Exploring Innovative Strategies for Managing Student Loan Payments

Exploring Innovative Strategies for Managing Student Loan Payments

In a landscape where student loan debt is a growing concern, borrowers are exploring creative methods to manage their financial obligations. According to EducationData.org’s 2023 report, the average federal student loan borrower owes $37,574, while private borrowers face an even steeper average of $54,921. With these daunting figures, many are considering unconventional methods to ease their financial burden.

- Contact Your Lender

For those with private loans, reaching out to your lender can reveal whether credit card payments are an option. While not all lenders offer this flexibility, some do, providing a possible avenue for managing payments more conveniently. - Utilize Third-Party Payment Platforms

Federal student loan borrowers might consider third-party platforms like PaySimply and Plastiq. These services enable payments via credit card by converting them into wire transfers or cash equivalents, although fees ranging from 2.5% to 3% can offset any potential rewards benefits. - Consider a Balance Transfer

For those nearing the end of their loan term, transferring the balance to a 0% APR balance transfer credit card could be a viable option. This method can provide an interest-free period of up to 21 months, though it comes with a transfer fee of 2% to 3%. - Creative Budgeting

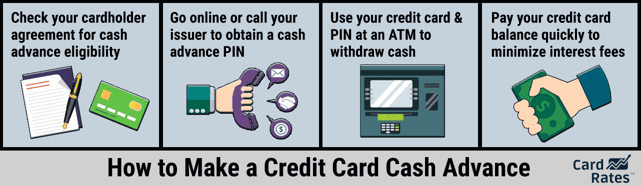

A strategic approach involves reallocating expenses. For example, paying for groceries with a credit card can free up cash for student loan payments, achieving the same financial effect without direct loan charges. - Cash Advances

While not ideal due to high APR rates and immediate interest accrual, cash advances can be a last-resort option. Borrowers should weigh the costs carefully before proceeding. - Explore Deferment and Forbearance

Federal loan holders should explore deferment and forbearance options, which offer payment relief without credit damage. Private lenders may also provide hardship plans, though these vary by institution.

While these strategies can provide temporary relief, borrowers must remain vigilant about the potential pitfalls, such as high interest rates and the risk of accumulating more debt. The original article by Erica Sandberg on CardRates.com emphasizes the importance of informed financial decisions and responsible credit management.

CSS for Styling

“`css h3 { color: #b40101; margin-bottom: 20px; } h4 { color: #b40101; margin-top: 30px; margin-bottom: 10px; } p { margin-bottom: 15px; } b { color: #b40101; } a { color: #b40101; text-decoration: none; } a:hover { text-decoration: underline; } img { margin: 20px 0; max-width: 100%; height: auto; } “`

This approach ensures that borrowers are equipped with the knowledge to navigate their financial landscape effectively, prioritizing both short-term relief and long-term financial health.

More Articles

Getting licensed or staying ahead in your career can be a journey—but it doesn’t have to be overwhelming. Grab your favorite coffee or tea, take a moment to relax, and browse through our articles. Whether you’re just starting out or renewing your expertise, we’ve got tips, insights, and advice to keep you moving forward. Here’s to your success—one sip and one step at a time!

Exploring Real Estate Investment: A Comprehensive Guide

Exploring Real Estate Investment: A Comprehensive Guide

Real estate investment is a popular avenue for diversifying one’s portfolio and generating passive income. However, the traditional notion of becoming a landlord—complete with calls about leaky faucets and pest control—might not appeal to everyone. Fortunately, as highlighted in a recent NerdWallet article, there are various strategies to invest in real estate without the hassle of direct property management.

-

Invest in REITs

Real Estate Investment Trusts (REITs) offer an accessible entry into the world of real estate. These entities own and manage a portfolio of real estate assets. They are akin to mutual funds and often pay high dividends, making them a favorite for retirement portfolios. New investors are advised to start with publicly traded REITs for ease of liquidity and valuation.

-

Utilize Online Real Estate Platforms

Platforms like Fundrise and RealtyMogul connect investors with developers seeking project financing. While these options can yield regular distributions, they are often open only to accredited investors, as defined by the SEC.

-

Consider Rental Properties

Buying and renting out properties can be lucrative. The concept of “house hacking,” popularized by BiggerPockets, involves living in a property while renting out parts of it to cover expenses. This approach can provide valuable industry insights, though it may require hiring a property manager if you prefer a hands-off role.

-

Flip Properties

Flipping properties involves purchasing undervalued homes, renovating them, and selling for a profit. While popularized by TV shows, this strategy carries risks, particularly if repair costs are underestimated. Partnering with experienced contractors can mitigate some of these risks.

-

Rent Out a Room

For those new to real estate, renting out a room in your home can be a gentle introduction. This arrangement can reduce housing costs and make mortgage payments more manageable. Platforms like Airbnb provide an opportunity for short-term rentals without the commitment of a long-term tenant.

Each investment strategy comes with its own set of challenges and rewards. As the NerdWallet article suggests, the best approach depends on your financial goals, available capital, and willingness to manage property-related issues. For those lacking DIY skills, REITs or crowdfunding platforms might be preferable to direct property investments.

Hurricane Helene’s Impact on the Southeast: A Real Estate Perspective

Hurricane Helene’s Impact on the Southeast: A Real Estate Perspective

As hurricane season descends upon the Southeast, residents are grappling with the aftermath of Hurricane Helene. This formidable storm made landfall as a Category 4 hurricane, with wind speeds reaching an alarming 140 mph, before it was downgraded to a tropical storm. The initial impact was felt in Florida’s Big Bend area, near Tallahassee, as Helene unleashed its fury on Thursday night.

By Friday morning, Helene had moved into northeast Georgia, near the South Carolina border, with sustained winds of 45 mph, according to the National Hurricane Center. In response to the devastation, Florida Governor Ron DeSantis declared a state of emergency for 41 of the state’s 67 counties.

Fatalities and Damage

The human toll has been tragic. Georgia Governor Brian Kemp reported at least 11 fatalities in the state, with numerous residents trapped in their homes. Additional deaths were confirmed in Florida, North Carolina, and South Carolina, bringing the total to at least 17 lives lost.

The full extent of the damage is yet to be determined, but it is expected to be substantial. CoreLogic estimates that 25,000 homes along Florida’s Gulf Coast are at risk of flooding, with potential financial losses reaching $5.6 billion. Meanwhile, Moody’s projects that 162,000 commercial properties, valued at a staggering $425 billion, face significant wind damage risks.

Insurance Challenges

Florida homeowners are already contending with rising insurance premiums, exacerbated by the storm’s impact. According to a report by S&P Global, insurance rates in Florida surged by 43% between 2018 and 2023, with residents paying nearly $6,000 annually—more than triple the national average.

Despite the high recovery costs, Mark Friedlander of the Insurance Information Institute remains optimistic. He believes insurers are well-prepared to handle claims related to Helene, thanks to adequate levels of reinsurance and recent legislative reforms that have bolstered their financial positions.

Legislative Reforms

Florida lawmakers have enacted reforms aimed at reducing property insurance premiums by $500 million statewide. These measures include eliminating certain taxes and fees on policies and allocating $200 million for home reinforcement grants, prioritizing low-income and senior households. Additionally, a pilot program has been established for condominium associations to apply for mitigation grants.

The Wall Street Journal highlights that home insurance expenses are influenced by population growth patterns, with South Carolina, Florida, and Texas being the fastest-growing states, making them more susceptible to natural disasters.

For more detailed insights, you can read the original article on HousingWire.

Real Estate Rule Changes Shift Commission Costs to Homebuyers

Real Estate Rule Changes Shift Commission Costs to Homebuyers

The winds of change are sweeping through the real estate industry, ushering in new rules that promise to reshape the financial landscape for homebuyers. As of this weekend, the longstanding practice where sellers routinely covered buyer agent commissions will become a relic of the past. These sweeping reforms, driven by the National Association of Realtors, are rooted in a recent settlement of federal lawsuits that accused the industry of inflating commission costs.Traditionally, sellers included a blanket commission offer for buyer’s agents in home listings. This practice will soon vanish from Multiple Listing Service (MLS)-affiliated properties. Instead, compensatory incentives will be negotiated separately, potentially leaving homebuyers responsible for agent fees. This shift could exacerbate financial pressures, particularly in a market already burdened by elevated mortgage rates and limited housing inventory.

Real estate giants such as Keller Williams, Re/Max, and others have agreed to policy revisions that underscore this shift. Starting Saturday, these modifications will require homebuyers to execute precise representation agreements before engaging an agent, demanding clarity on compensation terms.

As housing market dynamics evolve, sellers will need to evaluate whether to cover buyer agent commissions based on local market conditions. In a sluggish market, buyers might negotiate to sustain lower costs, while a competitive market might see sellers opting out of compensatory obligations.

While buyer-agent commissions have noted a slight decline recently, rising home values mean that prospective buyers might still face additional financial burdens. Consumer advocacy groups suggest that negotiations could potentially lower seller-side commissions, impacting overall market expenditure.

Ultimately, homebuyers must adapt to these regulatory refinements, assessing potential financial impacts when engaging real estate services under the new frameworks. For more details, refer to the original article on Finance & Commerce.

Florida Real Estate Market: A Forecast of Opportunities and Challenges

Florida Real Estate Market: A Forecast of Opportunities and Challenges

The Florida real estate market continues to intrigue both potential homeowners and investors as we look towards 2024, 2025, and 2030. With its perennial allure, Florida remains a hotspot for real estate activity, driven by a myriad of factors including interest rates, demographic shifts, and economic forecasts.

Current Market Dynamics

Recent data from Zillow and Bankrate indicate a slight dip in mortgage rates, contributing to a shift in affordability. Redfin reports that starter homes have appreciated by 4.2% year-over-year, yet several metropolitan areas have transitioned from “unaffordable” to “affordable.” This shift is attributed to mortgage interest rates dropping from 7.07% to 6.50%, making the median-priced starter home more accessible.

Inventory levels have risen by 36.2% in 2024, yet the market still favors sellers with demand outpacing supply. The median sales price climbed slightly to $416,990, while the number of homes sold decreased by 5.2% from the previous year. As the Fed cut its benchmark interest rate by 50 basis points, a fresh wave of buyers entered the market, though some still find qualifying for mortgages challenging.

Factors Influencing Prices

Several factors influence Florida’s real estate prices, including job growth, demographics, and demand from out-of-state and international buyers. Florida’s robust job market and lack of state income tax are significant attractors, particularly for younger generations. This demographic shift has sustained high property values, despite economic fluctuations.

Future Projections: 2024 to 2030

Looking ahead, the Southeast Florida Housing Outlook predicts a 2.1% increase in house values in 2024, with a further rise in single-family home prices by 7%. By 2025, the demand is expected to remain strong, especially for single-family homes, with prices potentially rising by nearly 10%. Dr. Lawrence Yun of the National Association of Realtors suggests a national market appreciation of 15% to 25% over the next five years, with Florida likely exceeding this forecast.

Challenges remain, such as potential economic downturns and the impact of natural disasters like hurricanes. However, the market’s resilience is notable, with consumer sentiment on the rise and unemployment rates remaining low.

Investment Opportunities and Risks

Florida real estate has long been a lucrative investment, but risks persist, particularly regarding insurance costs due to hurricanes. The state’s low property taxes offer some relief, with homestead exemptions reducing taxable values. Investors should also consider the potential impact of policy changes on hedge fund home purchases, which could dramatically increase inventory and shift the market dynamics.

In conclusion, while predictions are inherently uncertain, the Florida real estate market appears poised for growth. For those considering a purchase, engaging a reputable Buyer’s Agent and exploring mortgage options could be prudent steps toward capitalizing on the evolving market landscape.

How the Federal Reserve’s Rate Cut Could Reshape the Housing Market

How the Federal Reserve’s Rate Cut Could Reshape the Housing Market

In a move that has been eagerly anticipated, the Federal Reserve has cut interest rates by half a percentage point. While this decision is expected to influence the housing market, its impact on affordability remains uncertain.

In a move that has been eagerly anticipated, the Federal Reserve has cut interest rates by half a percentage point. While this decision is expected to influence the housing market, its impact on affordability remains uncertain.

Mortgage Rates: A Marginal Drop

Mortgage rates, which have been hovering around 8% after the pandemic-induced lows, are now at 6.2% following the Fed’s announcement. However, experts like Charlie Dougherty, a senior economist at Wells Fargo, predict only a marginal decrease. For those interested in the specifics, Freddie Mac provides current mortgage rate data.Higher Competition, Higher Prices

Lower mortgage rates are a double-edged sword. While they may attract more buyers, this influx could drive up housing prices due to increased competition. Real estate agents like Kim Kronenberger express concern for first-time buyers who might find themselves priced out of the market.Building the Future: More Homes on the Horizon?

The rate cut could incentivize builders by lowering the cost of loans tied to development. This may help address the national housing shortfall, as highlighted in a Harvard study. However, the impact of new home construction will take time to materialize.Affordability: Still a Major Hurdle

Despite potential benefits, affordability remains a significant issue. Home prices have surged by 50% since early 2020, outpacing income growth. As reported, many homeowners are unlikely to sell due to favorable existing mortgage rates, limiting market inventory. Greg McBride from Bankrate.com notes that lower rates have not significantly boosted the housing market. “Home prices are still at record highs, and inventory remains below pre-pandemic levels,” he explains.For more insights, the original article on NPR offers a comprehensive analysis of these developments.

Housing Market Predictions for 2024: Navigating the Path to Affordability

Housing Market Predictions for 2024: Navigating the Path to Affordability

In a landscape marked by fluctuating trends, the housing market of 2024 is poised at a crossroads. Recent declines in mortgage rates have kindled hopes among potential homebuyers, offering a glimmer of affordability. However, the journey to homeownership remains fraught with challenges, as experts weigh in on the future of home prices and market dynamics.

Current Market Conditions: A Mixed Bag

Despite a promising dip in mortgage rates, the housing market presents a complex picture. While some regions witness a decline in home prices, others continue to see an upward trajectory. According to the latest S&P CoreLogic Case-Shiller Home Price Index, U.S. home prices posted a 5% annual gain, signaling a slowdown from previous months but still reaching new highs. This variability underscores the challenges faced by potential buyers in 2024.

Expert Opinions and Projections

Industry experts provide a spectrum of forecasts for the housing market’s trajectory. Lisa Sturtevant, chief economist at Bright MLS, suggests that falling mortgage rates could temper home price growth if inventory continues to rise. Meanwhile, Ralph McLaughlin of Realtor.com anticipates a rebound in price growth as purchasing power improves amid favorable rate conditions. As these predictions unfold, potential homeowners are urged to seize current opportunities before a possible demand surge reignites price increases.

Impact of Policy Changes

Recent policy shifts further complicate the housing landscape. The National Association of Realtors (NAR) has introduced new rules aimed at enhancing transparency in real estate transactions. These changes, spurred by a significant antitrust settlement, redefine how broker commissions are handled, impacting both buyers and sellers. As these reforms take root, their influence on market dynamics remains to be seen.

Challenges and Strategies in a Competitive Market

Affordability remains a pressing concern, with home prices still out of reach for many. As potential buyers navigate this challenging terrain, strategies for first-time buyers become crucial. The responsibility for broker commissions now often falls on buyers, adding another layer to the affordability equation. Yet, experts advise against postponing home purchases, emphasizing the benefits of entering the market amid less frenzied competition.

Looking Ahead: Market Outlook for 2024 and Beyond

As we look toward the end of 2024 and beyond, the housing market’s future hangs in a delicate balance. While some anticipate a more favorable environment for buyers, others caution against waiting for ideal conditions. The potential for a resurgence in demand, coupled with evolving market dynamics, suggests a complex road ahead for both buyers and sellers.

In this ever-changing landscape, staying informed and adaptable is key. For those ready to embark on the journey to homeownership, understanding the market’s nuances and leveraging expert insights can make all the difference.

Innovation at the Intersection of Infrastructure and Real Estate

Innovation at the Intersection of Infrastructure and Real Estate

The ever-evolving landscape of technological innovation is reshaping the very fabric of our infrastructure and real estate. As the world’s energy needs surge exponentially, the demands of large language models and generative AI, such as ChatGPT, have reached unprecedented levels, requiring vast amounts of power, water, and electricity. This has created a ripple effect across infrastructures, particularly data centers, which are now grappling with these new challenges. Powering the Future: A New Era of Data Centers

Data centers, once modest in their energy consumption, have grown exponentially. “We were building data centers that were one megawatt, 10 megawatts. Now, they’re 100 megawatts, 500 megawatts, and one gigawatt,” said John Ghirardelli, executive director at Morgan Stanley Infrastructure Partners. This surge has put immense pressure on the US grid, which has remained relatively stable over the past 40 years.

At the MIT Sloan Reunion 2024, Ghirardelli moderated a panel titled “The Digitalization and Infrastructure of Real Estate,” where experts delved into the complexities and opportunities of this intersection.

The Green Revolution: Sustainable Solutions

The shift towards greener energy is not just a trend but a necessity. As data centers expand, so does the need for sustainable energy solutions. Dipul Patel, CTO at Soluna, emphasized the importance of relocating data centers to areas with abundant wind power. “AI is power-hungry and money-hungry on a level that no one’s ever seen,” Patel noted. By positioning data centers near wind farms, energy loss is minimized, making both the data centers and wind farms more efficient and profitable.

Powering the Future: A New Era of Data Centers

Data centers, once modest in their energy consumption, have grown exponentially. “We were building data centers that were one megawatt, 10 megawatts. Now, they’re 100 megawatts, 500 megawatts, and one gigawatt,” said John Ghirardelli, executive director at Morgan Stanley Infrastructure Partners. This surge has put immense pressure on the US grid, which has remained relatively stable over the past 40 years.

At the MIT Sloan Reunion 2024, Ghirardelli moderated a panel titled “The Digitalization and Infrastructure of Real Estate,” where experts delved into the complexities and opportunities of this intersection.

The Green Revolution: Sustainable Solutions

The shift towards greener energy is not just a trend but a necessity. As data centers expand, so does the need for sustainable energy solutions. Dipul Patel, CTO at Soluna, emphasized the importance of relocating data centers to areas with abundant wind power. “AI is power-hungry and money-hungry on a level that no one’s ever seen,” Patel noted. By positioning data centers near wind farms, energy loss is minimized, making both the data centers and wind farms more efficient and profitable.

Real Estate: A New Game

The real estate industry is undergoing a transformation, moving beyond traditional residential and commercial spaces to include assets like data centers, cell phone towers, and renewable energy farms. “Real estate is really an industry of innovate or die,” said Zvi Gordon, CEO of Gazit Horizons Inc. The industry must adapt to rapid technological changes, balancing innovation with the challenges of permits and slow processes.

John Ghirardelli encapsulated this shift, stating, “It’s no longer single-family homes and McDonald’s anymore. It’s a whole new game.”

Real Estate: A New Game

The real estate industry is undergoing a transformation, moving beyond traditional residential and commercial spaces to include assets like data centers, cell phone towers, and renewable energy farms. “Real estate is really an industry of innovate or die,” said Zvi Gordon, CEO of Gazit Horizons Inc. The industry must adapt to rapid technological changes, balancing innovation with the challenges of permits and slow processes.

John Ghirardelli encapsulated this shift, stating, “It’s no longer single-family homes and McDonald’s anymore. It’s a whole new game.”

Conclusion

The insights shared at the MIT Sloan Reunion 2024 highlight the critical need for smarter, faster, and more sustainable development in the face of growing technological demands. As the world continues to digitalize, the intersection of infrastructure and real estate will play a pivotal role in shaping our future.

Conclusion

The insights shared at the MIT Sloan Reunion 2024 highlight the critical need for smarter, faster, and more sustainable development in the face of growing technological demands. As the world continues to digitalize, the intersection of infrastructure and real estate will play a pivotal role in shaping our future.

Florida’s Short-Term Rental Boom: Top Cities to Invest

Florida Emerges as Prime Destination for Short-Term Rental Investments

In a comprehensive study conducted by Clever Real Estate in collaboration with Rabbu.com, Tampa, Florida has been identified as the premier city in the United States for investing in short-term rentals. This study meticulously analyzed various factors, such as median home prices, occupancy rates, and fluctuations in property values, to determine the most lucrative Airbnb investment markets across the nation. Read more here.

Tampa’s real estate market is thriving, having experienced a remarkable 71.6% increase in property values over the past five years, which is 55% higher than the median city in the study. The metro area boasts an impressive 16,020 property listings, tripling the median city average, alongside a respectable 44.8% Airbnb occupancy rate and an average annual Airbnb revenue of $52,705. These compelling statistics underscore Tampa’s allure for potential investors.

Top 10 U.S. Cities for Short-Term Rental Investments

- Tampa, FL

- Orlando, FL

- Jacksonville, FL

- Boston, MA

- Miami, FL

- Buffalo, NY

- Columbus, OH

- Chicago, IL

- Providence, RI

- Kansas City, MO

Conversely, San Jose, California is identified as the least attractive market for short-term rental investments. The city grapples with a high median home sale price of $1,447,955, which is over four times the national average, and a low number of just 1,296 listed properties, leading to a 76% decrease compared to the median. Consequently, San Jose has been assigned the lowest Rabbu return on investment score in America.

10 Worst Short-Term Rental Markets in the U.S.

- San Jose, CA

- Birmingham, AL

- San Antonio, TX

- Houston, TX

- Sacramento, CA

- Raleigh, NC

- Riverside, CA

- San Francisco, CA

- Oklahoma City, OK

- Pittsburgh, PA

Additionally, a survey conducted by Clever involving 1,000 Americans revealed that 76% of respondents have a favorable outlook towards Airbnbs, with 60% rating short-term rentals above hotels in terms of quality and 67% noting improved comfort. Nonetheless, a significant 96% identified disadvantages, such as misleading property descriptions, a lack of on-site assistance, and safety concerns.

Safety remains a concern, as only 44% of respondents perceive Airbnbs as safer than hotels—a viewpoint possibly exacerbated by rising crime rates. Emir Dukic, founder of Rabbu, commented, “We continue to observe growing interest from our user base in investing in short-term rentals and vacation homes, despite current interest rates. Although returns are somewhat compressed compared to previous years, the best properties in our top markets consistently generate double-digit returns.”

For those considering venturing into the short-term rental market, Tampa and other thriving cities present enticing opportunities. This extensive analysis offers valuable insights for potential investors eager to capitalize on the flourishing short-term rental market.

Top Real Estate Marketing Strategies to Boost Your Business

The realm of real estate marketing is a landscape filled with both challenges and rewarding opportunities. A recent 2023 study by the National Association of Realtors (NAR) reveals that a staggering 89% of recent homebuyers utilized a real estate agent or broker during their purchase. Furthermore, 73% of these buyers consulted only one agent, underscoring the critical importance of early visibility and swift engagement for real estate professionals.

Here are some pivotal marketing strategies that top agents employ to expand their business reach:

Create a Website: Establishing a website is essential for any real estate professional. It serves as a central hub to showcase services and property listings, thereby attracting potential clients. Adding features like mortgage calculators provides extra value, encouraging prolonged visitor engagement. Regular content updates keep the audience informed and ensure they return during their property search journey.

Build a Blog: Blogs are powerful tools for boosting online presence. Crafting SEO-optimized content increases visibility in search results. A blog should link to the main website and other real estate profiles, broadening the scope of business insights. This not only showcases expertise but also establishes authority in the market. Sharing insights and advice leaves a lasting impression on prospective clients.

Develop Email Marketing Campaigns: Email marketing remains effective for engaging both new and existing clients. Regular newsletters summarizing blog content and featuring new property listings keep the audience informed. High-quality images and virtual tours make the communication more captivating. Engaging subject lines increase the likelihood of emails being opened, enhancing customer connection.

Employ Virtual Staging: Virtual staging offers a cost-effective alternative to physical staging, allowing buyers to envision a furnished space. A 2023 study indicates that staged homes sell for 5-23% more, underscoring the financial advantage. This technique is particularly useful when physical visits are limited, making the buying process more streamlined.

Try Experiential Marketing: This innovative approach invites potential buyers to interact with properties through events such as homebuyer workshops or open houses. Providing an in-person experience helps foster deeper connections, ultimately leading to higher conversion rates.

Partner with Local Businesses: Collaborating with local enterprises enhances marketing efforts. Joint events, like open houses with pop-up shops, create unique experiences that spotlight listings and highlight the community’s appeal. Such partnerships boost word-of-mouth referrals and strengthen brand visibility.

Run Paid Instagram Promotions: Instagram offers a dynamic platform for real estate marketing. Through targeted promotions using stunning property images, agents can reach a specific demographic, enhancing engagement. Creative video content not only promotes listings but also builds trust and personality in the digital space.

By implementing these effective marketing tactics, real estate professionals can attract new clients, enhance property sales, and thrive in a competitive industry.

For those seeking property opportunities in Bali, Kibarer Property provides comprehensive services to assist in finding the ideal property.

This article draws on insights from the original piece published by Kibarer Property, which can be accessed for more detailed strategies and advice.

Navigating Australia’s Real Estate Investment: Commercial vs. Residential

In the ever-evolving landscape of **real estate investment**, the choice between **commercial** and **residential properties** is a pivotal decision for investors in **Australia**. As the property market continues to shift, understanding the nuances of each sector becomes crucial. A recent article from PressPay delves into this very topic, offering a comprehensive analysis of the pros and cons associated with these investment avenues.

Understanding the Differences

The fundamental differences between **commercial** and **residential real estate investments** are stark. **Commercial properties**, often characterized by longer lease terms, can provide stability and potentially higher rental yields. However, they also come with the challenge of lengthier vacancy periods, a factor that can impact profitability. In contrast, **residential properties** typically have shorter leases and more frequent tenant turnover, which can lead to a steady occupancy rate but might not offer the same yield potential as their commercial counterparts.

Lease Length and Vacancy Periods

In **Australia**, **commercial leases** can span from three to five years or longer, offering a semblance of stability for investors. This extended lease duration is attractive to those seeking consistent rental income. However, the tenant acquisition process can be more complex and time-consuming, resulting in longer vacancy periods. On the other hand, **residential properties**, with their shorter lease terms, often experience higher rental demand, especially in populated areas, ensuring a more consistent occupancy rate.

Rental Yields and Economic Vulnerabilities

One of the most significant distinctions lies in **rental yields**. **Commercial properties** in cities like **Sydney** and **Melbourne** offer yields ranging from 5% to 12%, significantly higher than the average 3.6% for **residential properties**. This disparity is primarily due to businesses occupying commercial spaces, generating greater income. However, **commercial properties** are more susceptible to economic shocks. Sudden changes in the economy can lead to increased vacancy rates and financial instability, a risk less pronounced in residential investments.

Maintenance and Tenant Behavior

Maintenance obligations also differ. In **commercial leases**, tenants often bear the costs of repairs and maintenance, reducing the burden on landlords. Conversely, **residential property owners** must manage these responsibilities, which can include regular inspections and compliance with building regulations. Tenant behavior further influences investment decisions. **Commercial tenants** usually sign net leases, assuming expenses like council rates and insurance, while **residential investors** may enjoy more stable long-term tenancies.

Impact of COVID-19 and Market Trends

The impact of COVID-19 has reshaped the **real estate landscape**, affecting both sectors. The pandemic led to increased office vacancies as businesses embraced remote work, challenging the **commercial market**. Meanwhile, **residential properties** faced reduced demand as renters opted for stability amid uncertainty. As the market adapts, understanding these trends and forecasts becomes essential for investors aiming to make informed decisions.

In conclusion, choosing between **commercial** and **residential real estate investments** in **Australia** requires a comprehensive understanding of market dynamics, economic vulnerabilities, and lease structures. Both sectors offer unique opportunities and challenges, and the decision ultimately hinges on an investor’s financial capacity, risk tolerance, and long-term goals. As the **PressPay article** suggests, a well-informed strategy can lead to lucrative returns, whether one chooses the stability of **residential properties** or the high-yield potential of **commercial investments**.

How to Sell Your House in 2024: A Complete Guide

Maximizing Real Estate Success: Top Lead Generation Websites for 2024

Real Estate Lead Generation: A Digital Imperative

The HousingWire article, “6 Best **Real Estate Lead Generation Websites** for 2024,” underscores the importance of harnessing digital tools to stay ahead. It highlights six platforms that are setting the standard for lead generation, each offering unique features to help real estate professionals connect with their audience.

- Placester: Known for its done-for-you support team and marketing services, Placester offers a starting price of $79/month. It provides IDX integration and CRM tools, making it ideal for agents looking to enhance their online presence. Visit Placester

- PropertyBase: With a focus on lead scoring and creating “sticky” customer relations, PropertyBase integrates Salesforce-based CRM with IDX. Starting at $79/month, it offers robust SEO features and lead capture tools. Visit PropertyBase

- Sierra Interactive: Best for advanced IDX feed integration, Sierra Interactive provides high conversion rates and supports multiple MLS feeds. Pricing requires an inquiry, but its SEO and CRM tools make it a strong contender. Visit Sierra Interactive

- iNCOM: Offering cost-effective IDX integration at $49.95/month plus a setup fee, iNCOM is perfect for budget-conscious agents. It features personalized ad targeting and strong SEO capabilities. Visit iNCOM

- Zillow Premier Agent: Known for matching with buyers, this platform requires no minimum monthly fee but charges per lead. It connects agents with buyers through a user-friendly dashboard. Visit Zillow Premier Agent

- CINC: Ideal for hyperlocal leads, CINC offers advanced demographic targeting and a comprehensive CRM. Starting at $900, it promises a guaranteed return on investment. Visit CINC

Key Features for Success

To transform a **real estate website** into a lead-generating powerhouse, certain features are indispensable. These include email capture capabilities, buyer and seller-specific landing pages, CRM integration with automated drip campaigns, excellence in branding, and a mobile-friendly design.

The Full Picture

In today’s fast-paced market, staying ahead of the tech curve is not just a choice but a necessity for **real estate success**. The digital landscape offers abundant opportunities to connect with potential clients online. The best lead generation website depends on your unique circumstances and objectives. Assess your specific requirements, budget constraints, and target audience before choosing the right platform for your business.

In conclusion, as the **real estate industry** continues to evolve, embracing digital tools and strategies is essential. Whether you’re a seasoned agent or a newcomer, leveraging these platforms can significantly enhance your lead generation efforts and help you thrive in the digital age.

Turbocharge Your Real Estate Success in 2024 with Cutting-Edge Lead Generation

Digital Marketing Evolution

In today’s fast-paced world, a mobile-first experience is no longer optional but essential. With many potential homebuyers initiating their search on mobile devices, optimizing online presence for mobile users is critical. This includes ensuring responsive website design, fast loading times, and content that adapts seamlessly to various screen sizes.

Moreover, the rise of video content cannot be ignored. As engaging as it is informative, video content—ranging from virtual tours to client testimonials—can significantly boost online visibility and engagement. By incorporating videos into marketing strategies, real estate professionals can capture the attention of potential clients more effectively.

Leveraging Social Media Platforms

Social media platforms like Facebook and Instagram remain powerhouses for lead generation. With millions of active users, these platforms offer unparalleled opportunities to connect with diverse audiences. Crafting targeted ads and sharing compelling organic content are key strategies to maximize reach and engagement. Understanding the unique algorithms and advertising features of each platform is crucial, as highlighted in a related article on generating real estate leads on Instagram.

Furthermore, exploring emerging platforms can provide access to a more engaged audience with less competition, creating fertile ground for lead generation.

SEO and Local Search

Search Engine Optimization (SEO) is pivotal in ensuring that potential clients find your website. This involves optimizing the site with relevant keywords, creating quality content, and ensuring a good user experience. For real estate professionals, local SEO is particularly vital. By optimizing online presence to attract traffic from specific geographic areas, professionals can tap into localized content and Google My Business listings to enhance visibility.

Interactive Content

Offering virtual tours and interactive listings can set real estate professionals apart in a digital-first world. These tools provide an immersive experience, allowing potential buyers to explore properties virtually. Additionally, interactive tools like mortgage calculators or home preference quizzes engage visitors and collect valuable lead information, adding value to your website.

Paid Lead Generation Services

While organic strategies are foundational, paid lead generation services can amplify reach by targeting specific demographics or geographic areas. These services can be particularly useful in highly competitive markets, boosting visibility and enhancing lead generation efforts.

As we look toward 2024, the real estate market continues to evolve, driven by technology and innovation. By embracing cutting-edge strategies—from optimizing for mobile users to leveraging social media and incorporating paid lead generation services—real estate professionals can significantly enhance their lead generation efforts. The key to success lies in staying adaptable, continually learning, and experimenting with new methods to connect with potential clients in this ever-changing landscape.

For more insights, visit the original article on Chicago Agent Magazine.

Real Estate: Strategic Advice

In the ever-evolving landscape of real estate, making informed decisions is crucial, whether you’re buying, selling, or investing. In a recent article published by SampleBoard, readers are guided through the complexities of the real estate market, offering valuable insights and strategic advice to navigate this challenging terrain.

Published three months ago, the article titled “Real Estate: Strategic Advice” serves as a compass for those looking to make savvy real estate decisions. The piece emphasizes the importance of understanding market trends and the factors influencing property values. Whether you’re a first-time buyer or a seasoned investor, the article provides a wealth of knowledge to help you make informed choices.

The article is enriched with practical tips, such as how to assess the potential of a property, the significance of location, and the impact of economic conditions on real estate markets. It underscores the importance of due diligence and the need for a strategic approach when entering the real estate arena.

For those interested in diving deeper into the world of real estate, the article is accompanied by an engaging image that captures the essence of real estate exploration. This visual element complements the article’s content, providing a holistic view of the real estate journey.

In conclusion, SampleBoard’s article on real estate offers a comprehensive guide for anyone looking to make informed decisions in the real estate market. By navigating the complexities with strategic advice, readers are better equipped to achieve their real estate goals.

Housing Industry Innovation: 5 Ways AI Can Help Boost Supply and Affordability

In an era where artificial intelligence (AI) is becoming increasingly pervasive, the housing industry stands on the cusp of a transformative phase. As reported by the Bipartisan Policy Center, AI is reshaping five critical areas in housing: predevelopment, construction, credit assessments, home appraisals, and property tax assessments. These advancements promise to enhance accessibility, reduce costs, and accelerate housing production.

AI and Predevelopment

Generative AI, a subset of machine-learning technology, is revolutionizing the predevelopment phase of housing projects. By automating various tasks, AI tools can significantly cut down on time and expenses. These tools generate multiple design options, emphasizing sustainable designs by considering local climate, energy usage, and available building materials. Developers can also leverage AI to ensure compliance with zoning and land-use regulations, thus avoiding costly delays. For more insights on generative AI in real estate, visit the Generative AI Applied to Real Estate article.

AI and Construction

The United States has grappled with a housing shortage, having “underbuilt” by millions of homes over the past two decades. AI is poised to bridge this gap by streamlining construction processes. AI-driven technologies, such as drones and mobile robots, monitor construction site progress and enhance safety by flagging potential hazards. This integration not only improves efficiency but also attracts new talent by creating job opportunities in emerging fields.

AI and Creditworthiness

The mortgage lending process is evolving with AI’s ability to incorporate alternative data, such as on-time utility or rent payments, to assess creditworthiness more accurately. This innovation broadens access to credit, particularly for those without traditional credit histories. However, the use of AI in credit scoring raises privacy and discrimination concerns, necessitating transparency and regulatory oversight. The Consumer Finance Blog provides further details on alternative data usage.

AI and Home Appraisals

Home appraisals, crucial for determining property value, are increasingly relying on automated valuation models (AVMs) powered by AI. These models offer more accurate valuations compared to traditional methods, although they require comprehensive and unbiased data to avoid perpetuating existing biases. The Urban Institute’s report explores the potential of AI in appraisals.

AI and Property Tax Assessments

Property tax assessments, essential for calculating taxes owed, benefit from AI’s ability to conduct frequent and accurate evaluations. By leveraging AI, jurisdictions can reduce workloads and improve assessment precision, thereby addressing disparities such as the over-assessment of Black-owned homes.

Looking ahead, the Biden administration’s executive order on AI aims to establish safety standards and encourage innovation across federal agencies, including the Department of Housing and Urban Development. Meanwhile, Congress evaluates AI’s impact through hearings and task forces, shaping the legislative landscape for AI’s role in housing.

AI presents a wealth of opportunities for the housing industry, from reducing project timelines to enhancing credit access. However, careful consideration of ethical and regulatory frameworks is essential to ensure these technologies benefit all Americans.

Housing Market Outlook for 2024: Will Affordability Return?

In a climate of fluctuating mortgage rates and shifting economic tides, the housing market remains a focal point of interest for prospective buyers and industry experts alike. As reported by Forbes, the landscape of homeownership is evolving, with mortgage rates finally dipping into a range that offers a glimmer of hope for many eager buyers.

While home prices continue to reach unprecedented heights, the pace of growth is starting to slow, thanks to an increase in inventory and a decrease in demand. This shift is providing buyers with more bargaining power as they engage with sellers. Yet, as the Federal Reserve recently enacted significant interest rate cuts, many potential buyers are choosing to wait on the sidelines, anticipating further reductions that could make homeownership even more attainable.

The S&P CoreLogic Case-Shiller Home Price Index indicates a 5% annual gain, reflecting a deceleration from previous months. However, the index still registers record highs, suggesting that affordability remains a challenge for many. Lisa Sturtevant, chief economist at Bright MLS, posits that the decline in mortgage rates could lead to slower home price growth as inventory rises, although this may only be a temporary respite.

Looking ahead to 2024 and 2025, experts like Ralph McLaughlin from Realtor.com predict a potential rebound in home price growth, fueled by falling mortgage rates and increased buyer purchasing power. The consensus is clear: waiting for further rate drops might leave many would-be homeowners scrambling in a competitive market.

For a sustainable recovery in the housing market, Keith Gumbinger of HSH.com emphasizes the need for a significant increase in home listings to alleviate price pressures. While recent mortgage rate declines have begun to ease inventory constraints, the journey to a balanced market is far from over.

Amidst these dynamics, the National Association of Realtors (NAR) has implemented practice changes following antitrust settlements, aiming to enhance transparency in real estate transactions. These reforms could influence affordability, as buyers may now bear more responsibility for broker commissions.

The question on everyone’s mind is whether the housing market will crash by 2025. Experts like Tom Hutchens of Angel Oak Mortgage Solutions suggest that low housing supply acts as a buffer against a potential downturn. Moreover, homeowners today are in a stronger financial position than during the 2008 crisis, with substantial equity and many owning their homes outright.

As we navigate through the latter part of 2024, the prospect of a foreclosure surge seems unlikely, with foreclosure activities remaining below pre-pandemic levels. The key takeaway for prospective buyers is that the housing market—like any other market—is challenging to time. Orphe Divounguy of Zillow Home Loans advises that the best time to buy is when a home meets one’s needs and budget.

In conclusion, as we move closer to 2025, the housing market presents a complex yet cautiously optimistic outlook. While affordability challenges persist, strategic planning and informed decision-making can pave the way for successful homeownership. For more insights, read the full article on Forbes.

How to Successfully Sell Your Home in 2024: A Comprehensive Guide

By [Your Name]

In the ever-evolving landscape of real estate, selling a house in 2024 demands strategic planning and a keen understanding of market dynamics. According to a recent article from Bankrate, the process is far from a simple transaction. Instead, it requires a meticulous approach to ensure a smooth sale and maximize financial returns.

Selling a home is a dream many homeowners envision as a seamless transaction — list the house, find a buyer, collect the cash, and hand over the keys. However, the reality is laden with complexities, some within the seller’s control and others dictated by external market forces.

Planning and Organization: The First Steps

The journey begins with setting a timeline. The article emphasizes the importance of starting preparations months in advance. A pre-sale home inspection is recommended, especially for older homes, to identify potential issues before listing. This proactive approach can expedite the selling process by addressing necessary repairs early on.

Enlisting Professional Expertise

Hiring a local real estate agent is crucial. An experienced agent, familiar with the local market, can position your home effectively to attract potential buyers. While some sellers may consider a “for sale by owner” approach to save on commissions, the expertise and broader exposure an agent provides can often justify their fee.

Pricing and Presentation

Setting a realistic price is another pivotal step. The article suggests consulting local real estate comps to gauge the market value accurately. Overpricing can deter buyers, while underpricing might leave money on the table.

In today’s digital age, the quality of your online listing is paramount. Professional photos are essential, as homebuyers often begin their search online. The article advises focusing on “online appeal” to ensure the first impression leads to inquiries and showings.

The Negotiation and Closing Process

Once offers start coming in, the negotiation phase begins. It’s not just about the highest bid but also considering factors like payment method, contingencies, and closing dates. Sellers should be prepared to make counter-offers and negotiate terms to reach the best possible agreement.

Finally, understanding closing costs and potential tax implications is vital. The article notes that recent changes due to a federal lawsuit may affect commission payments, making it essential to clarify who pays for what in the contract.

Conclusion

Selling a house in 2024 is a multifaceted process that requires careful planning, professional guidance, and strategic execution. By following these steps, sellers can navigate the complexities of the real estate market and achieve a successful sale. For a detailed guide, refer to the original article on Bankrate.

RE-generative AI: Transforming Commercial Real Estate – Disrupt or Be Disrupted

In the ever-evolving landscape of commercial real estate, a new force is reshaping the industry: generative AI. As reported by Deloitte, real estate firms are increasingly investing in artificial intelligence (AI) and machine learning (ML), with venture capital investments reaching a staggering $7.2 billion since 2017. This surge in funding highlights a growing recognition of AI’s transformative potential.

Since the advent of generative AI in 2021, corporate investment volumes have soared, surpassing $3.5 billion by October 2023. This represents a nearly 50% increase over the total investment from 2018 to 2020, and a 95% surge compared to the three years preceding the pandemic. Real estate investors are particularly interested in AI and ML services for transaction-focused functions, such as property listings, investment and valuation, and real estate data analytics.

Despite these promising trends, the road to AI adoption is not without challenges. Over 60% of respondents to the 2024 commercial real estate outlook survey indicated a reliance on legacy technology infrastructure, posing significant hurdles to integrating emerging technologies like generative AI. This underscores the need for a strategic approach to AI integration, tailored to each firm’s unique requirements.

Generative AI offers a wide array of potential use cases across various real estate functions, including property management, construction, legal due diligence, and architectural design. However, these use cases vary in terms of maturity, ease of adoption, and scalability. While some applications, like contract summarization, are well-validated and easy to implement, others, such as urban planning, remain at a conceptual stage.

Firms considering AI integration must weigh factors such as model customizability, data privacy, and cost implications. Options include:

- Using existing generative AI applications

- Integrating third-party APIs

- Deploying open-source models

- Developing private large language models (PLLMs) in-house

A human-centric approach to AI is crucial, ensuring that technology enhances rather than replaces the human experience. Real estate firms are increasingly hiring talent with generative AI skillsets, with job postings rising by 64% in 2022 and another 58% through August 2023. Key areas of hiring activity include architectural design, construction management, legal due diligence, and human resources.

However, firms must tread carefully, balancing the promise of AI with the complexities of data strategy, model validation, and organizational culture. Accurate, timely, and comprehensive data is paramount, as generative AI models require market-specific and asset-specific information to reduce the risk of errors and biases.

Ultimately, the adoption of generative AI in real estate is not a one-size-fits-all endeavor. Firms must prioritize high-impact use cases, assess their AI maturity, and ensure a skilled workforce is in place to navigate the challenges ahead. As the industry stands at a pivotal juncture, the mantra is clear: disrupt or be disrupted.

The Evolving Role of Virtual Tours in Real Estate: A Study of 75,000 Home Sales

In an era where technology continues to reshape the landscape of real estate, the role of virtual tours remains a topic of debate. According to a recent study published by HBS Working Knowledge, virtual tours, which surged in popularity during the COVID-19 pandemic, might not significantly enhance home sale prices or reduce the time properties spend on the market.

The comprehensive research, conducted by Isamar Troncoso of Harvard Business School and Mengxia Zhang of Western University, analyzed over 75,000 home sales in the greater Los Angeles area. Their findings suggest that while virtual tours offer certain advantages, their impact on sales outcomes is less pronounced than previously thought.

Troncoso’s study, accessible here, reveals that the quality of photos and listing descriptions often overshadow the benefits of virtual tours. “Maybe it doesn’t help you to get a 5 percent sales price rise by using visual tools—but it might help sellers in many other ways,” Troncoso notes. In the post-pandemic world, the initial boost virtual tours provided seems to have waned, with traditional factors like location and presentation regaining their prominence.

The study utilized cutting-edge machine learning techniques to sift through data from the real estate platform Redfin, examining various aspects such as sale prices, market duration, and initial pricing strategies. Interestingly, only about 22 percent of the listings included virtual tours, and these often came with higher-quality photos and longer descriptions.

One intriguing insight from the research is the nuanced role of virtual tours in different neighborhoods. In areas served by smaller real estate firms or those less sought after, virtual tours might still offer a marginal benefit. Troncoso explains, “These are areas in which these technologies penetrated less. So that’s why you see a little bit more of a marginal effect when those sellers have virtual tours.”

For buyers, virtual tours can streamline the house-hunting process by helping them eliminate properties that don’t meet their criteria, making their search more efficient. “Maybe it doesn’t really get you to say, ‘Oh, now I really like that house,’ but it’s going to help you to be like, ‘Oh, I don’t like this one, so I won’t bother to go and see it,’” Troncoso adds.

As virtual tour technologies continue to evolve and become more affordable, their application might expand beyond home sales to areas like long- and short-term rentals. However, for now, the key takeaway for sellers is to prioritize high-quality photos and descriptions unless specific conditions suggest otherwise.

In conclusion, the study underscores the importance of context in leveraging virtual tours effectively in real estate. For further insights and related topics, readers can explore articles such as When Glasses Land the Gig: Employers Still Choose Workers Who ‘Look the Part’ and Shrinking the Racial Wealth Gap, One Mortgage at a Time.

For more information and to view the original research, visit the HBS Working Knowledge website.

Exploring the Future of Real Estate: How Virtual Tours are Transforming the Industry

Published 2 months ago by Multi-Housing News

In the wake of the COVID-19 pandemic, virtual tours have emerged as indispensable tools in the real estate marketing and leasing industries. As social distancing became the norm, these digital experiences offered a safe alternative to in-person visits, and their popularity has only grown since. Today, virtual tours are celebrated for their interactive and immersive capabilities, providing potential renters with a comprehensive view of their prospective homes.

Understanding Virtual Tours

The distinction between video and virtual tours is crucial. While video tours provide a linear, pre-recorded sequence with limited interactivity, virtual tours offer a dynamic experience. Users can navigate through a digital representation of a space using 360-degree images or 3D models, allowing them to explore at their own pace.

Types of Virtual Tours

The realm of virtual tours is diverse. Among the most popular are:

- 360-degree Photo Tours: These utilize panoramic photos, enabling users to look around and navigate between rooms.

- Interactive 3D Tours: Leveraging 3D scanning technology, these tours offer a fully navigable model of the space.

- Virtual Reality (VR) Tours: Designed for VR headsets, these tours provide a highly immersive experience.

- Augmented Reality (AR) Tours: These integrate virtual elements with real-world views, often using smartphones or tablets.

- Guided Virtual Tours: These involve a leasing agent guiding users through a space via video call or pre-recorded session.

Popularity and Integration

As noted in the original article, the 360-degree Photo Tours and Interactive 3D Tours are particularly favored for their high interactivity and realistic experiences. They allow prospective renters to explore properties in detail, providing a sense of space and layout akin to an in-person visit. Furthermore, these tours integrate seamlessly with property management systems and marketing tools, enhancing their utility in the leasing process.

Future Trends

Looking ahead, virtual tours are set to become even more sophisticated. The integration of artificial intelligence will personalize user experiences, offering tailored recommendations based on individual preferences. Additionally, virtual tours may soon include smart home feature demonstrations, allowing users to interact with virtual controls and see real-time data.

There is also a growing trend towards unit-level tours, providing prospects with detailed views of specific apartment units. This level of detail is expected to increase conversion rates from leads to leases.

Conclusion

The convenience and efficiency of virtual tours, initially driven by the pandemic, continue to resonate with busy urban dwellers and remote workers. As technology advances, these digital experiences will likely become even more integral to the real estate market, particularly in multifamily communities. For more insights into renter preferences, visit Industry Surveys Reveal Renter Preferences for 2024.

Revolutionize Your Business with Lead Nurturing: Unlocking Untapped Potential

For those venturing into the realm of lead nurturing, the latest insights and statistics offer a treasure trove of actionable strategies to enhance your business’s sales. Whether you’re a newcomer, a seasoned marketer, or a business owner, these statistics provide a solid foundation to turn leads into committed customers. Dive into this extensive exploration for more information and insights.

Key Insights on Lead Nurturing

- Over eight out of ten new leads never convert into qualified sales.

- Only 4% of website visitors are ready to purchase.

- Lead nurturing emails receive 10% more responses than standalone email blasts.

- 80% of businesses utilizing automation software can generate leads.

- Companies using analysis and marketing automation experienced over a 451% boost in qualified leads.

Lead nurturing is not just about converting leads; it’s about building lasting relationships with your customers. According to The Tech Report, nurturing leads effectively can significantly lower costs and increase sales-ready leads.

Marketing Strategies

Among the various strategies, content marketing stands out as a powerful tool for businesses to engage with consumers. A staggering 93% of B2B businesses report that content marketing yields more leads than traditional marketing tactics. This is not surprising, given the diverse range of engaging content available today, from Instagram stories to informative videos and infographics.Moreover, SMS marketing and email list segmentation have proven to be effective methods for personalized lead nurturing, with 51% of email marketers affirming its efficacy.

Automation and Lead Nurturing

The role of automation in lead nurturing cannot be overstated. A whopping 79% of the most successful businesses have embraced marketing automation for at least two years, reaping benefits such as time savings and increased client engagement. As reported by CRM Statistics, automation not only streamlines processes but also enhances the effectiveness of marketing campaigns.In conclusion, lead nurturing is the cornerstone of business growth, transforming potential leads into loyal customers. By leveraging insights and adopting strategic marketing practices, businesses can significantly boost their sales and ensure sustained success. The journey of nurturing leads is ongoing, and the key lies in continually refining strategies to meet the evolving needs of the market.

Virtual Reality Revolutionizes the Housing Market: Efficiency, Accuracy, and Innovation Unleashed

In a groundbreaking shift for the real estate industry, virtual reality (VR) and artificial intelligence (AI) are transforming property appraisals, staging, and transactions, according to a recent report by Scotsman Guide. As the real estate market continues to drive economies, these modern technologies provide crucial resources for sustainable revenue streams and operational optimization.

Revolutionizing Property Appraisals

Property appraisals, the backbone of real estate transactions, are being revolutionized by digital technology. Accurate assessments are vital for determining value, loan interest rates, and tax rates. The integration of VR and AI allows real estate professionals to efficiently study properties, sale prices, and demand, providing data-driven decisions. This technological advancement not only boosts efficiency but also ensures reliable mortgage services for lenders and clients.

Reducing Bias and Enhancing Efficiency

One of the most significant benefits of VR appraisals is the potential to limit racial or ethnic bias, a concern highlighted by the Federal Housing Finance Agency (FHFA). By enabling appraisers to tour homes virtually, VR offers a more immersive experience than traditional photos or videos, particularly for properties in remote areas. However, challenges such as the cost of equipment and varying state regulations remain.

Cost-Effective Property Staging

VR has also revolutionized property staging, a crucial step in enticing buyers and expediting sales. During the pandemic, VR proved invaluable as it allowed realtors to access new markets without geographical boundaries. The National Association of Realtors reported that 20% of buyers’ agents experienced increased sale prices by up to 5% for properties staged using VR. This technology offers significant cost savings, reducing staging expenses by up to 70% compared to traditional methods.

Future Prospects

The transformative impact of VR and AI on the real estate market is undeniable. With Goldman Sachs predicting the real estate VR market to reach billions by 2025, the future looks promising. By providing immersive, realistic experiences, VR is unlocking new revenue streams and expediting accurate property appraisals, ensuring the industry can sustain itself even during sharp market changes.

For more insights, explore the works of Pravin Vazirani, Assistant Vice President of Operations at Chetu, who brings over two decades of experience in IT and digital transformation.

As the real estate industry embraces these advanced technologies, it stands on the brink of a new era, where efficiency, accuracy, and innovation go hand in hand.

The 9 Top Real Estate Lead Generation Companies for 2024: A Guide to Staying Ahead

By [Your Name], Special Correspondent

In the fast-paced world of real estate, staying ahead of the competition is crucial. As we look towards 2024, the landscape of lead generation is evolving with the integration of cutting-edge technologies such as AI and predictive analytics. HousingWire’s recent article, “The 9 Top Real Estate Lead Generation Companies for 2024”, provides an in-depth analysis of the leading companies poised to transform how real estate professionals close deals efficiently.

Market Leader emerges as a frontrunner, offering a comprehensive marketing suite that includes email and SMS marketing services, lead capture forms, and a robust CRM. Priced from $139, Market Leader provides exclusive leads, setting it apart in the industry. However, the absence of a concierge service and a free trial could be seen as drawbacks.

Another standout is SmartZip, renowned for its predictive analytics capabilities that identify potential sellers months in advance. With a starting price of $500, SmartZip is tailored for experienced agents, offering tools like direct mail campaigns and home valuation landing pages. Despite its strengths, the lack of lead exclusivity and higher price point may deter newcomers.

Offrs distinguishes itself by offering a no-contract option, albeit at a higher cost. Utilizing AI-powered predictive analytics, Offrs identifies likely sellers and nurtures leads through its ChatGPT-powered chatbot, RAIA. This innovative approach ensures agents can engage with the most qualified leads.

For those seeking exclusive, inherited-property seller leads, Catalyze AI is the ideal choice. By leveraging real-time data and predictive analytics, Catalyze AI identifies motivated inheritance leads. Starting at $360 per month, it offers an affordable solution for agents well-versed in the probate process.

Zillow Premier Agent remains a dominant force in the industry, providing buyer leads based on location. While the cost per lead varies, Zillow’s high traffic volume and straightforward CRM make it a top choice for many agents. However, some insiders argue that Zillow’s focus on its “Flex” program may overshadow its “Premier Agent” partners.

In the realm of AI-powered solutions, Ylopo leads the charge with its dynamic home search and AI-driven conversion tools. Starting at $395 per month, Ylopo’s AI assistants engage leads 24/7, making it a perfect fit for tech-savvy professionals.

RealGeeks offers an affordable, all-in-one lead generation platform with prices starting at $299 per month. Its comprehensive toolkit includes IDX websites, CRM, and marketing tools, catering to agents, teams, and brokerages alike.

Zurple excels in automated lead nurturing, generating leads through branded landing pages and engaging them via text or email. With a starting price of $309 per month, Zurple’s focus on automated conversations ensures prospects are nurtured until they’re ready to close.

Finally, zBuyer is noted for its exceptional customer service and transparent approach. Starting at $400 per month, zBuyer offers tech-forward features like email and SMS marketing, though the shared lead model may not appeal to all agents.

As the real estate industry continues to evolve, these companies offer diverse solutions tailored to different needs and budgets. For more detailed insights, visit the original article on HousingWire.

In conclusion, whether you’re a new agent or a seasoned professional, aligning your choice with your skill level, budget, and target market is key to maximizing your return on investment in lead generation.

Unleashing the Potential of the Drone Industry: Opportunities for Entrepreneurs

As technology continues to advance, drones are becoming increasingly accessible, empowering both individuals and businesses to harness their potential. With a surge in demand for drone services, now is a prime time for entrepreneurs to take flight in this dynamic field. The versatile nature of drones opens up endless possibilities, whether one’s interest lies in photography, surveying, agriculture, or even delivery services.

In a recent article by Business Model Analyst, a comprehensive exploration of 45 drone business ideas was presented, showcasing innovative ways drones are transforming industries. The article underscores the exciting avenues for growth and profit within the drone industry, catering to both tech enthusiasts and seasoned entrepreneurs.

Among the highlighted business ideas, aerial photography and videography stand out as a popular choice, offering professional services for events such as weddings and corporate functions. Companies like SkyPixel have made a mark by partnering with brands to capture stunning aerial content, enhancing promotional materials and event memories.

In the realm of real estate, drones are revolutionizing how properties are showcased. Firms like DroneBase provide tailored aerial photography services that significantly enhance property listings, offering prospective buyers a comprehensive view of the property and its surroundings.

Additionally, the agriculture sector is reaping the benefits of drone technology. With companies like DroneDeploy offering software solutions for crop health assessments and irrigation monitoring, farmers can optimize yields and reduce costs through timely data collection.

The construction industry is also leveraging drones for site monitoring and safety inspections. Skycatch exemplifies this by creating detailed site maps and delivering actionable insights that help maintain efficiency and safety standards.

The article further delves into niche markets such as forest management, where drones aid in monitoring tree health and identifying illegal logging activities. Organizations like Wildlife Drones are deploying drone solutions for wildlife conservation efforts, highlighting the environmental impact of this technology.

As the drone industry continues to soar, the opportunities for entrepreneurs are boundless. From drone delivery services to search and rescue operations, the potential applications are vast and varied. The original article from Business Model Analyst serves as a beacon, guiding aspiring entrepreneurs through the myriad possibilities within this burgeoning field.

For those ready to embark on this journey, the drone industry offers a promising path to success. With the right approach, your drone business can indeed reach new heights.

Innovative Marketing Strategies for High-Rise Projects in Dubai and Karachi

One of the key strategies highlighted in a recent LinkedIn article by Muhammad Asif, is the use of digital marketing and establishing a robust online presence. Platforms like Facebook, Instagram, and LinkedIn have become indispensable tools for reaching potential buyers. Developers leverage these platforms to create engaging content that showcases the unique features of their high-rise projects. The use of high-quality images, virtual tours, and client testimonials has proven effective in capturing the interest of a broad audience. For instance, iconic projects such as the Burj Khalifa in Dubai have successfully used social media to maintain a buzz around their developments.

In addition to social media, influencer partnerships have emerged as a powerful strategy. Collaborating with influencers who have significant followings can help developers reach a wider audience. These influencers offer authentic reviews and showcase the lifestyle these high-rise projects offer. In Karachi, partnering with local celebrities or lifestyle bloggers can create a positive impact and drive interest among potential buyers.

Moreover, developers are embracing Virtual Reality (VR) and Augmented Reality (AR) technologies to provide prospective buyers with immersive experiences. Virtual tours allow buyers to explore properties from the comfort of their homes, viewing different layouts and even customizing interiors. This technology is particularly beneficial for international buyers who cannot visit the sites physically. Developers in Dubai have been pioneers in incorporating VR and AR into their marketing strategies, setting a benchmark for others to follow.

Another innovative approach is content marketing and storytelling. By crafting compelling narratives around their projects, developers can build an emotional connection with potential buyers. Highlighting the history, vision, and unique aspects of a project can make it more relatable. For example, the transformation of Palm Jumeirah into a luxurious residential area has been a significant selling point in Dubai.

Strategic partnerships and collaborations also play a crucial role. Collaborating with local businesses, international brands, and renowned architects can enhance a project’s appeal. For instance, Dubai’s collaboration with international brands for projects like Armani Residences has set a precedent for such partnerships.

Finally, the focus on sustainability and green building practices is gaining traction. Highlighting eco-friendly features and sustainability initiatives can attract environmentally conscious buyers. Projects like The Sustainable City in Dubai have gained popularity due to their focus on sustainability.

In conclusion, these innovative marketing strategies are not just about enhancing visibility; they are about building trust and creating a lasting impact on the target audience. By adopting these strategies, developers in Dubai and Karachi can ensure their high-rise projects stand out in the bustling real estate market.