Cryptocurrency: A New Financial Frontier

Cryptocurrency: A New Financial Frontier

Cryptocurrencies have emerged as a groundbreaking innovation in the financial landscape, offering a decentralized alternative to traditional currencies. These digital or virtual currencies are secured by cryptography, which makes them resistant to fraud and double-spending. They operate on decentralized networks using blockchain technology, a distributed ledger enforced by a network of computers. This system provides both advantages and challenges, as detailed in a recent Investopedia article.

Understanding the Basics

At the core of cryptocurrencies is the concept of decentralization. Unlike traditional currencies, they are not issued by any central authority, making them theoretically immune to government interference. This decentralized structure allows for faster and cheaper transactions, as it eliminates the need for third-party intermediaries like banks.

Blockchain technology is central to the functionality of cryptocurrencies. It consists of a series of connected blocks of information, each containing a set of transactions that are independently verified by a network of validators. This makes it nearly impossible to forge transaction histories, as the contents must be agreed upon by a network of computers.

Types of Cryptocurrency

There are various types of cryptocurrencies, each serving different purposes. For example, Ethereum’s ether is used for validating transactions on its blockchain. Other types include transactional tokens like Bitcoin, governance tokens like Uniswap, and security tokens representing ownership of assets.

Investing in Cryptocurrency

Investing in cryptocurrencies requires careful consideration due to their inherent risks. While they offer potential for high returns, they are also known for their volatility and regulatory ambiguity. Investors can purchase cryptocurrencies through exchanges or invest in crypto ETFs, which provide exposure to the asset class without the need for a digital wallet.

The legal status of cryptocurrencies varies worldwide. In the United States, they are considered securities when purchased by institutional buyers but not by retail investors. In Asia, countries like Japan recognize Bitcoin as legal property, while China has banned cryptocurrency exchanges and transactions.

Advantages and Disadvantages

Cryptocurrencies offer several advantages, including the removal of single points of failure, easier fund transfers, and the elimination of third-party intermediaries. However, they also pose challenges such as pseudonymous transactions, which can be used for criminal activities, and high energy consumption for mining.

Despite these challenges, cryptocurrencies continue to gain popularity, with a total market capitalization reaching trillions of dollars. As digital assets, they appeal to those interested in speculative investments, but they require a cautious approach due to the risks involved.

:max_bytes(150000):strip_icc()/TermDefinitions_crypto_final-940e93a6cb5341999a5d735fbf04fbfe.png)

The Bottom Line

Cryptocurrencies represent a new financial paradigm, offering both opportunities and challenges. While they have the potential to disrupt various industries, they also require investors to understand the risks involved. As highlighted in the original article, it is crucial for investors to approach this innovative technology with caution and awareness of its potential and limitations.

More Articles

Getting licensed or staying ahead in your career can be a journey—but it doesn’t have to be overwhelming. Grab your favorite coffee or tea, take a moment to relax, and browse through our articles. Whether you’re just starting out or renewing your expertise, we’ve got tips, insights, and advice to keep you moving forward. Here’s to your success—one sip and one step at a time!

Unlocking Business Value: Navigating the AI Landscape

Unlocking Business Value: Navigating the AI Landscape

The journey to establish a return on investment (ROI) from AI projects can be as complex as it is rewarding. As organizations continue to invest in generative AI, the challenge lies in translating hype into tangible business value. According to a recent CIO article, focusing on specific metrics, aligning data operations with revenue-centric tasks, and enhancing employee engagement with AI are key strategies to maximize the potential of these technologies.The AI Hype Cycle: A Double-Edged Sword?

While the AI hype has fueled investments, Gartner’s recent analysis has placed generative AI at the “peak of inflated expectations,” suggesting a potential dip into the “trough of disillusionment” is imminent. Despite this, the AI honeymoon isn’t over yet. A report from AI at Wharton indicates that 72% of enterprises anticipate increased budgets for AI over the next year, though growth is expected to slow thereafter.Productivity and Beyond: The Real Impact of AI

Many early successes with generative AI have focused on boosting productivity. For instance, developers leveraging GitHub Copilot have reported a 26% increase in task completion. However, for CIOs, the challenge remains to justify continued investments by demonstrating AI’s broader strategic impacts, especially on the bottom line.Strategic Metrics: The Key to Success

To unlock AI’s potential, CIOs need to identify and focus on metrics that align with core business objectives. As Shaown Nandi from AWS suggests, setting clear, measurable goals is crucial. Whether it’s reducing call center escalation rates or enhancing customer communication, pinpointing these metrics can provide a roadmap for AI success.Data Strategies: The Backbone of AI Initiatives

Improving data quality and integration is vital for marketing departments aiming to track the financial impact of AI. As noted by Michelle Suzuki, CMO of Glassbox, a seamless partnership between CIOs and CMOs is essential to enhance decision-making capabilities. This involves prioritizing proactive data governance and embracing DataOps practices.Call Centers and Service Operations: A New Frontier

AI’s role in support services is transformative. By expediting operations and improving customer satisfaction, AI can significantly enhance service desk efficiencies. As Ram Ramamoorthy from ManageEngine highlights, AI-driven knowledge graphs and intelligent routing are game-changers in this space.Employee Experience: The Human Element

As AI reshapes work environments, CIOs must also consider its impact on employee well-being. A report by Deloitte reveals that only 20% of organizations are well-prepared for the talent considerations associated with AI adoption. This underscores the need for effective change management strategies to ensure a smooth transition.In conclusion, while the path to achieving ROI from AI investments is fraught with challenges, the potential rewards make it a journey worth undertaking. By focusing on strategic metrics, aligning data strategies, and fostering a supportive environment for employees, organizations can harness AI’s full potential.

Wearable Technology: A New Frontier in Heart Failure Management

Wearable Technology: A New Frontier in Heart Failure Management

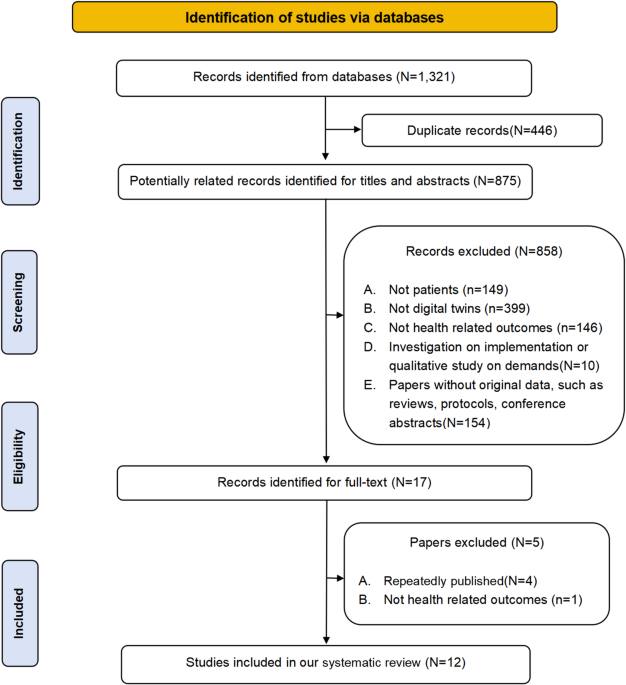

In the ever-evolving landscape of medical technology, wearables have emerged as a promising solution for enhancing the remote monitoring of heart failure patients. These devices, capable of tracking crucial physiological parameters, hold the potential to revolutionize patient care. However, their integration into clinical practice is not without challenges.A recent scoping review published in Nature highlights the current state of wearable technology for heart failure management. The review, conducted by a team of researchers including Annemiek E. van Ravensberg and Abdul Shakoor, delves into the readiness of these devices for clinical use, employing the Medical Device Readiness Level (MDRL) as a framework for assessment.

The Promise and the Pitfalls

Wearable devices offer a personalized and empowering experience for patients, potentially becoming a vital component of modern heart failure management. Yet, the review underscores a significant barrier: the lack of rigorous evaluations. Of the 99 studies identified, only a handful were randomized controlled trials, leaving a gap in robust evidence needed for widespread clinical adoption.The review also points out that most consumer-grade wearables are in the feasibility testing stage (MDRL 6), with only two devices specifically designed for heart failure remote monitoring receiving FDA approval.

Global Burden and the Need for Innovation

Heart failure affects approximately 63 million people worldwide, placing immense strain on healthcare systems. The necessity for frequent outpatient visits and hospitalizations exacerbates this burden, especially in today’s healthcare environment, which is already grappling with limited capacity and staff shortages. Remote monitoring, as highlighted in the meta-analysis by Scholte et al., has been proposed as a solution, showing promise in reducing mortality and hospitalization rates.Challenges in Clinical Integration

Despite the potential benefits, the integration of wearable technology into heart failure care faces significant hurdles. The absence of standardized methodologies and external validation contributes to uncertainty about the actual impact of these devices. Current heart failure guidelines offer limited endorsement for incorporating remote monitoring, reflecting the need for further research and validation.The Path Forward

As the healthcare industry looks to the future, the role of wearable technology in heart failure management remains a subject of intense interest and debate. The review calls for more extensive studies to establish clinical benefits, urging the medical community to bridge the gap between promising technology and practical application.For more details on this groundbreaking review, visit the original article.

AI’s Impact on Finance: Transformative Trends and Future Prospects

Transforming Customer Interactions

One of the most visible impacts of **AI in finance** is the rise of **conversational AI**. Virtual assistants and chatbots, powered by sophisticated algorithms, are providing real-time customer support, handling routine inquiries, and managing basic transactions. This automation frees up human resources for more complex tasks, enhancing both efficiency and customer satisfaction.

For example, HSBC has partnered with SoftBank Robotics to deploy the **AI robot ‘Pepper’** in its branches. Pepper assists customers with basic banking tasks and queries, thereby reducing the burden on human staff and improving operational efficiency.

Streamlining Operations with Machine Learning

The combination of **AI and machine learning (ML)** is instrumental in automating financial processes. **ML algorithms** analyze vast amounts of data to detect patterns and make predictions, enabling automated data entry, document processing, and reconciliation. This reduces manual effort and improves accuracy, allowing employees to focus on higher-value activities such as financial analysis and decision-making.

Benefits of AI in Finance

The integration of **AI in finance** offers numerous advantages:

- Operational Efficiency: Automating repetitive tasks minimizes human error and ensures data integrity.

- Improved Customer Experience: **AI-powered chatbots** provide 24/7 assistance, offering tailored financial advice.

- Competitive Advantage: Rapid data analysis enables quicker decision-making and adaptation to market changes.

- Accurate Models: **AI** enhances risk evaluation, investment strategies, and fraud detection with precise forecasts.

- Speed and Precision: **AI** processes data swiftly, facilitating real-time adjustments to market conditions.

Challenges and Solutions

While **AI** offers significant benefits, its integration into finance comes with challenges such as explainability, regulatory compliance, and cybersecurity risks. Solutions include adopting interpretable **AI techniques**, establishing strong governance structures, and implementing robust cybersecurity measures.

The Future of AI in Financial Services

The future holds immense potential for **AI-driven innovation in finance**. As technologies advance, financial institutions are increasingly leveraging **AI** for enhanced customer experiences, personalized wealth management, and accurate risk assessment. **AI algorithms** will continue to streamline operations, automate tasks, and optimize decision-making processes.

Generative **AI** is set to transform the sector by creating innovative financial products tailored to individual needs, while **machine learning** will push financial services into more predictive and prescriptive territories. By 2028, Citibank forecasts that **AI** could boost global banking profits by $170 billion.

For those looking to harness the power of **AI in finance**, companies like **Appinventiv** offer expert services in developing **AI-powered solutions** tailored to specific needs, ensuring businesses remain competitive and innovative in a rapidly evolving market.

Blockchain and Microcredit: A New Dawn for Financial Inclusion in Kenya?

Blockchain and Microcredit: A New Dawn for Financial Inclusion in Kenya?

In the heart of Kenya, a financial revolution is quietly unfolding. As traditional banking systems grapple with challenges of accessibility and trust, a new player emerges on the scene—blockchain-based microcredit. This innovative approach could potentially transform financial inclusion in the region, a topic explored in a recent article by Monash Lens.

In the heart of Kenya, a financial revolution is quietly unfolding. As traditional banking systems grapple with challenges of accessibility and trust, a new player emerges on the scene—blockchain-based microcredit. This innovative approach could potentially transform financial inclusion in the region, a topic explored in a recent article by Monash Lens.

The story of microcredit is not new. Pioneered by the Grameen Bank, microcredit has been a beacon of hope, offering financial lifelines to entrepreneurs in developing countries. Its success in Bangladesh, with a loan recovery rate surpassing traditional systems, underscores its potential. But in Kenya, the narrative takes a digital twist with blockchain technology.

The Blockchain Advantage

Blockchain offers a decentralized, secure alternative to conventional banking. By eliminating intermediaries, it reduces costs and enhances transaction security. This is particularly beneficial in regions like Sub-Saharan Africa, where financial inclusion lags behind the global average, as noted by the World Bank.However, the journey is fraught with challenges. Financial literacy remains a significant barrier, as highlighted by research by Schuetz and Venkatesh. Low education levels and a lack of awareness impede the adoption of financial services. Yet, the introduction of blockchain-based systems could serve as a catalyst for education and empowerment.

Overcoming Barriers

The integration of blockchain with existing platforms like M-Pesa could be transformative. While M-Pesa has revolutionized mobile banking in Kenya, it faces challenges such as privacy and security. Blockchain’s encrypted, immutable transactions offer a solution, enhancing transparency and reducing fraud risks.For blockchain to succeed, strategic implementation and comprehensive education are crucial. Our recent study funded by the Ethereum Foundation, reveals that understanding the platform’s benefits motivates users to learn. Solutions include localized education, practical use cases, and continuous engagement through community initiatives.

A Promising Future

As PricewaterhouseCoopers emphasizes, blockchain-based financial products must be accessible, reliable, and user-friendly to foster inclusion. The potential is promising, but success hinges on overcoming educational and infrastructural hurdles.Kenya stands on the brink of a financial transformation. By blending blockchain’s innovative capabilities with M-Pesa’s established network, a more inclusive and resilient financial future is within reach. The question remains: can blockchain-based microcredit truly transform financial inclusion in Kenya? The answer, as the Monash Lens article suggests, is a hopeful yet conditional yes.

The Revolutionary Role of Digital Twins in Precision Health

The Revolutionary Role of Digital Twins in Precision Health

In a groundbreaking exploration of healthcare innovation, digital twins are emerging as a pivotal technology in the realm of precision health. A recent systematic review published in Nature delves into the transformative potential of digital twins, highlighting their capacity to revolutionize patient outcomes through personalized health management, precision therapies, and risk prediction. Digital twins, essentially virtual replicas of human bodies, utilize real-time data to provide dynamic and individualized healthcare solutions. This technology marks a significant departure from conventional medical practices, which often employ a one-size-fits-all approach. Instead, digital twins offer tailored recommendations and interventions, thereby enhancing the precision and efficacy of healthcare delivery.

Digital twins, essentially virtual replicas of human bodies, utilize real-time data to provide dynamic and individualized healthcare solutions. This technology marks a significant departure from conventional medical practices, which often employ a one-size-fits-all approach. Instead, digital twins offer tailored recommendations and interventions, thereby enhancing the precision and efficacy of healthcare delivery.

Transformative Potential Across Healthcare Domains

The review underscores the broad applicability of digital twins across various medical fields. By integrating omics data, clinical information, and health outcomes, digital twins facilitate a more nuanced understanding of patient health. This capability is particularly beneficial in managing chronic conditions like type 2 diabetes and multiple sclerosis, where personalized treatment plans can significantly improve patient quality of life.Moreover, the technology’s predictive capabilities enable healthcare providers to anticipate and mitigate potential health risks. For instance, digital twins can forecast disease progression and suggest preemptive interventions, thereby reducing the likelihood of severe health complications.

Challenges and Future Directions

Despite their promising potential, the widespread adoption of digital twins in healthcare is not without challenges. Data accessibility and integration across disparate health systems remain significant hurdles. The review advocates for enhanced data-sharing frameworks and the development of robust computational infrastructures to support the seamless implementation of digital twins in clinical settings.The authors, Mei-di Shen from Peking University and Si-bing Chen and Xiang-dong Ding from Jilin University, emphasize the need for continued research and collaboration across medical and technological domains. Such efforts are crucial to unlocking the full potential of digital twins and realizing their promise in precision health.

Conclusion

As healthcare continues to evolve, digital twins stand at the forefront of this transformation, offering unprecedented opportunities for personalized and precise medical care. By bridging the gap between digital innovation and clinical practice, digital twins are poised to redefine the future of healthcare, ensuring better outcomes for patients worldwide.The 3D Printing Construction Market: A Future of Growth and Innovation

The 3D Printing Construction Market: A Future of Growth and Innovation

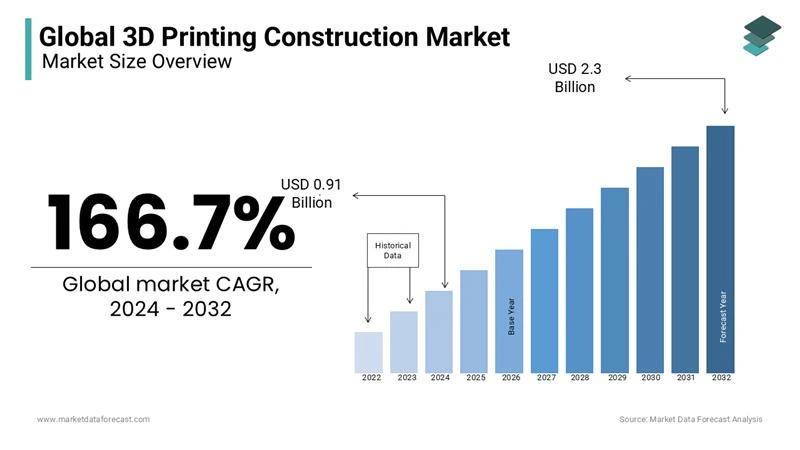

The global 3D printing construction market is on the brink of a remarkable transformation. Currently valued at USD 0.34 billion in 2023, it is projected to surge to USD 910 million by 2024, and ultimately reach USD 2.3 billion by 2032. This rapid expansion is fueled by the sector’s potential to revolutionize traditional building processes through innovative additive manufacturing technologies.

Key Market Trends The rise of sustainable construction practices is one of the most significant trends driving this market. 3D printing not only reduces material waste but also facilitates the use of eco-friendly materials, a crucial factor as the construction industry seeks to reduce its carbon footprint. Moreover, this technology supports accelerated affordable housing solutions, cutting down both construction times and costs, which is essential in addressing global housing shortages.

Drivers of Market Growth Labor shortages are a pressing issue in the construction industry, prompting a shift towards 3D printing. With an aging workforce and a scarcity of skilled labor, companies are increasingly turning to automation to reduce labor dependency. Additionally, the growing demand for customized construction projects is encouraging the adoption of 3D printing, allowing for the creation of intricate, tailored designs that cater to urban and cultural needs.

Government support is also playing a pivotal role in market growth. Initiatives like Saudi Arabia’s Vision 2030 and the European Union’s Horizon 2020 program are promoting the use of 3D printing in construction, further bolstering the market’s expansion.

Challenges and Opportunities Despite its promising advancements, the 3D printing construction market faces challenges such as the high initial capital investment required for equipment and a lack of skilled workforce to operate these technologies. However, opportunities abound, particularly in disaster-relief housing and the integration of 3D printing with smart city initiatives.

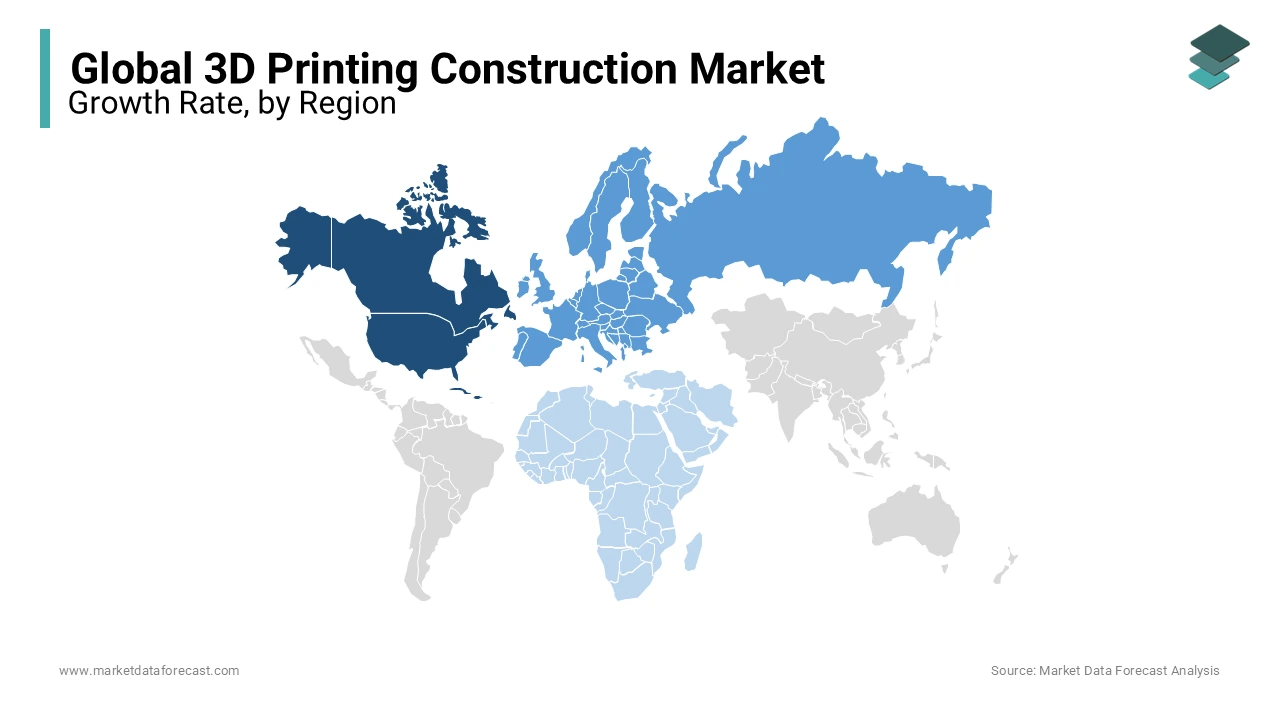

Regional Insights In 2023, North America led the market, holding a 35.8% share, thanks to significant investments and technological advancements. Europe is also experiencing robust growth driven by sustainability initiatives, while Asia-Pacific remains the fastest-growing region due to rapid urbanization and a high demand for affordable housing.

Key Players and Recent Developments Major companies such as WinSun, Apis Cor, and ICON are at the forefront of exploring new frontiers in 3D construction. Recent advancements include Apis Cor’s development of robotic printers and CyBe Construction’s collaborations in the Middle East for affordable housing projects. The introduction of the BetAbram P1 printer and Sika AG’s innovative concrete mix further highlight the industry’s ongoing efforts towards scalability and sustainability.

Overall, the 3D printing construction market is poised for significant growth, driven by its potential to redefine construction methodologies and effectively meet global demands.

The Growing Role of Telehealth in Nursing: A New Frontier for Patient Care

The Growing Role of Telehealth in Nursing: A New Frontier for Patient Care

As the world of healthcare continues to evolve, nurses are at the forefront, embracing telehealth technology to revolutionize patient care. With the increased demand on healthcare systems due to an aging population and ongoing nursing shortages, telehealth is becoming an indispensable tool for nurses, enhancing patient outcomes and expanding access to quality healthcare.

According to the Agency for Healthcare Research and Quality, the integration of telehealth services has accelerated since the onset of the COVID-19 pandemic. This trend is supported by data from the U.S. Department of Health and Human Services, which highlights the significant rise in telehealth usage during the pandemic.

Dr. Lisa Bechok, a clinical faculty member at Southern New Hampshire University, emphasizes the critical role nurses play in safeguarding public health. “From ensuring the most accurate diagnosis and treatment options to the ongoing education of the public about critical health issues, nurses are indispensable,” Bechok states.

Telehealth not only facilitates remote monitoring of patient health but also breaks down geographical barriers, allowing those in rural areas to access necessary healthcare services. This is particularly beneficial for managing chronic conditions, reducing hospitalizations, and lowering healthcare costs, as noted in an article from the National Library of Medicine.

What is Telehealth?

Defined by the National Institute of Biomedical Imaging and Bioengineering, telehealth uses communication technology to provide medical care at a distance. It replaces traditional face-to-face visits with video conferencing and phone calls, enabling patients to receive care from the comfort of their homes.

Telehealth’s role in nursing spans various areas, including acute and chronic care, hospice, palliative, and primary care. This expansion provides nurses with innovative tools to reach patients and improve healthcare access for all, as highlighted by Bechok.

The Four Ps of Telehealth Nursing

As telehealth continues to grow, the Four Ps of Telehealth framework aids in nursing education:

- Planning: Identifying issues, technology, and patient needs.

- Preparing: Setting up technology support and training personnel.

- Providing: Conducting patient history and physical examination remotely.

- Performance Evaluation: Assessing program impacts and outcomes.

Despite the numerous benefits, challenges such as broadband access and regulatory issues persist. However, the pandemic has propelled the integration of telehealth, with nurses continuing to adapt and innovate in their roles.

In conclusion, telehealth is reshaping the landscape of nursing, offering flexibility and improved access to care. As Dr. Bechok aptly puts it, “Nursing is the glue that holds a patient’s healthcare journey together,” whether through telehealth or face-to-face interactions.

Autonomous Vehicles and Their Economic Impact: A Look into the Future of Mobility

Autonomous Vehicles: Driving the Future of Urban Mobility and Economic Growth

The recent enactment of the Automated Vehicles Act in the UK heralds a new era for transportation, with self-driving vehicles expected to hit the roads by 2026. This legislative milestone is poised to revolutionize how people and goods move across the nation, potentially transforming urban spaces and transport systems as we know them.Economic Impact and Societal Interactions Understanding the intersection between autonomous vehicles (AVs) and society is crucial for assessing their economic impact. According to a study referenced by the Economics Observatory, the potential economic benefits in the UK could reach £51 billion by 2030. These gains stem from consumer savings, reduced travel time, and improved safety. The UK government is actively exploring policies to ensure AVs support sustainable economic growth and contribute to the transition to net-zero emissions.

Transforming Transport and Logistics The transport and logistics sectors are expected to be early adopters of AV technology, driven by the promise of reduced costs and increased efficiency. The elimination of human drivers could significantly cut labor expenses, while AVs’ ability to operate 24/7 could enhance productivity and customer satisfaction. Moreover, AVs could optimize delivery routes, addressing last-mile delivery challenges and improving customer experiences. Autonomous drones and robots, for example, could deliver packages to remote locations lacking proper transport infrastructure.

Personal Mobility and Social Inclusion AVs hold the potential to improve personal mobility, particularly for individuals underserved by current transport systems, such as the elderly and those with disabilities. By reducing transport costs, AVs could enhance mobility for middle and lower-income groups, fostering social inclusion and enabling access to employment and leisure activities. Fleet-based shared automated vehicles could offer low-cost, on-demand services, complementing traditional public transport and improving first- and last-mile connections.

Challenges and Opportunities Despite their benefits, AVs are expected to disrupt employment in sectors like public transport and delivery services, potentially leading to job losses. Policymakers must focus on education and retraining programs to help displaced workers transition to new roles. Additionally, AVs could exacerbate urban sprawl as individuals choose to live further from urban centers due to reduced transport costs and improved connectivity.

Driving Economic Growth AVs could significantly boost productivity by reducing travel costs and enhancing connectivity between urban centers and their peripheries. This improved accessibility could lead to job and population relocations, fostering agglomeration economies and increasing firms’ productivity. A study for the United States suggests that AVs could increase GDP by $214 billion and create 2.4 million new jobs.

Environmental Sustainability AVs offer the potential to optimize fuel consumption and reduce carbon emissions, contributing to a more sustainable transport system. By integrating electric and hybrid vehicles, AVs could further minimize greenhouse gas emissions, aiding in climate change mitigation efforts.

Addressing Concerns and Building Trust For AVs to gain public acceptance, companies and governments must address concerns about safety, reliability, and cybersecurity. Establishing robust security measures and transparent communication will be critical in fostering public trust. The UK government’s proactive approach to regulating AVs, as outlined in their regulation plan, sets a precedent for ensuring safety and legal clarity.

Conclusion

The advent of autonomous vehicles represents a pivotal moment in the evolution of urban mobility and economic growth. As the UK prepares for their integration into public roads, addressing challenges and leveraging opportunities will be essential in shaping a smarter, more connected future.

Conclusion

The advent of autonomous vehicles represents a pivotal moment in the evolution of urban mobility and economic growth. As the UK prepares for their integration into public roads, addressing challenges and leveraging opportunities will be essential in shaping a smarter, more connected future.

AI in Healthcare: Revolutionizing Medicine or Overhyped Promise

Current Advancements

**AI** has already demonstrated its prowess in several areas. Notably, it expedited the development of **mRNA vaccines** for COVID-19 and is now being harnessed to create new protections against a variety of diseases. **Generative AI**, akin to ChatGPT, is also paving the way for new immunotherapy drugs.

In diagnostics, **AI’s ability to analyze medical scans and records** is proving invaluable. The American College of Surgeons notes that **AI** often surpasses radiologists in interpreting scans, identifying subtle signs of diseases like cancer and Alzheimer’s disease.

Challenges and Caution

Despite these successes, **AI in healthcare** is not without its challenges. A study on pulmonary embolism highlighted **AI’s potential** to reduce hospital stays, yet not all **AI applications** have been as effective. The discontinuation of IBM’s Watson Health partnership with MD Anderson Cancer Center due to accuracy issues serves as a cautionary tale.

Moreover, symptom-checker tools, which sometimes rely on **AI**, have been criticized for their low accuracy, posing potential safety risks. Additionally, the promise of administrative efficiencies through **AI** remains largely unrealized, with little evidence of significant cost savings or improvements in patient care.

Expert Opinions

Experts offer a range of perspectives on **AI’s future in healthcare**. Dr. Eric Topol, author of Deep Medicine, acknowledges **AI’s utility** in certain applications but emphasizes the irreplaceable value of human interaction in patient care. He envisions a future where **AI** augments rather than replaces human skills, enabling doctors to spend more time with patients.

Dr. Fei-Fei Li from Stanford University echoes this sentiment, highlighting **AI’s role** in alleviating administrative burdens, thereby restoring the “human element” to medicine. However, an article in MIT Technology Review warns against over-reliance on **AI**, particularly when trained on biased data, which could lead to inequities in care.

The Path Forward

While **AI holds the promise of transforming healthcare**, it is not a panacea. The early successes in drug discovery and diagnostics are promising, yet challenges such as data privacy, cost, and training must be addressed. The consensus among professionals is that **AI** should enhance human expertise, not replace it.

For technology companies, the key to driving meaningful change lies in developing **AI applications** that complement human skills, thereby delivering tangible benefits to healthcare systems and patients alike.

The Rise of Central Bank Digital Currencies: A New Era in Finance

Countries around the globe, from the Bahamas to China, are actively exploring or have already initiated **CBDC projects**. The primary objective is to enhance financial inclusion, offering secure and efficient payment options for those without access to traditional banking systems. As noted in a report by the U.S. Federal Reserve, **CBDCs** have the potential to significantly reduce cross-border transaction costs, bolster the international standing of dominant currencies like the dollar, and simplify access to financial services.

However, this shift to digital currencies also presents several challenges. **Privacy concerns**, potential **cybersecurity threats**, and the impact on existing banking structures are critical issues that need careful consideration. Ensuring robust **cybersecurity frameworks** and balancing transaction monitoring to prevent financial crimes are essential steps in this journey.

**CBDCs** are categorized into two main types: wholesale and retail. Wholesale **CBDCs** are typically used by financial institutions for interbank transactions, while retail **CBDCs** are consumer-focused, allowing potentially anonymous transactions using public or private keys.

While smaller nations like Jamaica, Nigeria, and the Bahamas have already implemented **CBDCs**, larger economies and groups like the G20 are still in the exploratory stages, assessing the implications for monetary policy and financial stability.

For more in-depth information, the original article can be found on Investopedia.

The Ethical Maze of AI in Radiography: A Saudi Arabian Perspective

The Ethical Maze of AI in Radiography: A Saudi Arabian Perspective

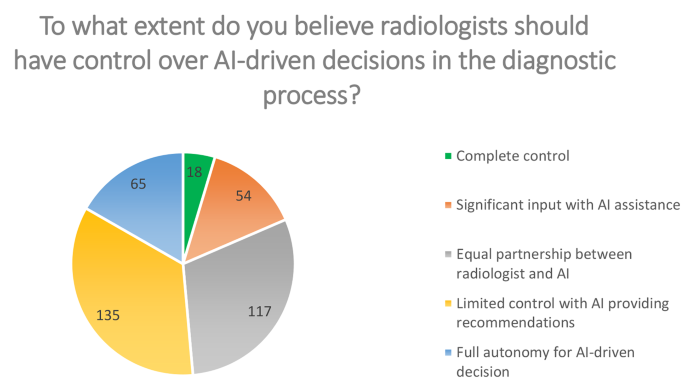

In an era where artificial intelligence (AI) is reshaping the landscape of healthcare, a recent study published in BMC Medical Ethics sheds light on the intricate ethical challenges radiographers face as they navigate AI integration in radiography. Conducted in Saudi Arabia, this cross-sectional study delves into the perspectives of radiographers, revealing a tapestry of enthusiasm and apprehension towards AI’s role in their field.The research, available on the BMC Medical Ethics website, highlights the transformative opportunities AI presents for diagnostic imaging, alongside the ethical considerations that accompany its adoption. Through a structured questionnaire, radiographers shared their insights on AI’s ethical implications, emphasizing the need for transparency, patient privacy, and the establishment of ethical guidelines.

Unfamiliar Terrain

The study reveals a significant portion of radiographers are unfamiliar with AI’s integration into their practice, with many expressing uncertainty about the importance of AI transparency. However, a notable number advocate for AI systems that provide justifications for their decision-making processes, highlighting a desire for clarity in AI operations.Ethical Dilemmas and Patient Privacy

Radiographers voiced concerns about ethical dilemmas that AI might introduce, with nearly half agreeing that AI could exacerbate these challenges. Patient privacy emerged as a critical issue, with a substantial portion of participants expressing apprehension about AI’s impact on confidentiality. These findings underscore the necessity for specific ethical guidelines to govern AI use in radiography.Guiding the Future

The study calls for the development of robust ethical frameworks, educational improvements, and policy enhancements to ensure AI technologies are implemented safely and ethically. These measures aim to maximize diagnostic benefits while minimizing ethical risks, providing a roadmap for policymakers and practitioners to navigate the evolving AI landscape in healthcare.For further insights into the study and its implications, visit the BMC Medical Ethics Journal.

CSS Styling

The Telehealth Revolution: Transforming the Healthcare Landscape

Telehealth: A New Era in Healthcare

Telehealth has dramatically transformed healthcare delivery, offering increased accessibility and reshaping patient care. The COVID-19 pandemic accelerated its adoption, with the U.S. experiencing a 154% surge in telehealth visits in March 2020. This adaptability is mirrored in mental health services, where telepsychiatry has become essential for continuous patient support, especially in remote areas.Financially, telehealth presents significant cost-saving opportunities by reducing non-urgent emergency visits. A McKinsey report suggests that up to $250 billion of U.S. healthcare spending could be virtualized.

Beyond Healthcare: Cross-Industry Applications

Telehealth technology extends its benefits beyond healthcare. In education, it bridges the gap between medical knowledge and practical application, enhancing clinical skills through simulation training. Platforms like Project ECHO facilitate knowledge sharing among healthcare professionals.In the corporate world, telehealth is integral to wellness programs, providing employees with convenient access to health services. This integration boosts productivity and reduces healthcare costs, as noted by the National Business Group on Health.

Technological Integration: No-Code and Low-Code Platforms

The rise of No-Code (NC) and Low-Code (LC) platforms is reshaping operational dynamics in healthcare. These platforms allow for the rapid development and deployment of digital solutions, making technology more accessible. According to a Healthcare Management Review study, they can accelerate clinical application development by 50-70%, reducing costs and improving efficiency.Personalization and Future Prospects

Personalizing telehealth services enhances patient satisfaction and engagement. Studies show that personalized interventions improve outcomes in chronic disease management, such as diabetes. AI and wearable technologies are advancing diagnostic precision and real-time monitoring, paving the way for more effective care.As we move into 2024, the integration of telehealth, AI, and wearables promises to set new benchmarks for accessible and personalized healthcare services. This evolution points towards a more connected, health-conscious future, as detailed in the original article.

Electric Vehicle Market Surges Amidst Economic and Environmental Challenges

Electric Vehicle Market Surges Amidst Economic and Environmental Challenges

The global electric vehicle (EV) market is experiencing a remarkable transformation, driven by a combination of technological advancements, policy incentives, and growing environmental awareness. According to a report by the TRENDS Research & Advisory, sales of battery electric vehicles (BEVs) and plug-in hybrid electric vehicles (PHEVs) soared beyond 10 million in 2022, marking a 55% increase from the previous year. This surge underscores the rapid adoption of EVs despite challenges such as supply chain disruptions and fluctuating energy prices.

The Global EV Outlook 2023 by the International Energy Agency (IEA) highlights the pivotal role of government policies in this growth. The Electric Vehicles Initiative (EVI), established under the Clean Energy Ministerial, has been instrumental in promoting zero-emission government fleets, further accelerating the shift towards sustainable transport solutions.

Global Trends and Policy Efforts

In line with the IEA’s Stated Policies Scenario (STEPS), the global share of EV sales is projected to reach 35% by 2030, with China, the United States, and Europe leading the charge. This growth trajectory is bolstered by strategic legislation and expanding battery manufacturing capacities, aimed at meeting the rising demand for EVs.

Despite these positive trends, the market faces hurdles such as the high cost of EVs, limited charging infrastructure, and battery technology challenges. To address these issues, governments and private entities are investing in innovative business models and enhanced charging networks, as emphasized in Fayez Alanazi’s research on EV adaptation.

Environmental and Economic Implications

Electric vehicles are heralded as a crucial solution to reducing greenhouse gas emissions, a sentiment echoed in the Gemopai report. EVs offer zero tailpipe emissions, contributing significantly to cleaner air and a reduction in the carbon footprint of transportation.

However, the economic rationale for EV adoption is complex. A study by David S. Rapson and Erich Muehlegger from the National Bureau of Economic Research explores the balance between operational savings and the upfront costs of EVs. The study suggests that while subsidies and incentives are crucial, they must be tailored to regional energy policies and market dynamics to maximize their impact.

The Future of Electric Mobility

The hybrid vehicle market is also experiencing growth, with projections indicating a 14% increase by 2031. This trend, highlighted by Fact.MR, reflects a shift in consumer preferences towards eco-friendly transportation options, driven by rising environmental consciousness and fuel efficiency demands.

Looking ahead, the EV market is poised for substantial expansion, with forecasts predicting a market size of $56.7 trillion by 2050, as reported by Nasdaq. This growth is expected to transform the automobile and energy sectors, with Chinese manufacturers leading the charge in EV production and innovation.

Conclusion

The path to achieving net-zero emissions by 2050 is intricately linked to the widespread adoption of electric vehicles. As highlighted by McKinsey & Company, this transition presents both opportunities and challenges for automakers and policymakers alike. By navigating these complexities and fostering collaboration across sectors, the electric vehicle industry can drive meaningful progress towards a sustainable and low-carbon future.

“`UAE’s Vision for Desert Expansion and Urban Innovation

UAE’s Vision for Desert Expansion and Urban Innovation

In a bold move to accommodate its rapidly growing population, the UAE is set to transform its expansive desert landscapes into thriving residential communities. This strategic development aligns with the nation’s commitment to harnessing natural resources and implementing the ’15-minute city’ model. This urban planning concept aims to make essential amenities accessible within a short walk, enhancing city life and promoting climate resilience.

Population Surge and Urban Planning

The population of Dubai is projected to nearly double by 2040, driven by its dynamic economy and global connectivity. According to the Dubai Statistics Centre, approximately 25,700 people relocated to the city in the first quarter of 2024. Other cities, including Abu Dhabi, Ras Al Khaimah, and Sharjah, are also experiencing increased migration.

Prof Carlos Moreno from IAE Paris Sorbonne University emphasizes the need for innovative urban planning to address the challenges and opportunities this growth presents. He envisions ‘proxilience,’ a concept promoting resilience through proximity and accessibility to community facilities.

Optimism at Big 5 Global

At the recent Big 5 Global event in Dubai, industry leaders expressed optimism about the UAE’s demographic potential. Discussions highlighted the importance of integrating residential, commercial, and recreational spaces to enhance quality of life.

As central areas in Abu Dhabi and Dubai become more crowded, developers are turning to peripheral lands for expansion, similar to suburban growth in North American cities. Areas like Al Ain Road and Dubai South are evolving from city fringes to self-sufficient communities.

Commercial real estate experts, including Jay French and Jack Sellers, predict these areas will become vibrant communities fueled by off-plan purchases, while traditional prime real estate remains valuable.

Building Smarter for the Future

The construction sector faces increased pressure to innovate. Jay French advocates for using steel framing, a sustainable method suitable for modular construction, to meet the demands of rapid urban expansion.

Despite the overall optimism, experts caution that maintaining inclusivity and infrastructure development is crucial for sustaining quality of life in growing urban spaces. Balancing economic progress with community well-being remains a challenge for the UAE’s urban planners.

Exploring the Role of Telemedicine in Medical Education

Exploring the Role of Telemedicine in Medical Education

In a recent study published by Frontiers, researchers delved into the transformative impact of a telemedicine-based course on undergraduate medical students during the COVID-19 pandemic. As the pandemic reshaped the landscape of healthcare, telemedicine emerged as a vital tool, not only in patient care but also in medical education.

The Study’s Core Findings

The study, conducted in Indonesia, focused on the reflections of medical students who participated in a telemedicine-based course designed to monitor COVID-19 patients in self-isolation. This innovative approach aimed to bridge the gap created by the suspension of traditional clinical rotations, providing students with crucial learning opportunities despite the pandemic’s constraints.

Four main themes emerged from the students’ self-reflective writings:

- Communication and Empathy: Students learned the importance of clear communication and empathy while interacting with patients remotely. This experience highlighted the challenges of building rapport without face-to-face contact.

- Professional Identity Formation: The course fostered a sense of purpose and responsibility among students, reinforcing their professional identity as future doctors.

- System-Based Practice: Students gained insights into the complexities of healthcare systems and the importance of interprofessional collaboration in pandemic management.

- Patient-Centered Care: The course emphasized the need for holistic, patient-centered care, considering patients’ biopsychosocial backgrounds.

Implications for Medical Education

This study underscores the potential of telemedicine to enhance medical education by providing students with real-world experiences in patient care. By involving students in telemedicine, medical schools can cultivate essential skills such as adaptability, empathy, and communication, which are critical for future healthcare professionals.

The findings also suggest that telemedicine can complement traditional clinical education, offering a valuable alternative in situations where direct patient interaction is limited. As telemedicine continues to play a significant role in healthcare, its integration into medical curricula is likely to persist, preparing students for the evolving demands of modern medical practice.

Challenges and Considerations

Despite its benefits, the implementation of telemedicine in medical education requires careful planning and adequate resources. Medical schools must ensure that students and clinical supervisors receive proper training and support to maximize the potential of telemedicine-based learning.

Additionally, addressing disparities in access to telemedicine across different regions is crucial to ensure equitable learning opportunities for all students.

Conclusion

The study provides compelling evidence of the benefits of incorporating telemedicine into medical education. By embracing this approach, medical schools can equip students with the skills and experiences needed to navigate the challenges of future healthcare practice, ultimately contributing to the development of competent, patient-centered physicians.

The Transformative Role of AI in Healthcare: Enhancing Patient Care and Health Management

The Role of AI in Healthcare

AI technology, according to a National Academy of Medicine report, holds the potential to improve clinical outcomes, reduce healthcare costs, and enhance population health. In the realm of preventive care, AI is being utilized in radiology to expedite cancer screenings, such as mammograms and lung cancer screenings. For example, at the Mayo Clinic’s PKD Center, AI automates the analysis of kidney images, reducing the process from 45 minutes to mere seconds, thereby aiding in the early detection of polycystic kidney disease.Risk Assessment and AI

AI’s capabilities extend to risk assessment, particularly in cardiology. A study by the Mayo Clinic demonstrated AI’s proficiency in identifying individuals at risk of left ventricular dysfunction, a condition often asymptomatic but potentially fatal. AI models can now alert patients to significant coronary artery calcium levels, predicting heart attack or stroke risks.Advancing Medicine and Public Health

Beyond individual patient care, AI is instrumental in advancing public health. It assists individuals in managing chronic conditions like asthma and diabetes by facilitating timely interventions and reminders. Moreover, AI’s ability to analyze social media trends could have been pivotal in predicting and managing health crises, such as the early stages of COVID-19, as suggested by a study on internet search correlations.AI’s Impact on Patient Care

While some may question AI’s ability to match human healthcare, studies indicate that AI can outperform traditional methods in certain scenarios. For instance, AI has been more accurate than current pathology methods in predicting survival rates for mesothelioma patients and has enhanced the accuracy of colonoscopy procedures by identifying colon polyps.AI and Healthcare Professionals

AI’s role is not to replace healthcare professionals but to augment their capabilities. It can save time by handling tedious tasks, like writing clinical notes and processing vast amounts of medical data. However, human expertise remains crucial for providing clinical context and translating AI findings into actionable insights for patients.Challenges and Future Directions

Despite AI’s promise, challenges remain, including potential biases and the need for effective regulation. AI systems must be trained on diverse datasets to avoid perpetuating existing healthcare disparities. As the Mayo Clinic and other members of the Health AI Partnership emphasize, ensuring equitable and safe AI implementation is essential.As AI continues to evolve, it promises to revolutionize healthcare by improving diagnostics, enhancing remote monitoring, and anticipating disease risks. However, its success hinges on a collaborative approach that leverages both technological advancements and human expertise.

Revolutionizing Healthcare: The Future of Medical Networking

Professional Networking and Collaboration

In today’s interconnected world, medical networking transcends traditional boundaries, fostering collaboration and knowledge sharing at a global level. Advanced platforms are connecting healthcare professionals with peers, mentors, and experts worldwide, facilitating rich discussions, advice-seeking, and peer learning. These networks are crucial for enhancing clinical decision-making and keeping professionals abreast of the latest medical advancements.Patient Education and Public Health Awareness

The COVID-19 pandemic has heightened individuals’ awareness of their health choices, leading to increased community-focused health initiatives. Through platforms like social media, healthcare institutions can disseminate valuable advice on preventive care and self-care, reaching a broader audience to foster healthier communities. Public health campaigns play a vital role in spreading crucial messages, such as vaccination drives and mental health awareness, while addressing medical misinformation effectively.Patient Support and Community Building

Medical networking also provides invaluable support through patient advocacy and community-building efforts. These platforms create safe spaces for individuals with similar health conditions to connect, share experiences, and offer mutual support. This fosters a sense of belonging and empowers patients to navigate their journeys confidently. Additionally, dedicated mental health resources are shared within these networks to promote self-care and provide professional guidance.Recruitment and Career Development

For healthcare professionals, medical networking offers numerous opportunities for career advancement and personal branding. From discovering job opportunities to engaging in networking events and accessing continuing education resources, these networks ensure professionals stay aligned with evolving practices. They also support professional branding by allowing individuals to share their expertise and achievements, enhancing their visibility within the industry.Research and Clinical Trial Recruitment

Medical networking plays a critical role in advancing research and clinical trials by connecting healthcare professionals, researchers, and patients. This targeted approach accelerates trial enrollment and enhances research outcomes by reaching specific patient populations. It also facilitates the dissemination of research findings, promoting collaboration and integrating evidence-based practices into clinical care.As highlighted by Dr. Prashant Bhand, Co-founder & Managing Director of LinkOmed, the future of medical networking is deeply intertwined with innovation and integration. With the emergence of AI-enabled solutions and telemedicine, the healthcare landscape is becoming more inclusive and efficient, setting the stage for a sustainable and collaborative patient-centric ecosystem.

For more insights, visit the original article on eHealth Magazine.

Innovative Urban Expansion: The UAE’s Vision for Sustainable Living

The concept of the 15-minute city, which aims to provide essential amenities within a short walk or bike ride from residents’ homes, is gaining traction as a model for future urban planning. This approach was a focal point at the recent Big 5 Global event in Dubai, where experts, including Prof Carlos Moreno, emphasized the importance of creating proxilience—resilient communities built on the principle of proximity.

In cities like **Dubai** and **Abu Dhabi**, where central areas are already densely populated, developers are looking to the outskirts to accommodate new residents. Areas such as **Dubai South** and **Al Ain Road** are poised to become self-sufficient communities, echoing the suburban expansion seen in North America’s Sun Belt cities. As Jack Sellers of YallaValue noted, these developments are transforming Dubai into a collection of sub-cities, with an increasing trend towards off-plan property purchases.

Building Smarter for the Future

The pressure on the **construction sector** to innovate is mounting. Jay French, CEO of Matthews for Europe, the Middle East, and Africa, advocates for the adoption of **steel framing** and **modular construction methods**, which offer both speed and sustainability benefits. These techniques could alleviate pressure on existing construction resources and provide a more efficient path forward.

Despite the optimism surrounding these developments, experts caution that rapid urban growth presents challenges. Dr Akram Awad of Boston Consulting Group stresses the need for inclusivity in urban planning, ensuring that all residents feel a sense of belonging. Meanwhile, Dr Anas AlMughairy highlights the critical role of infrastructure in supporting new communities, noting the importance of planning ahead to balance economic growth with quality of life.

As the **UAE** continues to evolve, these new **urban landscapes** must navigate the complexities of rapid expansion while striving to create vibrant, livable environments for all.

The Call for Climate Change in Medical Curricula

The Call for Climate Change in Medical Curricula

As the world grapples with the multifaceted impacts of climate change, a new urgency is emerging within the medical community. Experts argue that medical curricula must evolve to include comprehensive climate change education, a topic that was recently at the forefront of discussions at the Asia-Pacific forum of the World Health Summit in Melbourne. This forum highlighted the critical need for future health professionals to understand and mitigate the health impacts of global warming, which are becoming increasingly evident across all fields of human health.Escalating Health Crisis Jonathan Patz, a visiting professor at Monash University and a lead author for the United Nations Intergovernmental Panel on Climate Change, emphasized the severity of the situation. “Climate crisis is a human health emergency,” he stated, underscoring that climate change exacerbates nearly every type of illness. From waterborne diseases caused by extremes in the water cycle to respiratory issues linked to wildfire smoke, the pathways through which climate change impacts health are numerous and complex.

Education as a Tool for Change Despite the increasing recognition of these issues, a 2020 survey revealed that only 15 percent of medical schools had incorporated the health impacts of climate change into their curricula. This gap in education has prompted calls from experts like Professor Patz and others to expand medical training to prepare future health professionals for the realities of climate-related health challenges. An open letter from 2022 urged educators to ensure graduates can identify, prevent, and respond to these impacts.

Global Health and Policy Implications The forum also highlighted the broader implications of climate change on global health policies. Renzo Guinto of Duke-NUS Medical School in Singapore pointed out the mental health challenges associated with climate anxiety, particularly among young people in countries like the Philippines. He advocated for embedding climate health content into health curricula to address these emerging issues and ensure a steady supply of informed health workers.

Opportunities and Challenges While the challenges are significant, there are also opportunities for health benefits as the world tackles the climate crisis. Professor Patz noted that addressing air pollution from fossil fuels, which accounts for over 5 million premature deaths annually according to a BMJ report, could lead to substantial health improvements.

Conclusion

As the forum concluded, the message was clear: integrating climate change education into medical curricula is not just an option but a necessity. This integration will equip future health professionals with the knowledge and skills needed to face one of the most pressing global health emergencies of our time. For more insights from the original article, visit Times Higher Education.Artificial Intelligence in Diagnostics: A Revolution in Healthcare

Artificial Intelligence in Diagnostics: A Revolution in Healthcare

The global market for artificial intelligence in diagnostics is poised for remarkable growth, with projections estimating it to reach USD 7.3 billion by 2032. This surge, as reported by GlobeNewswire on October 7, 2024, is primarily driven by the increasing prevalence of chronic diseases and the escalating demand for AI-driven diagnostic tools.

Unveiling the Market Dynamics

The artificial intelligence in diagnostics market was valued at USD 1.1 billion in 2023. With a compound annual growth rate (CAGR) of 22.2% anticipated from 2024 to 2032, the market is on a robust development trajectory. The rise in chronic diseases, such as diabetes and cardiovascular conditions, is a significant factor fueling this growth.

Healthcare providers are increasingly turning to AI solutions to enhance early detection, ensure precise diagnoses, and facilitate tailored treatment strategies. These tools are indispensable in managing the high volume of medical data, offering faster and more reliable diagnostic processes, and intensifying the focus on personalized medicine.

Radiology: A Pioneering Segment

In 2023, the radiology segment led the artificial intelligence in diagnostics market with a revenue share of 28.4%. Radiology has been at the forefront of AI adoption, leveraging advanced tools to interpret vast amounts of medical images, such as X-rays, CT scans, and MRIs. This early adoption has resulted in mature and refined AI tools, now widely trusted across healthcare facilities.

North America’s Leadership

North America accounted for USD 451.6 million in the artificial intelligence in diagnostics market in 2023. With a projected CAGR of 21.2% from 2024 to 2032, the region stands out as a leader in embracing state-of-the-art healthcare technologies. The high prevalence of chronic diseases and a robust healthcare infrastructure further bolster the demand for AI-based diagnostics.

Key Players and Future Prospects

Major players in the market include Aidoc, AliveCor Inc., Digital Diagnostics, Inc., Enlitic, IBM Corporation, and Siemens Healthineers, among others. As the industry continues to evolve, swift advancements in AI technologies and the widespread adoption of digital healthcare platforms are expected to hasten the integration of AI tools across various diagnostic applications.

For more insights, the full report and additional resources can be accessed through the following links: Request a Sample, Report Customization, and Browse More Reports.

Revolutionizing Medical Education with Extended Reality

Revolutionizing Medical Education with Extended Reality

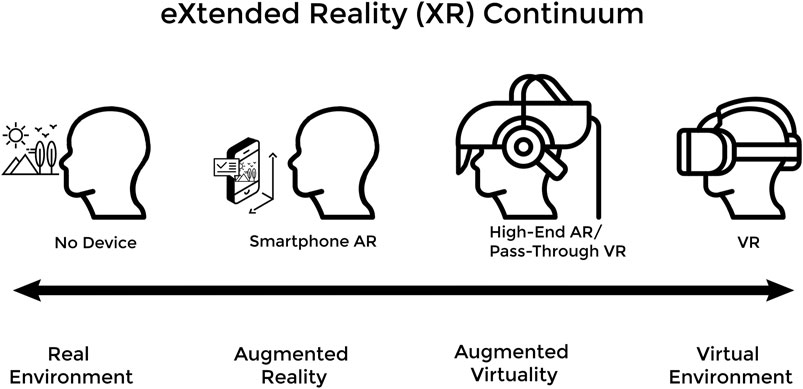

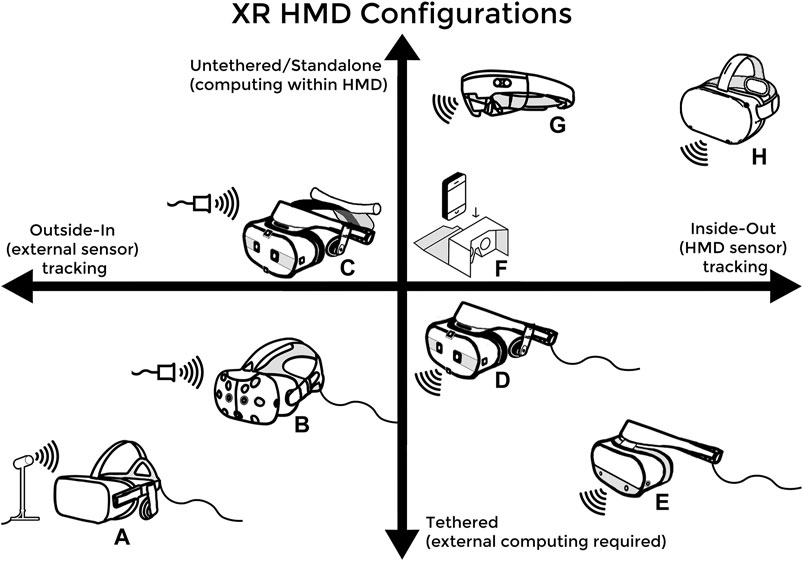

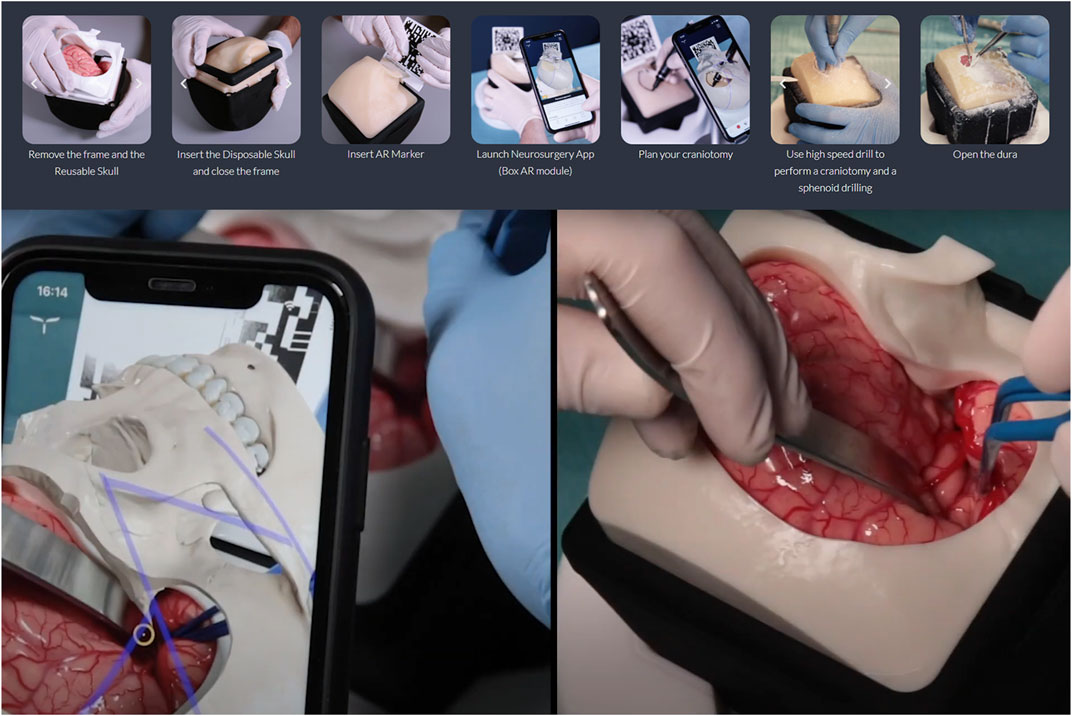

In the ever-evolving landscape of medical education, a new player has emerged, promising to revolutionize the way future doctors are trained. The integration of eXtended Reality (XR) technologies, which encompass both Virtual Reality (VR) and Augmented Reality (AR), is reshaping the educational landscape by addressing the limitations of traditional methods.

Transforming Learning Experiences

XR technologies are bridging gaps in medical training by offering immersive learning experiences that enhance the understanding of complex 3D structures, improve empathetic communication skills, and refine surgical techniques. Traditional educational tools like cadavers and patient actors are often costly and limited in availability. XR offers a cost-effective alternative, allowing students to practice repeatedly in a safe, controlled environment.

Adapting to a Post-Pandemic World

The COVID-19 pandemic has underscored the importance of virtual learning tools. Medical institutions that had invested in XR technologies found themselves better equipped to adapt to remote learning environments. This shift not only ensured continuity in education but also highlighted the potential of XR in providing accessible and engaging learning experiences outside traditional classrooms.

Challenges and Future Prospects

Despite its promise, the widespread adoption of XR in medical education faces challenges. Issues such as cybersickness, faculty resistance, and the need for robust evidence of educational superiority remain. However, as XR technology and its applications continue to evolve, these hurdles are expected to diminish. The future of medical education is poised to embrace these advancements, fostering a new generation of healthcare professionals equipped with cutting-edge skills.

Conclusion

As XR technologies continue to advance, their integration into medical education is not just a possibility but a necessity. By embracing these tools, medical schools can provide students with a more immersive, engaging, and effective learning experience, preparing them for the challenges of modern healthcare.

Genetic Testing: A New Dawn in Healthcare

Genetic Testing: A New Dawn in Healthcare

In the rapidly evolving landscape of healthcare, genetic testing is emerging as a pivotal force, promising to transform patient care through precision medicine. The insights derived from our genetic codes hold the potential to not only prevent diseases but also optimize treatments and promote healthier living. Yet, as highlighted in a recent MedCity News article, the journey towards realizing this potential is fraught with challenges, particularly around patient privacy and data sharing.

The Role of Information Technology

A critical component in addressing these challenges is information technology security. Organizations are turning to certifications like HITRUST to establish standards for safeguarding sensitive information. By aligning with these standards, they can protect data while facilitating the sharing necessary to enhance medical knowledge and patient care.

Collaborative Efforts and Data Sharing

Collaboration is at the heart of advancing genetic testing. Companies are contributing de-identified variant data to public health databases such as ClinVAR and the SEER Cancer Registries. These efforts, supported by cancer research registries, deepen insights and expedite advancements in patient care.

The analysis of expansive data sets is crucial for understanding diseases, allowing researchers to access, assess, and test hypotheses. This collaborative approach is paving the way for tailored treatment plans and new biological discoveries, enhancing early disease detection and intervention.

Integration with Electronic Health Records

Integrating genetic testing with Electronic Health Records (EHR) is another key strategy for improving patient outcomes. Collaborations with EHR vendors like Epic, Flatiron, and Athena streamline processes, making it easier for providers to order genetic products, optimize screening protocols, and identify potential pharmacogenetic interactions. Such collaborations break down silos, enhancing data exchange for more effective research and patient care.

Challenges and Future Trends

Despite the promising progress, the integration of genetic testing into mainstream medicine presents challenges, including managing the vast volume of genomic data. Companies are focusing on presenting complex clinical interpretations, integrating common data ontologies, overcoming data fragmentation, and ensuring data privacy to address these hurdles.

Looking ahead, the industry anticipates significant advancements, with trends like developing tests for early cancer recurrence detection and embracing a multi-omics approach that integrates RNA, proteins, and AI insights. The integration of generative AI for documentation and genetic counseling is another notable development on the horizon.

A New Era in Healthcare

Genetic testing represents more than just a scientific advancement; it signifies a fundamental shift in how we approach health and wellness. As public understanding grows and technology advances, we find ourselves at the dawn of a new era in healthcare, where our genetic code becomes a roadmap to better health and longevity.

About the Author

Kevin Haas, Ph.D., serves as the Chief Technology Officer at Myriad Genetics, where he leads the development of the precision medicine platform. With expertise in molecular simulation and machine learning, Haas is advancing genomics and digital patient/provider experiences. He has co-authored 16 peer-reviewed publications and nine patent applications, bringing a wealth of experience to his role.

Sustainable Architecture: Blending Innovation with Ecological Responsibility

Global Inspirations in Sustainable Architecture

From the towering Quay Quarter Tower in Sydney to the serene March House along the River Thames, these projects exemplify sustainable architecture’s potential to redefine urban landscapes. The eco-friendly synagogue in Palo Alto and the Black & White Building in London showcase how traditional and contemporary designs can coexist harmoniously, pushing the boundaries of what’s possible.

Principles of Sustainability

Sustainable architecture is not just about aesthetics; it’s a commitment to the environment. Key principles include using locally sourced materials, minimizing energy consumption, and ensuring the longevity and adaptability of structures. The 2022 Obel Prize-winning carbon-neutral composite cement by Seratech is a testament to the innovative materials that are shaping the future of construction.

Innovative Projects

Projects like the Slot House in Utah and the Reference Center of Babassu Coconut Breakers in Brazil highlight the diverse applications of sustainable architecture. These buildings are designed to support local communities and reduce environmental footprints, embodying the ethos of sustainability.

- Kempegowda International Airport Terminal 2 in India, a marvel of green technology and design.

- The Magasin Électrique in France, using sustainable materials and innovative reuse.

- Citizens House in London, supporting community through affordable housing.

Future-Proofing Our World

The journey toward sustainable architecture is ongoing, with each project serving as a beacon of what’s achievable when creativity meets ecological awareness. As we look to the future, these structures remind us that architecture can be both a shelter and a steward of the environment.

Conclusion

The original article from Wallpaper.com offers an in-depth exploration of these remarkable endeavors, highlighting the transformative power of sustainable architecture. It is a call to action for architects, designers, and communities to embrace sustainability as a core principle in building a better future.

AI in Clinical and Molecular Diagnostics: A Market on the Rise

AI in Clinical and Molecular Diagnostics: A Market on the Rise

In a significant development, the AI in Clinical and Molecular Diagnostics Market is set to experience remarkable growth, projected to surge from USD 2.6 billion in 2024 to USD 8.9 billion by 2029. This growth is driven by the integration of advanced AI technologies such as machine learning and deep learning into traditional diagnostic methodologies like imaging, genomics, and laboratory testing.

Personalized Medicine and AI Integration A growing emphasis on personalized medicine and the integration of AI into healthcare systems are key factors propelling this market expansion. The demand for accurate and efficient diagnostic solutions is rising, as AI technologies enhance the capabilities of traditional methods.

Regional Focus and Industry Initiatives Countries in North America, Europe, and Asia-Pacific are leading the charge with digital health initiatives, fostering innovative diagnostic solutions. Major industry players are investing in research and development, forming strategic partnerships, and expanding their product portfolios to leverage emerging opportunities in developing markets.

Comprehensive Market Analysis The report provides a detailed analysis of market size, growth trends, and segmentation by technology and application. It examines the challenges and opportunities influencing AI adoption in clinical and molecular diagnostics, focusing on specific applications in imaging, genomics, and laboratory diagnostics. Notable companies featured in the report include Siemens Healthineers AG, F. Hoffmann-La Roche Ltd., Koninklijke Philips N.V., and Fujifilm Holdings Corp.

Emerging Trends and Opportunities Emerging trends, such as AI integration in personalized medicine and telehealth, present significant opportunities for stakeholders including healthcare providers, technology developers, and policymakers. The report serves as an essential reference for those aiming to navigate and capitalize on the evolving AI landscape in diagnostics.

For more comprehensive insights, visit the ResearchAndMarkets.com report.

AI: A Revolution in Healthcare’s Future

The Promise of AI in Healthcare

**AI** is not a distant dream but a present reality, already integrated into everyday life through virtual assistants like Alexa and Siri. However, its potential extends far beyond convenience, reaching into the intricate world of healthcare. According to the National Academy of Medicine, **AI** can significantly enhance patient outcomes, reduce healthcare costs, and improve population health.In radiology, for instance, **AI** accelerates cancer screening results, offering swift and accurate diagnoses. A notable application is in the analysis of polycystic kidney disease (PKD), where **AI** rapidly evaluates total kidney volume, a critical factor in predicting disease progression.

Cardiology and Risk Assessment

**AI’s capabilities** extend into cardiology, where it has demonstrated a remarkable ability to identify risks for conditions like left ventricular dysfunction before symptoms appear. This proactive approach allows for early intervention, potentially averting serious health crises. **AI tools** also detect coronary artery calcium, signaling the risk of heart attacks or strokes years in advance, thus offering a window of opportunity for preventive care.Beyond Diagnostics: AI in Public Health

**AI’s influence** is not confined to individual patient care. It plays a vital role in public health management, particularly in disease prevention and outbreak prediction. During the COVID-19 pandemic, **AI** could have analyzed internet search trends and social media data to anticipate outbreak hotspots, aiding public health officials in making informed decisions to curb the spread.AI as a Complement to Human Expertise

While **AI** shows promise in enhancing medical accuracy, such as in predicting mesothelioma survival and improving colonoscopy accuracy, it is not intended to replace healthcare professionals. Instead, **AI** serves as an invaluable assistant, managing routine tasks and sifting through vast volumes of medical literature, thus freeing doctors to focus on patient care.However, the integration of **AI** in healthcare is not without challenges. Concerns about bias in **AI algorithms**, if trained on non-representative data, and the dissemination of misinformation through **AI chatbots** underscore the need for effective regulation.

The Road Ahead

The future of **AI in healthcare** is bright, with exciting possibilities on the horizon. From remote health monitoring and early diagnosis of imperceptible conditions to selecting suitable clinical trials, **AI** stands to redefine the landscape of medical care. The Mayo Clinic is at the forefront of this innovation, striving to harness **AI’s potential** to create new methods for diagnosing, treating, predicting, preventing, and curing diseases.

As **AI** continues to evolve, its role in healthcare will undoubtedly expand, offering new tools and insights that promise to enhance both individual and public health outcomes.