Jersey City Emerges as Top Pick for 2024 Apartment Investments

Jersey City Emerges as Top Pick for 2024 Apartment Investments

In an unexpected turn of events, Jersey City, New Jersey, has claimed the spotlight as the premier destination for apartment investments in 2024, according to the Urban Land Institute’s (ULI) annual “Emerging Trends” report. This finding defies the narrative of population decline in the broader New York City area, highlighting the resilience and appeal of the apartment market.

Jersey City’s ascent to the top of the investment charts reflects a broader shift in investor sentiment that began in 2022. As rent growth slows in Sunbelt markets, where apartment construction has surged, attention has turned to the Northeast and Midwest, where rent growth remains strong. This shift is underscored by the fact that New York City, despite losing approximately 468,000 residents between 2020 and 2022, maintains a low vacancy rate of about 2.5%, as reported by Cushman & Wakefield.

Sam Tenenbaum, a multifamily economist at Cushman & Wakefield, explains, “New York City is the tightest market in the country from a vacancy standpoint, so renters are being pushed out to New Jersey, which has some of the strongest rent growth in the country at the moment.”

The Big Apple’s Population Puzzle

While New York City has seen a significant population decline, the demand for apartments remains robust. The city’s population, now at 8.33 million, is down from 8.8 million in mid-2020, yet the metro area, including Jersey City, still boasts 19.6 million residents. Tenenbaum attributes this paradox to household growth driving apartment demand, coupled with limited new construction and nominal job growth.

Interestingly, the ULI report indicates a muted enthusiasm for apartment investments in 2024 compared to 2023, largely due to higher interest rates. However, the Northeast and Midwest are leading the nation in rent growth, making them attractive targets for investors.

Investment Trends and Recommendations

In ULI’s survey, 61% of respondents recommended buying in Jersey City for 2024. Brooklyn, which topped the list last year, received a 53% buy recommendation for the coming year. Other notable mentions include Madison, Wisconsin, and Columbus, Ohio, which are also gaining investor interest.

Conversely, many Sunbelt metro areas have fallen out of favor. Cities like Jacksonville, Tampa, and Miami did not make the ULI’s top 20 list, leaving West Palm Beach as the sole representative from Florida. This shift highlights a changing landscape in real estate investment, where performance is now being measured against national standards.

For a deeper dive into these trends, you can read the full Forbes article by Richard Lawson.

More Articles

Getting licensed or staying ahead in your career can be a journey—but it doesn’t have to be overwhelming. Grab your favorite coffee or tea, take a moment to relax, and browse through our articles. Whether you’re just starting out or renewing your expertise, we’ve got tips, insights, and advice to keep you moving forward. Here’s to your success—one sip and one step at a time!

The Future of Life Sciences: A Vision for 2030

The Future of Life Sciences: A Vision for 2030

As we edge closer to 2030, the life sciences industry stands on the threshold of transformative changes. With a global valuation exceeding $2 trillion, the sector is poised for significant growth, driven by technological advancements and an aging population. The resilience demonstrated during the COVID-19 pandemic has set the stage for ongoing evolution in healthcare development.Current Innovations and Trends

The rapid acceleration of digital technology, particularly artificial intelligence (AI), machine learning, and genomics, has revolutionized drug discovery and personalized medicine. Technologies such as wearables and telemedicine are reshaping healthcare delivery, marking the dawn of a digital health revolution.- AI and Machine Learning: These technologies are at the forefront of the industry’s progress, enhancing medical devices, discovering data patterns, and boosting productivity. However, legal challenges regarding intellectual property and data privacy remain.

- Precision Medicine: Leveraging genomics and AI, precision medicine offers tailored treatments to individual health profiles, significantly improving the management of chronic diseases like cancer and diabetes.

- Digital Health Technologies: The pandemic accelerated the adoption of cloud computing and AI, leading to scientific breakthroughs and improved manufacturing efficiency. Wearables and healthcare apps are crucial in early health issue detection and patient care enhancement.

- Patient-Centric Care: Smart technologies enable personalized healthcare through remote monitoring and tailored treatments, shifting the focus to a more patient-centric approach.

- Biotechnology Innovations: Companies are using biological processes to address global challenges, resulting in more effective medicines and sustainable farming solutions.

Challenges and Opportunities

The Inflation Reduction Act in the U.S. presents challenges for drug pricing and company revenue, prompting a reevaluation of investment strategies. Increasing diversity in clinical trials is essential for equitable treatment development. Legal and ethical concerns around gene editing and data privacy necessitate robust guidelines.Opportunities for Growth

Developing AI solutions that support healthcare workers’ daily decisions could revolutionize healthcare delivery, making it more personal and effective. Embracing advanced analytics enables healthcare organizations to make data-driven decisions, enhancing patient care and operational efficiency. Additionally, utilizing AI for drug repurposing could lead to innovative treatments for challenging conditions.As we look towards 2030, the life sciences industry is on the cusp of groundbreaking innovations that promise enhanced, personalized healthcare for all. The key challenge remains ensuring these advancements are accessible and beneficial to everyone, emphasizing the need for collaboration between governments, healthcare providers, and biotechnology companies.

Telehealth: A Boon for Patients, A Challenge for Rural Hospitals

Telehealth: A Boon for Patients, A Challenge for Rural Hospitals

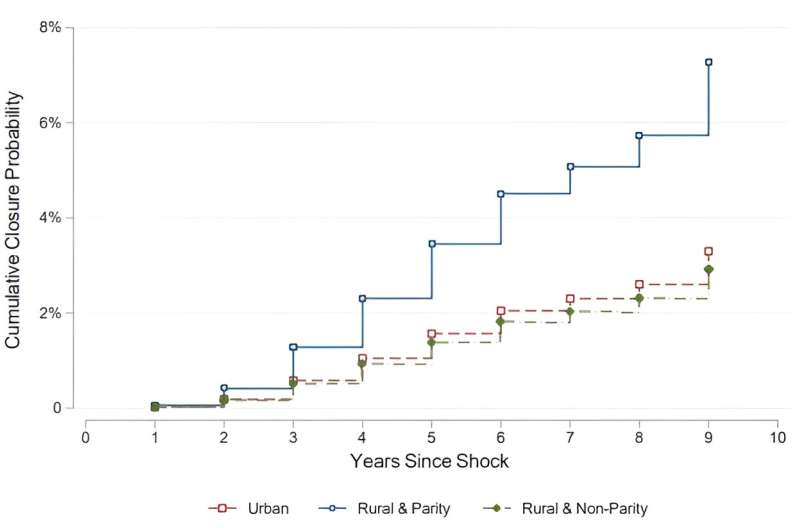

The advent of telehealth has revolutionized the way patients, particularly those in rural areas, access health care. By offering remote consultations and follow-up care, telehealth provides a convenient alternative to traveling long distances to urban hospitals. However, this technological advancement brings with it a set of challenges that could reshape the rural health care landscape.

The advent of telehealth has revolutionized the way patients, particularly those in rural areas, access health care. By offering remote consultations and follow-up care, telehealth provides a convenient alternative to traveling long distances to urban hospitals. However, this technological advancement brings with it a set of challenges that could reshape the rural health care landscape.A recent study by Zihan Ye from the University of Tennessee, alongside Kimberly Cornaggia from Penn State University and Xuelin Li from Columbia Business School, sheds light on the financial impacts of telehealth on rural hospitals. Their research, soon to be published in the Review of Financial Studies, reveals that while telehealth services enhance patient access to urban hospitals, they simultaneously drain resources from rural health care providers. This shift can lead to financial instability, increased leverage, and even bankruptcy for rural hospitals.

The study highlights a competitive imbalance, with urban hospitals benefiting from a larger patient base and the ability to charge higher fees. Conversely, rural hospitals, often unable to offer telehealth services, face dwindling patient numbers and diminished financial viability. The situation is exacerbated by disparities in insurance reimbursements, particularly from Medicare and Medicaid, which often fall short compared to private insurers.

Ye and her colleagues urge policymakers to consider the long-term effects of telehealth expansion, advocating for collaborative programs that allow rural hospitals to partake in the telehealth market’s benefits. Such measures could alleviate financial pressures and ensure continued access to health care for rural communities.

As communication technology continues to evolve, understanding its broader impacts remains crucial for a balanced and equitable health care system. For more insights, visit the original article on Medical Xpress.

References:

The Genetic Revolution: CRISPR and Public Opinion

The Genetic Revolution: CRISPR and Public Opinion

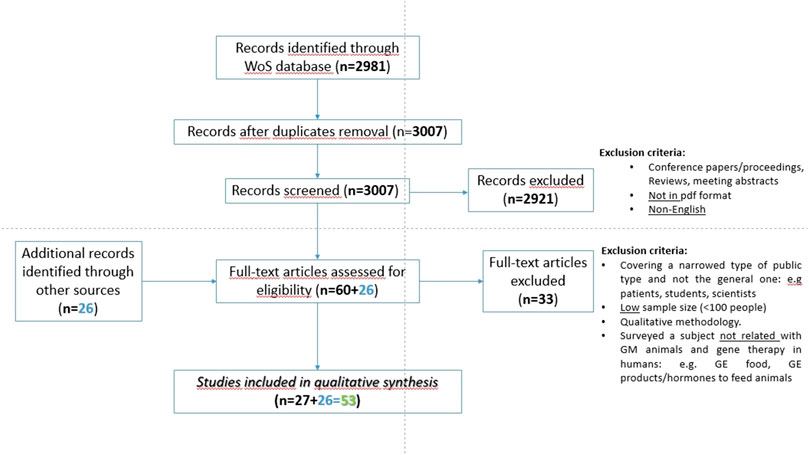

It was a monumental shift in the world of genetics when CRISPR-Cas9 burst onto the scene in 2012, democratizing the ability to edit genomes with unprecedented precision and ease. This revolutionary technology, as detailed in a systematic review published by Frontiers, has not only transformed scientific research but has also sparked a profound societal and ethical debate.

The CRISPR Effect

CRISPR’s impact is far-reaching, influencing fields from biomedical research and clinical practice to food production. The ability to edit genes with such precision has opened doors to potential cures for genetic diseases, enhancements in agricultural yields, and even the controversial editing of human embryos.

However, this power comes with significant ethical concerns. As the review notes, the application of CRISPR to human embryos has reignited debates over genetic manipulation, reminiscent of past controversies surrounding genetic engineering.

Public Sentiment: A Mixed Bag

Over the past 35 years, surveys have painted a complex picture of public attitudes towards genetic modification. Generally, there is strong support for therapeutic gene editing in humans, particularly when it comes to treating or preventing diseases. Yet, opinions diverge sharply when it comes to germline modifications and genetic enhancements, often viewed with skepticism or outright opposition.

The review highlights that while many embrace the potential health benefits, the notion of “designer babies” raises red flags for both ethical and safety reasons. This echoes the sentiments expressed by scholars like Camporesi and Cavaliere, who have explored the ethical dimensions of CRISPR in their work (Camporesi and Cavaliere, 2016).

Responsible Innovation

The key takeaway from the review is the critical need for responsible research and innovation (RRI). Aligning technological advancements with societal values is paramount. As CRISPR technology continues to evolve, ensuring that it is used ethically and responsibly will require ongoing dialogue between scientists, policymakers, and the public.

Looking Ahead

The path forward for CRISPR and genetic engineering is one of both promise and caution. As noted by Nordberg et al., the regulatory landscape will need to adapt to keep pace with these rapid advancements (Nordberg et al., 2018).

In conclusion, while CRISPR offers a glimpse into a future where genetic diseases could be eradicated, it also challenges us to consider the ethical implications of such power. The conversation is far from over, and as society grapples with these issues, the voices of both advocates and critics will be crucial in shaping the future of genetic engineering.

Revolutionizing Healthcare: The AI Transformation

Revolutionizing Healthcare: The AI Transformation

Artificial Intelligence (AI) is no longer a futuristic concept in healthcare; it is a reality reshaping the industry today. Visionaries like Vinod Khosla have long predicted AI’s potential, foreseeing its ability to replace up to 80% of standard medical tasks. This transformation is now evident as AI technologies begin to outperform traditional methods, particularly in areas requiring precision and data processing.

From Data to Diagnosis

AI is increasingly being integrated into healthcare systems, shifting from human-centered care to AI-driven solutions. As Kris Pahuja, co-founder of the Y Combinator-backed startup Piramidal, observes, AI “co-pilots” are becoming standard in medical decision-making, especially in complex environments like the ICU. This integration is not just about automation; it represents a profound change in medical diagnostics, reducing errors and biases in human diagnosis and leading to better patient outcomes.AI’s proficiency in analyzing medical imaging, particularly in fields like radiology and pathology, allows for the early detection of diseases such as cancer. This capability significantly improves treatment outcomes by enabling more accurate and timely diagnoses.

Personalized Medicine: Tailoring Treatment with AI

One of the most promising applications of AI in healthcare is its role in personalized medicine. By analyzing genetic profiles and real-time health data, AI enables treatments tailored to individual patients, moving away from the traditional one-size-fits-all approach. This personalization reduces adverse reactions and enhances treatment effectiveness. A study published in Nature Humanities and Social Sciences Communications highlights AI’s role in driving precision healthcare.Accelerating Drug Development

AI is also accelerating drug development by allowing pharmaceutical companies to analyze large datasets from clinical trials. This capability identifies potential new drug candidates more quickly and accurately than traditional methods, potentially transforming disease management and care.AI in Patient Care Management

AI’s potential in patient care management is substantial. By continuously monitoring patient health data, AI systems can predict potential health issues and provide timely interventions, shifting healthcare from a reactive model to a proactive one. This proactive approach not only improves patient outcomes but also reduces long-term healthcare costs.AI-powered predictive analytics also play a crucial role in preventive care, identifying patients at risk of developing conditions like diabetes or hypertension long before symptoms appear. This early intervention strategy can prevent the onset of these diseases, significantly reducing the burden of chronic illnesses.

Ethical Considerations and Challenges

Integrating AI into healthcare is not without challenges, particularly concerning privacy, security, and ethics. AI systems require vast amounts of data to function effectively, raising concerns about data breaches and privacy. As AI systems make more autonomous decisions, ethical questions arise, such as who is responsible for incorrect diagnoses or treatment recommendations made by AI. These are complex issues that healthcare providers and regulators must address as AI becomes more prevalent in the industry.The Nature article also underscores the ethical implications of AI in healthcare beyond data privacy and decision-making. AI’s use in patient care could lead to the dehumanization of healthcare, where decisions may become overly data-driven, potentially overlooking the nuances of human empathy and judgment.

Integrating AI

For healthcare leaders eager to embrace AI, a strategic, phased approach is recommended. Begin by identifying specific areas where AI can deliver immediate value, such as diagnostics or patient management, and launch pilot projects to test and refine these tools. Building a multidisciplinary team that includes clinicians, data scientists, and ethicists is essential to ensure that AI solutions are both effective and ethically sound.A New Era of Healthcare

The future of healthcare lies in the seamless integration of AI technologies as partners in care, not just tools. AI is set to reshape healthcare by improving outcomes, reducing costs, and enabling personalized care. While the journey toward AI-driven healthcare is still in its early stages, the impact of these technologies is already being felt. As AI continues to advance, it will redefine the relationship between patients and healthcare providers, making care more efficient, effective, and personalized.Original Article

Exploring the Intersection of AI and Patient-Centered Care

Exploring the Intersection of AI and Patient-Centered Care

In a groundbreaking study published in BMC Medical Ethics, researchers have delved into the public’s perception of artificial intelligence (AI) in healthcare, spotlighting both ethical concerns and potential opportunities for enhancing patient-centered care. As AI continues to permeate various facets of medical practice, understanding its impact on patient trust and decision-making has become increasingly critical.AI in Healthcare: A Double-Edged Sword

The study, conducted by researchers from Florida Atlantic University and the University of South Florida, surveyed 600 adults in Florida to gauge their comfort levels with AI in healthcare tasks. The findings reveal a complex relationship between AI integration and patient trust. While AI is seen as a tool that could potentially improve efficiency and support medical professionals, there is a palpable concern about losing the “human touch” in patient care.Interestingly, the study found that while 84.2% of respondents felt comfortable with AI handling administrative tasks, such as scheduling appointments, only 33.7% were comfortable with AI administering medications. This dichotomy underscores the need for careful integration of AI into healthcare settings, ensuring it complements rather than replaces human interaction.

Trust and Autonomy: Key Concerns

One of the study’s critical insights is the public’s apprehension about AI’s role in clinical decision-making. Many participants expressed discomfort with AI making autonomous medical decisions, highlighting a broader concern about maintaining patient autonomy and consent. As AI technologies advance, the study suggests that incorporating informed consent procedures and clearly communicating the benefits and risks of AI to patients could enhance trust and acceptance.Regulation and Ethical Guidelines: A Call to Action

Despite AI’s potential to revolutionize healthcare, the study emphasizes the urgent need for regulation and ethical guidelines. Without clear oversight, the integration of AI could inadvertently undermine patient-centered care principles. The researchers advocate for a framework that includes transparency, accountability, and patient choice, ensuring AI’s role in healthcare aligns with ethical standards.Opportunities for Equitable Care

Beyond the challenges, the study also highlights opportunities for AI to contribute to more equitable healthcare. By eliminating biases and supporting data-driven decisions, AI has the potential to enhance patient outcomes and reduce disparities. However, this potential can only be realized if AI systems are designed with patient values and preferences in mind.For those interested in exploring the full findings and methodology of this study, the original article is accessible on BMC Medical Ethics. The data, publicly released on September 6, 2023, is available on the University of South Florida’s webpage.

Conclusion

As AI continues to shape the future of healthcare, this study serves as a crucial reminder of the importance of balancing technological advancements with ethical considerations. By prioritizing patient-centered care and addressing public concerns, the medical community can harness AI’s potential to improve healthcare delivery while preserving the essential human elements of care.The AI Revolution in Real Estate

The AI Revolution in Real Estate

The real estate industry is experiencing a seismic shift, thanks to the integration of artificial intelligence (AI). This cutting-edge technology is fundamentally transforming property acquisition, sales, and management processes. AI’s influence extends to predictive analytics, which are reshaping investment decisions, and virtual property tours, which are revolutionizing how we navigate the real estate landscape.According to Deloitte’s research, 52% of corporate real estate developers believe AI can ensure precise property valuation, highlighting its pivotal role in property assessment and pricing accuracy. Additionally, 48% of property managers plan to enhance their revenue through tech-driven efficiency, as noted by Buildium.

Proptech: The Future of Real Estate

AI solutions are central to the rapidly expanding proptech sector. The global proptech market is projected to reach $94.2 billion by 2030, with a compound annual growth rate (CAGR) of 15.8% from 2022 to 2030.In 2021, global investments in proptech companies reached a remarkable total of $24.3 billion. This figure has shown a consistent upward trend since 2012, with the exception of 2020 when new proptech company establishment decreased. The United States recorded 154 proptech funding rounds in 2021, and 2022 secured the second-highest spot on the record charts, with an impressive count of 109 deals.

AI and ML: Streamlining Real Estate Processes

AI and machine learning (ML) technologies are revolutionizing the real estate sector, particularly by streamlining manual processes that have traditionally been paperwork-intensive. Entrepreneur reports that incorrect data in real estate can result in substantial revenue losses, including missed opportunities, lost sales, operational inefficiencies, legal complications, and poor decision-making.The global property management software market is anticipated to grow significantly, with its value projected to increase from $22.05 billion in 2023 to approximately $42.89 billion by 2030.

Data-Driven Market Analysis

Data-powered market analysis is a game-changer for the real estate industry, driven by AI platforms that empower rapid evaluation of real estate projects. These analyses, fueled by data from diverse sources, provide a solid foundation for informed decision-making. Additionally, AI-driven predictive analytics enhance investment strategies by streamlining approaches, reducing risks, and seizing market opportunities.For instance, Lennar collaborated with Climate Alpha, an AI analytics platform, to identify climate-resilient residential areas in the US for future investments.

Image source: REimagineHome

Image source: REimagineHome

Sustainability and Energy Efficiency

The real estate sector carries a substantial environmental burden, responsible for a staggering 40% of annual global CO2 emissions. McKinsey’s research suggests that approximately $7.5 trillion in property value is at risk due to climate-related challenges or the inability to decarbonize existing structures.Proptech presents a significant opportunity for the real estate industry by potentially reducing maintenance costs for green buildings by an average of 20%. To expedite the adoption of sustainable real estate practices, proptech introduces smart decarbonization strategies and green building technologies.

Conclusion

As the proptech industry continues to advance and introduce innovations, it holds the potential to transform the real estate landscape, improving accessibility, convenience, and the overall experience for all participants in the industry. This includes property managers, real estate agents, buyers, renters, and investors alike.Virtual Care in 2024: Challenges and Opportunities for Telehealth

Virtual Care in 2024: Challenges and Opportunities for Telehealth

The telehealth market is experiencing a remarkable surge, driven by the increasing adoption of digital health solutions and remote care services. As reported by PharmiWeb.com, the market was valued at USD 91.4 billion in 2023 and is projected to soar to USD 789.7 billion by 2032, with a compound annual growth rate (CAGR) of 27.4%. This growth highlights telehealth’s transformative role in enhancing healthcare delivery, promising improved accessibility, efficiency, and cost-effectiveness.Several key drivers are propelling this expansion. Advancements in digital health platforms, such as mobile health applications and live video consultations, are breaking down geographical barriers, providing unprecedented access to quality healthcare. The increasing demand for remote patient monitoring (RPM) technologies allows for real-time patient data tracking, ensuring proactive healthcare management. Additionally, the rising prevalence of chronic diseases like diabetes and hypertension accentuates the necessity for telehealth solutions. Government initiatives promoting digital healthcare adoption, particularly during the COVID-19 pandemic, have further strengthened the industry.

Moreover, telehealth’s cost-effective nature significantly reduces healthcare expenses for both providers and patients by minimizing the need for in-person visits and optimizing resource allocation.

Telehealth Market Segmentation

The telehealth market is segmented by component (software, services, hardware), mode of delivery (web-based, cloud-based, on-premises), and end-users (healthcare providers, patients, payers). Regionally, North America leads in telehealth adoption due to advanced technology, high healthcare spending, and favorable regulations. However, the Asia-Pacific region is expected to witness rapid growth, driven by increasing smartphone penetration and supportive governmental policies.Challenges and Innovations

Despite the positive outlook, the industry faces challenges, notably data privacy and security concerns, infrastructure limitations in developing regions, and regulatory hurdles for cross-border healthcare services. Innovations driving market growth include AI and machine learning for enhanced diagnostics, integration of wearable devices for continuous monitoring, blockchain for secure data management, and AR/VR technologies for immersive healthcare experiences.The COVID-19 pandemic dramatically accelerated telehealth adoption, acting as a catalyst for virtual healthcare solution uptake—a trend expected to continue post-pandemic as telehealth becomes integral to healthcare systems.

Prominent players in the telehealth market, such as Teladoc Health, American Well, and MDLIVE, are heavily investing in research and development to innovate and bolster their market standing, paving the way for a promising future in telehealth.

For more detailed insights, access the sample report or purchase the full report from Ameco Research.

NAR 2024 Sustainability Report: A Greener Future for Real Estate

Green Data Fields: A Step Towards Transparency

A notable shift is the integration of green data fields into the Multiple Listing Service (MLS). This innovation is transforming how properties are presented, emphasizing sustainable features to guide buyers towards eco-friendly homes. Such transparency not only promotes healthier living environments but also prepares the housing market for a sustainable future.Empowering Through Education

Education plays a crucial role in this transformation. The survey reveals that a quarter of individuals living in homes with sustainable features have received some form of training. This growing awareness among real estate professionals encompasses energy-efficient appliances, renewable energy systems, and eco-friendly building materials. Armed with this knowledge, agents are better equipped to advocate for green living, meeting the evolving demands of environmentally conscious clients.Energy Efficiency: A Key Market Driver

Energy efficiency is becoming a valuable asset in property descriptions, with more than half of the respondents recognizing its importance. As the demand for sustainable living grows, agents who champion energy-efficient properties are positioned as key change agents, enhancing the marketability of these buildings.Client Interest: Aligning with Eco-Conscious Preferences

The survey highlights a growing client interest in sustainability, with nearly half of respondents noting this trend. This shift underscores the necessity for REALTORS® to align with client preferences, fostering not just transactions but also positive environmental change.

Green Certifications: Dispelling Myths

Contrary to common misconceptions, over 40% of homes with green certifications experienced no difference in market time. This dispels the myth that eco-friendly certifications hinder marketability, highlighting the growing acceptance of green-certified homes.High-Performance Homes: A Worthwhile Investment

Interestingly, homes with high-performance features command a premium of 1% to 5% in dollar value compared to similar homes. This underscores the financial incentives associated with investing in homes that prioritize comfort, health, and operational efficiency.

Conclusion: A Green Horizon Beckons

The NAR 2024 Sustainability Report paints a landscape ready for transformation. It emphasizes the potential for the residential real estate sector to lead a more sustainable, resilient future by integrating green data fields and accepting eco-friendly certifications.As interest in sustainable living grows, real estate professionals are essential advocates for eco-friendly homes and practices. By furthering education, championing energy efficiency, and engaging with green properties, the real estate industry is paving the way for a greener future. For more details, explore the NAR 2024 Sustainability Report.

2025 Commercial Real Estate Outlook: Navigating a New Era

2025 Commercial Real Estate Outlook: Navigating a New Era

The commercial real estate landscape is on the brink of transformation as leaders seek to navigate the challenges of recent years and position their organizations for future opportunities. As we look into 2025, the insights from Deloitte’s Commercial Real Estate Outlook provide a comprehensive guide to understanding the shifting dynamics in this sector.Economic Insights: A Global Perspective

The economic forecasts from various regions offer a critical backdrop for understanding the commercial real estate market. In the United States, the economic outlook for Q2 2024 highlights a period of cautious optimism. Meanwhile, the Eurozone is navigating its economic challenges with a focus on stability, as detailed in the April 2024 report. In India, the April 2024 outlook emphasizes growth opportunities amidst global uncertainties. These regional insights, coupled with the global economic outlook from January 2024, underscore the interconnected nature of the commercial real estate market.Strategic Responses to Economic Fluctuations

In response to these economic conditions, businesses are reshaping their strategies to better align with the evolving market landscape. This includes adapting to post-pandemic realities and leveraging new opportunities. The integration of new technologies and innovative strategies is paramount in this transition, as organizations strive to maintain a competitive edge.Leveraging New Opportunities

The outlook for 2025 encourages leaders to harness emerging opportunities in commercial real estate. This involves not only adapting to current challenges but also anticipating future trends. By focusing on strategic innovation and resilience, businesses can position themselves to thrive in a rapidly changing environment.Conclusion The 2025 Commercial Real Estate Outlook serves as a pivotal resource for leaders seeking to navigate the complexities of the current market. By understanding regional economic insights and adopting strategic responses, organizations can effectively position themselves for success in the coming years.

The Emerging Mental Health Crisis Among Healthcare Workers During the COVID-19 Pandemic

The Emerging Mental Health Crisis

The pandemic has ushered in a wave of mental health challenges that affect healthcare workers profoundly. From the onset of COVID-19, these professionals have been at the forefront, facing immense pressure, long hours, and the constant fear of exposure. This has led to heightened levels of stress, burnout, and even post-traumatic stress disorder (PTSD) among many, as highlighted in a recent article from Frontiers.Stress and Burnout: The Silent Epidemic

Healthcare workers are no strangers to stress, but the pandemic has exacerbated this issue to unprecedented levels. The World Health Organization estimates a significant shortfall in healthcare workers by 2030, which further compounds the stress and burnout experienced by those currently in the field. The emotional toll of making life-and-death decisions, often with limited resources, adds to the moral injury many healthcare workers endure.Self-Care and Systemic Support

While individual self-care practices are crucial, they are not enough. The article emphasizes the need for systemic changes to provide robust support structures for healthcare workers. Implementing evidence-based interventions and policies that prioritize mental health can create a more sustainable and supportive work environment.Strategies for Promoting Mental Health

Several strategies can be employed to support healthcare workers’ mental health. These include providing psychological first aid, resilience training, and access to mental health resources. The use of telemedicine and digital platforms can also alleviate some of the pressures by offering remote consultations and support, as demonstrated during the COVID-19 outbreak in China.Moving Towards Systemic Change

The pandemic has underscored the need for a systemic shift in how we approach healthcare workers’ mental health. This involves not only addressing the immediate mental health needs but also implementing long-term strategies that foster resilience and well-being. As the article suggests, engaging healthcare workers in policy-making processes and promoting a culture of empathy and support are vital steps towards achieving this goal.

Conclusion

In conclusion, the mental health of healthcare workers is a critical public health priority that cannot be overlooked. By implementing systemic changes and providing comprehensive support, we can ensure that these essential workers are equipped to handle current and future health crises. As we move forward, let us remember the invaluable contributions of healthcare workers and strive to create a more supportive and resilient healthcare system.)

Ethical Concerns of Large Language Models in Healthcare

Since the release of ChatGPT by OpenAI in 2022, LLMs have rapidly expanded into healthcare, promising advancements in clinical decision-making, diagnosis, and patient communication. However, the review underscores persistent ethical challenges, including issues of fairness, bias, transparency, and privacy. These concerns underscore the pressing need for well-defined ethical guidelines and human oversight in medical applications.

Exploring Ethical Implications

The study identifies several core themes in the ethical use of LLMs. In clinical settings, LLMs hold potential for assisting in initial patient diagnosis and triage. Yet, there is apprehension about biases that may lead to incorrect diagnoses or treatment recommendations, highlighting the necessity for careful oversight by healthcare professionals.

Patient support applications of LLMs aim to improve health literacy and facilitate communication across language barriers. However, concerns about data privacy and the reliability of medical advice generated by these models remain significant.

Public Health Perspectives

From a broader public health perspective, the study warns of potential risks, such as the dissemination of misinformation and the concentration of AI capabilities in the hands of a few corporations. This could exacerbate existing health disparities and undermine public health efforts.

Ultimately, while LLMs present promising advancements in medical fields, ensuring their ethical deployment requires careful consideration. Addressing biases, enhancing transparency, and maintaining human oversight are crucial to mitigating potential harms and promoting equitable patient care.

For further insights, you can read the original article on News-Medical. Additionally, the full study is available on npj Digital Medicine.

The Role of Wearable Devices in Chronic Disease Monitoring and Patient Care: A Comprehensive Review

The Role of Wearable Devices in Chronic Disease Monitoring and Patient Care: A Comprehensive Review

In the ever-evolving landscape of healthcare, **wearable health devices** have emerged as pivotal tools in the management of chronic diseases. These devices, ranging from sophisticated smartwatches to implanted sensors, offer real-time monitoring and personalized care, thus transforming patient outcomes and healthcare delivery.Revolutionizing Chronic Disease Management Wearable devices have become integral in managing chronic conditions such as diabetes, cardiovascular diseases, and respiratory disorders. By providing continuous health data, these devices empower patients and healthcare professionals with insights that were previously unattainable. For instance, continuous glucose monitors (CGMs) have revolutionized diabetes management, offering real-time glucose readings that lead to precise insulin dosing and improved glycemic control.

Moreover, **wearable technologies** play a crucial role in cardiology by monitoring heart rate and blood pressure, aiding in the detection of arrhythmias, and supporting cardiac rehabilitation. In respiratory health, these devices continuously track vital indicators like respiratory rate and oxygen saturation, facilitating early diagnosis and treatment of conditions such as asthma and COPD.

Challenges and Opportunities Despite their potential, wearable health devices face several challenges. Data accuracy and reliability remain significant concerns, especially under varying physical conditions. Integrating wearable data with existing health records poses operational challenges, necessitating standardized protocols and robust data structures.

Data privacy and security are also critical issues. The continuous collection and transmission of sensitive health information expose users to potential data breaches. Ensuring confidentiality and compliance with regulatory standards like HIPAA and GDPR is essential to build trust among users and healthcare providers.

Cost is another barrier to widespread adoption, particularly in resource-constrained settings. While prices have declined, the initial investment in hardware, software, and training can be prohibitive for some patients and healthcare professionals.

Expanding the Horizon The potential of wearable devices extends beyond individual health management to broader public health interventions. Aggregate data from these devices can provide valuable insights into public health issues, disease outbreaks, and the effectiveness of interventions. This capability positions wearable devices as powerful tools for conducting extensive epidemiological studies and shaping public health policies.

Conclusion As wearable health devices continue to evolve, their integration into healthcare systems signifies a step toward improved patient care and resource utilization. To fully harness their benefits, continuous innovations and collaborations among healthcare professionals, researchers, and technology developers are essential. Addressing challenges related to data accuracy, privacy, and cost will be crucial in realizing the full potential of wearable devices in chronic disease management.

For more insights, refer to the original article on Cureus.

AI Training Mandates: Navigating Legal Waters in Dentistry

AI Training Mandates: Navigating Legal Waters in Dentistry

The integration of artificial intelligence (AI) into dental practices is more than a technological trend; it represents a seismic shift in the industry. This transformation is reshaping skill sets and prompting a thorough examination of legal and ethical implications. As AI systems increasingly perform tasks traditionally handled by human intelligence, the dental sector is grappling with new challenges and opportunities.Since its inception in the 1950s, AI has advanced rapidly, leading to its widespread adoption in healthcare and dentistry. This evolution has been driven by significant strides in computing power and data accessibility, ushering in an era where AI technologies are deeply embedded in dental practice management, patient care optimization, and administrative efficiency.

Legal Frameworks Across the Globe

In Canada, the dual framework of federal and provincial legislation governs employment law. While dental practices primarily fall under provincial jurisdiction, existing laws like the Personal Information Protection and Electronic Documents Act (PIPEDA) are crucial. As AI systems process sensitive patient data, the proposed Artificial Intelligence and Data Act (AIDA) signifies a forthcoming regulatory framework to oversee high-impact AI technologies.In the United States, the employment law landscape is shaped by federal statutes and state-specific regulations. The Equal Employment Opportunity Commission (EEOC) has proactively scrutinized AI’s role in hiring, ensuring applications align with federal civil rights laws, thus mitigating risks of discriminatory practices.

Meanwhile, the European Union has pioneered AI regulation within employment law, focusing on data protection and ethical AI deployment. The General Data Protection Regulation (GDPR) and the proposed AI Act impose stringent rules on AI systems, safeguarding privacy and ensuring fairness in employment contexts.

Employment Implications and Legal Challenges

Implementing AI training mandates in dental offices introduces several implications. Skill gaps among staff necessitate tailored training approaches, potentially impacting daily operations. Traditional roles may evolve to include AI-related responsibilities, altering job descriptions and expectations. Moreover, privacy concerns arise as AI systems handle sensitive patient data.Mandating AI training could also lead to constructive dismissal claims if it significantly alters employment terms. Legal precedents in Canada, such as Farber v. Royal Trust Co., highlight the potential for claims arising from substantial changes in job duties or skill requirements.

Discrimination concerns, particularly age-related disparities, are also significant. Mandatory AI training may disproportionately affect older employees, potentially leading to age discrimination claims. Dental offices must align AI training initiatives with human rights legislation, ensuring accommodations for employees with disabilities.

Strategies for Mitigation and Best Practices

To mitigate legal risks, transparent communication regarding AI training requirements is essential. Dental offices should clearly articulate the reasons for AI integration and document employee consent to participate in training programs. Consulting with legal experts and conducting audits of AI training programs can further ensure compliance with evolving legal frameworks.Offering voluntary AI training programs with incentives and implementing phased introductions to AI technologies can enhance employee motivation and engagement. By customizing training programs to individual needs, dental offices can foster a supportive learning environment.

As AI continues to transform the dental industry, navigating these advancements demands careful attention to legal and ethical principles. By embracing a thoughtful and inclusive approach to AI integration, dental offices can harness AI’s transformative potential while mitigating legal risks and cultivating a positive work environment.

For more insights, refer to the original article on the Oral Health Group.

Smart Home Energy Management Devices: A Market Poised for Growth

Smart Home Energy Management Devices: A Market Poised for Growth

The Global Smart Home Energy Management Device Market is on the brink of a significant transformation, driven by escalating demands for energy-efficient solutions and the increasing adoption of smart home technologies. As consumers become more conscious of the importance of energy conservation, fueled by environmental concerns and rising energy costs, the market is set for a promising trajectory.Government initiatives play a crucial role in promoting sustainable practices and integrating renewable energy sources, further accelerating the market’s expansion. Technological advancements, particularly in artificial intelligence and IoT connectivity, have enhanced these devices’ capabilities, making them more intuitive and user-friendly.

North America: Leading the Charge

North America has emerged as the dominant region in the Global Smart Home Energy Management Device Market, a position it is expected to maintain. This strong market presence is attributed to high consumer awareness about energy conservation, widespread adoption of smart home technologies, and supportive government initiatives. The region’s well-established IoT infrastructure and prevalent home automation systems have significantly contributed to the widespread adoption of these devices.Despite the promising growth, challenges such as integration complexities, data security concerns, and high initial costs persist. However, the future looks bright as innovations continue to shape the industry. According to a report, the market value is expected to rise from $3.7 billion in 2023 to $8.91 billion by 2029, marking a compound annual growth rate of 15.6%.

Key Market Drivers and Challenges

- Drivers: Increasing consumer awareness, advancements in IoT technology, government initiatives, and the integration of renewable energy sources.

- Challenges: Interoperability and integration complexity, data security and privacy concerns, limited consumer awareness, and high initial costs.

Looking Ahead

As the market continues to evolve with innovative product offerings and increasing consumer demand, North America is expected to maintain its leadership position. This growth will drive the Global Smart Home Energy Management Device Market in the coming years, contributing significantly to the global shift towards sustainable living.For more information, visit the original report.

Telehealth and Technology: Revolutionizing Behavioral Health Care

Telehealth: Expanding Access and Enhancing Care

**Telehealth** has emerged as a cornerstone of healthcare delivery, particularly in the realm of **behavioral health**. The COVID-19 pandemic accelerated its adoption, turning it from a supplementary service into a primary mode of care. **Telehealth** effectively bridges the gap for rural and underserved populations, offering treatment options right at patients’ doorsteps. As **telemedicine platforms** become more sophisticated and integrate seamlessly with **electronic health records (EHRs)**, they promise to provide personalized care and ensure continuity for a broader patient base.The Role of Technology in Behavioral Health

**AI** and **machine learning** are at the forefront of revolutionizing **behavioral health**. By developing predictive models, these technologies can identify individuals at risk of **mental health issues** before they become severe. **Wearable technology**, which monitors real-time physiological data, and **digital therapeutics**, which deliver evidence-based interventions through software programs, offer valuable insights into patients’ mental and physical health. These tools are proving to be cost-effective solutions for managing therapy and treatment.The Future Outlook

As **telehealth** and technology blend into every aspect of care, the healthcare industry is moving towards continuous, personalized, and preventive healthcare models. Advances in **genomics** and **precision medicine** will further aid healthcare providers in diagnosing and treating diseases tailored to individuals’ genetic makeups, enhancing both surgical outcomes and patient satisfaction.However, as these advancements unfold, the industry faces challenges in safeguarding **patient data** and ensuring that **AI tools** are responsibly utilized. Balancing technological progression with ethical practices is crucial. For healthcare to successfully integrate these innovations, it must focus on enhancing the human element in medical care, while leveraging technology’s vast potential to improve **patient outcomes**.

Revolutionizing Healthcare: AI and Precision Medicine for Chronic Diseases

Revolutionizing Healthcare: AI and Precision Medicine for Chronic Diseases

In a groundbreaking effort to redefine healthcare, the National Institute of Diabetes and Digestive and Kidney Diseases (NIDDK) is spearheading a workshop focused on the integration of Artificial Intelligence (AI) and Machine Learning (ML) in precision medicine, specifically targeting diabetes and other chronic diseases. This initiative aims to leverage recent advancements in AI, including generative AI and Large Language Models (LLMs), to innovate biomarker development, drug discovery, and diagnostics.

The workshop, detailed in the original article from the National Institutes of Health (NIH), promises to be a landmark event. It aims to bring together biomedical researchers and AI/ML experts to discuss the critical challenges, crosscutting gaps, and opportunities for actionable items in leveraging AI/ML in precision medicine.

Workshop Objectives and Agenda

The primary goal of the workshop is to heighten understanding of the unique opportunities AI provides in personalizing healthcare. Participants will delve into:

- The transformative power of AI in personalizing healthcare.

- Current approaches to precision medicine for chronic conditions.

- Addressing community needs and identifying gaps in current methodologies.

The event includes pre-workshop webinars designed to set the stage for discussions. Notable sessions include Part I: The Bio-Behavioral Dimensions of Diabetes Heterogeneity on October 17, featuring Dr. Yao Qin and Dr. Ashu Sabharwal, and Part II: Advances in AI and Applications in Biomedicine on October 24, featuring Dr. James Zou and Dr. Eran Halperin.

Key Organizers and Participants

The workshop will feature esteemed personnel, including external co-chairs Marcela Brissova from Vanderbilt University, Jeffrey Grethe from the University of California, San Diego, and Wei Wang from the University of California, Los Angeles. Participating NIH/NIDDK experts include Eric Brunskill, Debbie Gipson, Daniel Gossett, Carol Haft, Jia Nie, Xujing Wang, and Ashley Xia.

Event Details and Registration

The workshop was held at the Neuroscience Center Building in Rockville, MD, with virtual participation options available. Although registration has concluded, the event’s impact is expected to resonate throughout the scientific community.

For further information, interested parties could have contacted Xujing Wang, Ph.D., or Jia Nie, Ph.D., at the NIH, or Mark Dennis from The Scientific Consulting Group for logistical concerns.

Conclusion

The integration of AI and precision medicine offers a promising frontier in healthcare, particularly for managing chronic diseases like diabetes. As the NIDDK’s workshop highlights, the collaboration between AI/ML experts and biomedical researchers is crucial in overcoming existing challenges and harnessing AI’s full potential in revolutionizing healthcare.

FoxyAI and LOOM’s Game-Changing Partnership in South African Real Estate

FoxyAI and LOOM Property Insights: A New Era in South African Real Estate

In a transformative move for the **South African real estate landscape**, FoxyAI has unveiled a strategic partnership with LOOM Property Insights. This collaboration is set to revolutionize **property valuations** for 56% of the nation’s mortgage-linked market, blending cutting-edge **AI technology** with real-time **property data** and insights.

By integrating FoxyAI’s award-winning technology, **LOOM** is poised to enhance its valuation processes, transitioning from a traditionally manual, week-long appraisal system to a swift, **AI-driven evaluation** completed within a single day. This marks a significant shift towards more efficient, accurate, and standardized **property valuations**, crucial for banks and **real estate professionals**.

Setting New Standards

“This collaboration marks FoxyAI’s inaugural venture into the **South African market**, demonstrating the global applicability of its AI-driven solutions,” stated Vin Vomero, CEO of FoxyAI. Jacques Rossouw, CEO of LOOM, highlighted the partnership’s potential to elevate the accuracy and efficiency of the **property market** in South Africa, offering more reliable data and streamlined processes.

Founded in 2018, FoxyAI is at the forefront of utilizing **artificial intelligence** to convert **real estate images** into actionable data, providing a comprehensive suite of **Property Intelligence tools**. Meanwhile, **LOOM Property Insights** continues to leverage advanced technologies to deliver real-time, accurate **property data** and insights, enhancing understanding throughout the **property lifecycle**.

For further details, visit FoxyAI and LOOM Property Insights. For inquiries, reach out to sales@foxyai.com.

Bridging the Digital Divide in Rural Healthcare

Bridging the Digital Divide in Rural Healthcare

According to the World Health Organization (WHO), around two billion individuals residing in rural and remote areas worldwide lack sufficient healthcare access. A major contributor to this issue is inadequate broadband access, which severely limits the effectiveness of telehealth services. This digital divide hinders healthcare delivery and intensifies existing health disparities, preventing rural populations from fully benefiting from video-based telehealth consultations, remote monitoring, and other bandwidth-intensive applications.

Additionally, the shortage of healthcare professionals in rural communities is alarming. Although half of the global population resides in rural regions, these areas are served by only 38% of the total nursing workforce and an even smaller percentage of physicians. Many rural inhabitants also face the challenge of traveling long distances for specialty care, leading to delayed care and unfavorable health outcomes.

The Promise of Telehealth

Telehealth presents a promising solution by expanding access to healthcare services. Technological advancements have improved telehealth platform integration with medical devices and electronic medical records (EMRs), making these services more user-friendly and accessible. Scalable solutions that provide diverse healthcare services on a single platform can address multiple specialties.

Understanding the Rural Healthcare Landscape: Rural communities, comprising over 40% of the global population, face higher chronic disease rates as reported in 2023 by the Centers for Disease Control and Prevention (CDC). These areas suffer from inadequate access to both primary and specialty care, with critical health facilities becoming scarce.

Challenges for Rural Healthcare Executives

Rural healthcare executives list workforce shortages, financial constraints, and limited specialty care access as primary challenges, underlining the urgent need for innovative solutions like telehealth.

Telehealth’s Role in Addressing Challenges

Telehealth optimizes healthcare delivery, closing care gaps through systems like Health Information Technology (HIT) in the US, Pakistan’s COMSATS Telehealth program, and Kenya’s mHealth initiative. These examples demonstrate telehealth’s impact on local healthcare services by reducing costs and travel needs.

Best Practices for Telehealth Implementation

- To succeed, telehealth programs must incorporate thorough needs assessments, select appropriate platforms, and provide comprehensive training. These steps ensure effective solutions for rural healthcare challenges, should involve stakeholders for selecting the platform, and require ongoing technical support for healthcare providers.

Strategic Considerations

Effective telehealth integration requires financial assessments, adherence to regulatory and compliance standards, and robust technology infrastructure. Cost-benefit analyses, such as studies from Australia and Canada showing telehealth savings, emphasize telehealth’s financial viability. Ensuring compliance and robust connectivity infrastructures, like mobile hotspots, further support successful implementation.

The Future of Telehealth in Rural Healthcare

Effective telehealth adoption in rural settings relies on careful planning, stakeholder engagement, and continuous support to improve access, patient outcomes, and reduce costs. C-suite executives play a key role in driving adoption and ensuring high-quality rural healthcare. Embracing telehealth promises a future where healthcare services are equitable and accessible, bridging urban and rural disparities globally.

For a more detailed exploration, visit the original article on Omnia Health Insights.

AI Revolutionizing Cancer Diagnosis and Treatment

AI: The New Frontier in Cancer Care

AI’s potential in healthcare is vast, with its most promising applications in computer vision. As Dr. Yu explains, this technology, widely used in facial recognition and autonomous driving, can significantly enhance cancer diagnosis. By analyzing digital radiology and pathology images, AI can identify patterns typical of cancer, thus improving diagnostic accuracy and treatment precision.Furthermore, AI’s role extends to guiding radiation treatment. By using enhanced precision, AI can help protect healthy tissue while targeting cancerous cells, minimizing side effects. Radiation oncologists are exploring AI’s capabilities to better identify cancer margins and program radiation machines for more accurate treatment delivery.

Bridging the Gap: AI as a Medical Translator

AI’s influence is not limited to diagnosis and treatment. Large Language Models, such as those powering ChatGPT, offer a new way to demystify medical jargon. These tools can simplify complex medical documents, making them more accessible to patients. Dr. Yu notes that AI can address common patient queries with speed and accuracy, transforming how patients interact with their medical records.Ethical Considerations in AI Healthcare

While AI’s potential is exciting, it is not without ethical concerns. Dr. Yu emphasizes the importance of addressing issues such as patient privacy, data sharing, and the accuracy of AI-generated information. There is also the risk of perpetuating systemic biases through AI databases, a challenge that must be navigated carefully.Prevention: A Human Responsibility

Despite AI’s advancements in cancer care, Dr. Yu reminds us that prevention is a human responsibility. Cancer prevention involves lifestyle choices like HPV and Hepatitis B vaccinations, avoiding tobacco, and maintaining a healthy diet. These steps are crucial in reducing cancer risk, underscoring that while AI can aid in detection and treatment, prevention starts with personal choices.For more insights on healthcare innovations, visit the original article on Hartford Hospital’s news center.

Unlocking Business Value: Navigating the AI Landscape

Unlocking Business Value: Navigating the AI Landscape

The journey to establish a return on investment (ROI) from AI projects can be as complex as it is rewarding. As organizations continue to invest in generative AI, the challenge lies in translating hype into tangible business value. According to a recent CIO article, focusing on specific metrics, aligning data operations with revenue-centric tasks, and enhancing employee engagement with AI are key strategies to maximize the potential of these technologies.The AI Hype Cycle: A Double-Edged Sword?

While the AI hype has fueled investments, Gartner’s recent analysis has placed generative AI at the “peak of inflated expectations,” suggesting a potential dip into the “trough of disillusionment” is imminent. Despite this, the AI honeymoon isn’t over yet. A report from AI at Wharton indicates that 72% of enterprises anticipate increased budgets for AI over the next year, though growth is expected to slow thereafter.Productivity and Beyond: The Real Impact of AI

Many early successes with generative AI have focused on boosting productivity. For instance, developers leveraging GitHub Copilot have reported a 26% increase in task completion. However, for CIOs, the challenge remains to justify continued investments by demonstrating AI’s broader strategic impacts, especially on the bottom line.Strategic Metrics: The Key to Success

To unlock AI’s potential, CIOs need to identify and focus on metrics that align with core business objectives. As Shaown Nandi from AWS suggests, setting clear, measurable goals is crucial. Whether it’s reducing call center escalation rates or enhancing customer communication, pinpointing these metrics can provide a roadmap for AI success.Data Strategies: The Backbone of AI Initiatives

Improving data quality and integration is vital for marketing departments aiming to track the financial impact of AI. As noted by Michelle Suzuki, CMO of Glassbox, a seamless partnership between CIOs and CMOs is essential to enhance decision-making capabilities. This involves prioritizing proactive data governance and embracing DataOps practices.Call Centers and Service Operations: A New Frontier

AI’s role in support services is transformative. By expediting operations and improving customer satisfaction, AI can significantly enhance service desk efficiencies. As Ram Ramamoorthy from ManageEngine highlights, AI-driven knowledge graphs and intelligent routing are game-changers in this space.Employee Experience: The Human Element

As AI reshapes work environments, CIOs must also consider its impact on employee well-being. A report by Deloitte reveals that only 20% of organizations are well-prepared for the talent considerations associated with AI adoption. This underscores the need for effective change management strategies to ensure a smooth transition.In conclusion, while the path to achieving ROI from AI investments is fraught with challenges, the potential rewards make it a journey worth undertaking. By focusing on strategic metrics, aligning data strategies, and fostering a supportive environment for employees, organizations can harness AI’s full potential.

Wearable Technology: A New Frontier in Heart Failure Management

Wearable Technology: A New Frontier in Heart Failure Management

In the ever-evolving landscape of medical technology, wearables have emerged as a promising solution for enhancing the remote monitoring of heart failure patients. These devices, capable of tracking crucial physiological parameters, hold the potential to revolutionize patient care. However, their integration into clinical practice is not without challenges.A recent scoping review published in Nature highlights the current state of wearable technology for heart failure management. The review, conducted by a team of researchers including Annemiek E. van Ravensberg and Abdul Shakoor, delves into the readiness of these devices for clinical use, employing the Medical Device Readiness Level (MDRL) as a framework for assessment.

The Promise and the Pitfalls

Wearable devices offer a personalized and empowering experience for patients, potentially becoming a vital component of modern heart failure management. Yet, the review underscores a significant barrier: the lack of rigorous evaluations. Of the 99 studies identified, only a handful were randomized controlled trials, leaving a gap in robust evidence needed for widespread clinical adoption.The review also points out that most consumer-grade wearables are in the feasibility testing stage (MDRL 6), with only two devices specifically designed for heart failure remote monitoring receiving FDA approval.

Global Burden and the Need for Innovation

Heart failure affects approximately 63 million people worldwide, placing immense strain on healthcare systems. The necessity for frequent outpatient visits and hospitalizations exacerbates this burden, especially in today’s healthcare environment, which is already grappling with limited capacity and staff shortages. Remote monitoring, as highlighted in the meta-analysis by Scholte et al., has been proposed as a solution, showing promise in reducing mortality and hospitalization rates.Challenges in Clinical Integration

Despite the potential benefits, the integration of wearable technology into heart failure care faces significant hurdles. The absence of standardized methodologies and external validation contributes to uncertainty about the actual impact of these devices. Current heart failure guidelines offer limited endorsement for incorporating remote monitoring, reflecting the need for further research and validation.The Path Forward

As the healthcare industry looks to the future, the role of wearable technology in heart failure management remains a subject of intense interest and debate. The review calls for more extensive studies to establish clinical benefits, urging the medical community to bridge the gap between promising technology and practical application.For more details on this groundbreaking review, visit the original article.

AI’s Impact on Finance: Transformative Trends and Future Prospects

Transforming Customer Interactions

One of the most visible impacts of **AI in finance** is the rise of **conversational AI**. Virtual assistants and chatbots, powered by sophisticated algorithms, are providing real-time customer support, handling routine inquiries, and managing basic transactions. This automation frees up human resources for more complex tasks, enhancing both efficiency and customer satisfaction.

For example, HSBC has partnered with SoftBank Robotics to deploy the **AI robot ‘Pepper’** in its branches. Pepper assists customers with basic banking tasks and queries, thereby reducing the burden on human staff and improving operational efficiency.

Streamlining Operations with Machine Learning

The combination of **AI and machine learning (ML)** is instrumental in automating financial processes. **ML algorithms** analyze vast amounts of data to detect patterns and make predictions, enabling automated data entry, document processing, and reconciliation. This reduces manual effort and improves accuracy, allowing employees to focus on higher-value activities such as financial analysis and decision-making.

Benefits of AI in Finance

The integration of **AI in finance** offers numerous advantages:

- Operational Efficiency: Automating repetitive tasks minimizes human error and ensures data integrity.

- Improved Customer Experience: **AI-powered chatbots** provide 24/7 assistance, offering tailored financial advice.

- Competitive Advantage: Rapid data analysis enables quicker decision-making and adaptation to market changes.

- Accurate Models: **AI** enhances risk evaluation, investment strategies, and fraud detection with precise forecasts.

- Speed and Precision: **AI** processes data swiftly, facilitating real-time adjustments to market conditions.

Challenges and Solutions

While **AI** offers significant benefits, its integration into finance comes with challenges such as explainability, regulatory compliance, and cybersecurity risks. Solutions include adopting interpretable **AI techniques**, establishing strong governance structures, and implementing robust cybersecurity measures.

The Future of AI in Financial Services

The future holds immense potential for **AI-driven innovation in finance**. As technologies advance, financial institutions are increasingly leveraging **AI** for enhanced customer experiences, personalized wealth management, and accurate risk assessment. **AI algorithms** will continue to streamline operations, automate tasks, and optimize decision-making processes.

Generative **AI** is set to transform the sector by creating innovative financial products tailored to individual needs, while **machine learning** will push financial services into more predictive and prescriptive territories. By 2028, Citibank forecasts that **AI** could boost global banking profits by $170 billion.

For those looking to harness the power of **AI in finance**, companies like **Appinventiv** offer expert services in developing **AI-powered solutions** tailored to specific needs, ensuring businesses remain competitive and innovative in a rapidly evolving market.

Blockchain and Microcredit: A New Dawn for Financial Inclusion in Kenya?

Blockchain and Microcredit: A New Dawn for Financial Inclusion in Kenya?

In the heart of Kenya, a financial revolution is quietly unfolding. As traditional banking systems grapple with challenges of accessibility and trust, a new player emerges on the scene—blockchain-based microcredit. This innovative approach could potentially transform financial inclusion in the region, a topic explored in a recent article by Monash Lens.

In the heart of Kenya, a financial revolution is quietly unfolding. As traditional banking systems grapple with challenges of accessibility and trust, a new player emerges on the scene—blockchain-based microcredit. This innovative approach could potentially transform financial inclusion in the region, a topic explored in a recent article by Monash Lens.

The story of microcredit is not new. Pioneered by the Grameen Bank, microcredit has been a beacon of hope, offering financial lifelines to entrepreneurs in developing countries. Its success in Bangladesh, with a loan recovery rate surpassing traditional systems, underscores its potential. But in Kenya, the narrative takes a digital twist with blockchain technology.

The Blockchain Advantage

Blockchain offers a decentralized, secure alternative to conventional banking. By eliminating intermediaries, it reduces costs and enhances transaction security. This is particularly beneficial in regions like Sub-Saharan Africa, where financial inclusion lags behind the global average, as noted by the World Bank.However, the journey is fraught with challenges. Financial literacy remains a significant barrier, as highlighted by research by Schuetz and Venkatesh. Low education levels and a lack of awareness impede the adoption of financial services. Yet, the introduction of blockchain-based systems could serve as a catalyst for education and empowerment.

Overcoming Barriers

The integration of blockchain with existing platforms like M-Pesa could be transformative. While M-Pesa has revolutionized mobile banking in Kenya, it faces challenges such as privacy and security. Blockchain’s encrypted, immutable transactions offer a solution, enhancing transparency and reducing fraud risks.For blockchain to succeed, strategic implementation and comprehensive education are crucial. Our recent study funded by the Ethereum Foundation, reveals that understanding the platform’s benefits motivates users to learn. Solutions include localized education, practical use cases, and continuous engagement through community initiatives.

A Promising Future

As PricewaterhouseCoopers emphasizes, blockchain-based financial products must be accessible, reliable, and user-friendly to foster inclusion. The potential is promising, but success hinges on overcoming educational and infrastructural hurdles.Kenya stands on the brink of a financial transformation. By blending blockchain’s innovative capabilities with M-Pesa’s established network, a more inclusive and resilient financial future is within reach. The question remains: can blockchain-based microcredit truly transform financial inclusion in Kenya? The answer, as the Monash Lens article suggests, is a hopeful yet conditional yes.

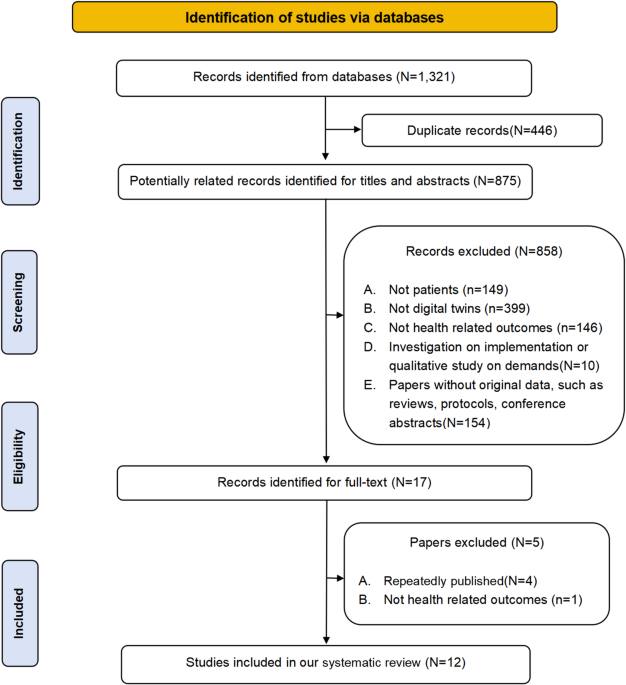

The Revolutionary Role of Digital Twins in Precision Health

The Revolutionary Role of Digital Twins in Precision Health

In a groundbreaking exploration of healthcare innovation, digital twins are emerging as a pivotal technology in the realm of precision health. A recent systematic review published in Nature delves into the transformative potential of digital twins, highlighting their capacity to revolutionize patient outcomes through personalized health management, precision therapies, and risk prediction. Digital twins, essentially virtual replicas of human bodies, utilize real-time data to provide dynamic and individualized healthcare solutions. This technology marks a significant departure from conventional medical practices, which often employ a one-size-fits-all approach. Instead, digital twins offer tailored recommendations and interventions, thereby enhancing the precision and efficacy of healthcare delivery.

Digital twins, essentially virtual replicas of human bodies, utilize real-time data to provide dynamic and individualized healthcare solutions. This technology marks a significant departure from conventional medical practices, which often employ a one-size-fits-all approach. Instead, digital twins offer tailored recommendations and interventions, thereby enhancing the precision and efficacy of healthcare delivery.

Transformative Potential Across Healthcare Domains

The review underscores the broad applicability of digital twins across various medical fields. By integrating omics data, clinical information, and health outcomes, digital twins facilitate a more nuanced understanding of patient health. This capability is particularly beneficial in managing chronic conditions like type 2 diabetes and multiple sclerosis, where personalized treatment plans can significantly improve patient quality of life.Moreover, the technology’s predictive capabilities enable healthcare providers to anticipate and mitigate potential health risks. For instance, digital twins can forecast disease progression and suggest preemptive interventions, thereby reducing the likelihood of severe health complications.

Challenges and Future Directions

Despite their promising potential, the widespread adoption of digital twins in healthcare is not without challenges. Data accessibility and integration across disparate health systems remain significant hurdles. The review advocates for enhanced data-sharing frameworks and the development of robust computational infrastructures to support the seamless implementation of digital twins in clinical settings.The authors, Mei-di Shen from Peking University and Si-bing Chen and Xiang-dong Ding from Jilin University, emphasize the need for continued research and collaboration across medical and technological domains. Such efforts are crucial to unlocking the full potential of digital twins and realizing their promise in precision health.

Conclusion

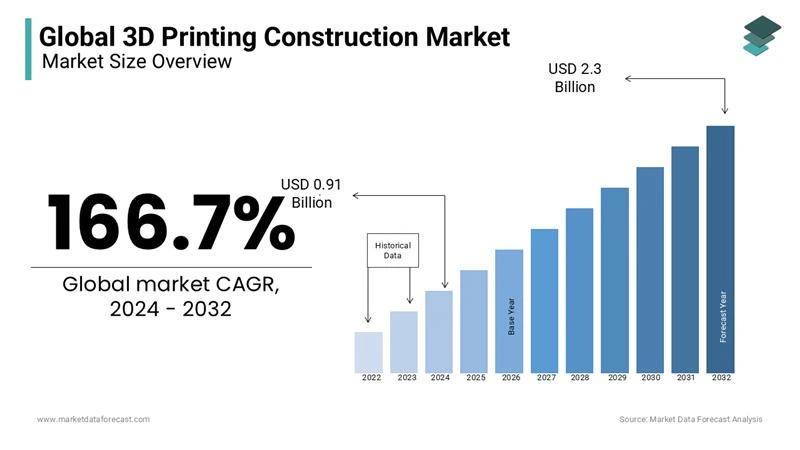

As healthcare continues to evolve, digital twins stand at the forefront of this transformation, offering unprecedented opportunities for personalized and precise medical care. By bridging the gap between digital innovation and clinical practice, digital twins are poised to redefine the future of healthcare, ensuring better outcomes for patients worldwide.The 3D Printing Construction Market: A Future of Growth and Innovation

The 3D Printing Construction Market: A Future of Growth and Innovation

The global 3D printing construction market is on the brink of a remarkable transformation. Currently valued at USD 0.34 billion in 2023, it is projected to surge to USD 910 million by 2024, and ultimately reach USD 2.3 billion by 2032. This rapid expansion is fueled by the sector’s potential to revolutionize traditional building processes through innovative additive manufacturing technologies.

Key Market Trends The rise of sustainable construction practices is one of the most significant trends driving this market. 3D printing not only reduces material waste but also facilitates the use of eco-friendly materials, a crucial factor as the construction industry seeks to reduce its carbon footprint. Moreover, this technology supports accelerated affordable housing solutions, cutting down both construction times and costs, which is essential in addressing global housing shortages.

Drivers of Market Growth Labor shortages are a pressing issue in the construction industry, prompting a shift towards 3D printing. With an aging workforce and a scarcity of skilled labor, companies are increasingly turning to automation to reduce labor dependency. Additionally, the growing demand for customized construction projects is encouraging the adoption of 3D printing, allowing for the creation of intricate, tailored designs that cater to urban and cultural needs.

Government support is also playing a pivotal role in market growth. Initiatives like Saudi Arabia’s Vision 2030 and the European Union’s Horizon 2020 program are promoting the use of 3D printing in construction, further bolstering the market’s expansion.

Challenges and Opportunities Despite its promising advancements, the 3D printing construction market faces challenges such as the high initial capital investment required for equipment and a lack of skilled workforce to operate these technologies. However, opportunities abound, particularly in disaster-relief housing and the integration of 3D printing with smart city initiatives.

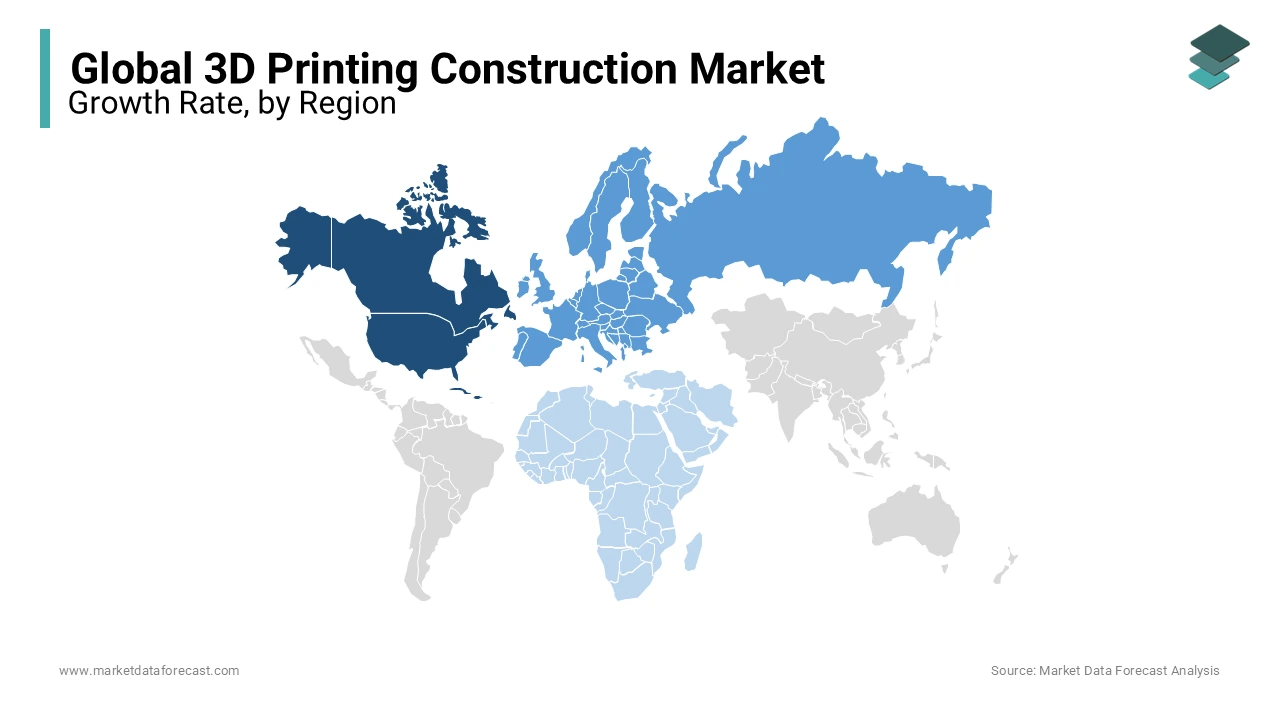

Regional Insights In 2023, North America led the market, holding a 35.8% share, thanks to significant investments and technological advancements. Europe is also experiencing robust growth driven by sustainability initiatives, while Asia-Pacific remains the fastest-growing region due to rapid urbanization and a high demand for affordable housing.

Key Players and Recent Developments Major companies such as WinSun, Apis Cor, and ICON are at the forefront of exploring new frontiers in 3D construction. Recent advancements include Apis Cor’s development of robotic printers and CyBe Construction’s collaborations in the Middle East for affordable housing projects. The introduction of the BetAbram P1 printer and Sika AG’s innovative concrete mix further highlight the industry’s ongoing efforts towards scalability and sustainability.

Overall, the 3D printing construction market is poised for significant growth, driven by its potential to redefine construction methodologies and effectively meet global demands.