The Rise of Central Bank Digital Currencies: A New Era in Finance

Countries around the globe, from the Bahamas to China, are actively exploring or have already initiated CBDC projects. The primary objective is to enhance financial inclusion, offering secure and efficient payment options for those without access to traditional banking systems. As noted in a report by the U.S. Federal Reserve, CBDCs have the potential to significantly reduce cross-border transaction costs, bolster the international standing of dominant currencies like the dollar, and simplify access to financial services.

However, this shift to digital currencies also presents several challenges. Privacy concerns, potential cybersecurity threats, and the impact on existing banking structures are critical issues that need careful consideration. Ensuring robust cybersecurity frameworks and balancing transaction monitoring to prevent financial crimes are essential steps in this journey.

CBDCs are categorized into two main types: wholesale and retail. Wholesale CBDCs are typically used by financial institutions for interbank transactions, while retail CBDCs are consumer-focused, allowing potentially anonymous transactions using public or private keys.

While smaller nations like Jamaica, Nigeria, and the Bahamas have already implemented CBDCs, larger economies and groups like the G20 are still in the exploratory stages, assessing the implications for monetary policy and financial stability.

For more in-depth information, the original article can be found on Investopedia.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

More Articles

Getting licensed or staying ahead in your career can be a journey—but it doesn’t have to be overwhelming. Grab your favorite coffee or tea, take a moment to relax, and browse through our articles. Whether you’re just starting out or renewing your expertise, we’ve got tips, insights, and advice to keep you moving forward. Here’s to your success—one sip and one step at a time!

The Remote Work Revolution: A New Chapter in U.S. Migration Patterns

The Remote Work Revolution: A New Chapter in U.S. Migration Patterns

The pandemic may no longer dominate the headlines, but its influence on migration patterns and the housing landscape continues to resonate across the United States. In a recent episode of Core Conversations, host Maiclaire Bolton Smith and CoreLogic Chief Economist Selma Hepp explore how the rise of remote work has reshaped the nation’s demographic and economic fabric. Remote work, once a temporary necessity, has become a permanent fixture for many. This shift has prompted a significant migration from high-cost coastal metros like San Francisco and New York to more affordable regions. The ripple effects of this migration are profound, altering home price dynamics and income distribution nationwide. Challenges and Opportunities

Challenges and OpportunitiesFor major cities, the challenges are clear. Retaining a high-wage workforce, navigating shrinking tax bases, and addressing declining home prices are pressing concerns. Yet, as Hepp points out, these urban centers are not fading into irrelevance. Instead, they are being urged to reinvent themselves, potentially embracing mixed-use developments to attract residents back to the city. Conversely, smaller towns and more affordable metros are seizing newfound opportunities. With an influx of high-wage earners, these areas are experiencing economic boons, including increased local spending and rising wages. This redistribution of economic benefits is reshaping the landscape, as highlighted in the original article. The Long-Term Impact

As the podcast delves deeper, questions arise about the long-term implications of these migration trends. How will remote work continue to decentralize job opportunities traditionally concentrated in urban centers? What will be the future economic roles of these evolving urban and suburban areas? Despite high mortgage rates, the trend of out-of-metro migration persists, driven by stable remote work opportunities. This narrative, as discussed by Hepp, underscores the need for both large cities and smaller towns to innovate and adapt to sustain growth and economic stability in the face of changing work and living preferences. In conclusion, the episode offers a comprehensive look at how remote work is reshaping the housing landscape and the economic fabric of the nation. As this story unfolds, it becomes evident that the future of U.S. cities and towns will be defined by their ability to adapt to new demographic realities.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

Top Destinations for Retirement in 2024: Best and Worst States

In a comprehensive analysis by Bankrate, Delaware has emerged as the top state for retirees in 2024. This ranking is based on a myriad of factors, including living costs, health care expenses, and overall well-being, among others. The methodology remained consistent with last year’s list, emphasizing affordability, which accounts for 40% of the ranking weight.

Top 5 States for Retirement in 2024

Delaware’s rise to the top is attributed to its tax-friendly policies and strong well-being metrics, despite a higher cost of living. The state offers no state or local sales tax and exempts Social Security benefits from taxation, making it appealing for retirees. Following Delaware, the top five states include West Virginia, Georgia, South Carolina, and Missouri.

- West Virginia: Known for its affordability, West Virginia boasts low property taxes and homeowners insurance rates. However, it struggles with health care costs and quality.

- Georgia: The Peach State has seen a drop in living costs and homeowners insurance premiums, pushing it up the ranks.

- South Carolina: Improved affordability and favorable weather conditions have boosted its ranking.

- Missouri: With a strong standing in affordability, Missouri faces challenges in health care quality and natural disasters.

Bottom 5 States for Retirement in 2024

The study also identifies the least favorable states for retirement, with Alaska, New York, Washington, California, and North Dakota occupying the bottom spots. These states are characterized by high living costs and, in some cases, challenging weather conditions.

As retirees consider relocating, it’s essential to weigh factors like retirement savings, community sense, and health care access. The decision should balance personal preferences with practical considerations, ensuring a fulfilling and secure retirement.

6 Important Considerations Before Relocating for Retirement

- The State of Your Finances: Evaluate your budget and spending habits. Use tools like the Bankrate retirement calculator to assess your financial readiness.

- Sense of Community: Consider the social environment and opportunities for engagement in the area.

- Cost of Living: Analyze the potential financial benefits of relocating, especially if moving from a higher-cost area.

- Quality and Cost of Health Care: Assess the availability and affordability of health care services.

- Taxes: Understand the tax implications of your chosen location, including property and sales taxes.

- Climate: Factor in the climate and potential natural disaster risks, which can affect insurance costs and quality of life.

These considerations, along with insights from financial and retirement experts, can guide retirees in making informed decisions about where to enjoy their retirement years.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

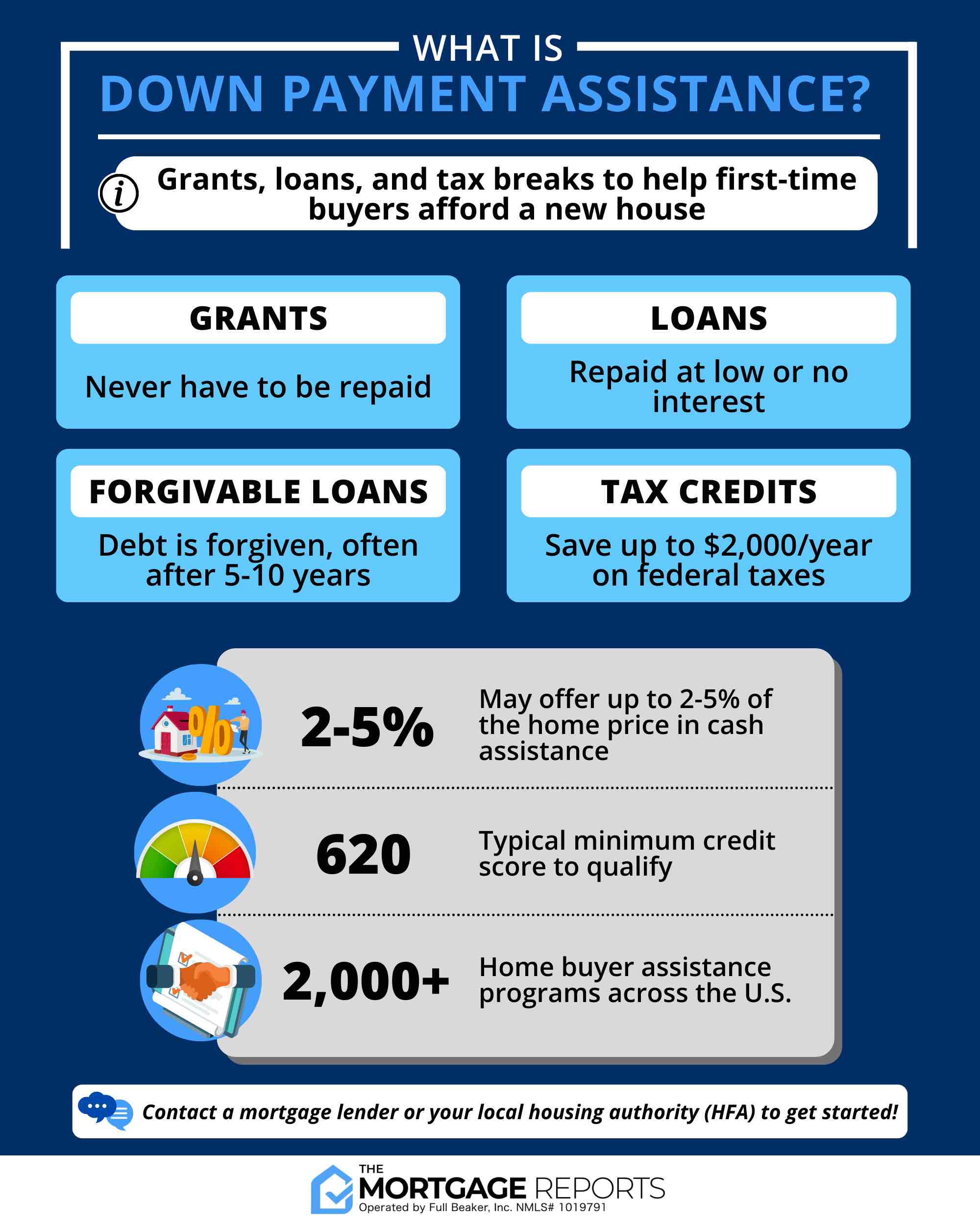

Making Homeownership a Reality: Exploring Down Payment Assistance Programs

Understanding Down Payment Assistance

Down payment assistance is available in multiple forms, including grants and loans, some of which may be interest-free or forgivable over time. These programs are particularly beneficial for first-time homebuyers or those who haven’t owned a home in the past three years. To qualify, individuals typically need to meet certain income requirements and, in some cases, purchase properties in designated areas.Eligibility and Application

Eligibility criteria for DPA programs often include being a first-time homebuyer and meeting income qualifications. Programs may also require purchasing within specific price limits or using approved mortgage programs. The original article from The Mortgage Reports provides a comprehensive guide to these programs, emphasizing the importance of consulting with local loan officers or brokers who can offer insights into regional grants and loans.Exploring Resources

For those eager to explore their options, the article encourages potential homebuyers to leverage resources like the U.S. Department of Housing and Urban Development (HUD), which lists various statewide and local assistance programs. Additionally, aspiring homeowners can benefit from understanding the intricacies of securing down payment assistance, as outlined in the article, to confidently navigate their path to homeownership.Conclusion

In essence, down payment assistance programs serve as a crucial tool for those looking to overcome the financial barriers to homeownership. By providing financial support and reducing upfront costs, these initiatives are paving the way for more individuals to achieve their dream of owning a home. For further details, readers are encouraged to visit the original article and explore additional resources such as the guide on buying a house with $0 down and the guide to mortgage closing costs.Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

Exploring the Top Real Estate Markets for Investors in 2025

Exploring the Top Real Estate Markets for Investors in 2025

In a world where financial security often hinges on smart investments, the real estate sector stands out as a beacon of opportunity. For those dreaming of building a substantial real estate portfolio, identifying the 10 best real estate markets for investors is crucial. This isn’t about striking gold overnight but rather about making informed decisions based on comprehensive research and market trends.

The latest insights from Norada Real Estate Investments provide a roadmap for investors seeking promising opportunities in 2025. The article emphasizes that successful real estate investments are grounded in understanding market dynamics and recognizing the potential for growth amidst economic fluctuations.

Understanding the Real Estate Investment Landscape

Before diving into the specifics of each market, it’s essential to grasp what makes a market attractive for investment. Factors such as strong rental demand, property appreciation, and economic stability play pivotal roles. Moreover, job growth and affordable housing options contribute significantly to a market’s appeal.

Top 10 Investment Hotspots for 2025

The article identifies ten markets showing considerable promise for investors. These include:

- Charlotte, NC: Known for its robust economy driven by finance and healthcare, Charlotte offers a balanced market with steady growth.

- Nashville, TN: Beyond its vibrant music scene, Nashville’s economy thrives on healthcare and tourism, making it a hotspot for rental demand.

- Austin, TX: A tech powerhouse, Austin attracts high-income residents, driving property values and offering significant returns.

- Tampa, FL: With a diverse economy and warm climate, Tampa provides a mid-range option with solid growth potential.

- Phoenix, AZ: Rapid growth and a sunny climate make Phoenix an attractive option for investors seeking opportunities in the Sun Belt.

- Raleigh, NC: A stable market with strong economic foundations, Raleigh is ideal for investors seeking predictable returns.

- Atlanta, GA: With its sprawling metropolis and diverse job market, Atlanta offers both affordability and growth potential.

- Jacksonville, FL: Affordable housing and a strong military presence provide a stable economic base.

- Dallas, TX: A mix of industries and a pro-business environment make Dallas a dependable choice for investors.

- Denver, CO: Known for its natural beauty and strong economy, Denver attracts new residents despite its higher property values.

Important Considerations for Investors

Investing in real estate requires due diligence. It’s crucial to conduct local market research, understand property management costs, secure appropriate financing, and be aware of legal and tax implications.

Conclusion

While the markets highlighted by Norada Real Estate Investments show significant promise, it’s vital for investors to combine thorough research with a strategic approach. Real estate investment is inherently risky, but with careful planning and professional advice, it can be a rewarding venture.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

Palm Beach: A Real Estate Renaissance

Palm Beach: A Real Estate Renaissance

In the sun-drenched locale of Palm Beach, South Florida, a compelling narrative is unfolding in the world of real estate. The “Palm Beach State of the Market” event, hosted by Bisnow, offers a panoramic view of the current dynamics shaping the region’s real estate landscape.Luxury Residential Projects: A New Era

Palm Beach is witnessing an unprecedented surge in luxury residential projects. These developments are not just reshaping the skyline but are also redefining the standards of opulence and comfort. With an influx of affluent buyers, the demand for high-end residences has never been more pronounced. This trend is a testament to Palm Beach’s allure as a premier destination for luxury living.Retail Real Estate Trends: Adapting and Thriving

As consumer preferences evolve, so too does the retail real estate sector in Palm Beach. The event highlighted how developers and investors are creatively adapting to these changes. From experiential retail spaces to mixed-use developments, the focus is on creating vibrant environments that cater to the modern consumer’s needs.Commercial Development: Building the Future

Commercial development in Palm Beach is on an upward trajectory, driven by a robust economy and strategic investments. The event provided a platform for local developers, investors, and brokers to discuss the factors propelling this growth. The consensus is clear: Palm Beach is poised to become a powerhouse in the commercial real estate sector.Networking Opportunities: Engaging with the Best

The “Palm Beach State of the Market” event is not just about discussions and insights; it is also a prime networking opportunity. Attendees have the chance to engage with some of the most influential figures in real estate, fostering connections that could shape future projects and collaborations.Conclusion

In summary, Palm Beach is experiencing a real estate renaissance, characterized by luxury, innovation, and growth. As the market continues to evolve, events like these are crucial in understanding the dynamics at play and seizing the opportunities that lie ahead.Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

Real Estate’s Resilience Amidst Economic Turbulence

Real Estate’s Resilience Amidst Economic Turbulence

In a riveting discussion at the Fortune Future of Finance conference, real estate experts Sean Dobson and Julie Ingersoll explored the perplexing durability of the housing market. Despite numerous economic pressures, home prices remain steadfast, a phenomenon senior editor-at-large Shawn Tully likened to “defying gravity.”Commercial Real Estate in Crisis The conversation shifted between the residential and commercial sectors, with Julie Ingersoll, from CBRE Investment Management, highlighting the vulnerabilities faced by commercial real estate. The sector grapples with higher interest rates and dwindling demand, particularly in office spaces. Ingersoll noted the alarming office vacancy rate, which has soared to 18% and may soon reach 20%.

The NIMBY Challenge The dialogue also addressed the historic inventory crisis exacerbated by NIMBYism—”not in my backyard” attitudes that hinder housing development. Ingersoll pointed to California’s struggles, where policy failures and community resistance continue to stifle housing supply despite recent legislative efforts to ease building constraints.

The Remote Work Revolution Remote work‘s enduring impact on real estate was another focal point. Sean Dobson, of Amherst Group, discussed how remote work has reshaped the sector, contributing to the pandemic housing boom and altering office dynamics. He predicted that hybrid work models are here to stay, challenging traditional commuting cultures.

Converting Commercial to Residential Ingersoll proposed converting underutilized commercial properties into residential spaces as a potential solution to the housing shortage. However, she acknowledged the financial and logistical hurdles involved in such transformations.

Unique American Factors The dialogue underscored uniquely American elements affecting the market, such as the 30-year mortgage and the decentralized nature of housing governance. These factors contribute to the complex landscape of real estate in the United States.

Conclusion As the real estate sector navigates these challenges, the insights shared by Dobson and Ingersoll offer a nuanced understanding of the forces at play. Their discussion at the conference, as reported in the original article, underscores the intricate interplay between economic pressures and market resilience.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

Unraveling the Affordable Housing Crisis Through Zoning Reforms

Unraveling the Affordable Housing Crisis Through Zoning Reforms

The affordable housing crisis in the United States is a complex issue, and no single solution can address it entirely. However, many cities are increasingly looking to zoning reform as a pivotal strategy to boost housing supply. As Urban Land Magazine reports, the severity of the crisis has pushed it to the forefront of political agendas, making politicians more inclined to tackle the issue.

City planner M. Nolan Gray, author of Arbitrary Lines: How Zoning Broke the American City and How to Fix It, highlights the shift in urban policies. “Dozens of cities have scrapped exclusionary single-family home zoning and parking requirements, which was previously inconceivable,” Gray notes.

The Shift Towards Inclusive Zoning

David Garcia, policy director for the Terner Center for Housing Innovation at the University of California, Berkeley, underscores the growing openness to zoning changes. “Many jurisdictions are reluctant to use zoning reform due to backlash, but the idea of allowing multiple units on single-family parcels is gaining traction,” Garcia explains.

Despite the momentum, the impact of recent zoning changes is still unfolding. Garcia warns that piecemeal reforms may not achieve the desired outcomes, and comprehensive zoning changes are often challenging to implement.

According to Toccarra Nicole Thomas, director of land use and development at Smart Growth America, zoning has historically contributed to the crisis by focusing on low-density, auto-centric housing. “Zoning is inherently inflexible,” Thomas asserts. She advocates for comprehensive reform to effectively generate affordable housing.

Strategies for Effective Zoning Reform

Gray suggests that allowing “by right” building permits could significantly streamline the development process. Other recommended zoning reforms include reducing lot size requirements, eliminating parking restrictions, and allowing manufactured housing.

- Reducing lot size requirements

- Eliminating parking restrictions

- Allowing manufactured housing

Several cities have successfully implemented zoning reforms. In Oakland, California, the transformation of Auto Row into a residential hub is a prime example. Similarly, Washington, D.C., has seen the revitalization of former industrial areas like the Navy Yard and NoMa into vibrant mixed-use communities.

Political Challenges and Opportunities

Zoning reform is not without its political challenges. Thomas points out that reform efforts often face opposition from NIMBYs (Not In My Backyard) and BANANAs (Building Absolutely Nothing Anywhere Near Anything). However, engaging with community stakeholders and building coalitions can help overcome resistance.

Garcia advises developers to engage with communities early in the planning process to demonstrate the benefits of new housing developments. “Data showing that new housing can increase the value of existing homes can be persuasive,” he says.

Ultimately, zoning reform is a gradual process. As Gray emphasizes, “We’re rolling back 100 years of policy that made it nearly impossible to build housing in dense cities, so it will take time to fix.” Yet, progress is being made, and the potential for transformative change is on the horizon.

For further insights, explore the Reshaping the City: Zoning for a More Equitable, Resilient, and Sustainable Future report and the accompanying webinar, featuring experts like Nolan Gray and Toccarra Nicole Thomas.

“`Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

Florida Struggling to Regain Footing After Consecutive Hurricanes

Florida Faces Daunting Recovery After Dual Hurricane Assault

As Hurricane Milton gathered strength in the south-western Gulf of Mexico, Florida braced itself for a second blow in as many weeks. The state, still nursing wounds from the recent wrath of Hurricane Helene, found itself once again in the crosshairs of nature’s fury.

The impact of these consecutive storms has been nothing short of catastrophic. While major urban centers like Tampa and St Petersburg narrowly avoided the worst, other regions along the Gulf coast were not as fortunate. The devastation has been unprecedented, with destruction sweeping through communities, leaving a trail of ruin in its wake.

The human toll is staggering: approximately 250 lives lost, countless homes destroyed, and millions left without power. The financial cost is equally severe, with early estimates placing the damage from Hurricane Milton alone at $160 billion to $180 billion. When combined with the losses from Hurricane Helene, Florida is facing a financial hit nearing half a trillion dollars, a figure that threatens to erase expected economic growth for the coming quarters.

Florida Governor Ron DeSantis, addressing the situation, noted the resilience required to recover from such disasters. “We did not get the worst-case scenario, but we did get hit,” he said, emphasizing the long road to recovery ahead. The state’s experience as the most hurricane-prone region in the nation underscores the challenges that lie ahead.

Even as rescue operations continue, the broader implications of these storms are becoming apparent. The electoral process, already under strain from Hurricane Helene, faces further disruption. Efforts are underway to ensure voting can proceed smoothly, with measures in place to accommodate displaced residents and affected polling sites.

Beyond immediate concerns, the hurricanes’ impact on Florida’s real estate and insurance markets could be profound. The insurance crisis in particular, exacerbated by these events, demands urgent attention. Experts believe these storms could finally prompt legislative action to address systemic issues in the market.

Despite the challenges, the allure of Florida remains strong. The state has historically seen economic growth following hurricanes, and the influx of new residents is unlikely to slow significantly. As Ken Johnson from the University of Mississippi notes, “There’s momentum for business capital to come in, and folks do still want to retire to Florida.”

Conclusion

Florida stands at a crossroads, grappling with the immediate aftermath of two devastating hurricanes while looking ahead to a complex recovery. The resilience of its people and the state’s ability to adapt will be crucial in navigating the challenges ahead.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

The Housing Dilemma in Steamboat Springs

The Housing Dilemma in Steamboat Springs

In the picturesque town of Steamboat Springs, Colorado, a fierce debate is underway over a proposed housing development known as Brown Ranch. This once-affordable “cowboy ski town” is grappling with skyrocketing real estate prices that have left even high-income professionals struggling to find homes.Rising Real Estate Challenges Since the pandemic, Steamboat Springs has seen single-family home prices soar by about 80% to an average of $1.8 million. The surge has put homeownership out of reach for many, with property taxes also escalating by 86%. Local realtors report that competition is so intense that those without all-cash offers are often sidelined. Read more about the housing crisis.

Brown Ranch: A Divisive Proposal The Yampa Valley Housing Authority’s Brown Ranch project has ignited a community-wide debate. Proponents argue that the development is essential for providing affordable housing. However, opponents, led by longtime resident Jim Engelken, voice concerns about its scale and impact on local infrastructure. Engelken, who has lived in Steamboat since 1979, believes the project is “too big, too much, and too expensive.”

“Yes, we need affordable housing, no question,” Engelken said. “It needs to be smaller to start with, it needs to have some ability to generate its own way, its own money.”

Despite these concerns, the city council approved the project, but opposition efforts have led to a ballot measure that will let voters decide its fate in March.

Broader Trends in Mountain Towns Steamboat Springs is not alone in this struggle. Other mountain and resort towns like Driggs, Idaho, and Woodstock, New York, have experienced similar real estate booms. In Driggs, home prices have risen around 80% since the pandemic, while Woodstock has seen a 78% increase. The influx of buyers seeking more affordable alternatives to high-profile destinations has exacerbated these issues. Explore Driggs home prices and Woodstock prices.

Community Identity at Stake Steamboat’s identity as a small-town Western haven is at risk. The town, once known for its affordability compared to places like Vail, is now facing a real estate crisis. City Manager Gary Suiter notes that the town’s authentic charm is being challenged by these rapid changes.

As the debate over Brown Ranch continues, the community must weigh the need for affordable housing against the preservation of its unique character. The outcome of the March ballot will be pivotal in shaping the future of this beloved “cowboy ski town.”

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

Hitting Home: Housing Affordability Crisis in the U.S.

Hitting Home: Housing Affordability in the U.S.

The American housing market is grappling with a crisis of affordability that is reshaping the landscape of homeownership and renting. A recent analysis by Econofact highlights the growing burden of housing costs on American households. With median house prices now six times the median income—up from four to five times two decades ago—the dream of homeownership is slipping away for many. Even renters, who have historically found refuge in more affordable options, are feeling the pinch as the ratio of median rents to median income has crept from 25% to 30%.

The Facts Behind the Crisis

- Worsening Affordability: The affordability crisis is not confined to coastal cities like San Francisco and New York. It is a nationwide issue, affecting both urban and rural areas.

- Cost-Burdened Households: A significant increase in cost-burdened renters—those spending more than 30% of their income on housing—has been observed, particularly among those earning between $35,000 and $49,000 annually.

- Geographic Variations: Traditionally affordable regions are seeing rapid price appreciation, shrinking the affordability gap with historically expensive areas.

The issue of housing affordability is compounded by a mix of demographic shifts and regulatory hurdles. The aging population, with more seniors opting to age in place, has contributed to a supply crunch. Meanwhile, zoning laws and other regulatory restrictions limit housing density, exacerbating the shortage. These factors, coupled with the rise in mortgage rates from 3.5% to nearly 8% since early 2022, have made the path to homeownership even steeper.

Hope on the Horizon?

Despite the grim outlook, there are glimmers of hope. The anticipated reversal of the Federal Reserve’s tightening cycle could lower mortgage rates, easing the financial strain on households. Additionally, there are signs of change in urban zoning laws to allow more affordable housing construction. A surge in multifamily housing starts and a large pipeline of apartments under construction may help relieve pressure on rents.The complexity of the housing affordability crisis suggests there is no quick fix. However, with concerted efforts to increase supply and reform regulatory practices, there is potential for a more balanced and accessible housing market. “`

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

Ultra-Wealthy Buyers: Shaping the Future of Luxury Real Estate

Luxury home prices are soaring, with an 8.8% year-over-year increase in Q2 2024, according to a Redfin report. This surge is more than double the rate of non-luxury homes, underscoring a fascinating trend in the real estate market.

Luxury home prices are soaring, with an 8.8% year-over-year increase in Q2 2024, according to a Redfin report. This surge is more than double the rate of non-luxury homes, underscoring a fascinating trend in the real estate market.

Understanding the Ultra-Wealthy Buyer

While sales of non-luxury homes have plummeted to their lowest in a decade, luxury home sales have inched up by 0.2%. The secret behind this resilience? The ultra-wealthy buyers, defined as those with at least $30 million in liquid assets, who are transforming the market with their strategic approaches. As Andrea Saturno-Sanjana from Coldwell Banker Warburg explains, these individuals often acquire wealth through their own efforts and approach real estate with a business mindset.

Market Savvy and Investment Focus

Ultra-wealthy buyers are highly informed about market values, often viewing properties as investments. According to Lorraine Baker, they have a keen eye for value and are not afraid to walk away if a deal doesn’t meet their expectations. This knowledge extends to understanding the costs of new constructions and renovations, as noted by Pate Stevens.

Long-Term Vision and Emotional Detachment

These buyers think long-term, often considering legacy and future appreciation potential in their purchases. Tate Kelly highlights their interest in properties that can display high-end artwork, viewing art as a strategic investment. This long-term perspective is coupled with a lack of emotional attachment, as Peter Mac points out, allowing them to make rational decisions without urgency.

Discretion and Unique Properties

Discretion is key for these buyers, as noted by Vickey Barron. They keep their intentions private to avoid driving up prices. Additionally, they seek unique properties in prime locations, a sentiment echoed by Jim Hayes and Ben Bacal.

Cash Offers and Strategic Networks

The ultra-wealthy often leverage cash offers to strengthen their negotiating position. Maria Kourepenos emphasizes the importance of experienced real estate agents and a network of professionals to navigate the complexities of luxury purchases.

Lessons for the Average Buyer

While not everyone can match the financial prowess of the ultra-wealthy, there are valuable lessons to be learned. Engaging with knowledgeable professionals, understanding market trends, and considering long-term value can enhance any homebuying journey. As Michelle Schwartz suggests, securing loan approval in advance can provide a competitive edge, even in a cash-dominated market.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

Office Space Transformation: A Post-Pandemic Opportunity

Office Space Transformation: A Post-Pandemic Opportunity

The COVID-19 pandemic has dramatically reshaped the landscape of commercial real estate in the United States. As remote work became the norm, office vacancy rates soared to unprecedented levels, leaving many urban centers with empty office buildings. This shift has sparked a new trend: converting vacant office spaces into housing.According to a report from the Center for American Progress, the United States is currently short 3.8 million housing units, and the adaptive reuse of office buildings is seen as a potential solution to this crisis. The report highlights that the Biden-Harris administration supports these conversions as a means to increase the housing supply while addressing the financial woes of commercial real estate owners.

Challenges and Opportunities

While converting office space into residential units offers potential benefits, it is not without challenges. The report emphasizes that financing, building layout, and market conditions are significant hurdles. Office buildings, especially those classified as Class B and C, often feature designs that are not conducive to residential use, lacking natural light and adequate plumbing for multiple units.

Despite these challenges, there are notable examples of successful conversions. Cities like Los Angeles and Alexandria, Virginia, have led the way in transforming office spaces into housing units. These cities have leveraged government incentives and streamlined zoning regulations to facilitate the conversions.

Government Initiatives

State and local governments are increasingly offering incentives to encourage office-to-housing conversions. For instance, California has allocated $400 million for such projects, while Wisconsin has introduced interest-free loans to support developers. These initiatives aim to address the affordable housing shortage and revitalize urban centers.

At the federal level, the Biden-Harris administration has released a guidebook outlining programs to support these conversions. The administration is focused on ensuring that new residential properties are not only affordable but also energy-efficient, aligning with broader climate goals.

Recommendations

The Center for American Progress report offers several recommendations to enhance the feasibility of office-to-housing conversions. It suggests integrating these projects into mixed-use development plans, utilizing climate-focused financial resources, and exploring all viable options to increase the overall housing supply. These strategies aim to create vibrant, sustainable urban environments that meet the housing needs of the population.

As cities continue to grapple with the dual challenges of office vacancies and housing shortages, the conversion of office spaces into residential units presents a promising opportunity. With the right incentives and strategic planning, these projects can play a crucial role in shaping the future of urban living.

“`Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

Blockchain in Real Estate: A Revolution Unfolds

Blockchain in Real Estate: A Revolution Unfolds

The real estate industry, long perceived as a bastion of tradition, is on the brink of a technological revolution. Enter blockchain technology, a digital innovation promising to transform property transactions by enhancing security, transparency, and efficiency. According to a survey, 35% of real estate companies globally have already embraced some level of blockchain integration, with the market expected to soar to $3.8 billion by 2025.What Is Blockchain in Real Estate?

Imagine a world where buying or selling property is as simple as a few clicks. Blockchain is making this a reality by introducing smart contracts—self-executing agreements that eliminate intermediaries. When a property is sold, these contracts automatically enforce the deal’s terms, ensuring seamless transactions.Benefits of Blockchain in Real Estate

- Enhanced Security: Blockchain’s decentralized nature makes it a digital fortress, safeguarding transactions with encrypted links.

- Reduced Costs: By removing brokers and banks, blockchain slashes transaction fees, saving time and money.

- Increased Speed: Transactions that once took weeks now conclude in days, thanks to blockchain’s efficiency.

- Tokenization: This allows for fractional property ownership, opening real estate investment to a global audience.

Real-World Applications

The potential of blockchain is already being realized through platforms like Propy, which streamlines international property deals online. Ubitquity is modernizing title management with tamper-proof records, while ShelterZoom offers digital solutions for real estate transactions.The State of Blockchain and Real Estate Today

Major industry players like Cushman & Wakefield and Microsoft are investing in blockchain to enhance data management and create more interactive property platforms. Additionally, the tokenization of assets is being explored by financial giants like JPMorgan, offering new investment avenues.The Future of Real Estate Transactions

Blockchain is not just a buzzword; it’s the future of real estate. By embracing this technology, the industry can achieve unprecedented levels of productivity and innovation. As blockchain continues to gain traction, it promises to redefine how we approach property transactions.FAQs

Which cryptocurrencies are tied to real estate?

Cryptocurrencies such as Brick, ELYSIA, and Propy are currently linked to real estate, facilitating smoother transactions and fractional ownership.How can I invest in real estate blockchain?

You can invest by purchasing tokenized properties or joining blockchain-based platforms, allowing you to own a fraction of real estate from anywhere.Can you sell a house on the blockchain?

Yes, property can be tokenized and sold using smart contracts, streamlining the process.Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

Transforming Urban Landscapes: The Push for Zoning Reform to Expand Affordable Housing

Transforming Urban Landscapes: The Push for Zoning Reform to Expand Affordable Housing

Recent developments have spotlighted a critical issue in urban America: the housing affordability crisis. With over 45 million U.S. households renting, many face severe financial strains due to high rental costs. The Center for American Progress’s report delves into potential solutions through local land-use reforms aimed at alleviating these pressures.

The study reveals daunting statistics—nearly 11.2 million households spend over half their income on rent. This housing cost burden signals an urgent need for comprehensive strategies to ease financial pressures on renters and potential homeowners alike. The current housing market challenges, driven by historical zoning ordinances that limit affordable options, point to a reform path that could significantly alter the landscape.

Local Land Use Reform as a Key Solution

The push for reforming zoning laws focuses on expanding the supply of affordable housing by revisiting and updating restrictive local policies. Traditional zoning practices have long favored single-family homes, inadvertently fostering exclusion and driving up housing costs. By transitioning to more inclusive zoning codes, communities can potentially unlock a diverse range of housing solutions—without the reliance on federal or state subsidies.

Federal Initiatives and Grassroots Movements

The federal government’s proposed Building Opportunity program could be pivotal, offering financial incentives to jurisdictions that commit to significant zoning reforms. These reforms promise to open high-frequency transit corridors and urban areas to a variety of housing types, thus promoting greater accessibility and affordability.

Cities like Minneapolis and states including Florida have already spearheaded initiatives to reduce zoning constraints, signaling a promising trend towards more affordable urban living solutions. The city eliminated parking mandates and expanded zoning to allow multifamily units, significantly transforming its housing landscape.

Conclusion: A Path Forward

This surge in regulatory reform is gaining momentum, evidenced by grassroots actions and the backing of federal incentives. As local governments begin dismantling barriers to affordable housing, the vision of a more inclusive and economically vibrant urban future becomes increasingly attainable.

The ongoing conversation highlights the vital role of reforms in realizing equitable growth and alleviating the housing crisis that has gripped communities nationwide. As the Center for American Progress notes, these initiatives not only build opportunity but also play a central role in mitigating deep-rooted inequalities in housing availability and affordability.

For more insights, read the full article on Building Opportunity: Expanding Housing in America by Reforming Local Land Use.

—

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

How Blockchain is Revolutionizing Real Estate Transactions

The Transformative Power of Blockchain

Imagine a world where buying or selling property is as simple as a few clicks. This is the promise of blockchain technology in real estate. By utilizing blockchain technology, the industry is poised to undergo a significant transformation. Smart contracts, for instance, are self-executing agreements that automatically enforce the terms of a deal, eliminating the need for intermediaries. This not only speeds up the process but also reduces costs.

Key Benefits of Blockchain in Real Estate

- Enhanced Security: Blockchain’s decentralized nature makes it incredibly difficult to hack, ensuring that each transaction is secure.

- Reduced Costs: By removing intermediaries such as brokers and lawyers, blockchain can significantly cut transaction costs.

- Increased Speed and Efficiency: Transactions that once took weeks can now be completed in days or even hours.

- Greater Accessibility: Blockchain opens up real estate markets to a global audience, allowing investors worldwide to participate.

- Immutable Records: Once data is entered into the blockchain, it cannot be changed, ensuring accuracy and reliability.

Leading Examples in the Industry

Several companies are already paving the way for blockchain in real estate. Propy is revolutionizing international property transactions by allowing users to complete deals entirely online. Ubitquity is bringing title management into the digital age, offering a secure way to record and verify property ownership. Meanwhile, ShelterZoom is making real estate transactions digital and hassle-free, using smart contracts to automate agreements.

The Future of Real Estate Transactions

The future of real estate is bright with blockchain technology. Major players in the industry, such as Cushman & Wakefield and Microsoft, are already exploring blockchain solutions to enhance data collection and improve property platforms. The potential for smoother transactions and increased transparency makes blockchain a game-changer for the industry.

By embracing blockchain, real estate professionals can boost productivity and rethink how transactions are conducted. As the global market size of real estate blockchain is expected to reach $3.8 billion by 2025, the time to adopt this technology is now.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

Understanding the Growing Importance of Cyber Insurance

Understanding the Growing Importance of Cyber Insurance

In today’s digital landscape, cyber insurance has emerged as a critical component of a modern security strategy. With cyber incidents on the rise and associated business costs soaring, many experts view it as indispensable. The global cyber insurance market is projected to reach a staggering $90.6 billion by 2033, underscoring its escalating relevance.

Challenges in Current Cyber Insurance Policies

Despite its necessity, many organizations find that their cyber insurance policies are not working effectively. According to a 2023 Delinea report, there is a growing disconnect between carriers and enterprises, leading to numerous claims being rejected. This issue is particularly prevalent among small businesses, which face an increase in cyberattacks yet often remain uncertain about their coverage details.

A striking example comes from a 2022 report by the UK’s Federation of Small Businesses, revealing that 38% of its members with cyber insurance do not know what their policy includes. Furthermore, a recent study by Aviva found that only 17% of small businesses have cyber insurance, illustrating the widespread skepticism and lack of adoption in the sector.

Barriers to Effective Coverage

One of the primary barriers to effective cyber insurance coverage is the complexity and ambiguity of policy terms. Tarnveer Singh, CISO of The Exeter, highlighted that this can lead to disputes and delays during cyber incidents, exacerbating stress and financial strain for policyholders. The evolving nature of cyber threats adds another layer of complexity, often resulting in inadequate or overpriced policies.

Additionally, the growing cost of premiums, projected to increase by 25-30% annually until 2025 by S&P Global Ratings, further complicates matters for small and medium-sized enterprises (SMEs).

Enhancing Cyber Insurance Effectiveness

To make cyber insurance more effective, insurers must offer customizable policies tailored to the specific needs of businesses. Amar Patel, a CISO in financial services, emphasized the importance of innovating product development to align with the evolving cyber threat landscape. This approach can provide more relevant insurance products and encourage broader adoption among SMEs.

Insurers should also improve transparency in policy terms and streamline the claims process, making it more accessible and efficient for businesses. This includes simplifying documentation requirements and establishing clear communication channels to expedite claim assessments and settlements.

Future Directions for Cyber Insurance

Looking to the future, cyber insurers are advised to consider providing holistic risk management services to enhance their offerings. These services could include cybersecurity assessments, incident response planning, and employee training, helping organizations proactively manage cyber risks.

Moreover, collaboration with the cybersecurity industry is crucial. By building closer relationships, insurers can gain insights into the evolving threat landscape and refine their risk assessment models. This partnership can lead to the development of joint frameworks for cyber risk assessment, standardizing and streamlining the process.

Conclusion

Cyber insurance is an essential part of modern cybersecurity strategies, but it remains a relatively young sector with room for growth. Addressing the challenges in policy application and fostering collaboration with the cybersecurity industry will be key to enhancing its effectiveness and adoption in the coming years.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

Surviving the Storm: Navigating Insurance and FEMA After Hurricane Helene

Surviving the Storm: Navigating Insurance and FEMA After Hurricane Helene

In the aftermath of Hurricane Helene, homeowners in North Carolina face the daunting challenge of securing compensation from insurance companies and the federal government. As reported by Christopher Flavelle and Emily Flitter of The New York Times, the process can be both infuriating and baffling, yet it is essential for recovery.

The key to overcoming these obstacles lies in meticulous documentation and understanding of insurance policies. As homeowners grapple with the aftermath, experts emphasize the importance of photographing damage and keeping detailed records of all interactions with insurers and government agencies.

Insurance Challenges

Many insurers are increasingly dropping customers who file claims, making it crucial for policyholders to understand their coverage specifics. With disaster-related deductibles often ranging from $1,000 to $5,000, homeowners must weigh the potential risks of filing claims for minor damages.

Flood damage presents another layer of complexity. Most standard home insurance policies do not cover flood damage, and distinguishing between flood and other types of damage is essential. According to Douglas Heller of the Consumer Federation of America, many homes in North Carolina suffered from landslides or mudflows, which may not be covered without specialized flood insurance.

Seeking Professional Help

When disputes arise, public adjusters and legal aid can be invaluable. Public adjusters negotiate with insurers to secure larger settlements, while legal assistance may be necessary if disputes remain unresolved. Chip Merlin, a Tampa-based lawyer, advises consulting legal professionals, especially for substantial claims.

FEMA Assistance

For those without adequate insurance, FEMA’s Individual Assistance program offers a lifeline. The program provides emergency housing assistance and other forms of aid. However, as highlighted by Reese May of SBP, appealing FEMA’s decisions can significantly increase the amount of assistance received.

For more information on FEMA housing assistance, visit their official website.

Community and Government Aid

In addition to insurance and FEMA, survivors can explore other avenues for assistance. Low-interest loans from the U.S. Small Business Administration, crowdfunding campaigns, and charitable organizations provide vital support. In cases of major disasters, Congress may authorize additional funding through the U.S. Department of Housing and Urban Development.

As the journey to recovery continues, the resilience and persistence of affected communities remain crucial. By staying informed and proactive, homeowners can navigate the complexities of post-disaster recovery with greater confidence and assurance.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

Tackling America’s Housing Affordability Crisis: The Power of Zoning Reform

Amidst the growing housing affordability crisis in the United States, a new proposal seeks to tackle the issue head-on by reforming local land use regulations. The Center for American Progress highlights the need to overhaul outdated zoning laws that have historically restricted housing supply, exacerbating the crisis.

Understanding the Crisis

According to recent data, nearly half of all rental households in America are cost-burdened, spending over 30% of their income on rent. This financial strain is even more pronounced in areas with strong employment growth, where housing costs are highest. The paradox is clear: regions with the most economic opportunities present the greatest barriers to affordable housing.

The Role of Local Zoning

A significant contributor to the housing crisis is local zoning ordinances that limit the construction of new housing, particularly affordable options. Reforming these regulations is crucial to easing the housing cost burden. Possible reforms include allowing taller apartment buildings along transit corridors and reducing parking requirements.

However, reforming zoning is not a standalone solution. It must be complemented by federal, state, and local programs that fund low-income housing projects. The federal government could play a pivotal role by incentivizing local jurisdictions to undertake substantial zoning reforms through a proposed Building Opportunity program.

Incentivizing Change

The Building Opportunity program, as proposed, would offer flexible funding to local governments that commit to significant zoning reforms. This initiative builds on the Biden-Harris administration’s 2022 Housing Supply Action Plan and HUD’s Pathways to Removing Obstacles to Housing (PRO Housing) program.

The theory is that local political opposition, not technical planning capacity, is the primary barrier to zoning reform. By offering substantial federal funding in exchange for zoning changes, local governments could be motivated to break the political logjam and embrace more inclusive growth.

Grassroots Reform Efforts

Some cities have already started to amend their zoning codes to permit more diverse housing options. For instance, Minneapolis eliminated single-family zoning citywide, allowing for the construction of triplexes. Similarly, the state of Florida passed the Live Local Act, which preempts certain local zoning laws to encourage multifamily housing development.

These efforts, while promising, need to be scaled up nationwide. The proposed federal incentives could serve as a catalyst for widespread reform, allowing market forces to play a larger role in meeting housing needs.

Conclusion

Reforming local land use regulations is a critical step in addressing the housing crisis in America. While more permissive zoning will not solve the issue overnight, it is a necessary move towards allowing private developers to contribute to the housing supply. The federal government’s role in incentivizing these changes could be the key to unlocking new housing opportunities across the nation.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

Deloitte’s 2025 Commercial Real Estate Outlook: Opportunities and Challenges

Global Economic Insights

In a world where economic forecasts shape strategic decisions, the insights from various regions are crucial. The United States Economic Forecast: Q2 2024 by Robyn Gibbard highlights the resilience and potential growth in the U.S. economy. Meanwhile, the Eurozone economic outlook by Dr. Alexander Boersch and Dr. Pauliina Sandqvist, and the India economic outlook by Dr. Rumki Majumdar, provide a broader perspective on international economic conditions. These reports collectively paint a picture of a global economy poised for transformation.

Strategic Positioning and Technological Advancements

As organizations look to the future, embracing technological advancements and adapting to policy changes become imperative. The evolving landscape of real estate is influenced by factors such as financial strategies and technological innovations. The Global economic outlook by Ira Kalish emphasizes the need for real estate entities to leverage technology to stay competitive and relevant in an ever-changing market.

Policy and Financial Strategies

The report also delves into the impact of policy changes and financial strategies on the real estate sector. As organizations navigate challenges, they must also explore innovative financial strategies to secure their future. The integration of sustainable practices and the adoption of new technologies are key components in this strategic realignment.

In conclusion, the 2025 commercial real estate outlook presents a generational opportunity for organizations to redefine their strategies and embrace the future. By understanding the economic forecasts and adapting to emerging trends, the sector can overcome current challenges and position itself for sustained growth.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

AI’s Role in Shaping Our Work Lives

Exploring the Future: AI’s Role in Shaping Our Work Lives

As artificial intelligence (AI) continues to evolve at an astonishing pace, its impact on the job market is becoming a focal point of discussion. A recent article from Futurist Speaker presents a compelling set of 25 questions designed to help individuals navigate the potential influence of AI on their careers and industries.Automation and Job Security

One of the key areas explored is the possibility of automation and its implications for job security. While AI could relieve workers from repetitive tasks, there’s a looming concern about roles becoming redundant. This duality underscores the need for a proactive approach in adapting to AI’s capabilities.

Human Skills vs. AI Replication

The article delves into the unique human skills that AI might struggle to replicate, such as emotional intelligence and creativity. However, as AI technology advances, even these skills may face challenges, prompting individuals to continuously enhance their skillsets.

Emerging Roles and Ethical Considerations

AI’s integration into the workplace is likely to give rise to new roles, such as AI trainers and ethics officers. These roles not only offer fresh career paths but also highlight the importance of addressing ethical considerations in AI deployment. For more on this, visit The Coming AI Job Explosion.

AI’s Impact on Income and Collaboration

The potential for AI to affect wage structures and income inequality is another critical discussion point. While AI could enhance productivity, it might also concentrate benefits among a select group. Furthermore, the article envisions new forms of human-AI collaboration, which could redefine workplace dynamics.

Adapting to an AI-Driven Future

To thrive in an AI-influenced job market, the article emphasizes maintaining a growth mindset and embracing lifelong learning. As AI reshapes industries, staying informed about developments and being adaptable will be crucial for success. Further insights can be found in The Great AI Disruption: Six Startling Predictions That Will Shape Our Lives and Test Our Limits.

Final Thoughts

The future impact of AI on the job market is not predetermined. By engaging in self-reflection and critical thinking, individuals can better prepare for the changes ahead. The article from Futurist Speaker encourages readers to focus on developing uniquely human skills while embracing AI technologies, ultimately fostering a future where humans and AI collaborate to create greater value.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

Tokenization: Reshaping Financial Landscapes

Tokenization: Reshaping Financial Landscapes

The advent of blockchain technology and decentralized finance (DeFi) is revolutionizing how we perceive and interact with financial markets. Central to this transformation is the concept of tokenization, a process that converts assets into digital tokens on a blockchain, enhancing security, accessibility, and liquidity.Tokenization is breaking down traditional barriers by fractionalizing assets, allowing investors with modest incomes to access markets like real estate and art. This democratization is particularly transformative for sectors historically dominated by high entry requirements. By 2030, real estate is expected to become the largest type of tokenized asset, signaling a significant shift in investment landscapes.

Understanding Tokenization

Tokenization involves transforming ownership of tangible and intangible assets into digital tokens, each representing a stake in the asset’s value or returns. These tokens are stored on a blockchain, ensuring data integrity and security through its decentralized nature. This technological foundation prevents unauthorized alterations and fraud, providing a robust system for verifying and tracking ownership.

The real advantage lies in fractionalizing assets, opening investment opportunities to a broader audience. This approach democratizes investment, particularly in markets like real estate and fine art, traditionally dominated by high entry barriers.

Impact on Real Estate and Art

Real estate, characterized by high capital requirements and transactional complexity, is undergoing a transformation through tokenization. It utilizes DeFi to make property investment more accessible and liquid. Investors can now invest in real estate with considerably lower initial capital through fractional shares, broadening the pool of potential investors and enhancing market liquidity.

Similarly, the art market is experiencing a revolution. Investors can purchase fractional shares in art, a market historically requiring significant upfront capital and insider knowledge. Tokenization lowers financial barriers, increasing liquidity and dynamism.

This type of asset is more liquid because it can be bought and sold on digital platforms without physical paperwork or face-to-face meetings. This liquidity allows investors to convert their investments into cash much faster than traditional real estate or art sales.

Addressing Challenges

While the potential is revolutionary, tokenization faces hurdles, including regulatory uncertainties, technological integration difficulties, investor skepticism, and scalability issues. The industry should explore regulatory technology (RegTech) to enhance compliance and adapt to changing legal frameworks efficiently.

Advancements in blockchain infrastructure, such as Layer-2 solutions, are crucial for scaling tokenization to meet enterprise demands. Educating potential investors and building robust business cases are also pivotal in overcoming skepticism and demonstrating the tangible benefits and security measures associated with tokenized assets.

The Future of Financial Ecosystems

The integration of DeFi frameworks and tokenization is reshaping financial markets, creating a more inclusive environment. As these technologies mature, they promise to redefine economic interactions and enhance the efficacy of financial systems, marking a shift towards a more equitable financial future.

Disclaimer: The views expressed in this article are those of the author and do not necessarily reflect the opinions of CCN, its management, or its employees. This content is intended for informational purposes and should not be construed as professional advice.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

Revolutionizing Real Estate: The AI and Blockchain Advantage

Revolutionizing Real Estate: The AI and Blockchain Advantage

In an era where technology is reshaping industries at an unprecedented pace, the real estate sector is no exception. As reported by Inman, the integration of AI and blockchain technology is set to transform how real estate professionals conduct business, offering a competitive edge in a rapidly evolving market.Streamlining Transactions and Security

The marriage of AI and blockchain promises to streamline transaction processing, significantly reducing paperwork and processing time. This newfound efficiency allows agents to handle more deals at their own pace, enhancing productivity and client satisfaction. Furthermore, the use of smart contracts ensures automated and transparent contract execution, minimizing disputes and expediting deal closures.

Blockchain technology also enhances security and transparency in property records, reducing the risk of fraud. This assurance of secure, transparent transactions fosters trust among clients, a vital component in attracting more business.

Global Market Outreach and Automation

With platforms like Propy, agents can expand their reach to a global marketplace, facilitating seamless cross-border transactions. This global outreach increases the likelihood of connecting with suitable buyers and sellers, ultimately leading to more deals.

Moreover, the adoption of AI and blockchain in real estate listings and buyer presentations significantly boosts the chances of being hired. The tech-savvy new generation demands tech-smart agents, while the older generation recognizes the opportunities that new technology brings to buying and selling homes.

Automation is another game-changer, potentially driving US transactions to 20 million homes sold annually, compared to the current 4-5 million. This surge in transactions will enable professional agents to close more deals faster each year.

Embracing the Digital Shift

The digital shift in finance and investment is led by giants like BlackRock, which has launched a Bitcoin ETF and aims to tokenize $10 trillion in assets. This reflects the rise of Real World Assets (RWA) tokenization, promising enhanced liquidity, ownership evidence, and transparency. BlackRock’s $39 billion real estate tokenization initiative aims to revolutionize property ownership, boosting market liquidity and transaction speed while ensuring integrity and reducing fraud risk.

In a real-world scenario, a Miami agent utilized Propy to streamline identity verification, analyze agreements, and send deposit links, impressing clients with efficiency. Platforms like Propy Title and Escrow further enhance transaction security with blockchain and smart contracts, providing a seamless experience for all parties involved.

Conclusion

The integration of AI and blockchain technology is poised to reshape the real estate industry significantly. Agents and brokers who embrace and adapt to these advancements will be well-positioned to capitalize on new opportunities, enhance their services, and drive success in the future.

Image:

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

New York City’s Commercial Real Estate on the Brink: A ‘Doom Loop’ Warning

Office Vacancies and Economic Impact

Office Vacancies and Economic ImpactThe rise of remote work, accelerated by the COVID-19 pandemic, has left a significant mark on urban office spaces. In New York City, office vacancies have soared to unprecedented levels, with nearly 20% of spaces sitting empty. This vacancy rate not only hemorrhages potential revenue but also shrinks the city’s tax base, a concern echoed in Colliers’ report.

Van Nieuwerburgh warns that the repercussions of these vacancies could extend far beyond real estate. The anticipated decline in tax revenue may force the government to cut spending on essential services such as transportation, education, and sanitation, making urban living less attractive and potentially driving residents to relocate to states with more favorable tax environments.

Changing Office Space Preferences

As companies adapt to new work paradigms, the demand for office spaces has shifted. Businesses are now seeking smaller, modern offices equipped with amenities to entice employees back to in-person work. This trend, as noted by Fred Cordova, CEO of real estate consultancy Corion Enterprises, is putting pressure on traditional office buildings, many of which face refinancing challenges due to expiring loans from the post-financial crisis era.

Banking Sector Vulnerabilities

The banking sector, particularly smaller regional banks, is heavily exposed to the commercial real estate market. According to Van Nieuwerburgh, these banks hold a significant portion of the $6 trillion in commercial real estate debt in the United States. With the potential for rising vacancies and declining property values, these financial institutions could face severe instability unless market conditions improve.

Potential Solutions and the Path Forward

To avoid the grim scenario outlined by Van Nieuwerburgh, substantial policy interventions are necessary. These could include strategic investments in public infrastructure and incentives to attract businesses back to urban centers. Without decisive action, the city risks entering a cycle of economic decline, echoing the fiscal challenges of the 1970s.

As New York City stands at this critical juncture, the insights from Fortune’s detailed analysis serve as a clarion call for city leaders and stakeholders to address these pressing challenges head-on.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

The Migration Shift: Affordable Housing’s Role in Changing US Migration Trends

A recent analysis by Zillow, leveraging data from United Van Lines, reveals a significant shift in interstate migration patterns. Last year, individuals often moved to regions where housing markets were less competitive, and new home construction was keeping pace with demand. On average, homes in these new metros were approximately $7,500 cheaper than those in the areas people left behind.

Migration Trends Driven by Affordability

Orphe Divounguy, a senior economist at Zillow, emphasizes the pivotal role of affordability in shaping these migration patterns. “Housing affordability has always mattered…and you’re seeing it across the country,” he notes, highlighting how this factor is influencing where people choose to live.

Jessica Lautz, deputy chief economist at the National Association of Realtors, points to a strong migration flow into states like Florida, North Carolina, South Carolina, Tennessee, and Texas. These regions are increasingly popular due to their combination of affordable housing options and robust job markets.

- Charlotte, North Carolina

- Providence, Rhode Island

- Indianapolis, Indiana

- Orlando, Florida

- Raleigh, North Carolina

These cities, among others, have become magnets for movers seeking not only affordable living but also substantial employment opportunities. For instance, Charlotte and Raleigh have emerged as tech and financial hubs, attracting workers from more expensive metro areas like New York City.

Economic and Job Factors

The appeal of these Southern and Midwestern cities lies not only in their affordability but also in their dynamic job markets. As Divounguy notes, these areas are “markets where jobs are being created rapidly,” providing a dual incentive for relocation—affordable housing and employment prospects.

As the real estate market continues to face a low supply of active listings, builders are stepping in to fill the gap, but only in areas where it is financially viable for both buyers and builders. This has led to a rise in the popularity of these relatively more affordable markets.

Conclusion

As the landscape of American housing continues to evolve, the influence of affordability on migration trends becomes increasingly evident. With states like Florida and the Carolinas leading the charge, the search for affordable housing coupled with promising job markets is set to redefine where and how Americans choose to live.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

Washington State Department of Commerce Awards $220,000 in Growth Management Grants

In a bold move to address the pressing housing needs of Washington’s most vulnerable residents, the Washington State Department of Commerce has awarded $220,000 in growth management grants to seven community partnerships. This initiative is part of a larger effort to meet the projected demand for over 1.1 million new housing units over the next 20 years, half of which are earmarked for residents earning less than half of their area median income.

Commerce Director Mike Fong emphasized the importance of housing security, stating, “Housing security, especially for our most vulnerable residents, is top of mind for many communities across the state.” With this in mind, the Department of Commerce is equipping local communities with the tools and resources necessary to tackle housing challenges head-on, laying the groundwork for a more equitable future.

Innovative Planning Tools

The department has introduced a first-of-its-kind toolkit designed to guide local governments in meeting the housing needs of their lowest-income residents. Developed in collaboration with Abt Associates and the Corporation for Supportive Housing (CSH), these tools include:

- STEP Model Ordinance, User Guide, and Best Practice Report to assist local jurisdictions in developing their own ordinances.

- STEP State of the Practice Report summarizing best practices for the development of emergency and supportive housing.

- Four STEP Case Studies showcasing successful implementations in King County, Spokane, Vancouver, and Wenatchee.

- STEP Communications Toolkit to aid jurisdictions in communicating the benefits and challenges of STEP.

Grant Awards and Collaborative Efforts

In addition to the planning tools, the department has distributed an additional $220,000 through Coordinated Low-Income Housing Planning (CLIHP) grants to support the coordination of land use and homeless services planning. To date, $460,000 has been awarded across 13 counties.

Kimberly Hendrickson, Housing, Health, and Human Services Director for the City of Poulsbo, highlighted the impact of these grants, noting that they provide opportunities for collaboration with neighboring areas like Bainbridge Island to explore STEP options and establish shared goals. The latest list of grant awards further outlines these collaborative efforts.

With the grant application period remaining open until funds are exhausted, eligible applicants can receive up to $25,000 to support their planning efforts. For more details, see the CLIHP grant instructions.

Conclusion

By providing both financial resources and insightful tools, the Washington State Department of Commerce is setting a proactive example of sustainable and inclusive community planning. This comprehensive effort signifies a concerted push towards meeting housing demands and ensuring that vulnerable populations find opportunities for stable habitats.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.