Exploring the Top Real Estate Trends of 2024

Exploring the Top Real Estate Trends of 2024

As we navigate the ever-evolving landscape of real estate, 2024 presents a fascinating array of trends that are reshaping the industry. According to a comprehensive report by Exploding Topics, nine pivotal trends are poised to redefine the market over the next 18-24 months.1. Home Prices Continue to Climb

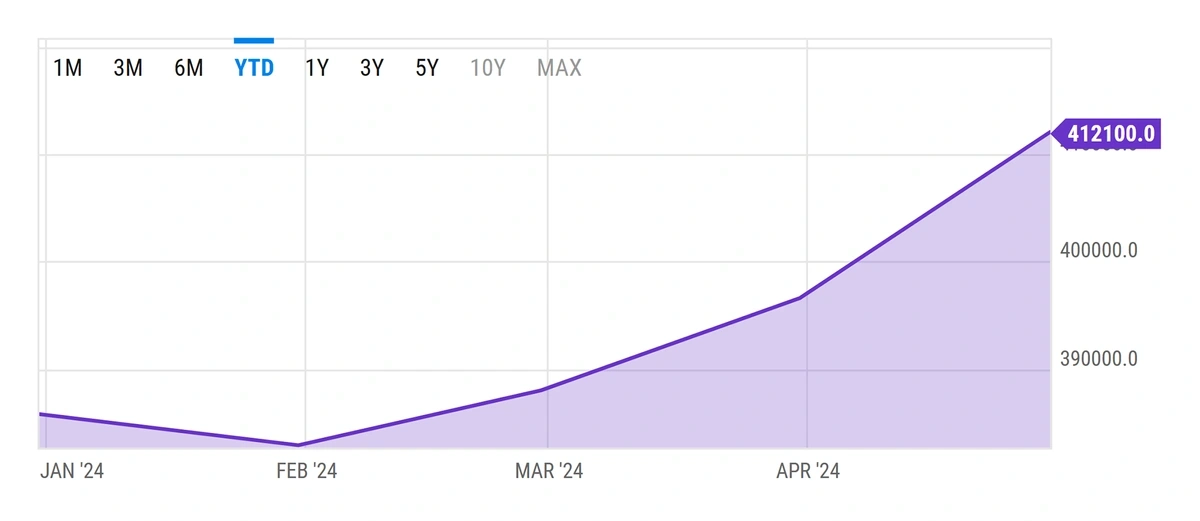

The quest for single-family homes is driving prices skyward, with a staggering 43% increase over the past four years. This surge, while beneficial for existing homeowners, poses significant challenges for first-time buyers. The average US homeowner saw a 9.6% equity increase last year, adding $1.5 trillion collectively. However, a cooling trend is emerging, as median prices declined in early 2024.

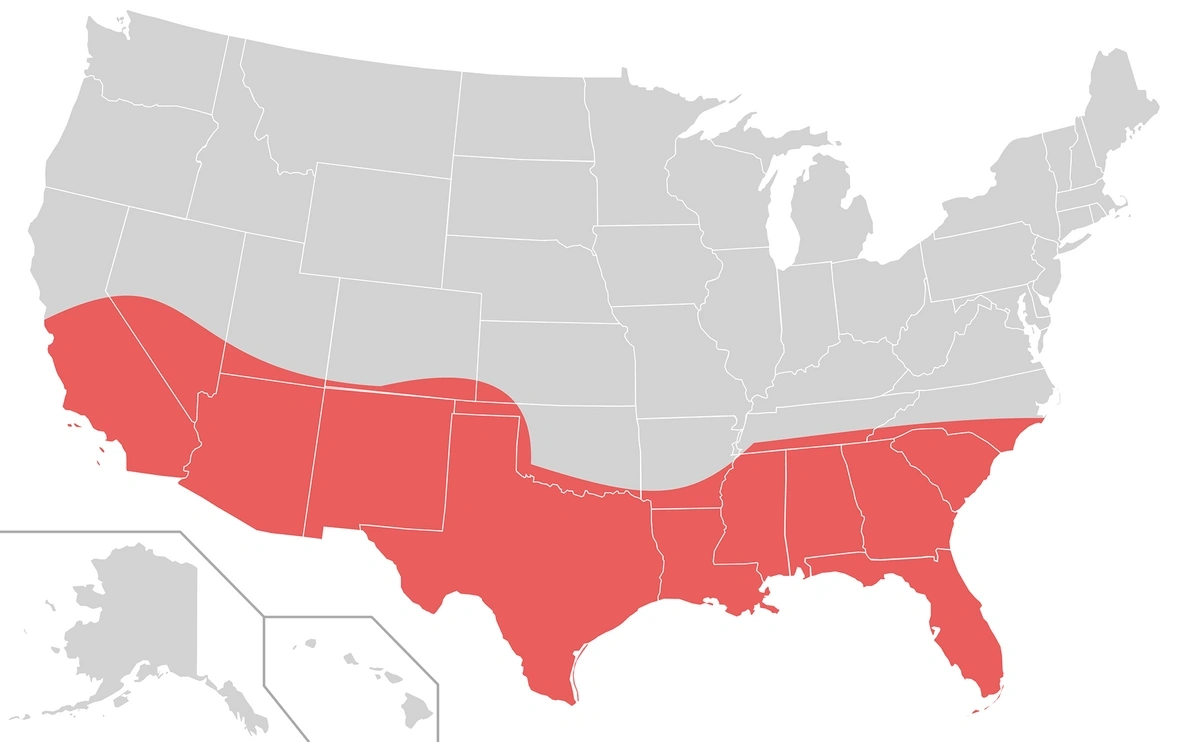

2. The Sun Belt’s Rising Popularity

The Sun Belt, stretching from California to North Carolina, is experiencing a population boom. With 80% of the nation’s growth concentrated here, the region’s appeal is undeniable. Lower taxes and affordable housing are drawing both retirees and young professionals. Cities like Dallas and Tampa are now among the top ten US cities for real estate potential.

3. Digital-First House Hunting

The digital transformation of real estate is in full swing. Virtual tours, drone videos, and online staging are revolutionizing how buyers interact with properties. The National Association of Realtors highlights that the internet is the starting point for 41% of buyers, underscoring the shift to digital-first strategies.

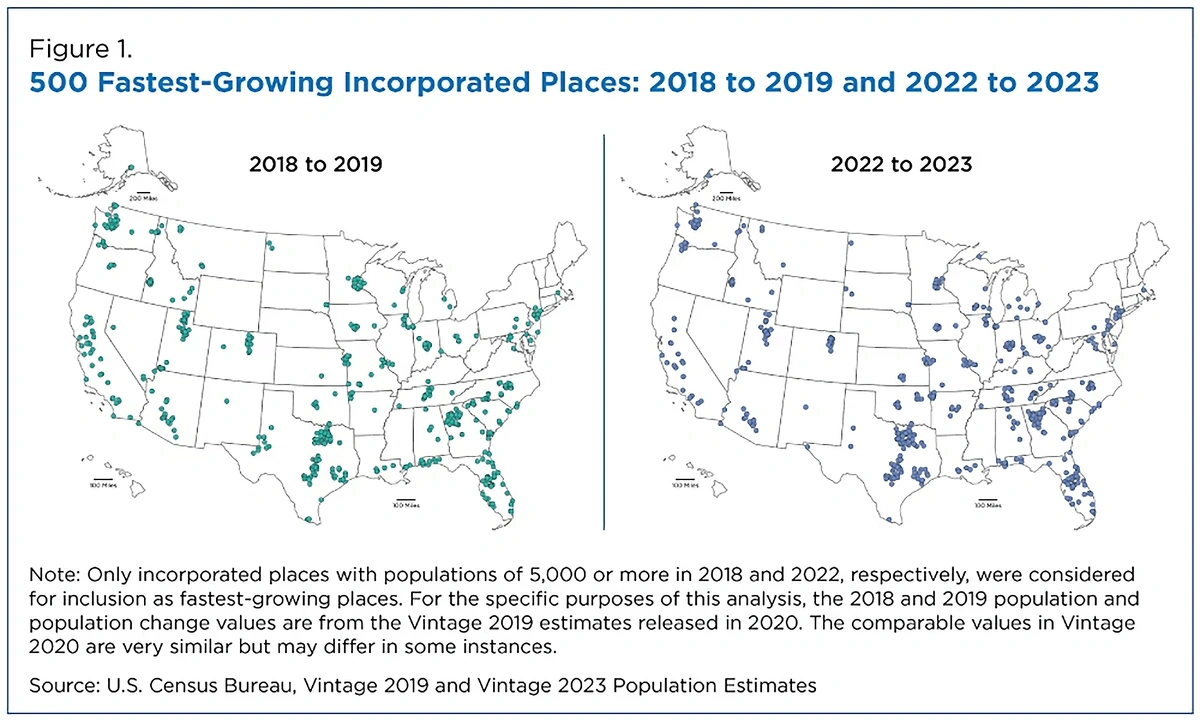

4. Movement from Cities to Suburbs

The suburban migration continues, driven by affordability and remote work flexibility. The US Census Bureau reports a significant shift towards smaller cities and suburbs, with “middle neighborhoods” offering a blend of suburban and urban amenities.

5. Single-Family Housing Demand Creates Shortages

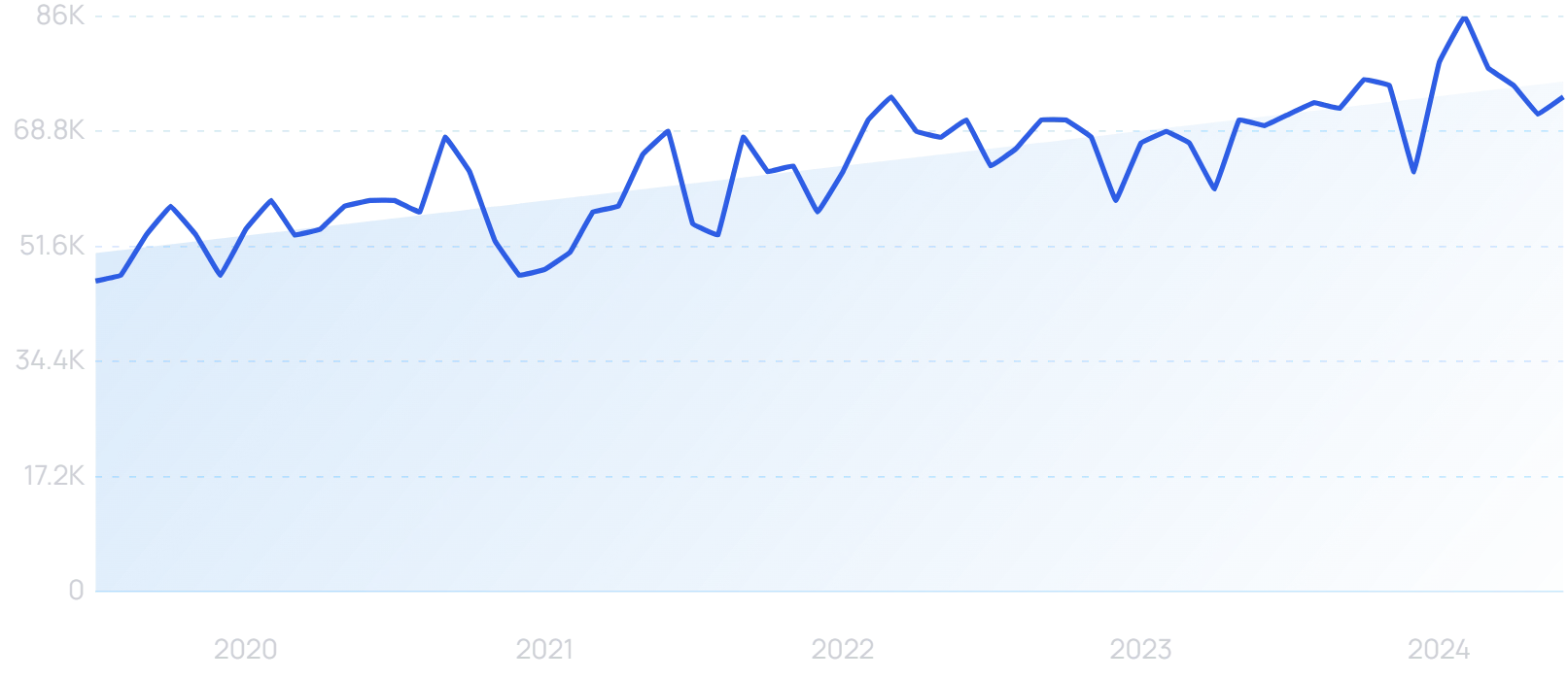

The demand for single-family homes is outpacing supply, with a gap of over 7 million homes since 2012. This shortage is exacerbated by millennials entering the housing market and institutional investors purchasing a significant share of available homes.

6. Multi-Generational Living on the Rise

Economic pressures and cultural shifts are driving an increase in multi-generational households. This trend is particularly notable among immigrant communities and is reshaping the housing landscape.7. Mortgage Rates Remain High

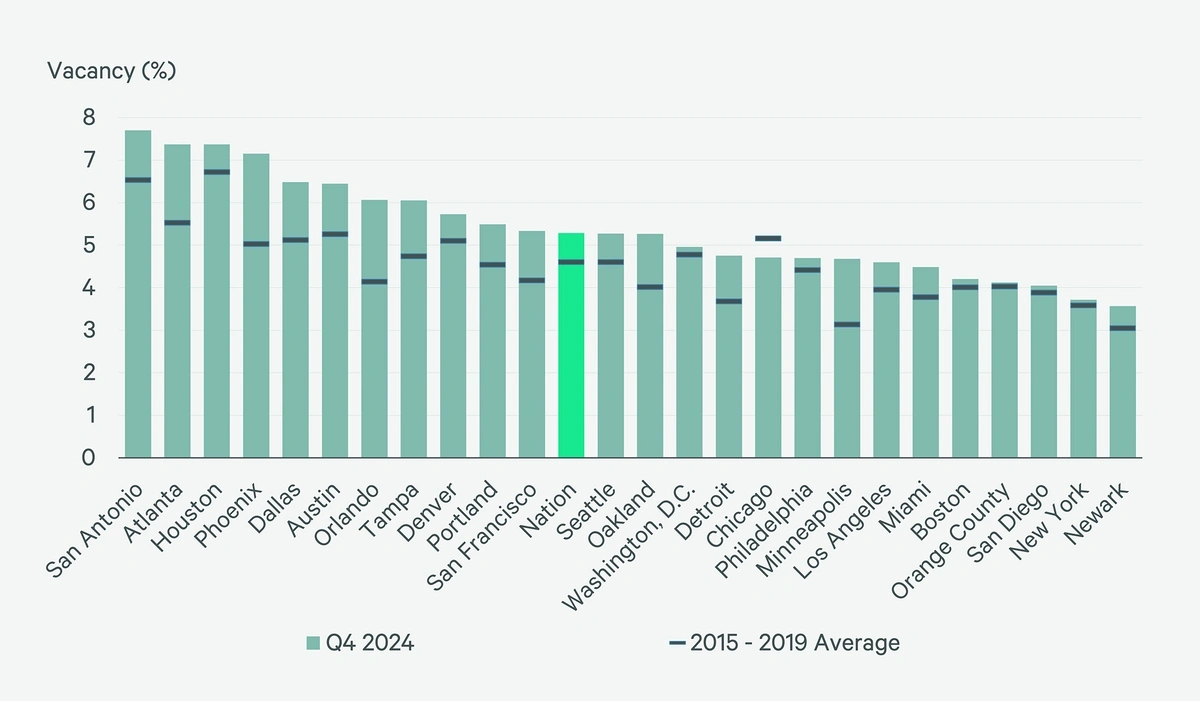

Mortgage rates, which once hit record lows, have climbed to around 7% in 2024. This rise is making home buying more expensive and impacting monthly payments for variable-rate mortgages. Fannie Mae forecasts a slight decrease in rates over the coming years.8. Decline in the Rental Property Market

The rental market in major cities is experiencing a downturn as more people seek homeownership or alternative living arrangements. However, mid-size and smaller cities are witnessing rising rental demand as housing supply struggles to keep up.9. Commercial Real Estate in Flux

Changing work patterns continue to impact commercial real estate. While office vacancies are high, opportunities are emerging in retail and multi-family properties. Moody’s Analytics notes a positive trend in neighborhood shopping centers.

Conclusion As these trends unfold, they present both challenges and opportunities within the real estate market. While high prices and mortgage rates may deter some buyers, the shifts to digital platforms and suburban living offer new avenues for growth and investment. For more insights, explore the full report on Exploding Topics.

More Articles

Getting licensed or staying ahead in your career can be a journey—but it doesn’t have to be overwhelming. Grab your favorite coffee or tea, take a moment to relax, and browse through our articles. Whether you’re just starting out or renewing your expertise, we’ve got tips, insights, and advice to keep you moving forward. Here’s to your success—one sip and one step at a time!

The Transformative Power of Fintech in Revolutionizing Financial Systems

In the ever-evolving landscape of financial innovation, fintech stands as a beacon of transformative change. Drawing from a recent article by Business.com, fintech is redefining the financial industry by leveraging modern technology and cloud services, stepping away from traditional physical infrastructures.

The fintech revolution is rooted in its ability to disrupt outdated legacy systems. By employing inventive strategies, fintech companies are empowering financial institutions to rethink data management and service delivery. This shift is not just about technology; it’s about creating a more efficient, cost-effective, and accessible financial ecosystem.

Why Fintech is Flourishing

The rapid growth of the fintech industry can be attributed to several key factors:

- Legacy System Limitations: Many financial institutions are burdened with outdated systems. Fintech provides a fresh approach, utilizing big data and cloud-based solutions to streamline operations.

- Increasing Competition: New regulations and investor capital have leveled the playing field, encouraging innovation and differentiation.

- Shifting Customer Demands: Today’s consumers seek convenience and speed, prompting financial services to adopt a customer-centric approach.

Fintech’s Impact Across Industries

Fintech’s influence is pervasive, touching various sectors:

- Payment Processing: Companies like PayPal and Square have revolutionized how transactions are conducted, ensuring they are seamless and secure.

- Alternative Lending: Services such as Buy Now Pay Later (BNPL) have made lending more accessible, particularly for younger consumers.

- Investing: Robo-advisors like Betterment and Wealthfront are democratizing investment opportunities.

- Cryptocurrency: Platforms like Coinbase and Binance are at the forefront of digital currency trading.

The Future of Fintech

Looking ahead, fintech is poised to continue its upward trajectory. The industry is expected to play a crucial role in enhancing financial literacy, promoting inclusivity, and refining customer experiences. The integration of fintech solutions in areas like wealth management, insurance, and regulatory compliance is set to deepen, paving the way for a more interconnected and efficient financial landscape.

For a comprehensive understanding of fintech’s impact and future, the Business.com article offers an insightful analysis, drawing on forecasts from Statista and others, painting a vivid picture of the digital economy’s evolution.

CRISPR: A New Frontier in Genetic Disease Treatment

CRISPR: A New Frontier in Genetic Disease Treatment

CRISPR technology is rapidly advancing, offering new hope for treating a myriad of genetic diseases. From muscular dystrophies to metabolic disorders, CRISPR’s potential to revolutionize medicine is significant. This review, originally published by the Wiley Online Library, provides a comprehensive overview of the current state of CRISPR technology and its applications in genetic disease therapy.Unveiling the Potential

The article highlights the transformative potential of CRISPR in treating genetic disorders such as muscular dystrophies, cardiovascular diseases, and more. With the recent FDA approval of CRISPR-based therapies, the technology is poised to make a significant impact on healthcare. Notably, the development of delivery systems like nanocarriers is a breakthrough, enhancing the precision and safety of CRISPR applications.

Challenges on the Horizon

While CRISPR’s promise is undeniable, challenges such as off-target effects and immunogenicity remain. The article discusses ongoing research aimed at addressing these issues, emphasizing the need for precise gene-editing tools and effective delivery methods. Ethical considerations also play a crucial role, particularly concerning germline editing and data privacy.Recent Developments

Recent trends in CRISPR technology include the approval of Casgevy, the first-ever CRISPR-based therapy for sickle cell disease. Additionally, advancements in base editing and prime editing technologies are paving the way for more targeted genetic interventions. These developments underscore the dynamic nature of CRISPR research and its potential to transform genetic medicine.Conclusion

As CRISPR technology continues to evolve, it offers unprecedented opportunities to treat previously untreatable conditions. However, the journey from laboratory to clinic is fraught with challenges. Addressing these hurdles through ongoing research and ethical oversight is essential to unlocking CRISPR’s full potential in genetic medicine.“`

Republicans Reclaim Senate Control in 2024 Elections

In a pivotal moment in U.S. politics, the Republican Party has reclaimed control of the Senate following the 2024 elections. This victory represents a significant shift in the political dynamics of the country, coming after the GOP’s absence from the Senate majority since 2021. The Republican takeover is expected to have profound implications for the legislative agenda, especially as Donald Trump resumes his presidency after defeating Kamala Harris in a closely contested race.

The GOP’s path to reclaiming the Senate was marked by strategic victories in several key states. In West Virginia, Republican Jim Justice successfully captured a Senate seat that had been held by Democrat-turned-independent Joe Manchin. Ohio witnessed a notable shift as Bernie Moreno, a fervent supporter of Trump, unseated the Democratic incumbent Sherrod Brown. Additionally, in Montana, Tim Sheehy emerged victorious over Democratic Senator Jon Tester, further consolidating the Republican hold.

While the Senate triumph has been a cause for celebration among Republicans, the battle for control of the House of Representatives remains unresolved. The GOP is currently defending a narrow majority, and the final outcome may not be known for several days or even weeks. Speaker Mike Johnson has expressed optimism about retaining control, pointing to successful efforts to flip key swing states such as Pennsylvania and Michigan.

The newly established Republican majority in the Senate is anticipated to play a crucial role in supporting Trump’s agenda. This includes potential judicial appointments and various policy initiatives that align with the administration’s priorities. The leadership race within the Senate is already underway, with prominent figures like John Thune, John Cornyn, and Rick Scott competing for the top position.

As the political landscape continues to evolve, the Republican Party’s focus will be on consolidating power and advancing its legislative priorities in collaboration with the Trump administration. This shift presents both opportunities and challenges as the GOP seeks to implement its vision for the country.

For those interested in the unfolding political scene, it is essential to stay informed through reputable news sources. Keeping abreast of developments can provide valuable insights into how these changes may impact various aspects of governance and policy-making.

- NBC News Article: Offers detailed insights into the Republican gains in the Senate and ongoing uncertainty regarding the House results.

- CNN Article: Provides live updates and analysis on the election outcomes, featuring commentary and images of key political figures.

- AP News Article: Offers a comprehensive overview of the election results, focusing on both the Senate and House races.

Trump’s Potential Impact on the Real Estate Market Under a 2024 Presidency

Economic Indicators and Market Reactions

The anticipation of Trump’s electoral success has already triggered notable market reactions. Stock futures and Treasury yields have risen, while the dollar has reached its highest level in a year. Bitcoin, too, has surged to a record high. These movements suggest that investors are bracing for inflationary pressures under Trump’s policies, which are expected to include increased spending, tax cuts, and potentially higher tariffs. The broader economic consequences of Trump’s policies could extend beyond the US, affecting international markets. His stance on NATO and reluctance to fund the war in Ukraine could alter the geopolitical landscape, influencing economic stability in Europe. Additionally, higher US tariffs could have damaging effects on the UK and eurozone economies, with projections indicating sluggish growth for the UK.Impact on the US Housing Market

The US housing market is already grappling with elevated mortgage rates, and Trump’s potential policies could exacerbate these challenges. The average 30-year mortgage rate has been rising for five consecutive weeks, driven by strong economic data and expectations of Trump’s victory. This trend has contributed to a 3.5% decline in existing home sales as of September, marking the lowest level since 2010. The continuation of high mortgage rates could delay the recovery of the US housing market. The Federal Reserve’s upcoming decision on interest rates is pivotal. While a rate cut is anticipated, any shifts in the Fed’s outlook will be closely scrutinized. Rising Treasury yields have implications beyond the US, affecting UK swap rates and exerting pressure on UK mortgage lenders. Although significant increases in mortgage rates are not expected in the short term, the situation could dampen demand across various housing market segments.Trump’s Housing Agenda and Immigration

Trump’s housing agenda remains somewhat ambiguous, with past policies suggesting a focus on reducing immigration to ease housing demand. However, mass deportations could reduce the construction labor force, potentially slowing homebuilding efforts. This presents a complex challenge for the housing market, balancing supply and demand dynamics in the face of potential policy shifts.GSE Reform and Privatization

A significant aspect of Trump’s potential impact on real estate involves the future of government-sponsored enterprises (GSEs) like Fannie Mae and Freddie Mac. Plans to remove them from conservatorship are in the works, with proposals for the Treasury Department to partially back certain loans. This move could reshape the mortgage-backed securities market and influence credit availability, with far-reaching implications for both lenders and borrowers.Regulatory Environment and Economic Policy Implications

A Trump administration is expected to bring a deregulatory approach to the financial sector, potentially benefiting the mortgage and real estate industries. Leadership changes in key housing agencies could result in less regulatory oversight, aligning with industry calls for reduced red tape. While this could lead to reduced regulation and potentially lower costs for mortgage lenders, the broader economic implications, including potential tariffs and budget cuts, could influence housing affordability and availability.Market Perceptions and Real Estate Ventures

Trump’s brand and persona have a notable impact on real estate markets. His properties, often branded with his name, are perceived as luxury and high-status, which can drive demand and property values in those developments. However, his polarizing nature might also deter certain buyers or investors who prefer to distance themselves from his brand. The future of Trump’s real estate ventures will likely continue to be shaped by public perception and market trends. Despite his political career, Trump has maintained a significant presence in real estate. His organization continues to manage and develop properties globally. Any new projects or expansions could influence local markets, particularly if they involve high-profile developments. Additionally, his business strategies, including branding and marketing approaches, might set trends within the industry.Conclusion

In conclusion, Donald Trump’s future impact on real estate will be determined by a combination of his political activities, business ventures, and the broader economic environment. Stakeholders in the real estate market should closely monitor these variables to anticipate potential changes and opportunities. As we move forward, the real estate market will need to adapt to the evolving economic landscape under Trump’s leadership. Stakeholders should stay informed and prepared for potential changes that could impact property values and investment strategies.- Knight Frank’s Perspective: Trump’s policies could lead to both opportunities and challenges within the property sector, with tax reforms and deregulation potentially stimulating real estate growth. However, uncertainties in international relations and trade policies could impact foreign investment in U.S. real estate.

- HousingWire’s Analysis on Mortgage Rates: Trump’s economic policies might lead to increased inflation and higher interest rates, possibly driving mortgage rates up to 8%, affecting housing affordability and demand.

- Economist’s Prediction on Housing Market: Potential regulatory rollbacks and tax cuts might stimulate housing market activity, but economic volatility and geopolitical tensions could introduce risks, affecting consumer confidence and real estate investment.

Florida’s Amendment 5: A Pivotal Shift in Property Tax Policy

In the 2024 election, Florida voters approved a pivotal change in the state’s property tax policy through Amendment 5. This amendment introduces an annual adjustment for inflation to the value of current or future homestead exemptions, specifically tied to the consumer price index (CPI). With more than 66% of voters in favor, this measure reflects a significant shift in the way property taxes are assessed and managed in Florida. For more details, you can read the overview on the 2024 Florida election amendments at First Coast News.

Understanding the Amendment

Currently, Florida homeowners benefit from a $25,000 homestead exemption, which allows them to exclude this amount from their home’s assessed value for tax purposes. Most homeowners qualify for at least two such exemptions, totaling a fixed $50,000 deduction from their property’s assessed value. Starting in 2025, one of these exemptions will be adjusted annually for inflation, potentially increasing the exemption amount over time. For an in-depth explanation of this new property tax break, visit WESH.

The Homeowner’s Perspective

The adjustment for inflation is designed to help homeowners maintain the relative value of their tax exemptions as the cost of living rises. This means that as inflation increases, the exemption will also increase, further reducing the taxable value of a homeowner’s property. While the financial savings might seem modest—estimated by experts like Dr. Aubrey Jewett to be around $10 to $20 annually—over time, this could represent a meaningful reduction in property tax burdens. For more on how Amendment 5 changes homestead tax exemptions, see the analysis by WUSF.

It is crucial to note that this adjustment will not apply to school taxes. Therefore, while homeowners may see a reduction in local government property taxes, the overall impact on their total tax bill could vary depending on other factors such as school tax rates and local government budgetary needs.

Economic Implications for Local Governments

The broader economic effects of Amendment 5 have sparked debate among policymakers and economists. The state’s Revenue Estimating Conference predicts a slight reduction in local government property tax revenues. Critics, including some Democrats, warn that this could lead to a shortfall in funding for essential public services such as public safety, water management, and parks and recreation.

For instance, in Orange County alone, the anticipated decrease in tax revenue could amount to over $1.6 million annually, affecting services including fire and rescue, the sheriff’s office, and county services. This potential reduction in revenue has raised concerns that local governments might need to find alternative revenue sources or adjust spending to compensate for the loss.

Political and Social Considerations

The passage of Amendment 5 was marked by political division, with the proposal originating from Republican lawmakers and facing opposition from some Democrats. The debate centered around the potential benefits for homeowners versus the financial impact on local governments and renters, who would not benefit from the tax break.

The League of Women Voters has taken a neutral stance on the amendment, acknowledging the complexity of the decision for voters. While the amendment offers a financial break for homeowners, it poses challenges for counties that rely on property tax revenue to fund public services.

Looking Ahead

As Florida moves forward with the implementation of Amendment 5, homeowners can expect to see adjustments to their homestead exemptions beginning in 2025. While the immediate financial benefits may be modest, the long-term impact could provide meaningful relief against rising inflation.

Local governments, on the other hand, will need to navigate the potential revenue shortfalls and find ways to maintain funding for essential services. This may involve exploring alternative revenue sources or making budgetary adjustments to ensure that public needs continue to be met.

Overall, Amendment 5 represents a significant policy shift in Florida’s property tax landscape, offering both opportunities and challenges for homeowners and local governments alike.

Donald Trump’s Historic Re-Election as U.S. President

AP News Article on Trump Winning 2024 Election

New York Times Live Coverage

AP News Article on Trump Winning 2024 Election

New York Times Live Coverage

**Key Developments and Political Reactions** Kamala Harris, the Democratic contender, is anticipated to address the nation from Howard University, her alma mater, to concede the race formally. This gesture underscores the importance of a peaceful transition, a sentiment echoed by former GOP presidential candidate Nikki Haley, who congratulated Trump while urging Harris to concede. A notable development in the upcoming administration is the inclusion of Robert F. Kennedy Jr., who has reassured the public that vaccines will remain available, addressing widespread speculation about his potential influence on health policies. With Trump’s victory, the Republican Party has also gained control of the Senate, which is expected to facilitate the advancement of Trump’s legislative agenda. Although the outcome for the House of Representatives remains uncertain, Republicans remain hopeful about gaining control.

**International and Domestic Reactions** The international community has responded with mixed reactions. Israeli Prime Minister Benjamin Netanyahu has welcomed Trump’s victory, while Ukrainian President Volodymyr Zelenskyy has expressed concerns regarding the future of U.S. support amid the ongoing conflict with Russia. Mexican President Claudia Sheinbaum has stated that Mexico will wait for all votes to be counted before officially recognizing Trump’s victory. Domestically, New York City Mayor Eric Adams has reassured residents that abortion care will remain accessible in the city, despite potential shifts in federal policies. This statement highlights the ongoing debates around reproductive rights and the importance of state-level protections.

**Insights from Political Figures** Senate Minority Leader Mitch McConnell highlighted the preservation of the filibuster as a significant outcome of the election, which could impact legislative proceedings in the Senate. Former Representative Liz Cheney, known for her criticism of Trump, called for Americans to accept the election results and uphold the Constitution, emphasizing the need for unity and adherence to democratic principles.

**Economic Implications** The stock market has responded positively to Trump’s re-election, with record highs reported as investors anticipate economic policies favorable to business interests. This reaction suggests confidence in Trump’s economic agenda and its potential to stimulate growth, though it remains to be seen how these policies will unfold in practice.

**Looking Ahead: What to Expect from Trump’s Second Term** As Trump prepares to return to the White House, both the nation and the world are closely watching to see how his administration will shape domestic and foreign policies in the coming years. Key areas to monitor include health care, economic strategies, and international relations, particularly in light of ongoing global challenges. For those interested in the political landscape, it is advisable to stay informed through reputable sources and engage in discussions that promote understanding and constructive dialogue.

AI Transformation in Healthcare: A Market on the Brink of Explosive Growth

AI Transformation in Healthcare: A Market on the Brink of Explosive Growth

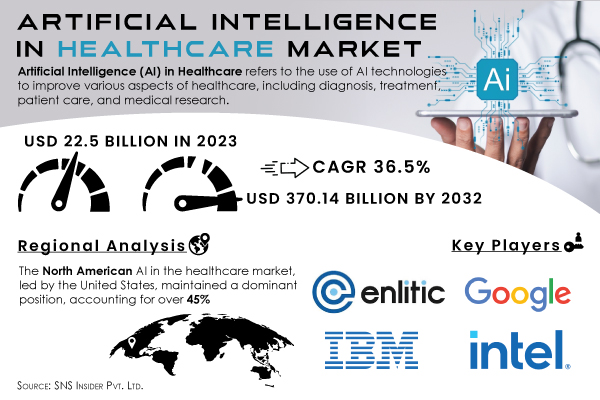

In a world where technology continues to reshape industries, the healthcare sector is witnessing a monumental transformation, largely driven by Artificial Intelligence (AI). According to GlobeNewswire, the AI in Healthcare market, valued at USD 22.5 billion in 2023, is projected to skyrocket to USD 370.14 billion by 2032. This growth is fueled by a remarkable compound annual growth rate (CAGR) of 36.5%.

The adoption of AI-based solutions across various healthcare applications, including diagnostics, treatment planning, and robotic surgeries, is on the rise. This surge is attributed to the increasing volume of healthcare data and advancements in machine learning and natural language processing, enhancing decision-making, patient outcomes, and operational efficiencies.

Market Dynamics

Technological innovations and heightened investments have paved the way for advanced AI tools catering to diverse healthcare needs. On the demand side, the necessity for data-driven decision-making in healthcare, coupled with the quest to improve patient outcomes, accelerates AI technology adoption. AI’s role in overcoming challenges like the shortage of skilled healthcare professionals is proving crucial.

Key Industry Players

Major industry players, including Enlitic Inc., GE Healthcare, Google Inc., IBM Corporation, iCarbonX, Intel Corporation, and Microsoft Corporation, are at the forefront of advancing AI applications in clinical tasks such as diagnostic imaging and drug discovery.

Regional Insights

In 2023, North America dominated the AI in Healthcare market, driven by early adoption of advanced technologies and significant investments. Meanwhile, Asia-Pacific is predicted to be the fastest-growing region from 2024 to 2032, with countries like China and India leading this growth.

Recent Developments

- August 2024: Philips introduced the AI-powered HealthSuite Platform for enhanced patient management.

- July 2024: IBM Watson Health launched an AI-driven drug discovery platform to expedite new therapies.

- June 2024: Microsoft unveiled Azure AI Health Insights for predictive analytics in healthcare.

- May 2024: Medtronic released the AI-based endoscopy system, GI Genius, for early colorectal cancer detection.

- April 2024: Siemens Healthineers launched an AI-enhanced imaging software to boost diagnostic imaging accuracy.

Outlook

As AI adoption in diagnostics, treatment, and robotic surgeries continues to rise, the healthcare AI market is poised for significant upswing, led by software solutions and robotic surgery applications. For further comprehensive details, visit the complete market outlook report here.

Propy Revolutionizes Home Inspections with Inspectify Partnership

Propy Revolutionizes Home Inspections with Inspectify Partnership

In a significant move towards streamlining the home-buying process, Propy, a San Francisco-based real estate technology platform, has announced its strategic partnership with Inspectify, a leading property inspection platform. This collaboration, revealed in a joint statement last month, enables users to handle property inspections without leaving the Propy app, marking a new era of efficiency in real estate transactions.Prior to this integration, homebuyers and real estate agents had to navigate through separate platforms to order inspection reports, often resulting in delays during the closing process. Now, with a single click, users can access inspection reports, transfer data, and complete payments seamlessly on one platform.

Streamlining the Home-Buying Journey Propy CEO Natalia Karayaneva expressed enthusiasm about this partnership, stating, “This integration with Inspectify is all about making life easier for our users. By keeping the inspection process within the Propy platform, we’re simplifying the home-buying journey and moving property settlements onchain without human off-line and off-chain interactions, one step closer to the full potential.”

This move aligns with Propy’s ongoing efforts to leverage blockchain technology and transition into the Web3 space, which promises enhanced data security and decentralization. Users can now access inspection reports without needing to go off chain, further simplifying the transaction process.

Unlocking the Full Potential of Home Inspections Inspectify CEO Josh Jensen also praised the partnership, highlighting the potential to create more utility and value for homebuyers. “We’ve always believed that the home inspection that happens at the time of home purchase is the most robust and complex data set that exists on homes today,” Jensen noted. “This partnership with Propy presents a tremendous opportunity to enhance efficiency and value for homebuyers.”

Since its inception in 2019, Inspectify has facilitated $19 billion in home inspections, accelerating the home-buying process nationwide. Propy, on the other hand, has closed approximately $10 billion in on-chain real estate transactions and plans to introduce remote notary scheduling features soon.

This integration marks a pivotal step forward in harnessing blockchain technology‘s potential to reduce costs on title transfers, title registries, and other transaction processes, potentially saving billions annually for consumers.

AI’s Transformative Impact on the Insurance Sector Unveiled at Hong Kong FinTech Week 2024

AI Revolutionizes the Insurance Sector at Hong Kong FinTech Week 2024

In a groundbreaking discussion at the 2024 Hong Kong FinTech Week InsurTech Forum, industry leaders delved into the transformative power of artificial intelligence in the insurance sector. Charles Hung, CEO of Blue Insurance; Gilbert Leung, CEO of Novo AI; and Priscilla Ng, Prudential’s Group Chief Customer & Marketing Officer, shared insights on how AI is reshaping customer experience, boosting operational efficiency, and tackling industry-specific challenges.

Applications and Challenges of AI in Insurance

Priscilla Ng emphasized Prudential’s strategic use of AI to process vast amounts of customer feedback, enabling swift issue resolution and enhanced engagement. Similarly, Charles Hung highlighted AI’s role in delivering personalized service at Blue Insurance, meeting customer expectations at scale. Meanwhile, Gilbert Leung from Novo AI discussed AI’s pivotal role in fraud detection and cost management, crucial for safeguarding the bottom line.

However, the implementation of AI is not without its hurdles. Prudential grapples with data quality and prioritizing use cases, while Blue Insurance faces challenges in sourcing skilled talent and ensuring data accuracy. Novo AI underscores the necessity of rapid iterations to keep pace with AI advancements. These discussions underscore the need for robust, carefully planned strategies tailored to the insurance industry’s unique challenges.

Ensuring Fairness and Accuracy with “Humans in the Loop”

A recurring theme was the critical role of human oversight in maintaining AI fairness and accuracy. Gilbert Leung stressed the importance of integrating human expertise at every stage of AI operations, reducing biases, and upholding ethical standards. This human element is particularly vital in sensitive areas like healthcare, where AI-driven decisions impact human outcomes, building trust and accountability.

AI as an Essential Tool for the Future of Insurance

The forum concluded with a consensus that AI has evolved from a competitive advantage to an essential survival tool. Its ability to streamline claims handling, enhance transparency, and combat fraud is revolutionizing insurance operations. Yet, human oversight remains indispensable to ensure AI-driven decisions reflect care and ethical integrity. This balanced approach paves a responsible path forward, enabling insurers to harness AI’s potential while maintaining customer trust.

The Dawn of Artificial Intelligence in Healthcare

The Dawn of Artificial Intelligence in Healthcare

The revolution of artificial intelligence (AI) in healthcare has just begun, with vast potential to transform patient care, research, and drug discovery. In a recent article by Forbes, five promising areas where AI could make a significant impact are highlighted.

1. Speeding New Drug Development

Drug discovery is a lengthy and costly process, often taking 10 to 15 years and costing billions. AI is beginning to change this dynamic. For instance, Insilico Medicine initiated a Phase I human trial for an anti-fibrotic drug discovered by AI in just 30 months. Although no AI-discovered drugs have yet been approved by the FDA, the rapid progress is promising.

2. Helping Doctors Make Tricky Diagnoses

AI is proving to be a valuable ally in clinical medicine. A study published in JAMA demonstrated that AI can assist doctors in diagnosing complex cases, showing the potential of AI to act as a copilot in challenging medical decision-making.

3. Improving Interpretation Of Diagnostic Images

AI’s ability to enhance diagnostic accuracy is evident in imaging. A study in Nature Medicine showed that AI models could outperform radiologists in detecting early lung cancer from CT scans. Similarly, a study in Lancet Digital Health found that AI-assisted mammography improved breast cancer detection rates.

4. Allowing Doctors To Focus On Patients

Ambient AI technology is revolutionizing the way doctors interact with patients. By listening to patient-doctor encounters and creating draft notes, it allows doctors to focus more on patient interaction. A study in NEJM Catalyst reported high adoption rates of Ambient AI, indicating its potential to streamline documentation.

5. Letting Patients Feel Heard

AI is also enhancing patient communication. Research published in the Proceedings of the National Academy of Sciences found that AI-generated messages often made patients feel more heard compared to human-generated ones. This suggests AI could play a supportive role in fostering empathy and understanding in healthcare communication.

The proliferation of healthcare AI companies signifies a transformative era. While it’s unclear which innovations will endure, the integration of AI into healthcare promises to reshape the industry profoundly.

AI’s Transformative Role in Healthcare

Upcoming Workshop and Conference

To tackle these challenges, the Institute for Experiential AI is hosting an all-day workshop on October 9 and a conference on October 10. These events will convene leaders in healthcare and AI to discuss the integration of AI into healthcare training and precision medicine. The workshop will focus on embedding AI literacy within educational curriculums, ensuring future health professionals are equipped with the skills necessary to thrive in a technologically advanced environment.

A Platform for Innovation

These events are timely as healthcare organizations begin to develop AI strategies, often in collaboration with large corporations and academic institutions. As noted by Raimond Winslow from Northeastern’s Roux Institute, the transformation toward a computational future is already underway, with practical applications emerging in the sector. The conference will highlight AI’s role in personalized medicine, showcasing its potential to process extensive patient data for precise health objectives.

The Role of AI in Precision Health

AI’s ability to refine precision health is emphasized by Usama Fayyad, who highlights how AI can suggest medical treatments based on data analysis, making it an invaluable tool in patient care. As the healthcare sector stands on the brink of a significant transformation, these discussions are crucial in steering an AI-driven future.

The original article from Northeastern Global News delves deeper into the transformative potential of AI in healthcare, highlighting advancements in AI-driven drug development, diagnosis, and data management. With AI set to revolutionize the industry, these upcoming events offer a pivotal opportunity for stakeholders to explore and address the challenges and strategies in AI adoption.

Revolutionizing Healthcare: The AI Transformation in Hospitals

In a world where healthcare systems are constantly evolving, artificial intelligence (AI) is emerging as a game-changer, revolutionizing patient care in hospitals. From diagnostics to personalized treatment plans and efficient administration, AI is transforming the way healthcare is delivered, making it more accessible, efficient, and tailored to individual needs.

Enhancing Patient Experience with AI

Imagine a healthcare experience where hospitals operate at peak efficiency, and patient care is personalized to meet specific needs. This is no longer a distant dream but a reality, thanks to AI-assisted scheduling, virtual health assistants, and remote monitoring. These technologies are reducing wait times and improving overall patient satisfaction by tailoring care to individual needs.

AI-Assisted Patient Scheduling

Long wait times and inefficient appointment scheduling have long been a source of frustration. By harnessing algorithms to analyze patient data, AI-assisted scheduling optimizes appointment times, enhancing patient flow and resource utilization in hospitals. This results in a significant improvement in patient experience and care delivery.

Virtual Health Assistants

Navigating the healthcare system can be overwhelming, but virtual health assistants are changing that. These digital tools provide personalized support, guiding patients through their healthcare journey and empowering them to take control of their health. By offering real-time assistance, virtual health assistants foster a more proactive approach to healthcare management.

AI-Powered Medical Diagnostics

The power of AI extends beyond patient experience, playing a crucial role in medical diagnostics. AI-powered diagnostics enhance accuracy and speed in identifying medical conditions, leading to better patient outcomes. AI-driven image analysis and pathology are revolutionizing the way medical professionals interpret data, reducing errors and improving patient outcomes.

Image Analysis and Radiology

AI-driven image analysis, like the model used in Google Med-PaLM 2, is transforming radiology by improving diagnostic accuracy. This technology is particularly beneficial in detecting early signs of diseases, allowing for faster intervention and treatment.

Pathology and Lab Tests

AI is also impacting pathology and laboratory tests, streamlining processes and increasing efficiency in diagnosing diseases. Companies like PathAI are developing techniques to reduce inaccuracies in cancer diagnosis, showcasing AI’s potential to revolutionize pathology and lab tests.

AI-Driven Personalized Treatment Plans

AI-driven personalized treatment plans are reshaping the approach to patient care. By leveraging precision medicine, drug dosing, and predictive analytics, AI creates tailored treatment plans based on individual patient data. This not only improves outcomes but also reduces healthcare costs by eliminating unnecessary treatments and tests.

Precision Medicine

Precision medicine tailors treatments based on an individual’s genetics, environment, and lifestyle. AI analyzes vast amounts of patient data to identify the most effective treatments, increasing effectiveness and reducing side effects.

Drug Dosing and Monitoring

AI-guided drug dosing and monitoring optimize medication administration, ensuring correct dosages and reducing errors. This improves patient safety and outcomes while reducing the time and cost associated with drug dosing.

AI Applications in Hospital Administration

Beyond patient care, AI applications in hospital administration streamline processes and reduce costs. AI aids in revenue cycle management, clinical documentation improvement, and supply chain optimization, ensuring that hospitals operate efficiently and effectively.

Revenue Cycle Management

AI-driven revenue cycle management automates and optimizes billing processes, reducing financial waste and enhancing hospital operations. This allows healthcare providers to focus on delivering high-quality patient care.

Clinical Documentation Improvement

Accurate clinical documentation is essential for effective patient care. AI reduces errors by automating the review process, improving communication, and ensuring adherence to regulatory requirements.

Supply Chain Optimization

AI-powered supply chain optimization ensures hospitals have the necessary resources and equipment, reducing waste and improving patient care. This optimization benefits both healthcare providers and patients.

Overcoming Challenges in Implementing AI in Patient Care

While AI holds immense potential, challenges such as ethical considerations, workforce adaptation, and regulatory compliance must be addressed for successful implementation. Ensuring transparency and adherence to ethical guidelines is crucial for maintaining patient trust and preventing adverse effects.

As AI continues to evolve, the future of patient care promises to be more personalized, efficient, and effective. By addressing these challenges and embracing the potential of AI, the healthcare industry can look forward to a brighter future.

The Future of Healthcare: Insights from the 2024 Digital Health Conference

The digital health industry is on the cusp of a transformative era, as highlighted in the recent virtual conference hosted by the Food and Drug Law Institute (FDLI). Held from January 31 to February 1, 2024, this event brought together key stakeholders from across the sector to discuss the latest advancements and regulatory developments in digital health technology.

With a focus on the rapid evolution of digital health, the conference delved into critical topics such as mobile health apps, health information technology, artificial intelligence, machine learning, wearables, and telemedicine. These discussions are particularly timely, given the increasing reliance on digital tools to enhance patient care and improve provider efficiency.

Keynote Speakers and Topics

Among the distinguished speakers was Dr. Sonja Fulmer, Deputy Director of the FDA’s Digital Health Center of Excellence. Dr. Fulmer provided valuable insights into the FDA’s ongoing efforts to establish robust regulatory frameworks to ensure the safety and efficacy of digital health innovations.

The conference also addressed pressing issues such as cybersecurity and privacy breaches within the digital health realm. As these challenges become more prevalent, the need for comprehensive regulatory measures at both state and federal levels becomes increasingly apparent.

Planning Committee and Participants

The event was meticulously organized by a planning committee comprising notable figures from leading organizations, including Nicholas Benetatos from Exponent, Inc., Charlene Cho from Johnson & Johnson, and Mahnu Davar from Arnold & Porter LLP, among others. Their collective expertise ensured a well-rounded and insightful exploration of the digital health landscape.

Overall, the conference underscored the critical role of digital health in the future of healthcare. It emphasized the importance of staying ahead of technological advancements while addressing regulatory challenges to protect patient data and ensure the integrity of digital health solutions.

AI Revolutionizing Healthcare: A Glimpse into the Future

AI Revolutionizing Healthcare: A Glimpse into the Future

In a world where technology is rapidly transforming industries, the healthcare sector stands at the forefront of this revolution. According to a recent report by GlobeNewswire, the Artificial Intelligence in Healthcare market is projected to skyrocket from USD 22.5 billion in 2023 to an astounding USD 370.14 billion by 2032. This exponential growth is largely driven by the integration of AI technologies in diagnostics, treatment planning, and robotic surgeries.

Driving Forces Behind AI Adoption

The healthcare industry is increasingly embracing AI-based solutions, with applications ranging from diagnostic imaging to personalized medicine. The surge in healthcare data, coupled with advancements in machine learning and natural language processing, is fueling the demand for AI-powered tools that enhance decision-making and optimize operational efficiency.

Market Dynamics and Key Players

The market is experiencing a surge on both supply and demand fronts. Technological advancements and increased investments are paving the way for sophisticated AI tools catering to diverse healthcare needs. Major players like Google Inc., IBM Corporation, and Microsoft Corporation are at the helm, driving innovation in AI healthcare technologies.

Regional Insights and Future Projections

North America currently holds the largest market share, thanks to its early adoption of advanced technologies and substantial investment in healthcare AI startups. However, the Asia-Pacific region is poised for rapid growth, driven by expanding healthcare infrastructure and significant investments in AI, particularly in China and India.

Recent Developments

Recent months have witnessed exciting developments in AI healthcare technologies. For instance, Philips introduced its AI-powered HealthSuite Platform, while IBM Watson Health launched an AI-driven drug discovery platform. These innovations underscore the rapid pace of advancement in the field.

Key Takeaways

- The AI healthcare market is set for explosive growth, driven by increasing adoption in diagnostics, treatment, and robotic surgeries.

- Software solutions and robot-assisted surgery applications dominated the market in 2023.

- North America leads the market, while Asia-Pacific is expected to be the fastest-growing region over the next decade.

- Recent developments from major companies highlight the rapid pace of innovation in AI healthcare technologies.

Personalized Medicine Biomarker Market: A Billion-Dollar Revolution

Personalized Medicine Biomarker Market: A Billion-Dollar Revolution

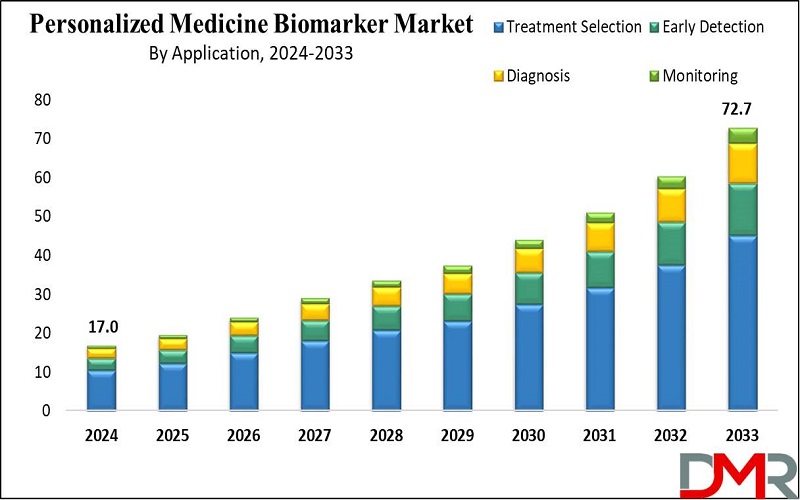

In a groundbreaking analysis released on July 1, 2024, GlobeNewswire sheds light on the transformative growth within the global personalized medicine biomarker sector. The report, curated by Dimension Market Research, forecasts the market to catapult from USD 17 billion in 2024 to a staggering USD 72.7 billion by 2033, marking a compound annual growth rate (CAGR) of 17.5%.

Market Dynamics and Projections

The personalized medicine biomarker market is a dynamic ecosystem, pivotal in tailoring treatments to individual patient characteristics. This approach optimizes therapeutic outcomes by leveraging genetic or molecular signatures to inform diagnosis and guide treatment decisions. The oncology sector is projected to dominate, commanding a significant 33.1% of the market share in 2024, driven by global cancer prevalence and advancements in genomic technologies.

Regional Insights

North America stands at the forefront, expected to hold 37.2% of the global market share in 2024. This dominance is attributed to the region’s robust biotech investments, advanced healthcare infrastructure, and a network of renowned research institutions. As North America leads, Europe and Asia-Pacific are not far behind, showing significant growth potential.

Technological Advancements

The report highlights several technological trends reshaping the market. Notably, advancements in genomic technologies like next-generation sequencing are driving biomarker identification, transforming personalized medicine globally. The rise of liquid biopsy technologies, particularly in oncology, offers non-invasive diagnostic methods, revolutionizing patient care.

Competitive Landscape

Key players such as Illumina, Roche Diagnostics, and Thermo Fisher Scientific are at the helm of this burgeoning market, leading in genomics, diagnostics, and biomarker discovery. Companies like Qiagen and Foundation Medicine enhance their market presence through strategic partnerships and collaborations, expanding their reach and forming alliances with healthcare providers and research institutions.

Challenges and Opportunities

Despite promising growth, the market faces challenges, including regulatory and ethical considerations that impact biomarker adoption. However, opportunities abound with the development of individualized therapeutic techniques and the integration of biomarkers into diagnostic algorithms, driving market expansion.

Recent Developments

Recent collaborations and innovations underscore the sector’s dynamic nature. For instance, in November 2023, Massive Bio partnered with Health in Code to advance personalized oncology treatments in Spain, emphasizing AI and genomic testing. Similarly, Ibex’s introduction of Galen™ Breast HER2 in September 2023, developed with AstraZeneca and Daiichi Sankyo, highlights the push towards precision in cancer pathology.

Conclusion

The personalized medicine biomarker market is poised for unprecedented growth, driven by technological advancements, strategic collaborations, and a global shift towards precision medicine. As the market evolves, it promises to redefine healthcare, offering tailored solutions that enhance patient outcomes across the globe.

Six Federal Agencies Finalize Rule for AI Safeguards in Real Estate Valuations

AVMs have become indispensable tools in real estate, offering efficiency and speed in estimating property values for mortgage and lending services. However, the increasing reliance on these AI-powered models has raised concerns about data accuracy, security, and potential discriminatory impacts. The newly finalized rule mandates the integration of five quality control measures to mitigate these concerns.

The Rule’s Key Provisions

The rule requires companies utilizing AVMs to ensure:- A high level of confidence in valuation estimates.

- Protection against data manipulation.

- Avoidance of conflicts of interest.

- Random sample testing and reviews.

- Compliance with applicable nondiscrimination laws.

Historical Context and Impact

The adoption of AVMs has accelerated due to advancements in AI and the shortage of human appraisers exacerbated by the COVID-19 pandemic. A report by the Brookings Institution highlights the critical role these models play for organizations like Fannie Mae and Freddie Mac. Despite their benefits, AVMs have faced scrutiny for potentially perpetuating biases present in human-performed appraisals.The finalized rule follows a proposed rule issued on June 1, 2023, in response to the Dodd-Frank Act. This proposal laid the groundwork for quality control standards, echoing the Biden administration’s executive orders on minimizing bias in AI processes.

Looking Ahead

When the rule takes effect a year after its publication in the Federal Register, it will represent a pivotal step in enhancing the integrity of real estate valuations. Companies are granted the flexibility to develop specific policies that align with their size and risk profile, ensuring a dynamic regulatory environment that evolves with technological advancements.BRICS Unveils Ambitious Plan to Reshape Global Financial Landscape

BRICS Unveils Ambitious Plan to Reshape Global Financial Landscape

In a bold move to challenge the dominance of the U.S. dollar, the BRICS organization has announced a comprehensive strategy aimed at transforming the international monetary and financial system. This initiative, spearheaded by Russia as the 2024 BRICS chair, seeks to establish a multi-currency system that could redefine global trade dynamics.At the heart of this plan is the proposed BRICS Cross-Border Payment Initiative (BCBPI), which will enable member countries to conduct trade using their national currencies. This initiative is designed to bypass the traditional SWIFT system, often seen as a tool of Western economic influence, and to mitigate the impact of unilateral sanctions.

Moreover, BRICS intends to explore the potential of central bank digital currencies (CBDCs) and distributed ledger technology. These innovations could allow nations to settle trade imbalances directly, enhancing financial autonomy and reducing dependency on third-party banks.

Building a New Financial Infrastructure

The BRICS framework includes the establishment of a BRICS Clear platform and a new system of securities accounting and settlement. These mechanisms aim to facilitate investment within BRICS nations and other emerging markets, while promoting the use of financial instruments denominated in national currencies.In addition, a BRICS Grain Exchange is on the horizon, set to revolutionize commodity trading in grains, oil, natural gas, and gold. This exchange will not only support trade but also serve as a tool for settling trade imbalances.

Challenging Existing Financial Powers

The Russian report, co-authored by the Ministry of Finance and the Bank of Russia, critiques the current international monetary and financial system (IMFS) as unjust and inefficient. It highlights the excessive reliance on a single currency and centralized financial infrastructure, which predominantly serves the interests of advanced economies.The report underscores the need for reform, citing the geo-economic fragmentation caused by the misuse of trade and financial restrictions. This sentiment echoes the broader call for a New International Economic Order (NIEO), a vision long advocated by the Group of 77 and supported by BRICS members.

Looking Ahead: The Role of SDRs

While the creation of a new international reserve currency remains a topic of debate, the report suggests that Special Drawing Rights (SDRs) could play a more significant role. Although currently limited in use, SDRs have the potential to act as a super-sovereign reserve currency, addressing the Triffin Dilemma and managing global liquidity.However, the SDR’s reliance on a basket of major currencies, including the U.S. dollar, presents challenges. The document calls for efforts to enhance the utilization of SDRs in the real economy, despite the inherent exchange-rate risks associated with borrowing in SDRs.

De-Dollarization: A Gradual Shift

The path to de-dollarization is complex, particularly in the realm of savings and investment. While trade de-dollarization is more feasible, shifting reserves and savings away from dominant currencies like the U.S. dollar will require strategic initiatives and time.BRICS proposes the creation of a BRICS Digital Investment Asset (DIA), backed by assets from member countries. This initiative, along with increased investment in gold, reflects a strategic pivot towards alternative reserve assets.

As the global economic landscape evolves, BRICS’ ambitious plan represents a significant step towards a more equitable financial system. While challenges remain, the ongoing efforts to establish alternative payment systems and financial messaging mechanisms signal a transformative shift in international economic relations.

Berlin-based Aignostics Secures €31.4 Million Series B Funding

Berlin-based Aignostics Secures €31.4 Million Series B Funding

In a significant stride for precision medicine, Aignostics, a pioneering artificial intelligence company, has announced the successful closure of a €31.4 million Series B funding round. This substantial investment underscores the growing reliance on AI to revolutionize the field of computational pathology.

The funding round, oversubscribed and led by ATHOS, also saw participation from prominent entities such as Mayo Clinic and HTGF, alongside existing investors like Wellington Partners and Boehringer Ingelheim Venture Fund. This brings Aignostics’ total funding to over $55 million, a testament to the confidence investors have in its cutting-edge AI models and strategic vision.

“At its core, Aignostics is a world-class machine learning company,” stated Julian Zachmann from ATHOS. “The field is advancing so quickly that, in order to succeed, AI companies need to avoid flashy distractions, stay laser-focused on the highest-quality science, and relentlessly innovate. Aignostics is doing just that.”

Strategic Partnerships and Innovations

Aignostics’ collaborations with esteemed institutions like Mayo Clinic are pivotal in developing foundational models for pathology. Jim Rogers, CEO of Mayo Clinic Digital Pathology, emphasized the potential impact of digital pathology paired with AI on patient diagnosis and treatment.

The new funding will bolster Aignostics’ offerings in target identification, translational research, and companion diagnostics (CDx). Viktor Matyas, CEO and Co-Founder of Aignostics, highlighted the launch of their first foundation model, RudolfV, as a key development. “With RudolfV, we’ve gained the ability to quickly develop cost-efficient algorithms that generalize to the real world,” he noted.

Future Prospects and Market Impact

As the landscape of precision medicine becomes increasingly complex, Aignostics is poised to lead the charge in integrating AI into biopharmaceutical research and diagnostics. The company’s strategic initiatives, including a major collaboration with Bayer, are set to propel its growth trajectory, particularly within the United States.

Niels Sharman, Senior Investment Manager at HTGF, expressed enthusiasm for Aignostics’ progress, stating, “We have been thoroughly impressed by Aignostics’ progress and their cutting-edge AI platform, which we believe will have a transformative impact on Pharma R&D.”

For more insights into Aignostics’ journey and strategic collaborations, refer to the original article on EU-Startups.

AI in Health Care: Opportunities and Challenges Ahead

In a world where technology is rapidly reshaping industries, the intersection of artificial intelligence (AI) and health care stands as a beacon of transformative potential. The Bipartisan Policy Center (BPC), a nonprofit organization dedicated to fostering bipartisan solutions, has recently addressed this critical synergy, emphasizing both the opportunities and challenges that lie ahead.

In a recent letter to Representative Ami Bera, BPC highlighted the immense promise AI holds in revolutionizing patient care. From enhancing diagnostic accuracy to optimizing health care costs, AI is poised to alleviate clinician burnout and improve patient experiences. However, as BPC notes, navigating this technological frontier requires careful consideration of potential pitfalls, especially as lawmakers contemplate legislative actions.

Current State of AI in Health Care

AI’s integration into health care is already underway, with applications ranging from administrative support to clinical decision-making. According to a survey by The Center for Connected Medicine, AI ranks as the most exciting emerging technology among health care executives. The expectation is clear: AI will lead to improved diagnostic accuracy, faster treatment delivery, and enhanced patient experiences.

Yet, the rapid adoption of AI has outpaced the implementation of adequate oversight and governance policies. A study by Bain & Company underscores this, revealing that only a small fraction of health systems have established a comprehensive AI strategy. This gap highlights the urgent need for robust governance frameworks to ensure responsible and ethical AI deployment.

Challenges and Considerations

While AI offers numerous benefits, its integration into health care is not without challenges. Issues such as data quality, privacy, and interoperability remain significant hurdles. Ensuring data represents diverse populations is crucial, as biases in AI algorithms can exacerbate existing health disparities. Moreover, the lack of a comprehensive privacy law in the United States complicates data protection efforts, necessitating a collaborative approach involving government agencies and industry stakeholders.

Another pressing concern is the ethical and legal framework surrounding AI in clinical decision-making. Determining accountability when AI tools produce incorrect diagnoses is complex, with current legal frameworks lagging behind technological advancements. The HHS Office of Civil Rights has made strides in addressing AI-related liability, but further clarity is needed to ensure equitable and safe AI use in health care.

Looking Ahead

The future of AI in health care is bright, with applications extending to medical imaging, predictive analytics, drug discovery, and remote monitoring. However, as AI continues to evolve, it is imperative to establish ethical guidelines and regulatory standards that safeguard patient safety and privacy. The BPC’s commitment to informing Congress and fostering dialogue with stakeholders is a crucial step in shaping a future where AI enhances health care delivery while ensuring equitable access for all.

For more insights on AI’s role in health care, explore BPC’s comprehensive resources on AI and the workforce, national security, research and development, and ethical considerations.

Revolutionizing Radiology with AI: The Future of Diagnostic Imaging

Revolutionizing Radiology with AI

In the rapidly evolving world of healthcare, artificial intelligence is reshaping the landscape, particularly in the realm of radiology. Companies such as Arterys, DeepMind, and Cleerly are pioneering new AI-driven approaches to streamline and enhance diagnostic accuracy. At the forefront of this transformation is Qure.ai, a company that is crafting AI-powered tools to lighten the workload of radiologists and improve patient outcomes, as reported in a recent Forbes article.AI’s Impact on Medical Imaging

Qure.ai’s innovation lies in its ability to process vast amounts of medical images, accelerating diagnostic processes significantly. Their deep learning models can autonomously analyze chest X-rays, CT scans, and MRIs to screen for diseases like tuberculosis, lung cancer, and stroke. This technology is especially crucial in resource-limited areas where access to radiologists is scarce. For instance, in TB-endemic regions, AI tools are deployed to swiftly identify cases requiring further testing. As Prashant Warier, co-founder and CEO of Qure.ai, noted, AI systems deployed in mobile vans in the Philippines have reduced TB diagnosis wait times from weeks to just 30 seconds.

Enhancing Diagnostic Consistency

The success of AI in radiology isn’t solely about speed; it’s also about improving accuracy. Studies highlight that Qure.ai’s AI can match or even surpass human radiologists in certain diagnostic tasks. Warier emphasized the importance of consistency, stating, “If you get two radiologists to report on the same chest X-ray, they will only agree 65% of the time. AI provides the same output consistently, ensuring reliable diagnoses.”

This consistency is vital for diseases requiring timely intervention, such as lung cancer and stroke. Qure.ai’s partnership with AstraZeneca focuses on analyzing routine chest X-rays to detect nodules and assess malignancy risks, often flagging potential cases that might otherwise go unnoticed.

Global Reach and Expansion

Qure.ai’s technology is not confined to one region; it’s deployed across more than 90 countries. From mobile TB screening in the Philippines to collaborations with pharmaceutical giants, Qure.ai is making AI-powered healthcare accessible worldwide. The company processes over 10 million scans annually, becoming a cornerstone of global healthcare.

Recently, Qure.ai raised $65 million in Series D funding, supported by investors like Lightspeed and 360 ONE Asset, as well as existing investors such as Novo Holdings. This funding aims to scale AI models and expand operations into new markets, including the U.S., enhancing diagnostic capabilities globally.

The Future of AI in Healthcare

Qure.ai’s technology marks the beginning of a broader trend where AI plays a pivotal role in diagnostics, treatment planning, and patient management. The company’s future focus is likely to involve integrating AI with other data sources, such as genomics and electronic medical records, to provide a comprehensive view of patient health. By doing so, AI can move beyond isolated diagnostic tasks to offer more personalized, predictive care.

Prashant Warier believes that AI in healthcare is still in its infancy, but its potential is vast. “We’re starting to integrate multiple data points to create more holistic AI models,” he explained, enabling doctors to make more informed decisions by considering a patient’s full medical history alongside diagnostic imaging.

Top 7 Construction Industry Trends in 2024

Top 7 Construction Industry Trends in 2024

As we step into 2024, the construction industry is navigating a complex landscape marked by both challenges and opportunities. Labor shortages and supply chain disruptions continue to pose significant hurdles. Yet, there are bright spots on the horizon, with environmentally responsible projects and AI-driven innovations leading the charge.

1. A Shortage of Workers for Construction Companies

The construction industry is grappling with a persistent labor shortage, driven by a low unemployment rate since 2023. This scarcity of skilled workers, particularly among the aging workforce, is impacting growth and recruitment efforts.

2. Ongoing Supply Chain Disruptions (and Solutions)

Extended lead times for supply deliveries remain a challenge. However, initiatives like the FLOW Initiative are being implemented to enhance efficiency in American supply chains.

3. The Popularity of Outdoor Spaces

The demand for outdoor spaces has surged post-pandemic, influencing both commercial and residential construction. This trend is expected to persist, catering to the growing desire for safe and stylish gathering areas.

4. The Influence of AI and New Construction Technology

Construction companies are increasingly leveraging AI and robotics to enhance site operations and project efficiency. From building information modeling (BIM) programs to autonomous equipment, technology is revolutionizing the industry.

5. More Sustainable Construction Practices

Sustainability is at the forefront, with companies adopting green building materials and solar energy. The push for sustainable practices addresses environmental impacts, making green construction more prevalent in 2024.

6. Prefabrication and Modular Construction

Interest in modular construction methods is rising, streamlining processes and reducing costs. These innovative solutions are seen as key to addressing housing shortages while minimizing emissions.

7. A Push for Innovative Materials

Innovative materials like self-healing concrete and 3D printing are transforming the industry. These advancements not only promote sustainability but also enhance efficiency, allowing companies to focus on other aspects of construction.

Other noteworthy trends include a rise in female-owned construction firms and increased female workforce participation, signaling a positive shift in industry demographics.

With these trends firmly established, industry observers are keenly awaiting which developments will carry into 2025. For more insights, visit the original article on Thomasnet.

AI in Healthcare: Pioneering Precision Health at Northeastern University

AI in Healthcare: A Seamless Revolution

“If AI is working the way that we envision it, you actually won’t notice a lot of direct impact,” says Sam Scarpino, the AI+Life Sciences director at Northeastern University. The vision is for AI to operate quietly in the background, much like a well-oiled engine, enhancing the efficiency of medical processes and enabling earlier detection of diseases, such as cancer.

Gene Tunik, the AI+Health director, echoes this sentiment, emphasizing that AI should function seamlessly, optimizing drug development, cancer diagnosis, and medical data management. Despite these advancements, AI is not yet universally adopted in healthcare settings due to challenges in accuracy, cost, and data quality.

Upcoming Events: Workshops and Conferences

To address these challenges and opportunities, Northeastern University will host two significant events. On October 9, the Future of AI in Health & Life Sciences Workshop will gather experts to discuss integrating AI into healthcare training. The following day, October 10, the State of AI in Precision Health Conference will focus on precision health, a highly individualized approach to medicine.

Precision Health: The Future of Medicine

Precision health requires physicians to analyze vast amounts of data quickly to meet specific health objectives. As Usama Fayyad, the institute’s executive director, explains, AI’s ability to process data efficiently makes it an invaluable tool in this area. The conference will feature discussions on AI’s role in drug discovery, aging in place, and patient care.

A Computational Transformation

Raimond Winslow, director of life sciences and medicine research, highlights that medicine is increasingly becoming a computational discipline. This transformation, akin to the shift in biology over the past two decades, means that AI will play a crucial role in informing healthcare decisions.

As Northeastern University prepares to lead these vital discussions, the healthcare industry stands on the brink of a transformation that will redefine patient care in the AI era.

U.S. Department of Transportation Unveils Roadmap for V2X Technology

U.S. Department of Transportation Unveils Roadmap for V2X Technology

Safety advocates have long praised the potential of Vehicle-to-Everything (V2X) technology, which enables vehicles to communicate wirelessly. Now, the U.S. Department of Transportation has released a comprehensive plan to accelerate the rollout of this transformative technology across American roads.

Safety advocates have long praised the potential of Vehicle-to-Everything (V2X) technology, which enables vehicles to communicate wirelessly. Now, the U.S. Department of Transportation has released a comprehensive plan to accelerate the rollout of this transformative technology across American roads. Enhancing Road Safety

V2X technology allows cars and trucks to exchange critical information such as speed, position, and road conditions with each other and with road infrastructure. This system is designed to prevent collisions and reduce the impact of crashes, potentially saving thousands of lives annually. With over 40,000 traffic fatalities each year in the U.S., the stakes are high for implementing this life-saving technology.

Shailen Bhatt, head of the Federal Highway Administration, emphasized the proven efficiency of V2X at a recent event marking the release of the deployment plan. Jennifer Homendy, Chair of the National Transportation Safety Board, joined the event remotely, advocating for the adoption of V2X to transform America’s transportation landscape.

Overcoming Past Challenges

The rollout of V2X technology faced significant setbacks during previous administrations due to regulatory uncertainty. However, industry leaders like John Bozzella, CEO of the Alliance for Automotive Innovation, express optimism that the new plan reflects a turning point. By 2028, the plan aims to enable 20% of the National Highway System with V2X infrastructure and achieve substantial implementation in major metropolitan areas.

Despite challenges such as securing infrastructure funding and protecting against cyber threats, safety experts continue to push for swift action. Dan Langenkamp, who tragically lost his wife in a road accident, urged for the technology’s deployment, highlighting the collective responsibility to harness available innovations to address the growing road safety crisis.

For more information, the full deployment plan can be accessed here.

Looking Ahead

The Department of Transportation’s roadmap is a vital step towards realizing the full potential of V2X technology. As the nation moves forward, the hope is that this initiative will not only improve road safety but also fundamentally transform the transportation landscape.“`

Unveiling the Genetic Secrets: Groundbreaking Study on Rare Diseases in Germany

Unveiling the Genetic Secrets

The study, which has been published in the esteemed journal Nature Genetics, marks a pivotal advancement in identifying the genetic underpinnings of ultra-rare diseases. The researchers utilized innovative technologies, including the “GestaltMatcher” AI software, designed to assist in diagnosing rare diseases through facial feature analysis. This tool plays a crucial role in early diagnostics by matching phenotypes to genotypes, highlighting the clinical benefit of AI integration.

Further research under the MVGenomSeq project aims to address unresolved cases using new methods like long-read sequencing. This approach seeks to uncover genetic changes missed by traditional tools, potentially paving the way for additional diagnoses.

Collaborative Efforts Across Institutions

Institutions such as the University Hospital Bonn, Charité-Universitätsmedizin Berlin, and Klinikum rechts der Isar of the Technical University of Munich have collaborated in this groundbreaking work. According to Dr. Theresa Brunet and Dr. Magdalena Danyel, the interdisciplinary approach involving case conferences plays a critical role in understanding patient phenotypes, thereby enhancing the effectiveness of genetic diagnostics.

The Role of AI in Healthcare

The integration of AI tools like GestaltMatcher into clinical settings provides swift support, especially for pediatricians during routine screenings. This study underscores the transformative role of AI in healthcare, offering a framework for continued exploration and understanding of rare genetic diseases through cutting-edge technology and collaborative efforts.

Overall, this project sets a precedent for future research, emphasizing the power of collaborative efforts in unveiling new medical insights and improving patient care.

AI Transforming Healthcare: A Leap Forward in Diagnostic Accuracy and Efficiency

AI Transforming Healthcare: A Leap Forward in Diagnostic Accuracy and Efficiency

The healthcare industry is undergoing a seismic shift, driven by the rapid advancement of artificial intelligence (AI). According to a recent TechTarget article, AI’s profound impact on healthcare is revolutionizing diagnostic accuracy, surgical precision, and operational efficiency.

A comprehensive study from Tata Consultancy Services reveals that nearly 94% of healthcare executives have already integrated AI or have plans to do so. This widespread adoption underscores AI’s transformative potential in the medical field.

Enhancing Diagnostic Accuracy

AI’s ability to analyze medical images with a precision that often surpasses human capabilities is one of its most promising applications. This technology is pivotal in early disease detection, such as identifying cancerous cells in mammograms, thereby improving patient outcomes through timely interventions.

Revolutionizing Surgical Procedures

AI is also making waves in surgical procedures. Robotics-assisted surgeries, like endovascular neurosurgery, are becoming more common, offering enhanced precision and reducing complication risks. These systems empower surgeons to perform complex operations with greater accuracy, leading to improved patient outcomes and shorter recovery times.

Boosting Productivity

According to the TCS study, AI is a significant driver of productivity in healthcare. Approximately 40% of executives anticipate incremental productivity gains, while 26% expect AI to double their productivity. AI achieves this by automating routine tasks, streamlining operations, and providing decision support to healthcare professionals.

Challenges and Ethical Considerations

Despite AI’s immense potential, the study highlights several challenges in its implementation, such as the lack of cohesive AI strategies and metrics to measure success. Additionally, nearly 75% of companies are revamping their strategies to leverage AI fully. This includes changes to business models and ensuring staff are adequately trained to use AI tools effectively.

The rapid advancement of AI in healthcare raises important regulatory and ethical considerations. The study notes that 81% of leaders have called for a global set of regulations and standards on AI to ensure responsible use and protect patient privacy and data security.

As AI continues to evolve, it is poised to revolutionize the healthcare industry by enhancing diagnostic accuracy, improving surgical precision, and boosting productivity. However, to fully realize these benefits, healthcare providers must develop cohesive AI strategies, establish clear KPIs, and navigate the regulatory landscape carefully.