The Fintech Boom: Redefining Banking Services In The Digital Age

The Fintech Boom: Redefining Banking Services In The Digital Age

The financial services industry is undergoing a seismic shift, driven by the rise of new fintech technologies. These innovations are revolutionizing how people invest, lend, and save money, responding to the modern demand for efficiency and convenience. Fintech provides transformative solutions that deviate from traditional banking practices, addressing long-standing challenges in the financial sector. Companies like DeepInspire are at the forefront, using innovative technologies to change the delivery of financial services.

Personalized Banking Experiences

One of the most significant advancements in fintech is the ability to offer personalized banking experiences through digital platforms, such as multifunctional mobile apps. Advanced data analytics enable a deep understanding of customer behavior, allowing businesses to tailor financial solutions to individual preferences. Budgeting apps provide insights into spending habits, suggest savings strategies, and warn against potential overspending. In contrast, traditional banks, burdened by outdated systems, struggle to match the level of personalization offered by fintech, risking market share loss to more agile competitors.User-Centric Design

Modern fintech solutions are characterized by their user-centric design, featuring intuitive and accessible mobile applications. These apps facilitate easy navigation of various banking functions and incorporate biometric security measures, such as fingerprint and facial recognition, to enhance security while simplifying login processes. Unlike the cumbersome interfaces of traditional banks, fintech solutions remove barriers to financial access, allowing clients to manage transactions, loans, and accounts seamlessly from anywhere at any time.Relentless Innovation

The innovation cycle in fintech is relentless, consistently presenting comprehensive financial solutions that elevate client interactions with banks. Fintech facilitates real-time transactions, prompt loan approvals, and immediate fund transfers. Platforms offering streamlined lending cut through the red tape of traditional banks’ approvals, setting industry benchmarks that compel banks to recalibrate operations and expand service offerings.Cost-Effectiveness

Fintech’s cost-effectiveness is another notable contribution, achieved by automating processes and eliminating the need for physical branches. This leads to reduced service costs and competitive pricing. The overheads experienced by traditional banks often translate to less favorable pricing for customers, while fintech leverages innovation to enhance service accessibility and affordability.Operational Efficiency

The adoption of technology in banking breathes new life into operational efficiencies, significantly reducing errors through tools like robotic process automation. Mundane tasks are expedited, freeing human resources for critical customer engagement activities. Moreover, tools for AI-driven financial analysis advance the accuracy of data interpretation, fostering informed decision-making.Emergence of New Business Models

New business models birthed by fintech include open banking, which champions third-party apps interfacing with financial institutions, fostering cooperation in service innovation. Neo-banks, operating without physical branches, deliver a streamlined, cost-efficient banking experience favorable to niche markets such as freelancers and younger clientele who prioritize transparency and convenience. Furthermore, peer-to-peer lending platforms revolutionize loan access by directly connecting borrowers with investors, enhancing competitive access to credit.Conclusion

The rapid evolution of the fintech sector is profoundly reshaping banking services through enhanced personalization, seamless user experience, optimized operations, and novel business models. The symbiotic relationship between fintech and traditional banking will be pivotal in defining the financial landscape of the future, as highlighted in the original article on ABCmoney.co.uk.Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

More Articles

Getting licensed or staying ahead in your career can be a journey—but it doesn’t have to be overwhelming. Grab your favorite coffee or tea, take a moment to relax, and browse through our articles. Whether you’re just starting out or renewing your expertise, we’ve got tips, insights, and advice to keep you moving forward. Here’s to your success—one sip and one step at a time!

NAR 2024 Sustainability Report: A Greener Future for Real Estate

Green Data Fields: A Step Towards Transparency

A notable shift is the integration of green data fields into the Multiple Listing Service (MLS). This innovation is transforming how properties are presented, emphasizing sustainable features to guide buyers towards eco-friendly homes. Such transparency not only promotes healthier living environments but also prepares the housing market for a sustainable future.Empowering Through Education

Education plays a crucial role in this transformation. The survey reveals that a quarter of individuals living in homes with sustainable features have received some form of training. This growing awareness among real estate professionals encompasses energy-efficient appliances, renewable energy systems, and eco-friendly building materials. Armed with this knowledge, agents are better equipped to advocate for green living, meeting the evolving demands of environmentally conscious clients.Energy Efficiency: A Key Market Driver

Energy efficiency is becoming a valuable asset in property descriptions, with more than half of the respondents recognizing its importance. As the demand for sustainable living grows, agents who champion energy-efficient properties are positioned as key change agents, enhancing the marketability of these buildings.Client Interest: Aligning with Eco-Conscious Preferences

The survey highlights a growing client interest in sustainability, with nearly half of respondents noting this trend. This shift underscores the necessity for REALTORS® to align with client preferences, fostering not just transactions but also positive environmental change.

Green Certifications: Dispelling Myths

Contrary to common misconceptions, over 40% of homes with green certifications experienced no difference in market time. This dispels the myth that eco-friendly certifications hinder marketability, highlighting the growing acceptance of green-certified homes.High-Performance Homes: A Worthwhile Investment

Interestingly, homes with high-performance features command a premium of 1% to 5% in dollar value compared to similar homes. This underscores the financial incentives associated with investing in homes that prioritize comfort, health, and operational efficiency.

Conclusion: A Green Horizon Beckons

The NAR 2024 Sustainability Report paints a landscape ready for transformation. It emphasizes the potential for the residential real estate sector to lead a more sustainable, resilient future by integrating green data fields and accepting eco-friendly certifications.As interest in sustainable living grows, real estate professionals are essential advocates for eco-friendly homes and practices. By furthering education, championing energy efficiency, and engaging with green properties, the real estate industry is paving the way for a greener future. For more details, explore the NAR 2024 Sustainability Report.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

2025 Commercial Real Estate Outlook: Navigating a New Era

2025 Commercial Real Estate Outlook: Navigating a New Era

The commercial real estate landscape is on the brink of transformation as leaders seek to navigate the challenges of recent years and position their organizations for future opportunities. As we look into 2025, the insights from Deloitte’s Commercial Real Estate Outlook provide a comprehensive guide to understanding the shifting dynamics in this sector.Economic Insights: A Global Perspective

The economic forecasts from various regions offer a critical backdrop for understanding the commercial real estate market. In the United States, the economic outlook for Q2 2024 highlights a period of cautious optimism. Meanwhile, the Eurozone is navigating its economic challenges with a focus on stability, as detailed in the April 2024 report. In India, the April 2024 outlook emphasizes growth opportunities amidst global uncertainties. These regional insights, coupled with the global economic outlook from January 2024, underscore the interconnected nature of the commercial real estate market.Strategic Responses to Economic Fluctuations

In response to these economic conditions, businesses are reshaping their strategies to better align with the evolving market landscape. This includes adapting to post-pandemic realities and leveraging new opportunities. The integration of new technologies and innovative strategies is paramount in this transition, as organizations strive to maintain a competitive edge.Leveraging New Opportunities

The outlook for 2025 encourages leaders to harness emerging opportunities in commercial real estate. This involves not only adapting to current challenges but also anticipating future trends. By focusing on strategic innovation and resilience, businesses can position themselves to thrive in a rapidly changing environment.Conclusion The 2025 Commercial Real Estate Outlook serves as a pivotal resource for leaders seeking to navigate the complexities of the current market. By understanding regional economic insights and adopting strategic responses, organizations can effectively position themselves for success in the coming years.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

The Emerging Mental Health Crisis Among Healthcare Workers During the COVID-19 Pandemic

The Emerging Mental Health Crisis

The pandemic has ushered in a wave of mental health challenges that affect healthcare workers profoundly. From the onset of COVID-19, these professionals have been at the forefront, facing immense pressure, long hours, and the constant fear of exposure. This has led to heightened levels of stress, burnout, and even post-traumatic stress disorder (PTSD) among many, as highlighted in a recent article from Frontiers.Stress and Burnout: The Silent Epidemic

Healthcare workers are no strangers to stress, but the pandemic has exacerbated this issue to unprecedented levels. The World Health Organization estimates a significant shortfall in healthcare workers by 2030, which further compounds the stress and burnout experienced by those currently in the field. The emotional toll of making life-and-death decisions, often with limited resources, adds to the moral injury many healthcare workers endure.Self-Care and Systemic Support

While individual self-care practices are crucial, they are not enough. The article emphasizes the need for systemic changes to provide robust support structures for healthcare workers. Implementing evidence-based interventions and policies that prioritize mental health can create a more sustainable and supportive work environment.Strategies for Promoting Mental Health

Several strategies can be employed to support healthcare workers’ mental health. These include providing psychological first aid, resilience training, and access to mental health resources. The use of telemedicine and digital platforms can also alleviate some of the pressures by offering remote consultations and support, as demonstrated during the COVID-19 outbreak in China.Moving Towards Systemic Change

The pandemic has underscored the need for a systemic shift in how we approach healthcare workers’ mental health. This involves not only addressing the immediate mental health needs but also implementing long-term strategies that foster resilience and well-being. As the article suggests, engaging healthcare workers in policy-making processes and promoting a culture of empathy and support are vital steps towards achieving this goal.

Conclusion

In conclusion, the mental health of healthcare workers is a critical public health priority that cannot be overlooked. By implementing systemic changes and providing comprehensive support, we can ensure that these essential workers are equipped to handle current and future health crises. As we move forward, let us remember the invaluable contributions of healthcare workers and strive to create a more supportive and resilient healthcare system.)

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

Ethical Concerns of Large Language Models in Healthcare

Since the release of ChatGPT by OpenAI in 2022, LLMs have rapidly expanded into healthcare, promising advancements in clinical decision-making, diagnosis, and patient communication. However, the review underscores persistent ethical challenges, including issues of fairness, bias, transparency, and privacy. These concerns underscore the pressing need for well-defined ethical guidelines and human oversight in medical applications.

Exploring Ethical Implications

The study identifies several core themes in the ethical use of LLMs. In clinical settings, LLMs hold potential for assisting in initial patient diagnosis and triage. Yet, there is apprehension about biases that may lead to incorrect diagnoses or treatment recommendations, highlighting the necessity for careful oversight by healthcare professionals.

Patient support applications of LLMs aim to improve health literacy and facilitate communication across language barriers. However, concerns about data privacy and the reliability of medical advice generated by these models remain significant.

Public Health Perspectives

From a broader public health perspective, the study warns of potential risks, such as the dissemination of misinformation and the concentration of AI capabilities in the hands of a few corporations. This could exacerbate existing health disparities and undermine public health efforts.

Ultimately, while LLMs present promising advancements in medical fields, ensuring their ethical deployment requires careful consideration. Addressing biases, enhancing transparency, and maintaining human oversight are crucial to mitigating potential harms and promoting equitable patient care.

For further insights, you can read the original article on News-Medical. Additionally, the full study is available on npj Digital Medicine.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

The Role of Wearable Devices in Chronic Disease Monitoring and Patient Care: A Comprehensive Review

The Role of Wearable Devices in Chronic Disease Monitoring and Patient Care: A Comprehensive Review

In the ever-evolving landscape of healthcare, wearable health devices have emerged as pivotal tools in the management of chronic diseases. These devices, ranging from sophisticated smartwatches to implanted sensors, offer real-time monitoring and personalized care, thus transforming patient outcomes and healthcare delivery.Revolutionizing Chronic Disease Management Wearable devices have become integral in managing chronic conditions such as diabetes, cardiovascular diseases, and respiratory disorders. By providing continuous health data, these devices empower patients and healthcare professionals with insights that were previously unattainable. For instance, continuous glucose monitors (CGMs) have revolutionized diabetes management, offering real-time glucose readings that lead to precise insulin dosing and improved glycemic control.

Moreover, wearable technologies play a crucial role in cardiology by monitoring heart rate and blood pressure, aiding in the detection of arrhythmias, and supporting cardiac rehabilitation. In respiratory health, these devices continuously track vital indicators like respiratory rate and oxygen saturation, facilitating early diagnosis and treatment of conditions such as asthma and COPD.

Challenges and Opportunities Despite their potential, wearable health devices face several challenges. Data accuracy and reliability remain significant concerns, especially under varying physical conditions. Integrating wearable data with existing health records poses operational challenges, necessitating standardized protocols and robust data structures.

Data privacy and security are also critical issues. The continuous collection and transmission of sensitive health information expose users to potential data breaches. Ensuring confidentiality and compliance with regulatory standards like HIPAA and GDPR is essential to build trust among users and healthcare providers.

Cost is another barrier to widespread adoption, particularly in resource-constrained settings. While prices have declined, the initial investment in hardware, software, and training can be prohibitive for some patients and healthcare professionals.

Expanding the Horizon The potential of wearable devices extends beyond individual health management to broader public health interventions. Aggregate data from these devices can provide valuable insights into public health issues, disease outbreaks, and the effectiveness of interventions. This capability positions wearable devices as powerful tools for conducting extensive epidemiological studies and shaping public health policies.

Conclusion As wearable health devices continue to evolve, their integration into healthcare systems signifies a step toward improved patient care and resource utilization. To fully harness their benefits, continuous innovations and collaborations among healthcare professionals, researchers, and technology developers are essential. Addressing challenges related to data accuracy, privacy, and cost will be crucial in realizing the full potential of wearable devices in chronic disease management.

For more insights, refer to the original article on Cureus.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

AI Training Mandates: Navigating Legal Waters in Dentistry

AI Training Mandates: Navigating Legal Waters in Dentistry

The integration of artificial intelligence (AI) into dental practices is more than a technological trend; it represents a seismic shift in the industry. This transformation is reshaping skill sets and prompting a thorough examination of legal and ethical implications. As AI systems increasingly perform tasks traditionally handled by human intelligence, the dental sector is grappling with new challenges and opportunities.Since its inception in the 1950s, AI has advanced rapidly, leading to its widespread adoption in healthcare and dentistry. This evolution has been driven by significant strides in computing power and data accessibility, ushering in an era where AI technologies are deeply embedded in dental practice management, patient care optimization, and administrative efficiency.

Legal Frameworks Across the Globe

In Canada, the dual framework of federal and provincial legislation governs employment law. While dental practices primarily fall under provincial jurisdiction, existing laws like the Personal Information Protection and Electronic Documents Act (PIPEDA) are crucial. As AI systems process sensitive patient data, the proposed Artificial Intelligence and Data Act (AIDA) signifies a forthcoming regulatory framework to oversee high-impact AI technologies.In the United States, the employment law landscape is shaped by federal statutes and state-specific regulations. The Equal Employment Opportunity Commission (EEOC) has proactively scrutinized AI’s role in hiring, ensuring applications align with federal civil rights laws, thus mitigating risks of discriminatory practices.

Meanwhile, the European Union has pioneered AI regulation within employment law, focusing on data protection and ethical AI deployment. The General Data Protection Regulation (GDPR) and the proposed AI Act impose stringent rules on AI systems, safeguarding privacy and ensuring fairness in employment contexts.

Employment Implications and Legal Challenges

Implementing AI training mandates in dental offices introduces several implications. Skill gaps among staff necessitate tailored training approaches, potentially impacting daily operations. Traditional roles may evolve to include AI-related responsibilities, altering job descriptions and expectations. Moreover, privacy concerns arise as AI systems handle sensitive patient data.Mandating AI training could also lead to constructive dismissal claims if it significantly alters employment terms. Legal precedents in Canada, such as Farber v. Royal Trust Co., highlight the potential for claims arising from substantial changes in job duties or skill requirements.

Discrimination concerns, particularly age-related disparities, are also significant. Mandatory AI training may disproportionately affect older employees, potentially leading to age discrimination claims. Dental offices must align AI training initiatives with human rights legislation, ensuring accommodations for employees with disabilities.

Strategies for Mitigation and Best Practices

To mitigate legal risks, transparent communication regarding AI training requirements is essential. Dental offices should clearly articulate the reasons for AI integration and document employee consent to participate in training programs. Consulting with legal experts and conducting audits of AI training programs can further ensure compliance with evolving legal frameworks.Offering voluntary AI training programs with incentives and implementing phased introductions to AI technologies can enhance employee motivation and engagement. By customizing training programs to individual needs, dental offices can foster a supportive learning environment.

As AI continues to transform the dental industry, navigating these advancements demands careful attention to legal and ethical principles. By embracing a thoughtful and inclusive approach to AI integration, dental offices can harness AI’s transformative potential while mitigating legal risks and cultivating a positive work environment.

For more insights, refer to the original article on the Oral Health Group.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

Smart Home Energy Management Devices: A Market Poised for Growth

Smart Home Energy Management Devices: A Market Poised for Growth

The Global Smart Home Energy Management Device Market is on the brink of a significant transformation, driven by escalating demands for energy-efficient solutions and the increasing adoption of smart home technologies. As consumers become more conscious of the importance of energy conservation, fueled by environmental concerns and rising energy costs, the market is set for a promising trajectory.Government initiatives play a crucial role in promoting sustainable practices and integrating renewable energy sources, further accelerating the market’s expansion. Technological advancements, particularly in artificial intelligence and IoT connectivity, have enhanced these devices’ capabilities, making them more intuitive and user-friendly.

North America: Leading the Charge

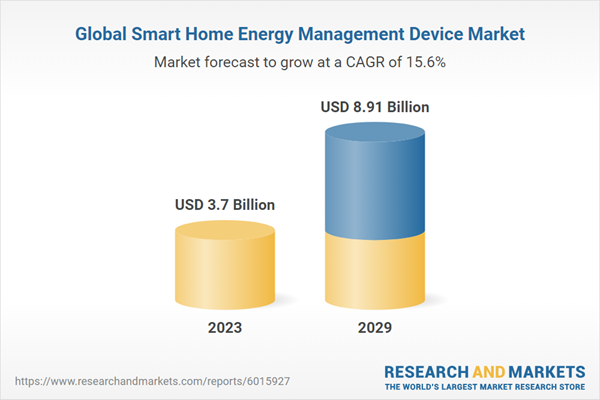

North America has emerged as the dominant region in the Global Smart Home Energy Management Device Market, a position it is expected to maintain. This strong market presence is attributed to high consumer awareness about energy conservation, widespread adoption of smart home technologies, and supportive government initiatives. The region’s well-established IoT infrastructure and prevalent home automation systems have significantly contributed to the widespread adoption of these devices.Despite the promising growth, challenges such as integration complexities, data security concerns, and high initial costs persist. However, the future looks bright as innovations continue to shape the industry. According to a report, the market value is expected to rise from $3.7 billion in 2023 to $8.91 billion by 2029, marking a compound annual growth rate of 15.6%.

Key Market Drivers and Challenges

- Drivers: Increasing consumer awareness, advancements in IoT technology, government initiatives, and the integration of renewable energy sources.

- Challenges: Interoperability and integration complexity, data security and privacy concerns, limited consumer awareness, and high initial costs.

Looking Ahead

As the market continues to evolve with innovative product offerings and increasing consumer demand, North America is expected to maintain its leadership position. This growth will drive the Global Smart Home Energy Management Device Market in the coming years, contributing significantly to the global shift towards sustainable living.For more information, visit the original report.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

Telehealth and Technology: Revolutionizing Behavioral Health Care

Telehealth: Expanding Access and Enhancing Care

Telehealth has emerged as a cornerstone of healthcare delivery, particularly in the realm of behavioral health. The COVID-19 pandemic accelerated its adoption, turning it from a supplementary service into a primary mode of care. Telehealth effectively bridges the gap for rural and underserved populations, offering treatment options right at patients’ doorsteps. As telemedicine platforms become more sophisticated and integrate seamlessly with electronic health records (EHRs), they promise to provide personalized care and ensure continuity for a broader patient base.The Role of Technology in Behavioral Health

AI and machine learning are at the forefront of revolutionizing behavioral health. By developing predictive models, these technologies can identify individuals at risk of mental health issues before they become severe. Wearable technology, which monitors real-time physiological data, and digital therapeutics, which deliver evidence-based interventions through software programs, offer valuable insights into patients’ mental and physical health. These tools are proving to be cost-effective solutions for managing therapy and treatment.The Future Outlook

As telehealth and technology blend into every aspect of care, the healthcare industry is moving towards continuous, personalized, and preventive healthcare models. Advances in genomics and precision medicine will further aid healthcare providers in diagnosing and treating diseases tailored to individuals’ genetic makeups, enhancing both surgical outcomes and patient satisfaction.However, as these advancements unfold, the industry faces challenges in safeguarding patient data and ensuring that AI tools are responsibly utilized. Balancing technological progression with ethical practices is crucial. For healthcare to successfully integrate these innovations, it must focus on enhancing the human element in medical care, while leveraging technology’s vast potential to improve patient outcomes.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

Revolutionizing Healthcare: AI and Precision Medicine for Chronic Diseases

Revolutionizing Healthcare: AI and Precision Medicine for Chronic Diseases

In a groundbreaking effort to redefine healthcare, the National Institute of Diabetes and Digestive and Kidney Diseases (NIDDK) is spearheading a workshop focused on the integration of Artificial Intelligence (AI) and Machine Learning (ML) in precision medicine, specifically targeting diabetes and other chronic diseases. This initiative aims to leverage recent advancements in AI, including generative AI and Large Language Models (LLMs), to innovate biomarker development, drug discovery, and diagnostics.

The workshop, detailed in the original article from the National Institutes of Health (NIH), promises to be a landmark event. It aims to bring together biomedical researchers and AI/ML experts to discuss the critical challenges, crosscutting gaps, and opportunities for actionable items in leveraging AI/ML in precision medicine.

Workshop Objectives and Agenda

The primary goal of the workshop is to heighten understanding of the unique opportunities AI provides in personalizing healthcare. Participants will delve into:

- The transformative power of AI in personalizing healthcare.

- Current approaches to precision medicine for chronic conditions.

- Addressing community needs and identifying gaps in current methodologies.

The event includes pre-workshop webinars designed to set the stage for discussions. Notable sessions include Part I: The Bio-Behavioral Dimensions of Diabetes Heterogeneity on October 17, featuring Dr. Yao Qin and Dr. Ashu Sabharwal, and Part II: Advances in AI and Applications in Biomedicine on October 24, featuring Dr. James Zou and Dr. Eran Halperin.

Key Organizers and Participants

The workshop will feature esteemed personnel, including external co-chairs Marcela Brissova from Vanderbilt University, Jeffrey Grethe from the University of California, San Diego, and Wei Wang from the University of California, Los Angeles. Participating NIH/NIDDK experts include Eric Brunskill, Debbie Gipson, Daniel Gossett, Carol Haft, Jia Nie, Xujing Wang, and Ashley Xia.

Event Details and Registration

The workshop was held at the Neuroscience Center Building in Rockville, MD, with virtual participation options available. Although registration has concluded, the event’s impact is expected to resonate throughout the scientific community.

For further information, interested parties could have contacted Xujing Wang, Ph.D., or Jia Nie, Ph.D., at the NIH, or Mark Dennis from The Scientific Consulting Group for logistical concerns.

Conclusion

The integration of AI and precision medicine offers a promising frontier in healthcare, particularly for managing chronic diseases like diabetes. As the NIDDK’s workshop highlights, the collaboration between AI/ML experts and biomedical researchers is crucial in overcoming existing challenges and harnessing AI’s full potential in revolutionizing healthcare.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

FoxyAI and LOOM’s Game-Changing Partnership in South African Real Estate

FoxyAI and LOOM Property Insights: A New Era in South African Real Estate

In a transformative move for the South African real estate landscape, FoxyAI has unveiled a strategic partnership with LOOM Property Insights. This collaboration is set to revolutionize property valuations for 56% of the nation’s mortgage-linked market, blending cutting-edge AI technology with real-time property data and insights.

By integrating FoxyAI’s award-winning technology, LOOM is poised to enhance its valuation processes, transitioning from a traditionally manual, week-long appraisal system to a swift, AI-driven evaluation completed within a single day. This marks a significant shift towards more efficient, accurate, and standardized property valuations, crucial for banks and real estate professionals.

Setting New Standards

“This collaboration marks FoxyAI’s inaugural venture into the South African market, demonstrating the global applicability of its AI-driven solutions,” stated Vin Vomero, CEO of FoxyAI. Jacques Rossouw, CEO of LOOM, highlighted the partnership’s potential to elevate the accuracy and efficiency of the property market in South Africa, offering more reliable data and streamlined processes.

Founded in 2018, FoxyAI is at the forefront of utilizing artificial intelligence to convert real estate images into actionable data, providing a comprehensive suite of Property Intelligence tools. Meanwhile, LOOM Property Insights continues to leverage advanced technologies to deliver real-time, accurate property data and insights, enhancing understanding throughout the property lifecycle.

For further details, visit FoxyAI and LOOM Property Insights. For inquiries, reach out to sales@foxyai.com.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

Bridging the Digital Divide in Rural Healthcare

Bridging the Digital Divide in Rural Healthcare

According to the World Health Organization (WHO), around two billion individuals residing in rural and remote areas worldwide lack sufficient healthcare access. A major contributor to this issue is inadequate broadband access, which severely limits the effectiveness of telehealth services. This digital divide hinders healthcare delivery and intensifies existing health disparities, preventing rural populations from fully benefiting from video-based telehealth consultations, remote monitoring, and other bandwidth-intensive applications.

Additionally, the shortage of healthcare professionals in rural communities is alarming. Although half of the global population resides in rural regions, these areas are served by only 38% of the total nursing workforce and an even smaller percentage of physicians. Many rural inhabitants also face the challenge of traveling long distances for specialty care, leading to delayed care and unfavorable health outcomes.

The Promise of Telehealth

Telehealth presents a promising solution by expanding access to healthcare services. Technological advancements have improved telehealth platform integration with medical devices and electronic medical records (EMRs), making these services more user-friendly and accessible. Scalable solutions that provide diverse healthcare services on a single platform can address multiple specialties.

Understanding the Rural Healthcare Landscape: Rural communities, comprising over 40% of the global population, face higher chronic disease rates as reported in 2023 by the Centers for Disease Control and Prevention (CDC). These areas suffer from inadequate access to both primary and specialty care, with critical health facilities becoming scarce.

Challenges for Rural Healthcare Executives

Rural healthcare executives list workforce shortages, financial constraints, and limited specialty care access as primary challenges, underlining the urgent need for innovative solutions like telehealth.

Telehealth’s Role in Addressing Challenges

Telehealth optimizes healthcare delivery, closing care gaps through systems like Health Information Technology (HIT) in the US, Pakistan’s COMSATS Telehealth program, and Kenya’s mHealth initiative. These examples demonstrate telehealth’s impact on local healthcare services by reducing costs and travel needs.

Best Practices for Telehealth Implementation

- To succeed, telehealth programs must incorporate thorough needs assessments, select appropriate platforms, and provide comprehensive training. These steps ensure effective solutions for rural healthcare challenges, should involve stakeholders for selecting the platform, and require ongoing technical support for healthcare providers.

Strategic Considerations

Effective telehealth integration requires financial assessments, adherence to regulatory and compliance standards, and robust technology infrastructure. Cost-benefit analyses, such as studies from Australia and Canada showing telehealth savings, emphasize telehealth’s financial viability. Ensuring compliance and robust connectivity infrastructures, like mobile hotspots, further support successful implementation.

The Future of Telehealth in Rural Healthcare

Effective telehealth adoption in rural settings relies on careful planning, stakeholder engagement, and continuous support to improve access, patient outcomes, and reduce costs. C-suite executives play a key role in driving adoption and ensuring high-quality rural healthcare. Embracing telehealth promises a future where healthcare services are equitable and accessible, bridging urban and rural disparities globally.

For a more detailed exploration, visit the original article on Omnia Health Insights.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

AI Revolutionizing Cancer Diagnosis and Treatment

AI: The New Frontier in Cancer Care

AI’s potential in healthcare is vast, with its most promising applications in computer vision. As Dr. Yu explains, this technology, widely used in facial recognition and autonomous driving, can significantly enhance cancer diagnosis. By analyzing digital radiology and pathology images, AI can identify patterns typical of cancer, thus improving diagnostic accuracy and treatment precision.Furthermore, AI’s role extends to guiding radiation treatment. By using enhanced precision, AI can help protect healthy tissue while targeting cancerous cells, minimizing side effects. Radiation oncologists are exploring AI’s capabilities to better identify cancer margins and program radiation machines for more accurate treatment delivery.

Bridging the Gap: AI as a Medical Translator

AI’s influence is not limited to diagnosis and treatment. Large Language Models, such as those powering ChatGPT, offer a new way to demystify medical jargon. These tools can simplify complex medical documents, making them more accessible to patients. Dr. Yu notes that AI can address common patient queries with speed and accuracy, transforming how patients interact with their medical records.Ethical Considerations in AI Healthcare

While AI’s potential is exciting, it is not without ethical concerns. Dr. Yu emphasizes the importance of addressing issues such as patient privacy, data sharing, and the accuracy of AI-generated information. There is also the risk of perpetuating systemic biases through AI databases, a challenge that must be navigated carefully.Prevention: A Human Responsibility

Despite AI’s advancements in cancer care, Dr. Yu reminds us that prevention is a human responsibility. Cancer prevention involves lifestyle choices like HPV and Hepatitis B vaccinations, avoiding tobacco, and maintaining a healthy diet. These steps are crucial in reducing cancer risk, underscoring that while AI can aid in detection and treatment, prevention starts with personal choices.For more insights on healthcare innovations, visit the original article on Hartford Hospital’s news center.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

Unlocking Business Value: Navigating the AI Landscape

Unlocking Business Value: Navigating the AI Landscape

The journey to establish a return on investment (ROI) from AI projects can be as complex as it is rewarding. As organizations continue to invest in generative AI, the challenge lies in translating hype into tangible business value. According to a recent CIO article, focusing on specific metrics, aligning data operations with revenue-centric tasks, and enhancing employee engagement with AI are key strategies to maximize the potential of these technologies.The AI Hype Cycle: A Double-Edged Sword?

While the AI hype has fueled investments, Gartner’s recent analysis has placed generative AI at the “peak of inflated expectations,” suggesting a potential dip into the “trough of disillusionment” is imminent. Despite this, the AI honeymoon isn’t over yet. A report from AI at Wharton indicates that 72% of enterprises anticipate increased budgets for AI over the next year, though growth is expected to slow thereafter.Productivity and Beyond: The Real Impact of AI

Many early successes with generative AI have focused on boosting productivity. For instance, developers leveraging GitHub Copilot have reported a 26% increase in task completion. However, for CIOs, the challenge remains to justify continued investments by demonstrating AI’s broader strategic impacts, especially on the bottom line.Strategic Metrics: The Key to Success

To unlock AI’s potential, CIOs need to identify and focus on metrics that align with core business objectives. As Shaown Nandi from AWS suggests, setting clear, measurable goals is crucial. Whether it’s reducing call center escalation rates or enhancing customer communication, pinpointing these metrics can provide a roadmap for AI success.Data Strategies: The Backbone of AI Initiatives

Improving data quality and integration is vital for marketing departments aiming to track the financial impact of AI. As noted by Michelle Suzuki, CMO of Glassbox, a seamless partnership between CIOs and CMOs is essential to enhance decision-making capabilities. This involves prioritizing proactive data governance and embracing DataOps practices.Call Centers and Service Operations: A New Frontier

AI’s role in support services is transformative. By expediting operations and improving customer satisfaction, AI can significantly enhance service desk efficiencies. As Ram Ramamoorthy from ManageEngine highlights, AI-driven knowledge graphs and intelligent routing are game-changers in this space.Employee Experience: The Human Element

As AI reshapes work environments, CIOs must also consider its impact on employee well-being. A report by Deloitte reveals that only 20% of organizations are well-prepared for the talent considerations associated with AI adoption. This underscores the need for effective change management strategies to ensure a smooth transition.In conclusion, while the path to achieving ROI from AI investments is fraught with challenges, the potential rewards make it a journey worth undertaking. By focusing on strategic metrics, aligning data strategies, and fostering a supportive environment for employees, organizations can harness AI’s full potential.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

Wearable Technology: A New Frontier in Heart Failure Management

Wearable Technology: A New Frontier in Heart Failure Management

In the ever-evolving landscape of medical technology, wearables have emerged as a promising solution for enhancing the remote monitoring of heart failure patients. These devices, capable of tracking crucial physiological parameters, hold the potential to revolutionize patient care. However, their integration into clinical practice is not without challenges.A recent scoping review published in Nature highlights the current state of wearable technology for heart failure management. The review, conducted by a team of researchers including Annemiek E. van Ravensberg and Abdul Shakoor, delves into the readiness of these devices for clinical use, employing the Medical Device Readiness Level (MDRL) as a framework for assessment.

The Promise and the Pitfalls

Wearable devices offer a personalized and empowering experience for patients, potentially becoming a vital component of modern heart failure management. Yet, the review underscores a significant barrier: the lack of rigorous evaluations. Of the 99 studies identified, only a handful were randomized controlled trials, leaving a gap in robust evidence needed for widespread clinical adoption.The review also points out that most consumer-grade wearables are in the feasibility testing stage (MDRL 6), with only two devices specifically designed for heart failure remote monitoring receiving FDA approval.

Global Burden and the Need for Innovation

Heart failure affects approximately 63 million people worldwide, placing immense strain on healthcare systems. The necessity for frequent outpatient visits and hospitalizations exacerbates this burden, especially in today’s healthcare environment, which is already grappling with limited capacity and staff shortages. Remote monitoring, as highlighted in the meta-analysis by Scholte et al., has been proposed as a solution, showing promise in reducing mortality and hospitalization rates.Challenges in Clinical Integration

Despite the potential benefits, the integration of wearable technology into heart failure care faces significant hurdles. The absence of standardized methodologies and external validation contributes to uncertainty about the actual impact of these devices. Current heart failure guidelines offer limited endorsement for incorporating remote monitoring, reflecting the need for further research and validation.The Path Forward

As the healthcare industry looks to the future, the role of wearable technology in heart failure management remains a subject of intense interest and debate. The review calls for more extensive studies to establish clinical benefits, urging the medical community to bridge the gap between promising technology and practical application.For more details on this groundbreaking review, visit the original article.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

AI’s Impact on Finance: Transformative Trends and Future Prospects

Transforming Customer Interactions

One of the most visible impacts of AI in finance is the rise of conversational AI. Virtual assistants and chatbots, powered by sophisticated algorithms, are providing real-time customer support, handling routine inquiries, and managing basic transactions. This automation frees up human resources for more complex tasks, enhancing both efficiency and customer satisfaction.

For example, HSBC has partnered with SoftBank Robotics to deploy the AI robot ‘Pepper’ in its branches. Pepper assists customers with basic banking tasks and queries, thereby reducing the burden on human staff and improving operational efficiency.

Streamlining Operations with Machine Learning

The combination of AI and machine learning (ML) is instrumental in automating financial processes. ML algorithms analyze vast amounts of data to detect patterns and make predictions, enabling automated data entry, document processing, and reconciliation. This reduces manual effort and improves accuracy, allowing employees to focus on higher-value activities such as financial analysis and decision-making.

Benefits of AI in Finance

The integration of AI in finance offers numerous advantages:

- Operational Efficiency: Automating repetitive tasks minimizes human error and ensures data integrity.

- Improved Customer Experience: AI-powered chatbots provide 24/7 assistance, offering tailored financial advice.

- Competitive Advantage: Rapid data analysis enables quicker decision-making and adaptation to market changes.

- Accurate Models: AI enhances risk evaluation, investment strategies, and fraud detection with precise forecasts.

- Speed and Precision: AI processes data swiftly, facilitating real-time adjustments to market conditions.

Challenges and Solutions

While AI offers significant benefits, its integration into finance comes with challenges such as explainability, regulatory compliance, and cybersecurity risks. Solutions include adopting interpretable AI techniques, establishing strong governance structures, and implementing robust cybersecurity measures.

The Future of AI in Financial Services

The future holds immense potential for AI-driven innovation in finance. As technologies advance, financial institutions are increasingly leveraging AI for enhanced customer experiences, personalized wealth management, and accurate risk assessment. AI algorithms will continue to streamline operations, automate tasks, and optimize decision-making processes.

Generative AI is set to transform the sector by creating innovative financial products tailored to individual needs, while machine learning will push financial services into more predictive and prescriptive territories. By 2028, Citibank forecasts that AI could boost global banking profits by $170 billion.

For those looking to harness the power of AI in finance, companies like Appinventiv offer expert services in developing AI-powered solutions tailored to specific needs, ensuring businesses remain competitive and innovative in a rapidly evolving market.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

Blockchain and Microcredit: A New Dawn for Financial Inclusion in Kenya?

Blockchain and Microcredit: A New Dawn for Financial Inclusion in Kenya?

In the heart of Kenya, a financial revolution is quietly unfolding. As traditional banking systems grapple with challenges of accessibility and trust, a new player emerges on the scene—blockchain-based microcredit. This innovative approach could potentially transform financial inclusion in the region, a topic explored in a recent article by Monash Lens.

In the heart of Kenya, a financial revolution is quietly unfolding. As traditional banking systems grapple with challenges of accessibility and trust, a new player emerges on the scene—blockchain-based microcredit. This innovative approach could potentially transform financial inclusion in the region, a topic explored in a recent article by Monash Lens.

The story of microcredit is not new. Pioneered by the Grameen Bank, microcredit has been a beacon of hope, offering financial lifelines to entrepreneurs in developing countries. Its success in Bangladesh, with a loan recovery rate surpassing traditional systems, underscores its potential. But in Kenya, the narrative takes a digital twist with blockchain technology.

The Blockchain Advantage

Blockchain offers a decentralized, secure alternative to conventional banking. By eliminating intermediaries, it reduces costs and enhances transaction security. This is particularly beneficial in regions like Sub-Saharan Africa, where financial inclusion lags behind the global average, as noted by the World Bank.However, the journey is fraught with challenges. Financial literacy remains a significant barrier, as highlighted by research by Schuetz and Venkatesh. Low education levels and a lack of awareness impede the adoption of financial services. Yet, the introduction of blockchain-based systems could serve as a catalyst for education and empowerment.

Overcoming Barriers

The integration of blockchain with existing platforms like M-Pesa could be transformative. While M-Pesa has revolutionized mobile banking in Kenya, it faces challenges such as privacy and security. Blockchain’s encrypted, immutable transactions offer a solution, enhancing transparency and reducing fraud risks.For blockchain to succeed, strategic implementation and comprehensive education are crucial. Our recent study funded by the Ethereum Foundation, reveals that understanding the platform’s benefits motivates users to learn. Solutions include localized education, practical use cases, and continuous engagement through community initiatives.

A Promising Future

As PricewaterhouseCoopers emphasizes, blockchain-based financial products must be accessible, reliable, and user-friendly to foster inclusion. The potential is promising, but success hinges on overcoming educational and infrastructural hurdles.Kenya stands on the brink of a financial transformation. By blending blockchain’s innovative capabilities with M-Pesa’s established network, a more inclusive and resilient financial future is within reach. The question remains: can blockchain-based microcredit truly transform financial inclusion in Kenya? The answer, as the Monash Lens article suggests, is a hopeful yet conditional yes.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

The Revolutionary Role of Digital Twins in Precision Health

The Revolutionary Role of Digital Twins in Precision Health

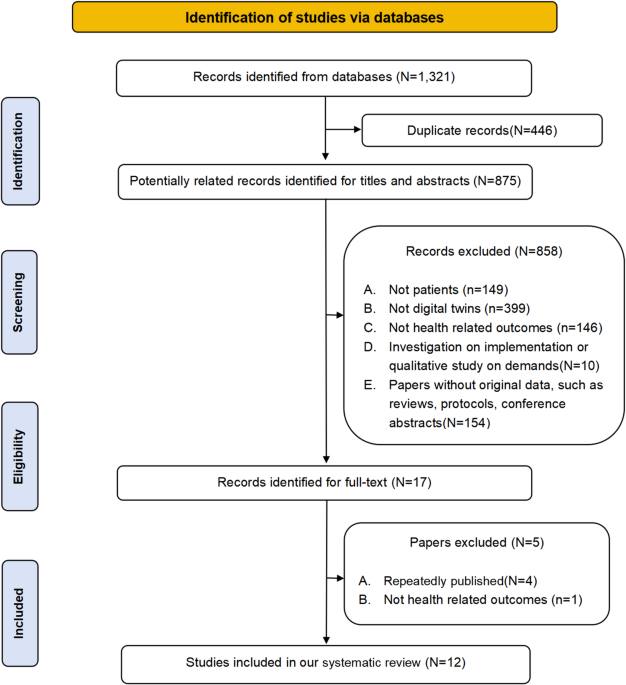

In a groundbreaking exploration of healthcare innovation, digital twins are emerging as a pivotal technology in the realm of precision health. A recent systematic review published in Nature delves into the transformative potential of digital twins, highlighting their capacity to revolutionize patient outcomes through personalized health management, precision therapies, and risk prediction. Digital twins, essentially virtual replicas of human bodies, utilize real-time data to provide dynamic and individualized healthcare solutions. This technology marks a significant departure from conventional medical practices, which often employ a one-size-fits-all approach. Instead, digital twins offer tailored recommendations and interventions, thereby enhancing the precision and efficacy of healthcare delivery.

Digital twins, essentially virtual replicas of human bodies, utilize real-time data to provide dynamic and individualized healthcare solutions. This technology marks a significant departure from conventional medical practices, which often employ a one-size-fits-all approach. Instead, digital twins offer tailored recommendations and interventions, thereby enhancing the precision and efficacy of healthcare delivery.

Transformative Potential Across Healthcare Domains

The review underscores the broad applicability of digital twins across various medical fields. By integrating omics data, clinical information, and health outcomes, digital twins facilitate a more nuanced understanding of patient health. This capability is particularly beneficial in managing chronic conditions like type 2 diabetes and multiple sclerosis, where personalized treatment plans can significantly improve patient quality of life.Moreover, the technology’s predictive capabilities enable healthcare providers to anticipate and mitigate potential health risks. For instance, digital twins can forecast disease progression and suggest preemptive interventions, thereby reducing the likelihood of severe health complications.

Challenges and Future Directions

Despite their promising potential, the widespread adoption of digital twins in healthcare is not without challenges. Data accessibility and integration across disparate health systems remain significant hurdles. The review advocates for enhanced data-sharing frameworks and the development of robust computational infrastructures to support the seamless implementation of digital twins in clinical settings.The authors, Mei-di Shen from Peking University and Si-bing Chen and Xiang-dong Ding from Jilin University, emphasize the need for continued research and collaboration across medical and technological domains. Such efforts are crucial to unlocking the full potential of digital twins and realizing their promise in precision health.

Conclusion

As healthcare continues to evolve, digital twins stand at the forefront of this transformation, offering unprecedented opportunities for personalized and precise medical care. By bridging the gap between digital innovation and clinical practice, digital twins are poised to redefine the future of healthcare, ensuring better outcomes for patients worldwide.Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

The 3D Printing Construction Market: A Future of Growth and Innovation

The 3D Printing Construction Market: A Future of Growth and Innovation

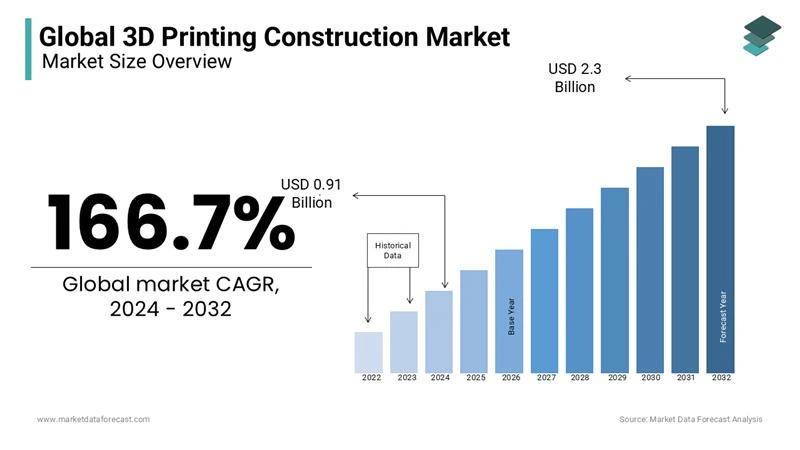

The global 3D printing construction market is on the brink of a remarkable transformation. Currently valued at USD 0.34 billion in 2023, it is projected to surge to USD 910 million by 2024, and ultimately reach USD 2.3 billion by 2032. This rapid expansion is fueled by the sector’s potential to revolutionize traditional building processes through innovative additive manufacturing technologies.

Key Market Trends The rise of sustainable construction practices is one of the most significant trends driving this market. 3D printing not only reduces material waste but also facilitates the use of eco-friendly materials, a crucial factor as the construction industry seeks to reduce its carbon footprint. Moreover, this technology supports accelerated affordable housing solutions, cutting down both construction times and costs, which is essential in addressing global housing shortages.

Drivers of Market Growth Labor shortages are a pressing issue in the construction industry, prompting a shift towards 3D printing. With an aging workforce and a scarcity of skilled labor, companies are increasingly turning to automation to reduce labor dependency. Additionally, the growing demand for customized construction projects is encouraging the adoption of 3D printing, allowing for the creation of intricate, tailored designs that cater to urban and cultural needs.

Government support is also playing a pivotal role in market growth. Initiatives like Saudi Arabia’s Vision 2030 and the European Union’s Horizon 2020 program are promoting the use of 3D printing in construction, further bolstering the market’s expansion.

Challenges and Opportunities Despite its promising advancements, the 3D printing construction market faces challenges such as the high initial capital investment required for equipment and a lack of skilled workforce to operate these technologies. However, opportunities abound, particularly in disaster-relief housing and the integration of 3D printing with smart city initiatives.

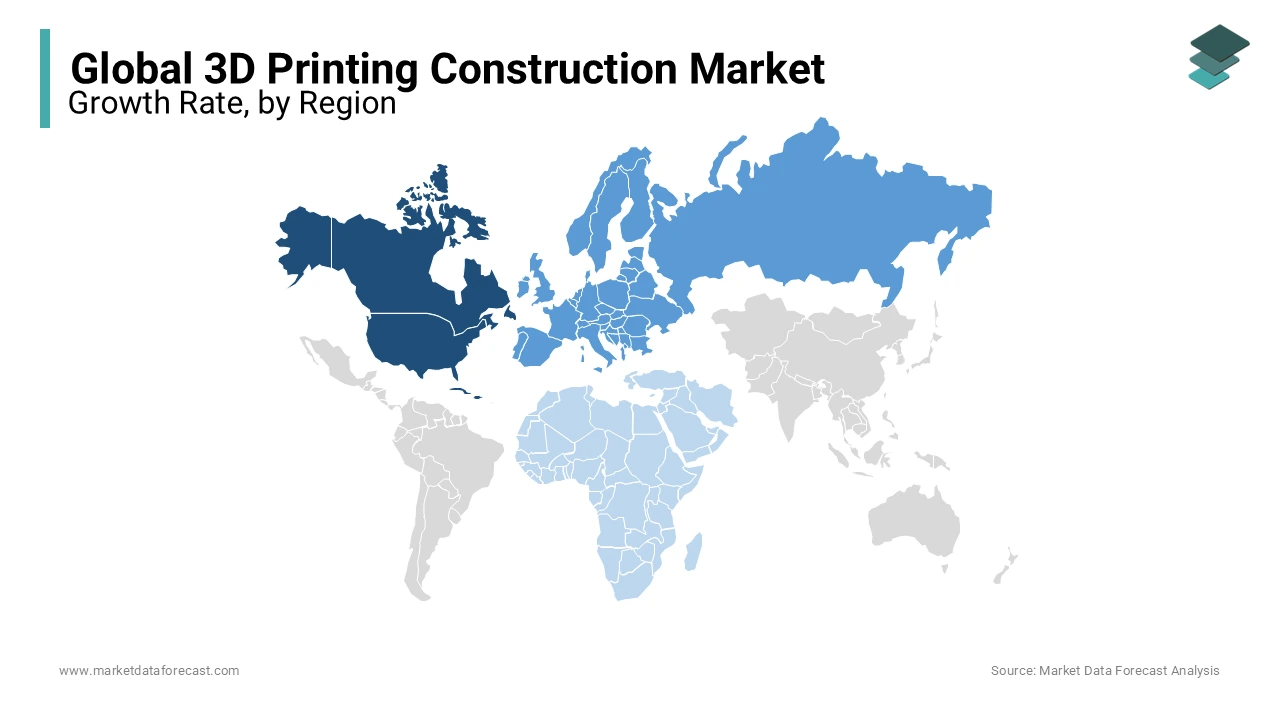

Regional Insights In 2023, North America led the market, holding a 35.8% share, thanks to significant investments and technological advancements. Europe is also experiencing robust growth driven by sustainability initiatives, while Asia-Pacific remains the fastest-growing region due to rapid urbanization and a high demand for affordable housing.

Key Players and Recent Developments Major companies such as WinSun, Apis Cor, and ICON are at the forefront of exploring new frontiers in 3D construction. Recent advancements include Apis Cor’s development of robotic printers and CyBe Construction’s collaborations in the Middle East for affordable housing projects. The introduction of the BetAbram P1 printer and Sika AG’s innovative concrete mix further highlight the industry’s ongoing efforts towards scalability and sustainability.

Overall, the 3D printing construction market is poised for significant growth, driven by its potential to redefine construction methodologies and effectively meet global demands.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

The Growing Role of Telehealth in Nursing: A New Frontier for Patient Care

The Growing Role of Telehealth in Nursing: A New Frontier for Patient Care

As the world of healthcare continues to evolve, nurses are at the forefront, embracing telehealth technology to revolutionize patient care. With the increased demand on healthcare systems due to an aging population and ongoing nursing shortages, telehealth is becoming an indispensable tool for nurses, enhancing patient outcomes and expanding access to quality healthcare.

According to the Agency for Healthcare Research and Quality, the integration of telehealth services has accelerated since the onset of the COVID-19 pandemic. This trend is supported by data from the U.S. Department of Health and Human Services, which highlights the significant rise in telehealth usage during the pandemic.

Dr. Lisa Bechok, a clinical faculty member at Southern New Hampshire University, emphasizes the critical role nurses play in safeguarding public health. “From ensuring the most accurate diagnosis and treatment options to the ongoing education of the public about critical health issues, nurses are indispensable,” Bechok states.

Telehealth not only facilitates remote monitoring of patient health but also breaks down geographical barriers, allowing those in rural areas to access necessary healthcare services. This is particularly beneficial for managing chronic conditions, reducing hospitalizations, and lowering healthcare costs, as noted in an article from the National Library of Medicine.

What is Telehealth?

Defined by the National Institute of Biomedical Imaging and Bioengineering, telehealth uses communication technology to provide medical care at a distance. It replaces traditional face-to-face visits with video conferencing and phone calls, enabling patients to receive care from the comfort of their homes.

Telehealth’s role in nursing spans various areas, including acute and chronic care, hospice, palliative, and primary care. This expansion provides nurses with innovative tools to reach patients and improve healthcare access for all, as highlighted by Bechok.

The Four Ps of Telehealth Nursing

As telehealth continues to grow, the Four Ps of Telehealth framework aids in nursing education:

- Planning: Identifying issues, technology, and patient needs.

- Preparing: Setting up technology support and training personnel.

- Providing: Conducting patient history and physical examination remotely.

- Performance Evaluation: Assessing program impacts and outcomes.

Despite the numerous benefits, challenges such as broadband access and regulatory issues persist. However, the pandemic has propelled the integration of telehealth, with nurses continuing to adapt and innovate in their roles.

In conclusion, telehealth is reshaping the landscape of nursing, offering flexibility and improved access to care. As Dr. Bechok aptly puts it, “Nursing is the glue that holds a patient’s healthcare journey together,” whether through telehealth or face-to-face interactions.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

Autonomous Vehicles and Their Economic Impact: A Look into the Future of Mobility

Autonomous Vehicles: Driving the Future of Urban Mobility and Economic Growth

The recent enactment of the Automated Vehicles Act in the UK heralds a new era for transportation, with self-driving vehicles expected to hit the roads by 2026. This legislative milestone is poised to revolutionize how people and goods move across the nation, potentially transforming urban spaces and transport systems as we know them.Economic Impact and Societal Interactions Understanding the intersection between autonomous vehicles (AVs) and society is crucial for assessing their economic impact. According to a study referenced by the Economics Observatory, the potential economic benefits in the UK could reach £51 billion by 2030. These gains stem from consumer savings, reduced travel time, and improved safety. The UK government is actively exploring policies to ensure AVs support sustainable economic growth and contribute to the transition to net-zero emissions.

Transforming Transport and Logistics The transport and logistics sectors are expected to be early adopters of AV technology, driven by the promise of reduced costs and increased efficiency. The elimination of human drivers could significantly cut labor expenses, while AVs’ ability to operate 24/7 could enhance productivity and customer satisfaction. Moreover, AVs could optimize delivery routes, addressing last-mile delivery challenges and improving customer experiences. Autonomous drones and robots, for example, could deliver packages to remote locations lacking proper transport infrastructure.

Personal Mobility and Social Inclusion AVs hold the potential to improve personal mobility, particularly for individuals underserved by current transport systems, such as the elderly and those with disabilities. By reducing transport costs, AVs could enhance mobility for middle and lower-income groups, fostering social inclusion and enabling access to employment and leisure activities. Fleet-based shared automated vehicles could offer low-cost, on-demand services, complementing traditional public transport and improving first- and last-mile connections.

Challenges and Opportunities Despite their benefits, AVs are expected to disrupt employment in sectors like public transport and delivery services, potentially leading to job losses. Policymakers must focus on education and retraining programs to help displaced workers transition to new roles. Additionally, AVs could exacerbate urban sprawl as individuals choose to live further from urban centers due to reduced transport costs and improved connectivity.

Driving Economic Growth AVs could significantly boost productivity by reducing travel costs and enhancing connectivity between urban centers and their peripheries. This improved accessibility could lead to job and population relocations, fostering agglomeration economies and increasing firms’ productivity. A study for the United States suggests that AVs could increase GDP by $214 billion and create 2.4 million new jobs.

Environmental Sustainability AVs offer the potential to optimize fuel consumption and reduce carbon emissions, contributing to a more sustainable transport system. By integrating electric and hybrid vehicles, AVs could further minimize greenhouse gas emissions, aiding in climate change mitigation efforts.

Addressing Concerns and Building Trust For AVs to gain public acceptance, companies and governments must address concerns about safety, reliability, and cybersecurity. Establishing robust security measures and transparent communication will be critical in fostering public trust. The UK government’s proactive approach to regulating AVs, as outlined in their regulation plan, sets a precedent for ensuring safety and legal clarity.

Conclusion

The advent of autonomous vehicles represents a pivotal moment in the evolution of urban mobility and economic growth. As the UK prepares for their integration into public roads, addressing challenges and leveraging opportunities will be essential in shaping a smarter, more connected future.

Conclusion

The advent of autonomous vehicles represents a pivotal moment in the evolution of urban mobility and economic growth. As the UK prepares for their integration into public roads, addressing challenges and leveraging opportunities will be essential in shaping a smarter, more connected future.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

AI in Healthcare: Revolutionizing Medicine or Overhyped Promise

Current Advancements

AI has already demonstrated its prowess in several areas. Notably, it expedited the development of mRNA vaccines for COVID-19 and is now being harnessed to create new protections against a variety of diseases. Generative AI, akin to ChatGPT, is also paving the way for new immunotherapy drugs.

In diagnostics, AI’s ability to analyze medical scans and records is proving invaluable. The American College of Surgeons notes that AI often surpasses radiologists in interpreting scans, identifying subtle signs of diseases like cancer and Alzheimer’s disease.

Challenges and Caution

Despite these successes, AI in healthcare is not without its challenges. A study on pulmonary embolism highlighted AI’s potential to reduce hospital stays, yet not all AI applications have been as effective. The discontinuation of IBM’s Watson Health partnership with MD Anderson Cancer Center due to accuracy issues serves as a cautionary tale.

Moreover, symptom-checker tools, which sometimes rely on AI, have been criticized for their low accuracy, posing potential safety risks. Additionally, the promise of administrative efficiencies through AI remains largely unrealized, with little evidence of significant cost savings or improvements in patient care.

Expert Opinions

Experts offer a range of perspectives on AI’s future in healthcare. Dr. Eric Topol, author of Deep Medicine, acknowledges AI’s utility in certain applications but emphasizes the irreplaceable value of human interaction in patient care. He envisions a future where AI augments rather than replaces human skills, enabling doctors to spend more time with patients.

Dr. Fei-Fei Li from Stanford University echoes this sentiment, highlighting AI’s role in alleviating administrative burdens, thereby restoring the “human element” to medicine. However, an article in MIT Technology Review warns against over-reliance on AI, particularly when trained on biased data, which could lead to inequities in care.

The Path Forward

While AI holds the promise of transforming healthcare, it is not a panacea. The early successes in drug discovery and diagnostics are promising, yet challenges such as data privacy, cost, and training must be addressed. The consensus among professionals is that AI should enhance human expertise, not replace it.

For technology companies, the key to driving meaningful change lies in developing AI applications that complement human skills, thereby delivering tangible benefits to healthcare systems and patients alike.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

The Rise of Central Bank Digital Currencies: A New Era in Finance

Countries around the globe, from the Bahamas to China, are actively exploring or have already initiated CBDC projects. The primary objective is to enhance financial inclusion, offering secure and efficient payment options for those without access to traditional banking systems. As noted in a report by the U.S. Federal Reserve, CBDCs have the potential to significantly reduce cross-border transaction costs, bolster the international standing of dominant currencies like the dollar, and simplify access to financial services.

However, this shift to digital currencies also presents several challenges. Privacy concerns, potential cybersecurity threats, and the impact on existing banking structures are critical issues that need careful consideration. Ensuring robust cybersecurity frameworks and balancing transaction monitoring to prevent financial crimes are essential steps in this journey.

CBDCs are categorized into two main types: wholesale and retail. Wholesale CBDCs are typically used by financial institutions for interbank transactions, while retail CBDCs are consumer-focused, allowing potentially anonymous transactions using public or private keys.

While smaller nations like Jamaica, Nigeria, and the Bahamas have already implemented CBDCs, larger economies and groups like the G20 are still in the exploratory stages, assessing the implications for monetary policy and financial stability.

For more in-depth information, the original article can be found on Investopedia.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

The Ethical Maze of AI in Radiography: A Saudi Arabian Perspective

The Ethical Maze of AI in Radiography: A Saudi Arabian Perspective

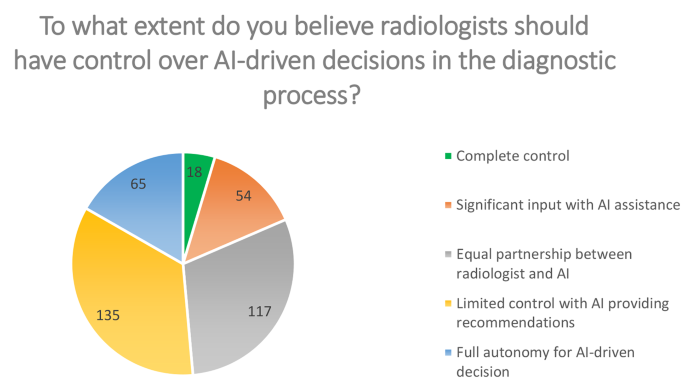

In an era where artificial intelligence (AI) is reshaping the landscape of healthcare, a recent study published in BMC Medical Ethics sheds light on the intricate ethical challenges radiographers face as they navigate AI integration in radiography. Conducted in Saudi Arabia, this cross-sectional study delves into the perspectives of radiographers, revealing a tapestry of enthusiasm and apprehension towards AI’s role in their field.The research, available on the BMC Medical Ethics website, highlights the transformative opportunities AI presents for diagnostic imaging, alongside the ethical considerations that accompany its adoption. Through a structured questionnaire, radiographers shared their insights on AI’s ethical implications, emphasizing the need for transparency, patient privacy, and the establishment of ethical guidelines.

Unfamiliar Terrain

The study reveals a significant portion of radiographers are unfamiliar with AI’s integration into their practice, with many expressing uncertainty about the importance of AI transparency. However, a notable number advocate for AI systems that provide justifications for their decision-making processes, highlighting a desire for clarity in AI operations.Ethical Dilemmas and Patient Privacy

Radiographers voiced concerns about ethical dilemmas that AI might introduce, with nearly half agreeing that AI could exacerbate these challenges. Patient privacy emerged as a critical issue, with a substantial portion of participants expressing apprehension about AI’s impact on confidentiality. These findings underscore the necessity for specific ethical guidelines to govern AI use in radiography.Guiding the Future

The study calls for the development of robust ethical frameworks, educational improvements, and policy enhancements to ensure AI technologies are implemented safely and ethically. These measures aim to maximize diagnostic benefits while minimizing ethical risks, providing a roadmap for policymakers and practitioners to navigate the evolving AI landscape in healthcare.For further insights into the study and its implications, visit the BMC Medical Ethics Journal.

CSS Styling

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

The Telehealth Revolution: Transforming the Healthcare Landscape

Telehealth: A New Era in Healthcare

Telehealth has dramatically transformed healthcare delivery, offering increased accessibility and reshaping patient care. The COVID-19 pandemic accelerated its adoption, with the U.S. experiencing a 154% surge in telehealth visits in March 2020. This adaptability is mirrored in mental health services, where telepsychiatry has become essential for continuous patient support, especially in remote areas.Financially, telehealth presents significant cost-saving opportunities by reducing non-urgent emergency visits. A McKinsey report suggests that up to $250 billion of U.S. healthcare spending could be virtualized.

Beyond Healthcare: Cross-Industry Applications

Telehealth technology extends its benefits beyond healthcare. In education, it bridges the gap between medical knowledge and practical application, enhancing clinical skills through simulation training. Platforms like Project ECHO facilitate knowledge sharing among healthcare professionals.In the corporate world, telehealth is integral to wellness programs, providing employees with convenient access to health services. This integration boosts productivity and reduces healthcare costs, as noted by the National Business Group on Health.

Technological Integration: No-Code and Low-Code Platforms

The rise of No-Code (NC) and Low-Code (LC) platforms is reshaping operational dynamics in healthcare. These platforms allow for the rapid development and deployment of digital solutions, making technology more accessible. According to a Healthcare Management Review study, they can accelerate clinical application development by 50-70%, reducing costs and improving efficiency.Personalization and Future Prospects

Personalizing telehealth services enhances patient satisfaction and engagement. Studies show that personalized interventions improve outcomes in chronic disease management, such as diabetes. AI and wearable technologies are advancing diagnostic precision and real-time monitoring, paving the way for more effective care.As we move into 2024, the integration of telehealth, AI, and wearables promises to set new benchmarks for accessible and personalized healthcare services. This evolution points towards a more connected, health-conscious future, as detailed in the original article.

Discover more from Cameron Academy

Subscribe to get the latest posts sent to your email.

Electric Vehicle Market Surges Amidst Economic and Environmental Challenges

Electric Vehicle Market Surges Amidst Economic and Environmental Challenges

The global electric vehicle (EV) market is experiencing a remarkable transformation, driven by a combination of technological advancements, policy incentives, and growing environmental awareness. According to a report by the TRENDS Research & Advisory, sales of battery electric vehicles (BEVs) and plug-in hybrid electric vehicles (PHEVs) soared beyond 10 million in 2022, marking a 55% increase from the previous year. This surge underscores the rapid adoption of EVs despite challenges such as supply chain disruptions and fluctuating energy prices.

The Global EV Outlook 2023 by the International Energy Agency (IEA) highlights the pivotal role of government policies in this growth. The Electric Vehicles Initiative (EVI), established under the Clean Energy Ministerial, has been instrumental in promoting zero-emission government fleets, further accelerating the shift towards sustainable transport solutions.

Global Trends and Policy Efforts

In line with the IEA’s Stated Policies Scenario (STEPS), the global share of EV sales is projected to reach 35% by 2030, with China, the United States, and Europe leading the charge. This growth trajectory is bolstered by strategic legislation and expanding battery manufacturing capacities, aimed at meeting the rising demand for EVs.

Despite these positive trends, the market faces hurdles such as the high cost of EVs, limited charging infrastructure, and battery technology challenges. To address these issues, governments and private entities are investing in innovative business models and enhanced charging networks, as emphasized in Fayez Alanazi’s research on EV adaptation.

Environmental and Economic Implications

Electric vehicles are heralded as a crucial solution to reducing greenhouse gas emissions, a sentiment echoed in the Gemopai report. EVs offer zero tailpipe emissions, contributing significantly to cleaner air and a reduction in the carbon footprint of transportation.

However, the economic rationale for EV adoption is complex. A study by David S. Rapson and Erich Muehlegger from the National Bureau of Economic Research explores the balance between operational savings and the upfront costs of EVs. The study suggests that while subsidies and incentives are crucial, they must be tailored to regional energy policies and market dynamics to maximize their impact.

The Future of Electric Mobility

The hybrid vehicle market is also experiencing growth, with projections indicating a 14% increase by 2031. This trend, highlighted by Fact.MR, reflects a shift in consumer preferences towards eco-friendly transportation options, driven by rising environmental consciousness and fuel efficiency demands.

Looking ahead, the EV market is poised for substantial expansion, with forecasts predicting a market size of $56.7 trillion by 2050, as reported by Nasdaq. This growth is expected to transform the automobile and energy sectors, with Chinese manufacturers leading the charge in EV production and innovation.

Conclusion

The path to achieving net-zero emissions by 2050 is intricately linked to the widespread adoption of electric vehicles. As highlighted by McKinsey & Company, this transition presents both opportunities and challenges for automakers and policymakers alike. By navigating these complexities and fostering collaboration across sectors, the electric vehicle industry can drive meaningful progress towards a sustainable and low-carbon future.