Federal Reserve’s Interest Rate Cut: Implications for the Housing Market

Mortgage Rate Dynamics

Despite the Federal Reserve’s interest rate cut, mortgage rates might not see a dramatic drop. Currently, the average rate for a 30-year fixed mortgage stands at 6.2%, according to Freddie Mac. While this is a decrease from previous highs, it remains significantly above the sub-3% rates seen during the pandemic.Charlie Dougherty, a senior economist at Wells Fargo, anticipates only a marginal decline in rates, projecting them to settle around 5.5% by the end of 2025. This suggests that while the Fed’s decision may offer some relief, it won’t be a panacea for the housing market’s challenges.

Impact on Housing Prices

Interestingly, lower mortgage rates could paradoxically lead to higher housing prices. As rates decrease, more buyers are likely to re-enter the market, intensifying competition for a limited housing supply. This scenario is particularly concerning for first-time buyers, who have already been grappling with affordability issues.Kim Kronenberger, a real estate agent from Denver, highlights the struggles faced by these buyers, many of whom regret not purchasing homes when prices were lower. The increased demand could further escalate prices, making it even harder for new entrants to secure their first homes.

Potential for Increased Housing Supply

The rate cut could, however, spur an increase in housing supply. The U.S. is currently facing a shortfall of millions of housing units, as noted in a JCHS Blog. Lower interest rates may enable builders, especially smaller developers, to commence new projects, potentially alleviating some supply-side pressures.As builders respond to the anticipated rise in demand, more homes could enter the market, gradually easing the upward pressure on prices. However, the construction and completion of these new homes will take time.

Affordability Challenges Persist

Despite the potential benefits of lower rates, affordability remains a significant hurdle. Home prices have surged by about 50% since early 2020, outpacing income growth and making housing increasingly inaccessible for many. Furthermore, a substantial number of homeowners are locked into low-rate mortgages from the pandemic era, reducing the incentive to sell and further constricting inventory.Greg McBride from Bankrate.com underscores that the housing market has yet to see a substantial boost from recent rate reductions. With home prices at record highs and inventory levels below pre-pandemic norms, the Fed’s rate cut alone is unlikely to resolve these deep-seated issues.

In conclusion, while the Federal Reserve’s rate cut introduces several dynamics that could reshape the housing market, it is clear that a multifaceted approach will be necessary to address the complex challenges of affordability and supply.

More Articles

Getting licensed or staying ahead in your career can be a journey—but it doesn’t have to be overwhelming. Grab your favorite coffee or tea, take a moment to relax, and browse through our articles. Whether you’re just starting out or renewing your expertise, we’ve got tips, insights, and advice to keep you moving forward. Here’s to your success—one sip and one step at a time!

AI in Healthcare: A Transformative Force Today and Tomorrow

AI in Healthcare: A Transformative Force Today and Tomorrow

In the ever-evolving landscape of healthcare, artificial intelligence (AI) has transcended its experimental roots to become an integral part of the system. As reported in a recent Forbes article, AI-powered tools are now delivering tangible improvements in patient outcomes, operational efficiency, and cost savings.

In the ever-evolving landscape of healthcare, artificial intelligence (AI) has transcended its experimental roots to become an integral part of the system. As reported in a recent Forbes article, AI-powered tools are now delivering tangible improvements in patient outcomes, operational efficiency, and cost savings.

Current AI Applications in Healthcare

AI is reshaping the healthcare ecosystem through various applications. From enhancing diagnostic accuracy to optimizing administrative processes, its impact is profound. Here are some notable examples:

- Diagnostics: AI algorithms are improving diagnostic accuracy and efficiency. Google Cloud Healthcare is using AI to enhance diagnostic speed and accuracy, while Butterfly Network’s ultrasound device provides accessible point-of-care imaging.

- Drug Discovery: AI accelerates drug development by simulating molecular interactions. Companies like Insilico Medicine are using AI to identify promising drug candidates swiftly.

- Personalized Medicine: AI analyzes patient data for personalized treatment plans. Tempus Labs leverages AI to tailor cancer treatments.

- Remote Monitoring: AI-enabled devices enhance remote patient monitoring. Livongo Health uses AI for diabetes management.

- Predictive Analytics: Health systems like Kaiser Permanente use AI to identify high-risk patients and prevent readmissions.

- Administrative Tasks: AI streamlines administrative tasks, reducing burdens on providers. Cedar’s platform automates billing processes.

- Clinical Decision Support: Companies like Epic Systems integrate AI-powered tools into electronic health records for real-time recommendations.

Future Innovations on the Horizon

Looking ahead, AI’s potential in healthcare is vast. Innovations such as predictive healthcare models, AI-driven telehealth, and robotic surgery are expected to emerge in the next few years. These advancements promise to shift the focus from reactive to predictive healthcare, offering early interventions and personalized care.

Challenges and Barriers

Despite its promise, AI in healthcare faces hurdles. Data privacy, integration with legacy systems, regulatory approval, ethical considerations, and trust are significant challenges that need addressing.

Action Steps for Embracing AI

To harness AI’s benefits, healthcare organizations and professionals can take strategic steps:

- Healthcare Organizations: Start small, invest in data infrastructure, develop an AI roadmap, and partner strategically.

- Healthcare Professionals: Embrace continuous learning, participate in pilots, and focus on AI-human collaboration.

- Patients: Stay informed, ask questions, and share data responsibly.

AI tools are already delivering significant value and are poised to further transform healthcare. Embracing these changes today will position organizations and individuals to capture the long-term benefits of a more effective, efficient, and personalized healthcare system.

2024 Housing Market Crystal Ball: Transformative Trends for the Next Decade

Demographic Shifts and Housing Demand

The US Census Bureau projects that by 2030, all baby boomers will be over 65, representing a significant 21% of the population. This aging demographic will drive demand for age-friendly housing with features like single-story layouts and wider doorways. Meanwhile, millennials and Gen Z will continue to influence market trends with their preference for urban living and sustainability.Technological Advancements in Real Estate

The rapid pace of technological innovation is poised to revolutionize the housing market. Virtual and augmented reality will make house hunting a predominantly digital experience, while AI and machine learning will transform property valuation and mortgage approvals. The integration of smart home technology promises enhanced energy efficiency and security, making IoT devices a standard feature in homes.Climate Change and Sustainable Housing

As climate change concerns intensify, there will be a greater emphasis on sustainability and resilience. Homes with high energy efficiency ratings and resilient construction will see increased demand, especially in areas prone to natural disasters. Urban planning will prioritize mixed-use developments and transit-oriented communities to reduce carbon footprints.Evolving Work Patterns

The shift towards remote work, accelerated by the COVID-19 pandemic, is likely to have lasting effects on the housing market. Homes may increasingly feature dedicated office spaces, while suburban and rural areas could see a revival as workers seek larger homes away from urban centers.Economic Factors and Housing Affordability

Housing affordability remains a critical issue. The trajectory of interest rates and income inequality will significantly impact the market. Government policies and alternative financing models, such as rent-to-own schemes, may offer solutions to affordability concerns.The Rise of Build-to-Rent and Institutional Investors

The rental market is set to evolve, with build-to-rent communities and institutional investors playing pivotal roles. The future of platforms like Airbnb also hangs in the balance, with potential for increased regulation.Urban Development and Regional Shifts

Cities will undergo significant changes, focusing on densification and adaptive reuse of commercial spaces. The concept of 15-minute cities, which emphasizes walkability and access to essential services, is likely to gain traction.As we look ahead, the housing market in 2034 presents both challenges and opportunities. From leveraging technology for sustainable housing solutions to developing innovative financing models, the coming decade promises significant change and opportunity in American real estate.

Final Thoughts The housing landscape of 2034 will be more diverse, technologically advanced, and responsive to the needs of an evolving population. As we navigate these changes, adaptability and forward-thinking will be essential for homeowners, investors, and industry professionals alike.

ALSO READ:

- Real Estate Forecast Next 5 Years: Top 5 Predictions for Future

- Housing Market Predictions for the Next 2 Years

- Housing Market Forecast for Next 5 Years (2024-2028)

- Real Estate Forecast Next 10 Years: Will Prices Skyrocket?

- Housing Market Predictions for 2027: Experts Differ on Forecast

- Will the Housing Market Crash in 2025?

- Goldman Sachs’ 5-Year Housing Market Forecast 2024 to 2027

- Housing Market 2026 Predictions by Top Economists

The Future of AI in Pathology: A Market on the Rise

The Future of AI in Pathology: A Market on the Rise

As the dawn of 2025 unfolds, the AI in pathology market is poised for significant growth, with projections estimating a surge from USD 82.8 million in 2024 to USD 169.8 million by 2029. This remarkable growth, at a compound annual rate of 15.4%, underscores the transformative potential of AI technologies in the healthcare sector.

AI in pathology is revolutionizing the field by enhancing the analysis of clinical data, genomic information, and disease progression. These advancements are not only streamlining personalized treatment plans but also optimizing healthcare resource allocation. AI models, employing advanced algorithms and machine learning, are empowering pathologists to extract and analyze critical information with unprecedented precision.

Key Market Segments and Growth Drivers

The drug discovery segment emerged as a dominant force in 2023, driven by the urgent need for efficient and cost-effective drug development. AI’s ability to accelerate the drug discovery process through automated data analytics and rapid identification of potential drugs is a game-changer. The advancements in imaging technologies and AI’s role in toxicology testing further bolster this segment’s growth.

Meanwhile, the pharmaceutical and biopharmaceutical companies sector is anticipated to experience the fastest growth. These companies are increasingly collaborating with AI providers, investing heavily in AI tools to maintain a competitive edge in drug development and innovation. AI’s capacity to analyze large datasets, identify patterns, and predict treatment responses is pivotal in reducing time and costs, thereby expediting innovation.

Regional Insights and Market Leaders

In 2023, North America claimed the largest market share, propelled by its high adoption of AI technologies and substantial investments in research and development. The region’s advanced healthcare infrastructure and extensive patient data pool further contribute to its leadership position. Companies like Koninklijke Philips N.V. have made significant investments in R&D, underscoring the region’s commitment to technological advancement.

The market’s competitive landscape features key players such as Koninklijke Philips N.V., F. Hoffmann-La Roche Ltd, and Hologic, Inc., among others. These companies are at the forefront of innovation, continuously evolving their product offerings and strategies to stay ahead in this rapidly advancing field.

Challenges and Opportunities

While the AI in pathology market is burgeoning, it faces challenges such as the high cost of digital pathology systems and the scarcity of AI expertise. However, opportunities abound in the growing demand for personalized medicine and the integration of multi-omics data for predictive analytics.

As the world embraces the potential of AI in healthcare, the pathology market stands as a testament to the transformative power of technology. For more detailed insights, the full report is available at Research and Markets.

Revolutionizing Precision Medicine: AI’s Role in Diabetes and Chronic Disease Management

Revolutionizing Precision Medicine: AI’s Role in Diabetes and Chronic Disease Management

In an era where data reigns supreme, the integration of artificial intelligence (AI) and machine learning (ML) into the realm of precision medicine is not just a possibility but a burgeoning reality. This transformative journey was the focal point of a recent workshop organized by the National Institutes of Health (NIH), which sought to bridge the gap between biomedical researchers and AI/ML experts. The gathering aimed to explore the immense potential AI holds in revolutionizing the treatment and management of diabetes and other chronic diseases.

Precision Medicine’s Evolving Landscape

The workshop underscored the significant strides AI/ML has made in biomedicine. From enhancing biomarker development to improving diagnostics, AI is paving the way for more personalized and effective healthcare solutions. Recent advancements in generative AI and Large Language Models (LLMs) promise to further revolutionize this field, offering new avenues for research and application.

Key Discussions and Objectives

The event was a melting pot of ideas, with discussions centered on the unique opportunities AI presents in precision medicine. Participants delved into the current status of AI-based precision medicine for diabetes, identifying community needs and gaps. The workshop also highlighted how NIH and the National Institute of Diabetes and Digestive and Kidney Diseases (NIDDK) data science programs can address these gaps.

Distinguished Participants and Organizers

The organizing committee comprised notable figures from academia and the NIH, including Marcela Brissova from Vanderbilt University and Jeffrey Grethe from the University of California, San Diego. Their expertise and insights were instrumental in steering the workshop’s discussions.

Pre-Workshop Speaker Series

To set the stage for the main event, a pre-workshop speaker series was held. The first session, The Bio-Behavioral Dimensions of Diabetes Heterogeneity, featured Dr. Yao Qin and Dr. Ashu Sabharwal, who shared their insights on data-driven machine learning and bio-behavioral pathways in diabetes.

The second session, Advances in AI and Applications in Biomedicine, showcased Dr. James Zou and Dr. Eran Halperin, who explored AI agents in biomedicine and the challenges and opportunities across data modalities in medicine.

Event Logistics and Participation

Hosted at the Neuroscience Center Building in Rockville, MD, the workshop offered both in-person and virtual participation options. This hybrid approach ensured a broad spectrum of engagement from the scientific community.

For those interested in revisiting the event, recordings of the sessions are available: Day 1 Webinar and Day 2 Webinar.

Conclusion

As AI continues to evolve, its integration into precision medicine promises to unlock new potential in the treatment of chronic diseases. The NIH workshop was a testament to the collaborative efforts needed to harness this potential, paving the way for a future where healthcare is more personalized, predictive, and precise.

Today’s Mortgage Rates Remain High: Insights from January 5, 2025

Today’s Mortgage Rates Remain High: Insights from January 5, 2025

In the ever-fluctuating world of real estate, understanding mortgage rates is crucial for prospective homeowners. As of January 5, 2025, the average rate for a 30-year fixed mortgage stands at a significant 6.70%. This figure, while daunting, is expected to see a slight decrease to around 6.20% by the end of the year, potentially saving homeowners approximately $66 monthly.

Understanding the Impact

Mortgage rates significantly influence the monthly payments and overall affordability of a home. For instance, a $200,000 loan at today’s rate of 6.70% results in a monthly payment of $1,291. Should this rate drop to 6.20%, the payment would decrease to $1,225, highlighting the importance of even minor rate changes. You can explore more about today’s mortgage rates in the original article by Norada Real Estate Investments.

The Federal Reserve’s Role

The Federal Reserve plays a pivotal role in determining these rates. By adjusting the federal funds rate, it directly impacts how much banks charge for loans, including mortgages. When the Fed increases rates, borrowing becomes more expensive, whereas a decrease can stimulate the economy by encouraging home buying.

Market Outlook and Predictions

The housing market is also influenced by inventory levels. An increase in available homes could potentially ease the buying process despite high rates. Norada Real Estate Investments suggests that the expected dip in rates could create more favorable conditions for buyers. For further insights, consider reading their article on NAR’s prediction about how 6% mortgage rates might boost the housing market.

Exploring Different Mortgage Types

It is essential to understand the variety of mortgage options available, as each type caters to different financial needs. From the traditional 30-year fixed mortgage to adjustable-rate mortgages (ARMs), each option offers unique benefits and challenges. For those considering refinancing, current rates are similar to purchase rates, making it a viable option for reducing monthly payments.

Long-term Financial Implications

Securing a lower interest rate can have profound long-term financial benefits. For a $300,000 mortgage, a rate reduction from 6.70% to 6.20% can save tens of thousands in interest over 30 years. This underscores the importance of staying informed about market trends and economic indicators that might affect mortgage rates.

Conclusion

As 2025 unfolds, staying abreast of mortgage rate trends and market dynamics is vital for both current homeowners and those looking to purchase. By understanding these factors, individuals can make informed decisions that align with their financial goals. For more detailed forecasts and expert predictions, you can explore the expert forecast on mortgage rates for 2025.

Innoviz Technologies and NVIDIA Drive Forward in Autonomous Driving

Innoviz Technologies and NVIDIA Drive Forward in Autonomous Driving

Innoviz Technologies, a prominent Tier-1 supplier known for its high-performance, automotive-grade LiDAR sensors and perception software, has announced groundbreaking advancements set to be unveiled at CES 2025. This development marks a significant collaboration with NVIDIA, integrating Innoviz’s perception software with the NVIDIA DRIVE AGX Orin platform. This partnership underscores a major leap in AI-enhanced perception systems tailored for the rapidly evolving autonomous driving industry.

The technologically advanced software interface with NVIDIA delivers real-time processing, a critical component for autonomous vehicle operations. Innoviz’s solutions are at the forefront of object detection, classification, and tracking, significantly enhancing safety measures and performance in both autonomous and advanced driver-assistance systems (ADAS).

Visitors to CES 2025 will have the opportunity to witness a live demonstration from Innoviz, showcasing the seamless integration of their software and hardware with NVIDIA’s platform. According to Omer Keilaf, CEO of Innoviz Technologies, this endeavor highlights their commitment to advancing autonomous driving technology. “At Innoviz, our focus remains on breaking new ground in autonomous driving to ensure safer, more reliable systems for the mobility of tomorrow. Leveraging the power of the NVIDIA DRIVE Orin platform allows us to offer a sophisticated blend of cutting-edge LiDAR sensors and perception software, enabling automakers to progress from L2+ ADAS to fully autonomous vehicles,” Keilaf stated.

This collaborative development represents a pivotal advancement in the field of autonomous transportation, positioning Innoviz Technologies as a crucial player in the industry’s shift toward comprehensive and dependable autonomous systems. For more details, refer to the original article on The Fast Mode.

“`AI Shaping the Future of Healthcare: What 2025 Holds

AI Shaping the Future of Healthcare: What 2025 Holds

As we stand on the precipice of 2025, the landscape of artificial intelligence (AI) in healthcare is poised for transformative change. The past year has been a whirlwind of innovation, setting the stage for what many experts predict will be a breakthrough year for AI. This evolution is not just a whisper of potential but a resounding call to action for the healthcare industry.Mount Sinai and Washington University Lead the Charge In 2024, the Mount Sinai Health System made headlines with the inauguration of the Hamilton and Amabel James Center for Artificial Intelligence and Human Health. This center, nestled in the heart of Manhattan, is a testament to AI’s burgeoning role in genomics and imaging. Similarly, the Washington University School of Medicine and BJC Health System in St. Louis launched their Center for Health AI, focusing on enhancing healthcare efficiency through AI-driven workflow improvements.

Predictive Analytics Market on the Rise The healthcare predictive analytics market is expected to skyrocket, with projections suggesting it will reach a staggering $126.15 billion by 2032. This growth is primarily driven by the increasing demand for AI-powered patient outcomes, as noted in a report by SNS Insider.

Radiology and AI: A Symbiotic Relationship At the RSNA Conference, experts discussed the transformative potential of generative AI and large language models (LLMs) in radiology. Dr. Tessa S. Cook from the University of Pennsylvania highlighted how AI could streamline radiologists’ workflows, from categorizing incidental findings to automating study processing. This sentiment was echoed by Dr. Dania Daye of Harvard Medical School, who emphasized AI’s ability to enhance the entire diagnostic imaging process.

AI’s Role in Clinical Settings AI is set to revolutionize clinical settings by enhancing decision-making processes and streamlining documentation. This is particularly crucial in areas like sepsis prediction and diagnostic imaging. Studies published in leading medical journals, such as a recent article in JAMA Network Open, have already begun to explore these applications.

Looking Ahead to 2025 As we look to 2025, the horizon is bright with possibilities. AI innovations are expected to expedite clinical workflows, enrich electronic health record systems, and significantly uplift patient care and diagnostic accuracy. The healthcare industry stands at the cusp of a new era, where AI continues to be a catalyst for transformation.

Conclusion The advancements of 2024 have laid a robust foundation for AI in healthcare. As we peer into 2025, the promise of AI is not just a possibility but an impending reality. The coming year is set to be a defining moment, with AI poised to make healthcare more efficient, accurate, and accessible for all.

U.S. Real Estate Market Outlook for 2025: Trends, Challenges, and Predictions

1. Economic Landscape in 2025

The broader economic context will be a pivotal influence on the real estate market. As the U.S. economy steps into 2025, the ramifications of economic policies, inflation, and labor market dynamics will become increasingly visible. Key economic indicators to watch include:

- Interest Rates and Inflation: The Federal Reserve’s monetary strategies will significantly impact real estate prices. As the Fed tweaks interest rates to tackle inflation, shifts in the housing market are anticipated. A prolonged period of high interest rates could dampen housing market demand.

- Inflation’s Impact on Building Costs: Inflation continues to affect construction expenses, making real estate development costlier due to supply chain challenges, material costs, and labor shortages.

- GDP Growth and Consumer Confidence: Economic growth, as indicated by GDP, will directly impact consumer confidence and purchasing abilities. Stable growth may encourage investments in housing or commercial properties, while uncertainty could delay decisions.

2. Residential Real Estate: A Varied Outlook

The U.S. residential real estate market is expected to face challenges as well as opportunities. Important factors shaping housing prices, sales, and demand include:

- Housing Supply Constraints: Persistent shortages in housing, particularly affordable homes, continue to drive prices upwards, especially in metropolitan and suburban areas.

- Generation Z and Millennial Buyers: The preferences of these tech-savvy demographics, such as sustainability and smart home features, will crucially influence market trends.

- The Affordability Challenge: The persistent affordability crisis, exacerbated by rising mortgage rates, may push first-time buyers out, elevating demand for rental properties, especially multifamily units and suburban homes.

3. Commercial Real Estate: A Sector in Transition

Commercial real estate is at a pivotal junction, adapting to changing work models and consumer behaviors:

- Office Space Evolution: The rise of remote work is altering demand for office spaces. Traditional office settings might decline in urban centers, whereas flexible workspaces could gain traction.

- Retail Adjustments: Despite e-commerce continuing to surge, experiential retail spaces such as entertainment venues might thrive.

- Industrial and Logistics Properties: The booms of e-commerce necessitate more industrial spaces like warehouses for efficient supply chains.

- Healthcare and Data Centers: With an aging population, demand for healthcare infrastructure grows, while data centers support the burgeoning digital economy.

4. Technological Transformation and Real Estate Innovation

Technology is reshaping real estate operations, driving innovations like:

- Smart Homes and Automation: Integrated tech will appeal to younger, tech-savvy buyers. Energy-efficient systems are essential for commercial spaces.

- AI and Big Data in Real Estate Investment: AI and big data are set to revolutionize investment strategies through improved analytics and forecasting.

- Virtual Reality and Augmented Reality: VR and AR tools will revolutionize property viewings, offering buyers virtual explorations from afar.

5. Regional Variations: Shifting Migration Patterns

Regional real estate trends remain influenced by migration patterns:

- Suburban and Secondary Markets Growth: The search for larger, affordable homes is boosting interest in suburban locales.

- Urban Revitalization and Gentrification: Certain cities could undergo urban renewal, driven by tech growth and young professionals.

The U.S. real estate market heading into 2025 is a dynamic landscape marked by challenges and the need for adaptive strategies, ushering in both hurdles and prospects. For more insights, visit the original article from The Africa Logistics.

Transforming Finance: Navigating Top Challenges for CFOs by 2025

Gartner Finance, through a survey of 250 CFOs and finance leaders during “The Top Priorities for CFOs in 2025” webinar, uncovered that slower top-line growth and talent retention are perceived as the most pressing challenges for enterprise performance by 2025. The evolving financial landscape necessitates CFOs to proficiently communicate data-driven insights and adopt new technologies.

According to Alexander Bant, Chief of Research at Gartner Finance practice, CFOs are endeavoring to streamline their finance functions to finance two emerging skill sets needed for the future. The ongoing digital integration across various sectors has led to a shortage of specialized talent in data analytics, technology, and finance, thereby exacerbating retention issues for CFOs.

The pandemic-driven transition to remote and hybrid work models has intensified the competition for top talent. To combat these challenges, CFOs are urged to devise strategies to improve employee development, work-life balance, engagement, and compensation.

Key Survey Insights on Enterprise Performance Challenges in 2025

- Slower top-line growth: 19%

- Talent retention: 18%

- Strategic alignment and execution gaps: 17%

- Rising costs: 15%

- Data quality: 14%

- AI strategy and implementation: 9%

- Political and regulatory shifts: 8%

To safeguard top-line growth, CFOs are advised to embrace five core practices outlined by Gartner:

- Cycle discipline ensures resilience during market fluctuations.

- Eradicating growth anchors that inadvertently divert resources.

- Cultivating an environment that fosters overperformance.

- Balancing cost-cutting measures without stifling growth.

- Simplifying product offerings to enhance efficiency.

Emphasizing revenue innovation and workforce development is crucial for CFOs to navigate future challenges. Organizations are encouraged to pursue digital transformation, data-driven decision-making, and foster a culture of innovation to remain adaptive and competitive.

As highlighted by Arjun Mahajan, Chief of Client Partnerships at AND Digital, attracting talent skilled in data analysis enables finance teams to streamline functions and generate actionable insights. Financial institutions must adopt a people-centric innovation approach, focusing on equipping staff with essential digital skills to withstand market pressures and enhance overall productivity.

Explore the latest edition of FinTech Magazine and join the conversation at our global conference series, FinTech LIVE. Secure your tickets and participate in upcoming events to stay ahead in the rapidly evolving financial sector.

AI’s Expanding Role: Balancing Innovation and Responsibility

AI’s Expanding Role: Balancing Innovation and Responsibility

The rapid advancement of artificial intelligence (AI) technologies is reshaping the world around us, often without us even realizing it. Whether it’s in healthcare, finance, or governance, AI’s influence is pervasive. Yet, as we embrace these innovations, we must also grapple with the ethical concerns they bring, such as fairness, bias, security, and resilience.

According to a recent article by the National Institute of Standards and Technology (NIST), these concerns are not merely academic. As AI systems become integral to processes like consumer credit underwriting, the need for trustworthy and responsible AI becomes paramount.

Understanding Bias in AI

A comprehensive report on AI bias by NIST highlights that fairness and bias are complex issues that can’t be reduced to simple statistics. The report underscores the importance of context in understanding these biases, especially in sectors like finance where decisions can have significant impacts on lives.For instance, AI’s role in determining creditworthiness raises questions about fairness. Historical data used to train AI systems often reflects societal biases, potentially perpetuating inequalities. To address this, NIST is leading efforts to develop guidance and testing infrastructure aimed at mitigating AI bias in specific contexts, starting with consumer credit underwriting.

Collaborative Efforts to Mitigate Bias

NIST’s work involves collaboration with industry partners, from small startups to large banks, to gather insights and develop tools that detect and manage bias. Workshops, such as the Mitigating AI Bias in Context workshop, have been instrumental in framing research questions and gathering feedback from diverse stakeholders.The goal is to ensure that AI systems operate fairly and responsibly, balancing innovation with risk management. By working with companies committed to solving these challenges, NIST aims to align business interests with societal needs.

Looking Ahead

As AI continues to shape our lives, the importance of eliminating bias becomes increasingly critical. NIST’s ongoing studies aim to map findings from specific sectors to broader principles established in their earlier reports, ensuring consistency and harmony.In conclusion, while AI offers immense potential, it also demands careful consideration of its societal impacts. By addressing these concerns proactively, we can harness AI’s power responsibly, ensuring it serves the needs of all people equitably.

The AI Revolution: Transforming Industries and Paving New Paths

The AI Revolution: Transforming Industries and Paving New Paths

Artificial Intelligence (AI) is not just a buzzword; it is a transformative force reshaping industries and influencing our daily lives in ways we could not have imagined a decade ago. According to a recent article on Simplilearn.com, AI is rapidly becoming an indispensable technology, automating mundane tasks and predicting user actions with unprecedented accuracy.AI’s Impact Across Sectors

The impact of AI on society and industry is profound. From healthcare to finance, manufacturing to transportation, AI is revolutionizing how these sectors operate. In healthcare, AI-powered diagnostics and personalized medicine are enhancing patient care and outcomes. Meanwhile, in finance, AI is making strides in fraud detection and risk assessment, revolutionizing customer service.Manufacturing is benefiting from predictive maintenance and optimized production processes, while transportation is witnessing improved safety and efficiency through autonomous vehicles and intelligent traffic management systems. AI is also transforming education, creating personalized learning experiences that make education more accessible and tailored to individual needs.

Beyond specific industries, AI is reshaping the job market, creating new opportunities while raising ethical and social concerns. Issues such as privacy, bias, and job displacement highlight the need for careful management and regulation. The potential of AI to drive future economic growth and societal progress is immense, marking a pivotal chapter in human history.

AI Projects: From Novice to Expert

The article details a wide array of AI projects suitable for different skill levels, from beginner to advanced. Beginners can explore projects like a Spam Email Detector or a Sentiment Analysis of Product Reviews, which provide a foundation in AI and machine learning concepts. For those with more experience, projects like an Autonomous Driving System or AI-Based Medical Diagnosis System offer a deeper dive into the complexities of AI.These projects not only build skills but also prepare individuals for the growing demands of the AI market. The global AI market is projected to expand at a compound annual growth rate (CAGR) of 37.3%, reaching $1,811.8 billion by 2030, according to Forbes.

Navigating the Ethical Landscape

As AI continues to evolve, ethical considerations become increasingly important. Ensuring fairness, maintaining data privacy, and preventing bias in AI algorithms are crucial. Moreover, transparency and explainability of AI decisions must be prioritized to safeguard against misuse in surveillance and autonomous weapons.AI has the potential to address global challenges, from optimizing resources in agriculture to enhancing healthcare through early diagnosis and personalized medicine. It can also improve disaster response with predictive models and foster sustainable cities through smart infrastructure management.

Building a Career in AI

For those looking to launch a career in AI, a blend of educational background, skill development, and practical experience is essential. Simplilearn’s article suggests starting with a foundation in mathematics and computer science, followed by learning AI and machine learning fundamentals. Engaging in practical projects, pursuing specializations, and gaining professional experience are key steps in building a successful AI career.The article also highlights the importance of staying updated with the latest tools and technologies, continually learning through advanced courses and certifications. Building a strong portfolio and preparing for the job market are crucial for aspiring AI professionals.

Conclusion

Delving into AI projects offers a thrilling journey filled with opportunities for creativity and development. For those aiming to deepen their understanding of AI and machine learning, Simplilearn’s Post Graduate Program in AI and Machine Learning is a premier choice, providing a comprehensive curriculum and practical learning experiences.

Japanese Startups Revolutionizing Cancer Treatment with AI and Ultrasound

Japanese Startups Revolutionizing Cancer Treatment with AI and Ultrasound

In a world where the World Health Organization has projected a staggering increase in cancer cases by 2050, Japan is at the forefront of pioneering solutions to combat this looming crisis. With an anticipated rise to 35 million new cancer cases globally, innovative Japanese startups are leveraging cutting-edge technologies to revolutionize cancer diagnosis and treatment.

AI Medical Service: Enhancing Cancer Detection

AI Medical Service, a Tokyo-based startup, is spearheading the use of artificial intelligence in medical diagnostics. Their gastroAI model-G is designed to assist doctors by analyzing gastroscopy images in real-time, identifying potential lesions that might be missed during initial examinations. According to recent studies, nearly 800,000 individuals in the U.S. face severe consequences due to late cancer detection. AI Medical Service aims to mitigate such risks by offering a second pair of eyes that never tires, as highlighted by CEO Tada Tomohiro. The company’s innovations have not gone unnoticed. AI Medical Service was featured in Forbes Asia’s 100 to Watch list, a testament to their potential in transforming healthcare.

The company’s innovations have not gone unnoticed. AI Medical Service was featured in Forbes Asia’s 100 to Watch list, a testament to their potential in transforming healthcare.

SONIRE Therapeutics: A New Hope for Pancreatic Cancer

On the other side of Tokyo, SONIRE Therapeutics is making strides with its high-intensity focused ultrasound (HIFU) technology. This non-invasive technique targets pancreatic cancer cells with precision, offering a promising alternative to traditional radiotherapy. The use of HIFU is particularly groundbreaking for pancreatic cancer, which is often diagnosed too late for surgical intervention. SONIRE’s approach, which utilizes cavitation to enhance treatment accuracy, has been recognized by the U.S. FDA as a breakthrough device. The company is currently conducting a world-first randomized trial to further validate the efficacy of their technology. As CEO Satoh Tohru notes, the goal is to offer a more effective and safer cancer treatment to patients worldwide.

SONIRE’s approach, which utilizes cavitation to enhance treatment accuracy, has been recognized by the U.S. FDA as a breakthrough device. The company is currently conducting a world-first randomized trial to further validate the efficacy of their technology. As CEO Satoh Tohru notes, the goal is to offer a more effective and safer cancer treatment to patients worldwide.

These Japanese startups are not only advancing medical technology but also providing hope for millions of cancer patients globally. As the world braces for a surge in cancer cases, innovations from companies like AI Medical Service and SONIRE Therapeutics could be pivotal in changing the landscape of cancer treatment.

Read the full article on Forbes.

These Japanese startups are not only advancing medical technology but also providing hope for millions of cancer patients globally. As the world braces for a surge in cancer cases, innovations from companies like AI Medical Service and SONIRE Therapeutics could be pivotal in changing the landscape of cancer treatment.

Read the full article on Forbes.

Exploring the Horizons of Artificial Intelligence Projects in 2025

Exploring the Horizons of Artificial Intelligence Projects in 2025

Artificial Intelligence (AI) is redefining the contours of our world, reshaping industries and daily life in ways previously unimaginable. As we delve into the intricacies of AI, it becomes evident that this technology is not just a tool but a transformative force. The original article from Simplilearn offers a comprehensive guide to AI project ideas, ranging from beginner to advanced levels, highlighting the practical applications and opportunities these projects present. Impact of AI Across IndustriesAI’s influence spans various sectors, from healthcare and finance to manufacturing and education. In healthcare, AI-powered diagnostics and personalized medicine are revolutionizing patient care. Meanwhile, the finance sector benefits from AI’s capabilities in fraud detection and risk assessment. Manufacturing sees enhancements through predictive maintenance and optimized production processes, while education becomes more personalized, thanks to AI-driven learning experiences. However, as AI becomes ubiquitous, ethical and social concerns arise. Issues such as privacy, bias, and job displacement necessitate careful management and regulation to maximize benefits while mitigating risks. The potential of AI to drive future economic growth and address complex global challenges marks a pivotal chapter in human history. AI Project Ideas for Skill Development

The article from Simplilearn outlines 30 AI projects, categorized by complexity, to help enthusiasts build a strong AI and machine learning foundation. These projects range from a Spam Email Detector, which uses algorithms like Naive Bayes, to more advanced endeavors like an Autonomous Driving System. For beginners, projects like Handwritten Digit Recognition using the MNIST dataset offer a glimpse into computer vision. Intermediate projects, such as Sentiment Analysis of Social Media Posts, leverage natural language processing to gauge public sentiment. Advanced projects like AI-Based Medical Diagnosis Systems require a nuanced understanding of AI and medical science, showcasing the potential of AI in enhancing diagnostic accuracy and speed. AI’s Economic Impact

The global AI market is projected to expand at a compound annual growth rate (CAGR) of 37.3%, reaching a staggering $1,811.8 billion by 2030. This growth underscores the importance of acquiring AI skills to remain competitive in this transformative industry. Launching a Career in AI

Embarking on a career in AI involves a blend of educational background, skill development, and practical experience. The article provides a step-by-step guide, emphasizing the importance of a strong foundation in mathematics and computer science, engaging in practical projects, and pursuing specializations. Platforms like SkillUp offer free resources for those eager to upskill in AI. As AI continues to evolve, staying updated with the latest tools and technologies is crucial. Simplilearn’s Post Graduate Program in AI and Machine Learning offers an extensive curriculum and real-world projects, equipping learners with the critical skills needed to thrive in the AI landscape. Conclusion

Delving into AI projects presents a thrilling journey filled with limitless opportunities for creativity and development. The article from Simplilearn serves as a valuable resource for anyone looking to deepen their understanding of AI and machine learning, offering a roadmap to mastering the intricacies of this transformative technology.

Unveiling the Intricacies of Fraud Detection

Unveiling the Intricacies of Fraud Detection

Fraud detection, a critical process in safeguarding financial and data resources, involves identifying suspicious activities that could signify criminal theft. As highlighted in a recent IBM article, such activities can significantly impact both individuals and businesses. The Association of Certified Fraud Examiners (ACFE) estimates that U.S. businesses lose an average of 5% of their gross annual revenues to fraud, underscoring the urgency of effective fraud detection strategies.The Importance of Fraud Detection

Fraud detection is paramount not only for minimizing financial losses but also for maintaining customer trust and adhering to regulatory mandates. Without robust fraud detection measures, businesses risk reputational damage and operational disruptions. Notably, during the COVID-19 pandemic, the Bank of America faced a hefty fine of USD 225 million due to a faulty fraud detection system.Techniques in Fraud Detection

Organizations employ various techniques to combat fraud, including transaction monitoring, artificial intelligence, and statistical data analysis. Transaction monitoring tools analyze transaction data in real-time, using anomaly detection to flag unusual activities. Meanwhile, AI and machine learning models can predict fraudulent behavior more efficiently, adapting to evolving fraud trends.Common Types of Fraud

Fraud manifests in numerous forms, from credit card fraud to money laundering. Credit card fraud involves unauthorized use of card information, leading to chargebacks and financial losses for merchants. Money laundering, on the other hand, involves concealing illegally obtained funds to make them appear legitimate.Challenges in Fraud Detection

The landscape of fraud detection is fraught with challenges. Generative AI, for instance, enables fraudsters to create convincing fake content, complicating detection efforts. Additionally, systems that produce excessive false positives can deter legitimate customers and slow down operations. Staying ahead of sophisticated fraud tactics, such as those used by the China-based fraud ring BogusBazaar, requires continuous adaptation and vigilance.Data Privacy and Fraud Detection

Balancing fraud detection with data privacy regulations presents another hurdle. While organizations need access to personally identifying information (PII) for effective fraud detection, privacy laws can restrict data access, potentially hindering detection efforts.The original IBM article provides a comprehensive overview of these issues, emphasizing the need for innovative strategies to counteract fraud in an ever-evolving digital landscape.

U.S. Real Estate Market Outlook for 2025: Trends, Challenges, and Predictions

As we edge closer to 2025, the U.S. real estate market stands at a pivotal juncture. A confluence of economic shifts, demographic changes, and technological advancements is set to redefine the landscape, impacting both housing and commercial real estate sectors profoundly. This transformation, detailed in a recent analysis by The Africa Logistics, highlights the challenges and opportunities that lie ahead.

As we edge closer to 2025, the U.S. real estate market stands at a pivotal juncture. A confluence of economic shifts, demographic changes, and technological advancements is set to redefine the landscape, impacting both housing and commercial real estate sectors profoundly. This transformation, detailed in a recent analysis by The Africa Logistics, highlights the challenges and opportunities that lie ahead.

The Economic Landscape

The broader economic context will be a significant determinant of real estate market dynamics. As we approach 2025, key economic indicators such as interest rates and inflation are poised to influence market activity. The Federal Reserve’s monetary policies will play a crucial role; their adjustments to interest rates could either cool or spur real estate activity. Elevated interest rates may dampen housing demand, while ongoing inflation continues to pressure construction costs, potentially leading to higher prices or reduced new projects.Residential Real Estate: A Mixed Outlook

The residential sector faces a dual reality of challenges and opportunities. A persistent shortage of housing inventory, particularly affordable homes, continues to drive up prices. This scarcity is exacerbated by supply constraints and rising mortgage rates, which may push first-time buyers out of the market. However, the entry of Generation Z and Millennials into the housing market will shape demand patterns, with a preference for tech-savvy, sustainable living spaces.Commercial Real Estate: A Sector in Transition

Commercial real estate is at a crossroads, adapting to post-pandemic realities and evolving consumer behaviors. The office space landscape is shifting with the rise of remote work, leading to a potential decline in demand for large urban office spaces. Meanwhile, the retail sector must navigate the ongoing e-commerce boom, focusing on experiential offerings. Industrial properties, driven by e-commerce and logistics needs, are expected to see continued growth.Technological Transformation

Technology is revolutionizing the real estate industry, from smart homes to AI-driven investment strategies. The integration of smart technology in buildings appeals to tech-savvy buyers, while AI and big data enhance investment decision-making. Virtual and augmented reality tools are also transforming property viewing experiences, making them more accessible and efficient.Regional Variations

Migration patterns, fueled by remote work policies, will continue to shape regional real estate trends. Suburban and secondary markets are witnessing growth as people seek affordable living spaces outside expensive metropolitan areas. Simultaneously, urban centers are experiencing revitalization, driven by mixed-use developments and urban renewal projects.As the U.S. real estate market navigates these changes, investors and developers must remain agile, leveraging technological tools and staying attuned to market trends. The landscape promises to be dynamic, driven by economic forces and innovative solutions to meet modern demands.

For further insights, explore related articles: “`

NVIDIA’s New Inspection Lab: A Leap Forward in Autonomous Vehicle Safety

NVIDIA’s New Inspection Lab: A Leap Forward in Autonomous Vehicle Safety

In a groundbreaking move to bolster safety standards in the autonomous vehicle industry, NVIDIA has unveiled its DRIVE AI Systems Inspection Lab. This state-of-the-art facility aims to assist automotive ecosystem partners in navigating the evolving landscape of autonomous vehicle safety standards. The lab is dedicated to inspecting and verifying that partner software and systems on the NVIDIA DRIVE AGX platform meet rigorous safety and cybersecurity standards.

NVIDIA’s lab has earned accreditation from the ANSI National Accreditation Board (ANAB) following the ISO/IEC 17020 assessment. This accreditation covers vital standards such as:

- Functional safety (ISO 26262)

- SOTIF (ISO 21448)

- Cybersecurity (ISO 21434)

- UN-R regulations, including UN-R 79, UN-R 13-H, UN-R 152, UN-R 155, UN-R 157, and UN-R 171

- AI functional safety (ISO PAS 8800 and ISO/IEC TR 5469)

“The launch of this new lab will help partners in the global automotive ecosystem create safe, reliable autonomous driving technology,” stated Ali Kani, vice president of automotive at NVIDIA. He emphasized the lab’s role in ensuring adherence to the industry’s safety standards by combining functional safety, cybersecurity, and AI.

The lab’s inaugural participants include industry giants like Continental and Sony SSS-America. Nobert Hammerschmidt of Continental expressed excitement about intensifying collaboration with NVIDIA, while Marius Evensen of Sony SSS-America highlighted the lab’s potential to enhance road safety.

Riccardo Mariani, head of industry safety at NVIDIA, noted the challenges of ensuring compliance with functional safety, SOTIF, and cybersecurity for complex AI-based systems. Through this lab, NVIDIA aims to verify the integration of partner products with DRIVE safety and cybersecurity requirements.

Aligning with Global Safety Standards

The NVIDIA DRIVE AI Systems Inspection Lab complements the missions of independent third-party certification bodies, such as TÜV SÜD, TÜV Rheinland, and exida. It aligns with vehicle certification agencies like VCA and KBA, further cementing NVIDIA’s commitment to safety.Recent certifications highlight this commitment.

TÜV SÜD granted ISO 21434 Cybersecurity Process certification to NVIDIA, acknowledging their robust processes and compliance with ISO 26262 ASIL D standards.

TÜV SÜD granted ISO 21434 Cybersecurity Process certification to NVIDIA, acknowledging their robust processes and compliance with ISO 26262 ASIL D standards.

Additionally,

TÜV Rheinland conducted an independent safety assessment of NVIDIA DRIVE AV, recognizing NVIDIA’s high-quality, safety-oriented processes.

TÜV Rheinland conducted an independent safety assessment of NVIDIA DRIVE AV, recognizing NVIDIA’s high-quality, safety-oriented processes.

For further insights into NVIDIA’s advancements in autonomous driving safety, refer to the NVIDIA Self-Driving Safety Report.

Revolutionizing Clinical Care: The Age of Genome Sequencing

Revolutionizing Clinical Care: The Age of Genome Sequencing

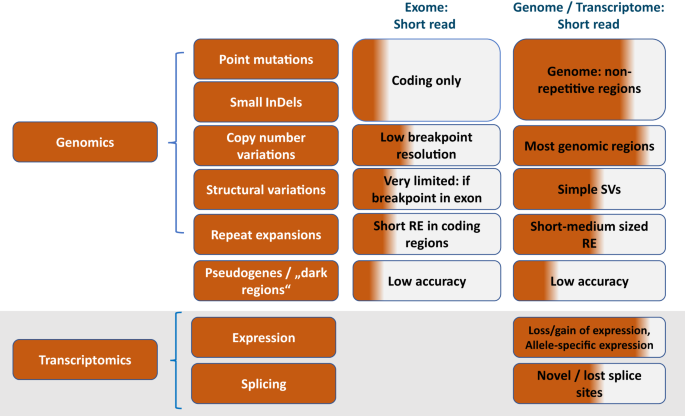

In a world where precision medicine is no longer a distant dream but a present reality, genome sequencing (GS) is taking center stage, reshaping how we approach the diagnosis and treatment of genetic conditions. The significance of genomics and multi-omics in the medical field has surged, driven by the increasing affordability and accessibility of GS technology. This shift is transforming the landscape of healthcare, particularly in the realms of rare diseases and cancer.

The original article from Nature delves into this transformative journey, highlighting the role of GS in providing precise molecular diagnoses. It not only addresses the technical and diagnostic superiority of GS over other sequencing methods but also emphasizes its broader implications for medical management and patient outcomes.

The Rise of Genome Sequencing in Clinical Care

The transition of GS into routine clinical practice marks a significant milestone. As sequencing and data analysis capacities advance, GS is becoming a first-line diagnostic tool in clinical settings. This evolution is not just about identifying the underlying causes of diseases but also about predicting genetic risks for conditions that have yet to manifest.Studies Paving the Path Forward

Studies like Genome First and Ge-Med are at the forefront of implementing genome-based medicine. These initiatives aim to integrate GS into clinical workflows, enhancing early disease detection and personalized treatment strategies. The impact of these efforts is profound, potentially altering medical management and improving patient outcomes.For those interested in exploring the original article further, you can find additional resources and supporting references here. The article provides a comprehensive look at how genome sequencing is poised to revolutionize clinical care, offering a glimpse into a future where precision medicine is the norm.

The Future of Health-Tech in 2025

The Future of Health-Tech in 2025

As the digital revolution continues to reshape industries, the health-tech sector stands on the brink of transformative growth. By 2025, driven by breakthroughs in AI, advanced data insights, and a shift toward predictive, personalized care, the industry is poised to redefine digital health. The global market is projected to surpass $200 billion, expanding at a compound annual growth rate (CAGR) of 25%.

Digitising Disconnected Journeys

One of the most significant transformations expected in 2025 is the digitization of disconnected care journeys. These often include specialist referrals, non-urgent follow-ups, or mental health pathways, which remain fragmented within broader healthcare ecosystems. Insurers are anticipated to play a pivotal role in bridging these gaps, aligning their efforts with mobile app strategies to create cohesive, accessible frameworks.For instance, a user might seamlessly transition from completing a virtual health assessment on their mobile app to scheduling an in-person consultation, with all relevant medical history shared automatically. This connectivity ensures a smoother, more integrated experience while reducing redundancies and delays in care delivery.

The Rise of Predictive and Personalised Care

Predictive and personalized healthcare will see significant advancements in 2025. Predictive insights will transform raw data into clear, actionable explanations, enabling healthcare providers and insurers to make informed decisions. This approach represents a shift from traditional, reactive healthcare models to preventive, user-focused strategies.By leveraging AI and actionable insights, health-tech solutions will deliver timely interventions throughout the patient’s journey, marking a move towards proactive health management.

AI’s Expanding Role in Healthcare

Artificial Intelligence will remain a cornerstone of health-tech innovations in 2025, with its applications expanding across diagnostics, treatment planning, and operational workflows. AI-powered imaging analysis will improve diagnostic accuracy, while automated systems for routine tasks, such as patient documentation, will alleviate staff shortages and burnout.AI-driven insights will also play a critical role in real-time patient monitoring. Predictive algorithms will translate complex health metrics into simple, actionable insights, enabling earlier interventions and improved outcomes.

Wearable Technology and Remote Monitoring

Wearables will continue to evolve, becoming indispensable tools for personalized care and chronic disease management. Innovations in sensors and smart devices will enable real-time data collection, offering healthcare providers continuous insights into patients’ health. These tools will drive growth in remote monitoring programs, particularly for managing chronic conditions such as diabetes, hypertension, and heart disease.A Focus on Mental Health

Mental health care will remain a priority in 2025, driven by ongoing societal stressors and demand for accessible solutions. AI-powered tools will provide personalized insights into emotional wellbeing, integrating mental health services into broader healthcare platforms for a holistic approach to health management.Overcoming Challenges in Health-Tech

While the future of health-tech looks promising, challenges such as data privacy concerns, the digital divide, and regulatory hurdles must be addressed for its full potential to be realized. Ensuring that data insights are accurate, actionable, and delivered in accessible formats will be critical to widespread adoption.For more insights, visit the full article on Irish Tech News.

Unveiling Flood Adaptation Disparities in the USA

Unveiling Flood Adaptation Disparities in the USA

In a groundbreaking analysis published in Nature on September 27, 2024, researchers have shone a light on the stark disparities in flood adaptation across the United States. Leveraging a dataset of approximately 2.5 million flood insurance claims from FEMA, the study exposes significant differences in how communities access and benefit from flood adaptation measures.

Flooding, as noted by Reuters, constitutes nearly a third of all losses from natural disasters worldwide. In the United States, it causes more damage than any other severe weather-related event, with annual losses averaging over $5 billion, according to the NOAA.

The Role of the Community Rating System

The study focuses on the National Flood Insurance Program’s Community Rating System (CRS), which aims to improve community flood adaptation and resilience. Communities participating in the CRS can implement various flood adaptation activities, such as floodplain mapping and stormwater management, in exchange for reduced flood insurance premiums.

However, the findings reveal that the benefits of the CRS are not evenly distributed. Discrepancies are evident among communities of varying income levels, racial compositions, and geographical characteristics. This calls for policies that address these inequities, ensuring that all communities can equally benefit from flood adaptation investments.

Key Findings and Implications

The study highlights that while flood adaptation measures generally reduce flood losses, the benefits are not uniformly felt. Affluent communities tend to experience more significant savings, while low-income and predominantly racial and ethnic minority communities often see less benefit. This inequity underscores the need for tailored interventions that consider socio-economic and demographic factors.

For instance, communities with high percentages of racial and ethnic minorities see their savings decrease with higher precipitation, indicating that current flood adaptation measures are less effective in these areas. Similarly, less populated communities may lack the resources or technical expertise to implement prescribed activities effectively.

Moving Towards Equitable Interventions

To address these disparities, future flood adaptation strategies must embed equity at their core. This involves re-examining flood adaptation prescriptions and incentives with a focus on race, income, and geographical characteristics to ensure a just and equitable distribution of benefits.

The study calls for interventions that reduce educational and technical barriers, providing necessary resources to communities that face financial and infrastructural challenges. By doing so, the goal is to break existing patterns of inequality and support all communities in mitigating flood losses effectively.

With climate change expected to increase the frequency and severity of flooding, the insights from this study are crucial for shaping policies that can protect vulnerable communities and ensure equitable resilience across the nation.

Ethereum’s Serenity Upgrade Sparks Excitement and Market Optimism

Ethereum’s Serenity Upgrade Sparks Excitement and Market Optimism

The Ethereum ecosystem is witnessing a significant transformation with the introduction of its much-awaited network upgrade, known as “Serenity.” This upgrade marks a pivotal moment, aiming to address long-standing challenges related to scalability, transaction speeds, and energy consumption within the blockchain community. Ethereum has shifted to a fully proof-of-stake consensus mechanism, drastically cutting down on the energy typically required for network maintenance.

A Major Breakthrough for Ethereum

The Serenity upgrade is considered a game-changer, primarily due to its cutting-edge security protocols and improved smart contract capabilities. This opens doors to more sophisticated applications in decentralized finance (DeFi), non-fungible tokens (NFTs), and beyond. The tech community and businesses are optimistic about the future, seeing this upgrade as a chance to develop complex projects that were previously impossible.

Widespread Crypto Adoption

As digital currencies mature, their application across diverse industries, including finance, retail, and gaming, has expanded. In the UK gaming sector, for example, new trends have emerged as strict UK Gambling Commission regulations push players toward non-GamStop casinos. Many of these platforms now accept cryptocurrencies like Ethereum, offering lower transaction fees and enhanced privacy. Such adoption is not just a fleeting trend but a reflection of the growing demand for digital payment solutions.

Market Response to Ethereum’s Upgrade

Ethereum’s market dynamics have shifted positively following the Serenity upgrade, with an observed price surge and renewed interest in DeFi platforms. The upgrade enhances the scalability and reduces operational costs of Ethereum, maintaining its position as a leader in the DeFi landscape. Competitors such as Solana and Cardano are challenged to keep pace with Ethereum’s advancements, which further drives innovation across the industry.

Future Prospects for Ethereum

As Ethereum continues to evolve, the broader blockchain market is poised for disruptive innovations particularly in fields like supply chain management and healthcare. These applications leverage blockchain’s capacity to provide secure, transparent, and tamper-proof records.

Conclusion

Ethereum’s Serenity upgrade is a landmark in the crypto world, setting the stage for future breakthroughs and increasing its influence beyond cryptocurrency into various sectors. The upgrade has not only boosted market optimism but also underlined Ethereum’s pivotal role in the advancement of blockchain technology that is set to transform industries worldwide.

Freddie Mac’s Mortgage Rates Reach New Heights

Freddie Mac’s Mortgage Rates Reach New Heights

In an ever-shifting economic landscape, mortgage rates have once again captured the spotlight. According to a recent report by Money, the average rate on a 30-year fixed-rate mortgage has climbed to 7.144%, while the 30-year refinance rate is averaging 7.211%. Meanwhile, Freddie Mac’s latest figures show their 30-year fixed-rate loan has increased to 6.91%, marking its highest level since July.

Rising Rates and Market Trends

For three consecutive weeks, mortgage rates have been on the rise, presenting significant affordability challenges for prospective homebuyers. Compared to the same period last year, the 30-year rate has increased by more than a quarter of a percentage point. Despite these hurdles, buyers are demonstrating resilience, as evidenced by a rise in pending home sales. Freddie Mac’s chief economist, Sam Khater, highlights this buyer activity as a sign that many are willing to step off the sidelines and enter the market.

Understanding the Numbers

Freddie Mac’s weekly analysis provides insights into the rates available to well-qualified buyers, who typically receive slightly more favorable terms than those reflected in Money’s daily survey. Borrowers with strong credit profiles are often positioned to secure better rates, underscoring the importance of financial health when seeking a mortgage.

Types of Mortgages: Fixed vs. Adjustable

Navigating the world of mortgages involves understanding the distinction between fixed-rate and adjustable-rate loans. Fixed-rate mortgages offer stability with consistent interest rates over the loan’s duration, while adjustable-rate mortgages (ARMs) start with a fixed rate for a set period before adjusting based on market conditions. The choice between these types depends on individual financial situations and future plans.

Factors Affecting Mortgage Rates

Several variables influence mortgage rates, including loan terms, insurance, taxes, closing costs, and broader economic conditions. These factors contribute to the variability in rates experienced by different borrowers, making it crucial to shop around and compare offers. For those looking to secure the best rates, larger down payments and excellent credit scores are advantageous.

Mortgage Affordability and Tools

The impact of mortgage rates on affordability is significant, affecting both the monthly payments and the overall cost of homeownership. Utilizing tools like mortgage calculators can help potential buyers explore different scenarios and better understand their financial commitments.

Securing the Best Rates

To maximize savings, borrowers are encouraged to obtain quotes from multiple lenders. According to Freddie Mac, doing so can lead to substantial savings over the life of a loan. Additionally, considering options like discount points can further reduce interest rates, offering long-term financial benefits.

For more information on securing the best mortgage rates and understanding the intricacies of the current market, visit Money’s guide to the best mortgage lenders and refinance companies.

AI Outperforms Human Experts in Ovarian Cancer Detection

AI Outperforms Human Experts in Ovarian Cancer Detection

In a groundbreaking study led by researchers at the Karolinska Institutet in Sweden, artificial intelligence (AI) has demonstrated a remarkable ability to detect ovarian cancer, surpassing the accuracy of human doctors. This revelation, published in Nature Medicine, marks a significant advancement in the use of AI as a diagnostic tool.

The study involved training AI models on an extensive dataset of over 17,000 ultrasound images from 3,652 patients across 20 hospitals in eight countries. The AI achieved an accuracy rate of 86% in distinguishing between benign and malignant ovarian lesions. In comparison, human experts scored an accuracy of 82%, while less experienced examiners achieved 77%.

Study author Elisabeth Epstein, a professor at the Department of Clinical Science and Education at Karolinska Institutet, expressed her surprise at the AI’s performance, stating, “I was surprised that the AI models outperformed all 33 of the expert examiners.” This sentiment was echoed by other researchers who see AI as a promising tool to enhance diagnostic accuracy and efficiency.

Dr. Brian Slomovitz, director of gynecologic oncology at Mount Sinai Medical Center in Florida, described the early detection of ovarian cancer as the “holy grail” in reducing mortality rates. He noted that AI-driven support could improve the interpretation of ultrasound findings, reducing both false positives and negatives.

The potential of AI in medical diagnostics extends beyond just radiology. Factors such as menopausal status and blood test results could also be integrated into AI models, enhancing their diagnostic capability. However, experts like Dr. Harvey Castro caution that AI’s effectiveness hinges on access to diverse, high-quality data. He emphasized the need for further research to ensure AI’s adaptability to real-world clinical settings.

Epstein highlighted that while AI can significantly aid in diagnostics, it is not a replacement for human physicians. “It is still the physician who remains responsible for the patient’s diagnosis and treatment,” she stated.

The Karolinska Institutet team, in collaboration with the KTH Royal Institute of Technology, plans to initiate clinical studies at Stockholm South Hospital. This research was funded by several organizations, including the Swedish Research Council and the Swedish Cancer Society.

As AI continues to evolve, it holds the promise of transforming medical diagnostics, potentially leading to earlier cancer detection and improved patient outcomes. For more details, you can read the full article on WFIN.

Revolutionizing Healthcare: The Transformative Power of AI

Revolutionizing Healthcare: The Transformative Power of AI

As we stand on the brink of a technological revolution, the integration of Artificial Intelligence (AI) into healthcare promises to be more transformative than the advent of electricity, the computer, or the internet. Kevin Riddleberger, co-founder of DispatchHealth, has been at the forefront of this evolution, witnessing firsthand the profound changes AI is bringing to clinical practices.

The Expanding Role of AI in Healthcare

AI’s integration is set to usher in personalized treatment plans tailored to individual genetic profiles and lifestyles. Virtual health assistants will soon provide real-time, accurate medical advice, managing over 85% of customer interactions by 2025. This shift allows healthcare professionals to focus more on patient care, emphasizing AI as a partner rather than a replacement.

Companies Leading the AI Healthcare Revolution

- Eko Health: Their AI-powered cardiac monitoring tools enhance heart condition detection, potentially reducing undiagnosed cardiac issues by up to 30%.

- Butterfly Network: Their portable ultrasound device, powered by AI, democratizes medical imaging, increasing diagnostic speed and accuracy.

- Abridge and Nuance: These companies reduce clerical burdens on clinicians by transcribing and structuring medical conversations, integrated into Epic systems.

- Hippocratic AI: Offers a staffing marketplace where companies can hire AI-powered agents to address healthcare staffing crises.

- Glass Health: Uses AI to integrate data sources, providing a holistic view of patient health for comprehensive care planning.

Looking Forward: Embracing the Future of Medicine

AI is a strategy enabler, not a standalone strategy. Effective adopters will prioritize integrated governance, using AI to support strategic endeavors and incorporate data as a competitive asset. However, challenges such as data privacy, ethical frameworks, and maintaining the human touch in medicine must be addressed.

As we prepare for the annual AAPA conference in Houston, the discussions around AI’s role in the future of medicine will be pivotal. Engaging with pioneers like Daniel Kraft, MD, and leading panel discussions will further our understanding and implementation of AI technologies.

Kevin Riddleberger’s insights highlight the exciting potential AI holds for healthcare, urging us to embrace this evolution boldly. The promise of AI is vast, and as we integrate these technologies, we must do so thoughtfully and ethically to enhance patient care and improve health outcomes worldwide.

Pioneering the Future: The Ethical Landscape of Fetal Genome Editing

Pioneering the Future: The Ethical Landscape of Fetal Genome Editing

In the ever-evolving world of science, the potential to edit fetal genomes is no longer a distant dream but an emerging reality. Yet, as the boundaries of genomic medicine expand, the ethical discussions surrounding these advancements remain in their infancy. Most scientists, driven by the pursuit of knowledge, are not traditionally equipped to navigate the societal implications of their breakthroughs, as noted in a recent piece from The Conversation.Uncharted Ethical Waters

The journey of genomic editing began in earnest in 2015 when U.S. scientists called for a moratorium on germline genome editing, a controversial practice where genetic alterations are inheritable. Despite these calls for open discussion, the dialogue remained largely insular, confined to scientific circles. By 2018, the world witnessed the birth of genetically modified babies in China, a stark reminder of the absence of ethical oversight and regulatory frameworks, as highlighted in a report.

Engaging Communities: A Crucial Step

The ethical debate is not just a scientific concern but a societal one. Engaging with communities, especially those directly affected by genetic diseases, is crucial. In 2022, a citizens’ jury in the U.K. composed of individuals affected by genetic disorders deliberated on the ethics of germline editing. Their verdict: it could be ethical, provided conditions like transparency and equal access are met. This approach underscores the importance of involving diverse voices in the conversation.

The Intersection of Science and Society

The potential to edit the genome of a fetus, also known as fetal genome surgery, offers unprecedented opportunities to address genetic diseases early. Yet, it also raises significant ethical questions, particularly regarding the role of the pregnant person in these procedures. Historically, seeing the fetus as a separate patient has sometimes overshadowed the interests of the pregnant individual, complicating the ethical landscape further.

Health Equity and Access

As with any groundbreaking technology, access and equity remain paramount. The high cost of genome editing, such as the $3.1 million price tag for treating sickle cell disease, poses significant barriers. Moreover, trust in the healthcare system is crucial, especially among communities historically underrepresented in genomic research. Addressing these disparities is essential to ensure that the benefits of genome editing are equitably distributed.

Conclusion

As we stand on the cusp of a new era in genomic medicine, the need for comprehensive ethical discussions is more pressing than ever. By engaging with the communities most affected and considering the broader societal impacts, we can navigate the complex ethical terrain of fetal genome editing. Only then can we ensure that these scientific advancements truly benefit humanity.

The Rise of Telemedicine: A Double-Edged Sword for Rural Healthcare

The Rise of Telemedicine: A Double-Edged Sword for Rural Healthcare

The advent of telemedicine has revolutionized healthcare delivery, providing a crucial bridge for patients who find it challenging to physically visit healthcare providers. This technological shift, which saw a significant uptick during the COVID-19 pandemic, has now become an indispensable part of modern healthcare systems.A recent study spearheaded by Zihan Ye from the University of Tennessee, along with Kimberly Cornaggia from Penn State University and Xuelin Li from Columbia Business School, sheds light on the financial ramifications of telemedicine. The study uncovers some unintended consequences, particularly concerning rural healthcare access.