The Rise of Central Bank Digital Currencies: Reshaping Global Finance

Understanding the Emergence of Central Bank Digital Currencies

Central bank digital currencies (CBDCs) are reshaping the financial landscape, emerging as a pivotal innovation in the digital age. Unlike decentralized cryptocurrencies, CBDCs are digital forms of a nation’s fiat currency, issued and regulated by central banks. This distinction ensures stability and trust, akin to traditional money.Exploration and Implementation

Around the globe, countries are actively exploring the integration of CBDCs into their financial systems. This forward-thinking move aims to enhance financial inclusion, streamline cross-border transactions, and provide a stable alternative to the volatile cryptocurrency market. Nations such as Jamaica, Nigeria, and The Bahamas have already implemented CBDCs, signaling a new era in digital finance. These currencies maintain the core attributes of fiat money while leveraging the efficiencies of distributed ledger technologies.:max_bytes(150000):strip_icc()/terms_c_central-bank-digital-currency-cbdc_FINAL-671aefb2905b407583007d63fa46e49d.jpg)

Key Advantages of CBDCs

CBDCs offer a myriad of benefits. For consumers, they promise enhanced convenience and security in financial transactions, reducing dependence on physical cash. Central banks, meanwhile, gain a powerful tool to implement monetary policies, manage inflation, and establish direct connections with the public. Additionally, CBDCs can bolster the global standing of a nation’s currency, exemplified by the enduring influence of the U.S. dollar.Challenges and Considerations

The path to widespread CBDC adoption is not without its challenges. Concerns about privacy, cybersecurity, and the impact on existing financial systems are paramount. These issues must be addressed to prevent potential destabilization of current monetary frameworks. As highlighted in the original article, the balance between innovation and stability is crucial.The Way Forward

Despite these hurdles, the move towards digital currencies marks a transformative phase for global economies. As more countries embark on pilot programs and develop the necessary technological infrastructure, the financial landscape continues to evolve. This evolution promises a more inclusive and efficient future for transactions and economic operations worldwide.For a deeper dive into the intricacies of CBDCs and their global impact, visit the comprehensive exploration available at Investopedia. “`

More Articles

Getting licensed or staying ahead in your career can be a journey—but it doesn’t have to be overwhelming. Grab your favorite coffee or tea, take a moment to relax, and browse through our articles. Whether you’re just starting out or renewing your expertise, we’ve got tips, insights, and advice to keep you moving forward. Here’s to your success—one sip and one step at a time!

Exploring the Future: AI Projects for All Levels

Exploring the Future: AI Projects for All Levels

In a world where technology is rapidly evolving, Artificial Intelligence (AI) is at the forefront, reshaping industries and altering our everyday lives. Recently, Simplilearn published an insightful article detailing the top 30 AI project ideas for 2025, offering a comprehensive guide for enthusiasts from beginners to advanced practitioners.Impact of AI Across Industries

AI’s transformative power is evident across multiple sectors. In healthcare, AI-driven diagnostics and personalized medicine are revolutionizing patient care. The financial industry benefits from enhanced fraud detection and risk assessment capabilities. Manufacturing sees improvements through predictive maintenance and optimized production processes, while transportation is becoming safer with autonomous vehicles and intelligent traffic systems. Education is also being personalized, making learning more accessible.

However, AI’s influence extends beyond industry-specific applications. It is reshaping the job market, demanding new skills and creating innovative opportunities. This technological shift brings with it ethical and social concerns, such as privacy and job displacement, necessitating careful management and regulation.

Beginner to Advanced AI Projects

For those eager to dive into AI, the article outlines a series of projects that cater to different skill levels. Beginners can start with projects like a Spam Email Detector or Sentiment Analysis of Product Reviews. These projects introduce fundamental AI concepts using machine learning algorithms like Naive Bayes.

Intermediate projects such as a Chatbot for Customer Service or an Image Classification System allow developers to delve deeper into natural language processing and computer vision. Meanwhile, advanced projects like an Autonomous Driving System or AI-Based Medical Diagnosis System require a sophisticated understanding of AI and machine learning algorithms.

Building a Career in AI

Embarking on a career in AI involves a blend of education, practical experience, and continuous learning. The article suggests starting with a strong foundation in mathematics and computer science, followed by engaging in practical projects and participating in competitions on platforms like GitHub. Specializing in areas like robotics or natural language processing can further enhance one’s career prospects.

For those looking to formalize their education, Simplilearn offers a Professional Certificate Program in AI and ML in collaboration with Purdue University, designed to equip learners with the necessary skills to thrive in this dynamic field.

Conclusion

Delving into AI projects is a thrilling journey of creativity and development. For those seeking to deepen their understanding and mastery of AI, Simplilearn’s Post Graduate Program in AI and Machine Learning offers a comprehensive curriculum, real-world projects, and practical learning experiences.

FAQs: Navigating the AI Landscape

What is the difference between machine learning and deep learning?

Machine learning, a subset of AI, enables computers to learn from data. Deep learning, a further specialization, uses multi-layered neural networks for more complex pattern recognition.Can AI replace human jobs, or will it create new opportunities?

While AI can automate tasks, potentially displacing jobs, it also creates roles in development, maintenance, and oversight, emphasizing the need for skills adaptation.How to learn AI for free?

Simplilearn’s SkillUp resources offer free learning opportunities for those seeking to enhance their AI knowledge.AI’s Transformative Role in Healthcare: The 2023 Shift in Patient Diagnostics

The Dawn of AI-Driven Diagnostics

AI has not only automated certain diagnostic tasks but, more importantly, augmented the abilities of medical professionals in making informed decisions. By swiftly analyzing vast amounts of data, AI assists in identifying diseases in their early stages, allowing for prompt and accurate interventions that greatly affect patient outcomes.Case Studies and Real-World Applications

In 2024, AI diagnostic tools, especially in the realm of medical imaging, have become remarkably precise. Such tools, leveraging advanced machine learning algorithms, have been recognized with numerous FDA approvals, particularly in radiology. The capability of AI to handle both structured and unstructured data has revolutionized healthcare, making AI indispensable in this field.Impact on Healthcare Delivery

The implications of AI integration in healthcare extend beyond mere diagnostics, redefining the essence of patient care itself. AI enables more personalized and effective treatment regimens, greatly enhancing patient experiences. By analyzing comprehensive patient data, AI facilitates personalized care, transcending the traditional one-size-fits-all approach and ensuring that treatments are tailored to individual needs.Personalization at the Forefront

One remarkable aspect of AI’s application in healthcare is its ability to enhance the accuracy of treatment plans. Through pattern recognition and data correlation, AI predicts the most effective treatments, minimizing trial and error. This significant improvement saves both time and resources in healthcare delivery.Real-world examples in 2024 illustrate the success of AI-driven treatment plans, particularly in oncology, where AI models integrate diverse types of clinical data. These models precisely predict treatment outcomes and personalize cancer care, advancing precision medicine.

Navigating Ethical Complexities

However, with these advancements come challenges, notably ethical and privacy concerns. As AI technology continues to evolve, issues surrounding data privacy, algorithmic bias, and the moral implications of AI decisions need addressing. Fairness, transparency, and respect for patient data confidentiality are crucial.Data Privacy and Security

With AI systems processing vast amounts of personal health data, safeguarding this information is critical. The industry faces the challenge of protecting patient data while harnessing AI’s potential for improving healthcare outcomes.Algorithmic Bias and Fairness

There’s an ongoing concern about biases in AI algorithms, which can stem from skewed data sets or flawed programming. Ensuring these algorithms are as objective and unbiased as possible is crucial for equitable healthcare delivery.Balancing AI and Human Judgment

Balancing AI with human judgment remains vital, ensuring that AI acts as a valuable tool to support, rather than replace, the expert decisions of medical professionals. As the future of AI in healthcare looks promising, ongoing efforts are essential to address ethical challenges, ensuring AI remains advantageous for all stakeholders in healthcare.Looking Ahead

The future of AI in healthcare is bright, but it necessitates a collaborative effort to address these ethical considerations. As AI continues to evolve, so too must approaches to managing these challenges, ensuring AI remains a beneficial tool for all in healthcare.About the Author: Dr. Liz Kwo, the chief commercial officer of Everly Health, is a recognized entrepreneur in healthcare, a practicing physician, and a faculty lecturer at Harvard Medical School. Her academic credentials include an MD from Harvard Medical School, an MBA from Harvard Business School, and an MPH from the Harvard T.H. Chan School of Public Health.

Unveiling the Future: Technology Trends to Watch in 2025

Unveiling the Future: Technology Trends to Watch in 2025

In an ever-evolving digital landscape, staying ahead of the curve is not just an option but a necessity. As we edge closer to 2025, the technological horizon is brimming with innovations poised to redefine industries and reshape our daily lives. According to a recent article on Simplilearn.com, 25 emerging technology trends are set to dominate the future, urging IT professionals to adopt a mindset of continuous learning and adaptation.Generative AI leads the pack as a transformative force, promising to revolutionize content creation across various sectors. With advancements in models like GPTs, the potential applications are vast, from design automation to interactive experiences. For those keen on diving deeper, Simplilearn offers an Applied Generative AI Specialization.

Quantum Computing is another game-changer, leveraging quantum mechanics to solve complex problems beyond the reach of classical computers. Its implications in cryptography and drug discovery are just the tip of the iceberg. Learn more about this groundbreaking technology in the Quantum Computing Tutorial.

The 5G Expansion continues to gain momentum, enabling transformative technologies like IoT and augmented reality by providing faster data speeds and more stable connections. This expansion is crucial for real-time communications, paving the way for innovations such as autonomous vehicles.

Virtual Reality (VR) 2.0 and Augmented Reality (AR) are set to offer even more immersive experiences, with applications ranging from gaming to education. As hardware evolves, these technologies are expected to become more integrated into our daily lives, enhancing how we interact with the digital world.

The Internet of Things (IoT) plays a pivotal role in smart cities, optimizing everything from traffic management to energy use. IoT technology is essential for managing urban complexities and improving residents’ quality of life.

In agriculture, Biotechnology is making strides with techniques like CRISPR, creating crops that are more resilient to environmental stresses. This is crucial for adapting to climate change and ensuring food security.

The journey doesn’t end here. The article delves into other significant trends, including Autonomous Vehicles, Blockchain Beyond Crypto, Edge Computing, and Personalized Medicine. Each of these technologies holds the promise of reshaping industries and creating new opportunities.

Preparing for Tomorrow’s Job Market

With these technological advancements come new career opportunities. By 2025, roles such as AI Specialist, Quantum Computing Engineer, and 5G Network Engineer will be in high demand. The evolving landscape highlights the importance of acquiring relevant skills to thrive in the future job market.Conclusion

As we navigate through these technological shifts, it becomes clear that the future is not just about adopting new tools but embracing a mindset of constant evolution. By staying informed and adaptable, professionals can position themselves at the forefront of innovation, ready to tackle the challenges and opportunities that lie ahead.Understanding the Legal and Ethical Challenges AI Poses in Oncology

Understanding the Legal and Ethical Challenges AI Poses in Oncology

The field of oncology is undergoing a transformation, driven by the rapid integration of artificial intelligence (AI) technology. These advancements promise unprecedented improvements in cancer detection, personalized treatment strategies, and patient support. However, as the integration of AI into oncology progresses, a myriad of legal and ethical challenges emerges.AI in Diagnosis and Treatment AI tools have been instrumental in enhancing the analysis of medical imaging data, such as MRI scans, CT scans, and mammograms. These algorithms are adept at identifying subtle patterns that might elude human observation, potentially leading to faster and more accurate cancer detection. AI also plays a crucial role in treatment delivery and decision-making, particularly in radiation therapy and immunotherapy regimen design.

Yet, the use of AI in diagnosis raises significant legal questions. Traditionally, human physicians are not held strictly liable for incorrect diagnoses or treatments if their conduct meets the standard of care. However, defining a legal standard for AI-related errors remains uncertain. Some propose a strict liability standard, holding manufacturers accountable for defects without needing to prove fault, while others suggest alternative product liability standards.

Legal Standards and Liability

The complexity of applying legal standards to AI tools is compounded by their evolving nature. AI algorithms often change as they process more data, challenging traditional product liability frameworks. Different jurisdictions are adopting varied approaches to liability, with the European Commission discussing a proposed AI Liability Directive for high-risk AI systems.

Legal Standards and Liability

The complexity of applying legal standards to AI tools is compounded by their evolving nature. AI algorithms often change as they process more data, challenging traditional product liability frameworks. Different jurisdictions are adopting varied approaches to liability, with the European Commission discussing a proposed AI Liability Directive for high-risk AI systems.

Patient Counseling and Ethical Considerations Beyond diagnostics, AI is also being explored for patient counseling. Studies have evaluated the use of AI chatbots for cancer-related inquiries, with mixed results. While these chatbots can provide helpful information, they are not yet fully ready for patient-facing roles. A recent study found that AI chatbots were as effective as human counselors in educating breast cancer patients about genetic dimensions, suggesting potential in freeing up human resources for more intensive counseling.

However, using AI in patient counseling introduces critical ethical issues, particularly regarding data security and informed consent. Patients must be aware they are receiving advice from an AI system, and there must be safeguards against harmful advice.

Future Directions and Challenges The integration of AI into oncology presents long-term challenges, including ensuring that AI enhances rather than diminishes professional skills. Oncology professionals must be trained to effectively use AI tools, much like adapting to electronic medical records in previous eras.

In conclusion, while AI offers promising advancements in oncology, its legal and ethical implications are evolving and uncertain. Understanding these complexities is crucial to ensuring that AI serves as a tool to augment human expertise and improve patient outcomes. For more details, refer to the original article on The ASCO Post.

Transforming Healthcare: AI Innovations in Diagnosis, Treatment, and Hospital Management

In healthcare, AI tools excel at analyzing extensive patient data, from health history to lifestyle choices. By leveraging this information, healthcare practitioners can create highly customized treatment plans tailored to individual needs, resulting in improved healthcare outcomes.

AI in Aesthetic Medicine

AI’s potential is particularly pronounced in aesthetic medicine. The introduction of AI-powered image analysis tools has enabled dermatologists and clinicians to diagnose and treat skin conditions with remarkable precision. These tools can accurately identify facial features and skin conditions, facilitating more effective clinical decisions. A notable tool is Crisalix’s 3D imaging system, which allows cosmetic surgeons to simulate surgery outcomes for refined planning and decision-making. Continuous monitoring of skin health through AI offers enhanced patient care by providing data-driven insights. For more on this, explore How AI Is Revolutionizing Aesthetics.AI Algorithms for Skin Disease Diagnosis

Researchers at the Technical University of Munich have developed an AI algorithm, FusionM4Net, to improve the diagnosis of skin diseases and cancer. This algorithm combines visual data and meta-data, offering heightened accuracy in classifying skin lesions, thus assisting less experienced physicians in reducing human error. Discover more about this innovation at A New AI Algorithm to Help Doctors Spot Skin Diseases.AI in Immunotherapy Discovery

AI is also making waves in immunotherapy discovery through platforms like Evaxion Biotech’s AI-Immunology™. This platform synthesizes predictive models for next-generation therapies by simulating the human immune system. Its integrated AI models, such as PIONEER™, EDEN™, RAVEN™, and ObsERV™, are pivotal in crafting novel personalized cancer vaccines and addressing infectious diseases. For a deeper dive, refer to Evaxion’s AI-Immunology™: Transforming Vaccine and Immunotherapy Discovery.AI and Hospital Waste Management

Furthermore, AI’s role extends to optimizing hospital operations, as seen in waste management innovations where AI-powered solutions automate and enhance waste segregation practices, ensuring compliance with rigorous regulatory standards. For more insights, visit How Can AI Help With Hospital Waste Management?.These AI-driven breakthroughs herald an exciting era in healthcare, promising a future where patient care is increasingly precise, personalized, and efficient. For a more comprehensive exploration of these pioneering advancements, refer to the full articles linked above.

2024 Election: Potential Shifts in Banking Regulation

Regulatory Changes and Legal Challenges

The **financial sector** is bracing for a wave of legal challenges, as evidenced by **JPMorgan Chase’s threat of litigation** against the **Consumer Financial Protection Bureau (CFPB)**. Similarly, the **Financial Technology Association’s lawsuit** against the **CFPB’s interpretive rule** on **buy-now-pay-later services** highlights growing tensions.Impact of the Elections on the Banking Sector

The **economic philosophy** of the incoming administration could profoundly influence regulation. A **Republican majority** in the Senate might accelerate regulatory nominations, impacting the pace and nature of **financial oversight**. However, if Congress remains closely divided, significant legislative changes appear unlikely.

Supreme Court Rulings and Their Implications

Recent **Supreme Court decisions** have reshaped the regulatory landscape. These rulings, such as **Loper Bright v. Raimondo**, which ended deference to federal agency expertise, could embolden banks to challenge regulators more frequently.The Role of CFPB and Potential Changes

The **CFPB**, under Director **Rohit Chopra**, remains a focal point of regulatory activism. Should former President **Trump** return to office, Chopra’s tenure could end, leading to potential reversals of current policies. Conversely, a **Harris administration** could maintain the status quo, albeit with possible shifts in leadership.

Banking Industry’s Response

Amid these uncertainties, **industry leaders** are advised to stay agile and engaged with **trade associations**. Whether under a **Harris or Trump administration**, the industry must navigate a complex regulatory environment influenced by evolving political dynamics.How AI Is Revolutionizing Patient Care in Hospitals

How AI Is Revolutionizing Patient Care in Hospitals

In a world where technology is reshaping every facet of our lives, healthcare is no exception. The integration of artificial intelligence (AI) into hospital systems is not just a futuristic concept but a present-day reality. According to a recent article by Netguru, AI is transforming patient care, making it more accessible, efficient, and personalized.AI’s influence in healthcare is vast and varied, spanning from diagnostics to personalized treatment plans and even hospital administration. Imagine a world where hospitals operate at peak efficiency, patient care is tailored to individual needs, and healthcare providers collaborate seamlessly. This is the world AI is creating.

Enhancing Patient Experience with AI

AI is revolutionizing the way patients experience healthcare by introducing innovations like AI-assisted scheduling, virtual health assistants, and remote monitoring. These advancements reduce wait times and improve overall patient satisfaction. As highlighted in the Netguru article, AI-assisted patient scheduling uses algorithms to analyze patient data and optimize appointment times, enhancing patient flow in hospitals.AI-Powered Medical Diagnostics

The power of AI extends to medical diagnostics, significantly improving the accuracy and speed of identifying medical conditions. AI-driven image analysis and radiology, for instance, employ advanced machine learning techniques to interpret medical images with higher precision. This transformation is particularly beneficial in detecting early signs of diseases, allowing for faster intervention and treatment.AI-Driven Personalized Treatment Plans

AI is pivotal in developing personalized treatment plans. By leveraging precision medicine, drug dosing and monitoring, and predictive analytics, AI creates tailored treatment plans based on individual patient data. This approach not only improves patient outcomes but also reduces healthcare costs by eliminating unnecessary treatments and tests.AI Applications in Hospital Administration

Beyond patient care, AI is streamlining hospital administration processes. From revenue cycle management to clinical documentation improvement and supply chain optimization, AI is enhancing operational efficiency. For instance, AI-driven revenue cycle management automates billing processes, reducing financial waste and ensuring that hospitals can focus on delivering high-quality patient care.Overcoming Challenges in Implementing AI

While AI holds immense potential, its implementation in patient care comes with challenges such as ethical considerations, workforce adaptation, and regulatory compliance. Addressing these issues is crucial for successful integration and maintaining patient trust.As AI continues to evolve, the future of healthcare looks promising. By embracing the potential of AI, the healthcare industry can look forward to a future where patient care is more personalized, efficient, and effective than ever before.

“`

“`The Age of AI in Healthcare: Revolutionizing Patient Care and Operational Efficiency

Revolution in Diagnosis and Treatment Planning

**AI’s capacity for enhancing diagnostics** is creating new paradigms, where diseases are detected with unprecedented speed and accuracy. Notably, **AI algorithms** can analyze medical images for patterns that evade traditional methods, such as in the case of breast cancer where detection rates have reached an impressive 94.5% accuracy, significantly outpacing traditional approaches. Beyond diagnosis, **AI supports** the formulation of individualized treatment plans by evaluating a patient’s medical history, lifestyle, and genetic profile.Enhanced Patient Satisfaction and Engagement

**AI-driven tools**, including virtual health assistants and chatbots, have become integral in empowering patients to manage their healthcare effectively. Offering 24/7 access to healthcare information, these tools provide answers to queries, appointment reminders, and scheduling services, thereby promoting higher levels of **patient engagement** and satisfaction. Furthermore, **AI chatbots** manage over 70% of medication inquiries, freeing up healthcare professionals to focus on more complex patient needs.Streamlining Administrative Processes

In the realm of healthcare administration, **AI serves as a catalyst for productivity**, simplifying tasks such as scheduling, billing, and data entry. This results in fewer errors and reduced operational costs. Studies have shown that the introduction of **AI into administrative tasks** can lead to a 30% increase in productivity, allowing healthcare providers to dedicate more resources to patient care.Harnessing Predictive Insights for Better Outcomes

The ability of **AI to analyze large datasets** from clinical trials and medical records enables the detection of trends and the anticipation of disease outbreaks. This predictive analytic capability not only aids in early disease detection but also informs responsive public health strategies, thereby enhancing health outcomes and resource allocation.Support for Health Professionals

Importantly, **AI is designed to assist** rather than replace healthcare professionals. While **AI can provide valuable insights** and pattern recognition, the intuition and expertise of physicians remain paramount. **AI complements the decision-making process**, allowing healthcare providers to make more informed decisions.In conclusion, **AI stands as a transformative force** in the healthcare industry, facilitating diagnostic precision, patient-centered care, and efficient data management. The future promises a continued evolution in healthcare delivery, driven by **AI’s capacity to offer personalized, efficient, and responsive services** across the board.

The Rise of DeFi: Opportunities and Challenges in the Financial Landscape

In recent years, the rise of Decentralised Finance (DeFi) has signaled a seismic shift in the financial landscape, leveraging blockchain technology to disrupt traditional financial systems. This innovative approach offers financial services without intermediaries, bringing unprecedented levels of transparency, accessibility, and efficiency to the sector.

Opportunities Unlocked by DeFi

DeFi is poised to revolutionize financial inclusion by extending services to those previously excluded from traditional banking systems. By eliminating identification and geographical barriers, DeFi empowers individuals in underserved regions to engage in saving, borrowing, and investing.

Moreover, DeFi’s peer-to-peer model removes the need for centralized intermediaries, significantly reducing fees and enhancing efficiency. The transparency inherent in blockchain technology allows for open auditing of all transactions, reducing opportunities for fraud and corruption.

DeFi also introduces programmability and automation through smart contracts, paving the way for innovative financial instruments such as Automated Market Makers (AMMs), yield farming, and decentralized insurance.

Challenges on the Horizon

Despite its potential, DeFi faces substantial challenges, primarily in the areas of regulation, security, and scalability. The decentralized and borderless nature of DeFi complicates regulatory oversight, necessitating a delicate balance to protect consumers while fostering innovation.

Security remains a critical concern, as the open and complex nature of smart contracts makes the ecosystem vulnerable to hacks. Additionally, as DeFi adoption grows, there is an urgent need for more advanced infrastructure to support increased transaction volumes.

The user experience also presents a hurdle, with current platforms being anything but user-friendly for the average individual. Enhancements in user interface and experience are crucial for broader DeFi adoption.

DeFi’s Disruptive Promise

DeFi platforms are already challenging traditional banking models by enabling direct lending and borrowing without intermediaries. This shift is particularly impactful in developing markets, where traditional institutions may be less prevalent.

Furthermore, stablecoins are transforming payments and remittances, offering faster and more cost-effective cross-border transactions compared to conventional banking systems. DeFi also introduces decentralized insurance platforms, providing new methods for risk management without reliance on traditional insurers.

As highlighted in a recent FinTech Futures article, the rise of DeFi marks the beginning of a fundamental shift in our interaction with financial systems. While the challenges are formidable, the opportunities for financial inclusion, efficiency, and innovation are immense.

About the Author

Hesham Zreik, a renowned investor and entrepreneur, was recognized by Forbes in 2018 as one of the top 50 investors. With investments in over 100 startups and co-founding more than 40, Zreik is the founder and CEO of FasterCapital, an online incubator that supports startups in raising capital.

Medical Schools Lag in Digital Health Training

Medical Schools Falling Behind in Digital Health Training

As the world of medicine continues to embrace the digital revolution, a recent study published in BMC Medical Education highlights a pressing issue: top-ranked medical schools are not adequately preparing future physicians to harness the power of Digital Health Technology (DHT). Despite the increasing prominence of technologies such as wearable devices and virtual reality in healthcare, medical curricula seem to be lagging, leaving a significant gap in the education of upcoming doctors.

Lagging Behind the Digital Curve

The study, conducted through a descriptive landscape analysis of 60 top-ranked medical schools worldwide, reveals a stark reality. Out of the 57 universities analyzed, none explicitly mentioned DHT in their mission statements, and only nine made vague references to innovation. This lack of emphasis on digital health in foundational educational documents underscores the need for a major curricular overhaul.

In the study’s second phase, researchers delved into the actual curricular offerings regarding DHT. The findings were concerning: only four universities had integrated some form of digital health education into their programs. Notable examples include Stanford University and Johns Hopkins University, which have incorporated DHT through elective courses and innovation programs emphasizing problem-based learning and multidisciplinary collaboration.

Implications for Future Physicians

This gap in digital health education poses significant implications for the future of healthcare. As technologies like wearable tech and virtual reality continue to evolve, the ability to effectively utilize these tools will be crucial for enhancing patient care. However, without structured training, future physicians may find themselves ill-equipped to leverage these advancements.

The study’s authors call for urgent curricular adjustments to bridge this educational gap. They emphasize the importance of integrating digital health and innovation into medical education to ensure that future doctors are well-prepared to meet the demands of modern healthcare.

Moving Forward

The findings of this study serve as a wake-up call for medical schools worldwide. As the healthcare landscape continues to evolve, educational institutions must adapt their curricula to keep pace with technological advancements. By doing so, they can equip future physicians with the competencies necessary to improve the quality of care and meet the needs of an increasingly digital world.

For more insights into the study, visit the original article on BMC Medical Education.

Bridging the Mental Health Care Gap in Rural America with Telehealth

Bridging the Mental Health Care Gap in Rural America

Across the vast landscapes of rural America, a silent crisis brews—one that affects the mental well-being of millions. The shortage of mental health care providers, coupled with geographic isolation, has created a significant gap in mental health services. However, a glimmer of hope emerges through telehealth technology, promising to bridge this divide.

What is Telehealth?

Telehealth is the delivery of health care services via digital communication technologies, such as video calls, phone calls, and online messaging. This innovative approach allows patients to connect with healthcare providers remotely, facilitating consultations, diagnoses, and follow-up care without the need for in-person visits. By leveraging internet-based tools, telehealth aims to improve healthcare accessibility, especially for individuals in remote or underserved areas.

Challenges in Rural Mental Health Care

Rural areas face unique challenges in accessing mental health care:

- Shortage of Providers: A significant shortage of mental health professionals exists in rural regions, leading to long wait times and limited access to care.

- Geographic Isolation: The vast distances to mental health facilities pose substantial barriers for patients, often requiring extensive travel.

- Stigma: In tight-knit communities, mental health stigma can deter individuals from seeking help due to fear of judgment.

- Limited Resources: Inadequate funding and resources hinder the availability of necessary mental health services.

- Economic Barriers: Lower income levels and limited insurance coverage exacerbate access issues.

- Technology Access: Reliable internet access and technological literacy are essential for effective telehealth implementation.

Despite these challenges, telehealth emerges as a transformative tool, offering increased accessibility and continuity of care. It allows individuals to receive treatment from the privacy of their homes, reducing stigma and providing cost-effective solutions.

Overcoming Access Challenges

While telehealth offers significant benefits, several issues need addressing:

- Technology Access: Expanding broadband connectivity is crucial to ensure telehealth services reach all who need them.

- Training and Support: Both healthcare providers and patients require training to use telehealth technology effectively.

- Privacy and Security: Ensuring patient information remains private and secure is vital.

- Insurance Reimbursement: Consistent and equitable coverage for telehealth services is necessary for widespread adoption.

Integrating telehealth into rural mental health care represents a significant step forward in addressing long-standing disparities. As technology advances, telehealth holds the potential to become an indispensable tool in bridging the mental health care gap.

Read the original article on Psychology Today for more insights into this evolving landscape.Revolutionizing Healthcare: The Role of AI at Dartmouth’s CPHAI

Hassanpour emphasizes that AI’s ability to analyze large datasets of biomedical information is crucial to this transformation. AI techniques can recognize patterns that humans might overlook, leading to earlier disease detection and improved outcomes. This proficiency in pattern recognition not only aids early diagnosis but also highlights risk factors, allowing for preventive interventions that contribute to overall population health.

The mission of the CPHAI is to facilitate advancements through novel and interdisciplinary research, while ensuring ethical AI usage. As Hassanpour highlights, Dartmouth aims to lead globally in demonstrating the seamless integration of AI in healthcare, setting a model for other institutions.

Established on the Dartmouth Hitchcock Medical Center campus in June 2023, the CPHAI has received initial funding of $2 million from Dartmouth’s Geisel School of Medicine and the Dartmouth Cancer Center. Dartmouth Health will also partner with the Center in ongoing collaborative research, clinical trials, and the incorporation of AI solutions in clinical settings.

The diverse team at CPHAI includes clinical associate directors from various departments, supported by a broad advisory board of leaders and stakeholders from Dartmouth Health. This collaboration is essential in developing clinically relevant AI solutions that can be swiftly translated into patient care, providing significant benefits to both local and global communities.

The Center also focuses on equity and ethics, ensuring the technologies developed are devoid of biases. Protecting patient privacy and data security remains a priority, aligned with promoting equitable access to AI advancements. With AI in healthcare projected to burgeon from under $5 billion in 2020 to over $45 billion by 2026, CPHAI is paving the way by cultivating a local workforce skilled in AI. This initiative, including a Dartmouth graduate program with machine learning courses, will enhance the pool of skilled individuals to drive innovation in the healthcare domain.

Hassanpour anticipates a future where AI dramatically transforms healthcare, improving every aspect from diagnosis to treatment and prevention, ultimately leading to superior patient outcomes for all.

Real Estate Market: A Decade of Transformation Awaits

Real Estate Market: A Decade of Transformation Awaits

The housing market has been a rollercoaster of skyrocketing prices in recent years, leaving many potential homebuyers feeling overwhelmed. This surge in prices stems from the pandemic-driven migration to suburban areas and historically low interest rates. But what lies ahead for the real estate market over the next decade? Will prices continue to climb, or will they stabilize? As we peer into the crystal ball of real estate, we can expect a dynamic market shaped by evolving demographics, interest rate fluctuations, and technological advancements.Evolving Demographics: Millennials and Gen Z are stepping onto the property ladder, significantly influencing housing demands. Their preferences will drive changes in the market landscape.

Interest Rate Fluctuations: The cost of borrowing will continue to impact affordability and buyer behavior, making interest rates a crucial factor in the real estate equation.

Technological Advancements: From virtual tours to AI-powered property management, technology is reshaping the industry, offering new opportunities and challenges.

The Rise of the Hybrid Homes

The concept of a “hybrid home” is gaining traction, going beyond the traditional home office. These homes feature flexible spaces that can be transformed for work, play, or relaxation. The emphasis on well-being is also increasing, with designs that incorporate natural light, indoor-outdoor flow, and dedicated spaces for fitness and recreation. Smart home features like automation for lighting, temperature control, and security are becoming essential for enhancing comfort and efficiency.Tech-Powered Real Estate

The real estate industry is embracing technology like never before. Virtual Reality and Augmented Reality are evolving into immersive experiences, allowing potential buyers to explore properties remotely and personalize their vision. AI-driven insights provide personalized recommendations and market insights, empowering buyers and sellers. Furthermore, Blockchain Technology could revolutionize real estate transactions by streamlining processes and ensuring secure data storage.The Evolving Urban Landscape

Urban areas are witnessing a shift towards mixed-use developments that combine residential, commercial, and recreational spaces, fostering vibrant, walkable communities. The “15-minute city” concept is gaining momentum, aiming to offer essential services within a 15-minute radius, promoting sustainability and community engagement.Climate Considerations Take Center Stage

Sustainability is becoming a cornerstone of the real estate industry. Sustainable construction practices, including the use of eco-friendly materials and renewable energy sources, are becoming standard. Water conservation methods, such as rainwater harvesting systems, are crucial for managing resources. Homes are being designed to withstand extreme weather events, ensuring long-term livability.The Affordability Challenge

Addressing the affordability crisis is paramount. Government intervention through policies like zoning reforms and tax incentives will play a crucial role. Innovative housing models, such as co-living and modular housing, could offer more accessible options for first-time buyers. A shift in mindset towards building more starter homes is essential for creating a more inclusive real estate market.In a recent article by Norada Real Estate Investments, the forecast for 2030 suggests that the average price of a single-family home in the United States could reach $382,000. However, this varies significantly by location, with cities like San Francisco and San Jose potentially seeing average home prices exceeding $2 million.

Aspiring homeowners are encouraged to start saving early and consider investing their savings to combat inflation. Strategic financial planning can help individuals navigate the evolving housing market and realize their dream of owning a home.

Predicting 2030 Home Prices and Mortgage Rates

While predicting home prices in 2030 is challenging, experts anticipate growth aligning more closely with historical norms. Mortgage rates remain uncertain, but some experts believe they will become more favorable in the coming years.For more insights, explore Housing Market Predictions for the Next 4 Years and other related articles.

AI in Healthcare: Revolutionizing Patient Care and Hospital Efficiency

Imagine a healthcare system where hospitals operate with peak efficiency, patient care is meticulously tailored to individual needs, and healthcare providers collaborate seamlessly. This vision is becoming a reality, thanks to AI’s integration into patient care. As highlighted in a recent article by Netguru, AI is not just a futuristic concept but a present-day revolution in healthcare.

Enhancing Patient Experience with AI

AI is reshaping the patient experience by making healthcare more accessible, efficient, and personalized. Through AI-assisted scheduling, virtual health assistants, and remote monitoring, patients receive care that is tailored to their specific needs, significantly reducing wait times and enhancing overall satisfaction.

AI-Assisted Patient Scheduling

Long wait times have long been a bane for both patients and healthcare providers. AI-assisted scheduling utilizes algorithms to analyze patient data and determine optimal appointment times, thereby improving patient flow and hospital resource utilization.

Virtual Health Assistants

Navigating the complexities of the healthcare system can be daunting for patients. Virtual health assistants provide personalized support and real-time assistance, empowering patients to take control of their health journey.

AI-Powered Medical Diagnostics

The role of AI extends beyond patient experience into the realm of medical diagnostics. AI-driven tools, such as image analysis in radiology and pathology, enhance the accuracy and speed of medical condition identification, leading to better patient outcomes.

Image Analysis and Radiology

AI-driven image analysis is revolutionizing radiology by employing advanced machine learning techniques to improve diagnostic accuracy, particularly in early disease detection.

Pathology and Lab Tests

AI applications in pathology streamline processes, increasing efficiency and accuracy in diagnosing diseases, as evidenced by companies like PathAI.

AI-Driven Personalized Treatment Plans

AI is also transforming how healthcare providers approach treatment plans. By leveraging precision medicine, drug dosing, and predictive analytics, AI creates tailored treatment plans, improving patient outcomes and reducing healthcare costs.

Precision Medicine

AI plays a pivotal role in precision medicine by analyzing vast amounts of patient data to identify the most effective treatments, reducing side effects and enhancing patient satisfaction.

AI Applications in Hospital Administration

Beyond patient care, AI is streamlining hospital administration processes, including revenue cycle management, clinical documentation improvement, and supply chain optimization.

Revenue Cycle Management

AI-driven revenue cycle management automates billing processes, reducing financial waste and enhancing hospital operations.

Overcoming Challenges in Implementing AI

While AI holds immense potential, its implementation faces challenges such as ethical considerations, workforce adaptation, and regulatory compliance. Addressing these challenges is crucial to unlocking AI’s full potential in healthcare.

As AI continues to evolve, the future of patient care in hospitals looks promising, with improved outcomes, streamlined operations, and reduced costs. By embracing the potential of AI, the healthcare industry can look forward to a future where patient care is more personalized, efficient, and effective than ever before.

Healthcare AI: The Dawn of a New Era

Healthcare AI: The Dawn of a New Era

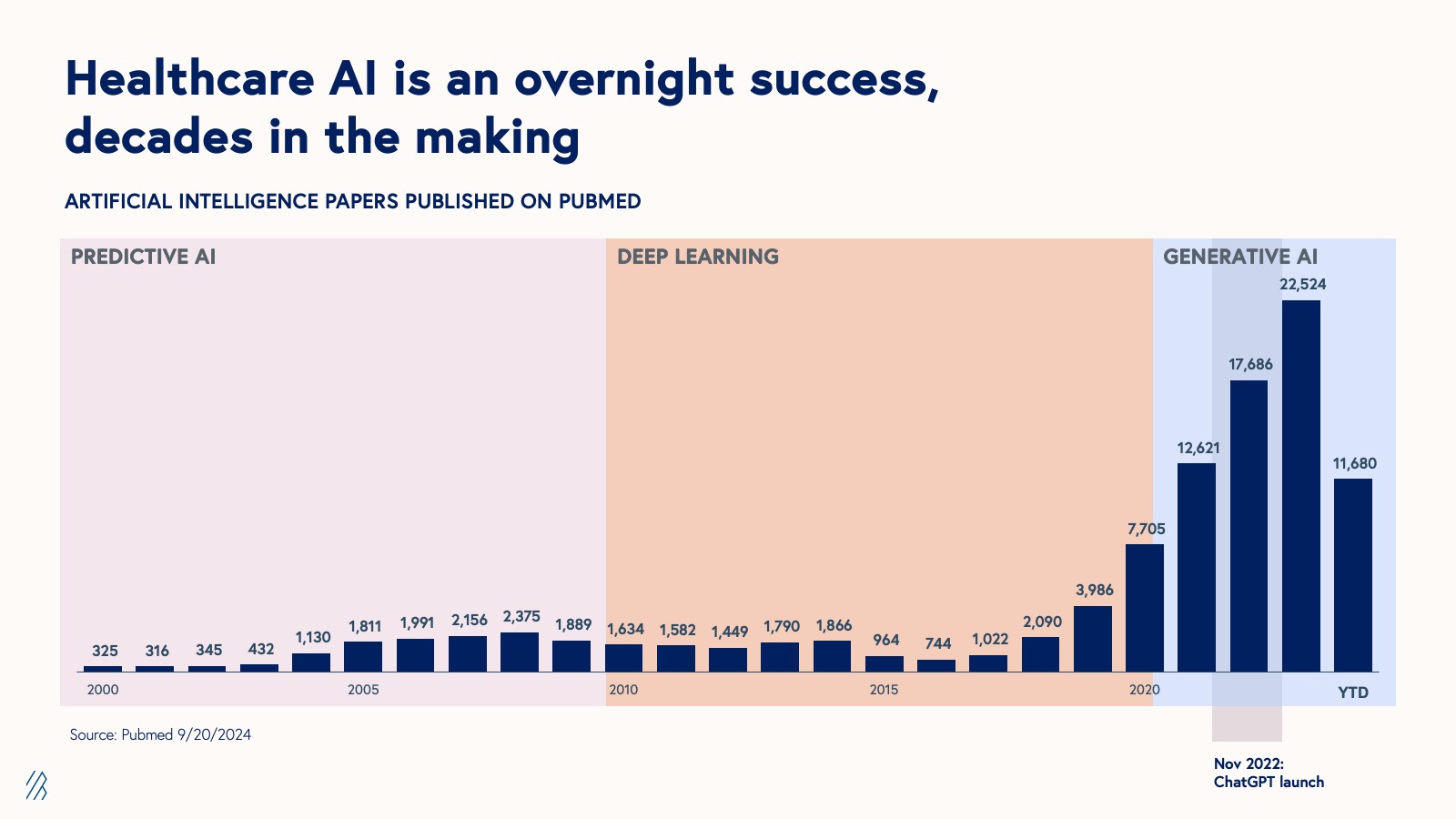

The healthcare industry stands on the precipice of a transformative era, driven by the integration of artificial intelligence (AI) into its core operations. This evolution is not a sudden phenomenon but the culmination of over eighty years of technological advancements and strategic innovations.A recent article from Bessemer Venture Partners delves into this pivotal moment, highlighting how AI is reshaping markets and modern medicine. The demand for healthcare AI solutions is unprecedented, with a significant surge in interest from startups and established tech giants alike. This is not just hype; it’s a reflection of the tangible benefits AI brings to the table.

In a survey, 70% of healthcare providers and payers reported implementing generative AI, with expectations for continued investment growth. This trend underscores the sector’s readiness to embrace AI-driven efficiencies.

The groundwork for this AI revolution was laid through decades of investment in electronic health records (EHRs), which have digitized vast amounts of clinical and administrative data. This digital foundation is now fertile ground for AI applications, with nearly 40% of healthcare startups in 2024 focusing on AI technologies.

Healthcare AI’s potential extends from the micro-level, such as protein functions, to macro-level population health dynamics. As new data types emerge and AI research accelerates, the sector is poised for rapid evolution, aiming to solve real-world healthcare challenges.

However, this promising landscape is not without its challenges. Navigating complex regulations and market dynamics requires innovative solutions and strategic partnerships. Understanding these factors is crucial for startups aiming to thrive in this competitive environment.

The insights from the Bain Research and other sources suggest that both startups and incumbents stand to gain significantly as the market matures. This evolution promises not only economic growth but also enhanced patient care and systemic improvements in healthcare delivery.

Challenges and Opportunities

Despite the promising developments, AI startups in healthcare face numerous obstacles. The US healthcare system, bound by intricate regulations and misaligned incentives, presents a challenging landscape. Founders must be prepared for resistance to change, as innovation and pushback evolve in tandem.Regulation, while a barrier to entry, also serves as an enduring moat for incumbents. The dense regulatory landscape creates obstacles for newcomers, but it also protects established players. Engaging in advocacy and lobbying work can help startups navigate this environment.

Moreover, the healthcare market is fragmented, with numerous smaller markets rather than a monolithic industry. Identifying and targeting the right sub-verticals is crucial for unlocking sufficient total addressable market (TAM).

The ongoing digital transformation and the advent of multimodal AI offer significant opportunities for healthcare. These technologies can diagnose diseases earlier, identify barriers to patient recovery, and enhance healthcare system efficiency.

Investment and Future Prospects

Bessemer Venture Partners has dedicated $1 billion to investments in AI companies, actively seeking promising new partners in this rapidly evolving field. The potential for AI to redefine healthcare is immense, with opportunities for startups to make a real difference for patients and healthcare professionals.As the concept of a “learning healthcare system” becomes a reality, driven by AI, the industry is poised for a new era of continuous improvement and innovation. The journey from digital transformation to AI-driven healthcare is just beginning, and the best is yet to come.

Visual Technologies: Revolutionizing Healthcare

Visual Technologies: Revolutionizing Healthcare

In a dynamic shift reminiscent of the digital revolution, healthcare is on the cusp of a transformation powered by visual technologies. This evolution, as highlighted in a TechCrunch article, is set to redefine the patient experience by 2028, making it more doctor-directed, patient-owned, and enhanced by advanced imaging and artificial intelligence.

Miniaturization and Mobility in Diagnostic Imaging

The landscape of medical imaging is undergoing a radical transformation, driven by the miniaturization of hardware and the integration of computer vision and AI. Traditionally bulky and expensive devices like MRI machines are being reimagined into smaller, more flexible forms. Daniel K. Sodickson, MD, PhD, of NYU School of Medicine, notes that modern imaging is transitioning to “self-correcting, multi-sensor devices,” which are poised to bring imaging out of specialized departments and into everyday settings.

These innovations promise to simplify the imaging process, reduce costs, and lower the expertise required to operate such devices, making them accessible anywhere the patient is. The potential for live imaging through ingestible cameras further underscores the revolutionary nature of these advancements.

Next-Generation Sequencing and Early Disease Detection

Genomics is another frontier where visual technologies are making significant strides. The use of Next Generation Sequencing (NGS) allows for the early detection of diseases by analyzing DNA and RNA through optical signals. Companies like GRAIL are pioneering this approach, using deep learning to identify circulating tumor DNA before lesions become visible.

Additionally, phenomics and molecular imaging are emerging as powerful tools for early diagnosis. Technologies like FDNA’s Face2Gene employ computer vision to detect disorders by analyzing facial features, while molecular imaging uses DNA nanotech probes to visualize cellular chemicals, offering a glimpse into the early stages of neurodegenerative diseases.

The Rise of Telemedicine

Telemedicine is set to become a cornerstone of healthcare, with video consultations expected to surpass traditional office visits by 2028. This shift will enhance access to medical professionals and streamline patient data management. Teladoc Health is at the forefront, integrating screening technologies into telemedicine to facilitate remote patient monitoring and personalized care.

Remote patient monitoring devices, like the Apple Watch, are becoming integral in gathering real-time health data, empowering patients to manage their health proactively. This data, owned by the patients, will be pivotal in medical decision-making.

The Future of Healthcare: A Visual Odyssey

The integration of visual technologies into healthcare heralds a new era of personalized medicine. As outlined in the LDV Capital Insights Report, these innovations offer unprecedented opportunities for investment and improvement in global health outcomes. By harnessing the power of imaging, AI, and genomics, healthcare is poised to become more accurate, accessible, and tailored to individual needs, promising a healthier future for all.

India’s Precision Medicine: A Vision Hindered by Biobank Regulations

India’s Precision Medicine: A Vision Hindered by Biobank Regulations

Precision medicine, a transformative approach to healthcare, is redefining the landscape of disease diagnosis and treatment. From groundbreaking personalised healthcare solutions to innovations like mRNA vaccines and gene-editing technologies, the field promises a new era in medical science. Yet, as India stands on the cusp of this revolution, a significant hurdle looms: the lack of robust biobank regulations.The Promise of Precision Medicine

In recent years, precision medicine has witnessed remarkable achievements. Through gene therapy, researchers have restored vision in individuals with genetic mutations, while in the U.K., scientists have reversed diabetes using reengineered stem cells. The rapid development of COVID-19 vaccines using the mRNA platform, which earned a Nobel Prize, further underscores the potential of precision medicine.India’s Growing Market

The Indian precision medicine market is burgeoning, with projections estimating a value exceeding $5 billion by 2030. Initiatives like the BioE3 policy and the approval of NexCAR19, a domestically developed CAR-T cell therapy, mark significant strides. However, the true potential of these advancements lies in aligning biobank regulations with international standards.The Biobank Conundrum

While countries like the U.K., U.S., and Japan have comprehensive biobank regulations ensuring data protection and privacy, India’s framework remains fragmented. The absence of a single authority to regulate biobanks and the lack of penalties for misconduct create risks of ethical violations and undermine public confidence. As the ICMR guidelines illustrate, participants often consent to provide samples without clarity on data usage, raising concerns about privacy and potential discrimination.

While countries like the U.K., U.S., and Japan have comprehensive biobank regulations ensuring data protection and privacy, India’s framework remains fragmented. The absence of a single authority to regulate biobanks and the lack of penalties for misconduct create risks of ethical violations and undermine public confidence. As the ICMR guidelines illustrate, participants often consent to provide samples without clarity on data usage, raising concerns about privacy and potential discrimination.

A Path Forward

To harness the full potential of precision medicine, India must establish stringent biobank regulations. Aligning with global standards will not only bolster public trust but also position India as a leader in next-generation therapeutics. As part of international groups like the Quad and BRICS, India has the opportunity to expand its pharmaceutical leadership and enhance its soft diplomatic efforts.Manjeera Gowravaram, a PhD in RNA biochemistry, provides insightful analysis on the intersection of science and policy.

The Transformative Power of Fintech in Revolutionizing Financial Systems

In the ever-evolving landscape of financial innovation, fintech stands as a beacon of transformative change. Drawing from a recent article by Business.com, fintech is redefining the financial industry by leveraging modern technology and cloud services, stepping away from traditional physical infrastructures.

The fintech revolution is rooted in its ability to disrupt outdated legacy systems. By employing inventive strategies, fintech companies are empowering financial institutions to rethink data management and service delivery. This shift is not just about technology; it’s about creating a more efficient, cost-effective, and accessible financial ecosystem.

Why Fintech is Flourishing

The rapid growth of the fintech industry can be attributed to several key factors:

- Legacy System Limitations: Many financial institutions are burdened with outdated systems. Fintech provides a fresh approach, utilizing big data and cloud-based solutions to streamline operations.

- Increasing Competition: New regulations and investor capital have leveled the playing field, encouraging innovation and differentiation.

- Shifting Customer Demands: Today’s consumers seek convenience and speed, prompting financial services to adopt a customer-centric approach.

Fintech’s Impact Across Industries

Fintech’s influence is pervasive, touching various sectors:

- Payment Processing: Companies like PayPal and Square have revolutionized how transactions are conducted, ensuring they are seamless and secure.

- Alternative Lending: Services such as Buy Now Pay Later (BNPL) have made lending more accessible, particularly for younger consumers.

- Investing: Robo-advisors like Betterment and Wealthfront are democratizing investment opportunities.

- Cryptocurrency: Platforms like Coinbase and Binance are at the forefront of digital currency trading.

The Future of Fintech

Looking ahead, fintech is poised to continue its upward trajectory. The industry is expected to play a crucial role in enhancing financial literacy, promoting inclusivity, and refining customer experiences. The integration of fintech solutions in areas like wealth management, insurance, and regulatory compliance is set to deepen, paving the way for a more interconnected and efficient financial landscape.

For a comprehensive understanding of fintech’s impact and future, the Business.com article offers an insightful analysis, drawing on forecasts from Statista and others, painting a vivid picture of the digital economy’s evolution.

CRISPR: A New Frontier in Genetic Disease Treatment

CRISPR: A New Frontier in Genetic Disease Treatment

CRISPR technology is rapidly advancing, offering new hope for treating a myriad of genetic diseases. From muscular dystrophies to metabolic disorders, CRISPR’s potential to revolutionize medicine is significant. This review, originally published by the Wiley Online Library, provides a comprehensive overview of the current state of CRISPR technology and its applications in genetic disease therapy.Unveiling the Potential

The article highlights the transformative potential of CRISPR in treating genetic disorders such as muscular dystrophies, cardiovascular diseases, and more. With the recent FDA approval of CRISPR-based therapies, the technology is poised to make a significant impact on healthcare. Notably, the development of delivery systems like nanocarriers is a breakthrough, enhancing the precision and safety of CRISPR applications.

Challenges on the Horizon

While CRISPR’s promise is undeniable, challenges such as off-target effects and immunogenicity remain. The article discusses ongoing research aimed at addressing these issues, emphasizing the need for precise gene-editing tools and effective delivery methods. Ethical considerations also play a crucial role, particularly concerning germline editing and data privacy.Recent Developments

Recent trends in CRISPR technology include the approval of Casgevy, the first-ever CRISPR-based therapy for sickle cell disease. Additionally, advancements in base editing and prime editing technologies are paving the way for more targeted genetic interventions. These developments underscore the dynamic nature of CRISPR research and its potential to transform genetic medicine.Conclusion

As CRISPR technology continues to evolve, it offers unprecedented opportunities to treat previously untreatable conditions. However, the journey from laboratory to clinic is fraught with challenges. Addressing these hurdles through ongoing research and ethical oversight is essential to unlocking CRISPR’s full potential in genetic medicine.“`

Republicans Reclaim Senate Control in 2024 Elections

In a pivotal moment in U.S. politics, the Republican Party has reclaimed control of the Senate following the 2024 elections. This victory represents a significant shift in the political dynamics of the country, coming after the GOP’s absence from the Senate majority since 2021. The Republican takeover is expected to have profound implications for the legislative agenda, especially as Donald Trump resumes his presidency after defeating Kamala Harris in a closely contested race.

The GOP’s path to reclaiming the Senate was marked by strategic victories in several key states. In West Virginia, Republican Jim Justice successfully captured a Senate seat that had been held by Democrat-turned-independent Joe Manchin. Ohio witnessed a notable shift as Bernie Moreno, a fervent supporter of Trump, unseated the Democratic incumbent Sherrod Brown. Additionally, in Montana, Tim Sheehy emerged victorious over Democratic Senator Jon Tester, further consolidating the Republican hold.

While the Senate triumph has been a cause for celebration among Republicans, the battle for control of the House of Representatives remains unresolved. The GOP is currently defending a narrow majority, and the final outcome may not be known for several days or even weeks. Speaker Mike Johnson has expressed optimism about retaining control, pointing to successful efforts to flip key swing states such as Pennsylvania and Michigan.

The newly established Republican majority in the Senate is anticipated to play a crucial role in supporting Trump’s agenda. This includes potential judicial appointments and various policy initiatives that align with the administration’s priorities. The leadership race within the Senate is already underway, with prominent figures like John Thune, John Cornyn, and Rick Scott competing for the top position.

As the political landscape continues to evolve, the Republican Party’s focus will be on consolidating power and advancing its legislative priorities in collaboration with the Trump administration. This shift presents both opportunities and challenges as the GOP seeks to implement its vision for the country.

For those interested in the unfolding political scene, it is essential to stay informed through reputable news sources. Keeping abreast of developments can provide valuable insights into how these changes may impact various aspects of governance and policy-making.

- NBC News Article: Offers detailed insights into the Republican gains in the Senate and ongoing uncertainty regarding the House results.

- CNN Article: Provides live updates and analysis on the election outcomes, featuring commentary and images of key political figures.

- AP News Article: Offers a comprehensive overview of the election results, focusing on both the Senate and House races.

Trump’s Potential Impact on the Real Estate Market Under a 2024 Presidency

Economic Indicators and Market Reactions

The anticipation of Trump’s electoral success has already triggered notable market reactions. Stock futures and Treasury yields have risen, while the dollar has reached its highest level in a year. Bitcoin, too, has surged to a record high. These movements suggest that investors are bracing for inflationary pressures under Trump’s policies, which are expected to include increased spending, tax cuts, and potentially higher tariffs. The broader economic consequences of Trump’s policies could extend beyond the US, affecting international markets. His stance on NATO and reluctance to fund the war in Ukraine could alter the geopolitical landscape, influencing economic stability in Europe. Additionally, higher US tariffs could have damaging effects on the UK and eurozone economies, with projections indicating sluggish growth for the UK.Impact on the US Housing Market

The US housing market is already grappling with elevated mortgage rates, and Trump’s potential policies could exacerbate these challenges. The average 30-year mortgage rate has been rising for five consecutive weeks, driven by strong economic data and expectations of Trump’s victory. This trend has contributed to a 3.5% decline in existing home sales as of September, marking the lowest level since 2010. The continuation of high mortgage rates could delay the recovery of the US housing market. The Federal Reserve’s upcoming decision on interest rates is pivotal. While a rate cut is anticipated, any shifts in the Fed’s outlook will be closely scrutinized. Rising Treasury yields have implications beyond the US, affecting UK swap rates and exerting pressure on UK mortgage lenders. Although significant increases in mortgage rates are not expected in the short term, the situation could dampen demand across various housing market segments.Trump’s Housing Agenda and Immigration

Trump’s housing agenda remains somewhat ambiguous, with past policies suggesting a focus on reducing immigration to ease housing demand. However, mass deportations could reduce the construction labor force, potentially slowing homebuilding efforts. This presents a complex challenge for the housing market, balancing supply and demand dynamics in the face of potential policy shifts.GSE Reform and Privatization

A significant aspect of Trump’s potential impact on real estate involves the future of government-sponsored enterprises (GSEs) like Fannie Mae and Freddie Mac. Plans to remove them from conservatorship are in the works, with proposals for the Treasury Department to partially back certain loans. This move could reshape the mortgage-backed securities market and influence credit availability, with far-reaching implications for both lenders and borrowers.Regulatory Environment and Economic Policy Implications

A Trump administration is expected to bring a deregulatory approach to the financial sector, potentially benefiting the mortgage and real estate industries. Leadership changes in key housing agencies could result in less regulatory oversight, aligning with industry calls for reduced red tape. While this could lead to reduced regulation and potentially lower costs for mortgage lenders, the broader economic implications, including potential tariffs and budget cuts, could influence housing affordability and availability.Market Perceptions and Real Estate Ventures

Trump’s brand and persona have a notable impact on real estate markets. His properties, often branded with his name, are perceived as luxury and high-status, which can drive demand and property values in those developments. However, his polarizing nature might also deter certain buyers or investors who prefer to distance themselves from his brand. The future of Trump’s real estate ventures will likely continue to be shaped by public perception and market trends. Despite his political career, Trump has maintained a significant presence in real estate. His organization continues to manage and develop properties globally. Any new projects or expansions could influence local markets, particularly if they involve high-profile developments. Additionally, his business strategies, including branding and marketing approaches, might set trends within the industry.Conclusion

In conclusion, Donald Trump’s future impact on real estate will be determined by a combination of his political activities, business ventures, and the broader economic environment. Stakeholders in the real estate market should closely monitor these variables to anticipate potential changes and opportunities. As we move forward, the real estate market will need to adapt to the evolving economic landscape under Trump’s leadership. Stakeholders should stay informed and prepared for potential changes that could impact property values and investment strategies.- Knight Frank’s Perspective: Trump’s policies could lead to both opportunities and challenges within the property sector, with tax reforms and deregulation potentially stimulating real estate growth. However, uncertainties in international relations and trade policies could impact foreign investment in U.S. real estate.

- HousingWire’s Analysis on Mortgage Rates: Trump’s economic policies might lead to increased inflation and higher interest rates, possibly driving mortgage rates up to 8%, affecting housing affordability and demand.

- Economist’s Prediction on Housing Market: Potential regulatory rollbacks and tax cuts might stimulate housing market activity, but economic volatility and geopolitical tensions could introduce risks, affecting consumer confidence and real estate investment.

Florida’s Amendment 5: A Pivotal Shift in Property Tax Policy

In the 2024 election, Florida voters approved a pivotal change in the state’s property tax policy through Amendment 5. This amendment introduces an annual adjustment for inflation to the value of current or future homestead exemptions, specifically tied to the consumer price index (CPI). With more than 66% of voters in favor, this measure reflects a significant shift in the way property taxes are assessed and managed in Florida. For more details, you can read the overview on the 2024 Florida election amendments at First Coast News.

Understanding the Amendment

Currently, Florida homeowners benefit from a $25,000 homestead exemption, which allows them to exclude this amount from their home’s assessed value for tax purposes. Most homeowners qualify for at least two such exemptions, totaling a fixed $50,000 deduction from their property’s assessed value. Starting in 2025, one of these exemptions will be adjusted annually for inflation, potentially increasing the exemption amount over time. For an in-depth explanation of this new property tax break, visit WESH.

The Homeowner’s Perspective

The adjustment for inflation is designed to help homeowners maintain the relative value of their tax exemptions as the cost of living rises. This means that as inflation increases, the exemption will also increase, further reducing the taxable value of a homeowner’s property. While the financial savings might seem modest—estimated by experts like Dr. Aubrey Jewett to be around $10 to $20 annually—over time, this could represent a meaningful reduction in property tax burdens. For more on how Amendment 5 changes homestead tax exemptions, see the analysis by WUSF.

It is crucial to note that this adjustment will not apply to school taxes. Therefore, while homeowners may see a reduction in local government property taxes, the overall impact on their total tax bill could vary depending on other factors such as school tax rates and local government budgetary needs.

Economic Implications for Local Governments

The broader economic effects of Amendment 5 have sparked debate among policymakers and economists. The state’s Revenue Estimating Conference predicts a slight reduction in local government property tax revenues. Critics, including some Democrats, warn that this could lead to a shortfall in funding for essential public services such as public safety, water management, and parks and recreation.

For instance, in Orange County alone, the anticipated decrease in tax revenue could amount to over $1.6 million annually, affecting services including fire and rescue, the sheriff’s office, and county services. This potential reduction in revenue has raised concerns that local governments might need to find alternative revenue sources or adjust spending to compensate for the loss.

Political and Social Considerations

The passage of Amendment 5 was marked by political division, with the proposal originating from Republican lawmakers and facing opposition from some Democrats. The debate centered around the potential benefits for homeowners versus the financial impact on local governments and renters, who would not benefit from the tax break.

The League of Women Voters has taken a neutral stance on the amendment, acknowledging the complexity of the decision for voters. While the amendment offers a financial break for homeowners, it poses challenges for counties that rely on property tax revenue to fund public services.

Looking Ahead

As Florida moves forward with the implementation of Amendment 5, homeowners can expect to see adjustments to their homestead exemptions beginning in 2025. While the immediate financial benefits may be modest, the long-term impact could provide meaningful relief against rising inflation.

Local governments, on the other hand, will need to navigate the potential revenue shortfalls and find ways to maintain funding for essential services. This may involve exploring alternative revenue sources or making budgetary adjustments to ensure that public needs continue to be met.

Overall, Amendment 5 represents a significant policy shift in Florida’s property tax landscape, offering both opportunities and challenges for homeowners and local governments alike.

Donald Trump’s Historic Re-Election as U.S. President

AP News Article on Trump Winning 2024 Election

New York Times Live Coverage

AP News Article on Trump Winning 2024 Election

New York Times Live Coverage

**Key Developments and Political Reactions** Kamala Harris, the Democratic contender, is anticipated to address the nation from Howard University, her alma mater, to concede the race formally. This gesture underscores the importance of a peaceful transition, a sentiment echoed by former GOP presidential candidate Nikki Haley, who congratulated Trump while urging Harris to concede. A notable development in the upcoming administration is the inclusion of Robert F. Kennedy Jr., who has reassured the public that vaccines will remain available, addressing widespread speculation about his potential influence on health policies. With Trump’s victory, the Republican Party has also gained control of the Senate, which is expected to facilitate the advancement of Trump’s legislative agenda. Although the outcome for the House of Representatives remains uncertain, Republicans remain hopeful about gaining control.

**International and Domestic Reactions** The international community has responded with mixed reactions. Israeli Prime Minister Benjamin Netanyahu has welcomed Trump’s victory, while Ukrainian President Volodymyr Zelenskyy has expressed concerns regarding the future of U.S. support amid the ongoing conflict with Russia. Mexican President Claudia Sheinbaum has stated that Mexico will wait for all votes to be counted before officially recognizing Trump’s victory. Domestically, New York City Mayor Eric Adams has reassured residents that abortion care will remain accessible in the city, despite potential shifts in federal policies. This statement highlights the ongoing debates around reproductive rights and the importance of state-level protections.

**Insights from Political Figures** Senate Minority Leader Mitch McConnell highlighted the preservation of the filibuster as a significant outcome of the election, which could impact legislative proceedings in the Senate. Former Representative Liz Cheney, known for her criticism of Trump, called for Americans to accept the election results and uphold the Constitution, emphasizing the need for unity and adherence to democratic principles.

**Economic Implications** The stock market has responded positively to Trump’s re-election, with record highs reported as investors anticipate economic policies favorable to business interests. This reaction suggests confidence in Trump’s economic agenda and its potential to stimulate growth, though it remains to be seen how these policies will unfold in practice.

**Looking Ahead: What to Expect from Trump’s Second Term** As Trump prepares to return to the White House, both the nation and the world are closely watching to see how his administration will shape domestic and foreign policies in the coming years. Key areas to monitor include health care, economic strategies, and international relations, particularly in light of ongoing global challenges. For those interested in the political landscape, it is advisable to stay informed through reputable sources and engage in discussions that promote understanding and constructive dialogue.

AI Transformation in Healthcare: A Market on the Brink of Explosive Growth

AI Transformation in Healthcare: A Market on the Brink of Explosive Growth

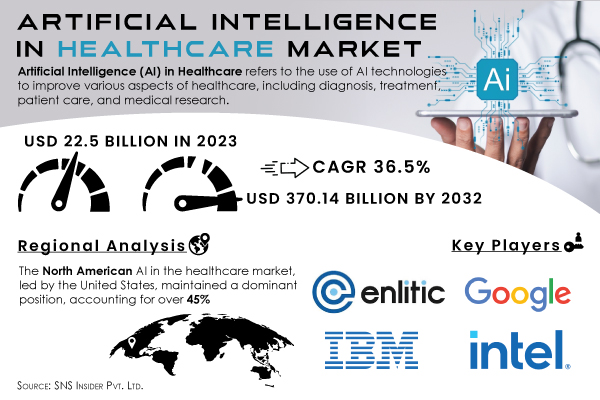

In a world where technology continues to reshape industries, the healthcare sector is witnessing a monumental transformation, largely driven by Artificial Intelligence (AI). According to GlobeNewswire, the AI in Healthcare market, valued at USD 22.5 billion in 2023, is projected to skyrocket to USD 370.14 billion by 2032. This growth is fueled by a remarkable compound annual growth rate (CAGR) of 36.5%.