The Impact of FinTech on Sub-Saharan Africa’s Financial Landscape

The Impact of FinTech on Sub-Saharan Africa’s Financial Landscape

The financial sector worldwide has been revolutionized by the advent of Financial Technology (FinTech), marking a new phase in the evolution of financial services. According to a detailed analysis by TRENDS Research & Advisory, FinTech’s integration of technological innovations with financial services has brought about a transformative impact, offering novel, flexible, and cost-effective financial products.Sub-Saharan Africa: A Fertile Ground for FinTech

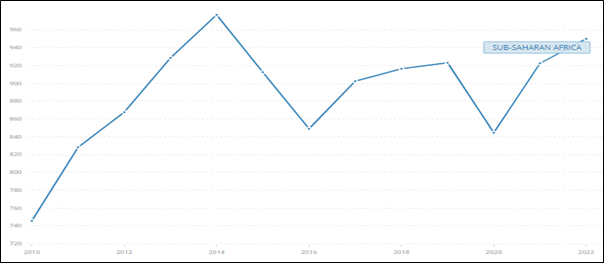

Sub-Saharan Africa, with its youthful demographic—approximately 40% of its population is under 15—presents a ripe opportunity for FinTech adoption. This region’s large underbanked population, estimated at 42% of adults, underscores the potential for FinTech to drive financial inclusion. The widespread use of mobile technology, with around 650 million mobile users, further enhances this potential. The GSMA Mobile Economy Report highlights that Sub-Saharan Africa leads globally in mobile money transactions, totaling $490 billion in 2020.

Challenges and Opportunities

Despite the promising landscape, FinTech adoption in Sub-Saharan Africa faces several challenges. Regulatory hurdles, infrastructure limitations, and cybersecurity threats are significant barriers. However, these challenges also present opportunities for growth. Policy reforms, investment in infrastructure, and public-private partnerships are vital to overcoming these obstacles and seizing the opportunities FinTech offers.Success Stories and Future Prospects

Countries like Zambia and Nigeria illustrate the transformative power of FinTech. Zambia has seen a dramatic rise in digital financial inclusion, with active digital financial accounts increasing from 2% to 44% of the adult population between 2014 and 2019. Meanwhile, Nigeria’s FinTech sector is thriving, driven by a tech-savvy population and government support for digital financial solutions.Looking ahead, the future of FinTech in Sub-Saharan Africa is promising. Emerging technologies such as AI-driven solutions and blockchain applications hold significant potential for enhancing financial services accessibility and efficiency. With continued investment and innovation, FinTech is poised to play a pivotal role in transforming the financial landscape of the region and improving the lives of millions.

Conclusion

The impact of FinTech on Sub-Saharan Africa’s financial services sector is profound, fostering financial inclusion and reshaping traditional banking paradigms. As the region continues to embrace innovative solutions, collaboration among policymakers, regulators, and stakeholders is crucial to harnessing the full potential of FinTech for sustainable growth.More Articles

Getting licensed or staying ahead in your career can be a journey—but it doesn’t have to be overwhelming. Grab your favorite coffee or tea, take a moment to relax, and browse through our articles. Whether you’re just starting out or renewing your expertise, we’ve got tips, insights, and advice to keep you moving forward. Here’s to your success—one sip and one step at a time!

2407, 2023

Pennsylvania

Forgive the Cyber Dust

We will return shortly after upgrades are complete

2407, 2023

Oregon

Forgive the Cyber Dust

We will return shortly after upgrades are complete

2407, 2023

Oklahoma

Forgive the Cyber Dust

We will return shortly after upgrades are complete

2407, 2023

Ohio

Forgive the Cyber Dust

We will return shortly after upgrades are complete

2407, 2023

North Dakota

Forgive the Cyber Dust

We will return shortly after upgrades are complete

2407, 2023

North Carolina

Forgive the Cyber Dust

We will return shortly after upgrades are complete

2407, 2023

New York

Forgive the Cyber Dust

We will return shortly after upgrades are complete

2407, 2023

New Mexico

Forgive the Cyber Dust

We will return shortly after upgrades are complete

2407, 2023

New Jersey

Forgive the Cyber Dust

We will return shortly after upgrades are complete

2407, 2023

New Hampshire

Forgive the Cyber Dust

We will return shortly after upgrades are complete

2407, 2023

Nevada

Forgive the Cyber Dust

We will return shortly after upgrades are complete

2407, 2023

Nebraska

Forgive the Cyber Dust

We will return shortly after upgrades are complete

2407, 2023

Montana

Forgive the Cyber Dust

We will return shortly after upgrades are complete

2407, 2023

Missouri

Forgive the Cyber Dust

We will return shortly after upgrades are complete

2407, 2023

Mississippi

Forgive the Cyber Dust

We will return shortly after upgrades are complete

2407, 2023

Minnesota

Forgive the Cyber Dust

We will return shortly after upgrades are complete

2407, 2023

Michigan

Forgive the Cyber Dust

We will return shortly after upgrades are complete

2407, 2023

Massachusetts

Forgive the Cyber Dust

We will return shortly after upgrades are complete

2407, 2023

Maryland

Forgive the Cyber Dust

We will return shortly after upgrades are complete

2407, 2023

Maine

Forgive the Cyber Dust

We will return shortly after upgrades are complete

2407, 2023

Louisiana

Forgive the Cyber Dust

We will return shortly after upgrades are complete

2407, 2023

Kentucky

Forgive the Cyber Dust

We will return shortly after upgrades are complete

2407, 2023

Kansas

Forgive the Cyber Dust

We will return shortly after upgrades are complete

2407, 2023

Iowa

Forgive the Cyber Dust

We will return shortly after upgrades are complete

2407, 2023