Growth

AI in Breast Imaging Market Set for Explosive Growth

The global AI in breast imaging market is on a remarkable growth trajectory, projected to swell from USD 451.6 million in 2023 to an impressive USD 5944.3 million by 2033. This represents a compound annual growth rate (CAGR) of 29.4%, primarily driven by cutting-edge advancements in AI technologies that significantly enhance diagnostic accuracy, facilitate early detection, and boost healthcare efficiency.Despite this optimistic outlook, the market is not without its challenges. Regulatory hurdles in deploying AI technologies, the prohibitive costs of cancer treatment, and stringent compliance requirements for patient privacy and data use present significant obstacles. Moreover, the financial burden associated with breast cancer treatment could limit patient access to advanced diagnostic technologies.

Currently, North America leads the market with a revenue of USD 205.4 million, thanks to its high breast cancer incidence and sophisticated healthcare infrastructure. However, the Asia-Pacific region is expected to experience the fastest growth, driven by rising breast cancer prevalence, increased healthcare investments, and technological advancements in imaging. These regional dynamics underscore the market’s evolving nature and its transformative impact on global healthcare.

Recent industry developments have highlighted a focus on collaborations and innovations to refine breast imaging technologies. Strategic alliances, such as those between Google Health and iCAD, emphasize AI’s potential to enhance the accuracy of breast cancer screenings and risk assessments. These partnerships merge medical expertise with cutting-edge technology, paving the way for accelerated market expansion.

In conclusion, while the AI in breast imaging market is poised for significant growth, overcoming current challenges is crucial. Strategic innovations and collaborations, as evidenced by products like the Genius AI Detection 2.0 by Hologic and GE Healthcare’s MyBreastAI Suite, will further propel the market, enhancing breast cancer detection and patient care. As AI systems continue to integrate into clinical workflows, they hold the promise of redefining breast cancer diagnosis and treatment, offering promising solutions to enhance patient outcomes and healthcare efficiency.

For more in-depth insights, refer to the original article.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

Virtual Real Estate: Navigating Investments in Metaverse Platforms

Exploring the Metaverse Investment Potential

Among the various platforms available, Decentraland, The Sandbox, and Holiverse are leading the charge. Each offers unique opportunities for investors to diversify their virtual portfolios. Decentraland stands out for its vibrant community and impressive growth, while The Sandbox has attracted attention with high-profile collaborations, including a landmark sale next to Snoop Dogg’s virtual mansion.

Holiverse, however, is making waves with its innovative approach to digital interaction. The platform has notably partnered with Dr. Dmitry Chebanov to integrate DNA avatar technology, allowing users to create digital prototypes based on genetic codes. This collaboration opens new doors in personalized medicine, offering potential for safer and more effective therapeutic practices.

The Influence of Celebrities and Corporations

The allure of virtual real estate is further amplified by the involvement of celebrities and major brands. Snoop Dogg’s creation of the “Snoop Verse” in The Sandbox and Ariana Grande’s concert in Fortnite highlight the entertainment potential of these digital spaces. Meanwhile, corporations like JP Morgan and Warner Music Group are establishing a presence in metaverses, signaling a growing acceptance and recognition of virtual real estate’s value.Market Growth and Challenges

The virtual real estate market is on an upward trajectory, with projections indicating an increase from $1.14 billion in 2022 to $15.7 billion by 2030. North America currently leads this market, but the Asia Pacific region is expected to experience the fastest growth, driven by advancements in VR and AR technologies.However, challenges persist. Cybersecurity remains a major concern as the value of virtual assets rises, and regulatory frameworks are still in development, posing potential risks for investors. Despite these hurdles, the future of virtual real estate looks promising, with continuous innovations in metaverse technologies paving the way for new investment opportunities.

For more insights, you can refer to the original article at e-architect.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

The Transformative Power of AI in In-Vitro Diagnostics

The Transformative Power of AI in In-Vitro Diagnostics

In the ever-evolving landscape of healthcare, artificial intelligence (AI) and machine learning are at the forefront of revolutionizing in-vitro diagnostic (IVD) tools. As highlighted in a recent article from BW Healthcare, these cutting-edge technologies are redefining diagnostics and enhancing healthcare outcomes on multiple fronts.Enhanced Diagnostic Accuracy

AI’s ability to process vast datasets with remarkable speed and precision is unparalleled. By detecting patterns and anomalies often missed by human observation, AI-driven IVD platforms are paving the way for more accurate diagnostics. This advancement is particularly crucial in the early detection of diseases like cancer and genetic disorders.

Personalised Medicine

The era of one-size-fits-all treatment is fading into history. Machine learning enables the personalization of diagnostic results, tailoring treatments based on an individual’s genetic makeup and medical history. This approach not only improves patient outcomes but also guides personalized treatment plans for conditions such as diabetes and cardiovascular diseases.

Automation and Workflow Efficiency

In high-throughput environments like clinical laboratories, AI-powered IVD tools automate repetitive tasks, enhancing workflow efficiency and reducing human error. Automated systems can interpret complex data sets in real-time, thereby accelerating diagnosis and alleviating the workload on lab technicians.

Predictive Analytics

AI’s predictive capabilities are a game-changer in disease management. By analyzing historical and real-time data, AI algorithms can forecast disease outbreaks and progression, empowering healthcare systems to prepare for potential challenges proactively.

Integration with IoT and Wearables

The integration of AI-driven IVD tools with wearables and IoT devices is enabling continuous health monitoring. This seamless connectivity allows for real-time diagnostic data collection, facilitating proactive disease management and early interventions.

Cost Reduction

AI’s role in reducing healthcare costs cannot be overstated. By minimizing diagnostic errors and streamlining procedures, AI-driven IVD tools significantly lower the financial burden on healthcare systems.

Early Disease Prediction

AI’s prowess in processing large datasets is instrumental in the early prediction of diseases, even before symptoms manifest. This capability is invaluable in preventive healthcare, allowing for timely interventions and lifestyle modifications.

Standardisation and Reduction of Human Error

Ensuring consistency and standardization in diagnostic procedures, AI minimizes human error and variability, leading to more reliable and uniform results across different laboratories.

Self-Learning Diagnostic Tools

AI-powered IVD systems are continuously learning and adapting. As they process more diagnostic data, they improve their accuracy, making them invaluable assets in the healthcare sector.

%20(1).jpg) The author of the article is Chandra Ganjoo, Group CEO of Trivitron Healthcare, who eloquently outlines the transformative impact of AI and machine learning on in-vitro diagnostics.

The author of the article is Chandra Ganjoo, Group CEO of Trivitron Healthcare, who eloquently outlines the transformative impact of AI and machine learning on in-vitro diagnostics.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

The Future of Life Sciences: A Vision for 2030

The Future of Life Sciences: A Vision for 2030

As we edge closer to 2030, the life sciences industry stands on the threshold of transformative changes. With a global valuation exceeding $2 trillion, the sector is poised for significant growth, driven by technological advancements and an aging population. The resilience demonstrated during the COVID-19 pandemic has set the stage for ongoing evolution in healthcare development.Current Innovations and Trends

The rapid acceleration of digital technology, particularly artificial intelligence (AI), machine learning, and genomics, has revolutionized drug discovery and personalized medicine. Technologies such as wearables and telemedicine are reshaping healthcare delivery, marking the dawn of a digital health revolution.- AI and Machine Learning: These technologies are at the forefront of the industry’s progress, enhancing medical devices, discovering data patterns, and boosting productivity. However, legal challenges regarding intellectual property and data privacy remain.

- Precision Medicine: Leveraging genomics and AI, precision medicine offers tailored treatments to individual health profiles, significantly improving the management of chronic diseases like cancer and diabetes.

- Digital Health Technologies: The pandemic accelerated the adoption of cloud computing and AI, leading to scientific breakthroughs and improved manufacturing efficiency. Wearables and healthcare apps are crucial in early health issue detection and patient care enhancement.

- Patient-Centric Care: Smart technologies enable personalized healthcare through remote monitoring and tailored treatments, shifting the focus to a more patient-centric approach.

- Biotechnology Innovations: Companies are using biological processes to address global challenges, resulting in more effective medicines and sustainable farming solutions.

Challenges and Opportunities

The Inflation Reduction Act in the U.S. presents challenges for drug pricing and company revenue, prompting a reevaluation of investment strategies. Increasing diversity in clinical trials is essential for equitable treatment development. Legal and ethical concerns around gene editing and data privacy necessitate robust guidelines.Opportunities for Growth

Developing AI solutions that support healthcare workers’ daily decisions could revolutionize healthcare delivery, making it more personal and effective. Embracing advanced analytics enables healthcare organizations to make data-driven decisions, enhancing patient care and operational efficiency. Additionally, utilizing AI for drug repurposing could lead to innovative treatments for challenging conditions.As we look towards 2030, the life sciences industry is on the cusp of groundbreaking innovations that promise enhanced, personalized healthcare for all. The key challenge remains ensuring these advancements are accessible and beneficial to everyone, emphasizing the need for collaboration between governments, healthcare providers, and biotechnology companies.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

Telehealth: A Boon for Patients, A Challenge for Rural Hospitals

Telehealth: A Boon for Patients, A Challenge for Rural Hospitals

The advent of telehealth has revolutionized the way patients, particularly those in rural areas, access health care. By offering remote consultations and follow-up care, telehealth provides a convenient alternative to traveling long distances to urban hospitals. However, this technological advancement brings with it a set of challenges that could reshape the rural health care landscape.

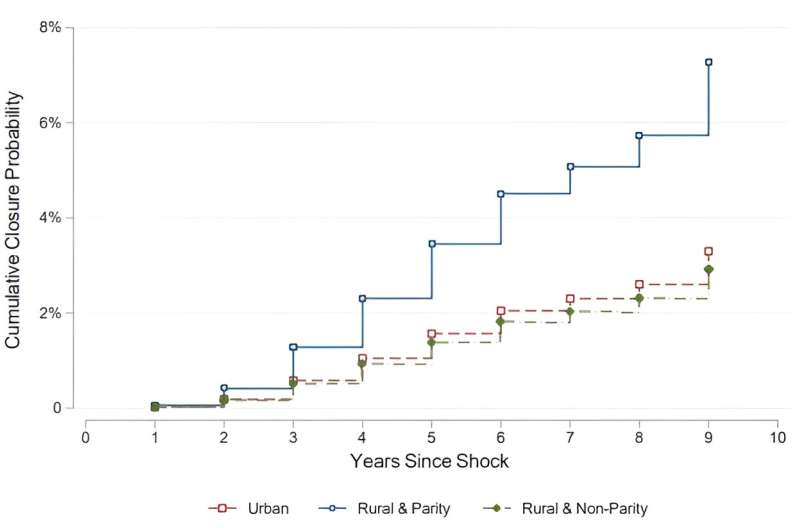

The advent of telehealth has revolutionized the way patients, particularly those in rural areas, access health care. By offering remote consultations and follow-up care, telehealth provides a convenient alternative to traveling long distances to urban hospitals. However, this technological advancement brings with it a set of challenges that could reshape the rural health care landscape.A recent study by Zihan Ye from the University of Tennessee, alongside Kimberly Cornaggia from Penn State University and Xuelin Li from Columbia Business School, sheds light on the financial impacts of telehealth on rural hospitals. Their research, soon to be published in the Review of Financial Studies, reveals that while telehealth services enhance patient access to urban hospitals, they simultaneously drain resources from rural health care providers. This shift can lead to financial instability, increased leverage, and even bankruptcy for rural hospitals.

The study highlights a competitive imbalance, with urban hospitals benefiting from a larger patient base and the ability to charge higher fees. Conversely, rural hospitals, often unable to offer telehealth services, face dwindling patient numbers and diminished financial viability. The situation is exacerbated by disparities in insurance reimbursements, particularly from Medicare and Medicaid, which often fall short compared to private insurers.

Ye and her colleagues urge policymakers to consider the long-term effects of telehealth expansion, advocating for collaborative programs that allow rural hospitals to partake in the telehealth market’s benefits. Such measures could alleviate financial pressures and ensure continued access to health care for rural communities.

As communication technology continues to evolve, understanding its broader impacts remains crucial for a balanced and equitable health care system. For more insights, visit the original article on Medical Xpress.

References:

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

The Genetic Revolution: CRISPR and Public Opinion

The Genetic Revolution: CRISPR and Public Opinion

It was a monumental shift in the world of genetics when CRISPR-Cas9 burst onto the scene in 2012, democratizing the ability to edit genomes with unprecedented precision and ease. This revolutionary technology, as detailed in a systematic review published by Frontiers, has not only transformed scientific research but has also sparked a profound societal and ethical debate.

The CRISPR Effect

CRISPR’s impact is far-reaching, influencing fields from biomedical research and clinical practice to food production. The ability to edit genes with such precision has opened doors to potential cures for genetic diseases, enhancements in agricultural yields, and even the controversial editing of human embryos.

However, this power comes with significant ethical concerns. As the review notes, the application of CRISPR to human embryos has reignited debates over genetic manipulation, reminiscent of past controversies surrounding genetic engineering.

Public Sentiment: A Mixed Bag

Over the past 35 years, surveys have painted a complex picture of public attitudes towards genetic modification. Generally, there is strong support for therapeutic gene editing in humans, particularly when it comes to treating or preventing diseases. Yet, opinions diverge sharply when it comes to germline modifications and genetic enhancements, often viewed with skepticism or outright opposition.

The review highlights that while many embrace the potential health benefits, the notion of “designer babies” raises red flags for both ethical and safety reasons. This echoes the sentiments expressed by scholars like Camporesi and Cavaliere, who have explored the ethical dimensions of CRISPR in their work (Camporesi and Cavaliere, 2016).

Responsible Innovation

The key takeaway from the review is the critical need for responsible research and innovation (RRI). Aligning technological advancements with societal values is paramount. As CRISPR technology continues to evolve, ensuring that it is used ethically and responsibly will require ongoing dialogue between scientists, policymakers, and the public.

Looking Ahead

The path forward for CRISPR and genetic engineering is one of both promise and caution. As noted by Nordberg et al., the regulatory landscape will need to adapt to keep pace with these rapid advancements (Nordberg et al., 2018).

In conclusion, while CRISPR offers a glimpse into a future where genetic diseases could be eradicated, it also challenges us to consider the ethical implications of such power. The conversation is far from over, and as society grapples with these issues, the voices of both advocates and critics will be crucial in shaping the future of genetic engineering.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

Revolutionizing Healthcare: The AI Transformation

Revolutionizing Healthcare: The AI Transformation

Artificial Intelligence (AI) is no longer a futuristic concept in healthcare; it is a reality reshaping the industry today. Visionaries like Vinod Khosla have long predicted AI’s potential, foreseeing its ability to replace up to 80% of standard medical tasks. This transformation is now evident as AI technologies begin to outperform traditional methods, particularly in areas requiring precision and data processing.

From Data to Diagnosis

AI is increasingly being integrated into healthcare systems, shifting from human-centered care to AI-driven solutions. As Kris Pahuja, co-founder of the Y Combinator-backed startup Piramidal, observes, AI “co-pilots” are becoming standard in medical decision-making, especially in complex environments like the ICU. This integration is not just about automation; it represents a profound change in medical diagnostics, reducing errors and biases in human diagnosis and leading to better patient outcomes.AI’s proficiency in analyzing medical imaging, particularly in fields like radiology and pathology, allows for the early detection of diseases such as cancer. This capability significantly improves treatment outcomes by enabling more accurate and timely diagnoses.

Personalized Medicine: Tailoring Treatment with AI

One of the most promising applications of AI in healthcare is its role in personalized medicine. By analyzing genetic profiles and real-time health data, AI enables treatments tailored to individual patients, moving away from the traditional one-size-fits-all approach. This personalization reduces adverse reactions and enhances treatment effectiveness. A study published in Nature Humanities and Social Sciences Communications highlights AI’s role in driving precision healthcare.Accelerating Drug Development

AI is also accelerating drug development by allowing pharmaceutical companies to analyze large datasets from clinical trials. This capability identifies potential new drug candidates more quickly and accurately than traditional methods, potentially transforming disease management and care.AI in Patient Care Management

AI’s potential in patient care management is substantial. By continuously monitoring patient health data, AI systems can predict potential health issues and provide timely interventions, shifting healthcare from a reactive model to a proactive one. This proactive approach not only improves patient outcomes but also reduces long-term healthcare costs.AI-powered predictive analytics also play a crucial role in preventive care, identifying patients at risk of developing conditions like diabetes or hypertension long before symptoms appear. This early intervention strategy can prevent the onset of these diseases, significantly reducing the burden of chronic illnesses.

Ethical Considerations and Challenges

Integrating AI into healthcare is not without challenges, particularly concerning privacy, security, and ethics. AI systems require vast amounts of data to function effectively, raising concerns about data breaches and privacy. As AI systems make more autonomous decisions, ethical questions arise, such as who is responsible for incorrect diagnoses or treatment recommendations made by AI. These are complex issues that healthcare providers and regulators must address as AI becomes more prevalent in the industry.The Nature article also underscores the ethical implications of AI in healthcare beyond data privacy and decision-making. AI’s use in patient care could lead to the dehumanization of healthcare, where decisions may become overly data-driven, potentially overlooking the nuances of human empathy and judgment.

Integrating AI

For healthcare leaders eager to embrace AI, a strategic, phased approach is recommended. Begin by identifying specific areas where AI can deliver immediate value, such as diagnostics or patient management, and launch pilot projects to test and refine these tools. Building a multidisciplinary team that includes clinicians, data scientists, and ethicists is essential to ensure that AI solutions are both effective and ethically sound.A New Era of Healthcare

The future of healthcare lies in the seamless integration of AI technologies as partners in care, not just tools. AI is set to reshape healthcare by improving outcomes, reducing costs, and enabling personalized care. While the journey toward AI-driven healthcare is still in its early stages, the impact of these technologies is already being felt. As AI continues to advance, it will redefine the relationship between patients and healthcare providers, making care more efficient, effective, and personalized.Original Article

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

Exploring the Intersection of AI and Patient-Centered Care

Exploring the Intersection of AI and Patient-Centered Care

In a groundbreaking study published in BMC Medical Ethics, researchers have delved into the public’s perception of artificial intelligence (AI) in healthcare, spotlighting both ethical concerns and potential opportunities for enhancing patient-centered care. As AI continues to permeate various facets of medical practice, understanding its impact on patient trust and decision-making has become increasingly critical.AI in Healthcare: A Double-Edged Sword

The study, conducted by researchers from Florida Atlantic University and the University of South Florida, surveyed 600 adults in Florida to gauge their comfort levels with AI in healthcare tasks. The findings reveal a complex relationship between AI integration and patient trust. While AI is seen as a tool that could potentially improve efficiency and support medical professionals, there is a palpable concern about losing the “human touch” in patient care.Interestingly, the study found that while 84.2% of respondents felt comfortable with AI handling administrative tasks, such as scheduling appointments, only 33.7% were comfortable with AI administering medications. This dichotomy underscores the need for careful integration of AI into healthcare settings, ensuring it complements rather than replaces human interaction.

Trust and Autonomy: Key Concerns

One of the study’s critical insights is the public’s apprehension about AI’s role in clinical decision-making. Many participants expressed discomfort with AI making autonomous medical decisions, highlighting a broader concern about maintaining patient autonomy and consent. As AI technologies advance, the study suggests that incorporating informed consent procedures and clearly communicating the benefits and risks of AI to patients could enhance trust and acceptance.Regulation and Ethical Guidelines: A Call to Action

Despite AI’s potential to revolutionize healthcare, the study emphasizes the urgent need for regulation and ethical guidelines. Without clear oversight, the integration of AI could inadvertently undermine patient-centered care principles. The researchers advocate for a framework that includes transparency, accountability, and patient choice, ensuring AI’s role in healthcare aligns with ethical standards.Opportunities for Equitable Care

Beyond the challenges, the study also highlights opportunities for AI to contribute to more equitable healthcare. By eliminating biases and supporting data-driven decisions, AI has the potential to enhance patient outcomes and reduce disparities. However, this potential can only be realized if AI systems are designed with patient values and preferences in mind.For those interested in exploring the full findings and methodology of this study, the original article is accessible on BMC Medical Ethics. The data, publicly released on September 6, 2023, is available on the University of South Florida’s webpage.

Conclusion

As AI continues to shape the future of healthcare, this study serves as a crucial reminder of the importance of balancing technological advancements with ethical considerations. By prioritizing patient-centered care and addressing public concerns, the medical community can harness AI’s potential to improve healthcare delivery while preserving the essential human elements of care.Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

The AI Revolution in Real Estate

The AI Revolution in Real Estate

The real estate industry is experiencing a seismic shift, thanks to the integration of artificial intelligence (AI). This cutting-edge technology is fundamentally transforming property acquisition, sales, and management processes. AI’s influence extends to predictive analytics, which are reshaping investment decisions, and virtual property tours, which are revolutionizing how we navigate the real estate landscape.According to Deloitte’s research, 52% of corporate real estate developers believe AI can ensure precise property valuation, highlighting its pivotal role in property assessment and pricing accuracy. Additionally, 48% of property managers plan to enhance their revenue through tech-driven efficiency, as noted by Buildium.

Proptech: The Future of Real Estate

AI solutions are central to the rapidly expanding proptech sector. The global proptech market is projected to reach $94.2 billion by 2030, with a compound annual growth rate (CAGR) of 15.8% from 2022 to 2030.In 2021, global investments in proptech companies reached a remarkable total of $24.3 billion. This figure has shown a consistent upward trend since 2012, with the exception of 2020 when new proptech company establishment decreased. The United States recorded 154 proptech funding rounds in 2021, and 2022 secured the second-highest spot on the record charts, with an impressive count of 109 deals.

AI and ML: Streamlining Real Estate Processes

AI and machine learning (ML) technologies are revolutionizing the real estate sector, particularly by streamlining manual processes that have traditionally been paperwork-intensive. Entrepreneur reports that incorrect data in real estate can result in substantial revenue losses, including missed opportunities, lost sales, operational inefficiencies, legal complications, and poor decision-making.The global property management software market is anticipated to grow significantly, with its value projected to increase from $22.05 billion in 2023 to approximately $42.89 billion by 2030.

Data-Driven Market Analysis

Data-powered market analysis is a game-changer for the real estate industry, driven by AI platforms that empower rapid evaluation of real estate projects. These analyses, fueled by data from diverse sources, provide a solid foundation for informed decision-making. Additionally, AI-driven predictive analytics enhance investment strategies by streamlining approaches, reducing risks, and seizing market opportunities.For instance, Lennar collaborated with Climate Alpha, an AI analytics platform, to identify climate-resilient residential areas in the US for future investments.

Image source: REimagineHome

Image source: REimagineHome

Sustainability and Energy Efficiency

The real estate sector carries a substantial environmental burden, responsible for a staggering 40% of annual global CO2 emissions. McKinsey’s research suggests that approximately $7.5 trillion in property value is at risk due to climate-related challenges or the inability to decarbonize existing structures.Proptech presents a significant opportunity for the real estate industry by potentially reducing maintenance costs for green buildings by an average of 20%. To expedite the adoption of sustainable real estate practices, proptech introduces smart decarbonization strategies and green building technologies.

Conclusion

As the proptech industry continues to advance and introduce innovations, it holds the potential to transform the real estate landscape, improving accessibility, convenience, and the overall experience for all participants in the industry. This includes property managers, real estate agents, buyers, renters, and investors alike.Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

Virtual Care in 2024: Challenges and Opportunities for Telehealth

Virtual Care in 2024: Challenges and Opportunities for Telehealth

The telehealth market is experiencing a remarkable surge, driven by the increasing adoption of digital health solutions and remote care services. As reported by PharmiWeb.com, the market was valued at USD 91.4 billion in 2023 and is projected to soar to USD 789.7 billion by 2032, with a compound annual growth rate (CAGR) of 27.4%. This growth highlights telehealth’s transformative role in enhancing healthcare delivery, promising improved accessibility, efficiency, and cost-effectiveness.Several key drivers are propelling this expansion. Advancements in digital health platforms, such as mobile health applications and live video consultations, are breaking down geographical barriers, providing unprecedented access to quality healthcare. The increasing demand for remote patient monitoring (RPM) technologies allows for real-time patient data tracking, ensuring proactive healthcare management. Additionally, the rising prevalence of chronic diseases like diabetes and hypertension accentuates the necessity for telehealth solutions. Government initiatives promoting digital healthcare adoption, particularly during the COVID-19 pandemic, have further strengthened the industry.

Moreover, telehealth’s cost-effective nature significantly reduces healthcare expenses for both providers and patients by minimizing the need for in-person visits and optimizing resource allocation.

Telehealth Market Segmentation

The telehealth market is segmented by component (software, services, hardware), mode of delivery (web-based, cloud-based, on-premises), and end-users (healthcare providers, patients, payers). Regionally, North America leads in telehealth adoption due to advanced technology, high healthcare spending, and favorable regulations. However, the Asia-Pacific region is expected to witness rapid growth, driven by increasing smartphone penetration and supportive governmental policies.Challenges and Innovations

Despite the positive outlook, the industry faces challenges, notably data privacy and security concerns, infrastructure limitations in developing regions, and regulatory hurdles for cross-border healthcare services. Innovations driving market growth include AI and machine learning for enhanced diagnostics, integration of wearable devices for continuous monitoring, blockchain for secure data management, and AR/VR technologies for immersive healthcare experiences.The COVID-19 pandemic dramatically accelerated telehealth adoption, acting as a catalyst for virtual healthcare solution uptake—a trend expected to continue post-pandemic as telehealth becomes integral to healthcare systems.

Prominent players in the telehealth market, such as Teladoc Health, American Well, and MDLIVE, are heavily investing in research and development to innovate and bolster their market standing, paving the way for a promising future in telehealth.

For more detailed insights, access the sample report or purchase the full report from Ameco Research.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

NAR 2024 Sustainability Report: A Greener Future for Real Estate

Green Data Fields: A Step Towards Transparency

A notable shift is the integration of green data fields into the Multiple Listing Service (MLS). This innovation is transforming how properties are presented, emphasizing sustainable features to guide buyers towards eco-friendly homes. Such transparency not only promotes healthier living environments but also prepares the housing market for a sustainable future.Empowering Through Education

Education plays a crucial role in this transformation. The survey reveals that a quarter of individuals living in homes with sustainable features have received some form of training. This growing awareness among real estate professionals encompasses energy-efficient appliances, renewable energy systems, and eco-friendly building materials. Armed with this knowledge, agents are better equipped to advocate for green living, meeting the evolving demands of environmentally conscious clients.Energy Efficiency: A Key Market Driver

Energy efficiency is becoming a valuable asset in property descriptions, with more than half of the respondents recognizing its importance. As the demand for sustainable living grows, agents who champion energy-efficient properties are positioned as key change agents, enhancing the marketability of these buildings.Client Interest: Aligning with Eco-Conscious Preferences

The survey highlights a growing client interest in sustainability, with nearly half of respondents noting this trend. This shift underscores the necessity for REALTORS® to align with client preferences, fostering not just transactions but also positive environmental change.

Green Certifications: Dispelling Myths

Contrary to common misconceptions, over 40% of homes with green certifications experienced no difference in market time. This dispels the myth that eco-friendly certifications hinder marketability, highlighting the growing acceptance of green-certified homes.High-Performance Homes: A Worthwhile Investment

Interestingly, homes with high-performance features command a premium of 1% to 5% in dollar value compared to similar homes. This underscores the financial incentives associated with investing in homes that prioritize comfort, health, and operational efficiency.

Conclusion: A Green Horizon Beckons

The NAR 2024 Sustainability Report paints a landscape ready for transformation. It emphasizes the potential for the residential real estate sector to lead a more sustainable, resilient future by integrating green data fields and accepting eco-friendly certifications.As interest in sustainable living grows, real estate professionals are essential advocates for eco-friendly homes and practices. By furthering education, championing energy efficiency, and engaging with green properties, the real estate industry is paving the way for a greener future. For more details, explore the NAR 2024 Sustainability Report.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

2025 Commercial Real Estate Outlook: Navigating a New Era

2025 Commercial Real Estate Outlook: Navigating a New Era

The commercial real estate landscape is on the brink of transformation as leaders seek to navigate the challenges of recent years and position their organizations for future opportunities. As we look into 2025, the insights from Deloitte’s Commercial Real Estate Outlook provide a comprehensive guide to understanding the shifting dynamics in this sector.Economic Insights: A Global Perspective

The economic forecasts from various regions offer a critical backdrop for understanding the commercial real estate market. In the United States, the economic outlook for Q2 2024 highlights a period of cautious optimism. Meanwhile, the Eurozone is navigating its economic challenges with a focus on stability, as detailed in the April 2024 report. In India, the April 2024 outlook emphasizes growth opportunities amidst global uncertainties. These regional insights, coupled with the global economic outlook from January 2024, underscore the interconnected nature of the commercial real estate market.Strategic Responses to Economic Fluctuations

In response to these economic conditions, businesses are reshaping their strategies to better align with the evolving market landscape. This includes adapting to post-pandemic realities and leveraging new opportunities. The integration of new technologies and innovative strategies is paramount in this transition, as organizations strive to maintain a competitive edge.Leveraging New Opportunities

The outlook for 2025 encourages leaders to harness emerging opportunities in commercial real estate. This involves not only adapting to current challenges but also anticipating future trends. By focusing on strategic innovation and resilience, businesses can position themselves to thrive in a rapidly changing environment.Conclusion The 2025 Commercial Real Estate Outlook serves as a pivotal resource for leaders seeking to navigate the complexities of the current market. By understanding regional economic insights and adopting strategic responses, organizations can effectively position themselves for success in the coming years.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

The Emerging Mental Health Crisis Among Healthcare Workers During the COVID-19 Pandemic

The Emerging Mental Health Crisis

The pandemic has ushered in a wave of mental health challenges that affect healthcare workers profoundly. From the onset of COVID-19, these professionals have been at the forefront, facing immense pressure, long hours, and the constant fear of exposure. This has led to heightened levels of stress, burnout, and even post-traumatic stress disorder (PTSD) among many, as highlighted in a recent article from Frontiers.Stress and Burnout: The Silent Epidemic

Healthcare workers are no strangers to stress, but the pandemic has exacerbated this issue to unprecedented levels. The World Health Organization estimates a significant shortfall in healthcare workers by 2030, which further compounds the stress and burnout experienced by those currently in the field. The emotional toll of making life-and-death decisions, often with limited resources, adds to the moral injury many healthcare workers endure.Self-Care and Systemic Support

While individual self-care practices are crucial, they are not enough. The article emphasizes the need for systemic changes to provide robust support structures for healthcare workers. Implementing evidence-based interventions and policies that prioritize mental health can create a more sustainable and supportive work environment.Strategies for Promoting Mental Health

Several strategies can be employed to support healthcare workers’ mental health. These include providing psychological first aid, resilience training, and access to mental health resources. The use of telemedicine and digital platforms can also alleviate some of the pressures by offering remote consultations and support, as demonstrated during the COVID-19 outbreak in China.Moving Towards Systemic Change

The pandemic has underscored the need for a systemic shift in how we approach healthcare workers’ mental health. This involves not only addressing the immediate mental health needs but also implementing long-term strategies that foster resilience and well-being. As the article suggests, engaging healthcare workers in policy-making processes and promoting a culture of empathy and support are vital steps towards achieving this goal.

Conclusion

In conclusion, the mental health of healthcare workers is a critical public health priority that cannot be overlooked. By implementing systemic changes and providing comprehensive support, we can ensure that these essential workers are equipped to handle current and future health crises. As we move forward, let us remember the invaluable contributions of healthcare workers and strive to create a more supportive and resilient healthcare system.)

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

Ethical Concerns of Large Language Models in Healthcare

Since the release of ChatGPT by OpenAI in 2022, LLMs have rapidly expanded into healthcare, promising advancements in clinical decision-making, diagnosis, and patient communication. However, the review underscores persistent ethical challenges, including issues of fairness, bias, transparency, and privacy. These concerns underscore the pressing need for well-defined ethical guidelines and human oversight in medical applications.

Exploring Ethical Implications

The study identifies several core themes in the ethical use of LLMs. In clinical settings, LLMs hold potential for assisting in initial patient diagnosis and triage. Yet, there is apprehension about biases that may lead to incorrect diagnoses or treatment recommendations, highlighting the necessity for careful oversight by healthcare professionals.

Patient support applications of LLMs aim to improve health literacy and facilitate communication across language barriers. However, concerns about data privacy and the reliability of medical advice generated by these models remain significant.

Public Health Perspectives

From a broader public health perspective, the study warns of potential risks, such as the dissemination of misinformation and the concentration of AI capabilities in the hands of a few corporations. This could exacerbate existing health disparities and undermine public health efforts.

Ultimately, while LLMs present promising advancements in medical fields, ensuring their ethical deployment requires careful consideration. Addressing biases, enhancing transparency, and maintaining human oversight are crucial to mitigating potential harms and promoting equitable patient care.

For further insights, you can read the original article on News-Medical. Additionally, the full study is available on npj Digital Medicine.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.