How the Federal Reserve’s Rate Cut Could Reshape the Housing Market

How the Federal Reserve’s Rate Cut Could Reshape the Housing Market

In a move that has been eagerly anticipated, the Federal Reserve has cut interest rates by half a percentage point. While this decision is expected to influence the housing market, its impact on affordability remains uncertain.

In a move that has been eagerly anticipated, the Federal Reserve has cut interest rates by half a percentage point. While this decision is expected to influence the housing market, its impact on affordability remains uncertain.

Mortgage Rates: A Marginal Drop

Mortgage rates, which have been hovering around 8% after the pandemic-induced lows, are now at 6.2% following the Fed’s announcement. However, experts like Charlie Dougherty, a senior economist at Wells Fargo, predict only a marginal decrease. For those interested in the specifics, Freddie Mac provides current mortgage rate data.Higher Competition, Higher Prices

Lower mortgage rates are a double-edged sword. While they may attract more buyers, this influx could drive up housing prices due to increased competition. Real estate agents like Kim Kronenberger express concern for first-time buyers who might find themselves priced out of the market.Building the Future: More Homes on the Horizon?

The rate cut could incentivize builders by lowering the cost of loans tied to development. This may help address the national housing shortfall, as highlighted in a Harvard study. However, the impact of new home construction will take time to materialize.Affordability: Still a Major Hurdle

Despite potential benefits, affordability remains a significant issue. Home prices have surged by 50% since early 2020, outpacing income growth. As reported, many homeowners are unlikely to sell due to favorable existing mortgage rates, limiting market inventory. Greg McBride from Bankrate.com notes that lower rates have not significantly boosted the housing market. “Home prices are still at record highs, and inventory remains below pre-pandemic levels,” he explains.For more insights, the original article on NPR offers a comprehensive analysis of these developments.

More Articles

Getting licensed or staying ahead in your career can be a journey—but it doesn’t have to be overwhelming. Grab your favorite coffee or tea, take a moment to relax, and browse through our articles. Whether you’re just starting out or renewing your expertise, we’ve got tips, insights, and advice to keep you moving forward. Here’s to your success—one sip and one step at a time!

The Evolving Role of AI in Education: A Delicate Balance

The Evolving Role of AI in Education: A Delicate Balance

As the new semester unfolds, the profound influence of artificial intelligence (AI) on education and beyond is becoming increasingly evident. In a recent article from Marquette Today, Dr. Michael Zimmer, an associate professor of computer science and director of the Center for Data, Ethics and Society at Klingler College of Arts and Sciences, shares his insights on the transformative power of AI in the classroom.

AI’s Dual Nature: Opportunities and Challenges

AI is rapidly reshaping educational landscapes by automating routine tasks and personalizing learning experiences. Online textbook publishers, for instance, are leveraging AI to tailor content to individual students’ needs, facilitating a more customized educational journey. However, this technological advancement brings with it a set of challenges. The reliance on AI tools may inadvertently stifle critical thinking and problem-solving skills, as students might become overly dependent on automated solutions.Preparing Students for an AI-Driven World

Dr. Zimmer emphasizes the importance of equipping students with the skills necessary to navigate an AI-infused future. Teachers are increasingly focusing on digital literacy, ensuring students can critically assess AI technologies and understand the ethical implications associated with their use. This preparation is crucial as students enter a workforce where AI will play a significant role.Looking Ahead: A Balanced Perspective

While the potential of AI to automate mundane tasks and inspire creativity is undeniable, Dr. Zimmer urges caution against unbridled optimism. He advocates for a measured approach, recognizing both the benefits and limitations of AI. In the next 10 to 20 years, he predicts a “middle ground” where society will benefit from AI tools without allowing them to overshadow humanity’s core values and purpose.As we continue to explore the integration of AI in education, it is essential to strike a balance between harnessing its capabilities and maintaining the human element that is integral to learning and growth.

MedTech vs BioTech: The Future of Healthcare Innovation

MedTech vs BioTech: The Future of Healthcare Innovation

In the rapidly evolving landscape of healthcare, two fields stand at the forefront of innovation: MedTech and BioTech. While both are pivotal in enhancing patient care, they operate in distinct domains. MedTech focuses on developing medical devices and technologies for diagnosis and treatment, whereas BioTech leverages biological processes to create drugs and therapies. This article, based on insights from Netguru, explores the core differences between these fields and their impact on healthcare.Understanding MedTech and BioTech

MedTech, short for Medical Technology, encompasses a wide range of devices and technologies used in healthcare settings. From pacemakers and insulin pumps to advanced imaging systems and robotic surgery tools, MedTech innovations are crucial in diagnosing and treating patients effectively. These technologies are designed to enhance the accuracy and efficiency of medical procedures, ultimately improving patient outcomes.On the other hand, BioTech, or Biotechnology, involves the use of living organisms or their systems to develop health-related products and technologies. This field is heavily invested in drug development, genetic engineering, and creating new therapies. BioTech companies are pioneering personalized medicine and targeted treatments, offering new hope for patients with complex health conditions.

Key Differences and Challenges

While both sectors are experiencing rapid growth, they face distinct regulatory challenges. MedTech products often require less extensive clinical trials compared to BioTech innovations, which involve longer, more rigorous processes due to the complex nature of biological processes. This regulatory landscape shapes the innovation strategies and market dynamics of each field.Emerging technologies like AI and gene editing are set to revolutionize both MedTech and BioTech. AI plays a crucial role in speeding up drug discovery and analyzing genetic information, making therapies more effective and personalized. Meanwhile, gene editing technologies like CRISPR offer potential solutions for genetic disorders, paving the way for more effective treatments.

Market Trends and Growth

The MedTech market was valued at $456.9 billion in 2020 and is projected to reach $800 billion by 2030. Innovations in telemedicine and wearable devices are transforming patient monitoring, enabling real-time health management and intervention. The increasing demand for remote monitoring devices reflects a shift towards more accessible healthcare options.In contrast, the BioTech market continues to grow, driven by the potential for groundbreaking therapies and personalized medicine. The first CRISPR-based therapy approved for treating genetic blood disorders marks a significant milestone in gene therapy.

Opportunities for Innovation

Despite the challenges, both fields offer immense potential for innovation. AI-driven diagnostics and next-generation gene therapies are emerging technologies that promise to revolutionize healthcare. For instance, Merck’s AI R&D Assistant has demonstrated the potential of AI to streamline research processes, completing tasks under budget and within deadlines.Moreover, partnerships like the one with Nodus Medical have resulted in digital assistant tools for surgical teams, enhancing efficiency and reducing stress.

Impact on Healthcare Providers and Patients

Advancements in MedTech and BioTech are transforming healthcare delivery, improving patient experiences and outcomes. Telemedicine usage surged during the COVID-19 pandemic, highlighting its value in providing healthcare access. BioTech plays a crucial role in advancing healthcare through genetic research and the development of personalized medications.Future Outlook

The future of MedTech and BioTech is bright, with emerging technologies and potential breakthroughs set to revolutionize healthcare. AI-driven diagnostics, next-generation gene therapies, and advanced biomaterials are poised to transform the landscape, offering new possibilities for healthcare innovation.As we look ahead, the journey of innovation continues, bringing us closer to a future where personalized and effective healthcare is accessible to all. “`

Nanomedicine Market Poised for Explosive Growth

Nanomedicine Market Poised for Explosive Growth

The nanomedicine market is set to experience a remarkable expansion, projected to surge from USD 223.6 billion in 2023 to a staggering USD 634.2 billion by 2032. This growth trajectory, highlighted in a recent GlobeNewswire article, is fueled by advancements in drug delivery systems and the increasing prevalence of chronic diseases.Revolutionizing Drug Delivery

The rise in chronic conditions such as cancer and diabetes has intensified the demand for innovative drug delivery systems. Nanotechnology has emerged as a key player, offering targeted therapies with enhanced efficacy and reduced side effects. This technological leap is not only transforming treatment protocols but also attracting significant interest from the scientific community and healthcare practitioners.

Collaborations Driving Innovation

The surge in the nanomedicine market is underpinned by robust collaborations between pharmaceutical giants and academic institutions. These partnerships are paving the way for groundbreaking research and development, resulting in a steady influx of nanomedicine products into the market. Notable players such as Johnson & Johnson, GE Healthcare, and Pfizer are at the forefront of this innovation wave.

Regional Insights

North America currently dominates the nanomedicine landscape, thanks to substantial investments in research and development, coupled with a strong presence of leading pharmaceutical companies. However, the Asia-Pacific region is poised for the fastest growth, driven by a surge in demand for affordable healthcare solutions and significant advancements in healthcare infrastructure.Recent Developments

The market has witnessed a flurry of activity with the launch of nanoparticle-based drugs, FDA approvals for new devices, and the unveiling of nanotube-based scaffolds for tissue engineering. These developments underscore the dynamic nature of the nanomedicine sector and its potential to revolutionize healthcare.

For those interested in a deeper dive into the market dynamics, the full report is available for purchase here. For inquiries or to speak with an analyst, visit this link.

U.S. Economy Shows Resilience Amid Upward Revisions

U.S. Economy Shows Resilience Amid Upward Revisions

The U.S. economy continues to demonstrate its resilience, as highlighted in a recent report by Freddie Mac. The Bureau of Economic Analysis (BEA) confirmed a 3% GDP growth for the second quarter of 2024, maintaining its previous estimates. This steady growth is supported by a robust labor market, with September witnessing a significant addition of 254,000 payroll jobs. The cumulative job growth throughout 2024 aligns with pre-pandemic averages, showcasing the economy’s strength.Inflation and Federal Reserve’s Monetary Policy

Inflationary pressures have been easing, with the Federal Reserve implementing a rate cut to steer the economy towards its inflation targets. This monetary policy shift is expected to bolster consumer spending and credit performance, fostering optimism for a soft economic landing.Housing Market: A Gradual Awakening

The housing market is showing signs of life, as mortgage rates hit a two-year low in late September. Despite this, August saw a 2.9% decline in home sales, indicating ongoing challenges for first-time homebuyers. The market’s recovery is hindered by affordability issues and limited supply, yet the demographic tailwind from millennials suggests potential growth.First-Time Homebuyers: A Rising Force

First-time homebuyers are becoming increasingly prominent in the housing market. This trend is fueled by the financial empowerment of younger adults and the mortgage lock-in effect that has cooled resale activity. According to the Freddie Mac report, the share of first-time homebuyers has been on the rise since the pandemic, with these buyers navigating complex market dynamics and evolving geographic preferences.Economic Outlook: Cautious Optimism

Freddie Mac projects continued economic growth, albeit at a slower pace. The housing market is expected to experience modest gains, driven by demographic factors and a gradual easing of mortgage rates. However, the supply-demand imbalance remains a core issue, posing potential challenges to sustained growth.For more in-depth insights, explore the comprehensive report available on Freddie Mac’s research page.

Modernizing Medical Education: Embracing Public Health at the University of Dundee

Modernizing Medical Education: Embracing Public Health at the University of Dundee

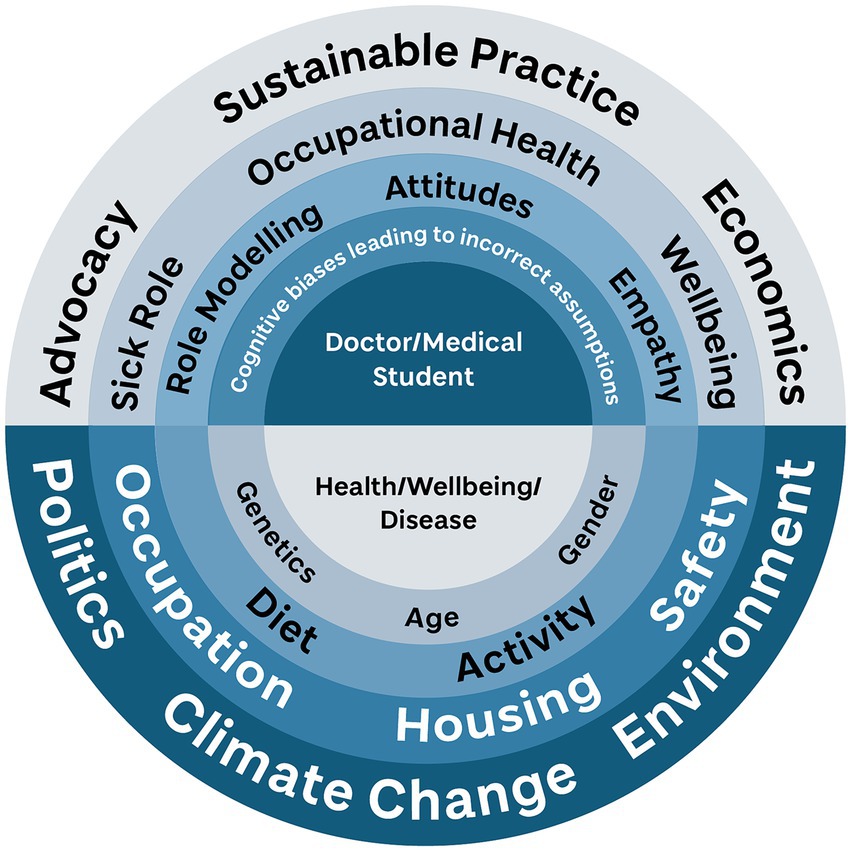

In a world where healthcare and its education are undergoing seismic shifts, the University of Dundee is pioneering a transformative approach. The institution is integrating public health into its medical curriculum, responding to the rapid technological, political, and social changes reshaping the medical landscape. This initiative is detailed in a recent article published by Frontiers.The article underscores the urgent need for medical education to evolve, highlighting the challenges posed by technological advancements, curriculum overload, and evolving medical practices. As non-communicable diseases rise, there’s a compelling economic argument for preventive medicine, which even corporations recognize. The University of Dundee’s curriculum overhaul aims to produce graduates ready for the demands of modern healthcare, emphasizing public health’s critical role.

The Role of Technology

Technological advancements, particularly in artificial intelligence and machine learning, are reshaping healthcare delivery. However, these innovations have yet to make a significant impact on medical education. The Topol review highlighted potential future changes, but current curricula lack comprehensive teaching on these topics. Dundee’s program addresses this gap, preparing students to navigate a tech-driven healthcare environment.Curriculum Overload

Medical students face daunting amounts of information, with knowledge potentially doubling every few months. Standardized assessments and shared curricula are becoming more prevalent, emphasizing core scientific knowledge. Yet, there’s a growing recognition of the need for doctors to understand interpersonal communication, leadership, and teamwork. Dundee’s curriculum seeks to balance these elements, moving from a micro to a macro perspective.Adapting to New Medical Practices

The role of doctors is changing, influenced by global health priorities and societal expectations. The COVID-19 pandemic highlighted the need for robust healthcare systems and the challenges of misinformation. Dundee’s curriculum aims to equip students with the skills to navigate these shifts, fostering adaptability and resilience.Curriculum Review and Implementation

Dundee’s curriculum review, initiated before the pandemic, aims to facilitate transitions for learners, especially those from non-traditional backgrounds. Using the double diamond design methodology, the review involved stakeholders from various disciplines. The curriculum introduces two key strands: “The Bigger Picture” and “The Dundee Doctor.”

The Bigger Picture emphasizes public health, encouraging students to understand social determinants of health and their role as healthcare providers. It integrates public health and behavioral sciences, fostering a deeper understanding of healthcare’s broader context.

The Dundee Doctor represents the unique qualities of Dundee graduates, focusing on professional development and adaptability. It serves as a guiding framework for curriculum implementation, ensuring alignment with the institution’s values.

Challenges and Future Directions

Implementing changes in a constrained curriculum like medicine is challenging. Dundee’s approach aims for a “quiet revolution,” balancing core and elective elements to provide diverse learning opportunities. Formal evaluation of the new curriculum is underway, with anecdotal feedback indicating positive reception.As healthcare continues to evolve, Dundee’s curriculum is designed to adapt, preparing students for future challenges. The article posits that medical education must continuously renew itself, fostering adaptable, socially conscious doctors.

Institutional DeFi: Navigating the Financial Frontier

Institutional DeFi: Navigating the Financial Frontier

In the rapidly evolving world of finance, Decentralized Finance (DeFi) is emerging as a transformative force, reshaping the landscape of traditional banking and investment strategies. The whitepaper titled “Institutional DeFi: Navigating the Landscape” offers a comprehensive analysis of this dynamic sector.

Authored by industry experts, including Hagen Weiss, Counsel at Dentons for Digital Finance, Stefan Grasmann, and Christoph Hock, this publication delves into the challenges, opportunities, and future directions of DeFi, offering valuable insights for financial institutions eager to explore this new terrain.

Understanding DeFi’s Impact

DeFi platforms are revolutionizing financial services, affecting everything from asset management to banking and compliance. This transformation is driven by the transparency and efficiency of blockchain technology, which introduces innovations like smart contracts and tokenization.

Technological Advancements

Blockchain technology is at the heart of DeFi, enabling transparent and efficient financial operations. The paper highlights key advancements, including the emergence of smart contracts and the growing trend of tokenization.

Strategic Adaptation for Institutions

For traditional financial institutions, adapting to DeFi strategies is crucial. By integrating these innovative approaches, institutions can enhance operational efficiency and improve customer satisfaction.

Regulatory Considerations

Navigating the regulatory landscape is a significant challenge for DeFi. The whitepaper provides a thorough review of the current regulatory environment, offering strategic recommendations for compliance and integration.

Future Outlook

Looking ahead, the potential developments in DeFi promise profound implications for the financial industry. The publication explores these possibilities and outlines preparatory strategies for institutions to stay ahead of the curve.

For those interested in a deeper dive into this transformative sector, the whitepaper is available for download here.

Unmasking The Banking Sector’s Vulnerability To Cyber Threats

Unmasking The Banking Sector’s Vulnerability To Cyber Threats

In a world where digital threats loom large, the banking sector finds itself at a critical juncture. A recent story shared by an acquaintance, Dave, underscores the pervasive risk of cyberattacks that banks face today. Dave, who works in the banking sector, was caught off guard by a phishing attempt that seemed legitimate. Fortunately, it was a security test, but it highlighted a glaring vulnerability.

According to a Trend Micro report, the first half of 2021 saw an alarming 1,300% increase in ransomware incidents targeting banks. This surge is a wake-up call for financial institutions to reassess their cybersecurity strategies.

Challenges in Banking Cybersecurity

The banking sector’s reliance on outdated systems and slow adoption of cloud technologies are significant hurdles. As Dave pointed out, “Regulations make banks cautious, but this caution leaves us exposed.” This cautious approach has led to systemic flaws that cybercriminals exploit.

Phishing, ransomware, and advanced persistent threats (APTs) are the tools of choice for cybercriminals. These attacks don’t just aim for financial gain; they target sensitive data, which can be weaponized for future attacks or extortion.

Proactive Measures for Enhanced Security

To combat these threats, banks must adopt a proactive cybersecurity posture. Implementing a zero-trust framework—where trust is never assumed, even within the organization—can significantly enhance security. This approach involves verifying every user, device, and application, irrespective of their location.

In addition to zero trust, leveraging advanced tools like remote browser isolation (RBI) can provide an extra layer of protection. RBI ensures that web content is executed in a secure environment, preventing potential malware from reaching users’ devices.

These strategies form the essential toolbox the banking sector must revisit to bolster its defenses against evolving cyber threats. As cybercriminals become more sophisticated, banks must innovate and ensure employees are well-trained to stay ahead.

For more insights, visit the full article on Forbes.

AI’s Transformative Role in Healthcare Diagnostics

AI’s Transformative Role in Healthcare Diagnostics

In a rapidly evolving landscape, artificial intelligence (AI) is reshaping the very fabric of healthcare diagnostics. As highlighted in a recent Forbes article, AI’s integration into healthcare is not just a technological advancement but a revolution in patient care.

The Power of Machine Learning

At the heart of this transformation is machine learning (ML), a subset of AI that excels in processing complex datasets. From big data analysis to pattern recognition, ML is pivotal in identifying disease markers that might otherwise remain hidden. This capability allows for earlier detection of diseases and the development of personalized treatment plans.- Insights from Diverse Datasets: AI can synthesize data from molecular biomarkers, wearables, and lifestyle factors, offering a comprehensive view of patient health.

- Early Disease Detection: AI-powered tests enhance sensitivity, allowing for proactive management of diseases.

- Personalized Care: By analyzing unique biomarkers, AI helps tailor interventions, minimizing trial-and-error in treatments.

Ethical and Security Considerations

However, the journey is not without challenges. Ethical considerations, such as bias in data and potential misdiagnoses, are critical. As the article emphasizes, ensuring data integrity and patient privacy is paramount. Organizations must implement robust data governance and cybersecurity measures to protect sensitive patient information.Collaborative Efforts for a Healthier Tomorrow

The call to action is clear: technology leaders must forge alliances across disciplines, bringing together the strengths of tech firms, healthcare entities, and academia. This collaboration is essential for driving patient-centered innovation and ensuring the ethical deployment of AI technologies.As we stand on the cusp of a new era in healthcare, AI is not merely a tool but a catalyst for precision medicine. By acting decisively and ethically, we can harness AI’s potential to create a healthier future for all.

Innovative Recruitment Strategies to Combat Nursing Shortages

**Nursing vacancies** have surged to 17%, more than doubling pre-pandemic levels, prompting hospitals to go beyond mere salary increases and benefits enhancements. According to a recent Medscape article, hospitals are enticing nurses with substantial **signing bonuses**, **flexible work schedules**, and other creative incentives.

Signing Bonuses and Flexible Scheduling

Among the most eye-catching incentives are **signing bonuses**, with nearly 18% of job openings advertising this perk. The average **signing bonus** for registered nurses (RNs) has soared above $11,000. A standout example is Palomar Health, which offered eligible RNs a staggering $100,000 bonus, paid over three years.

Hospitals are also embracing **flexible scheduling**. This approach is not only attractive to new and experienced RNs but could also lure back nurses who have left clinical practice. The American Nurses Foundation report highlights that 45% of nurses who exited clinical roles would consider returning if self-scheduling were implemented.

Hiring Beyond Borders

Despite these enticing offers, some hospitals still struggle to fill positions, turning to **international recruitment**. Data from KFF shows that 32% of hospitals hired foreign-educated RNs in 2022, a significant increase from 2010. However, Jennifer Mensik Kennedy, President of the American Nurses Association, warns that relying on **international recruitment** is not a sustainable long-term solution. She advocates for focusing on **retention** through fostering healthy work environments and updating payment models.

Retention: The Other Half of the Equation

**Retaining nursing staff** is equally crucial. A significant portion of new nurses—33%—leave the profession within two years. To combat this, many hospitals have launched **retention programs**. Lifepoint Health’s Nurse Residency Program is one such initiative, offering mentorship and training to help new graduates transition into clinical practice. This program has successfully recruited 750 new nurses, and plans are underway for a two-year fellowship program to further support professional development.

The Reimagining Nursing Initiative by the American Nurses Foundation aims to modernize nurses’ reimbursement structures, ensuring they feel valued and adequately compensated.

In conclusion, attracting and retaining **top nursing talent** goes beyond merely filling vacancies. It is about building a healthcare system where nurses can thrive, ultimately benefiting the communities they serve.

The Role of Telehealth, AI, and Wearables in Modern Healthcare

The Role of Telehealth, AI, and Wearables in Modern Healthcare

In an era where technology is reshaping every facet of our lives, healthcare stands at the forefront of this digital revolution. As we delve into 2024, the integration of telehealth, AI, and wearable technologies is setting new benchmarks in patient care and accessibility.Telehealth: A Game Changer

Telehealth has emerged as a pivotal force in modern healthcare, dramatically transforming the delivery of medical services. The COVID-19 pandemic acted as a catalyst, with a reported 154% increase in telehealth visits during the last week of March 2020 compared to the same period in 2019. This surge underscores telehealth’s scalability and versatility, especially in mental health services, where virtual care has become indispensable.

Moreover, the financial implications of telehealth are profound. A study in the American Journal of Emergency Medicine highlighted cost savings through reduced non-urgent emergency department visits. According to a McKinsey report, up to $250 billion of U.S. healthcare spending could be virtualized, showcasing telehealth’s potential to revolutionize healthcare economics.

Cross-industry Applications

The influence of telehealth extends beyond traditional healthcare. In education, it bridges the gap between medical knowledge and practical application, as evidenced by a Journal of Medical Internet Research study on telehealth simulation training. Additionally, corporate wellness programs are increasingly incorporating telehealth, enhancing employee well-being and productivity.

Technological Integration: No-Code and Low-Code Platforms

The integration of No-Code (NC) and Low-Code (LC) platforms is another transformative trend in healthcare. These platforms enable rapid development of digital solutions, crucial for adapting to evolving healthcare scenarios. A study in the Healthcare Management Review found that NC and LC platforms could accelerate clinical application development by 50-70%, significantly reducing time-to-market.

Financially, these platforms are a boon for healthcare organizations facing budget constraints, with reports indicating up to a 20% reduction in application development costs.

Personalized Telehealth: Enhancing Patient Experience

Personalization in telehealth is key to enhancing patient and consumer experiences. Tailoring services to individual preferences not only improves patient satisfaction but also boosts adherence and outcomes in chronic disease management. A study in Diabetes Technology & Therapeutics demonstrated that personalized telehealth coaching significantly improved glycemic control compared to standard care.

Future Prospects

Looking ahead, two compelling developments are poised to redefine healthcare:

- AI-driven Diagnostics and Personalized Medicine: AI and Machine Learning are enhancing diagnostic accuracy and treatment efficacy, with expectations of significant advancements in early disease detection and personalized treatment plans by 2024.

- Wearable Technology for Chronic Disease Management: Wearable devices are transforming patient monitoring, enabling timely interventions and potentially reducing hospital costs and readmission rates.

As we navigate this technological leap, the emphasis on equitable access to digital health by organizations like the World Health Organization highlights the need for inclusive and ethical technology deployment. The healthcare industry is on the brink of a new epoch, where technology plays a central role in shaping a healthier, more connected world.

Unraveling the Ties Between Sleep and Chronic Disease: Insights from Wearable Technology

Unraveling the Ties Between Sleep and Chronic Disease: Insights from Wearable Technology

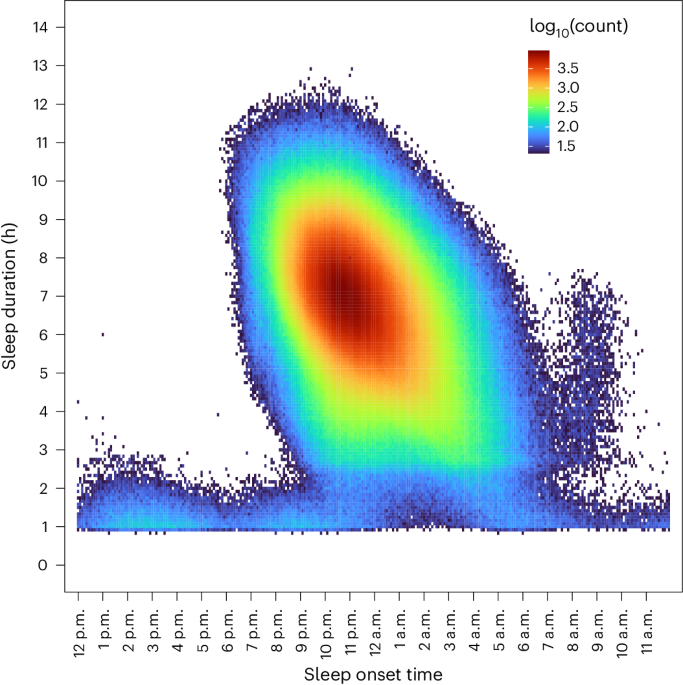

In a groundbreaking study published in Nature, researchers have delved into the intricate relationship between sleep patterns and chronic disease risk, using data harvested from commercial wearable devices like Fitbit. This study, part of the All of Us Research Program, harnesses the power of long-term monitoring to paint a comprehensive picture of how sleep impacts health over time.The researchers meticulously analyzed the sleep data of thousands of participants, focusing on various metrics such as sleep stages, duration, and regularity. The findings underscore a significant association between these sleep patterns and the incidence of chronic diseases, including obesity, hypertension, and psychiatric disorders.

The study’s results are not only a testament to the potential of wearable technology in health monitoring but also a call to action for public health initiatives. By tracking sleep patterns over extended periods, wearables provide a unique opportunity to observe the long-term effects of sleep on health, offering valuable insights for both public health policies and individual health management.

As noted in the original article, this research builds on previous studies, such as those by Ayas et al. on sleep duration and coronary heart disease, and Cribb et al. on sleep regularity and mortality. These studies have laid the foundation for understanding the critical role sleep plays in overall health.

Wearables: A New Frontier in Health Monitoring

The use of devices like Fitbit has revolutionized the way we approach health monitoring. By providing continuous, objective data, these devices allow researchers to conduct longitudinal studies that were previously impractical due to cost and logistical constraints. This paradigm shift is opening new doors for understanding the complex interactions between lifestyle factors and health outcomes.The implications of this study are far-reaching. For individuals, it highlights the importance of maintaining healthy sleep habits as a preventive measure against chronic diseases. For healthcare providers, it emphasizes the potential of integrating wearable data into routine care, enabling more personalized and proactive health management.

Conclusion

In conclusion, the study published in Nature offers a compelling argument for the integration of wearable technology in health research and management. By shedding light on the profound impact of sleep on chronic disease risk, it provides a roadmap for future research and underscores the importance of sleep in maintaining overall health. As we continue to embrace technology in healthcare, the insights gained from such studies will be invaluable in shaping a healthier future.Precision Medicine Market: A Tailored Approach Revolutionizing Healthcare

Precision Medicine Market: A Tailored Approach Revolutionizing Healthcare

The global precision medicine market is experiencing a remarkable surge, with its valuation projected to skyrocket from USD 83.80 billion in 2023 to USD 207.80 billion by 2032, boasting a compound annual growth rate (CAGR) of 10.8%. This growth is primarily driven by the increasing demand for personalized treatment strategies that leverage advanced technologies like genomics, proteomics, and bioinformatics to provide more effective and precise healthcare solutions. Global Trends & Drivers:

The precision medicine market has witnessed a significant expansion in research and development activities, especially following the COVID-19 pandemic. The pandemic underscored the necessity for individualized treatment regimes, leading to increased investments in precision medicine. The shift towards integrating cell and gene therapies, coupled with regulatory approvals for novel treatments, further signals promising growth prospects.

Regional Insights:

North America remains at the forefront, dominating the market with a share of 50.91% in 2023. This dominance is attributed to the region’s advanced healthcare infrastructure and a high incidence of chronic diseases, such as cancer, which propels the demand for personalized treatments. According to the Centre for Disease Control and Prevention (CDC), the U.S. reported an estimated 1,603,844 new cancer cases in 2020, highlighting the critical need for tailored healthcare solutions.

Europe holds the second-largest market share, driven by significant advancements in biomarker testing and diagnostics. The region’s superior healthcare infrastructure and increasing healthcare expenditure contribute to its market growth. Meanwhile, Asia Pacific is poised for expansion, fueled by population growth, rising disease burden, and government support for healthcare innovations.

Key Players and Collaborations:

The competitive landscape of the precision medicine market is characterized by strategic partnerships and collaborations among key industry players. Companies like Illumina, Inc., Agilent Technologies, Inc., and Thermo Fisher Scientific Inc. are at the forefront, expanding their presence through innovative products and collaborations with research institutions. Notably, in July 2023, Agilent Technologies, Inc. partnered with Institut Curie to launch a new kit for identifying vital genetic abnormalities causing cancer.

Future Outlook:

The precision medicine market is on the cusp of a transformative journey. With increasing governmental and private investments, the demand for precision medicine is expected to rise steadily. The commitment to addressing chronic conditions, coupled with strategic industry collaborations and advanced diagnostic tools, will sustain market growth. Moreover, the integration of AI in healthcare systems is set to revolutionize the precision medicine landscape.

Conclusion:

As the precision medicine market continues to evolve, its promise of personalized healthcare solutions becomes increasingly tangible. The market’s trajectory indicates robust growth, driven by the ongoing demand for customized treatment approaches that effectively manage chronic diseases. For more insights on the precision medicine market, visit the original article.

Global Trends & Drivers:

The precision medicine market has witnessed a significant expansion in research and development activities, especially following the COVID-19 pandemic. The pandemic underscored the necessity for individualized treatment regimes, leading to increased investments in precision medicine. The shift towards integrating cell and gene therapies, coupled with regulatory approvals for novel treatments, further signals promising growth prospects.

Regional Insights:

North America remains at the forefront, dominating the market with a share of 50.91% in 2023. This dominance is attributed to the region’s advanced healthcare infrastructure and a high incidence of chronic diseases, such as cancer, which propels the demand for personalized treatments. According to the Centre for Disease Control and Prevention (CDC), the U.S. reported an estimated 1,603,844 new cancer cases in 2020, highlighting the critical need for tailored healthcare solutions.

Europe holds the second-largest market share, driven by significant advancements in biomarker testing and diagnostics. The region’s superior healthcare infrastructure and increasing healthcare expenditure contribute to its market growth. Meanwhile, Asia Pacific is poised for expansion, fueled by population growth, rising disease burden, and government support for healthcare innovations.

Key Players and Collaborations:

The competitive landscape of the precision medicine market is characterized by strategic partnerships and collaborations among key industry players. Companies like Illumina, Inc., Agilent Technologies, Inc., and Thermo Fisher Scientific Inc. are at the forefront, expanding their presence through innovative products and collaborations with research institutions. Notably, in July 2023, Agilent Technologies, Inc. partnered with Institut Curie to launch a new kit for identifying vital genetic abnormalities causing cancer.

Future Outlook:

The precision medicine market is on the cusp of a transformative journey. With increasing governmental and private investments, the demand for precision medicine is expected to rise steadily. The commitment to addressing chronic conditions, coupled with strategic industry collaborations and advanced diagnostic tools, will sustain market growth. Moreover, the integration of AI in healthcare systems is set to revolutionize the precision medicine landscape.

Conclusion:

As the precision medicine market continues to evolve, its promise of personalized healthcare solutions becomes increasingly tangible. The market’s trajectory indicates robust growth, driven by the ongoing demand for customized treatment approaches that effectively manage chronic diseases. For more insights on the precision medicine market, visit the original article.

U.S. Wearable Medical Devices Market: Growth Trends and Future Prospects

U.S. Wearable Medical Devices Market: A Surge in Growth

The U.S. wearable medical devices market, currently valued at an estimated $11.45 billion in 2023, is set to experience an astronomical rise to approximately $112.67 billion by 2033. This projection, reported by BioSpace, highlights a compound annual growth rate (CAGR) of 25.69% from 2024 to 2033.Technological Advancements and Market Leaders

The market’s growth is fueled by technological advancements and a heightened consumer focus on health and wellness. Major players such as Apple Inc., Fitbit Inc., and Garmin Ltd. are at the forefront, introducing innovative products like smartwatches and fitness trackers. Notably, Apple has unveiled mental health and vision health features, enhancing the Apple Watch’s capabilities in tracking anxiety, depression, and vision health, thus setting a competitive standard in the industry.Dominance of Diagnostic Devices

The diagnostic devices segment is leading the market, driven by the increasing demand for personalized medicine and remote patient monitoring. These devices offer cost-effective solutions and real-time health data, facilitating early detection and management of health issues.North America’s Leading Role

North America, accounting for 42.11% of the revenue share in 2023, remains a dominant force in the wearable medical devices market. The region’s emphasis on preventive healthcare and consumer interest in wellness continues to propel its leading position.Future Prospects and Regional Insights

With the market poised for significant growth, the future of wearable technology in healthcare looks promising. The integration of real-time health monitoring and preventive care strategies is revolutionizing healthcare delivery and management. As the market expands, consumer-grade wearable devices are expected to see a surge in demand, driven by technological advancements and a proactive approach to health monitoring.For further insights and detailed analysis, the full report is available at Nova One Advisor.

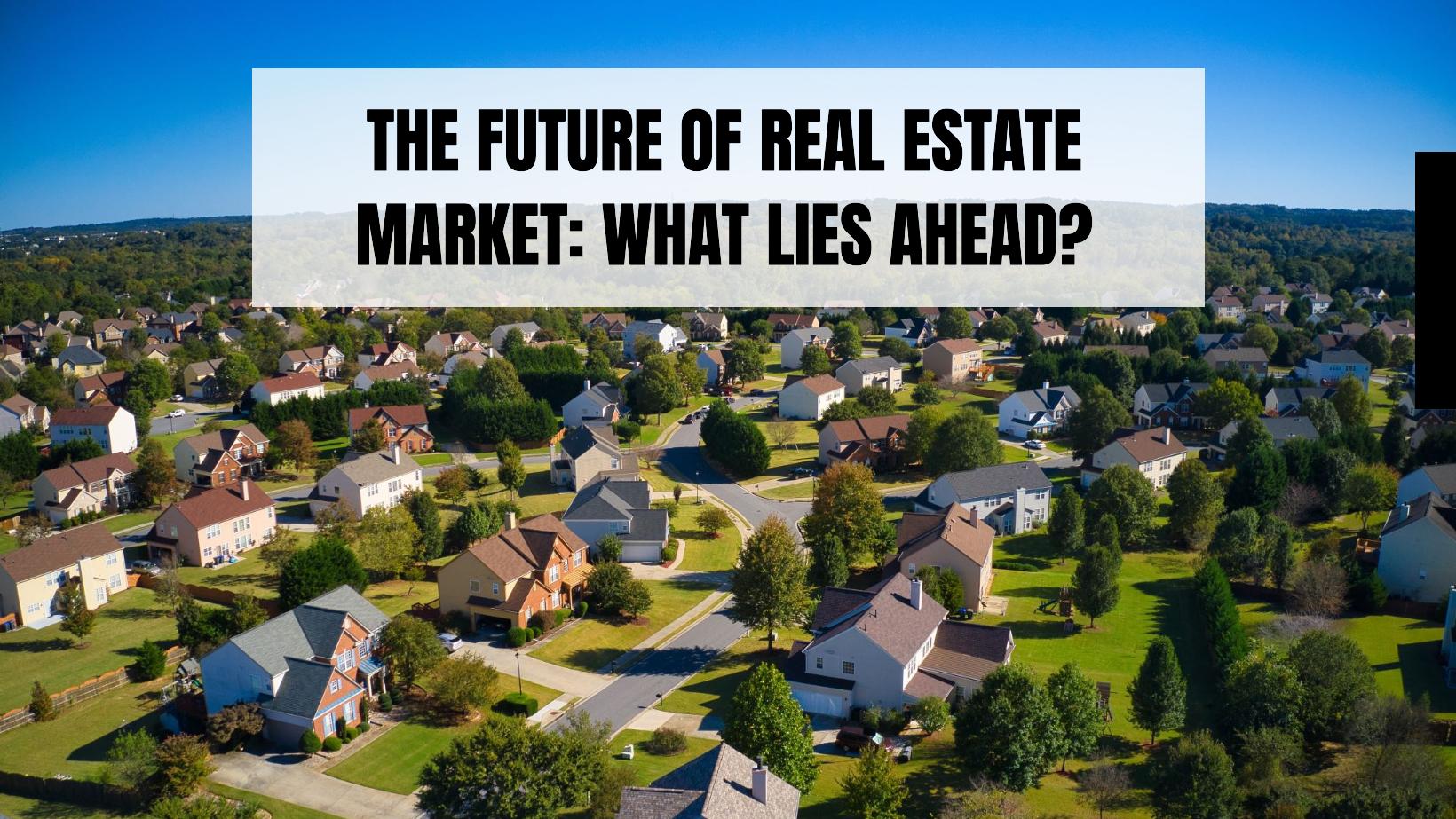

The Future of Real Estate Market: What Lies Ahead?

The Future of Real Estate Market: What Lies Ahead?

The real estate market is on the brink of transformation, captivating the attention of buyers, sellers, investors, and industry professionals. As we look toward the end of 2024, experts predict a shift in the landscape, particularly with home prices expected to decline due to increased inventory levels.

One of the driving forces behind this shift is the anticipated stabilization or reduction of mortgage rates, which will make home ownership more accessible. Additionally, a push for eco-friendly homes and the integration of advanced technologies is set to reshape the market.

Key Insights from Expert Forecasts

- Economic Conditions and Housing Affordability: Housing affordability remains a central concern. A report by Bankrate highlights that high prices and mortgage rates currently hinder many potential buyers. However, with expected price decreases and mortgage rates dropping to around 6.6% by late 2024, purchasing power is likely to improve.

- Shift in Supply and Demand Dynamics: The real estate market is predicted to experience a rise in new homes, particularly in suburban and rural areas. This surge in supply is expected to balance market conditions, allowing buyers to choose from a wider selection of properties, as noted in U.S. News.

- The Role of Technology: Technological advancements, such as virtual reality tours and blockchain for transactions, are expected to streamline real estate processes. PwC remarks these innovations will enhance transaction efficiency and user experience.

- Emphasis on Sustainability: There is a growing trend toward sustainable living, with buyers increasingly favoring eco-friendly developments, as remarked by the Global Wellness Institute. This trend may encourage more developers to incorporate sustainable features in their projects.

- Changes in Residential Preferences: Remote work is influencing residential choices, with individuals opting for suburban or rural areas renowned for lower living costs and higher quality of life, as outlined by Business Insider.

- Impact of Changing Demographics: The market is being shaped by Millennials and Gen Z, who prioritize community features in potential neighborhoods, informed by the National Association of Realtors.

Conclusion

As we approach 2024 and beyond, the real estate market is poised for transformative changes driven by economic factors, technological advancements, and evolving consumer preferences. These developments necessitate strategic adaptation by all market participants—buyers, sellers, and investors alike—to thrive in this evolving landscape.Bridging the Healthcare Gap in Rural Areas with Telehealth

Bridging the Healthcare Gap in Rural Areas with Telehealth

According to the World Health Organization (WHO), nearly two billion people in rural and remote areas worldwide lack access to essential healthcare solutions. This staggering statistic highlights a critical issue: the digital divide that limits telehealth services, primarily due to inadequate broadband access. The repercussions are significant, exacerbating existing health disparities and hindering healthcare delivery.

Rural areas face another daunting challenge: a severe shortage of healthcare professionals. Despite housing over 40% of the global population, these regions are served by only 38% of the nursing workforce and less than a quarter of the physician workforce. This imbalance forces many rural inhabitants to travel long distances for specialty care, often resulting in delayed treatment and poorer health outcomes.

The Promise of Telehealth

Telehealth offers a beacon of hope in bridging these gaps. Technological advancements have significantly improved telehealth platforms, integrating seamlessly with medical devices and electronic medical records (EMRs). These innovations make telehealth more user-friendly and accessible, providing scalable solutions that cater to multiple specialties.

Rural communities, which often report higher rates of chronic diseases like cancer, diabetes, and heart disease, stand to benefit immensely from telehealth. The Centers for Disease Control and Prevention (CDC) noted in 2023 that these areas struggle with limited access to both primary and specialty care. Telehealth can mitigate these challenges by offering e-visits and virtual consultations, reducing the need for lengthy travel to access medical services.

Innovative programs worldwide illustrate telehealth’s potential. For instance, Pakistan’s COMSATS Telehealth and Africa’s mHealth Kenya initiatives have successfully connected remote patients with healthcare providers, demonstrating the effectiveness of telehealth in overcoming geographical barriers.

Strategic Implementation

Successfully implementing telehealth in rural areas requires a strategic approach. A comprehensive needs assessment is critical to understand the specific healthcare needs of these communities. Selecting the right telehealth platform, which offers interoperability and scalability, is equally important. Comprehensive training and ongoing support for healthcare providers ensure effective adoption of these technologies.

Financial considerations, regulatory compliance, and infrastructure development are also crucial. A cost-benefit analysis can elucidate telehealth’s financial impact, while understanding and adhering to regulatory requirements maintain trust and credibility. Reliable broadband connectivity is essential, and innovative solutions like mobile hotspots and satellite internet can help overcome connectivity barriers.

Embracing the Future

Embracing telehealth in rural healthcare settings involves collaboration and continuous improvement to address existing challenges. The goal is to make healthcare more accessible and equitable, reducing the disparity between urban and rural healthcare outcomes. With the involvement of C-suite executives, telehealth can ensure high-quality care delivery to rural communities, ultimately enhancing patient outcomes and reducing costs.

For more insights, visit the original article on Omnia Health Insights.

Navigating Ethical Challenges: AI in Healthcare

Unraveling Algorithmic Bias

**AI’s potential to transform healthcare** is undeniable, yet it carries the risk of reinforcing existing biases entrenched in historical data. These biases can lead to skewed outcomes, particularly affecting marginalized communities such as the LGBTQIA+ and certain ethnic groups. The need for rigorous testing and continuous monitoring of **AI systems** is paramount to ensure equitable healthcare delivery.

Ensuring Informed Consent

**Patient autonomy** remains a cornerstone of medical ethics, especially in the age of AI. Educating patients about **AI tools** and providing options to opt-out are crucial steps in fostering trust. Addressing concerns about **data privacy and security** is essential to assuage patient fears and enhance transparency in healthcare decisions.Regulatory and Ethical Frameworks

The dynamic landscape of **AI in healthcare** necessitates robust regulatory frameworks. Organizations like the U.S. Food and Drug Administration play a vital role in establishing guidelines to prevent misuse and ensure ethical **AI development**. Regular audits and assessments of **AI systems** can maintain transparency and accountability.

Addressing Liability Concerns

As **AI becomes more prevalent**, liability in adverse outcomes presents a complex challenge. Physicians and AI developers must share responsibility for ensuring the safety and efficacy of **AI systems**. The emergence of **AI-specific liability insurance** offers a novel solution to manage potential malpractice claims.Emotional and Ethical Considerations

AI’s rise in healthcare is not merely a technological shift but one that deeply intertwines with human emotions. The introduction of **AI-powered tools** must be communicated with sensitivity to prevent patient distress and anxiety. Maintaining the empathetic human connection in healthcare is essential to addressing emotional needs and fostering deeper therapeutic relationships. As the healthcare industry navigates this transformative phase, it is crucial to uphold **ethical principles**, address biases, and ensure informed consent. By actively engaging in these considerations, the full potential of **AI** can be harnessed to improve patient outcomes without compromising the values of medicine.

As the healthcare industry navigates this transformative phase, it is crucial to uphold **ethical principles**, address biases, and ensure informed consent. By actively engaging in these considerations, the full potential of **AI** can be harnessed to improve patient outcomes without compromising the values of medicine.New SCLC Biomarkers Enable Advances in Precision Medicine Approaches

New SCLC Biomarkers Enable Advances in Precision Medicine Approaches

A groundbreaking study published in Volume 15 of Oncotarget on October 11, 2024, titled “Relationship between the expressions of DLL3, ASC1, TTF-1 and Ki-67: First steps of precision medicine at SCLC” showcases pivotal advancements in the fight against small cell lung cancer (SCLC). Spearheaded by the Federal University of Ceará in Brazil, along with institutions from Argentina and Spain, the research uncovers new biomarkers that may revolutionize treatment strategies for one of the most challenging forms of lung cancer.SCLC, responsible for 15% of lung cancer cases, is notorious for its aggressive progression and limited treatment options, with a daunting five-year survival rate below 5%. However, the tide may be turning as precision medicine begins to tailor therapies to an individual’s unique tumor profile, significantly improving patient outcomes.

The researchers, including Samuel Silva and Juliana C. Sousa, delved into tumors from 64 SCLC patients. Their analysis utilized both traditional methods and innovative digital pathology software, QuPath, which allowed for a nuanced evaluation of tumor morphology. This led to the identification of key biomarkers such as Delta-like ligand 3 (DLL3) and Thyroid transcription factor-1 (TTF-1) as promising targets for new treatments.

Interestingly, DLL3 was detected in over 70% of the samples, suggesting therapies like Tarlatamab could be effective. TTF-1’s presence was linked to better survival rates, highlighting its potential as a critical prognostic marker. These findings suggest a bright future where therapies are not only more effective but also individualized to fit the patient’s specific cancer profile.

The study is a testament to the power of multidisciplinary collaboration and technological innovation in medical research. Accessing the full study and further details on biomarkers can be facilitated through the provided DOI link or learn more about what defines a biomarker.

For further reading on medical research and conditions, visit News-Medical’s sections on Medical Research News and Medical Condition News.

This study is poised to set a new precedent in the realm of personalized cancer therapy, marking an important milestone in the ongoing battle against SCLC.

The Remote Work Revolution: Redefining Real Estate

The Remote Work Revolution: Redefining Real Estate

Imagine a morning where the commute is just a few steps from your bedroom to your home office. This is the reality for many in today’s post-pandemic world, where remote work has become a staple of the modern workforce. As we look ahead to 2025, projections suggest that 22% of the American workforce will continue to embrace this work-from-home model. This shift is not just changing how we work but also where we choose to live.Changing Housing Preferences

The demand for spacious homes is on the rise. Homebuyers are now seeking properties that offer dedicated areas for work, leisure, and family life. Features such as additional bedrooms, home offices, and expansive backyards are more sought after than ever. This trend is transforming homes into multifunctional spaces, balancing efficiency with comfort.Urban Exodus and the Suburban Surge

An intriguing trend is the move away from bustling urban centers to more affordable suburban and rural areas. Recent studies highlight a significant uptick in demand for housing in smaller towns, as remote workers capitalize on the freedom to live without the constraints of a daily commute. The data underscores this shift, with suburban and rural homes experiencing notable price increases. For a deeper dive into these trends, visit the original article.Impact on Rental Markets

The rental market is not immune to these changes. Many renters are now considering locations previously deemed less desirable due to high urban rents. Areas in the Midwest and South are witnessing a surge in rental applications, driven by the remote work boom.Ownership vs. Renting: A Changing Dynamic

The allure of homeownership is growing, particularly among millennials and Gen Zers. With the flexibility to choose their living environment, many are opting to invest in homes, tapping into the benefits of equity. Meanwhile, renters are prioritizing higher-quality housing equipped with essential office infrastructure, such as fiber optic internet and home offices.Challenges of Affordability

Despite these trends, affordability remains a pressing concern. Rising home prices and increasing mortgage rates can be barriers for potential buyers. This has led to innovative financing solutions, such as co-buying among families, to navigate the fluctuating market.Commercial Real Estate: A New Landscape

The rise of remote work is also reshaping the commercial real estate sector. Companies are reevaluating their office space needs, leading to a shift toward flexible working environments. This transition could pave the way for collaborative coworking spaces, allowing businesses to maintain a presence in urban centers while offering employees a choice of flexible workspaces.Looking Ahead

As remote work continues to influence the housing market, several outcomes are anticipated:- Continued demand for space in suburbs and smaller cities.

- Growth of hybrid work models, impacting housing market dynamics.

- Increased infrastructure investments in suburban areas.

Adapting to the New Era

Understanding these shifts is crucial for anyone involved in real estate. Whether you’re a buyer, seller, or agent, staying informed about these evolving preferences is essential. Consider market trends when pricing properties, offer features that appeal to remote workers, and remain adaptable in this rapidly changing landscape.ALSO READ:

- Housing Market Predictions for Next 5 Years (2024-2028)

- Housing Market Predictions for the Next 2 Years

- Housing Market Predictions: 8 of Next 10 Years Poised for Gains

- Housing Market Predictions: Top 5 Most Priciest Markets of 2024

- Real Estate Forecast Next 5 Years: Top 5 Future Predictions

- Housing Market Predictions for 2027: Experts Differ on Forecast

CRISPR: The Future of Gene Editing and Its Clinical Implications

CRISPR: The Future of Gene Editing and Its Clinical Implications

In a groundbreaking development, CRISPR technology has become the frontrunner in genome editing, surpassing earlier methods like zinc finger nucleases and transcription activator-like effector nucleases. The recent approval by the FDA of the CRISPR-Cas9 drug, exa-cel, marks a significant milestone in clinical applications, particularly for treating sickle cell disease and transfusion-dependent beta thalassemia.Advancements in CRISPR Technology CRISPR technology is diverse, with various methods tailored for specific applications. CRISPR-Cas9, derived from the immune system of Streptococcus pyogenes, acts as molecular scissors to cut DNA at precise locations. Other variants, such as CRISPR-Cas12 and CRISPR-Cas3, offer unique advantages, including shorter guide RNA requirements and extensive DNA removal capabilities, respectively. Meanwhile, CRISPR-Cas13 targets RNA, opening avenues for treating viral infections like influenza and SARS-CoV-2.

Clinical Trials and Therapeutic Potential The approval of exa-cel, developed by Vertex Pharmaceuticals and CRISPR Therapeutics, is based on promising phase 3 trial data, where a majority of patients with sickle cell disease and beta thalassemia showed significant improvement. Other companies, such as Editas Medicine and Beam Therapeutics, are also exploring CRISPR’s potential in treating these blood disorders through innovative approaches like base editing.

Beyond blood diseases, CRISPR is being trialed for urinary tract infections, hereditary transthyretin amyloidosis, and hereditary angioedema. For instance, Locus Biosciences is conducting trials using CRISPR-Cas3 to tackle antibiotic-resistant UTIs, while Intellia Therapeutics is pioneering therapies for genetic diseases using lipid nanoparticles for systemic delivery.

Expanding Horizons: Cardiovascular and Metabolic Diseases CRISPR’s application extends to cardiovascular diseases, with Verve Therapeutics testing gene editing treatments for familial hypercholesterolemia. In type 1 diabetes, CRISPR Therapeutics is exploring gene-edited pancreatic cells to potentially eliminate the need for lifelong immunosuppression.

Challenges and Ethical Considerations Despite these advancements, challenges remain, particularly concerning the high costs of CRISPR therapies and the regulatory frameworks required to ensure safety and efficacy. Ethical considerations, especially those involving heritable genetic changes, necessitate careful oversight.

As the landscape of gene editing evolves, the focus will be on making these transformative therapies accessible and affordable. The original article from Endocrinology Advisor provides a comprehensive overview of these developments, highlighting the potential of CRISPR to revolutionize medical treatments and improve human health outcomes.

AI Revolution in Oncology: Transformative Potential or Overhyped?

The AI Revolution in Oncology: Transformative Potential or Overhyped?

In recent years, artificial intelligence (AI) has emerged as a revolutionary tool in the field of oncology. While initial fears suggested a nearing AI bubble, experts like Ghazenfer Mansoor of Technology Rivers clarify that it’s a misalignment of expectations versus actual industry contributions. AI’s integration into healthcare transcends buzzwords, transforming cancer diagnosis, treatment personalization, and drug discovery.

AI in Cancer Detection

Ryan Schoenfeld of the Mark Foundation for Cancer Research emphasizes AI’s leap in oncology diagnostics, particularly in radiology. AI’s precision and speed in analysis can enhance early cancer detection. In contrast, Philip Lieberman of Analog Informatics notes AI’s consistency over human capability, especially in underserved or rural areas. Jeffery Sorenson highlights AI’s prowess in predictive medicine, surpassing traditional diagnostic goals.

For example, Mayo Clinic has pioneered a hypothesis-driven AI tool improving cancer diagnostics by integrating clinical, radiology, and genomic data. As a result, AI-enhanced precision in treatment strategies is becoming more evident, as exemplified by liquid biopsy advancements at Weill Cornell Medicine and Johns Hopkins, which have marked improvements in earlier cancer detection.

AI in Drug Discovery and Development

AI is also a game-changer in drug discovery. Tools like DeepMind’s AlphaFold have accelerated the identification of novel cancer therapeutics. AlphaFold’s prediction of over 200 million proteins has profoundly influenced oncology research. Moreover, drugs like BBO-8520 and collaborations between Evotec and Exscientia have reached trial phases much faster due to AI’s efficiency.

Movements Toward Precision Oncology

AI’s capacity to create highly personalized treatments, as described by Jason Williams, could surpass traditional methods. Multi-faceted data integration, including genetics and tumor profiling, allows AI to craft individualized treatment plans. Recent studies from Oxford University and Evaxion Biotech demonstrate AI’s capability in creating adaptive therapies and personalized vaccines.

Challenges and Future Prospects

Despite its potential, deploying AI in oncology faces regulatory hurdles and ethical considerations, particularly around data bias and transparency. The evolution of regulations, like the European Commission’s AI Liability Directive and FDA’s AI/ML plan, remains a work in progress. Ghazenfer Mansoor stresses the need for regulatory frameworks that encourage innovation without stifling progress.

Looking Forward

Industry experts are optimistic about AI’s trajectory in oncology. Areas such as predicting immune responses, designing therapeutic proteins, and leveraging large language models for analytics hold significant promise. The fusion of AI with biological computing may streamline and personalize cancer treatment, promising a brighter future in oncology as we refine AI’s potential to truly revolutionize cancer care.

The AI revolution in oncology is here, and while tempered expectations may facilitate a more sustainable integration, the road ahead is undeniably transformative.

AI in Radiology: A Double-Edged Sword

AI in Radiology: A Double-Edged Sword

The rapid advancements in artificial intelligence (AI) are transforming the landscape of radiology, promising to enhance diagnostic accuracy and support personalized medicine. However, as this technology becomes more integral to medical imaging, it brings with it a host of ethical and societal considerations that cannot be ignored.

The Promise of AI

AI technologies, particularly those employing machine learning (ML) and deep learning (DL), are being hailed for their potential to improve predictive analytics and diagnostic performance. Studies, such as those by McKinney et al., have demonstrated AI’s ability to outperform human experts in tasks like breast cancer screening. This has sparked excitement about AI’s role in advancing healthcare and promoting health equity.

Challenges and Ethical Concerns

Despite the hype, the implementation of AI in healthcare lags behind its technological development. As noted in the article, “The state of AI hype has far exceeded the state of AI science.” This gap highlights several ethical concerns, including transparency, accountability, and potential biases in AI systems. The “black box” nature of many AI algorithms raises questions about their decision-making processes and the implications for patient care.

Bias and Responsibility

A major concern is the potential for AI systems to perpetuate or even amplify existing biases in healthcare. The article references works such as those by Mittelstadt and Floridi, which discuss the ethical foresight needed to address these issues. Ensuring that AI tools are developed and deployed with fairness and justice in mind is crucial to avoid exacerbating healthcare disparities.

Guidelines for Ethical AI

To navigate these challenges, robust ethical guidelines are essential. Initiatives like FUTURE-AI, as discussed by Lekadir et al., aim to align technological advances with ethical standards. These guidelines emphasize principles such as explainability, trustworthiness, and accountability, ensuring that AI systems serve the common good.

Looking Forward

As AI continues to evolve, its integration into radiology and healthcare must be guided by interdisciplinary research and a deep understanding of its societal implications. The article underscores the need for a shift from focusing solely on technological advancements to considering the broader context in which AI operates.

In conclusion, while AI holds great promise for the future of radiology, it is imperative that its development and deployment are approached with caution and a commitment to ethical integrity. By doing so, we can harness the power of AI to create more equitable and effective healthcare systems.

Humanity at the Crossroads: Ethical Implications of AI in Medicine

Humanity at the Crossroads: Ethical Implications of AI in Medicine

The integration of artificial intelligence (AI) in healthcare has ushered in a new era of medical advancements, but not without raising significant ethical concerns. As AI systems become more prevalent in fields like radiology, emergency medicine, and telehealth, the challenge lies in addressing fundamental issues such as patient consent, data privacy, and implicit biases that these technologies often overlook.Unraveling the Bias in Algorithms

AI’s promise in healthcare is undeniable, with its ability to uncover hidden disease patterns and predict illnesses. However, the reliance on historical data can exacerbate existing biases, particularly affecting marginalized communities such as the LGBTQIA+ and certain ethnic and racial groups. As highlighted in the article, addressing these biases during the initial implementation phase is crucial to enhancing outcomes more effectively than traditional methods.

Despite the importance of this issue, a study by du Toit et al. revealed that many peer-reviewed articles fail to address algorithm biases adequately. Out of 63 articles on hypertension, none tackled the bias issue, underscoring the need for healthcare and AI professionals to develop stringent measures to identify and rectify such biases.

Empowering Patients Through Informed Consent

Patient autonomy remains a cornerstone of medical ethics, especially in the AI era. Older patients with multiple chronic conditions often express skepticism toward AI-based modalities. An ethical AI system must ensure that these patients are informed about the benefits and have the option to opt out. Transparency in this process fosters trust and addresses concerns about data security and privacy.

Responsible Deployment of AI Technologies

Regulatory bodies like the U.S. Food and Drug Administration (FDA) play a pivotal role in the ethical deployment of AI in healthcare. Establishing comprehensive guidelines and conducting frequent assessments are essential to maintaining transparency and accountability. The article emphasizes the need for a dynamic regulatory framework to prevent AI misuse and ensure patient welfare.

Liability Concerns and AI Hallucinations

Liability concerns present a complex challenge in the event of adverse outcomes. While physicians hold primary responsibility for AI technology selection, manufacturers must also ensure product safety and efficacy. The emergence of AI-specific liability insurance offers a novel solution to managing malpractice claims.

Moreover, healthcare providers must address AI hallucinations—AI-generated misinformation not based on real data. Recognizing the limitations of AI and its inability to replace personalized care is crucial.

Emotions and the Ethical Use of AI in Healthcare

AI’s impact on patient emotions is significant. The introduction of AI-powered diagnostic tools can lead to increased patient distress if not communicated empathetically. Ensuring equity and fairness in AI algorithms is imperative to prevent biases that affect emotional well-being.

Preserving the empathetic human connection in an AI-driven healthcare landscape is paramount. While AI can streamline tasks, it cannot replace the irreplaceable role of human healthcare practitioners in addressing emotional needs.

As AI continues to transform healthcare, it is vital to prioritize ethical considerations. By actively engaging in ethical discussions, the healthcare industry can harness AI’s full potential to improve patient outcomes while upholding the values of medicine.

The Future of Telemedicine: Challenges and Opportunities Beyond the Pandemic

Dr. Mehrotra, a key figure among policymakers and researchers, is at the forefront of ensuring that telemedicine remains a viable option in the healthcare arsenal. The challenge is to integrate this technology without escalating costs, diminishing the quality of care, or overshadowing the indispensable role of in-person consultations.

Adapting to Change

Telemedicine’s meteoric rise during the pandemic was facilitated by flexible rules from both government and private insurers. Although the urgency of the pandemic has waned, the demand for telemedicine persists. Advances in technology, shifting preferences among patients and doctors, and new legislative frameworks have all contributed to this ongoing demand.However, the path forward is fraught with questions. What are the best practices for telemedicine? How should it be integrated into the broader U.S. healthcare system? These questions are critical as we consider the impending expiration of certain Medicare and Medicaid policies in December 2024.

Medicare Telehealth Services

For Medicare, the decision to extend, amend, or extinguish telemedicine access is a delicate balancing act between costs and benefits. Dr. Mehrotra’s research, published in Health Affairs, offers a comprehensive analysis of telemedicine’s impact on a national scale. His findings suggest that the temporary rules facilitating remote healthcare should become permanent, given the modest increase in spending and improved access to care.Cost-Benefit Analysis for U.S. Health Systems

In 2021 and 2022, health systems with high telemedicine use saw a 2.2% increase in visits but a 2.7% decrease in non-COVID-19 emergency visits. While spending increased slightly, patients were more compliant with medication regimens for chronic conditions. These insights reinforce the value of telemedicine, a sentiment echoed in studies on mental health and pediatrics.Protecting In-Person Practices, Preserving Access to Care

In his testimony before Congress, Dr. Mehrotra recommended lower payment rates for telehealth visits compared to in-person visits, to ensure the competitiveness of traditional practices. He also advocated for the removal of in-person visit requirements for mental health telemedicine appointments, recognizing the shift to virtual-only practices among many clinicians.Telemedicine Care Across State Lines

One of the thorniest issues is the restriction on telemedicine across state lines. Current regulations often prevent patients from accessing care from their regular doctors when out of state. Dr. Mehrotra’s work highlights the need for federal laws to allow telemedicine across state borders, safeguarding the continuity of care.New Ways of Practicing Medicine

The evolution of telemedicine is not just about video calls. It’s about reimagining how care is delivered, whether through secure messaging or remote monitoring technologies. As Dr. Mehrotra points out, the challenge lies in navigating these advances to enhance patient care while ensuring fair compensation for providers. As we stand on the cusp of a new era in healthcare, the potential of telemedicine is immense. But to realize this potential, we must establish the right rules and frameworks. The stakes are high, but the promise of a more accessible, efficient healthcare system is within reach.

As we stand on the cusp of a new era in healthcare, the potential of telemedicine is immense. But to realize this potential, we must establish the right rules and frameworks. The stakes are high, but the promise of a more accessible, efficient healthcare system is within reach.The Digital Healthcare Revolution: Transforming Patient Care with Technology

The global digital health market is set to skyrocket, with projections estimating it will reach $551.09 billion by 2027. This growth is fueled by innovations that are setting new benchmarks in healthcare delivery.

Telehealth: A Game Changer in Healthcare

**Telehealth** has emerged as a pivotal player in the healthcare industry, especially during the COVID-19 pandemic. According to the U.S. Centers for Disease Control and Prevention, there was a 154% increase in telehealth visits during the last week of March 2020 compared to the same period in 2019. This surge highlights telehealth’s scalability and versatility in meeting diverse healthcare needs.

The impact of **telehealth** is particularly significant in mental health services, where virtual care has provided continuous support to patients, especially those in remote areas. The original article emphasizes the transformative role telehealth is playing across various sectors.

Beyond Healthcare: Cross-Industry Applications

**Telehealth’s influence** extends beyond traditional healthcare boundaries. In education, telehealth platforms are bridging the gap between medical knowledge and practical application, enhancing the clinical skills of medical students. In the corporate world, telehealth is being integrated into wellness programs, offering employees convenient access to health services, which in turn boosts productivity and reduces costs.

Revolutionizing Healthcare Operations with No-Code and Low-Code Platforms

The integration of **No-Code (NC)** and **Low-Code (LC)** platforms is revolutionizing healthcare operations. These platforms allow for the swift development and deployment of digital solutions, making technology more accessible to healthcare providers. This efficiency is crucial in rapidly evolving healthcare scenarios, such as during pandemics.

Studies have shown that **NC** and **LC platforms** can reduce application development costs by up to 20%, offering significant financial benefits to healthcare organizations.

Personalized Telehealth: Enhancing Patient Experience

Customizing **telehealth services** to cater to individual patient needs significantly enhances the healthcare experience. Personalized telehealth interventions have been shown to improve patient satisfaction and engagement, particularly in chronic disease management. This tailored approach not only improves outcomes but also fosters patient loyalty and trust.

The Future of Healthcare: Technological Integration

As we look to the future, **AI-driven diagnostics** and **wearable technology** are poised to redefine the healthcare landscape. **AI** is expected to revolutionize diagnostic accuracy and treatment efficacy, while wearable devices offer real-time patient monitoring, particularly for chronic conditions like diabetes and heart disease.

These technological advancements underscore the importance of equitable access to digital health, as emphasized by the World Health Organization. The healthcare industry is on the brink of a new era, where technology is central to creating a healthier, more connected world.

University of Pennsylvania Pioneers the Planetary Health Curriculum

Dr. Hussain, who originally found her passion for environmental advocacy during her undergraduate studies with sea anemones, has become a trailblazer in integrating **environmental considerations** into **medical education**. Inspired by the stark evidence presented in the Intergovernmental Panel on Climate Change’s reports, Hussain realized the importance of aligning her medical career with ecological preservation.

The curriculum, launched in 2022, enjoys growing momentum, reflecting a broader trend in **medical education** as institutions like Harvard Medical School and Stanford University’s School of Medicine adopt similar programs. The educational content is seamlessly woven into existing courses at PSOM, where students learn about the direct implications of **climate changes**—such as extreme weather and pollution—on **human health** alongside traditional medical subjects.

Aside from core courses, PSOM continues to offer specialized classes like the **Climate Change and Health elective**, examining the differential impact of environmental changes on vulnerable populations and their healthcare outcomes. This elective delves into how shifts in the ecosystem can influence disease prevalence and respiratory health.

Collaboration is Key

A crucial component of this educational initiative is collaboration. Under Hussain’s guidance, PSOM’s students and faculty collaborate to integrate **climate-awareness** in various medical disciplines, from Psychiatry to Pulmonology, ensuring that students are well-prepared to tackle these challenges in their professional lives.

Additionally, the thriving student-led **Healthcare Sustainability Group** leads efforts in pushing beyond classroom learning. Their projects aim to transform healthcare operations, such as creating greener operating rooms, thus reducing the **environmental footprint** of healthcare services.

From Classroom to Clinical Practice

The curriculum’s next phase will broaden its scope from classroom learning to practical applications during clinical rotations, preparing students to engage with patients directly on **environmental factors** affecting health and advocating for systemic changes.