Hurricane Helene’s Impact on the Southeast: A Real Estate Perspective

Hurricane Helene’s Impact on the Southeast: A Real Estate Perspective

As hurricane season descends upon the Southeast, residents are grappling with the aftermath of Hurricane Helene. This formidable storm made landfall as a Category 4 hurricane, with wind speeds reaching an alarming 140 mph, before it was downgraded to a tropical storm. The initial impact was felt in Florida’s Big Bend area, near Tallahassee, as Helene unleashed its fury on Thursday night.

By Friday morning, Helene had moved into northeast Georgia, near the South Carolina border, with sustained winds of 45 mph, according to the National Hurricane Center. In response to the devastation, Florida Governor Ron DeSantis declared a state of emergency for 41 of the state’s 67 counties.

Fatalities and Damage

The human toll has been tragic. Georgia Governor Brian Kemp reported at least 11 fatalities in the state, with numerous residents trapped in their homes. Additional deaths were confirmed in Florida, North Carolina, and South Carolina, bringing the total to at least 17 lives lost.

The full extent of the damage is yet to be determined, but it is expected to be substantial. CoreLogic estimates that 25,000 homes along Florida’s Gulf Coast are at risk of flooding, with potential financial losses reaching $5.6 billion. Meanwhile, Moody’s projects that 162,000 commercial properties, valued at a staggering $425 billion, face significant wind damage risks.

Insurance Challenges

Florida homeowners are already contending with rising insurance premiums, exacerbated by the storm’s impact. According to a report by S&P Global, insurance rates in Florida surged by 43% between 2018 and 2023, with residents paying nearly $6,000 annually—more than triple the national average.

Despite the high recovery costs, Mark Friedlander of the Insurance Information Institute remains optimistic. He believes insurers are well-prepared to handle claims related to Helene, thanks to adequate levels of reinsurance and recent legislative reforms that have bolstered their financial positions.

Legislative Reforms

Florida lawmakers have enacted reforms aimed at reducing property insurance premiums by $500 million statewide. These measures include eliminating certain taxes and fees on policies and allocating $200 million for home reinforcement grants, prioritizing low-income and senior households. Additionally, a pilot program has been established for condominium associations to apply for mitigation grants.

The Wall Street Journal highlights that home insurance expenses are influenced by population growth patterns, with South Carolina, Florida, and Texas being the fastest-growing states, making them more susceptible to natural disasters.

For more detailed insights, you can read the original article on HousingWire.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

More Articles

Getting licensed or staying ahead in your career can be a journey—but it doesn’t have to be overwhelming. Grab your favorite coffee or tea, take a moment to relax, and browse through our articles. Whether you’re just starting out or renewing your expertise, we’ve got tips, insights, and advice to keep you moving forward. Here’s to your success—one sip and one step at a time!

Fort Collins Housing Market: A Balancing Act in 2025

Fort Collins Housing Market: A Balancing Act in 2025

The Fort Collins housing market is currently experiencing a fascinating transition, marked by a slight cooling trend. While this might sound ominous, it’s far from a freefall. According to a recent report from Norada Real Estate Investments, the market remains vibrant, with increased inventory and a mixed bag of price changes across different property types.

In December 2024, Fort Collins saw a remarkable 46.4% increase in single-family home sales compared to the previous year. This surge suggests a robust demand even during the typically slower winter months. Meanwhile, sales of townhouses and condos also rose, albeit at a more modest rate.

Price Trends: A Tale of Two Markets

The market is showing diverging price trends. The median sales price for single-family homes increased by 1.7%, whereas townhouses and condos experienced a 4.4% decrease. Despite a decline in average prices for both property types in December, single-family homes recorded a year-to-date price increase. This indicates a preference for more spacious, detached homes among buyers.

Inventory and Market Balance

The housing supply paints a picture of contrasting trends. There was a 5.4% decrease in single-family home listings, while townhouses and condos saw a 7.3% increase in listings. This shift might introduce more balance into the market, although both categories still reflect a seller’s market due to lower-than-average inventory levels.

Market Dynamics and Buyer Power

Market dynamics such as extended days on market and sellers receiving 98-99% of list prices suggest that buyers have gained slightly more negotiating power. The affordability index indicates a decline in affordability for single-family homes but a slight increase for townhouses and condos.

Looking Ahead: Steady Growth Predicted

Expert forecasts anticipate a 1% rise in Fort Collins home values by the end of 2025, reflecting a stable growth trajectory. This aligns with moderate predictions for other Colorado cities, as detailed in the Colorado Housing Market Predictions 2025. Despite fears of a market crash, Fort Collins remains stable, with gradual price increases expected.

With its strong rental market and favorable regulatory environment, Fort Collins continues to be a compelling choice for real estate investors. For those considering an investment, the city’s robust market fundamentals, diverse housing options, and proximity to Denver make it an attractive prospect.

Conclusion

While the Fort Collins housing market is no longer the frenetic seller’s paradise it once was, it remains a dynamic and promising environment for both buyers and investors. As the market continues to evolve, keeping a close eye on these trends will be crucial for making informed real estate decisions.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

Hard Money Lenders Arizona Expands Real Estate Investment Programs

Hard Money Lenders Arizona Expands Real Estate Investment Programs

In a significant move to bolster Arizona’s thriving real estate market, Hard Money Lenders Arizona has announced an expansion of its loan programs, offering enhanced support to local investors. The private loan provider, under the leadership of CEO and founder Michael Iuculano, is introducing new Development and Acquisition financing solutions tailored to meet the evolving needs of developers and real estate investors in the region.Arizona’s real estate market has seen a surge in demand for accessible and flexible financing solutions, enabling investors to capitalize on the growing opportunities. Recognizing this trend, Hard Money Lenders Arizona has crafted innovative financing options that streamline the investment process, allowing investors to secure funding swiftly and efficiently.

Michael Iuculano commented on the expansion, stating, “We understand the challenges that real estate investors face when it comes to securing funding for their ventures, especially in a competitive market.” He further added, “With our expanded loan programs, we’re in a great position to provide quick and reliable financing solutions that enable investors to seize opportunities and develop successful projects.”

The expanded loan programs offer several key benefits for investors:

- Flexible Loan Terms: Each loan is designed to meet the specific needs of unique projects, providing more flexibility than traditional financing options.

- Fast Approval Process: Lending decisions are typically made within 24 to 48 hours, streamlining the application timeframe.

- Competitive Rates: Loans are offered at competitive rates, with fewer paperwork requirements, expediting the approval process.

Hard Money Lenders Arizona has established a reputation for high-quality financial services, supporting both seasoned investors and newcomers. The company’s commitment to local investors is evident in its efforts to bolster the region’s economy by facilitating market entry and funding for both commercial and residential property development.

For more information, visit the original article on GlobeNewswire.

About Hard Money Lenders Arizona

Hard Money Lenders Arizona is a leading provider of hard money loans based in Arizona. The company focuses on speed, simplicity, and expertise, offering fast and flexible financing solutions for real estate investors, fix-and-flip investors, and other borrowers requiring quick capital access.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

10 Mindset Shifts for Thriving in Real Estate

The real estate industry is akin to a thrilling rollercoaster ride, where agents find themselves soaring with successful deals one moment, only to confront unforeseen challenges the next. In such a dynamic field, cultivating a resilient mindset is not just beneficial—it’s essential. As we step into a new year, embracing strategies that foster growth and adaptability can be the key to thriving in this unpredictable landscape.

1. Embrace a Growth Mindset

Believing in the potential for growth through learning and experience is the cornerstone of a growth mindset. This attitude encourages resilience and openness to feedback, turning setbacks into stepping stones. When a deal doesn’t pan out as expected, reflect and learn from it. This approach not only strengthens your career foundation but also opens doors to new opportunities.

2. Set Clear Goals

Setting clear and achievable goals can transform overwhelming targets into manageable tasks. Break down your annual objectives into quarterly, monthly, or even weekly milestones. This method not only keeps you motivated but also allows for strategic adjustments along the way. For more guidance, explore An Agent’s Guide to Goal-Setting.

3. Visualize Your Success

Incorporating visualization into your morning routine can set a positive tone for the day. Spend a few moments picturing a successful day, from smooth client meetings to closing deals. This practice can boost your confidence and focus.

4. Learn from Failures

Failures are inevitable but serve as powerful teachers. Instead of moving on quickly, analyze what went wrong and how you can improve. Each setback provides valuable lessons, enhancing your strategic and resilient capabilities.

5. Turn Challenges into Opportunities

Adopt an abundance mindset by viewing challenges as opportunities. A tough market might push you to explore new strategies or niches. This perspective shift can inspire creative solutions and uncover hidden opportunities.

6. Step Outside Your Comfort Zone

Growth happens outside the comfort zone. Experiment with new marketing tactics or attend unfamiliar networking events. Embrace the excitement of the unknown to unlock potential and expand your professional network.

7. Seek Mentorship

A mentor can provide invaluable guidance and insights. Learning from someone with experience can accelerate your growth and help you avoid common pitfalls. Consider finding a mentor through the NAR Spire Program.

8. Celebrate Success and Practice Gratitude

Recognize and celebrate your achievements, no matter how small. This practice boosts motivation and fosters a positive work environment. Additionally, expressing gratitude towards clients and colleagues can strengthen relationships.

9. Commit to Continuous Learning

The real estate industry is ever-evolving, and staying ahead requires a commitment to continuous learning. Attend workshops, listen to industry podcasts, or enroll in online courses to enhance your knowledge and skills.

10. Build Strong Relationships

Success in real estate is built on strong relationships. Use a CRM tool to keep track of important dates and maintain regular contact with clients. Consistently adding value to your network will ensure long-term support and success.

Long-Term Achievements through Positive Mindset Shifts

Adopting these mindset strategies can lead to significant, long-term achievements in your real estate career. Commit to these practices and witness how they transform your business in the coming year. For more insights, visit the agent resource center.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

Oyssey: A New Dimension in Real Estate

Oyssey: A New Dimension in Real Estate

A groundbreaking real estate platform is redefining how homebuyers explore potential neighborhoods. Oyssey, a tech startup now available in South Florida and New York City, provides unprecedented insights into neighborhood dynamics, including political affiliations, based on election results and campaign contributions.

Beyond the Basics: Socially Informed Decisions

The platform is tailored for today’s discerning buyers, who are increasingly interested in the values of their potential neighbors, as much as they are in property features. As Huw Nierenberg, CEO of Oyssey, explains, “It’s about getting buyers homes that they love.” The platform’s functionality extends beyond mere property listings, offering a comprehensive view of neighborhood demographics and housing trends.Oyssey operates as a one-stop shop for homebuyers, streamlining the process from browsing listings to signing contracts and communicating with agents, all while integrating block-by-block political and consumer data. This innovation is particularly timely, given the recent shakeup in the real estate industry, where buyers must now sign contracts with agents and negotiate commission fees upfront.

The Social Impact: A Double-Edged Sword

While Oyssey aims to empower buyers with data-driven insights, it also raises concerns about further deepening societal divides. One industry insider warns, “We are already becoming increasingly polarized as a nation; I fear this could further deepen it.”The platform’s launch is a strategic move to capitalize on evolving buyer priorities and industry changes. By offering political transparency, Oyssey provides a competitive edge for agents and a sense of belonging for buyers seeking like-minded communities.

The Future of Real Estate

As Oyssey continues to expand, its impact on the real estate landscape will be closely watched. The platform’s innovative approach to integrating political and consumer data with real estate tools is set to redefine how buyers and agents navigate the home-buying process.CSS Styling: “`css h3 { color: #b40101; font-weight: bold; } h4 { color: #b40101; font-weight: bold; } p { margin-bottom: 15px; } img { margin: 15px 0; display: block; max-width: 100%; height: auto; } “`

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

Seattle’s Bold Plan to Revolutionize Housing

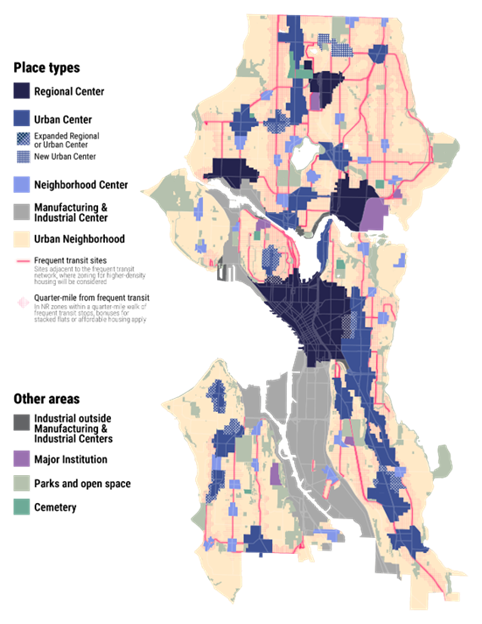

The plan, a visionary initiative to dramatically expand housing opportunities, is designed to address the pressing issues of affordability and availability in urban areas. With a target to increase Seattle’s housing capacity to over 330,000 units, the proposal is a response to current cost pressures and anticipated population growth. Mayor Harrell emphasized the importance of this once-in-a-decade opportunity to update Seattle’s Comprehensive Plan, allowing the city to meet its dynamic housing needs while centering core values of inclusivity and economic sustainability.

Key Components of the Update

- Diverse Housing Types: The integration of diverse housing types such as duplexes, triplexes, and quadplexes citywide aligns with recent legislative changes under HB 1110. This aims to diversify housing options in all neighborhoods, bringing much-needed family-sized and community-friendly housing closer to amenities and transit routes.

- Innovative Strategies: The plan introduces innovative strategies such as an Affordable Housing Bonus and expansion of the Mandatory Housing Affordability program, providing incentives for affordable housing development near frequent transit routes.

- Urban Centers and Neighborhood Centers: The introduction of new Urban Centers and the designation of 30 Neighborhood Centers aim to boost housing availability near transit hubs, making Seattle’s neighborhoods more accessible and vibrant.

Commitment to Community Protection

The plan underscores the city’s commitment to protecting existing communities through robust anti-displacement measures, ensuring that vulnerable and historically marginalized communities can remain in their neighborhoods. Strategic investments in community-driven projects and new legislation to prevent predatory home buying are pivotal elements to mitigate displacement.

Through these proposed changes, Mayor Harrell seeks to position Seattle as a leader in addressing urban housing challenges, creating a more equitable and accessible city environment for all residents. The City of Seattle has invited public feedback on the draft zoning maps, with in-person and online sessions scheduled until December 20, 2024.

The comprehensive update is supported by local officials, housing advocates, and community leaders who express optimism about the plan’s potential to transform Seattle into a more inclusive, affordable, and sustainable city.

Statements from Stakeholders

Representative Nicole Macri:

“I’m grateful for this plan which clearly addresses the escalating demand for increased and diverse housing across Seattle. It acknowledges the necessity to combat displacement risks for low-income and BIPOC communities, with a vision of affordable and accessible housing.”

Patience Malaba, Executive Director, Housing Development Consortium:

“The increase in zoning capacity is a critical step towards alleviating the housing shortage by providing a wider variety of homes in every neighborhood. This plan actively promotes equitable, livable communities, aligning with our shared vision of a welcoming and sustainable city.”

Mayor Harrell’s release of the Comprehensive Plan Update is a strategic step towards a more inclusive future, ensuring Seattle grows responsibly to meet the housing needs of its diverse residents.

Read the original article for more information.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

Commercial Real Estate: Navigating the Next Five Years

Commercial Real Estate: Navigating the Next Five Years

As the commercial real estate landscape continues to evolve, stakeholders are gearing up for a transformative journey over the next five years. The industry is poised at a critical juncture, influenced by economic shifts, technological innovations, and changing consumer preferences. Understanding these dynamics is essential for making informed strategic decisions.

Key Market Dynamics

- Remote Work and Office Spaces: The traditional office space is undergoing a significant transformation. With an increasing number of companies adopting flexible work arrangements, the demand for office spaces is projected to decline. According to the JPMorgan Chase report, offices in prime locations may outperform, but overall demand remains tepid.

- Retail Real Estate Adaptations: Retail spaces are reinventing themselves to keep up with the e-commerce boom. There’s a shift towards creating immersive experiences and integrating omnichannel strategies that blend online and offline shopping.

- Industrial Real Estate Boom: The rise of e-commerce is driving demand for warehouses and distribution centers. Companies are investing in expanding logistics hubs to meet delivery expectations, as highlighted by Statista’s market outlook.

- Sustainability Trends: Sustainability is no longer optional; it’s a necessity. Investors are gravitating towards properties that meet environmental standards. Green building certifications and energy-efficient systems are becoming essential.

- Economic and Technological Factors: The influence of interest rates, inflation, and economic growth cannot be overlooked. Technological innovations such as PropTech and smart buildings are reshaping the industry, as noted by Deloitte’s insights.

Market Outlook and Challenges

While opportunities abound in the commercial real estate sector, challenges such as market volatility, regulatory changes, and evolving workforce dynamics pose significant hurdles. Investors must remain agile, ready to pivot their strategies in response to these evolving conditions. The future promises a transformative phase, demanding strategic foresight and adaptability. Staying informed and responsive to changing work patterns, consumer behavior, and societal expectations will be crucial for thriving in this new commercial real estate paradigm.Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

The Coming Vacant Home Crisis in an Aging, Low Birth Rate Society

The Coming Vacant Home Crisis in an Aging, Low Birth Rate Society

Japan is facing an extraordinary housing crisis, not due to a lack of homes, but because of an overwhelming abundance of them. Currently, there are nine million vacant homes across the country, a figure that exceeds the population of New York City. These empty homes, known as akiya, are no longer just a rural issue but have become a common sight in bustling urban centers like Tokyo and Kyoto.As Japan grapples with this paradox, the world should take note. The issues of akiya and the demographic trends driving them are not unique to Japan. Countries globally are beginning to experience similar challenges due to low birth rates and an aging population. This shift threatens the vibrancy of even the most dynamic societies, leading to urban decay and reduced economic activity.

Unraveling Japan’s Vacant Home Dilemma

The demographic trends in Japan have been alarming for decades. The country, facing one of the steepest population declines in the developed world, saw a decrease of over 800,000 individuals in 2022 alone. This decline directly impacts the housing market, leading to an increase in vacant properties.Economically, tax policies inadvertently encourage property owners to leave homes empty rather than redevelop them. Socially, younger generations are moving to urban centers, leaving rural homes abandoned. This migration results in a generational disconnect from rural life, contributing heavily to the abandonment of these homes.

The Urban Spread and Changing Dynamics of Supply and Demand

The phenomenon of vacant homes has spread to urban centers, affecting cities like Tokyo and Kyoto. This shift complicates government efforts in housing market stabilization and urban planning. Jeffrey Hall, a lecturer at Kanda University of International Studies, notes that the rise in urban vacant homes is due to alarming demographic trends rather than an oversupply. Yuki Akiyama, a professor at Tokyo City University, highlights the safety risks these vacant homes pose, especially during natural disasters.Government and Community Challenges

The Japanese government faces significant hurdles in addressing vacant homes, especially in rural areas. Existing tax policies provide little incentive for owners to demolish or renovate unoccupied homes. Vacant properties also pose safety risks during natural disasters and stall regional development.Solutions and Innovations

Innovative solutions are being sought to mitigate the impact of vacant homes. Yuki Akiyama has developed an AI program to identify areas most vulnerable to akiya accumulation. Other solutions include adaptive reuse projects, tax incentives, and simplified ownership transfer laws.Internationally, Japan’s strategies could serve as a model for other nations facing similar demographic challenges. By looking both inward for innovative solutions and outward for international inspiration, Japan can better address the complex issue of vacant homes.

Addressing Japan’s Vacant Home Crisis in a Global Context

The vacant home crisis in Japan presents a multifaceted challenge with deep social, economic, and cultural implications. As Japan continues to confront these challenges, the situation presents critical lessons for the rest of the world. Many countries are beginning to experience similar demographic shifts, and Japan’s approach could serve as a valuable model.Japan’s experience with akiya is not just a national issue but a harbinger of global changes. How Japan navigates this crisis could provide valuable lessons for other countries soon to face similar issues, making it essential for global leaders to observe and learn from Japan’s innovations and responses.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

Exploring the Impact of AI on Real Estate

Artificial Intelligence (AI) is no longer just a buzzword—it is fundamentally reshaping industries worldwide, with the real estate sector being no exception. From leveraging predictive analytics to offering immersive virtual tours, AI is revolutionizing how properties are bought, sold, and managed. By processing vast amounts of data quickly and accurately, AI empowers buyers, sellers, and agents to make more informed decisions, ultimately creating a more seamless property transaction experience.

Artificial Intelligence (AI) is no longer just a buzzword—it is fundamentally reshaping industries worldwide, with the real estate sector being no exception. From leveraging predictive analytics to offering immersive virtual tours, AI is revolutionizing how properties are bought, sold, and managed. By processing vast amounts of data quickly and accurately, AI empowers buyers, sellers, and agents to make more informed decisions, ultimately creating a more seamless property transaction experience.

In this examination, we delve into AI’s transformative impact on the real estate industry and its future implications for property investment and management. This story is inspired by an insightful article from Substack.

Predictive Analytics for Smarter Decisions

AI employs historical and real-time data to forecast market trends, aiding investors and developers in making informed choices. For buyers and investors, AI-powered platforms analyze market conditions, property values, and neighborhood growth trends. Meanwhile, developers benefit from predictive models that suggest optimal locations and property types, ensuring their projects align with market demand.Virtual Tours and Enhanced Customer Experience

AI-driven virtual reality (VR) and augmented reality (AR) tools revolutionize property viewing, allowing buyers to explore homes remotely, thus saving time and reducing effort. Furthermore, AI enhances the virtual staging of properties, enabling potential buyers to visualize various layouts and designs.Chatbots and AI Assistants

AI-driven chatbots and virtual assistants improve customer service by providing immediate responses to inquiries. For agents and brokers, chatbots handle repetitive queries, freeing them to focus on closing deals. Buyers and renters enjoy 24/7 support, including property searches, viewing scheduling, and mortgage estimates.Property Valuation and Pricing

By analyzing market trends, property features, and comparable sales, AI algorithms provide precise property valuations. Sellers can set competitive asking prices, while buyers are ensured to not overpay by having insights into market data and predicted price trends.Fraud Detection and Risk Management

AI enhances security and reduces risks in real estate transactions. It detects fraud by identifying unusual patterns in data and assesses potential risks in investments, such as market volatility or environmental hazards, providing critical insights for investors.Streamlined Property Management

AI-powered tools bring efficiency to property management. Smart maintenance systems predict property conditions and maintenance needs, preventing costly repairs. Additionally, AI evaluates tenant applications, ensuring reliable renters are selected based on credit history and rental behavior.Some noteworthy examples of AI integration include Zillow’s AI-powered algorithms for property valuations, Compass’s use of AI in providing tools for pricing strategies, and OpenDoor’s streamlined home-buying and selling processes.

While AI offers significant opportunities, its widespread adoption faces challenges such as data privacy concerns, bias in algorithms, and the substantial investment required for technology integration. Looking ahead, AI’s role in real estate promises innovations like smart contracts, blockchain integration, and a shift toward AI-driven property development. The technology is expected to contribute to smarter cities, facilitate global real estate transactions, and promote sustainability through optimized energy management in properties.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

Divided Nation: Trump’s Second Term Begins with Controversy

Trump’s Second Term: Approval Ratings, Pardons, and Public Opinion

As Donald Trump begins his second term as President of the United States, a recent Reuters/Ipsos poll reveals a deeply divided nation. With an approval rating of 47%, Trump starts this term with a higher popularity than during most of his first tenure. This figure, however, is accompanied by significant discontent regarding some of his initial actions, particularly his decision to pardon individuals involved in the January 6, 2021, Capitol riot.Approval Ratings and Controversial Pardons

The poll, conducted just after Trump’s inauguration, highlights the contentious nature of his pardons. A substantial 58% of respondents opposed pardoning those convicted in connection with the Capitol siege. Despite this opposition, Trump proceeded to pardon nearly 1,600 individuals involved, including 14 leaders of the incident, mere hours into his second term. In contrast to these controversial pardons, Trump’s handling of immigration issues garnered a more favorable response. Approximately 46% of respondents approved of his approach, with many Americans expressing a desire for immigration reform to be prioritized by the new administration. A notable 58% agreed with reducing the number of migrants allowed to claim asylum at the U.S. border, reflecting support for Trump’s early actions to restrict immigration.Polarization and Political Dynamics

Trump’s approval ratings, while higher than those of his first term, remain historically low compared to other U.S. presidents who typically begin their terms with approval ratings above 50%. As political analyst Jacob Rubashkin points out, Trump’s ratings are “roughly in line with what we saw in the first term,” indicating a persistent polarization within the American public. The survey also highlights the stark partisan divide, with 91% of Republicans approving of Trump’s leadership and 84% of Democrats disapproving. This division mirrors the political landscape during Joe Biden’s presidency, which saw similar challenges in garnering bipartisan support.International Ambitions and Public Sentiment

Trump’s return to office brings with it potential shifts in international relations. However, the poll suggests limited public support for his more ambitious plans, such as acquiring Greenland from Denmark or regaining control of the Panama Canal. Only 16% of respondents supported the idea of pressuring Denmark to sell Greenland, and a mere 21% believed the U.S. should expand its territory in the Western Hemisphere. These findings indicate that while Trump may focus on satisfying his core supporters, broader public opinion remains skeptical of his territorial ambitions. As public opinion expert John Geer notes, second-term presidents often prioritize their legacy over popular opinion, suggesting that Trump may continue to pursue policies aligned with his “Make America Great Again” movement.Conclusion and Future Prospects

As Trump navigates his second term, the challenges of maintaining a balanced approach between satisfying his base and addressing broader national and international concerns will be crucial. His initial actions have already sparked significant debate and opposition, but they also highlight the enduring support among his most ardent followers. Moving forward, Trump’s ability to manage these dynamics will likely define the success of his presidency and its impact on both domestic and global affairs. For those interested in following these developments, the Reuters Politics U.S. newsletter offers weekly insights and analysis on how U.S. politics influence the world.Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

Time for a Change? Signs Your Property Management Needs an Overhaul

Time for a Change? Signs Your Property Management Needs an Overhaul

As the year draws to a close, property owners may find themselves reflecting on the effectiveness of their management companies. David Crown, CEO of L.A. Property Management Group, recently shared insights on when it’s time to consider a change in management. His article, published on Forbes, highlights three critical signs that it might be time to seek new management in 2025.

1. Poor Communication and Responsiveness

Effective communication is the bedrock of any successful property management relationship. When communication falters, property owners can feel left in the dark, leading to frustration and distrust. Crown emphasizes that if your current management company frequently ignores calls or emails, it might be indicative of deeper systemic issues. A management team that prioritizes timely, clear, and proactive communication is essential for peace of mind.2. Lack of Modern Technology and Innovation

In an ever-evolving business landscape, the adoption of modern technology is crucial. Crown shares that his company has implemented a new artificial intelligence (AI) platform to automate maintenance scheduling, significantly improving response times. If your current management company hasn’t embraced technological advancements, it may result in slower, less efficient service. AI is more than just a buzzword; it’s a transformative tool in property management.3. High Tenant Turnover Rates

High tenant turnover can be costly and disruptive. It often signals tenant dissatisfaction due to poor service or unaddressed maintenance issues. Good property management companies focus on tenant retention through responsive service and effective communication. If you’re experiencing high turnover rates, it’s worth investigating the underlying causes.In conclusion, if these signs resonate with your experience, it might be time to explore other management options. Your property is a priority, and ensuring that your management team aligns with your best interests is crucial for long-term success.

For more insights, visit the original article on Forbes.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

19 Real Estate Investment Trends to Watch in 2025

In the ever-evolving world of real estate, staying ahead of the curve is not just advantageous, but essential. As we peer into the horizon of 2025, the landscape is poised to be shaped by a confluence of emerging trends. A recent Forbes Business Council article delves into these anticipated shifts, offering insights from 19 industry experts.

In the ever-evolving world of real estate, staying ahead of the curve is not just advantageous, but essential. As we peer into the horizon of 2025, the landscape is poised to be shaped by a confluence of emerging trends. A recent Forbes Business Council article delves into these anticipated shifts, offering insights from 19 industry experts.

1. Embracing a Growth Mindset

Real estate investors are gearing up for 2025 with an increased spending on both new and existing properties. This proactive approach, highlighted by RentRedi‘s Ryan Barone, suggests a diversification of portfolios and a keen interest in geographical and property type expansion. Such strategies are expected to bolster the rental property sector and open doors to new markets.2. Demand for Flexible and Sustainable Spaces

The hybrid work model is driving a surge in demand for flexible spaces in prime locations, as noted by Beate van Loo-Born of PhysikInstrumente (PI). Coupled with this is a growing emphasis on sustainability, with investors and tenants increasingly prioritizing eco-friendly and resilient buildings.3. Navigating High-Risk Areas

Nathan Miller from Rentec Direct anticipates a strategic shift away from high-risk regions, such as the hurricane-prone Southeast and wildfire-vulnerable Northwest. This creates opportunities for investors with a higher risk tolerance and may present attractive prospects for first-time homebuyers.4. Technological Advances in Real Estate

The integration of AI-driven property analyses is set to revolutionize the industry by 2025. As Shehar Yar of Software House explains, leveraging predictive analytics will enable investors to identify high-yield opportunities with precision, although it may also heighten competition and inflate property prices in hotspots.5. The Rise of Eco-Friendly Investments

Stephen Nalley from Black Briar Advisors foresees a surge in demand for eco-friendly real estate, driven by climate awareness and sustainability incentives. Investors focusing on green properties may reap higher returns as tenants and buyers increasingly seek energy-efficient spaces.Additional Trends to Watch

- Increased social impact investing, particularly in affordable housing, as discussed by Seth Gellis of Community Preservation Partners.

- Growth in co-living spaces, catering to those seeking affordable and flexible living arrangements, highlighted by Goro Gupta of Ethical Property Investments.

- Investment in digital infrastructure, such as data centers and server farms, noted by Sabeer Nelliparamban of Tyler Petroleum Inc.

These insights from the Forbes Business Council underscore the dynamic nature of the real estate market. As 2025 approaches, investors are encouraged to stay informed and agile, adapting to these trends to optimize their strategies and capitalize on emerging opportunities. “`

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

AI Outperforms Doctors in Diagnostics but Faces Challenges in Clinical Integration

LLMs: The Future of Diagnostic Accuracy?

The study meticulously compares the diagnostic reasoning of physicians using conventional resources against the standalone performance of LLMs. It reveals a stark contrast: while LLMs independently deliver superior diagnostic results, their integration into clinical practice requires strategic enhancement to complement, not replace, human expertise.AI as a Supplementary Tool

Despite the impressive diagnostic capabilities of LLMs, the study emphasizes their role as supplementary tools in healthcare settings. The integration of these AI models should aim to augment the expertise of physicians, ensuring that human judgment remains central to patient care. This approach calls for comprehensive training for healthcare professionals to effectively utilize LLMs, optimizing their performance through structured prompt design.

Challenges and Considerations

The findings suggest a nuanced approach to AI integration in clinical settings. While LLMs demonstrate remarkable diagnostic accuracy, their role should not undermine the indispensable aspects of human interaction and judgment in medical practice. As AI technology continues to evolve, the healthcare industry must prioritize patient care by leveraging these tools to enhance, rather than overshadow, the expertise of medical professionals.Looking Ahead

The study’s conclusions highlight the need for ongoing research and evaluation of AI applications in healthcare. As LLMs inch closer to clinical integration, it becomes imperative to develop reliable metrics and evaluation methods that reflect real-world clinical scenarios. This will ensure that AI tools are used to their fullest potential, enhancing diagnostic reasoning while safeguarding patient welfare.Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

The Role of Blockchain in Real Estate

The Role of Blockchain in Real Estate

The transformative power of blockchain technology is making significant waves across various industries, and real estate is no exception. Once considered a novelty, blockchain in real estate is now a practical solution revolutionizing the sector. As highlighted in a recent Appinventiv article, blockchain offers a myriad of applications beyond cryptocurrencies, providing innovative solutions to the industry’s prevailing challenges.Challenges in Real Estate The real estate industry has long been plagued by several inefficiencies, including a lack of transparency, tedious paperwork, higher risk of fraud, expensive investments, and poor transaction speed. These issues have historically hindered the sector’s growth and accessibility. However, blockchain technology offers a beacon of hope, addressing these challenges head-on.

Blockchain Solutions Blockchain technology introduces transparency through decentralized records, reducing the need for intermediaries, and enhancing transaction efficiency with smart contracts. Smart contracts automate processes, eliminating the need for middlemen, and ensuring transactions are executed when specific conditions are met. This not only speeds up transactions but also reduces the risk of human error.

Moreover, blockchain facilitates asset tokenization and fractional ownership, making real estate investments more accessible by allowing investors to purchase and sell fractional shares of properties. This democratizes real estate investing and enhances market liquidity.

Global Accessibility and Efficiency Blockchain’s decentralized infrastructure significantly enhances global accessibility, enabling seamless cross-border transactions. This opens up the real estate market to a broader range of investors, promoting diversification across different geographical areas. Furthermore, by eliminating intermediaries and automating processes, blockchain reduces administrative costs and accelerates transaction speeds, making real estate transactions more efficient and cost-effective.

Real-World Applications Several major players in the real estate industry have already begun leveraging blockchain technology to streamline operations and offer innovative investment opportunities. For instance, CBRE Group is using blockchain to transform property management, while Simon Property Group utilizes it for tenant relations and retail lease administration. These applications set new standards for efficiency, transparency, and tenant involvement in the real estate sector.

Overcoming Challenges Despite its potential, the integration of blockchain in real estate is not without challenges. Issues such as inadequate knowledge, scaling, and chain interoperability pose significant hurdles. However, solutions like education and training programs, collaboration with blockchain development firms, and the adoption of interoperability protocols can help overcome these barriers.

Conclusion The future of real estate is poised for a revolutionary change with the integration of blockchain technology. As businesses continue to explore and implement blockchain solutions, the real estate industry is set to become more transparent, secure, and efficient, paving the way for a more inclusive and reliable market landscape.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

48th Edition of Florida Real Estate Pre-License Textbook: A Must-Have Resource

For aspiring real estate professionals in Florida, obtaining the right educational resources is crucial to success. The 48th edition of the Florida pre-license real estate textbook, entitled “Textbook for Sales Associate Pre-License Course- Florida Principles, Practices & Law”, is a pivotal tool for those preparing for their real estate exam. This newly updated edition for 2025 is specifically tailored to meet the needs of students entering the dynamic world of real estate.

Available at the Florida Real Estate Book Store, this textbook is priced at $60.00, making it an affordable investment in your future career. The book is designed to provide comprehensive coverage of essential real estate principles, practices, and laws specific to Florida. It serves not only as a study guide but also as a valuable reference throughout your real estate career.

While the specific details of the 48th edition are not extensively covered in other sources, it is clear that the updated content reflects the latest changes in real estate laws and practices, ensuring that students are well-prepared for both the exam and real-world applications. The textbook is a part of a broader educational offering that includes various real estate courses and materials aimed at providing a solid foundation for students. You can explore further options related to real estate textbooks at the Florida Real Estate Book Store or check out additional resources and course materials at Florida Real Estate School Courses and Products.

For those considering a career in real estate, it’s important to stay informed about the best resources available. Utilizing the latest edition of the textbook ensures that you are up-to-date with current industry standards and regulatory requirements. Additionally, engaging with supplementary resources such as practice exams, online courses, and study groups can significantly enhance your learning experience.

In conclusion, the 48th edition of the Florida pre-license real estate textbook is an indispensable resource for any aspiring real estate professional in Florida. By investing in this updated edition, you are taking a critical step towards achieving success in your pre-licensing course and beyond. Make sure to visit the Florida Real Estate Book Store to secure your copy and embark on your journey with the confidence that you have the most current and comprehensive materials at your disposal.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

Gene Editing: Hope, Hype, and Humanity’s Ultimate Challenge

One of the most controversial chapters in this saga was written by He Jiankui, a Chinese biophysicist who, as reported in the MIT Technology Review, created the first “CRISPR babies” with the aim of making them immune to HIV. This bold move led to his imprisonment and sparked a global debate on the ethics of genetic manipulation.

The Ethical Quagmire

The implications of editing the human genome are profound. As highlighted in the original article, the potential to change human evolution raises questions about morality and the long-term effects on our species. Gene editing in embryos, which is restricted or illegal in many parts of the world, could lead to a future where genetic enhancements are commonplace, potentially creating a new form of inequality.Scientific Perspectives

Experts like George Church and Fyodor Urnov offer varied insights into the future of genetic editing. Church envisions a world where enhancements are as common as consumer technology, while Urnov warns of the potential for misuse and the ethical dilemmas that accompany such power. The article also references He Jiankui’s announcement of his intention to continue research, albeit with more caution.

The Road Ahead

As technology continues to advance, the line between enhancement and therapy becomes increasingly blurred. The biotechnology industry is already exploring ways to emulate beneficial genetic variants, potentially offering enhancements to those who can afford them. This raises concerns about accessibility and fairness, as well as the potential for unforeseen consequences.The future of human evolution, as discussed in the article, may not rely solely on editing embryos. Instead, advances in delivering CRISPR technology to adults could democratize genetic enhancements, making them available to a broader population. However, this also opens the door to new risks, including the possibility of unauthorized genetic modifications.

Conclusion

The potential to rewrite the human genome is both exhilarating and daunting. As we stand on the brink of a new era in biotechnology, the choices we make today will shape the future of our species. The conversation around gene editing is far from over, and it remains to be seen whether humanity will wield this power with wisdom and responsibility.Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

Unveiling the Impact of 3D Printing on Business Growth

Unveiling the Impact of 3D Printing on Business Growth

In today’s rapidly evolving technological landscape, 3D printing emerges as a revolutionary force propelling businesses towards sustainable growth. This transformative technology not only addresses pressing environmental concerns but also reshapes production methods across industries, enhancing efficiency and enabling innovation.3D printing significantly reduces material waste and promotes on-demand production, proving invaluable in industries like healthcare, automotive, and aerospace. Notably, startups like rrreefs and Impressora are utilizing 3D printing to craft eco-friendly solutions, such as artificial coral reefs and affordable housing, respectively.

The Versatile Applications of 3D Printing

Exploring the myriad ways 3D printing fosters business innovation, the original article from StartUs Insights highlights:

- Tackling Climate Change: By minimizing energy use and waste, 3D printing supports sustainable manufacturing practices. Companies like rrreefs are developing 3D-printed structures to combat climate change and rejuvenate marine ecosystems.

- Navigating Demographic Shifts: The technology allows for customized healthcare solutions, such as personalized prosthetics and implants. Viortec, for instance, enhances joint replacement surgeries with tailored 3D-printed implants.

- Rapid Urbanization Solutions: Efficient, cost-effective housing solutions are possible through 3D printing. Companies like Impressora integrate eco-friendly materials in constructing modular and customizable urban infrastructure.

- The Energy Transition: In energy sectors, 3D printing aids in producing optimized components, like custom wind turbine parts, enhancing energy efficiency and sustainability.

- Emerging Trends in Mobility: 3D printing facilitates the production of lightweight vehicle components, improving fuel efficiency and enabling swift prototyping, pivotal for innovative mobility solutions.

Startups Revolutionizing Industries

Several startups harnessing 3D printing are highlighted, showcasing its diverse applications in addressing global challenges. Examples include LPrint for hyper-connectivity via printed electronics and Additive Drives GmbH for advancing electric motor technology in transportation.

The Outlook for 3D Printing

The innovative future of 3D printing is underscored by continuous investments and technological advancements, with significant contributions from industry leaders like Techstars and MassChallenge. The technology’s global footprint is expanding, with major hubs in the USA, Germany, and beyond, indicating a promising trajectory for industry growth.

Conclusion

3D printing stands as a pillar of innovation, driving industries toward a sustainable and efficient future. With its ability to address global economic, environmental, and societal shifts, 3D printing redefines possibilities across sectors, marking a new era of industrial advancement.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

10 Essential Real Estate Concepts from Prep Agent’s Crash Course

10 Real Estate Concepts You Need to Know: My (Slightly Overwhelmed) Reaction to Prep Agent’s Crash Course

Alright, imagine this: you want to become a real estate mogul—or maybe you just need your real estate license so you can finally stop fantasizing about flipping that shady duplex down the block. Either way, you’ve got to pass your real estate exam. And if, like me, you’ve ever felt the creeping doom of important information flying over your head, then Joe from Prep Agent is absolutely your guy.

Joe’s latest breakdown of “10 Concepts You Must Know to Pass Your Real Estate Exam” feels like drinking from a firehose—but in the best way possible. Picture a no-nonsense friend who drags you through all the need-to-know basics, but does it with the tough love of a coach who really wants you to win—and maybe yell “studs” under your breath at practice.

So, buckle up. I’m here to unpack Joe’s crash course in a somewhat digestible (and hopefully entertaining) way while processing how I, too, might survive this mental workout.

Real Property vs. Personal Property: What’s Planting Roots and What’s Hitting the Road?

First up, Joe hit us with the concept that real property is immovable (think land, buildings, the roots of your sanity), while personal property is movable (shoes, maybe your coffee maker if you’re civilized, or even your lease agreement).

“Real property goes to the REAL estate; personal property goes with the PERSON.”

Easy enough, right? Except now I’m looking at my potted plant wondering if I’d have the emotional bandwidth to let it go during a sale. (Spoiler: I wouldn’t. It’s coming with me. Thanks, Joe.)

Estates: Freehold, Not-So-Freehold, and Deadbeat Tenants

Let’s talk estates. Apparently, there are freehold estates (aka you own it forever) and less than freehold estates (leases that come with expiry dates). The part that stuck in my brain like peanut butter? Joe calling tenants who overstay their welcome a “deadbeat tenant.” Honestly, iconic.

- Estates for years (think a summer rental)

- Periodic tenancy (month-to-month rentals)

- Estate at will (a wildcard lease that could poof into thin air)

- Estate at sufferance (translation: “Please leave; you’re here too long.”)

Freehold estates, on the other hand, are where the real drama lives—are you sipping a life estate or skipping alcohol sales on your property because of a weird condition? Don’t worry; Joe’s got you covered.

P.E.T.E. the Power-Hungry Uncle: Government Powers

When Joe mentioned P.E.T.E., I immediately imagined a guy at Thanksgiving who constantly chimes in with unsolicited advice (and occasional ultimatums). P.E.T.E. is all about government powers:

- Police Power: “You can keep your home, but you will follow zoning laws.”

- Eminent Domain: “We’re taking this for a freeway, but here’s a check.”

- Taxation: Pay the man.

- Escheat: No heirs? Your property goes to the state.

PETE doesn’t mess around.

Ownership: Are You Flying Solo or Part of a Real Estate Squad?

Here’s where joint tenancy and tenancy in common entered the chat. If you’re into acronyms, joint tenancy sounds like #SquadGoals: T-TIP (time, title, interest, and possession shared equally). If one buddy kicks the bucket, the others absorb their share like some kind of financial photosynthesis. With tenancy in common, however, everyone gets their own slice of the pie. Die? Your slice goes to your heirs. A tidy way of saying, “You do you, boo.”

S.T.U.D. (or D.U.S.T.): Essential Elements of Value

Scarcity, Transferability, Utility, and Demand. Without these, your property value might as well be imaginary.

For instance, being the only house on an island (scarcity) = cha-ching. Living behind an airport (low utility)? Maybe not so much.

Depreciation: When Stuff Falls Apart

- Economic obsolescence: External problems (e.g., neighbors with backyard chickens).

- Functional obsolescence: Bad designs (e.g., no bathrooms in your 10-bedroom house).

- Physical deterioration: Your house is straight-up falling apart.

The Market Data Approach vs. The “How Much Do Shoes Cost?” Method

Fair pricing boils down to:

- Market Data Approach: It’s like saying, “These sneakers cost $100 at three stores, so I guess that’s the fair price!”

- Cost Replacement Approach: Replacing the structure piece by piece.

- Income Capitalization Approach: How much rental income will this generate?

Special shoutout to libraries, schools, and police stations for transcending traditional valuation metrics. We see you.

Deeds vs. Titles: The “Marriage Certificate” of Real Estate

Deed: Proof of ownership transferring.

Title: Actual ownership.

Simple. Just don’t confuse it with a marriage certificate, which is…well, another story.

Fair Housing Laws: Don’t Steer, Blockbust, or Redline—Ever

Joe wrapped up strong with concepts that everyone (not just future agents) should know:

- Steering: Don’t guide buyers based on race or ethnicity.

- Blockbusting and panic selling: Big no.

- Redlining: Drawing circles to exclude areas from lending? Hard pass.

This isn’t just about the exam—these are the basics of being a decent human being who understands 1968 was a pivotal year.

Let’s Hear It for Joe…and the Hustle!

I’ve gotta hand it to Joe—he didn’t just outline 10 real estate concepts; he threw in memory hacks (thank you, T-TIP and S.T.U.D.), dad jokes (here’s looking at you, “deadbeat tenants”), and the kind of brutally honest perspective I personally find refreshing.

Seriously, if you’re prepping for the exam or just curious about dipping your toes into real estate, Joe’s content lays a solid base—even if your brain feels like mush afterward.

What about you? Are you knee-deep in real estate study prep or just mildly intrigued by all the acronyms? Share your experiences in the comments below. And hey, don’t forget: real property stays; personal property goes. That’s advice for real estate and life.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

Beyond the Vocabulary Drill: Jonathan Goforth’s Real Estate Prep

Ever Wondered Why Real Estate Exams Feel Like Brain Surgery?

Let’s face it—studying for the real estate exam feels like being force-fed a dictionary while simultaneously dissecting a Sudoku puzzle. After trawling through Jonathan Goforth’s marathon YouTube transcript—a treasure trove of real estate practice questions—I found myself flinching at words like “alienated,” “hypothecated,” and “impertinence.” Who knew passing the real estate exam felt like acing a spelling bee for vocabulary you’ll never use again (yes, I’m looking at you, “severance”)?

But hey, if reaction content is your preferred dose of study procrastination, you’re in for a treat. Consider this article your much-needed coffee break—a relatable, digestible analysis of Jonathan’s 75-best-question classroom. Let’s dive in, shall we?

Context: What Is Jonathan’s Video Even About?

Picture this: Jonathan Goforth (yes, that’s really his name—does fate truly exist?) sits down with us eager learners to share 75 handpicked real estate exam questions. By “handpicked,” I mean he plucked them from previous videos because, well, when you’ve got content, why not cobble together a highlight reel? He promises these questions work for all 50 states—which is comforting, unless, like me, you’re bad at math anywhere.

He wants us to master concepts like leasehold estates, deed restrictions, and the strange world of easements (spoiler: it’s way less exciting than it sounds). But wait, there’s more—he includes tips on overcoming obnoxious test trickery and the dreaded double negatives. You know the drill: “Which of the following is not unessential?” Um… what?

By the end of it, you’re ready to scream, “Yes, Jonathan, I will screenshot every slide and pass this test just so I can stop hearing the word ‘encumbrance’ in my nightmares!”

Main Reaction: Confusing Yet Weirdly Addictive

The Good

- Instant Clarity on Tough Concepts: It’s like he grabbed that bowl of spaghetti noodles you call knowledge and untangled it. For example:

- Appurtenances: Sounds like a Hogwarts spell but actually means rights or improvements that “run with the land.” Get a pool? Boom, appurtenance. Mineral rights? Yup, that too.

- Encumbrances: These are party poopers like liens and easements that burden property titles. Got a fence? Sorry, that’s not “easy, breezy, beautiful” either.

- Cheat Sheet Tips for Math Haters: Jonathan gives you simple formulas for stuff like calculating real estate taxes or down payments. Example: “Property sold for $400,000. LTV is 80%. What’s the loan?” Math-phobes rejoice—he shows you exactly when to multiply, subtract, and ignore irrelevant details.

- Realistic Test Scenarios: Jonathan delivers tricky questions you’ll undoubtedly see on your exam. Remember “Which government power does not include condemnation?” (Hint: It’s not listed, because condemnation is a process… mind blown).

The Frustrating

- The Transcript Reads Like a Scroll from the Dark Ages: Clocking in at enough words to rival War and Peace, this script kind of broke me. I scrolled endlessly trying to stay on track. It didn’t help that questions like “Which of the following is not a characteristic of land?” required mental gymnastics just to break down.

- Vocabulary Overload: Severance? Alienation? Hypothecation? I mean, does anyone actually say these things outside the exam? Realistically, you’ll forget 75% of this the second you ace the test. (Trust me, I’ve Googled “tenancy in common” five times already.)

Analysis And Comparisons: Why Jonathan Is The MVP of Real Estate Prep

From YouTube University to cram apps, there are a gazillion ways to prep for the real estate exam. Yet Jonathan’s granular video sticks out because:

- He’s Thorough AF: Unlike TikTokers breezing through ten-second flashcards, Jonathan dives dee-eep. Want to understand why a ceiling fan is personal property until it’s installed (hello, fixture status)? He’s got you covered.

- His Humor is Dry and Dad-Like: Occasionally self-deprecating, Jonathan is like that one teacher who goes rogue on lecture plans but somehow keeps the jokes coming. Example: He reminds us that Realtors rarely use the fancy jargon the test obsessively drills into our heads. A truth bomb I needed.

Engagement: So… What Did YOU Think?

Look, we can’t all be walking encyclopedias like Jonathan. I’m genuinely curious—how are you tackling real estate study stress? Are you screencapping YouTube slides like a digital hoarder? How many practice questions have sent you into a minor existential crisis?

Let’s vent together—leave a comment below! Whether you’re team “memorize the glossary” or team “watch-the-test-prep-guy-three-times-faster,” I genuinely want to hear your study hacks and horror stories.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

Mainstreaming Blockchain: A New Era of Finance

Mainstreaming Blockchain: A New Era of Finance

In a world where traditional finance is not just adopting crypto but being fundamentally rebuilt around it, Forbes reports on the seismic shifts reshaping the financial landscape. Major financial institutions are not only embracing blockchain technology but are actively integrating it into their core operations, heralding a new era of financial innovation.

Blockchain Integration in Banking JPMorgan has taken a pioneering step by launching instant dollar-euro conversions on its Kinexys blockchain platform. This move is part of a broader trend where transaction volumes have surged tenfold, processing over $2 billion daily. Meanwhile, Visa’s Tokenized Asset Platform is enabling banks like BBVA to create and manage digital tokens, with pilot programs slated to commence in 2025.

Advancements in Tokenization Tokenization is emerging as a transformative force, bridging traditional finance with the decentralized world. Industry projections suggest that the market for tokenized real-world assets could expand dramatically, potentially reaching $10-15 trillion within the next decade. Goldman Sachs is at the forefront with the launch of three new tokenization products, focusing on money market funds and real estate assets.

AI and Blockchain Collaboration The collaboration between AI and blockchain is forging a new digital frontier. As artificial intelligence decodes complex data patterns, blockchain anchors these insights in an immutable ledger. This synergy is transforming raw information into verifiable, tamper-proof intelligence, rewriting the rules of data integrity. VeraViews exemplifies this innovation by integrating blockchain-based Proof of View technology with AI-driven fraud detection, showcasing how emerging technologies can tackle industry-wide challenges.

The Rise of DeFi and Stablecoins DeFi represents blockchain’s most radical innovation yet—a financial system that operates purely on code. By replacing traditional intermediaries with automated smart contracts, DeFi enables complex financial operations to occur in seconds. Stablecoins, maintaining stable value through fiat currency pegs, serve as the critical bridge between DeFi and traditional finance, accelerating mainstream adoption.

Cross-Border Payments and Technology Innovation Blockchain is revolutionizing cross-border payments, creating new pathways that bypass traditional banking systems. The combination of blockchain networks and stablecoins is transforming the global remittance market, estimated at $630 billion in 2022, by enabling faster and cheaper transfers. To support these transactions, robust exchange infrastructures like BestChange are emerging, providing cryptocurrency exchanger directories that aggregate real-time rate comparisons, contributing to market efficiency and accessibility.

The Path Forward: Regulation and Growth The regulatory environment has matured significantly, with comprehensive frameworks balancing innovation with consumer protection. This clarity is crucial for institutional adoption, providing the certainty needed for larger financial institutions to invest in blockchain-based solutions.

A New Era of Finance As traditional finance integrates digital innovations, it is actively building the future of finance. Those who recognize this shift are not just adapting to change but are positioning themselves to shape how value moves in a digital economy.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

AI in Radiology: Balancing Innovation with Concerns

AI in Radiology: Balancing Innovation with Concerns

A recent analysis has shed light on the public’s perception of artificial intelligence (AI) in radiology. While the majority of patients are supportive of AI’s integration into this field, concerns about data privacy and job displacement remain prevalent. The study, led by Mansour Almanaa, PhD, from King Saud University in Saudi Arabia, provides a nuanced view of the current discourse surrounding AI in healthcare.Understanding Public Sentiment

Almanaa’s research involved a comprehensive analysis of over 1,000 social media posts on platforms like Reddit and X (formerly Twitter) spanning from 2019 to 2024. The findings, published in the journal Cureus on September 23, revealed that approximately 55% of comments were positive, highlighting AI’s potential to enhance diagnostic accuracy and efficiency. However, 35% of the comments were neutral, and 10% expressed negative sentiments, primarily focused on job loss, ethics, and privacy concerns.Expert Insights

Mansour Almanaa emphasized the necessity of addressing these concerns to ensure AI’s responsible application in medical imaging. He advocates for the development of clear regulatory frameworks and ethical guidelines to safeguard patient safety and data security. Furthermore, Almanaa underscores the importance of continuous education for healthcare professionals to adapt to AI’s evolving role in medicine.Methodology and Challenges

The study meticulously filtered through nearly 4,000 posts using 20 different search phrases such as “radiology,” “computed tomography,” “AI,” and “medical imaging.” The sentiment analysis was conducted using Python’s VADER tool, focusing on ethical and privacy issues associated with AI. The study identified challenges including the transparency of AI processes and accountability for AI-generated errors.The Dual Nature of AI’s Impact

Despite the concerns, there is recognition of AI’s potential to complement the work of radiologists rather than replace them. AI’s ability to automate routine tasks and improve workflow efficiency could allow radiologists to focus on more complex cases, potentially reducing their overall workload.Conclusion

Almanaa’s study highlights a general acceptance of AI’s benefits in medical imaging but stresses the need to address ethical, privacy, and job displacement concerns. Future research should focus on creating robust ethical standards and regulatory practices, while also supporting continuous education for healthcare professionals to effectively integrate AI into medical practice.For further details, the original article can be accessed here. “`

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

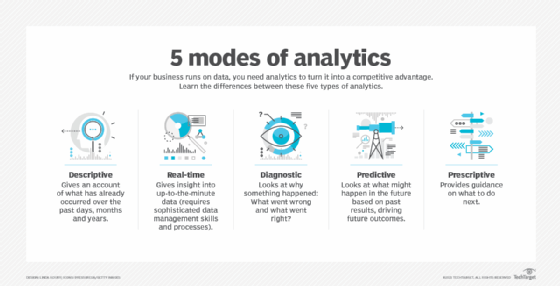

Predictive Analytics Tools Reshaping Business Landscape by 2025

In the ever-evolving landscape of business technology, predictive analytics tools are emerging as indispensable assets for companies aiming to stay ahead of the curve. As we look towards 2025, these tools are not only becoming more sophisticated but also increasingly accessible to both IT professionals and business users alike.

In a recent article by TechTarget, eight leading predictive analytics tools were profiled, each offering unique capabilities that cater to diverse business needs. These tools are paving the way for more intuitive and efficient data analysis, empowering users to make informed decisions with greater ease.

Revolutionizing Predictive Analytics

The traditional realm of analytics focused on understanding past events through descriptive analytics and diagnostic analytics. However, predictive analytics shifts the focus towards forecasting future outcomes by examining patterns and trends in data. This transformation has been accelerated by advancements in automated machine learning (AutoML), which simplifies the predictive modeling process.

According to Carlie Idoine, a vice president analyst at Gartner, the barriers to entry for using these tools have significantly lowered. “You don’t have to be an expert to go in and use these tools anymore,” she noted. The automation of complex tasks now allows users to achieve in minutes what once took weeks of coding.

Top Predictive Analytics Tools for 2025

- Altair AI Studio: Known for its strengths in data mining and text mining, Altair AI Studio offers a comprehensive suite of tools for both data scientists and non-coding experts.

- Alteryx AI Platform: This platform excels in automated data preparation and offers robust visual tools for predictive modeling.

- Dataiku: With both visual and code-based interfaces, Dataiku caters to a wide range of users, facilitating data preparation, machine learning, and deployment.

- H2O Driverless AI: This tool simplifies AI development with automated capabilities for feature engineering, model selection, and more.

- IBM Watson Studio: Building on the legacy of SPSS, IBM Watson Studio offers a consolidated platform for various analytics functions.

- Microsoft Azure Machine Learning: Complementing tools like Power BI and Excel, Azure Machine Learning manages the complete predictive analytics lifecycle.

- SAP Analytics Cloud: Integrating BI, planning, and predictive analytics, this tool is ideal for enterprises with extensive SAP deployments.

- SAS: As a pioneer in statistical analytics, SAS continues to innovate with modern data science and machine learning workflows.

Choosing the Right Tool

When selecting a predictive analytics tool, it’s crucial to align the tool’s capabilities with the specific needs of your organization. Some platforms offer generic solutions applicable across industries, while others provide industry-specific functionalities. Understanding the difference between traditional regression-based tools and machine learning-based tools is also essential for making an informed choice.

Ultimately, the right tool should empower users to collaborate effectively, whether they are seasoned data scientists or business professionals with domain expertise. As businesses continue to integrate AI and machine learning into their workflows, predictive analytics tools will play a pivotal role in driving innovation and success.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

Artificial Intelligence Revolutionizing Healthcare: A New Era of Efficiency and Patient Care

Artificial Intelligence Revolutionizing Healthcare: A New Era of Efficiency and Patient Care

The global healthcare industry is on the brink of a transformative shift, as artificial intelligence (AI) technologies are poised to revolutionize patient care and operational efficiency. According to a recent report by GlobeNewswire, the AI in healthcare market is projected to surge at a compound annual growth rate (CAGR) of 18.2% from 2025 to 2035, reaching an estimated value of USD 77,456.4 million by 2035.

Key Drivers of Growth

The exponential growth in the AI healthcare market is driven by several factors. The integration of AI technologies such as machine learning, natural language processing, and deep learning is enhancing diagnostics, treatment planning, and patient management. These advancements are not only streamlining operations but also paving the way for personalized and efficient healthcare delivery.The rising healthcare costs and a growing shortage of care providers are further propelling the demand for AI solutions. AI’s ability to analyze vast amounts of medical data, perform clinical diagnoses, and suggest treatment strategies is proving invaluable in reducing operational costs and improving decision-making efficiency.

Opportunities and Challenges

The potential of AI in healthcare is vast, yet several challenges need to be addressed. Data privacy and security remain significant concerns, as does the high cost of implementation. Moreover, the industry faces a skill gap, with a shortage of professionals trained in AI technologies.Ethical considerations also come to the forefront, particularly regarding AI-driven decision-making in critical healthcare scenarios. Sabyasachi Ghosh, Associate Vice President at Future Market Insights, emphasizes the need for innovation and collaboration to overcome these hurdles and fully realize AI’s potential in healthcare.

Regional Insights and Market Leaders

North America leads the charge in AI healthcare adoption, thanks to advancements in healthcare IT infrastructure and supportive regulatory environments. Europe and the Asia Pacific regions are also experiencing significant growth, driven by increasing awareness and demand for AI-based healthcare solutions.Prominent players in the market include Amazon Web Services, DeepMind, IBM, Intel Corporation, Microsoft Corporation, and Siemens Healthcare, among others. These companies are at the forefront of developing innovative AI solutions that are reshaping the healthcare landscape.

For a detailed analysis, the full report on the Artificial Intelligence in Healthcare Market offers comprehensive insights into this rapidly evolving industry.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

The Threats Posed by Environmental, Social, and Governance Policies

The Threats Posed by Environmental, Social, and Governance Policies

In a world increasingly dominated by the language and priorities of Environmental, Social, and Governance (ESG) policies, leaders in business, government, and finance are steering society toward a new paradigm. The American Institute for Economic Research (AIER) recently published a comprehensive paper detailing the profound impact of ESG on public and private institutions worldwide.According to AIER, these top-down restrictions, though well-intentioned, are costly and ineffective in addressing perceived and actual social problems. The paper argues that societies thrive when allowed to solve their issues through decentralized experimentation and innovation. ESG’s advocates, however, aim to reshape the world—from the way we travel and heat our homes to the practices and products businesses must prioritize.

The Ideological Underpinnings

ESG policies are rooted in the concept of stakeholder capitalism, which posits that companies have sweeping social responsibilities and are the property of the community rather than shareholders. This philosophy has permeated institutions globally, leading to a push for a “low carbon” economy built on renewable energy and a dramatic redistribution of wealth and power.Yet, the AIER paper highlights several shortcomings of ESG, including its epistemological and ethical issues, conceptual ambiguity, and inefficiency. ESG’s advocates often conflate financial and nonfinancial objectives, advancing a deeply partisan progressive ideology on climate change, pollution, diversity, and LGBTQ+ issues.

Global Influence and Local Impact

The influence of ESG is not limited to the corporate boardroom. In the United States, President Biden’s administration has signed executive orders prioritizing Diversity, Equity, and Inclusion (DEI) and climate-related financial risks, embedding ESG priorities into federal policy. Similarly, states like California and New York have enacted legislation aligning with ESG goals, while others like Texas and Florida have moved to reduce its impact.International Reach